#gst accounting software in india

Explore tagged Tumblr posts

Text

Unlocking Efficiency with Link ID Assignment feature in RealBooks

In the dynamic world of business, keeping track of your financial data is essential. But with countless transactions occurring daily, maintaining accuracy and organization can feel like a constant struggle. Fortunately, RealBooks offers a powerful solution: the link ID assignment feature.

What is Link ID Assignment?

Link IDs are unique identifiers assigned to individual transactions. They act like labels, enabling categorization and tracking across different transactions and reports. Think of them as serial numbers for your transactions, offering a distinct reference point.

How Link IDs Simplify Your Life

1. Enhanced Tracking and Analysis: Say goodbye to sifting through endless data. Link IDs allow you to effortlessly track specific transactions across various ledgers and reports. This means you can identify trends, patterns, and anomalies with ease, gaining valuable insights into your financial health.

2. Error-Free Organization: Tired of duplicate entries and inconsistencies? Link IDs eliminate the confusion by ensuring each transaction has a unique identity. This promotes accuracy and organization in your financial records, boosting your confidence in data-driven decisions.

3. Effortless Exception Management: Not all transactions fit neatly into predefined categories. Link IDs come to the rescue by allowing you to assign them to a dedicated "exception" category. This keeps your main ledgers clean while still providing easy access to these transactions for analysis.

How to Leverage Link IDs in RealBooks:

To Use Link Transaction Feature first enable the feature from RealBooks Configuration option.

Go to Settings => Configuration => Accounts => General => Link Transaction

Click the Toggle button to enable the Link Transaction Feature.

Next, Enable Link id feature in Ledger

For ledger new Creation enable the toggle button available in right hand side of the screen.

For existing ledgers go to edit and enable it.

That’s it now just record entries and assign link ids in transaction page.

Take Control of Your Data

Whether you're a small business owner or a large organization, the link ID assignment feature in RealBooks empowers you to take control of your financial data. With increased accuracy, organization, and reporting capabilities, you gain the insights needed to make informed decisions and drive your business forward.

So, unleash the power of link IDs today and experience the difference in your financial management journey!

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software

0 notes

Text

The Importance of Using Google Authenticator for Enhanced Security

In an era where cyber threats are growing at an unprecedented rate, securing online accounts has never been more critical. Passwords alone are no longer sufficient to safeguard personal and business data. Cybercriminals employ increasingly sophisticated techniques to breach security barriers, leading to financial loss, identity theft, and data breaches. One of the most effective solutions to counter these threats is two-factor authentication (2FA), and Google Authenticator stands out as a highly reliable tool in this domain.

Understanding Two-Factor Authentication (2FA)

Two-factor authentication (2FA) is a security process that requires users to provide two different forms of identification before gaining access to an account. Traditionally, logging in only required a username and password. However, this method is vulnerable to hacking, phishing, and credential theft.

With 2FA, even if an attacker acquires your password, they would still need the second form of authentication, typically a time-sensitive code generated by an authentication app like Google Authenticator. This extra layer of security significantly reduces the risk of unauthorized access.

What is Google Authenticator?

Google Authenticator is a free mobile application developed by Google that generates time-based one-time passwords (TOTP) for 2FA. When enabled for an account, it provides an additional layer of protection by requiring users to enter a code from the app alongside their regular password. The app does not require an internet connection to function and works on both Android and iOS devices.

How Google Authenticator Works

Enabling Google Authenticator – Users must first enable two-factor authentication on their online accounts and select Google Authenticator as their authentication method.

Scanning QR Code – A QR code is provided by the website or service, which the user scans using the Google Authenticator app.

Code Generation – The app then generates a six-digit TOTP every 30 seconds.

Verification – To complete the authentication process, users enter the displayed code within the timeframe.

Each time a user logs in, they will need to enter a new code from the Google Authenticator app, ensuring security even if their password is compromised.

Why is Google Authenticator Important?

1. Enhanced Security Against Cyber Threats

Google Authenticator provides a significant security upgrade compared to relying solely on passwords. Passwords can be easily stolen through phishing attacks, keyloggers, or data breaches. However, the dynamic and time-sensitive nature of authentication codes generated by Google Authenticator makes it nearly impossible for cybercriminals to gain unauthorized access.

2. Protection Against Phishing Attacks

Phishing is one of the most common methods used by hackers to steal login credentials. Even if a user mistakenly provides their password to a fake website, the attacker would still need the authentication code to gain access. Since the code is constantly changing, it adds a robust defense against phishing attempts.

3. Offline Functionality

Unlike SMS-based 2FA, which requires network connectivity, Google Authenticator works entirely offline. This eliminates risks associated with SIM swapping attacks, where hackers hijack a victim’s phone number to intercept authentication codes sent via SMS.

4. Faster and More Secure than SMS Authentication

Many services offer SMS-based authentication as a second factor, but this method has vulnerabilities. SMS codes can be intercepted, delayed, or redirected by hackers. Google Authenticator generates unique codes on your device, making it a faster and more secure option.

5. Wide Adoption and Compatibility

Google Authenticator is compatible with a vast range of services, including email accounts, social media platforms, banking applications, and cloud storage services. Major platforms such as Google, Facebook, Instagram, Twitter, Amazon, and Dropbox support Google Authenticator, making it a versatile and reliable tool for securing multiple accounts.

6. Simple and Convenient to Use

Once set up, Google Authenticator is simple to use. The codes are generated automatically, requiring no extra effort beyond opening the app and entering the displayed code when prompted. The app’s straightforward interface makes it user-friendly, even for those who are not tech-savvy.

Potential Drawbacks and How to Overcome Them

While Google Authenticator offers significant advantages, there are some challenges users may face:

1. Device Loss or Change

If a user loses their phone or switches to a new device, recovering Google Authenticator codes can be challenging. To mitigate this, users should:

Save backup codes provided during the initial setup.

Use Google’s built-in account recovery options.

Utilize a backup authentication app that supports cloud synchronization, such as Authy.

2. No Cloud Backup

Google Authenticator does not offer cloud-based backup, which means that users must manually transfer their accounts when switching devices. Some authentication apps like Authy offer cloud backup, but for maximum security, keeping codes stored locally remains a safer option.

3. One-Time Setup Complexity

For users unfamiliar with 2FA, setting up Google Authenticator for multiple accounts can feel cumbersome. However, most online services provide step-by-step guides to simplify the process.

How to Set Up Google Authenticator

To enable Google Authenticator on an account, follow these steps:

Download the Google Authenticator App from the Google Play Store (Android) or App Store (iOS).

Enable 2FA on the online service you wish to protect (e.g., Gmail, Facebook, Amazon, etc.).

Choose Google Authenticator as the preferred authentication method.

Scan the QR Code provided by the service using the Google Authenticator app.

Enter the Verification Code displayed in the app to confirm setup.

Save Backup Codes in case you lose access to your authenticator.

Conclusion

With cyber threats escalating daily, using only a password to protect online accounts is no longer sufficient. Google Authenticator is a highly effective tool that adds a critical layer of security through two-factor authentication. It protects against phishing, SIM swapping, and brute-force attacks while offering a simple, offline, and widely supported security solution. By integrating Google Authenticator into your security practices, you can significantly enhance the protection of your digital identity, financial data, and personal information.

Cybersecurity is a shared responsibility, and taking proactive steps like using Google Authenticator ensures that you remain one step ahead of cybercriminals. If you haven’t already enabled 2FA, now is the time to strengthen your security and safeguard your online presence.

#gst software#spine software#billing software#pharma#accounting software#distributor#industry#erp#india#software

0 notes

Text

TRIRID Biz accounting solution for small businesses in India

Why TRIRID Biz Is the #1 Accounting Solution for Small Businesses in India

Well, in today's fast-paced business world, being on top of your finances is super crucial for small businesses. Small businesses in India have to face such stringent requirements, from cash flow management to doing everything that's related to GST compliance. Well, this is where TRIRID Biz Accounting and Billing Software comes into play as a foolproof solution tailor-made specifically for small businesses. Let's explore why TRIRID Biz has emerged as an accounting solution at the #1 rank in India.

User-Friendly Interface

TRIRID Biz is designed specifically for small business owners. With its intuitive interface, whether a tech-savvy person or a beginner, you can find your way around easily. No more extensive training procedures; just download and start.

All GST Compliance

GST compliance for Indian businesses is non-negotiable. TRIRID Biz makes GST billing easy by auto-calculating GST rates, generating accurate invoices, and creating tax reports. The risk of error is reduced to a minimum while keeping your business compliant with the latest tax regulations.

Affordable Pricing

Unlike other accounting software that could put a strain on your budget, TRIRID Biz is very cost-effective while retaining quality. This makes it ideal for small businesses aiming to optimize their accounting without overspending.

Cloud-Based Accessibility

TRIRID Biz offers cloud-based access in an era where remote work is becoming the norm. This means you can manage your accounts anytime, anywhere. Whether you're at the office, at home, or on the go, your data is always within reach.

Customizable Features for Diverse Business Needs

No two businesses are alike, so the software has custom-made features that let you make it available according to your business requirements. It has features from inventory management to multi-currency billing. So, TRIRID Biz adapts to your needs.

Real-Time Financial Insights

Track your business's financial health closely. TRIRID Biz has reporting and analytics at real-time for you, hence clear revenue, expense, and profitability that helps you to make the best decisions and strategies.

Exceptional Customer Support

The standout feature of TRIRID Biz is its customer support team. Whether you need a technical question answered or you need help setting up, the support team makes sure you get prompt and effective solutions.

Secure Data Management

Any business would want data security to be at the top of the list. TRIRID Biz employs advanced encryption and security protocols that keep your financial data safe from unauthorized access and cyber threats.

Scalable for Growth

As your business expands, so does your accounting needs. TRIRID Biz is scalable and will help you to scale up and add features to it as your business grows. Thus, you are never likely to outgrow the software.

Small Business Owners Testimonials

Many small business owners across India have been appreciative of TRIRID Biz. They praise its usability, the fact that it saves time, and the reliability with which the software functions.

TRIRID Biz Accounting and Billing Software is the best accounting software for small businesses. It has a user-friendly design, rich features, and unmatched customer support to be deemed as the #1 accounting solution that your small business in India needs. It simplifies financial management, enhances productivity, and provides peace of mind so you can focus more on adding wings to the business.

Ready to take your business to the next level? Try TRIRID Biz today and see how it can change your accounting process.

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best accounting software for small businesses in India#GST billing software for small businesses#Accounting solutions for Indian businesses#TRIRID Biz features for small businesses#TRIRID Biz Accounting & Billing Software

0 notes

Text

#disqus#erp software#erp manufacturing#trending#india#finance#accounting software#gst registration#b2bmarketing

0 notes

Text

🚨 Special All India Drive Against Fake GST Registrations 🚨

The Indian government has launched a nationwide crackdown on fake GST registrations. It's crucial to ensure your compliance to avoid hefty penalties. 💼💰 🔍 Why This Matters: - Protect your business from legal consequences. - Ensure your GST registration is valid and up-to-date. - Stay ahead of the curve with proper documentation and filings. 📍 For more information and support, visit the AJMS Global office in Jaipur. Our experts are here to guide you through the process and ensure full compliance. Don't take any risks—get the right advice today!

📞 Contact Us: https://wa.link/8zz9db

Landline: 0141-4812238 - Mobile: +91-7303587271

#tax managed services#gst services#gst compliances#gst registration#india gst#gst filing 2024#accounting services#company registration#investing#gst accounting software

0 notes

Text

The importance of the best billing software in India free for small businesses

A billing system is a process used by businesses and companies to simplify the process of sending invoices to clients. Online billing software free is a software that computerizes the procedure of receiving payments and sending out regular invoices. As well, tracking expenses and tracking invoices are frequently included in free accounting software India. This blog is all about the importance of the best billing software in India free for small businesses. The best billing software in India free ensures that your clients can easily pay for the products and services they render. For small businesses, free accounting software India is important as it offers a range of benefits to businesses in achieving their goals.

Apart from that, free accounting software India for small businesses helps enhance the cost-efficiency and productivity of employees by automating repetitive tasks. In today’s time, mostly businesses are using online billing software free to manage their whole business, including accounts, financial statements, inventory management, and others.

The importance of the best billing software in India free

If you are a small business owner and looking to expand your business, then opting for online billing software free, will be the best solution for all your business requirements. Some of the benefits of

free accounting software India are as follows:

Easy creation of invoices: Since all the debit and credit information is filled out in the billing software, it automatically calculates the amount and combines all the data to create new invoices in a professional way.

Customer history and data: The information of every customer is saved in a particular database. Since all of the customer information is available in a single place, retrieving customer data and tracking becomes extremely simple. You don’t need to struggle through multiple files and papers.

Information Organization: The organization of information is a very tough and time-consuming task. For that, you need a free invoice software download that can save, organize, and fetch the data in real-time. It makes the transaction of data more accessible and smooth.

Design your invoice: Billing software for small businesses comes with predefined invoice templates that can be made according to your requirements. Customization of your own invoice template with your brand identity makes your invoices look more professional and separate from others.

Multiple modes of payment: modern-day billing software in India is coherent with payment gateways that permit you to accept payments from your customers through various modes of payment. Free invoice software download authorizes you with special features like auto-bank reconciliation, saving time and effort for integrating the transactions.

Strategies to select the best billing software in India

The selection of efficient billing processes is important for maintaining a healthy cash flow that ensures the smooth working of the business. Below are the strategies to follow before finalizing the accounting software:

Business Requirements: Understand your business needs and identify the features and functionalities that you want in a billing software.

User-friendly: Select the accounting software that is easy to use and operate and that doesn’t require any extra training.

Automation: In today’s world, time is money. So choosing billing software that has automation can help you save both time and money.

Safety: The safety of the customer's information is paramount. So, selecting accounting software that has top-notch security is a must.

After reading this blog, it is clear that billing software in India is an important factor in the expansion of business. So if you are searching for reliable and trustworthy billing software, then go for Eazybills, as it has robust security and all the features required for the proper functioning of billing.

#best billing software in india free#free accounting software india#online billing software free#free invoice software download#billing software#invoice software#easy billing software#free invoicing software#gst billing software#best gst billing software

0 notes

Text

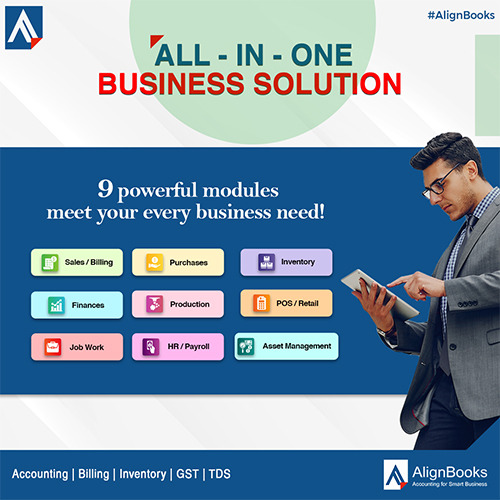

AlignBooks is the best accountancy software that helps you deal with the bookkeeping & accountancy problemswith zero paperwork and automated cash flow management. We provide CRM software that helps you manage your field manpower and order bookings and attendance on the go. Use the GST billing software to keep ahead with the auto calculation of GST components such as SGST and CGST.

We provide Open developer APIs to help you make your own innovations. For all documents, you can get alerts through SMS and Mailer facility. You get the best GST software available right now for your business. Contact us to get more information.

Contact Us:-

Align Info Solutions PVT. LTD.

Website:- https://alignbooks.com/accounting-softwares

Address: - 801-804 Assotech Tower Noida sector 135

Hours: Open ⋅ Closes 8PM

Toll Free : 1800 120 8581

Phone :- +91 11 49863201-04

#accounting software#small business accounting software#gst software#billing software#gst billing software#online accounting software#accounting software for small business#finance software#accounting software in india#pos software

0 notes

Text

GSTR-2A and GSTR-2B are two types of GST (Goods and Services Tax) return forms in India. These forms are used by registered taxpayers to provide information about their purchases and input tax credits. While they serve similar purposes, there are some differences between GSTR-2A and GSTR-2B.

GSTR-2A: GSTR-2A is an auto-generated form that is populated based on the details provided by the suppliers. It is a read-only form and cannot be edited by the recipient. GSTR-2A is automatically generated for each registered taxpayer based on the outward supplies filed by their suppliers in their GSTR-1 forms.

GSTR-2B: GSTR-2B is also an auto-generated form, but it is a static form that is generated monthly. It provides a consolidated view of the eligible input tax credit for a taxpayer based on the information available in GSTR-1, GSTR-5, and GSTR-6 filed by their suppliers. GSTR-2B is mainly designed to facilitate the reconciliation of input tax credits and provide a summary of the available credit for a given tax period.

Here are some key differences between GSTR-2A and GSTR-2B:

Generation: GSTR-2A is generated on a real-time basis as and when the supplier files their GSTR-1 form, whereas GSTR-2B is generated once a month.

Editability: GSTR-2A is a read-only form and cannot be edited by the recipient, as it reflects the details provided by the suppliers. On the other hand, GSTR-2B is also a read-only form, but it allows the recipient to make changes in certain sections.

Supplier Details: GSTR-2A provides details of all the supplies made by the suppliers for a given tax period. It includes information such as invoice number, invoice date, taxable value, and tax amount. GSTR-2B, however, provides a consolidated view of eligible input tax credit and includes details of the supplier's GSTIN (Goods and Services Tax Identification Number) and the recipient's GSTIN.

Relevance: GSTR-2A is primarily used for reconciliation purposes, allowing recipients to verify the details of the supplies made by their suppliers. GSTR-2B is useful for taxpayers to identify and claim eligible input tax credits based on the summarized information provided.

It's important to note that the GST return filing process and forms can be subject to changes and updates by the Indian government. Therefore, it's always advisable to refer to the latest guidelines and instructions provided by the Goods and Services Tax Network (GSTN) or consult a qualified tax professional for accurate and up-to-date information.

Read more: https://myefilings.com/comparing-gstr-2a-and-gstr-2b-understanding-the-differences-and-benefits/

#myefilings#business#taxes#income tax#india#accounting#income taxes#gst#gst registration#gst return filing#gst accounting software

0 notes

Text

Online GST Billing, Invoicing & Accounting Software App For Small Business - Onlinekhata

Simplify your bookkeeping with our user-friendly online accounting software. Manage your finances effortlessly, track expenses, generate invoices, and stay organized. Start streamlining your business operations today. https://onlinekhata.co.in/

#Accounting and billing software#Billing#Invoicing & Accounting Software#Best Billing and Invoicing Software#Online Billing & Invoicing Software in India#GST Billing Software for Small Business

0 notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Beyond Troubleshooting: RealBooks Support – Your Co-Pilot in Financial Excellence

In the dynamic world of business, accounting plays a crucial role in ensuring financial stability and growth. RealBooks, a leading provider of online accounting software in India, understands this importance and has built a robust support system to assist its users every step of the way.

The Human Touch

RealBooks knows that every problem you have is different, so we give you personalized attention. Our support team is made up of experts who are ready to help you with whatever you need. Whether you're a small business owner or a big company, our goal is to make sure you have the support you need when you need it.

Operating Hours

Our support service operates during standard business hours, ensuring that you have access to assistance when most needed. We believe in quality over quantity, focusing on delivering impactful solutions during the times you're actively engaged with your accounting processes.

How It Works

Reaching out for support is a breeze. Simply dial our helpline during operating hours, and you'll be connected with a knowledgeable support representative. Alternatively, if you prefer written communication, you can also reach us via email. Our team is ready to assist with everything from software navigation to troubleshooting.

Beyond Troubleshooting

RealBooks support goes beyond just resolving issues. We view each interaction as an opportunity to empower our users. Whether you need clarification on a feature, want guidance on best practices, or seek advice on optimizing your accounting processes, our team is here to help.

Continuous Improvement

Your feedback matters. We constantly strive to enhance our support services based on user experiences and evolving needs. By listening to your suggestions and concerns, we ensure that our support system grows and adapts alongside your business.

Instant Responses for Seamless Resolution

RealBooks understands that time is of the essence in business, and delays in resolving accounting issues can have significant consequences. That's why we prioritizes instant responses to customer inquiries. Whether you reach out through phone, email, or chat, you can expect a quick and helpful response from RealBooks' support team.

Having a strong support system is like having a compass for any business, regardless of its size or stage. RealBooks is here to help you navigate the ups and downs of your financial journey. We're committed to providing you with the support you need during our regular business hours. While we might not be available around the clock, our focus on excellence during operating hours ensures that you receive the support you deserve.

Remember, at RealBooks, success is not just a destination; it's a journey we navigate together.

#accounting#online accounting software#accounting software#gst accounting software in india#accounting software india#cloud accounting software#gst accounting software#best accounting software for gst#cloud accounting#multi branch accounting software#freeaccountingsoftware#freeaccountingsoftwareinindia

0 notes

Text

Accounting Services in Delhi India by SC Bhagat & Co. – Your Trusted Financial Partner

In today’s dynamic business landscape, having a reliable accounting partner is essential for maintaining financial health. For businesses and individuals in Delhi, India, SC Bhagat & Co. offers comprehensive accounting services tailored to meet the needs of different industries. With a focus on accuracy, efficiency, and compliance, SC Bhagat & Co. has established itself as a trusted name in the accounting world.

Why Choose SC Bhagat & Co. for Accounting Services in Delhi? When it comes to managing your finances, it’s important to work with experts who understand the local regulations, tax laws, and accounting practices. Here are some key reasons why SC Bhagat & Co. stands out:

Expert Team of Accountants

SC Bhagat & Co. boasts a team of seasoned Chartered Accountants (CAs) and financial experts who bring years of experience to the table. They are well-versed in handling complex accounting needs, ensuring compliance with local tax laws, and providing timely financial insights. Customized Accounting Solutions

Every business has unique accounting needs. Whether you are a startup, a growing business, or an established corporation, SC Bhagat & Co. offers customized accounting services to meet your specific requirements. Their services include bookkeeping, financial reporting, tax filing, payroll management, and more. Compliance with Indian Accounting Standards

Staying compliant with the ever-changing accounting and tax regulations is crucial for any business. SC Bhagat & Co. ensures that all financial activities adhere to the latest Indian Accounting Standards (Ind AS), helping businesses avoid legal issues and penalties. Use of Advanced Accounting Software

To maintain accuracy and efficiency, SC Bhagat & Co. utilizes state-of-the-art accounting software. This ensures that all financial data is properly recorded, analyzed, and reported in a timely manner. It also helps in generating real-time reports for better decision-making. Affordable Accounting Services

One of the main concerns for businesses is the cost of outsourcing accounting services. SC Bhagat & Co. offers affordable packages for accounting services in Delhi India ensuring you get the best value without compromising on quality. Key Accounting Services Offered by SC Bhagat & Co. Bookkeeping Services

Keeping accurate records of your financial transactions is the foundation of good accounting. SC Bhagat & Co. offers bookkeeping services that ensure all your financial data is organized and up to date. Tax Planning and Filing

Effective tax planning can help reduce your tax liabilities and optimize your financial position. SC Bhagat & Co. provides expert tax planning and tax filing services to help businesses and individuals comply with Indian tax laws. Financial Reporting

Get a clear view of your financial health with detailed financial reports. SC Bhagat & Co. prepares accurate financial statements such as profit & loss statements, balance sheets, and cash flow reports. GST Compliance

With the introduction of GST (Goods and Services Tax) in India, businesses need to ensure proper GST registration, filing, and compliance. SC Bhagat & Co. offers GST-related services to make sure your business remains compliant. Payroll Services

Managing payroll can be time-consuming and complex. SC Bhagat & Co. handles all aspects of payroll management, including salary processing, deductions, and compliance with labor laws. Audit and Assurance Services

For businesses requiring auditing services, SC Bhagat & Co. provides thorough audit and assurance services that ensure transparency and accuracy in financial reporting. Why Accounting Services Are Crucial for Businesses in Delhi As one of the most vibrant business hubs in India, Delhi is home to a variety of industries ranging from IT, manufacturing, real estate, and more. With the growth of these industries comes the need for businesses to maintain proper financial records and ensure compliance with government regulations.

Professional accounting services like those offered by SC Bhagat & Co. provide businesses with the necessary tools to manage their finances efficiently. By outsourcing your accounting needs, you can focus on your core business activities while leaving the financial management to the experts.

Conclusion For businesses in Delhi, having a trusted accounting partner is essential for success. SC Bhagat & Co. provides a wide range of accounting services that cater to businesses of all sizes. With their team of experts, cutting-edge technology, and affordable pricing, SC Bhagat & Co. is your go-to partner for accounting services in Delhi India.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

3 notes

·

View notes

Text

Best Accounting Software in India for Businesses in 2025

As businesses across India gear up for a tech-driven future, efficient financial management tools are becoming indispensable. In 2025, TRIRID Biz Accounting and Billing Software stands out as one of the best accounting solutions for businesses looking to simplify their operations and boost productivity.

Why TRIRID Biz Accounting and Billing Software?

TRIRID Biz is not just another accounting tool; it's a comprehensive solution designed with the needs of Indian businesses in mind. Whether you run a small startup, a mid-sized enterprise, or a large organization, TRIRID Biz adapts to your requirements seamlessly. Here's why it's leading the way in 2025: 1. GST-Compliant Billing One of the highlights of TRIRID Biz is its strong GST billing capabilities. Right from generating GST invoices to return filing, it ensures that your business is on the right track with Indian tax regulations. It reduces errors and saves time for you to concentrate on growing the business. 2. User-Friendly Interface Accounting software is not usually non-intimidating for non-accountants. The interface of TRIRID Biz solves this problem, as it is intuitive and easy to use. First-time users can also easily navigate the software with minimal training. 3. Cloud-Based Accessibility Mobility is key in today's dynamic business environment. TRIRID Biz gives you cloud-based access, which allows you to access your accounts anywhere, at any time. Your financial data will always be accessible to you whether you are at the office or on the move. 4. Advanced Reporting and Analytics TRIRID Biz offers fully powerful reporting and analytics to help you make smart business decisions. Cash flow, revenue trend, and expense pattern may all be analyzed to ensure you outpace your competition. 5. Multi-User Functionality It supports all businesses with various departments as TRIRID Biz allows multi-user functionality. Team members can collaborate in real-time, ensuring that your processes will be streamlined to the minimum delays in decision-making processes. 6. Customized Solutions Every business is different, and TRIRID Biz understands that. The software has modules specifically tailored for retail, wholesale, service-based industries, and more. 7. Better Security Your financial data is one of your most prized possessions. TRIRID Biz uses state-of-the-art encryption and security protocols to ensure your information is not accessed by others without your permission.

Why Indian Businesses Love TRIRID Biz in 2025

India's business landscape is as diverse as it is vibrant. Flexibility, scalability, and cost-effectiveness are the hallmarks of accounting solutions that work for Indian businesses. TRIRID Biz delivers on all these fronts. From small kirana shops to large corporates, businesses across sectors are choosing TRIRID Biz for its unmatched blend of innovation and practicality. Here are some key benefits that users highlight:

Affordability: Cost-effective plans suitable for businesses of all sizes.

Scalability: The ability to grow alongside your business needs.

Excellent Customer Support: Prompt response to your queries through a dedicated support team.

Conclusion

In 2025, the competition to identify India's best accounting software is stiff, but TRIRID Biz takes the lead by focusing on customer-centric issues and innovative solutions. Be it to smarten up the billing process, comply with GST, or get a better overview of all finance-related matters, TRIRID Biz Accounting and Billing Software will be the right partner in your quest for business success. Take the next step in the path to efficiency and growth. Try TRIRID Biz today and transform the way you manage your business finances!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best Accounting Software In India#GST Billing Software#Best Business Software for SMBs in India#TRIRID Biz Accounting Software#Best Accounting Software in India for Businesses in 2025

0 notes

Text

How to Select the Right ERP Software for Your Indian Manufacturing Firm: Key Considerations

Introduction

In the dynamic landscape of the Indian manufacturing industry, the integration of an efficient Enterprise Resource Planning (ERP) system is paramount. Selecting the right ERP system for manufacturing industry can significantly impact a firm's operational efficiency, productivity, and overall competitiveness. This article delves into the crucial aspects of choosing the best ERP system tailored for the unique needs of Indian manufacturing firms.

Understanding the Unique Needs of the Indian Manufacturing Industry

1. Regulatory Compliance: Navigating the Complexities

One of the primary considerations for Indian manufacturers is ensuring compliance with local regulations. The selected ERP modules for manufacturing industry should seamlessly align with the Goods and Services Tax (GST) framework, a cornerstone of the Indian taxation system. It is imperative to choose a system that streamlines compliance with industry-specific regulations, safeguarding the manufacturing firm from legal complications.

2. Scalability: Growing with Your Business

As Indian manufacturing firms aspire for growth, scalability becomes a pivotal factor in ERP selection. Opt for a system that can effortlessly adapt to the evolving needs of your business. Scalability is particularly crucial for Indian manufacturers aiming for expansion in a market known for its dynamism and ever-changing demands.

3. Localization: Aligning with the Indian Operational Landscape

ERP software must be tailored to the nuances of the Indian market. Look for solutions offering localization features, including support for multiple languages, adherence to regional accounting standards, and culturally relevant interfaces. This ensures that the Best ERP for manufacturing industry seamlessly integrates into the operational fabric of your Indian manufacturing firm.

Key Features to Consider

1. Supply Chain Management: Navigating the Complex Web

Efficient supply chain management is integral for Indian manufacturers dealing with diverse suppliers and fluctuating market demands. The chosen ERP system should provide real-time visibility into the entire supply chain, encompassing procurement, production, and distribution. This ensures that your manufacturing firm can proactively respond to market changes and optimize resource allocation.

2. Production Planning and Control: Meeting the Complexities Head-On

The intricacies of manufacturing processes in India necessitate a comprehensive production planning and control module within the ERP system. Look for software that offers advanced features such as demand forecasting, capacity planning, and real-time monitoring of production processes. This empowers your manufacturing firm to enhance operational efficiency and meet customer demands with precision.

3. Quality Management: Upholding Excellence

Maintaining high-quality standards is non-negotiable for the success of any manufacturing firm. The ERP for manufacturing industry should include robust quality management modules that facilitate adherence to stringent quality control measures. This ensures that your products meet regulatory requirements and customer expectations, bolstering your reputation in the competitive Indian market.

Best ERP for the Indian Manufacturing Industry

1. Evaluating the Options

Selecting the best ERP for your Indian manufacturing firm involves a meticulous evaluation of available options. Consider industry-specific solutions renowned for their effectiveness in addressing the challenges prevalent in the Indian manufacturing landscape.

2. ERP Modules Specifically Tailored for Manufacturing

Explore ERP systems that offer modules explicitly designed for the manufacturing industry. These modules should cover essential aspects such as material requirements planning (MRP), shop floor control, and advanced planning and scheduling (APS). The seamless integration of these modules enhances operational visibility and control.

Customization and Integration: A Prerequisite for Success

1. Tailoring the ERP System to Your Needs

No two manufacturing firms are identical, and the chosen ERP system should accommodate this diversity. Look for software that allows customization to align with the unique processes and requirements of your Indian manufacturing firm. This ensures that the ERP system becomes an asset tailored to your specific needs rather than a one-size-fits-all solution.

2. Integration with Existing Systems

The ERP system should seamlessly integrate with existing software and systems within your manufacturing firm. This includes compatibility with Customer Relationship Management (CRM) software, Human Resource Management Systems (HRMS), and other relevant applications. A well-integrated ERP system for manufacturing industry streamlines data flow, minimizing redundancies and enhancing overall efficiency.

User-Friendly Interface and Training

Ensuring Adoption and Efficiency

An ERP system is only as effective as its adoption by the end-users. Prioritize user-friendly interfaces that facilitate easy navigation and understanding. Additionally, invest in comprehensive training programs to ensure that your team is proficient in utilizing the ERP system to its full potential. This approach maximizes the benefits derived from your ERP investment.

Cost Considerations: Balancing Investment and Returns

1. Calculating the Total Cost of Ownership (TCO)

While the initial cost of ERP implementation is a crucial consideration, it's equally essential to assess the Total Cost of Ownership (TCO) over the long term. Evaluate not only the upfront costs but also ongoing expenses related to maintenance, upgrades, and potential customization. This holistic approach ensures that the chosen ERP system aligns with your budgetary constraints without compromising on functionality.

2. Return on Investment (ROI): Ensuring Long-Term Value

Consider ERP implementation as a strategic investment rather than a mere expense. Calculate the anticipated Return on Investment (ROI) based on enhanced operational efficiency, reduced lead times, and improved customer satisfaction. A thorough ROI analysis ensures that the chosen ERP system delivers long-term value and contributes to the overall success of your Indian manufacturing firm.

Vendor Reputation and Support

1. Choosing a Reliable Partner

Selecting an ERP vendor with a proven track record in the manufacturing industry is crucial. Research and assess the reputation of potential vendors, considering factors such as the number of successful implementations, customer reviews, and the vendor's financial stability. A reliable vendor ensures ongoing support and updates, safeguarding your investment and providing peace of mind.

2. Support and Training Services

Evaluate the support and training services offered by the Best ERP for manufacturing industry. Responsive customer support and comprehensive training programs contribute to a smooth implementation process and ongoing success. Prioritize vendors that prioritize customer satisfaction and offer tailored support to address the unique needs of your Indian manufacturing firm.

Conclusion

In conclusion, choosing the right ERP software for manufacturing industry requires a strategic approach that considers the unique challenges and opportunities in the dynamic Indian market. By prioritizing regulatory compliance, scalability, localization, and key features such as supply chain management, production planning, and quality control, you can identify an ERP solution that aligns seamlessly with the needs of your manufacturing operations. Additionally, evaluating customization options, integration capabilities, user-friendliness, cost considerations, and the reputation of ERP software providers ensures a well-informed decision that propels your Indian manufacturing firm toward enhanced efficiency, productivity, and long-term success.

#ERP for manufacturing industry#ERP system for manufacturing industry#ERP software for manufacturing industry#Best ERP for manufacturing industry#ERP modules for manufacturing industry#India#Gujarat#Vadodara#STERP#shantitechnology

7 notes

·

View notes

Text

Tripta Accounting & Gst Softwre

TRIPTA Innovations Pvt. Ltd., based in Surat, India, has been a leader in accounting software since 1995. Our expertise in simplifying accounting has earned us a family of over 13,000 satisfied customers. Our flagship products, RADIX and RELY, offer comprehensive, GST-ready solutions catering to businesses of all sizes. RADIX combines robust functionality with innovative features, while RELY offers a unique blend of traditional and modern accounting methods. Our mobile application, ReflectR, keeps you connected to your financial insights on-the-go. At TRIPTA, we are committed to evolving with the latest government policies and technological trends, ensuring that our clients are always ahead in the dynamic world of business.

#Accounting Software#Financial Technology#TRIPTA Innovations#Business Software#RADIX Software#RELY Software

2 notes

·

View notes

Text

If you are facing any problem in account software then you should try Alignbook Accounting Software for easy accounting, billing, GST, Income tax etc.

AlignBooks is the best accountancy software that helps you deal with the bookkeeping & accountancy problemswith zero paperwork and automated cash flow management. We provide CRM software that helps you manage your field manpower and order bookings and attendance on the go. Use the GST billing software to keep ahead with the auto calculation of GST components such as SGST and CGST.

We provide Open developer APIs to help you make your own innovations. For all documents, you can get alerts through SMS and Mailer facility. You get the best GST software available right now for your business. Contact us to get more information.

Contact Us:-

Align Info Solutions PVT. LTD.

Website:- https://alignbooks.com/accounting-softwares

Address: - 801-804 Assotech Tower Noida sector 135

Hours: Open ⋅ Closes 8PM

Toll Free : 1800 120 8581

Phone :- +91 11 49863201-04

#accounting software#small business accounting software#gst software#billing software#gst billing software#online accounting software#accounting software in india#accounting software for small business#finance software#pos software

0 notes