#estate sale liquidators

Explore tagged Tumblr posts

Text

Unlocking the Best Estate Liquidation Services in New Jersey

In the realm of estate liquidation, finding the right services tailored to your needs can be akin to navigating a maze. Fear not, for we are here to guide you through the intricate world of estate liquidation NJ. With our comprehensive expertise and dedication to excellence, we are committed to providing you with unparalleled assistance every step of the way.

Understanding Estate Liquidation in New Jersey

Before delving into the specifics of estate liquidation New Jersey services, it's imperative to grasp the concept itself. In essence, estate liquidation encompasses the process of efficiently and effectively disposing of the assets within an estate. Whether it's due to downsizing, relocation, or the unfortunate passing of a loved one, estate liquidation ensures a seamless transition while maximizing the value of assets.

What Are Estate Liquidation Services?

Estate liquidation services encompass a wide array of offerings designed to facilitate the smooth execution of the liquidation process. From conducting estate sales Montclair NJ to appraising assets and managing the logistics of liquidation sales, these services cater to the diverse needs of clients in New Jersey and beyond.

How Do Estate Sale Liquidators Assist?

Estate sale liquidators play a pivotal role in orchestrating successful estate sales New Jersey. Leveraging their expertise in pricing, marketing, and sales strategy, these professionals work tirelessly to attract prospective buyers and maximize returns for the estate. By meticulously assessing the value of each item and employing proven sales tactics, estate sale liquidators ensure optimal outcomes for their clients.

Unparalleled Estate Liquidation Services in New Jersey

When it comes to Estate sale liquidators in New Jersey, excellence is non-negotiable. As industry leaders, we take pride in offering a comprehensive suite of services aimed at exceeding our clients' expectations.

Tailored Solutions for Every Client

We understand that each estate is unique, and as such, we approach every project with a customized strategy tailored to the client's specific needs. Whether you require assistance with downsizing, relocation, or managing the assets of a deceased loved one, our team is equipped to handle every aspect of the liquidation process with precision and professionalism.

Seamless Execution, Exceptional Results

From the initial consultation to the final sale, our team is committed to delivering a seamless experience marked by efficiency, transparency, and superior results. With a keen eye for detail and a relentless pursuit of perfection, we leave no stone unturned in our quest to maximize the value of your assets and ensure stress-free estate liquidation sales.

Transparent Pricing, No Hidden Costs

At the core of our ethos lies a commitment to transparency and integrity. Unlike other estate liquidation services that may surprise you with hidden fees and exorbitant charges, we believe in upfront pricing and honest communication every step of the way. With us, you can rest assured knowing that your estate sale NJ is always our top priority.

Elevate Your Estate Liquidation Experience Today

Don't settle for subpar estate liquidation services when you can partner with the best in the liquidation estate sales business. With our unwavering dedication to excellence and a track record of success, we are poised to elevate your liquidation experience to unprecedented heights. Contact us today to learn more about how we can assist you with all your estate liquidation needs in New Jersey and beyond.

#estate liquidation nj#estate liquidation new jersey#estate sales new jersey#estate sale liquidators#liquidation sales#estate sales montclair nj

0 notes

Text

Downsize Managers | Estate Liquidator in Bridgeport CT

Ours is among the most renowned Auction Houses in Bridgeport CT. We offer a wide range of items, from rare antiques to modern collectibles. We are passionate about providing a fair and transparent bidding process for both buyers and sellers. Furthermore, we have a well-earned reputation as the best Estate Liquidator in Bridgeport CT. With years of industry experience, we have the expertise and knowledge to handle any size estate. We take pride in our professional and compassionate approach to every client, making the process as stress-free as possible. So, get in touch with us today to find your next treasure.

#Estate Liquidator in Bridgeport CT#Auction Houses in Bridgeport CT#Estate Liquidator near me#Antiques Sale near me#Real Estate Auctions near me

2 notes

·

View notes

Text

Estate Liquidator Gastonia NC: Estate Cleanout, Sales & Junk Removal Services

If you’re dealing with the daunting task of clearing out a home or property in Gastonia, NC, the services of an estate liquidator can offer valuable assistance. Estate liquidation is not only about removing items; it’s a process that can help organize, sell, or donate belongings while ensuring that everything is handled with care and professionalism. In this article, we’ll explore what estate liquidation involves, why it’s beneficial, and how it ties into junk removal in Gastonia, NC.

What is an Estate Liquidator?

An Estate Liquidator In Gastonia NC, specializes in helping families or individuals liquidate the contents of an estate, typically after a life event such as the passing of a loved one, downsizing, or relocation. These professionals help with sorting, organizing, selling, and removing items. They may also conduct estate sales, providing a way to sell personal belongings in a structured, organized manner.

An estate liquidator’s role can vary depending on the needs of the client. Some liquidators focus on the financial aspect, helping to organize and sell valuable items, while others may specialize in the removal of unwanted or unsellable goods.

Estate Liquidation Services in Gastonia, NC

Estate Cleanout

One of the main services provided by an estate liquidator is an estate cleanout. This involves clearing out the entire property, ensuring that every room and space is carefully emptied of all personal belongings. Whether you're facing a large home or a small apartment, estate cleanout services in Gastonia, NC, can be a critical part of the liquidation process. The goal is to leave the space clean, organized, and ready for sale or transfer.

Estate cleanouts are particularly helpful when it’s difficult to handle the task on your own. An estate liquidator will bring the necessary manpower and expertise to ensure everything is done efficiently and respectfully, allowing you to focus on other matters.

Estate Sales

Estate sales are another common service offered by estate liquidators. These sales provide an opportunity for individuals to sell high-value items such as antiques, jewelry, or artwork, as well as everyday household items. Estate sales can take place on-site, where items are displayed and sold directly to buyers, or they may be conducted online, depending on the preferences and needs of the client.

Estate sales are an excellent way to ensure that valuable items find new owners, and they can help ease the burden of sorting and pricing everything individually. Working with an estate liquidator ensures that the sale is organized and that all items are fairly priced to reflect their market value.

Garage Cleanout

Garages often accumulate a lot of clutter over the years, from old tools and sporting equipment to outdated furniture and boxes of forgotten items. A garage cleanout is another essential service offered by estate liquidators. Clearing out a garage can be a time-consuming task, but with the help of an experienced team, it can be done quickly and efficiently. Whether you’re preparing for an estate sale, downsizing, or simply need to clear out excess items, a garage cleanout is a necessary part of many estate liquidation projects.

Junk Removal Gastonia NC

While estate liquidation focuses on sorting and organizing belongings, junk removal in Gastonia, NC, deals specifically with the removal of items that have little to no value. These items could include old furniture, broken appliances, or things that are too worn out to be sold or donated.

Junk removal is often an essential component of an estate liquidation, as many items need to be discarded once the estate cleanout or sale is complete. An estate liquidator can also offer junk removal services to ensure that unwanted items are taken away promptly and disposed of responsibly. Working with a professional junk removal service ensures that your items are removed safely and efficiently, without you having to worry about the logistics of hauling them away.

Why Hire an Estate Liquidator in Gastonia NC?

Expertise in Handling Valuable Items

Estate liquidators are skilled in identifying valuable items, from antique furniture to rare collectibles. If you're not sure what might be worth something, their experience ensures that nothing valuable is accidentally discarded or sold for less than its worth. They have the knowledge to sort through belongings and determine which items should be kept for sale and which can be removed.

Emotional Support

Estate liquidation often occurs during a difficult time, such as following the death of a loved one or while dealing with personal transitions like moving or downsizing. Estate liquidators are accustomed to working with families during these emotional moments and can provide the necessary support and professionalism. They understand the sensitivity of the situation and are committed to handling all belongings with care and respect.

Time-Saving

Trying to manage an estate liquidation on your own can be overwhelming, especially if the property is large or the items are numerous. Hiring an estate liquidator in Gastonia, NC, can save you significant time and effort. Estate liquidators are experienced in organizing, sorting, and selling items efficiently, ensuring that the entire process moves quickly and smoothly. This gives you the ability to focus on other important matters without worrying about the logistics of liquidation.

Stress Reduction

Handling an estate can be a stressful experience, and the idea of cleaning out an entire property can be a daunting task. An estate liquidator takes the stress out of the situation by overseeing the entire process. From the estate cleanout to junk removal, they ensure that everything is taken care of with minimal disruption to your daily life.

The Importance of Junk Removal in Estate Liquidation

Junk removal plays a critical role in the overall estate liquidation process. After an estate cleanout, some items may not be suitable for sale, donation, or recycling. Junk removal services help to clear out these unwanted items, making the space cleaner and ready for the next stage, whether it's an estate sale, rental, or sale of the property.

Junk removal is also important for creating a clutter-free environment. A cluttered space can delay the process of selling or moving, making it harder for potential buyers or renters to envision the property’s full potential. Junk removal helps in improving the overall appearance of the estate and ensuring that it is ready for its next phase.

Conclusion

Estate liquidation in Gastonia, NC, is a complex process that involves a combination of estate cleanout, estate sales, and junk removal. Working with an experienced estate liquidator can make the entire process more manageable and stress-free, whether you’re dealing with a loved one’s belongings, downsizing, or preparing a property for sale.

With services such as estate cleanouts, estate sales, and garage cleanouts, an estate liquidator ensures that your needs are met efficiently. Moreover, Junk Removal Services Gastonia NC complement these efforts, ensuring that everything is cleared and disposed of properly. No matter the size or complexity of the estate liquidation, hiring a professional team can make a significant difference in streamlining the entire process.

0 notes

Text

Website : https://kings-auctions.com/beverly-hills-estate-sales-and-auctions

Address : 9903 Santa Monica Blvd. Beverly Hills, California 90212

Phone : +1 800-524-1032

Headquartered in Las Vegas Nevada, Kings Auctions has 23 additional locations across the USA, including of course, Beverly Hills. The auction and consignment business model serves public and private sales, corporate clients, luxury estate sales, celebrity representation, appraisals, and consulting.

Business mail : [email protected]

#Beverly Hills Estate Sales#Estate Sales#Auctions#Consignments#Estate Liquidations#Business Liquidations

1 note

·

View note

Text

Website : https://kings-auctions.com/las-vegas-estate-sales-and-auctions

Address : 5530 S. Valley View Blvd, Las Vegas, NV 89118

Phone : +1 800-524-1032

Headquartered in Las Vegas Nevada, Kings Auctions has 23 additional locations across the USA. The auction and consignment business model serves public and private sales, corporate clients, luxury estate sales, celebrity representation, appraisals, and consulting.

Business mail : [email protected]

#Las Vegas Estate Sales#Estate Sales#Auctions#Consignments#Estate Liquidations#Business Liquidations

1 note

·

View note

Text

Fountain Hills Estate Sales | Professional Estate Liquidation Services - Fresh Start Estate Sale

Looking for trusted Fountain Hills estate sales services? Fresh Start Estate Sale provides expert estate liquidation and downsizing solutions in Fountain Hills. Our dedicated team ensures a smooth process, helping you sell valuable items from furniture to collectibles. Whether you are moving, downsizing, or managing an estate, we deliver a stress-free and efficient experience.

0 notes

Text

Maximize Your Estate Sale with Professional Liquidators | Tips for Downsizing Homeowners

Some individuals unknowingly sell valuable items at a loss when downsizing or managing an estate. Estate liquidators can assist with pricing, marketing, and selling, but it's crucial to vet them carefully. Prepare by organizing, researching values...

Someone pays $10 for $2,000 worth of gold coins and $30 for a $3,000 1960’s Gibson acoustic guitar. These are extreme examples, but some homeowners sell their family estate items at big losses because they didn’t know the values of those items. Also, some coffee mugs sell for $100 and vintage bottle caps sell for $20 each. If you are downsizing and have time, then you may research sale…

View On WordPress

#estate liquidator#estate sale#finding estate sales company#how to find estate sales person#How to handle estate#Personal Representative#Selling Parent&039;s House

0 notes

Text

All about EstateMAX! A Full Service, Estate Sale and Move Management Company- Take What You Love & Leave the Rest to EstateMAX

View On WordPress

#Advertising#Downsizing#Estate Liquidation#Estate Sale Companies#Estate Sale DC Metro#Estate Sale Maryland#EstateMAX#Senior Citizens#Stuff#Transitions

0 notes

Text

KIRBY

WELCOME TO KIRBY'S ESTATE SALES, Kirby and his team of qualified professionals can assist you through all stages of Estate Liquidation and Clean Out services. Our full-service, turn-key company provides estate sales (organizing, staging, pricing, on-site management of sales, and removal of items after the sale) as well as item appraisals and complete clean.

#appraisal service milwaukee#appraisals milwaukee#clean out sale milwaukee#cleanout companies milwaukee#cleanout company milwaukee#cleanouts & liquidations milwaukee#estate clean outs milwaukee.

0 notes

Text

Maximizing Your Success with Estate Sales in New Jersey

Welcome to our comprehensive guide on navigating the world of estate sale NJ! As estate liquidators based in the vibrant state of New Jersey, we understand the intricacies and nuances involved in orchestrating successful estate sales liquidation events. Whether you're a seasoned investor or a first-time attendee, our expertise and dedication to excellence ensure that your experience with estate liquidation services is nothing short of exceptional.

Understanding Estate Sales

What Are Estate Sales?

Estate sales NJ are unique events where the possessions of a home are sold off, typically due to major life events such as a death, relocation, or downsizing. These sales offer a diverse array of items, ranging from furniture and antiques to collectibles and household goods.

The Role of Estate Liquidators

Estate liquidators play a crucial role in facilitating the smooth execution of estate sales liquidation. They are experts in pricing items, marketing the sale, managing logistics, and maximizing profits for the estate.

Key Factors for Success

Strategic Planning

Successful estate liquidators NJ sales require meticulous planning and organization. From setting a date to sorting and staging items, every aspect must be carefully coordinated to ensure a seamless experience for buyers and sellers alike.

Effective Marketing

Utilizing various channels such as social media, email newsletters, and local advertisements is essential for attracting a diverse pool of buyers to your estate sale NJ. Our team employs cutting-edge marketing strategies to generate buzz and drive foot traffic to your event.

Professional Presentation

First impressions are crucial for estate liquidators New Jersey. By investing in professional staging and presentation, you can elevate the perceived value of your items and entice buyers to make purchases.

Our Commitment to Excellence

We pride ourselves on delivering unparalleled service and results to our clients. With years of experience in the industry, we have established ourselves as leaders in the field of estate liquidation sales. Our dedicated team works tirelessly to exceed your expectations and ensure a successful outcome for your estate sale.

#estate sale nj#estate sales liquidation#liquidation estate sales#estate liquidation services#estate liquidators new jersey#estate liquidators nj

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

6K notes

·

View notes

Text

Estate Liquidation Auctions: Everything You Need to Know

An estate liquidation auction is a sale of all or part of the contents of an estate, typically held after the death of the owner. Estate liquidation auctions can also be held to downsize an estate, settle a divorce, or simply to sell off unwanted items.

#liquidators florida#florida estate auctions#estate buyers west palm beach#estate auction liquidators#estate liquidators palm beach county#estate liquidation auctions#palm beach county auction#estate sales fl#sound estate auctions

0 notes

Text

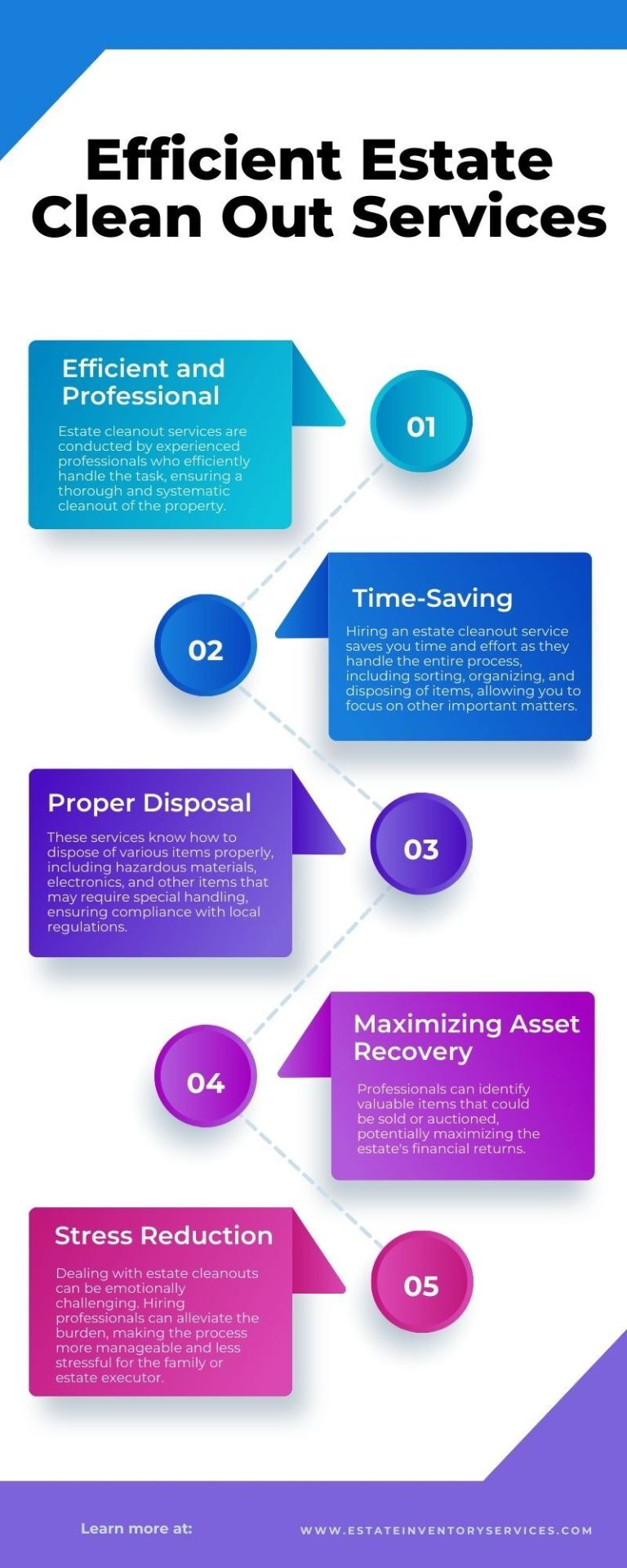

Efficient Estate Clean Out Services

Our efficient estate cleanout services offer a streamlined process with expert guidance. Our experienced team handles sorting, organizing, and proper disposal of items, including hazardous materials. Maximize asset recovery as we identify valuable items for potential sale or auction. Trust us to ease the burden and stress of estate cleanouts with professionalism and care.

#estate auction#estate sale#online auction#estate inventory#estate sale planners#estate sale organizers#estate buyouts#estate liquidation services#estate planning#estate cleanout

0 notes

Text

Blue Moon Estate Sales - Spartanburg, SC | Estate liquidator in Spartanburg SC

Our Estate Sales Company in Laurens SC, specializes in helping clients navigate the complex process of liquidating an estate. Our experienced team can handle everything from organizing and pricing to marketing and conducting the sale. We take pride in providing a seamless and hassle-free experience for our clients, ensuring they receive maximum value for their items and peace of mind. Moreover, we have a well-earned reputation as the most notable Estate Liquidator in Spartanburg SC. Our goal is to create monetary benefits for you by helping you get rid of unwanted or unused items – ensuring seamless estate sales. So, if you need our expert assistance, call us today.

#Estate liquidator in Little Mountain SC#estate liquidators near me#estate sales company in Little Mountain SC#estate tag sales near me

1 note

·

View note

Text

i got a soft spot for you / r. c | part two

pairing: rafe cameron x female reader

part one / part two / part three

cw: exes to lovers, angst, rafe redemption arc, brief mentions of alcohol/substances, some swearing, there's sweet and fluffy reconciliation at the end.

summary: y/n breaks up with rafe due to his problem with alcohol/substances. summer passes by and they find themselves at the same place one night. rafe is determined to prove he's changed for the better.

inspiration: soft spot by keshi

♫ you know i got a soft spot for you

baby, can't you see?

i need you 'cause you're everything that i’m not...

. . .

the last place you wanted to be was in a random kildare bar, flanked by sweaty bodies while electronic music reverberated through your skull.

your friends had somehow convinced you this was just a part of the “healing journey” after your breakup.

it sounded like a good idea on paper - or rather, text. but once you put yourself into your favourite outfit and took a shot of liquid courage, the novelty was already wearing off.

you missed him.

him being the only thing on your mind all summer. you thought that time would naturally heal the wound you were nursing, but it soon became evident the gap was too big to fill.

besides, filling it with alcohol and parties — given what you’d been through, was laughable. in a not-so-funny manner.

before your mind could slip further away from the present, you heard the sound of your name pull you back.

“it’s y/n, right?” a guy in a fitted polo chimed as he saddled up to your section of the dance floor.

you didn’t recognize him. a slight panic began to crawl up your throat.

it was extinguished by a tap on your shoulder, as one of your friends revealed themself.

they shot you a wide grin with two thumbs-up before ushering the rest of the group away.

just great. i’ve been ambushed with a set up.

you pushed out an exasperated breath and retrained your focus on the guy in front of you.

“sorry, uh — i don’t know your name…” you replied, offering a polite smile.

maybe this was good. talking to someone new could be good for you.

he was fairly handsome, blonde waves kissing the top of his shoulders and a pair of deep brown eyes.

“i’m paul. i’m in town for an estate sale,” he grinned, but it didn’t feel overly warm. there was an air of arrogance embedded in his expression.

“oh! well, that’s pretty interesting…” you trailed, waiting for him to continue.

when he didn’t, you nodded awkwardly, absently searching for your friends.

paul must’ve registered your lack of interest because he worked quickly to remedy this sinking ship.

“look — i’ve kinda been working up the courage to talk to you all night,” he said, before scratching the back of his head. “care for a dance?”

without waiting for your answer, paul reached out his hand just as a new song began playing, something with a slower tempo.

“i gave the dj a ten to play this song, what do ya say?” he gave you a toothy smile.

deciding quickly that one dance couldn’t hurt, you placed your hand in his as you began moving to the beat.

halfway into the song, paul took it upon himself to twirl you outwards, leaving you to follow his lead.

you tried to focus on the moment as the strobing lights flashed overhead and the music swelled.

but just then, the dam you'd built so high, abruptly broke.

a singular memory from a year ago burst through with a force strong enough to put your next step off kilter.

“you’d think you were born with two left feet, rafe cameron,” you giggled as rafe struggled to avoid stepping on your toes.

you were suddenly transported back in time to your cousin’s wedding a year ago.

“listen, we all can’t be as graceful as y/n l/n,” rafe sighed, exacting another misstep. but there was a smirk on his face, the kind of smirk where his eyes would crinkle with pure admiration.

“i told you we should have practiced before — ah!” your next sentence was cut short as the two of you fell into a tangled mess of limbs in the middle of the dance floor.

the absurdity of the situation outweighed any embarrassment and soon, the both of you were in uncontrollable hysterics.

a giggle tumbled from your lips as you spun before evolving into a full unabridged fit of laughter.

your heart pinched, the memory wedging itself deep within it. an overwhelming feeling of longing came next, just as the song was ending.

paul spun you inward to his body, before dipping you downwards to end your dance with a flourish.

blood rushed to your head, and it wasn’t due to being propelled downward, although that added a dizzying pressure behind your eyes. you needed some air.

you would thank paul for the dance, exit quietly and —

“wow. a girl as gorgeous as you AND a great dancer?” paul leaned in. too close. “i’m in love,” he murmured in your ear.

“i’m so in love with you, rafe.”

and with that, the dam was shattered.

“why is that not good enough for you? are the drugs and alcohol all you fucking care about?”

that morning was now playing on a vicious loop in your mind. you, standing in front of rafe on his porch, packed bags hanging from your arms.

“of course not! fuck — y/n, baby, please. i’ll get better — i will. i will. i’m sorry!”

tears stung your eyes.

“i’ve heard that so many times before, rafe. but you know what i haven’t heard once come from your mouth?”

“i’m sorry — i have to go,” you shook from paul’s hold, leaving him stunned and alone in the middle of the bar.

you began to rush towards the exit, running past your confused friends as you clutched a hand to your heaving chest.

“i’ve never heard you say you love me.”

barreling through the side door, you spluttered out a few ragged breaths, the scent of sea salt reaching your nose.

you teetered towards the shore of the beach opposite the bar, feeling an overwhelming urge to sink your knees into the cool sand to ground yourself.

all of a sudden, a familiar voice cut through the night air.

“y/n?”

your head shot up, never expecting to hear your name pass his lips again.

rafe’s blue eyes held you in place.

you drank him in. his hair was buzzed and he appeared to have packed on some muscle. he looked healthy.

when your gaze finally settled on his, his throat wobbled. his next intake of breath thick with emotion.

here he was, in all his glory. time seemed to come to a halt.

slam.

“wait! y/n…” paul appeared, throwing the back door open. he was panting slightly but righted himself when he spotted you.

this could not be happening.

rafe had been in the middle of taking a step towards your crumpled form, burning with the need to hold you. he retracted, standing up tall and shoving his hands into his front jean pockets.

he felt like a fool as he followed your line of sight to paul, agony flashing across his face.

unable to steal another glance at rafe, you slowly rose, making your way towards paul.

wiping your tear-stained face, you offered an unconvincing “hey.”

paul seemed to clock rafe’s facial expression, the desire apparent.

his jaw ticked and suddenly, the suave aura paul had exuded, evaporated. once you reached him, he scoffed incredulously, earning a confused look from you.

“so what? you ditched me to run out here for another guy?” paul spat, crossing his arms defensively.

“what? no - i just needed some — ”you began.

“save it. girls like you aren’t worth my time.”

you were suffering from whiplash. this guy, this stranger, had just shown his true intentions.

discomfort bloomed in your chest.

“woah — listen here, dumbass,” rafe snarled, taking large strides towards paul, venom oozing from his voice.

“stop. it’s okay, rafe.”

and rafe did indeed stop.

because you had said his name and it sounded so good.

“think whatever you want,” you replied, not giving paul the decency of eye contact. he huffed before muttering some other insult and stormed back towards the bar.

the only sound to be heard was the gentle lapping of waves against the sand. you were suddenly feeling very tired.

you turned to rafe, who was now only a few steps from you, his towering frame just about absorbing all of the light the full moon had to offer tonight.

your heart ached as you instinctively wrapped your arms around your body. rafe noticed and cleared his throat, becoming overly invested in the sand beneath his feet.

“uhm… thank you. for being there while he…” you had no idea what you were saying. heat rose to your cheeks.

rafe shook his head swiftly and waved you off.

“no — i mean, i didn’t do much. you were, you were great. you handled that very well, i mean,” he mumbled, rubbing the back of his neck.

a small smile pulled at the corners of your mouth, but you were brought back to reality when you remembered the memory you were recounting before you broke out into tears in the middle of a crowded bar.

“look, y/n i — ” rafe started, capturing your stare, wanting to be in your presence for just a little longer.

a beat passed, you lowered your eyes.

“no, please. i’m not interested in hearing what you have to say. i can’t handle any more empty promises,” you remarked, recalling how many times rafe would apologize and claim he would change his destructive habits.

“but i’ve actually been doing pretty well,” rafe spoke quickly, desperate to keep your attention. he didn’t have the words to express himself.

a humourless chuckle left your lips.

“and i’m happy for you, rafe. really, i am. but you’ve already shown me that i don’t fit into your life,” you sniffed.

great, the tears were threatening to spill once more. how pathetic.

it was like you had slapped rafe square across the face. that’s what you thought of him?

pure shame and regret bubbled in his chest as he combed through every stupid mistake he’d made that led to this moment.

rafe then noticed his face was wet. silent tears were streaming down his face. he hastily brushed them away before you could see, coming to terms with the fact he was losing you all over again.

if only he could hear you say his name one more time. if you would just look at him.

unable to say more, you turned to trudge back towards the bar, determined to find your friends so you could go home.

“you’re the only piece of my life that made sense,” his voice was raw, ladened with truth.

the confession nearly stopped you in your tracks as you shuddered an uneasy breath.

you willed yourself to keep your head forward, denying the urge to turn around and take one more glance at the boy you had loved so deeply.

“just let me prove it to you…” rafe whispered as he watched your figure disappear into the bar.

. . .

too late, don't wanna fall, baby, i just

don't need somebody else to throw me aside

but i’m up all night, thinkin' "bout how

it could be you to change my heart... ♫

part three

#rafe cameron x reader#rafe cameron#drew starkey#rafe cameron fanfiction#rafe obx#obx fanfiction#obx fic#rafe outer banks#outerbanks rafe#rafe x you#rafe x reader#rafe imagine#rafe fanfiction#rafe fic

222 notes

·

View notes

Text

Fountain Hills Estate Sales | Professional Estate Liquidation Services - Fresh Start Estate Sale

Looking for trusted Fountain Hills estate sales services? Fresh Start Estate Sale provides expert estate liquidation and downsizing solutions in Fountain Hills. Our dedicated team ensures a smooth process, helping you sell valuable items from furniture to collectibles. Whether you are moving, downsizing, or managing an estate, we deliver a stress-free and efficient experience.

0 notes