#forex indicator signals

Explore tagged Tumblr posts

Text

FX #EURJPY H4 timeframe last 3 Non Repaint Signals. Buy Trade running with profits. Non Repaint signals more info in official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#forexsignals#indicatorforex#cashpowerindicator#forex#forexindicator#forextradesystem#forexindicators#forexprofits#forexvolumeindicators#forexchartindicators#eurjpy#usdjpy#audjpy#how trade forex#best forex indicators#forex signals#forex signals service#best forex signals

3 notes

·

View notes

Text

Sell trade in #EURNZD opens with a Sell Signal of HUNTER Indicator.

🎓HUNTER NON REPAINT Forex Indicator Signals is developed for Metatrader 4 is a Fixed and "Non Repaint signals for Metatrader4" send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Ultimate Indicator concept available for Forex.

The process to receive the download of Hunter Indicator is automatically after your purchase you will auto-redirectly to download page.

Please access now this link: https://hunterforexindicatormt4.wordpress.com/

Inside this link you can have access to Official Hunter Website www HunterForexIndicator com.

🎓Hunter is a complete and last generation Indicator, is a Lifetime License, NOT have Monthly Fees and give in your accuracy signals,Hunter is a complete and last generation Indicator:

🔔 SOUND ALERTS for all signals./ 🔔 VISUAL ALERTS texts for all signals./ 🔔 EMAIL ALERTS actvation option.This Metatrader indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

⚠️HUNTER indicator is The most efficient way to Trade Manually and safely in Forex Market (Majors and exotics pairs), Indices, bonds, cryptos and shares, which is one of the best indicator for MT4 plataform. VIP Tool. Powerful fixed signals not move or transfer the signal to another candle.

⚠️HUNTER is a simple Indicator, it can be used for any type of trading and any type of counters/pairs, the interface of the indicator is very simple to use, buy when blue signal apears and sell when red arrow apears ; so you can use right immediately, the success ratio is 93% higher than the failure ratio, is a solid technical indicator.

#forex trading#forexindicators#forex signal#forex#forexindicator#hunter forex indicator#non repaint forex signals#forex signals service

3 notes

·

View notes

Text

Gold Surges Amid Geopolitical Tensions & Forex Market Shifts

GOLD

Gold has reached record highs as geopolitical risks escalate. Reports indicate Iran is accelerating its nuclear program, heightening investor uncertainty. Former President Donald Trump suggested potential U.S. intervention in Gaza, later moderated by aides, while talks on renegotiating the Iran nuclear deal add to market volatility. Washington’s proposal for a resolution in the Russia-Ukraine conflict further complicates global markets. Technically, forex chart patterns indicate a bullish structure. The RSI reflects strong momentum, while algorithmic trading signals suggest potential resistance levels. However, the MACD signals a possible pullback, and the EMA200 remains a key support level. Unless a clear reversal emerges, gold's overall outlook stays bullish.

SILVER

Silver struggles to break past the 32.5177 resistance level. The RSI reflects consolidation with bullish undertones, and the MACD highlights limited selling pressure. Breakout trading methods indicate continued bullish potential, provided the market sustains its gradual buildup in buying interest.

DXY

The worldwide economic indicators signal a shift as the Dollar Index (DXY) slides below 107.834, confirming a bearish momentum. The MACD shows weak buying volume, while RSI indicates overbought conditions. The upcoming Non-Farm Payroll (NFP) report will be a crucial factor, but expectations of a prolonged rate cut cycle weigh on the dollar’s strength.

FOREX PAIRS

GBPUSD

The Pound surged past resistance before retracing amid speculation of a 92% chance of a rate cut. The MACD suggests strong momentum, while the RSI indicates oversold conditions, supporting potential bullish attempts. However, market direction hinges on upcoming economic data and central bank policy.

AUDUSD

The Australian Dollar sees buying pressure as the U.S. dollar weakens. The MACD hints at bearish undertones, but the RSI signals oversold conditions, aligning with capital distribution strategies. A continued bullish outlook is expected unless key support levels break.

NZDUSD

The Kiwi consolidates near 0.56859 after surpassing key resistance. MACD indicates low volume, while RSI suggests oversold conditions, pointing to further upside potential. If consolidation continues, a breakout higher may be in store.

EURUSD

The Euro remains cautiously bullish, supported by the EMA200. RSI indicates buying interest, but resistance at swing highs restricts momentum. A potential breakout is likely, contingent on economic developments and market sentiment.

USDJPY

The Yen strengthens amid Bank of Japan rate hike expectations. The MACD recently crossed upward, signaling a short-term correction, while RSI reflects overbought dollar conditions. The downtrend holds as long as BOJ maintains a tightening stance.

USDCHF

The Swiss Franc maintains its downtrend. The MACD presents mixed signals, while RSI indicates overbought conditions, reinforcing bearish momentum. The EMA200 acts as a resistance level, capping potential upside.

USDCAD

The Canadian Dollar stabilizes near key support but remains in a broader bearish trend. The MACD suggests strong selling volume, while RSI signals overbought conditions, limiting upside potential. Consolidation may persist, but overall sentiment favors further downside.

COT REPORT ANALYSIS

AUD: WEAK (5/5) GBP: WEAK (4/5) CAD: WEAK (4/5) EUR: WEAK (4/5) JPY: WEAK (1/5) CHF: WEAK (5/5) USD: STRONG (4/5) NZD: WEAK (4/5) GOLD: STRONG (5/5) SILVER: STRONG (4/5)

These market movements align with forex chart patterns, breakout trading methods, and capital distribution strategies, helping traders navigate shifting economic conditions.

#Breakout trading methods#Algorithmic trading signals#Capital distribution strategy#Worldwide economic indicators#Forex chart patterns

0 notes

Text

Unlocking Forex Market Trends: Strategies and Insights for Success

Market Overview Asian stock markets and the U.S. dollar paused on Wednesday as investors anticipated potential rate cuts in Canada and awaited a crucial U.S. inflation report. Markets have priced in an 85% probability of a Federal Reserve rate cut next week. However, with Wall Street indices nearing record highs, there is a risk of disappointment.

Canada, having already cut rates by 125 basis points in this cycle, is expected to deliver another 50 basis points cut, lowering its overnight rate to 3.25%. This prediction follows a sharp rise in Canada’s unemployment rate to 6.8% in November, the highest in eight years. Similarly, markets are pricing in a European Central Bank rate cut on Thursday, and the Swiss National Bank has a 61% chance of implementing a 50-basis-point cut, potentially easing the franc’s rally.

In Australia, the Reserve Bank kept rates steady at 4.35% on Tuesday but changed its tone by removing language about maintaining restrictive policies. This shift caused the Aussie dollar to tumble, reflecting growing expectations for rate cuts. Traders using Rich Smart FX's currency trading techniques can leverage these pivotal events to adapt strategies effectively.

Market Analysis

GOLD GOLD prices have turned bullish, breaking past the previous swing high. The RSI shows strong momentum with divergence, indicating a possible market shift soon. The MACD also signals robust momentum and buying strength. Geopolitical risks and the anticipated U.S. rate cut next week support further bullish movement. Analysts predict that GOLD could reach a new high before the rate cut announcement. China resuming GOLD purchases to boost reserves also strengthens GOLD’s position. This scenario offers substantial opportunities with DBGMFX's forex trading signals for traders seeking to capitalize on commodity market trends.

SILVER SILVER prices remained flat after yesterday’s trading session, showing no movement beyond the previous swing high. Current lows might represent a bottom before a bullish continuation. The RSI indicates consolidation, while the MACD suggests weakening bearish momentum with crossover signals hinting at a bullish shift. Overall, price action supports another bullish run leading into next week, as highlighted by GFS Markets' trusted forex signals.

DXY The dollar holds gains ahead of the CPI report. The RSI shows oversold conditions despite weak price pullbacks, highlighting strong bullish momentum. The MACD has recently crossed, but as with the previous crossover, this one may be short-lived. Price momentum remains consolidated as traders await inflation data that will shape next week’s rate-cut expectations. Utilizing Topmax Global's advanced currency trading strategies can help navigate these mixed signals.

GBPUSD Current charts show the Pound in consolidation, awaiting clues from the CPI report to determine market direction. Both the MACD and RSI are neutral, reflecting market uncertainty. Scalpers might find value in these conditions using World Quest FX's scalping strategies for beginners to navigate the volatility.

AUDUSD The Aussie dollar has fallen to new lows, with the MACD indicating strong bearish momentum. While the RSI signals exaggerated levels and a potential pullback, bearish continuation is expected. A deeper retracement may lead to further dollar weakness. Traders can apply Axel Private Market's advanced forex trading plans to prepare for significant rate movements.

NZDUSD The Kiwi faces increased selling momentum, supported by the RSI and MACD. Despite a minor price pullback, overbought RSI levels confirm bearish conditions. Analysts expect continued selling pressure as price action signals bearish continuation. Rich Smart's forex trading strategies are useful for traders identifying prolonged bearish trends.

EURUSD The Euro shows buying continuation, though current price action suggests consolidation. The MACD has crossed into bullish territory, but the RSI indicates overbought levels despite weak market movements. Analysts expect a bearish reversal in price momentum, with continued consolidation as traders await further ECB clarity. GFS Markets' trusted forex signal providers can guide timing in such scenarios.

USDJPY The Yen continues to weaken as prices trend higher, showing strong buying momentum. Despite a pullback, the MACD suggests bullish continuation, and the RSI remains oversold. Market sentiment favors further price increases, indicating ongoing buying strength. Traders can use Rich Smart FX's momentum trading techniques for success.

USDCHF The Franc has weakened amid expectations of an SNB rate cut. The MACD shows increased buying momentum, supported by the RSI despite smaller levels and divergence. Analysts forecast continued bullish activity in the Franc’s price movement. Monitoring DBGMFX's forex trading signals offers insight into timing effective trades.

USDCAD The Canadian dollar is under pressure ahead of the expected Bank of Canada rate cut. A significant cut could weaken the CAD further, pushing prices beyond 1.41774. The RSI shows exaggerated selling levels, while the MACD suggests a deeper retracement possibility. However, current price levels might already represent the bottom before further upward movement. Employing Topmax Global's forex trading strategies ensures readiness to act on strong signals.

#Scalping indicators#Trading entry and exit#Automated trading signals#Forex portfolio strategy#Forex market trends

0 notes

Text

Is $500 enough to trade Forex?

Yes, $500 can definitely be enough to start trading Forex, but it’s important to approach it with the right mindset and strategies. Based on my experience, here’s how you can make the most out of that capital:

1. Leverage Wisely

Forex brokers offer leverage, which allows you to control a larger position with a smaller amount of money. With $500, you could use leverage to control a larger trade, but beware of over-leveraging. When starting out, I recommend keeping leverage conservative, like 1:10 or 1:20, so you can limit your exposure to potential losses. High leverage can be tempting, but it also magnifies the risk.

2. Start Small with Micro Lots

With $500, you should focus on trading micro lots (1,000 units) or even nano lots (100 units) if available. This way, each pip movement will be worth a smaller amount, reducing your risk. For instance, with micro lots, each pip is worth around $0.10. This gives you the ability to test strategies without risking large amounts of your account balance.

3. Risk Management is Key

One of the biggest mistakes I see with new traders is risking too much on a single trade. A good rule of thumb is to risk no more than 1-2% of your capital on each trade. For a $500 account, that means risking $5-$10 per trade. It might not sound like much, but this approach helps you stay in the game for the long term. Protecting your capital should always be a priority.

4. Be Realistic About Expectations

With $500, you shouldn’t expect to make huge profits quickly. Focus on consistent, small gains instead of trying to double your account overnight. It’s important to be patient and allow your trading skills to grow over time. Remember, Forex is a marathon, not a sprint.

5. Choose the Right Broker

When you're starting with a smaller account, finding the right broker is crucial. Look for one with low spreads, good customer support, and the option to trade small lots. Many brokers allow you to start with a low minimum deposit and provide demo accounts to practice with before risking real money.

6. Focus on Education and Strategy

Don’t rush into trading without a clear plan. Spend time learning the basics of technical and fundamental analysis, and develop a strategy that works for you. Stick to your strategy and avoid chasing after quick wins. As you gain more experience, you’ll be able to refine your approach.

Conclusion

Trading Forex with $500 can be a great way to get started, but patience and discipline are key. Start small, manage your risks, and focus on learning and improving over time. With the right mindset, you can grow that $500 into a more substantial trading account.

#forex education#Trade copier#Telegram Signal Copier#TSC#Signal Copier#Forex Copier#Gold Copier#Indices Copier

0 notes

Text

From Analysis to Action: Combining Technical and Fundamental Approaches in Forex Trading

#Forex Trading#Technical Analysis#Fundamental Analysis#Trading Strategies#Currency Trading#Forex Market#Investment Strategies#Market Analysis#Day Trading#Swing Trading#Forex Education#Online Trading#Global Economics#Economic Indicators#Risk Management#Forex Signals#Trading Tips#Trading Psychology#Market Trends#Forex News#Foreign Exchange#Financial Markets#Trade Setup#Forex Charts#Forex Community#Trading Systems#AI in Trading#Forex Forecasting#Wealth Building#PipInfuse

1 note

·

View note

Text

10 Forex Strategies for Scalping

Scalping is a popular trading strategy in the forex market, characterized by short-term trades aimed at capturing small price movements. This strategy requires quick decision-making, discipline, and a keen understanding of the market. In this article, we’ll explore 10 effective forex strategies for scalping that can help traders maximize their profits while minimizing risk. 1. Moving Average…

#Bollinger Bands#Candlestick Patterns#CCI#Crossovers#Divergence#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Market#Forex Strategies#MACD#MACD Line#Momentum Indicator#Moving Average#Moving Average Convergence Divergence#Overbought Conditions#Oversold Conditions#Parabolic SAR#Pivot Points#Price Action#Price Movements#Relative Strength#RSI#Scalping#Scalping Strategy#Security#Signal Line#Stochastic Oscillator#Stop-Loss#Support And Resistance

0 notes

Text

The benefits and drawbacks of being a solo vs part of a team in the industry

DOES TEAMWORK PAY? In the professional world, there are two primary work styles: working solo or being a part of a team. Each work style has its own benefits and drawbacks depending on the industry, personality, and preferences of the worker. Some people thrive in a solitary environment where they can work independently, while others prefer to be surrounded by colleagues and actively collaborate…

View On WordPress

#Automated trading#CFD Trading#Currency Exchange#Currency trading#Forex analysis#Forex brokers#Forex charts#Forex education#Forex market#Forex Market Hours#Forex Market Trends#Forex news#Forex signals#Forex strategies#Forex Tips#Forex trading#Forex trading software#Forex Trading Strategies#Forex trading systems#Fundamental analysis#Indicators#Online Forex Trading#Price Action#Psychology#Risk Management#Technical analysis#Trading Forex#Trading platforms#Trading Psychology#Trading robots

1 note

·

View note

Text

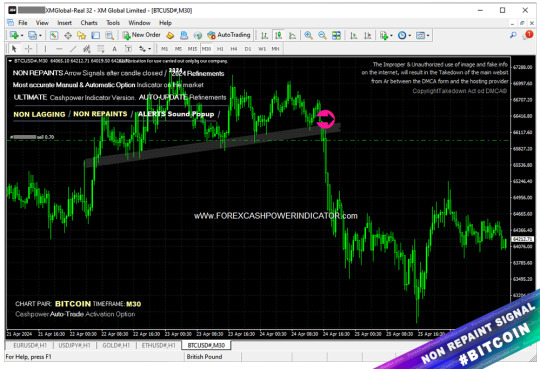

⭐ Metatrader4 chart SELL entry Bitcoin (BTCUSD) m30 non repaint signal. ( More info inside Official Website: wWw.ForexCashpowerIndicator.com ). . ⭐ Cashpower Indicator *Lifetime License with right to Future updates versions FREE. No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees; Lifetime License ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification ✅ Powerful AUTO-Trade Option Subscription . ✅ *Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.* . PS:( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our Genuine old Indicator . Beware, this FAKE FILE reproduction can break and Blown your Mt4 account and also currupt your computer. . Recommended FX Brokerage to run Cashpower-XM Broker: https://clicks.pipaffiliates.com/c?c=817724&l=en&p=6

#best-forex-indicator-non-repaint-buy-and-sell-signal-download#forexsignals#forexindicators#cashpowerindicator#forexindicator#forextradesystem#forexchartindicators#forexprofits#indicatorforex#forex factory#forex forum#cashpower indicator review#cashpower indicator download#forex cashpower indicator settings

4 notes

·

View notes

Text

Buy trade in #USDJPY in H1 (1 Hour Chart) opens based in last NON REPAINT BUY Signal of HUNTER Indicator.

🎓HUNTER NON REPAINT Forex Indicator Signals is developed for Metatrader 4 is a Fixed and "Non Repaint signals for Metatrader4" send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Ultimate Indicator concept available for Forex.

The process to receive the download of Hunter Indicator is automatically after your purchase you will auto-redirectly to download page.

Please access now this link: https://www.hunterforexindicator.com

Inside this link you can have access to Official Hunter Website www HunterForexIndicator com.

🎓Hunter is a complete and last generation Indicator, is a Lifetime License, NOT have Monthly Fees and give in your accuracy signals,Hunter is a complete and last generation Indicator:

🔔 SOUND ALERTS for all signals./ 🔔 VISUAL ALERTS texts for all signals./ 🔔 EMAIL ALERTS actvation option.This Metatrader indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

⚠️HUNTER indicator is The most efficient way to Trade Manually and safely in Forex Market (Majors and exotics pairs), Indices, bonds, cryptos and shares, which is one of the best indicator for MT4 plataform. VIP Tool. Powerful fixed signals not move or transfer the signal to another candle.

⚠️HUNTER is a simple Indicator, it can be used for any type of trading and any type of counters/pairs, the interface of the indicator is very simple to use, buy when blue signal apears and sell when red arrow apears ; so you can use right immediately, the success ratio is 93% higher than the failure ratio, is a solid technical indicator.

#forexindicators#forex signal#forex trading#forexindicator#forexsignals#forex signals#forex#forextrader#forex indicators#hunter forex indicator#usdjpy

0 notes

Text

The Best Forex Management Services to Buy Online | knowify capital

Explore the finest online forex management services at Knowify Capital. Elevate your investment game with expert guidance and seamless execution. To learn more, click here: https://www.knowifycapital.com/service/.

#best forex portfolio management services#trading forex signals#forex signals providers#best indices signal provider

0 notes

Text

Learn How To Use The Relative Strength Index To Identify Forex Trading Siganls

The power of the Relative Strength Index is its ability to identify momentum and gauge market sentiment, providing traders with valuable insights that can inform confident decision-making.

0 notes

Text

This blog serves as a user-friendly guide for those just stepping into the world of forex trading. It meticulously breaks down the concept of forex trading signals, highlighting their immense value for beginners in navigating the intricate forex market. It emphasizes the advantages of using signals, such as their potential to save time, reduce emotional stress, and offer a learning opportunity for novice traders. Throughout the guide, the presence of Funded Traders Global as a supportive and educational partner is evident, ensuring that beginners gain confidence in their learn more...

#Analyzing Fundamental Data#Basics of Trading Signals#Candlestick patterns#Complete Guide to Forex Trading Signals for Beginners#currency pairs#Defining Forex Trading Signals#dojis#economic calendars#economic indicators#engulfing candles#Evaluating Sentiment Indicators#Forex charts#Forex News Sources#forex trading 2023#Forex Trading Signals for Beginners#Fundamental Analysis Signals#hammers#How to Choose a Reliable Provider#How to Find Forex Trading Signals#Interpreting Forex Trading Signals#MACD (Moving Average Convergence Divergence)#Market Analysis Tools#Market Sentiment Indicators#mood and perceptions of traders in the market#moving averages#Position Sizing Strategies#Risk Management in Forex Trading#RSI (Relative Strength Index)#Self-Analysis and Research#Sentiment Analysis Signals

0 notes

Text

Forex Market Trends and Key Trading Indicators This Week

Market Overview

This week, economic data releases will impact global forex markets. In Australia, the Reserve Bank of Australia (RBA) will announce its Cash Rate decision, with little chance of a rate cut. U.S. inflation and labor market data will dominate the headlines, including the Consumer Price Index (CPI) report on Wednesday. Canada’s Bank of Canada (BOC) will also release its rate decision on Wednesday, while the Swiss National Bank (SNB) and the European Central Bank (ECB) will make announcements on Thursday. The UK will release GDP data on Friday. For in-depth market updates, visit Rich Smart FX.

Market Analysis

GOLD

Prices remain stagnant, with limited support and a bearish outlook due to a stronger U.S. dollar. Technical indicators show mixed signals, with MACD gains but low momentum, suggesting a period of consolidation. Learn more about gold trading strategies at GFS Markets.

SILVER

After a brief rally, silver faces selling pressure. The MACD shows strengthening bearish momentum, and the RSI remains flat, indicating potential further declines. For silver market insights, check out DBGM FX.

DXY

The U.S. dollar weakened after falling below 105.840. Despite short-term weakness, the dollar is expected to recover in the long term, with bullish momentum reflected in technical indicators. Gain insights into currency trading at Axel Private Market.

GBPUSD

The British pound is strengthening, driven by expectations of a U.S. rate cut. While technical signals are mixed, underlying buying momentum suggests potential gains for the pound. Explore more at Top Max Global.

AUDUSD & NZDUSD

Both the Australian and New Zealand dollars are facing significant selling pressure, with MACD showing increasing bearish momentum and RSI indicating weak buying interest. For real-time forex analysis, visit World Quest FX.

EURUSD

The euro faces selling pressure, but oversold conditions could lead to a short-term reversal. Traders are watching for buying continuation based on technical signals. For trading platforms comparison, check Rich Smart.

USDJPY

The USD/JPY pair shows consolidation, with low momentum ahead of the Bank of Japan’s rate decision in December. Learn effective strategies for yen trading at Axel Private Market.

USDCHF

The Swiss franc has gained strength against the U.S. dollar, though overbought conditions suggest a potential pause in the rally.

USDCAD

The Canadian dollar remains strong, but caution is advised as it approaches overbought levels.

COT Report Analysis

AUD - STRONG GBP - STRONG CAD - WEAK EUR - WEAK JPY - STRONG CHF - WEAK USD - WEAK NZD - WEAK GOLD - STRONG SILVER - STRONG

This analysis highlights key forex market trends and trading indicators for the week ahead, helping traders assess entry and exit strategies and make informed decisions. For additional trading tools and resources, visit Rich Smart FX.

#Scalping indicators#Trading entry and exit#Automated trading signals#Forex portfolio strategy#Forex market trends

0 notes

Text

HeroFX Review: A Comprehensive Look at the Alleged Forex Scam

In the vast and often volatile world of forex trading, the presence of unscrupulous brokers is a constant threat to both novice and seasoned traders. HeroFX, a broker that has recently come under scrutiny, is the subject of many discussions and concerns. This review delves into the various aspects of HeroFX to determine whether it is a legitimate broker or a potential scam.

Background and Overview

HeroFX claims to offer a comprehensive trading platform with a wide range of assets, including forex, commodities, indices, and cryptocurrencies. Promising competitive spreads, high leverage, and a user-friendly interface, HeroFX aims to attract traders looking for a reliable trading experience.

Regulation and Licensing

One of the primary red flags for any forex broker is the lack of proper regulation and licensing. HeroFX is reportedly not registered with any reputable financial regulatory authority. This absence of regulation means that traders are not protected by any governing body, increasing the risk of fraudulent activities and loss of funds.

Trading Platform and Tools

HeroFX offers its own proprietary trading platform, which is marketed as intuitive and feature-rich. While the platform appears to be functional, there have been numerous complaints about its reliability and execution speed. Some users have reported significant delays in order execution, leading to potential losses.

The broker also provides various tools and resources for traders, such as educational materials, market analysis, and trading signals. However, the quality and accuracy of these resources are questionable, with many users alleging that the information provided is often outdated or misleading.

Customer Support

Effective customer support is crucial for any forex broker, especially when dealing with complex financial transactions. HeroFX has received mixed reviews in this area. While some traders have reported satisfactory interactions with the support team, many others have experienced long wait times, unhelpful responses, and unresolved issues. This inconsistency in customer service further undermines the broker's credibility.

Withdrawal and Deposit Issues

One of the most significant concerns surrounding HeroFX is the difficulty many traders face when trying to withdraw their funds. Numerous complaints highlight delayed withdrawals, with some users claiming they never received their money. This pattern of behavior is often indicative of a scam broker, as legitimate brokers prioritize transparent and efficient fund transfers.

Additionally, the deposit process has also raised suspicions. HeroFX allegedly encourages large initial deposits and offers enticing bonuses that come with restrictive terms and conditions, making it challenging for traders to access their funds.

User Reviews and Complaints

A cursory glance at various online forums and review sites reveals a plethora of negative feedback from traders who have used HeroFX. Common grievances include:

Unresponsive or hostile customer service.

Manipulated trading conditions leading to unexpected losses.

Inability to withdraw funds.

Suspiciously positive reviews that appear fabricated.

These recurring themes paint a concerning picture of HeroFX and suggest a pattern of unethical practices.

Conclusion

In conclusion, while HeroFX presents itself as a reputable forex broker with attractive features, the overwhelming evidence points to the contrary. The lack of regulation, persistent withdrawal issues, and numerous negative user reviews all indicate that HeroFX may not be a trustworthy broker. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. In the unpredictable world of forex trading, it is always better to err on the side of caution and choose a broker with a proven track record of reliability and transparency.

For more check out this article: Herofx-review

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

61 notes

·

View notes

Text

Reversal Trading: Forex Trading Strategy Explained

In the dynamic world of forex trading, strategies are essential for navigating the volatile market. One such effective strategy is reversal trading. This technique involves identifying points at which a trend is likely to reverse direction. Understanding and mastering this strategy can provide traders with significant advantages, enabling them to capitalize on market shifts. This article delves…

#Candlestick Patterns#Divergence#Downtrend#Entry and Exit Points#Fibonacci Retracement#Forex#Forex Strategy#Forex Trading#Geopolitical Events#Market Conditions#Market Indicators#Market Sentiment#Moving Average#Overtrading#Price Movements#Profitability#Relative Strength#Reversal Signals#Reversal Trading#Risk Management#RSI#Stop-Loss#Support And Resistance#Trading Strategy#Trading Techniques#Trading Volume#Trend Following#Uptrend#Volume Analysis

0 notes