#have to file taxes with at least three different agencies

Explore tagged Tumblr posts

Text

don't have to file us taxes become

swiss taxes way harder

#im sure tumblr will fuck up the formatting but whatever you get the idea#i didnt even make any money in the us last year but because i lived in ohio for one (1) month i need to fill out an absurd amount of forms#have to file taxes with at least three different agencies#vs switzerland is like 'oh youre not a permanent resident? we'll just tax you directly out of your salary and youre set'#rays european hot girl phd

4 notes

·

View notes

Text

WASHINGTON — Black taxpayers are at least three times as likely to be audited by the Internal Revenue Service as other taxpayers, even after accounting for the differences in the types of returns each group is most likely to file, a team of economists has concluded in one of the most detailed studies yet on race and the nation’s tax system.

The findings do not suggest bias from individual tax enforcement agents, who do not know the race of the people they are auditing. They also do not suggest any valid reason for the I.R.S. to target Black Americans at such high rates; there is no evidence that group engages in more tax evasion than others.

Instead, the findings document discrimination in the computer algorithms the agency uses to determine who is selected for an audit, according to the study by economists from Stanford University, the University of Michigan, the University of Chicago and the Treasury Department.

Some of that discrimination appears to be rooted in decisions that I.R.S. officials made over the past decade as they sought to maintain tax enforcement in the face of budget cuts, by relying on automated systems to select returns for audit.

Those decisions have produced an approach that disproportionately flags tax returns with potential errors in the claiming of certain tax credits, like the earned-income tax credit, which supplements low-income workers’ incomes in an effort to alleviate poverty. Those tax returns are more often selected for audits, regardless of how much in owed taxes the agency might recover.

The result is audit rates of Black Americans that are between three and five times the rate of other taxpayers, even when comparing that group to other taxpayers who also claim the E.I.T.C.

👉🏿 https://www.nytimes.com/2023/01/31/us/politics/black-americans-irs-tax-audits.html

Black people earn less, but are taxed more. There is also a marriage penalty that works against married Black people.

👉🏿 https://podcasts.apple.com/us/podcast/planet-money/id290783428

42 notes

·

View notes

Text

ITS CALLED STEALING

By David A. Fahrenthold and Theodore Schleifer

Reporting from Washington

Dec. 12, 2024

For the third year in a row, Elon Musk’s charitable foundation did not give away enough of its money.

And it did not miss the mark by a small amount.

New tax filings show that the Musk Foundation fell $421 million short of the amount it was required to give away in 2023. Now, Mr. Musk has until the end of the year to distribute that money, or he will be required to pay a sizable penalty to the Internal Revenue Service.

Mr. Musk, in his new role as a leader of what President-elect Donald J. Trump is calling the Department of Government Efficiency, is promising to downsize and rearrange the entire federal government — including the I.R.S. But the tax records show he has struggled to meet a basic I.R.S. rule that is required of all charity leaders, no matter how small or big their foundations.

Mr. Musk's is one of the biggest. His foundation has more than $9 billion in assets, including millions of shares in Tesla, his electric vehicle company. By law, all private foundations must give away 5 percent of those assets every year. The aim is to ensure that wealthy donors like Mr. Musk use these organizations to help the public instead of simply benefiting from the tax deductions they are afforded.

Mr. Musk’s group has fallen further and further behind. In 2021, his foundation was $41 million short, then $234 million the following year. Now, the hole is deeper still.

Private foundations do have a way to solve the problem if they do not give away enough money. They can distribute more the following year as a make-good. Mr. Musk could choose to do so in 2024.

Mr. Musk did not respond to requests for comment. His foundation, which is required to make its tax filings public, provided the 2023 document to The New York Times.

The I.R.S. appears to be among Mr. Musk’s early targets as a leader of Mr. Trump’s government efficiency initiative. The tax agency serves as the federal government’s charity regulator and thus oversees Mr. Musk’s foundation.

Last month, Mr. Musk used X, his social media platform, to ask users if the I.R.S.’s budget should be increased, kept the same, decreased or “deleted.” His followers chose “deleted.”

Mr. Musk, who on Wednesday became the first person with a net worth of over $400 billion, has been an unusual philanthropist. He has been critical of the effectiveness of large charitable gifts, and his foundation maintains a minimal, plain-text website that offers very little about its overarching philosophy. That is different from some other large foundations that seek to have national or even worldwide impact by making large gifts to causes like public health, education or the arts.

The Musk Foundation’s largess primarily stays closer to home. The tax filings show that last year the group gave at least $7 million combined to charities near a launch site in South Texas used by Mr. Musk’s company SpaceX.

Other large charitable foundations have also failed to distribute the I.R.S.’s minimum required amount in recent years, sometimes by more than $100 million, according to tax filings compiled by the company CauseIQ, which analyzes charity data.

But Mr. Musk’s foundation is unusual even among those, both for the amount of its shortfall and the speed at which it is increasing. In 2022, the last year for which full data is available, the Musk Foundation had the fourth-largest gap of any private foundation in the country, according to CauseIQ data.

Mr. Musk’s charity, which he founded in 2002, has never hired paid employees, according to tax filings.

Its three directors — Mr. Musk and two people who work for his family office — all work for free. The filings show they did not spend very much time on the foundation: just two hours and six minutes per week for the past three years.

But the board’s task grew enormously in 2021 and 2022, when Mr. Musk tripled the foundation’s assets by giving it billions of dollars’ worth of Tesla stock. Tax experts said if he claimed those donations on his personal taxes in the year given, those gifts would have been very beneficial to him. Because of the deductions allowed for charitable gifts, they potentially saved Mr. Musk as much as $2 billion on his tax bills.

Because of the skyrocketing growth in assets, the three-person board had to give away hundreds of millions of dollars per year just to meet the minimum. That group entered 2023 needing to pay off the previous year’s $234 million shortfall, or they would have to pay a penalty tax of 30 percent on whatever was left over at the end of the year.

The foundation met that, giving away a total of $236 million and avoiding the penalty.

But it also had to give away another $424 million to meet its obligation for 2023. The filings show it did not come close, leaving an even bigger deficit to make up this year.

“The distributions made by the foundation are meeting the bare minimum to avoid penalties,” said Brian Mittendorf, an accounting professor at the Ohio State University who studies nonprofits. “It is clear that the organization is not in a hurry to spend its money.”

In 2023, as in other years, many of the foundation’s gifts went to organizations that were closely tied to Mr. Musk or his businesses. In 2023, for instance, he gave $25 million to a donor-advised fund, a separate charitable account over which Mr. Musk retains effective control.

Mr. Musk began donating to schools in the Brownsville, Texas, area just after his company’s reputation took a major hit: One of its rockets exploded, showering the area with twisted metal.

The foundation’s largest gift for the year — $137 million in cash and stock — went to a nonprofit called The Foundation. That charity, run by Mr. Musk’s close associates, has set up a private elementary school in Bastrop, Texas. The school is a short distance from large campuses operated by Mr. Musk’s businesses and a 110-home subdivision planned for his employees.

Dr. Mittendorf noted that Mr. Musk gave that school $102 million on Dec. 28 — days before the deadline to give away the unspent millions from the year before.

The Musk Foundation’s gifts for 2023 gave little hint of the political transformation that would follow this year, as he spent hundreds of millions of dollars to support Mr. Trump’s presidential campaign. Throughout 2023, Mr. Musk became increasingly right-wing in his public statements, especially on issues like crime and immigration.

But his foundation’s only gift with an apparent political tilt was a small one: The Musk Foundation gave $100,000 to a libertarian think tank in Utah.

https://www.nytimes.com/2024/12/12/us/politics/musk-foundation-taxes-donations.html

0 notes

Text

Canada is currently spending $90 billion on housing programs for assisted housing surpassed $6 billion in 2022 – the highest in at least 15 years – according to the office of the parliamentary budget office. Ottawa added $20 billion to the housing file last year finance minister pledged to “top up” spending in the 2023 budget, expected March 28.

Planned federal spending housing the homeless increased 240 percent last $420 million annually. Much of the assistance flows into British Columbia, which is recognized as a frontline in Canada’s housing crisis.

In B.C., the province’s 2023 budget pledged $4.3 billion for subsidized housing, equal to the entire provincial deficit, after a million funds to help non-profits buy old rental buildings. This is in addition to $428 million aimed at those “currently homeless or unstably housed” in the 2022 provincial budget.

But, the parliamentary budget office noted no standard government definition of affordable housing. And, in B.C., no one knows how many homeless there are and if the programs meant to house them are making any difference.

Questions regarding provincial government spending and accountability have led to a forensic audit of the agency. Conducted and completed last year by Ernest Young under orders from B.C. Premier and former housing minister David Eby, the potentially explosive audit has yet to be released.

B.C. currently has 70,000 subsidized housing units in 3,200 non-profit buildings number is mushrooming as billions of dollars are pumped in from taxpayers.

The big winners, however, appear to be politicians queuing for the spending announcements and registered housing charities with multimillion-dollar payrolls.

Losers include the innocent living in old hotels converted to house the homeless, where violence and others are a threat. On March 15, 2023, four federal politicians and the mayor of Surrey were on hand for the announcement of the latest B.C. homes funded by the federal government under its $4 billion Rapid Housing Initiative (RHI) “serving people experiencing or at risk of homelessness and other vulnerable people.” There are supportive housing or shelter beds under construction in Surrey, B.C.’s second-largest city.

Typical of the half-dozen RHI projects approved in Metro Vancouver since 2021, each of the 23 apartments in the latest Surrey project will cost the government $500,000 to build, plus ongoing staffing and security costs. A 2021 Surrey permanent modular social housing project for women at risk, managed by Atira Womens’ Resource Society per unit covering annual operation funding for 20 years.

In average cost for a private developer to build a 450-square-foot economy-level rental apartment in Metro Vancouver is $110,000, or $245 per square foot, according to the Altus Group construction cost guide for 2023. While developers also pay for the land, social housing sites are often offered in low-cost, long-term lease arrangements by the host municipalities or other levels of government.

Surprisingly, despite the billions in subsidies, there is no reliable data on the number of homeless people in B.C. or where or if they are finding homes.

The B.C. homeless count was held on March 8 and 9. It was in three years, but results will not be available for at least seven months, according to the Homeless Services Association of B.C., which conducted the count. This suspected homeless was asked 27 detailed questions, but their name or contact information was not among them.

That anonymity, which negates access to or the monitoring of individuals, is one of the reasons the BC Non-Profit Housing Association declined to oversee the 2023 count, as they have done in the past.

“We started to question whether sending 1,100 volunteers out to ask people deeply personal questions to come up with an anonymous data set was something we wanted to put our resources in,” association CEO Jill Atkey told Glacier Media.

Despite the lack of data, tax-exempt non-profit housing societies access government funding. A cursory investigation finds that, in 2022, just four Vancouver housing groups set up to house and support the most vulnerable – Atira Women’s Resource Society, Lookout Housing Society, PHS Community Services Society and RainCity Housing and Support Society – took in a combined $204 million from government and, all told, paid their own staff more than $151 million in wages and salaries.

A fifth, Pacific Community Resource Society, which is completing a Surrey housing-for-homeless project that was funded under the RHI in 2021, took in $30.2 million in total government funds last year, paid out $18.6 million in wages and salaries and logged nearly $30,000 per month in travel and car expenses, according to its filings with the Canada Revenue Agency.

Atkey defended the staff compensation paid by non-profit housing groups. “Providing leadership and oversight to a multimillion-dollar agency requires skill and expertise. I’m not sure where the expectation that these skills be provided at rates dramatically below market comes from an expectation that causes harm to the people providing and receiving service,” she stated in an email to Western Investor.

The cost of acquiring old hotels to convert them to house the homeless is also eye-popping, however. Last January, the City of Vancouver, using federal funds allocated through the RHI, bought the aging Days Inn hotel at 2075 Kingsway, Vancouver, paying $25 million and earmarking the same amount for renovations. The 65-room property is valued at just $4.4 million, according to the latest BC Assessment. As a permanent housing shelter, the single-room-occupancy residents, whose rents are covered by a B.C. shelter allowance, have fully staffed wrap-around supports, including daily meals and a “safe room” where people can consume hard drugs.

In March 2022, Atira paid $6 million over the assessed value for the century-old Columbia, an SRO hotel and beer parlour on the Downtown East Side. The cost-per-key was $202,000.

The far above-assessed value when it embarked on a buying spree of hotels in Vancouver and Victoria despite the hotel industry facing a distressed market due to the pandemic. The headline 2021 deal was the Patricia Hotel on troubled East Hastings Street – where a tent-city homeless encampment appears firmly entrenched paid $327,000 per door for the old hotel, which was more than three times higher than the average price of a hotel room sold in Canada in the same year, based on industry data from Colliers.

However, many homeless people we met of staying in SROs, including those managed by the government. Johnny Frias, a 55-year-old resident in the City of Vancouver in November, witnessed a fist fight in the lobby the day he said drug dealing, thefts and assaults are common.

“I don’t lock my door anymore,” Frias said, gesturing to a broken door frame in his 100-square-foot room in the former Days Inn. “They just break in anyway.”

In the past year, Vancouver police responded to 119 calls at 2075 Kingsway, but this is considered low when compared to other hotels converted to house the homeless. After BC Housing paid $500,000 per key to buy an old 110-room hotel at 1176 Granville Street to shelter former residents of an Oppenheimer Park homeless encampment in 2020, police have been called to the site 2,494 times, including 751 calls last year, according to the Vancouver Police Department.

A Vancouver homeless man, who asked not to be named because he is on the list for a BC Housing apartment, said he was sleeping in a car rather than suffering another night in a “scary” downtown SRO managed by a non-profit housing society.

0 notes

Photo

CAN’T PAY YOUR TAX DEBT IN FULL? YOUR POSSIBLE OPTIONS?

If you’re unable to pay your tax debt, it’s important that you still file on time, or ask for an extension to file. Those who cannot pay at least 90% of their tax debt by the original deadline will typically be subject to penalties.

The longer it takes you to file and pay, the more penalties you’ll accrue—but how are you supposed to pay off a bill that continues to rise? There are a few ways to avoid excessive penalties. An Advance Tax Relief expert can help you explore one of the following solutions: Pay with a credit card: If you don’t have the money to pay for your tax debt currently, you can choose to put in on a credit card. At its core, this is essentially trading one debt for another, but choosing the right credit company could help you pay less in the long run, as you can likely qualify for an interest rate that costs less than the penalties the IRS will enforce.

NEED HELP WITH AN OFFER IN COMPROMISE, TAX DEBT HELP, TAX PREPARATION, AUDIT REPRESENTATION OR STOP WAGE GARNISHMENTS?

ADVANCE TAX RELIEF LLC Call (713)300-3965 www.advancetaxrelief.com BBB A+ RATED

Offer in Compromise: If it’s apparent that you’ll never be able to pay your total tax debt, the IRS may agree to an Offer in Compromise (OIC). This solution requires the taxpayer to come up with a new balance; if the IRS agrees to this offer, the remainder of your balance (anything more than the new number you’ve agreed upon) is forgiven.

In order to qualify for an Offer in Compromise, you must continue to make payments on your debt while the IRS considers your request. If not, the OIC will be denied. You can apply for an OIC with Form 656-B, which comes with a $186 application fee (if your income is below the specified poverty level, this application fee may be waived).

You’ll also be required to detail important financial information using one of two types of Collection Information Statement: Form 433-A (for individuals) or Form 433-B (for businesses). If you’re currently married and live in a community property state, you may be required to provide detailed data on your spouse. The information flow doesn’t stop at these forms. The IRS will also take a deep look into your financial records, including vehicle registrations, bank records, pay stubs, and anything else they may deem important for their decision-making process. It’s not uncommon for taxpayers to submit stacks upon stacks of paperwork for IRS review, and you may need to dig through scores of past financial statements—not unlike preparing for an IRS audit.

The IRS uses this information in order to determine your reasonable collection potential. The offer you make must equal the net realizable value of your assets along with your excess monthly income (the amount left over after your monthly necessary expenses are subtracted from your monthly total income).

Keep in mind that what the IRS deems as a “necessary expense” could be much different than your definition. If you don’t receive approval, this paperwork gives the IRS all it needs to come after you quickly for collection after the negotiation process has ceased. It’s also important to keep in mind that interest continues to accrue during the negotiation; if your request is denied, you’ll end up owing more than you did previously. These potential consequences make it crucial for you to create and submit a realistic offer in compromise request that is likely to be approved.

There are typically three instances in which the IRS will approve an OIC request: When there is reasonable doubt that the tax debt owed is incorrect When there is doubt you could ever hope to pay off your debt in full When paying the total amount due would cause undue financial hardship

It’s difficult to get approval for an Offer in Compromise, and it’s important to work with a qualified tax professional to create a realistic solution that works for both you and the government agency. Contact the professionals at Community Tax to discover the ways we may be able to effectively submit an OIC that can settle your outstanding tax balance.

Installment Agreements: If you can’t currently pay off your tax debt in full and would like to receive more time, the IRS may approve your request for an installment agreement.

You can apply for one of these agreements with Form 9465 Installment Agreement Request, which is used to ask the IRS for a monthly payment plan that will allow you to pay off what you owe in a pre-specified amount of time. To qualify, your total tax debt must be less than $50,000, and you must be able to pay off your balance within 72 months. This is most often used when paying old tax debt but could be useful in failure-to-file situations that have caused your total balance to skyrocket due to penalties and interest. However, therein lies the stipulation: the IRS will not accept an Installment Agreement Request if you’re not up to date on all current tax filings, so submitting your tax return is the first step. While the IRS assesses your application, you must make the payments as set out in your request and you must file all taxes on time in the future; if you fail to do so, the installment agreement can be revoked and the IRS can come after you for the original tax debt owed. We have a team of dedicated experts skilled in negotiating installment agreements with the government.

We can guarantee that your tax filing status is up to date and create a plan with provisions that suit your financial needs while appeasing the IRS to help you avoid further penalties and costs.

Filing for Bankruptcy: This is typically a last-ditch effort for taxpayers in difficult financial straits and should only be considered as a last resort.

Only certain tax debts can be wiped out. If the following conditions are true of your tax debt, you may be able to discharge your debt with Chapter 7 Bankruptcy filing. Always speak to a tax professional or accountant before filing for bankruptcy. This action can have lasting ramifications and it’s important to consider all available routes before deciding on bankruptcy.

Here are some considerations to bear in mind:

It’s been 240 days: The IRS must have assessed your income tax debt 240 days before you file a petition for bankruptcy. However, this time limit can be extended if the IRS suspended collections due to installment agreements, currently uncollectible status, or Offer in Compromise filings. In some cases, you may be able to file for bankruptcy if the IRS has yet to assess your debt.

Your debt is three years old: You can only discharge tax debt through bankruptcy if your tax return was due at least three years prior.

You’ve filed your tax return: You must file a tax return for the debt you wish to discharge at least two years before filing for bankruptcy. As you can see, the penalties for filing taxes late are long-spanning and could affect your financial options for years. You didn’t commit fraud or evasion: If you filed a fraudulent return or you attempted to avoid paying your taxes, you cannot file for bankruptcy.

Your tax debt is income taxes: Any other taxes—like fraud penalties or payroll taxes—can’t be solved with bankruptcy.

If you’re unsure which of these solutions best suits your needs, contact the team of tax resolution specialists at Advance Tax Relief. We’re well versed in IRS negotiations, and can help you create a plan to settle your debt and make your necessary payments in the quickest time frame possible. If you are facing wage garnishment, call today (713)300-3965 for a free consultation!

Seeking professional help when handling back taxes can help you avoid the discussed errors. At Advance Tax Relief, we offer specialized tax resolution services to help you deal with IRS debt.

Our experts can help rectify erroneous tax bills and guide you in picking a suitable repayment program. Contact us today (713)300-3965 for back tax filing and tax relief services.

Advance Tax Relief is rated one of the best tax relief companies nationwide.

#FreshStartInitiative #OfferInCompromise #TaxPreparation #TaxAttorneys #TaxDebtRelief #TaxHelp #BestTaxReliefCompanies #TaxRelief

0 notes

Text

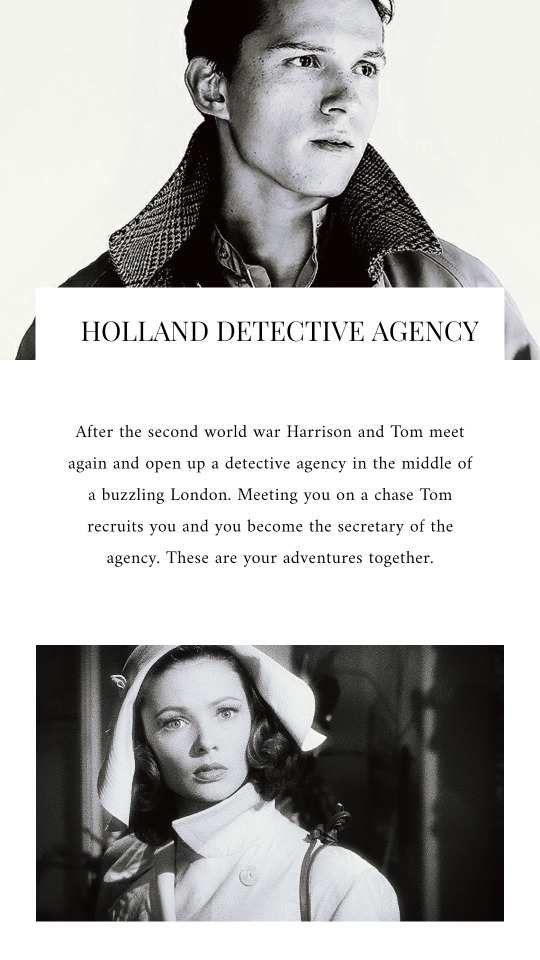

A/N: Cointens violence and mentions of injuries, war and blood. Also swearing and drinking. Smut in future parts, nothing in this.

“It seemed like a nice neighbourhood to have bad habits in.”

― Raymond Chandler, The Big Sleep

When Tom’s grandfather passes away, he inherits an office in the middle of a buzzling London. He has no idea what to do with it.

The year is 1947 and Tom is restless after the war. After a chance meeting with his old comrade Harrison and a drunken lunch at the local pub they decide to open up a detective agency. After finding you huddled up in a library while chasing an unwilling witness Tom decides to hire you as the agency’s secretary. You, reluctantly, take up the offer from the charming stranger.

Together the three of you face some of London’s most hard-boiled criminals and lethal femme fatales.

You have to navigate your way through adulthood, life after war and your growing feelings for your boss.

***

The pub was unusually crammed with people, workers meeting up with each other for a pint before heading home to their families. He could see them through the muted windows, cheering and laughing, pints of beer clutched in their hands. Now, it certainly wasn’t the nicest pub in London, a thick cover of mud covered the floor, the walls were so dirty that it was hard to tell what the original wallpaper had looked like. But then again, it was the Bugle, a pub well hidden in the Shafto Mews in London. It was not a pub you just happened to stroll in to, looking for a place to eat or a friendly place to catch up with a long-lost comrade in. It was a seedy and dirty place, where the beers came cheap and the brawls started easy.

The barman, a Mr. Eric Brew, was a brusque and quick-tempered elderly man with a beer belly so large it made it hard for him to steer his way through the many bottles and glasses behind the bar. Luckily for him it was unusual for anyone to ordered anything other than a pint or perhaps a glass of cheap and watered-down whiskey.

Tom loved this place, because no one ever bothered him here. This was not a place to talk to strangers in.

On this particular autumn afternoon the air outside was crisp and full of the smell of pavement after rain, it smelled of London. Currently though the sky was bluer than it had been all summer and the leaves on the trees had just started to change their colours. There was a distinct chill in the air. Tom shivered in his dress shirt, thinking to himself that this was sure to be the last time that year he’d get away with not wearing a jacket.

As he stepped inside, he exchanged the almost impossible fresh autumn air for a cigarette smoke fog. It was unusually busy for a Tuesday afternoon, and the sound of loud voices and clinking glasses filled the air. Tom gathered it must be payday. It was long ago that he stopped to bother about the days of the week or when pay was due. Not because of an abundance of money but for the lack of a steady job.

Walking up the bar he told Eric to pour the usual and handed him a coin. Eric grunted and started to pour into a glass that looked like it hadn’t been cleaned in months.

“Busy today, mate” Tom stated. Eric grunted again and handed him his drink.

As Tom sat down in the far, and well hidden, corner of the pub he thought to himself that his so-called conversation with the barman had been his longest conversation in days. After the war had ended, he’d stayed out in France, despite his mother’s letters begging him to come home he hadn’t. It wasn’t that he didn’t miss his family, on the contrary, being apart from them felt more torturous than anything he’d lived through during the war.

Still, he thought as he gulped down on his drink, he had been through war, and that does change a person. He wasn’t the same care-free boy who’d so gladly enlisted, desperate for some preconceived idea that the war would satisfy his deep-rooted need for adventure, to please his longing for glory. He’d happily waved his younger brothers and his parents goodbye on the platform, surrounded by sad looking boys saying farewells to their loved ones.

The war had not given him what he wanted. There had been no glory or sense of adventure. And even though the worst injury he’d suffer was a broken nose that had more to do with his own stupidity than actual fighting he had still seen the suffering of others. Walked through villages so bombed there was nothing, no human nor animal left. Nothing but ruin and corpses left to rot. He’d seen the torn apart remains of what had once been children on the street. He had had to breath trough the smell of decaying flesh as they walked by. He had lost friends and comrades.

The war had changed him, and he still wasn’t sure if it was for better or worse. All he knew was that he couldn’t face his father, or his mother. Not yet. He thought of his little brothers, how much five years must have changed them. He quietly wondered if he’d recognise them if he passed them on the streets today. He tried to convince himself that he would, and only after half a bottle of whiskey did he feel brave enough to admit it to himself that he probably wouldn’t. Too long had passed.

The only reason he had come back to England at all was for a surprise visit from a solicitor, who had tracked him down somewhere outside of Cannes, informing him of the passing of his grandfather. Tom had few memories of said grandfather What he could recall was a fearsome and stern figure, Victorian in his manner. Tom could remember looking up to the damn near giant as he looked down at Tom with disapproval written all over his face as Tom stood in front of a broken vase, he’d accidentally shattered while chasing the cat. It certainly had not been a man fond of children. Tom had always kept his distance from the man whenever they had visited, scared of the scolding the older man was more than capable of.

Therefore, it had been, to say the least, a great surprise when said grandfather had left his entire inheritance to his oldest grandson.

Sure, there hadn’t been a lot of actual money, not after all the death-duties and inheritance taxes had gone through, but he’d gotten his office and the apartment above it, placed bang on one of the busiest streets of London. What his grandfather had used the office for he had no idea, and the solicitors refused to tell him anything about is grandfathers’ dealings, but judging by the state of the place it must have been an awfully long time since anyone sat their foot in the place, probably not since before the war, the first one. The entire place was, like this very pub, filled with dirt and dust and long abandoned forgotten things. Most of which was nothing more than trash, a chair that surely would break as soon as anyone sat down on it, a desk with one broken leg and a filing cabinet full of mouldy documents.

The only distinctive feature was a rather well-made painting. Not only was the portrait of the young lady striking, but the gold frame surrounding it was solid gold. Something that had chocked Tom greatly. For he had never seen anything look quite so out of place than that gold framed picture of a young, beautiful women with seemingly shining eyes –

“Surely it can’t be – Tom Holland, OI! Tom!”

Tom instinctively looked up, only to meet the eyes of a dearly beloved friend.

“Mate! As I live and breathe!”

“Where have you been, buddy?” Harrison happily exclaimed, pulling out the chair opposite of Tom and before pretty much falling down on it, a pint of beer in hand and a massive grin on his face.

“I haven’t seen you since Monte Cassino– ” he silenced himself. Maybe because of the look in Tom’s eyes, maybe because of memories of his own.

(I haven’t seen you since the war, I haven’t seen you since we were crying in the bunkers, thinking we would die. Hoping that we would. Hoping that we wouldn’t.)

“Yeah” is all Tom can manage to get out, lungs suddenly feeling too tight.

They both take large gulps from their glasses, avoiding the others eye.

“So how you’ve been, mate?” Harrison asks, sounding more mellow now, less cheerful.

“It’s been good, bud” Tom says, trying to sound happy, trying to raise the mood a little. He can see the dark clouds of the war in Harrisons eyes, can see it clear as day even in this smoke-filled, god forsaken pub. It’s still haunting him. And he doesn’t quite know what else to say, doesn’t know how to voice the fact that he himself is hardly sleeping anymore, that he spent two years in France living as a wanderer and picking up odd jobs wherever he could find them, not even trying to pick up the pieces from the past. Not knowing where to begin

(At home, the part of him that’s braver than the rest seem to always whisper. Start at home and build from there.)

“Yeah?” There’s a note of hope in Harrison’s voice and as he looks at him the clouds in his eyes seem to clear, if only a little, and Tom’s heart breaks for his old friend. He knows that desperation, saw it all over France in the soldier's eyes. A desperate longing for proof that there was something good in the world, even after everything that had been done.

“Yes, mate! It’s been grand. I came into an inheritance and all!” And upon seeing the look of pure surprise in Harrisons now cloud-free face Tom bursts into genuine laughter, not caring to think about how long ago it had been since he had made a whole-hearted, genuine laughter.

“Alright, let’s order some food and then let’s catch up, yeah?”

And they did. The food at The Bugle was awful. Tom knew this, since coming back to London he’d drink away his consciousness in this pub and once or twice he had given in and ordered what The Bugle’s chef referred to as food. He knew this but did not care, for the company was excellent.

It turned out Harrison had come home immediately after the war. Had tried to pick up the pieces from before. He met up with his old friends (the ones that’d survived), he dated a different girl every week, unable to settle and now lived in his parent’s townhouse in Belgravia while they spent most of their time on the family estate out in Norfolk. He too was currently out of a job, however the difference was that Harrison had no need for work, the allowance his parents gave him and his own grandparents inheritance (which, although Tom never asked, but presumed) far exceeded his own.

Tom sensed that Harrison, just like himself, felt a deeply-rooted restlessness since coming home. It was in the way his left leg wouldn’t stop tapping, his regular glances around the room, in the way he just shovelled the food around his plate, not eating much.

Tom in return told him, although with far less detail than his friend had given, of staying out in France, of a surprise visit by the solicitors. He told him of the abandoned office and apartment he now was the owner of. He even told him of the portrait hanging above the broken desk.

They talked about old times, of old friends and past lovers, and every time the name of one of those comrades that didn’t make it to the end of the war was mentioned an awkward silence spread between them before the other one quickly started a new story.

(Harrison noticed that Tom never mentioned his parents, or his brothers. Not once. But he doesn’t say anything. He think they’ll get to that eventually.)

A loud crashing breaks their conversation and both Harrison and Tom are on their feet before either one of them has even registered where the sound came from.

“YOU FUCKING SWINE, I’LL GIVE YOU NOTHING!” The screeching, and surprisingly high-pitched voice, comes from Eric the barman, who’s standing arms raised above his head behind the bar. A young man, not even wearing anything to mask his face, is holding a revolver and pointing it right at Eric’s chest.

Before he’s even fully comprehended what he’s doing he’s halfway across the pub, people scattering out of his way, and out of the robbers aim. He can sense Harrison’s presence right behind him and then they’ve both tackled the young man to the ground. All Tom can think about is to get his hands on the man’s revolver, so that he can secure it. He sees how Harrison tries to get a hold of the young robbers’ arms as he’s waving them around, trying to fight them both at once. Unfortunately, he gets in a lucky swing that hits Tom right over his nose, a nose that’s already been broken once, and blood gushes out. The man looks surprised by this, partly because of the sudden stream of blood falling over him and partly because he actually just hit someone. Tom quickly uses this for his advantage and dives down for the revolver as Harrison secures the burglar’s arms behind his back.

They manage to hold him down until the police comes. They give them a quick rundown of what happened. Eric, furious and face alarmingly red, fills in when he manages to find words, shaking from fury. One of the policemen offer to drive Tom to the hospital to have his nose looked at but he refuses. Then they ask if he’d like to press charges. Tom takes one quick look at the young man now sitting in a police car and shakes his head. The boy, for on closer inspection he’s nothing more than a boy, looks terrified, and honestly, he’s already in enough trouble with the law. During the past few years crime in London has been on the rise. Young and restless men all coming home from the war, looking for jobs where there are none and haunted from memories from the battlefields. It’s no wonder there’s desperation in the air.

So, Tom and Haz walks away, leaving the two police cars and its officers, a furious pub owner with an unexpectedly high-pitched voice, and an entire pub of people with their noses pressed up against its foggy windows.

As they walk, without discussing where they’re going, Tom suddenly bursts out in laughter. He doesn’t know why, but the restlessness that’s done nothing short but haunted him for years now has suddenly vanished. There’s a pause and then Harrison joins in and Tom knows, knows that he feels the same. That this sudden rush of adrenalin was just what he needed too.

They practically double over with laughter, leaning on the other to keep upright and when they finally stop a comfortable silence fill the quiet as they walk on.

Before long, and before having reflected on where his feet are leading him, they’re standing outside of 15 Sloane street.

“Is this it?” Harrison asks, voice filled with curiosity as he looks up at the red-bricked building.

“Yeah” is all Tom manage to get out as an answer. Because suddenly he feels almost shy, like he’s showing Harrison some long kept secret. And for a moment they just stand and admire the building. “Can I look inside?” Haz asks, curiosity colouring his every word. So, Tom unlocks the door and they step inside.

Inside the air feels heavy, not like in the pub where it had been full of smoke, but instead it feels old, and if it hadn’t been so damn cold outside Tom would have opened up the windows.

The ground is as covered in mud and dust and dirt as the pubs floor. The walls look dull too. But the space is good, a large foyer to receive visitors, a guest bathroom, an office, a kitchen and a staff bathroom too.

“So” Harrison finally says, having taken in the place in silence. “What are you going to do with it?”

And Tom doesn’t know what to say because honestly – is that not just the question that’s frequently been on his mind since he first got here. “Dunno” ha answers lamely. “I suppose,” he starts but stops himself, feeling too embarrassed at his childish idea.

“What?” Haz encourages.

“Well” Tom begins, and then before he loses his gut he rambles out “It would be cool to be a detective though, wouldn’t it?” He doesn’t look at his old friend as he says this. He should though, because he misses out on the massive grin spreading across Harrison’s face.

“Oh totally!” He all but yells. “Like Sherlock Holmes, or Phillip Marlowe?”

“Phillip Marlowe, surely!” Tom responds, finally looking at his old comrade. He feels light as air, having finally put words on a wish that’s long been on his mind.

But now Haz looks awkwardly down, down on his well-polished, hand-made shoes and the muddy ground. “What?” Tom asks, worry threatening to blow his happy bubble.

“Look, you don’t have to, it’s just, like if you don’t want it or you find me lacking you could just sack me bu–“

“Of course, you’ll join me” Tom interrupts Harrisons awkward attempt at asking to work with him. “Really?” He asks, eyes gleaming with happiness. “You, ‘course mate, wouldn’t wanna do it without you”.

***

And so, it begins.

They start with trying to make the place habitable. After all, the office space needs to be a presentable enough environment for clients to feel comfortable to share their troubles with them and preferably the apartment above needs to be clean enough for Tom to live in without contracting a disease. It’s hard work, and Harrison loudly complains and gruntles and questions why they can’t hire someone to do it. Tom just laughs and tells him to shut his over-privileged mouth and keep mopping.

The truth is they could easily get someone in to do the cleaning for them, it’s just that Tom doesn’t want to, feels like they really ought to do this by hand, by themselves. To build the business from the ground up. And quite frankly, some real, good hard work is just what he needs. For the first time in ages he’s so physically exhausted by the time he goes to bed that he falls asleep as soon as his head hits the pillow. He still has nightmares, but he gets in a couple more hours sleep every night and that makes it worth it.

Even though Harrison loudly grumbles about the rough labour he is a hard worker. Tom teases him a lot about it. Telling him he didn’t expect to end up doing this when he was sent to that posh public school as a child. Telling him that this is what good honest works feels like. Informing him that the pain he had in his knees from scrubbing the floors is what heavy labour feels like. It’s all jokes thought, for even they grew up worlds apart on the social scale they still fought on the same battlefield and as children they fought the same imaginary dragons.

In the end aid comes in the form of Lady Lauren Osterfield herself.

Tall and lean and dressed from top to toe in fine silk and fur in soft colours and with hair, the same shade as her son, in soft waves. She sways into the office one day, unannounced, as Tom’s trying to scrub the dirt from the walls and Harrison’s sprawled out on the floor, fighting a particularly stubborn piece of dirt. A hard a look of deepest disapproval is written all over her face as she takes in the scene.

“Darling” she drags out the word and make the endearment sound like a loving, but stern warning. “You simply cannot do this on your own”

“But mommy we-” Harrison begin but she stops him with a raised hand. “I will hear none of it, sweetie. If there is one thing I know it’s potential, and this place has got spades of it. However, I will not see my darling boys like this” she huffs, then adds “also, the rate you two are going at you’ll be in your 50’s before you even had your first client.”

She walks over to where Tom stands, now leaning against the broken desk, hands in pockets and covered in dust and sweat. “Sweetheart, it is wonderful to see you again” And she strokes his cheek with a satin gloved hand and Tom can’t help but to lean into the touch.

He had spent many a school holiday at the Osterfield house. Although, house wasn’t the right word. Technically it was a manor house – Osterfield manor was in fact its name. It had been built by Lord Ashley Osterfield in the early 1600th and had stood proudly on its green fields ever since. Tom had lived in the village, in a small cottage with his mother, father, three brothers and a half-blind cook/nanny named Cully. Harrison, since it was the family tradition, had been sent away to Eton whereas Tom had gone to the village school. But whenever summer holiday rolled around, they’d play on the grounds to the manor and in the forest surrounding it. They had played thief’s and robbers, Robin Hood and Peter Pan. Life had been blissful and full of light. He can still remember how the last month before summer break had seemed endless, how he’d counted down the days until his best friend would return, staring out of the window during class, not listening to whatever Ms Frank was going on about. They sent each other letters of course. About what was going on at home, what tricks each had played on their friends, or on their teachers, how awful school was or about the latest mystery novel they’d read.

His memories of the Osterfield family were many and fond. Lady Osterfield, with her loving but stern ways, never looking anything less than perfection, bringing them meringues and freshly made lemonade to the treehouse where they sat people-watching, spying on the garden parties going on below. Memories of Lord Osterfield, reading his newspaper outside in the warm summer sun, dressed in linen suits and with a great moustache covering his upper lip, teaching Tom tennis and playing croquet with them. And then little Charlotte Osterfield, Harrisons little sister. With her long, blonde hair neatly combed and braided, always carrying around a teddy bear, following them wherever they went. Harrison would get rather annoyed with her for that, but Tom had always said that she could join them if she wanted to.

He remembers Christmas eve at their house. A ginormous three in the hall, neatly decorated by Lady Osterfield herself. Countless of cousins and great-aunts and uncles coming over. The staff running around cleaning every corner. The chef, Mary her name had been, yelling orders and shouting herself blue in the face. The end result had been incredible though, and as snow covered the entire manor and its grounds there was a fire lit in every room, the smell of ham and turkey in the air, glitter and light and mistletoe and presents in overload. He remembers still, being sent home in the horse driven carriage on Christmas eve, belly full of delicious food and sweets, and presents from Lord and Lady Osterfield to every member of his family, including one to Cully, surrounding him as he watched the snow fall over the pretty little village outside the carriage window.

“Hello, Lady Osterfield, it’s been a while” he manages to get out. Because this is, has always been, his second mother. And it hurts even more to see her now, despite the fact that war doesn’t seem to have aged her a day. But seeing her reminds him so much of his own mommy, and his stomach seems to revolt.

“That” she says, and he thinks her eyes are wet with unshed tears “it certainly has been”. She doesn’t ask how his war had been, why he hadn’t return sooner, or sent them letters. Probably understands that he cannot give her those answers. Not yet at least. She lowers her hand and take a step back.

“So” she announces and there’s a level of authority to her voice that makes both Harrison and Tom stand up straighter. “I will send Georgina over, hopefully she can start tomorrow already, because this really is urgent”. She looks around her surrounding, the broken furniture, the floors and ceiling that refuse to give up the dirt they’ve been holding onto for years, despite Tom and Harrisons desperate scrubbing.

“Sorry? Mommy, who.... who on earth is Georgina?”

Tom smiles, for he can almost hear the curse word Harrison so nearly lets out.

“Oh darling, it’s Georgina Brewster, she is simply marvellous and really the only one who can save this place. I shall call on her immediately, she will work wonders, just you see”.

*

Georgina Brewster, as it turns out, would have put fear of the devil into any and every one of the generals Tom had met during the war. She practically comes in as a steamroller into the office the very next day and before either Tom or Harrison know what’s going on they’ve been thrown out of their office with strict orders to “keep out of the way, for gods sake, and don’t come back until next Friday at least!”

And because neither Tom nor Harrison dare to contradict her, even though Tom’s apartment is above the office and he now has nowhere to sleep, they listen and keep out of her way, spending their time at Harrisons, or rather Harrisons parents, place in Belgravia.

There they plan out and strategize, trying to agree on what exactly their business should be and how they should conduct it.

Their first hurdle is the name of the agency.

“So”

They’re at ‘The Bugle’ again and Tom is swirling the liquid in his glass back and forth, holding a lit cigarette in his other hand. Around them the air is filled with smoke and conversations. Tom had, rather cheekily, asked the barman if they shouldn’t get their drinks for free, seeing as they did save his ass just the other night. The barman had done his usual ritual of mumbles and grumbles before pouring them some watered down Irish whiskey.

“So?” he asks, implying that Harrison should continue his unfinished statement.

“What should we name it, mate?” Harrison is leaning back against the wall, his long legs sprawled out. He looks as exhausted as Tom feels.

“Name what?” Tom dumbly inquires, only half his mind on the conversation, the other on the gorgeous woman at the bar. She looks strangely out of place, wearing a respectably coat, dark hair neatly organised in curls and a soft smile on face as she’s conversation with the infamously grumpy barman, who – and Tom can hardly believe his eyes – is smiling back at her.

Harrison snorts and with a voice practically dripping in sarcasm he answers “Oh the golden retriever puppy we’re adopting! The fuck you think, mate? The detective agency of course!”

Tom gives his friend a kick on his sprawled-out legs.

“Holland Detective Services” he then states.

Harrison goes quiet for a second, rubbing the aching spot on his leg where Tom managed to get in a perfect hit, the bastard had always been good and noting soft spots. “Not Holland & Osterfield?” he asks, only half joking.

“Nah, too posh mate, we’ll sound like some solicitors’ firm, you know, like ‘Bundle & Alfredson & Alfredson & Bundle”, too ridiculous. Plus, no one trusts solicitors with their secrets, they’re too posh and proper. We need people to feel like they can come to us with things they can’t go to the police with.”

He looks over to the bar again, but the beatiful lady is nowhere to be seen.

*

And so, Harrison Detective Service is founded. The office (the apartment miss Brewster luckily left him handle himself) is revealed to them.

It’s perfect. There’s no other word for it. It’s looks professional but not over styled. The two large desks made from oak, the bar table with its whiskey decanter, the filing cabinets strategely placed in the little backroom, the lamps giving the office an almost golden and mysterious lightning, and on the wall hanging above his own desk, the painting of the woman that his grandfather left him. The only thing remaining from the original office.

*

It doesn’t take long until their first client arrives. He’s a perhaps not the ideal client, Tom notes. The man is in his late 50’s, wearing an ill fitted suit and smelling distinctly of B.O. He is however willing to pay.

Thus, this is how Tom ends up chasing a, to say the least, unwilling witness all down Euston Road. The man he’s chasing is fast, and Tom’s side is hurting and he feels out of form. He really should have had something other than whiskey for lunch. The man does a quick turn left, right over the road and Tom’s right at his heel.

A car horn blows and there’s a blinding light and for a moment Tom’s back on the battlefield in France, he throws up his arms, trying to shield himself for whatever is coming at him. His entire body tenses up and he waits for the inventible crash. But it doesn’t come, and there’s shouting but he can’t hear what they’re saying, the blood rushing through his head too loud for anything else to sound real. His lungs feel too tight and his breaths are shallow.

Slowly he regains control of himself, as he tries to take the world around him in.

The shouting is coming from a very angry driver, half hanging out of his window telling Tom to get out of the way, waving his arms in fuming gestures. People on the pavement have stopped what they’re doing, some mid conversation or mid walk, all just staring at him. He jumps into action again, desperately trying to push down the part of his brain that’s still in France. He can’t see his witness, but there’s only one place he really can have gone.

He runs up the marble stairs, ignoring the glaring stares around him.

The foyer is impressive to say the least. It’s a large circular room, marble from floor to ceiling. Right in front of him, but all across the room, is a reception and an elderly woman sitting behind it.

“Excuse me sir, we close in twenty minutes,” she calls after him, but it’s all she manages to get out before he’s gone, having made his way all across the hall and into the large oak doors with a sign simply stating ‘Main Library’.

The doors slam behind him and the sound eco in the silence. At first he’s taken aback, for this is nothing like the marble mausoleum he’s left behind, and if he thought the reception area had been large then this room is massive. It’s nothing short of a labyrinth of oak bookshelves, reaching from top to ceiling and filled with large volumes of books that look as if they must be older than queen Victoria.

He can only assume that this is where his witness is hiding, somewhere in this maze he has taken cover, wrongly assuming that Tom will just give up and leave. His witness is in no such luck. Tom does however remember noting the lineament of a revolver inside the other man’s jacket, and by now he’s had more than enough time to take it out, perhaps just waiting for Tom to be close enough not to miss.

The library looks empty and surely it must be this late. On slow but quiet feet he makes his way to the left side of the room, deciding to start there. Careful not to make a sound he removes his own revolver from its holster. Slowly he starts to make his way down the aisles, every time he turns a corner he knows it’s about whoever is the quickest with their trigger that will win.

By the time he’s made it down aisle three he can feel his heart beat so hard in his chest he finds himself wondering if it’s going to leave a bruise on his skin with its violent beating. Adrenaline has been running in his veins since the near contact with the automobile outside.

And then he hears it, a sound, what might be the noise of shuffling, and he starts to move with even higher awareness of the danger of the situation. Any second now he could stare down the barrel of a gun.

Before he can be a coward about it, he jumps around the corner of the shelf, gun in hand and pointing it straight at the witness.

Except it’s not him.

It most certainly is not him.

A pair of enormous and breathtakingly beautiful - but also terrified - eyes stare at him and for a second the whole world seems to stop, or crash, and Tom can’t help but feel like he’s a planet that completely unexpectedly has gotten knocked of its axis. He goes still, not just his body but his mind too. Everything just seems to stop, and Tom can not remember anytime that has ever happened to him before. All he sees is a pair of hauntingly beautiful, and vert familiar, eyes.

“I’m sorry sir, but weapons are not allowed inside the library.” Her voice is soft and even, but Tom can hear the slight tremble behind them, he can tell she’s playing braver than she feels. He knows that trick all too well. So, he lowers his revolver, but doesn’t unload it, still ready for his hostile witness to pop up, and if he does Tom will be ready for him.

“I beg your pardon, miss” he says and looks her up and down, trying to take in the rest of the woman in front of him. He’s pretty sure she is the same woman he saw at the Bugle the other night. She’s only a few centimetres shorter than he is, but then she’s wearing a pair of kitten heels. Her black pencil skirt and white blouse practically scream out respectability and woman. Around her neck hangs a thin, golden necklace with a little golden heart attached to it. A fleeting question of who has given her this pass his brain. And then there’s her hair, brown and styled in and fashionable curls.

“Sir” she says, and she sounds sterner now, a little wrinkle between her eyebrows “could you please pu-“ but before she can finish the sentence, before she can even finish her though Tom’s pushed her down on the ground, trying to cover her with his body as bullets fly around him. He swears under his breath, and he feels the librarians still body under him and he can practically feel her heartbeat. He tries very hard not to react to how close their bodies are to each other. His hyper focused mind hears her hitched breathing even above the sound of a firing gun and he sends a silence prayer to whatever god might be listening that she’ll get out of this unharmed.

The witness is far away from them, all across the hall and if it wasn’t for the fact that he didn’t want to leave this woman unprotected he would just hope for the best and rush against him, firing as many bullets as he had and if he survived this, and if Harrison found out he would just have to take his scolding later. Still trying to cover the women underneath him he raises his gun and fires. He knows the chances of him aiming right are damn near zero from here, but he wants to make it clear to the other man that he sure is not going to give in without a fight.

Still keeping his eyes on the bookshelf the witness has hidden behind he whispers to the librarian, “when I move off you, go hide behind the bookshelf, do not run for the main entrance whatever you do, but if there’s another way out, and you get a chance to leave, I suggest you fucking take it miss”. He hears a hiss of breath and then, a quiet “alright” and that is all he needs.

Springing to his feet he rushes seven meters ahead and then throws himself down behind another bookshelf. Daring to cast a look behind him he just about manages to see the secretary hide behind another bookshelf. Good, he thinks to himself, at least he doesn’t have to worry about her. And so he sprints out from the bookshelf and runs for all his might straight against the bookshelf the witness is hiding behind. It doesn’t fall, but he can hear countless of books falling, hopefully all over the man with the gun. He hears a shout of surprise and despite the situation he can’t help but smiling, the all too familiar rush of adrenalin runs through him and he jumps around the corner. However, before he can even raise his weapon something hard hits his temple and the world goes white for a moment as he stumbles over.

The other man is above him, throwing punches, hitting different places of Tom’s face with every hit. Tom tries kicking and luckily enough the stupid idiot above him has mounted him at chest level and haven’t taken his legs in consideration. One of Tom’s kicks hits the shelf and as he grabs the man's arms with his, stopping the flow of punches he sees a thick book (Dostoevsky’s The Idiot, he notices with glee) fall down and hit the man straight on the head. This time it’s his turn to stumble and Tom shake him off him with ease, but the other man quickly recovers, and lunches over him again, arms stretched out to grasp around his throat. Before he can even try to fight the bigger man off him, the loud sound of the shot of a gun echoes against the walls of the library and he stills. Then he feels it. A bright burning in his side and then, another shot.

He manages to turn around trying to make sense of the situation. On the floor lays the hostile witness, clutching his leg, where he’s clearly just been shot, and above him stands the librarian. Arms shaking as she’s clasping the gun in her hands.

For a moment Tom forgets about everything else. The mess they’ve made. The fact the police must be on their way. The bleeding man beside him. The fact that he’s bleeding too. All he sees is he terrified but impossibly brave woman in front of him.

Slowly, trying to ignore the pain in the side of his stomach, he gets up and walks over to her, arms stretched up in a gesture to show that he means her no harm, for she looks terrified to the point where she’s trembling all over. Her eyes are still fixed on the man on the ground, who’s shouting in agony.

“Look at me” he says, and his voice is firm and calm “Hey, miss, look at me”. She does, and something in his stomach churns. Once in the woods he and Harrison had all but stumbled over an injured deer, it had had the same look upon its face then as the woman had upon hers now. But he doesn’t flinch, don’t want her to lose focus but keep it on him and not the bleeding bastard on the floor.

When he finally reaches her, he takes the gun from her still clasped hands, unloads it, and put it in its folder by his chest.

“You’ll be alright, yeah? I promise you’ll be alright” he tries to reassure her but she keeps looking at him with that utterly terrified look on her face.

“Just hang on for a second, alright?” He doesn’t want take his eyes off of her, but he knows he has to, so he turns away from her and walks over to the injured man. Leaning down over him he whispers in his ear “mate, the police and probably the ambulance are on their way. They will be here any moment. Now, listen up, alright, ‘cause I’m only saying this once. You will be a fucking gentleman about this and when the police ask what happened here you’ll tell them it was some randy bugger trying to nick your stuff, yeah? You defended yourself, ‘cause you’re a lad and all that bullocks. They won’t believe you, but they can’t prove anything else.” His voice is low and threatening and he knows he has the witness full attention. “And in return” he continues “in return, I’ll stop hunting you over this Faulcon business, yeah? I’ll go after someone else, and when I finally have enough to turn that bastard over to the police, your name won’t be mentioned anywhere, yeah?” The man looks up at him with bloodshot eyes and nods.

Moving away from him he swiftly walks over to where the other mans’ revolver got lost in the fight and he takes it, places it in the inside pocket of his jacket. Then he walks over to the librarian, who, apart from her shaking hands has not moved a muscle. She’s staring at him, but not at his face this time, but eyes fixed on the wound at his right side. It’s pretty much only graced him. It still hurts though, and a bloodstain is growing ever larger and larger, staining his white button ups to the point where he doubts he’ll ever get the red out.

“Miss, look at me, yeah?” He tried to get eye-contact with her again, because even if she’s been incredible brave so far, she looks as if she’s about to pass out “Just focus on me, I’ve got to get us out of here thought, do you know any other way then the main entrance? Some back door?”

As he’s talking he buttons up the suit jacket, effectively hiding the wound. He sees her eyes flicker down for a brief second as he does so. Then, as if she suddenly wakes up she takes a breath so deep he can’t help but to wonder if her lungs had been empty. “Yes” she then says, and he feels the immense relief over the fact that her voice sounds clear and controlled again. “It leads straight out into a back alley and then out on Gordon Street.”

He stares at her, taking her in again. Her dark hair still in perfect curls framing her, perhaps somewhat paler, face. Her back is straight, her hands still somewhat shaking. He notices her red fingertips, and no gold ring to be seen. At least he doesn’t have to deal with some unknown husband, who probably wouldn’t be too happy with him if he’d heard what Tom dragged her into.

“What’s your name?” he asks, because he has to know.

“Laura” she breath out.

Just a first name then.

“Well Laura” he says “let’s leave”.

He takes one of her shaking hands in his, and she leads the way out of the chaotic scene, leaving behind them a massive hall and a labyrinth of bookshelves and in that labyrinth an injured man slowly losing consciousness.

***

A/N - Harrisons family is of course entirely fictionalised. As is everyone in this story.

Also, my sort of face claim for Laura in this story is Gene Tierney, but imagine it as whoever you like.

#tom holland#tom holland headcanon#tom holland imagine#tom holland x reader#tom holland fanfiction#tom holland x y/n#tom holland x oc#tom holland au#tom holland x you

41 notes

·

View notes

Text

6 Surprising Reasons Why You Keep Getting Denied for a Small Business Loan

If you have okay credit and you are still having trouble getting a business loan, you are probably very confused. You may be wondering why you are being denied for a small business loan.

Lenders do not necessarily have to tell you, and it may not have anything to do with your credit score. On the other hand, it may have everything to do with your credit score—just not the one you think.

Strong fundability vital to business loan approval

Fundability is a business’s current ability to get financing. Sounds easy enough, right? Here’s the thing: there are over 100 factors that affect the fundability of your business. Some of them are obvious and easy to fix; others are not so obvious and can be very difficult to fix.

Fundability is like a giant puzzle, but some of the pieces are larger than others. If your larger pieces are in place, the smaller pieces will not matter so much when it comes to the big picture. However, if you are having trouble with your larger pieces, those smaller pieces can make all the difference when it comes to loan approval.

So, the moral of the story is that all the pieces count, and you need to do all you can to make sure each piece is in place. Why are you being denied for a small business loan? Maybe one of these fundability issues is causing problems.

6 possible reasons you’ve been denied for a small business loan

1. You do not have a fundable foundation

The foundation of your business refers to how your business is set up. If it is not set up to be fundable, lenders will deny you every time. Your business has to be set up to appear to be a fundable entity separate from you, the owner. If you do this from the beginning, it’s faster and easier, but it’s never too late to do it.

The fundable foundation is like a puzzle within a puzzle; it’s a big piece of fundability made up of a lot of smaller pieces. What does a fundable foundation consist of?

The first step in setting up a fundable foundation is to ensure your business has its own phone number and address. The address needs to be a physical address where you can receive mail—a P.O. box or UPS box will not work. You also need a business phone number listed in the 411 directory.

Employer Identification Number

The next thing you need to do is get an Employer Identification Number (EIN) for your business. This is an identifying number for your business that works similar to how your Social Security number works for you personally.

Sole proprietorships and partnerships often just use their SSN. This, however, looks unprofessional to lenders, and it can cause problems when you are trying to establish and build a business credit profile that is separate from your personal credit profile.

Incorporate

Incorporating your business as an LLC, S corporation, or C corporation is important. It doesn’t guarantee approval, nor does not incorporating guarantee denial.

However, it lends to the legitimacy of your business in the eyes of lenders, not to mention that it also offers some protection from liability. Be sure to discuss with your attorney or tax professional which option will work best for your business.

Business bank account

A separate, dedicated business bank account is important. Many lenders require it, and it helps with the general operations in a number of ways. You cannot get a merchant account to accept credit card payments without a business bank account, and it also aids in keeping business expenses separate from personal for tax purposes.

Other elements of a fundable foundation include:

Licenses. Make sure you have all the licenses you need to operate legally.

Website. A professional business website is important. Yes, lenders may look. It should be hosted on a paid platform.

Business email address. It should have the same URL as your business website. Do not use free email like Gmail or Yahoo.

2. You don’t have an established business credit report, or you have a bad one

Did you know your business could have its own business credit report? Most business owners realize this, but what they do not realize is that it is vastly different from personal credit, right down to how you get it.

It does not happen on its own; you have to intentionally work to establish and build a business credit profile. The great part is, having a fundable foundation is the first step.

A business credit report is much like your consumer credit report. It details the credit history of your business. It is a tool that lenders can use to help determine the creditworthiness of your business.

Other areas that can affect your credit score:

“Secret” business data agencies

In addition to the agencies that directly calculate and issue credit reports, there are other business data agencies that can affect those reports indirectly: LexisNexis and the Small Business Finance Exchange are two examples of this. They gather data from a variety of sources, including public records.

As a result, they have access to information you probably do not realize could affect your ability to get a business loan.

For example, data relating to automobile accidents and liens is out there for lenders to see. You cannot access or change the data these agencies have on your business, but you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

Identification numbers

There are other identification numbers that you need in addition to an EIN. Each business credit reporting agency (CRA) has a number that it uses to identify your business.

However, typically you are assigned a number. One notable exception to this is the D-U-N-S number used by Dun & Bradstreet. As it is the largest and most commonly used CRA, you definitely need this number.

Business credit history

In addition to your business credit score, lenders will look at your business credit history. They want to know:

How many accounts are reporting payments?

How long have you had each account?

What type of accounts are they?

How much credit are you using on each account versus how much is available?

Are you making your payments on these accounts consistently on time?

The more accounts you have reporting on-time payments, the stronger your credit score will be.

Business information

Consistency is of utmost importance as well. Be absolutely certain that your business name and address are listed exactly the same everywhere. If you spell out “street” one time and use “ST” another time, it could be a problem; if you use an ampersand in your business name on one document and the word “and” on another, that could also be an issue. Little details can cause big problems with lenders, and can result in you being denied for a small business loan.

3. There is an issue with financial statements

Obviously, both your personal and business tax returns need to be in order if someone is going to lend you money. But there is more to this than just tax returns:

Business financials

If you can, have an accounting professional prepare regular financial statements for your business. This is much better than simply printing reports from your accounting system.

Having an accountant’s name on your financial statements lends to their reliability. Monthly or quarterly are great, but at least have professional statements prepared annually so they are ready whenever you need to apply for a loan.

Personal financials

Typically, lenders will ask for personal tax returns from the past three years. It is best if a tax professional prepares them, but obviously if the years are already passed and that isn’t the case, you use what you have.

This is the bare minimum you will need. Lenders may ask for a number of other documents, such as check stubs and bank statements, among other things.

4. Other bureaus have information on you or your business that looks bad to lenders

An example of another bureau having negative information on you is ChexSystems, a consumer reporting agency which provides information on closed checking and savings accounts.

ChexSystems also keeps up with bad check activity that will make a difference when it comes to your bank score. Too many bad checks can keep you from being able to open a bank account in the banks of camp hill pa, and that will definitely look bad to lenders.

Pretty much everything else is also fair game. Have you ever been convicted of a crime? Do you have a bankruptcy or short sell on your record? Are there any UCC filings or liens? All of this can and will play into the fundability of your business and may result in your being denied for a small business loan.

5. You have bad personal credit

Your personal credit score from Experian, Equifax, and TransUnion can all affect the fundability of your business as well. The No. 1 way to get a strong personal credit score or improve a weak one is to make payments consistently on time. Be certain you monitor your personal credit regularly to ensure mistakes are corrected and that there are no fraudulent accounts being reported.

6. You botched the application process

Yep, even the application process can be an issue. First, consider the timing. Is your business fundable right now? If not, this may not be the best time to apply for a loan with a traditional lender. Try another funding option, like an alternative lender, while you work on fundability.

Next, make sure that your business name, business address, and ownership status are all verifiable—lenders will check.

Lastly, choose the right lending product for your business and your needs. Is a traditional loan or a line of credit better for you? Would a working capital loan or expansion loan work best? Choosing the right product to apply makes a difference.

1 note

·

View note

Text

What To Ask The IRS Tax Lawyer Los Angeles Before Hiring Them

The IRS Tax Lawyer Los Angeles is a crucial part of your team, and before you hire them you should ask them for a list of their qualifications. You should also inquire as to the reasons why they are leaving their current employer or if they have any issues.

youtube

For example, if you get your taxes done at a local firm and find they have no IRS tax expertise, there’s probably not much you can do about it. IRS Tax Lawyer Los Angeles is here to help. You would have to seek help elsewhere.

However, if you do get help from a tax law expert, ask for an IRS Tax Lawyer Los Angeles who specializes in handling the complexities of the U.S. tax code. They can review your taxes and help you find the right solution.

Learn More Ways To Improve Your Finance

This kind of assistance is invaluable, as it gives you the peace of mind you need when filing your taxes. Consult with IRS Tax Lawyer Los Angeles Today. They will analyze your situation and advise you on how to maximize your deductions while minimizing your tax liability.

In the past, there was a clear difference between a tax lawyer who was a "tax specialist" and a tax attorney. But not so much anymore. For more information, contact IRS Tax Lawyer Los Angeles. There are now tax specialists that specialize in specific areas like construction or mergers and acquisitions. While tax lawyers who are known as "tax attorneys" are now being used to handle all facets of taxation.

The IRS Tax Lawyer Los Angeles needs to possess some level of specialization in the area of taxation. This is important because many individuals do not know all of the tax provisions and laws so having a tax specialist is a must.

More importantly, you should know the types of problems that you may face as a business owner. Reach out to IRS Tax Lawyer Los Angeles for more info. A tax lawyer who is experienced in your industry can determine what the challenges are and which laws you can take advantage of.

Ask Your IRS Tax Lawyer Los Angeles for qualifications