#GST login process

Explore tagged Tumblr posts

Text

Goods and Service Tax Login (GST)

In today’s digital age, managing tax responsibilities has become easier and more streamlined thanks to online portals. One such portal is the Goods and Service Tax (GST) portal, which plays a crucial role in the taxation process in India. If you’re new to GST or simply looking to get a better handle on how to log in and manage your GST account, this guide will walk you through everything you need to know.

What is Goods and Service Tax (GST)?

https://paisainvests.com/wp-content/uploads/2024/07/Screenshot-2024-07-26-132454.webp

Overview of GST

Goods and Service Tax (GST) is a comprehensive tax levied on the supply of goods and services, right from the manufacturer to the consumer. It is designed to replace multiple indirect taxes previously levied by the central and state governments. By merging these taxes into one, GST aims to simplify the taxation process, making it more transparent and easier to manage.

Importance of GST in India

GST has significantly impacted the Indian economy by creating a unified tax structure. This change reduces the cascading effect of taxes and promotes seamless trade across state borders. For businesses, it means less paperwork and more efficient tax compliance, while consumers benefit from reduced tax burdens on goods and services.

Why You Need to Log in to GST Portal

Benefits of Logging in to the GST Portal

Logging in to the GST portal provides several advantages. It allows you to file GST returns, track your tax payments, view your tax credit, and manage your account details. Essentially, it is your gateway to all GST-related activities.

Common Tasks Performed via GST Portal

When logged in, users can perform a variety of tasks, including:

Filing GST Returns: Submit your monthly or quarterly tax returns.

Tracking Payments: Monitor your tax payments and credits.

Updating Profile Information: Modify your business details as required.

Generating GST Reports: Obtain detailed reports for your records.

How to Access the GST Portal

GST Portal URL and Accessibility

To access the GST portal, navigate to www.gst.gov.in. This official website is the gateway to all GST-related services and resources.

Navigating the GST Portal Home Page

Once on the GST portal home page, you’ll find various options such as login, registration, and help resources. The user-friendly interface makes it easy to find the information you need.

System Requirements for GST Portal

Browser Compatibility

For optimal performance, the GST portal is compatible with modern browsers such as Google Chrome, Mozilla Firefox, and Microsoft Edge. Ensure that your browser is updated to the latest version to avoid compatibility issues.

Technical Specifications

Make sure your system meets the following requirements:

Operating System: Windows 7 or later, macOS 10.0 or later.

Browser: Latest versions of Chrome, Firefox, or Edge.

Internet Connection: Stable and reliable connection.

Step-by-Step Guide to GST Login

Creating Your GST Login Credentials

Registration Process

To create login credentials, you first need to register on the GST portal. Provide the required details such as your PAN, email ID, and mobile number. Once registered, you’ll receive a confirmation email with a link to set up your credentials.

Setting Up Your Username and Password

Follow the instructions in the confirmation email to create a username and password. Ensure that your password is strong, combining letters, numbers, and special characters for better security.

Logging in to GST Portal

Enter Your Credentials

On the GST portal login page, enter your username and password. Click on the “Login” button to access your account.

Troubleshooting Login Issues

If you encounter login issues, check if you’ve entered the correct username and password. If you’ve forgotten your password, use the “Forgot Password” option to reset it. Ensure that your browser is not blocking any cookies or scripts required by the portal.

Managing Your GST Account

Dashboard Overview

The dashboard provides a comprehensive view of your GST account. From here, you can navigate to various sections such as return filing, payment tracking, and profile management.

Updating Your Profile Information

It’s important to keep your profile information up-to-date. Navigate to the profile section and update details like your business address, contact information, and bank details as needed.

Security Tips for GST Portal

Protecting Your Login Credentials

Always ensure that your login credentials are kept confidential. Avoid sharing your username and password with others. Use a password manager to securely store your credentials.

Recognising Phishing Scams

Be cautious of phishing scams that attempt to steal your login information. Ensure that you only access the GST portal through the official website and avoid clicking on suspicious links or emails.

Conclusion

Navigating the GST portal and managing your tax-related activities can seem daunting at first, but with the right information and guidance, it becomes much easier. By following the steps outlined above, you can efficiently log in, manage your GST account, and ensure that you stay on top of your tax responsibilities. Remember to keep your login credentials secure and be aware of potential scams. For any additional help, the GST support team is always there to assist you.

By Paisainvests.com

#Goods and Services Tax login#GST account access#GST account management#GST account setup#GST compliance#GST e-filing#GST login#GST login details#GST login guide#GST login process#GST login steps#GST management#GST online access#GST portal access#GST portal login#GST registration

0 notes

Text

Goods and Service Tax Login (GST)

In today’s digital age, managing tax responsibilities has become easier and more streamlined thanks to online portals. One such portal is the Goods and Service Tax (GST) portal, which plays a crucial role in the taxation process in India. If you’re new to GST or simply looking to get a better handle on how to log in and manage your GST account, this guide will walk you through everything you need to know.

What is Goods and Service Tax (GST)?

https://paisainvests.com/wp-content/uploads/2024/07/Screenshot-2024-07-26-132454.webp

Overview of GST

Goods and Service Tax (GST) is a comprehensive tax levied on the supply of goods and services, right from the manufacturer to the consumer. It is designed to replace multiple indirect taxes previously levied by the central and state governments. By merging these taxes into one, GST aims to simplify the taxation process, making it more transparent and easier to manage.

Importance of GST in India

GST has significantly impacted the Indian economy by creating a unified tax structure. This change reduces the cascading effect of taxes and promotes seamless trade across state borders. For businesses, it means less paperwork and more efficient tax compliance, while consumers benefit from reduced tax burdens on goods and services.

Why You Need to Log in to GST Portal

Benefits of Logging in to the GST Portal

Logging in to the GST portal provides several advantages. It allows you to file GST returns, track your tax payments, view your tax credit, and manage your account details. Essentially, it is your gateway to all GST-related activities.

Common Tasks Performed via GST Portal

When logged in, users can perform a variety of tasks, including:

Filing GST Returns: Submit your monthly or quarterly tax returns.

Tracking Payments: Monitor your tax payments and credits.

Updating Profile Information: Modify your business details as required.

Generating GST Reports: Obtain detailed reports for your records.

How to Access the GST Portal

GST Portal URL and Accessibility

To access the GST portal, navigate to www.gst.gov.in. This official website is the gateway to all GST-related services and resources.

Navigating the GST Portal Home Page

Once on the GST portal home page, you’ll find various options such as login, registration, and help resources. The user-friendly interface makes it easy to find the information you need.

System Requirements for GST Portal

Browser Compatibility

For optimal performance, the GST portal is compatible with modern browsers such as Google Chrome, Mozilla Firefox, and Microsoft Edge. Ensure that your browser is updated to the latest version to avoid compatibility issues.

Technical Specifications

Make sure your system meets the following requirements:

Operating System: Windows 7 or later, macOS 10.0 or later.

Browser: Latest versions of Chrome, Firefox, or Edge.

Internet Connection: Stable and reliable connection.

Step-by-Step Guide to GST Login

Creating Your GST Login Credentials

Registration Process

To create login credentials, you first need to register on the GST portal. Provide the required details such as your PAN, email ID, and mobile number. Once registered, you’ll receive a confirmation email with a link to set up your credentials.

Setting Up Your Username and Password

Follow the instructions in the confirmation email to create a username and password. Ensure that your password is strong, combining letters, numbers, and special characters for better security.

Logging in to GST Portal

Enter Your Credentials

On the GST portal login page, enter your username and password. Click on the “Login” button to access your account.

Troubleshooting Login Issues

If you encounter login issues, check if you’ve entered the correct username and password. If you’ve forgotten your password, use the “Forgot Password” option to reset it. Ensure that your browser is not blocking any cookies or scripts required by the portal.

Managing Your GST Account

Dashboard Overview

The dashboard provides a comprehensive view of your GST account. From here, you can navigate to various sections such as return filing, payment tracking, and profile management.

Updating Your Profile Information

It’s important to keep your profile information up-to-date. Navigate to the profile section and update details like your business address, contact information, and bank details as needed.

Security Tips for GST Portal

Protecting Your Login Credentials

Always ensure that your login credentials are kept confidential. Avoid sharing your username and password with others. Use a password manager to securely store your credentials.

Recognising Phishing Scams

Be cautious of phishing scams that attempt to steal your login information. Ensure that you only access the GST portal through the official website and avoid clicking on suspicious links or emails.

Conclusion

Navigating the GST portal and managing your tax-related activities can seem daunting at first, but with the right information and guidance, it becomes much easier. By following the steps outlined above, you can efficiently log in, manage your GST account, and ensure that you stay on top of your tax responsibilities. Remember to keep your login credentials secure and be aware of potential scams. For any additional help, the GST support team is always there to assist you.

By Paisainvests.com

#Goods and Services Tax login#GST account access#GST account management#GST account setup#GST compliance#GST e-filing#GST login#GST login details#GST login guide#GST login process#GST login steps#GST management#GST online access#GST portal access#GST portal login#GST registration

0 notes

Text

Learn How to check GST Payment status complete guide - Taxring

Stay informed about your GST obligations with our comprehensive guide. Learn how to check your GST payment status, make payments online, and understand important deadlines. Access details on GST login procedures, CPIN number retrieval, and how to download GST payment challan receipts. Whether you're looking for GST payment status updates or tips for efficient online transactions, we've got you covered. Navigate the GST Portal with ease and ensure compliance with all GST regulations.

Check also: How to check GST ARN Status? , What is Goods and Service Tax (GST)

#gst payment status#how to check gst status#gst payment#gst payment online#gst paymmet due date#GST login#GST payment online#GST Portal#GST payment status#GST payment online without login#GST payment receipt download#GST challan#GST search#What is the process of GST payment?#How to find cpin number in GST?#How to download GST payment challan receipt?#goods and service tax act#What is GST#Goods and service tax act

0 notes

Text

Paytm Hdfc Credit Card kaise banaye 2023

paytm hdfc credit card kaise banaye, paytm hdfc credit card customer care number, hdfc credit card login, how to activate paytm hdfc credit card, paytm credit card customer care, paytm credit card apply online, paytm hdfc credit card limit, paytm hdfc credit card verification process, paytm hdfc credit card kaise banaye टॉपिक को इंटरनेट पर सर्च कर रहे हैं हम आपको इसके बारे में पूरी जानकारी देंगे इसलिए निवेदन है कि आर्टिकल को पूरा पढ़ें पूरी बात समझ में आ जाएगी आज ऑनलाइन अगर आप कोई भी चीज करना चाहते हैं तो वहां पर आपको बिल पेमेंट करने के लिए क्रेडिट कार्ड का विकल्प जाता है कि कार्ड के माध्यम से आप घर बैठे कोई भी चीज ऑनलाइन से खरीद सकते हैं I सबसे बड़ी बात है कि उसे आप अपने मुताबिक किस्तों में तब्दील भी कर सकते हैं ताकि आपको खरीदी गई चीज के पैसे चुकाने में आसानी हो हम सभी लोग पेटीएम का इस्तेमाल करते हैं लेकिन आप क्या जानते हैं कि पेटीएम के द्वारा क्रेडिट कार्ड बनाने के ऑफर चलाए जाते हैं I ऐसे में आप पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं कैसे बनाएंगे उसकी प्रक्रिया के बारे में अगर आप नहीं जानते हैं तो आर्टिकल को पूरा पढ़े ही जानते हैं

Paytm HDFC बैंक क्रेडिट कार्ड क्या है ?

Paytm hdfc credit card पेटीएम के द्वारा लांच किया गया क्रेडिट कार्ड इस कार्ड को पेटीएम कंपनी ने एचडीएफसी बैंक के साथ मिलकर लॉन्च किया है I इसके अलावा Paytm ने HDFC बैंक के साथ मिलकर अपने 5 क्रेडिट लॉन्च किए हैं इसका लाभ पेटीएम इस्तेमाल करने वाले कस्टमर उठा सकते हैं | इसे बनाने के लिए आपको अपने पेटीएम एप्स को ओपन करना होगा I

paytm hdfc credit card

Paytm hdfc credit card के प्रकार

कुल मिलाकर पांच प्रकार के कार्ड लांच किए गए हैं इसका विवरण हम आपको नीचे बिंदु अनुसार देंगे आइए जानते हैं - Paytm HDFC बैंक क्रेडिट कार्ड - Paytm HDFC बैंक मोबाइल क्रेडिट कार्ड - Paytm HDFC बैंक सेलेक्ट क्रेडिट कार्ड - Paytm HDFC बैंक बिज़नस क्रेडिट कार्ड - Paytm HDFC बैंक सेलेक्ट बिज़नस क्रेडिट कार्ड

Paytm hdfc credit के फायदे

- इसके द्वारा आप मूवी अमोल जैसी जगह पर अगर पेमेंट करते हैं तो आपको 3% का कैशबैक मिलेगा - यूटिलिटी बिल पेमेंट कर पाएंगे - बैंक की तरफ से आपको जीरोकोड चला बेटी दी जाएगी या नहीं अगर आपका कार्ड कहीं खो जाता है तो आप कस्टमर सर्विस को तुरंत इसकी जानकारी दे आपका कार्ड वहां से ब्लॉक कर दिया जाएगा और कार्ड की जिम्मेदारी आपके ऊपर ही रहेगी - फ्यूल (fuel) के खर्चों पर 1% लगने वाले फ्यूल सरचार्ज को नहीं लिया जाएगा | यदि आप ₹400 का फुल यहां पर मरवाते हैं तो आपको ₹250 का कैशबैक दिया जाएगा I

Paytm HDFC Credit Card charges and Fee

- मेम्बरशिप के तौर पर आपको – 49 रु���ए + GST चार्ज देना होता है | 1 महीने के लिए

Paytm hdfc credit card बनाने की Paytm Hdfc Credit Card योग्यता

- 21 साल से ऊपर होना चाहिए - पीएम का अकाउंट नंबर होना - Paytm Payment Bank में Saving Account होना चाहिए - क्रेडिट स्कोर अच्छा होना चाहिए - Income source - पैन कार्ड होना चाहिए Paytm मे आधार कार्ड से Upi कैसे बनाये | Create Upi pin in Paytm Through Aadhar Card 2023 Fastag Recharge Online: Fastag Online रिचार्ज कैसे करें | Axis Bank, Bhim App, Paytm कैसे करें

Paytm Hdfc Credit Card

Paytm Credit Card अप्लाई करने के लिए डाक्यूमेंट्स?

- Ration Card, Passport, Voter ID, Aadhar Card. निवास प्रमाण पत्र के तौर पर - Salary Slip, ITR Copy - Driving Licence, Passport, Addhar Card पहचान पत्र के तौर पर

Paytm hdfc credit card बनाने की प्रक्रिया

- ���बसे पहले आपको पेटीएम एप ओपन करना होगा और अगर आपके मोबाइल में नहीं है तो उसे डाउनलोड कर लीजिए - इसके होमपेज पर पहुंच जाएंगे यहां पर आपको Loans and Credit Cards’ वाले ऑप्शन दिखाई देगा उस पर क्लिक करेंगे - आपके सामने क्रेडिट कार्ड कार्ड वाला ऑप्शन आएगा उस पर आपको क्लिक करना है - अब आपके सामने आवेदन पत्र ओपन होगा जहां से जो भी आवश्यक जानकारी पूरी जाएगी उसका विवरण देंगे और उसके बाद आपको ‘Terms & Condition’ Agree करने के ऑप्शन पर क्लिक करेंगे - घर का पता और कितना पैसा महीने में कमाते हैं उसका यहां पर विवरण देंगे - सभी डिटेल्स भर देंगे आपको ‘Submit’ वाले बटन पर क्लिक करना है। - अब पेटीएम के अधिकारी योगिता की जांच करेंगे कि आप यहां पर लोन लेने के लिए योग्य है कि नहीं अगर है तो आपके मोबाइल में मैसेज आ जाएगा - उसके बाद आपको apply now के बटन पर क्लिक करना है - जिसके बाद आपके सामने एक नया पेज ओपन होगा जहां आप से कुछ आवश्यक चीजें मां की जाएंगे जिसका आपको सही ढंग से विवरण देना है - अब आपको Terms & Condition” को accept करके ‘Submit’ पर क्लिक करना है। - के बाद आपके स्किन पर एप्लीकेशन नंबर आएगा जिससे आपको कहीं पर लिख कर रखना है - अब बैंक के अधिकारी आपके आवेदन पत्र का वेरिफिकेशन करेंगे - जिसके बाद ही आपको क्रेडिट कार्ड मिल पाएगा - इस प्रकार आप आसानी से पेटीएम एचडीएफसी बैंक क्रेडिट कार्ड बना सकते हैं

Paytm Credit Card का Status कैसे check करे?

Paytm HDFC Credit Card के स्थिति का विवरण चेक करना बिल्कुल आसान है इसके लिए आपको अपने पेटीएम एप के credit card के ऑप्शन में जाना होगा वहां पर आपको क्रेडिट कार्ड अप्लाई स्टेटस का ऑप्शन दिखाई पड़ेगा उस पर क्लिक करके आप जान पाएंगे अपने क्रेडिट कार्ड का इसके बाद भी अगर आपको मालूम नहीं चल रहा है तो आप बैंक ऑफिशल वेबसाइट पर जाकर के टायर के स्टेटस का पूरा विवरण चेक कर सकते हैं इसके अलावा कस्टमर सर्विस में भी फोन कर कर आप जान पाएंगे

Paytm hdfc क्रेडिट कार्ड की लिमिट कितनी होती है?

आप पेटीएम एचडीएफसी बैंक एटीएम कार्ड इस्तेमाल करेंगे तो हम आपको बता दें कि इसकी एक निश्चित लिमिट तय की गई है जायदा का खर्चा करते है तो आपको 2.5 प्रतिशत के दर से अतिरिक्त fine जो कि ₹600 होती है इसके अलावा और भी कई प्रकार की चीजें आपको ध्यान में रखनी होंगी ताकि आप fine देने बच सके I Read the full article

2 notes

·

View notes

Text

Understanding modes of GST payments: The comprehensive guide.

GST is another reform in the Indian tax system that makes the procedure of collection and compliance of tax smooth. However, in the midst of changing things, the issue arising here is the payment method of GST. Here lies a comprehensive guide to GST payment modes along with the features, advantages, best practices, and more. All these are important for an entrepreneur, a professional in finance, or a student getting enrolled in a GST Course in Kolkata.

What are GST Payment Modes?

GST payment modes refer to the modes of payment through which business persons can pay their dues under GST to the government. These should be paid in time and correctly for the compliance of regulations for GST and avoiding penalities. The government is also providing various modes of payments to cater to different taxpayer needs.

The most common payment mode is through the official GST portal. This is more convenient and efficient.

Steps to Pay Online Step 1: Login to the GST Portal ⦁ Log in to the official GST portal using your login credentials. ⦁ Select 'Services' followed by 'Payments': From the 'Services' tab, click on 'Payments,' then on 'Create Challan.' ⦁ Select the Right Challan: Fill in all the necessary information along with the type of tax, and you will be able to see the right challan available for selection ⦁ Payment Medium: Choose the mode of payment whether it is Net banking, Debit card or Credit card; and finally pay. Advantages ⦁ Instant success of the payment ⦁ Taxpayer ledger is updated automatically

Net Banking Net banking provides you with safe and reliable way to do GST payments from your banking account itself. Step to Apply Net Banking: ⦁ Log in to your bank's online net banking portal. ⦁ Click on GST payment. ⦁ Fill in the required information, like GSTIN and amount, etc. ⦁ Confirm the process of payment.

Advantages: ⦁ It gets processed very fast and is credited directly to the government's account. ⦁ Quick processing ⦁ Direct credit to government's account

Challan Payment through Banks Taxpayers also get a chance for payment through physical challans through banks. This is ideal for those who like old-fashioned banking.

How to Pay through Challan: ⦁ Go to a branch of a bank as directed and submit the pre-filled GST challan. ⦁ Submit along with the payment this challan. ⦁ Collect the receipt from the bank- it shall suffice as proof of payment.

Benefits It is useful in case the business entities do not make much use of the internet It offers a paper record of the payment

Electronic Wallets Some taxpayers utilize e-wallets for easy payment of their GST. This method may not be popular and will depend on the government.

⦁ Procedure on How to Use an E-Wallet ⦁ One should attach the e-wallet to your GST payment portal. ⦁ Then, click on a payment gateway and complete all steps involved in the transactions.

Benefits ⦁ Flexible and user-friendly ⦁ Useful for small business and start-ups.

Due Dates for Payments

Payment of GST is a time-sensitive process. Late payments lead to the levy of penalty and interest. You need to get familiar with the due dates for different types of GST payments-whether it will be monthly or quarterly basis according to the type of your business and turnover.

Maintain records of each transaction, like payment receipts and challans. In fact, this is indispensable while referring to the transaction data in the future as required during audits or assessment purposes. Accounting software such as Tally can even automate this process.

Choice of Medium of Payment

This, of course, keeps in mind the size, nature, and technology absorption capacity of a business. In this regard, online payment options may be preferred by smaller businesses. Similarly, a more established enterprise may seek the services of banks.

Take Related Courses

To know more about GST and its financial procedures, a student can take up a course on Taxation Course in Kolkata or GST courses i to expand knowledge about tax laws and the associated compliance needs for proper business administration.

Role of Tally in payment process through GST.

In this manner, for the companies who actually manage their accounts, making GST payments would indeed be much simpler with the help of Tally. The software calculates automatic GST, generates GST reports, and prepares payment challans efficiently. One should, therefore, get enrolled in a Tally Course in Kolkata to learn it well.

Conclusion

The knowledge of the GST payment modes will make the business compliant and save from a penalty with the help of online payments, net banking, and traditional bank payments. This also allows selecting a mode of payment most apt for him or her. Further, the investment in time for the right kinds of educational courses, including an Accounting Course in Kolkata r even a GST Course to one's knowledge and proficiency in dealing effectively with GST payments.

#accounting course#GST Course#taxation course#tally course#Accounting Course in kolkata#Gst Course in kolkata

0 notes

Text

A Comprehensive Guide to GST Return Filing Online

Introduction

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. GST has simplified the indirect tax system in India by replacing multiple taxes levied by the central and state governments. With the advent of digital technology, GST return filing has become more accessible through online platforms. The article provides a step-by-step guide to filing GST returns online.

Types of GST Returns

Before diving into the filing process, it's essential to understand the various types of GST returns, each serving a different purpose:

GSTR-1: Details of outward supplies of goods or services.

GSTR-2A: Read-only document containing details of inward supplies auto-populated from the supplier's GSTR-1.

GSTR-3B: Simple summary return of inward and outward supplies.

GSTR-4: Quarterly return for composition scheme taxpayers.

GSTR-5: Return for non-resident taxable persons.

GSTR-6: Return for input service distributors.

GSTR-7: Return for authorities deducting tax at source.

GSTR-8: Return for e-commerce operators collecting tax at source.

GSTR-9: Annual return for regular taxpayers.

GSTR-10: Final return in case of cancellation of GST registration.

GSTR-11: Return for taxpayers with a Unique Identification Number (UIN).

Prerequisites for GST Return Filing

Before you start the GST return filing process, ensure you have the following:

Active GSTIN (Goods and Services Tax Identification Number): You must be registered under GST and have an active GSTIN.

Login Credentials: Access the GST portal with your username and password.

Digital Signature Certificate (DSC) or EVC: For authentication purposes, businesses (other than proprietorships) must use a DSC, while proprietorships can use an Electronic Verification Code (EVC).

Required Data: Sales and purchase invoices, outward and inward supplies details, and other necessary documents.

Step-by-Step Guide to Filing GST Returns Online

Step 1: Access the GST Portal

Visit the GST Portal: Go to the official GST portal (https://www.gst.gov.in/).

Login: Click the 'Login' button and enter your credentials (username and password).

Step 2: Navigate to the Return Filing Section

Dashboard: After logging in, you will be directed to the dashboard.

Services: From the main menu, navigate to 'Services'> 'Returns'> 'Returns Dashboard'.

Step 3: Select the Return Period

Financial Year and GST Return Filing Period: From the dropdown menu, select the financial year and the return filing period (monthly or quarterly).

Search: Click on the 'Search' button to proceed.

Step 4: Choose the Return Form

Select Form: Select the appropriate return form (e.g., GSTR-1, GSTR-3B) based on your registration type and business activities.

Step 5: Fill in the Return Details

Outward Supplies (Sales): For GSTR-1, provide details of outward supplies, including invoice-wise information for B2B transactions and aggregate details for B2C transactions.

Inward Supplies (Purchases): Ensure all purchase details are correctly captured for GSTR-2A (auto-populated) and GSTR-3B.

Tax Calculation: Calculate the tax liability, including CGST, SGST, IGST, and cess, if applicable.

Step 6: Validate and Submit the Return

Save and Preview: Save the details periodically to avoid data loss. Preview the return to ensure all details are correctly entered.

Submit: Click the 'Submit' button to validate your return.

Step 7: Payment of Tax Liability

Create Challan: If there is any tax liability, generate a challan for tax payment.

Payment: Pay using modes such as Net Banking, Credit/Debit Card, or NEFT/RTGS.

Step 8: File the Return

Authentication: Use DSC or EVC to authenticate the return.

File Return: Click on the 'File Return' button. A confirmation message and an acknowledgement reference number (ARN) will be generated.

Step 9: Download the Acknowledgment

Download and Save: Download the filed return and acknowledgement for your records.

Conclusion

Filing GST returns online is a streamlined and efficient process that ensures compliance with the GST law. Regular and accurate filing helps businesses avoid penalties and maintain compliance ratings. The GST return filing process and ensure your business complies with all regulatory requirements.

0 notes

Text

The Ultimate Guide to GEM Consultation and Registration

The Government e-Marketplace (GeM) has changed the way businesses interact with government procurement processes in India. If you're a business owner and looking to expand your market reach, GeM portal registration is a golden opportunity you shouldn't miss. This article will walk you through the GeM registration process, highlight the benefits, and explain how product listing on GeM can elevate your business to new heights.

What is the Government e-Marketplace (GeM)?

The Government e-Marketplace is an online platform launched by the Government of India to facilitate the procurement of goods and services by various government departments, organizations, and public sector undertakings. GeM aims to enhance transparency, efficiency, and speed in public procurement.

Benefits of Registering on GeM Portal

1. Expanded Market Access

By registering on the GeM portal, your business gets direct access to a vast market of government buyers. This not only increases your sales potential but also establishes your brand in the government sector.

2. Transparency and Efficiency

The GeM portal ensures a transparent procurement process, reducing the chances of corruption and favoritism. All transactions are recorded, and the system is designed to be user-friendly, making the entire process efficient.

3. Ease of Doing Business

With features like e-bidding, reverse e-auction, and demand aggregation, the GeM portal simplifies the procurement process. This ease of doing business encourages more participation from sellers.

4. Prompt Payment

The GeM portal has mechanisms in place to ensure timely payments to sellers, improving cash flow and financial planning for businesses.

GeM Portal Registration - Benefits

Access to National Market: Reach out to government buyers across the country.

Cost Reduction: Minimize marketing costs and efforts.

Equal Opportunity: Level playing field for all sellers, big or small.

Feedback Mechanism: Improve your services based on buyer feedback.

GeM Registration Process

Step 1: Visit the GeM Portal

Navigate to the official GeM portal and click on the 'Seller' option to start the registration process.

Step 2: Provide Business Details

Fill in your business information, including PAN, GST number, and other essential details.

Step 3: Submit Required Documents

Gem Portal Registration Documents Required

PAN Card of the business entity

Udyog Aadhaar or Company Registration Certificate

GST Registration Certificate

Bank Account Details with canceled cheque

Authorized Signatory Identification (Aadhaar, Voter ID, etc.)

Step 4: Verification Process

After submitting the documents, the GeM authorities will verify your details. This may take a few days.

Step 5: Account Activation

Once verified, your account will be activated, and you can start listing your products.

Product Listing on GeM

How to List Products

Login to your GeM seller account.

Navigate to the 'Add New Product' section.

Fill in the product details, including specifications, images, and pricing.

Submit for approval.

Tips for Effective Product Listing on GeM

High-Quality Images: Use clear and professional images of your products.

Accurate Descriptions: Provide detailed and precise product information.

Competitive Pricing: Research market rates to price your products competitively.

Keywords Optimization: Use relevant keywords to make your products easily discoverable.

GeM Consultation Services

Navigating the GeM registration and product listing can be overwhelming. This is where GeM consultation services come into play.

Why Opt for GeM Consultation?

Expert Guidance: Get assistance from professionals who understand the intricacies of the GeM portal.

Time-Saving: Speed up the registration and listing process.

Compliance Assurance: Ensure all your documents and listings comply with GeM guidelines.

Introducing Bidz Professional

At Bidz Professional, we specialize in providing comprehensive GeM consultation services. Our team of experts will guide you through the registration process, help with document preparation, and assist in product listing to maximize your visibility on the platform.

Benefits of Registering on GeM Portal

Business Growth: Tap into new markets and increase sales.

Brand Recognition: Build credibility by associating with government procurement.

Networking Opportunities: Connect with other businesses and government entities.

Innovation Encouragement: Stay updated with the latest market trends and demands.

Conclusion

The GeM portal registration opens doors to vast opportunities for businesses willing to expand their horizons. The benefits of registering on GeM portal are immense, from increased market access to streamlined procurement processes. With the right guidance and approach, especially through professional GeM consultation services like those offered by Bidz Professional, you can navigate the GeM registration process with ease.

Don't miss out on the chance to elevate your business to the next level. Start your GeM registration today and take the first step towards a more prosperous future.

For personalized assistance with your GeM registration and product listing, contact Bidz Professional. We're here to help you every step of the way.

1 note

·

View note

Text

Company Creation in Tally Prime: An Easy Guide

Tally Prime is one of the most widely used accounting software platforms for small and big businesses. Most routine activities like bookkeeping, inventory management, tax filing, and payroll are made very easy by it. The very first thing to do when you open Tally Prime is create a company. You will get step by step steps regarding the creation of a company in Tally Prime, and there's no delay for its usage. For someone who wants more knowledge, here is Tally Course in Kolkata for continuous enhancement.

Why Learn Company Creation in Tally Prime?

This is the starting point in Tally Prime towards efficiently managing your financial data; it sets up a basic environment where all financial records are stored. Regardless of which kind of course an accounting or taxation student is undertaking in Kolkata, "how to use Tally Prime, starting with making a company is a very important skill.

You will also get the facility of multiple companies that can be set up, financial year assigned, and different businesses managed from the same interface. So, come, let's see how we can create a company in Tally Prime.

How to Create Company in Tally Prime: Step by Step Guide

Creation of company in Tally Prime is not something that is a bit difficult job. It can be done with the following steps.

Step 1: Open Tally Prime Run Tally Prime, and you get the startup screen. If this is the first time you are using Tally Prime, the first screen will invite you to create a company.

Step 2: Click the Create Company Option You have to click the "Create Company" option from the startup screen. This is where you start the whole process of creating a new business in Tally Prime.

Step 3: Enter the Company Details In the Company Creation screen, enter:

Company name. Here you should enter the name of your company.

Mailing Name and Address. You can use this to enter the mailing address for all the bills and communication

Country and State. Enter your country and state for which you pay taxes.

Pincode. Enter the Postal code for your pincode

Contact Details. Add your contact number and email ID for the company. This is optional but recommended.

Financial Year Start Date: Mention the date when the financial year will commence. For most Indian companies, it is on April 1st.

Books From Date: Fill in the date from which the accounting records shall be posted, preferably the date at which the financial year commences.

Step 4: Security Control Configuration In this step, assign an admin username and password to protect the data of your company. You can also define user roles and permissions if you have a number of users login.

Step 5: Enable GST and Other Add-ons This is the correct procedure to guide through if your business is GST-compliant; then the on switch must be toggled into "Yes" as well as type in your GST Registration number. You can visit a GST Course in Kolkata to get a better understanding of GST.

Step 6: Save Company Details Once all the details are filled in, press Ctrl + A to save the company data. You can use Tally Prime for accounting, inventory, and compliance related works. Features Available After Company Registration

After successfully registering a company in Tally Prime, you can avail of the following features:

Creation of Chart of Accounts Ledger for Revenues, Expenses, Assets, and Liabilities Maintain ledgers in respect of revenues, expenses, assets and liabilities so that accounting records will be kept rather clean.

Step 7: Accounting and Stock Control The entries, receipt, payment, and stock detail can be managed so that financial and inventory records are maintained up-to-date.

GST, TDS and TCS Compliance Information of GST, TDS, and TCS can be prepared to ease tax reporting and compliance.

If you like this information and would like to learn practically, then opt for an Accounting course in Kolkata.

Benefits of Learning Company Creation in Tally Prime

Learning how to create a company in Tally Prime comes with many benefits, among which are the following:

Creation of Multiple Companies This comes in very handy for accountants who have multiple clients as it allows the creation of multiple companies quite easily.

Data Security Tally Prime has great data security features in which you can protect your company information by giving role-based access.

GST Management It offers management of GST as well, including return filing, which is a pretty considerable part of running the business.

Where to Learn Company Creation in Tally Prime?

Enrolling in a Tally course in Kolkata helps you learn how to create a company and how to get through all the features of Tally Prime. Such courses are inclusive, in the sense, from basic company creation to advanced accounting tasks. Furthermore, you will gain knowledge about GST and taxation course in kolkata by taking such courses that would help you understand tax and account management in Tally Prime.

Conclusion

In Tally Prime, first of all, you have to create the company that will manage your account book and manage your inventory as well as compliance aspects. After creating a company, you can experience Tally Prime fully in its roles regarding financial dealings of your business. By mastering this technique of company creation in Tally Prime, one will discover the true prowess of this software for finance management in entirety.

#Accounting Course#taxation course#tally course#GST Course#Accounting Course in kolkata#Tally Course in Kolkata#GST Course in Kolkata

0 notes

Text

Filing Process of GSTR-1: Detailed Step-by-Step Guide

According to this, every business has a responsibility of filing GSTR-1 as it contains all the sales and services that are rendered in a specific period. Whether to file it every month or every quarter depends on the turnover of the company annual turnover. On-time error-free submission of GSTR-1 helps the business avoid penalties and ensures complete compliance with regulatory necessities. Below is the detailed guideline on how to file GSTR-1 with facts learned during the GST Course in Kolkata.

What is GSTR-1?

GSTR-1 is one of the GST returns that a registered person has to provide while reporting the sales made in a specific period. It consists of all taxable supplies made within the said period. All those who are registered under GST, except for the composition scheme and input service distributor, must file GSTR-1. The periodicity of the filing depends upon the turnover basis of the company:

Monthly business having an annual turnover of more than ₹5 crores.

Quarterly: For businesses whose turnover is within ₹5 crores, benefit is drawn under QRMP scheme, Quarterly Return Filing and Monthly Payment

Important Details Needed to Submit GSTR-1

Threshold Business Before applying for the submission of GSTR-1, you would need the following significant information:

GSTIN: Your unique Goods and Services Tax Identification Number.

Invoice Details: Invoice no., date, and value for every sale.

HSN Codes: The Harmonized System of Nomenclature code applicable on products and services sold.

Buyers GSTIN: B2B – meaning Business to Business.

Value of Supplies/Services: includes relevant CGST, SGST, and IGST Amounts

Export: Deal for goods/services exported from India

Advances received for supply in the future.

Credit/Debit Notes: Primarily for amending the sales details already reported.

Implementation of all these measures and utilizing the knowledge obtained in a GST and Tally Course in kolkata will guarantee hassle-free, error-free GSTR-1 filing.

Step 1: GST Portal Access Log onto www.gst.gov.in. Log in with the registered details. This is your first time? Ensure the GSTIN has been duly registered.

Step 2: Locate GSTR-1

Step 3: Login: Move to 'Services' Tab and click on 'Returns.' On the 'Returns Dashboard,' you will have to click on the fiscal year and then the filing period, either monthly or quarterly. Click 'Search' then click 'Prepare Online' under 'Monthly Returns.'

Insert Sales Information

for B2B sales, invoice details, GSTIN of buyer, tax amount and credit amount; for B2C sales, taxable amount, tax liability, other taxes; for exports, numbers of shipping bills, port codes. Nil-rated or exempt supplies should be reported on a separate part of the return, while credit or debit notes that need to be issued.

Ensure that all information entered, especially on Invoices, Credit Notes and Customer details, are accurate before filing .

Submit the Return After validation, click the 'File' button to submit your return; at this stage you cannot make changes .

Sign with Digital Signature EVC or DSC: End the filing process with an EVC or DSC. After a successful filled return, a confirmation message and the ARN will be received .

5. Download Copy Generate a copy of the returned document filed to be kept for audit purposes and for later use, in particular when tax authorities request for the same.

Importance of GST Filing

It is a basic duty of businesses under GST to file GSTR-1. Errors in their returns will attract penalties and delay input tax credits business partners. Understanding GST compliance, therefore, forms an essential part of any educational curriculum in finance or accountancy.

Benefits of Studying a GST or Taxation Course

Expert Knowledge: A GST or taxation course in Kolkata equips professionals with all the latest rules and practices under GST, helping them to undertake all tax matters diligently.

Practical Experience: Most courses incorporate case studies, giving students practical experience in filing GSTR-1 and other forms.

Career Opportunities: GST features as a critical component of the Indian tax system, and doing a Taxation and Accounting course in Kolkata opens up a host of career avenues.

Stay Updated: The tax laws keep changing frequently, so a GST course makes sure the learner is updated with the new developments.

Conclusion

Filing GSTR-1 is the most crucial part of GST compliance for any business. A GST course would substantially enhance your confidence level in handling GST returns and other tax-related duties. Think about joining a course to further upgrade your knowledge in this matter.

#accounting course#gst registration#GST Course#Taxation Course in kolkata#Taxation Course#Tally Course

1 note

·

View note

Text

Your Comprehensive Guide to Getting GST Refund in India (2024)

It is not difficult to navigate through claiming a refund of the GST; still, business houses, financial professionals, entrepreneurs, and also individual taxpayers must understand the easiest mode of claiming these refunds. In this article, we have segregated the process of refund under GST, the eligibility criteria, and timeline so you can claim your refund.

What is GST Refund?

A GST refund arises from the situation where registered taxpayers have overpaid the amount of tax owed. This amount can be recovered through an online procedure on the GST portal. In a timely manner, GST refunds are crucial for businesses as well as exporters to keep cash flow and working capital healthy.

Who Can Claim Refund in GST?

Businesses and companies with excess paid taxes or ITC accumulation.

Exporters who have paid Integrated GST (IGST) on exports.

Individual taxpayers who have paid more in error or eligible for refunds pertaining to special purchases. As defined, special purchases include those of the UN agencies and embassies.

International tourists can claim a refund of GST paid on goods purchased from India at the time of departure from the country.

When can GST Refund be claimed?

The following are circumstances under which a GST refund can be claimed:

Excess GST paid due to calculation errors or over-payment.

Amount of ITC on exports/deemed exports.

GST paid on exports.

Inverted Duty Structure, which refers to a structure where input tax exceeds the output tax.

Refund on provisional assessments.

Time Limit for Claiming GST Refund Application

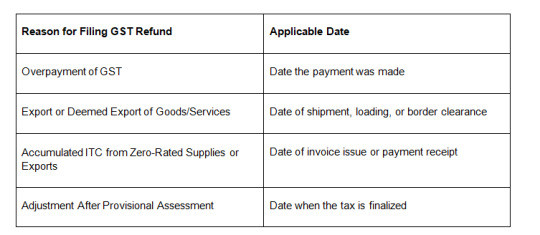

Taxpayers are expected to file their GST refund applications within two years from the relevant date. Time limitation and grounds for filing in a GST refund application are as stated below:

This deadline ensures that companies and tax payers file within a stipulated time frame before losing their rightful refunds.

How to Apply for a GST Refund Step by Step

Login to the GSTN Portal: Login into your account at the GSTN Portal .

Fill Form RFD-01: This would be the form on which refund claims would be supported, and the form should be filed online. All details like the amount to be refunded and relevant invoices must be correctly filled in this form.

Submission of Supporting Documents: Invoices, ITC statements, etc. that may be necessitated.

Track Refund Status: For this, follow the GST portal to track the application

Confirmation: After submission, you will receive an ARN (Application Reference Number) for tracking the status of a refund

Processing of Refund: In most cases, authorities take 30 days to process applications for claiming a refund. Once approved, the amount would directly be credited into your bank account.

How to Monitor Your GST Refund Status

Post-submission

Checking Post-Login: Log in to the GST portal. From the Services tab, click on "Track Application Status".

Pre-Login Tracking: Clicking on "Track Application Status" on the homepage of the GST portal and then filling up the ARN without login.

Key Points to Ensure a Smooth Refund Process

Ensure all invoices and documents are accurate and correctly uploaded.

Monitor the refund status regularly for any updates.

Be mindful of the two-year time limit for refund claims to avoid rejection.

How Online Chartered Makes Your GST Refund Claims Easy

Online Chartered has made the refund process under GST quite smooth and effortless. Our knowledge in GST compliance at Online Chartered would ensure that you receive your refund claim on time. We take our time to help you individually, keeping you oblivious of the persisting turmoil of tax consultancy.

Conclusion

Filing a GST refund does not necessarily need to be so overwhelming. Provided proper steps and observation of important dates are taken, businesses and taxpayers can effectively retrieve their excess payments and give control of their cash flow. Online Chartered is your expert on GST compliance. Streamlined help and support is aimed at simplifying your GST refund claims and getting you the results you need.

0 notes

Text

Cloud-Based Retail Software

Are you currently looking for affordable and feature-rich retail POS software that is customized to meet the unique requirements of your business? Experience the future of retail with our pocket-friendly retail POS software. Say goodbye to manual billing and embrace a seamless, automated system. Generate customized barcodes, speed up checkouts, and effortlessly manage inventory. Integrate with e-commerce platforms for a unified order management solution. Stay compliant with GST regulations and streamline financial tasks with the best POS software solution - Best Restaurant Billing Software

We offer a wide range of solutions that help retailers streamline their management and operations effectively. Provides smart integration with payment, logistics, and many other platforms. Simplified operations with easy access from multiple devices. Our implementation team offers ongoing guidance and support to clients throughout their product training journey. Simplify the processes, reduce errors, and improve inventory management. Login anytime, anywhere, without hardware worries. Safely store data on a secure and reliable cloud platform. The Support team is available to provide you with all the assistance - restaurant management software.

Provides smart integration with payment, logistics, and many other platforms. Simplified operations with easy access from multiple devices. Our implementation team offers ongoing guidance and support to clients throughout their product training journey. Simplify the processes, reduce errors, and improve inventory management. For more information, please visit our site https://billingsoftwareindia.in/restaurant-billing-software/

0 notes

Text

If You Lost Your PAN Card, complete guide to How to Apply for a Duplicate pan card!

What is a Duplicate PAN Card?

A Duplicate PAN (Permanent Account Number) card is a reissued version of the original PAN card, typically requested when the original is lost, damaged, or needs to be replaced. The PAN card is a crucial document in India, used for various financial transactions and tax purposes, serving as a unique identifier for individuals and entities.

Steps to Apply for Duplicate PAN Card Online

1. Visit the Official Website: Go to the websites of NSDL (now Protean) or UTIITSL. 2. Select the Application Type: Choose “Reprint of PAN Card” or “Duplicate PAN Card”. 3. Fill in the Form: Provide necessary details like your PAN, name, and date of birth. 4. Submit Documents: Upload required documents, such as identity proof. 5. Pay the Fee: Make the payment using the available online options. 6. Receive Acknowledgment: After submission, you’ll receive an acknowledgment receipt with a token number for tracking.

Applying Duplicate PAN Card Without Changes

If you need a duplicate PAN card without any changes in personal details, the process is simplified. Follow the same online steps as above, ensuring you select the option for a duplicate without changes. Your existing information will be retained.

Who Can Apply For Duplicate PAN Card?

Any individual or entity that holds a PAN card can apply for a duplicate. This includes:

- Indian citizens - Non-resident Indians (NRIs) - Companies - Partnerships - Trusts

When to Apply for a Duplicate PAN Card

You should apply for a duplicate PAN card in the following situations:

- Loss or theft of the original card - Damage or wear and tear making the card unreadable - Incorrect details on the original card (if needing a change, opt for the correction process instead)

Documents Required for a Duplicate PAN Application

To apply for a duplicate PAN card, you typically need:

- A copy of your lost or damaged PAN card (if available) - Identity proof (e.g., Aadhar, passport, voter ID) - Address proof (e.g., utility bill, bank statement) - Passport-sized photographs - Payment receipt (for online applications)

Fees to Apply for a Duplicate PAN Card

The fee for applying for a duplicate PAN card varies based on the applicant’s location:

- For Indian residents: Approximately ₹110 (including GST) - For applicants outside India: Approximately ₹1,020 (including GST)

Check the latest fee structure on the official websites before applying.

Steps to Download a Duplicate PAN Card

Once your duplicate PAN card application is approved, you can download it:

1. Visit the PAN Service Website: Go to NSDL or UTIITSL. 2. Select ‘Download PAN’: Look for the option to download the e-PAN. 3. Enter Details: Provide your PAN and acknowledgment number. 4. Authenticate with OTP: An OTP will be sent to your registered mobile number for verification. 5. Download the Card: After verification, download the e-PAN card.

Steps to Surrender a Duplicate PAN Card

If you have received a duplicate PAN card but realize you have multiple PANs, it’s advisable to surrender the extra one:

1. Write a Request Letter: Address it to the Income Tax Department, mentioning your details and PAN numbers. 2. Include Documents: Attach copies of your PAN cards and identity proof. 3. Submit: Send the letter to the appropriate IT office or online via the official portal.

Conclusion

A duplicate PAN card is essential for maintaining seamless financial transactions and tax compliance. The process for obtaining one, whether online or offline, is straightforward. Ensuring you have a valid PAN card helps in avoiding penalties and facilitates smoother dealings with banks and other financial institutions.

Related article: How to track your Pan card status? , Pan card application form pdf

#Duplicate PAN card#Lost PAN card#Apply for PAN card#PAN card reissue#PAN card application process#Online PAN card duplicate#Offline PAN card duplicate#PAN card fees#PAN card documents required#PAN card tracking#Income Tax PAN#e-PAN card download#Surrender PAN card#PAN card for individuals#PAN card for NRIs#Surrender Duplicate PAN Card#Surrender Duplicate PAN Card how to apply#download pan card online#pan application form pdf#apply pan card application#income tax login#income tax return#taxring#itr filing#gst registration#tax refund#income tax audit#tax audit#income tax

0 notes

Text

Best Accounting & Billing Software Development in Lucknow

In today’s fast-paced business environment, efficient financial management is essential for success. To meet this need, businesses are increasingly turning to customized accounting and billing software that can streamline operations and improve accuracy. In Lucknow, SigmaIT Software Designers Pvt. Ltd. has emerged as a leader in developing the Best Accounting and Billing Software in Lucknow tailored to the unique needs of businesses across various industries.

Why SigmaIT Software Designers Pvt. Ltd.? -

1. Expertise in Software Development: SigmaIT Software Designers Pvt. Ltd. boasts a team of experienced developers who specialize in creating robust accounting and billing software. With deep expertise in software development and a thorough understanding of financial processes, SigmaIT delivers solutions that are not only functional but also user-friendly and scalable. Their software is designed to grow with your business, providing the flexibility to adapt to changing needs.

2. Customized Solutions: Every business has unique accounting and billing requirements, and SigmaIT understands that a one-size-fits-all solution is not always effective. That’s why they offer customized software development services, ensuring that the software aligns perfectly with your specific business processes. Whether you need a basic invoicing system or a comprehensive accounting solution with multi-currency support, SigmaIT tailors the software to meet your exact needs.

3. Comprehensive Features: SigmaIT’s accounting and billing software is packed with features designed to simplify financial management. Some of the key features include:

Invoicing: Create, send, and manage invoices with ease. The software allows for customizable invoice templates, automated reminders, and payment tracking.

Expense Management: Track expenses in real-time, categorize them, and generate detailed reports to monitor spending.

Financial Reporting: Generate accurate financial reports such as profit and loss statements, balance sheets, and cash flow reports, providing valuable insights into your business’s financial health.

GST Compliance: Ensure compliance with GST regulations with automated tax calculations and GST return filing capabilities.

Multi-User Access: Provide different levels of access to multiple users, ensuring that team members can collaborate effectively while maintaining data security.

Integration Capabilities: SigmaIT’s software can be seamlessly integrated with other business systems such as CRM and ERP, allowing for streamlined operations and data consistency.

4. User-Friendly Interface: One of the hallmarks of SigmaIT’s software solutions is their user-friendly interface. The software is designed with the end-user in mind, making it easy for even non-technical users to navigate and operate. This intuitive design reduces the learning curve, allowing businesses to start using the software efficiently right from the start.

5. Focus on Security: In an era where data breaches are a significant concern, SigmaIT places a strong emphasis on security. Their accounting and billing software is equipped with robust security features, including data encryption, secure login protocols, and regular security updates. This ensures that your financial data is protected from unauthorized access and potential threats.

6. Excellent Support and Maintenance: SigmaIT Software Designers Pvt. Ltd. is committed to providing ongoing support and maintenance for their software solutions. Whether it’s troubleshooting issues, providing updates, or offering training sessions, SigmaIT’s dedicated support team is always ready to assist. This ensures that your software remains up-to-date and continues to perform optimally.

7. Proven Track Record: With a portfolio of successful projects and a reputation for delivering high-quality software, SigmaIT has established itself as a trusted name in the software development industry. Their clients range from small businesses to large enterprises, and they have consistently received positive feedback for their accounting and billing solutions.

8. Competitive Pricing: SigmaIT offers its software development services at competitive prices, making it accessible to businesses of all sizes. They provide transparent pricing structures with no hidden costs, ensuring that you get the best value for your investment.

Conclusion -

SigmaIT Software Designers Pvt. Ltd. is the best choice for accounting and billing software development in Lucknow. With their expertise, commitment to customization, and focus on user experience, they deliver software solutions that simplify financial management and help businesses achieve their goals. Whether you are a small business owner looking for a simple invoicing tool or a large enterprise in need of a comprehensive accounting system, SigmaIT has the skills and experience to deliver a solution that meets your needs.

For businesses in Lucknow and beyond, SigmaIT Software Designers Pvt. Ltd. is the go-to partner for reliable, efficient, and secure accounting and billing software development.

Contact Information -

Email - [email protected]

Phone - 9956973891

Address - 617, NEW -B, Vijay Khand, Ujariyaon, Vijay Khand 2, Gomti Nagar, Lucknow, Uttar Pradesh 226010

#accountingsoftwarecompanyinlucknow#bestaccountingsoftwarecompanyinlucknow#billingsoftwarecompanyinlucknow#bestbillmgsoftwarecompanyinlucknow#accountingsoftwaredevelopmentcompanyinlucknow

0 notes

Video

youtube

IT Refund payment failed| How to apply for IT Refund reissue| Know the reason for IT Refund failure @cadeveshthakur #refund #incometax #cadeveshthakur Dear Viewers, How to handle an Income Tax (IT) refund reissue when the refund payment fails due to non-validation of the bank account: Income Tax Refund Reissue Process When an Income Tax refund payment fails due to non-validation of the bank account, taxpayers can request a reissue of the refund. This situation typically arises when the bank account details provided are incorrect or not pre-validated. Here’s a step-by-step guide to address this issue: 1. Reasons for Refund Failure Refunds can fail for several reasons, including: Incorrect bank account details (e.g., account number, IFSC code, MICR code). Name mismatch between the bank account and the PAN. KYC (Know Your Customer) pending for the bank account. The account provided is not a savings or current account. 2. Pre-Validation of Bank Account Before requesting a refund reissue, ensure that your bank account is pre-validated on the Income Tax e-filing portal. Follow these steps: Login to the e-Filing Portal: Go to www.incometax.gov.in and log in using your credentials. Navigate to ‘My Profile’: Under the ‘Profile Settings’ section, select ‘My Profile’. Add Bank Account: Click on ‘Add Bank Account’ and enter the required details. Pre-Validate: Submit the details for pre-validation. The status of the validation request will be sent to your registered mobile number and email ID. 3. Requesting Refund Reissue Once your bank account is pre-validated, you can request a refund reissue: Login to the e-Filing Portal: Use your credentials to log in. Go to ‘Services’: Select ‘Refund Reissue’ from the ‘Services’ menu. Create Refund Reissue Request: Click on ‘Create Refund Reissue Request’. Select the Record: Choose the record for which you want the refund to be reissued. Select Bank Account: Choose the pre-validated bank account where you want to receive the refund. Submit Request: Confirm and submit your request. 4. Monitoring the Status You can monitor the status of your refund reissue request on the e-Filing portal: Login to the e-Filing Portal: Use your credentials to log in. Navigate to ‘My Account’: Select ‘Refund/Demand Status’ under ‘My Account’. Check Status: View the status of your refund reissue request. 5. Common Issues and Solutions Validation Failure: If the bank account validation fails, check the reason (e.g., PAN not linked, name mismatch) and rectify it by contacting your bank. Multiple Accounts: You can pre-validate multiple bank accounts but can nominate only one for the refund. Index 00:00 to 02:00 IT Refund failed 02:01 to 04:00 IT Refund reissue 04:01 to 08:14 IT Refund reissue process 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 YouTube Channel: https://www.youtube.com/@cadeveshthakur TDS ki कक्षा: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R E-commerce sellers: https://www.youtube.com/playlist?list=PL1o9nc8dxF1ShUNXkAbYrAYj2Pile1Rim GST Knowledge Bank: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RjdRrG4ZKXeJNed6ekhjoR Goods & Services Tax: https://www.youtube.com/playlist?list=PL1o9nc8dxF1SlBw2kSpZ9ay1jnEOkbDYN TDS: https://www.youtube.com/playlist?list=PL1o9nc8dxF1RXi2GaEckeXGmJy_FYOj9q Shorts for Accountants, Professionals, Finance, Students: https://www.youtube.com/playlist?list=PL1o9nc8dxF1TqoRTWoA1_l0kmtsbyNEB5 Accounting concept, Entries, Final Accounts preparation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1T4GSjBPboXxBgFgkVZmDbQ Direct Taxation: https://www.youtube.com/playlist?list=PL1o9nc8dxF1S7BBNeuL3fzV_fDl9V88C2 🎥 Hello, lovely viewers! Welcome back to the @cadeveshthakur channel! 🎉 I’m thrilled to have you here, and I want to connect with you beyond YouTube. Let’s take our journey together to the next level! 😊 Whatsapp Group: https://whatsapp.com/channel/0029Va6GOVE9MF92Ylmo7e0L #cadeveshthakur https://cadeveshthakur.com/ Disclaimer: The content shared on this channel is purely for educational purposes. As a Chartered Accountant, I strive to provide accurate and insightful information related to GST, income tax, accounting, and tax planning. However, please note that the content should not be considered as professional advice or a substitute for personalized consultation. income tax refund payment failed,it refund payment failed,how to apply for it refund reissue,income tax refund reissue,reason for it refund failure,reason for income tax refund failure,cadeveshthakur,income tax refund not received,income tax refund status,income tax refund status kaise check kare,income tax refund not processed,income tax refund still processing,income tax refund processing time,it refund,itr refund status check,itr refund IT Refund payment failed| How to apply for IT Refund reissue| Know the reason for IT Refund failure

#youtube#income tax refund#income tax refund status#income tax#income tax refund reissue#cadeveshthakur

0 notes

Text

How to Ensure Accuracy in Your GST Return Filing Online

A Comprehensive Guide to GST Return Filing Online

Introduction

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. GST has simplified the indirect tax system in India by replacing multiple taxes levied by the central and state governments. With the advent of digital technology, GST return filing has become more accessible through online platforms. The article provides a step-by-step guide to filing GST returns online.

Types of GST Returns

Before diving into the filing process, it's essential to understand the various types of GST returns, each serving a different purpose:

GSTR-1: Details of outward supplies of goods or services.

GSTR-2A: Read-only document containing details of inward supplies auto-populated from the supplier's GSTR-1.

GSTR-3B: Simple summary return of inward and outward supplies.

GSTR-4: Quarterly return for composition scheme taxpayers.

GSTR-5: Return for non-resident taxable persons.

GSTR-6: Return for input service distributors.

GSTR-7: Return for authorities deducting tax at source.

GSTR-8: Return for e-commerce operators collecting tax at source.

GSTR-9: Annual return for regular taxpayers.

GSTR-10: Final return in case of cancellation of GST registration.

GSTR-11: Return for taxpayers with a Unique Identification Number (UIN).

Prerequisites for GST Return Filing

Before you start the GST return filing process, ensure you have the following:

Active GSTIN (Goods and Services Tax Identification Number): You must be registered under GST and have an active GSTIN.

Login Credentials: Access the GST portal with your username and password.

Digital Signature Certificate (DSC) or EVC: For authentication purposes, businesses (other than proprietorships) must use a DSC, while proprietorships can use an Electronic Verification Code (EVC).

Required Data: Sales and purchase invoices, outward and inward supplies details, and other necessary documents.

Step-by-Step Guide to Filing GST Returns Online

Step 1: Access the GST Portal

Visit the GST Portal: Go to the official GST portal (https://www.gst.gov.in/).

Login: Click the 'Login' button and enter your credentials (username and password).

Step 2: Navigate to the Return Filing Section

Dashboard: After logging in, you will be directed to the dashboard.

Services: From the main menu, navigate to 'Services'> 'Returns'> 'Returns Dashboard'.

Step 3: Select the Return Period

Financial Year and GST Return Filing Period: From the dropdown menu, select the financial year and the return filing period (monthly or quarterly).

Search: Click on the 'Search' button to proceed.

Step 4: Choose the Return Form

Select Form: Select the appropriate return form (e.g., GSTR-1, GSTR-3B) based on your registration type and business activities.

Step 5: Fill in the Return Details

Outward Supplies (Sales): For GSTR-1, provide details of outward supplies, including invoice-wise information for B2B transactions and aggregate details for B2C transactions.

Inward Supplies (Purchases): Ensure all purchase details are correctly captured for GSTR-2A (auto-populated) and GSTR-3B.

Tax Calculation: Calculate the tax liability, including CGST, SGST, IGST, and cess, if applicable.

Step 6: Validate and Submit the Return

Save and Preview: Save the details periodically to avoid data loss. Preview the return to ensure all details are correctly entered.

Submit: Click the 'Submit' button to validate your return.

Step 7: Payment of Tax Liability

Create Challan: If there is any tax liability, generate a challan for tax payment.

Payment: Pay using modes such as Net Banking, Credit/Debit Card, or NEFT/RTGS.

Step 8: File the Return

Authentication: Use DSC or EVC to authenticate the return.

File Return: Click on the 'File Return' button. A confirmation message and an acknowledgement reference number (ARN) will be generated.

Step 9: Download the Acknowledgment

Download and Save: Download the filed return and acknowledgement for your records.

Conclusion

Filing GST returns online is a streamlined and efficient process that ensures compliance with the GST law. Regular and accurate filing helps businesses avoid penalties and maintain compliance ratings. The GST return filing process and ensure your business complies with all regulatory requirements.

0 notes

Text

Best Insurance advisor in Gurugram 2024

Importance of an Insurance Advisor

Let’s face it, insurance isn’t the most thrilling topic to dive into, but it’s essential for securing your future. Whether it’s life, health, or property, having the right coverage can make a world of difference. That’s where an insurance advisor steps in, guiding you through the maze of policies and helping you make informed decisions. In this article, we’ll explore why you need an insurance advisor, introduce you to the top 5 in Gurugram, including Paisainvests, and delve into the types of insurance they offer. So, buckle up, and let’s get started!

🔵Go ahead and enjoy your Insurance Journey🔵

Why Do You Need an Insurance Advisor?

An insurance advisor is like a guiding star in the complex world of insurance. They help you navigate through various policies, ensuring that you make informed decisions. Hiring an insurance advisor means gaining access to expert knowledge, personalised advice, and peace of mind knowing that your financial interests are well-guarded.

Navigating Complex Policies

Insurance policies can be as complex as a legal document. An advisor breaks down the jargon, helping you understand the terms and conditions.

Personalized Recommendations

Not all insurance policies are created equal. An advisor provides tailored suggestions based on your unique needs and financial situation.

Hassle-free Claim Process

Filing a claim can be daunting. An advisor streamlines the process, ensuring you get your due without unnecessary stress.

Suggested Articles: Goods and Service Tax Login (GST)

Top 5 Insurance Advisors in Gurugram

Paisainvests

Renowned for its comprehensive services, Paisainvests stands out with its client-first approach. They offer a wide range of insurance products, ensuring you’re covered on all fronts. Official Link: Paisa Invests – Your Trusted Financial Advisor

SecureLife Insurance

With a focus on life and health insurance, SecureLife has earned a reputation for reliability and customer satisfaction.

Gurugram Insure Solutions

Specializing in motor and travel insurance, this firm offers competitive pricing and excellent customer support.

TrustShield Advisors

Known for their expertise in home and property insurance, TrustShield offers comprehensive coverage plans.

CareProtect Services

CareProtect excels in health insurance, offering plans that cater to a variety of medical needs. Official Link: Care + Protect – International

Suggested Articles: Life Insurance Corporation of India (LIC) Online Payment

Types of Insurance

Life Insurance

Provides financial security to your loved ones in the event of your passing. It’s a must-have for anyone with dependents. Life Insurance: Life Insurance: Policies for Financial Security

Health Insurance

Covers medical expenses, ensuring you don’t have to dip into your savings for healthcare. Health Insurance: Health Insurance: Plans for Your Peace of Mind

Motor Insurance

Protects your vehicle against damage, theft, and third-party liabilities. Motor Insurance: Auto Insurance: Compare Quotes & Save

Home Insurance

Safeguards your property and belongings against risks like fire, theft, and natural disasters. Home Insurance: Home Insurance: Protect Your Property

Travel Insurance

Offers coverage for trip cancellations, medical emergencies, and lost luggage during travel. Travel Insurance: Travel Insurance: Coverage for Your Journey

Paisainvests: A Closer Look

PaisaInvests is a comprehensive financial advisory firm that offers expert guidance across various financial services, including investments, loans, insurance, Credit cards and trade assistance. They aim to simplify financial decision-making by providing streamlined solutions and personalized advice. The firm prides itself on its holistic approach, catering to both individual and corporate clients, ensuring they have access to the best financial products and services tailored to their unique needs

Best Coverage

Paisainvests offers an extensive range of insurance products, from life and health to motor and home insurance.

Customizable Plans

They provide flexible plans that can be tailored to meet individual needs, making it easier for you to find the perfect fit.

How Paisainvests Help in Your Insurance Journey

Expert Guidance

With a team of seasoned professionals, Paisainvests offers expert advice to help you choose the best policies.

Simplified Processes

From policy selection to claim filing, they make the process seamless and hassle-free.

Competitive Pricing

They offer competitive rates, ensuring you get the best value for your money.

How to Purchase Insurance

Paisainvests.com

You can buy Insurance directly from Paisainvests.

Online Platforms

Many insurers offer the convenience of buying policies online, allowing you to compare plans and make purchases at your own pace.

In-Person Consultation

For those who prefer a personal touch, visiting an advisor’s office can provide a more in-depth understanding of the options available.

Through an Insurance Advisor

Advisors can offer a comprehensive overview of available policies and help you make an informed choice.

Features of Paisainvests as an Insurance Advisor

Expert Knowledge

Paisainvests boasts a team of seasoned professionals with deep expertise in the insurance industry. Their advisors are well-versed in the latest trends and policies.

User-Friendly Platform

The Paisainvests website is designed to be user-friendly, offering a seamless experience from exploring insurance options to managing your policies.

Transparent Processes

Transparency is a core value at Paisainvests. They ensure that you fully understand the terms and conditions of your policies, eliminating any hidden surprises.

Suggested articles: New health insurance claims rule | Best Insurance Companies in 2024

Additional Services Offered by Paisainvests

Investment Planning

Beyond insurance, Paisainvests also offers robust investment planning services, helping you grow your wealth strategically and securely.

Tax Planning

Effective tax planning can save you significant money. Paisainvests provides expert advice on optimising your tax liabilities while staying compliant with the law.

Credit Card Advisory

We are thinking of providing the best Credit advice for your needs for Luxury, Household, Daily usage, Personal stuff etc.

Loan

We have all types of loans including HOME loans, PERSONAL LOAN, GOLD LOAN, AUTO LOAN, MEDICAL LOAN and EDUCATION LOAN.

Suggested articles: New health insurance claims rule | Best Insurance Companies in 2024

Conclusion

Choosing the right insurance advisor can significantly impact your insurance experience. With their expertise, personalized advice, and hassle-free service, an advisor can help you navigate the complexities of insurance and secure the best coverage for your needs. Whether you’re looking for life, health, motor, or home insurance, the advisors we’ve highlighted, including Paisainvests, offer top-notch services in Gurugram. So, don’t wait—secure your future today!

By Paisainvests.com

#2024 insurance trends#best insurance advisors#best insurance plans#financial planning Gurugram#Gurugram 2024#Gurugram advisors#Gurugram financial services#Gurugram insurance#health insurance Gurugram#insurance advisor#insurance consultants#insurance policies#investment planning#life insurance Gurugram#top insurance agents

0 notes