#credit fha loan score

Explore tagged Tumblr posts

Text

How to Qualify For a Kentucky FHA Mortgage Loan

How to Qualify For a Kentucky FHA Mortgage Loan

Kentucky FHA Loan Requirements for 2023

View On WordPress

#2021 kentucy fha loan guide#580 credit score loan FHA KY#580 fico score FHA KY#chapter 13 fha mortgage#collections fha mortgage#condo fha kentucky#credit fha loan score#Credit score#difference in usda vs fha in kentucky#FHA#fha $100 down mortgage#fha anti-flipping 90 day waiver policy#fha appraisal requirements#Kentucky#Kentucky Housing Corporation#Loan#Mortgage loan#Refinancing#Zero down home loans

0 notes

Text

For people wanting to own a house in country places, the USDA Home Loan program is like an awesome chance that only opens for them. It helps such folks reach their dream of becoming homeowners. This blog focuses on key aspects, benefits, and requirements for securing a USDA home loan, aiding home buyers in rural or small areas.

#property#real estate#united states#gustancho associates#gca mortgage#usa#va loans#fha loan#first time home buyer#bad credit score#usda loans#fha loans

2 notes

·

View notes

Text

#FHA loans#Florida#Homeownership#Mortgage#First-time buyers#Real estate#Credit score#Down payment#Loan process

0 notes

Text

Real Estate Financing Trends:

Market Trends: Rising Interest Rates: The Federal Reserve’s recent interest rate increases have significantly impacted mortgage rates, making borrowing more expensive for homebuyers. This has led to a decrease in loan applications and refinancing activity. (Source: Federal Reserve, https://www.federalreserve.gov/) Tightening Lending Standards: Lenders are becoming more cautious, making it…

View On WordPress

0 notes

Text

Official Presentation VA Mortgage Corp

We offer a wide variety of mortgage products, including conventional loans, FHA loans, VA loans, USDA loans, and jumbo loans. We also offer a variety of mortgage services, including pre-qualification and loan origination.

2513 Squadron Court,Unit 112,Virginia Beach‚VA 23453

(757) 580–0060

#best mortgage rates virginia#cash out mortgage virginia#fha loans virginia#first time home buyer virginia#low credit score mortgage virginia.

0 notes

Text

Investing In Hard Money Loans

Consider investing in hard money loans if you want to invest in real estate but don't want to purchase the property yourself. Real estate investors frequently employ hard money loans, which have a short duration, to buy and remodel buildings. You can finance these loans as an investor and profit from your financial commitment.

Instead of traditional banks, private lenders or tiny financial organizations generally make hard money loans. These loans frequently have higher interest rates and costs since they are thought to be riskier than conventional mortgages. They do, however, also present investors with greater potential rewards.

A few important criteria need to be taken into account while investing in hard money loans. You must first carefully assess both the borrower and the property they are acquiring. This may entail looking at the borrower's income, assets, and credit history in addition to performing an appraisal and property inspection. Both the borrower's ability to repay the loan and the property's potential to produce a sufficient income or appreciation in value over time must be considered.

The potential risks connected with investing in hard money loans are another crucial factor to take into account. There is a higher chance of default with these loans than with standard mortgages because they are short-term and frequently used to buy houses that need extensive improvements. As an investor, you must carefully weigh the advantages and dangers associated with each loan opportunity to make sure you are comfortable with the level of risk.

Investing in hard money loans can be a profitable choice for real estate investors despite the possible hazards. You can get a good return on your investment and contribute to the expansion of the real estate sector by financing these loans. As with any investment, it's crucial to do your homework, carefully consider each opportunity, and collaborate with reliable partners in order to make decisions that are in line with your overall investment objectives.

#mortgages#gustancho associates#fha loans#bad credit score#va loans#jumbo loans#money#loans#real estate#home buyers#investors

1 note

·

View note

Text

Explaining the housing woes to one of my coworkers:

"Both my grandparents died within the span of a year, leaving me with enough for a down payment, and I've been extra conscious about my credit score for the past ten years, so my credit score is excellent. But the bank won't let me have a loan because I don't make enough per year."

Him: "yeah, that debt to income ratio is a real killer."

Me: "...I have zero debt."

Him: "...? Let me sort this out. You say you have the down payment, which is the hard part."

Me: "yeah."

Him: "and you have agood credit score which is the other hard part."

Me: "yeah."

Him: "and zero debt."

Me: "none."

Him: "... how much did they say you have to make?"

Me: "30k a year to qualify for fha loans."

Him: "you got all the hard parts done and they STILL won't let you have a mortgage loan now"

Me: "seems it."

Him: "...it's way worse than I thought it was."

Me: "yup!"

435 notes

·

View notes

Text

Bad Credit Mortgages Explained: How Mortgage Brokers Can Assist You in Finding the Right Loan

Having bad credit can make securing a mortgage seem daunting, but it doesn’t mean homeownership is out of reach. While traditional lenders may be hesitant to approve a loan for someone with poor credit, there are still options available. A mortgage broker can be your best ally in navigating the world of bad credit mortgages, helping you find the right loan that aligns with your financial situation. In this article, we’ll explain what bad credit mortgages are and how mortgage brokers can assist you in securing one.

What Is a Bad Credit Mortgage?

A bad credit mortgage, often referred to as a subprime mortgage, is a home loan specifically designed for individuals with a low credit score or poor credit history. Lenders view applicants with low credit scores as higher-risk borrowers, which can make it harder to qualify for a standard loan. Bad credit mortgages typically come with higher interest rates and stricter terms compared to conventional mortgages, reflecting the added risk to the lender.

Factors That Affect Your Credit Score

Before diving into bad credit mortgages, it’s important to understand what affects your credit score:

- Payment History: Missed or late payments can significantly lower your score.

- Credit Utilization: How much of your available credit you’re using can impact your score.

- Length of Credit History: The longer you’ve responsibly managed credit, the better.

- Types of Credit: A mix of different types of credit (e.g., credit cards, loans) can boost your score.

- Recent Inquiries: Applying for too much credit in a short time can lower your score.

For those with a score below 620, finding a conventional mortgage may be difficult, but this is where a bad credit mortgage becomes an option.

How Mortgage Brokers Can Help with Bad Credit Mortgages

1. Access to Specialized Lenders

Mortgage brokers have access to a wide network of lenders, including those that specialize in bad credit mortgages. Unlike going directly to a single bank, which may reject your application based on credit alone, brokers can connect you with lenders who are more flexible and willing to work with low credit scores. This increases your chances of finding a suitable loan.

2. Expert Guidance and Tailored Solutions

A mortgage broker can assess your overall financial situation, not just your credit score. They’ll take into account factors like your income, employment history, and any assets you might have. From there, they can recommend loan options that fit your circumstances, whether it's an FHA loan, a VA loan (if applicable), or another type of loan designed for borrowers with lower credit.

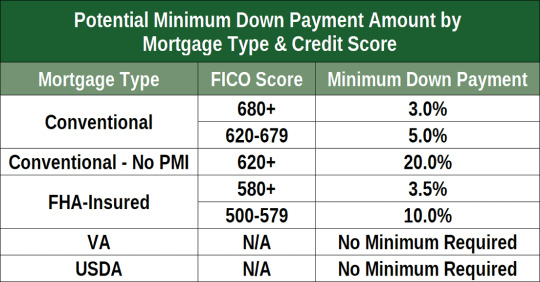

For example, FHA loans are government-backed mortgages that are more forgiving of credit issues, allowing scores as low as 500 (with a higher down payment). A broker familiar with these options can guide you through the application process.

3. Negotiating Terms

Brokers often have relationships with lenders, which can help in negotiating better terms, even with bad credit. While your interest rate may still be higher than that of a borrower with excellent credit, a broker can work to find you a competitive rate and favorable loan conditions.

4. Saving Time and Stress

Applying for a mortgage when you have bad credit can be overwhelming. You might feel unsure about which lenders will approve you or what documentation is needed. A mortgage broker can streamline this process by handling the research, paperwork, and communication with lenders on your behalf. This saves you time and reduces stress by letting the broker do the legwork.

5. Improving Your Credit Profile

Mortgage brokers don’t just help you secure a loan—they can also provide valuable advice on improving your credit. If you’re not in a rush to buy, they may suggest actions to boost your credit score, such as paying off specific debts or correcting errors on your credit report. Improving your credit score, even slightly, can help you secure better mortgage terms in the future.

6. Guidance Through the Approval Process

Getting approved for a bad credit mortgage often requires more documentation and proof of financial stability. Mortgage brokers can help you gather and organize these documents, making sure your application is as strong as possible. They’ll ensure you meet the lender’s requirements, increasing your chances of approval.

What to Expect with a Bad Credit Mortgage

While a bad credit mortgage can help you achieve homeownership, it’s important to understand the trade-offs involved:

- Higher Interest Rates: Expect to pay more in interest over the life of the loan compared to borrowers with good credit. A mortgage broker can help minimize this by finding the best available rate for your situation.

- Larger Down Payments: Some lenders may require a larger down payment to offset the risk. A mortgage broker can explain the minimum down payment requirements for different types of loans, like FHA or subprime mortgages.

- More Fees: Bad credit mortgages may come with higher fees, including mortgage insurance premiums or origination fees. A broker can help you understand these costs upfront and compare them across different lenders.

Can You Refinance a Bad Credit Mortgage?

One of the advantages of working with a mortgage broker is that they can help you develop a long-term strategy. If you secure a bad credit mortgage now but improve your credit score later, refinancing into a better mortgage with a lower interest rate may become an option. Mortgage brokers can monitor your situation and guide you through the refinancing process when the time is right.

Conclusion

Having bad credit doesn’t mean you have to give up on your dream of homeownership. With the help of a mortgage broker, you can find a loan that suits your financial situation, even with a lower credit score. Brokers have the expertise and connections to find lenders who are more flexible and willing to work with you. They can simplify the process, negotiate better terms, and provide guidance to improve your financial future. If you’re concerned about bad credit, reaching out to a mortgage broker can be the first step toward owning your home.

3 notes

·

View notes

Text

If you want to be a home owner please look into local assistance for first time home buyers.

In the US there are special loans for first time home buyers as well as assistance if you want to live in a rural area ( FHA and USDA loans). Special loans are more flexible with minimum down payment and credit score minimums as well as don't have some requirements that Conventional Loans have.

Ie one thing that helped us is Conventional loans require you to work full time consistently in the same field for 2 years. FHA only requires 6 months of employment and a letter explaining your history and to have an income that can afford the loan. I didn't have the work history needed for a Convention Loan.

The Loans, Grants, and Assistance vary state to state and you may have other options if you live in a major city. (Our second grant was only for our area.)

There also may be government backed housing assistance agencies which will help you with going through the process for free or a low payment (our state requires you to do some education with them for the FHA loan, and it was free).

My partner and I recently bought a house with a FHA Loan/Grant and a First Homeowners Grant from our lender (which has the qualifications of being a low income area, low income, as well as first homeowners). We were able to forgo any down payment or closing costs and will be paying less monthly costs then the rentals we were considering month to month.

We still had to pay some things. We paid for inspection, appraisal, insurance upfront, refundable deposit and 1000 dollars at closing.

FHA loans also have the added cost of loan insurance for month to month costs, but overall is still cheaper then renting so 🤷 I am not complaining.

Another thing to expect as a lower income buyer is you likely will only be able to afford fixer uppers so expect to have a lot of initial repair costs as well as maintaining your home over time. There is assistance for those things as well but be careful of loan scams when looking for those.

If you do consider going this route, make sure to be thorough with inspections and negotiate with what you find. It is a lot of upfront costs for something you may not go with, but can save you thousands in the long run. We needed to change out knob and tube in our house and since we found it in the inspection we were able to negotiate 12k from the sellers to fix it rather than paying that out of our pockets later. We also saved over a thousand by getting them to service the neglected HVAC. You're not likely to get a seller to fix everything, but you can save a lot with negotiating.

More homeowners can stabilize communities and help rent to not skyrocket uncontrollably. Especially if the homeowners arent nimbys who only care about their property values and instead actually care about their renting neighbors. Homeowners also have more power in your local politics, so taking advantage of these programs and getting more power to disadvantaged people and communities is so important.

#new homeowner#my partner and o have been yapping about this to everyone who will listen because fuck landlords and our city is gentrifying at a terrifyin#pace and the more homeowners the better#low income homeowners#not rich ppl moving in and buying the shiny new luxury housing that was built on demolished 100 yr old rowhomes#i want my neighbors to be safe from eviction and have the equity for retirement#for full disclosure i make 15.50 and my partner makes 17 an hr in a major city#we have good credit but it took a bit of a hit when applying to rentals#i dont know abt this stuff internationally#but theres likely simular stuff

3 notes

·

View notes

Text

Explore FHA loans Florida and discover trusted mortgage lenders to make your homebuying journey a reality. FHA loans offer low down payment options and flexible credit qualifications, making them ideal for first-time buyers and those with varying credit scores. Connect with experienced mortgage lenders in Florida who specialize in FHA loans, guiding you through the application process and helping you secure a home loan tailored to your needs. Begin your path to homeownership today with the support of FHA loans and reputable lenders.

#fha loans florida#mortgage lenders in florida#fha loans for first time buyers#FHA loan for new construction

2 notes

·

View notes

Text

What is the minimum credit score I need to qualify for a Kentucky mortgage currently?

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan?

View On WordPress

#580 credit score loan FHA KY#bad credit va mortgage ky#credit#credit fha loan score#credit karma#Credit Report#Credit Reports credit score Credit Score First Time Home Buyer Louisville Kentucky KHC Credit Scores Credit Scores and Credit Report#Credit score#credit score for a kentucky mortgage loan approval#credit score kentucky loan#fha kentucky bad credit#Kentucky#Kentucky Housing Corporation#kentucky mortgage loan with bad credit#Loan#Louisville Kentucky#Mortgage loan#Refinancing#VA loan#Zero down home loans

0 notes

Text

Jumbo Mortgages

Jumbo Mortgages are a type of home loan used to finance high-value real estate properties that exceed the loan limits set by government-sponsored enterprises.These loans are designed for purchasing or refinancing upscale homes in areas with high property values. Jumbo mortgages are a financing option for individuals looking to purchase high-value homes, but they come with stricter requirements and potentially higher costs. Borrowers should carefully evaluate their financial situation and work with experienced mortgage professionals to find the best jumbo mortgage lender and terms that suit their specific needs.

#property#real estate#united states#usa#gustancho associates#gca mortgage#va loans#first time home buyer#fha loan#bad credit score

2 notes

·

View notes

Text

First-time homebuying is a thrilling milestone, but it can be overwhelming without a comprehensive checklist for a successful journey. Here's a Checklist to help you secure your dream home, covering everything from assessing your finances to closing day preparations.

#refinances#mortgage#mortgages#loans#fha loans#va loans#real estate#gustancho#united states#usa#first time homebuyers#bad credit score

0 notes

Text

“How to Choose the Right Financing Options When Buying Property in Scottsdale”

Introduction

Buying property is an exciting journey, especially in a vibrant locale like Scottsdale, Arizona. Renowned for its stunning desert landscapes and luxurious lifestyle, Scottsdale attracts homebuyers from all walks of life. However, navigating the financing options available can be as daunting as picking the right property. Whether you're looking to purchase a cozy condo or a sprawling estate, understanding how to choose the right financing options when buying property in Scottsdale is crucial.

In this extensive guide, we'll explore everything you need to know about financing your dream home. From understanding various mortgage types to working with a seasoned realtor in Scottsdale, AZ, we'll cover it all. Let’s dive into the world of real estate financing and uncover what you need to know!

How to Choose the Right Financing Options When Buying Property in Scottsdale

When considering how to choose the right financing options when buying property in Scottsdale, it's essential to evaluate your financial situation, credit score, and long-term goals. The perfect financing realtor scottsdale az option isn't just about securing a low-interest rate; it also involves understanding your needs realtor listings nearby and preferences.

Understanding Your Financial Situation

Assess Your Budget

Before you start browsing listings with your Realtor Scottsdale AZ, it's wise to assess your budget comprehensively. Calculate all potential costs associated with property ownership—mortgage payments, property taxes, homeowners insurance, and maintenance costs.

Check Your Credit Score

A crucial factor that lenders consider when approving loans is your credit score. A higher score can lead to better interest rates and favorable loan terms. Regularly checking your credit report allows you to address any discrepancies before applying for a mortgage.

Determine Your Financing Needs What Type of Property Are You Buying?

The type of property can greatly influence your financing options. Here are some common types:

youtube

Single-family homes Condominiums Luxury estates Investment properties

Understanding which category your desired property falls into helps narrow down suitable financing options.

What Is Your Purchase Timeline?

Are you looking to buy soon or just gathering information for future plans? If you're ready to purchase immediately, you'll want access to quicker funding solutions.

The Different Types of Mortgages Available

When exploring how to choose the right financing options when buying property in Scottsdale, familiarize yourself with various mortgage types:

Fixed-rate Mortgages

This traditional mortgage provides stability through fixed monthly payments over time. It's ideal if you plan on staying long-term in one location.

Adjustable-rate Mortgages (ARMs)

ARMs offer lower initial rates but may fluctuate after a set period. This option suits buyers who expect their income to grow or plan on selling within a few years.

FHA Loans

Backed by the Federal Housing Administration (FHA), these loans cater primarily to first-time buyers with lo

0 notes

Text

Mortgage Mondays with John V. Pinto, Realtor: Mastering Your Mortgage Moves!

Welcome to this week's edition of "Mortgage Mondays"!

Today, we're diving into the world of FHA financing for single-family homes in high-cost areas of California.

Learn about the minimum down payments, maximum loan amounts (up to $1,089,300!), required credit scores, and how to manage your debt-to-income ratios effectively.

We’ll also discuss how to combine FHA financing with valuable down payment and closing cost assistance programs, making your journey to homeownership more accessible.

Whether you're a first-time buyer or looking to upgrade, this information is crucial for making informed decisions.

Don't miss out on the insights shared in my FHA podcast episode! [Listen Here]

https://open.spotify.com/episode/1PC5SivM3fzCJh7xv2TwLy?si=qB9h7-ZcSfqd3zOZS-2vuA&context=spotify%3Ashow%3A7dYomdtaHzy5HDedeZIE1k

Ready to take the next step on your path to homeownership?

DM me at 408-829-4141, and let's financially model and storyboard your successful road to owning your dream home! 🏡✨

#fha #downpaymentassistance #closingcostsassistance

#1sttimehomebuyers

#realtortips

#JohnVPintoRealtor

#buyersbroker

0 notes

Text

From Application to Closing: A Complete Timeline for FHA Loans

Navigating the home buying process can be daunting, particularly for first-time buyers. One popular option for many individuals and families is the Federal Housing Administration (FHA) loan. These loans are specifically designed to help individuals with lower credit scores and financial limitations achieve their dream of homeownership. Understanding the timeline from application to closure of an…

0 notes