#fintech power

Explore tagged Tumblr posts

Text

How AI Improves Decision-Making for Financial Deicisions?

AI has fundamentally transformed decision-making in the financial industry, equipping institutions with the ability to make faster, data-driven, and more accurate financial decisions. By leveraging vast amounts of historical and real-time data, AI algorithms enhance the decision-making process, helping financial professionals, institutions, and even everyday consumers make smarter financial choices.

One of the core ways AI improves financial decision-making is through predictive analytics. AI systems analyze historical data to forecast future trends, enabling financial institutions to make proactive decisions. For example, predictive analytics helps banks assess the creditworthiness of borrowers beyond traditional credit scores. By analyzing a wider range of data, including social behavior and spending patterns, AI can predict a borrower’s likelihood of repaying a loan more accurately, leading to fairer lending practices and minimizing the risk of default.

AI also plays a crucial role in risk management. Traditional risk assessment methods often rely on rigid criteria that may miss subtle indicators of potential risk. In contrast, AI systems use machine learning to detect complex patterns that humans might overlook. For instance, in stock trading, AI algorithms can process financial reports, economic indicators, and even sentiment analysis from news sources to determine which investments carry higher risk. By continuously learning from new data, these algorithms adapt their assessments in real-time, providing financial advisors and traders with up-to-date insights that improve decision quality.

In addition, real-time decision-making is enhanced significantly by AI-driven automation. Fintech solutions powered by AI enable institutions to automate key decision processes, such as fraud detection. By analyzing large transaction datasets, AI can detect anomalies that suggest fraudulent activity within seconds, allowing banks to respond swiftly. This capacity for instant, data-informed decision-making minimizes financial losses and ensures secure transactions, bolstering consumer trust.

Finally, personalization is another area where AI is revolutionizing financial decision-making. AI analyzes individual transaction histories, spending patterns, and financial goals to recommend tailored financial products, such as investment portfolios or credit options. This level of personalization helps consumers make informed decisions aligned with their unique financial circumstances.

In summary, AI improves decision-making for financial decisions by enabling predictive insights, efficient risk management, rapid real-time responses, and customized financial advice. As AI continues to evolve, its impact on the fintech industry and financial decision-making is likely to grow, empowering both institutions and consumers to make smarter, more informed choices.

1 note

·

View note

Text

5 Benefits and Key Features of Hotel Chatbot - Technology Org

New Post has been published on https://thedigitalinsider.com/5-benefits-and-key-features-of-hotel-chatbot-technology-org/

5 Benefits and Key Features of Hotel Chatbot - Technology Org

A hotel chatbot is an AI-powered bot that performs human conversations between hotels and their visitors or potential guests via its website, messaging apps, and social media. It works as an automated chat or discussion interface. A chatbot can be referred to by several names, including virtual assistants, digital assistants, conversational bots, and intelligent chatbots. Companies can use these chatbots to handle orders, provide product suggestions, assist customers, schedule meetings, and perform similar duties.

Here are some of the key benefits and features of using Hotel Chatbots.

A chatbot �� artistic interpretation. Image credit: Mohamed Hassan via Pxhere, CC0 Public Domain

24×7 response time

Customer service or contact center hours are often used to determine service availability. Chatbots, on the other hand, are always available to handle leads. It allows real-time communication between website visitors and hotel organizations, increasing customer trust. Furthermore, it makes it possible for hotels to react to guest requests anytime, ensuring ongoing service even during peak seasons and holidays.

Data Collection

An AI-powered chatbot can collect and analyze huge data about customer interactions, preferences, and behavior. Hotel management can use this information to make pricing choices, conduct promotional campaigns, and offer service upgrades. Furthermore, these chatbots can be great lead-generation tools, converting new leads into customers via follow-up processes or targeted marketing campaigns. For instance, Marriott’s Enhanced Internet service runs chatbots on its website servers to gather guest data.

Upsells Growth

Chatbots can boost the upselling potential by providing a personalized customer experience. Hotels can generate personalized offers for guests by providing hotel upgrades, spa treatments, on-site restaurants, and other amenities. They can also consider cross-selling opportunities, such as tailored recommendations for special discounts.

Cost Reductions

Chatbots have the potential to save your hotel up to 30% on these expenses. Hotels may save money by automating customer care tasks. Using chatbots for first-level customer service also saves time and provides better customer service and prompt responses to hotel guests. A virtual assistant can reduce human support costs by reducing the need for a large staff.

Fast service

Chatbots allow hotels to service several clients at once and provide them with information quickly rather than making them wait. Furthermore, it is important to reply promptly when visitors make complaints or urgent requests. Therefore, chatbots and human agents should work together to resolve these issues as soon as possible. Notably, several hotels such as Amtrak also offers free WiFi, making it easy for guests to access the internet and communicate with chatbots.

Better Visiting Experience

Visitors can learn about the booking process, pricing, and availability through an AI-powered assistant. It may also provide quick answers to frequently asked questions (FAQs) and detailed information about hotels and the surrounding community. AI chatbots can assist visitors throughout their journey by communicating at every stage.

#ai#AI-powered#apps#Behavior#bot#bots#chatbot#chatbots#communication#Community#Companies#customer experience#customer service#data#data collection#easy#Features#Fintech news#growth#hand#holidays#human#Internet#issues#it#Learn#management#Marketing#media#Messaging Apps

0 notes

Text

Unlocking the Potential: How Blockchain is Transforming the Fintech Landscape

In the realm of financial technology, blockchain stands as a beacon of innovation, promising to revolutionize the way transactions are conducted and financial data is managed.��Blockchain in Fintech: The Power of Blockchain Technology in Fintech Evolution is not just a concept; it's a tangible force reshaping the industry's foundations. Let's delve into how blockchain is set to redefine the future of fintech.

Blockchain technology, at its core, is a decentralized ledger system that records transactions across a network of computers. This distributed ledger eliminates the need for intermediaries, such as banks or payment processors, streamlining processes and reducing costs.

One of the key ways blockchain is poised to transform the fintech sector is through enhanced security and transparency. The immutable nature of blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with. This feature mitigates the risk of fraud and enhances trust among participants in financial transactions.

Furthermore, blockchain has the potential to expedite cross-border payments, a process traditionally plagued by inefficiencies and high fees. By leveraging blockchain technology, financial institutions can facilitate near-instantaneous transactions at a fraction of the cost compared to traditional methods. This not only benefits consumers by reducing transaction fees but also opens up new opportunities for businesses to engage in global commerce.

Smart contracts, another innovation enabled by blockchain, have the potential to automate and streamline various financial processes. These self-executing contracts automatically enforce the terms and conditions of an agreement when predefined conditions are met. This eliminates the need for intermediaries and reduces the risk of human error, ultimately saving time and reducing costs for all parties involved.

Moreover, blockchain technology holds the promise of democratizing access to financial services, particularly in underserved regions where traditional banking infrastructure is lacking. By providing individuals with access to digital wallets and decentralized financial services, blockchain can empower the unbanked and underbanked populations, fostering greater financial inclusion on a global scale.

As the fintech landscape continues to evolve, blockchain stands out as a transformative force driving innovation and reshaping traditional paradigms. From enhancing security and transparency to facilitating cross-border payments and promoting financial inclusion, the potential applications of blockchain in fintech are vast and far-reaching. Embracing this technology presents boundless opportunities for businesses, consumers, and society as a whole to thrive in an increasingly interconnected and digital world.

So, are you ready to harness the power of blockchain and join the fintech revolution? The future of finance awaits, and blockchain is leading the way.

0 notes

Text

youtube

Fintech, short for "financial technology," refers to the use of technology to provide innovative financial services and solutions. It encompasses a wide range of applications and services that aim to disrupt and improve traditional financial processes, making them more efficient, accessible, and user-friendly.

Fintech companies leverage various technologies, including mobile apps, data analytics, artificial intelligence, blockchain, and more, to deliver services such as online banking, digital payments, peer-to-peer lending, robo-advisors, crowdfunding, cryptocurrency exchanges, and insurance technology, among others. These technologies enable fintech companies to streamline processes, reduce costs, and enhance the overall customer experience.

Fintech has the potential to reach individuals and businesses that were previously underserved or excluded from traditional banking systems. Mobile banking and digital payment solutions have enabled people in remote or unbanked areas to access financial services without requiring a physical presence.

Fintech has had a significant impact on the financial industry, promoting financial inclusion by providing services to underserved populations, increasing competition among financial service providers, and driving innovation in areas that were previously dominated by traditional financial institutions. The rapid growth of fintech has led to collaborations between fintech startups and established financial institutions, as well as regulatory changes to accommodate new financial technologies.

Understanding Fintech: The Power of Technology in Finance

#understanding fintech#the power of technology in finance#fintech#finance#what is fintech#fintech explained#financial technology explained#fintech opportunity#fintech finance#what is financial technology#how fintech works#what is fintech technology#fintech technology#fintech banking#fintech trading#what is fintech banking#the future of finance in fintech#technology trends in the fintech industry#LimitLess Tech 888#fintech future trends#financial technology#Youtube

0 notes

Text

youtube

Fintech, short for "financial technology," refers to the use of technology to provide innovative financial services and solutions. It encompasses a wide range of applications and services that aim to disrupt and improve traditional financial processes, making them more efficient, accessible, and user-friendly.

Fintech companies leverage various technologies, including mobile apps, data analytics, artificial intelligence, blockchain, and more, to deliver services such as online banking, digital payments, peer-to-peer lending, robo-advisors, crowdfunding, cryptocurrency exchanges, and insurance technology, among others. These technologies enable fintech companies to streamline processes, reduce costs, and enhance the overall customer experience.

Fintech has the potential to reach individuals and businesses that were previously underserved or excluded from traditional banking systems. Mobile banking and digital payment solutions have enabled people in remote or unbanked areas to access financial services without requiring a physical presence.

Fintech has had a significant impact on the financial industry, promoting financial inclusion by providing services to underserved populations, increasing competition among financial service providers, and driving innovation in areas that were previously dominated by traditional financial institutions. The rapid growth of fintech has led to collaborations between fintech startups and established financial institutions, as well as regulatory changes to accommodate new financial technologies.

Understanding Fintech: The Power of Technology in Finance

#understanding fintech#the power of technology in finance#fintech#finance#what is fintech#fintech explained#financial technology explained#fintech opportunity#fintech finance#what is financial technology#how fintech works#what is fintech technology#fintech technology#fintech banking#fintech trading#what is fintech banking#the future of finance in fintech#technology trends in the fintech industry#LimitLess Tech 888#fintech future trends#financial technology#Youtube

0 notes

Text

Check and Pay North Bihar Power Distribution Company Limited Bill Online on abhieo, get up to ₹30 back.

https://www.abhieo.in/electricity30

#abhieo#finance#recharge#billpayment#fintech#rechargeapp#mobilerecharge#paymentapp#payment#fintechstartup#electricitybillpayment#electricity#electricitybill#electricity bill#billpayments#bill pay#cashback offer#offersale#North Bihar Power Distribution Company Limited#NBPDCL#cashback#cashackapp#bbps#electricty#electricityoffer#bijlibill

0 notes

Text

Explore how Nu10 leverages the transformative potential Powering Fintech with web3 technology to revolutionize the fintech industry. Discover cutting-edge solutions and opportunities at the intersection of finance and blockchain, as we pave the way for a decentralized financial future.

0 notes

Text

#Ai-powered#Ai automation#chatbot#ai chatbot#fintech#BFSI#business#artificial intelligence#bots#customer service#werqlabs

0 notes

Photo

Powering the Future of FinTech with Machine Learning: Uncovering Groundbreaking Applications Transforming Finance and Tech Industries

Financial Technology, or FinTech, has been revolutionizing the finance world by leveraging technology and innovative approaches to provide better financial services. Machine Learning (ML) plays a significant role in this transformation, offering groundbreaking applications that are reshaping the finance and tech industries. Here are some uncommon tips and applications of ML that might not be known to most people.</p>

1. Fraud Detection with Unsupervised ML Models</h2>

While fraud detection is a known use-case of ML, what's uncommon is using unsupervised ML models for the job. These models can identify suspicious patterns and anomalies in large datasets without being explicitly trained on labeled data. Unsupervised learning can be particularly effective in detecting new types of fraud, as it doesn't rely on pre-defined labels or patterns, and can adapt to changing fraud tactics.

2. Enhanced Sentiment Analysis for Trading Strategies

Sentiment analysis is a popular technique used in trading strategies to gauge the market sentiment based on news articles, social media, and other text sources. By incorporating advanced ML algorithms like Deep Learning and Natural Language Processing (NLP), sentiment analysis can reach new levels of accuracy and provide traders with more reliable signals. This can lead to improved decision-making and better trading performance in the financial markets.

3. ML-Driven Robo-Advisors for Personalized Investment Advice

Robo-advisors have gained popularity in recent years as a cost-effective alternative to traditional financial advisors. However, most robo-advisors use simple algorithms based on historical data and fail to provide tailored advice for individual investors. By harnessing the power of ML, robo-advisors can analyze vast amounts of data, learn from user preferences and behaviors, and provide personalized investment advice. This can lead to better investment outcomes and higher customer satisfaction.

4. ML for Algorithmic Trading with Alternative Data

<p>Algorithmic trading has been a staple in the financial markets for years, but ML can take it to new heights by incorporating alternative data sources. These can include social media, satellite imagery, or even weather data, which can provide unique insights into market trends and opportunities. ML algorithms can analyze these unconventional data sources and make more informed trading decisions, potentially leading to higher returns and reduced risk.</p>

5. Credit Scoring with ML for the Unbanked Population

Traditional credit scoring methods rely on a person's credit history, which can exclude a large portion of the global population without access to formal financial services. ML can help bridge this gap by using alternative data sources, such as mobile phone usage or social media activity, to assess a person's creditworthiness. This can enable financial institutions to provide loans and other services to the unbanked population, fostering financial inclusion and economic growth.

In conclusion, Machine Learning is driving the future of FinTech by offering groundbreaking applications that are transforming the finance and tech industries. From fraud detection to personalized investment advice, ML is reshaping the way we approach finance and technology, unlocking new potential and opportunities for businesses and consumers alike.

#fintech and machine learning#fintech and the future of banking#fintech the future#fintech the future of finance#how fintech is shaping the future of banking#powering the future of fintech with machine learning and ai#machine learning for fintech

0 notes

Photo

From payments to investments, blockchain technology is transforming the financial services sector. Discover how this revolutionary technology is disrupting traditional finance and paving the way for a more decentralized and secure financial future.

https://www.algoworks.com/blog/blockchain-disruption-in-financial-services-sector/

#fintech#revolution#power#blockchain#payments#investment#technology#financial#services#secure#future

1 note

·

View note

Text

“The Fagin figure leading Elon Musk’s merry band of pubescent sovereignty pickpockets”

This week only, Barnes and Noble is offering 25% off pre-orders of my forthcoming novel Picks and Shovels. ENDS TODAY!.

While we truly live in an age of ascendant monsters who have hijacked our country, our economy, and our imaginations, there is one consolation: the small cohort of brilliant, driven writers who have these monsters' number, and will share it with us. Writers like Maureen Tkacik:

https://prospect.org/topics/maureen-tkacik/

Journalists like Wired's Vittoria Elliott, Leah Feiger, and Tim Marchman are absolutely crushing it when it comes to Musk's DOGE coup:

https://www.wired.com/author/vittoria-elliott/

And Nathan Tankus is doing incredible work all on his own, just blasting out scoop after scoop:

https://www.crisesnotes.com/

But for me, it was Tkacik – as usual – in the pages of The American Prospect who pulled it all together in a way that finally made it make sense, transforming the blitzkreig Muskian chaos into a recognizable playbook. While most of the coverage of Musk's wrecking crew has focused on the broccoli-haired Gen Z brownshirts who are wilding through the server rooms at giant, critical government agencies, Tkacik homes in on their boss, Tom Krause, whom she memorably dubs "the Fagin figure leading Elon Musk’s merry band of pubescent sovereignty pickpockets" (I told you she was a great writer!):

https://prospect.org/power/2025-02-06-private-equity-hatchet-man-leading-lost-boys-of-doge/

Krause is a private equity looter. He's the guy who basically invented the playbook for PE takeovers of large tech companies, from Broadcom to Citrix to VMWare, converting their businesses from selling things to renting them out, loading them up with junk fees, slashing quality, jacking up prices over and over, and firing everyone who was good at their jobs. He is a master enshittifier, an enshittification ninja.

Krause has an unerring instinct for making people miserable while making money. He oversaw the merger of Citrix and VMWare, creating a ghastly company called The Cloud Software Group, which sold remote working tools. Despite this, of his first official acts was to order all of his employees to stop working remotely. But then, after forcing his workers to drag their butts into work, move back across the country, etc, he reversed himself because he figured out he could sell off all of the company's office space for a tidy profit.

Krause canceled employee benefits, like thank you days for managers who pulled a lot of unpaid overtime, or bonuses for workers who upgraded their credentials. He also ended the company's practice of handing out swag as small gifts to workers, and then stiffed the company that made the swag, wontpaying a $437,574.97 invoice for all the tchotchkes the company had ordered. That's not the only supplier Krause stiffed: FinLync, a fintech company with a three-year contract with Krause's company, also had to sue to get paid.

Krause's isn't a canny operator who roots out waste: he's a guy who tears out all the wiring and then grudgingly restores the minimum needed to keep the machine running (no wonder Musk loves him, this is the Twitter playbook). As Tkacik reports, Krause fucked up the customer service and reliability systems that served Citrix's extremely large, corporate customers – the giant businesses that cut huge monthly checks to Citrix, whose CIOs received daily sales calls from his competitors.

Workers who serviced these customers, like disabled Air Force veteran David Morgan, who worked with big public agencies, were fired on one hour's notice, just before their stock options vested. The giant public agency customers he'd serviced later called him to complain that the only people they could get on the phone were subcontractors in Indian call centers who lacked the knowledge and authority to resolve their problems.

Last month, Citrix fired all of its customer support engineers. Citrix's military customers are being illegally routed to offshore customer support teams who are prohibited from working with the US military.

Citrix/VMWare isn't an exception. The carnage at these companies is indistinguishable from the wreck Krause made of Broadcom. In all these cases, Krause was parachuted in by private equity bosses, and he destroyed something useful to extract a giant, one-time profit, leaving behind a husk that no longer provides value to its customers or its employees.

This is the DOGE playbook. It's all about plunder: take something that was patiently, carefully built up over generations and burn it to the ground, warming yourself in the pyre, leaving nothing behind but ash. This is what private equity plunderers have been doing to the world's "advanced" economies since the Reagan years. They did it to airlines, family restaurants, funeral homes, dog groomers, toy stores, pharma, palliative care, dialysis, hospital beds, groceries, cars, and the internet.

Trump's a plunderer. He was elected by the plunderer class – like the crypto bros who want to run wild, transforming workers' carefully shepherded retirement savings into useless shitcoins, while the crypto bros run off with their perfectly cromulent "fiat" money. Musk is the apotheosis of this mindset, a guy who claims credit for other peoples' productive and useful businesses, replacing real engineering with financial engineering. Musk and Krause, they're like two peas in a pod.

That's why – according to anonymous DOGE employees cited by Tckacik – DOGE managers are hired for their capacity for cruelty: "The criteria for DOGE is how many you have fired, how much you enjoy firing people, and how little you care about the impact on peoples well being…No wonder Tom Krause was tapped for this. He’s their dream employee!"

The fact that Krause isn't well known outside of plunderer circles is absolutely a feature for him, not a bug. Scammers like Krause want to be admitted to polite society. This is why the Sacklers – the opioid crime family that kicked off the Oxy pandemic that's murdered more than 800,000 Americans so far – were so aggressive about keeping their association with their family business, Purdue Pharma, a secret. The Sacklers only wanted to be associated with the art galleries and museums they put their names over, and their lawyers threatened journalists for writing about their lives as billionaire drug pushers (I got one of those threats).

There's plenty of good reasons to be anonymous – if you're a whistleblower, say. But if you ever encounter a corporate executive who insists on anonymity, that's a wild danger sign. Take Pixsy, the scam "copyleft trolls" whose business depends on baiting people into making small errors when using images licensed under very early versions of the Creative Common licenses, and then threatening to sue them unless they pay hundreds or thousands of dollars:

https://pluralistic.net/2022/01/24/a-bug-in-early-creative-commons-licenses-has-enabled-a-new-breed-of-superpredator/

Kain Jones, the CEO of Pixsy, tried to threaten me under the EU's GDPR for revealing the names of the scammer on his payroll who sent me a legal threat, and the executive who ran the scam for his business (I say he tried to threaten me because I helped lobby for the GDPR and I know for a fact that this isn't a GDPR violation):

https://pluralistic.net/2022/02/13/an-open-letter-to-pixsy-ceo-kain-jones-who-keeps-sending-me-legal-threats/

These people understand that they are in the business of ripping people off, causing them grave and wholly unjust financial injury. They value their secrecy because they are in the business of making strangers righteously furious, and they understand that one of these strangers might just show up in their lives someday to confront them about their transgressions.

This is why Unitedhealthcare freaked out so hard about Luigi Mangione's assassination of CEO Brian Thompson – that's not how the game is supposed to be played. The people who sit in on executive row, destroying your lives, are supposed to be wholly insulated from the consequences of their actions. You're not supposed to know who they are, you're not supposed to be able to find them – of course.

But even more importantly, you're not supposed to be angry at them. They pose as mere software agents in an immortal colony organism called a Limited Liability Corporation, bound by the iron law of shareholder supremacy to destroy your life while getting very, very rich. It's not supposed to be personal. That's why Unitedhealthcare is threatening to sue a doctor who was yanked out of surgery on a cancer patient to be berated by a UHC rep for ordering a hospital stay for her patient:

https://gizmodo.com/unitedhealthcare-is-mad-about-in-luigi-we-trust-comments-under-a-doctors-viral-post-2000560543

UHC is angry that this surgeon, Austin's Dr Elisabeth Potter, went Tiktok-viral with her true story of how how chaotic and depraved and uncaring UHC is. UHC execs fear that Mangione made it personal, that he obliterated the accountability sink of the corporation and put the blame squarely where it belongs – on the (mostly) men at the top who make this call.

This is a point Adam Conover made in his latest Factually podcast, where he interviewed Propublica's T Christian Miller and Patrick Rucker:

https://www.youtube.com/watch?v=Y_5tDXRw8kg

Miller and Rucker published a blockbuster investigative report into Cigna's Evocore, a secret company that offers claims-denials as a service to America's biggest health insurers:

https://www.propublica.org/article/evicore-health-insurance-denials-cigna-unitedhealthcare-aetna-prior-authorizations

If you're the CEO of a health insurance company and you don't like how much you're paying out for MRIs or cancer treatment, you tell Evocore (which processes all your claim authorizations) and they turn a virtual dial that starts to reduce the number of MRIs your customers are allowed to have. This dial increases the likelihood that a claim or pre-authorization will be denied, which, in turn, makes doctors less willing to order them (even if they're medically necessary) and makes patients more likely to pay for them out of pocket.

Towards the end of the conversation, Miller and Rucker talk about how the rank-and-file people at an insurer don't get involved with the industry to murder people in order to enrich their shareholders. They genuinely want to help people. But executive row is different: those very wealthy people do believe their job is to kill people to save money, and get richer. Those people are personally to blame for the systemic problem. They are the ones who design and operate the system.

That's why naming the people who are personally responsible for these immoral, vicious acts is so important. That's why it's important that Wired and Propublica are unmasking the "pubescent sovereignty pickpockets" who are raiding the federal government under Krause's leadership:

https://projects.propublica.org/elon-musk-doge-tracker/

These people are committing grave crimes against the nation and its people. They should be known for this. It should follow them for the rest of their lives. It should be the lead in their obituaries. People who are introduced to them at parties should have a flash of recognition, hastily end the handshake, then turn on their heels and race to the bathroom to scrub their hands. For the rest of their lives.

Naming these people isn't enough to stop the plunder, but it helps. Yesterday, Marko Elez, the 25 year old avowed "eugenicist" who wanted to "normalize Indian hate" and could not be "[paid] to marry outside of my ethnicity," was shown the door. He's off the job. For the rest of his life, he will be the broccoli-haired brownshirt who got fired for his asinine, racist shitposting:

https://www.npr.org/2025/02/06/nx-s1-5289337/elon-musk-doge-treasury

After Krause's identity as the chief wrecker at DOGE was revealed, the brilliant Anna Merlan (author of Republic of Lies, the best book on conspiratorialism), wrote that "Now the whole country gets the experience of what it’s like when private equity buys the place you work":

https://bsky.app/profile/annamerlan.bsky.social/post/3lhepjkudcs2t

That's exactly it. We are witnessing a private equity-style plunder of the entire US government – of the USA itself. No one is better poised to write about this than Tkacik, because no one has private equity's number like Tkacik does:

https://pluralistic.net/2023/06/02/plunderers/#farben

Ironically, all this came down just as Trump announced that he was going to finally get rid of private equity's scammiest trick, the "carried interest" loophole that lets PE bosses (and, to a lesser extent, hedge fund managers) avoid billions in personal taxes:

https://archive.is/yKhvD

"Carried interest" has nothing to do with the interest rate – it's a law that was designed for 16th century sea captains who had an "interest" in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Trump campaigned on killing this loophole in 2017, but Congress stopped him, after a lobbying blitz by the looter industry. It's possible that he genuinely wants to get rid of the carried interest loophole – he's nothing if not idiosyncratic, as the residents of Greenland can attest:

https://prospect.org/world/2025-02-07-letter-between-friendly-nations/

Even if he succeeds, looters and the "investor class" will get a huge giveaway under Trump, in the form of more tax giveaways and the dismantling of labor and environmental regulation. But it's far more likely that he won't succeed. Rather – as Yves Smith writes for Naked Capitalism – he'll do what he did with the Canada and Mexico tariffs: make a tiny, unimportant change and then lie and say he had done something revolutionary:

https://www.nakedcapitalism.com/2025/02/is-trump-serious-about-trying-to-close-the-private-equity-carried-interest-loophole.html

This has been a shitty month, and it's not gonna get better for a while. On my dark days, I worry that it won't get better during my lifetime. But at least we have people like Tkacik to chronicle it, explain it, put it in context. She's amazing, a whirlwind. The same day that her report on Krause dropped, the Prospect published another must-read piece by her, digging deep into Alex Jones's convoluted bankruptcy gambit:

https://prospect.org/justice/2025-02-06-crisis-actors-alex-jones-bankruptcy/

It lays bare the wild world of elite bankruptcy court, another critical conduit for protecting the immoral rich from their victims. The fact that Tkacik can explain both Krause and the elite bankruptcy system on the same day is beyond impressive.

We've got a lot of work ahead of ourselves. The people in charge of this system – whose names you must learn and never forget – aren't going to go easily. But at least we know who they are. We know what they're doing. We know how the scam works. It's not a flurry of incomprehensible actions – it's a playbook that killed Red Lobster, Toys R Us, and Sears. We don't have to follow that playbook.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/02/07/broccoli-hair-brownshirts/#shameless

#pluralistic#Maureen Tkacik#the american prospect#corporate sociopaths#pixsy#luigi mangione#propublica#doge#coup#elon musk#guillotine watch#adam conover#private equity#citrix#tom krause#looters#marko elez

394 notes

·

View notes

Text

From Casinos to Crypto: How Las Vegas Became a Blockchain Innovation Hub

Las Vegas, long synonymous with its iconic casinos and vibrant entertainment, is now emerging as an unexpected hub for blockchain innovation. Inspired by the gaming industry’s need for security, transparency, and enhanced user experiences, the city is becoming a leader in fintech applications powered by blockchain. This transformation is driving the convergence of technology, finance, and entertainment, paving the way for the city’s tech-driven future. Fifteen years ago, in 2010, 10,000 Bitcoin was used to purchase two pizzas, a transaction that marked the first real-world use of the cryptocurrency. At the time, Bitcoin was practically worthless. Fast forward to today, and the value of Bitcoin has skyrocketed. Now, selling just 33 Bitcoin could buy you a $3 million penthouse at the prestigious Four Seasons Private Residences in Las Vegas. This dramatic shift highlights not only Bitcoin’s meteoric rise but also redefining how wealth and assets are exchanged in a tech-driven world.

1. Blockchain Integration in Las Vegas

Resorts World Las Vegas

Resorts World Las Vegas is a prime example of how casinos are embracing blockchain technology and digital currencies.

Crypto Payments: The casino allows customers to use Bitcoin and Ethereum for hotel bookings, dining, and other services, partnering with Gemini, a regulated crypto exchange.

Cashless Gaming: Patrons can use mobile wallets instead of carrying physical cash. This not only enhances convenience but also increases transaction security, reducing risks of theft or fraud.

Wynn Las Vegas

Wynn Las Vegas has partnered with fintech firms to explore blockchain-based loyalty rewards programs. Customers can earn digital tokens tied to casino activities, which can be redeemed for hotel stays, entertainment, or dining experiences.

Case Study: Blockchain for Fair Play

A notable example of blockchain in casinos is FunFair Technologies, a platform that offers decentralized casino solutions using Ethereum smart contracts. While not exclusive to Las Vegas, FunFair’s model ensures provable fairness by publishing game outcomes on the blockchain, making it impossible for casinos to manipulate results.

Such innovations are being tested in Las Vegas-style gaming platforms globally, showing how blockchain can build trust between casinos and players.

Casinos in Las Vegas Accepting Bitcoin for Payments

Golden Gate Hotel & Casino

Location: 1 Fremont Street, Las Vegas, NV 89101

Details: As the oldest casino in Las Vegas, Golden Gate accepts Bitcoin for hotel bookings, dining, and gift shop purchases.

Note: Bitcoin is not accepted for gambling activities but can be converted to U.S. dollars for gaming.

The D Las Vegas Hotel & Casino

Location: 301 Fremont Street, Las Vegas, NV 89101

Details: The D Las Vegas allows Bitcoin payments for hotel rooms, dining, and merchandise at its gift shop.

Note: Bitcoin cannot be used directly for gambling but works for other non-gaming services.

Resorts World Las Vegas

Location: 3000 Las Vegas Blvd S, Las Vegas, NV 89109

Details: Resorts World has partnered with Gemini, a cryptocurrency platform, to accept Bitcoin for hotel stays, dining, and select retail purchases.

Innovation: The resort also offers cashless gaming solutions, making it one of the most tech-forward destinations on the Strip.

2. Fintech Innovations Inspired by Gaming

The gaming industry’s push for seamless, secure, and engaging user experiences has inspired broader fintech applications.

Cashless Gaming Solutions

Casinos like The Venetian and MGM Grand have integrated cashless payment systems. Platforms such as Sightline Payments provide mobile wallets for gaming, dining, and retail, eliminating the need for physical cash.

These systems use fintech innovations like real-time payment settlement and biometric security for user verification, enhancing both speed and safety.

Gamification in Fintech

Gamification—using game-like elements in financial services—draws heavily from the gaming industry’s playbook.

Example: Robinhood: The stock trading app uses gamified features such as streaks, confetti animations, and rewards to engage users.

Las Vegas Influence: Gaming incentives and loyalty programs serve as inspiration for fintech apps offering rewards for saving, spending, or investing responsibly.

Case Study: The Link Between Casinos and Fintech Apps

Las Vegas casinos often deploy advanced AI-powered analytics to predict player behavior and optimize incentives. This same data-driven approach is now being used in fintech apps like Acorns and Stash, which offer personalized financial advice and savings plans based on user habits.

3. Las Vegas-Based Blockchain Gaming Companies

Infinite Games

Las Vegas-based Infinite Games is pioneering blockchain integration in mobile and online gaming:

NFT Ownership: Players can own in-game items as NFTs (non-fungible tokens), enabling trade and resale across different platforms.

Player Economy: By using blockchain, Infinite Games creates decentralized gaming economies where players can monetize their skills and assets.

PLAYSTUDIOS

PLAYSTUDIOS, famous for its loyalty-based mobile games, is exploring blockchain to make rewards more transparent and tradable:

Blockchain allows digital tokens to replace traditional rewards points. Players can transfer, sell, or redeem tokens in ways not previously possible.

Emerging Companies in the Sector

Startups like Decentral Games are pushing the boundaries by creating virtual casinos in the metaverse, powered by blockchain and cryptocurrencies.

Players can visit virtual versions of Las Vegas casinos, bet using digital assets, and enjoy provably fair gameplay.

4. Future Prospects for Blockchain in Las Vegas

Las Vegas’s integration of blockchain technology points toward a future that is both innovative and economically diverse.

Enhanced Security and Transparency

Blockchain creates an immutable ledger for transactions, making gaming and financial processes tamper-proof and transparent.

For example, blockchain is being explored to log all bets, winnings, and payouts, ensuring trust between players and casinos.

Blockchain for Tourism and Hospitality

The Las Vegas tourism industry can leverage blockchain for smart contracts in hotel bookings, event tickets, and tours.

For instance, a blockchain-based booking platform could eliminate intermediaries like OTAs (Online Travel Agencies), offering tourists lower costs and direct transparency.

Economic Diversification

By embracing blockchain technology, Las Vegas is diversifying its economy beyond casinos and entertainment:

Tech Startups: The city’s business-friendly policies are attracting fintech and blockchain startups.

Investors and Talent: Las Vegas is becoming a hub for blockchain conferences like Money 20/20, drawing global investors and tech talent.

Conclusion

Las Vegas’s journey from a global gaming capital to a blockchain innovation hub is a testament to its ability to adapt and evolve. By integrating blockchain into its casino operations, the city is setting new standards for transparency, security, and user engagement in gaming and fintech. From cashless gaming solutions to decentralized casinos, Las Vegas serves as both a case study and a blueprint for other cities looking to harness the power of blockchain.

Platforms like RealOpen are now facilitating real estate purchases using Bitcoin, Ethereum, and other cryptocurrencies. These platforms convert crypto to cash en route to escrow, allowing buyers to purchase any property, even if the seller isn’t crypto-friendly. For example, crypto enthusiasts can test these innovations by using Bitcoin to purchase luxury properties, including a Trump Las Vegas condos for sale. This seamless process allows digital asset holders to invest directly into the Las Vegas real estate market, turning crypto wealth into tangible luxury assets.

As fintech innovations inspired by the gaming industry continue to grow, Las Vegas is uniquely positioned to lead this revolution—solidifying its status not just as the Entertainment Capital of the World, but also as a Tech and Blockchain Capital for the Future.

8 notes

·

View notes

Text

Benefits of using artificial intelligence in online pokies. - Technology Org

New Post has been published on https://thedigitalinsider.com/benefits-of-using-artificial-intelligence-in-online-pokies-technology-org/

Benefits of using artificial intelligence in online pokies. - Technology Org

The integration of machine learning and advanced algorithms has brought about a new level of excitement and sophistication to the gaming industry. Not only has it made the gaming experience more enjoyable, but it has also made it more engaging by providing personalized gaming.

There are many benefits of using AI-powered features in the pokies online real money Australia, and below, we will describe some of them.

Casino – illustrative photo. Image credit: Esteban López via Unsplash, free license

Personalized Gaming Experience: Tailoring Gameplay to Player Preferences

AI-powered algorithms are designed to analyze player data and create a personalized gaming experience. AI may be regarded as a virtual concierge, sifting through players’ past preferences and carefully curating games based on their tastes.

Personalized features include various aspects, such as:

recommended games,

bonus offers, and

gameplay suggestions.

With AI acting as a virtual scout, players can be assured that they will get gaming experiences that are tailor-made just for them.

Adaptive Gameplay Mechanics: Dynamic Adjustments for Optimal Experience

AI optimizes the mechanics au online pokies based on players’ behavior and preferences. This adaptive feature allows game developers to create a more personalized gaming experience for their users. AI can adjust the game’s difficulty level based on the player’s skill level, making the game more challenging for experienced players while ensuring that new players aren’t overwhelmed.

Moreover, AI can customize the game’s bonus rounds. In addition to enhancing the gameplay mechanics, AI can also improve the game’s visual components.

Predictive Analytics: Anticipating Player Needs and Preferences

Predictive analytics is a powerful tool that enables operators to gain valuable insights into player behavior, market trends, and campaign performance. By analyzing vast amounts of data using AI algorithms, predictive analytics can provide highly accurate predictions that enable operators to make informed decisions.

For example, operators can quickly pivot their marketing campaigns if predictive analytics indicate a rising trend in adventure-themed slots. In addition, predictive analytics can help operators optimize their promotions and rewards programs.

Real-time Data Analysis: Enhancing Game Performance and Rewards

With the help of AI-powered real-time data analysis, online casinos can optimize game performance and rewards. In particular, casinos can make dynamic adjustments to odds in real-time, ensuring the game remains challenging and exciting for players. Additionally, operators can offer personalized rewards to players based on their gaming behavior and preferences.

Future Trends and Implications

Artificial intelligence is changing the world of gambling and its role in the gambling industry is expected to reach new heights in 2024. Today’s casino online pokies provide a personalized, dynamic, and immersive gaming experience.

However, while AI has transformative potential in the gambling industry, it is essential to remember the importance of responsible gambling.

#2024#ai#AI-powered#Algorithms#Analysis#Analytics#artificial#Artificial Intelligence#Australia#Behavior#casino#data#data analysis#developers#Experienced#Features#Fintech news#Future#gambling#game#games#gaming#gaming industry#Industry#insights#integration#intelligence#it#learning#Machine Learning

0 notes

Text

AI in Finance Summit New York 2025

AI & Blockchain Are Changing the Game in Finance! 🤖 The AI in Finance Summit New York 2025 (April 15-16) will explore how AI, blockchain, and deep learning are revolutionizing banking and fintech.

✨ What’s in it for you? 🔹 Learn how AI detects fraud and enhances security 🔹 Meet top AI leaders and blockchain innovators 🔹 Stay ahead of industry trends in AI-powered finance

If you want to understand the future of finance, this is the place to be!

5 notes

·

View notes

Text

Exploring AI's Benefits in Fintech

The integration of artificial intelligence (AI) in the financial technology (fintech) sector is bringing about significant changes. From enhancing customer service to optimizing financial operations, AI is revolutionizing the industry. Chatbots, a prominent AI application in fintech, offer personalized and efficient customer interactions. This article explores the various benefits AI brings to fintech.

Enhanced Customer Experience

AI-powered chatbots and virtual assistants are revolutionizing customer service in fintech. These tools provide 24/7 support, handle multiple queries simultaneously, and deliver instant responses, ensuring customers receive timely assistance. AI systems continually learn from interactions, improving their efficiency and effectiveness over time.

Superior Fraud Detection

Fraud detection is crucial in the financial sector, and AI excels in this area. AI systems analyze vast amounts of transaction data in real time, identifying unusual patterns and potential fraud more accurately than traditional methods. Machine learning algorithms effectively recognize subtle signs of fraudulent activity, mitigating risks and protecting customers.

Personalized Financial Services

AI enables fintech companies to offer highly personalized services. By analyzing customer data, AI provides tailored financial advice, recommends suitable investment opportunities, and creates customized financial plans. This level of personalization helps build stronger customer relationships and enhances satisfaction.

Enhanced Risk Management

AI-driven analytics significantly enhance risk management. By processing large datasets and identifying trends, AI can predict and assess risks more accurately than human analysts. This enables financial institutions to make informed decisions and manage risks more effectively.

Automation of Routine Tasks

AI automates many routine and repetitive tasks in fintech, such as data entry, account reconciliation, and compliance checks. This reduces the workload for employees and minimizes the risk of human errors. Automation leads to greater operational efficiency and allows staff to focus on strategic activities.

Advanced Investment Strategies

AI revolutionizes investment strategies by providing precise, data-driven insights. Algorithmic trading, powered by AI, analyzes market conditions and executes trades at optimal times. Additionally, AI tools assist investors in making better decisions by forecasting market trends and identifying lucrative opportunities.

In-Depth Customer Insights

AI provides fintech companies with deeper insights into customer behavior and preferences. By analyzing transaction history, spending patterns, and other relevant data, AI predicts customer needs and offers proactive solutions. This level of insight is invaluable for targeted marketing strategies and improving customer retention.

Streamlined Loan and Credit Processes

AI streamlines loan and credit approval processes by automating credit scoring and underwriting. AI algorithms quickly assess an applicant’s creditworthiness by analyzing various factors, such as income, credit history, and spending habits. This results in faster loan approvals and a more efficient lending process.

Conclusion

AI is transforming the fintech industry by improving efficiency, enhancing customer experiences, and providing valuable insights. As technology advances, the role of AI in fintech will grow, driving further innovation and growth. Embracing AI solutions is essential for financial institutions to stay competitive in this rapidly changing landscape.

8 notes

·

View notes

Text

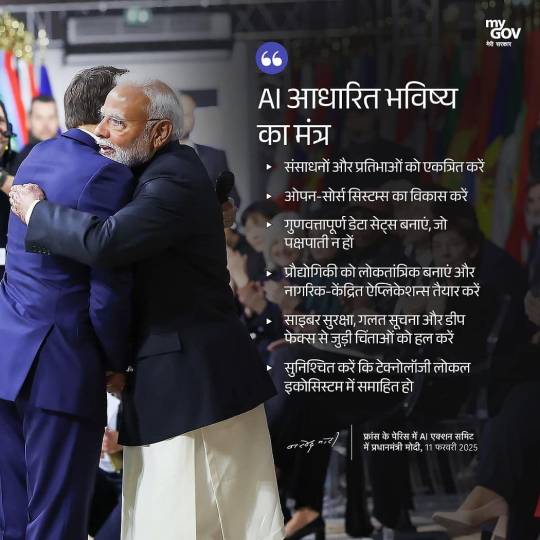

AI-Based Future Mantra: Col Rajyavardhan Rathore’s Vision for Innovation & Growth 🤖🚀

In an era where Artificial Intelligence (AI) is reshaping industries, economies, and societies, Col Rajyavardhan Singh Rathore envisions a future-driven, innovation-led India that embraces AI to power growth, governance, and global competitiveness. His AI-based Future Mantra focuses on leveraging AI for digital transformation, job creation, industry modernization, and national security, ensuring India emerges as a leader in the AI revolution.

🌟 Key Pillars of Col Rathore’s AI Vision

1️⃣ AI-Driven Digital India: Transforming Governance & Public Services

✅ AI-powered e-Governance — Enhancing efficiency, transparency & citizen services. ✅ Smart City Development — AI-based urban planning, traffic management & waste control. ✅ Predictive Analytics for Policy Making — Data-driven decision-making for better governance.

“AI is the key to revolutionizing governance and making citizen services more efficient, accessible, and transparent.”

2️⃣ AI for Industry & Economic Growth: Powering Smart Enterprises

✅ AI in Manufacturing & MSMEs — Enhancing productivity & automation. ✅ AI-powered Startups & Innovation Hubs — Supporting entrepreneurs with next-gen AI solutions. ✅ Boosting IT, Fintech & Smart Commerce — Strengthening India’s global digital economy presence.

“AI is not about replacing jobs; it’s about creating new opportunities, industries, and careers.”

3️⃣ AI in Agriculture: Revolutionizing Rural Economy 🌾🤖

✅ Smart Farming with AI — Precision agriculture & automated irrigation. ✅ AI-based Crop Monitoring & Forecasting — Reducing farmer losses & improving productivity. ✅ Digital Marketplaces for Farmers — Connecting rural producers to global markets.

“AI can empower farmers with knowledge, tools, and predictive analytics to revolutionize Indian agriculture.”

4️⃣ AI in Education & Skill Development: Empowering Youth for Future Jobs 🎓💡

✅ AI-driven Personalized Learning — Smart classrooms & adaptive learning systems. ✅ AI Upskilling Programs — Training youth in AI, robotics & machine learning. ✅ AI-Powered Job Market Platforms — Connecting talent with industries using AI analytics.

“The future belongs to those who master AI. We must equip our youth with the skills to lead in the AI economy.”

5️⃣ AI in National Security & Defense: A Smarter, Safer India 🛡️🚀

✅ AI in Cybersecurity — Advanced threat detection & prevention. ✅ AI-powered Surveillance & Defense Tech — Strengthening India’s armed forces. ✅ AI in Disaster Management — Early warning systems & crisis response automation.

“AI is the force multiplier for India’s defense and security strategy in the 21st century.”

🚀 The Road Ahead: Col Rathore’s Action Plan for AI-Driven Growth

🔹 AI Policy & Infrastructure Development — Strengthening India’s AI ecosystem. 🔹 Public-Private Partnerships for AI Innovation — Encouraging global collaborations. 🔹 AI Talent & Research Investments — Making India a global hub for AI development. 🔹 Ethical AI & Responsible Innovation — Ensuring AI benefits all sections of society.

“AI is India’s gateway to a smarter, more efficient, and innovative future. Let’s lead the way!” 🚀

🌍 India’s AI Future: Leading the Global Innovation Wave

✅ AI-powered industries, smart cities, and a digital economy. ✅ Next-gen job creation & future-ready workforce. ✅ Stronger governance, national security, and agriculture. ✅ A global AI leader driving innovation & inclusivity.

🔥 “AI is not just a tool — it’s the future. And India will lead it!” 🤖 Jai Hind! Jai Innovation! 🇮🇳🚀

4 notes

·

View notes