#free invoicing software

Explore tagged Tumblr posts

Text

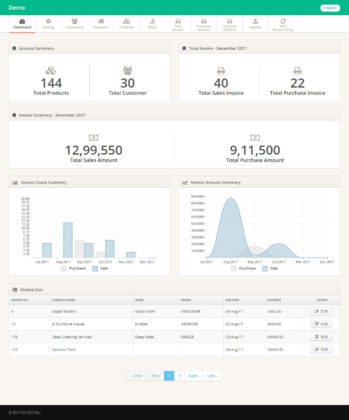

Free invoicing Software

Urban Ledger: Simplifying Finances, Empowering Businesses

Urban Ledger is a smart financial management platform designed to help businesses and individuals track transactions, manage credit, and streamline payments effortlessly. With an intuitive digital ledger, automated reminders, and secure payment integrations, Urban Ledger ensures seamless financial tracking, reducing errors and enhancing cash flow. Whether you are a small business, freelancer, or enterprise, our platform empowers you with real-time insights, easy invoicing, and multi-channel payment options. Say goodbye to manual bookkeeping and experience the future of hassle-free financial management with Urban Ledger.

Urban Ledger: The Ultimate Digital Ledger App for Business Finance Tracking

Managing finances has never been easier with Urban Ledger, the best digital ledger app designed to streamline business finance tracking. Whether you’re a small business owner, freelancer, or entrepreneur, our platform helps you maintain online payment management, track expenses, and manage credits effortlessly.

With Urban Ledger, you get a secure and smart accounting solution that simplifies expense & credit management, ensuring you never miss a payment or outstanding balance. Say goodbye to manual bookkeeping and experience the best accounting software for small business, offering real-time insights, automated reminders, and multi-channel payment options.

Try Urban Ledger – The Ultimate Digital Ledger App for Your Business!

Take control of your business finance tracking with Urban Ledger, the smartest digital ledger app designed to simplify online payment management and expense & credit management. Whether you’re a small business owner, freelancer, or entrepreneur, our platform ensures seamless transactions, automated reminders, and real-time financial insights.

Key Features:

Effortless expense & credit management

Secure online payment management

Smart invoicing & automated reminders

Real-time insights for business finance tracking

The best accounting software for small business

Try Urban Ledger Today! Visit our website to explore more: https://geturbanledger.com/

#free invoicing software#accounting software#Digital Ledger App#Online Payment Management#Business Finance Tracking#Expense & Credit Management#Best Accounting Software for Small Business

1 note

·

View note

Text

Mastering the GST Invoice Format: A Comprehensive Guide to Create and Manage Your Invoices

Learn how to create and manage GST-compliant invoices with ease. This comprehensive guide covers the essential components of a GST invoice, legal requirements, and best practices to ensure accuracy and compliance. Streamline your billing process and stay tax-ready with actionable tips and expert insights.

0 notes

Link

2 notes

·

View notes

Text

Orange Blue Minimalist Business Invoice A4 Document

Orange Blue Minimalist Business Invoice A4 Document is a vibrant and modern template designed for businesses that value clarity and style. Featuring a clean layout with orange and blue accents, it balances professionalism with a touch of creativity.

Buy this

#free invoice software#invoice software development bd#money transfer#finance#money#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

2 notes

·

View notes

Text

Free Invoice Generator with Online Templates

Would you like to Generate a Free invoice?

Zozo online invoicing software and templates make it simple to create a free invoice in Australia. Online templates for pre-made invoices are available for use. You can edit many of these templates for free to add your information. Millions of people trust us as your original Invoice Generator. With our eye-catching invoice template, Invoice Generator allows you to quickly create invoices right from your web browser. Create an invoice online customized for your brand or business using a Zozo free online invoice template.

Contact Us - https://www.zozo.com.au/contact-us

Regsiter - https://www.zozo.com.au/register

Website - https://www.zozo.com.au/

Our Plans - https://www.zozo.com.au/plans

2 notes

·

View notes

Text

EASY BILL - Basic Overview of SGST ✨ 2025

VISIT : https://sites.google.com/view/easy-billing-software/blog/basic-overview-of-sgst

EASY BILL - Basic Overview of SGST 2025 is a user-friendly platform designed to simplify the billing process for businesses in India. This tool integrates seamlessly with the Goods and Services Tax (GST) system, offering a clear understanding of SGST (State Goods and Services Tax) for the year 2025. EASY BILL helps businesses generate accurate invoices while automatically calculating SGST rates based on the state-specific tax structure. With its intuitive interface, users can efficiently manage tax compliance, ensure accurate reporting, and stay updated with the latest regulations. EASY BILL streamlines SGST management for enhanced efficiency and compliance.

#easy billing software#easy billing#gst easy bill#easy gst billing software#easy gst#invoice easy#free billing software for mobile#easy gst software#online billing software free#online software for billing#software for billing#easy accounting software#gst billing software online#simple billing#easy invoice#e billing software#quick bill software

1 note

·

View note

Text

Best Accounting and Billing Software in India

TRIRID Biz: The Best Accounting and Billing Software in India

There is no headache in managing your finance the same way it would not be with TRIRID Biz Accounting and Billing Software. It is ideal for the Indian business and caters to billing, garners GST compliance, and ensures simplifying your financial management to become and remain seamless and without stress.

Why Is TRIRID Biz The Best Choice? Tax Compliance Made Simpler Generate your GST-invoicing process, and automate tax filing.

Conveniently Cloud Based Access accounts and reports securely from anywhere, anytime, on any device.

User-Friendly Interface Intuitive design ensures smooth navigation for all users, regardless of technical expertise.

Detailed Insights Create custom reports on sales, expenses, and profits to make informed decisions.

Cost-Efficient Plans Advanced features provided at lower prices, fit for any business size.

Who Should Use TRIRID Biz? TRIRID Biz provides its offers to virtually every type of industry-from a small retail shop to large enterprises, covering:

Retail or wholesale businesses E-commerce websites Service providers All that you need is to automate the billing or make the financial accuracy better, TRIRID Biz's got it all for you.

Start Your Journey Today Are you now ready to take charge of your finances? Among these millions satisfied in using TRIRID Biz: accounting and billing software from India.

👉 Get Started: Try TRIRID Biz for Free!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Accounting and Billing Software#Best Accounting & Billing Software In India#GST Billing Software for Small Businesses in India#Best Accounting Software in India for Businesses in 2025#Free GST Invoice Software for Indian Business

0 notes

Text

Best GST Software to Learn Practically

In today’s competitive world, practical knowledge is the key to success, especially in the fields of taxation and accounting. Understanding the Goods and Services Tax (GST) system is essential for students, professionals, and business owners alike. But how can you move beyond theoretical knowledge to truly grasp the intricacies of GST?

There are multiple software solutions available that can simplify the process of learning GST practically. For educational institutions, these tools provide an excellent way to teach students GST in a hands-on manner. Additionally, institutions can also use these platforms to offer GST-related services, enhancing their offerings and value

Why Practical Learning is Crucial in GST

GST is not just about understanding laws and percentages. It’s about:

Filing accurate returns.

Managing TDS (Tax Deducted at Source).

Generating invoices that comply with legal standards.

Understanding input tax credits.

Practical learning allows users to:

Apply theoretical concepts to real-world scenarios.

Develop hands-on skills in GST filing and compliance.

Enhance confidence in handling business finances.

Features of the Best GST Software for Learning

Technotronixs has developed a robust GST Simulation Software that is perfect for practical learning. Here’s why it stands out:

eBay-Like Simulations:

Simulate real-world transactions in a controlled environment.

Understand GST implications on various goods and services.

TDS Management Tools:

Learn how to calculate and deduct TDS correctly.

Get practical experience in filing TDS returns.

Student Information System Integration:

Track learning progress.

Access detailed guides and tutorials.

Hands-On GST Filing Practice:

Create and upload GST returns.

Handle errors and corrections just like in real situations.

Institute Earnings Opportunity:

Educational institutions can use this software to generate additional income by offering specialized GST training courses.

Benefits for Students and Institutes

For Students:

Master GST compliance without the risk of penalties.

Gain a competitive edge in the job market.

Build a strong foundation in taxation and financial management.

For Institutes:

Provide value-added courses to attract more enrollments.

Monetize through specialized GST training programs.

Build a reputation as a center of excellence in taxation education.

Why Choose Technotronixs’ Tax Simulation Software

User-Friendly Interface: Designed with students and educators in mind, it’s easy to navigate even for beginners.

Customizable Modules: Tailor the software to suit specific training needs.

Affordable Pricing: High-quality learning at a budget-friendly cost.

Proven Results: Backed by positive feedback from users and institutions.

Conclusion

When it comes to learning GST practically, Technotronixs Tax Software is the ultimate tool. Its innovative features and real-world applications make it the best choice for students and institutions alike. Start your journey to mastering GST today and unlock new career opportunities!

Ready to take the next step? Explore the possibilities with Technotronixs’ Tax Simulation Software and transform how you learn and teach GST.

#Best Gst simulation software#gst software#best tax learning app#erp#software#billing software#gst software free#best gst billing software#best gst invoice softwar

0 notes

Text

Mastering the GST Invoice Format: A Comprehensive Guide to Create and Manage Your Invoices

Learn how to create and manage GST-compliant invoices with ease. This comprehensive guide covers the essential components of a GST invoice, legal requirements, and best practices to ensure accuracy and compliance. Streamline your billing process and stay tax-ready with actionable tips and expert insights.

As a business owner in India, it is important to understand the Goods and Services Tax (GST) and its impact on your invoicing process. Invoicing is a critical aspect of any business, and it is essential to ensure that your GST invoices comply with the GST laws and regulations. In this blog post, we will provide you with a comprehensive guide on how to create and manage your GST invoices using free invoicing software.

Understanding the Basics of GST

The GST is an indirect tax that is levied on the supply of goods and services in India. It was introduced in July 2017 to replace multiple taxes such as service tax, excise duty, VAT, etc., with a unified tax structure. The GST is divided into three categories: CGST (Central GST), SGST (State GST), and IGST (Integrated GST).

What is a GST Invoice?

A GST invoice is a document that is issued by a registered supplier to their customers to indicate the details of the goods or services provided, the amount charged, and the applicable GST. The GST invoice serves as proof of the supply of goods or services and is a crucial document for claiming input tax credit (ITC). Invoicing software can help you easily generate compliant GST invoices.

i) GST Invoice Format

The GST invoice format must comply with the GST laws and regulations. The format of the GST invoice includes the following details:

ii) Name and Address of the Supplier

The name, address, and GSTIN (GST Identification Number) of the supplier must be mentioned on the invoice.

iii) Invoice Number and Date

The invoice number and date must be mentioned on the invoice, which should be a consecutive serial number unique to each financial year.

iv) Name and Address of the Recipient

The name, address, and GSTIN of the recipient must be mentioned on the invoice.

v) Description of Goods or Services

The description of the goods or services provided must be mentioned on the invoice. The HSN (Harmonized System of Nomenclature) code must also be mentioned for goods and SAC (Services Accounting Code) for services.

vi) Quantity and Unit of Measure

The quantity of the goods or services provided must be mentioned on the invoice along with the unit of measure.

vii) Total Value of Supply

The total value of the supply, excluding the GST, must be mentioned on the invoice.

viii) Taxable Value

The taxable value is the value of the supply on which the GST is applicable. The taxable value must be mentioned on the invoice.

ix) Rate of GST

The rate of GST applicable to the supply must be mentioned on the invoice.

x) Amount of GST

The amount of GST applicable to the supply must be mentioned on the invoice.

xi) Place of Supply

The place of supply, i.e., the location where the goods or services were delivered or provided, must be mentioned on the invoice.

xii) Payment Terms

The payment terms, i.e., the date by which the payment must be made, must be mentioned on the invoice.

xiii) Signature of the Supplier

The invoice must be signed by the supplier or their authorized representative

Benefits of GST Invoicing

The GST invoicing system has several benefits, such as:

Streamlined Invoicing Process

The GST invoicing system has made the invoicing process more streamlined, reducing the paperwork and making it easier for businesses to comply with the GST laws and regulations.

Improved Input Tax Credit

GST invoices serve as proof of the supply of goods or services and enable businesses to claim input tax credit (ITC) on the GST paid.

Reduced Tax Evasion

The GST invoicing system has reduced the instances of tax evasion by making it easier for the authorities to track the movement of goods and services.

Tips for Managing GST Invoicing

Understand the GST regulations: Before you start invoicing, it's important to understand the GST regulations in your country. This will help you ensure that your invoices are compliant and avoid any penalties or fines.

Include all necessary details: Your GST invoices should include all necessary details such as your business name and address, GST number, invoice number, date of issue, and a description of the goods or services provided. It's also important to include the GST amount and the total amount payable.

Use a GST-compliant invoicing software: There are many invoicing software programs available that are GST-compliant and can help you streamline your invoicing process. These programs can also help you keep track of your invoices and payments, making it easier to manage your finances.

Issue your invoices promptly: It's important to issue your invoices promptly to ensure that you receive payment in a timely manner. Consider setting up an invoicing schedule to help you stay on track.

Follow up on late payments: If a payment is late, it's important to follow up with the customer to ensure that payment is received. Consider sending a reminder or following up with a phone call or email.

Keep accurate records: It's important to keep accurate records of all your GST invoices and payments. This will help you stay organized and make it easier to file your taxes at the end of the financial year.

Seek professional advice: If you're unsure about any aspect of GST invoicing, it's important to seek professional advice. This could include consulting with a tax professional or seeking advice from your business advisor.

Pros of GST invoice:

Compliance with tax regulations: GST invoices help businesses comply with the tax regulations of their country, ensuring that they do not face any penalties or fines.

Claiming input tax credit: GST invoices allow businesses to claim input tax credit for the GST paid on purchases, which can help reduce their tax liability.

Increased transparency: GST invoices provide transparency to both businesses and customers regarding the taxes being paid on goods and services, promoting fair competition and reducing tax evasion.

Simplified tax system: GST replaced multiple taxes, making the tax system more streamlined and easy to understand.

Reduces cascading effect: The GST system reduces the cascading effect of taxes by allowing businesses to claim input tax credit on all purchases.

Cons of GST invoice:

Requires detailed documentation: GST invoicing requires detailed documentation, which can be time-consuming and require additional resources.

Complexity: The GST system can be complex, requiring businesses to stay updated with the latest regulations and changes.

Additional compliance costs: Compliance with the GST system may require additional resources and costs for businesses, especially for smaller businesses.

Disruption during implementation: The implementation of GST can cause short-term disruptions for businesses, such as changes in pricing and invoicing.

Impact on cash flow: Businesses may need to pay the GST collected to the government even before receiving payment from customers, impacting cash flow.

Final Thoughts

Overall, GST invoicing has many benefits for businesses, such as compliance with tax regulations, claiming input tax credit, increased transparency, and a simplified tax system. However, there are also some challenges, such as the need for detailed documentation, complexity, additional compliance costs, short-term disruptions during implementation, and impact on cash flow. Using free invoicing software will help you change the challenges more successfully and keep your business running smoothly.

0 notes

Text

The importance of the best billing software in India free for small businesses

A billing system is a process used by businesses and companies to simplify the process of sending invoices to clients. Online billing software free is a software that computerizes the procedure of receiving payments and sending out regular invoices. As well, tracking expenses and tracking invoices are frequently included in free accounting software India. This blog is all about the importance of the best billing software in India free for small businesses. The best billing software in India free ensures that your clients can easily pay for the products and services they render. For small businesses, free accounting software India is important as it offers a range of benefits to businesses in achieving their goals.

Apart from that, free accounting software India for small businesses helps enhance the cost-efficiency and productivity of employees by automating repetitive tasks. In today’s time, mostly businesses are using online billing software free to manage their whole business, including accounts, financial statements, inventory management, and others.

The importance of the best billing software in India free

If you are a small business owner and looking to expand your business, then opting for online billing software free, will be the best solution for all your business requirements. Some of the benefits of

free accounting software India are as follows:

Easy creation of invoices: Since all the debit and credit information is filled out in the billing software, it automatically calculates the amount and combines all the data to create new invoices in a professional way.

Customer history and data: The information of every customer is saved in a particular database. Since all of the customer information is available in a single place, retrieving customer data and tracking becomes extremely simple. You don’t need to struggle through multiple files and papers.

Information Organization: The organization of information is a very tough and time-consuming task. For that, you need a free invoice software download that can save, organize, and fetch the data in real-time. It makes the transaction of data more accessible and smooth.

Design your invoice: Billing software for small businesses comes with predefined invoice templates that can be made according to your requirements. Customization of your own invoice template with your brand identity makes your invoices look more professional and separate from others.

Multiple modes of payment: modern-day billing software in India is coherent with payment gateways that permit you to accept payments from your customers through various modes of payment. Free invoice software download authorizes you with special features like auto-bank reconciliation, saving time and effort for integrating the transactions.

Strategies to select the best billing software in India

The selection of efficient billing processes is important for maintaining a healthy cash flow that ensures the smooth working of the business. Below are the strategies to follow before finalizing the accounting software:

Business Requirements: Understand your business needs and identify the features and functionalities that you want in a billing software.

User-friendly: Select the accounting software that is easy to use and operate and that doesn’t require any extra training.

Automation: In today’s world, time is money. So choosing billing software that has automation can help you save both time and money.

Safety: The safety of the customer's information is paramount. So, selecting accounting software that has top-notch security is a must.

After reading this blog, it is clear that billing software in India is an important factor in the expansion of business. So if you are searching for reliable and trustworthy billing software, then go for Eazybills, as it has robust security and all the features required for the proper functioning of billing.

#best billing software in india free#free accounting software india#online billing software free#free invoice software download#billing software#invoice software#easy billing software#free invoicing software#gst billing software#best gst billing software

0 notes

Text

Create a Free Invoice With mazu In 2025

Mazu makes invoicing easy for retail businesses in India. It provides invoice templates that follow GST rules and can be customized. You can streamline your GST filing, automatically calculate taxes, and improve your brand's professional appearance with Mazu's simple tools.

Create GST-compliant invoices effortlessly.

Customize templates with logos and colours.

Auto-fill GST details and calculate taxes.

Manage GST returns efficiently.

For Further Information Please Visit: https://mazu.in/retail-invoice-bill-generator/

0 notes

Text

Black White Bold Simple Photography Studio Invoice

Black White Bold Simple Photography Studio Invoice is a sleek and modern template tailored for photography professionals. Featuring a clean white background with bold black accents, it exudes sophistication and clarity.

Buy this

#free invoice software#invoice software development bd#money transfer#money#finance#invoice discounting#invoice management system#invoice maker#invoice processing#invoice

0 notes

Text

𝗛𝗼𝘄 𝘁𝗼 𝗨𝘀𝗲 𝗮 𝗙𝗿𝗲𝗲 𝗜𝗻𝘃𝗼𝗶𝗰𝗲 𝗧𝗲𝗺𝗽𝗹𝗮𝘁𝗲 𝗶𝗻 𝗚𝗼𝗼𝗴𝗹𝗲 𝗗𝗼𝗰𝘀: 𝗔 𝗦𝘁𝗲𝗽-𝗯𝘆-𝗦𝘁𝗲𝗽 𝗚𝘂𝗶𝗱𝗲 This article is a comprehensive guide on how to create professional invoices using a free Google Docs template. It walks you through every step, from customizing the template to adding client details, listing products or services, and saving the final document. Perfect for small businesses and freelancers, this guide helps you streamline your invoicing process in just minutes. Discover how easy it is to get started—read the article now!

#business#finance#entrepreneurship#startup#google docs#invoice generator#invoice maker#free invoice software#invoice management system

1 note

·

View note

Text

Make Business Accounting Stress-Free with Go GST Bill’s Modern, Easy-to-Use Software

Managing your business finances doesn’t have to be stressful or time-consuming. Go GST Bill is dedicated to making accounting easy and efficient for businesses of all sizes. With a focus on streamlining financial tasks, they offer a range of user-friendly tools to help manage invoicing, purchasing, and compliance with GST regulations. Their solutions are designed not only to save time but also to reduce the complexities of manual bookkeeping.

With Go GST Bill, businesses can enjoy the benefits of modern technology, which simplifies their daily accounting processes. Their platform caters to all types of businesses, from startups to well-established companies, ensuring that everyone can manage their financial operations hassle-free. What sets them apart is their offering of free online accounting software, which empowers users to track expenses, create invoices, and monitor financial health in real-time.

From Startups to Enterprises—Streamline Accounting with Free Tools by Go GST Bill

Additionally, their professionally designed purchase order template makes procurement processes seamless and error-free. This tool ensures you stay organized and maintain a clear record of transactions. For businesses looking to comply with GST regulations, Go GST Bill provides a versatile GST invoice template that helps create error-free invoices. The platform also offers a variety of configurations for GST invoice format, enabling businesses to customize invoices to fit their unique needs.

Go GST Bill is more than just software—it’s a partner in your financial success. Their commitment to simplifying accounting processes helps businesses focus on growth and customer satisfaction. Explore their advanced tools today and experience accounting like never before. Take control of your finances with the support of experts who truly understand your needs!

0 notes

Text

Modern Blue and White Technology Invoice Design

The "Blue and White Illustrative Technology Invoice" is a modern, professional invoice design featuring a sleek blue and white color scheme. The layout combines clean lines with subtle graphical elements, ideal for tech companies or businesses in the digital sector. It includes clearly marked sections for services rendered, pricing details, payment terms, and contact information, ensuring clarity and ease of use for both the sender and recipient. The illustrative design enhances the overall presentation while maintaining a formal, business-appropriate look.

Buy now by clicking on the below link:

#invoicefinancing#invoice maker#free invoice software#invoice software development bd#invoicemanagement

0 notes

Text

Top 10 Billing Software Features for Growing Businesses

The current business landscape is so competitive that growth and efficiency depend on the right billing software. TRIRID Biz Accounting and Billing Software helps empower growing businesses with leading-edge features. Here are the top 10 billing software features every business should look for:

User-Friendly Interface

A simple, intuitive interface guarantees easy navigation by users so that the learning curve is low and productivity high.

Customized Invoices

Your customized invoicing with your logo, branding, and itemization provides a professional look to your invoices while ensuring that your brand is well-protected.

GST Compliance

In India, all businesses are expected to compute and file GST with minimal errors. TRIRID Biz offers accurate tax calculations as well as ensures compliance with the latest regulatory changes.

Real-Time Reporting

Have detailed sales, expenses, and customer reports at your fingertips and make business decisions with the click of a button.

Cloud Accessibility

Run your billing system from any location with cloud-based functionality, ideal for businesses spread over many locations or with remote teams.

Inventory Management

Manage your inventory levels and know when to reorder so that you never run out or have too much stock.

Multi-User Support

Provide role-based access to employees so that they can collaborate without exposing sensitive business information.

Automated Reminders

Send automated payment reminders to clients, reducing late payments and improving cash flow.

Integration Capabilities

Integrate with ERP, CRM, or e-commerce platforms to streamline workflows and improve operational efficiency.

Scalability

Your billing software should grow with your business. TRIRID Biz offers flexible solutions that cater to startups and enterprises alike.

Why TRIRID Biz is the Right Choice

TRIRID Biz Accounting and Billing Software combine all these features into a single powerful platform tailored for growing businesses. Whether you are looking to save time, reduce errors, or enhance your financial processes, TRIRID Biz has you covered.

Boost your business efficiency today with TRIRID Biz!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Top 10 Billing Software for Small Businesses#Free GST Invoice Software for Indian Business#best billing software in india for small business

0 notes