#e-visa charges

Explore tagged Tumblr posts

Text

Kenya eVisa

The Kenya eVisa is an electronic visa that can be obtained online, eliminating the need to visit an embassy or apply on arrival. It's available for tourist, business, and transit purposes. Applicants must complete an online form, upload required documents (including a passport copy and photo), and pay the fee using a credit card. Processing typically takes 2-3 business days. The eVisa is valid for 90 days from the date of issue and allows for stays up to 90 days in Kenya. It's linked electronically to the traveler's passport. More info: https://toppicksreviews.com

#Kenya visa fees#visa cost#entry permit price#e-visa charges#tourist visa cost#visa on arrival fee#single entry visa price#multiple entry visa cost#Kenya immigration fees#visa application charges#passport requirements#travel expenses#Kenya entry cost#visa processing fees#East Africa visa price#budget travel#Kenya tourism#visa validity period#visa payment options#visa fee comparison

0 notes

Text

#tour operators in kannur#best travel agency in kannur#tours and travels in kannur#kannur travel agency contact number#saudi visa stamping#saudi visa stamping status#saudi visit visa stamping#visa stamping saudi arabia#e wakala saudi arabia#saudi visit visa stamping in india#new visa stamping for saudi arabia#visa stamp on passport saudi arabia#india to saudi visa stamping#saudi family visit visa stamping in india#family visit visa stamping for saudi arabia in india#saudi employment visa stamping in india#visa stamping charges for saudi in india#working visa stamping for saudi arabia#umrah package from kannur

0 notes

Text

Liam's death investigation official update

The head of the National Criminal and Correctional Court No. 34, Laura Bruniard, processed last Friday the five people accused in the framework of the investigation that the Public Prosecutor's Office carried out on the death of Liam James Payne, which occurred on October 16 when the 31-year-old British musician fell from the balcony of the hotel in the Buenos Aires neighborhood of Palermo where he had been staying for three days. Three of the accused were processed without preventive detention for negligent homicide, and the other two for the crime of supplying narcotics, and they were ordered to preventive detention.

The defendants were charged at the time by the head of the National Criminal and Correctional Prosecutor's Office No. 14, prosecutor Andrés Esteban Madrea, who investigated the circumstances of the incident from the beginning.

RLN, the victim’s representative who accompanied Payne on this trip to Buenos Aires to obtain his US visa again; the hotel manager, GAM; and the head of reception, ERG; are the three accused of “culpable homicide,” a crime contemplated in article 84 of the Penal Code (CP) and which provides for a sentence of 1 to 5 years in prison for anyone who “through imprudence, negligence, lack of skill in their art or profession or failure to observe the regulations or duties in their charge causes the death of another.” The judge also placed an embargo on all three of them for 50 million pesos each.

Meanwhile, the EDP hotel employee and a waiter whom Payne met in the Puerto Madero neighborhood and whose initials are BNP, were prosecuted for “supply of narcotics,” a crime specified in article 5, section “e” of Law No. 23,737 on Narcotics, which provides for a sentence of 4 to 15 years in prison. Both were given preventive detention and five million pesos in assets were seized.

In the case of RLN, Payne's companion during his stay in Argentina, there was a difference in the criminal classification chosen by the judge, since the prosecutor Madrea, when charging him and requesting his questioning, had done so for more serious crimes: abandonment of a person followed by death - contemplated in article 106 of the Criminal Code and which carries a sentence of 5 to 15 years in prison -, as the author, in ideal competition with supply and facilitation of narcotics.

"Bringing Payne up to room 310 in that state, where he was staying, was creating a legally unacceptable risk to his life," the judge said.

The accusations

In the resolution, Bruniard transcribes the five charges formulated by the MPF at the time of the investigations and whose details are as follows:

EDP (hotel employee): He is accused of having delivered cocaine, for a fee, once on October 15, 2024, at 3:25 a.m., and the next time on October 16, 2024, between 3:30 p.m. and 4:00 p.m., for Liam James Payne to consume during his stay at the Casa Sur Palermo hotel, located at 6032 Costa Rica Street in this city.

BNP (waiter): he is accused of having delivered cocaine, for a fee, on October 14, at 3:24 a.m., for Payne to consume at the hotel, where he even accompanied him to room #310, checking in with him, between 3:25 a.m. and 8:15 a.m. when he checked out. Also, on the same day, he is accused of having delivered more cocaine, for a fee, for the accused to consume, between 10:03 a.m. and 10:44 a.m., on which occasion Payne went to the defendant's home, at 400 Agüero Street in the Federal Capital, traveling in a taxi and returning to the hotel.

RLN (representative): he is held criminally responsible for the death of Liam James Payne through the execution of actions and omissions in the period prior to and contemporaneous that culminated in Payne falling from the balcony of room No. 310 corresponding to the Casa Sur Palermo hotel […]. Thus, the accused N. failed to comply with his duties of care, assistance and aid that he had towards Payne due not only to a pre-existing legal duty but also to specific functions of guidance and personal accompaniment, previously coordinated and accepted by the relevance and activities of his profession, abandoning him to his fate, knowing that he was incapable of caring for himself, knowing that the accused suffered from multiple previous addictions - to alcohol and cocaine - and having full knowledge of the state of intoxication, vulnerability and helplessness in which he found himself.

GAM (hotel manager): She was present in the lobby at the time prior to the events and noticed the state of health of Lyam James Payne, who was unable to stand due to the consumption of various substances. The manager was in charge of the establishment and allowed, at least by omission, for Payne to be taken to his room moments before his death. In the room, number 310 of the Casa Sur Palermo hotel, there was a balcony that, given the detailed situation, was a source of risk for Payne. […] The conduct that M. should have carried out was to keep him safe in an area without sources of danger, in company and until medical care was provided for him.

ERG (hotel reception manager): was present in the hotel lobby at the time prior to the events and noticed the state of health of Lyam James Payne, who was unable to stand due to the consumption of various substances. G. led a group of three people who dragged Payne to his room moments before his death. In the room, number 310 of the Casa Sur Palermo hotel, there was a balcony that, given the detailed picture, was a source of risk for Payne. […] The conduct that G. should have carried out was to keep him safe in an area without sources of danger, in company and until he could be provided with medical care.

"I maintain that the person named tried to leave from the balcony of the place where he was left because the forensic experts noted that he did not lose his balance. This is how the fall occurred," explained the magistrate.

The supply of drugs

In the case of the EDP hotel employee, Bruniard said he shared "the prosecutor's theory that the accused provided cocaine to Payne for a fee."

Based on testimony and analysis of some of the footage, he mentioned that the accused received “100 dollars” from the victim in exchange for buying drugs from him and that, on another occasion, the British musician sent a car to the defendant’s home in the Buenos Aires district of Lomas de Zamora to bring him more narcotics.

Regarding the waiter BNP - who in his defense admitted having given drugs to Payne but stated that he did so to spend time with him - the judge also agreed with "the prosecutor's thesis that the delivery of cocaine was for money."

To do so, he evaluated the chats between the musician and the defendant that talked about it, the hotel footage that captured the waiter's arrival at the hotel in the early hours of October 14 and his departure almost five hours later, and the fact that "Payne asked for money at the reception desk while the defendant was in his room."

"In this case, it was proven that both EDP and BNP supplied cocaine in exchange for money to Liam James Payne," Bruniard said, supporting the MPF's accusation.

The judge's thesis

In the grounds of the indictment, and after analyzing and validating the evidence collected by the prosecution, the judge developed her own "thesis" on what happened to the former leader of the band One Direction .

Bruniard stated that “it was proven by the testimonies gathered by the prosecutor that Liam James Payne had a history of addiction.” In this regard, he explained that he was seen demanding cocaine and alcohol by the staff of the Casa Sur Palermo hotel and that “the autopsy performed on his body showed that the death was caused by multiple trauma and internal and external bleeding,” and that “the presence of cocaine and alcohol in large quantities was confirmed.”

“On October 16, moments before 5 p.m., Payne was unable to care for himself,” the judge noted, pointing out as evidence of this the photograph incorporated into the case, which corresponds to the footage taken by a camera in the hotel lobby, where at 4:54 p.m. the musician was seen unconscious and being dragged “by three people.”

“The way he was being handled shows a state of vulnerability,” the judge said, referring to the situation of the hotel manager and receptionist, stating that “bringing Payne up in that state to room 310 where he was staying was creating a legally disapproved risk to his life.”

“Payne’s consciousness was altered and there was a balcony in the room. The proper thing to do was to leave him in a safe place and with company until a doctor arrived. The people responsible at the hotel that day were the manager GAM and the head of reception ERG,” he added.

When analyzing the hotel security camera recordings presented by the prosecution, Bruniard also highlighted that thanks to them it was possible to observe that the head of reception ERG “is the one who led Payne to be dragged to his room” and that “the images are compelling” when this defendant and the manager GAM are seen moments before 5 p.m. “in the hallway of room 310,” and that minutes later the victim was found dead in the restaurant's patio.

Payne wanted to leave through the balcony

In another section of the ruling, the judge mentioned that, according to her hypothesis, Payne did not faint when he fell into the void, but that, in his state of intoxication due to polydrug use, he tried to leave the room through the balcony and thus fell.

“I maintain that the person named tried to leave from the balcony of the place where he was left because the forensic experts noted that he did not lose his balance. This is how the fall occurred,” explained the magistrate, who to support this theory mentioned an extension of the report of the Forensic Medical Corps and an ocular inspection carried out on December 5 at the Casa Sur Palermo hotel, in which the magistrate herself participated.

“I believe that M. (manager) and G. (head of reception) did not act maliciously in relation to the singer's death, but they were imprudent in allowing him to be taken to the room and taking him there respectively. They created a legally disapproved risk and Payne's death is the concretisation of that risk. The named man tried to leave via the balcony, in the state detailed, he fell into the void and died,” he concluded.

According to the forensic experts, Payne fell into the hotel restaurant's patio "without any sign of defense," which caused multiple injuries to his body, especially to his head after hitting the concrete support of an umbrella directly.

"Payne's consciousness was altered and there was a balcony in the room. The proper thing to do was to leave him in a safe place and with company until a doctor arrived," the judge said.

The situation of the companion

Regarding RLN -who assisted Payne during his stay in Buenos Aires-, the judge held that “he is responsible for the crime of negligent homicide as the perpetrator given that he had assumed a position of guarantor in front of the family of the deceased.” Based on testimony statements and analysis of communications and messaging chats presented by the prosecution, she added that “it is evident that this defendant was Liam James Payne's contact for the hotel.”

She explained that RLN was present at the hotel moments before the dangerous situation occurred and this is supported by the images that show him leaving Casa Sur at 16:11 - some 50 minutes before the incident. "I believe that at that point, given the results of the autopsy, Payne's state of vulnerability was evident. N. could not trust that the rest of the hotel staff would act appropriately," the magistrate assessed, beyond the continuity of the investigation.

The rating

In justifying the criminal classification chosen for the three defendants for negligent homicide, the judge explained that "the situation of these defendants can be treated jointly, although each one must answer as the author for their act given that there is no co-authorship in the negligent crime and the way in which they have created the risk situation, which resulted in Payne's death, is different."

“In this specific case, I do not consider that N. (representative), M. (manager) or G. (head of reception) planned and wanted Payne’s death. They did not imagine the outcome but they created a legally disapproved risk. M. created this, in his role as manager of the establishment, by allowing Payne to go up to room 310. G. did so by leading the group of people who took Payne to the aforementioned room. […] What happened was foreseeable,” he said.

"In the case of N. (representative), he should have consulted a doctor given the commitment made to the family of the deceased. He should have done this without relying on what the hotel employees could do," he assessed.

Finally, the judge considered that "the three people who are being prosecuted have contributed, although not in a planned manner, to creating a risk that resulted in Payne's death, whether by action or omission."

Precautionary measures

In justifying the pretrial detention of the hotel employee and the waiter, Bruniard took into account the expected sentence for the crime for which they were prosecuted, which does not allow a suspended sentence.

Regarding the three defendants charged with manslaughter - who were not given preventive detention - the magistrate indicated that there were no procedural risks, that they have roots and that the sentence does allow for a suspended sentence. In any case, the prohibition against RLN, a US citizen, was upheld in order to guarantee his permanence in the country.

[SOURCE]

#liam payne#tw death details#tw death#tw death mention#liam investigation update#rip liam#roger nores#liam's case

24 notes

·

View notes

Text

The U.S. Justice Department on Tuesday sued Visa

, the world’s biggest payments network, saying it propped up an illegal monopoly over debit payments by imposing “exclusionary” agreements on partners and smothering upstart firms.

Visa’s moves over the years have resulted in American consumers and merchants paying billions of dollars in additional fees, according to the DOJ, which filed a civil antitrust suit in New York for “monopolization” and other unlawful conduct.

“We allege that Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market,” Attorney General Merrick Garland said in a DOJ release.

“Merchants and banks pass along those costs to consumers, either by raising prices or reducing quality or service,” Garland said. “As a result, Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.”

Visa and its smaller rival MasterCard have surged in the past two decades, reaching a combined market cap of roughly $1 trillion, as consumers tapped credit and debit cards for store purchases and e-commerce instead of paper money. They are essentially toll collectors, shuffling payments between the merchants’ banks and cardholders.

18 notes

·

View notes

Text

Learn Korean with me - Week 27

Day 1 - 3: Let's Speak Korean Ch 8 - Visa & Immigration (1 - 30)

** Don't forget your journals and of course Netflix.

어떤일로오셨나요?

Eo tteon il lo o syeoss nay o

(Literal) What kind of matter did you come (here) for? = How may I help you?

비자를갱신하려고요.

Bi ja reul gaeng sin ha ryeo go yo

I’d like to get (my) visa renewed.

비자가만기되었어요.

Bi ja ga man gi doe eoss eo yo

(My/Your) visa has expired.

어떤비자를갖고계시죠?

Eo tteon bi ja reul gaj go gye si jyo

What kind of visa do you have? = What’s your visa status?

관광/투자/학생비자입니다.

Gwan gwang/tu ja/ hag saeng bi ja ib ni da

It’s a tourist/investor/student visa.

영주줜자인가요?

Yeong ju jwon ja in ga yo

Are you a premanent resident?

어느나라국적이시죠?

Eo neu na rag ug jeog I si jyo

(Literal) What country nationality are you? = What’s your nationality?

신청서를작성해주세요.

Sin cheong seo reul jag seong hae ju se yo

Please fill out the application.

서류가부족합니다.

Seo ryu ga bu jug hab ni da

(Literal) Documents are insufficient. = You are missing some documents.

서류가빠진것같아요.

Seo ryu ga bba jin geos gad a yo

It seems like documents are missing.

신청서가통과되지못했습니다.

Sin cheong seo ga tong gwa doe ji mos haess seub ni da

(Your) application didn’t go through.

신청서가통과되었습니다.

Sin cheong seo ga tong gwa doe eoss seub ni da

(Your) application did go through.

다시작성해주세요.

Da si jag seong hae ju se yo

Please fill it out again.

담당자가자리에없습니다.

Dam dang ja ga ja ri e eobs seub ni da

(Literal) The person in charge isn’t in (his) seat. = The person in charge is away.

어디한번볼까요?

Eo di han beon bur gga yo

Shall we take a look.

빠진게없는지확인해보세요.

Bba jin ge eobs neun ji hwag in hae bu se yo

Please check of there isn’t anything missing.

이렇게작성하면되나요?

I reoh ge jag seong ha myeon doe nay o

(Literal)Is this okay if I fill out like this? = Can I fill it out like this?

어떻게작성해야하나요?

Eo tteoh ge jag seong hae ya ha nay o

How should I fill it out?

이부분이잘이잘이해가안됩니다.

I bu bun I jar I jar I hae ga an deob ni da

I don’t quite understand this part.

필요한서류는무엇인가요?

Pir yo han seo ryu neun mu eos in ga yo

What are the necessary/requited documents?

어느부서로가면될까요?

Eo neu bu seo ro ga myeon doer gga yo

Which department should I go to?

오늘종로처리될까요?

O neur jong ro cheo ri doer gga yo

Will it be processed within today?

택배로보내주세요.

Taeg bae ro bo nae ju se yo

Please send (it) by courier service.

자리에서대기해주세요.

Ja ri e seo dae gi hae ju se yo

Please wait from (=at) (your) seat.

번호표를뽑아주세요.

Beon ho pyo reur bbob a ju se yo

Please pick (=take) a number ticket.

아직차례가아닙니다.

A jig cha ryega a nib ni da

It’s not (your) turn yet.

온라인으로도신청가능합니다.

On ra in eu ro do sin cheong ga neung hab ni da

(Literal) It’s possible to submit it by online as well. =You can submit it online as well.

내일다시오세요.

Nae ir da si o se yo

Please come again tomorrow.

며칠정도걸릴까요?

Myeo chir Jeong do geor rir gga yo

About how many days (=long) would it take?

통역이있나요?

Tong yeog I iss nay o

Do you have an interpreter?

#Learning Korean#Korean#Hanguel#BTS#Bangtan#RM#Jin#Suga#J Hope#Jimin#V#Jungkook#South Korea#Korea#motivation#that girl#badass#glow up#Military Wife#We Will Wait#2025#travel#self care#self improvement#love#borahae#fighting#no more excuses#2024

17 notes

·

View notes

Text

Travel Essentials: 50 things you Must-Have for Flights, Packing, and More

Traveling can be an exhilarating experience, but it requires preparation to ensure everything goes smoothly. Having the right travel essentials can mean the difference between an enjoyable trip and one filled with unnecessary stress. In this blog, we’ll cover everything you need to pack for a seamless journey, whether you're planning a weekend getaway, a business trip, or a long-term adventure.

Why do Travel Essentials matter?

Packing the right travel essentials simplifies your journey, keeps you prepared for unexpected situations, and enhances your overall travel experience. Travelers who plan effectively save time, money, and the hassle of purchasing forgotten items on the go.

Must-Have Travel Essentials Checklist Below

A. Travel Documents and Accessories

Passport and Visas: Ensure your passport is valid for at least six months beyond your travel dates. Check visa requirements for your destination.

Travel Insurance: Protect yourself against unexpected events such as medical emergencies or trip cancellations.

Flight Tickets and Itineraries: Keep digital and printed copies handy.

Dummy Ticket: A flight reservation or dummy ticket can be essential for visa applications. Websites like DummyTicket.travel provide reliable services for this purpose.

Wallet and Money: Carry a mix of cash and credit/debit cards.

Travel organizer: Use a travel wallet or organizer to store documents, tickets, and other essentials in one place.

B. Packing Essentials

Luggage and Bags: Choose durable suitcases and lightweight carry-ons. A backpack or tote is perfect for day trips.

Clothing: Pack versatile clothing suitable for the weather and activities planned. Include comfortable footwear.

Toiletries: compact toiletry kits with travel-sized bottles of shampoo, toothpaste, and sunscreen.

First Aid Kit: Basic medications for headaches, stomach issues, and allergies.

Reusable Water Bottle: Stay hydrated during your journey.

C. Technology and Gadgets

Smartphone and charger: Travel essential for navigation, communication, and entertainment.

Power Bank: Ensure your devices stay charged on the go.

Travel Adapter: For international trips, carry a universal adapter.

Noise-Canceling Headphones: Block out noise during flights or long commutes.

Camera: Capture memorable moments, or use your phone’s camera if traveling light.

D. Comfort and Convenience Items

Travel Pillow: For comfortable naps during long journeys.

Eye Mask and Earplugs: Ensure restful sleep, even in noisy environments.

Snacks: healthy options like nuts, granola bars, or dried fruits.

Books or E-Reader: Entertainment for Downtime.

Travel Blanket: Compact and lightweight for colder journeys.

Travel Essentials for Different Types of Trips

E. Weekend Getaway

Light luggage: A carry-on is usually sufficient. Minimal clothing: Stick to basics that can be mixed and matched. Quick snacks and toiletries.

F. Business Trips

Formal attire: wrinkle-resistant suits or dresses.

Work essentials: laptop, chargers, and presentation materials.

Personal grooming kit: compact and professional.

G. For Long-Term Travel

Durable luggage: Invest in high-quality bags.

Multi-purpose clothing: Layered outfits that suit different climates.

Portable laundry kit: Wash clothes on the go.

Travel guidebook: For exploring local attractions.

Portable Wi-Fi device: Stay connected wherever you go.

Packing Tips for Travel Essentials

A. Use Packing Cubes

These help organize items and maximize luggage space.

B. Roll Your Clothes

Rolling reduces wrinkles and saves space.

C. Follow the 3-1-1 Rule for Liquids

Keep all liquids in containers of 3.4 ounces (100 ml) or less and store them in a single quart-sized bag for easy airport security checks.

D. Layer Your Packing

Pack heavier items at the bottom and lighter ones on top.

E. Create a Packing List

Make a checklist to ensure nothing is forgotten.

Travel Essential Apps for Travelers

Google Maps: For navigation and exploring local areas.

TripIt: organizes your travel plans.

PackPoint: Helps you create customized packing lists.

Duolingo: Learn basic phrases in the local language.

XE Currency: Quick currency conversions.

WhatsApp: For easy communication.

Uber/Lyft: Transportation solutions at your fingertips.

Sustainable Travel Essentials

Contribute to eco-friendly travel by packing:

Reusable water bottles and straws.

cloth tote bags for shopping.

solar-powered chargers.

eco-friendly travel gear: sucah as bamboo cultery and compostable trash bags.

Travel Essentials for safety

Personal safety alarms.

RFID-blocking wallet to protect credit card information.

Emergency contact list.

Maps of the destination (both digital and printed).

small flashlight for unforeseen situations.

Pepper spray or other self-defense tools (if allowed).

Health essentials: vaccination records and a thermometer.

Why Dummy Tickets Are Essential for Travel

A dummy ticket is a verifiable flight reservation that shows your travel itinerary without requiring full payment. This is especially useful for visa applications where proof of travel is mandatory. Services like DummyTicket.travel offer cost-effective and reliable dummy tickets, ensuring a hassle-free visa process. Including a dummy ticket in your travel documents adds credibility to your application and can save money.

Tips for Hassle-Free Air Travel

Check-in online to save time at the airport.

Wear comfortable clothing and shoes.

Keep your travel documents easily accessible.

Arrive at the airport at least 2-3 hours before departure.

Follow TSA guidelines for security checks.

Carry entertainment options for long flights.

Stay hydrated and move around during long-haul flights.

Conclusion

Having the right travel essentials not only ensures a stress-free journey but also enriches your travel experience. Whether you’re planning a short trip or a long-term adventure, use this guide to pack efficiently and stay prepared for anything. Including travel-specific items like dummy tickets for visa applications can save you time and stress during your preparations. With thoughtful planning, you can focus on what truly matters—enjoying your journey and making unforgettable memories.

Happy travels!

2 notes

·

View notes

Text

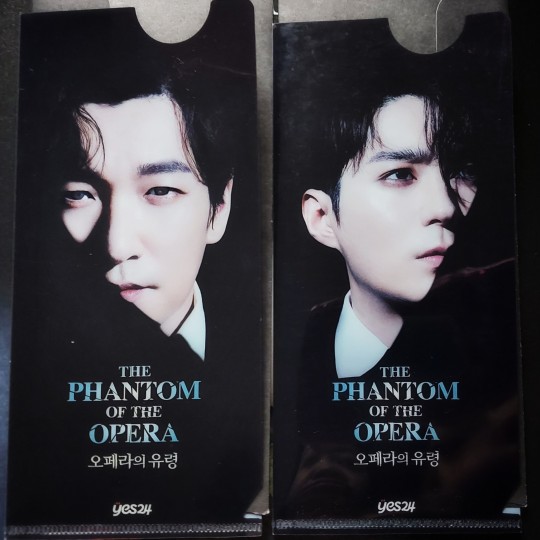

Let your S(e)oul take you where you long to be - pt 1

a.k.a. finally writing my phantom korea travelogue

Watching Phantom in Korea has been this big goal of mine since December 2012.

When I saw the vast spread of Phantom merchandise at the Blue Square theatre and how they decked the theatre with a Phantom tree and had all sorts of Phantom-themed food, it became crystal clear that Korea goes hard for Phantom like no other, and I wanted to be part of that action.

I planned to visit Seoul when the World Tour revival was slated to visit in 2020, but that one got axed and squashed as a pandemic would do to hopes and dreams.

Cut to October 2021, news of a new Korean production got out around, but I was pessimistic. The borders were still closed and who knew for how much longer. Even as they started reopening toward 2022, there was a quarantine / covid-19 test requirement upon arrival. Then our local Korean embassy started taking a hardhanded stance on applications that made it difficult for visas to be issued. Add to that, the fact that the embassy have limited slots every month.

The odds were wildly stacked against me, but travel restrictions eased up and nothing serves as a better motivator than watching people you know actually go to the place.

Months of mental prep, doing things for the first time, and many expenditures later, I was deemed worthy of a visa. The next step was a ticket to the show…which was an entirely different main quest on its own.

Buying show tickets in Korea is like a national sport

I witnessed this during the first waves of Phantom Seoul tickets sale. The moment the dates open, you would find most of the tickets are already gone. So you are left to buy what's left but even when you manage to click on one, another person is likely completing their purchase ahead of you.

I did manage to snag a Jeon Dong-seok ticket. But the Cho Seung-woo one, I didn't manage to get until a month later.

I have to pause and thank @fadinglandtragedy for actually answering my questions, providing valuable tips, and encouraging me when I myself have given up lol.

The beauty of tickets in Korea is you can actually cancel and if you are early, you can get your money back with minimal processing fee. That means cancellations peek now and then when the ticket vendors refresh their systems everyday. I was able to move to a better row for my JDS show, and I eventually managed to buy my CSW ticket (that no one fought me for 😭😭😭😭😭).

But it took extreme patience, nightly refreshes, and trying not to nod asleep. It was worth it in the end.

So I only had to find a decent airfare, accommodations, and wake up insanely early to catch the flight, and print out all the things to prove to the immigration officer that I'm not pulling a Valjean on his Javert. 🥲🥲🥲

Tip: Overseas fans can buy through Yes24 and Global Interpark, but I highly recommend Yes24 for the exclusive ticket sleeves and the fact that they have a mobile app that you can use to book, stalk last-minute tickets, and eventually claim them.

Tip 2: For faster purchase using Yes24, look into loading your cc info in Paypal so you'd just be one click away to everything. For some reason I found the native cc method a bit harder to deal with (and it charged me more for some reason).

Korea things and hopefully an actual review to follow!

16 notes

·

View notes

Text

The Impact of Global Economic Trends on UAE Businesses

The UAE provides a perfect example of an economy in transition in an ever shifting global economy. The globality of opportunities and challenges is currently in negotiation among the businesses within the United Arab Emirates. Both present companies and those seeking to gain larger market footprints in the area; the best business setup consultants are knowledgeable about such patterns and their consequences.

Global Economic Trends Affecting UAE Business

Shift towards Digital Transformation: The drive towards digital transformation has been affecting UAE businesses throughout the world. The COVID-19 crisis shifted consumption towards digital solutions, such as e-commerce, cloud solutions, and artificial intelligence becoming competitive necessities. The secrets have been picked up by companies in the UAE which have ensured that they remain connected due to the strong digital infrastructure in the country.

Energy Transition and Sustainability: Since adopting sustainable modern trends the UAE achieved significant progress in economic diversification. Vision 2030 involves businesses in sustainable development processes as it prioritizes renewable energy projects across wind and solar sources.

Global Trade Shifts: The UAE is especially sensitive to changes in international trade because of its advantageous position as a trading hub. International business operations in the UAE seek out new markets while modernizing their supply chain solutions following disruptive supply network challenges and protectionist market interventions in select regions. The UAE's status as an international trade hub receives added strength from its free trade pacts with countries such as China and India.

Post-Pandemic: Recovery organizations in the UAE are seeing a boom in travel, real estate, and retail businesses as the world economy gets back from the pandemic. Reviving economic movement, attracting ventures, and expanding buyer certainty have all been made conceivable by Expo 2020 Dubai.

Rise of Emerging Markets: Businesses operating in the United Arab Emirates experience promising growth opportunities thanks to the ongoing economic growth in Asian and African emerging markets. United Arab Emirates trade connections enable businesses to expand their client reach beyond their current markets during country development.

Why Set Up a New Business in Dubai?

The economic centre of the UAE known as Dubai appeals to both international companies and entrepreneurs to operate their businesses. The following are the main benefits of establishing a business in Dubai:

Strategic Location: Due to its strategic position Dubai establishes unmatched market access across Asia along with Africa and the Middle East. Companies begin their global expansion journey in this city.

Tax Benefits: Dubai operates as a tax-friendly zone since it does not charge personal income tax and corporate tax applies to most industries. The government achieved two aims by raising VAT rates to at least 5% - it secured revenue collection and maintained business market appeal.

World-Class Infrastructure: Dubai's infrastructure, including cutting-edge seaports, airports, and sophisticated digital connectivity, is built to accommodate companies of all sizes and sectors.

Free Zones: Many free zones in Dubai provide simpler regulatory frameworks, tax benefits, and 100% foreign ownership. Certain industries are served by free zones, such as Jebel Ali Free Zone for logistics and Dubai Internet City for technology.

Supportive Government Policies: Through programs like Golden Visas for entrepreneurs, streamlined licensing procedures, and investment for startups in essential industries, the UAE government actively encourages enterprises.

Diverse Talent Pool: Dubai draws workers from all over the world, giving companies access to a talented and diverse talent pool.

How a Business Setup Firm Can Help

Navigating several legal, administrative, and logistical processes is necessary when starting a business in Dubai. This procedure can be streamlined by working with a business setup consultancy, which will guarantee compliance and save time. These companies can help in the following ways:

1. Market Research and Feasibility Studies: To assist entrepreneurs in understanding the competitive environment, identifying target markets, and assessing the viability of their business concepts, business set up consultants in UAE carry out in-depth market research.

2. Legal and Regulatory Guidance:The discussion covers every law requirement to enable customers to pick the appropriate business type and secure necessary permits. Business set up consultants in UAE offer customized guidance based on business objectives and help with mainland, free zone, and offshore company setups.

3. PRO Services: To ensure a hassle-free experience for entrepreneurs, Public Relations Officer (PRO) services manage government-related paperwork, including labor card issuance, trade license renewals, and visa processing.

4. Office Setup and Location Advisory: Depending on the type and size of activities, business setup services and consultants in UAE assist in locating appropriate office spaces, whether in business districts, free zones, or shared coworking spaces.

5. Banking Assistance: Because of the strict requirements, opening a corporate bank account in the United Arab Emirates might be difficult. Business setup services and consultants in UAE can streamline this procedure because they have established bank connections.

Conclusion Dubai provides several opportunities for individuals willing to start their own businesses. It will often prove much easier to overcome the multitude of hurdles associated with business setup and formation with the help of the best business setup consultants in UAE. In one of the most rapidly evolving economies, business venturing strategies can be successfully established and developed, helped by the valuable assets of Dubai and keeping track of global opportunities.

#business setup services in dubai#business in dubai#corporate finance services uae#accounting firms in abu dhabi

0 notes

Text

ITR Filing: A Comprehensive Guide to Filing Your Income Tax Return

Introduction:

Filing your Income Tax Return (ITR) is a crucial obligation for all taxpayers. This process not only ensures adherence to tax regulations but also provides financial advantages such as potential tax refunds and serves as documentation of income for various financial transactions. In this article, we will delve into the essential aspects of ITR filing, including its significance, different types, the filing process, and common pitfalls to avoid.

What is ITR Filing?

ITR Filing refers to the submission of income tax returns to the Income Tax Department. This process encompasses information regarding your income, deductions, exemptions, and tax obligations for a specific financial year. It is required for individuals, businesses, and other entities to file their ITR in accordance with their income levels and applicable tax laws.

Why is ITR Filing Important?

Legal Compliance: Under the Income Tax Act, it is obligatory for eligible taxpayers to submit their ITR by the specified deadline.

Avoid Penalties: Failing to file on time can lead to penalties and interest charges on outstanding tax amounts.

Claim Tax Refunds: If you have had excess tax deducted from your earnings, filing your ITR allows you to request a refund.

Proof of Income: The ITR serves as valid proof of income when applying for loans, visas, and government assistance.

Carry Forward Losses: Timely ITR filing enables you to carry forward any business or capital losses to offset against future earnings.

Avoid Notices and Scrutiny: Not filing or incorrectly filing your ITR may result in inquiries from the tax authorities.

Who is Required to File an Income Tax Return (ITR)?

Individuals whose earnings exceed the basic exemption threshold

Businesses and self-employed professionals

Corporations, partnerships, and firms

Non-Resident Indians (NRIs) with taxable income generated in India

Individuals possessing foreign assets or income

Taxpayers seeking refunds

Investors in foreign stocks or mutual funds

Categories of ITR Forms

The Income Tax Department has established various ITR forms tailored to different categories of taxpayers and types of income:

ITR-1 (Sahaj): Designed for salaried individuals with income not exceeding ₹50 lakh

ITR-2: Applicable to individuals and Hindu Undivided Families (HUFs) without business or professional income

ITR-3: Intended for individuals and HUFs with income derived from business or profession

ITR-4 (Sugam): For individuals, HUFs, and firms choosing presumptive taxation

ITR-5: For Limited Liability Partnerships (LLPs), Associations of Persons (AOPs), and Bodies of Individuals (BOIs)

ITR-6: For companies, excluding those claiming tax exemption under Section 11

ITR-7: For trusts, political organizations, and charitable entities.

Step-by-Step Guide for Submitting Income Tax Returns (ITR)

Collect Necessary Documents: Ensure you have your PAN, Aadhaar, Form 16, Form 26AS, bank statements, proof of investments, and salary slips ready.

Select the Appropriate ITR Form: Determine the correct form based on the nature of your income.

Access the Income Tax Portal: Navigate to the e-filing portal and log in with your credentials.

Identify the Assessment Year: Select the financial year relevant to your tax return submission.

Complete the Information: Input your income, deductions, and details of tax payments.

Review and Submit: Verify the accuracy of the information, validate it, and proceed to submit the return.

E-Verify Your ITR: Complete the verification process using Aadhaar OTP, net banking, or a Digital Signature Certificate (DSC).

Common Errors to Avoid When Filing ITR

Selecting an incorrect ITR form

Inputting inaccurate personal information

Failing to report all income sources

Claiming erroneous deductions

Missing the filing deadline

Neglecting to e-verify the return.

Due Date for ITR Submission

The deadline for submitting the Income Tax Return (ITR) is determined by the category of the taxpayer:

Individuals and Hindu Undivided Families (HUFs): July 31st (unless an extension is granted by the government)

Businesses subject to audit: September 30th

Companies: October 31st

Consequences of Missing the Deadline

Failure to submit your ITR by the due date may result in:

A penalty of up to ₹5,000 as stipulated under Section 234F.

Inability to carry forward any losses.

Accrual of interest on any outstanding tax.

Potential legal repercussions for intentional non-compliance.

Conclusion

Timely submission of your ITR is essential for maintaining financial discipline and adhering to legal requirements. The availability of online e-filing options has simplified the process significantly. Whether you choose to file independently or enlist professional help, ensuring that your ITR is accurate and submitted on time will alleviate stress and optimize your tax advantages.

Filing your Income Tax Return (ITR) is a crucial financial responsibility that ensures compliance with tax laws and helps you claim deductions, refunds, and other benefits. With the assistance of GTS Consultant India , the process becomes more streamlined, accurate, and hassle-free. Their expert guidance ensures that your tax filing is done efficiently, minimizing errors and maximizing potential savings.

By staying informed and filing your returns on time, you can avoid penalties and contribute to a transparent financial system.

0 notes

Text

How much is Kenya visa

The cost of a Kenya visa varies depending on the type and duration. As of September 2024, a single-entry tourist visa costs $51 USD, while a transit visa is $21 USD. The East Africa Tourist Visa, valid for Kenya, Uganda, and Rwanda, costs $100 USD. Prices may change, so it's best to check the official e-visa portal for the most current fees. Additional service charges may apply when using the online system. Some nationalities may be exempt from visa fees, but this should be confirmed through official channels.

More info: https://toppicksreviews.com

#Kenya visa fees#visa cost#entry permit price#e-visa charges#tourist visa cost#visa on arrival fee#single entry visa price#multiple entry visa cost#Kenya immigration fees#visa application charges#passport requirements#travel expenses#Kenya entry cost#visa processing fees#East Africa visa price#budget travel#Kenya tourism#visa validity period#visa payment options#visa fee comparison

0 notes

Text

📌Surffares Help Guide for Your Canada to India Flights

Planning your journey from Toronto, Calgary, or any Canadian city to India? Whether you're flying to Ahmedabad, Delhi, or Hyderabad, navigating airports smoothly can make a big difference. This guide covers essential airport tips, baggage rules, transit information, and exclusive flight booking hacks to ensure a stress-free journey.

✈ Toronto Pearson (YYZ), Calgary (YYC) – Departure Guide

✅ Arriving at the Airport: When & How Early?

International flights require you to check in at least 3 hours before departure.

Peak hours at Toronto Pearson (YYZ) & Calgary Airport (YYC) can lead to long security lines. Arriving early helps you avoid delays.

For seamless travel, use online check-in before reaching the airport.

✅ Baggage & Security Guidelines

Most airlines allow 2 checked bags (23 kg each) for Canada to India flights.

Carry-on limit: 7 kg (Ensure compliance to avoid extra charges).

Security Tip: Keep electronics & liquids easily accessible to speed up screening.

✅ Navigating Airport Terminals

Toronto Pearson (YYZ): Air India, Air Canada, Emirates, and Qatar Airways usually operate from Terminal 1.

Calgary Airport (YYC): International flights depart from Concourse D or E.

Always check your departure gate ahead of time to avoid last-minute confusion.

🔄 Connecting Flights & Layovers: What You Need to Know

Many flights from Canada to India involve layovers in cities like Dubai (DXB), London (LHR), Frankfurt (FRA), or Doha (DOH).

✅ Important Layover Tips

Short Layover (Under 2 Hours)

Stay near your gate & keep an eye on real-time updates.

Long Layover (4+ Hours)

Some airports (Dubai, Doha) offer free transit hotels or lounges.

Transit Visa Check:

If your layover is in London (LHR), you may need a transit visa (depending on passport type).

Baggage Transfer:

If flying different airlines, confirm whether you need to recheck your bags at layover airports.

🛄 Arrival at Ahmedabad (AMD), Delhi (DEL), Hyderabad (HYD)

✅ Customs & Immigration at Indian Airports

Visa Check: Ensure your e-Visa or stamp visa is valid before departure.

Customs Declaration: If carrying valuables above INR 50,000 or electronics, declare them to avoid fines.

✅ Airport Transfers & Ground Transportation

Ahmedabad (AMD): Prepaid taxis & Uber are available outside Terminal 2.

Delhi (DEL): Delhi Metro’s Airport Express Line is the fastest way to reach central Delhi.

Hyderabad (HYD): Ola, Uber, and airport cabs are located near the exit gates.

💰 How to Get the Cheapest Flights from Canada to India?

🔥 Best Booking Hacks for Toronto to Ahmedabad, Calgary to Delhi & Hyderabad Flights

1️⃣ Book Early (2-3 Months in Advance):

International flight fares rise 30-40% closer to departure.

2️⃣ Compare Prices on Surffares:

Our system scans the lowest fares across multiple airlines.

3️⃣ Check Alternative Airports:

Flying from Edmonton (YEG) instead of Calgary (YYC) can sometimes save $200-$400.

4️⃣ Use Weekday Discounts:

Tuesday & Wednesday bookings often have the lowest fares.

5️⃣ Sign Up for Surffares Alerts:

Get notified about flash sales & last-minute deals on India-bound flights.

🚀 Why Book with Surffares?

🔹 Real-Time Price Comparison – No need to search multiple sites! 🔹 Exclusive Discounts – Access special fares not available elsewhere. 🔹 No Hidden Fees – See the full cost upfront before booking.

📌 Ready to fly? Find the lowest fares on: 👉 Toronto to Ahmedabad Flights 👉 Calgary to Delhi Flights 👉 Calgary to Hyderabad Flights

✈ Book now & save big on your next India trip!

This "Airport Help Guide" enhances the Surffares flight pages by providing practical travel tips, airport information, and exclusive booking hacks. The strategic integration of flight booking links & Surffares advantages keeps users engaged while increasing conversions. 🚀

#TorontoToAhmedabadFlights#CalgaryToDelhiFlights#CalgaryToHyderabadFlights#CheapCanadaToIndiaFlights#BestFlightDealsToIndia#CanadaToIndiaAirfare#BookInternationalFlights#YYZToAMDFLights#YYCToDELFlights#YYCToHYDFlights#IndiaFlightBooking#LowestAirfaresToIndia#AirCanadaIndiaFlights#EmiratesIndiaFlights#QatarAirwaysIndiaFlights#TorontoToIndiaFlights#CalgaryToIndiaFlights#AffordableIndiaFlights#SurffaresDeals#FlightDiscountsCanadaToIndia#IndiaTravelDeals#BudgetFlightsToIndia#DirectFlightsToIndia#OneStopFlightsToIndia#LayoverInDubai#LayoverInLondon#TravelHacksIndiaFlights#WhenToBookIndiaFlights#CanadaToIndiaCheapFlights#YYZToIndiaTickets

0 notes

Text

Income Tax Return Submission: An In-Depth Overview

Introduction:

Submitting your Income Tax Return filing is a crucial obligation for both individuals and businesses. This process not only ensures adherence to tax regulations but also establishes a transparent record of your earnings and tax contributions. Below is a thorough overview designed to assist you in navigating the ITR submission process.

What Constitutes an Income Tax Return?

An Income Tax Return (ITR) is a document that taxpayers are required to file with the Income Tax Department of their respective country. It includes information regarding income, deductions, and taxes remitted throughout the financial year. The submission of an ITR enables the government to evaluate your tax obligations and ascertain whether you have overpaid or underpaid your taxes.

Why Is It Essential to Submit an ITR?

Legal Obligation: Filing an ITR is compulsory for individuals and entities whose earnings exceed a designated income threshold.

Refund Claims: If you have overpaid your taxes, submitting an ITR is necessary to initiate a refund process.

Income Verification: An ITR serves as a verification of income, which is often required for securing loans, visas, or engaging in other financial activities.

Avoiding Fines: Failure to comply with tax filing requirements can result in significant penalties and legal complications.

Who Is Required to Submit an ITR?

The obligation to file an ITR is determined by factors such as income level, age, and other specific criteria. Typically, the following individuals are required to file an ITR:

Individuals whose annual income surpasses the basic exemption limit.

Self-employed individuals and business proprietors.

Individuals earning income from foreign investments or assets.

Corporations and partnerships, regardless of their income levels.

Individuals seeking tax refunds.

Categories of ITR Forms

The Income Tax Department offers various ITR forms tailored to the taxpayer's classification and income sources. Notable forms include:

ITR-1 (Sahaj): Designed for salaried individuals earning income from salary, pension, or interest.

ITR-2: Intended for individuals and Hindu Undivided Families (HUFs) with income derived from capital gains or multiple house properties.

ITR-3: Applicable to individuals and HUFs with income generated from business or professional activities.

ITR-4 (Sugam): For individuals and HUFs who choose to follow a presumptive taxation scheme.

Procedure for Filing Your Income Tax Return

Document Collection: Assemble all essential documents, including Form 16, salary slips, bank statements, and proof of investments.

Select the Appropriate ITR Form: Identify the form that corresponds to your income type.

Register on the Income Tax Portal: If you are not already registered, create an account on the official income tax website.

Input the Information: Accurately enter your income, deductions, and tax payments.

Confirm Tax Liability: Verify that your tax liability aligns with the taxes paid throughout the year.

File the Return: Submit your ITR online and retain an acknowledgment for your records.

Complete E-Verification: Finalize the e-verification process to authenticate your ITR submission.

Common Errors to Avoid

Choosing an incorrect ITR form.

Failing to disclose all income sources.

Neglecting to claim eligible deductions.

Entering incorrect bank account information.

Overlooking the filing deadline.

Advantages of Timely ITR Filing

Eligibility for tax refunds.

Prevention of penalties and interest charges.

Establishment of financial credibility.

Facilitation of visa and loan applications.

Conclusion

Filing your income tax return is not just a legal obligation but a smart financial practice. It’s a seamless way to stay compliant, access benefits like refunds, and build your financial credibility. Experts at GTS Consultant India recommend starting early, organizing your financial records, and filing within the deadline to avoid last-minute stress. Make tax filing a priority to secure your financial future.

0 notes

Text

How to Avoid Common Pitfalls in Dubai’s Free Zones

Understanding the Pitfalls in Dubai’s Free Zones

Dubai’s Free Zones are designed to offer favorable conditions for both local and international businesses. However, failing to understand the regulations and nuances of these zones can lead to potential setbacks. Here are some common challenges in Dubai’s Free Zones that you need to be aware of:

1. Not Choosing the Right Free Zone

Each Free Zone in Dubai has its own set of regulations, benefits, and industry focus. Whether you are in logistics, media, tech, or any other sector, it's crucial to select the right Free Zone that aligns with your business goals. Failing to do so can limit growth opportunities, increase costs, or restrict your operations.

How to Avoid This Pitfall: Before committing to a Free Zone, research the different zones that cater to your specific industry. Consult with business advisors or experts who can guide you on selecting the most suitable Free Zone.

2. Ignoring the Legal Framework

Dubai’s Free Zones are governed by specific regulations that can differ significantly from those in the mainland. For example, some Free Zones only allow businesses to operate within the zone, limiting your ability to interact with the local market unless you establish additional branches. These legal complexities are often overlooked by new entrepreneurs.

How to Avoid This Pitfall: Familiarize yourself with the legal requirements of the Free Zone where you plan to operate. If necessary, consult with legal professionals who specialize in Dubai’s Free Zones to avoid any unforeseen complications.

3. Underestimating Setup Costs

While Dubai Free Zones offer various incentives, such as tax exemptions and reduced operational costs, the initial setup costs can still be high. These costs can vary based on the zone, the size of the business, and the type of licenses required. Entrepreneurs may fail to account for hidden expenses like office space rent, visa fees, and registration charges.

How to Avoid This Pitfall: Plan your budget carefully. Obtain a detailed breakdown of all costs associated with setting up a business in your chosen Free Zone. Keep a buffer for unforeseen expenses and ensure that your financial planning aligns with the long-term sustainability of the business.

4. Not Considering the Type of License

When registering a company in Dubai’s Free Zones, you will need to choose the type of license that best suits your business. This includes options like trading, industrial, service, or e-commerce licenses. Choosing the wrong license can lead to additional costs and regulatory hurdles.

How to Avoid This Pitfall: Take time to evaluate your business model and select the most appropriate license. If you are unsure about the best option, seek guidance from experts who can help determine the right type of license for your business.

5. Lack of Knowledge About Market Access

While Free Zones offer significant advantages, one major limitation is the restriction on market access. Some Free Zones allow businesses to operate only within the zone, which means that if you want to expand into mainland Dubai or other markets, you may need to set up additional operations, which can incur extra costs and administrative delays.

How to Avoid This Pitfall: Understand the geographical limitations of the Free Zone you choose. If you plan to access the mainland market, consider partnering with a local distributor or exploring hybrid setups that provide more flexibility.

6. Misunderstanding Visa and Residency Rules

The visa process in Dubai’s Free Zones is often more straightforward than in other regions. However, entrepreneurs sometimes misinterpret the visa requirements for their employees and family members. Failing to secure the correct type of visa can cause delays and legal issues down the line.

How to Avoid This Pitfall: Ensure that you understand the visa and residency rules within the Free Zone. If you plan to employ people or sponsor family members, ensure that the Free Zone can accommodate these requirements. Consult with immigration specialists if needed.

7. Failing to Adapt to Market Changes

Dubai’s business environment is dynamic, and the market can shift rapidly. Some entrepreneurs make the mistake of focusing solely on their initial business model without considering potential changes in demand, competition, or regulations. This lack of flexibility can result in stagnation.How to Avoid This Pitfall: Regularly assess market trends and be open to adapting your business model as required. Stay informed about changes in government policies, industry trends, and customer preferences. Flexibility is key to long-term success.

0 notes

Text

BANGALORE TO BHUTAN TRIP

Tourist Hub India DMC of Bhutan offer Bhutan packages from Bangalore with flight the best rate for 2024.

We offer the customized Bhutan package tour from Bangalore and also having the group tour for our guest. For more details for Bhutan tour packages from Bangalore call to our specialist 9830170902 or to get the best deal for our Best Bhutan packages from Bangalore visit: - https://www.touristhubindia.com/packages/bhutan-package-tour-from-bangalore

Package: - Bhutan packages from Bangalore

Duration: 7n8d

Pickup - Paro

Bhutan trip cost from Bangalore Starts from Bagdogra Rs. 38,500/-. It can be varies depending upon your hotel options and duration of the trip.

Bhutan itinerary from Bangalore: -

Here is the Bhutan trip itinerary from Bangalore which can be customized as per our guest requirements.

Day 1 Bagdogra to Phuentsholling

Day 2 Phuentsholling to Thimphu

Day 3 Thimphu Local Sightseeings

Day 4 Thimphu To Punakha

Day 5 Punakha to Paro

Day 6 Tiger Nest Monastry Trek

Day 7 Paro to Phuentsholling

Day 8 Phuentsholling to Bagdogra

Bhutan trip from Bangalore Inclusion:

→ Accommodation on double/twin sharing room

→ Both Way Non AC transfers PARO-PARO

→ Meal Plan on MAP (Breakfast + Dinner)

→ SDF Charges (Sustainable Development Fees)

→ All Permits/E-Visa

→ Travel Insurance with (Up to 60 years)

→ 01 Tour Guide (Phuentsholing - Phuentsholing)

Bhutan tour package from Bangalore Exclusion

→ Air Fare, Train Fare

→ Monuments Entrance Fees

→ Any item which is not mentioned in the 'Inclusion' section

→ Laundry, Tips, phone call or any such personal expenses

→ Snacks, Lunch or any other meals

How to reach Bhutan from Bangalore?

There are various options are available for Bangalore to Bhutan travel to Paro or Thimpu City.

The most common way to reach Bhutan from Bangalore is to take a Bhutan flight from Bangalore to Paro International Airport (PBH) in Bhutan. There is Bangalore to Bhutan direct flights not available to Paro as you need to book the connecting flights from the airlines. Some airlines offer flights from Bangalore to Paro Bhutan during peak season.

There is another travel option for Bangalore to Bhutan route to go to Bhutan from Bangalore by train, in which you need to book the train to Siliguri/ NJP and start your Bangalore to Bhutan road trip.

Drive from Bangalore to Siliguri in West Bengal. The Distance from Bangalore to Bhutan is approximately 2,500 to 2,800 kilometers, depending on the route taken from Bangalore. This road trip offers a scenic and adventurous route through multiple states in India before reaching the picturesque landscapes of Bhutan.

Places to visit in your trip to Bhutan from Bangalore:-

Here are some best places that you must include in your Bangalore to Bhutan tour packages.

Thimpu

Paro

Punakha

Bumthang

Haa Valley

Phobjikha Valley

Permits needed for travel to Bhutan from Bangalore:

Entry Permits Processing: Local tour agencies like Tourist Hub India Bhutan can assist in obtaining the necessary entry permits for your Bangalore to Bhutan packages.

Document Requirements: According to the new Bhutan Tourism Policy (2023), a valid Passport (with a minimum of 6 months validity) or a Voter ID Card is mandatory for the Bangalore to Bhutan trip.

For Bhutan trip package from Bangalore please Contact

Tourist Hub India - (Bhutan travel Agency)

0 notes

Text

PLEASE PRAY FOR IMRAN KHAN & NEW ISLAMIC REPUBLIC OF PAKISTAN (NEW PAKISTAN),

A STATE OF MADINAH

MIRACLE is an extraordinary event manifesting divine intervention in human affairs.

Miracles do happen in everyone’s life. For some It means I was at the right place at the night time It means to be a location where something good is about to happen at just the time of its occurrence; lucky; fortunate; able to obtain a benefit due to circumstances, rather than due to merit.

In the middle of November 2024, My children came to me and asked me if I can take two weeks off from TSH to travel with them without giving me any details. I said I will ask my boss if can get two weeks off. I told my children she said OK.

On November 19, 2024, when I came back, they told me that we were going to Madinah Munawwarah for 3 days and to Makkah Mukarramah for 7 days to perform Umrah, as a GIFT for my 85th Birthday. When I told them that I am not ready, as I don’t have a Visa and nothing has been packed for me.

They told me that they had already arranged everything, Passport, Visa, return Ticket by Saudia Airlines, Also my baggage is packed with clothings and other necessities of life ready to go. What a pleasant surprise!

I used to listen regularly the Na’at, “Ayaa hai bulaawaa mujhe Darbar-e-Nabee se,” by Shamshad Begum, meaning that I have a call from the Rowdah of Prophet Muhammad (SallAllahu ‘Alaihi wa Sallam).

Aayaa Hai Bulaawaa Mujhe Darbaar-e-Nabee Se, Shamshad Begum, 1935

https://www.youtube.com/watch?v=lkxHhkwfaKY and I did get a CALL.

We were on the plane at Dulles Int’l Airport on Friday nighty and reached Madinah on Saturday morning and stayed in Swiss Hotel. We prayed five (5) times a day in Masjid-e-Nabavi, visited Riad-ul-Jannah, and prayed two (2) Raka’at there and after three (3) days left for Makkah by Bus. We reached Haram in Makkah Mukarramah the same evening and stayed Makkah Hotel Near the Clock Tower.

We prayed five (5) times a day from my room in Haram from which I could see the Ka’bah, another Miracle of God Almighty, because I prayed to Him for it so that I don’t have to walk to Haram to pray five times day near the Ka’bah. All Praises are due to God Almighty Alone.

Mission was accomplished successfully in ten (10) days by the Grace of God Almighty.

We left on Sunday afternoon by Bus and reached Jaddah Int’ Airport. We flew on another fight by Saudia Airlines and reached Dulles Intl. Airport on Monday morning. We were picked up by the wife of our son, Ibrahim, who went with us. We stayed for few hours, and then drove by car to Johnstown PaA, because I had to work on Tuesday.

In Harmain Sharifain at Madinah and Makkah we prayed for H.E. Imran Khan, now in Adyalah Jail accused of 200 false criminal charges filed by the PDM Government against him. He has fought his cases in all the provincial, district and supreme courts and won most of them.

Imran Khan needs no introduction. He is the most popular leader in the world of Islam and is loved by more than 85% of the 250 million people in Pakistan. If they release him today, hold an election, he will win the seat hands down and will be the next Prime Minister of Pakistan by a majority vote, In shaa Allah.

اللهمانانجعلکفینحورهمونعوذبكمنشرورهم

O Allah, we ask You to repel the and we seek refuge in you from their evil, Ameen

أعوذبكلماتاللهالتاماتمنشرماخلق

I seek refuge in the perfect words of Allah from the evil of that which He has created, Ameen

Imran Khan, is no doubt making waves right in the very heart of Pakistan’s political spectrum. The achievements of the PTI government are unprecedented and surpassed by any previous government, and overcome various challenges.

قُلِ ٱللَّهُمَّ مَـٰلِكَ ٱلْمُلْكِ تُؤْتِى ٱلْمُلْكَ مَن تَشَآءُ وَتَنزِعُ ٱلْمُلْكَ مِمَّن تَشَآءُ وَتُعِزُّ مَن تَشَآءُ وَتُذِلُّ مَن تَشَآءُ ۖ بِيَدِكَ ٱلْخَيْرُ

ۖ إِنَّكَ عَلَىٰ كُلِّ شَىْءٍۢ قَدِيرٌۭ ٢٦

Say, "O. Allah , Owner of Sovereignty, You give sovereignty to whom You will and You take sovereignty away from whom You will. You honor whom You will and You humble whom You will. In Your hand is [all] good. Indeed, You are over all things competent. NOBLE QUR'AN, Al-e-‘Imran, 3, Verse (Ayah) 26

شایدکہتیرےدلمیںاترجائےمیریبات

PLEAE PRAY TWO RAKA’AT OF SALAT AL-HAAJAH,AND MAKE DU’A FOR THE SURVIVAL OF PAKISTAN UNDER ATTACK BY ALL THOSE WHO HATE ISLAM, PAKISTAN AND FUTURE PRIME MINISTER OF NEW ISLAMIC REPUBLIC OF PAKISTAN, (NAYA PAKISTAN) H. E. IMRAN KHAN.

Lastly, yet importantly, I plead rio Allah (Subhanahu wa Ta’ala) to protect him from the corrupt politicians all around him, and keep him steadfast in His Way, and grant him success in his honest, humble and sincere efforts to win equality, freedom and justice for all people of Pakistan so that they can live together as brothers and sisters in peace and harmony with each other as One Nation (Ummah) under God Almighty, Ameen, So help us God Almighty, Thumma Ameen Yaa Rabbil ‘aalameen.

I pledged to sacrifice one goat, lamb and sheep as a token of gratitude to Allah (Subhanahu wa Ta’ala) on the release of Imran Khan from Adiyala Jail, Ameen, and sacrifice another goat, lamb or sheep as Sadaqah on his behalf, when he is made Prime Minister of New Islamic Republic of Pakistan (Nayaa Pakistan) as a State of Madinah, Thumma Ameen Yaa Rabbil ’aalameen.

I request my brothers and sisters inn Pakistan and overseas to pledge to donate the same asa Sadaqah on behalf of Imran for his release andreinstatement as the next Prime Minister of Islamic Republic of Pakistan, by Allah (Subhanahu wa Ta’ala), In shaa Allah.

NOTE:

Sadaqah is charity given voluntarily in order to please God Almighty.

0 notes

Text

The Connected Car Economy: Tapping into In-vehicle Payment Potential

The global in-vehicle payment services market size is expected to reach USD 14.43 billion by 2030, registering a CAGR of 12.1% from 2023 to 2030, according to a new report by Grand View Research, Inc. The aggressive spending by automakers on enabling drivers to make payments and authenticate transactions from the vehicle itself coupled with the rising levels of disposable income, especially in the developed economies, and the growing preference for contactless payments are expected to drive the growth of the market over the forecast period.

Busy schedules are prompting drivers to look forward to hassle-free experiences as part of an upgraded lifestyle. At this juncture, the ability to shop, order, and pay on the go without performing any cash transactions for swiping credit/debit cards would allow commuters to save time and ensure a convenient commute. In-vehicle payment services offer drivers and passengers the convenience of making payments through various payment modes from the vehicle itself. The demand for In-vehicle payment services is expected to increase over the forecast period in line with the proliferation of connected cars and the growing preference for advanced infotainment.

Automakers, such as BMW AG, Mercedes-Benz, Ford Motor Co., Honda Motor Co. Ltd., General Motors Co., and Jaguar Land Rover Automotive PLC, have already started integrating in-vehicle payment services and solutions into their vehicle models. Payment service providers, such as MasterCard, Visa, and PayPal, are also striking strategic partnerships and collaborations with automotive OEMs to deliver efficient in-vehicle payment platforms.

The preference for contactless payments is growing in the wake of the outbreak of the COVID-19 pandemic. As such, the majority of the parking systems, gas stations, and toll collection booths have already incorporated mobile payment technology. The popularity of e-wallets is rising owing to the convenience and ease of payment e-wallets can offer. Digital wallet and online payment platforms, such as Google Pay, Amazon Pay, and Apple Pay, are also getting immensely popular and their adoption is expected to increase significantly over the forecast period.

However, automotive OEMs are looking forward to designing and developing a payment ecosystem that would allow drivers and passengers to avail and pay for all the desired services, such as filling gasoline or charging electric cars, booking and paying for parking slots, paying tolls at toll booths, and ordering food and coffee, among others, without having to get out of the vehicle. Hence, the market for in-vehicle payment services is expected to grow significantly over the forecast period.

In-vehicle Payment Services Market Report Highlights

The gas & charging station segment accounted for a significant revenue share of around 27.5% in 2022. This is attributed to the increasing adoption of electric vehicles (EVs), the growing popularity of contactless payments, and the increasing availability of in-vehicle payment technology.

The credit/debit card segment accounted for the largest market share of 53.2% in 2022.Debit cards and credit cards remain the most popular payment modes and are used extensively to make contact and contactless payments.

North America accounted for a market share of around 39.3% in 2022. Continued integration of the latest technologies in automobiles and the rising levels of disposable income are anticipated to drive the growth of the regional market

In-vehicle Payment Services Market Segmentation

Grand View Research has segmented the global in-vehicle payment services market on the basis of mode of payment, application, and region:

In-vehicle Payment Services Mode Of Payment Outlook (Revenue, USD Million, 2018 - 2030)

NFC

QR Code/RFID

App/E-wallet Based

Credit/Debit Card Based

In-vehicle Payment Services Application Outlook (Revenue, USD Million, 2018 - 2030)

Parking

Gas & Charging Stations

Shopping

Food & Coffee

Toll Collection

Others

In-vehicle Payment Services Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

UAE

List of Key Players

BMW AG

Daimler AG

Ford Motor Co.

General Motors Co.

Honda Motor Co. Ltd.

Hyundai Motor Co.

Jaguar Land Rover Automotive PLC

Volkswagen AG

ZF Friedrichshafen AG

Google

Amazon

Visa

MasterCard

PayPal

Order a free sample PDF of the In-vehicle Payment Services Market Intelligence Study, published by Grand View Research.

0 notes