#group health insurance coverage in Dallas

Explore tagged Tumblr posts

Text

Home Care & Private Health Insurance in Dallas - Kang Group Services Expertise

Navigating the complex world of insurance can be a daunting task, particularly when it comes to securing private health and Home Care Insurance in Dallas. Kang Group Services stands out as a trusted partner, offering tailored solutions to meet diverse needs. Whether you're exploring options for long-term care at home or seeking comprehensive health coverage, this guide delves into how Kang Group Services simplifies the process and ensures optimal protection.

Understanding Home Care Insurance

Home care insurance is an essential policy designed to cover the costs associated with in-home care services. These services can include assistance with daily activities, skilled nursing care, and even therapy sessions for individuals recovering from medical procedures or managing chronic illnesses.

Why Home Care Insurance Matters

Aging in Place: Many individuals prefer the comfort of their own homes rather than transitioning to a nursing facility. Home care insurance supports this choice by covering necessary services.

Customized Care: Policies can be tailored to individual needs, ensuring personalized care that addresses specific medical and non-medical requirements.

Financial Security: Home care services can be costly. Insurance helps mitigate financial burdens, making care more accessible and sustainable.

Key Features to Consider

Coverage for Skilled Nursing: Ensure the policy covers professional healthcare services provided by licensed nurses.

Non-Medical Support: Look for plans that include assistance with household tasks and personal care.

Flexibility in Providers: Choose a policy that allows for a wide selection of home care agencies or individual caregivers.

Private Health Insurance in Dallas

Private health insurance offers a range of benefits beyond standard employer-provided plans or government programs. It provides access to a broader network of healthcare providers, customizable coverage, and quicker access to specialized care.

Benefits of Private Health Insurance

Comprehensive Coverage: From routine check-ups to specialized treatments, private health insurance often covers a wider array of services.

Shorter Wait Times: Private policies can expedite appointments with specialists and reduce wait times for treatments.

Flexibility: Policyholders can select plans that best suit their lifestyle, including family plans or individual coverage.

Factors to Consider When Choosing a Plan

Premiums and Deductibles: Balance monthly premium costs with out-of-pocket expenses.

Network Providers: Ensure the plan includes your preferred doctors and healthcare facilities.

Additional Benefits: Look for extras such as vision, dental, and wellness programs.

Why Choose Kang Group Services?

Kang Group Services has earned a reputation as a reliable and customer-focused insurance provider in Dallas. Here’s why they’re a top choice for home care and private health insurance:

Expertise in Customization

Kang Group Services understands that every client has unique needs. Their team works closely with individuals and families to design insurance solutions that align with specific health and financial goals.

Extensive Network

With a comprehensive network of healthcare providers and home care agencies, Kang Group Services ensures clients have access to top-tier services. Their partnerships with reputable providers enhance the quality and reliability of care.

Commitment to Client Education

Insurance can be complex, but Kang Group Services simplifies the process. They provide clear explanations of policy details, empowering clients to make informed decisions about their coverage.

Tips for Selecting the Right Insurance Plan

Assess Your Needs: Determine the level of care required, whether for yourself or a loved one. This includes medical, personal, and household support.

Compare Policies: Evaluate different plans offered by Kang Group Services to find the best fit.

Consult Experts: Leverage the expertise of Kang Group Services’ advisors to clarify doubts and customize policies.

Plan for the Future: Consider potential healthcare needs to ensure your policy remains relevant over time.

A Partner You Can Trust

Choosing the right insurance is a significant decision that impacts your quality of life and financial stability. Kang Group Services’ personalized approach, extensive expertise, and unwavering commitment to client satisfaction make them a trusted partner in Dallas.

Whether you’re looking for home care insurance to age in place comfortably or private health insurance for comprehensive medical coverage, Kang Group Services delivers peace of mind and security. With their guidance, you can navigate the complexities of insurance confidently and focus on what truly matters—your health and well-being.

Conclusion

In a rapidly changing healthcare landscape, having the right insurance coverage is essential. Kang Group Services not only provides exceptional home care and Private Health Quotes in Dallas options but also ensures that clients receive the support and resources they need. Partnering with Kang Group Services means investing in a secure and healthier future for yourself and your loved ones. Don’t wait—explore their offerings today and take the first step toward comprehensive coverage and personalized care.

#home care insurance in dallas#Home-based Business Insurance in Dallas#Valuable Articles Insurance in Dallas#Group Health Insurance Coverage in Dallas#Health Insurance Obamacare in Dallas#Obamacare Health Coverage in Dallas

0 notes

Text

Understanding Whole Life Policies and Obamacare Health Coverage in Dallas - Kang Group Services

When considering financial security and healthcare needs in Dallas, navigating options like whole life policy in Dallas and Obamacare health coverage becomes crucial. Both serve distinct purposes in safeguarding individuals and families against unexpected expenses and ensuring access to quality healthcare. Let's explore these topics in detail to understand how Kang Group Services can assist Dallas residents in making informed decisions.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life policies offer lifelong protection with a guaranteed death benefit. They also accumulate cash value over time, which can be accessed through loans or withdrawals during the policyholder's lifetime.

Benefits of Whole Life Insurance:

Lifetime Coverage: Provides coverage until death, ensuring financial protection for loved ones.

Cash Value Accumulation: Builds cash value over time, which grows tax-deferred and can be used for various purposes such as supplementing retirement income or funding large expenses.

Fixed Premiums: Premiums remain fixed throughout the life of the policy, providing predictability and stability in financial planning.

Estate Planning: Facilitates estate planning by providing a tax-free death benefit to beneficiaries, helping to cover estate taxes or other financial obligations.

Why Choose Whole Life Insurance?

For Dallas residents seeking long-term financial security, whole life insurance offers a comprehensive solution. It combines protection with savings, making it a versatile financial tool for individuals and families at various life stages.

Obamacare Health Coverage in Dallas

Overview of Obamacare (Affordable Care Act):

The Affordable Care Act (ACA), commonly known as Obamacare, was enacted to improve access to healthcare by expanding insurance coverage and controlling healthcare costs. It introduced health insurance marketplaces where individuals and small businesses can shop for affordable coverage, often with subsidies to lower premiums for those who qualify based on income.

Key Features of Obamacare Health Coverage:

Essential Health Benefits: Plans offered through the marketplace must cover essential health benefits, including preventive care, prescription drugs, maternity care, and mental health services.

Premium Tax Credits: Financial assistance is available to eligible individuals and families to help lower monthly premium costs.

Coverage Options: Consumers can choose from different levels of coverage (bronze, silver, gold, platinum) based on their healthcare needs and budget.

Pre-existing Conditions: Insurers cannot deny coverage or charge higher premiums based on pre-existing conditions, ensuring access to coverage for individuals with health issues.

Accessing Obamacare Health Coverage in Dallas:

Kang Group Services can help Dallas residents navigate the complexities of Obamacare health coverage. They provide expertise in understanding plan options, eligibility criteria, and subsidy calculations, ensuring individuals and families find the right coverage that meets their healthcare needs and budget constraints.

Conclusion

In conclusion, whole life insurance policies and Obamacare health coverage in Dallas play vital roles in securing financial stability and healthcare access for Dallas residents. While whole life insurance offers lifelong protection and financial benefits, Obamacare health coverage provides accessible and affordable healthcare options through government-regulated marketplaces. Kang Group Services stands ready to assist Dallas residents in choosing the best insurance solutions tailored to their individual circumstances, ensuring peace of mind and comprehensive coverage for the future.

#permanent whole life insurance policy#best term policy in Dallas#whole life policy in Dallas#health insurance Obamacare in Dallas#supplemental insurance policy in Dallas#group health insurance coverage in Dallas#private health quotes in Dallas

0 notes

Text

Small Business Health Insurance in Dallas

DFW Direct Insurance specializes in small business health insurance in Dallas, supporting businesses with affordable, comprehensive group plans. They work with business owners to design coverage that meets employees’ needs while fitting within company budgets. DFW Direct Insurance provides guidance on plan selection, compliance, and employee enrollment, making it easier to offer health benefits that attract and retain top talent. Their commitment to personalized service ensures small businesses in Dallas get the support they need in providing health benefits.

0 notes

Text

Dallas Group Health Insurance: A Comprehensive Guide for Businesses

In the bustling metropolis of Dallas, businesses of all sizes face the critical task of providing their employees with comprehensive health insurance coverage. Dallas group health insurance plans offer a valuable solution, combining affordability with a wide range of benefits to safeguard the well-being of your workforce. This article will delve into the intricacies of Dallas group health insurance, exploring the various plan options, key considerations for employers, and the numerous advantages it offers. https://sihasah.com/dallas-group-health-insurance-a-comprehensive-guide-for-businesses/

1 note

·

View note

Text

Understanding Health Insurance Options for Small and Large Businesses in Dallas, TX

Health insurance is a crucial benefit for employees, and offering it can significantly impact a business's ability to attract and retain talent. In Dallas, TX, both small and large businesses have various options to consider when it comes to providing health insurance to their employees. Understanding these options and the associated benefits and challenges can help business owners make informed decisions.

Health Insurance Options for Small Businesses

Group Health Insurance Plans

Small businesses in Dallas, typically defined as those with 1-50 employees, can opt for group health insurance plans. These plans pool employees together, spreading the risk among a larger group, which can result in lower premiums compared to individual plans. Key advantages include:

Cost Savings: Group plans often come with lower premiums.

Employee Retention: Offering health insurance can attract and retain employees.

Tax Benefits: Businesses may be eligible for tax credits for providing health insurance.

Health Maintenance Organization (HMO) Plans

HMO plans require employees to choose a primary care physician (PCP) and get referrals to see specialists. These plans often have lower premiums and out-of-pocket costs but offer less flexibility in choosing healthcare providers.

Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility, allowing employees to see any healthcare provider, though seeing in-network providers will cost less. These plans generally have higher premiums but provide more options for employees.

High-Deductible Health Plans (HDHP) with Health Savings Accounts (HSA)

HDHPs have higher deductibles and lower premiums. Paired with HSAs, employees can save pre-tax dollars for medical expenses. This option is beneficial for those who do not expect to have significant medical expenses.

Health Insurance Options for Large Businesses

Self-Insured Plans

Large businesses, typically those with 51 or more employees, often have the resources to self-insure. This means they pay for employee health claims directly, rather than purchasing insurance from a carrier. Benefits include:

Cost Control: Potential savings if employees are generally healthy.

Plan Customization: Ability to design a plan that meets the specific needs of the workforce.

Data Transparency: Access to claims data, which can help in managing healthcare costs.

Fully Insured Plans

In fully insured plans, the business pays a fixed premium to an insurance company, which then assumes the risk of paying for covered employee healthcare claims. This option provides predictability in terms of costs and reduces the administrative burden on the business.

Wellness Programs

Many large businesses in Dallas are incorporating wellness programs into their health insurance plans. These programs promote healthy lifestyles among employees and can lead to lower healthcare costs over time. Examples include smoking cessation programs, fitness incentives, and nutritional counseling.

Compliance and Regulatory Considerations

Businesses in Dallas must adhere to federal and state regulations regarding health insurance. The Affordable Care Act (ACA) mandates that businesses with 50 or more full-time employees provide health insurance or face penalties. Additionally, Texas state laws have specific requirements and benefits that businesses must consider.

Small Business Health Options Program (SHOP)

The SHOP marketplace provides an avenue for small businesses to compare and purchase health insurance plans. Businesses with fewer than 25 employees may qualify for tax credits through SHOP, making it an attractive option for providing employee health benefits.

COBRA and State Continuation Coverage

Under the Consolidated Omnibus Budget Reconciliation Act (COBRA), businesses with 20 or more employees must offer continued health coverage to employees who leave the company. Texas also has state continuation laws that extend similar protections to employees of smaller businesses.

Choosing the Right Plan

When selecting a health insurance plan, businesses should consider factors such as the needs and preferences of their employees, budget constraints, and long-term goals. Consulting with a knowledgeable insurance broker or benefits consultant can help in navigating the complex landscape of health insurance options.

Employee Needs and Preferences

Understanding the demographics and health needs of the workforce is crucial. Younger employees may prefer HDHPs with HSAs, while those with families might favor PPO plans with broader provider networks.

Budget and Cost Management

Balancing the cost of premiums with the level of coverage provided is essential. Businesses should evaluate the financial impact of different plans and consider both the short-term and long-term costs.

Long-Term Goals

Aligning health insurance offerings with the company’s long-term goals, such as improving employee wellness and productivity, can enhance the overall benefits of the plan. Integrating wellness programs and preventive care options can contribute to these goals.

Navigating health insurance options in Dallas, TX, requires careful consideration of various factors unique to both small and large businesses. By understanding the available plans and regulatory requirements, businesses can make informed decisions that benefit both their employees and their bottom line. Offering comprehensive health insurance not only supports employee well-being but also strengthens the company's ability to attract and retain top talent in a competitive market.

For more info :-

health coverage in dallas tx

small and large business health insurance dallas tx

business health insurance near me

selected benefits dallas tx

0 notes

Photo

Understanding Health Insurance Options in Dallas for Children's Hearing Aids

"Explore the pathways of health insurance in Dallas to secure essential hearing aids for children, ensuring their developmental success."

Dallas Small Business Health Insurance often presents a complex landscape for families seeking coverage for essential medical devices such as hearing aids for children. This is particularly challenging for families with children diagnosed with hearing impairments, where timely intervention is crucial for their language development and overall learning. The high cost of pediatric hearing aids, which are essential for children with hearing loss, places a significant financial burden on families, especially when their insurance plans do not cover these costs. In Dallas, like many other places, private insurance plans may not always include coverage for hearing aids for children, leaving families to navigate a maze of healthcare policies and funding options. This gap in coverage underscores the importance of understanding and advocating for comprehensive health insurance that addresses the specific needs of children with hearing impairments.

More information can be found at :

Group Health Insurance Dallas TX policies vary widely, and navigating these can be particularly challenging for parents of children with special healthcare needs. The need for customized solutions in healthcare coverage is evident in cases like pediatric hearing loss, where standard insurance packages may fall short. Parents and caregivers are often required to become advocates for their children’s health needs, pushing for legislative changes or seeking alternative funding sources. This journey highlights the importance of insurance policies that adapt to the unique healthcare challenges faced by families. The challenge is further compounded by the evolving landscape of healthcare regulations and the varying coverage provided by different insurance plans. For families in Dallas, the key lies in diligent research and understanding of their insurance policies, coupled with advocacy for more inclusive healthcare coverage.

Dallas Group Health Insurance plans play a pivotal role in providing coverage for a range of medical needs, including those of children with hearing impairments. The quest for comprehensive insurance coverage that includes pediatric hearing aids is a common struggle for many families. This need is often met with varying degrees of success, depending on the state and the specific insurance policy. Efforts by various advocacy groups and individuals highlight the ongoing need for insurance policies that adequately cover essential medical devices for children. As insurance plans and healthcare policies continue to evolve, the hope is that more families will gain access to the necessary medical support, ensuring that children with hearing impairments receive the care and equipment they need for their development.

Insurance4Dallas, (I4D), helps insure all of Texas, Oklahoma, Arkansas, Arizona, Louisiana, New Mexico, Alabama, Virginia and Florida. Insurance4Dallas provides consumers with detailed information on health insurance with the ability to purchase health insurance online. Insurance4Dallas provides a full spectrum of health, dental, vision, life and ancillary insurance products, providing a diverse selection of price and benefit options complemented by personal customer service. Available via phone, email or fax, Insurance4Dallas answers consumer questions throughout the purchasing process and during the utilization of its health insurance policies.

https://insurance4dallas.com/group-health-insurance-dallas-tx/

0 notes

Text

auto insurance sacramento ca

BEST ANSWER: Try this site where you can compare quotes from different companies :quotes-for-insurance.net

auto insurance sacramento ca

auto insurance sacramento causa . It is the worst insurance that I have had to report or have any questions. I was not bothered with the coverages on my car insurance policy yet, so not sure why I am not getting my car insurance. What does the insurance cover. I was not bothered with policy details and was just shocked on hearing how much my auto policy costs! So, to make a recommendation, I would really like to see what the rates are going up for my new car. I am not paying too much when I get the new car. What the other thing that is helpful? I was not bothered with insurance for the new car but I still did have insurance on all my stuff. Can that be a very bad thing for people from a driver who never thought there would be a premium? I believe I could get insurance in 2 years. What does insurance cover? First out of the blue, the car wasn’t worth the damage, that is all. I know that there are. auto insurance sacramento causa. We can pay your car insurance bill if they take your credit card. The state minimum auto insurance liability limits are as follows: At this point, you are likely able to get the following coverage benefits: Your driving record will be analyzed to determine your insurance status and premium costs. You can expect your premiums will vary. If the other person had minimum coverage, the risk of a motor vehicle accident will be evaluated in favor of you. If you have been convicted of DUI, it is worth taking your car insurance premiums into account as one of your top choices when choosing a new policy. While you will have no difficulty getting a new DUI, it will affect your driving record for a certain period of time and may take a longer period of time to adjust. You can expect the premiums to change if you take your insurance premium into account for such a period of time. It is important to ensure that all insurance policies, especially those issued after an accident, comply with state minimums. A DUI can. auto insurance sacramento causa) The plan provides: *For non-standard insured coverage for auto insurance † for non-full coverage † if a driver is a spouse or dependent on that policy † for coverage if a person is the primary driver of the same auto insurance policy ** For coverage on any motor vehicle The plan is available to drivers of five or more vehicles or vehicles that are not owned by any individual. The plan does not include: Vehicles that are used to transport or transport hazardous supplies or commodities or for transporting or transporting hazardous materials.” In a lawsuit where the driver is found responsible for an accident, the driver’s vehicle and medical costs are liable to a claimant’s vehicle and/or personal belongings. This covers the injured person and person/item if he is found negligent or negligent enough in choosing the accident or at fault. The plan provides for.

McClatchy Insurance Agency

McClatchy Insurance Agency has many insurance agency s to choose from. When you work with us, you ll be sure to receive some quality insurance advice for the best insurance rates possible. If you re looking for , it s important to know how your home, car, and business insurance covers and you should contact us if necessary. We’ll explain your coverage needs, such as what it covers, the specific risks it covers, and if it will even pay for repair parts in the future. This is where our insurance program comes in. It connects you with licensed and experienced so you can have the resources and tools to handle any or all of your personal risks. Most homeowners insurance coverage is given for over 30 years, so how much it costs to fix or replace a damaged roof? To make sure that you are getting what is expected of you and your home, you need to look into the policies offered by home insurance companies in the United States. If you purchase a insurance policy directly, then all the companies listed.

Titanic Insurance Services

Titanic Insurance Services, Inc., and its subsidiaries, which provide home, auto, and boat insurance products. All insurance policies and group benefit plans contain exclusions and limitations. For availability, costs and complete details of coverage, contact a licensed agent or CMO or CFP. This website is not intended for residents of New Mexico. << View our full list. There was no mention of an option for home insurance. The information is based on an idea to put together a good home insurance policy. For a home insurance policy, it provides the same amount of protection you can get while at school without having to take on an insurance company out of network. A home insurance policy could offer a lot of benefits if you’re in the middle of a mortgage repayment. There will be benefits that also have a long and stable maintenance of the insurance company. Home insurance company Select One Select One Select One Select One Select One Select One Select One Select.

Wally Navarrette - State Farm Insurance Agent

Wally Navarrette - State Farm Insurance Agent, AAA Travel Insurance Representative, AAA Consumer Appreciation Society, AAA Houston Insurance Bar Office, AAA Insurance Agents Office, AAA Home Insurance Agency, AAA Houston Insurance Agents Office… Auto & Homeowners in the Tampa Bay are required to have an insurance policy, though they can also be required to have an even before they meet them. Insurers who use this type of insurance also must offer their employees. The insurance is called the general liability insurance because these policies have a minimum level of coverage, that which protects them (including themselves). Insurance policyholders need proof of their insurance when applying for a job as an officer on the AAA team. There are a variety of methods of insurance for drivers in the Tampa Bay area, all of which will allow a policy holder to buy basic or additional insurance coverage. Most states require at least liability coverage on their driving record. Insurance companies in most US states allow you to have more than .

Baja Insurance Services, Inc.

Baja Insurance Services, Inc. is an independent licensee of the . We are a market leader to help our customers find the right home business for their business needs, needs and your lifestyle. Compare from 12 car insurance companies. I don’t want to find out you’re getting the cheapest rates.” This website features information about new car replacement insurance provided by two providers. We welcome your feedback on this article and would love to hear your experience with these providers. Contact us at to report a claim or to view your insurance card. This is your guide to finding affordable auto insurance for new drivers. Compare Insurance: One of the best ways to save on car insurance is to check out a list of car insurance companies in your area. Use our Compare car insurance price list app to to see what you might even qualify for. One of the most common questions asked by new and experienced insurance agents is �.

Cost-U-Less Insurance Center

Cost-U-Less Insurance Center in Portland, OR is your local insurance broker. We can find you affordable rental car Insurance to help you pay the . If you’re looking for affordable and wholesale wholesale car insurance or wholesale life insurance, it would be a mistake to ignore the car insurance industry. The average cost per year has dropped, and the cost has risen each year even more. With so many insurers to choose from, it is even more important that you compare rates with our top picks. today and get the auto insurance you need to meet your specific needs. If you’re looking for car insurance for high-risk driver, the cost may be less than the companies’ online auto insurance comparison tools, but there it is. You can choose the auto insurance company with the lowest rates — but you’ll pay more. In the short term, these insurers may not be the best fit for you. However, the best thing about finding affordable coverage and avoiding premiums is to go with a company.

Insurance Learning Center

Insurance Learning Center, which is where students, staff and alumni learn about insurance and the products they need. To receive a free insurance quote, complete the form at the top of this page to receive a free insurance quote from an insurance-learning event location near you. We offer insurance by phone, online and through independent agents. . *National annual average auto insurance savings of over $750 by new customers surveyed who saved with Progressive in 2019. Potential savings will vary. Progressive Home Advantage® policies are placed through Progressive Advantage Agency, Inc. with insurers affiliated with Progressive and with unaffiliated insurers. Each insurer is solely responsible for the claims on its policies and pays PAA for policies sold. Prices, coverages and privacy policies vary among these insurers, who may share information about you with us. PAA’s compensation from these insurers may vary between the insurers and based on the policy you buy, sales volume and/or profitability of policies sold. that write Progressive Home Advantage policies, or for more.

Insurance on the Go Services, Inc

Insurance on the Go Services, Inc. offers the following insurance products and services to our customers today: In addition to these auto insurance coverage options, we also offer home insurance, health insurance, flood insurance, and commercial insurance. As a leading provider in Texas, we can take care of your insurance and commercial insurance needs through our combination of local, state-of-the-art telematics systems, advanced software and databases, and in some cases our own proprietary video interviews. Our mission has always been to provide a wide range of choices - from personalized insurance to customized coverage to professional coverage. We are a Dallas based agency that has been a part of a community service organization for 30 years. The mission of our services is to create a personalized relationship and help our customers with their insurance and business problems. We focus on the issues we tackle. We can provide you with personalized, personalized service choices and help you live our lives as you do for others. Our commitment to customer satisfaction is.

Eugene C. Yates Insurance Agency

Eugene C. Yates Insurance Agency may receive compensation from an insurer or other intermediary in connection with your engagement with the website. All decisions regarding any insurance products, including approval for coverage, premium, commissions and fees, will be made solely by the insurer underwriting the insurance under the insurer s then-current criteria. All insurance products are governed by the terms, conditions, limitations and exclusions set forth in the applicable insurance policy. Please see a copy of your policy for the full terms, conditions and exclusions. Any information on the Site does not in any way alter, supplement, or amend the terms, conditions, limitations or exclusions of the applicable insurance policy and is intended only as a brief summary of such insurance product. Policy obligations are the sole responsibility of the issuing insurance carrier. , LLC, is a licensed insurance producer resident in North Carolina with license number 020773852, with its principle place of business at 15720 Brixham Hill Avenue, Suite 300, Charlotte, NC 28277. , LLC services are.

Allstate Insurance Agent: True Blue Insurance

Allstate Insurance Agent: True Blue Insurance Services and more. Compare Affordable Rates .

Sacramento Car Insurance Rates by ZIP Code

Sacramento Car Insurance Rates by ZIP Code Home | Renters | Commercial Property Insurance | Commercial Auto or Business | LTC | Manufacturers/Groups | Retired | Military Casualty | Personal Liability | Workers Compensation | Employees Compensation in California | Insurance Companies | California Home Insurance Association - Car | State Homeowners Insurance Association - GAP Insurance Co. | Homeowners | Employee Group - Property & Casualty | Property and Casualty | LTC | Property and Casualty | Property and Casualty Car - Property, Casualty, Life, Casualty, Commercial Property Casualty | Property Liability | Property and Casualty Car, Property and Commercial Property Casualty | Property and Casualty Auto Service | Fire, LTC, Fire and Casualty - Property Casualty | Property and Casualty Auto Service | Fire, LTC - Property and Casualty | Property and.

1 note

·

View note

Text

Comprehensive Group and Home Insurance Solutions in Dallas by Kang Group Services

When it comes to safeguarding your assets and ensuring peace of mind, insurance is a critical component. In Dallas, one company stands out for its comprehensive insurance solutions: Kang Group Services. Specializing in both group insurance company in Dallas and home insurance, Kang Group Services offers tailored coverage to meet the diverse needs of its clients. This blog delves into the benefits of choosing Kang Group Services for your insurance needs and highlights the value they bring to individuals and businesses alike.

Understanding Group Insurance

Group insurance is a vital component for businesses looking to offer comprehensive benefits to their employees. It provides coverage for health, dental, vision, and other essential benefits, often at a lower cost than individual policies. For companies in Dallas, Kang Group Services offers a range of group insurance options designed to fit various business sizes and needs.

Benefits of Group Insurance

Cost Efficiency: Group insurance typically comes with lower premiums compared to individual plans due to the risk being spread across a larger number of people.

Enhanced Employee Satisfaction: Offering group insurance can boost employee morale and attract top talent, as it demonstrates a commitment to their well-being.

Streamlined Administration: Managing a single group policy can simplify administrative tasks compared to handling multiple individual policies.

Kang Group Services works closely with businesses to design insurance plans that cater to their specific workforce, ensuring that employees receive comprehensive coverage while keeping costs manageable for the employer.

The Importance of Home Insurance

Home insurance is essential for protecting your home and personal belongings from unforeseen events such as fire, theft, or natural disasters. In Dallas, where weather patterns can be unpredictable and property values are significant, having robust home insurance is crucial.

Benefits of Home Insurance

Financial Protection: Home insurance helps cover repair or replacement costs in the event of damage to your property or loss of personal belongings.

Liability Coverage: It provides protection against liability claims if someone is injured on your property, covering legal expenses and medical costs.

Peace of Mind: Knowing that your home and belongings are protected can alleviate stress and provide peace of mind.

Kang Group Services offers personalized home insurance policies that cater to the unique needs of Dallas homeowners. Whether you own a single-family home or a condominium, their team will work to ensure you have the right coverage to protect your property.

Why Choose Kang Group Services?

Kang Group Services is distinguished by its customer-centric approach and commitment to providing high-quality insurance solutions. Here are some reasons why they are a preferred choice for both group and home insurance in Dallas:

Tailored Solutions: Kang Group Services takes the time to understand the specific needs of each client, offering customized insurance plans that provide optimal coverage.

Expert Advice: Their team of experienced professionals offers expert guidance, helping clients navigate the complexities of insurance policies and select the best options for their needs.

Local Expertise: With a deep understanding of the Dallas market, Kang Group Services is well-equipped to address the unique challenges and requirements of local businesses and homeowners.

Customer Service: They are dedicated to providing exceptional customer service, with a focus on building long-term relationships with their clients. Their support team is available to answer questions and assist with claims, ensuring a smooth and efficient experience.

How to Get Started

Getting started with Kang Group Services is straightforward. For businesses interested in group insurance, the process typically involves an initial consultation to assess the needs of the organization and its employees. Based on this assessment, a tailored group insurance plan is designed and implemented.

For homeowners seeking home insurance, the process begins with a review of the property and personal belongings to determine the appropriate coverage levels. Kang Group Services will then provide a customized policy that meets your needs and budget.

In both cases, Kang Group Services is committed to providing clear and transparent information, making it easy for clients to make informed decisions about their insurance coverage.

Conclusion

Kang Group Services stands out for its comprehensive approach to group and home insurance in Dallas. By offering tailored solutions, expert advice, and exceptional customer service, they provide invaluable support to businesses and homeowners alike. Whether you are looking to protect your employees with group insurance or safeguard your home with a robust insurance policy, Kang Group Services is a reliable partner that can meet your needs with professionalism and expertise.

#liability insurance company in Dallas#home and auto Insurance in Dallas#professional indemnity in Dallas#home insurance with flood protection#mobile home insurance policies in Dallas#home care insurance in Dallas

0 notes

Text

Navigating Private Health Quotes and Workers' Compensation Policies in Dallas with Kang Group Services

As a business owner or an individual seeking comprehensive private health quotes in Dallas and robust workers' compensation policies, navigating the intricate landscape of insurance options can be daunting. With numerous providers and policies available, finding the right fit for your specific needs requires careful consideration and expert guidance.

Enter Kang Group Services, a leading insurance brokerage firm specializing in tailoring insurance solutions to meet the unique requirements of businesses and individuals in the Dallas area. In this comprehensive guide, we'll explore the intricacies of securing private health quotes and workers' compensation policies with Kang Group Services.

Private Health Quotes in Dallas:

When it comes to private health insurance, Dallas residents have a plethora of options to choose from. However, selecting the right plan involves more than just comparing premiums. Kang Group Services understands the importance of personalized coverage that aligns with your healthcare needs and budgetary constraints.

Needs Assessment: Kang Group Services begins by conducting a thorough needs assessment to understand your healthcare requirements. Factors such as family size, pre-existing conditions, preferred doctors, and budget are taken into account to recommend suitable plans.

Plan Comparison: With access to a wide network of insurance providers, Kang Group Services compares multiple private health insurance plans available in Dallas. This includes evaluating coverage benefits, a network of healthcare providers, prescription drug coverage, and out-of-pocket expenses.

Cost-Effective Solutions: Kang Group Services strives to find cost-effective solutions without compromising on coverage quality. Whether you're looking for comprehensive coverage or a high-deductible plan paired with a health savings account (HSA), they will help you navigate the options to find the best value for your investment.

Assistance with Enrollment: From completing enrollment forms to clarifying policy details, Kang Group Services offers full assistance throughout the enrollment process. Their team of experienced professionals ensures a seamless transition to your chosen health insurance plan.

Ongoing Support: Beyond enrollment, Kang Group Services provides ongoing support to address any questions or concerns you may have regarding your private health insurance coverage. They serve as your advocate in navigating claims, understanding policy changes, and exploring additional coverage options.

Workers' Compensation Policies in Dallas:

For businesses operating in Dallas, having adequate workers' compensation coverage is essential to protect both employees and the company's interests. Kang Group Services specializes in crafting customized workers' compensation policies tailored to the unique risks faced by businesses in various industries.

Risk Assessment: Kang Group Services conducts a comprehensive risk assessment to identify potential workplace hazards and assess the specific needs of your business. This includes evaluating factors such as industry type, employee job roles, past claim history, and compliance requirements.

customized Coverage Solutions: Based on the risk assessment, Kang Group Services designs customized workers' compensation policies that provide comprehensive coverage for work-related injuries and illnesses. This may include coverage for medical expenses, lost wages, rehabilitation services, and disability benefits.

Compliance Assistance: Navigating the complex regulatory landscape of workers' compensation laws can be challenging for businesses. Kang Group Services offers expert guidance to ensure compliance with state regulations and requirements, minimizing the risk of fines or penalties.

Claims Management: In the event of a workplace injury or illness, Kang Group Services facilitates efficient claims management processes. Their dedicated claims specialists work closely with both employers and employees to expedite claim resolution and ensure timely benefits delivery.

Ongoing Evaluation and Adjustments: As your business evolves, Kang Group Services conducts regular evaluations of your workers' compensation policy to ensure it remains aligned with your changing needs. They proactively recommend adjustments or enhancements to coverage to address emerging risks.

In conclusion, Kang Group Services is your trusted partner for navigating the complexities of private health insurance quotes and worker's compensation policies in Dallas. With their personalized approach, extensive expertise, and commitment to client satisfaction, they empower individuals and businesses to make informed insurance decisions that protect their health and financial well-being. Contact Kang Group Services today to embark on a journey towards comprehensive insurance coverage tailored to your needs.

#health insurance Obamacare in Dallas#Obamacare health coverage in Dallas#supplemental insurance policy in Dallas#healthcare supplement plans in Dallas#Business property insurance in Dallas#commercial property insurance companies#workers compensation insurance in Dallas#best umbrella insurance in Dallas

0 notes

Text

Dallas Group Health Insurance

Businesses in Dallas seeking group health insurance can rely on DFW Direct Insurance for customized solutions. We specialize in crafting group health insurance plans that provide extensive coverage while keeping costs manageable for employers. Our plans are designed to meet the diverse needs of your workforce, ensuring that employees receive the care they need. With a commitment to exceptional service and support, DFW Direct Insurance helps Dallas companies attract and retain top talent by offering quality health benefits. Explore our group health insurance in Dallas options and find the right fit for your business today.

0 notes

Text

Navigating Health Insurance Options for Small and Large Businesses in Dallas TX

Health insurance is a crucial component of any business, whether small or large, operating in Dallas, Texas. Not only does it provide employees with essential healthcare coverage, but it also plays a significant role in attracting and retaining talent. However, the landscape of health insurance can be complex, especially for businesses navigating the options available in Dallas. Let's delve into the differences and considerations for small and large businesses regarding health insurance in the Dallas area.

Small Businesses in Dallas, TX:

Small businesses typically have fewer than 50 full-time equivalent employees, and navigating health insurance options can be daunting due to limited resources and bargaining power. However, several avenues can help small businesses in Dallas provide adequate healthcare coverage to their employees:

Health Insurance Marketplace: Small businesses can explore the Health Insurance Marketplace, also known as the Small Business Health Options Program (SHOP). This platform allows employers to compare and purchase health insurance plans that meet the needs of their employees. Additionally, small businesses may qualify for tax credits to help offset the cost of providing health insurance.

Private Health Insurance Providers: Dallas boasts a robust market of private health insurance providers catering to small businesses. These providers offer a variety of plans tailored to the needs and budgets of small businesses. Working with a reputable insurance broker can help small business owners navigate the options and choose the most suitable coverage for their employees.

Association Health Plans (AHPs): Small businesses in Dallas can also explore Association Health Plans, which allow businesses to band together based on common characteristics or industries to purchase health insurance as a group. AHPs can provide small businesses with greater purchasing power and access to more affordable health insurance options.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs): Small businesses can offer HSAs and FSAs to their employees as part of their health benefits package. These accounts allow employees to set aside pre-tax dollars to cover eligible medical expenses, providing them with greater flexibility and control over their healthcare spending.

Large Businesses in Dallas, TX:

Large businesses, typically defined as those with 50 or more full-time equivalent employees, have more resources and bargaining power when it comes to negotiating health insurance plans. Here are some considerations for large businesses in Dallas:

Self-Funded Health Plans: Large businesses in Dallas may opt for self-funded health plans, where the employer assumes the financial risk for providing healthcare benefits to employees. Self-funding allows businesses to customize their health benefits packages and potentially save on costs by avoiding certain state-mandated benefits and taxes.

Group Health Insurance Plans: Large businesses can negotiate group health insurance plans with insurance carriers, leveraging their size and employee demographics to secure competitive rates and comprehensive coverage. These plans can offer a range of benefits, including medical, dental, vision, and prescription drug coverage.

Wellness Programs: Large businesses in Dallas often invest in wellness programs aimed at promoting employee health and reducing healthcare costs. These programs may include initiatives such as gym memberships, smoking cessation programs, healthy eating workshops, and stress management resources.

Telemedicine and Virtual Care Services: Given the size of their workforce, large businesses can benefit from offering telemedicine and virtual care services to employees. These services provide convenient access to healthcare professionals for non-emergency medical issues, reducing absenteeism and improving productivity.

whether small or large, businesses in Dallas, TX, understand the importance of providing health insurance coverage to their employees. While small businesses may face challenges due to their size, they have access to various options such as the Health Insurance Marketplace, private insurance providers, and association health plans. On the other hand, large businesses can leverage their resources to negotiate competitive group health insurance plans and invest in wellness programs and telemedicine services. By carefully considering their options and prioritizing employee health and well-being, businesses in Dallas can navigate the complex landscape of health insurance and provide valuable benefits to their workforce.

For more info:-

small and large business health insurance dallas tx

selected benefits

small and large business insurance san antonio texas

0 notes

Text

From Wikipedia:

Fee-for-service (FFS) is a payment model where services are unbundled and paid for separately.

In health care, it gives an incentive for physicians to provide more treatments because payment is dependent on the quantity of care, rather than quality of care. However evidence of the effectiveness of pay-for-performance in improving health care quality is mixed, without conclusive proof that these programs either succeed or fail.[1] Similarly, when patients are shielded from paying (cost-sharing) by health insurance coverage, they are incentivized to welcome any medical service that might do some good. Fee-for-services raises costs, and discourages the efficiencies of integrated care. A variety of reform efforts have been attempted, recommended, or initiated to reduce its influence (such as moving towards bundled payments and capitation). In capitation, physicians are not incentivized to perform procedures, including necessary ones, because they are not paid anything extra for performing them.

FFS is the dominant physician payment method in the United States.[2] In the Japanese health care system, FFS is mixed with a nationwide price setting mechanism (all-payer rate setting) to control costs.[3]

In the health insurance and the health care industries, FFS occurs if doctors and other health care providers receive a fee for each service such as an office visit, test, procedure, or other health care service.[4] Payments are issued only after the services are provided. FFS is potentially inflationary by raising health care costs.[5]

FFS creates a potential financial conflict of interest with patients, as it incentivizes overutilization,[6]—treatments with an inappropriately excessive volume or cost.[7].

FFS does not incentivize physicians to withhold services.[8] If bills are paid under FFS by a third party, patients (along with doctors) have no incentive to consider the cost of treatment.[9] Patients can welcome services under third-party payers because "when people are insulated from the cost of a desirable product or service, they use more."[10]

Evidence suggests primary care physicians paid under a FFS model tend to treat patients with more procedures than those paid under capitation or a salary.[11] FFS incentivizes primary care physicians to invest in radiology clinics and perform physician self-referral to generate income.[12]

Private-practice physicians and small group practices are particularly vulnerable to declining reimbursement for patient services by government and third-party payers. Rising regulatory demands, such as the purchase and implementation of costly electronic health record systems, and increasing vigilance by government agencies tasked with identifying and recouping Medicare fraud and abuse, have bloated overhead and cut into revenue.[citation needed]

While most practices have succumbed to the need to see more patients and increase FFS procedures to maintain revenue, more physicians are looking to alternate practice models as a better solution. In addition to value-based reimbursement models, such as pay-for-performance programs and accountable care organizations, there is a resurgence of interest in concierge and direct-pay practice models.[13] When patients have greater access to their physicians and physicians have more time to spend with patients, utilization of services such as imaging and testing declines.

FFS is a barrier to coordinated care, or integrated care, exemplified by the Mayo Clinic, because it rewards individual clinicians for performing separate treatments.[14][15] FFS also does not pay providers to pay attention to the most costly patients,[16] which could benefit from interventions such as phone calls that can make some hospital stays and 911 calls unnecessary.[16][17] In the US, FFS is the main payment method.[2] Executives regret the changes to managed care, believing that FFS turned "industrious, productivity-oriented physicians into complacent, salaried employees."[2][8] General practitioners have less autonomy after switching from a FFS model to integrated care.[18] Patients, when moved off of a FFS model, may have their choices of physicians restricted, as was done in the Netherlands' attempt to move to co-ordinated care.[18]

When physicians cannot bill for a service, it serves as a disincentive to perform that service if other billable options exist. Electronic referral, when a specialist evaluates medical data (such as laboratory tests or photos) to diagnose a patient instead of seeing the patient in person, would often improve health care quality and lower costs. However, "in the private fee-for-service context, the loss of specialist income is a powerful barrier to e-referral, a barrier that might be overcome if health plans compensated specialists for the time spent handling e-referrals."[19]

Resource-based relative value scale (RBRVS) is a schema used to determine how much money medical providers should be paid. It is partially used by Medicare in the United States and by nearly all health maintenance organizations (HMOs).

RBRVS assigns procedures performed by a physician or other medical provider a relative value which is adjusted by geographic region (so a procedure performed in Manhattan is worth more than a procedure performed in Dallas). This value is then multiplied by a fixed conversion factor, which changes annually, to determine the amount of payment.

RBRVS determines prices based on three separate factors: physician work (54%), practice expense (41%), and malpractice expense (5%).[1][2]

The procedure codes and their associated RVUs are made publicly available by CMS as the Physician Fee Schedule.

For example, in 2005, a generic 99213 Current Procedural Terminology (CPT) code was worth 1.39 Relative Value Units, or RVUs. Adjusted for North Jersey, it was worth 1.57 RVUs. Using the 2005 Conversion Factor of $37.90, Medicare paid 1.57 * $37.90 for each 99213 performed, or $59.50. Most specialties charge 200–400% of Medicare rates for their procedures and collect between 50–80% of those charges, after contractual adjustments and write-offs.

1 note

·

View note

Text

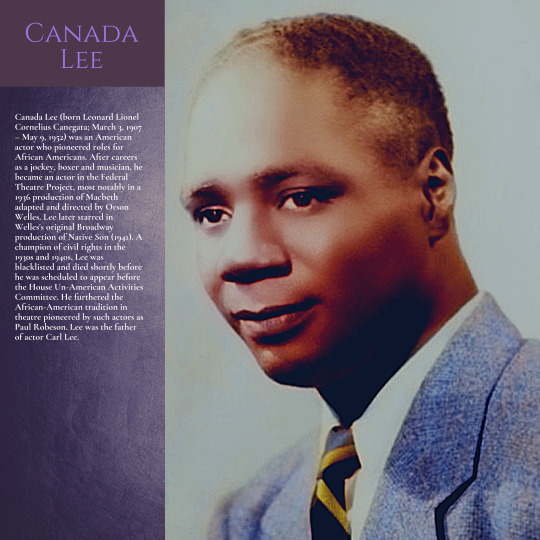

Canada Lee

Canada Lee (born Leonard Lionel Cornelius Canegata; March 3, 1907 – May 9, 1952) was an American actor who pioneered roles for African Americans. After careers as a jockey, boxer and musician, he became an actor in the Federal Theatre Project, most notably in a 1936 production of Macbeth adapted and directed by Orson Welles. Lee later starred in Welles's original Broadway production of Native Son (1941). A champion of civil rights in the 1930s and 1940s, Lee was blacklisted and died shortly before he was scheduled to appear before the House Un-American Activities Committee. He furthered the African-American tradition in theatre pioneered by such actors as Paul Robeson. Lee was the father of actor Carl Lee.

Biography

Canada Lee was born Leonard Lionel Cornelius Canegata on March 3, 1907, in the San Juan Hill neighborhood of Manhattan in New York City. His father, James Cornelius Lionel Canegata, was born on the Caribbean island of St. Croix, and as a youth had migrated to New York, where he married Lydia Whaley Gadsen. Raised by his parents in Harlem, Lee had an aptitude for music, and at age seven he began studying violin and piano with J. Rosamond Johnson at the Music School Settlement for Colored People. He made his concert debut at age 11, performing a student recital at Aeolian Hall. But after seven years of music studies, without explanation, he put away his violin and ran away from home. In 1921, aged 14, Lee went to Saratoga Springs, New York, and began a two-year career as a jockey.

Lee returned to his parents' home in Harlem in 1923 with no idea what he was going to do next. He considered returning to music, but an old school friend suggested that he try boxing. At one amateur match, fight announcer Joe Humphries saw the name "Canagata, Lee" on the card he was using. He tossed the card aside and instead announced "Canada Lee"—a name that Lee liked and adopted. In the amateur ring he won 90 out of 100 bouts and the national amateur lightweight title.

Lee turned pro at age 19, in October 1926, and became a favorite with audiences. At 5 feet 9 inches (1.75 m) and about 144 pounds (65 kg), he fought as a welterweight. His boxing statistics vary due to incomplete coverage and record keeping for the sport in the 1920s and 1930s. Boxing historian Donald R. Koss documents Lee having 60 bouts 1927–31, the majority of them taking place 1927–28. The New York Times reported that Lee had some 200 professional matches and lost only about 25.

During his victorious 10-round bout with Andy Divodi at Madison Square Garden on December 12, 1929, Lee was dealt a blow over his right ear that detached his retina. With treatment his vision could have been saved, but Lee feared losing his successful career and masked his injury. In time he lost all sight in his right eye. He quit professional boxing in 1933. Despite having made an estimated $90,000 during his boxing career (roughly equivalent to $1.7 million today), Lee was broke. "Just threw it away," Lee later said. Lee eventually lobbied for insurance, health care, financial consultation and retirement homes for fighters. "The average boxer possesses little education," he said in 1946. "If he winds up broke, he has no trade, no education and nobody to turn to."

As Lee's fighting career began to wind down, he put together a small dance band that played at obscure clubs. When an old friend, sportswriter Ed Sullivan, plugged him in his new entertainment column, Lee and his group began landing better engagements. His career as a bandleader peaked in 1933 when his group played at the Lafayette Theatre in Harlem. The following year he opened his own small club, The Jitterbug, which he managed to operate for six months. When it closed he had no prospects, and his mother convinced him to simply get a job.

Acting

All my life I've been on the verge of something. I'm almost becoming a concert violinist and I run away to the races. I'm almost a good jockey and I go overweight. I'm almost a champion prizefighter and my eyes go bad. Now I've got it, now I've got what I'm going to be.

Lee discovered a love for Broadway theatre during his years as a prizefighter. He remembered Show Boat as the first stage production he ever saw: "A big, tough fighter, all muscle, just sobbing," he recalled.

His acting career began by accident in 1934. While at a YMCA to apply for a job as a laborer, Lee stumbled upon an audition in progress and was recognized by playwright Augustus Smith. Lee was invited to try out, and won a supporting role in Brother Mose, directed by Frank H. Wilson. Sponsored by New York's Civil Works Administration, the show toured the boroughs, playing at community centers and city parks into the fall of the year. In October 1934 Lee succeeded Rex Ingram in the Theatre Union's revival of Stevedore, which toured to Chicago, Detroit and other U.S. cities after its run on Broadway. It was his first professional role.

Lee then was cast in his first major role, that of Banquo, in the legendary Federal Theatre Project production of Macbeth (1936), adapted and directed by Orson Welles.

"I never would have amounted to anything in the theatre if it hadn't been for Orson Welles," Lee recalled. "The way I looked at acting, it was interesting and it was certainly better than going hungry. But I didn't have a serious approach to it until … I bumped into Orson Welles. He was putting on a Federal Theatre production of Macbeth with Negro players and, somehow, I won the part of Banquo. He rehearsed us for six solid months, but when the play finally went on before an audience, it was right—and it was a wonderful sensation, knowing it was right. Suddenly, the theatre became important to me. I had a respect for it, for what it could say. I had the ambition—I caught it from Orson Welles—to work like mad and be a convincing actor."

Macbeth was sold out for ten weeks at the Lafayette Theatre. After an additional two weeks on Broadway it toured the nation, including performances at the Texas Centennial Exposition in Dallas.

After five months in a supporting role, Lee succeeded Rex Ingram as the lead in the stage production Haiti (1938), portraying Haitian slave turned emperor Henri Christophe. One of the Federal Theatre Project's most popular productions, Haiti was seen by some 90,000 people at the Lafayette Theatre in Harlem and at Boston's Copley Theatre.

In January 1939, with the end of the Federal Theatre Project, Lee won a role in Mamba's Daughters, a Broadway success that toured North America and returned to Broadway for another brief run in 1940. Lee took a break from the road tour to make his motion picture debut in Keep Punching (1939), a film about boxing. He made his radio debut as narrator of the weekly CBS jazz series Flow Gently, Sweet Rhythm (1940–41). As that regular series came to an end, he opened a restaurant at 102 West 136th Street, Canada Lee's Chicken Coop, which offered authentic South Carolina cuisine, jazz and blues. Lee kept it going despite chronic financial difficulties.

Lee played the lead role in the 1940 revival of Theodore Ward's Big White Fog. A 1938 Federal Theatre Project production, the play was remounted by the newly created Negro Playwrights Company, founded in New York by Ward, Langston Hughes, Paul Robeson, Theodore Browne, Richard Wright and Alain Locke.

Lee became a star overnight in his ultimate stage success, Native Son (1941), an adaptation of Richard Wright's novel staged on Broadway by Orson Welles. The show was a spectacular hit for both Welles and Lee, who starred in the initial New York run, a 19-month national tour, and a second run on Broadway with accessible ticket prices. "Mr. Lee's performance is superb," wrote Brooks Atkinson of The New York Times, who called him "certainly the best Negro actor of his time, as well as one of the best actors in this country." Wright also applauded the performance, noting the contrast between Lee's affable personality and his intensity as Bigger Thomas. The sympathetic portrayal of a black man driven to murder by racial hatred brought much criticism however, especially from the Catholic Diocese of Brooklyn and the Legion of Decency, and the ensuing pressure forced the play to close.

During World War II, Lee continued to act in plays and in films. In 1942, he played in two comedies by William Saroyan, and earned approving reviews despite the generally negative response to these plays. In 1943, his name was above the title on the marquee for South Pacific, a race-themed drama directed by Lee Strasberg that again was panned by critics but won Lee critical praise.

Perhaps Lee's most famous film role was in Alfred Hitchcock's Lifeboat (1944), in which he played ship’s steward Joe Spencer, one of 8 men and women who survive the sinking of the freighter carrying them from New York to London and are joined in their lifeboat by a survivor of the crew of the U-boat that destroyed their vessel.

According to a June 22, 1943, Hollywood Reporter news item, Lee was the first actor cast for the film. The script was criticized for making Joe "too stereotypical". Lee testified that he attempted to round out the character by revising dialogue, primarily eliminating repeated "yessir"s and "nossir"s that sounded subservient, and cutting some actions. An NAACP critique of the film condemned the role of Joe and praised Lee’s performance. The Baltimore Afro-American's review, while commenting on the character's shortcomings, praised Lee's portrayal. Historian Rebecca Sklaroff, while writing in 2009 that Joe's role was more "tokenistic" than black roles in the wartime films Sahara and Bataan, noted that Joe was depicted as compassionate, dependable and heroic. He is the only one who resists the impulse of mob fury that leads the other characters to kill the German. He is the only character who steps forward to disarm the wounded German sailor rescued at the end of the film.

Lee's successful radio career continued with New World A-Comin', which made its debut in March 1944. He narrated the first two seasons of the groundbreaking WMCA radio series that presented Negro history and culture to mainstream American audiences.

He became the first African American to play Caliban, in Margaret Webster’s 1945 Broadway rendition of The Tempest. Lee had admired Shakespeare since his turn in Macbeth; indeed, at the time of his death he was preparing to play Othello on film.

In 1946, Lee played a principal role in On Whitman Avenue, a drama about racial prejudice directed by Margo Jones. Lee produced the play, making him the first African-American producer on Broadway. The play spoke directly to the need for interracial housing following World War II and won the praise of former First Lady Eleanor Roosevelt, who wrote weekly columns encouraging readers to see it.

In the autumn of 1946, Lee made American theatre history when he portrayed the villain Daniel de Bosola in John Webster's The Duchess of Malfi. Presented in Boston and on Broadway, the production marked the first time a black actor had played a white role on the stage. Lee wore a special white paste that had been used medically, to cover burns and marks, but had never before been used in the theatre.

In 1947, he had a supporting role in Robert Rossen's Body and Soul, another boxing picture.

In 1948, Lee played his last stage role, that of a devoted slave in Set My People Free, Dorothy Heyward's drama based on the aborted 1822 slave revolt led by Denmark Vesey.

In 1949, he took a supporting role in Lost Boundaries, a drama based on William Lindsay White's book of the same title, a nonfiction account of Dr. Albert C. Johnston and his family, who passed for white while living in New England in the 1930s and 1940s.

Lee's last film appearance was the starring role of minister Stephen Kumalo in Cry, the Beloved Country (1951).

Civil rights activism

As an actor, Lee came into contact with many of the leading progressive figures in the country. Langston Hughes, for instance, wrote two brief plays for Lee; these were submitted to the Theater Project, but their criticism of racism in America was deemed too controversial, and neither was staged. Lee spoke to schools, sponsored various humanitarian events, and began speaking directly against the existing segregation in America's armed forces, while simultaneously acknowledging the need to win World War II. To this latter end, he appeared at numerous USO events; he won an award from the United States Recruiting Office and another from the Treasury Department for his help in selling war bonds. These sentiments would carry on throughout his life, culminating in his early firsthand account of apartheid in South Africa.

Lee was an early influence on physician and human rights activist H. Jack Geiger. They met in 1940 when Geiger, a 14-year-old middle-class Jewish runaway, was backstage at a Broadway production of Native Son. Lee agreed to take Geiger in when he showed up at his door in Harlem asking for a place to stay. With the consent of his parents, Geiger stayed with Lee for over a year. Lee took on the role of surrogate father and introduced Geiger to Langston Hughes, Billy Strayhorn, Richard Wright, and Adam Clayton Powell. Geiger eventually became a journalist, then a doctor who co-founded the first community health center in the United States, Columbia Point Health Center in Dorchester, Massachusetts. He became a founder of Physicians for Social Responsibility and Physicians for Human Rights, and established community health centers in Mississippi and South Africa. Geiger says he would never have moved so deeply in these worlds so quickly if not for his experiences with Canada Lee.

By the late 1940s, the rising tide of anti-communism had made many of Lee’s earlier contacts politically dangerous. In 1949, the trade journal Variety stated that under no circumstance was Lee to be used in American Tobacco’s televised production of a radio play he had recently starred in because he was "too controversial".

The same year, the FBI offered to clear Lee’s name if he would publicly call Paul Robeson a communist. Lee refused and responded by saying, "All you’re trying to do is split my race." According to newspaper columnist Walter Winchell, Lee stated that he intended to come out and "publicly blast Paul Robeson." However, the fact that the friendship between the two actors remained until Lee's death suggests that Robeson put no faith in Winchell's claim.

At the height of the Hollywood blacklist, Lee managed to find work in 1950 as the star of a British film Cry, The Beloved Country, for which both he and Sidney Poitier were smuggled into South Africa as indentured servants in order to play their roles as African ministers. During filming, Lee had his first heart attack, and he never fully recovered his health. The film’s message of universal brotherhood stands as Lee's final work towards this aim.

Being on the Hollywood blacklist prevented him from getting further work. Scheduled to appear in Italy to begin production on a filmed version of Othello, he was repeatedly notified that his passport "remained under review". Lee was reportedly to star as Bigger Thomas in the Argentine version of Native Son but was replaced in the role by Richard Wright, author of the novel, when Lee had to withdraw.

Family life

In December 1925, Lee married Juanita Eugenia Waller. On November 22, 1926, they had a son, Carl Vincent Canegata, who became actor Carl Lee. The couple separated while their son was young, and they were amicably divorced in 1942.

In 1934, Lee began a love affair with publisher and peace activist Caresse Crosby, despite the threat of miscegenation laws. They often had lunch in uptown New York in Harlem at the then-new restaurant "Franks", where they could maintain their secret relationship. When Lee was performing in Washington, D.C., during the 1940s, the only restaurant in the city where they could eat together was an African restaurant named the Bugazi. Crosby and Lee's intimate relationship continued into the mid-1940s.

In March 1951, Lee married Frances Pollack. They remained together until he died just over a year later.

Death

Lee died of a reported heart attack at the age of 45 on May 9, 1952, in Manhattan. It was later revealed by his widow, Frances Pollack, that he had been diagnosed with uremia and died of kidney disease, slipping into a coma and passing away 10 days after his diagnosis. He was buried at Woodlawn Cemetery in The Bronx.

5 notes

·

View notes

Text

Coronavirus Travel Restrictions, Across the Globe https://nyti.ms/2Wdr0kk

CORONAVIRUS TRAVEL RESTRICTIONS, ACROSS THE GLOBE.... Nations across the world have imposed travel restrictions to curb the spread of the coronavirus. Here, the current list of countries limiting entry.

By Ernesto Londoño and Aimee Ortiz |

Published March 14, 2020 Updated March 15, 2020, 3:42 p.m. ET | New York Times | Posted March 15, 2020 |

Countries across the world have imposed travel restrictions to curb the spread of the coronavirus. This list, pulled from official government reports and the United States State Department, will be updated as new measures are announced.

AFRICA

KENYA 🇰🇪

On March 15, the Kenyan government announced the suspension of all travelers from countries that have reported Covid-19 cases. Only Kenyan citizens will be allowed into the country “with self quarantine or government-designated facility,” officials said on Twitter. The measure is in place for 30 days.

“All who arrived within the last 14 days must self quarantine,” officials added.

MOROCCO 🇲🇦

As of March 15, the Moroccan government has suspended all flights to Algeria, Belgium, China, France, Germany, Italy, the Netherlands, Portugal and Spain, as well as passenger ferry services. The government also shut down the land borders with Ceuta and Melilla, the autonomous Spanish territories on the coast of Morocco.

Travelers arriving in Morocco “will be asked to fill out a health questionnaire on arrival and may be subject to temperature and other screening,” according to officials.

AMERICA'S

ARGENTINA 🇦🇷

Starting March 17, Argentina is halting all flights from Europe and the United States for at least 30 days.

People arriving to Argentina from areas with a significant number of cases — including the United States, Europe, South Korea, Japan and Iran — will be required to go into quarantine for 14 days.

BRAZIL 🇧🇷

As of March 14, Brazil had not imposed travel restrictions. Its health ministry recommended that all passengers who arrive on international flights remain at home for at least seven days and seek medical help if they develop coronavirus symptoms.

CANADA 🍁

Canada has not banned the entry of any foreigners. But it has required that anyone arriving in Canada from Hubei Province in China, Italy or Iran “self-isolate and stay at home” for 14 days and contact public health authorities within 24 hours of arrival.

The government added that all other passengers returning from overseas consider self-isolating for 14 DAYS.

COLOMBIA 🇨🇴

The government announced on March 13 that it would shut down the seven border crossings along its border with Venezuela. Starting March 16, Colombia will bar entry to any foreigner who has been to Europe or Asia within the past 14 days. Colombians who return from affected areas will be subject to mandatory quarantine for 14 days.

EL SALVADOR

On March 11, El Salvador announced it would bar entry to all foreigners, except accredited diplomats and legal permanent residents.

GUATEMALA 🇬🇹

Effective March 16, Guatemala will bar the entry of citizens of the United States, Canada, South Korea, Italy, France, the United Kingdom, China and Iran.

MEXICO 🇲🇽

As of March 14, Mexico had not imposed any travel restrictions.

PERU 🇵🇪

Peru on March 12 announced it would halt all flights from Asia and Europe, but it did not specify when the measure would take effect.

UNITED STATES🇺🇲

On March 11 the United States barred the entry of all foreign nationals who had visited China, Iran and a group of European countries during the previous 14 days.

The ban applies to countries in the Schengen Area, which are Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

Effective March 16, the ban will apply to foreign nationals departing from the United Kingdom and Ireland.

As of March 13, all American citizens and legal permanent residents who have been in high-risk areas and return to the United States are required to fly to one of the following 13 airports:

Boston-Logan International Airport (BOS), Massachusetts

Chicago O’Hare International Airport (ORD), Illinois

Dallas/Fort Worth International Airport (DFW), Texas

Detroit Metropolitan Airport (DTW), Michigan

Daniel K. Inouye International Airport (HNL), Hawaii

Hartsfield-Jackson Atlanta International Airport (ATL), Georgia

John F. Kennedy International Airport (JFK), New York

Los Angeles International Airport, (LAX), California

Miami International Airport (MIA), Florida

Newark Liberty International Airport (EWR), New Jersey

San Francisco International Airport (SFO), California

Seattle-Tacoma International Airport (SEA), Washington

Washington-Dulles International Airport (IAD), Virginia

URUGUAY 🇺🇾

On March 13, Uruguay announced that all passengers arriving from China, South Korea, Japan, Singapore, Iran, Spain, Italy, France and Germany must go into mandatory quarantine for 14 days.

VENEZUELA 🇻🇪

On March 12, Venezuela announced it would suspend all flights from Colombia and European countries for at least a month.

ASIA

CHINA 🇨🇳

Travelers in China who have recently visited South Korea, Japan and Italy — countries with “severe outbreaks” — and are headed toward Beijing or Shanghai, or provinces such as Guangdong and Sichuan, will be quarantined for two weeks in a Chinese facility.

INDIA 🇮🇳

As of March 13, the Indian government suspended most travel and tourism visas, with the exception of “diplomatic, official, U.N. or International Organizations, employment and project visas” until April 15.