#features of merchant banking

Explore tagged Tumblr posts

Text

What Are 3 Examples of Merchant Banks?

#What Are 3 Examples of Merchant Banks?#merchant banking#services of merchant banking#functions of merchant banking#what is merchant banking#scope of merchant banking#meaning of merchant banking#merchant banking in india#features of merchant banking#merchant banking bcom#complete topic of merchant banking#activities of merchant banker#qualities of merchant banking#role of merchant bankers#role of merchant banking#objectives of merchant banking#advantages of merchant banking#merchant bank

1 note

·

View note

Text

Resistance Banker: Walraven van Hall

$250 Million Heist

Walraven van Hall was a Dutch banker whose brains, bravery, and unwavering moral compass saved thousands of Jews and anti-Nazi resistance fighters during the German occupation of the Netherlands.

Walraven was born to a prominent Dutch family in Haarlem, the Netherlands, in 1906. The dream of his youth was to join the merchant marine and see the world, but because of poor eyesight his application was rejected. Instead Walraven moved to New York City, and with the help of his brother Gijs, a banker (and future mayor of Amsterdam), Walraven got a job on Wall Street. After learning the ropes of the banking industry, Walraven returned to the Netherlands and worked as a banker and stockbroker.

In 1940, Germany invaded the Netherlands. Among those affected by this calamitous event were families of merchant sailors who were unable to return home. Walraven and his brother Gijs created a fund to help these families pay their bills. The fund was guaranteed by the Dutch government-in-exile in London.

It didn’t take long after occupying Holland for the Nazis to start enacting anti-Jewish regulations, taking away Dutch Jews’ most basic liberties and conscripting them into forced labor camps and later, death camps. (Ultimately, 75% of Dutch Jews were murdered by the Nazis.) As the persecution intensified, so did the anti-Nazi resistance movement. Walraven expanded his fund to support a wide range of resistance activities, with a particular emphasis on helping Dutch Jews. He tapped into his network of wealthy Dutch citizens to fundraise and quickly became known as the “banker to the resistance.”

For three years, Walraven funded the Dutch resistance, providing about $500 million (!) to save Jews and other victims of the Nazis. How did Walraven, with his brother’s help, raise such a massive amount of money? Incredibly, they obtained $250 million by robbing De Nederlandsche Bank (Dutch National Bank), the biggest bank heist in European history. The details of how they achieved this are complicated, involving multiple shell companies, fake documents, bureaucrats who were friendly to the cause, and cooperation between a wide network of resistance organizations. Walraven was known as the Olieman (Oilman) because his warmth and charisma lubricated the friction between various resistance groups and fighters. The rest of the money was supplied by donations and loans from generous Dutch people who were outraged by the Nazi atrocities taking place in their country.

The complete story of how Walraven raised so much money may never be known, but one of his tricks was falsifying bank bonds and exchanging them for real bonds, and then paper money. He did this right under the nose of bank president Rost van Tonningen, a prominent Nazi who collaborated with the German occupiers.��The money Walraven collected was used to secretly house and support over 8000 Jews in hiding, conduct acts of sabotage against Nazi targets in Holland, and rescue captured Allied pilots.

In January 1945, Walraven was arrested by the Germans, along with seven other resistance fighters, in revenge for the death of a police commander. All eight were quickly executed without trial. Ironically, the Germans had no idea who Walraven was; they assumed he was just another resistance fighter rather than the banker and leader who made so much resistance activity possible.

Posthumously, Walraven received several honors including the Dutch Cross of Resistance and the U.S. Medal of Freedom. He was honored as Righteous Among the Nations by Israeli Holocaust Memorial Yad Vashem in 1978. However, Walraven’s brave deeds were not widely known until recently, possibly because powerful banks didn’t want people to know the secrets of how they were robbed.

In 2018, Dutch director Joram Lursen released “The Resistance Banker,” a feature film about Walraven van Hall that became one of the highest-grossing Dutch films of all time. Joram said in an interview with the Jewish Telegraph Agency (JTA), “When people think of the resistance.. they rarely think of the enormous amounts of money that it cost to keep this organization – the resistance – running.” He likened his film to a Hollywood action film, characterizing it as “easy to follow and full of suspense as a casino heist.” The film is available on Netflix.

For saving thousands of lives by funding the Dutch resistance to Nazi occupation, we honor Walraven van Hall as this week’s Thursday Hero.

41 notes

·

View notes

Text

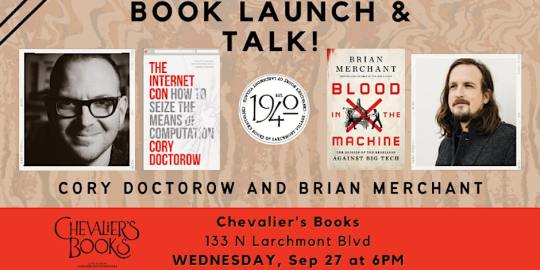

On September 22, I'm (virtually) presenting at the DIG Festival in Modena, Italy. On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

It's been 21 years since Bill Willingham launched Fables, his 110-issue, wide-ranging, delightful and brilliantly crafted author-owned comic series that imagines that the folkloric figures of the world's fairytales are real people, who live in a secret society whose internal struggles and intersections with the mundane world are the source of endless drama.

Fables is a DC Comics title; DC is division of the massive entertainment conglomerate Warners, which is, in turn, part of the Warner/Discovery empire, a rapacious corporate behemoth whose screenwriters have been on strike for 137 days (and counting). DC is part of a comics duopoly; its rival, Marvel, is a division of the Disney/Fox juggernaut, whose writers are also on strike.

The DC that Willingham bargained with at the turn of the century isn't the DC that he bargains with now. Back then, DC was still subject to a modicum of discipline from competition; its corporate owner's shareholders had not yet acquired today's appetite for meteoric returns on investment of the sort that can only be achieved through wage-theft and price-gouging.

In the years since, DC – like so many other corporations – participated in an orgy of mergers as its sector devoured itself. The collapse of comics into a duopoly owned by studios from an oligopoly had profound implications for the entire sector, from comic shops to comic cons. Monopoly breeds monopoly, and the capture of the entire comics distribution system by a single company – Diamond – was attended by the capture of the entire digital comics market by a single company, Amazon, who enshittified its Comixology division, driving creators and publishers into Kindle Direct Publishing, a gig-work platform that replicates the company's notoriously exploitative labor practices for creative workers. Today, Comixology is a ghost-town, its former employees axed in a mass layoff earlier this year:

https://gizmodo.com/amazon-layoffs-comixology-1850007216

When giant corporations effect these mergers, they do so with a kind of procedural kabuki, insisting that they are dotting every i and crossing every t, creating a new legal entity whose fictional backstory is a perfect, airtight bubble, a canon with not a single continuity bug. This performance of seriousness is belied by the behind-the-scenes chaos that these corporate shifts entail – think of the way that the banks that bought and sold our mortgages in the run-up to the 2008 crisis eventually lost the deeds to our houses, and then just pretended they were legally entitled to collect money from us every month – and steal our houses if we refused to pay:

https://www.reuters.com/article/idINIndia-58325420110720

Or think of the debt collection industry, which maintains a pretense of careful record-keeping as the basis for hounding and threatening people, but which is, in reality, a barely coherent trade in spreadsheets whose claims to our money are matters of faith:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

For usury, the chaos is a feature, not a bug. Their corporate strategists take the position that any ambiguity should be automatically resolved in their favor, with the burden of proof on accused debtors, not the debt collectors. The scumbags who lost your deed and stole your house say that it's up to you to prove that you own it. And since you've just been rendered homeless, you don't even have a house to secure a loan you might use to pay a lawyer to go to court.

It's not solely that the usurers want to cheat you – it's that they can make more money if they don't pay for meticulous record-keeping, and if that means that they sometimes cheat us, that's our problem, not theirs.

While this is very obvious in the usury sector, it's also true of other kinds of massive mergers that create unfathomnably vast conglomerates. The "curse of bigness" is real, but who gets cursed is a matter of power, and big companies have a lot more power.

The chaos, in other words, is a feature and not a bug. It provides cover for contract-violating conduct, up to and including wage-theft. Remember when Disney/Marvel stole money from beloved science fiction giant Alan Dean Foster, whose original Star Wars novelization was hugely influential on George Lucas, who changed the movie to match Foster's ideas?

Disney claimed that when it acquired Lucasfilm, it only acquired its assets, but not its liabilities. That meant that while it continued to hold Foster's license to publish his novel, they were not bound by an obligation to pay Foster for this license, since that liability was retained by the (now defunct) original company:

https://pluralistic.net/2022/04/30/disney-still-must-pay/#pay-the-writer

For Disney, this wage-theft (and many others like it, affecting writers with less fame and clout than Foster) was greatly assisted by the chaos of scale. The chimera of Lucas/Disney had no definitive responsible party who could be dragged into a discussion. The endless corporate shuffling that is normal in giant companies meant that anyone who might credibly called to account for the theft could be transfered or laid off overnight, with no obvious successor. The actual paperwork itself was hard for anyone to lay hands on, since the relevant records had been physically transported and re-stored subsequent to the merger. And, of course, the company itself was so big and powerful that it was hard for Foster and his agent to raise a credible threat.

I've experienced versions of this myself: every book contract I've ever signed stipulated that my ebooks could not be published with DRM. But one of my publishers – a boutique press that published my collection Overclocked – collapsed along with most of its competitors, the same week my book was published (its distributor, Publishers Group West, went bankrupt after its parent company, Advanced Marketing Services, imploded in a shower of fraud and criminality).

The publisher was merged with several others, and then several more, and then several more – until it ended up a division of the Big Five publisher Hachette, who repeatedly, "accidentally" pushed my book into retail channels with DRM. I don't think Hachette deliberately set out to screw me over, but the fact that Hachette is (by far) the most doctrinaire proponent of DRM meant that when the chaos of its agglomerated state resulted in my being cheated, it was a happy accident.

(The Hachette story has a happy ending; I took the book back from them and sold it to Blackstone Publishing, who brought out a new expanded edition to accompany a DRM-free audiobook and ebook):

https://www.blackstonepublishing.com/overclocked-bvej.html

Willingham, too, has been affected by the curse of bigness. The DC he bargained with at the outset of Fables made a raft of binding promises to him: he would have approval over artists and covers and formats for new collections, and he would own the "IP" for the series, meaning the copyrights vested in the scripts, storylines, characters (he might also have retained rights to some trademarks).

But as DC grew, it made mistakes. Willingham's hard-fought, unique deal with the publisher was atypical. A giant publisher realizes its efficiencies through standardized processes. Willingham's books didn't fit into that standard process, and so, repeatedly, the publisher broke its promises to him.

At first, Willingham's contacts at the publisher were contrite when he caught them at this. In his press-release on the matter, Willingham calls them "honest men and women of integrity [who] interpreted the details of that agreement fairly and above-board":

https://billwillingham.substack.com/p/willingham-sends-fables-into-the

But as the company grew larger, these counterparties were replaced by corporate cogs who were ever-more-distant from his original, creator-friendly deal. What's more, DC's treatment of its other creators grew shabbier at each turn (a dear friend who has written for DC for decades is still getting the same page-rate as they got in the early 2000s), so Willingham's deal grew more exceptional as time went by. That meant that when Willingham got the "default" treatment, it was progressively farther from what his contract entitled him to.

The company repeatedly – and conveniently – forgot that Willingham had the final say over the destiny of his books. They illegally sublicensed a game adapted from his books, and then, when he objected, tried to make renegotiating his deal a condition of being properly compensated for this theft. Even after he won that fight, the company tried to cheat him and then cover it up by binding him to a nondisclosure agreement.

This was the culmination of a string of wage-thefts in which the company misreported his royalties and had to be dragged into paying him his due. When the company "practically dared" Willingham to sue ("knowing it would be a long and debilitating process") he snapped.

Rather than fight Warner, Willingham has embarked on what JWZ calls an act of "absolute table-flip badassery" – he has announced that Fables will hereafter be in the public domain, available for anyone to adapt commercially, in works that compete with whatever DC might be offering.

Now, this is huge, and it's also shrewd. It's the kind of thing that will bring lots of attention on Warner's fraudulent dealings with its creative workforce, at a moment where the company is losing a public relations battle to the workers picketing in front of its gates. It constitutes a poison pill that is eminently satisfying to contemplate. It's delicious.

But it's also muddy. Willingham has since clarified that his public domain dedication means that the public can't reproduce the existing comics. That's not surprising; while Willingham doesn't say so, it's vanishingly unlikely that he owns the copyrights to the artwork created by other artists (Willingham is also a talented illustrator, but collaborated with a who's-who of comics greats for Fables). He may or may not have control over trademarks, from the Fables wordmark to any trademark interests in the character designs. He certainly doesn't have control over the trademarked logos for Warner and DC that adorn the books.

When Willingham says he is releasing the "IP" to his comic, he is using the phrase in its commercial sense, not its legal sense. When business people speak of "owning IP," they mean that they believe they have the legal right to control the conduct of their competitors, critics and customers:

https://locusmag.com/2020/09/cory-doctorow-ip/

The problem is that this doesn't correspond to the legal concept of IP, because IP isn't actually a legal concept. While there are plenty of "IP lawyers" and even "IP law firms," there is no "IP law." There are many laws that are lumped together under "IP," including the big three (trademark, copyright and patent), but also a bestiary of obscure cousins and subspecies – trade dress, trade secrecy, service marks, noncompetes, nondisclosues, anticirumvention rights, sui generis "neighboring rights" and so on.

The job of an "IP lawyer" is to pluck individual doctrines from this incoherent scrapheap of laws and regulations and weave them together into a spider's web of tripwires that customers and critics and competitors can't avoid, and which confer upon the lawyer's client the right to sue for anything that displeases them.

When Willingham says he's releasing Fables into the public domain, it's not clear what he's releasing – and what is his to release. In the colloquial, business sense of "IP," saying you're "releasing the IP" means something like, "Feel free to create adaptations from this." But these adaptations probably can't draw too closely on the artwork, or the logos. You can probably make novelizations of the comics. Maybe you can make new comics that use the same scripts but different art. You can probably make sequels to, or spinoffs of, the existing comics, provided you come up with your own character designs.

But it's murky. Very murky. Remember, this all started because Willingham didn't have the resources or patience to tangle with the rabid attack-lawyers Warners keeps kenneled on its Burbank lot. Warners can (and may) release those same lawyers on you, even if you are likely to prevail in court, betting that you – like Willingham – won't have the resources to defend yourself.

The strange reality of "IP" rights is that they can be secured without any affirmative step on your part. Copyrights are conjured into existence the instant that a new creative work is fixed in a tangible medium and endure until the creator's has been dead for 70 years. Common-law trademarks gradually come into definition like an image appearing on photo-paper in a chemical soup, growing in definition every time they are used, even if the mark's creator never files a form with the USPTO.

These IP tripwires proliferate in the shadows, wherever doodles are sketched on napkins, wherever kindergartners apply finger-paint to construction-paper. But for all that they are continuously springing into existence, and enduring for a century or more, they are absurdly hard to give away.

This was the key insight behind the Creative Commons project: that while the internet was full of people saying "no copyright" (or just assuming the things they posted were free for others to use), the law was a universe away from their commonsense assumptions. Creative Commons licenses were painstakingly crafted by an army of international IP lawyers who set out to turn the normal IP task on its head – to create a legal document that assured critics, customers and competitors that the licensor had no means to control their conduct.

20 years on, these licenses are pretty robust. The flaws in earlier versions have been discovered and repaired in subsequent revisions. They have been adapted to multiple countries' legal systems, allowing CC users to mix-and-match works from many territories – animating Polish sprites to tell a story by a Canadian, set to music from the UK.

Willingham could clarify his "public domain" dedication by applying a Creative Commons license to Fables, but which license? That's a thorny question. What Willingham really wants here is a sampling license – a license that allows licensees to take some of the elements of his work, combine them with other parts, and make something new.

But no CC license fits that description. Every CC license applies to whole works. If you want to license the bass-line from your song but not the melody, you have to release the bass-line separately and put a CC license on that. You can't just put a CC license on the song with an asterisked footnote that reads "just the bass, though."

CC had a sampling license: the "Sampling Plus 1.0" license. It was a mess. Licensees couldn't figure out what parts of works they were allowed to use, and licensors couldn't figure out how to coney that. It's been "retired."

https://creativecommons.org/licenses/sampling+/1.0/

So maybe Willingham should create his own bespoke license for Fables. That may be what he has to do, in fact. But boy is that a fraught business. Remember the army of top-notch lawyers who created the CC licenses? They missed a crucial bug in the first three versions of the license, and billions of works have been licensed under those earlier versions. This has enabled a mob of crooked copyleft trolls (like Pixsy) to prey on the unwary, raking in a fortune:

https://doctorow.medium.com/a-bug-in-early-creative-commons-licenses-has-enabled-a-new-breed-of-superpredator-5f6360713299

Making a bug-free license is hard. A failure on Willingham's part to correctly enumerate or convey the limitations of such a license – to list which parts of Fables DC might sue you for using – could result in downstream users having their hard work censored out of existence by legal threats. Indeed, that's the best case scenario – defects in a license could result in downstream users, their collaborators, investors, and distributors being sued for millions of dollars, costing them everything they have, up to and including their homes.

Which isn't to say that this is dead on arrival – far from it! Just that there is work to be done. I can't speak for Creative Commons (it's been more than 20 years since I was their EU Director), but I'm positive that there are copyfighting lawyers out there who'd love to work on a project like this.

I think Willingham is onto something here. After all, Fables is built on the public domain. As Willingham writes in his release: "The current laws are a mishmash of unethical backroom deals to keep trademarks and copyrights in the hands of large corporations, who can largely afford to buy the outcomes they want."

Willingham describes how his participation in the entertainment industry has made him more skeptical of IP, not less. He proposes capping copyright at 20 years, with a single, 10-year extension for works that are sold onto third parties. This would be pretty good industrial policy – almost no works are commercially viable after just 14 years:

https://rufuspollock.com/papers/optimal_copyright.pdf

But there are massive structural barriers to realizing such a policy, the biggest being that the US had tied its own hands by insisting that long copyright terms be required in the trade deals it imposed on other countries, thereby binding itself to these farcically long copyright terms.

But there is another policy lever American creators can and should yank on to partially resolve this: Termination. The 1976 Copyright Act established the right for any creator to "terminate" the "transfer" of any copyrighted work after 30 years, by filing papers with the Copyright Office. This process is unduly onerous, and the Authors Alliance (where I'm a volunteer advisor) has created a tool to simplify it:

https://www.authorsalliance.org/resources/rights-reversion-portal/

Termination is deliberately obscure, but it's incredibly powerful. The copyright scholar Rebecca Giblin has studied this extensively, helping to produce the most complete report on how termination has been used by creators of all types:

https://pluralistic.net/2021/10/04/avoidance-is-evasion/#reverted

Writers, musicians and other artists have used termination to unilaterally cancel the crummy deals they had crammed down their throats 30 years ago and either re-sell their works on better terms or make them available directly to the public. Every George Clinton song, every Sweet Valley High novel, and the early works of Steven King have all be terminated and returned to their creators.

Copyright termination should and could be improved. Giblin and I wrote a whole-ass book about this and related subjects, Chokepoint Capitalism, which not only details the scams that writers like Willingham are subject to, but also devotes fully half its length to presenting detailed, technical, shovel-ready proposals for making life better for creators:

https://chokepointcapitalism.com/

Willingham is doing something important here. Larger and larger entertainment firms offer shabbier and shabbier treatment to creative workers, as striking members of the WGA and SAG-AFTRA can attest. Over the past year, I've seen a sharp increase in the presence of absolutely unconscionable clauses in the contracts I'm offered by publishers:

https://pluralistic.net/2022/06/27/reps-and-warranties/#i-agree

I'm six months into negotiating a contract for a 300 word piece I wrote for a magazine I started contributing to in 1992. At issue is that they insist that I assign film rights and patent rights from my work as a condition of publication. Needless to say, there are no patentable inventions nor film ideas in this article, but they refuse to vary the contract, to the obvious chagrin of the editor who commissioned me.

Why won't they grant a variance? Why, they are so large – the magazine is part of a global conglomerate – that it would be impractical for them to track exceptions to this completely fucking batshit clause. In other words: we can't strike this batshit clause because we decided that from now on, all out contracts will have batshit clauses.

The performance of administrative competence – and the tactical deployment of administrative chaos – among giant entertainment companies is grotesque, but every now and again, it backfires.

That's what's happening at Marvel right now. The estates of Marvel founder Stan Lee and its seminal creator Steve Ditko are suing Marvel to terminate the transfer of both creators' characters to Marvel. If they succeed, Marvel will lose most of its most profitable characters, including Iron Man:

https://www.reuters.com/legal/marvel-artists-estate-ask-pre-trial-wins-superhero-copyright-fight-2023-05-22/

They're following in the trail of the Jack Kirby estate, whom Marvel paid millions to rather than taking their chances with the Supreme Court.

Marvel was always an administrative mess, repeatedly going bankrupt. Its deals with its creators were indifferently papered over, and then Marvel lost a lot of the paperwork. I'd bet anything that many of the key documents Disney (Marvel's owner) needs to prevail over Lee and Ditko are either unlocatable or destroyed – or never existed in the first place.

A more muscular termination right – say, one that kicks in after 20 years, and is automatic – would turn circuses like Marvel-Lee/Ditko into real class struggles. Rather than having the heirs of creators reaping the benefit of termination, we could make termination into a system for getting creators themselves paid.

In the meantime, there's Willingham's "absolute table-flip badassery."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/15/fairy-use-tales/#sampling-license

Image: Tom Mrazek (modified) https://commons.wikimedia.org/wiki/File:An_Open_Field_%2827220830251%29.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/deed.en

--

Penguin Random House (modified) https://www.penguinrandomhouse.com/books/707161/fables-20th-anniversary-box-set-by-bill-willingham/

Fair use https://www.eff.org/issues/intellectual-property

#pluralistic#fables#comics#graphic novels#dc#warner#monopoly#publishing#chokepoint capitalism#poison pills#ip#bill willingham#public domain#copyright#copyfight#creative commons#licenses#copyleft trolls

242 notes

·

View notes

Text

okay I think we should take inventory of what we learned about Marius's house.

In fact, the impression was one of comfortable messiness.

(i think the tiktok kids started calling ADHD clutter clustering or something LMAO marius de romanus cluster girlie i guess. thanks i hate it)

Here's some stuff that Marius had on his island!!!!!!!

stone benches

a lighted oil lamp on a stand

a pair of heavy wooden doors

a sarcophagus with a plain lid, cleanly fashioned out of diorite

The lid plated in iron and contained

a golden mask, its features carefully molded, attached to a hood made up of layered plates of hammered gold.

a pair of leather gloves covered completely in tinier more delicate gold plates like scales.

a large folded blanket of the softest red wool with one side sewn with larger gold plates

Magnificent Grecian urns on pedestals in the corridors

great bronze statues from the Orient

exquisite plants at every window and terrace open to the sky.

Gorgeous rugs from India, Persia, China c

giant stuffed beasts mounted in lifelike attitudes-

--the brown bear,

--the lion,

--the tiger,

--even the elephant standing in his own immense chamber,

--lizards as big as dragons,

--birds of prey clutching dried branches made to look like the limbs of real trees.

brilliantly colored murals covering every surface from floor to ceiling

a dark vibrant painting of the sunburnt Arabian desert complete with an exquisitely detailed caravan of camels and turbaned merchants moving over the sand

a jungle warming with delicately rendered tropical blossoms, vines, carefully drawn leaves

creatures everywhere in the texture of the jungle-

--insects,

--birds,

--worms in the soil-

too many monkeys in the jungle,

too many bugs crawling on the leaves.

thousands of tiny insects in one painting of a summer sky.

a large gallery walled on either side by painted men and women staring at me

Figures from all ages these were-

--bedouins,

--Egyptians,

--Greeks and Romans,

--knights in armor,

--peasants

--kings

--queens.

--Renaissance people in doublets and leggings,

--the Sun King with his massive mane of curls,

--people of our own age.

droplets of water clinging to a cape,

the cut on the side of a face,

the spider half-crushed beneath a polished leather boot.

a library, blazing with light.

Walls and walls of books and

rolled manuscripts,

giant glistening world globes in their wooden cradles,

busts of the ancient Greek gods and goddesses,

great sprawling maps.

Newspapers in all languages lay in stacks on tables.

Fossils,

mummified hands,

exotic shells.

bouquets of dried flowers,

figurines and fragments of old sculpture,

alabaster jars covered with Egyptian hieroglyphs.

comfortable chairs with footstools,

candelabra or oil lamps.

a forest of cages.

birds of all sizes and colors

monkeys

baboons,

Potted plants crowded against the cages-

--ferns and

--banana trees,

--cabbage roses,

--moonflower,

--jasmine,

--other sweetly fragrant nighttime vines.

purple and white orchids,

waxed flowers that trapped insects in their maw,

little trees groaning with peaches and lemons and pears.

a hall of sculptures equal to any gallery in the Vatican museum.

adjoining chambers full of paintings,

Oriental furnishings,

mechanical toys.

fine rosewood paneling with framed mirrors rising to the ceiling.

painted chests,

upholstered chairs,

dark and lush landscapes,

porcelain clocks.

A small collection of books in the glass-doored bookcases,

a newspaper of recent date lying on a small table beside a brocaded winged chair.

the stone terrace. where banks of white lilies and red roses gave off their powerful perfume.

a pair of winged chairs that faced each other

a dozen or so candelabra and sconces on the paneled walls.

brocade cushions

#marius de romanus#tvl quotes#the vampire lestat#marius's elephant tag#tag urself im worms in the soil#Vampire chronicles

27 notes

·

View notes

Text

You decide to investigate the sound, finishing your sandwich and standing as you pull your bag and water skin onto your shoulders, stepping back onto the bank and looking around you.

" Psst... Psst!"

That third one caused you to look directly down into the yellow eyes of a river mermaid.

Knowledge was power, so you knew from the books you had studied and brought that they were common enough in this river.

Whether or not they were friendly was a whole other separate matter.

Since you were practically on top of it, you took a step back, seeing them flicking their tail from side to side, the colors of river stones, as the mermaid's androgynous features including mossy green hair that framed those big yellow eyes.

" What are you doing this far out, human?" The river mermaid asked, leaning onto the bank as you took another step back, cautious, " Not a scratch on you either... You seem quite lucky."

Their eyes flicked over you again, settling on the white and red rose you had kept away from the Mushroom Merchant.

" So far away from Home, little human... A shame for you that a protective charm from small fry doesn't protect you from me."

It was then they lashed out, grasping your ankles with surprising force, yanking you down as you landed on your bag, dragging at you.

With alarm, you kicked the mermaid as best as you could, but it's sharp nails used to spear fish sunk deeper into your ankles, your cry enough to stir whatever birds didn't leave from the loud splash and grab.

You yanked at your legs as your nails dug into the pebbled earth of the bank, the land way too soft for your fingers as their own raked down your flesh, causing you to cry out again as it gave a fierce pull, submerging your lower half into the river with it, closer to it's face as it gave a sharp, near carnivorous grin.

" I haven't had human in a long time, especially in such a pristine state! I'll make sure to savor every-"

Thunk! Splt!

You jolt as a splatter of deep blue blood splashes across your face.

The mermaid's face is frozen in a grin, even though one of it's eyes is shot out from a crossbow bolt to the back of the head.

You look up, seeing a figure on the other bank.

He stood there with his feet planted firmly on the ground, lowering his crossbow.

Cold night blue eyes stare at the creature, framed by dark brown hair in a half-up half-down style.

The taller figure lowers his crossbow, showing the basic silver armor he was wearing, along with the night blue that matched his eyes.

With it were a heavy pair of earrings that hung from pointed ears, that and his woodsy skin tone showing off that he was a wood elf.

After a beat, he softened a tad, walking over to the river, using your shock of the whole thing to hop over rocks to you.

" Hey." He gave a small smile to you, as if to assure you it was okay as he knelt down and grasped the bolt, yanking it out, " I'm sorry you had to see that, are you okay? Can I help you get their nails out?"

Tags: @abrokecupoftea, @one-really-annoying-tree-rat

7 notes

·

View notes

Text

Ivalice is segmented into nine regions, each characterized by its unique climate, topographical features, and quality of mist, collectively shaping the vibrant and diverse environment of the world.

Region Guide: Deserts of Dalmasca

This expansive desert dominates most of the Dalmasca region, featuring the typical rugged landscape with scattered bedrock formations. It is divided into two main sections, Estersand and Westersand, with the royal capital Rabanastre situated in the middle.

Estersand serves as a vital hub with established trade routes connecting Rabanastre and Nalbina, facilitating the passage of diverse travelers through the desert. Villages on both banks of the Nebra River, which courses through the heart of the desert, offer resting spots for many merchants on their desert journeys. In contrast, Westersand is infamous for its fierce sandstorms and sees fewer travelers as it lacks direct connections to other cities. The western edge of the desert leads to the Ogir-Yensa Sandsea, a region abandoned even by the Rozarrian Empire.

27 notes

·

View notes

Text

Discussing POS & Merchant Payment Processing

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the fast-evolving digital landscape of today, the capacity to welcome credit card payments is a paramount necessity for businesses of all sizes. Merchant account processing and payment processing have ushered in a transformation in the world of commercial transactions, reshaping the dynamics of buying and selling goods and services. Let's explore the realm of point of sale (POS) systems and merchant payment processing to comprehend their significance and the array of benefits they offer to your business.

Merchant Account Processing: The Solid Foundation of Success Merchant account processing acts as the bedrock upon which any thriving business is built. This indispensable service empowers businesses to securely accept credit card payments. With the explosive growth of online shopping and the dwindling popularity of cash transactions, having a merchant account has shifted from a choice to a fundamental necessity. These accounts establish a pivotal link between your business and the vast payment processing network, making it possible to accept a wide spectrum of payment methods, including credit cards and debit cards.

The Power of Embracing Credit Cards Opting to embrace credit card payments can be a game-changing decision for your business. It has the potential to expand your customer base significantly, as a considerable number of consumers favor the convenience and security of credit card transactions. Whether you run a physical store, an online shop, or a combination of both, accepting credit cards can be a catalyst for a substantial boost in your sales and can propel your business to newfound heights.

Payment Processing: The Crux of Effortless Transactions Payment processing encapsulates a series of steps, commencing from the moment a customer initiates a purchase to the moment when funds are safely deposited into your bank account. It encompasses transaction authorization, fund capture, and settlement, all while incorporating robust security measures to ensure the safeguarding of customer data. Modern payment processing solutions are engineered to be swift, secure, and hassle-free, ensuring a seamless shopping experience that elevates customer satisfaction and fosters long-term loyalty.

Revealing the Advantages of a POS System A POS system assumes a pivotal role in the realm of merchant payment processing, adeptly managing sales while providing invaluable insights into the dynamics of your business operations. The key advantages of POS systems include enhanced efficiency, streamlined inventory management, data analytics that support well-informed decision-making, and fortified security measures to fortify customer payment data.

youtube

Selecting the Ideal Payment Processing Solution The process of choosing the right payment processing solution demands a comprehensive evaluation of factors such as transaction fees, security features, integration simplicity, and the quality of customer support. The decision should seamlessly align with the nature and requisites of your business, irrespective of whether it operates primarily online, within a physical space, or adopts a hybrid approach.

Merchant account processing ensures the secure embrace of credit card payments, while payment processing simplifies the intricate web of transactions. POS systems inject operational insights and efficiencies, enhancing inventory management and data-informed decision-making. By electing the most fitting payment processing solution, you unlock a realm of benefits and set a strong foundation for long-term success in the fluid and ever-changing landscape of today's marketplace.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#accept credit cards#high risk payment processing#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

Pirates! (VII)

Chapter 7 : The Moving Sands

Hello, lovelies! Here we go with a new chapter for this Caspian fic!

I’m sorry, I got the dates wrong on my planner, hence the little delay, I know this was supposed to come out yesterday… SORRY :/

I hope you like this new chapter! Tell me what you think!

****

Pairing: Caspian x Pirate!Reader

Warnings: depictions of violence in later chapters (fight scenes… nothing too terrible), slow burn, fluff!

Summary: As ships disappear across the sea, Caspian is forced to go investigate himself. But to win against the wild uncharted waters he must cross to reach his people, he needs to bargain with pirates. And then, he finds you…

Word Count: 2282

Masterlist for the series – Caspian’s Masterlist – Main Masterlist

Caspian didn’t know what to think of you.

You were a riddle, and he wanted to figure out how to read right through you.

On one hand you were a pirate, with a reputation bloody enough to scare your rivals. On the other hand, you were kind to your crew. When, four days after your departure, you crossed path with a merchant ship, you didn’t attack them. You let them sail in peace.

So, what kind of person were you? Good or evil?

As Caspian pulled as hard as he could on a rope, studying carefully the movement of the sail as he maneuvered, he let his mind ponder on this question. His aching muscles and blistered palms bothered him, but he did not complain. He was used to this, the pain through his arms, the shallow breath, the warm sun shining on his wet brow. He was used to it, it was a familiar feeling, really. And it stopped him from thinking, perhaps it was the fact that his hands were occupied in a task that required instinct more than thought. He could feel the tension in the rope, peek upwards to the movement of the sail and he knew what to command to his hands before he could properly think of it.

He loosened his grip only slightly, then pulled harder, using his weight to bring the sail about. And while he watched the red fabric catch the wind, he thought of you, of your features and your voice and the way you looked at him with mischief and defiance.

“Slow down!” you commanded, your voice steady and certain, and Caspian, like the rest of your crew, maneuvered the ship to obey your order without a second thought.

From the corner of his eye, Caspian saw you moving across the bridge, waving at Sophia and silently giving her an order to place the Dawn Treader behind your ship. You would be their guide.

And he admired you, at this moment. Standing by the helm, studying the wind in silence and the shape of your sails as they expanded under the breeze. All leather and white shirt and sword and knives and a blue feather on your tricorne hat. There was something about you that drew him to you. He had noticed it already on Saint Iron, but the more time he spent with you, the more obvious it was…

“Steady on!” you ordered, voice ringing again across the murmur of the waves.

At the top of the mizzen mast, the two squirrels who watched your course silently indicated to alter course, aiming for the right. You guided your ship in that direction.

You were about to enter the Hundred Banks, that some also called the Moving Sands. A collection of tiny lands made of sand, that moved with the currents that carried the material to form and destroy the small islands. Some of them could barely be seen from the surface, still underwater, and caution was vital now.

Caspian’s eyes filled with wonder at the sight of the specks of creamy-white that erupted from the blue waves. Under the cloudless sky, some almost seemed like foam, others were large enough to be hosting the crew of both ships. A bad idea for a resting spot, though. The treacherous surface would capture your ships and you would be left stranded there, with no help in sight.

He heard you cursing under your breath, and he turned to you at the sound. He was, after all, standing on the deck, right under the higher floor of the helm.

“Bloody Narnians,” he heard you cursing as you turned around to check the position of the Dawn Treader.

“Peter! Get your arse up here!”

Your gentle mood had disappeared, and you were frowning in an annoyance that was bordering anger when Caspian hurried up the stairs.

“Yes, captain?”

“Tell your idiotic friend over there to stay behind us, if he doesn’t want to die stranded like a moron.”

You were surprised to see that he was refraining an endeared smile.

“Yes, captain.”

“Hurry, you’ve got work to do!”

He nodded, strode to the back of the ship, wrapped his hands around his mouth for his voice to be carried further upon the wind.

And you couldn’t help but turn around, look at Peter stand there, by the banister, the wind caught in his hair, the dark locks flying around his face. And he was all leather, and a large purple shirt, high boots that made your heart stutter.

You cleared your throat. After all, you needed to make him fall for you. It would allow you to get information about Narnia. Useful, even vital information, indeed.

The fact that your cheeks warmed up at the sight of the tanned skin revealed by the open buttons of Caspian’s shirt did make your mission more pleasant, there was no denying it.

“The Dawn Treader will follow,” he informed you, and indeed, the ship was already altering its course to follow yours to perfection.

“Good,” was all that you could manage as you noticed the glimmering sweat on his temples, and found the detail extremely endearing, for some strange reason.

“Can I do anything else for you, captain?”

There was this crooked smile of his again. Your heart skipped a beat at the sight…

But you shook your head, bringing yourself back to the task at hand. The purpose was to make him fall for you, not the other way around… by Aslan’s tail, you really did need to get a grip…

But how would you seduce him?

You put on a flirtation smile, tilted your head a little, your tone honeyed when you spoke again.

“Thank you, Peter.”

But you saw the small frown that flashed across his brow, the way he tensed at your tone.

You stood straighter, set your eyes on the horizon again.

“Now, get going. Try to make yourself useful.”

Too cold. You saw it in the way he gave you a short nod, in the slumping of his shoulders as if he was disappointed.

You let him walk away, focusing on the treacherous path again.

How to get under his skin, without letting him in?

The crossing of the Hundred Banks was long and tedious, slow progress made through treacherous waters. It was exhausting, for everyone in your crew, but most of all for you, as you stirred the helm without any break for most of the day and night.

When darkness fell upon the world, you ordered for two longboats to be lowered down, and a small group of your crew went ahead, using lanterns to guide you and watch out for treacherous sand you couldn’t see in the shadows of the night.

The sand now shone silver under the moonlight. You recognized the constellations above you, the long trace of purple and red that crossed them. You were still on course, despite the detours needed to safely go through these parts.

You barely noticed Charlotte walking up to you: through your exhaustion and your focus on the sky and the tiny flames up ahead, there was little your brain could notice anyway.

“You should get some rest. We have less than an hour left of night. Dawn will soon rise. You can get a few hours of sleep, I’ll handle it.”

You were too tired to argue, and agreed instead.

“Come and wake me up if anything seems off. And wake me up after we’re out of the sand.”

“Yes, captain.”

“Did you sleep?”

“Yes, I’ve slept with the first team.”

“Lucky you…”

“Come on, grumpy. Go to bed, before you become truly insufferable.”

“You’re talking to your captain!”

“I’m talking to a woman who hasn’t slept in over thirty-six hours and could fall unconscious any minute now.”

“And looks stunning doing it. You forgot that part.”

“It’s good to have dreams, apparently.”

“Shut it.”

You let her take the helm anyway, walked away with a silent thank you written in your tired smile, and headed for your cabin.

You noticed at once that Peter was up. He was watching the tiny boats ahead, leaning on the banister.

As you walked closer, you noticed that he had wrapped cloths around his palms.

“Are you hurt?”

He jumped at the sound of your voice, turned around in a jolt and you noticed at once that he spontaneously took a fighting stance, that his hand came to his hip looking for his sword. He heaved a relieved sigh as he saw you.

“I beg your pardon?” he asked.

There was a limited crew on the bridge now. Most were asleep, resting after an exhausting day. There was no one to hear your words, and only a handful to see the scene from afar.

You couldn’t push away the thought that Peter looked stunning like this, standing in the twin lights of the lanterns and the moon, a mix of silver and gold dancing over his features.

“Your hands,” you went on, a worried frown evident on your brow. “Did you hurt yourself?”

“Oh, it is nothing. Blisters.”

You nodded.

“My hands are calloused, but working the ropes for so long under such heat is a lot, even for me,” he smiled, but you didn’t.

You shifted, from one foot to the other, uneasy.

“Come, I’ll take a look.”

“It is nothing…”

“It’s an order, Peter. I’m still your captain. Come on.”

You raised an eyebrow as he smiled, amused.

“What is it?” you asked.

“Nothing, I just… I am not so used to being given orders, it is a nice change.”

You raised an eyebrow, a playful smile forming on your lips.

“If you’re lucky, I’ll manhandle you too.”

He laughed, an earnest wave spreading in the space between the two of you. You liked that sound…

So, that was it. Playful. He liked it confident, but still kind. A little teasing, a little defiant, perhaps…

“I’m sure you would make it unbearably agreeable.”

You were surprised by his answer, and merely nodded towards the door leading to your cabin in response.

This time, Peter did not argue. He followed you, let you guide him towards your cabin. A simple one. A couple of lamps, a desk covered with parchments, maps, and ink. A bed. A large, locked chest. A couple of chairs.

“Sit down,” you pointed at one of the empty chairs, reached for a stool, some water and some cloth.

He obeyed, looking at the room while you settled before him. He let you take his hand in yours, unwrap the bandage he had made.

The water was cold against his hands, it made him jump, he apologized for it. He didn’t even flinch as you cleaned his wounded skin.

“Ask Amelia tomorrow, our cook. She’ll give you gloves.”

“It is nothing. Blisters come and go.”

“Your skin needs to heal. There is no need to hurt yourself.”

He noticed the way your fingers trailed across the unharmed part of his palms and fingers too, but he didn’t say anything about it. He merely stared at you, instead.

Perhaps it was because he was out of breath under your gentle touch, perhaps it was because he was underestimating you. Indeed, you recognized the patterns of callous skin on his hands. The ones owned by a warrior, holding a pommel and being highly trained.

Peter was a soldier. He was dangerous. Despite Bethy’s words, you couldn’t trust him. What if he was stronger than you in single combat?

Finally, you reached for some clean bandages, placed them around his palms.

You were surprised by his next question.

“Do you play chess?”

Before your frown, he nodded towards the set placed on a small table in a corner of your room. You couldn’t refrain a fond smile at the sight.

“I used to.”

“Not anymore?”

“I don’t have anyone to play with on this ship.”

“Really? Who did you play with, then?”

“My mother.”

You were surprised by your answer, by the fact that it was the truth and that it was natural for you to let the words out. As if you were not baring your soul, your past…

You shifted, uncomfortable. You were the one who ought to get under his skin, not the other way around…

“I apologize. I did not mean to intrude, or upset you.”

“I am not upset,” you lied, tightening the knot around his hand a little too tightly, and immediately regretting your gesture. You left it like that, though, as if it had been done on purpose.

“My father taught me to play,” Caspian spoke, his voice quiet. “A long time ago. I used… I used to play with a friend of mine who is long gone now…”

His eyes were unfocused as they stared at your board. He shook himself quickly, sadness lingering in his dark eyes for a moment longer, a tinge of melancholia that disappeared as he focused on you again.

“Thank you, for my hand.”

You cleared your throat.

“You’re welcome.”

When Caspian stood up to leave, you didn’t know what came over you exactly. Was it a plot to connect with him and seduce him? Was it earnest longing?

No matter why, the words were out before you could think them properly.

“Would you like to play? One day? When we have time?”

His features broke into a grin, and you hated yourself for the warm sensation spreading across your heart.

“I would love to, captain.”

His smile lingered on his lips as he walked away, and Caspian kind of hated himself for the warmth that was spreading through his chest at the sight of your smile.

#caspian x#king caspian#caspian x reader#caspian x y/n#caspian x fem!reader#caspian x you#caspian fanfiction#caspian series#caspian fanfic#narnia#narnia fanfiction#fanfic#fanfiction#writing

15 notes

·

View notes

Text

What Are Micro ATM Services and How Do They Revolutionize Banking in Rural Areas?

In the age of digital transformation, access to financial services is more critical than ever. Yet, for millions in rural and semi-urban areas, traditional banking facilities remain out of reach due to the lack of infrastructure and logistical challenges. This gap is where Micro ATM Services come into play, bridging the divide and empowering communities with financial access.

What Are Micro ATM Services?

Micro ATM services refer to a portable and user-friendly banking solution that allows basic banking operations to be conducted in areas with limited or no access to traditional banking infrastructure. Micro ATMs are compact, mobile devices operated by banking correspondents (BCs), often in local shops or community hubs, where they act as an extended arm of the bank.

These devices are designed to perform essential banking functions such as:

Cash withdrawal

Cash deposit

Balance inquiry

Fund transfers

Aadhaar-enabled payment services (AEPS)

Micro ATM services are linked to the user’s bank account and utilize biometric authentication or debit card verification to ensure secure transactions. They operate through mobile or internet connectivity, making them ideal for rural and remote regions.

The Working of Micro ATM Services

A Micro ATM device is equipped with a card reader, fingerprint scanner, and sometimes a small display screen. Here’s how it typically works:

Banking Correspondent Role: A banking correspondent operates the Micro ATM. They connect with individuals who need banking services but lack access to traditional ATMs or branches.

Authentication: Customers authenticate themselves using biometric data (such as Aadhaar fingerprint verification) or by inserting their debit/credit cards.

Transaction Processing: The device connects to the customer’s bank account via a secure network, enabling transactions like withdrawals or deposits.

Transaction Completion: After processing, a receipt is generated, and the customer receives real-time updates, ensuring transparency and trust.

Revolutionizing Banking in Rural Areas

1. Accessibility and Convenience

For people living in remote areas, traveling to the nearest bank branch can be time-consuming and expensive. Micro ATM services eliminate this need by bringing banking to their doorstep. Villagers can perform financial transactions conveniently without leaving their communities.

2. Financial Inclusion

One of the main objectives of Micro ATM services is to promote financial inclusion. By offering banking services to the unbanked and underbanked populations, these devices empower people to participate in the formal economy. They also help in disbursing government subsidies directly to beneficiaries under schemes like DBT (Direct Benefit Transfer).

3. Cost-Effective Banking Solution

Building and maintaining traditional bank branches in rural areas is costly and often unfeasible. Micro ATMs provide a cost-effective alternative for banks to expand their reach without significant infrastructure investments.

4. Boosting Rural Economy

With access to banking services, rural residents can save money, avail loans, and invest in small businesses, which collectively contribute to the growth of the rural economy. Micro ATM services also enable merchants to accept digital payments, further driving economic activity.

5. Enhancing Digital Literacy

By exposing rural populations to modern financial tools, Micro ATM services play a role in improving digital literacy. As people become familiar with using these services, they are more likely to adopt other digital payment methods, contributing to India’s vision of a cashless economy.

Role of Technology in Micro ATM Services

Advanced technologies have made Micro ATM services reliable and efficient. Features such as biometric authentication, real-time transaction updates, and integration with Aadhaar ensure secure and smooth operations. The portability and simplicity of these devices allow them to function even in low-connectivity areas.

Xettle Technologies, a leading innovator in the financial technology sector, has made significant strides in enhancing the efficiency of Micro ATM services. By developing user-friendly and secure solutions, Xettle Technologies ensures that financial services reach every corner of the country, fostering greater inclusion and economic empowerment.

Challenges in Implementing Micro ATM Services

While Micro ATM services have been transformative, there are challenges to address:

Connectivity Issues: Rural areas often face inconsistent mobile and internet connectivity, which can hamper device functionality.

Awareness and Trust: Many rural residents are unfamiliar with digital banking tools and may hesitate to use them due to concerns about fraud or complexity.

Limited Cash Flow: Banking correspondents operating Micro ATMs may run out of cash, limiting the ability to meet customer demands.

The Future of Micro ATM Services

The future of Micro ATM service is promising, with advancements in technology poised to overcome existing challenges. Some trends include:

Improved Connectivity: The expansion of mobile networks and internet infrastructure in rural areas will ensure uninterrupted service.

Enhanced Features: Newer Micro ATM models may include multilingual support, better biometric scanners, and integration with advanced payment systems.

Policy Support: Government initiatives like the Jan Dhan Yojana and Digital India will continue to drive the adoption of Micro ATM services.

Conclusion

Micro ATM services are a game-changer in the quest for financial inclusion, particularly in rural and underserved areas. They bring banking closer to the people, foster economic activity, and pave the way for a more inclusive financial ecosystem.

Companies like Xettle Technologies are at the forefront of this revolution, developing solutions that make banking accessible, secure, and efficient for everyone. By addressing challenges and embracing innovation, Micro ATM services are set to play a vital role in shaping the future of banking in India and beyond.

2 notes

·

View notes

Text

Palestinian graphic designer Bilal Tamimi’s YouTube videos from the village of Nabi Saleh in the West Bank have received 6 million views during the past 13 years. His uploads document joyous festivals and peaceful protests—but also violent skirmishes between Nabi Saleh’s 600 residents and occupying Israeli soldiers. “I need to show to the world what’s happening in my village and the suffering of my people from occupation,” he says.

The platform has helped Tamimi broadcast to his more than 20,000 subscribers, but he’s locked out of YouTube’s revenue sharing program that pays a share of ad sales to more than 2 million video creators in 137 countries or territories. When Tamimi tries to sign up, YouTube’s app says, “The YouTube Partner Program is not available in your current location Palestine.”

The internet has given some Palestinians a global audience, but many benefits of online life that billions around the world can take for granted simply don’t work for people in Gaza and the West Bank. In addition to YouTube’s partner program, money transfer services such as PayPal and ecommerce marketplaces, including Amazon, largely bar Palestinian merchants from entry. Google tools for generating revenue from web ads or in-app purchases are technically open to Palestinians but can, in practice, be inaccessible due to challenges verifying their identity or collecting payment.

As Israeli forces have bombarded Gaza in pursuit of Hamas, tech workers’ and rights activists’ frustrations with the region’s digital inequality has grown. Palestinians are barred from YouTube’s Partner Program and struggle with intermittent connectivity. Israeli YouTube channels in the program could be bringing in some revenue from conflict-related content. Popular Israeli singers have drawn views with songs honoring victims of Hamas’ October 7 attack on Israel, while travel advice channel Traveling Israel has received millions of views on historical explainers.

Human rights organizations say the disparity in access to online sources of income weakens the Palestinian economy. "Many Palestinians who work online struggle to be paid," says Marwa Fatafta, a policy and advocacy manager at the rights organization Access Now. YouTube’s policy “fits a larger pattern of tech companies’ discriminatory approach to Palestinians.”

Google spokespeople, who asked not to be named for safety concerns, say in a statement that the company is committed to creating economic opportunities for Palestinians through services and training. The YouTube Partner Program won’t be available in the Palestinian territories until Google launches a local version of YouTube, which involves customizing features and options to the language and culture. "We continue to invest in the infrastructure that's needed to offer more tools to monetize with Google to ensure it’s a seamless process and follows local legal requirements,” one of the spokespeople says.

To get a sense of how Palestinians are excluded from or face barriers to tapping the world’s largest ecosystem for making money online—Google’s—WIRED reviewed popular Palestinian YouTube channels, news websites, and apps associated with the region. Interviews with content creators, activists, and current and former Google staff familiar with the region and company policies helped fill out the picture. The investigation revealed how a series of Palestinian projects and companies hit financial dead ends when attempting to monetize online in ways easy for people in countries such as the US and Israel. Others resorted to complicated geographic workarounds that siphon off revenue.

The Google sources not authorized to speak to media allege those challenges reflect years of internal politics and neglect of Palestinian users at the company. The sources say a localized version of the company’s search engine, Google.ps, launched in 2009 only after a desire to provide more relevant results narrowly beat out concerns about public backlash for an action some people could view as endorsing disputed territories. But there hasn’t been management resolve in recent years to risk changing the status quo to introduce a Palestinian YouTube that would give local creators access to monetization.

US congressman Mark Pocan of Wisconsin says Israel’s current attack on Gaza underscores how wrong that pattern of online exclusion is. “When massive companies make money hand over fist from creators but deny them their fair share just because of where they live, that is just plain wrong,” he says. It is crucial, he argues, that “Palestinians in Gaza and the West Bank have equal opportunities for economic participation.” In May, Pocan led several Democratic US lawmakers in urging PayPal to allow Palestinian accounts. PayPal, which declined to comment, hasn’t changed its policies.

Duty First

Tamimi, 57, started posting on YouTube in 2010 and views it as a duty in service of his villagers, not a way to get rich. He first tried to join the service’s revenue sharing program a few years ago as a way to defray his costs. “I would for sure try to improve my work, to have a good camera,” he says. “And maybe I can help other people who are doing what I am doing through workshops and cameras.”

Today Tamimi uses an iPhone 12 Pro Max he bought himself and camcorders and equipment donated by B'Tselem, a Jerusalem-based nonprofit organization that aims to document human rights issues in Palestinian territories.

Tamimi’s focus on winning attention over profit is no different than other YouTube creators, says Bing Chen, who once led global creator initiatives at YouTube. “Revenue is of course an incentive, but fame is more so,” says Chen, who now develops and invests in creators through his company AU Holdings.

You don’t need a fancy camera or editing to draw an audience. When Israeli professors analyzed about 340 TikTok videos from 2021 related to the Israeli-Palestinian conflict they found pro-Israeli videos had higher production values but received lower engagement. They argued that viewers preferred Palestinian content because public sentiment tends to favor those seen as victims.

At a time of widespread suffering now on both sides of the border and an intense period of global attention on the region, Palestinian channels like Tamimi’s could be drawing record engagement and revenue—money that could, one day, make rebuilding easier.

Instead, Tamimi has withdrawn from YouTube. He started posting only infrequently after his village stopped organizing weekly protests around 2018 and with no income available feels no loyalty to the Google service. When an incident flares up, he is now more likely to livestream on Meta’s Facebook, where he draws thousands of viewers. “YouTube is like an archive,” he says, not a place to share new content.

Geographic Gaps

YouTube’s revenue program for creators, known as YPP, launched in 2007 and pioneered the concept of a major social media platform turning amateur stardom into a well-paying job. It now has competition from Meta, X, and TikTok—which also don’t offer their programs to people in Palestinian territories—but remains the leader in influence and geographic reach.

Despite YouTube’s dominant position, WIRED’s review found that YPP doesn’t let in creators from over a quarter of the world's 100 most populous countries, most of them in Africa. It welcomes people from many countries with smaller populations than the Palestinian territories, where, combined, an estimated 5 million people reside. Creators from Iraq and Yemen, also Arabic-speaking places troubled by conflict, are listed as supported.

Chen, who helped develop YPP while working at YouTube, believes that the platform’s leaders may want to avoid funding creators whose content puts them at risk from local authorities, and also worry that language barriers or limited staffing could make it difficult to provide suitable customer service.

But it’s not impossible for platforms to work with creators in Palestine. California-based fundraising service Patreon gets money to Palestinian users through the payments provider Payoneer, and smaller money-moving tools such as Saudi Arabia’s PayTabs say they support transactions with Palestinian accounts.

Other parts of Google’s vast empire claim to serve Palestinians businesses, but people reached by WIRED say the reality is very different.

Google documentation says the Google Play app store allows developers from 163 markets, including one listed as “Palestine,” to sell apps and in-app purchases and that Google’s AdSense advertising system supports 232 countries or territories, including “Palestinian Territory.”

Odeh Quraan, who runs a Ramallah-based software development agency called iPhase with overseas customers, says the sign-up process for AdSense requires entering a PIN mailed by Google. But Israel controls the flow of mail to the West Bank, and many items never arrive, he says. He circumvented that by using Stripe’s Atlas service to establish a company in the US state of Delaware without ever setting foot there. But it comes with downsides. “Taxes are a headache, and transferring money from the US bank account to the local banks has turned out costly,” Quraan says.

Three out of 12 popular Palestinian news websites display ads using Google technology, compared with 11 out of 12 well-known Israeli news sources, WIRED found. One of the Google spokespeople says the company in late October began notifying websites in the region about a virtual alternative to the mailed PINs, though the option is not stated in public support documentation.

Elsewhere in Ramallah, software development company Mongid stopped offering in-app purchases from an ecommerce app on Google Play and abandoned a YouTube channel with tutorials on using online learning tools because it was too difficult to receive revenue via Google, says CEO Mongid Abu-Baker.

This month, he and two other app developers interviewed by WIRED have been stymied by a new Google Play requirement that all developers get verified by global professional services firm Dun & Bradstreet. Neither the Palestinian territories nor their country code for phone numbers are listed as options on sign-up webpages, and Palestinian developers must seek customer service from Dun & Bradstreet through offices in Israel rather than an Arab country.

Abu-Baker calls the lack of recognition an affront on his identity. “Palestinian companies hold an importance no less significant than any other worldwide,” he says. He downgraded his account to avoid verification and now worries about losing access to some Google Play features.

Efrat Segev, chief of data and product for Dun & Bradstreet in Israel, says hundreds of Palestinian businesses have finished verification over the past two years and that complaints are few but that it is trying to remedy the concerns. Google declined to comment.

The difficulties faced by Abu-Baker and others in Palestine clash with messaging from Google’s leaders in California about its work in the Middle East. Last year, Google chief financial officer Ruth Porat announced that the company would spend $10 million over three years to help Palestinian graduates, developers, and entrepreneurs “advance their digital skills and find employment.” Just weeks before the recent war broke out, Google said it aims to serve 3,500 Palestinians from the West Bank, Gaza, and East Jerusalem through the investment.

Asked on stage at a conference this month about Google’s role in contested areas like Gaza, Google CEO Sundar Pichai said his company can be a critical technology partner. “We don't see it in the geopolitical context,” he said. “We see it in an enabling context.”

Some Israeli creators, like those in Palestine, feel Google isn’t living up to that. Oren Cahanovitc, owner of the Traveling Israel channel, says videos discussing politics are being flagged by YouTube as not suitable for ads. Corey Gil-Shuster, the Tel Aviv-based creator behind the Ask Project, which interviews Israelis and Palestinians about their views on the conflict, says he’s seen the same pattern.

YouTube’s screening tools can deem videos showing violence or capitalizing on war as inappropriate for advertisers, although partner program participants also get some revenue from paid subscribers to YouTube who don’t see ads. That business, and revenue stream for creators, is growing.

Palestinians lack the opportunity to receive checks from YouTube at all. The Israeli creator Gil-Shuster says the disparity was news to him and that the fix seems clear. “Palestinians living in the West Bank and Gaza, obviously,” he says, “should have equal right to benefit from monetization as anyone else.”

13 notes

·

View notes

Text

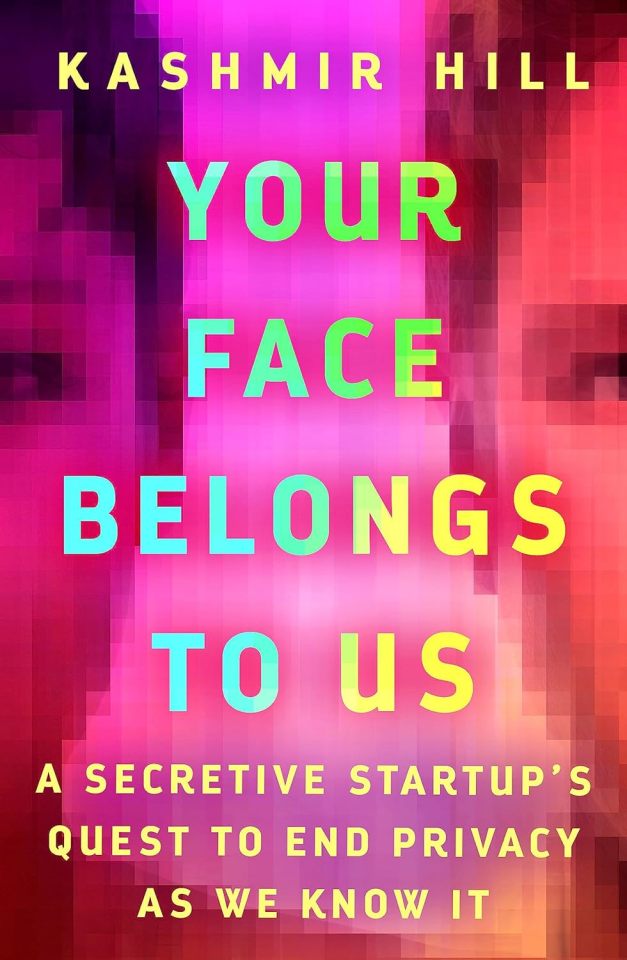

Kashmir Hill’s “Your Face Belongs to Us”

This Friday (September 22), I'm (virtually) presenting at the DIG Festival in Modena, Italy. That night, I'll be in person at LA's Book Soup for the launch of Justin C Key's "The World Wasn’t Ready for You." On September 27, I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine.

Your Face Belongs To Us is Kashmir Hill's new tell-all history of Clearview AI, the creepy facial recognition company whose origins are mired in far-right politics, off-the-books police misconduct, sales to authoritarian states and sleazy one-percenter one-upmanship:

https://www.penguinrandomhouse.com/books/691288/your-face-belongs-to-us-by-kashmir-hill/

Hill is a fitting chronicler here. Clearview first rose to prominence – or, rather, notoriety – with the publication of her 2020 expose on the company, which had scraped more than a billion facial images from the web, and then started secretly marketing a search engine for faces to cops, spooks, private security firms, and, eventually, repressive governments:

https://www.nytimes.com/2020/01/18/technology/clearview-privacy-facial-recognition.html