#e invoicing software india

Explore tagged Tumblr posts

Text

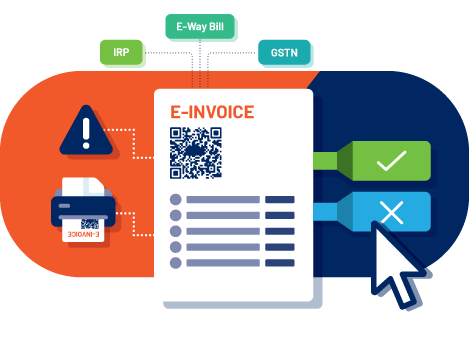

Why E-Invoicing is in Focus nowadays

The government has initiated the trial of the e-way bill system from 15 January 2018 for the generation of e-way bills for intra-state and Interstate movement of goods but the system is expected to be rolled out soon and make it mandatory for transporters and organizations to generate the new e-way bill online according to the law of GST and in compliance with rules of the CGST rules.

Every taxpayer or every registered person who transferred his goods or causes to the movement of goods of value exceeding ₹50,000 concerning supply or the reasons which are other than supply or for inward supply from an unregistered person then e-way bill generation is necessary.

The relevance of GST E-invoicing software plays a role, as it is well known that E-invoicing is not a new technology but its relevance has grown multiple folds in recent times.

For choosing the best E-invoicing software india, users must keep an eye out for one of the features for choosing E-invoicing software is its ability to integrate with an accounting system.

This software allows the users to see where your operating funds were channeled and for that, you can also determine where your business finances are headed and in which direction.

E-way bill portal has also released the e-way bill APIs to license GST Suvidha providers for helping large transporters or large organizations automate the entire process by integrating their solution within an ERP taxpayer or an existing e-way bill system for generating new e-way bills online in real-time.

A user can generate the bulk E-way bill from the system by using software or when the user needs to generate multiple bills available in one shot they can generate the bulk E-way Bill by adopting touchless technologies of e-invoicing.

The concept of an E-way bill to generate online under GST was to abolish the Border Commercial Tax post to avoid the evasion of tax in India.

So it is crucial to know every aspect related to the E-way bill system under GST. The E-way bill system is very much important for both parties whether it would be for the government or the business industry.

For More Information

Call +91-7302005777

Or visit https://unibillapp.com/

#e way bill generate online#best e invoicing software#gst e invoicing software#eway bill generate online#generate e way bill online#e invoice software free#gst e way bill software#e invoicing software india#e invoicing software free#e invoicing software download

2 notes

·

View notes

Text

5 Tips to Streamline Your Billing Process

Efficient billing is the backbone of successful business operations. The streamlined process not only saves time but also improves customer satisfaction and ensures steady cash flow. Here are five actionable tips to simplify and enhance your billing process using TRIRID Accounting and Billing Software:

Automate Repetitive Tasks

Manual invoicing is time-consuming and prone to errors. With TRIRID, you can automate recurring invoices, set reminders for payments, and generate GST-compliant bills with ease. This automation eliminates delays and reduces human errors.

Leverage Real-Time Reporting

Keep yourself updated with the real-time reporting feature of TRIRID. Track pending invoices, payment statuses, and overall financial health with a click. This transparency helps in taking timely actions to manage receivables.

Cloud-Based Solution

TRIRID's cloud-based platform provides you with access to your billing data at any time and from anywhere. Whether in the office or on the go, you can securely manage invoices, payments, and customer records from any device.

Simplify GST Compliance

Managing taxes can be challenging, but TRIRID makes it easy. Generate GST-ready invoices, calculate tax rates automatically, and stay compliant with the latest regulations—all within the software.

Integrate Billing with ERP Systems

Make your billing software integrate with other business tools such as ERP or inventory management systems to ensure seamless workflow. TRIRID compatibility ensures smooth data flow and enhances efficiency.

Why Choose TRIRID Accounting and Billing Software?

You get a robust solution designed to simplify complex billing processes with TRIRID. The user-friendly interface, customization options, and advanced features make it the go-to choice for businesses of all sizes.

Ready to transform your billing process? Contact us today!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Best GST e-Invoicing Software for Business#Top 10 Easy To Use Billing and Invoicing Software in India#Best e-Invoicing Software for SMBs in India

0 notes

Text

Opt for the Best e-Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy.

For more detail :- https://meontechnologie.wixsite.com/meon-technologies/post/opt-for-the-best-e-invoice-software-in-india

0 notes

Text

https://jabitsoft.com/10-key-signs-for-introducing-an-erp-solution-to-your-business/

#Website and Mobile App Development Company#Android and iOS App Development company#mobile app development company#iOS app development services#Android app development services#App Development Company#Mobile App Development Company in Noida#Android App Development Company#Android App Development Company in Noida#iOS App Development Company in Noida#iOS App Development Company#iOS App Development Company India#Mobile Application Development company#Invoicing Software development company in Noida#eCommerce Application Development Company#eCommerce app development services#eCommerce App Development Company#Custom E-Commerce App Development#Custom Software Development Services#Best Website Development Services in Noida#Best Website Development Services in India#Best Website Development Company in Noida#Web Development Services in Noida#software development company in india#Best software development company in india#Best Software Development Companies in India

0 notes

Text

As a popular business management software, Tally has no alternative at present. The reasons being its cost, ease of use, scalability, flexibility, and features.

#Why Is Tally Irreplaceable#business management software#GST software in India#prime GST software in India#Tally’s e-invoicing software provides

0 notes

Text

Why small businesses need cloud-based GST Billing Software

GST Billing Management software is exactly what you need to manage the returns and filings, cloud-based software is nothing but a new way of filing GST returns without installing any software. It is a platform where you can access the business data anywhere and at any time hence knowing how your business is doing in real-time. GST Billing Software helps the business to manage their financial operations and automates the process. Most Businesses use simple accounting software to cope with all the requirements.

It stores all the documents with ease and also helps in classifying those based on their types and then storing those in different folders. As we all know that data security is one of the most important things at this time because there is a high chance of breaching the data. GST Billing Management Software helps in overcoming this situation. Small businesses need cloud-based GST billing and accounting software because of various advantages.

Free GST Billing Software makes GST easy because it is convenient compliance as the cloud-based GST software enables all types of businesses to file their returns, reconcile their mismatches, manage inventories, calculate taxes, and prepare invoices as per the guidelines of the government. GST Billing Management software is useful for supporting the business in saving time and eliminating errors complying with the provisions of GST easily securely and quickly.

A better cloud-based GST software can help the users to do the auto-matching, purchases, and returns reconciliation. Along with this cloud wise GST software has made GST compliance so easy that business owners can access their data anytime from anywhere. It also helps in making better financial decisions as the owners would be aware of up-to-date current financial position.

Role-based access control is also a great feature provided by cloud-based GST software. This role-based access control is a simple and authentic approach where you can restrict the access of your system to authorize users. Now the owners can simply assign the task to an authorized person only to fulfill their requirements of the business.

For More Information: -

Contact us: - +91-7078602005

Visit us: - https://unibillapp.com/

#Best Billing Software#Inventory System Software#Free GST Billing Software#Easy Bill Software#E-way Billing Software#GST E- Invoice#Lifetime Free GST Billing Software#Invoice Software India

0 notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

Discover the best invoicing software solution for small businesses in India. Streamline GST compliance effortlessly with TallyPrime. Get a free trial, now!

0 notes

Text

GST Billing Software in Ooty

The Simplest Solution for Your Business by Optech Software

The beautiful town of Ooty has made it increasingly easier for small and big businesses to minimize complications in operations and stay in touch with taxes. Invoicing and ensuring proper accounts of goods and services tax might not be very easy processes for businesses.

With the implementation of the GST in India, the need to invest in compliant billing software increases tremendously. The answer to business houses in Ooty lies with Optech Software providing simple, effective, and dependable GST billing software.

Why GST Billing Software Is a Must in Ooty for Entrepreneurs

GST billing software is much more than a simple invoicing tool, but that very tool that helps bring all the finances into one place, helps with your tax compliance, and therefore smoothens business operations. Entrepreneurs working from Ooty have many advantages with GST billing:

1. GST-compliance: Perhaps the biggest gain businesses execute from using GST billing software is compliance with GST. The invoicing generated through the software typically keeps pace with the changes and innovation in regulation on the GST front, which in themselves create possibilities for mistakes leading to penalties and audits.

2. Easing of tax calculations: This could really become a complex affair with so many tax slabs. Optech Software offsets this by very skillfully determining the priced tax under the various slabbed taxes; that is, the computation of the right tax rate.

3. Saving Time: Documentation in terms of manual generation of invoices and maintaining hard records can take up an additional chunk of time.

4. Optech Software allows for a quicker way for entrepreneurs to prepare GST-compliant invoices and ease in tracking the payments and managing inventories-a boost for time and labor, with far less thought towards documentation, allowing you to focus on growing your business.

5. I assure that every invoice will be generated under the guidelines of GST compliance; the software will keep tax rates up to date per the latest government notifications automatically so that you need not update manually.

6. Invoicing-Optech Software’s best quality is the ability to customize your invoices, and use them to represent your corporate identity. Depending on your firm’s designs, you can include your logo, name of the business, and the format of the invoice.

Features on offer with GST software from Optech:

Optech Software open system offers just the right features for the businesses in Ooty:

1. GST-Compliant Invoicing: Optech Software ensures that each invoice is duly GST-compliant and updates tax rates according to the latest government notifications automatically. You don’t even have to worry about it at all.

2. Customizable Invoice for Branding Purposes: Businesses can customize their invoices to their branding preferences, including logos, company names, and personalization of the invoice format.

3. Inventory Control: In addition to billing, Optech Software has an inventory control facility. Under it, the level of stocks is to be located; reorder points can be set, and they can generate purchase orders.

4. Simplified GSTR Filing: Filing returns is a tough ask, especially with the volume of transactions. Optech makes things easy by generating the report that can be directly used for filing GSTR returns rather than traversing the e-filing portal.

5. Multiple User Access: If a business works in separate fields and retains multiple employees, Optech Software grants the permission for multiple users to keep a common access point for more efficient working.

6. Offline Functionality: Optech Software provides offline functionality to Ooty businesses that may face internet connectivity disruptions; this means you can create invoices and do recordkeeping without internet connectivity.

Why Choose Optech Software in Ooty?

Optech Software is trusted by businesses all across Ooty for its simple, reliable, and inexpensive services. Here are a few reasons why the businesses in Ooty should choose Optech Software for their GST billing:

1. Affordable Pricing: Optech Software has very affordable prices and can be the right choice for all small businesses and startups in Ooty that want quality software but do not wish to pay a premium.

2. Customer Support: Optech Software provides good customer support to all businesses in Ooty. Whenever you face difficulty or have a query, our team will always be there to guide you.

3. Regular Updates: GST regulations are frequently changing. Optech Software takes care that it stays updated with the latest GST guidelines so that your software is compliant at all times.

Conclusion

GST billing software has become a necessity for businesses in Ooty; it is no longer a luxury. With Optech Software’s GST-compliant billing solution, it becomes easier to stay compliant and avoid mistakes or lapse at the end of the financial year.

Businesses in Ooty after Optech Software can afford to keep themselves away from the hassles of the GST billing procedure thanks to its user-friendly platform, customizable features, reliable customer service, and active assistance. Try Optech Software today, and find out the difference that being compliant makes.

1 note

·

View note

Text

How to Make an E-Way Bill Online: A Step-by-step guide

What is an e-way bill and why is it important?

It is very easy to create an e way bill online, and from there, we will learn everything about e-way bills from the beginning to the latest update. Therefore, transporting goods from one state to another in India would not be possible after the introduction of GST without this e-way bill.

This guide will help you generate e way bill online easily by walking you through each step on the GST portal or with the eway bill app for pc. It will serve as the most convenient way of managing bills directly from your computer, making it relatively easy to handle high volumes of shipments.

Want a Smarter Way to Manage E-Way Bills? Explore GimBook Today! https://bit.ly/4eMIOHF

Requirements for generating an e-way bill online

Having these in place ensures a smooth, quick process and keeps your business in line with GST rules. Here’s what you need to get started:

GST Regn - (GSTIN) One eway bill online can be generated only when the GSTINs of both sender and receiver are valid. That is the first movement towards compliance with all procedures necessitated and executed on an online basis by the GST rules.

Invoice or Bill of Supply - A commercial invoice or bill of supply is essential. This document should include details such as item description, HSN code, quantity, and value. When you’re ready to eway bill generate online, having a clear and accurate invoice helps avoid delays.

Transport Information - Transportation details are crucial for generating an eway bill online. You’ll need to provide: Mode of transport (road, rail, air, or ship).

Place of Dispatch and Delivery - Therefore, you will need to identify both, the pickup location and also the destination.

Details of Goods - Details of the goods should include HSN, number, and the total amount.

Recipient’s Details - Enter the recipient’s name, address, and GSTIN to ensure that the goods are traceable and reach the correct destination.

Distance and Estimated Transport Time - Inputting the approximate distance between the origin and destination can help estimate transport time.

Secure and Accurate E-Way Bill Generation – Get the App Now: https://bit.ly/4g48T6E

Getting Started with the E-Way Bill Process

By having these details ready, you can generate the e-way bill smoothly on the GST portal or via the eway bill app for PC. Using the app for PC makes it even easier to access your records, update transport information, and handle large volumes of e-way bills efficiently.

Having everything prepared helps ensure that your e way bill online��process is seamless, allowing your business to stay compliant and focus on smooth operations.

Step-by-step process to create an e-way bill online

An e-way bill online to provide a hassle-free glitch-free process for transportation under GST is created. The very easy process explained below will guide you through the process as to how one can generate an e-way bill online without any glitches thus ensuring compliance and thus smooth delivery.

Whether one is logging in through the GST portal or an eway bill app on PC, the following steps cut down on time and errors.

This is how to generate an e way bill online: step-by-step process-

Login to E-Way Bill Portal of GST

You ought to login to the authentic GST e-way portal using your credentials, or you may access the eway bill app for pc if you want to use computer software as it is more convenient for managing your e way bills.

Click "Generate New" on the Dashboard.

Once one logs in, then click on the "Generate New" option on the dashboard to initiate a new e way bill.

Provide Transportation Information

Transport Mode: Choose the correct mode of transport, such as rail, road, air, or ship.

Vehicle Details: For road transport, enter the vehicle number. If using another mode, enter relevant information like transporter ID or document number.

Ensuring correct transport details is crucial, as missing or incorrect information can invalidate your e-way bill online.

Verify and Submit the Information.

Double-check all the entered details to avoid mistakes, as errors can cause delays or compliance issues. When everything is correct, click "Submit" to generate the e-way bill online.

Download or print the e way bill.

After successfully generating the e way bill online, download or print it for your records and for transport purposes. This is the document that will accompany the goods during transport, ensuring a smooth and compliant journey.

Using the eway bill app for pc can make these steps even easier by keeping all your information organized and ready for any future e-way bill requirements.

By following these steps, you can confidently manage and generate e-way bill online without complications, ensuring each shipment is legally compliant and properly documented.

Common Mistakes to Avoid When Making an E-Way Bill:

Avoid several common traps associated with generate e-way bill online implementation: being genuinely meticulous about details and accurate in filling up every field. Some common pitfalls to look out for are:

Incorrect GSTIN of Sender or Receiver

Wrong HSN Code or Item Description

Missing or Incorrect Vehicle Details

Not Updating Details When There’s a Change

Generating Duplicate E-Way Bills

Incorrect Value of Goods

Late Generation of E-Way Bill

Incase you make a wrong e way bill or wish to cancel an e way bill online relax because the good news is that the GST portal makes cancellation or updation of an e way bill quite easy. Read on as this stepwise guide will help you understand the process for managing updates as well as cancellations so that all your e-way bills are GST compliant.

0 notes

Text

Reliable & Complete E-Invoicing Solution

Electronic invoicing or GST e invoicing software in India is a method for creating invoices and it enables the invoices created through one software program that is accessible by the other software, it has also reduced the need for further data entry and the labor-intensive manual process.

It is an invoice that has been produced using a single standard format so that others can share the electronic data or ensures information consistency.

E-invoicing software provides a reliable and complete invoicing solution, it provides the features for generation, tracking, or managing the invoices.

Unibill App is an GST e invoicing software in India that helps in generating the E invoices in a single click, also it automatically prints IRN or invoice reference number and QR code with the invoicing software.

It is certified software which means your invoices can be directly uploaded to the IRP portal to generate the E invoices seamlessly.

There are so many benefits of the Unibill App, the best GST e-invoicing software as it reduces the reporting of the same invoice details multiple times, it helps in real-time tracking of invoices, confirms the ITC eligibility, it prevents errors and fraud, it saves time and effort to file returns or it helps in reducing the reporting of same invoice details in multiple times.

There are some key factors to be considered while choosing a GST E-invoicing software like whether it can generate bulk E-way Bill invoices seamlessly whether it can generate E-way Bills along with E invoices as applicable or whether it has the flexibility to use the offline mode to generate the E invoices that deals in possible network issues.

Electronic invoicing is a system in which all B2B invoices are uploaded electronically and then authenticated by the designated portal.

Post authentication, a unique invoice reference number is generated along with the QR code and that needs to be printed on the invoice.

Electronic invoices apply to all the businesses that are registered under GST and those that issue B2B invoices in a phased manner as notified by the central government.

Therefore there are many benefits of E-invoicing, first, it can curb tax evasion and with this the chances of editing invoices are low.

For More Information

Call us on +91-7302005777

Or visit https://unibillapp.com/

#best e invoicing software#gst e invoicing software#e invoice software free#e invoicing software india#e invoicing software#e invoicing software download#gst e way bill software#eway bill generate online#generate e way bill online#e way bill generate online

0 notes

Text

Price: [price_with_discount] (as of [price_update_date] - Details) [ad_1] Book Keeper is most simplified accounting software for Micro and Small businesses. With over 1 Lac Users worldwide and 4.5 rating on Play Store/ App Store, Book Keeper is one of the leading accounting software in India. Works Offline Create GST invoices, file GST returns Complete Inventory Management + Warehouse + Barcode Sync Across Devices + User Management Generate Quotation/Orders Track Receivable/Payable Supports Windows, Android, iOS devices No Hidden Charges Get 3 months FREE subscription with this package Book Keeper is a product of Just Apps Pvt Ltd. Made in India specially for Indian businesses. Fully GST compatible - GST Invoicing se GST Filing tak. Book Keeper Accounting is Tally compatible. Sync your company accounts with Tally by importing existing Tally Masters into Book Keeper, and exporting Masters and Transactions from Book Keeper to Tally Works on Windows desktop, Android/iOS devices Generate and print invoices as per GST format Generate GST returns (GSTR1, 2, 3B, 4) in either JSON format or Excel offline utility Generate and manage e-Way Bills easily Track and maintain the right stocks at the right time, manage raw material and finished goods [ad_2]

0 notes

Text

Opt for the Best e Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy. So, what are you waiting for? Embrace the advanced e-invoicing technologies and stay ahead in the tough competition.

Find the Best auto mailer software.

Significance of Customer Service Tools

Customer service tools are not a new concept, but these are indispensable for organisations to handle their customer issues and enhance their experience. These software solutions are based on ticketing systems and allow customer support representatives to track, manage, and set priorities based on client preferences. In this system, the customers get a notification regarding their raised tickets, and they can complete and upload the documents related to the bug issues they are facing. For more details, visit the website!

Enhance your Customer Trip Plans with Itinerary Creator

An itinerary creator tool is specially designed for the travel industry, which reduces the burden of travel agents as well as travel enthusiasts. This software empowers users to create beautiful itineraries with the help of advanced artificial intelligence algorithms and saves time and energy. It enables users to make travel plans quickly and efficiently under their budgets. If you're interested in getting a free demo, don't hesitate to fix a schedule right now!

source

#best e-invoice software in India#best auto mailer software#Customer service tools#itinerary creator

0 notes

Text

E way bill software

Our e way bill software is an essential tool for businesses that need to comply with India’s Goods and Services Tax (GST) regulations. This software simplifies the generation and management of e-way bills, which are mandatory documents required for the transport of goods exceeding a specified value. With user-friendly interfaces and automated processes, e invoicing software allows users to quickly create, track, and cancel e-way bills with ease.

1 note

·

View note

Text

Superfast E-Way Bill Solution

Superfast E-Way Bill Solution with TRIRID Accounting and Billing Software.

Managing the process of the e-way bill will be extremely important for India businesses in terms of smoother transportation and compliance with GST regulations, but it always involves an amount of tedious time when done manually, so let's see if you can speed up your e-way bill generation time and free up resources, thanks to TRIRID Accounting and Billing Software.

Why Choose TRIRID for E-Way Bill Generation?

Instant E-Way Bill Creation

With the automated system, e-way bills can be easily generated in real time in compliance with GST regulations in TRIRID. Whatever the number of invoices it may be, single or multiple, you will definitely get the necessary document that you need.

Seamless Integration with GST Portal

TRIRID directly integrates with the GST e-way bill portal so that every data entered is valid and submitted successfully. This helps eliminate chances of mistakes that can lead to delaying shipments or paying fines.

Batch Generation and Management

If you generate bulk transactions, TRIRID provides the functionality for multiple e-way bills at a time. It saves the time you may require generating multiple shipments through simple, few steps.

Real-Time Tracking

As soon as the e-way bill is generated, TRIRID gives you real-time tracking for the status of your e-way bills. You will come to know whether your bill is accepted, rejected, or requires further action.

Compliance and Error-Free Documentation

TRIRID ensures that the e-way bills generated are complaint with the latest GST law. The software also includes inbuilt checks to avoid error so that the chances of penalty for non-compliance will be less.

Features that make E-Way Bill generation easy

Easy Interface: TRIRID ensures an intuitive interface, which is so simple that even first-time users can generate e-way bills with a few clicks.

Automated Invoice Mapping: The software automatically fetches details from your invoices and pre-fills the required fields for e-way bill generation, thus making the process faster.

Cross-Platform Accessibility: Whether you’re on your desktop, tablet, or smartphone, TRIRID allows you to generate and manage e-way bills from anywhere, ensuring your business stays compliant on the go.

How TRIRID Helps Your Business Stay Compliant

The significance of staying in compliance with e-way bill rules cannot be underestimated. Non-compliance would attract huge penalties and hamper the movement of goods. TRIRID's superfast e-way bill solution ensures that businesses always stay on top of legal requirements, reducing the chance of penalty.

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#Best accounting software in Ahmedabad Gujarat#track your business finances#Accounting software for small business#TRIRID-Billing software in Bopal in Ahmedabad#TRIRID-Billing software in ISCON-Ambli road-ahmedabad

0 notes