#debt buyers

Explore tagged Tumblr posts

Text

The Morning After Series: Chapter 2

Why I'm Mad at Debt Buyers

The second installment of The Morning After Series focuses on the topic of an older episode of John Oliver's Last Week Tonight: Debt Buyers!

Now, not everyone may know what debt buying is, but reading this article is certain to show you why you should be just as mad as me, and give you the solution.

An excerpt:

"I know and love people who require a great deal of healthcare to survive. I have racked up a fair amount of bills in my short lifetime. The idea of medical debt is not new to me and has always been a threat. Debt buyers — strangers who essentially buy the suffering of others and then extort them for profit — made me so mad I didn’t know what to do with myself."

#debt#debt buyers#debt relief#debt forgiveness#john oliver#last week tonight#non profit organization#literally been wanting to rant about this for years in a public space lmao#article has some cool resources#the morning after series

19 notes

·

View notes

Text

sorry but i need to share the thought of Bailey being the closest thing the LIs (except. Robin i guess) have to/can consider as a father/mother-in-law when in a relationship with the PC is fucking hysterical to me 💀 knowing them they will just disapprove all of them regardless of who they are

#degrees of lewdity#bailey the caretaker#bailey: your weekly debt has been increased. now it is $4000 for you and robin; and $4000 for making me deal with your horrible taste.#(tbf bailey for sure thinks i have horrible taste in my current save. i've brought both kylar and whitney to the orphanage now.#and whitney calling him my 'daddy' was what inspired this post. ah yes; bailey; whitney and kylar's father-in-law......)#bunny talks#(though i've heard that bailey and eden seem to have more lore than just eden being my buyer if i fail to pay him. have yet to discover it)#(if it wasn't seen in game and it was a question vrelnir answered pls pls tell me through my inbox. or just tell me anyway i'm curious)

25 notes

·

View notes

Text

my dad pulled some shit of such extreme magnitudes on me earlier today, lmao. my hands were shaking for an hour after we ended the phone call. some of you may know or remember (if you follow me on twitter) that last september he basically handed me an ultimatum on a $7,500 loan he gave me in cash in 2018 so I could buy a car. I had to start paying him in monthly installments or we were going to have some Problems.

the main issue I had with all that at the time is that he basically said a bunch of shit that implied, quite candidly, that his help and support is fully conditional and I can’t expect to get anything without having to pay him back. he had a whole spiel about how he wasn’t going to “contribute to the cycle of losers in society who expect everything for free” and from that logic you can deduce that I was being called a loser by proxy. great times.

today he calls me up out of the blue and says he’ll shave $3,000 off the remaining $6,000 of “my debt” *if* I run a zillow page for his house and screen calls from potential buyers. BUT THE ONLY WAY I’LL GET ANY COMPENSATION FOR MY TIME, is if one of my buyer referrals purchases his house. otherwise I get nothing. he’s only willing to truncate the debt if one of the people I screen and refer to him buys his fucking house. otherwise there is no payment or debt relief.

I feel fucking insane? like I could spiderman climb the walls like a fucking demon and chew through the beams with my bare teeth? does he not realize that he’s using me as a plaything for his own benefit and amusement at this point?

his house would sell for upwards of $480,000 (or more) and yet he’s keeping me on the hook like this over $6,000 he doesn’t need. I can’t wrap my head around this. I can’t comprehend what the message is, here, other than the fact that I really don’t matter as his daughter more than his six grand. insane. fucking mental.

#he is the michael jordan of being a son of a bitch#he just keeps setting the bar higher and higher#I really don't know how to process this#I don't know if I should tell him to fuck off and pay the six grand out of sheer spite#or take calls for two weeks until the house sells and get him off my fucking back a year earlier than planned#the stipulation about me not getting any debt relief unless I refer the buyer who gets the house is.......idek man#like are we in a saw movie? lmfao? is this saw?????????

9 notes

·

View notes

Text

3 notes

·

View notes

Text

Self-Employed Mortgage In Abbotsford: A Guide to Homeownership

For many self-employed mortgages in Abbotsford, securing a mortgage can feel like an uphill battle. Unlike traditional employees who receive a steady paycheck, self-employed borrowers must provide additional documentation to prove their income stability. However, with the right approach and guidance from a knowledgeable mortgage broker, homeownership is well within reach.

#first home buyers#local mortgage brokers#first time home buyer loan#home financing#home purchases#home refinance#mortgage portability#mortgage prequalification#best debt consolidation#mortgage broker abbotsford

0 notes

Text

How Medical Debt Impacts Credit Scores and Mortgage Approval for Kentucky Homebuyers

How Medical Debt Impacts Credit Scores and Mortgage Approval for Kentucky Homebuyers

#First-time buyer#How Medical Debt Impacts Credit Scores and Mortgage Approval for Kentucky Homebuyers#louisville#Mortgage loan#Refinancing#USDA#Zero down home loans

0 notes

Text

In the past, people in the Animal Crossing community would make fun of Tom Nook as a sleazy landlord. Since then, he's really rehabilitated his image as this 'heart of gold' businessman (he's the one who puts bells and furniture in trees for you to find! he adopted orphans! he donates to charity!), but New Horizons genuinely paints the most devious version of him.

He's successfully privatized settler colonialism: you pay HIM to move to a "deserted island" (which apparently the oceans in the AC world are just full of) and start a colony that he is directly invested in. At best he's running a weird vacation package scam (you arrive on the island with no money and in debt for "using his services"). At worst, he's using you to set up company towns. For god's sake, he literally has his own fake currency that he forces you to use to pay off your debt. But don't worry, he's repackaged it in a way that definitely doesn't sound like an MLM scam: the Nook Mileage Program!

You're no longer just his tenant or his temporary part-timer, you're his business lackey. The entire tutorial section of the game has you spending actual weeks running around completing tasks and doing hard labor to set up his colony. You're even tasked with preparing his properties and finding buyers for them. No, you aren't a tenant anymore. You work for the landlord. You are directly responsible for finding tenants for him. And he doesn't even fucking pay you. Not for setting up town hall and museum, or his nephew's shop –– which is the ONLY store on the entire island that sells necessities –– or bringing KK Slider to town, or helping populate his town. Not a single cent. No, actually, you have to pay HIM to BUY infrastructure like bridges and stairs and park benches. And all the while, he's telling you're the "resident representative"; you get to call the shots! That the reward is the community's progress. That what you're doing is in everyone's best interest (but most importantly, his).

Since NH's release, people have done a lot of legwork to say that Tom Nook isn't a capitalist while the game shows him at his very worst. He owns the only general store in town. You're forced to use a phone that he modified and branded as his own. Buy Nook-branded furniture and merchandise at the self-serve kiosk in the town hall, a governmental building! There's no conflict of interest here!

But hey, if you're tired of being the landlord/business mogul's goon, you can also find work as a deluxe resort home designer for a company that also pays you in their special company currency that can only be used to buy their products instead of a real salary! Because that's what the Animal Crossing franchise needs! More vacation homes!!!

#this is a really long winded way to say i really really really really hate new horizon's storyline and player role#i really hate that not only your house but the entire TOWN. the whole COMMUNITY you're a part of is owed to tom nook's business#i really hate the “vacation getaway package” angle because it shows just how commercialized the entire premise of nh is#and how lost the game is in its original core concept#animal crossing is about the experience of moving to a new town and becoming a part of that community#just to compare: all past ac games have a similar opening#you're on a bus or train or taxi to someplace new. a stranger strikes up a conversation and you get to know them before arriving#new horizons opens with you at customer service desk filling out an client application before a flight.#in prev games working for nook in the tutorial is meant to be demeaning. you want it to be over with so you can actually start living life#but in new horizons working for tom nook IS your life. and it's so rewarding! don't you feel rewarded?#you aren't a person. you aren't a new neighbor. you're tom nook's client. and then his unpaid employee. and the game insists it's fun to be#that's how void the game is#because it's bad enough that a rpg life sim got turned into a sandbox game where you have to build the town yourself#but the only reason why you're building it is because the landlord who you're in debt to TOLD you to build it.#everything is a rewards program! everything is a tour service! be sure to do your daily tasks to earn nook bucks to spend on nook merch!#that really sucks imo.#i mean. the entire game is based around the vacationing industry. of course it all feels fake and temporary. it's only a vacation.#long post#rant#not art#god the fact that your starter villagers can't even decide where to live you have to decide for them#i've never played a game that does the opposite of handholding#where instead it's the PLAYER who has to handhold the npcs through everything. and newsflash!! it's really exhausting and boring

3K notes

·

View notes

Text

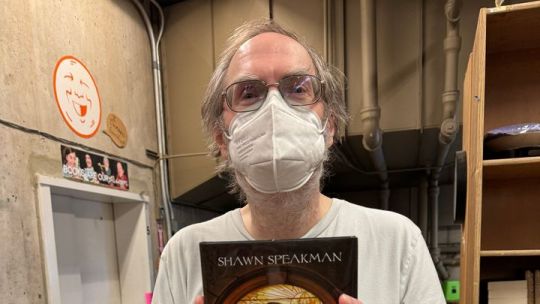

Legendary U Washington bookseller Duane Wilkins is drowning in medical debt

Nearly every sf writer who's ever toured the west coast knows Duane - he's the encyclopedically knowledgeable sf buyer for the U Washington Bookseller, who has organized some of the best sf signings in Seattle history. He's a force of nature.

He's also broke. A two-week hospital stay left him drowning in medical debt - despite being insured! - and now he's being threatened by a collection agency.

Now, Duane is forced into participating in one of the most barbaric of contemporary American rituals, fundraising to cover his medical debt. He's raised $6k of the $10k he needs (I just pitched in $100).

If you can afford to help out someone who's done so much for our community, please kick Duane whatever you can spare.

6K notes

·

View notes

Text

Former Lawyer And Bank Director Faces 125 Years In Prison

Former Lawyer And Bank Director Mendel Zilberberg Faces 125 Years In Prison For $1.5 Million Straw Deal Scam Mendel Zilberberg A former lawyer who ran a Manhattan bank faces 125 years in federal prison. A federal jury convicted Mendel Zilberberg for engaging a straw buyer for a $1.5 million fraudulent loan scam. The scam led to the collapse of Park Avenue Bank. The jurors convicted…

View On WordPress

#bank fraud#banking#banks#debt#foreclosures#lending fraud#liens#Mendel Zilberberg#mendel zilberberg guilty#mortgage fraud#mortgages#New York lawyers#real estate#straw buyer fraud#Straw buyers#straw deal scam#straw deal schemes#straw deals

0 notes

Text

Why Choose a Mortgage Broker in Abbotsford

Looking to buy a home in Abbotsford? A mortgage broker in abbotsford can simplify the process by offering expert guidance, access to competitive rates, and personalized solutions tailored to your financial situation. With their deep understanding of Abbotsford’s market and connections to various lenders, they save you time, money, and the stress of navigating the mortgage maze alone. Whether you're a first-time buyer or self-employed, a trusted local broker ensures your journey to homeownership is smooth and successful. Reach out today!

#home financing#home purchases#mortgage prequalification#first time home buyer loan#mortgage portability#local mortgage brokers#home refinance#first home buyers#mortgage broker abbotsford#best debt consolidation

0 notes

Text

DTI) ratio requirements for different types of mortgage loans in Kentucky, including FHA, VA, USDA, Fannie Mae, and Kentucky Housing loans

Debt-to-Income (DTI) ratio requirements for Kentucky FHA, VA, USDA, and conventional mortgage loans

#Debt ratio#debt ratios#debt to income ratios#dependable income#Kentucky#ky first time home buyer#Rural development#USDA Rural Development#zero down kentucky home loan

0 notes

Text

The Swansea Mortgage Broker - Life Insurance for Mortgage in Llanelli

Are you looking for Life Insurance for Mortgage in Llanelli? You've come to the right place if the response is yes. The Swansea Mortgage Broker is aware that life insurance protects the lender from high-risk loans going bad. If you die within the time period you choose when you purchase a life insurance policy, it will pay out. It doesn't pay out if you make it through the period. The length of the period could be determined, for instance, by how long it will take your children to become financially independent or by how long your mortgage will be paid off. Please explore our website today for more information. https://theswanseamortgagebroker.co.uk/Llanelli/

#Best Lenders for First Time Home Buyers in Llanelli#Remortgage for Debt Consolidation in Llanelli#Home Mortgage Lenders for Bad Credit Llanelli#Life Insurance for Mortgage Llanelli#Mortgage Payment Protection Insurance in Llanelli#Independent Mortgage Broker in Llanelli

0 notes

Text

Things Biden and the Democrats did, this week #13

April 5-12 2024

President Biden announced the cancellation of a student loan debt for a further 277,000 Americans. This brings the number of a Americans who had their debt canceled by the Biden administration through different means since the Supreme Court struck down Biden's first place in 2023 to 4.3 million and a total of $153 billion of debt canceled so far. Most of these borrowers were a part of the President's SAVE Plan, a debt repayment program with 8 million enrollees, over 4 million of whom don't have to make monthly repayments and are still on the path to debt forgiveness.

President Biden announced a plan that would cancel student loan debt for 4 million borrowers and bring debt relief to 30 million Americans The plan takes steps like making automatic debt forgiveness through the public service forgiveness so qualified borrowers who don't know to apply will have their debts forgiven. The plan will wipe out the interest on the debt of 23 million Americans. President Biden touted how the plan will help black and Latino borrowers the most who carry the heavily debt burdens. The plan is expected to go into effect this fall ahead of the election.

President Biden and Vice-President Harris announced the closing of the so-called gun show loophole. For years people selling guns outside of traditional stores, such as at gun shows and in the 21st century over the internet have not been required to preform a background check to see if buyers are legally allowed to own a fire arm. Now all sellers of guns, even over the internet, are required to be licensed and preform a background check. This is the largest single expansion of the background check system since its creation.

The EPA published the first ever regulations on PFAS, known as forever chemicals, in drinking water. The new rules would reduce PFAS exposure for 100 million people according to the EPA. The Biden Administration announced along side the EPA regulations it would make available $1 billion dollars for state and local water treatment to help test for and filter out PFAS in line with the new rule. This marks the first time since 1996 that the EPA has passed a drinking water rule for new contaminants.

The Department of Commerce announced a deal with microchip giant TSMC to bring billions in investment and manufacturing to Arizona. The US makes only about 10% of the world's microchips and none of the most advanced chips. Under the CHIPS and Science Act the Biden Administration hopes to expand America's high-tech manufacturing so that 20% of advanced chips are made in America. TSMC makes about 90% of the world's advanced chips. The deal which sees a $6.6 billion dollar grant from the US government in exchange for $65 billion worth of investment by TSMC in 3 high tech manufacturing facilities in Arizona, the first of which will open next year. This represents the single largest foreign investment in Arizona's history and will bring thousands of new jobs to the state and boost America's microchip manufacturing.

The EPA finalized rules strengthening clean air standards around chemical plants. The new rule will lower the risk of cancer in communities near chemical plants by 96% and eliminate 6,200 tons of toxic air pollution each year. The rules target two dangerous cancer causing chemicals, ethylene oxide and chloroprene, the rule will reduce emissions of these chemicals by 80%.

the Department of the Interior announced it had beaten the Biden Administration goals when it comes to new clean energy projects. The Department has now permitted more than 25 gigawatts of clean energy projects on public lands, surpass the Administrations goal for 2025 already. These solar, wind, and hydro projects will power 12 million American homes with totally green power. Currently 10 gigawatts of clean energy are currently being generated on public lands, powering more than 5 million homes across the West.

The Department of Transportation announced $830 million to support local communities in becoming more climate resilient. The money will go to 80 projects across 37 states, DC, and the US Virgin Islands The projects will help local Infrastructure better stand up to extreme weather causes by climate change.

The Senate confirmed Susan Bazis, Robert White, and Ann Marie McIff Allen to lifetime federal judgeships in Nebraska, Michigan, and Utah respectively. This brings the total number of judges appointed by President Biden to 193

#Thanks Biden#Joe Biden#student loans#student loan debt#debt forgiveness#gun control#forever chemicals#PFAS#climate change#green energy

3K notes

·

View notes

Text

Find The Best & Most Suitable Investment Property Loans Melbourne

Whether you want to invest in your first home or expand your portfolio, LS Finance Broking can help. Property investment mortgages can sometimes be trickier than traditional home loans. Still, with our knowledge and experience, we are here to help you navigate the process. Our team of mortgage brokers is ready to assist you with your investment property finance needs. We are a team of experienced mortgage brokers who specialize in investment property finance and have extensive knowledge of the industry. We aim to provide you with the best possible advice, whether you are purchasing your first investment property or looking to refinance an existing one. Contact us for more details about Investment Property Loans Melbourne.

#investment loans near me#investment property loans melbourne#debt consolidation melbourne#home loan health checks victoria#mobile brokers melbourne#first home buyer melbourne#first home buyers loan victoria#home loans victoria#machinery finance melbourne#mortgage lenders near me#refinancing victoria

0 notes

Text

Over the Limit

jenna ortega x female reader

part i | part ii | part iii | part iv | part v | part vi

summary: In a town divided between two rival street racing crews, you’re caught between your cousin’s crew, the Sinners and Jenna, a mysterious girl from the Vipers who’s more than just a pretty face. Both of you need something from each other, but as the stakes rise, you’re left wondering: what makes your heart race more— the thrill of the competition or the girl who’s impossible to ignore?

word count: 6.7k

A very special thank you to @ortegalvr for giving me the very much needed nudge to start moving my work to Tumblr. And to @cobaltperun for being so patient and thoroughly answering all my questions, essentially giving me (a Tumblr noob) a dummies guide to Tumblr. Appreciate you both!

————

Why is it that some of the best feel goods in life can just as easily kill you if you indulge in it too much?

Alcohol, drugs, illegal driving... love?

Fortunately for you, you only indulge in only one of those.

There's just something so satisfying about watching your car pick up speed; watching the little arm on the speed gauge reach it's full potential. If cars are able to reach those speeds then they should, it's a fact of the matter. And when you're surrounded by cars all your life and the only reason you have a livelihood is because of those three thousand pounds of steel, you're bound to make some fun out of it.

You push down on the accelerator with more pressure, reaching speeds of almost 180 km/hour when you see the flashing blue and red lights in the rear view mirror.

The feds.

"Took them longer than usual." you thought out loud.

Now there could be two reasons they're after you. The obvious, speeding. But then there's also the fact that you stole the beauty you're driving from the town's richest neighbourhood, Summer Valley.

Of course stealing it is not enough for you, so you made some tweaks here and there in the garage so this ride could be even more illegal than it already is, and now you're selling it to an off the grid buyer.

Escaping the police wasn't something new, it's become routinely. You'd be more concerned if the cops weren't on your tail during a delivery.

You make a sharp turn right into a short alleyway marking the start of this high speed chase.

Being the exceptional mechanic that you are, your work on this car has given it a larger than usual turn radius which allowed the turn to be much smoother, giving you a good head start.

"Why are these fuckers in the middle of road!" You yelled panickily, upon seeing the herd of people in front of you.

You don't know when people decided to ditch the sidewalks and walk in the middle of the road, but clearly, you missed the memo. You were forced to sound the horn a few times, and luckily the pedestrians were responsive and didn't cause you to lose your lead on the cop, but it may have alerted them—if you were lucky enough to lose them in the first place.

Once you finally got out of the alleyway, your phone started ringing, stealing your focus from the dark road in front of you to glance down at your phone for a millisecond.

Anton. Your cousin.

Anton Y/l/n. Your older cousin of three years. He was an impulsive firecracker that has the tendency to rope you into his shenanigans, not deliberately of course. Despite his flaws he'd do anything for family. You like to joke around and call him Dom Toretto, and those jokes have only gotten worse after he buzzed his head after an unfortunate grease spillage accident that was entirely his and your fault.

That five letter name is the most anxiety inducing noun known to man in your books and everytime you answer the older guy's call, you feel as if your gambling your mental health. He could either be calling to tell you about a huge car gig that he scored for you both or that he owes a million dollar debt.

You legit never know.

You groan and answer the call, putting it on speaker and tossing the phone to the passenger seat.

"What now?" you yell over the sounds of acceleration and police sirens.

"Come to Chester and Dan's lane." He says straight to the point, not questioning the noises he hears on your end of the phone. "After your delivery of course." At this point he's used to his little cousin getting chased down by the cops too.

"What's happening at Chester and Dan?" You ask looking at the side view mirror, squinting at the piercing blue and red flashes.

"Sinners are doing a couple rounds before the big race tomorrow. Join us, it'll be fun."

You sigh at your cousin's billionth attempt to get you acquainted with the Sinners. He's been trying ever since he first started as a general member of the club to now, the leader of the street race club.

"We'll see, I'm kind of in the middle of something," you shout over the sound of the tires screeching from a sharp turn you just made.

"Ugh! I'm not gullible like the other fucks in your life. Don't 'we'll see' me thinking it'll keep me satisfied and off your back for a while."

"I'm busy."

"Just step on the gas you pussy, going past two hundred won't kill you."

With a roll of your eyes, you think that you've entertained Anton's wishes enough and hung up the phone with the determination to lose the cops and deliver the 1969 Ford Mustang you're driving in one piece.

Twenty minutes later, a handful full of sharp turns later and momentarily stopping to let a group of duckling cross the street, you were finally at your destination.

"Car looks good to me," the off the grid buyer who introduced himself as John said with an approving nod after surveying the vintage black vehicle for quite some time.

You let out a breath. You've made your fair share of deliveries over the years, and just like Anton's calls, you never know the type of customer you're gonna get.

Some customers complain about the price of parts, or a scratch on the car that doesn't exist or they go back on their word and attempt to haggle the price to something ridiculous.

"Nice work kid," John says handing you the promised amount you both settled on a couple weeks prior. You didn't have to count the stash of cash to know that all of it was there.

"Finally," you sigh, smiling at the wad of cash in your hands and running your thumb along the bills, walking towards the direction of home.

Suddenly a car pulls up. "Give me the cash or give me your life. Your choice." Before you can register the words, you're met with the barrel of a pistol pointed at you through an unrolled passenger side window.

You knew you weren't a fighter nor were you confrontational. Even though you grew up in the tougher parts of the town, your brain is what got you out of your predicaments. If you were a fighter you wouldn't be spending your life stealing, fixing and selling cars.

Laughter interrupted you from handing over the cash. Confused, you focus on the face holding the glock, and all previous thoughts disappeared and was now replaced with relief and anger.

"What the fuck Anton!" you angrily say, hopping into the passenger seat of the car next to your laughing cousin.

You knew better than to question the fact that your cousin had a gun. When you're the leader of a street race club, you need protection. Especially when all the other club owners own a gun, and fights always break out.

"You should've seen your face," he slips out in his fit of laughter, beginning to drive off as his cousin settles in his car.

"I thought you were street smart, you know better than to walk around this time flaunting your cash."

"I can handle myself, but yeah I should've been more careful. I was just a little excited finally getting paid," You admit, recalling the rut you've recently been in and the struggles you and your mother have recently been facing to make ends meet.

Anton acknowledges the response, "You know you could always ask me for help?

"My mom wouldn't take it."

Anton let's out a loud sigh, "No offense dude, but I don't get your mom's deal. She acts as if I'm the reason our dads are dead."

You wince at the mention of your dead fathers. Sometimes you wonder how Anton could talk about this stuff so easily. "You just resemble Uncle so much, and to be fair you are following the same path as him."

Anton's father and yours, who were brothers, founded the Sinner's Race Club. Anton's dad had always been your father's right-hand man in races, often riding in the passenger seat. During a high-stakes race meant to settle a territory dispute, the brakes on your father's car failed, and both men were pronounced dead at the scene.

Since then, your mom understandably kept you away from cars, Anton, and anything related to the race club. She forbade you from getting a driver's license and doesn't even know you have one. Hiding it wasn't difficult, though, given that your family has more pressing expenses than a car.

"Alright, we're here," Your cousin announces, snapping you out of your thoughts. "I still think you should show up tomorrow. Sleep on it."

You step out of the car, once Anton puts the money you made from your sale in a spare backpack he had. So your mom wouldn't ask questions.

"How was your shift?" your mom asks from the couch as you walk through the door.

"Fine, just sore from lifting all those boxes," you lie smoothly.

"Hmm, get to bed early tonight."

As you head toward your room, her voice calls out again. "Oh, and Y/n," she says, making you turn back. "That better not have been Anton dropping you off."

You stay silent and head to bed, unsure of what tomorrow will bring.

————

"How the hell does your mom not catch on? She really thinks some warehouse gig's got you pullin' in forty grand at a time?"

You wipe the sweat of your brow, while you grab a car wrench. "She doesn't know I make that much, I help pay the rent and get food on our table. The rest I save."

"Smart. So, what's the big plan? Get outta Brimstone? Buy yourself a mansion in Summer Valley?" Mason sneers condescendingly.

This morning, you woke up to a text from Anton that convinced you to at least help prep the cars for tonight's big race, even if you don't plan on showing up. Now, you find yourself at the Brimstone Sinner's garage, the garage where you do your car modifications which sits at the edge of Sinner territory.

The place is buzzing with other club members scattered around, working on various cars. You, Anton, and—unfortunately—Mason, a friend of Anton's, who somehow wormed his way into the conversation, are huddled by the main cars, making sure they're in prime condition for the race.

"Ay! Stop distracting my best mechanic!" Anton shouts over the hood of the car to Mason.

Before you knew it you were rolling under the car via the creeper to work on the underside of the car. As you were finishing up you suddenly heard the garage go dead silent, but you didn't know why since your view was limited.

You hear Anton break the silence, "You got some fucking nerve walking into my garage asshat."

As you were lying on your back you could see about one foot from the ground up. You couldn't see who it was, but you could tell where they were from. The grey Dior dunks paired with the most unfashionable pants ever told you everything you needed to know.

Someone from Summer Valley is here.

Then came the laugh. That short, arrogant chuckle, the kind that practically exhaled wealth. Privilege. The very thing you despised.

"Just wanted to see you pussies before you lose all your dignity—oh and your garage. I'm already imagining what I'm gonna do with the place," the voice laughs again.

The conversation around you fades as your mind fixates on a single phrase. Lose the garage? Your hand curls into a tight fist, knuckles turning white. Did your dumbass cousin actually gamble the garage for tonight's race?

You try to focus your hearing, trying to see if anyone else is upset by the fact. But it's silent, they're unfazed, indifferent to the fact that Anton—the club's supposed leader—might have just wagered the club's most valuable asset. Property. You let out a sharp exhale. This is exactly what you couldn't stand about racers. They're all thrill-seeking junkies who only care about going fast. Does no one else here realize the gravity of losing this garage?

Anton snaps you back to reality. "Percy you ain't riding tonight if you're dead. Now get the fuck out before you catch a bullet."

Percy.

Leader of the Summer Valley Vipers. Just another privileged trust fund brat, bored one summer, who saw that the kids on the wrong side of the tracks had a race club and wanted in. So formed his own club. For the Vipers, racing was a hobby. For anyone from Brimstone? It was survival.

Once the obnoxious figure in those ridiculous pants left the garage, you rolled out from under the car, wiping grease from your hands. A quick glance around told you that everyone had already returned to their tasks, like the tense exchange with the Viper hadn't even happened.

Jaw clenched, you stomped over to Anton and gave him a firm nudge—just hard enough to make your frustration clear. "What the hell, Ant?"

Anton, mid-conversation with Madison—one of the club's members—turned to face you, exhaling a cloud of smoke. His brow furrowed in confusion. "What?"

"What? Seriously?" you snap. "What was Pissy going on about, losing the garage?"

He let out a long, drawn-out sigh before flicking the ash off his cigarette. "Relax, Y/n. It's just to raise the stakes, nothing serious."

"Nothing serious?" you say, mirroring his words once again. "This is my fucking livelihood, I can't live without this garage Ant? Where else am I going to fix cars?!"

Anton calmy takes one last drag, puts out his cigarette, and gestures for you to follow him outside of the garage, away from the rest of the club members.

Once you were outside Anton wasted no time in getting to the point.

"I'm only gonna say this once, Y/n. Don't ever talk to me like that in front of my people again. I run this crew."

His gaze softened slightly as he added, "I know we're family, but out here, I gotta be their leader. You get me?"

You nod understanding the politics of running a club like this. It wasn't simple and it wasn't like Anton was being rude to you.

"Now kid, listen to me very closely." Anton starts, his eyes narrowing, words firm.

You hated when he called you "kid," and Anton damn well knew it. He was only three years older, but you decided to bite your tongue this time, sensing he had something important to say.

"You don't take risks," he said, his voice steady.

You opened your mouth to cut him off, but he quickly held up a hand, his words rushing out before you could get a word in. "—hold on, let me finish! I know you think stealing cars, making illegal mods, and dodging the feds is risky—and yeah, it is... for most people. But not for you. You're too good at it. It's not a risk when you know you're always gonna pull it off. You're in your comfort zone. You don't even flinch anymore."

You crossed your arms, shaking your head. "I don't need the gamble, Ant. Why would I put myself in a position to lose something—everything?"

"But why wouldn't you?" Anton fires back passionately.

For a moment neither of you say anything.

"That's the problem, Y/n," he said finally, his voice low. "You don't take real risks anymore because you're afraid to lose. But sometimes... you gotta lose something to really win. You know what I'm saying?"

You frowned, not fully understanding. "What's that even supposed to mean? I'm not trying to play some high-stakes game just for the thrill of it."

"That's not what I'm talking about, kid. I'm saying there's more to life than just getting by. You can't just keep doing the same shit because it's easy and familiar. You gotta challenge yourself, push yourself outta that comfort zone. That's where the real reward is."

You shifted uncomfortably, not liking where the conversation was headed. "So what, you want me to throw myself into danger for no reason? What are you really getting at, Ant?"

His gaze stayed steady, not backing down. "I'm talking about the garage. Everything we've built. If you keep playing it safe, we'll stay small. But if we take some risks? We could grow this into something huge, we could run the city, Y/n."

His words hung in the air, heavy. You hesitated, feeling the pressure. "And what's the catch?"

A slow smirk crept onto his face as he leaned in. "The catch is, we go all in, or we lose it all."

Your head shook slightly, confused and uneasy. Anton sounded insane right now, with all this talk of taking over the city. "I don't know," you muttered, your voice wavering.

"I'm not saying you have to. Maybe this," he said, gesturing around the garage and the cars. "...isn't your thing, and that's fine. But you've got to find what is. What's your purpose, your drive Y/n/n? What makes your heart race? What's worth risking everything for?"

————

"Just get home safe, and grab me a pack of cigarettes on your way," your mom says, her tone casual. You exhale, relieved she let you leave without too many questions.

After your talk with Anton, and spending hours tuning up cars for the race, you head home, but your mind lingers on what your cousin said earlier. His words hit deeper than you care to admit—he was right. You've been stuck in your comfort zone for far too long, and you can't even remember the last time you did something that pushed your boundaries.

So, here you are, lying to your mom about getting called in for a late night shift when in reality, you're on your way to the race between the Sinners and Vipers.

Anton was practically beaming when you told him you were finally coming to the race. He couldn't wait to give you a ride to the track.

"Took me, what—six years? Finally got you to show up," Anton shakes his head, laughing as you slide into the passenger seat.

You ignore his teasing, cutting straight to the point. "You nervous?"

"Nah, fuck no. Pussy's a trash driver—he's got nothing on me."

Your eyes widen. "Wait, this is a title race?"

You didn't realize the leaders of both clubs were squaring off tonight. A title race meant more than bragging rights—both sides were gambling big, this race could mean life or death for both clubs.

You were about to ask what else Anton had on the line besides the garage, but the car suddenly surged forward, the burst of speed nearly throwing you out of your seat.

"What the hell! Slow down!" you shout, gripping the armrest tightly.

"Relax, I'm not even hitting two hundred yet—"

The older driver begins to roll his windows up, a sign that he wants to go even faster. The world outside blurred as the engine roared, drowning out the sound of your pulse hammering in your ears.

"Anton. Stop." Your voice is steady, firmer than ever leaving no room for argument.

The driver sighs, gradually slowing the car down to legal road limits. "You need to get over it eventually Y/n."

Those were the last words said for the remainder of the ride, you didn't want to argue with your cousin before he has one of the biggest races of his life. He knew why you were antsy with the going beyond a certain speed limit. He knew. Of course, he knew. The crash. The speed. The helplessness you felt back then. You gritted your teeth, willing yourself not to dwell on it, not to bring it up again.

You finally pull into the track, and your eyes widen in awe. It's like you were stepping onto the movie set of Fast and Furious. The area is packed with custom cars, their paint jobs gleaming under the glow of neon lights and street lamps, unique to fit the personality of each driver. Engines roar and rev, filling the air with a pulse that matches the energy of the crowd. People are everywhere—leaning against cars, laughing, shouting over the music blasting from speakers.

The race course itself stretches down a wide, abandoned road, littered with warehouses and graffiti-covered walls. Smoke drifts in the air from burning rubber, and the smell of gasoline is thick. You can feel the intensity of the competition buzzing in the air. This wasn't just a race—it was a spectacle, alive with adrenaline and danger.

Anton slowly turns into beneath a large abandoned overpass that you've often heard was a hotspot for racers and ragers. You pan your eyes across the windshield and immediately spot the rival race crews: a sea of black jackets to the right and a wall of red to the left, each group eyeing each other with the tension only moments from snapping.

You were so caught up in the moment you didn't even notice Anton turn the volume up as he played I Don't Fuck with You by Big Sean while rolling past the Viper's crew. Typical Anton—always stirring the pot. The Vipers glared but didn't act, clearly aware of who you were. You both look at each other and laugh as you join the rest of your crew a bit further into the underpass.

As your cousin parks the car he grabs something from the back seat and tosses it onto your lap—a black leather jacket.

You stared at it for a moment. The design was unmistakable. A large, detailed skull with flames rising behind it, symbolizing both danger and speed. The club's name, Sinners, arched above the skull in bold gothic, tattoo-style font. The club your father founded. The legacy you never wanted.

Your chest tightened as you ran your fingers over the smooth leather. Putting it on would be more than just an outfit choice—it would be an open declaration of association. Your mom would kill you if she ever found out.

Sensing your hesitation, Anton laughed. "Relax, I can see the steam coming out of your head from here. You don't have to wear it, alright? Just throw it over your shoulder or something. People need to know who you're with, that's all."

With that, you both stepped out of the car, and the cheers erupted. They were loud, wild, and unmistakably for Anton—he was their leader. But as the energy surged through the crowd, you couldn't help but wonder if a few of those cheers were meant for you. After all, it was your first time showing up to a race.

As you slipped into the crowd, a few familiar faces greeted you with nods and casual grins, clearly surprised to see you here. You exchanged small talk with some of the members, their conversations a mix of race gossip, bets, and tales of past victories. The atmosphere was charged with excitement, but as the minutes ticked by, you felt the need to break away, the noise and energy overwhelming you.

Stepping out from the cluster of people, you wandered toward the edge of the underpass, taking in the scene. The place was massive—graffiti-streaked pillars towering above, just like the one you were leaning against.

You took this moment to observe the Vipers. You've always had the displeasure of seeing the odd one or two while you were out doing your runs, but this is the first time you've seen the entire crew together. Your eyes land on a certain member. Percy. The only one that had a leader patch on the right sleeve of his jacket, an absurd attempt to assert dominance. You laugh at how lame this guy is. Anton exudes leader, he didn't need a patch on his sleeve reminding everyone he is one.

As you continue making your observations about the Vipers, from the corner of your eye, you noticed movement—someone else seeking the same kind of quiet as you. You glanced over, and there she was, leaning against the opposite side of the same pillar as you. The roar of engines and the blaring music made it easy to miss each other until now.

She was alone, her red jacket slung casually over her arm, a cigarette between her fingers. The contrast of her dark hair against the dim lighting made her stand out even more, and for a moment, she hadn't noticed you.

You tried not to stare, but there was something magnetic about her presence—like the calm before a storm. She flicked her eyes in your direction and froze, her gaze locking onto yours as if she wasn't expecting company either.

She glanced up at the black jacket draped over your shoulder, then at her own red one, casually slung over her arm. With a raised eyebrow and a playful smirk, she broke the silence.

"Guess neither of us is feeling the uniform tonight, huh?" she said, flicking ash from her cigarette, her voice low and surprisingly soft.

Of course her voice had to be the sexiest thing you've ever heard. You remained silent, not because you wanted to, but you didn't know how to respond. This is the first time you've ever spoken to a Viper—a hot Viper at that. You didn't know how to interact with a pretty girl, let alone someone who should be your sworn rival.

"Didn't think anyone else would find this spot," she sighs, not sure if she was saying it to you or outloud to herself.

You pushed off the pillar slightly, offering a small shrug. "Needed a breather."

She smirked, exhaling smoke slowly. "Yeah? Thought you Sinners thrived on chaos."

You glanced at the jacket hanging over your shoulder, then back at her. "Guess I'm not like the others." You weren't going to explain to a stranger that you technically aren't a Sinner but you also are.

She raised an eyebrow, intrigued. "Clearly." There was a pause, then she gave you a once-over, the faintest hint of a smile tugging at her lips. "So, what's a Sinner doing hiding out here, away from the action?"

You crossed your arms, feeling the pull of the conversation. "Could ask you the same thing. Vipers don't usually stray from their pack."

She let out a soft laugh, the sound almost lost in the night air. "Maybe I needed a break from all the posturing. You know how it is."

Posturing. What an interesting way to put it you thought to yourself. She wasn't wrong, but it was an oddly honest thing to bring up barely thirty seconds into the conversation. As intrigued as you are, you're also cautious.

You glanced her over in return, taking in her outfit—black combat boots, short black shorts, and a plain white tee, almost identical to the one you were wearing. It was shocking to see a girl from Summer Valley dressed so simply. But the simplicity suited her. She didn't need to be extravagant to stand out, if it wasn't for the jacket on her arm, you would've totally mistaken her for a flag girl, the ones who countdown the race. You've always heard that they're the most beautiful girls on the track, but clearly it wasn't the case tonight.

Your eyes met again, and something unspoken hung in the air between you. Two people from rival crews, both stepping away from the world that defined them.

She held your gaze. You didn't know what it was behind those intense brown eyes. Hatred, curiosity, attraction, a cry for help? You couldn't tell, but you also didn't want to define it. Defining it may mean having to look away. And you didn't want that. Maybe she didn't either, you doubt she would force herself to stay here with you if she didn't want to.

The universe however, had other plans. The voice of one of the flag girls crackled through the megaphone, cutting through the tension. "The big day is finally here!" The rest of her corny speech faded into the background as your focus remained on the girl in front of you. She tore her eyes from yours, sighed, and glanced back at her club.

"I have to go. See you around, Greaser."

"Greaser?" you echoed, raising a brow.

She smirked, giving you a slow, deliberate once-over before turning away.

As much as you wanted to watch her walk away, curiosity tugged at you, pulling your gaze down. You glanced at yourself and chuckled softly—faded blue jeans, white tee, and a black leather jacket. Yeah, you did kind of look like a greaser tonight.

But then you saw it. A grease stain on your shirt. You chuckled softly. So that's why.

You decided it was time to head back to your group. You return a bit more upbeat than when you'd left. As you approached, you noticed Anton climbing into the car you'd been working on earlier with the crew gathered around, wishing him luck before the race. That's when he spotted you at the edge of the crowd and waved you over. The group parted, and soon you were standing face to face with Anton.

"You look happy. Having fun?" he shouted over the roar of his engine and Percy's nearby.

"It's been pretty cool," you replied with a shrug, nodding along—though it wasn't the race itself you were enjoying, but who it had brought here.

Anton hummed in approval before dapping you up and pulling you into a quick hug. "I'll see you in a bit," he grinned, hyping up his team one last time before sliding into the driver's seat, Mason settling into the passenger side.

As Anton shut his door, your eyes drifted to the car next to his. You watched Percy with his crew, their energy almost a mirror of your own. But then you saw something that left you utterly confused.

The mystery girl. She was on her tiptoes, arms wrapped around Percy's neck in a hug that felt way too intimate for your liking.

Is she his girl? Disgusting. More thoughts crept in, but you quickly shut it down. She was a Viper, and you'd only talked to her for ten minutes. You didn't get to feel some type of way about it. She was just...intriguing. Nothing more.

You shook your head, trying to dispel the thoughts. Focus on the race, focus on Anton. You told yourself.

You take a step back and settle in a spot between Madison and Hunter as the flag girls strutted to the front of the starting line, their boots clicking against the asphalt. One girl raised a checkered flag high, her red lips curled into a seductive smile as she glanced at both drivers. The other girl held the megaphone to her lips.

"Racers, are you ready?!" Her voice echoed across the lot, the engines revving in response.

"Three!"

"Two!"

"One!" Time seemed to slow. The crowd held its breath, and for a split second all that existed was the hum of engines, the gleam of metal, and the flashing lights.

Then, with a flick of her wrist, the flag girl swung the checkered flag down, and the cars exploded off the line.

Anton's car launched forward, while Percy's stayed right on his tail, neck and neck. The crowd erupted into cheers, the sheer speed of the cars leaving only a blur of metal behind them as they tore down the street.

With the cars gone you had nothing left to distract you from your thoughts. What were you genuinely doing here, you ask yourself.

Your eyes wandered back to the spot where you had last seen her. That girl—the one who had slipped into your mind with just a few words and a lingering look. Now, with Percy racing down the track, she stood with another Viper. This one was taller, with short hair, and they were both laughing, completely at ease with each other.

You laugh in disbelief shaking your head. This didn't seem like posturing to you, she seemed like she had fit right in. But again you catch yourself thinking, why were you even upset? She never said she hated her crew, she never said anything that implied she was like you, and now you wonder if you interpreted your interaction with her to something you wanted it to be rather than what it actually was.

The thought crept in, unwelcome. Maybe you were projecting your own loneliness, your desire to feel seen, onto someone who didn't even feel the same way. Someone who was just passing time in a moment. She was a Viper, fully a part of this world, while you were just an outsider passing through.

You turned to Madison and Hunter. "I'm gonna grab a drink. You guys want anything?"

They shook their heads, and you made your way to one of the cars stocked with drinks in the trunk. You opted for a soda rather than a beer.

You leaned against the car, slowly sipping your soda and trying to clear your head. The night had taken a strange turn—what started as excitement was now muddy with emotions you weren't sure how to handle. The hum of conversation and the occasional laughter from nearby crews were the only sounds cutting through the noise in your mind.

Then, suddenly, the atmosphere shifted.

It was subtle at first, a ripple of unease passing through the crowd. You heard hushed whispers and saw people glancing toward the far end of the lot. Then, like a wave crashing down, the sound of sirens pierced the night.

"Cops!" someone yelled, and the panic spread like wildfire.

People scrambled in every direction, grabbing their things and sprinting for their cars. Engines roared to life, and tires screeched as racers and spectators alike tried to escape before the police descended on the scene.

You tossed your soda to the ground, adrenaline surging through you as you looked around for Madison and Hunter, but they were already sprinting towards the opposite direction with the rest of the crew. You turned to follow, but something made you stop.

She wasn't moving.

In the chaos, you spotted her standing in the middle of the lot, frozen, her eyes wide but not making any attempt to run. She wasn't panicked—she looked more...indifferent, like the flashing red and blue lights didn't mean anything to her.

Without thinking, you darted towards her. Your heart pounded in your chest as you weaved through the fleeing crowd, the sound of sirens growing louder by the second. When you reached her, you didn't hesitate—you grabbed her arm and pulled her.

"Come on!" you shouted over the noise, but she barely reacted, her feet stumbling as you dragged her away from the open lot.

You didn't stop until you reached the mouth of a narrow alleyway between two buildings. You pulled her into the shadows, pressing your back against the wall as you caught your breath. She was in front of you, calm in a way that made no sense considering the chaos unfolding behind you.

She gazed at you, a hint of amusement in her eyes as she was catching her breath. "You didn't have to do that, you know."

You shot her a look, exasperated. "You're welcome."

The distant sound of police radios crackled through the air as you both stood in silence, waiting for the madness to pass.

"You really should be more careful," you said, trying to break the silence. "It's not safe out there, especially with the cops around."

She shrugged, a faint smile playing on her lips. "I guess I'm just used to it. But I appreciate the concern."

You couldn't help but feel a mix of admiration and curiosity. "So, what do you usually do in moments like this? Just... stand around?"

Her laughter was light, almost melodic. "Well, not exactly. Usually, I'd just blend in and keep my head down. But you've thrown a bit of a wrench in that plan."

"Is that a bad thing?" you asked, intrigued.

"Not necessarily," she replied, her eyes sparkling with mischief. "But it's definitely unexpected."

You took a step closer, feeling the distance between you narrow. "And here I thought I was just being a good Samaritan."

"Good Samaritan, huh?" She raised an eyebrow, playful yet cautious. "Seems like you might be getting in over your head, then."

"Maybe I like the thrill," you shot back, trying to keep the mood light. But beneath the banter, you both knew the stakes were higher than either of you wanted to admit.

"Well, be careful what you wish for," she said softly, her expression shifting momentarily to something more serious. "Not everything is as exciting as it seems."

You paused, trying to decipher her words. There was a depth to her that hinted at more than she was letting on. But before you could ask, she turned her gaze back to the alley,

Your phone suddenly dinged, breaking the tension. You glanced at it and saw a message from Mason.

"Seems like the cops cut the race short. Your crew lives to see another day."

You chuckled, but she didn't respond, just watching you with her doe eyes. You thought about what it would be like to give in.

But just then, the light caught her wrist, glinting off the expensive bracelet she wore. The sight of it sent a jolt through you—a stark reminder that she was from Summer Valley, a Viper, and probably a handful you couldn't handle.

The realization hit hard, and you felt a rush of uncertainty. She was part of a world you didn't want to dive into, no matter how intriguing she might be.

You decide to walk off, out of the alley.

"Hey! Where are you going?" she called out, jogging to catch up.

"Home. The cops seem to be gone," you replied, keeping your tone light, words short.

The brown-eyed girl looked confused, she thought you were building a connection. Now you were suddenly dismissive, leaving without a word, and you could see her trying to process it.

"...Wait, um..." she stammered, hesitating as if searching for the right words.

You turned back, sensing the moment hanging between you. You had a feeling you knew what she was going to say, and a knot formed in your stomach.

You took a step back, breaking the spell. "I really should go," you said, your voice firm, not giving her a chance to speak. You turned away, leaving her standing there, a mixture of confusion and disappointment on her face.

With that, you turned and walked deeper into the night. You could feel her watching you, but you kept moving, the weight of your decision heavy in your chest. But telling her your name would mean chaos.

As you navigated the alley, Anton's words echoed in your mind. "Maybe this isn't your thing, and that's fine. But you've got to find what is. What's your purpose, your drive? What makes your heart race? What's worth risking everything for?"

You were sure it wasn't her. As much as you felt a connection, you couldn't get further involved with the race world. She was just a pretty girl you met, and seemed to have some semblance of intellectuality. You know how this ends and its not pretty. You had responsibilities waiting at home—your mom counting on you, the weight of family expectations pressing down like a heavy fog. You had to figure things out on your own, even if it meant leaving her behind.

You can't just be the calculated person that you are and then immediately start taking risks because your cousin told you to. This was your nature. Careful.

Still, a part of you wondered if the real risk was not in chasing the girl but in denying yourself the chance to discover what could truly make your heart race.

next chapter

#jenna ortega#jenna ortega x female reader#jenna ortega x reader#jenna ortega x y/n#jenna ortega x you#tara carpenter imagine#beetlejuice#tara carpenter x female reader#tara carpenter x reader#tara carpenter x y/n#jenna x reader#jenna ortega imagines#jenna ortega imagine#jenna au#jenna ortega au#lesbian#bisexual#jenna ortega edit#jenna ortega fanfic#jenna ortega fanart#astrid deetz#cairo sweet#wednesday addams

429 notes

·

View notes

Text

Cars bricked by bankrupt EV company will stay bricked

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

There are few phrases in the modern lexicon more accursed than "software-based car," and yet, this is how the failed EV maker Fisker billed its products, which retailed for $40-70k in the few short years before the company collapsed, shut down its servers, and degraded all those "software-based cars":

https://insideevs.com/news/723669/fisker-inc-bankruptcy-chapter-11-official/

Fisker billed itself as a "capital light" manufacturer, meaning that it didn't particularly make anything – rather, it "designed" cars that other companies built, allowing Fisker to focus on "experience," which is where the "software-based car" comes in. Virtually every subsystem in a Fisker car needs (or rather, needed) to periodically connect with its servers, either for regular operations or diagnostics and repair, creating frequent problems with brakes, airbags, shifting, battery management, locking and unlocking the doors:

https://www.businessinsider.com/fisker-owners-worry-about-vehicles-working-bankruptcy-2024-4

Since Fisker's bankruptcy, people with even minor problems with their Fisker EVs have found themselves owning expensive, inert lumps of conflict minerals and auto-loan debt; as one Fisker owner described it, "It's literally a lawn ornament right now":

https://www.businessinsider.com/fisker-owners-describe-chaos-to-keep-cars-running-after-bankruptcy-2024-7

This is, in many ways, typical Internet-of-Shit nonsense, but it's compounded by Fisker's capital light, all-outsource model, which led to extremely unreliable vehicles that have been plagued by recalls. The bankrupt company has proposed that vehicle owners should have to pay cash for these recalls, in order to reserve the company's capital for its creditors – a plan that is clearly illegal:

https://www.veritaglobal.net/fisker/document/2411390241007000000000005

This isn't even the first time Fisker has done this! Ten years ago, founder Henrik Fisker started another EV company called Fisker Automotive, which went bankrupt in 2014, leaving the company's "Karma" (no, really) long-range EVs (which were unreliable and prone to bursting into flames) in limbo:

https://en.wikipedia.org/wiki/Fisker_Karma

Which raises the question: why did investors reward Fisker's initial incompetence by piling in for a second attempt? I think the answer lies in the very factor that has made Fisker's failure so hard on its customers: the "software-based car." Investors love the sound of a "software-based car" because they understand that a gadget that is connected to the cloud is ripe for rent-extraction, because with software comes a bundle of "IP rights" that let the company control its customers, critics and competitors:

https://locusmag.com/2020/09/cory-doctorow-ip/

A "software-based car" gets to mobilize the state to enforce its "IP," which allows it to force its customers to use authorized mechanics (who can, in turn, be price-gouged for licensing and diagnostic tools). "IP" can be used to shut down manufacturers of third party parts. "IP" allows manufacturers to revoke features that came with your car and charge you a monthly subscription fee for them. All sorts of features can be sold as downloadable content, and clawed back when title to the car changes hands, so that the new owners have to buy them again. "Software based cars" are easier to repo, making them perfect for the subprime auto-lending industry. And of course, "software-based cars" can gather much more surveillance data on drivers, which can be sold to sleazy, unregulated data-brokers:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

Unsurprisingly, there's a large number of Fisker cars that never sold, which the bankruptcy estate is seeking a buyer for. For a minute there, it looked like they'd found one: American Lease, which was looking to acquire the deadstock Fiskers for use as leased fleet cars. But now that deal seems dead, because no one can figure out how to restart Fisker's servers, and these vehicles are bricks without server access:

https://techcrunch.com/2024/10/08/fisker-bankruptcy-hits-major-speed-bump-as-fleet-sale-is-now-in-question/

It's hard to say why the company's servers are so intransigent, but there's a clue in the chaotic way that the company wound down its affairs. The company's final days sound like a scene from the last days of the German Democratic Republic, with apparats from the failing state charging about in chaos, without any plans for keeping things running:

https://www.washingtonpost.com/opinions/2023/03/07/east-germany-stasi-surveillance-documents/

As it imploded, Fisker cycled through a string of Chief Financial officers, losing track of millions of dollars at a time:

https://techcrunch.com/2024/05/31/fisker-collapse-investigation-ev-ocean-suv-henrik-geeta/

When Fisker's landlord regained possession of its HQ, they found "complete disarray," including improperly stored drums of toxic waste:

https://techcrunch.com/2024/10/05/fiskers-hq-abandoned-in-complete-disarray-with-apparent-hazardous-waste-clay-models-left-behind/

And while Fisker's implosion is particularly messy, the fact that it landed in bankruptcy is entirely unexceptional. Most businesses fail (eventually) and most startups fail (quickly). Despite this, businesses – even those in heavily regulated sectors like automotive regulation – are allowed to design products and undertake operations that are not designed to outlast the (likely short-lived) company.

After the 2008 crisis and the collapse of financial institutions like Lehman Brothers, finance regulators acquired a renewed interest in succession planning. Lehman consisted of over 6,000 separate corporate entities, each one representing a bid to evade regulation and/or taxation. Unwinding that complex hairball took years, during which the entities that entrusted Lehman with their funds – pensions, charitable institutions, etc – were unable to access their money.

To avoid repeats of this catastrophe, regulators began to insist that banks produce "living wills" – plans for unwinding their affairs in the event of catastrophe. They had to undertake "stress tests" that simulated a wind-down as planned, both to make sure the plan worked and to estimate how long it would take to execute. Then banks were required to set aside sufficient capital to keep the lights on while the plan ran on.

This regulation has been indifferently enforced. Banks spent the intervening years insisting that they are capable of prudently self-regulating without all this interference, something they continue to insist upon even after the Silicon Valley Bank collapse:

https://pluralistic.net/2023/03/15/mon-dieu-les-guillotines/#ceci-nes-pas-une-bailout

The fact that the rules haven't been enforced tells us nothing about whether the rules would work if they were enforced. A string of high-profile bankruptcies of companies who had no succession plans and whose collapse stands to materially harm large numbers of people tells us that something has to be done about this.

Take 23andme, the creepy genomics company that enticed millions of people into sending them their genetic material (even if you aren't a 23andme customer, they probably have most of your genome, thanks to relatives who sent in cheek-swabs). 23andme is now bankrupt, and its bankruptcy estate is shopping for a buyer who'd like to commercially exploit all that juicy genetic data, even if that is to the detriment of the people it came from. What's more, the bankruptcy estate is refusing to destroy samples from people who want to opt out of this future sale:

https://bourniquelaw.com/2024/10/09/data-23-and-me/

On a smaller scale, there's Juicebox, a company that makes EV chargers, who are exiting the North American market and shutting down their servers, killing the advanced functionality that customers paid extra for when they chose a Juicebox product:

https://www.theverge.com/2024/10/2/24260316/juicebox-ev-chargers-enel-x-way-closing-discontinued-app

I actually owned a Juicebox, which ultimately caught fire and melted down, either due to a manufacturing defect or to the criminal ineptitude of Treeium, the worst solar installers in Southern California (or both):

https://pluralistic.net/2024/01/27/here-comes-the-sun-king/#sign-here

Projects like Juice Rescue are trying to reverse-engineer the Juicebox server infrastructure and build an alternative:

https://juice-rescue.org/

This would be much simpler if Juicebox's manufacturer, Enel X Way, had been required to file a living will that explained how its customers would go on enjoying their property when and if the company discontinued support, exited the market, or went bankrupt.

That might be a big lift for every little tech startup (though it would be superior than trying to get justice after the company fails). But in regulated sectors like automotive manufacture or genomic analysis, a regulation that says, "Either design your products and services to fail safely, or escrow enough cash to keep the lights on for the duration of an orderly wind-down in the event that you shut down" would be perfectly reasonable. Companies could make "software based cars" but the more "software based" the car was, the more funds they'd have to escrow to transition their servers when they shut down (and the lest capital they'd have to build the car).

Such a rule should be in addition to more muscular rules simply banning the most abusive practices, like the Oregon state Right to Repair bill, which bans the "parts pairing" that makes repairing a Fisker car so onerous:

https://www.theverge.com/2024/3/27/24097042/right-to-repair-law-oregon-sb1596-parts-pairing-tina-kotek-signed

Or the Illinois state biometric privacy law, which strictly limits the use of the kind of genomic data that 23andme collected:

https://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=3004

Failing to take action on these abusive practices is dangerous – and not just to the people who get burned by them. Every time a genomics research project turns into a privacy nightmare, that salts the earth for future medical research, making it much harder to conduct population-scale research, which can be carried out in privacy-preserving ways, and which pays huge scientific dividends that we all benefit from:

https://pluralistic.net/2022/10/01/the-palantir-will-see-you-now/#public-private-partnership

Just as Fisker's outrageous ripoff will make life harder for good cleantech companies:

https://pluralistic.net/2024/06/26/unplanned-obsolescence/#better-micetraps

If people are convinced that new, climate-friendly tech is a cesspool of grift and extraction, it will punish those firms that are making routine, breathtaking, exciting (and extremely vital) breakthroughs:

https://www.euronews.com/green/2024/10/08/norways-national-football-stadium-has-the-worlds-largest-vertical-solar-roof-how-does-it-w

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/10/software-based-car/#based

#pluralistic#enshittification#evs#automotive#bricked#fisker#ocean#cleantech#iot#internet of shit#autoenshittification

577 notes

·

View notes