#economic efficiency

Explore tagged Tumblr posts

Text

The Positive Side of Free Riders: Efficiency, Redundancy, and Social Welfare

While free riders are often viewed negatively in economic theory, there are some potential positive aspects to their existence, especially in highly efficient systems. These benefits can include reducing waste, providing redundancy in labor, and even promoting social welfare in certain contexts. Here’s a breakdown of some positives associated with free riders:

1. Prevention of Resource Waste

Maximizing the Use of Public Goods: Free riders ensure that public goods, which are non-excludable and non-rivalrous, are fully utilized. In systems where resources are already provided regardless of individual contribution, free riding can prevent underuse or waste of these resources.

For example, a public transportation system operates whether or not every citizen pays for its upkeep. Free riders may fill empty seats on buses or trains, ensuring these resources are used efficiently and do not go to waste.

Efficient Distribution of Surplus Goods: In some cases, systems that overproduce resources (due to hyper-efficiency or overabundance) may benefit from free riders, who consume surplus goods that would otherwise go unused. This can prevent the waste of excess production.

2. Redundancy in Labor and Services

Backups in Labor: In certain labor markets or sectors, free riders may act as a reserve or backup labor force when others cannot perform their duties. They may not contribute actively all the time but can step in when needed, reducing the burden on others in emergencies or during peak demand.

For example, in collaborative work environments, some team members may contribute less consistently, but their occasional involvement can prevent burnout for others or provide support during unexpected surges in workload.

Social Safety Net: Free riders may also function as a form of informal safety net. In systems that depend on voluntary contributions or cooperation, people who temporarily benefit from the system without contributing can still support it indirectly through their future contributions when their circumstances improve.

3. Incentivizing Higher Efficiency and Innovation

Pressure to Improve Systems: The presence of free riders may push organizations or systems to become even more efficient and innovate ways to optimize operations. Since free riders expose inefficiencies or gaps in contribution systems, they can incentivize managers and policymakers to find solutions that are more resilient, ensuring the system works well even with some level of non-participation.

For example, in open-source software development, many users benefit from the work of a few developers without contributing code. This dynamic can drive innovation, as developers often strive to make their software more accessible, scalable, and self-sustaining, benefiting all users.

4. Encouraging Social Solidarity and Welfare

Shared Benefit for Society: In some cases, allowing certain individuals or groups to "free ride" promotes broader social welfare. Welfare programs, public education, or healthcare often allow individuals to benefit without direct contribution, especially when they are economically disadvantaged. This can strengthen social solidarity and create a more equitable society by ensuring that everyone, regardless of their ability to contribute financially, has access to essential services.

This also ensures social stability, as widespread exclusion from public goods and services could lead to inequality and social unrest.

Cultural and Knowledge Sharing: In areas like education and culture, free riders can help disseminate knowledge or art without directly contributing to their creation. For example, free access to educational materials, artistic performances, or research can promote cultural enrichment and knowledge sharing, benefiting society as a whole.

5. Reduced Barriers to Entry

Access to Systems with High Entry Costs: In systems that have high initial entry costs (e.g., research institutions, expensive healthcare systems, or technology platforms), free riders can lower the barriers to participation for people who might otherwise be excluded. Over time, these individuals may transition from free riders to contributors, especially as they benefit from their inclusion.

This dynamic can create a virtuous cycle, where people who initially use a system without contributing may later become active participants or even innovators within that system.

6. Spurring Volunteerism and Altruism

Balancing Contribution Levels: Free riders can indirectly motivate others to take on a volunteer or altruistic role. For example, when some people free ride on public goods or services, others may step up out of a sense of responsibility or altruism, thus creating opportunities for personal growth and community engagement.

This balance between free riders and contributors can foster a sense of community duty or social obligation, where contributors feel they are doing their part for the greater good.

7. Cost-Effective Public Goods

Reduces Cost for Contributors: In some cases, allowing free riders helps distribute the cost of maintaining public goods more efficiently. In highly efficient economies, systems are designed to function with or without full participation from all users. Since free riders don’t significantly increase the marginal cost of public goods, they can enjoy these services without placing a large burden on the economy or contributors.

For example, Wikipedia relies on a small number of active contributors, yet millions of people benefit from the platform. The system functions with high efficiency, making it cost-effective even when most users don’t contribute directly.

While free riders are often seen as a problem in economic systems, they can have positive effects, especially in hyper-efficient economies. Free riders can prevent the waste of public goods, serve as backup labor, reduce barriers to entry, promote social welfare, and even drive innovation. They can indirectly support systems by making them more resilient, incentivizing efficiency, and fostering social cohesion. While not ideal in all contexts, free riders can play a role in maintaining the balance between individual contributions and collective benefit.

#philosophy#epistemology#knowledge#learning#education#chatgpt#ethics#economics#Free Rider Problem#Public Goods#Economic Efficiency#Social Welfare#Redundancy in Labor#Innovation and Cost Savings#Social Solidarity

0 notes

Text

they call me two cocktails vincent. because that’s alll it takes. to get drijnk

0 notes

Text

The Impact of Taxation on Resources: A Comprehensive Analysis

Taxation is a fundamental tool used by governments to finance public expenditure and redistribute wealth within society. While taxation serves various purposes, its effects on resources, both tangible and intangible, are profound and multifaceted. From influencing consumer behavior to shaping investment decisions, taxation exerts a significant influence on the allocation and utilization of resources within an economy. In this article, we delve into the intricate effects of taxation on resources across different sectors and dimensions.

1. Economic Efficiency:

Taxation can affect the allocation of resources by influencing economic efficiency. When taxes are levied on certain goods or activities, such as carbon taxes on fossil fuels or sin taxes on cigarettes and alcohol, they aim to internalize externalities and correct market failures. By increasing the cost of consumption or production associated with negative externalities, taxes incentivize individuals and firms to reduce their consumption or production of these goods, thereby conserving resources and mitigating environmental damage.

However, the efficiency of taxation depends on its design and implementation. Distortionary taxes, such as high marginal income tax rates or taxes on capital gains, can discourage work, saving, and investment, leading to suboptimal allocation of resources and reduced economic growth. In contrast, non-distortionary taxes, such as lump-sum taxes or consumption taxes like the value-added tax (VAT), have less adverse effects on economic efficiency as they do not distort individual behavior as significantly.

2. Resource Allocation:

Taxation can influence the allocation of resources across sectors and industries. Tax policies, including incentives, exemptions, and deductions, can direct resources towards specific activities deemed beneficial for economic development or social welfare. For instance, tax credits for research and development (R&D) expenditures incentivize firms to invest in innovation, leading to technological advancements and productivity gains.

Moreover, tax incentives for renewable energy projects or energy-efficient technologies can promote resource conservation and environmental sustainability by steering investment away from fossil fuel-based industries towards cleaner alternatives. Similarly, targeted tax breaks for small businesses or certain geographical areas can stimulate local economic development and reduce regional disparities in resource allocation.

3. Behavioral Responses:

Taxation influences individual and firm behavior, leading to changes in resource utilization patterns. Changes in relative prices due to taxation can alter consumer preferences and consumption patterns. For example, higher taxes on luxury goods may discourage conspicuous consumption, leading individuals to allocate their resources towards essential goods and services or savings.

Similarly, taxation can affect investment decisions by altering the after-tax returns on different assets. Capital gains taxes, dividend taxes, and interest taxes influence investors' decisions regarding portfolio composition and asset allocation. Tax policies that favor investment in certain assets, such as qualified retirement accounts or tax-exempt municipal bonds, can channel resources towards specific sectors or activities, impacting capital formation and economic growth.

4. Resource Conservation and Environmental Protection:

Taxation plays a crucial role in promoting resource conservation and environmental protection. Environmental taxes, such as carbon taxes or emissions trading schemes, internalize the external costs of pollution and encourage firms to adopt cleaner production methods and invest in renewable energy sources. By incorporating the environmental costs of resource use into market prices, taxation incentivizes firms to innovate and develop sustainable technologies while discouraging resource-intensive production processes.

Moreover, tax incentives for recycling, waste reduction, and energy efficiency improvements encourage individuals and businesses to adopt environmentally friendly practices, leading to more efficient resource utilization and reduced environmental degradation. By harnessing market mechanisms, taxation can align economic incentives with environmental objectives, fostering sustainable development and preserving natural resources for future generations.

5. Income Distribution and Social Equity:

Taxation plays a crucial role in redistributing resources and reducing income inequality within society. Progressive taxation systems, where tax rates increase with income levels, enable governments to collect a larger share of revenue from higher-income individuals and redistribute it to low-income households through social welfare programs, public services, and transfer payments.

Additionally, targeted tax credits, deductions, and subsidies for low-income earners can alleviate poverty and improve access to essential resources such as education, healthcare, and housing. By redistributing resources from the affluent to the disadvantaged, taxation contributes to social equity and enhances the overall well-being of society.

6. Investment and Economic Growth:

Taxation influences investment decisions, capital accumulation, and economic growth. High tax rates on capital income, such as corporate taxes and capital gains taxes, can reduce the after-tax returns on investment, discouraging entrepreneurship, innovation, and risk-taking. Lower taxes on capital income, on the other hand, incentivize savings, investment, and capital formation, stimulating economic growth and productivity enhancement.

Moreover, tax policies that promote long-term investment, such as preferential tax treatment for capital gains held for a certain period or tax deferral mechanisms, can encourage patient capital and foster sustainable economic development. By incentivizing investment in productive assets and innovation, taxation can catalyze economic growth and enhance resource utilization efficiency.

FAQ's

How does taxation impact resource allocation?

Taxation influences resource allocation by changing prices and encouraging certain behaviors. For example, taxes on carbon emissions push firms towards cleaner technologies, while R&D tax incentives spur innovation.

What role does taxation play in environmental conservation?

Taxation encourages resource conservation and environmental protection by internalizing pollution costs. Carbon taxes and incentives for recycling and renewable energy promote sustainability.

How does taxation contribute to income distribution?

Taxation redistributes resources to reduce income inequality. Progressive tax systems and targeted credits for low-income individuals help improve access to essential resources like education and healthcare.

Conclusion:

In conclusion, taxation exerts a profound influence on the allocation, utilization, and conservation of resources within an economy. By shaping economic incentives, consumer behavior, and investment decisions, taxation plays a pivotal role in promoting efficiency, sustainability, and social equity. Effective tax policies must strike a balance between revenue generation, economic efficiency, and distributional objectives to maximize welfare and foster sustainable development. As economies evolve and global challenges such as climate change and income inequality loom large, the role of taxation in resource management and allocation will continue to be a subject of critical importance for policymakers, businesses, and society as a whole.

0 notes

Text

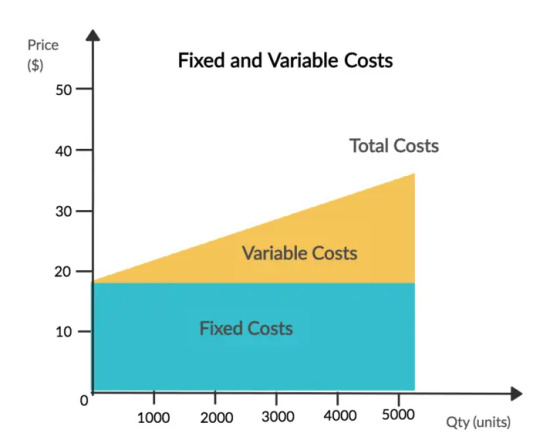

Decoding Production Costs: A Comprehensive Guide to Economic Efficiency in Business Operations

In the complex realm of business management, mastering the intricacies of production costs is paramount for achieving economic efficiency and profitability. Production costs encompass a spectrum of expenditures incurred in the process of manufacturing goods or delivering services, each playing a distinct role in shaping operational dynamics. This article delves into the nuances of production…

View On WordPress

0 notes

Text

Government Focus on Tax Framework: Interim Budget 2024

The Indian government is set to make significant changes to the tax framework in the upcoming interim budget for 2024. One major area of focus is the simplification of withholding tax provisions, aimed at creating a more business-friendly environment.This strategic initiative is part of the broader plan to reduce business tax burdens, minimize disputes, and enhance overall economic efficiency in…

View On WordPress

#business tax burdens#digitization#economic efficiency#economic growth#India tax#interim budget 2024#MSMEs#revenue collection#tax base#TDS rates#withholding tax provisions#working capital

0 notes

Link

1 note

·

View note

Text

I wonder how many business majors turn out like I did: disillusioned leftists who view all they learned for that degree with a healthy dose of skepticism.

#don't get me wrong there ARE things that are worth knowing. how to distribute a supply chain or scheduling a project efficiently#I'm a big fan of how it taught me to understand tariffs and PPP and comparative productivity etc#but most of what I got out of it was either understanding economics at scale or understanding human psychology/sociology wrt capitalism#anyway. weird thoughts after the hbomberguy video mentioned Somerton was a business grad more than once#phoenix talks

183 notes

·

View notes

Text

"If we keep on optimizing the proxy objective, even after our goal stops improving, something more worrying happens. The goal often starts getting worse, even as our proxy objective continues to improve. Not just a little bit worse either — often the goal will diverge towards infinity. This is an extremely general phenomenon in machine learning. It mostly doesn't matter what our goal and proxy are, or what model architecture we use. If we are very efficient at optimizing a proxy, then we make the thing it is a proxy for grow worse."

Too much efficiency makes everything worse: overfitting and the strong version of Goodhart's law

23 notes

·

View notes

Text

i love shopping online and filling up my cart and then never buying anything and then emptying out my cart and then filling it up all over again but still never buying anything

6 notes

·

View notes

Text

The social control function within psy-professional work practices and knowledge claims is reasonably easy to identify and has been a major focus of critical scholars—Marxist and otherwise—since the 1960s. The moral judgements that mental health experts make of people's behaviour under the claims of scientific neutrality and objectivity allow them to sanction forms of deviance which run contrary to the prevailing social order. For example, Szasz stated in 1964 that "agoraphobia is illness because one should not be afraid of open spaces. Homosexuality is an illness because heterosexuality is the social norm. Divorce is illness because it signals failure of marriage." Specifically, Marxist contentions of the psy-professions as agents of social control focus on the ways in which these experts contribute to the alienation of people from their own creative abilities. These experts utilise their knowledge claims on human behaviour to depoliticise attempts at social transformation at the group and community level, in turn acknowledging only individual solutions as possible. Consequently, states Parker, this "psychologisation of social life" performed by mental health workers "encourages people to think that the only possible change they could ever make would be in the way they dress and present themselves to others."

Ultimately, however, a Marxist critique of political economy needs to consider the ideological function in the context of the underlying economic prerogatives of capitalism. The social control of populations considered as deviant and labelled as "mentally ill" by the psy-professions serves specific requirements of the market, whether this is through the profiteering from individual treatments, the expansion of professional services, or the reinforcement of work and family regimes in the name of appropriate treatment outcomes. In his critical work on the history of psychiatry, Scull argues that the emergence of the psychiatric profession can be explained as a result of the changes in the social organisation of deviance brought about by new market relations. He asserts that the rise of industrial society required a more complex response to social deviance; there was especially a need to adequately control such groups—who were no longer tied to the land, but instead "free" to sell their labour to the emerging bourgeois—and separate the non-able bodied (e.g., the sick, disabled, poor, alcoholic, vagrant, and elderly) from the "healthy" population. Thus, the growth of the asylums for "the mad" is understood as an economically efficient means by which groups of deviants could be physically separated from the rest of society and kept under close surveillance by new professional authorities. In Scull's words, "the main driving force behind the rise of a segregative response to madness (and to other forms of deviance) can . . . be asserted to lie in the effects of a mature capitalist market economy and the associated ever more thoroughgoing commercialization of existence". Therefore, it is ultimately the goals of capitalism which directs industrial society's response to social deviance and, in this way, brings about the formation of the medical attendants/mad doctors/alienists who would in time become the psychiatric profession.

Bruce M.Z. Cohen, Psychiatric Hegemony: A Marxist Theory of Mental Illness

#bruce m.z. cohen#psychiatric hegemony#psychiatry#to be fair the state run asylums in particular very quickly became not economically efficient in the least#which influenced the drive to find curative measures particularly ones that conformed to a biomedical understanding of mental illness

7 notes

·

View notes

Text

weirdly im like the first generation of my family who did not engage in any form of subsistence farming

#iso.txt#barely any kind of farming#on a few occasions i picked fruit from the trees in the yard for a few hours and it felt like my arm would fall off. so im pretty grateful#i was very efficient though#im in this weird position of like being very economically privileged bc of my parents#but other than them my family historically being very much Not

5 notes

·

View notes

Text

page 562 - ugh, efficiency.

#economics#economy#economist#equilibrium price shortages and surpluses#unstable equilibrium#equilibrium#unstable#surplus#shortage#time#architecture#building#cliff#extreme#constriction#efficient#efficiency#ai#machine learning#construction#geology#engineering

4 notes

·

View notes

Link

1 note

·

View note

Text

i joked i was gonna get an econ degree to follow kpop news, but i honestly couldn't stand the amount of vacuous bullshit the feed you in the basic courses

#I'm studying just a module of something vaguely related to economics and the sheer amount of ''this is EFFICIENT and perfectly normal''#but also we had to read an intro to economics concepts and GOD it's like they think you haven't ever read a a fucking newspaper#it's like they're describing both spherical cows and the actual cow and expecting you to decide that it's a perfectly fine model#and calling you an idiot if you don't

7 notes

·

View notes

Text

Understanding Partially Public Goods: Excludability and Rivalry

There are several things that could potentially be considered public goods but are not due to various reasons. These goods may be excludable (meaning access can be restricted) or rivalrous (meaning consumption by one person reduces availability to others) to some extent. Here are some examples:

Broadcast Television: While television broadcasts are non-excludable (many people can watch the same program simultaneously), they are not entirely non-rivalrous. Limited advertising space and time slots mean that the more viewers a program attracts, the more revenue it generates. Therefore, broadcast television is not a pure public good.

WiFi in Public Spaces: Publicly available WiFi in parks or airports is often considered a public good because anyone can access it freely. However, it can be limited by factors such as bandwidth, speed, and user restrictions, making it partially excludable and rivalrous to some extent.

Clean Air: Clean air is typically regarded as a classic public good because it is non-excludable and non-rivalrous. However, localized air pollution can affect air quality in specific areas, making it somewhat rivalrous on a regional scale.

Public Transportation: Public transportation systems aim to provide accessible services to everyone. Still, they are not entirely non-excludable, as users typically need to pay fares, and they can become congested during peak hours, introducing rivalry for seating and space.

Online Information: Information on the internet is often considered a public good because it can be freely accessed by anyone. However, some content is protected by paywalls, and high-quality, specialized information may require subscriptions or fees, making it partially excludable.

National Parks: National parks are intended to provide natural beauty and recreational opportunities to all. However, access to some areas may require entrance fees or permits, rendering them partially excludable.

Social Media Platforms: Social media platforms like Facebook and Twitter offer free access to users worldwide. However, they are not pure public goods because users' data and content contribute to their revenue through advertising and data monetization.

In these examples, the classification of goods as public or non-public depends on factors like the degree of excludability and rivalry. While they exhibit some characteristics of public goods, they are not entirely non-excludable and non-rivalrous, which is the hallmark of pure public goods like clean air or national defense.

#philosophy#epistemology#knowledge#learning#education#chatgpt#ethics#politics#Public Goods#Excludability#Rivalry#Economic Concepts#Market Efficiency#Resource Allocation#Accessible Services#Common Resources#Public Policy#Goods Classification#economics

2 notes

·

View notes

Note

Does wolf have any kinks? What are some of her turn ons?

Wolf is obviously not someone without kinks, but she also has not the words to properly describe what she likes and what she does not like. She likes to be a switch, even if she very much avoids beeing dominant because she is terrified of holding too hard to a partner and hurt them. She also is a little into Voyeurism in the manner that she like to watch her partner touch themselfs or tell her about their sexual stories, although the latter is probably only part of her dirty humor. In this manner she also enjoys a very good tease, especially if they are done in public and only noticeable for her. Some coy questions and witty hints in a normal conversation that would only be picked up by her, humorous innuendos, whispered plans of what one wnats to do with her when they are alone. Wolf does not like to be touched without her consent (especially when she is grabbed more roughly without former warning) so she is very focused on what she can see her partner doing and what they are using their words for. For the things she does not like: She is easily made uncomfortable and not attracted to very big, muscular, angry and commanding men for the obvious reason that that description fits Leo and Wolf does not like to be remainded of the person that had been her slaveowner for years. In fact its this kind of person she will actively go against like in an instinct. Be openly brutal, loud or easily irritated and you will notonly make Wolf get stubborn and snarky but very easily might end up with a dane-axe by your throat now that Wolf knows that she is very likely stronger than anyone around her and has the chance to protect people in which palce she had been once. There are reasons beside her upbringing and social Community (free republic tadingcity that is Pisa, living in a convent as a tightly knitted community with no social difference beside the Mother superior that had been voted into the position by the community, grown up in Cologne as a tradingknot wit a flourishing middleclass) why she does not like getting commanded around and beeing remainded of Leo is one of them. Its also easily noticeable about her, because the people presenting as masculine she is usually dating are either rather shy, openly nurturing and gentle, or witty and sly but not commanding, or pysically short. For the same reason you would be able to make her swing out of a window halfnaked if one would ever ask her to take part in bondage. She got her old chains molten and casted into a spider-shaped brooch by your friendly nieghbourhood toolsmith and occiaonally jeweller Hinze who has a strangely unending source of metal, silver and gold -*coughs*- , and she is not going back there in any form, even if it is for pleasure.

#best example of the men Wolf is usually dating would b Hinze who is not only the same height as her but also very much a weed.#Yes Hinze as black cat very much is the one who first steals the gold/silver/steel and then works it into different forms or melts it down.#he got his professional workplan planned out.Quiver before his economical efficiency.#werspinna#headcanon#thanks for the ask dear nonnie!#tw#trigger warning#tw: slavery

2 notes

·

View notes