#gst filing details

Explore tagged Tumblr posts

Text

With the continuous evolution of the GST framework, staying updated on the latest amendments is crucial for your business’s financial health. These recent changes in the GST return filing process have introduced new requirements that could impact your compliance status. In this article, we break down how the latest GST amendments affect your business compliance and offer insights into navigating these updates. w the Latest GST Amendments Affect Your Business Compliance

Key Impacts of GST Amendments on Your Business

Revised GST Return Filing Process The GST return filing process has undergone significant changes with the latest amendments. Businesses are now required to follow updated formats and deadlines to ensure timely and accurate submissions. Understanding these changes will help streamline your filing process and reduce the risk of non-compliance.

Updated GST Return Filing Rules The new GST return filing rules introduce adjustments to filing thresholds and requirements. These rules demand more detailed disclosures and timely updates, ensuring greater transparency. Adhering to these updated rules is essential for maintaining compliance and avoiding penalties.

Detailed GST Filing Details Recent amendments have brought more detailed GST filing details into play. Businesses must now provide comprehensive information in their returns, including precise transaction records and adjustments. Familiarizing yourself with these details will help ensure complete and accurate filings.

Ensuring GST Return Compliance GST return compliance has become more stringent with the latest changes. Enhanced scrutiny and stricter compliance measures mean businesses need to be more vigilant. Regular reviews and adherence to updated guidelines are crucial for avoiding issues and maintaining compliance.

How to File GST Return Under New Regulations Knowing how to file GST return under the new regulations is essential for smooth compliance. The latest amendments involve changes in filing procedures and electronic submissions. By following the revised guidelines, you can ensure accurate and timely GST return filings.

Tips for Adapting to GST Amendments

Stay Informed: Keep up-to-date with the latest GST notifications and consult with experts to understand the amendments.

Update Your Systems: Adjust your accounting systems to align with the new filing requirements and formats.

Seek Professional Assistance: Engage with a GST consultant for tailored advice and support in navigating complex compliance issues.

Conclusion

The latest GST amendments bring important changes that affect your business compliance. By understanding the revised GST return filing process, following updated GST return filing rules, and familiarizing yourself with the new GST filing details, you can ensure effective GST return compliance. For more guidance on how to file GST return under the new rules, consider consulting with GST professionals or utilizing official resources.

0 notes

Text

Goods and Service Tax Login (GST)

In today’s digital age, managing tax responsibilities has become easier and more streamlined thanks to online portals. One such portal is the Goods and Service Tax (GST) portal, which plays a crucial role in the taxation process in India. If you’re new to GST or simply looking to get a better handle on how to log in and manage your GST account, this guide will walk you through everything you need to know.

What is Goods and Service Tax (GST)?

https://paisainvests.com/wp-content/uploads/2024/07/Screenshot-2024-07-26-132454.webp

Overview of GST

Goods and Service Tax (GST) is a comprehensive tax levied on the supply of goods and services, right from the manufacturer to the consumer. It is designed to replace multiple indirect taxes previously levied by the central and state governments. By merging these taxes into one, GST aims to simplify the taxation process, making it more transparent and easier to manage.

Importance of GST in India

GST has significantly impacted the Indian economy by creating a unified tax structure. This change reduces the cascading effect of taxes and promotes seamless trade across state borders. For businesses, it means less paperwork and more efficient tax compliance, while consumers benefit from reduced tax burdens on goods and services.

Why You Need to Log in to GST Portal

Benefits of Logging in to the GST Portal

Logging in to the GST portal provides several advantages. It allows you to file GST returns, track your tax payments, view your tax credit, and manage your account details. Essentially, it is your gateway to all GST-related activities.

Common Tasks Performed via GST Portal

When logged in, users can perform a variety of tasks, including:

Filing GST Returns: Submit your monthly or quarterly tax returns.

Tracking Payments: Monitor your tax payments and credits.

Updating Profile Information: Modify your business details as required.

Generating GST Reports: Obtain detailed reports for your records.

How to Access the GST Portal

GST Portal URL and Accessibility

To access the GST portal, navigate to www.gst.gov.in. This official website is the gateway to all GST-related services and resources.

Navigating the GST Portal Home Page

Once on the GST portal home page, you’ll find various options such as login, registration, and help resources. The user-friendly interface makes it easy to find the information you need.

System Requirements for GST Portal

Browser Compatibility

For optimal performance, the GST portal is compatible with modern browsers such as Google Chrome, Mozilla Firefox, and Microsoft Edge. Ensure that your browser is updated to the latest version to avoid compatibility issues.

Technical Specifications

Make sure your system meets the following requirements:

Operating System: Windows 7 or later, macOS 10.0 or later.

Browser: Latest versions of Chrome, Firefox, or Edge.

Internet Connection: Stable and reliable connection.

Step-by-Step Guide to GST Login

Creating Your GST Login Credentials

Registration Process

To create login credentials, you first need to register on the GST portal. Provide the required details such as your PAN, email ID, and mobile number. Once registered, you’ll receive a confirmation email with a link to set up your credentials.

Setting Up Your Username and Password

Follow the instructions in the confirmation email to create a username and password. Ensure that your password is strong, combining letters, numbers, and special characters for better security.

Logging in to GST Portal

Enter Your Credentials

On the GST portal login page, enter your username and password. Click on the “Login” button to access your account.

Troubleshooting Login Issues

If you encounter login issues, check if you’ve entered the correct username and password. If you’ve forgotten your password, use the “Forgot Password” option to reset it. Ensure that your browser is not blocking any cookies or scripts required by the portal.

Managing Your GST Account

Dashboard Overview

The dashboard provides a comprehensive view of your GST account. From here, you can navigate to various sections such as return filing, payment tracking, and profile management.

Updating Your Profile Information

It’s important to keep your profile information up-to-date. Navigate to the profile section and update details like your business address, contact information, and bank details as needed.

Security Tips for GST Portal

Protecting Your Login Credentials

Always ensure that your login credentials are kept confidential. Avoid sharing your username and password with others. Use a password manager to securely store your credentials.

Recognising Phishing Scams

Be cautious of phishing scams that attempt to steal your login information. Ensure that you only access the GST portal through the official website and avoid clicking on suspicious links or emails.

Conclusion

Navigating the GST portal and managing your tax-related activities can seem daunting at first, but with the right information and guidance, it becomes much easier. By following the steps outlined above, you can efficiently log in, manage your GST account, and ensure that you stay on top of your tax responsibilities. Remember to keep your login credentials secure and be aware of potential scams. For any additional help, the GST support team is always there to assist you.

By Paisainvests.com

#Goods and Services Tax login#GST account access#GST account management#GST account setup#GST compliance#GST e-filing#GST login#GST login details#GST login guide#GST login process#GST login steps#GST management#GST online access#GST portal access#GST portal login#GST registration

0 notes

Text

Trusted Income Tax Advisors Delhi – Expert Tax Support for Individuals & Businesses

Professional Income Tax Advisors Delhi – Tailored Solutions for Your Tax Needs

Managing taxes can be a complicated and time-consuming task, especially with India’s ever-evolving tax laws. That’s where Income Tax advisors Delhi play a crucial role. These professionals offer personalized tax services that help individuals and businesses meet their obligations while optimizing their tax liabilities. From return filing to strategic planning, a skilled advisor ensures compliance and peace of mind.

Benefits of Hiring Income Tax Advisors Delhi

Delhi is a major commercial center with diverse taxpayers including salaried employees, entrepreneurs, startups, and multinational companies. With so many financial variables and changing laws, managing taxes alone can lead to costly mistakes. Here’s how professional Income Tax advisors in Delhi can assist:

Expert Guidance: Up-to-date knowledge of Indian tax laws ensures accurate and lawful practices.

Timely Filing: Advisors help avoid penalties by ensuring your returns are filed correctly and on time.

Tax Optimization: Reduce your tax outgo legally through strategic exemptions and deductions.

Support During Scrutiny: If you’re ever under assessment, a tax advisor can represent and defend you effectively.

Services Offered by Income Tax Advisors Delhi

These experts offer a broad array of tax-related services that are tailored to the unique needs of each client. Their offerings typically include:

1. Income Tax Return Filing

Correct and timely filing is crucial. Whether you’re an individual, freelancer, or business owner, advisors prepare and file your returns with complete accuracy.

2. Tax Planning and Savings

They help you plan your finances in a way that reduces tax liability without compromising compliance. This includes investment advice and optimizing deductions.

3. Representation Before Tax Authorities

In case of notices, assessments, or audits, your advisor can appear on your behalf and handle the process professionally.

4. Corporate Tax Advisory

Businesses benefit from detailed corporate tax planning, TDS management, and GST compliance assistance.

5. NRI Tax Services

Non-resident Indians (NRIs) receive guidance on income tax filing, capital gains tax, property-related taxes, and DTAA benefits.

Choosing the Right Income Tax Advisors Delhi

Selecting the right advisor can make a significant difference in your financial health. Here are a few factors to consider:

Experience: Opt for advisors with a proven track record and in-depth knowledge of both individual and corporate taxation.

Client Reviews: Look for testimonials and references that reflect consistent service quality.

Service Range: Ensure the advisor offers comprehensive tax and financial advisory services.

Transparent Pricing: Avoid hidden charges by choosing a consultant who provides upfront and fair pricing.

Final Thoughts

Working with experienced Income Tax advisors Delhi can help you stay on top of your financial responsibilities without stress. Their services not only ensure that you stay compliant with the law but also help you make smarter financial decisions. Whether it’s tax season or a year-round strategy, having a dedicated tax expert is a worthwhile investment for both peace of mind and financial well-being.

2 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Do non-profit organizations pay GST?

Goods and Services Tax (GST) is a comprehensive tax levied on the supply of goods and services in India. While businesses are generally required to register for GST and comply with tax regulations, many non-profit organizations (NPOs) wonder whether they are liable to pay GST. This article explores whether non-profits need GST registration and under what circumstances they are taxed.

Are Non-Profit Organizations Required to Register for GST?

Non-profit organizations (NPOs), including trusts, societies, and charitable institutions, are not automatically exempt from GST. Their liability depends on the nature of their activities and the type of income they generate.

If an NPO is engaged in the supply of goods or services and its annual turnover exceeds the prescribed threshold of ₹40 lakh (for goods) or ₹20 lakh (for services), GST registration is required. For organizations in special category states, the threshold is lower at ₹20 lakh for goods and ₹10 lakh for services.

If your non-profit operates in Tamil Nadu, opting for GST registration in Coimbatore ensures compliance with tax laws.

When Do Non-Profits Have to Pay GST?

Non-profits must pay GST in the following cases:

Commercial Activities: If an NPO provides services or sells goods for a fee, GST applies. For example, if a charitable trust sells handmade products to raise funds, GST is applicable.

Sponsorship & Advertisements: If an NGO receives sponsorship or earns revenue through advertisements, GST is levied.

Paid Events & Workshops: If an NPO organizes training sessions, workshops, or ticketed events for a fee, GST is chargeable.

Services to Businesses: If a non-profit provides services to companies (e.g., consultancy, CSR-related projects), GST registration is mandatory.

For smooth compliance, choosing online GST registration in Coimbatore helps NPOs fulfill their tax obligations.

When Are Non-Profits Exempt from GST?

Non-profit organizations can claim GST exemption in the following cases:

Charitable Activities: Services directly related to education, healthcare, or public welfare may be exempt.

Donations & Grants: If an NPO receives funds as pure donations without any service in return, GST does not apply.

Government-Approved Exemptions: Some NGOs registered under Section 12AA of the Income Tax Act may receive GST exemptions on specific activities.

How to Get GST Registration for Non-Profits?

If your NPO is liable to pay GST, here’s how to register:

Collect Required Documents – PAN, trust registration certificate, bank details, and address proof.

File Application on GST Portal – Submit the details online.

Receive GSTIN – After verification, the organization gets a unique GST Identification Number (GSTIN).

For seamless registration, opting for GST registration in Coimbatore through expert services ensures accuracy and compliance.

Conclusion

Non-profits are not automatically exempt from GST. If they engage in commercial activities, sponsorships, or charge fees for services, GST applies. To ensure compliance, non-profits can opt for online GST registration in Coimbatore and follow necessary tax regulations.

2 notes

·

View notes

Text

Simplifying GST Registration: A Comprehensive Guide by GTS Consultant

Introduction

With the economy adopting a dogfight-like pace, organisations face the need to become agile enough to grow unhindered. As goods and services tax (GST) is one of the most important reforms in the Indian tax system, it means the inclusion of indirect tax in a single tax. Understanding and filling the GST Registration is the dire straits that every company will have to face because it is to operate within the law and take the advantage. Holding a reputable GTS Consultant AB, with a past period of more than 12 years of combine experience. We are combining our expertise to offer businesses a hassle- free expedition.

In this blog, we will provide an in-depth look at GST registration, its importance, process, benefits, and the expertise GTS Consultant brings to the table.

What is GST Registration?

The identification of goods and services that require a business to be in line with local legislation by obtaining registration under the GST Act is called the process of GST registration. It authorizes the entities to not only collect tax from their clients but also to claim Input Tax Credit (ITC) for the taxes that were paid on their purchases. Depending upon the limit of the prescribed turnover or the activities engaged in, the businesses are obliged to get registered for GST

Who Needs GST Registration?

GST registration is mandatory for:

Businesses with Aggregate Turnover:

₹20 lakhs (₹10 lakhs for special category states): For service providers.

₹40 lakhs (₹20 lakhs for special category states): For goods suppliers.

Interstate Suppliers: Businesses involved in the interstate supply of goods and services.

E-commerce Operators: Platforms facilitating sales of goods and services.

Casual Taxable Persons: Individuals undertaking occasional transactions involving the supply of goods or services.

Input Service Distributors: Businesses distributing input tax credits to their branches.

Documents Required for GST Registration

For the smooth registration process, be sure to gather the following documents:

PAN Card: It's essential for the business and for the owner and owner(s) of the business to have a PAN card.

Proof of Business: This along with partnership deeds, incorporation certificates, as well as, registration certificates.

Identity and Address Proof of Promoters: The Aadhaar card, the passport, or the voter ID should be provided.

Business Address Proof: Lease agreements, contract transit costs, or utility bills.

Bank Account Details: One may use the copy of a canceled cheque, a bank statement, or a passbook copy.

Digital Signature: It is required to be electronically signed prior to online submission.

Authorization Letter: For the account signatories that are authorized to, if applicable.

Benefits of GST Registration

Legal Compliance: Penalty prevention and adherence to Indian tax laws.

Input Tax Credit (ITC): The ITC claim should be able to reduce the total tax burden by this method.

Market Expansion: GST registration will help in the inter-State sales and e-commerce trade.

Credibility: A registered GST number enhances the credibility of a business and makes it more trustworthy in the eyes of their clients.

Ease of Doing Business: One consolidated tax system offers several advantages such as easier filing of tax returns and tax payments.

Why Choose GTS Consultant for GST Registration?

GTS Consultant, located in Bhiwadi, Alwar, Rajasthan is a determined and particular accounting and tax services company dedicated to offering the best services Imagine why the companies would trust us:

Expert Guidance: Our group of skilled public accountants and chartered accountants guarantees a mistake-free and effective GST registration.

Comprehensive Support: From preparation to submission and post-registration help, we include each and every part of it.

Time-Saving: You focus on your operations, we refine your registration business process.

Cost-Effective Solutions: Services of high rank at budget prices.

Client-Centric Approach:We will customize our services so that they match your requirements and bring you the best possible benefits.

Frequently Asked Questions (FAQs)

1. What is the penalty for not registering under GST?

A penalty of the greater of ten percent of the tax due or ten thousand rupees is paid for non-registration. If a taxpayer evades tax on his own volition, DRI is supposed to impose a penalty equal to the tax that was evaded, i.e. 100%

2. Can I voluntarily register for GST?

Yes, turnover not reaching the requirement limit, businesses can choose to register at their own discretion and thus gain great benefits such as ITC and market credibility.

Contact GTS Consultant Today

Certainly, getting through the GST registration process be a hard time, however, if your partner is GTS Consultant, you can rest assured you will be guided thoroughly through the process. Be it a new business venture or an already existing set up, we, the team at GTS Consultant, will get you the best service by ensuring that we register you without pain points.

Reach us at:

Address: TC-321-325, R-Tech Capital Highstreet, Phool Bagh, Bhiwadi, Alwar (RJ) - 301019

Email: [email protected]

Website: Explore our services and resources on our official website GTS Constultant india

2 notes

·

View notes

Text

Benchmark Professional Solutions Pvt. Ltd.: Comprehensive Business & Finance Services with Expertise in Tally Solutions

Comprehensive legal and finance solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, offers an extensive range of business and financial services to cater to the needs of modern enterprises. With an expert team, Benchmark delivers tailor-made solutions to its clients, ensuring compliance, efficiency, and growth. Whether you're a startup or an established business, their comprehensive services aim to streamline your financial and legal processes while providing expert advice on navigating complex regulations.

Core Services

1. DSC & Token : Benchmark offers Digital Signature Certificates (DSC) and tokens from leading providers like EMUDHRA, Capricorn, and more. These DSCs are essential for secure online transactions, filings, and authentications, ensuring your business remains compliant with digital regulations.

2. Accounts Audit: Benchmark provides detailed accounts auditing services, ensuring your business follows financial standards and maintains transparency. Their audits cover all aspects of financial reporting, helping identify areas for improvement and ensuring regulatory compliance.

3. Trademark Registration: Protect your brand identity with Benchmark’s trademark registration services. They assist in filing, securing, and maintaining trademarks, allowing businesses to safeguard their intellectual property and prevent unauthorized use.

4. ROC Compliance (Registrar of Companies): Benchmark ensures your company adheres to ROC guidelines by managing all filings, annual returns, and other documentation. This service keeps businesses compliant with government regulations and helps avoid legal penalties.

5. License & Registration: From obtaining business licenses to registering your company, Benchmark handles the entire process, ensuring that your operations meet local and national regulatory requirements.

6. Income Tax Solutions: Benchmark provides expert guidance on filing income taxes for businesses and individuals, offering strategies to minimize tax liabilities while staying compliant with current tax laws.

7. GST Compliance: The company’s GST services include filing, reconciliation, and audit support to ensure businesses remain compliant with GST regulations. Benchmark’s expertise in GST helps reduce errors and optimize tax benefits.

8. Consultancy: Benchmark offers professional consultancy services tailored to your business needs. Whether you’re seeking advice on tax planning, regulatory compliance, or business strategy, their consultants provide actionable insights to drive growth.

9. Outsourcing: The company offers outsourcing services for various business functions, including payroll, accounting, and legal processes. Outsourcing to Benchmark allows companies to focus on core operations while maintaining efficiency in back-office tasks.

10. Civil & Criminal Lawyer Services: Benchmark provides legal support through its civil and criminal lawyer services. Whether you're dealing with business disputes, legal compliance, or criminal cases, their legal team ensures you receive the right counsel and representation.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Choosing Benchmark Professional Solutions Pvt. Ltd. means partnering with a company that prioritizes your business success. Their expertise in Tally Solutions and diverse service portfolio ensures that your financial, legal, and operational needs are managed seamlessly. With a focus on accuracy, compliance, and client satisfaction, Benchmark becomes not just a service provider but a strategic partner in your growth journey.

2 notes

·

View notes

Text

Anisha Sharma & Associates: Comprehensive Business & Finance Solutions for Every Need

Comprehensive finance and legal solutions with Anisha Sharma & Associates

Anisha Sharma & Associates is a business and finance company that delivers a wide range of core and specialized services. With a team of seasoned professionals, the firm ensures that businesses, individuals, and entrepreneurs have access to reliable and expert financial solutions. Their commitment to providing tailored guidance in various domains makes them a trusted partner for numerous clients. Below is an overview of their core and specialized services.

Core Services:

1.Accounts: Maintaining accurate and timely financial records is crucial for every business. Anisha Sharma & Associates ensures that their clients’ accounting needs are managed with precision, enabling seamless financial operations.

2.Audit: Through detailed audits, the firm provides clients with insights into their financial health. Their audit services help identify areas of improvement and ensure compliance with regulatory requirements.

3.Trademark: Protecting intellectual property is vital for brand success. The firm helps clients register and safeguard their trademarks, ensuring that their brand identity is secure and recognized.

4.ROC (Registrar of Companies): Navigating company registration and ROC compliance can be complex. Anisha Sharma & Associates simplifies this process, ensuring all filings and compliances are met, avoiding legal complications.

5.License & Registration: Securing the appropriate licenses and registrations is essential for any business. The firm assists in obtaining licenses that enable businesses to operate legally and efficiently.

6.Loans: Access to finance is a key driver for business growth. Anisha Sharma & Associates assists clients in securing loans, offering guidance on the most suitable options to meet their needs.

7.Income Tax: Their income tax services ensure that clients remain compliant with tax laws while minimizing their tax liabilities through expert planning and timely filings.

8.GST: Goods and Services Tax (GST) compliance can be challenging for businesses. The firm ensures that all GST filings are accurate and up-to-date, allowing businesses to avoid penalties and manage taxes efficiently.

9.Consultancy: The company provides tailored consultancy services, offering expert advice to help businesses grow, streamline operations, and optimize financial strategies.

10.Outsourcing: For businesses looking to delegate their accounting and finance processes, the firm offers comprehensive outsourcing services that help reduce costs and improve efficiency.

11.DSC & Token: Digital signatures (DSC) are essential for secure electronic transactions. The firm assists clients in obtaining DSCs and tokens, ensuring the safe and authorized use of digital platforms.

12.Software: Anisha Sharma & Associates offers customized software solutions to streamline business processes, enhance productivity, and ensure smooth financial operations.

Specialized Services:

1.Stock Broking & Advisory: Offering guidance on investments and stock market trading, the firm helps clients make informed decisions and maximize returns on their portfolios.

2.Website & Digital: The digital landscape is evolving rapidly. The firm provides website development and digital solutions that help businesses establish a strong online presence and reach their target audience.

3.Real Estate Placement Consulting: Whether for buying, selling, or leasing, the firm’s real estate consulting services ensure that clients make profitable and well-informed decisions.

4.PF & ESI: Managing Provident Fund (PF) and Employee State Insurance (ESI) is crucial for employee welfare. Anisha Sharma & Associates ensures that clients remain compliant with these regulations while optimizing benefits for their workforce.

5.Civil & Criminal Lawyer: In addition to financial services, the firm provides legal support for both civil and criminal matters, ensuring comprehensive legal representation for their clients.

Why Choose Anisha Sharma & Associates?

Anisha Sharma & Associates stands out for its comprehensive range of services, combining financial expertise with legal acumen. Their client-centric approach ensures that each business or individual receives personalized solutions tailored to their specific needs. Whether managing day-to-day financial operations, navigating the complexities of compliance, or seeking legal representation, Anisha Sharma & Associates is a reliable partner for long-term success.

2 notes

·

View notes

Text

Can I Sell Online Without GST? GST Requirements for E-commerce

In 2024, the trend of e-commerce has transformed the way people shop and businesses operate online. Whether you're selling groceries, electronic items, or running a full-fledged online store, the question of GST (Goods and Services Tax) often arises. GST is a consumption tax levied on the supply of goods and services in Chennai, Tamilnadu designed to replace various indirect taxes.

What is GST?

GST is a comprehensive indirect tax on online store, sale, and consumption of goods and services throughout India, aimed at simplifying the tax structure on consumers. It is mandatory for businesses whose turnover exceeds specified thresholds to register under GST and comply with its regulations.

You Need GST for Selling Online on Shocals

The requirement for GST registration depends primarily on your turnover and the category of your business. Here are some key points to consider for GST:

Threshold Limits: As of the latest information available, businesses with an aggregate turnover exceeding Rs. 40 lakhs (Rs. 10 lakhs for northeastern states) in a financial year must register for GST. This turnover includes all taxable supplies, exempt supplies, exports of goods and services, and inter-state supplies.

Inter-state Tamilnadu Sales: If you are selling goods or services to customers in different states, you are likely to exceed the turnover threshold sooner. GST registration is mandatory for businesses making inter-state supplies, regardless of turnover.

Mandatory Registration: Even if your turnover is below the threshold, you may choose to voluntarily register for GST. This can be beneficial for claiming input tax credits on purchases and improving your business credibility.

Selling on Shocals Partners

If you are selling through popular Shocals Partners, you need to understand the policies regarding GST compliance. It requires sellers to provide GSTIN (GST Identification Number) during registration and ensure compliance with GST laws.

Steps to Register for GST

If you decide to register for GST, here's a brief overview of the registration process:

Prepare Documents: Keep your PAN (Permanent Account Number), proof of business registration, identity and address proof, bank account details, and business address proof.

Online Registration: Visit the GST portal (www.gst.gov.in) and fill out the registration form with required details. Upload scanned copies of documents as specified.

Verification: After submission, your application will be verified by the GST authorities. Once approved, you will receive your GSTIN and other credentials.

Benefits of GST Registration

While GST compliance involves maintaining proper accounting records and filing periodic returns, it offers several advantages:

Input Tax Credit: You can claim credit for GST paid on your business purchases, thereby reducing your overall tax liability.

Legal Compliance: Avoid penalties and legal repercussions by operating within the GST framework.

Business Expansion: Facilitates smoother inter-state and international sales, enhancing business opportunities.

Conclusion

In conclusion, while small businesses and startups may initially wonder if they can sell online without GST, understanding the thresholds and benefits of GST registration is crucial. Compliance not only ensures legal adherence but also opens avenues for business growth and competitiveness in the digital marketplace. Whether you're a budding entrepreneur or an established seller, staying informed about GST requirements will help you navigate the e-commerce landscape more effectively.

For more details please visit - https://partner.shocals.com/

2 notes

·

View notes

Text

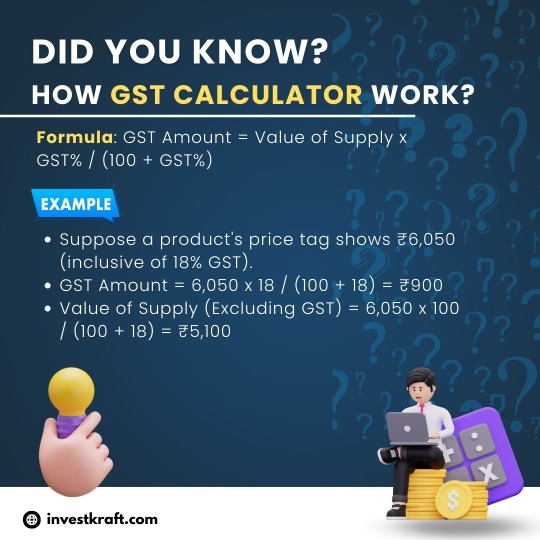

GST Confusion? Try Our Calculator for Easy Tax Calculation!

A GST Calculator simplifies the complex task of computing Goods and Services Tax (GST) in India. It efficiently determines the GST amount payable or included in a transaction, enabling accurate financial planning for businesses and individuals. Investkraft, a trusted financial platform, offers a user-friendly GST Calculator on its website. This tool allows users to swiftly calculate GST on various goods and services, ensuring compliance with tax regulations. With Investkraft's GST Calculator, users can input transaction details effortlessly and obtain precise GST figures, minimizing errors and saving time. Whether for business invoicing, tax filing, or personal budgeting, this calculator proves invaluable in navigating the intricacies of GST, empowering users to make informed financial decisions with ease.

2 notes

·

View notes

Text

Top Most Trusted CA Firm in Delhi NCR | SRV Associates

In a world where trust is as valuable as expertise, choosing the right Chartered Accountant firm isn’t just about services—it’s about finding a reliable partner who values your business as much as you do. Whether you're launching a startup, scaling operations, or restructuring your finances, having a dependable CA firm by your side can make all the difference.

That’s why SRV Associates is proudly recognized as the Top Most Trusted CA Firm in Delhi NCR—delivering not just compliance, but complete financial confidence.

Why Trust Matters When Choosing a CA Firm?

When it comes to financial services, there’s no room for doubt or delay. From filing your GST returns on time to managing statutory audits, from reducing tax liabilities to ensuring ROC filings—every detail counts. You need a CA firm that offers more than numbers; you need one that offers peace of mind.

At SRV Associates, we believe trust is built through consistency, transparency, and results—and that’s exactly what we deliver for every client, every time.

About SRV Associates – Built on Ethics, Driven by Precision

Led by CA Rohit Gupta, SRV Associates has emerged as a trusted name in the financial and compliance domain. With a growing client base across Delhi, Gurugram, Noida, Faridabad, and Ghaziabad, we offer tailored financial services that solve problems, add value, and support business growth.

What sets us apart is our commitment to integrity, responsiveness, and personalized service. We don’t just deliver compliance—we empower business decisions.

Services That Earn Your Trust

We offer a full range of CA services, making SRV Associates a one-stop destination for all your financial and legal needs:

✔ Business Incorporation

Start your journey with full legal support. Whether it’s Pvt Ltd, LLP, or OPC, we handle registrations with precision and speed.

✔ GST Compliance

From registration to monthly returns, audits, and reconciliations, we ensure you remain 100% GST compliant, stress-free.

✔ Income Tax Filing & Tax Planning

We prepare and file ITRs for individuals, firms, and corporates, while also guiding you on ways to minimize taxes legally.

✔ Accounting & Bookkeeping

Our digital accounting tools and experienced team ensure accurate financial records and reports that are always audit-ready.

✔ ROC, TDS & Other Filings

Stay on top of deadlines with our complete regulatory support for TDS, MCA, and ROC compliance.

✔ Statutory & Internal Audits

We perform comprehensive audits that uncover inefficiencies, improve internal controls, and support informed decision-making.

✔ Virtual CFO Services

Need strategic financial planning without hiring a full-time CFO? We offer budgeting, forecasting, and business performance analysis on-demand.

Why SRV Associates Is the Most Trusted CA Firm in Delhi NCR?

Here’s why clients across the NCR region consistently choose us over others:

✅ Proven Track Record

Hundreds of businesses trust us to handle their finances. We deliver consistent results and build lasting relationships.

✅ Ethical Practices

We believe in transparency, honesty, and compliance. Your data, money, and business interests are always protected.

✅ Personalized Solutions

No two businesses are the same. That’s why we provide tailored services instead of generic templates.

✅ Timely Delivery

We respect your time and the importance of every deadline. No delays. No excuses.

✅ Expert Team

Our team of experienced Chartered Accountants and finance professionals offers deep expertise across industries and regulations.

Industries We Serve

We provide services to a wide range of clients across sectors, including:

• Startups & SMEs

• E-commerce & Retail

• Education & Healthcare

• Manufacturing & Trading

• Real Estate & Construction

• NGOs & Trusts

• Freelancers & Professionals

Whether you're based in a co-working space in Gurugram or running a legacy business in Old Delhi, SRV Associates has the knowledge and tools to support you.

Ready to Work With a CA Firm You Can Trust?

If you’re looking for a Chartered Accountant firm that not only handles your finances but also respects your time and vision—SRV Associates is the partner you need.

Whether it’s your first balance sheet or your hundredth tax audit, we deliver with clarity, precision, and integrity.

Let’s Get Started

📞 Call Now: 91-9953004026 📧 Email: [email protected] 🌐 Website: https://srvassociates.in

📍 Visit Us: 8/100, First Floor, Double Storey, Old Market, Block 2, Tilak Nagar, Delhi – 110018

Book your free initial consultation and experience the confidence of working with one of the most trusted CA firms in Delhi NCR.

0 notes

Text

Checklist to Keep Your Virtual PPOB GST-Compliant Year-Round

To remain Virtual PPOB GST compliant throughout the year, a regular and organized approach to taxation and documentation is the key. As the initial step, ensure that all invoices raised are GST compliant, mentioning GSTIN, SAC codes, taxable value, and tax rate. The monthly activities must comprise timely submission of GSTR-1 and GSTR-3B and reconciliation of Input Tax Credit (ITC) with GSTR-2B to ensure no mismatch. It's equally crucial to credit the GST paid within the set due dates in order to avoid interest

and fines. Quarterly, check vendor compliance, reconcile purchases and sales reports, and submit GSTR-4 if your Virtual PPOB is subject to the composition scheme. Annually, submission of GSTR-9 and, where needed, GSTR-9C is required in order to remain GST-compliant.

Establishing a GST-Compliant Virtual PPOB

Setting up a GST-compliant Virtual PPOB (Payment Point Online Bank) requires organizing your business structure according to Goods and Services Tax regulations from the beginning. Start with registering your business as GST and securing a valid GSTIN, which is obligatory for businesses dealing with taxable services. While providing services like mobile recharges, bill payments for utilities, and DTH services, make your invoices GST-compliant by including your GSTIN, SAC codes, taxable amount, and the applicable tax rate.

Select the proper tax category—normal or composition—according to your annual turnover and business model. Make use of GST-compliant accounting software to mechanize invoicing, tax computation, and return filing. You need to submit periodic GST returns like GSTR-1 and GSTR-3B, and keep proper records of all electronic transactions via your PPOB platform.

Accurate GST Registration and Updates

Proper GST registration and time updates are essential to ensure legal compliance and a hassle-free run in the Goods and Services Tax regime. At the time of registering for GST, proper details regarding business name, PAN, principal place of business, and classification of the right business activity using HSN/SAC codes must be furnished. For a Virtual PPOB or any service-based enterprise, selection of the appropriate nature of services and state-wise registration (if it is operating in more than one state) guarantees correct tax jurisdiction. After registration, enterprises are assigned a unique GSTIN, which should be quoted on invoices and communications. To remain compliant, changes in business structure—address updates, change in authorized signatories, or addition of new branches—need to be updated immediately on the GST portal via an amendment application. It is essential to keep your GST registration and updates accurate to avoid fines and legal consequences and to ensure trust with clients and suppliers by having updated information in all GST filings and verifications.

Invoice Management and E-Invoicing Compliance

Invoice Management & E-Invoicing Compliance

Issue GST-Compliant Invoice

Add supplier & recipient GSTIN, invoice number, date, HSN/SAC codes, taxable value, GST rate, and total amount.

Meet E-Invoicing Requirements (if applicable)

Compulsory for businesses having turnover over ₹5 crore (as per most recent threshold); invoices should be registered with Invoice Registration Portal (IRP).

Create IRN and QR Code

Upload invoice details to IRP to receive a distinct Invoice Reference Number (IRN) and dynamic QR code, which has to be printed on the end invoice.

Use GST-Compliant Accounting Software

Automate generation of invoices, IRN generation, and GST format compliance through tools embedded in NIC-IRP.

Store Digital Copies of Invoices

Save all issued and received invoices digitally for audit, reconciliation, and future reference.

Reconcile Invoices Monthly with GSTR-1 & GSTR-3B

Make sure to report all sales invoices correctly in monthly GST returns for claiming Input Tax Credit to prevent mismatches.

Prevent Manual Mistakes

Automate to the greatest extent possible to avoid GST calculation mistakes or omitting invoice information.

Renew Invoice Series Annually

Renew invoice serial number series at the beginning of every financial year, as is mandated under GST law.

Get E-Invoice Information into Returns

Make sure that e-invoice information auto-populates within GSTR-1 and reflects your monthly returns.

Timely Filing of GST Returns

File GSTR-1 (Outward Supplies)

File monthly on or before the 11th of next month (or quarterly under QRMP scheme). Ensures correct reflection of sales to customers and recipients.

File GSTR-3B (Summary Return)

Compulsory monthly/quarterly filing for reporting tax liability and availing Input Tax Credit (ITC). To be filed by the 20th, 22nd, or 24th, depending on your state and scheme.

Escape Interest & Penalties

Filing GST returns in time prevents late fees, interest, and GST registration cancellation.

Monitor Due Dates on a Regular Basis

Make use of compliance calendars, reminders, or accounting software to keep ahead of all the return deadlines.

File NIL Returns in Case of No Activity

Despite zero turnover during a period, NIL returns need to be filed in order to keep up with compliance and prevent system blocking.

Reconcile Before Filing

Align data from your books with GSTR-2B and earlier returns to avoid errors and minimize the likelihood of notices.

File GSTR-9 and GSTR-9C Every Year

Applicable for companies with annual turnover over ₹2 crore and ₹5 crore respectively.

Utilize GST Portal or Authorized Software

File returns through the official GST portal or authorized software connected with GSTN to provide secure and accurate filing.

Input Tax Credit (ITC) Reconciliation

Match Purchases with GSTR-2B: regularly reconcile ITC claimed in your books with the auto-generated GSTR-2B to ensure vendor compliance and avoid ineligible claims.

Verify Vendor Filings: Ensure suppliers have filed GSTR-1 correctly and on time so that their invoices reflect in your GSTR-2B.

Claim Only Eligible ITC: Follow GST rules to claim only ITC on goods/services used for business purposes; block credits (like on personal expenses) must be excluded.

Maintain Proper Documentation: Keep all purchase invoices, debit notes, and payment proofs organized as valid supporting documents for claiming ITC.

Timely Booking of Invoices: Book purchase invoices in the correct tax period; delayed entries can lead to missed ITC claims or notices from the department.

Reverse Ineligible ITC Promptly: Reverse ITC on unpaid invoices after 180 days or on ineligible goods/services to avoid penalties.

Adjust ITC in GSTR-3B: Make necessary additions/reversals in Table 4 of GSTR-3B based on reconciliation outcomes.

Use ITC Reconciliation Tools: Utilize accounting software or GST compliance platforms for automated Input Tax Credit (ITC) reconciliation and reporting.

Reverse Charge Mechanism (RCM) Compliance

Reverse Charge Mechanism (RCM) Compliance

Understand When RCM Applies

RCM compliance is necessary when GST is to be paid by the recipient, and not by the supplier—common in situations such as legal services, transport (GTA), or purchases from unregistered vendors.

Identify RCM Transactions

Categorize expenses such as import of services, security services, rent from unregistered individuals, and other notified services under RCM.

Self-Invoice for RCM Transactions

Create a self-invoice for each such applicable RCM transaction where the supplier has not charged GST.

Pay Cash Only

GST under RCM has to be paid in cash (in electronic cash ledger), but not through Input Tax Credit (ITC).

Claim ITC on RCM Tax Paid

Once payment under RCM is made, you can claim the same as Input Tax Credit, subject to the condition that the supply is for business purposes and otherwise qualifying.

Report in GSTR-3B Correctly

Mention outward RCM liability in Table 3.1(d) and ITC in Table 4(A)(3) of GSTR-3B.

Keep Comprehensive RCM Records

Retain records like self-invoices, payment receipts, and RCM ledger postings for audit and compliance purposes.

Check RCM Applicability Periodically

Regularly review your business transactions to look for new RCM notifications or changes in applicability.

Year-End Compliance Activities

Year-End Compliance Activities

Reconcile All GST Returns

Reconcile all GST returns (GSTR-1, GSTR-3B, GSTR-9, etc.) to reflect accurately sales, purchases, tax liabilities, and ITC claims.

File GSTR-9 (Annual Return)

File GSTR-9 on or before 31st December for firms with turnover more than ₹2 crore. It combines all the information filed through monthly or quarterly returns.

File GSTR-9C (Reconciliation Statement)

If your turnover crosses ₹5 crore, submit GSTR-9C, which contains audited financial statements of a Chartered Accountant (CA).

Reconcile Input Tax Credit (ITC)

Verify that all ITC availed throughout the year is valid, properly reported, and backed by proper documents, such as invoices and payments.

Reconcile Accounts with GST Returns

Align the books of accounts of the business with the GST returns to verify that there is no mismatch in reported sales, purchases, and tax dues.

Guarantee Compliance with E-Invoicing

Scan all e-invoicing compliance and guarantee all eligible invoices registered in the Invoice Registration Portal (IRP) with the suitable IRN and QR code.

Review Pending Payments and Liabilities

Identify pending GST payments and guarantee these are paid in full before end-of-year so no penalties or interest are applicable.

Audit Vendor and Customer GST Compliance

Ensure that all the suppliers and recipients have submitted their GST returns and that ITC claims are not being held back because of non-compliance from suppliers.

Conclusion

In summary, GST compliance is a year-round obligation that must be given high priority by businesses, particularly Virtual PPOBs. By keeping track of timely GST return filings like GSTR-1 and GSTR-3B, and regularly dealing with invoices and ITC reconciliation, businesses can avoid penalties and provide correct tax reporting. Reverse Charge Mechanism (RCM) rules must be understood and implemented for particular transactions to remain compliant. While nearing the end of the year, the companies need to concentrate on certain year-end compliances like depositing GSTR-9 and GSTR-9C, reconciliations of accounting, and properly disclosing tax payables and tax credits. Maintenance of regular updations in GST details of registration along with verifying compliance of vendors as well as customers is equally crucial. Through the use of technology to mechanize tasks and make processes efficient, companies are able to minimize the chances of errors and increase efficiency, providing long-term financial stability and efficient operations.

0 notes

Text

Can You Register a Company with a Virtual Office Address in Delhi?

Starting a business in India’s capital can be a strategic move for entrepreneurs aiming to tap into a vast, diverse, and dynamic market. But with the soaring cost of real estate and rising operational expenses, many startups and SMEs are exploring more cost-effective ways to build their presence in the city. One of the most popular solutions is a virtual office in Delhi—but a critical question arises: Can you register a company using a virtual office address in Delhi?

The short answer is yes. But there are a few important details you must know to do it correctly, legally, and efficiently. In this blog, we’ll cover everything you need to know about registering a company using a virtual office in Delhi—from legal validity to the types of documentation required, and how it benefits businesses of all sizes.

🏢 What is a Virtual Office in Delhi?

A virtual office provides a professional business address in a prime location—without the need for renting a physical office space. Virtual offices are particularly popular in metro cities like Delhi, where office rents can be prohibitively expensive for startups and solopreneurs.

Services typically include:

Business address in a prestigious commercial area

Mail and courier handling

Document support for company and GST registration

Optional services like call answering, meeting rooms, and reception support

✅ Is It Legal to Register a Company with a Virtual Office in Delhi?

Yes, it is completely legal to register a company with a virtual office address in Delhi, provided the virtual office provider offers the necessary documentation as per the Ministry of Corporate Affairs (MCA) and Goods and Services Tax (GST) requirements.

Many startups and even large businesses now use virtual office addresses for the following:

Private Limited Company registration

LLP (Limited Liability Partnership) registration

One Person Company (OPC) registration

Partnership firm registration

As long as the documentation provided by your virtual office provider meets the compliance norms, you’re good to go.

🧾 What Documents Do You Need for Company Registration?

To successfully register your company using a virtual office in Delhi, you’ll typically need the following documents from the service provider:

1. Rent Agreement

A formal agreement between the virtual office provider and your company (even if the space is not physically occupied). This is necessary for address validation.

2. No Objection Certificate (NOC)

Issued by the space owner, stating that they have no objection to their premises being used as the registered address of your company.

3. Utility Bill (Electricity or Water)

Usually less than 2–3 months old, this proves the existence and legitimacy of the address.

These documents are required when filing incorporation forms with the Registrar of Companies (RoC) under the MCA portal.

🧠 Why Use a Virtual Office Address for Registration?

Now that we’ve established that it's legal, let’s explore the practical benefits of registering your business with a virtual office in Delhi.

1. Cost-Effective

Delhi's commercial office space is expensive. Virtual offices eliminate the need for renting physical space—making it ideal for bootstrapped startups or remote-first businesses.

2. Professional Image

An address in Connaught Place, Nehru Place, or Saket boosts your company’s credibility with clients, investors, and partners.

3. Pan-India Presence

If your business operates in multiple states, you can have multiple virtual office addresses to comply with state-wise GST and business regulations—without the need to be physically present.

4. Compliance Ready

Most virtual office providers are well-versed in legal and compliance procedures, helping you smoothly register your company or GST with zero friction.

5. Privacy for Solopreneurs

If you're running your startup from home, using a virtual office address allows you to keep your residential address private.

📍 Best Locations in Delhi to Register Your Company Virtually

Choosing the right location enhances your business profile and increases trust. Here are some of the most preferred commercial hubs for virtual offices:

Connaught Place (CP) – Delhi’s central business district; ideal for finance, law, and consulting firms

Nehru Place – Popular among tech startups and IT businesses

Saket & Green Park – Great for D2C brands, wellness, and marketing startups

Okhla Industrial Area – Suitable for e-commerce, logistics, and manufacturing firms

Lajpat Nagar – Cost-effective and well-connected to the rest of the city

👣 Step-by-Step Process to Register a Company with a Virtual Office in Delhi

Step 1: Choose a Reliable Virtual Office Provider

Look for one that specializes in company and GST registrations. Check for Google reviews and legal compliance.

Step 2: Select Your Plan and Location

Choose your desired area based on business goals, clientele, or GST registration needs.

Step 3: Get Required Documents

The provider should offer the Rent Agreement, NOC, and utility bill. Ensure documents are in the correct format required by the MCA.

Step 4: File Company Incorporation

With the help of a CA or company secretary, file your incorporation with the RoC using the virtual office address.

Step 5: Use the Address for Communication

You can now use the address on your business cards, website, and for official communications.

📌 Can You Use a Virtual Office for GST Registration Too?

Absolutely. A virtual office in Delhi can also be used for GST registration, provided the documentation complies with GST department requirements. Most virtual office providers now offer GST-compliant documentation, making it easier to register and get your GSTIN.

This is particularly helpful for:

E-commerce sellers on platforms like Amazon or Flipkart

Service-based companies offering interstate services

Businesses with clients spread across North India

🔍 Common Myths About Virtual Offices & Company Registration

❌ Myth 1: It's not legal to register a company using a virtual office.

✔️ Truth: It’s 100% legal with proper documentation.

❌ Myth 2: You need to physically occupy the space to register.

✔️ Truth: Virtual offices are designed for remote registration and operation.

❌ Myth 3: It doesn’t look professional.

✔️ Truth: A virtual address in a prime Delhi location enhances your brand credibility.

👥 Who Should Consider This Setup?

A virtual office in Delhi is ideal for:

Startups looking to save on costs without sacrificing professional presence

Freelancers registering their first company

Consulting firms expanding into the Delhi market

E-commerce businesses needing a GST address in North India

Remote teams that operate without a fixed office

�� Real Example: From Lucknow to Delhi

A SaaS startup based in Lucknow used a virtual office in Connaught Place to register their Delhi entity. Within two weeks, they had:

GST registration

Delhi-based business address on their website

Increased trust from corporate clients in NCR

Access to meeting rooms for quarterly in-person client sessions

All of this was accomplished without renting a physical office, saving them over ₹1.5 lakh annually.

🏁 Final Thoughts

Registering your company with a virtual office in Delhi isn’t just legal—it’s also smart, cost-effective, and incredibly efficient. For startups, solopreneurs, and expanding SMEs, it opens the door to establishing a legitimate presence in one of India’s most powerful markets without the heavy cost of traditional office infrastructure.

So, whether you're incorporating your first company or expanding operations, choosing a virtual office may be one of the most practical decisions you make.

0 notes

Text

GST Registration Services Provider in Delhi by SC Bhagat & Co.

In today’s dynamic business landscape, GST registration is a crucial step for any business operating in India. If you are looking for a reliable GST Registration Services Provider in Delhi, SC Bhagat & Co. offers expert assistance to ensure a smooth and hassle-free registration process.

Why is GST Registration Important?

GST (Goods and Services Tax) is a unified tax system that has replaced multiple indirect taxes in India. Every business with an annual turnover exceeding ₹40 lakh (₹10 lakh for special category states) must register for GST. Even businesses below this threshold can opt for voluntary registration to avail benefits like input tax credit and improved compliance.

Services Offered by SC Bhagat & Co.

SC Bhagat & Co. specializes in providing end-to-end GST solutions, ensuring that businesses remain compliant with tax regulations. Our services include:

GST Registration

Assistance in preparing and submitting GST registration applications

Obtaining GST Identification Number (GSTIN)

Handling queries from tax authorities

GST Return Filing

Monthly, quarterly, and annual GST return filing

Ensuring timely and accurate compliance to avoid penalties

GST Advisory Services

Expert consultation on GST applicability and exemptions

Guidance on tax planning and input tax credit claims

GST Audit & Compliance

Regular audits to identify compliance gaps

Representation before tax authorities in case of disputes

GST Cancellation & Amendments

Assistance in cancellation of GST registration if business operations cease

Support for modifications in GST registration details

Why Choose SC Bhagat & Co.?

With years of experience and a team of skilled professionals, SC Bhagat & Co. ensures that businesses comply with GST regulations seamlessly. Our commitment to accuracy, transparency, and customer satisfaction makes us the preferred GST registration services provider in Delhi.

Key Benefits of Choosing Us:

✔️ Quick and hassle-free registration process ✔️ Affordable and transparent pricing ✔️ Personalized consultation and support ✔️ Expert handling of GST compliance and disputes ✔️ Timely reminders for return filing

Get Started Today!

If you are a business owner looking for professional GST Registration Services in Delhi, SC Bhagat & Co. is your trusted partner. Contact us today to ensure a smooth GST registration and compliance process.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances#beauty#actors

3 notes

·

View notes

Text

GST Consultants in India by Mercurius & Associates LLP

In the ever-evolving landscape of taxation in India, the Goods and Services Tax (GST) has transformed the way businesses operate. While GST simplifies taxation, it also brings along complexities in compliance, filing, and structuring. This is where Mercurius & Associates LLP, a leading GST consultant in India, plays a crucial role in helping businesses navigate the GST framework efficiently.

Why Businesses Need GST Consultants

GST compliance requires meticulous attention to detail, regular updates on tax laws, and accurate filing to avoid penalties. Whether you are a startup, a small business, or a multinational company, seeking professional GST consultation can save time, reduce errors, and ensure seamless operations. Some key challenges businesses face include:

Understanding GST applicability and registration requirements

Filing monthly, quarterly, and annual GST returns

Claiming input tax credits correctly

Managing audits and assessments by tax authorities

Keeping up with frequent changes in GST laws and regulations

Services Offered by Mercurius & Associates LLP

At Mercurius & Associates LLP, we offer end-to-end GST consulting services to ensure your business remains compliant and optimized for tax benefits. Our services include:

GST Registration & Compliance

We assist businesses in registering for GST under the correct category, ensuring that all documents are in order and compliance is maintained from day one.

GST Return Filing

Filing returns accurately and on time is crucial to avoid penalties. We handle GSTR-1, GSTR-3B, GSTR-9, and other applicable returns to ensure smooth compliance.

GST Advisory & Structuring

Our team provides expert advice on optimizing GST structures to minimize tax liabilities while remaining fully compliant with the law.

GST Audit & Assessment Assistance

Facing a tax audit? Our consultants assist in preparing audit reports, responding to tax notices, and ensuring a hassle-free assessment process.

Input Tax Credit (ITC) Management

We help businesses maximize their input tax credit (ITC) by ensuring accurate record-keeping and proper claim filing.

GST Litigation & Representation

In case of disputes, our experienced professionals provide legal representation before tax authorities and tribunals to safeguard your business interests.

Why Choose Mercurius & Associates LLP?

Experienced Professionals: Our team consists of seasoned GST consultants with deep expertise in Indian taxation laws.

Customized Solutions: We tailor our services to meet the specific needs of your business.

Timely Compliance: We ensure that all GST filings and compliance requirements are met well before deadlines.

Cost-Effective Services: Get top-notch GST consultation at competitive pricing.

Nationwide Support: We serve businesses across India, providing assistance in multiple languages.

Conclusion

Navigating the complexities of GST requires expert guidance, and Mercurius & Associates LLP is your trusted partner in ensuring seamless GST compliance in India. With a client-centric approach and an in-depth understanding of tax laws, we help businesses stay compliant and financially efficient.

If you're looking for reliable GST consultants in India, get in touch with Mercurius & Associates LLP today for professional and customized GST solutions!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

3 notes

·

View notes

Text

Gain Business Clarity with Professional Due Diligence Services in India

In the ever-evolving business ecosystem of India, risk management and informed decision-making are crucial to success. Whether you're planning a merger, acquiring a company, or investing in a startup, conducting a proper evaluation beforehand is essential. This is why Due Diligence Services in India have become an indispensable part of modern business strategy. These services help in uncovering financial inconsistencies, legal challenges, and operational flaws that may not be visible on the surface.

Why Due Diligence Matters in Today’s Market

The Indian market offers vast opportunities, but it also comes with unique risks due to varying compliance norms, regional regulations, and complex tax structures. A detailed due diligence exercise acts as a safeguard against entering into unfavorable or high-risk ventures.

By performing due diligence, you can:

Identify potential risks and liabilities early

Validate the financial and legal standing of a business

Make confident, data-driven decisions

Prevent legal complications after deal closure

Strengthen your negotiation capabilities

Key Categories of Due Diligence Services in India

Indian due diligence firms cater to a wide array of industries and offer specialized solutions based on the nature of the transaction. Some key types of due diligence include:

1. Financial Due Diligence

Assesses a company’s financial history, revenue streams, debt structure, and profitability to provide a clear picture of its economic health.

2. Legal Due Diligence

Checks for legal disputes, ownership of assets, licenses, contracts, and compliance with statutory obligations.

3. Tax Due Diligence

Analyzes past tax filings, pending liabilities, and compliance with GST, income tax, and other applicable taxes.

4. Operational Due Diligence

Evaluates internal controls, supply chain processes, workforce structure, and IT systems for overall efficiency.

5. Sector-Specific & Environmental Due Diligence

Focuses on adherence to industry-specific standards and environmental regulations, especially in manufacturing, construction, and mining sectors.

Benefits of Using Due Diligence Services in India

Choosing the right due diligence partner in India helps businesses navigate complexities while mitigating risks. Key advantages include:

Thorough insight into target entities

Reduction in post-deal surprises or legal hassles

Increased investor confidence

Streamlined integration after mergers or acquisitions

Better long-term financial outcomes

Due diligence can also reveal hidden strengths in a potential partner or acquisition target, giving you an edge during negotiations.

Conclusion

In a business environment as diverse and dynamic as India’s, due diligence isn’t just a best practice—it’s a necessity. Due Diligence Services in India provide companies with the knowledge and confidence needed to pursue opportunities without fear of costly surprises. Whether you're a domestic enterprise or a global investor, these services are key to making smart, secure, and successful business moves.

0 notes