#crv scout

Explore tagged Tumblr posts

Text

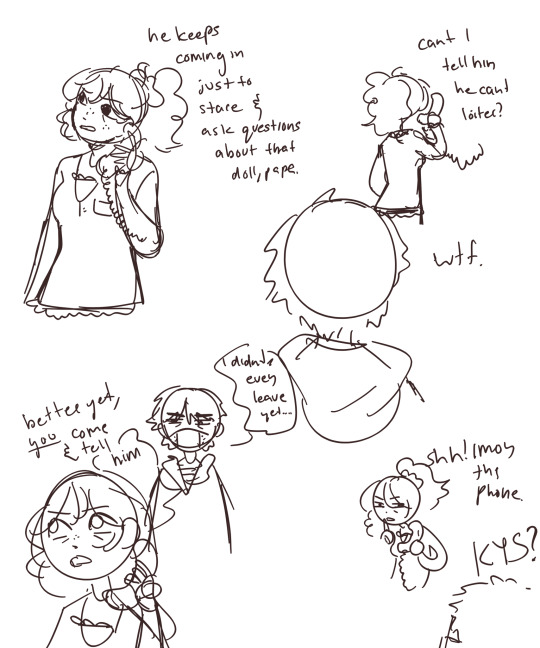

BOBA RUN!!!!

#Crv Bonnie#Crv Shannon#Crv tali#Crv scout#sucker art#is that what we r titling my art HAHA#crv#creepedverse#creepypasta au

82 notes

·

View notes

Text

JANUARY XX, 2008

FARNBURY, ALABAMA.

Characters & creators can be found on @creepedverse PT 1

#sweetart#creepypasta#creepypasta fanart#creepypasta art#creepypasta au#creepypasta oc#crp oc#crp au#creepypasta headcanon#fandom#crp fandom#creepypasta fandom#creepedverse#crv#creepedverse au#Shannon jones#Bonnibel Hayes#Dia medici#Tobin lawsen#tali marks#Thomas barclay#joy Bennett#Nico nakai#scout crv#Arthur habermann#crv bonnie

552 notes

·

View notes

Text

Doodles from the drive to my aunt and back because I am not gonna sleep through a seven hour car ride wtf

None of the characters are mine, Bonnie belongs to @crushedsweets , Tobin to @necroromantics , Tali to @clockeyedtoy , Shannon to @daydreamteardrop and Scout to @lcvenderrot !!

#creepypasta#not my ocs#bonnibel hayes#tobin lawsen#crv tobin#tali marks#crv tali#shannon jones#scout crv#creepedverse#COOLEST OCS EVA OMG

61 notes

·

View notes

Text

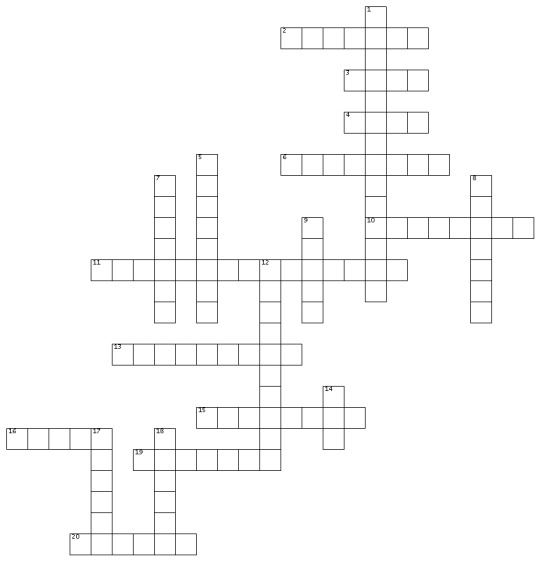

WTNV - Ep 182 - It Sticks With You

Across

2. In Cecil’s favorite episode of The Office, the corporate manager is interrogated for successfully doing what?

3. What kind of birds did Cecil remember most from going to the woods as a young boy with his sister and mother?

4. Everything that is unknown is what?

6. In Cecli’s favorite episode of The Office, the corporate manager is interrogated by what agency?

10. The man in the car hopes that he is to be what?

11. What did John Peters build in his field? (Two words)

13. What part of the 2004 Honda CRV was broken?

15. The main character of the version of The Office Cecil watched was what kind of bird?

16. What kind of birds did Cecil and his family see on their hike?

19. Which animals did their son want to play with?

20. What color was the 2004 Honda CRV? Down

1. What was the name of the state park that Cecil and his family went to? (Two words)

5. Which version of The Office was Cecil watching?

7. What did Cecil’s mother leave at the base of a giant tree?

8. What is the name of Carlos and Cecil’s child?

9. Which amphibians did their son actually play with?

12. John Peters sent letters to some scouts for the Padres, Diamondbacks, ___ ___, and Dodgers.

14. How many eyes did the main character of The Office have?

17. What is the name of the man in the car during the traffic report?

18. Cecil said it’s never too early to introduce children to what?

#wtnvcrossword#Welcome to Night Vale#cecil palmer#carlos the scientist#the office#john peters#abby palmer#cassette recorder#night vale community radio#nvcr#wtnv ep 182#it sticks with you

6 notes

·

View notes

Text

Investors explain COVID-19’s impact on consumer startups

Home fitness and games as gathering places are a few of the startup verticals propelled by unprecedented shifts in behavior due to shelter-in-place orders. We surveyed the top investors in consumer and social apps to learn about 2020’s startup trends, the M&A climate, the threat of incumbents copying new entrants, underserved demographics and which features are poised to be unbundled from the biggest apps.

The Extra Crunch survey series assembles the best minds in different verticals, drawing on investors who’ve backed or worked at the companies defining their industry. For this survey, we asked how COVID-19 was affecting their investment strategies and the operations of their portfolio companies. We also dug into whether founders are more or less hopeful about being acquired, which startup ideas they wish they were being pitched and what age groups or cultures deserve new social products.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like General Catalyst, Kleiner Perkins and Sweet Capital.

Here are the 17 leading social network VCs who participated in our survey:

Olivia Moore, CRV

Justine Moore, CRV

Connie Chan, Andreessen Horowitz

Alexis Ohanian, Initialized Capital

Niko Bonatsos, General Catalyst

Josh Coyne, Kleiner Perkins

Wayne Hu, Signal Fire

Alexia Bonatsos, Dream Machine

Josh Elman, Angel Investor

Aydin Senkut, Felicis Ventures

James Currier, NFX

Pippa Lamb, Sweet Capital

Christian Dorffer, Sweet Capital

Jim Scheinman, Maven Ventures

Eva Casanova, Day One Ventures

Masha Drokova, Day One Ventures

Dan Ciporin, Canaan

Olivia Moore & Justine Moore, CRV

How much time are you spending on social right now? Is the market underheated, overheated, or just right?

It’s been a tough couple of years for new social startups — but when something hits in this space, it hits big! We’re always spending time looking at consumer social — we have a network of 200+ college scouts at campuses around the country, so we hear about (and try) new apps pretty frequently.

It is difficult for new social startups to reach any kind of meaningful scale. The average person doesn’t download any apps in a given month, and even though younger users may be more willing to try new things, they often face storage or data constraints.

We feel that the market is probably “appropriately heated.” Once a social startup is “working,” it shouldn’t struggle to raise capital, but there are probably fewer investors making large pre-launch social bets because there have been so few breakout hits recently.

How has COVID-19 impacted social startups operationally?

1 note

·

View note

Text

Scout 58 in 1 Precision Screwdriver Bit Sets with 54 Bits, Magnetic Repair Tool Kit Ideal for PC, Laptops, Phones, Game Consoles and Electronics (Chrome Vanadium Alloy Steel) - PLATINUM (Orange)

Scout 58 in 1 Precision Screwdriver Bit Sets with 54 Bits, Magnetic Repair Tool Kit Ideal for PC, Laptops, Phones, Game Consoles and Electronics (Chrome Vanadium Alloy Steel) – PLATINUM (Orange)

Price: [price_with_discount] (as of [price_update_date] – Details)

[ad_1] Variety of Bits : Different kind of bits made of CRV that are carefully selected by Scout to meet all your need. Flexible design: Flexible Shaft Extension is great for those where the screws are hard to reach. Material: Tough CR-V mini ratcheting screwdriver set made of chrome-vanadium steel for long life and durability Portab…

View On WordPress

0 notes

Text

Honda Fob Keys And Remote Program Bayonne NJ

Breaking the key in the ignition cylinder or Misplacing your motor vehicle keys at your workplace or driving in a crowded highway might certainly be a terrible situation, and consequently hiring a loyal trained roadside lock smith business that go all out to resolve your troubles as quick as possible 24 hr is truly important. As a top notch Honda lock man in Bayonne NJ and countrysides area, Bayonne Key Replacement workmanship are serviceable 24/7 rain or shine equipped to the brim with each and every single cutters, diagnostic equipment and lock picking tools needed to rekey, install or repair your car lock, key or ignition at your location.

Models: HRV, Stream, StepWGN, S2000, Accord, Fit, Ridgeline, Civic, Insight, Shuttle, Del, Prelude, Integra, CRV and Sol

Honda replacement keys in Bayonne NJ

Ordering a fresh car key from the dealer-ship is normally expensive or lengthy quest, still in lots of conditions, singling out a driveSIDE vehicle key replacement solution can be unbeatable price or shorter solution. Our emergency lock man are equipped with compatible lock cracking hardware as well as high security, switch-blade key, VAT or P.A.T blank-keys capable to help 24hr and cut and program a new car key for Honda owners who got their keys stolen or lost for every single domestic or imported automaker on-site.

About Honda lock and key instrument

Honda is Japan's multinational trendy auto maker of commercial vehicles, Scooters, mainstream motor vehicles, luxury cars and Motorcycles and evolve into being one of the widest Japanese automaker since 1946.

Honda originate utilizing transponder keys in 1996. Earliest Honda keys might be copied by a simple economical dash-board duplication procedure.

Recent models bases on year and model shifted it's keys and locks mechanism to an enciphered transponder chip keys that need a distinct diagnostic machinery and key programmer in order to copy a surplus key.

Starting from 2007, A few Honda models utilize push button start ignition and Smart Entry System as either optional or standard technology.

Ignition switch repair

Your car ignition switch supplies current from your battery to nearly every of your car electrical components and compose of small mechanical and electrical parts that normally tend to wear through by cause of heavy traffic using for so many years.

If your Honda ignition key is broken, ignition key wont turn in the ignition cylinder, ignition key is stiffly turning and key is stuck in the key mouth and do not turn, it's apparently a signs of worn ignition lock or key because of a loose cylinder pin, bad ignition switch contacts or dent ignition key that can surely provoke the ignition cylinder to fail, countering you from lighting up your vehicle.

While on the road, faulty ignition switch could turn off the engine during driving, which could be incredibly unsafe, henceforth we recommend not to poke the ignition lock by inexperienced individual that most likely going to lead to a deeper deterioration and risk.

The only thing an owner advised to do coming across ignition switch or key complications is to double check you’re actually attempting to light up your own vehicle and schedule with a car key smith to arrive to your location to rekey, reprogram repair the ignition or key which will priced as around $140–$325.

Transponder key form

Because of the high rates of car theft two decades ago, practically all vehicle producers since nearby 1995 utilize electrical key lock employing transponder key, passive anti theft system or VAT keys.

The idea behind this is to acquire antitheft technology where the car contain car computer module and the key contain a small scale chip normally concealed in it's plastic cork.

The moment the owner stick the key into the ignition crack-hole, a combination of audio and infrared signal is transmitted to the ECM. If the vehicle ECM will not detect the code, the vehicle engine won’t crank. This system implies that sitting on top of cutting a blank-key, the key should be programmed to the vehicle by a relevant programming machine done at the dealer or by a lock-smith .

Honda key-less entry

Honda key-less entry let a user to lock and unlock the car doors and moreover kindling the car while avoiding inserting a metal key, and since 2007, a lot of Honda vehicles on the road are furnished with some type of a proximity key technology that accommodate a short range transmitter.

Using a keyless device, entry to your Honda is normally achieved by delivering a combination of audio and infrared indication message from a remote transmitter to an ECU in the car on a ciphered data stream when the user merely walks within a distance of five ft of the car with the keyless device on a key ring or in the pocket.

This radio frequency indication message and the Honda smart key platform, moreover fit push start ignition (also called Clutch starting or Clutch popping). Using this system a car owner is adept of starting up a vehicle by pushing a button on the dash-board in place of turning a key in a crack-hole.

Copy vs lost car keys

In the 1990’s, numerous vehicle makers began to use immobilizer and electronic keys as an additional safety means in which an ECU in the car will recognize the transponder key when you go to fire up the car. If the car doesnt recognize a compatible key, car computer module subdue the fuel supply and the car will not turn on.

This infrastructure work as anti theft to avert against lock crackerjack or hot wiring the car and relief drivers and insurance companies in defeating motor vehicle theft all over the world, yet the prices of vehicle keys rise to $55-$125 for a elemental duplicate transponder key and seemingly around a $100 more if the key is lost.

24 hours vehicle lockout

If you’re being subjected to the annoying episode of locking your keys in the car while in the middle of the highway or pulling off the kids from school, our quick vehicle lock-out virtuoso craftsmanship can arrive at your location promptly to aptly unlock your car door for any kind of American, Japanese, Asian or European car manufacturer promptly, put you back into your car and retrieve your peace of mind.

Vehicle locks modify

Bayonne Key Replacement is glad to cater all type of Honda re key services on premises to oust a embezzled, misplaced or smashed keys. Approximately all stylish car are furnished with electric locks and key system and the action demanded to get your lock corrected must consists of the legitimate compiler for the exact car. Instead of dragging your car to the dealer, just hoist the cell-phone and call our dispatch center in Bayonne NJ and one of our vehicle adapting technicians will be with you as quick as possible with a roaming van having most advance key cutters, blank keys, ignition parts and programmers ready to figure out any sort of emergency situations.

Conclusion

Our well rounded agents are competent to solve a lot of car ignition, locks and keys dilemmas and get you back inside your car fast. Equipped to the brim with modern diagnostic equipment, lock-picking tools and key programmers they are able to perfect ANY vehicle lock-smith duty on site 24hrs. Wheather it is, duplicating fobik-key, emergency lockout and replacing lost keys, we take pride of our typically fastest response time besides bargain rates. . If you are scouting for Honda key replacement service 24HR in Bayonne New Jersey, call (973)200-4870 for a reliable local mobile locksmith, lost car keys made, ignition repair, transponder, keyless entry remote fob cut and program.

0 notes

Text

Investors explain COVID-19’s impact on consumer startups

Home fitness and games as gathering places are a few of the startup verticals propelled by unprecedented shifts in behavior due to shelter-in-place orders. We surveyed the top investors in consumer and social apps to learn about 2020’s startup trends, the M&A climate, the threat of incumbents copying new entrants, underserved demographics and which features are poised to be unbundled from the biggest apps.

The Extra Crunch survey series assembles the best minds in different verticals, drawing on investors who’ve backed or worked at the companies defining their industry. For this survey, we asked how COVID-19 was affecting their investment strategies and the operations of their portfolio companies. We also dug into whether founders are more or less hopeful about being acquired, which startup ideas they wish they were being pitched and what age groups or cultures deserve new social products.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like General Catalyst, Kleiner Perkins and Sweet Capital.

Here are the 17 leading social network VCs who participated in our survey:

Olivia Moore, CRV

Justine Moore, CRV

Connie Chan, Andreessen Horowitz

Alexis Ohanian, Initialized Capital

Niko Bonatsos, General Catalyst

Josh Coyne, Kleiner Perkins

Wayne Hu, Signal Fire

Alexia Bonatsos, Dream Machine

Josh Elman, Angel Investor

Aydin Senkut, Felicis Ventures

James Currier, NFX

Pippa Lamb, Sweet Capital

Christian Dorffer, Sweet Capital

Jim Scheinman, Maven Ventures

Eva Casanova, Day One Ventures

Masha Drokova, Day One Ventures

Dan Ciporin, Canaan

Olivia Moore & Justine Moore, CRV

How much time are you spending on social right now? Is the market underheated, overheated, or just right?

It’s been a tough couple of years for new social startups — but when something hits in this space, it hits big! We’re always spending time looking at consumer social — we have a network of 200+ college scouts at campuses around the country, so we hear about (and try) new apps pretty frequently.

It is difficult for new social startups to reach any kind of meaningful scale. The average person doesn’t download any apps in a given month, and even though younger users may be more willing to try new things, they often face storage or data constraints.

We feel that the market is probably “appropriately heated.” Once a social startup is “working,” it shouldn’t struggle to raise capital, but there are probably fewer investors making large pre-launch social bets because there have been so few breakout hits recently.

How has COVID-19 impacted social startups operationally?

via Social – TechCrunch https://ift.tt/2XHzj90

0 notes

Text

Investors explain COVID-19’s impact on consumer startups

Home fitness and games as gathering places are a few of the startup verticals propelled by unprecedented shifts in behavior due to shelter-in-place orders. We surveyed the top investors in consumer and social apps to learn about 2020’s startup trends, the M&A climate, the threat of incumbents copying new entrants, underserved demographics and which features are poised to be unbundled from the biggest apps.

The Extra Crunch survey series assembles the best minds in different verticals, drawing on investors who’ve backed or worked at the companies defining their industry. For this survey, we asked how COVID-19 was affecting their investment strategies and the operations of their portfolio companies. We also dug into whether founders are more or less hopeful about being acquired, which startup ideas they wish they were being pitched and what age groups or cultures deserve new social products.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like General Catalyst, Kleiner Perkins and Sweet Capital.

Here are the 17 leading social network VCs who participated in our survey:

Olivia Moore, CRV

Justine Moore, CRV

Connie Chan, Andreessen Horowitz

Alexis Ohanian, Initialized Capital

Niko Bonatsos, General Catalyst

Josh Coyne, Kleiner Perkins

Wayne Hu, Signal Fire

Alexia Bonatsos, Dream Machine

Josh Elman, Angel Investor

Aydin Senkut, Felicis Ventures

James Currier, NFX

Pippa Lamb, Sweet Capital

Christian Dorffer, Sweet Capital

Jim Scheinman, Maven Ventures

Eva Casanova, Day One Ventures

Masha Drokova, Day One Ventures

Dan Ciporin, Canaan

Olivia Moore & Justine Moore, CRV

How much time are you spending on social right now? Is the market underheated, overheated, or just right?

It’s been a tough couple of years for new social startups — but when something hits in this space, it hits big! We’re always spending time looking at consumer social — we have a network of 200+ college scouts at campuses around the country, so we hear about (and try) new apps pretty frequently.

It is difficult for new social startups to reach any kind of meaningful scale. The average person doesn’t download any apps in a given month, and even though younger users may be more willing to try new things, they often face storage or data constraints.

We feel that the market is probably “appropriately heated.” Once a social startup is “working,” it shouldn’t struggle to raise capital, but there are probably fewer investors making large pre-launch social bets because there have been so few breakout hits recently.

How has COVID-19 impacted social startups operationally?

0 notes

Text

Investors explain COVID-19’s impact on consumer startups

New Post has been published on https://magzoso.com/tech/investors-explain-covid-19s-impact-on-consumer-startups-2/

Investors explain COVID-19’s impact on consumer startups

Home fitness and games as gathering places are a few of the startup verticals propelled by unprecedented shifts in behavior due to shelter-in-place orders. We surveyed the top investors in consumer and social apps to learn about 2020’s startup trends, the M&A climate, the threat of incumbents copying new entrants, underserved demographics and which features are poised to be unbundled from the biggest apps.

The Extra Crunch survey series assembles the best minds in different verticals, drawing on investors who’ve backed or worked at the companies defining their industry. For this survey, we asked how COVID-19 was affecting their investment strategies and the operations of their portfolio companies. We also dug into whether founders are more or less hopeful about being acquired, which startup ideas they wish they were being pitched and what age groups or cultures deserve new social products.

Subscribe to Extra Crunch to read the full answers to our questionnaire from funds like General Catalyst, Kleiner Perkins and Sweet Capital.

Here are the 17 leading social network VCs who participated in our survey:

Olivia Moore, CRV

Justine Moore, CRV

Connie Chan, Andreessen Horowitz

Alexis Ohanian, Initialized Capital

Niko Bonatsos, General Catalyst

Josh Coyne, Kleiner Perkins

Wayne Hu, Signal Fire

Alexia Bonatsos, Dream Machine

Josh Elman, Angel Investor

Aydin Senkut, Felicis Ventures

James Currier, NFX

Pippa Lamb, Sweet Capital

Christian Dorffer, Sweet Capital

Jim Scheinman, Maven Ventures

Eva Casanova, Day One Ventures

Masha Drokova, Day One Ventures

Dan Ciporin, Canaan

Olivia Moore & Justine Moore, CRV

How much time are you spending on social right now? Is the market underheated, overheated, or just right?

It’s been a tough couple of years for new social startups — but when something hits in this space, it hits big! We’re always spending time looking at consumer social — we have a network of 200+ college scouts at campuses around the country, so we hear about (and try) new apps pretty frequently.

It is difficult for new social startups to reach any kind of meaningful scale. The average person doesn’t download any apps in a given month, and even though younger users may be more willing to try new things, they often face storage or data constraints.

We feel that the market is probably “appropriately heated.” Once a social startup is “working,” it shouldn’t struggle to raise capital, but there are probably fewer investors making large pre-launch social bets because there have been so few breakout hits recently.

How has COVID-19 impacted social startups operationally?

0 notes

Text

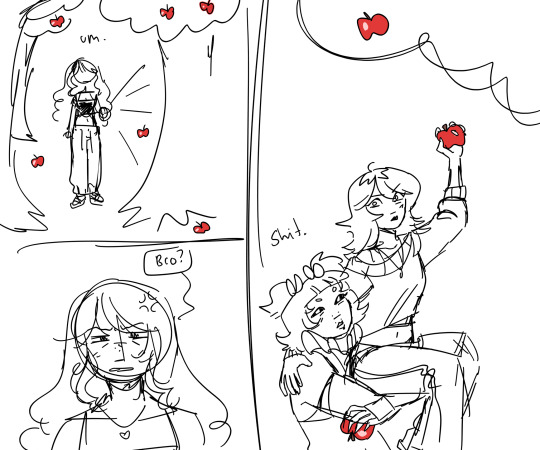

CREEPEDVERSE heights!

Tommie: 6'4 Nico: 5'9 Tali: 5'9 Tobin: 5'8 Joy: 5'7 Arthur: 5'5 Shannon: 5'3 Scout: 5'3 Dia: 5'3 Bonnie: 5'1

#crv#creepedverse#crv tommie#crv nico#crv tali#crv tobin#crv joy#crv arthur#crv shannon#crv scout#crv dia#crv bonnie#do i gotta tag everyones full names... (starts shaking) dont make me do this...

40 notes

·

View notes

Note

Go crazy abt Bonnie (and others) free space ask

alright dia. fine. fine. fine. you got me. alright. here's bonnibel. also credit to @necroromantics for the reference sheet I filled out (and like half of the shit i fill out for this)

here's the cast and their creators... Bonnibel, Dia (@diasartstuff), Shannon (@daydreamteardrop), Scout (@.), Joy (@jumping-joey1104), Tobin (@necroromantics), Tali (@clockeyedtoy), Nico (@redevilries), and Tommie (@deepsix-art) ! some other artists and friends made some OCs in the server too but i didnt get the chance to add them to the height chart </3

so basically. my friends and i came up with this little slenderverse . @creepedverse is my enemies account with a lil more details on it. (we call it CRV for short)

the story is set in 2008 and basically follows a random cast of people in a small town called Farnbury, Alabama. everyone comes together cuz everyone is getting fucked over by slenderman in some way, whether it be directly them or their loved ones.

Bonnie's entire thing is being haunted by slendersick ghosts, but not having the sickness herself. When she meets members of the cast who ARE slendersick, she gets hopeful that they'll be able to help her. unfortunately, not everyone is as excited to get rid of this issue. . . She’s not really a “creepypasta”, just a victim to circumstance. With a body count of one, I guess

heres some more stuff ive scrambled together... and my friends have made some really awesome maps, animations, etc for this AU! i dunno who has posted what, but this is what I work on when im not doing Creeped LOL

The jester-looking cryptid in the last two pictures are @creepspastaarts oc, Creep!

136 notes

·

View notes

Text

Scout 110 PCs Tool Kit for iPhone X, 8, 7, Smartphone, Macbook,Tablet, Cellphone, PC, Game Console, Mobiles, and Other Electronics Devices

New Post has been published on https://apzweb.com/scout-110-pcs-tool-kit-for-iphone-x-8-7-smartphone-macbooktablet-cellphone-pc-game-console-mobiles-and-other-electronics-devices/

Scout 110 PCs Tool Kit for iPhone X, 8, 7, Smartphone, Macbook,Tablet, Cellphone, PC, Game Console, Mobiles, and Other Electronics Devices

Price: (as of Jan 01,1970 00:00:00 UTC – Details)

Scout 110 pcs tool kit model id: c-11001 package details: 1 x aluminum screwdriver handle 1 x link bar 1 x flexible shaft 1 x short bar 1 x tweezer 2 x openers 1 x sim card pin 1 x magnetizer/de magnetizer 1 x suction tool 2 x pry tools 98 x screwdriver bits.

Variety of Bits : 98 kind of bits made of CRV steel that are carefully selected by Scout to meet all your need & are Suitable For Disassembling Computers, Smartphones, Glasses, Watches, Etc. All Screwdriver Heads Have Been Processed With High Temperature. The screwdriver has inbuilt extension handle. The Grip Is Durable And Convinient To Use With The Bearing At The Tail Of The Grip. Package includes the flexible bar that can be used to reach the places that are hard to reach. Precise Design, High Quality, Compact Material, Static-Free Handle. Package Includes : Screwdriver, Flexible Extension, Tweezer, Pry Tools, Openers, Suction Tool, SIM Card Opener, Magnetizer & 98 Screwdriver Bits

0 notes

Text

Is Facebook dead to Gen Z?

Olivia Moore Contributor

Share on Twitter

Olivia Moore is a venture investor at CRV and co-founded Cardinal Ventures alongside her sister, Justine.

More posts by this contributor

After a breakout year, looking ahead to the future of podcasting

What VidCon means for the future of social media platforms

Justine Moore Contributor

Share on Twitter

Justine Moore is a venture investor at CRV and co-founded Cardinal Ventures alongside her sister, Olivia.

More posts by this contributor

After a breakout year, looking ahead to the future of podcasting

What VidCon means for the future of social media platforms

The writing is on the wall for Facebook — the platform is losing market share, fast, among young users.

Edison Research’s Infinite Dial study from early 2019 showed that 62% of U.S. 12–34 year-olds are Facebook users, down from 67% in 2018 and 79% in 2017. This decrease is particularly notable as 35–54 and 55+ age group usage has been constant or even increased.

There are many theories behind Facebook’s fall from grace among millennials and Gen Zers — an influx of older users that change the dynamics of the platform, competition from more mobile and visual-friendly platforms like Instagram and Snapchat, and the company’s privacy scandals are just a few.

We surveyed 115 of our Accelerated campus ambassadors to learn more about how they’re using Facebook today. It’s worth noting that this group skews older Gen Z (ages 18–24); we suspect you’d get different results if you surveyed younger teens.

Overall penetration is still high, as 99% of our respondents have Facebook accounts. And most aren’t abandoning the platform entirely — 59% are on Facebook every day, and another 32% are on weekly. Daily Facebook usage is much lower than Instagram, however, which 82% of our respondents use daily and 7% use weekly.

Data from our scouts also confirms that the shift in usage in the last few years is particularly dramatic among younger users. 66% report using Facebook less frequently over the past two years, compared to 11% who use it more frequently (23% say their usage hasn’t changed).

What’s most interesting is what college students are using Facebook for. When we were in high school and college in the early/mid 2010s, our friends used Facebook to post (broadcast) content via their status, photos, and posts on friends’ Walls. Today, very few students use Facebook to “broadcast” content. Only 5% of our respondents say they regularly upload photos to Facebook, 4% post on friends’ Walls, and 3.5% post content to the Newsfeed (statuses). What are they doing instead?

from Facebook – TechCrunch https://ift.tt/34alL5i via IFTTT

0 notes

Photo

Skoda Kodiaq Scout launched in India for Rs. 33.99 lakhs. . Placed between Style variant and L&K variant of the Kodiaq range. . Most distinct feature is a off-road mode and tyre pressure monitoring system first to offered in a kodiaq. . It also has some styling tweaks like black cladding with silver inserts in it. . Gets panoramic sunroof,9.2-inch touchscreen infotainment system with Apple CarPlay and Android Auto,Canton Sound System, 3 zone climate control and more. . Powered by 2.0 litre diesel producing 150 Bhp/340 Nm of torque mated to a 7 speed DSG auto gearbox. . Will rival Toyota Fortuner,Ford Endeavour,Honda CR-V, Mahindra Alturas G4, VW tiguan and Isuzu MU-X. . #carholic #carholic_in #isuzu #mux #fortuner #toyota #ford #endeavour #hondacrv #crv #mahindra #alturasg4 #auto #automoblies #automotive #vehicles #czech🇨🇿republic https://www.instagram.com/p/B3FSvm1HLov/?igshid=1xdip17arr99g

#carholic#carholic_in#isuzu#mux#fortuner#toyota#ford#endeavour#hondacrv#crv#mahindra#alturasg4#auto#automoblies#automotive#vehicles#czech🇨🇿republic

0 notes

Text

How students are founding, funding and joining startups

There has never been a better time to start, join, or fund a startup as a student.

Young founders who want to start companies while still in school have an increasing number of resources to tap into that exist just for them. Students that want to learn how to build companies can apply to an increasing number of fast-track programs that allow them to gain valuable early stage operating experience. The energy around student entrepreneurship today is incredible. I’ve been immersed in this community as an investor and adviser for some time now, and to say the least, I’m continually blown away by what the next generation of innovators are dreaming up (from Analytical Space’s global data relay service for satellites to Brooklinen’s reinvention of the luxury bed).

Bill Gates in 1973

First, let’s look at student founders and why they’re important. Student entrepreneurs have long been an important foundation of the startup ecosystem. Many students wrestle with how best to learn while in school —some students learn best through lectures, while more entrepreneurial students like author Julian Docks find it best to leave the classroom altogether and build a business instead.

Indeed, some of our most iconic founders are Microsoft’s Bill Gates and Facebook’s Mark Zuckerberg, both student entrepreneurs who launched their startups at Harvard and then dropped out to build their companies into major tech giants. A sample of the current generation of marquee companies founded on college campuses include Snap at Stanford ($29B valuation at IPO), Warby Parker at Wharton (~$2B valuation), Rent The Runway at HBS (~$1B valuation), and Brex at Stanford (~$1B valuation).

Some of today’s most celebrated tech leaders built their first ventures while in school — even if some student startups fail, the critical first-time founder experience is an invaluable education in how to build great companies. Perhaps the best example of this that I could find is Drew Houston at Dropbox (~$9B valuation at IPO), who previously founded an edtech startup at MIT that, in his words, provided a: “great introduction to the wild world of starting companies.”

Student founders are everywhere, but the highest concentration of venture-backed student founders can be found at just 5 universities. Based on venture fund portfolio data from the last six years, Harvard, Stanford, MIT, UPenn, and UC Berkeley have produced the highest number of student-founded companies that went on to raise $1 million or more in seed capital. Some prospective students will even enroll in a university specifically for its reputation of churning out great entrepreneurs. This is not to say that great companies are not being built out of other universities, nor does it mean students can’t find resources outside a select number of schools. As you can see later in this essay, there are number of new ways students all around the country can tap into the startup ecosystem. For further reading, Pitchbook produces an excellent report each year that tracks where all entrepreneurs earned their undergraduate degrees.

Student founders have a number of new media resources to turn to. New email newsletters focused on student entrepreneurship like Justine and Olivia Moore’s Accelerated and Kyle Robertson’s StartU offer new channels for young founders to reach large audiences. Justine and Olivia, the minds behind Accelerated, have a lot of street cred— they launched Stanford’s on-campus incubator Cardinal Ventures before landing as investors at CRV.

StartU goes above and beyond to be a resource to founders they profile by helping to connect them with investors (they’re active at 12 universities), and run a podcast hosted by their Editor-in-Chief Johnny Hammond that is top notch. My bet is that traditional media will point a larger spotlight at student entrepreneurship going forward.

New pools of capital are also available that are specifically for student founders. There are four categories that I call special attention to:

University-affiliated accelerator programs

University-affiliated angel networks

Professional venture funds investing at specific universities

Professional venture funds investing through student scouts

While it is difficult to estimate exactly how much capital has been deployed by each, there is no denying that there has been an explosion in the number of programs that address the pre-seed phase. A sample of the programs available at the Top 5 universities listed above are in the graphic below — listing every resource at every university would be difficult as there are so many.

One alumni-centric fund to highlight is the Alumni Ventures Group, which pools LP capital from alumni at specific universities, then launches individual venture funds that invest in founders connected to those universities (e.g. students, alumni, professors, etc.). Through this model, they’ve deployed more than $200M per year! Another highlight has been student scout programs — which vary in the degree of autonomy and capital invested — but essentially empower students to identify and fund high-potential student-founded companies for their parent venture funds. On campuses with a large concentration of student founders, it is not uncommon to find student scouts from as many as 12 different venture funds actively sourcing deals (as is made clear from David Tao’s analysis at UC Berkeley).

Investment Team at Rough Draft Ventures

In my opinion, the two institutions that have the most expansive line of sight into the student entrepreneurship landscape are First Round’s Dorm Room Fund and General Catalyst’s Rough Draft Ventures. Since 2012, these two funds have operated a nationwide network of student scouts that have invested $20K — $25K checks into companies founded by student entrepreneurs at 40+ universities. “Scout” is a loose term and doesn’t do it justice — the student investors at these two funds are almost entirely autonomous, have built their own platform services to support portfolio companies, and have launched programs to incubate companies built by female founders and founders of color. Another student-run fund worth noting that has reach beyond a single region is Contrary Capital, which raised $2.2M last year. They do a particularly great job of reaching founders at a diverse set of schools — their network of student scouts are active at 45 universities and have spoken with 3,000 founders per year since getting started. Contrary is also testing out what they describe as a “YC for university-based founders”. In their first cohort, 100% of their companies raised a pre-seed round after Contrary’s demo day. Another even more recently launched organization is The MBA Fund, which caters to founders from the business schools at Harvard, Wharton, and Stanford. While super exciting, these two funds only launched very recently and manage portfolios that are not large enough for analysis just yet.

Over the last few months, I’ve collected and cross-referenced publicly available data from both Dorm Room Fund and Rough Draft Ventures to assess the state of student entrepreneurship in the United States. Companies were pulled from each fund’s portfolio page, then checked against Crunchbase for amount raised, accelerator participation, and other metrics. If you’d like to sift through the data yourself, feel free to ping me — my email can be found at the end of this article. To be clear, this does not represent the full scope of investment activity at either fund — many companies in the portfolios of both funds remain confidential and unlisted for good reasons (e.g. startups working in stealth). In fact, the In addition, data for early stage companies is notoriously variable in quality, even with Crunchbase. You should read these insights as directional only, given the debatable confidence interval. Still, the data is still interesting and give good indicators for the health of student entrepreneurship today.

Dorm Room Fund and Rough Draft Ventures have invested in 230+ student-founded companies that have gone on to raise nearly $1 billion in follow on capital. These funds have invested in a diverse range of companies, from govtech (e.g. mark43, raised $77M+ and FiscalNote, raised $50M+) to space tech (e.g. Capella Space, raised ~$34M). Several portfolio companies have had successful exits, such as crypto startup Distributed Systems (acquired by Coinbase) and social networking startup tbh (acquired by Facebook). While it is too early to evaluate the success of these funds on a returns basis (both were launched just 6 years ago), we can get a sense of success by evaluating the rates by which portfolio companies raise additional capital. Taken together, 34% of DRF and RDV companies in our data set have raised $1 million or more in seed capital. For a rough comparison, CB Insights cites that 40% of YC companies and 48% of Techstars companies successfully raise follow on capital (defined as anything above $750K). Certainly within the ballpark!

Source: Crunchbase

Dorm Room Fund and Rough Draft Ventures companies in our data set have an 11–12% rate of survivorship to Series A. As a benchmark, a previous partner at Y Combinator shared that 20% of their accelerator companies raise Series A capital (YC declined to share the official figure, but it’s likely a stat that is increasing given their new Series A support programs. For further reading, check out YC’s reflection on what they’ve learned about helping their companies raise Series A funding). In any case, DRF and RDV’s numbers should be taken with a grain of salt, as the average age of their portfolio companies is very low and raising Series A rounds generally takes time. Ultimately, it is clear that DRF and RDV are active in the earlier (and riskier) phases of the startup journey.

Dorm Room Fund and Rough Draft Ventures send 18–25% of their portfolio companies to YCombinator or Techstars. Given YC’s 1.5% acceptance rate as reported in Fortune, this is quite significant! Internally, these two funds offer founders an opportunity to participate in mock interviews with YC and Techstars alumni, as well as tap into their communities for peer support (e.g. advice on pitch decks and application content). As a result, Dorm Room Fund and Rough Draft Ventures regularly send cohorts of founders to these prestigious accelerator programs. Based on our data set, 17–20% of DRF and RDV companies that attend one of these accelerators end up raising Series A venture financing.

Source: Crunchbase

Dorm Room Fund and Rough Draft Ventures don’t invest in the same companies. When we take a deeper look at one specific ecosystem where these two funds have been equally active over the last several years — Boston — we actually see that the degree of investment overlap for companies that have raised $1M+ seed rounds sits at 26%. This suggests that these funds are either a) seeing different dealflow or b) have widely different investment decision-making.

Source: Crunchbase

Dorm Room Fund and Rough Draft Ventures should not just be measured by a returns-basis today, as it’s too early. I hypothesize that DRF and RDV are actually encouraging more entrepreneurial activity in the ecosystem (more students decide to start companies while in school) as well as improving long-term founder outcomes amongst students they touch (portfolio founders build bigger and more successful companies later in their careers). As more students start companies, there’s likely a positive feedback loop where there’s increasing peer pressure to start a company or lean on friends for founder support (e.g. feedback, advice, etc).Both of these subjects warrant additional study, but it’s likely too early to conduct these analyses today.

Dorm Room Fund and Rough Draft Ventures have impressive alumni that you will want to track. 1 in 4 alumni partners are founders, and 29% of these founder alumni have raised $1M+ seed rounds for their companies. These include Anjney Midha’s augmented reality startup Ubiquity6 (raised $37M+), Shubham Goel’s investor-focused CRM startup Affinity (raised $13M+), Bruno Faviero’s AI security software startup Synapse (raised $6M+), Amanda Bradford’s dating app The League (raised $2M+), and Dillon Chen’s blockchain startup Commonwealth Labs (raised $1.7M). It makes sense to me that alumni from these communities that decide to start companies have an advantage over their peers — they know what good companies look like and they can tap into powerful networks of young talent / experienced investors.

Beyond Dorm Room Fund and Rough Draft Ventures, some venture capital firms focus on incubation for student-founded startups. Credit should first be given to Lightspeed for producing the amazing Summer Fellows bootcamp experience for promising student founders — after all, Pinterest was built there! Jeremy Liew gives a good overview of the program through his sit-down interview with Afterbox’s Zack Banack. Based on a study they conducted last year, 40% of Lightspeed Summer Fellows alumni are currently active founders. Pear Ventures also has an impressive summer incubator program where 85% of its companies successfully complete a fundraise. Index Ventures is the latest to build an incubator program for student founders, and even accepts founders who want to work on an idea part-time while completing a summer internship.

Let’s now look at students who want to join a startup before founding one. Venture funds have historically looked to tap students for talent, and are expanding the engagement lifecycle. The longest running programs include Kleiner Perkins’ class="m_1196721721246259147gmail-markup--strong m_1196721721246259147gmail-markup--p-strong"> KP Fellows and True Ventures’ TEC Fellows, which focus on placing the next generation’s most promising product managers, engineers, and designers into the portfolio companies of their parent venture funds.

There’s also the secretive Greylock X, a referral-based hand-picked group of the best student engineers in Silicon Valley (among their impressive alumni are founders like Yasyf Mohamedali and Joe Kahn, the folks behind First Round-backed Karuna Health). As these programs have matured, these firms have recognized the long-run value of engaging the alumni of their programs.

More and more alumni are “coming back” to the parent funds as entrepreneurs, like KP Fellow Dylan Field of Figma (and is also hosting a KP Fellow, closing a full circle loop!). Based on their latest data, 10% of KP Fellows alumni are founders — that’s a lot given the fact that their community has grown to 500! This helps explain why Kleiner Perkins has created a structured path to receive $100K in seed funding to companies founded by KP Fellow alumni. It looks like venture funds are beginning to invest in student programs as part of their larger platform strategy, which can have a real impact over the long term (for further reading, see this analysis of platform strategy outcomes by USV’s Bethany Crystal).

KP Fellows in San Francisco

Venture funds are doubling down on student talent engagement — in just the last 18 months, 4 funds have launched student programs. It’s encouraging to see new funds follow in the footsteps of First Round, General Catalyst, Kleiner Perkins, Greylock, and Lightspeed. In 2017, Accel launched their Accel Scholars program to engage top talent at UC Berkeley and Stanford. In 2018, we saw 8VC Fellows, NEA Next, and Floodgate Insiders all launch, targeting elite universities outside of Silicon Valley. Y Combinator implemented Early Decision, which allows student founders to apply one batch early to help with academic scheduling. Most recently, at the start of 2019, First Round launched the Graduate Fund (staffed by Dorm Room Fund alumni) to invest in founders who are recent graduates or young alumni.

Given more time, I’d love to study the rates by which student founders start another company following investments from student scout funds, as well as whether or not they’re more successful in those ventures. In any case, this is an escalation in the number of venture funds that have started to get serious about engaging students — both for talent and dealflow.

Student entrepreneurship 2.0 is here. There are more structured paths to success for students interested in starting or joining a startup. Founders have more opportunities to garner press, seek advice, raise capital, and more. Venture funds are increasingly leveraging students to help improve the three F’s — finding, funding, and fixing. In my personal view, I believe it is becoming more and more important for venture funds to gain mindshare amongst the next generation of founders and operators early, while still in school.

I can’t wait to see what’s next for student entrepreneurship in 2019. If you’re interested in digging in deeper (I’m human — I’m sure I haven’t covered everything related to student entrepreneurship here) or learning more about how you can start or join a startup while still in school, shoot me a note at [email protected]. A massive thanks to Phin Barnes, Rei Wang, Chauncey Hamilton, Peter Boyce, Natalie Bartlett, Denali Tietjen, Eric Tarczynski, Will Robbins, Jasmine Kriston, Alicia Lau, Johnny Hammond, Bruno Faviero, Athena Kan, Shohini Gupta, Alex Immerman, Albert Dong, Phillip Hua-Bon-Hoa, and Trevor Sookraj for your incredible encouragement, support, and insight during the writing of this essay.

[Telegram Channel | Original Article ]

0 notes