#digital financial solutions

Explore tagged Tumblr posts

Text

Could we take a loan from a mobile app?

loan from a mobile app: In today’s fast-paced world, convenience is king. Enter mobile app loans, a relatively new player in the financial arena that’s catching everyone’s attention. But what exactly are these loans, and how do they work? Are they as great as they sound, or is there more to the story? Let’s dive into the world of mobile app loans to uncover their secrets and figure out if they’re a good fit for your financial needs.

What is a Mobile App Loan?

A mobile app loan is exactly what it sounds like a loan that you apply for and manage through a mobile application. These apps offer a streamlined process for getting a loan without the need to visit a physical bank. Essentially, they bring the bank to your fingertips.

Suggested Articles: Best Financial Advisor in Gurugram | Financial Advisor

How Mobile App Loans Work

Application Process

Applying for a mobile app loan is as simple as downloading an app, filling out a form, and pressing submit. Here’s a quick rundown:

Download the App: Start by downloading the loan app from your preferred app store.

Fill Out the Application: Enter your details, including income, employment status, and credit history.

Submit and Wait: After submission, the app processes your information and lets you know if you’re approved.

Approval and Disbursement

Once you’re approved, the funds are usually transferred directly to your bank account or a digital wallet. The speed of this process can vary, but many apps promise near-instant disbursement.

Suggested Articles: Best Student credit card Providers in Gurgaon | credit card

Advantages of Mobile App Loans

Convenience and Accessibility

Imagine being able to apply for a loan while lounging on your couch or waiting in line at the supermarket. That’s the beauty of mobile app loans—they offer unparalleled convenience. No more scheduling appointments or waiting in line; you can get a loan from anywhere, anytime.

Quick Processing Times

Time is money, and mobile app loans know that. Many apps boast quick approval times, often within minutes. This means you can get the funds you need fast, which is perfect for unexpected expenses.

Minimal Paperwork

Traditional loans can involve heaps of paperwork and bureaucratic hurdles. Mobile app loans simplify things with minimal documentation. You’ll often need just a few documents to verify your identity and income.

Suggested Articles: Documents required for buying insurance

Disadvantages and Risks

High-Interest Rates

One downside to mobile app loans is that they sometimes come with higher interest rates compared to traditional loans. Lenders compensate for the risk and convenience with higher costs, so it’s essential to read the fine print before committing.

Risk of Fraud

With the rise of mobile apps, there’s also an increase in fraudulent activities. It’s crucial to ensure the app is legitimate and secure to avoid falling victim to scams. Always check for proper encryption and read reviews before downloading.

Limited Loan Amounts

Mobile app loans often have lower borrowing limits compared to traditional loans. If you need a substantial sum, you might find these loans insufficient for your needs.

Suggested Articles: Life Insurance Corporation of India (LIC) Online Payment

How to Choose a Reliable Mobile App

Research and Reviews

Before downloading any loan app, do your homework. Look for user reviews and ratings to gauge the app’s reliability and customer service. A well-reviewed app with a solid reputation is usually a safer bet.

Company Credentials

Verify the credentials of the lending company behind the app. Ensure they are licensed and regulated by financial authorities to ensure they operate within legal boundaries.

Suggested Articles: Best Insurance advisor in Gurugram 2024

Alternatives to Mobile App Loans

Traditional Bank Loans

If you’re wary of mobile app loans, traditional bank loans are a reliable alternative. While they might involve more paperwork and a longer approval process, they often come with lower interest rates and higher loan limits.

Online Lenders

Online lenders are another option. They combine the convenience of mobile apps with the reliability of traditional lenders. When choosing an online lender, look for those with good reviews and transparent terms.

Conclusion

Mobile app loans offer a convenient and fast way to access funds, but they come with their own set of advantages and disadvantages. They’re great for quick cash needs but may not be the best option for everyone due to higher interest rates and potential security risks. Always research thoroughly and consider your options before deciding. After all, the right loan for you is the one that fits your financial situation best.

By Paisainvests.com

#App-Based Loans#Could We Take a Loan from a Mobile App#Digital Financial Solutions#Digital Loan Services#Instant Loans Mobile Apps#Mobile App Loans#Mobile Lending India#Mobile Loan Application#Mobile Loan Apps#Online Loans India

1 note

·

View note

Text

Modern KYC Capabilities: Revolutionizing Compliance and Customer Experience

Know Your Customer (KYC) is one of the most important processes and compliances followed in several industry verticals such as banking, telecom, insurance, healthcare, real estate, gaming, retail, eCommerce, telecommunications, and government. The importance of robust KYC practices cannot be overstated. As financial institutions and telecom digital financial platforms strive to meet stringent regulatory requirements and enhance customer trust, modern KYC has emerged as a critical component. Traditional KYC processes, however, have often been cumbersome and prone to inefficiencies.

The advent of modern KYC capabilities, integrated with digital financial solutions, is revolutionizing compliance and customer experience. By leveraging advanced technologies such as AI, machine learning, and blockchain, financial institutions can now achieve greater accuracy, efficiency, and security in customer verification. These innovations not only streamline the onboarding process but also reduce fraud and financial crimes, offering a seamless experience for customers.

Furthermore, modern KYC solutions are playing a pivotal role in the broader context of digital financial solutions, including agency banking solutions, mobile wallet solutions, and convergent billing platforms. These integrated systems ensure a holistic approach to managing customer data, improving operational efficiency, and maintaining compliance. The transformation brought about by modern KYC is a significant leap forward, positioning financial institutions to better serve their clients while adhering to evolving regulatory landscapes.

The Global Importance of KYC Compliance

KYC compliance is crucial for financial institutions to verify customer identities and ensure secure transactions. When onboarding new customers, banks perform KYC checks to meet regulatory standards. If verification fails, banks can deny account opening requests. This process helps combat money laundering and terrorist financing.

As the financial world digitizes, manual KYC checks are becoming outdated. Online KYC verification offers a more efficient solution, aligning with global compliance requirements. Modern KYC technologies enhance accuracy, security, and efficiency, making them essential for today’s digital financial solutions.

How KYC Protects Global Businesses?

KYC compliance enables financial institutions to conduct thorough customer due diligence, preventing identity theft, money laundering, and fraud. Robust KYC processes involve extensive verification, blacklist screening, and risk assessment, ensuring only legitimate customers engage with businesses. According to Fenergo, over 10 years, about 91% of the total value of non-compliance-related fines which is around $23.52 billing related to KYC is registered in the USA.

Regulatory authorities impose strict penalties for non-compliance with KYC and anti-money laundering (AML) norms. Despite this, companies face significant fines and reputational damage due to compliance failures.

Major Challenges with Traditional KYC Process

1. Time-Consuming Manual Verification

Traditional KYC processes rely heavily on manual verification. This not only slows down customer onboarding but also increases the risk of human error. Employees must handle large volumes of paperwork, leading to inefficiencies and potential mistakes. Manual processes also extend the time needed to verify customer identities, frustrating customers and increasing operational costs.

2. Increased Vulnerability to Fraud

Manual KYC checks are less effective at detecting sophisticated fraud schemes. Financial institutions using traditional methods are more vulnerable to money laundering and identity theft. Fraudsters can exploit weaknesses in the manual verification process, making it easier for them to bypass checks and engage in illegal activities.

3. Lack of Integration with Modern Digital Solutions

Traditional KYC methods often fail to integrate with modern digital financial solutions. This lack of integration is particularly problematic for telecom digital financial platforms and agency banking solutions, which require seamless and efficient verification processes. The result is a fragmented system that struggles to provide a cohesive customer experience.

4. Challenges in Meeting Regulatory Compliance

Regulatory requirements for KYC are constantly evolving. Traditional methods lack the agility needed to adapt quickly to new regulations. This can lead to compliance risks, as financial institutions may not be able to update their processes in time. Non-compliance can result in hefty fines and damage to the institution’s reputation.

5. Inefficiencies Without Convergent Billing Platforms

Traditional KYC processes are often incompatible with convergent billing solutions. These platforms unify billing processes across different services, but without proper KYC integration, institutions face difficulties in consolidating customer data. This leads to inefficiencies and potential gaps in compliance, as the data remains siloed and harder to manage.

Modern KYC Overcomes Challenges of Traditional KYC

Modern KYC solutions address the limitations of traditional KYC by leveraging advanced technologies and integrating seamlessly with digital financial platforms. They offer automated verification, enhanced fraud detection, and agility in regulatory compliance. Compatibility with convergent billing platforms further ensures efficient data management and operational effectiveness. Adopting modern KYC is essential for financial institutions to stay competitive and compliant in today's digital age.

Automated Verification Processes

Modern KYC platforms leverage advanced technologies like AI and machine learning to automate customer verification. This automation dramatically reduces the time and effort required for customer onboarding, eliminating the inefficiencies and errors associated with manual processes. With AI, institutions can quickly scan and verify documents, cross-reference data, and perform biometric checks. This reduces onboarding times from days to minutes. Customers experience faster service, leading to higher satisfaction rates, while institutions benefit from streamlined operations, reduced costs, and the ability to handle larger volumes of customers efficiently.

Enhanced Fraud Detection

Modern KYC systems employ sophisticated algorithms to analyze vast datasets and identify suspicious patterns that might indicate fraud. Unlike traditional methods, these systems can continuously monitor transactions in real time, updating risk profiles as new data emerges. Advanced machine learning models detect anomalies and potential threats with greater accuracy, significantly reducing the risk of money laundering, identity theft, and other financial crimes. The system's ability to learn and adapt ensures it stays ahead of evolving fraudulent tactics, providing a higher level of security and compliance.

Seamless Integration with Digital Financial Platforms

Modern KYC solutions are designed to integrate seamlessly with various digital financial platforms, including telecom digital financial platforms and agency banking solutions. This integration enables a unified and efficient verification process, ensuring that customer data is consistently verified and updated across all services. Customers benefit from a cohesive experience, as their verification details are accessible and usable across multiple platforms, reducing the need for repeated checks and enhancing the convenience and speed of transactions.

Agility in Meeting Regulatory Compliance

Modern KYC systems are built to be highly adaptable, allowing financial institutions to quickly update their processes in response to evolving regulatory requirements. This agility ensures continuous compliance with KYC and AML norms, minimizing the risk of penalties and reputational damage. Automated compliance features help institutions stay ahead of regulatory changes by automatically adjusting verification processes and maintaining up-to-date records. This reduces the need for extensive manual updates and audits, ensuring that institutions remain compliant without significant operational disruptions.

Compatibility with Convergent Billing Platforms

Modern KYC solutions are compatible with convergent billing solutions, which unify billing processes across various services. This compatibility ensures efficient data consolidation and management, enhancing operational efficiency and regulatory compliance. Financial institutions can better track and manage customer data, ensuring comprehensive records and streamlined processes. Integration with convergent billing platforms allows for seamless customer verification and billing across multiple services, reducing administrative overhead and improving the accuracy of billing information.

Global Industries Redefining Identity Verification: eKYC and Mobile KYC

Both eKYC and Mobile KYC solutions offer innovative approaches to identity verification, catering to the evolving needs of businesses and customers alike. By harnessing the power of technology and addressing associated challenges, organizations can unlock new levels of efficiency, security, and accessibility in the verification process.

Unlocking Efficiency and Security: The Power of eKYC

Brief Overview of eKYC

Electronic Know Your Customer (eKYC) revolutionizes identity verification by digitizing the process, eliminating the need for physical documents or in-person visits. Leveraging cutting-edge technologies like biometrics and AI, eKYC streamlines onboarding, enhances security, and ensures compliance with regulatory requirements.

Process

Digital Data Collection: Users provide personal information through online channels.

Biometric Verification: Biometric data such as fingerprints or facial recognition is captured for identity authentication.

Document Authentication: Digital documents like passports or driver's licenses are scanned and authenticated electronically.

Automated Checks: Automated checks verify the accuracy of provided information and ensure compliance with regulatory standards.

Benefits

Efficiency: Streamlines the onboarding process, reducing time and effort for both customers and businesses.

Security: Enhances security with advanced biometric authentication and encryption methods.

Accuracy: Minimizes errors associated with manual data entry and document processing.

Compliance: Helps organizations meet regulatory requirements and mitigate risk.

Challenges

Privacy Concerns: Balancing data security with user privacy remains a challenge.

Technological Limitations: Integration with existing systems and compatibility issues may arise.

Regulatory Compliance: Adapting to evolving regulations and ensuring compliance can be complex.

Solutions

Advanced Encryption: Implement robust encryption protocols to protect sensitive data.

Continuous Monitoring: Utilize AI-driven fraud detection systems to identify and prevent fraudulent activities.

Regulatory Compliance Tools: Invest in compliance management software to ensure adherence to regulatory standards.

Enhancing Accessibility and Convenience: Mobile KYC Solutions

Brief Overview of Mobile KYC

Mobile KYC solutions empower organizations to verify identities remotely using mobile devices. By leveraging smartphone capabilities such as cameras and biometric sensors, Mobile KYC offers a convenient and accessible way to onboard customers, enhance security, and improve user experience.

Process

Mobile App Interaction: Users interact with a mobile application to provide personal information.

Biometric Authentication: Biometric data like fingerprints or facial features is captured for identity verification.

Document Capture: Users can scan and upload digital documents directly from their smartphones.

Real Time Verification: Verification processes are conducted in real time, enabling instant decision-making.

Benefits

Convenience: Enables remote verification, allowing users to onboard from anywhere, at any time.

Accessibility: Expands access to services for individuals without access to traditional verification methods.

Speed: Accelerates onboarding processes with real-time verification and instant decision-making.

User Experience: Enhances customer experience with intuitive and user-friendly mobile interfaces.

Challenges

Device Compatibility: Ensuring compatibility with various mobile devices and operating systems can be challenging.

Network Connectivity: The reliability of network connections can impact the speed and efficiency of verification processes.

Data Security: Safeguarding sensitive information on mobile devices requires robust security measures.

Solutions

Cross-Platform Development: Develop applications that are compatible with a wide range of devices and operating systems.

Offline Capabilities: Implement offline functionality to enable verification processes in areas with limited connectivity.

Data Encryption: Utilize encryption techniques to secure data stored and transmitted on mobile devices.

Unveiling Modern KYC Trends: Enhancing Efficiency and Security

With advancements in digital financial solutions, the industry is constantly evolving, presenting both challenges and opportunities. Forward-thinking banks that anticipate KYC changes and take proactive steps can position themselves for success. Here are four pivotal trends reshaping KYC efforts:

1. Embracing ESG in Compliance

The scope of KYC due diligence now extends to encompass environmental, social, and corporate governance (ESG) factors. Regulatory bodies like the FATF are increasingly scrutinizing ESG violations, reflecting the need to address issues such as illegal mining and human trafficking. Integrating ESG factors into KYC practices is essential for maintaining reputation and compliance.

Incorporate ESG considerations into KYC due diligence.

Adapt existing workflows to include ESG parameters.

Leverage data-driven processes to enhance reporting.

2. Harnessing AI and Machine Learning

Advancements in AI and machine learning offer banks powerful tools to bolster AML efforts. These technologies can analyze vast datasets swiftly, improving fraud detection and reducing false positives. However, effective implementation requires robust training, monitoring, and governance mechanisms.

Train AI models on high-quality data.

Establish procedures for monitoring AI performance.

Mitigate risks associated with AI biases and errors.

3. Turning KYC into a Profit Center

Transforming KYC from a cost center into a profit center is a strategic imperative for financial institutions. By enhancing customer lifecycle management, banks can streamline onboarding processes, reduce costs, and unlock revenue opportunities through targeted marketing and personalized offerings.

Offer superior KYC experiences to attract and retain customers.

Streamline processes to minimize costs and improve efficiency.

Leverage automated CLM to identify upsell and cross-sell opportunities.

4. Adopting a Holistic Approach to KYC

A holistic view of the customer enables banks to better assess risk, detect fraud, and capitalize on growth opportunities. Leveraging data fabric technology, organizations can orchestrate end-to-end KYC workflows seamlessly, ensuring compliance while maintaining agility in response to evolving regulatory landscapes.

Implement data fabric technology to streamline KYC workflows.

Ensure organizational agility to adapt to new regulations and risks.

Embrace a unified approach to KYC to enhance speed, security, and agility.

By embracing these trends, financial institutions can navigate the complexities of KYC compliance effectively, driving operational efficiency, and delivering superior customer experiences in the digital age.

Embracing the Future: Revolutionizing Compliance and Customer Experience with Modern KYC Capabilities

The significance of robust Know Your Customer (KYC) practices cannot be overstated. As financial institutions and telecom digital financial platforms strive to meet stringent regulatory requirements and foster customer trust, modern KYC capabilities have emerged as a game-changer. Traditional KYC processes, often cumbersome and inefficient, are undergoing a paradigm shift with the integration of digital financial solutions.

The advent of modern KYC capabilities, integrated with Aureus, Digital Financial Suite, is revolutionizing compliance and customer experience. By harnessing advanced technologies such as AI, machine learning, and blockchain, financial institutions can achieve greater accuracy, efficiency, and security in customer verification. These innovations streamline the onboarding process, reduce fraud, and elevate the overall customer experience.

Furthermore, modern KYC solutions are pivotal within the broader context of digital financial platforms, including agency banking solutions and convergent billing platforms. These integrated systems ensure a holistic approach to managing customer data, driving operational efficiency, and maintaining compliance. The transformation brought about by modern KYC represents a significant leap forward, positioning financial institutions to better serve their clients while adhering to evolving regulations.

The importance of KYC compliance remains paramount in the digital financial industry. Modern KYC capabilities not only enhance security and efficiency but also empower financial institutions to thrive in an increasingly digital world. By embracing these trends and leveraging innovative solutions, institutions can achieve operational excellence while delivering unparalleled value to their customers. 6D Technologies offers the best telecom digital financial platform that provides modern KYC capabilities. To learn more about this platform, please visit https://www.6dtechnologies.com/products-solutions/digital-financial-suite/

0 notes

Text

Step into Financial Freedom with DLC Coin Bot

Are you looking for an opportunity to improve your income and invest your time wisely?With DLC Coin Bot, you can begin your journey in the world of cryptocurrencies with ease and safety. This bot is designed to be your personal guide to earning profits in an innovative and efficient way.No prior experience is needed—just the determination to succeed. Start now and join a growing community of individuals achieving their financial goals with the help of this smart tool.Take the first step today and make your future brighter

Click on the link and check for yourself https://t.me/DLCcoin_Bot/app?startapp=i_1214717039

#Crypto Community#Digital Wealth#DLC Coin Bot#Innovative Profits#Smart Investment Tool#Cryptocurrency World#Financial Freedom#Future Finance#Financial Goals#Easy Registration#Secure Investments#No Experience Needed#Earning Potential#Wealth Management#Crypto Revolution#Investment Opportunities#Automated Profits#Financial Independence#Online Earnings#Digital Assets#Blockchain Solutions#Cryptocurrency Trading#Secure Crypto Transactions#Digital Finance Platform#Future Investments#Crypto Savings#Crypto Tools#Growth Opportunities#Innovative Technology

3 notes

·

View notes

Video

youtube

🌈 Ready to Start Earning with GotBackUp? Here’s Your Guide! 💰

Imagine combining data security with financial freedom. GotBackUp isn’t just another backup service—it’s a whole new way to secure your data and earn an income by sharing it with others. 📂✨

What’s GotBackUp All About?

💼 Earn Residual Income by referring people to secure their files and memories.

🌍 Work from Anywhere—GotBackUp is perfect for remote workers, network marketers, and anyone looking for extra income.

🔒 Peace of Mind knowing that your data is safe and accessible whenever you need it.

How to Get Started:

Share GotBackUp with your network.

Help people see the value of protecting their digital lives.

Watch your income grow with every referral!

Curious? Reach out to me for more details, or click the link to explore how GotBackUp can start working for YOU today!

👉 https://bit.ly/3XNMpzO

Let’s make 2024 your year of financial growth and digital peace of mind! 🌟

#GotBackUp #PassiveIncome #DataSecurity #NetworkMarketing #RemoteWorkLife #EarnWithGotBackUp #FinancialFreedom #SideHustle #DigitalProtection #BackupSolutions

(via 🔥 Ready to Start Earning with GotBackUp? Here’s How! 💰)

#gotbackup#passive income#data security#network marketing#remote work life#earn with gotbackup#financial freedom#side hustle#digital protection#backup solution

3 notes

·

View notes

Text

BitNest

BitNest: The Leader of the Digital Finance Revolution

BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive cryptocurrency services, including saving, lending, payment, investment and many other functions, creating a rich financial experience for users.

Our story began in 2022 with the birth of the BitNest team, which has since opened a whole new chapter in digital finance. Through relentless effort and innovation, the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.

The core functions of BitNest ecosystem include:

Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed to providing users with a safe and efficient savings solution to help you achieve your financial goals. Lending Platform: BitNest lending platform provides users with convenient borrowing services, users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliable, providing users with flexible financial support. Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creating a borderless payment network that allows users to make cross-border payments and remittances anytime, anywhere. Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in various digital assets and gain lucrative returns. Our investment platform is safe and transparent, providing users with high-quality investment channels. Through continuous innovation and efforts, BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting the development of digital finance, providing users with more secure and efficient financial services, and jointly creating a better future for digital finance.

#BitNest: The Leader of the Digital Finance Revolution#BitNest is a leading platform dedicated to driving digital financial innovation and ecological development. We provide comprehensive crypto#including saving#lending#payment#investment and many other functions#creating a rich financial experience for users.#Our story began in 2022 with the birth of the BitNest team#which has since opened a whole new chapter in digital finance. Through relentless effort and innovation#the BitNest ecosystem has grown rapidly to become one of the leaders in digital finance.#The core functions of BitNest ecosystem include:#Savings Service: Users can deposit funds into BitNest's savings system through smart contracts to obtain stable returns. We are committed t#Lending Platform: BitNest lending platform provides users with convenient borrowing services#users can use cryptocurrencies as collateral to obtain loans for stablecoins or other digital assets. Our lending system is safe and reliab#providing users with flexible financial support.#Payment Solution: BitNest payment platform supports users to make secure and fast payment transactions worldwide. We are committed to creat#anywhere.#Investment Opportunities: BitNest provides diversified investment opportunities that allow users to participate in trading and investing in#providing users with high-quality investment channels.#Through continuous innovation and efforts#BitNest has become a leader in digital finance and is widely recognised and trusted globally. We will continue to be committed to promoting#providing users with more secure and efficient financial services#and jointly creating a better future for digital finance.#BitNest#BitNestCryptographically

3 notes

·

View notes

Text

#eCheck#Electronic checks#ACH (Automated Clearing House)#Digital payments#Payment processing#Merchant services#Payment solutions#Secure transactions#Business payments#Online payments#Payment gateway#Payment technology#Financial services#E-commerce#Retail business#Small business#USA businesses#American merchants#Payment methods#Payment processing company#Payment processing solutions#Electronic payment options#Payment security#Card processing#Payment terminals#Mobile payments#Payment software#Point of sale (POS)#Payment integration#Business growth

6 notes

·

View notes

Text

Fintech built smarter. 🤓💻

SDH integrates cutting-edge technologies with your vision. Digital banking, blockchain, personal finance apps—done right. Explore:

#financial software development#custom app solutions#fintech#SDH#digital banking#blockchain#personal finance apps

0 notes

Text

Decentralized Finance (DeFi): Reshaping Financial Systems

Decentralized Finance (DeFi) is at the forefront of fintech innovation in 2025, significantly reshaping how individuals and businesses access financial services. Built on blockchain technology, DeFi eliminates the need for traditional intermediaries like banks, allowing users to conduct transactions directly through smart contracts self-executing code on the blockchain.

DeFi platforms offer financial services such as lending, borrowing, trading, and saving to anyone with an internet connection. This is particularly transformative for underbanked populations in emerging economies, where traditional banking infrastructure is often limited.

All transactions on DeFi platforms are recorded on public ledgers, ensuring full transparency. The use of decentralized networks reduces the risk of single points of failure, enhancing security and resilience.

#fintech financial services#bank of canada digital currencies and fintech#cybersecurity fintech#fintech payment services#fintech payment solutions

0 notes

Text

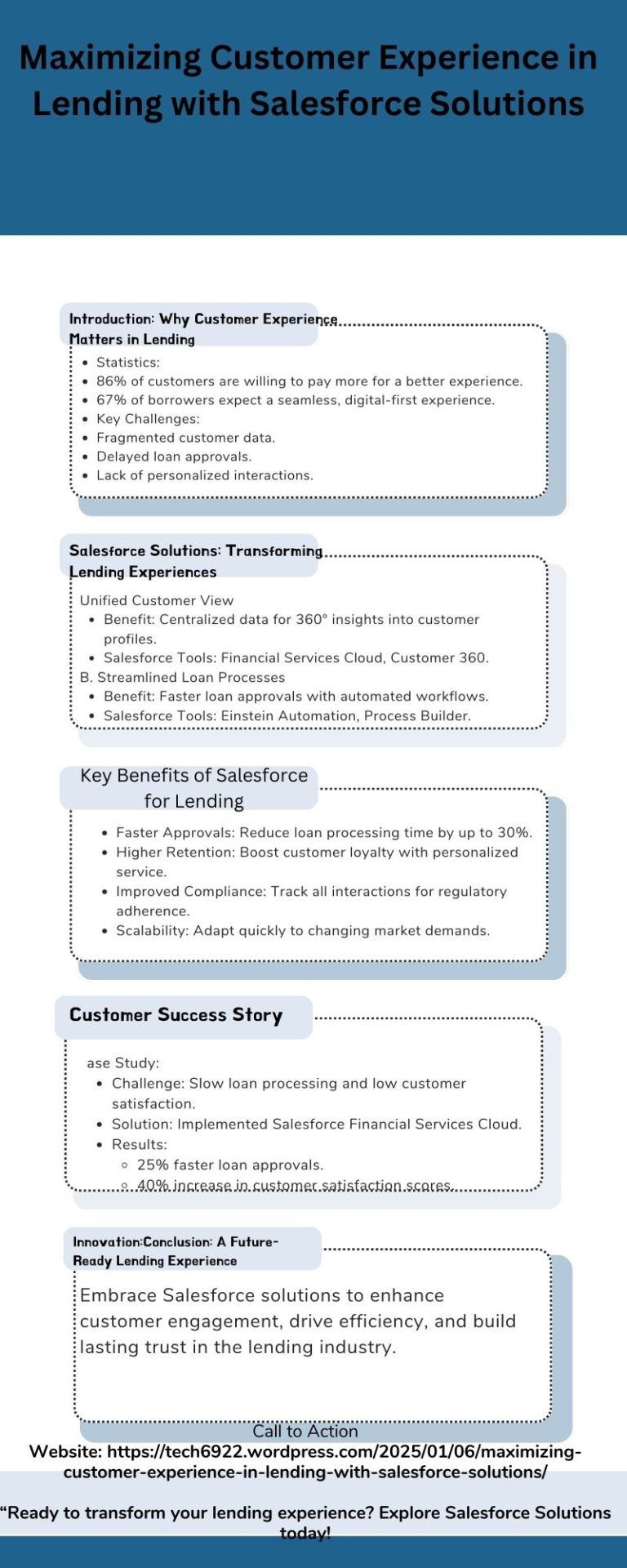

Discover how Salesforce solutions can transform the lending process by streamlining workflows, enabling personalized interactions, and enhancing customer engagement. Learn how tools like Financial Services Cloud and Einstein Automation deliver faster loan approvals, improved compliance, and a seamless lending experience. Boost customer satisfaction and retention toda

#Customer experience in lending#Salesforce solutions for lending#Salesforce Financial Services Cloud#Loan approval automation#Personalized lending solutions#Streamlined loan processes#Customer engagement in lending#Salesforce for financial services#Salesforce tools for lending#Lending customer experience#Omnichannel communication in lending#Improved customer satisfaction in lending#Salesforce automation in lending#Enhancing loan approval speed#Salesforce for loan officers#Financial services customer experience#Digital lending solutions.

0 notes

Text

The Role of Agency Banking in Balancing the Financial Divide

Economic empowerment hinges upon access to financial services. Certainly, it is a crucial driver for poverty reduction and global economic development. Yet, significant portions of the global population remain unbanked. In recent years, agency banking solutions have emerged as transformative tools, bridging the gap between traditional banking services and underserved communities.

The Rise of Agency Banking

Agency banking involves the provision of financial services by non-bank entities through existing retail outlets or mobile networks. It has emerged as a beacon of hope for the unbanked. Authorized agents operate within local communities using digital financial solutionslike an agency banking platform. It offers essential services such as deposits, withdrawals, money transfers, and bill payments. This model empowers individuals in remote and underserved areas by bringing banking services to their doorstep.

Agency Banking Solutions: The Positive Impact on the Unbanked Population

Increased Access to Financial Services

Agency banking solutions have dramatically expanded financial access for the unbanked, leveraging existing retail networks to reach rural and remote areas lacking traditional bank branches. This accessibility enables individuals, who were previously excluded from formal financial services, to securely save money, access credit, and conduct transactions conveniently.

By bringing banking services closer to their communities, digital financial solutions like an agency banking systembreak down geographical barriers and empower individuals to participate more actively in economic activities. Moreover, the ease of access to financial services encourages savings and fosters a culture of financial inclusion, where individuals can better plan for their future and mitigate financial risks.

Enhanced Financial Literacy

In addition to expanding access to financial services, agency banking solutions act as a catalyst for financial inclusion by incorporating comprehensive financial education programs. These initiatives go beyond merely providing banking services. They empower individuals with essential information and skills to make informed financial decisions.

Financial literacy programs cover topics such as budgeting, savings, responsible borrowing, and understanding financial products. By equipping individuals with the necessary knowledge and skills, agency banking promotes financial independence and resilience, enabling them to navigate the complexities of the financial system with confidence. Moreover, increased financial literacy fosters a sense of empowerment and self-reliance, laying the foundation for long-term financial well-being and economic stability within communities.

Boost to Local Economies

The availability of banking services through digital financial solutions like an agency banking system not only benefits individuals but also stimulates local economies. By facilitating small scale businesses, efficient payment mechanisms, and entrepreneurship, an agency banking platform contributes to economic growth and development at the grassroots level.

Small businesses, previously underserved by traditional banking channels, now have access to digital financial services that enable them to manage cash flow, access credit for expansion, and conduct transactions seamlessly. This economic boost leads to job creation, increased productivity, and poverty alleviation within communities. Moreover, by promoting financial inclusion and supporting local businesses, the agency banking platform fosters a thriving economic ecosystem that benefits everyone.

Empowerment of Women and Vulnerable Communities:

One of the most significant impacts of agency banking is its role in empowering women and marginalized communities. Traditionally, women and vulnerable groups faced barriers to accessing formal banking channels, such as lack of documentation, cultural norms, and limited mobility. However, agency banking overcomes these barriers by bringing financial services directly to their communities. Increased financial inclusion using agency banking solutions enables women to take control of their finances, start businesses, and improve their socio-economic status.

By providing access to savings accounts, credit facilities, and other financial products, agency banking empowers women to participate more actively in economic activities and decision-making processes. Moreover, financial independence enhances women's autonomy, self-esteem, and overall well-being, contributing to gender equality and social inclusion. Similarly, vulnerable communities, including rural populations and minorities, benefit from the agency banking system by gaining access to essential financial services that improve their livelihoods and quality of life. Overall, agency banking plays a pivotal role in promoting economic empowerment and social upliftment, particularly among marginalized groups.

Future Scenario of Agency Banking

The future of agency banking using one of the best digital financial solutionsappears promising, with several trends indicating continued growth and impact:

Technological Advancements: Smartphone proliferation and digital payment platforms will deepen financial inclusion by enabling agents to offer a broader range of services.

Collaboration and Partnerships: Stakeholders will collaborate to refine regulatory frameworks and accelerate adoption through partnerships with fintech companies and international organizations.

Data-Driven Approach: Customer data analysis will drive personalized financial products and services, enhancing customer experience and promoting loyalty.

Expansion in Rural Areas: Efforts will focus on reaching underserved rural areas through agent network expansion and digital technologies.

Best Practices to Maximize Reach

Implementing effective strategies and best practices using the best agency banking platform is essential for maximizing the reach of agency banking:

Establish a Robust Agent Network

Agent Selection and Training

Simplify Account Opening Processes

Leverage Mobile Technology

Offer Comprehensive Services

Conduct Financial Education Programs

Collaborate with Local Stakeholders

Focus on Security and Trust

Tailor Solutions to Local Needs

Regular Monitoring and Evaluation

Conclusion

Agency banking has revolutionized financial inclusion, offering access to banking services for the unbanked. Its positive impact includes increased financial access, enhanced financial literacy, empowerment of women, and a boost to local economies. Aureus, a Digital financial solution has a powerful agency banking platformthat redefines the future of agency banking and financial inclusion.

With ongoing technological advancements, collaboration among stakeholders, and a data-driven approach, the future of agency banking looks promising. Moreover, it paves the way for greater financial inclusion and economic empowerment for the unbanked.

To learn more about the agency banking solution of 6D Technologies and how it can benefit you, please visit https://www.6dtechnologies.com/fintech/agency-banking-solution/

0 notes

Text

What are you waiting for more than an application that has been written for you to benefit from, I mean to earn encrypted codes without paying money. You are still living in ignorance!

Start today without any delay.

There are many explanations on YouTube.

https://minepi.com/MISSIONGD

and use my username (MISSIONGD) as your invitation code 👋🏻

#Earnencrypted codes#Earn free codes#The digital future#Youth of today#Earn Pi#Cryptocurrency#Financial solutions#Good morning#bahrain#Minepi#Pi coin#Pi

14 notes

·

View notes

Text

ICICI Bank शेतकऱ्यांसाठी: आर्थिक उन्नतीसाठी उपयुक्त योजना आणि सेवा

शेतकऱ्यांसाठी आर्थिक विकास साधण्याच्या उद्देशाने ICICI Bank ने विविध उपयुक्त योजना आणल्या आहेत. या योजनांमुळे शेतकऱ्यांना आर्थिक सहाय्य मिळते आणि त्यांच्या शेती व्यवसायात सुधारणा होते. या लेखात ICICI बँकेच्या योजनांची माहिती देऊन, त्याचा उपयोग ग्रामीण भागातील शेतकऱ्यांसाठी कसा होतो हे समजून घेऊ.

#ICICI Bank#naruto#news#marathi#good omens#breaking news#agriculture#Banking Solutions#Financial Services#Personal Banking#Corporate Banking#ICICI Credit Card#Digital Banking#Wealth Management#ICICI Loans#Savings Account#Current Account#Banking App#ICICI Net Banking#Investment Plans#Home Loans#Education Loans#Business Banking#ICICI Bank Offers#Banking MadeEasy#Premier Banking#ICICI Bank India

0 notes

Text

🎉 Celebrate the Festive Season with Exclusive Discounts on Digital Marketing Services! 🎉

✨ This festive season, take your business to new heights with Growmore Business Pty Ltd! ✨ 💡 Enjoy up to 30% OFF on all our premium Digital Marketing services:

🚀 Google Ads & Meta Ads to drive traffic and boost conversions. 📧 Email Marketing campaigns tailored to engage your audience. 📱 Social Media Management to enhance your brand visibility. 🖌️ Content & Graphic Design for a creative edge. 🌐 Website Design on WordPress that captivates and converts. 📅 Offer valid until [insert end date]! 🌟 Don't miss this chance to grow your business while saving big!

👉 Click now to claim your festive discount: https://growmorebiz.com.au/christmas-offers/

#DigitalMarketingDiscount #FestivalOffers #GrowYourBusiness #GoogleAds #SocialMediaMarketing #ContentDesign #GrowmoreBiz #SEO #MarketingDeals #BusinessGrowth #FestiveDeals

Let us help you shine brighter this festival season! 🌟

#digital marketing#accountingexperts#bookkeeping#accountingservices#content marketing#financial analysis#accounting#seo#website development solutions#web development#telemarketingservices#telemarketing#seoforbusiness#seo optimization#graphic design#wix

0 notes

Text

The Green Manufacturing Revolution: Finance as an Enabler for Sustainable Industry

Discover sustainable manufacturing with Siemens Financial Services! Madlen Junker shares insights on innovative financing, digital twins, and green energy solutions. Learn how to reduce carbon footprint and gain competitive edge. #SIEX #Sustainability

The industrial sector stands at a critical juncture, contributing to one-quarter of all energy-related CO2 emissions. However, innovative financing solutions are emerging as key enablers for sustainable manufacturing transformation, as revealed in this interview with Madlen Junker, Financing Solution Partner for Digital Industries at Siemens Financial Services. Strategic Imperatives for…

#Carbon Footprint#competitive advantage#decarbonization#digital industries#Energy efficiency#financing solutions#green technologies#Siemens#Siemens Financial Services#sustainable manufacturing#talent attraction

0 notes

Video

youtube

🌟 Protect Your Data & Earn Income with GotBackUp! 💼💰

Looking for a way to safeguard your digital files while creating a steady income? GotBackUp offers secure cloud storage and a powerful income opportunity!

Why GotBackUp? ✔ Protect your important files ✔ Build residual income with referrals ✔ Flexible, work-from-anywhere opportunity

💡 Perfect for network marketers, remote workers, and entrepreneurs!

🚀 Click below to start your journey today: 👉 bit.ly/3XNMpzO

#GotBackUp #PassiveIncome #DataSecurity #NetworkMarketing #WorkFromAnywhere #FinancialFreedom #ResidualIncome #BackupSolutions #DigitalProtection #EarnOnline

(via 🌟 Ready to Start Earning with GotBackUp? Here’s How! 💰)

#gotbackup#passive income#data security#network marketing#work from anywhere#financial freedom#residual income#backup solutions#digital protection#earn online

1 note

·

View note

Text

Financial Digital Solutions

Financial Digital Solutions

Join us at the annual Digital Marketing for Financial Services NY Summit. Gain actionable insights from leading marketers from award-winning FS companies.

0 notes