#export of cement from India

Explore tagged Tumblr posts

Text

#cement export from India#cement exporters in India#export of cement from India#cement export data#India cement exports

0 notes

Text

How is Cement Export from India Influencing the Global Market?

Cement is a fundamental material in the construction industry, and India, being one of the largest producers of cement globally, plays a significant role in meeting the global demand. The cement export from India has been steadily growing, supported by a robust network of manufacturers and exporters. But how does India’s position as a cement exporter impact the global market? This article explores the dynamics of cement export from India, examines cement export data, and identifies the leading cement exporters in India.

Why is Cement Export from India Important?

What Makes India a Major Player in Cement Exporting Countries?

India is among the top 10 cement exporting countries in the world, thanks to its vast production capacity and high-quality products. The country's cement industry is one of the largest and most efficient, driven by abundant natural resources, skilled labor, and advanced manufacturing technology. This has enabled India to cater to the growing global demand for cement, particularly in developing countries where infrastructure development is a priority.

How Does Cement Export from India Benefit the Economy?

The export of cement from India significantly contributes to the nation’s economy by generating foreign exchange earnings and creating employment opportunities. The cement industry supports related sectors such as logistics, packaging, and shipping, further enhancing its economic impact. By leveraging its production capabilities to meet global demand, India strengthens its economic position and bolsters its trade relationships with other countries.

Who are the Leading Cement Exporters in India?

Which Companies Dominate Cement Export from India?

India is home to several prominent cement exporters that have established themselves as key players in the global market. The top cement exporting companies in India include:

UltraTech Cement: As the largest cement producer in India, UltraTech Cement plays a significant role in the country’s cement exports, supplying high-quality cement to various countries across Asia, Africa, and the Middle East.

Shree Cement: Known for its superior quality products, Shree Cement is a major exporter to countries in Africa, the Middle East, and Southeast Asia.

Ambuja Cement: Part of the global LafargeHolcim Group, Ambuja Cement is one of the leading cement exporters from India, with a strong presence in South Asia and Africa.

ACC Limited: Another major player in the Indian cement industry, ACC exports a substantial amount of cement to neighboring countries and the Middle East.

Dalmia Cement: Recognized for its innovative and sustainable products, Dalmia Cement is expanding its export footprint, particularly in Southeast Asia and Africa.

How Do Small and Medium-Sized Enterprises Contribute to Cement Export from India?

In addition to the large corporations, numerous small and medium-sized enterprises (SMEs) contribute significantly to the export of cement from India. These SMEs often focus on niche markets or specific regions, providing customized products to meet local demands. Their flexibility and adaptability make them vital players in India’s overall cement export landscape, ensuring that Indian cement remains competitive in various global markets.

What is the Process of Cement Export from India?

What Are the Key Steps in the Cement Export Process?

The export of cement from India involves several critical steps to ensure that the product meets international standards and is delivered efficiently. The key steps in the cement export process include:

Production and Quality Assurance: Cement is produced using advanced manufacturing techniques and stringent quality control measures. This ensures that the cement meets the required specifications for export markets.

Compliance with HS Codes: The Harmonized System (HS) code is crucial for international trade, classifying products under specific codes for ease of customs processing. The cement HS code, for instance, is 2523, which covers hydraulic cements, including Portland cement.

Packaging and Labeling: Proper packaging is essential to protect the cement during transit and ensure it reaches its destination in good condition. Cement is typically packaged in bags, bulk containers, or shipped as loose bulk depending on the requirements of the importing country.

Documentation and Legal Compliance: Exporters must prepare and submit necessary documentation, including the bill of lading, certificate of origin, and commercial invoices, to comply with the import regulations of the destination country.

Shipping and Logistics: Cement is generally transported via sea freight, although road and rail transport are also used for neighboring countries. Exporters work closely with logistics partners to manage the complexities of international shipping and ensure timely delivery.

What Challenges Do Cement Exporters in India Face?

Exporting cement from India is a complex process that comes with its own set of challenges, including:

High Logistics and Transportation Costs: The cost of transporting cement, especially over long distances, can be substantial. Exporters must manage these costs effectively to remain competitive in the global market.

Regulatory Compliance: Different countries have varying import regulations, making it necessary for exporters to stay updated on international trade laws to avoid delays or penalties.

Global Competition: India faces stiff competition from other top cement exporting countries like China, Vietnam, and Turkey. To maintain its market share, Indian cement must consistently meet or exceed quality standards and be competitively priced.

What Does Cement Export Data Reveal About India’s Global Market Position?

How Does Cement Export Data Reflect India’s Standing Among Cement Exporting Countries?

Cement export data provides valuable insights into India’s position in the global market. India consistently ranks among the top 10 cement exporting countries, with significant exports to regions like Asia, Africa, and the Middle East. The data shows a steady increase in cement exports, driven by rising demand for infrastructure development in emerging economies and a growing preference for Indian cement due to its quality and reliability.

Which Countries are the Major Importers of Indian Cement?

India exports cement to a wide array of countries, with key markets including:

Bangladesh: As a neighboring country with a high demand for construction materials, Bangladesh is one of the largest importers of Indian cement.

Nepal: Another significant market, Nepal relies heavily on Indian cement for its infrastructure projects.

Sri Lanka: Indian cement is widely used in Sri Lanka for residential, commercial, and infrastructure development.

African Nations: Several African countries, including Kenya, Mozambique, and Tanzania, import Indian cement due to its affordability and high quality.

Middle Eastern Countries: Countries such as the UAE, Saudi Arabia, and Oman are key importers of Indian cement, driven by ongoing construction and infrastructure projects.

How Can India Strengthen Its Position as a Leading Cement Exporter?

What Strategies Can Enhance India’s Cement Export Market?

To strengthen its position as a leading exporter of cement, India can adopt several strategies:

Focus on Innovation and Product Development: Investing in research and development to create innovative cement products, such as eco-friendly or high-performance cements, can help Indian exporters cater to the evolving needs of global markets.

Explore New Markets: Expanding into new and emerging markets in Africa, Latin America, and Southeast Asia can help diversify India’s customer base and reduce reliance on traditional markets.

Sustainability Initiatives: Emphasizing sustainable production methods and reducing carbon footprints can appeal to environmentally conscious consumers and increase demand for Indian cement.

Enhance Supply Chain Efficiency: Strengthening logistics and transportation infrastructure can help reduce costs and improve the efficiency of cement export operations, making Indian cement more competitive globally.

How Important is Adapting to Global Market Trends for Indian Cement Exporters?

Adapting to global market trends is crucial for the continued success of Indian cement exporters. As construction practices evolve, there is an increasing demand for specialized cement products that offer enhanced durability, sustainability, and cost-effectiveness. By staying ahead of these trends and continuously improving their product offerings, Indian cement exporters can maintain their competitive edge in the global market.

Conclusion

Cement export from India is a vital component of the country’s economy, supported by a strong network of manufacturers and exporters. India’s position as one of the top cement exporting countries highlights its production capacity, quality standards, and ability to meet global demand. By focusing on innovation, exploring new markets, and embracing sustainability, Indian cement exporters can continue to thrive in the competitive international market.

FAQs

1. What are the main cement exporting countries? The main cement exporting countries include China, Vietnam, Turkey, and India.

2. Who are the leading cement exporters in India? Leading exporters include UltraTech Cement, Shree Cement, Ambuja Cement, ACC Limited, and Dalmia Cement.

3. What is the HS code for cement? The HS code for hydraulic cements, including Portland cement, is 2523.

4. What challenges do cement exporters in India face? Challenges include high logistics and transportation costs, regulatory compliance in different countries, and competition from other top cement exporting countries.

5. How can India strengthen its position in the global cement export market? India can strengthen its position by investing in innovation, exploring new markets, adopting sustainable practices, and improving supply chain infrastructure.

#cement export from india#cement exporters in india#cement export data#export of cement from india#cement hs code#india cement exports#cement exporting countries#top 10 cement exporting countries#cement exporting companies in india#india top 5 cement export

0 notes

Text

Cement Export from India: A Comprehensive Guide

India's cement industry is a crucial part of its economy, serving as a backbone for infrastructure and construction projects. But beyond domestic needs, India also stands as a significant player in the global cement export market. This article delves into the export of cement from India, exploring the industry's history, key players, export processes, and future prospects.

Overview of India's Cement Industry

History of Cement Production in India

Cement production in India dates back to 1914, when the first plant was set up in Chennai. Over the decades, the industry has evolved, adopting advanced technologies and increasing its production capacity. Today, India is one of the largest cement producers in the world.

Current State of the Industry

Currently, India boasts over 210 large cement plants and around 350 mini plants. The industry has a production capacity of more than 500 million tons per year, with a significant portion allocated for export.

Cement Exporters in India

Major Players in the Market

India's cement export market is dominated by several key players, including UltraTech Cement, Ambuja Cement, ACC Cement, and Shree Cement. These are to be considered the top cement exporters in India. These companies have established strong international networks and are known for their high-quality products.

Rising Exporters

Apart from the major players, several mid-sized companies are making their mark in the export market. Companies like JK Cement and Dalmia Bharat have been expanding their reach, contributing significantly to India's export figures.

Export of Cement from India: Process and Regulations

Export Process

Cement export from India involves several steps, starting from production to transportation and, finally, shipment. Companies must ensure that their products meet the importing country's standards and requirements.

Regulatory Framework

The Directorate General of Foreign Trade (DGFT) regulates cement exports from India. Exporters need to obtain necessary licenses and adhere to guidelines laid out by the DGFT and the Bureau of Indian Standards (BIS).

Quality Standards

Indian cement exporters must comply with international quality standards. This includes ensuring proper packaging, labelling, and adhering to specific chemical and physical property requirements.

Top Cement Exporting Countries

Leading Global Exporters

Top cement exporting countries like China, Turkey, and Vietnam lead the global cement export market. These countries have developed efficient production and logistics networks, allowing them to dominate the market.

India's Position in the Global Market

India holds a significant position among the top cement exporters, thanks to its large production capacity and competitive pricing. The country exports to over 40 countries worldwide.

India's Cement Exports: Key Markets

Asia

Asia is a major market for Indian cement. Countries like Nepal, Sri Lanka, and Bangladesh import large quantities due to geographical proximity and cost advantages.

Africa

African countries, such as Kenya, Tanzania, and Mozambique, are emerging as significant players in India's cement export market. The growing infrastructure projects in these regions drive the demand.

Middle East

The Middle East, with its constant construction activities, is another vital market. Countries like the UAE, Saudi Arabia, and Oman are key importers of Indian cement.

Cement Exporting Companies in India

Profiles of Major Exporters

UltraTech Cement: As the largest manufacturer in India, UltraTech exports to various countries, focusing on quality and sustainability.

Ambuja Cement: Known for its sustainable practices, Ambuja Cement has a strong export network, particularly in Asia and Africa.

ACC Cement: ACC Cement is another major player, exporting to multiple regions with a reputation for consistent quality. These are the top cement exporting companies in India; below is a small success story of one such company.

Success Stories

UltraTech's successful penetration into African markets has set a benchmark for other exporters. Their strategic partnerships and investments in logistics have paid off, making them a preferred supplier in several countries.

Challenges and Opportunities in Cement Exports

Key Challenges

Exporting cement involves several challenges, including high logistics costs, stringent quality standards, and fluctuating international prices. Additionally, political and economic instability in importing countries can impact export volumes.

Emerging Opportunities

Despite challenges, opportunities abound. The growing demand for sustainable and eco-friendly cement, coupled with increasing infrastructure projects worldwide, presents a significant growth avenue for Indian exporters.

Future of Cement Exports from India

Trends to Watch

Sustainable Practices: The global shift towards sustainable construction materials is a trend Indian exporters should capitalize on.

Digital Transformation: Embracing digital technologies for logistics and supply chain management can enhance efficiency and reduce costs.

Strategic Recommendations

To stay competitive, Indian cement exporters should focus on innovation, invest in sustainable practices, and expand their presence in emerging markets. Building robust international networks and improving logistics can also provide a competitive edge.

Conclusion

India's cement export industry is poised for growth, backed by a robust production capacity and competitive pricing. While challenges exist, the opportunities for expansion and innovation are vast. By adopting sustainable practices and leveraging digital technologies, Indian exporters can secure a stronger foothold in the global market.

FAQs

What are the main countries to which India exports cement? India primarily exports cement to countries in Asia, Africa, and the Middle East, including Nepal, Sri Lanka, Kenya, and the UAE.

What challenges do Indian cement exporters face? High logistics costs, stringent quality standards, and fluctuating international prices are some of the main challenges.

Which Indian companies are major players in the cement export market? UltraTech Cement, Ambuja Cement, and ACC Cement are some of the major exporters from India.

What are the future trends in the cement export industry? Key trends include a focus on sustainable practices and the adoption of digital technologies for improved logistics and supply chain management.

How does the regulatory framework affect cement exports from India? The DGFT and BIS set guidelines and standards that exporters must adhere to, ensuring compliance with international requirements.

#cement export from India#cement exporters in India#export of cement from India#cement exporting countries#India cement exports#cement exporting companies in India#cement#global market#global trade data#export#cement export#global business#import export#import export business#import export data

0 notes

Text

The Role of Automotive Exporters in the Global Economy

The automotive industry has long been a pillar of global economic development. It connects nations through a complex web of trade, technology, and innovation, driving significant contributions to GDP and employment worldwide. Among the various contributors to this global sector, automotive products exporters in Gujarat play a crucial role in cementing India’s position as a key player in the global automotive market.

The Rising Importance of Automotive Exports

Automotive exports have become a cornerstone of international trade. From passenger cars to commercial vehicles, spare parts, and other components, the automotive sector’s products are in constant demand globally. Emerging markets in Asia, Africa, and South America are hungry for affordable, high-quality automotive products, and nations like India are stepping up to fulfill these needs.

India, being one of the largest automotive markets in the world, has not only catered to domestic demands but has also established itself as a significant exporter. Gujarat, in particular, has emerged as a hub for automotive production and export. With state-of-the-art manufacturing facilities, world-class infrastructure, and a business-friendly environment, the region has become home to some of the top 10 automotive products exporters in Gujarat.

Gujarat: The Automotive Export Hub of India

Gujarat’s strategic location, robust port infrastructure, and pro-industrial policies make it a natural choice for automotive manufacturers and exporters. The state’s ports, such as Mundra and Kandla, enable seamless export operations to global markets. Additionally, Gujarat’s proximity to major industrial clusters enhances its appeal as a center for automotive exports.

Some of the top 10 exporters of automotive products operate from Gujarat, leveraging the state’s logistical advantages and skilled workforce. These companies specialize in a diverse range of products, including:

Passenger Vehicles: Compact cars, sedans, and SUVs.

Commercial Vehicles: Trucks, buses, and trailers.

Auto Components: Engine parts, brakes, clutches, and transmission systems.

Electric Vehicles (EVs): Batteries, chargers, and EV-specific components.

Key Contributions of Automotive Exporters

Automotive exporters from Gujarat and other parts of India contribute significantly to the global economy. Here are some of their key contributions:

Employment Generation: Export-oriented automotive companies create numerous job opportunities. From manufacturing to logistics and sales, the industry employs millions directly and indirectly, ensuring economic stability for many families.

Boosting India’s Economy: The automotive sector accounts for a significant portion of India’s exports. By shipping vehicles and components to over 100 countries, automotive exporters strengthen India’s balance of trade and foreign exchange reserves.

Technology Transfer: Collaborations with international partners often lead to the adoption of cutting-edge technologies. Indian automotive exporters benefit from this knowledge exchange, enhancing their manufacturing capabilities and global competitiveness.

Improved Standards: To meet international demands, automotive exporters in Gujarat adhere to stringent quality and environmental standards. This not only boosts the reputation of Indian-made products but also raises the bar for domestic markets.

Top Automotive Products Exporters in Gujarat

Gujarat is home to some of the top 10 exporters in India, specializing in automotive products. These companies have achieved global recognition for their commitment to quality, innovation, and timely delivery. Some of their key attributes include:

Global Reach: Extensive networks in Europe, North America, the Middle East, and Asia.

Sustainability Practices: Adoption of eco-friendly manufacturing processes to meet global environmental regulations.

Customer-Centric Approach: Customized solutions tailored to the specific needs of international clients.

India’s Automotive Export Strengths

The success of automotive products exporters in Gujarat is a testament to India’s broader strengths in the automotive sector. Here are some factors that give Indian exporters a competitive edge:

Cost Advantage: Indian manufacturers offer high-quality automotive products at competitive prices, making them attractive to cost-conscious international buyers.

Diverse Product Range: From two-wheelers to heavy-duty vehicles and specialized auto parts, Indian exporters cater to a wide array of market needs.

Strong R&D Focus: Indian companies invest heavily in research and development to stay ahead in innovation, particularly in the EV segment.

Government Support: Policies such as the 'Make in India' initiative and export incentives encourage Indian companies to expand their global footprint.

Challenges and Opportunities

While India’s automotive exporters, including the top 10 exporters of automotive products from Gujarat, have achieved significant milestones, they also face challenges:

Global Competition: Exporters must compete with established players from countries like Germany, Japan, and South Korea.

Regulatory Barriers: Varying import regulations and standards in different countries can complicate export operations.

Supply Chain Disruptions: Events like the COVID-19 pandemic and geopolitical tensions can impact the availability of raw materials and shipping routes.

However, these challenges present opportunities for innovation and growth. By embracing digital technologies, enhancing supply chain resilience, and diversifying export markets, automotive exporters can secure their place among the best exporters in India.

Future Prospects

The global shift towards sustainability and green mobility opens new avenues for automotive exporters. Electric vehicles and related components are expected to dominate exports in the coming years. Gujarat’s manufacturers are already investing in EV technology, ensuring their readiness to meet future demands.

Additionally, partnerships with global OEMs (Original Equipment Manufacturers) and participation in international trade fairs will help Indian exporters showcase their capabilities to a broader audience.

Why Gujarat Stands Out

Among the top 10 exporters in Gujarat, the state’s automotive sector shines due to its:

Strategic Initiatives: Government-backed policies that promote exports.

Robust Infrastructure: Advanced manufacturing facilities and ports.

Skilled Workforce: Availability of technically proficient labor.

These factors make Gujarat a preferred destination for global buyers seeking reliable automotive products exporters.

Conclusion

The role of automotive exporters in the global economy cannot be overstated. They not only drive economic growth but also foster innovation and international collaboration. As India continues to establish itself as a global automotive powerhouse, the contribution of automotive products exporters in Gujarat remains indispensable.

Whether you are looking at the top 10 automotive products exporters in Gujarat or the top 10 exporters in India, their commitment to excellence and sustainability is a common thread. As the industry evolves, these exporters are poised to lead India’s charge into a future defined by green mobility, advanced technology, and robust global trade.

In a rapidly changing world, automotive exporters from Gujarat and India as a whole stand out as beacons of quality, innovation, and reliability. Their journey of excellence underscores why they are among the best exporters in India, contributing to the nation’s growing stature on the global stage.

#Top 10 exporters in India#Automotive products exporters in Gujarat#Top 10 automotive products exporter in Gujarat#Top 10 exporter of the automotive products

4 notes

·

View notes

Text

China, China, China. Scarcely a day passes without some new scare story about China. The Middle Kingdom was struggling with its image overseas long before Covid, but the pandemic cemented attitudes in the West. Ever since, and with plenty of justification, its every move has been regarded with growing “reds under the bed” paranoia. The feeling is mutual.

The mood has darkened further in the past week. British democracy is under threat from Chinese cyber attacks, the Deputy Prime Minister, Oliver Dowden, told MPs this week in imposing sanctions on a number of Chinese officials. If that’s what standing up to China means these days then the central committee doesn’t have a lot to worry about.

Rather more seriously, the US and Japan are meanwhile planning the biggest upgrade to their security alliance since the mutual defence treaty of 1960.

Not to be outdone by the US ban on exports of hi-tech chips to China, Beijing responded this week by saying it will be phasing out even the low-tech variety on all government computers and servers, replacing foreign chips with its own home-grown ones.

And then of course, there is China’s de facto alliance with Vladimir Putin’s Russia, forming a new axis of authoritarian powers with an overtly anti-Western agenda. The rupture with the West seems virtually complete.

Years of integration into the global economy, in the hope that it might make China more like us, have backfired and are now going powerfully into reverse.

But does the nature of the threat fully justify all the noise which is made about it? In military terms, possibly, even if China plainly poses no direct threat to Europe, and unlike Putin, has no plans to lay claim to any part of it.

It does, however, pose a clear and present danger to Taiwan, where President Xi Jinping would plainly like to crush the life out of this vibrant, free enterprise economy in the same way as he has in Hong Kong. His rhetoric is bellicose and hostile, and we must therefore assume he means what he says.

In economic terms, however, the China threat is receding fast. After decades of stellar growth, China’s medium to long-term economic prospects are at best mediocre and at worst grimly dispiriting.

Now gone almost entirely is the idea of China as an unstoppable economic leviathan that will inevitably eclipse the US and Europe. Already it is obvious that this is not going to be the Chinese century once so widely forecast. Instead, Western commerce is looking increasingly to India as the economic superpower of the future.

Nor is this just because of the immediate causes of China’s economic slowdown – a woefully unbalanced economy which in recent years has relied for its growth substantially on debt-fuelled property development.

For China is indeed, to use the old cliche, getting old before it gets rich. Demographic factors alone are highly likely to floor President Xi’s grandiose ambitions for economic hegemony before they can be realised.

The fundamentals of China’s predicament, in other words, do not support the narrative of democracy under threat from an insurgent totalitarian rival.

There’s been a lot in the papers about demographics over the last week following a new study, published in the Lancet, on declining fertility rates. At some stage in the next 60 years, the global population will peak, and then fast start contracting.

The birth rate is projected to fall below population replacement levels in around three-quarters of countries by 2050, with only a handful of mainly Sub-Saharan nations still producing enough babies to ensure expanding populations by 2100.

In China, however, it has already started, with the population falling in 2022 for the first time since the Great Famine of 1959-61. This wasn’t just a one-off blip: last year deaths continued to significantly outnumber births.

There may be a slight pause in the decline this year. Some couples may have delayed their plans for children in anticipation of the Year of the Dragon, synonymous in Chinese mythology with good fortune.

Any relief will be only temporary. According to projections by the Shanghai Academy of Social Sciences, which correctly forecast the onset of Chinese population decline, it’ll essentially be all downhill from here on in, with the population more than halving between now and the turn of the century.

This is a huge fall, with far-reaching implications for economic development and China’s superpower ambitions. What’s more, there is almost nothing the Chinese leadership can do about it, beyond imprisoning China’s fast-declining cohort of women of child-bearing age and forcing them to breed.

Across much of the developed world and beyond, the birth rate has long since declined below the 2.1 offspring per woman generally thought to be the level required to maintain the population. But thanks to its dictatorial one-child policy introduced in 1980 to curb China’s then almost ruinous birth rate, China has a particularly acute version of it.

China abandoned the one-child policy – limiting urban dwellers to one child per family and most rural inhabitants to two – in favour of a “three-child” policy in 2016, but too late.

Even if women of child-bearing age could be persuaded to have more babies, there are simply not enough of them any longer even to maintain today’s population, let alone increase it.

The one-child policy may have perversely further accentuated this deficiency because of the Chinese preference for male offspring over female, though most studies on this are inconclusive.

In any case, China finds itself classically caught in a “low-fertility trap”, the point of no return, where precipitous population decline becomes inevitable.

The implications are as startling as the statistics themselves. The Shanghai Academy of Social Sciences forecasts that the working-age population will fall to 210 million by 2100, having peaked in 2014, and the ratio of working-age citizens to notionally non-working from 100 to 21 today, to 100 to 137 at the turn of the century.

One thing we know about ageing populations is they like life to be as comfortable and settled as possible. They also don’t like fighting wars, which have historically required a surplus of testosterone-fuelled young men desperate to prove themselves on the battlefield.

The turn of the century is of course still a long way off; there is easily enough time for several wars in between. The nature of warfare has also changed. It no longer requires the bravery of the young.

Even so, totalitarian dictatorships may well struggle with selling the multiple other hardships of war to an elderly population. Putin may seem to disprove this observation, but in doing so he is also demonstrating anew the futility of expansionist warfare. They make a desert, and call it peace.

A couple of other points seem worth making about our propensity to exaggerate the Chinese threat. Anyone would think that China is already a dominant force in the UK economy. It is not; in fact it is still only our fifth-largest trading partner after the US, Germany, the Netherlands and France. Even on imports alone it’s not as big as the US and Germany.

Whether because of the growing diplomatic standoff or other factors, moreover, this position is eroding. The size of trade with China fell last year. The same is true of direct investment by China in the UK economy, which was just 0.3pc of total foreign direct investment in 2021.

We worry about China’s imagined ability to close down our critical infrastructure, but should that really be allowed to influence decisions on whether the Chinese battery company EVE should be building a new gigawatt factory at Coventry Airport, or for that matter whether super-tariffs should be charged on Chinese EVs?

Should they exist at all, these risks can surely be managed. In any case, no nation that hopes to trade with others would deliberately turn the lights off, even if it could. In over-reacting to the Chinese threat, we only shoot ourselves in the foot.

China has lied, copied, stolen and cheated its way up the economic league tables, but ultimately it is a closed economy which increasingly repudiates foreign influence and thereby severely limits its own powers of innovation.

The danger is that now at the peak of its powers, it hubristically lashes out. But in the medium to long term, the demographic die is cast, and it spells a future of waning influence and economic heft.

#nunyas news#my only fear is that they start a war#in order to reduce their population#it's china so not something historically I'd put past them

4 notes

·

View notes

Text

WOODBINE Offers High-Quality Grounded Calcium Carbonate Powder, CaCO3

#IndustrialMinerals #GroundedCalciumCarbonate #WoodbineGCC #NewDelhi #Rajasthan #CalciumCarbonate

Attention industries! Looking for top-quality Grounded Calcium Carbonate Powder for your industry needs? Look no further! DHANSRI INFRAX PRIVATE LIMITED presents WOODBINE brand of GCC (Grounded Calcium Carbonate – CaCO3), your ultimate solution for various applications. Our extensive range of Grounded Calcium Carbonate Powder, with a formula of CaCO3, caters to diverse industries including cement, paint, glass, soap & detergent, ceramics, rubber, cosmetics, and more.

Available in micron sizes ranging from (2/5/8/10/15/20) and grades including (Super/2nd Super/Normal). WOODBINE GCC meets the stringent requirements of industrial manufacturers Like cement, paint, glass, soap & detergent, footwear, ceramics, paper & pulp, rubber, tyre, cosmetics, toothpaste, PVC wire & pipe, fertilizers, and putty manufacturers. Whether you're in any part of Entire India Tier 1, Tier 2, Tier 3 with in City Limit or with a manufacturing plant in Outer Area (Industrial Clusters), our Indian manufacturing facility based at Rajasthan, India, ensures high-quality alternatives to imported CaCO3. Search DHANSRI INFRAX Private Limited, Industries can rely on us for bulk purchases, with packaging options of 50 kg and 1000 kg HDPE woven laminated bags, ensuring convenient handling and transportation. With a brightness range of 92-98%, WOODBINE GCC guarantees superior performance in your products.

For B2B, B2C, and B2BD2C needs, DHANSRI INFRAX PRIVATE LIMITED stands as your trusted partner. Contact us now to elevate your industry standards with WOODBINE Grounded Calcium Carbonate Powder, a superior option for B2B, B2C, and B2BD2C buyers, suppliers, dealers, importers, exporters, and wholesalers.

2 notes

·

View notes

Text

China’s economy is limping back to life after President Xi Jinping’s ill-fated “zero covid” decree, but there is one big victim: the country’s efforts to tackle climate change. China’s carbon emissions recently recorded their largest annual jump and are on track to reach an all-time high. Fueled by new Chinese Communist Party (CCP) language that posits coal as the mainstay of the energy system, domestic production and consumption have ticked up. As has approval of new coal-fired power stations.

Xi’s signature “dual carbon” goals—for China to peak emissions before 2030, and to reach carbon neutrality by 2060—are not yet at risk. But that’s only because of Beijing’s preponderance for setting its climate targets so low to begin with. However, the cost of China now meeting these goals is only going up, and the room for them to do more is shrinking.

The problem is that for the CCP leadership the only thing that matters at present is ensuring a short-term economic bump. Xi’s modest annual growth target of 5 percent must be achieved at all costs. That’s why if we are to have any hope of stopping runaway climate change in time, the West needs a strategy that is as much about climate sticks as it is about carrots. It’s about time we see climate inaction on the same par as human rights abuses or even incursions to international peace and security.

By far the biggest stick available to the west is implementing new green tariffs. These tariffs would increase the cost to China of exporting carbon intensive goods such as cement, steel and aluminum to regions like the European Union where local manufacturers are already subject to strict regulations on their own pollution. For the first time, it would mean a direct hip pocket cost for climate inaction on the Chinese trade balance sheet. It would help force Chinese manufacturers to adapt to lower polluting methods.

In October, the European Union will begin implementing a “carbon border adjustment mechanism” (CBAM), due to be fully operationally in its coverage by 2026. In the United States, both Republicans and Democrats have already taken steps to prepare for a similar scheme. A bill to calculate the emissions intensity of industrial materials produced domestically was recently passed, and there is a possibility of a follow-up to the CHIPS and Science Act or a new standalone “Foreign Pollution Act” bill will put in place the cornerstone of a future scheme—though that is still some time away. In the meantime, the United States and the European Union are also negotiating a green steel deal that will be an important placeholder by individually placing some tariffs on China absent a wider scheme.

The Middle Kingdom hates the idea of green tariffs. For them, trade and climate should never be discussed in the same sentence. It’s easy to see why. Deloitte estimates China will be the most exposed market (behind Russia) to the EU’s new scheme, with €6.5 billion of trade from China affected to begin with. The United Kingdom and Canada are also considering similar schemes. Persuading others like South Korea and Japan—which already have or are implementing domestic carbon markets—to follow suit would help tighten the screws on Beijing by covering over a quarter of their export market. Just as important will be getting developing countries like South Africa (and perhaps even India over time) to also do so to avoid fragmenting the global trade environment they already complain of.

It’s crucial these countries can not only come together, but that they then stick together. When dealing with China, it is always better to move in packs. Unfortunately, Brussels has a propensity for wanting to play the good cop with China to Washington’s bad cop. For instance, a recent commitment by the EU to “better understand and address China’s concerns” with their scheme has raised eyebrows.

Diplomacy therefore still matters. It can also show the foreign policy hard heads in Beijing who continue to set the small playing field for China’s international climate agenda, that this issue is fundamental to China’s global standing and not one that cannot be geopolitically horse traded. Given his proclivity for the opposite, Wang Yi’s return as foreign minister has likely made that job harder in recent weeks.

The bottom line is the world is running out of time for dialogue alone to solve the climate crisis. In May, the World Meteorological Organization said that by 2027 we were more likely than not to breach the 1.5 degrees Celsius temperature limit, widely considered by scientists to be a climate tipping point.

Yet in the face of this, Xi is only standing firm. During a recent visit by U.S. climate envoy John Kerry, Xi defended the pace and intensity of China’s actions, which he said “should and must be” determined free of outside interference. And while the resumption of climate talks between the United States and China is a welcome step forward in the geopolitical milieu of the broader relationship, Beijing clearly feels it owes nothing more to Washington.

It’s time get tougher. For the last decade or more, the cornerstone of the West’s approach to China on climate change has simply been to encourage the country to play a part in combatting it. That has had some impact. In 2009, China was prepared to walk away from a proposed global deal in Copenhagen that posited developed and developing countries should be treated the same. But by 2014, China stood alongside the United States and put forward its own plan to reduce emissions that helped pave the way for the Paris Agreement. A shifting domestic zeitgeist as air pollution in Chinese cities, and a greater awareness of the impacts of climate change taking hold was far more consequential for changing the attitude of the CCP leadership. The west needs to help that shifting domestic sentiment along.

For its part, China would say its installed more renewable energy last year and sold more electric vehicles than the rest of the world combined. China is also on track to double its goal for installed solar and wind capacity this decade. But absent a more concerted effort by Beijing, none of this is likely to matter much. More than two-thirds of the world’s installed coal-fired power capacity will soon be in China, if over 300 mooted new plants are built. By the middle of the century, China will also overtake the United States as the world’s largest historical emitter. This will remove its bifurcated defense against responsibility that because it did not cause the issue, it has no responsibility for fixing it.

If the West can move quickly to implement new green tariffs, it won’t take us long to know if they have been effective. In 2025, China along with the rest of the world will be required to set new targets to reduce emissions for a decade ahead. For its part, the United States will be under particular pressure to take a big step up from its goal of a 50 percent to 52 percent emissions reduction by 2030, buoyed by the Inflation Reduction Act’s new measures. Having finally peaked emissions at the end of this decade, the key question for China will be whether they can put them into structural decline. If it doesn’t, the consequences will be felt by us all.

4 notes

·

View notes

Text

HOW NEHRU CAN TRULY BE CALLED 'THE ARCHITECT OF INDIA'S BIMARU ECONOMIC STRUCTURE'. ................................................................................. - HOW NEHRU INCOMPETENTLY, & PER MANY HISTORIANS, MALICIOUSLY, RUINED EASTERN INDIAN ECONOMIES, LIKE BENGAL, BIHAR, JHARKHAND, MADHYA PRADESH, CHHATTISGARH, & ORISSA, BY HIS ONE SIDED (SUBSIDIZED/EQUALIZED FREIGHT COST OF RAW MATERIAL ONLY & NOT FOR FINISHED GOODS) FREIGHT EQUALIZATION POLICY. - HOW NEHRU IN THE GARB OF A SOCIALIST INDIA, MANAGED TO CREATED A REGRESSIVELY CAPITALISTIC INDIA INSTEAD.

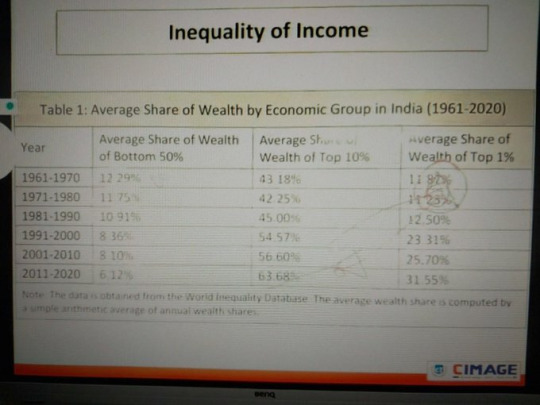

Here are India's 60 yr Share of Wealth stats, from 1961-2020, taken from the 'World Inequality Database'.

Looking at which, most would be forced to ask, why is it that in a wholly socialized state like India (& heavily publicized so at that for 60 yrs)....that our Top 1% 's share in wealth goes up 3 times, Top 10%'s share goes up 1.5 times, BUT SHARE OF THE BOTTOM 50% IS LITERALLY HALVED?

The answer to this lies largely in one man, Nehru, & his policies, either incompetently unintentional or maliciously intentional, policies directly responsible for creating a deeply disparate & heavily lopsided yet overall non-flourishing economic structure, for the entire first half century of the 'Dominion (of Britain) India'.

And the biggest mishap-causing misadventure, being 1951's infamous FREIGHT EQUALIZATION POLICY.

👇

https://en.wikipedia.org/wiki/Freight_equalisation_policy#:~:text=Freight%20equalisation%20policy%20was%20adopted,subsidised%20by%20the%20central%20government.

☝

Above is the Russian Govt+military reaction, to Indian 'independence' in mid 1947. This article was published in the Russian central military newspaper 'Red Star' on July 31, 1947, just 2 weeks before the official date of India's so-called Independence.

"Chief economic positions still remain in British hands–railways,marine transport,port economy,irrigation systems,finance,basic part of jute,industry,almost whole mining industry etc"

“The defence of economic positions and interests is not possible without political power. That power will be secured in the person of the capitalists, landowners and businessmen who are dependent upon British capital.”

“The partition, does not affect the feudal power of the Princes who have always supported British domination.”

"The British Govt plans to artificially separate industrial from agricultural areas,turning it to a agrarian & raw material appendage of Britain."

Exactly what Nehru's Freight Equalization Policy achieved 4 yrs later!

And to add to what y'all I assume would already have read from above, as to it's evil designs & effects, it created a reverse-reward scenario, whereby all the resource-rich states were essentially penalized for their natural advantages, by taking away all incentive for processing-industries & final transportation industries, that are a logical next step from the extraction industries, to germinate & set base in these places. Thereby creating a scenario where the South-western & western coastal states like Maharashtra, Gujarat & Tamil Nadu, & parts of Punjab in North India, were able to find logical easy base for all the processing & transportation industries in their states, for industries like steel, cement, heavy manufacturing, & power, all enabled via raw materials from the other far-off states, like iron ore, coal, limestone, bauxite, copper etc, even w/o any personal natural resources to rely on themselves, merely by virtue of being easy locations to set up ports in for exports, & w/o industries having to compromise on higher transportation & value-added processing costs, that cost aspect equalized & protected for all distances from the resource point. All this, with resource states not finding even some respite in terms of return benefits from any possibly subsidized finished product costs, finished goods not covered by this policy!

These 4-5 states effectively thus became the parasites, for atleast 7 of the traditionally god-gifted states of today like Bihar, Jharkhand, Madhya Pradesh, Chhattisgarh, Orissa, Bengal & Uttar Pradesh, killing all their hope at industrial development & economic progress, & where there is economic (or lotsa times attached) spiritual hopelessness, springs leftism in all it's devious forms, giving birth to intense communism & it's shameful offsprings of caste-divide & gang-culture, literally turning these states HOUSING HALF OF INDIA'S POPULATION, into the pot-holes of the Indian Union -the BIMARU (for Bihar, Madhya Pradesh, Rajasthan, Uttar Pradesh) states of India.

Now in all of this, it's not as if the above-mentioned coastal states were turning themselves into heavens of prosperity either, merely relatively well-off & with a hopeful disposition of the future, that in itself enough to attract large-scale migration from the above BIMARU states, particularly Maharashtra with a more traditionally Hindi-friendly ambience, but also in TN, creating a new urban housing problem, giving birth anew to Mumbai's infamously gargantuan chawl (dingy hutment) lifestyle.

And the reasons for these states, given all these special privileges, not able to take off well enough, aren't directly visible, yet that we can now, on basis of our analysis of Nehru & his so-called Independent India, over innumerable blogs prior, safely interpret, to be an India yet functioning in 1950s & till mid-1960s as some sort of a vassal state of Britain. Only natural then for a supreme state in such a relationship, to not be assumed to desire nations other than itself any sorta economic or strategic base in it's territory, thus curtailing more robust foreign economic to-and-fro.

A utterly class-subservient bent, not seen just for the British race, but per historians, eg Kanchan Gupta, in his hateful sense of complex & hatred of dark-skinned & skinny Bengali community, even worse passionate Hindu Durga-lovers, & per many, all largely borne of his hatred for Bose.

And thus ends yet another inglorious chapter from the life of the self-confessed Last British Ruler of India.

The Tale of the Internal Destruction of India, & it's Premier at it.

2 notes

·

View notes

Text

Exploring the Versatility of Quartz Powder in Industry

Quartz powder, derived from the natural mineral quartz, has emerged as a cornerstone material across various industries. With its unique physical and chemical properties, it has become indispensable in applications ranging from construction to electronics. Quartz Powder Manufacturers around the globe are striving to meet the increasing demand for this versatile material, ensuring that industries continue to thrive with high-quality quartz powder.

Understanding Quartz Powder

Quartz is a silica-rich mineral that undergoes processing to produce fine quartz powder. The end product is known for its high purity, excellent hardness, and resistance to chemical reactions. These qualities make quartz powder a preferred choice in sectors such as:

Construction: Used in cement and concrete mixtures for improved durability and aesthetic appeal.

Electronics: Essential for producing semiconductors, solar panels, and optical devices due to its insulating properties.

Glass Manufacturing: Serves as a key raw material in the production of glass, contributing to its clarity and strength.

Paints and Coatings: Acts as a filler to enhance weather resistance and texture.

Ceramics: Adds strength and smoothness to ceramic tiles and sanitary ware.

With such diverse applications, the demand for quartz powder continues to soar, urging manufacturers to innovate and deliver products that meet industry standards.

Qualities of High-Grade Quartz Powder

For quartz powder manufacturers, quality is paramount. High-grade quartz powder possesses:

Purity: Contains minimal impurities, especially in silicon dioxide (SiO₂) content.

Granular Consistency: Fine, uniform particles that ensure seamless application.

Thermal Stability: Withstands high temperatures, making it ideal for industrial processes.

Chemical Resistance: Non-reactive to most chemicals, ensuring long-lasting performance.

Manufacturing Process of Quartz Powder

Quartz powder production involves a multi-step process:

Mining and Extraction: Raw quartz is mined from quarries and transported for processing.

Crushing and Grinding: Quartz is crushed into smaller pieces and ground to the desired powder consistency.

Screening and Sorting: Advanced machinery ensures that the powder meets specific size requirements.

Purification: Techniques such as magnetic separation and acid washing remove impurities to achieve high purity.

Packaging and Distribution: The final product is packed in moisture-resistant bags and transported to clients.

The process is energy-intensive and requires precision to maintain consistent quality.

The Role of Quartz Powder in Modern Industries

The adaptability of quartz powder has positioned it as a vital resource in modern industrial applications. For instance:

In the solar energy sector, quartz powder is used to manufacture photovoltaic cells, driving sustainable energy solutions.

In oil and gas exploration, it plays a crucial role in hydraulic fracturing, improving extraction efficiency.

Pharmaceutical and cosmetic industries utilize its non-toxic nature for formulating products that are safe and effective.

Such wide-ranging uses underline its importance in both traditional and emerging markets.

India’s Growing Market for Quartz Powder

India has emerged as a significant player in the global quartz powder market. With abundant natural resources and advanced manufacturing capabilities, the country has positioned itself as a hub for high-quality quartz powder. Indian manufacturers focus on:

Export Excellence: Supplying premium quartz powder to countries across Asia, Europe, and the Americas.

Sustainability: Implementing eco-friendly practices in mining and processing.

Customization: Catering to specific client needs by offering tailored grades of quartz powder.

One such prominent name in the Indian quartz powder manufacturing landscape is the Sudarshan Group. Known for its commitment to quality and innovation, the company has set benchmarks in delivering quartz powder that meets global standards.

Choosing the Right Quartz Powder Manufacturer

For businesses reliant on quartz powder, selecting the right manufacturer is crucial. Here are key factors to consider:

Reputation: Look for manufacturers with a proven track record of quality and reliability.

Certifications: Ensure compliance with industry certifications and environmental standards.

Supply Chain Efficiency: A robust logistics network ensures timely delivery of products.

Customer Support: Responsive service for addressing client requirements and concerns.

Conclusion

Quartz powder manufacturers are the backbone of industries that depend on this versatile material. With advancements in technology and increasing global demand, the future of quartz powder manufacturing is bright. Companies like the Sudarshan Group exemplify the industry's potential by consistently delivering quality products tailored to diverse needs.

By choosing the right quartz powder manufacturer, businesses can ensure the success of their projects while contributing to sustainable industrial growth. As quartz powder continues to shape industries, its significance in the global economy will only expand further.

0 notes

Text

An Insider’s Guide to Exporting Limestone from India | High-Quality Lime Solutions

India is one of the world’s largest producers of limestone, offering abundant reserves of high-quality material. Exporting limestone from India has become a lucrative opportunity, thanks to its growing demand in industries such as construction, steel, and environmental remediation. If you’re considering venturing into the export business, this guide will provide all the essential insights to help you succeed.

Whether you’re targeting markets that need high-quality lime for asphalt or are supplying materials for lime for industrial flotation Rajasthan, understanding the nuances of exporting limestone is critical. Let’s explore the key aspects of this process.

1. Why Export Limestone from India?

India’s limestone reserves are renowned for their purity, consistency, and quality. Industries across the globe rely on Indian limestone for applications such as:

Asphalt production

Industrial flotation processes

Cement manufacturing

Soil stabilization

Suppliers from regions like Rajasthan, in particular, are highly sought after for their expertise in producing lime for industrial flotation Rajasthan and other specialized applications.

Advantages of Indian Limestone:

High calcium carbonate (CaCO3) content

Minimal impurities like silica and magnesium

Competitive pricing

Well-established mining and processing infrastructure

2. Key Steps in Exporting Limestone

a. Identify Target Markets

The first step in exporting limestone is to identify demand in international markets. Countries in Southeast Asia, the Middle East, and Europe are major importers of lime in flotation process India and other specialized limestone products.

b. Comply with Export Regulations

Exporting limestone from India requires adherence to government regulations, including:

Obtaining an Import-Export Code (IEC)

Meeting customs documentation requirements

Ensuring compliance with environmental and mining laws

c. Partner with Reputable Suppliers

Collaborate with trusted suppliers who provide consistent quality. For instance, companies producing high-quality lime for asphalt often have robust quality assurance practices to meet international standards.

d. Arrange for Logistics

Efficient logistics are essential for successful exports. This includes:

Selecting the right shipping method (bulk or containerized)

Coordinating with freight forwarders

Ensuring proper packaging and labeling

3. Quality Assurance: A Key to Success

Quality assurance is paramount in the limestone export business. International buyers expect consistent quality, especially for specialized uses such as lime for industrial flotation Rajasthan or lime in flotation process India.

Tips for Maintaining Quality:

Conduct regular chemical and physical testing.

Use advanced processing techniques to ensure uniformity.

Provide detailed specifications to buyers, including calcium carbonate content and particle size.

4. Marketing Strategies for Limestone Exports

a. Build a Strong Online Presence

Create a professional website highlighting your products, certifications, and case studies. Optimize your site with keywords like high-quality lime for asphalt and lime in flotation process India to attract potential buyers.

b. Leverage Trade Platforms

Participate in trade shows, online marketplaces, and industry-specific forums to connect with global buyers. Platforms like Alibaba and IndiaMART can help showcase your offerings to a broader audience.

c. Develop Long-term Relationships

Establish trust with your clients by delivering consistent quality and excellent customer service. Repeat customers are crucial for sustainable growth in the export business.

5. Benefits of Sourcing Limestone from Rajasthan

Rajasthan is India’s leading limestone-producing state, known for its high-quality deposits. Suppliers from this region cater to diverse industries with products like lime for industrial flotation Rajasthan and high-quality lime for asphalt.

Key Advantages:

Rich natural reserves with consistent quality

Advanced processing facilities

Expertise in tailoring products for specific applications

Proximity to ports for easy export logistics

6. Challenges in Limestone Export and How to Overcome Them

a. Regulatory Hurdles

Exporting limestone involves navigating complex regulations. Work with experienced compliance officers and customs agents to streamline this process.

b. Quality Control

Maintaining quality across large shipments can be challenging. Invest in advanced testing facilities and implement strict quality assurance protocols.

c. Competition

The global limestone market is highly competitive. Differentiate yourself by offering superior quality, competitive pricing, and exceptional customer service.

7. Applications of Limestone in International Markets

Understanding the end-use of your product is crucial for targeting the right customers. Common applications include:

a. High-Quality Lime for Asphalt

Limestone is a key ingredient in asphalt production, improving its durability and stability. Buyers in infrastructure-focused regions often prioritize high-quality lime for asphalt.

b. Lime for Industrial Flotation Rajasthan

This specialized product is used in mining processes to separate valuable minerals. Indian suppliers are known for producing lime in flotation process India, meeting stringent international standards.

c. Cement and Concrete Production

Limestone is a primary raw material in cement manufacturing, making it a staple for construction industries worldwide.

8. Future Opportunities in Limestone Exports

The demand for limestone is expected to grow due to increasing infrastructure projects, environmental initiatives, and industrial development. Areas of opportunity include:

Supplying high-quality lime for asphalt for road construction projects

Expanding into emerging markets requiring lime in flotation process India

Developing value-added products like hydrated lime

9. How to Choose the Right Buyers

a. Conduct Market Research

Identify buyers in industries such as construction, steel, and mining who require products like lime for industrial flotation Rajasthan.

b. Evaluate Buyer Credibility

Verify potential buyers through references, trade directories, and credit checks to ensure reliability.

c. Establish Clear Contracts

Negotiate terms that cover product specifications, delivery timelines, and payment conditions to avoid disputes.

Conclusion

An Insider’s Guide to Exporting Limestone from India provides essential knowledge for navigating this lucrative industry. By focusing on quality assurance, compliance, and effective marketing, you can establish a strong foothold in the global market. Leveraging India’s reputation for producing high-quality lime for asphalt, lime for industrial flotation Rajasthan, and lime in flotation process India, exporters can tap into growing demand and build a sustainable business.

Rajasthan’s rich limestone reserves and experienced suppliers make it the perfect starting point for your export journey. With careful planning and execution, exporting limestone from India can become a profitable and rewarding venture

#High-quality lime for asphalt#Lime for industrial flotation Rajasthan#Lime in flotation process India

0 notes

Text

#cement export from India#cement exporters in India#cement HS code#export of cement from India#cement export data

0 notes

Text

Rosneft and Reliance Sign Historic $13 Billion Oil Deal, Strengthening India-Russia Ties

https://oilgasenergymagazine.com/wp-content/uploads/2024/12/1-Rosneft-and-Reliance-Sign-Historic-13-Billion-Oil-Deal-Strengthening-India-Russia-Ties-Source-businessupturn.com_.jpg

Source: businessupturn.com

Category: News

In a landmark agreement, Russia’s state-owned oil giant Rosneft has signed its largest-ever crude supply deal with India’s private refiner, Reliance Industries. The deal, spanning 10 years, involves the supply of approximately 500,000 barrels per day (bpd) of crude oil, accounting for nearly 0.5% of the global supply. At current prices, this agreement is valued at around $13 billion annually. The deal comes at a time when Western sanctions on Russia, stemming from its 2022 invasion of Ukraine, have redirected global energy trade flows.

The agreement highlights India’s growing role as a critical buyer of Russian oil amid sanctions. As the European Union reduced Russian imports, India seized the opportunity to purchase oil at discounted prices. Russia now accounts for over a third of India’s total energy imports, making it a significant player in India’s energy security strategy. This deal strengthens bilateral energy cooperation ahead of Russian President Vladimir Putin’s planned visit to India.

Competitive Edge and Market Dynamics

The Reliance and Rosneft deal poses a challenge for competing oil producers, particularly those in the Middle East, like Saudi Arabia. India is one of the fastest-growing energy markets, with increasing demand positioning it as a key player in global energy consumption. With slowing growth in China, oil producers are fiercely competing for market share in India.

Under the agreement, Rosneft will supply Reliance with 20-21 Aframax-sized shipments of Russian crude monthly, along with three cargoes of fuel oil. These deliveries will be directed to Reliance’s Jamnagar refining complex in Gujarat, the largest refining hub in the world. The deal’s terms allow for annual reviews of pricing and volumes to reflect changes in global market dynamics.

Reliance and Rosneft had previously collaborated on smaller crude supply deals, but this agreement marks a substantial increase in volumes. It is expected to absorb nearly half of Rosneft’s seaborne oil exports, significantly limiting supplies available for intermediaries and other buyers.

Oil Pricing and Future Prospects

Sources familiar with the agreement revealed that pricing will be linked to the Dubai benchmark, with slight premiums for specific Russian light sweet crude grades like ESPO, Sokol, and Siberian Light. Meanwhile, the medium-sulphur Urals crude, which is particularly favored by Indian refiners, will be priced at a discount of $3 per barrel to Dubai quotes.

This long-term deal, set to begin in January 2024, could extend for another decade, underlining the strategic importance of the India-Russia energy partnership. Reliance’s imports of Russian crude have already surged, averaging 405,000 bpd between January and October 2023, up from 388,500 bpd during the same period last year.

With this agreement, Reliance further cements its position as a leading buyer of Russian oil, ensuring a steady and cost-effective supply. For Rosneft, this deal secures a long-term buyer at a time when Western sanctions have restricted access to key markets. As global energy dynamics evolve, this partnership underscores how geopolitical shifts are reshaping the flow of oil trade across the world.

0 notes

Text

[ad_1] Greater Noida, Uttar Pradesh, India 135000 square metres of exhibition space brimming with state-of- the-art solutions. 51,118 trade visitors from across India and global markets. 6,298 buyer-seller meetings fostering impactful collaborations. Introduction of 20,000+ groundbreaking products and solutions The 7th edition of bauma CONEXPO INDIA has set a transformative precedent for India’s construction, mining, and infrastructure industries. Held from December 11 to14, 2024, at the India Expo Centre in Greater Noida, this year’s edition has been a landmark in the nation’s infrastructure journey. Mr. Bhupinder Singh, CEO, Messe Muenchen India, Shri Nitin Gadkari, Hon’ble Minister for Road Transport and Highways (GOI), Dimitrov Krishnan, Mr. V. Vivekanand at the recently concluded bauma CONEXPO India 2024 Spanning over 135,000 square metres of exhibition space, bauma CONEXPO INDIA 2024 showcased groundbreaking innovations that drew more than 51,118 trade visitors from 83 countries. The trade fair facilitated 6,298 impactful buyer-seller meetings and unveiled more than 20,000 cutting-edge products and solutions, driving transformative advancements in India’s infrastructure landscape. Bringing together 984 exhibitors, the trade fair created a dynamic platform for innovation, collaboration, and sustainable growth, cementing its stature as the largest construction trade fair in North India. These numbers underscore the event’s critical role in powering India’s infrastructure ambitions, aligning with the nation's aspirations to become a $5 trillion economy. The trade fair was officially inaugurated by Shri Nitin Gadkari, Hon’ble Union Minister for Road Transport and Highways, Government of India. He marked the occasion by lighting the ceremonial lamp. In his inaugural address, he stated that, "India is rapidly transforming into a global infrastructure powerhouse with large-scale projects worth ₹70 lakh crore already underway. To sustain this momentum, we must prioritize technological innovation, invest in research & development, and adopt sustainable fuels. The construction equipment industry, being the world’s third largest, has immense potential to expand exports and strengthen India’s manufacturing capabilities. I urge industry leaders to focus on advanced technologies and global partnerships to ensure long-term growth and a greener, more competitive future.” Bhupinder Singh, CEO, Messe Muenchen India, "bauma CONEXPO INDIA 2024 has firmly established itself as a platform that bridges India’s unique needs with global expertise, playing its part in shaping the vision of a ‘Viksit Bharat.’ The strong participation this year highlights India’s growing prominence as a hub for innovation and progress in infrastructure. From live demonstrations of advanced machinery to focused discussions on sustainability, emerging technologies, and project execution, this edition showcased practical steps the industry is taking to meet India’s ambitious infrastructure goals. It reflects the industry’s collective drive to harness innovation and collaboration as key tools to build a resilient, sustainable future for the nation." Stefan Rummel, CEO, Messe München GmbH, "bauma CONEXPO INDIA 2024 has become a trusted platform for the global construction machinery community, where ideas are exchanged, partnerships are formed, and the groundwork for future growth is laid. This year’s edition has further strengthened international collaborations and created opportunities that will contribute to the long-term progress of the industry. It’s great to see the collective effort and innovation driving this transformation." Demtech India 2024 debuted as a collocated show, bringing a dedicated focus to the latest trends and advancements in demolition technology, further enriching the event’s offerings.

The NASSCOM Pavilion drew significant attention by spotlighting transformative innovations in construction technology and digital solutions. Meanwhile, the Finance Zone served as a vibrant networking hub, fostering valuable connections between industry stakeholders and leading financial institutions. Adding a global dimension, International Pavilions from countries like Germany, Italy, China, and South Korea, and many others showcased groundbreaking technologies, offering attendees an unparalleled opportunity to explore diverse innovations. Voices That Matter: Insights from Leaders Dimitrov Krishnan, Chairman, bauma CONEXPO INDIA 2024 and Managing Director, Volvo Construction Equipment, "This edition of bauma CONEXPO INDIA underscored the industry’s role as a driver of change, emphasizing smarter, more resilient infrastructure solutions. By championing cutting-edge technologies, skill development, and sustainability, the trade fair has provided a powerful blueprint for the future. It reflects a unified effort to not only meet current demands but to shape a more sustainable and globally competitive ecosystem." K. Vishwanathan, All India President, Builders Association of India (BAI), "bauma CONEXPO INDIA 2024 has been a critical trade fair for the construction sector. It provided a platform where industry leaders, contractors, and manufacturers could come together to explore advanced technologies and solutions. Such engagements are essential for driving India’s infrastructure growth and ensuring industry-wide progress.” V. Vivekanand, President, ICEMA & Managing Director, Caterpillar India Pvt. Ltd., "bauma CONEXPO INDIA 2024 continues to serve as the cornerstone trade fair for the construction equipment industry. It creates an unmatched environment for industry stakeholders to collaborate, showcase innovations, and strengthen India’s position as a global manufacturing hub. The knowledge-sharing and business opportunities here are critical for the sector’s future." The trade fair’s strategic influence resonates far beyond its exhibition halls, creating ripple effects across the industry. By showcasing solutions tailored for large-scale infrastructure projects, the event supports India’s economic aspirations, accelerating the construction of smart cities, highways, and industrial corridors. With participation from international exhibitors and buyers, the trade fair positioned India as a global hub for construction innovation, inviting foreign investments and fostering cross-border collaborations. Through partnerships with organizations like ICEMA and CRRI, the event emphasized skilling initiatives, preparing the workforce for the demands of digital transformation and next-gen machinery. By connecting exhibitors, buyers, policymakers, and thought leaders, bauma CONEXPO INDIA 2024 has catalysed partnerships that will steer the sector toward greater resilience and innovation. This edition was jointly organised by the Builders Association of India (BAI) along with the association partners Indian Construction Equipment Manufacturers’ Association (ICEMA). Leading industry associations that supported bauma CONEXPO INDIA 2024 were Construction Equipment Rental Association (CERA), Committee for European Construction Equipment (CECE), Spanish Manufacturers Association of Construction and Mining Equipment (ANMOPYC), German Machinery and Equipment Manufacturers Association (VDMA), Cranes Owners Association of India (COAOI), Construction Federation of India (CFI) and many more. Banayenge Viksit Bharat: A Vision in Action This edition's theme, Banayenge Viksit Bharat, was woven into every aspect of the event. Showcasing technologies that prioritize efficiency, sustainability, and resilience, bauma CONEXPO INDIA 2024 became a rallying point for industry stakeholders striving to shape India's infrastructure future. Knowledge at the Core: Conferences Driving Change

With 30+ knowledge-sharing sessions, bauma CONEXPO INDIA 2024 went beyond an exhibition. Organized by ICEMA, CRRI, TAI, and CFI, key conferences included: Charting India’s Infrastructure Growth Journey for Viksit Bharat Innovative Techniques in Demolition & Recycling Use of Waste Materials in Road Construction These sessions offered actionable insights, addressing key challenges in sustainability, skill development, and digital transformation. For more details and post-event highlights, visit www.bcindia.com. About bauma CONEXPO INDIA bauma CONEXPO INDIA is the premier international trade fair for construction machinery, building material machines, mining machines, and construction vehicles in North India. A pivotal industry event, it unites the global expertise of two leading trade fairs—bauma by Messe München in Munich and CONEXPO-CON/AGG by the Association of Equipment Manufacturers (AEM) in Las Vegas. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Rajat Export: Your Trusted Partner for Elevator Bucket Bolts in India

When it comes to sourcing top-quality elevator bucket bolts in India, Rajat Export is the name you can trust. With decades of expertise and a reputation for excellence, we specialize in manufacturing durable, precision-engineered bolts that cater to a wide range of industrial and agricultural applications. Our commitment to quality, reliability, and innovation has made us a leading supplier in the market, delivering superior products to customers across India and beyond.

Why Choose Rajat Export for Elevator Bucket Bolts in India?

At Rajat Export, we understand the critical role that elevator bucket bolts play in conveyor and material handling systems. These bolts are essential for ensuring the secure attachment of buckets to conveyor belts or chains, contributing to the efficiency and safety of your operations. Here’s why Rajat Export is the preferred choice for customers:

1. Uncompromised Quality

We prioritize quality above all else. Our elevator bucket bolts are manufactured using high-grade raw materials that ensure durability, resistance to wear and tear, and long-lasting performance even in demanding environments. Every bolt undergoes stringent quality checks to meet international standards.

2. Precision Engineering

With advanced manufacturing facilities and a skilled team of engineers, we produce bolts that are precise in dimensions and robust in construction. This guarantees a perfect fit and reliable performance, making them ideal for various conveyor systems.

3. Wide Product Range

Rajat Export offers a comprehensive range of elevator bucket bolts in India, including standard designs and customized options. Whether you need bolts for light-duty or heavy-duty applications, we have the right solution for you. Our bolts come in various sizes, finishes, and grades to meet diverse customer requirements.

4. Competitive Pricing

We believe in delivering value to our customers. Our competitive pricing ensures that you get the best quality products without exceeding your budget. At Rajat Export, affordability goes hand-in-hand with excellence.

5. Timely Delivery

We understand the importance of timely deliveries for your business operations. Our efficient logistics network ensures that your orders are delivered on schedule, no matter where you are in India or overseas.

Applications of Elevator Bucket Bolts

Elevator bucket bolts are an integral part of various industries, including:

Agriculture: Used in grain elevators and conveyors for transporting crops like wheat, rice, and maize.

Construction: Essential for handling materials such as sand, gravel, and cement.

Food Processing: Used in systems that transport raw or processed food products.

Mining: Ideal for heavy-duty applications involving coal, minerals, and ores.