#gst benefits for business

Explore tagged Tumblr posts

Text

youtube

GST Benefits in Budget 2023 - Cheer to some | Mint Primer | Mint

North-eastern states have recorded a compounded annual GST revenue growth rate of 27.5% so far since the implementation of the GST as against 14.8% for all states, making them the biggest gainers of the new indirect tax regime. The north-eastern states have been the biggest beneficiaries of the five-year-old goods and services tax (GST) regime, according to the Reserve Bank of India (RBI) report on State Finances.

#budget 2023#gst#union budget 2023#budget 2023 news#budget 2023 india#gst return#nirmala sitharaman#gst news#gst benefit#gst benefits for business#fm nirmala sitharaman#revenue growth#goods and services tax#mint#mint primer#igst#budget 2023 income tax#tax saving#union budget 2023-24#2023 budget#income tax#tax#how to save tax#india budget 2023#union budget#national budget 2023#gst 2023#Youtube

0 notes

Text

Still, awaiting your GST or Tax refund? Get it earlier than your family and friends like over 1 million other Canadians. The Secret? https://web.koho.ca/referral/RV2TV073

Get your FREE ACCOUNT HERE. Canadian Accounts with cash back, high-interest rates and free over-draft protection to name a few benefits. #directdeposit #GST #incometax #familybonus #childtaxcredit #workingbenefit Refunds #credit #deposit #banking #finaince #overdraft #freeaccounts #badcreditok #mastercarddebitcard #rewards #incometaxrefund #CRAdirectdeposit #GSTcredit #GSTcreditpayment #childtaxpayment #earlydeposit #mastercarddebitcard

#youtube#canada#vancouver#business#abbotsford#news#music#ontario#GST#GST Credit#GSt payment#banking#direct deposit#early payment#family#child tax#child tax benefit#carbon tax credit#tax refund#tax refund deposit#GST Credit deposit#cash back#high interest#mastercard#interac#free#accounts#overdraft#free overdraft#credit rebuilding

4 notes

·

View notes

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

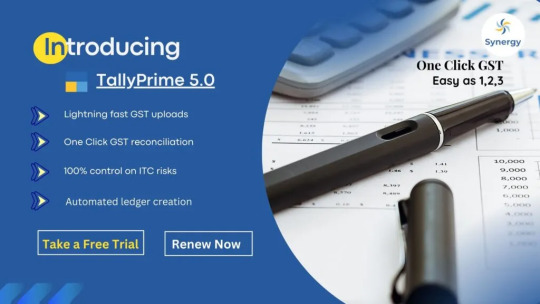

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

GST Council Extends ITC Claim Period, Brings Relief to Jamshedpur Traders

Over 1500 local businesses benefit from retrospective input tax credit allowance Jamshedpur’s commercial sector welcomes GST Council’s decision to extend input tax credit claim period and waive certain penalties, easing financial pressures on traders. JAMSHEDPUR – The GST Council’s recent amendments have brought significant relief to more than 1500 traders in the Jamshedpur Commercial Tax…

View On WordPress

#बिजनेस#business#commercial tax division Jamshedpur#GST appeal process changes#GST Council amendments#GST framework improvements#GST return filing deadline#input tax credit extension#Jamshedpur business community#Jamshedpur traders relief#Singhbhum Chamber of Commerce#trader tax benefits

0 notes

Text

Unlock Business Opportunities in Singapore with a Dependent Pass | InCorp Global

Discover how to expand your business horizons in Singapore by securing a Dependent Pass through InCorp Global. Our expert team provides comprehensive guidance on obtaining this vital visa, enabling you to tap into the city-state's thriving economy while maintaining family ties. Explore the benefits and requirements of Dependent Pass in Singapore, and embark on your journey towards business success in Singapore today.

#dependent pass singapore#business license singapore#gst refund singapore#long term pass singapore#psg grant#singapore pr benefits#company tax rate singapore

0 notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world. Introduction: Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

0 notes

Text

0 notes

Text

Supporting early-stage investments in startups is crucial for fostering innovation and economic growth. To encourage angel investors to provide funding to startups, many countries offer income tax benefits and incentives. These incentives can vary significantly from one jurisdiction to another, but here are some common income tax benefits for angel investors in startups. Read more: https://myefilings.com/supporting-early-stage-investments-income-tax-benefits-for-angel-investors-in-startups/

0 notes

Text

Simplifying GST Registration: A Comprehensive Guide by GTS Consultant

Introduction

With the economy adopting a dogfight-like pace, organisations face the need to become agile enough to grow unhindered. As goods and services tax (GST) is one of the most important reforms in the Indian tax system, it means the inclusion of indirect tax in a single tax. Understanding and filling the GST Registration is the dire straits that every company will have to face because it is to operate within the law and take the advantage. Holding a reputable GTS Consultant AB, with a past period of more than 12 years of combine experience. We are combining our expertise to offer businesses a hassle- free expedition.

In this blog, we will provide an in-depth look at GST registration, its importance, process, benefits, and the expertise GTS Consultant brings to the table.

What is GST Registration?

The identification of goods and services that require a business to be in line with local legislation by obtaining registration under the GST Act is called the process of GST registration. It authorizes the entities to not only collect tax from their clients but also to claim Input Tax Credit (ITC) for the taxes that were paid on their purchases. Depending upon the limit of the prescribed turnover or the activities engaged in, the businesses are obliged to get registered for GST

Who Needs GST Registration?

GST registration is mandatory for:

Businesses with Aggregate Turnover:

₹20 lakhs (₹10 lakhs for special category states): For service providers.

₹40 lakhs (₹20 lakhs for special category states): For goods suppliers.

Interstate Suppliers: Businesses involved in the interstate supply of goods and services.

E-commerce Operators: Platforms facilitating sales of goods and services.

Casual Taxable Persons: Individuals undertaking occasional transactions involving the supply of goods or services.

Input Service Distributors: Businesses distributing input tax credits to their branches.

Documents Required for GST Registration

For the smooth registration process, be sure to gather the following documents:

PAN Card: It's essential for the business and for the owner and owner(s) of the business to have a PAN card.

Proof of Business: This along with partnership deeds, incorporation certificates, as well as, registration certificates.

Identity and Address Proof of Promoters: The Aadhaar card, the passport, or the voter ID should be provided.

Business Address Proof: Lease agreements, contract transit costs, or utility bills.

Bank Account Details: One may use the copy of a canceled cheque, a bank statement, or a passbook copy.

Digital Signature: It is required to be electronically signed prior to online submission.

Authorization Letter: For the account signatories that are authorized to, if applicable.

Benefits of GST Registration

Legal Compliance: Penalty prevention and adherence to Indian tax laws.

Input Tax Credit (ITC): The ITC claim should be able to reduce the total tax burden by this method.

Market Expansion: GST registration will help in the inter-State sales and e-commerce trade.

Credibility: A registered GST number enhances the credibility of a business and makes it more trustworthy in the eyes of their clients.

Ease of Doing Business: One consolidated tax system offers several advantages such as easier filing of tax returns and tax payments.

Why Choose GTS Consultant for GST Registration?

GTS Consultant, located in Bhiwadi, Alwar, Rajasthan is a determined and particular accounting and tax services company dedicated to offering the best services Imagine why the companies would trust us:

Expert Guidance: Our group of skilled public accountants and chartered accountants guarantees a mistake-free and effective GST registration.

Comprehensive Support: From preparation to submission and post-registration help, we include each and every part of it.

Time-Saving: You focus on your operations, we refine your registration business process.

Cost-Effective Solutions: Services of high rank at budget prices.

Client-Centric Approach:We will customize our services so that they match your requirements and bring you the best possible benefits.

Frequently Asked Questions (FAQs)

1. What is the penalty for not registering under GST?

A penalty of the greater of ten percent of the tax due or ten thousand rupees is paid for non-registration. If a taxpayer evades tax on his own volition, DRI is supposed to impose a penalty equal to the tax that was evaded, i.e. 100%

2. Can I voluntarily register for GST?

Yes, turnover not reaching the requirement limit, businesses can choose to register at their own discretion and thus gain great benefits such as ITC and market credibility.

Contact GTS Consultant Today

Certainly, getting through the GST registration process be a hard time, however, if your partner is GTS Consultant, you can rest assured you will be guided thoroughly through the process. Be it a new business venture or an already existing set up, we, the team at GTS Consultant, will get you the best service by ensuring that we register you without pain points.

Reach us at:

Address: TC-321-325, R-Tech Capital Highstreet, Phool Bagh, Bhiwadi, Alwar (RJ) - 301019

Email: [email protected]

Website: Explore our services and resources on our official website GTS Constultant india

2 notes

·

View notes

Text

Best company Incorporation Consultants in India

Starting a business in India is an exciting yet challenging journey. One of the critical steps in this process is company incorporation, which involves navigating legal, regulatory, and compliance requirements. To make this process seamless, businesses often seek the assistance of expert consultants. Among the best company incorporation consultants in India, SC Bhagat & Co. stands out for its unmatched expertise and client-centric approach.

Why Company Incorporation is Crucial Incorporating your company is the first official step in establishing a legal business entity. It provides several benefits, including:

Legal Recognition: Establishes your business as a separate legal entity. Limited Liability: Protects personal assets of the business owners. Enhanced Credibility: Builds trust with customers, suppliers, and investors. Tax Benefits: Opens doors to specific tax advantages for incorporated entities. Ease of Raising Capital: Simplifies securing investments from banks and venture capitalists. However, the incorporation process can be complex due to the various regulations, documentation requirements, and procedural formalities involved. This is where SC Bhagat & Co. comes in to simplify the process.

About SC Bhagat & Co. SC Bhagat & Co. is a leading consultancy firm in India, renowned for its expertise in company incorporation services. With decades of experience, they have assisted startups, SMEs, and large enterprises in setting up their businesses efficiently and compliantly.

Their team of highly skilled professionals ensures that the entire process is smooth and stress-free, allowing entrepreneurs to focus on their business goals.

Services Offered by SC Bhagat & Co.

Company Incorporation Services SC Bhagat & Co. specializes in incorporating all types of entities, including:

Private Limited Companies Limited Liability Partnerships (LLPs) One Person Companies (OPCs) Public Limited Companies Section 8 Companies (Non-Profits)

Document Preparation and Filing They handle all necessary documentation, such as drafting Memorandum of Association (MoA) and Articles of Association (AoA), obtaining Director Identification Numbers (DIN), and registering for GST and PAN.

Regulatory Compliance SC Bhagat & Co. ensures your business complies with all regulatory frameworks, including the Companies Act, 2013.

Post-Incorporation Support Their services don’t end with incorporation. They offer continued support with statutory filings, annual returns, and compliance audits.

Custom Business Advisory The team provides personalized guidance to ensure your business structure aligns with your objectives and market demands.

Why Choose SC Bhagat & Co. for Company Incorporation?

Expertise and Experience SC Bhagat & Co. has years of experience in handling company incorporations across various industries. Their expertise ensures a hassle-free process for clients.

Tailored Solutions Every business is unique, and SC Bhagat & Co. takes a personalized approach to meet your specific requirements.

Time and Cost Efficiency Their streamlined processes save you time and money, allowing you to focus on growing your business.

100% Compliance They ensure your business adheres to all legal and regulatory norms, minimizing risks of non-compliance.

Customer-Centric Approach SC Bhagat & Co. is known for its responsive and supportive team, providing end-to-end guidance throughout the incorporation process.

The Process of Company Incorporation with SC Bhagat & Co. Initial Consultation: Understanding your business needs and goals. Business Structure Selection: Advising on the most suitable entity type. Document Preparation: Drafting and compiling all required documents. Registration and Filing: Submitting applications with the Ministry of Corporate Affairs (MCA). Certificate of Incorporation: Assisting in obtaining the official Certificate of Incorporation. Post-Incorporation Setup: Helping with bank account setup, GST registration, and other requirements. Contact SC Bhagat & Co. If you’re looking for the best company incorporation consultants in India, SC Bhagat & Co. is your trusted partner.

Conclusion Choosing the right consultant for your company incorporation is critical to ensuring a smooth and compliant process. With their vast experience, tailored solutions, and dedication to excellence, SC Bhagat & Co. has earned its reputation as one of the best in the industry. Set your business up for success by partnering with SC Bhagat & Co. today!

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

Affordable Tax Law Firms in Delhi: Expert Legal Services

Introduction to Affordable Tax Law Firms in Delhi

Tax law can be complicated, but finding an affordable tax law firm in delhi doesn’t mean sacrificing quality legal services. Many tax law firms in Delhi offer expert legal counsel at competitive rates, helping businesses and individuals navigate the complexities of taxation while keeping costs in check. Whether you need assistance with tax planning, corporate taxation, or resolving disputes, affordable tax law firms are here to offer expert solutions without the hefty fees typically associated with large, high-end firms.

What Makes a Tax Law Firm Affordable in Delhi?

When searching for an affordable tax law firm in delhi, it’s important to understand what contributes to the cost-effectiveness of a firm. Key factors include:

Efficient Services: Affordable firms focus on delivering quality services with efficiency, minimizing unnecessary costs while ensuring clients receive effective solutions.

Transparent Pricing: Leading affordable tax law firms provide clear and upfront pricing with no hidden fees, making it easier for clients to understand what they’re paying for.

Experienced Legal Team: Despite offering cost-effective rates, many affordable firms maintain a team of experienced tax lawyers who specialize in handling a range of tax-related matters.

Tailored Solutions: Instead of offering generic advice, affordable firms provide personalized, targeted solutions that meet the specific needs of each client, ensuring value for money.

Key Services Provided by Affordable Tax Law Firms in Delhi

An affordable tax law firm in delhi can offer a wide variety of services to individuals and businesses, ensuring their clients can handle tax matters efficiently without breaking the bank. Some of the key services include:

Tax Planning and Strategy: Affordable tax law firms help clients optimize their tax position, minimize liabilities, and stay compliant with local regulations.

Tax Dispute Resolution: They offer expert representation in tax disputes, helping clients handle audits, assessments, and legal challenges.

Corporate Tax Services: Businesses benefit from cost-effective advice on corporate tax laws, mergers, acquisitions, and compliance with national and international regulations.

Indirect Taxes (GST, Customs, etc.): Affordable tax firms also provide legal services related to indirect taxes such as GST, customs duties, and other applicable levies.

International Taxation: For businesses with global operations, affordable tax law firms provide expert advice on cross-border tax issues at competitive rates.

These services are designed to meet the needs of both small and large clients, ensuring they can effectively manage their tax affairs without overpaying.

Why Aayati Legal is an Affordable Tax Law Firm in Delhi

Aayati Legal is one of the affordable tax law firms in delhi that offers expert legal services at competitive rates. The firm’s experienced team of tax lawyers specializes in a wide range of tax-related matters, from dispute resolution to corporate tax services, and they offer customized solutions for both individuals and businesses. Aayati Legal’s transparent pricing structure ensures clients receive high-quality legal advice without hidden costs, making it an ideal choice for those seeking an affordable tax law firm in Delhi.

How to Find the Right Affordable Tax Law Firm in Delhi

When searching for an affordable tax law firm in delhi, consider these key steps:

Assess the Firm’s Experience: Look for firms that specialize in tax law and have experience handling the type of tax issues you’re facing.

Check Pricing and Transparency: Ensure the firm provides clear pricing without hidden charges, helping you make an informed decision about the costs involved.

Review Client Feedback: Look for testimonials or reviews from previous clients to gauge the firm’s effectiveness and the quality of its services.

Evaluate the Range of Services: Choose a firm that offers a broad spectrum of tax-related services to meet your needs, from planning to dispute resolution.

By considering these factors, you can find an affordable tax law firm in delhi that offers the expertise you need at a price that fits your budget.

#AffordableTaxLawFirm#TaxLawFirmInDelhi#TaxPlanning#AayatiLegal#TaxDisputeResolution#CorporateTaxation#GST#LegalExperts

2 notes

·

View notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes

Text

Experience Excellence in Business Services with Benchmark Professional Solutions Pvt. Ltd.

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, is a leading provider of a wide range of business and financial services. Their expertise lies in offering tailored solutions to businesses, ensuring smooth operations across various sectors. As a reliable partner, Benchmark Professional Solutions offers an extensive array of services that cater to diverse business needs.

One of the standout services provided by Benchmark is their Digital Signature Certificate (DSC) and token services. As a trusted partner for EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN, they ensure the highest standards in digital security, enabling businesses to operate with confidence in an increasingly digital world.

In the field of accounting and finance, Benchmark delivers professional services in accounts management, audits, and consultancy. Whether you're a small business or a large enterprise, their team ensures that your financial operations are compliant with the latest regulations, streamlining your accounting processes to boost efficiency.

Their legal expertise spans across trademark registrations, ROC compliance, and license and registration services. They provide comprehensive solutions to protect intellectual property and ensure businesses meet all statutory requirements without hassle.

Benchmark Professional Solutions also excels in handling income tax and GST compliance. Their team offers guidance on tax strategies to minimize liabilities while ensuring complete adherence to tax laws. Their consultancy services cover a wide spectrum of financial and operational matters, empowering businesses to grow sustainably.

Additionally, they offer outsourcing solutions, allowing businesses to delegate essential tasks to experts while focusing on core functions. Legal services, including civil and criminal representation, add another layer of support, ensuring clients receive comprehensive assistance in all legal matters.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Benchmark Professional Solutions Pvt. Ltd. stands out for its holistic approach to business and financial solutions. Their status as a certified Tally Solutions partner, combined with their extensive service portfolio, makes them a reliable and trustworthy partner. By choosing Benchmark, businesses benefit from expert guidance, streamlined operations, and the peace of mind that comes with knowing that every financial and legal detail is handled with precision.

2 notes

·

View notes

Text

Your One-Stop Destination for Business and Financial Solutions : Anisha Sharma & Associates

Comprehensive finance and legal solutions with Anisha Sharma & Associates

Anisha Sharma & Associates stands as a versatile and trusted name in the realm of business and finance, offering a comprehensive range of services to meet diverse client needs. With an unwavering commitment to excellence and client satisfaction, the company specializes in providing both core and specialized services, ensuring that businesses and individuals alike are equipped to navigate financial and legal challenges seamlessly.

Core Services

The company's core services span across critical areas such as accounts management, audit services, trademark registration, Registrar of Companies (ROC) compliance, and license & registration support. These services are designed to help businesses maintain financial transparency, protect intellectual property, and stay compliant with legal requirements. Furthermore, their expertise extends to loans, income tax filings, GST management, and comprehensive consultancy services, enabling clients to optimize their financial standing and grow their business.

In addition, outsourcing services, along with digital signature certificates (DSC) and tokens, are available to streamline business operations. Anisha Sharma & Associates also offers reliable software solutions, ensuring that businesses have access to the latest tools to manage their finances efficiently.

Specialized Services

Anisha Sharma & Associates distinguishes itself with an array of specialized services. These include stock broking and advisory, offering clients the guidance needed to navigate the stock market and maximize investment returns. Their website and digital solutions provide businesses with a strong online presence, crucial for success in today’s digital age.

The company also excels in real estate placement consulting, helping clients secure lucrative property investments. Their PF and ESI services ensure compliance with employee benefit regulations, while their legal expertise covers both civil and criminal law, providing clients with legal protection and counsel when needed.

Why Choose Anisha Sharma & Associates?

Anisha Sharma & Associates is more than just a service provider; it is a dedicated partner in your business and financial journey. The firm’s wide-ranging expertise, personalized approach, and commitment to client success set it apart from competitors. Whether you need assistance with everyday financial management or specialized services tailored to your unique needs, Anisha Sharma & Associates provides the solutions that ensure your business thrives in a competitive marketplace.

2 notes

·

View notes

Text

Streamlining Tax Compliance: Using Quaderno to Automate Taxes for Businesses Shipping into the EU.

Quaderno is a powerful tool designed to simplify the process of managing taxes for online businesses. It automates the calculation, collection, and reporting of sales tax, VAT, and GST, helping businesses stay compliant with tax regulations around the world. Introduction: Automating taxes for businesses shipping into the EU can be a game-changer in streamlining operations and ensuring…

View On WordPress

#accounting#and GST#Automate Taxes#automated-eu-vat-calculator#automated-vat-tools#Automating taxes for EU shipments#automating-taxes-for-businesses-shipping-into-the-eu#avoiding EU penalties#Benefits of Automating Tax Compliance#bigcommerce#compliance-risks#DUTIES#DUTIES AND TAXES#e#e-commerce platforms#ecommerce#EU#EU market#EU Shipping#eu-vat-tools#European Union#finance#INTERNATIONAL#IOSS#online-shopping#payment gateways#Quaderno#real-time-insights#sales tax#shipping

1 note

·

View note