#cpafirms

Explore tagged Tumblr posts

Text

Ready to grow your tax filing business? Check out our proven strategies to attract more clients during tax season and build lasting relationships!

Visit us for more info:👉 🌐 www.varundigitalmedia.com 👉 📧 [email protected] 👉 📲 (+1) 877-768-2786

#taxseason#digitalmarketing#strategies#taxfiling#cpa#cpafirms#cpamarketing#targetedads#paidadsforcpa#provenstrategies#socialmediamarketing#taxes#tax#accounting#business#smallbusiness#taxpreparer#bookkeeping#taxprofessional#taxrefund#accountant#taxreturn#finance#entrepreneur#taxtips#businessowner#accountingservices#taxation

10 notes

·

View notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

Our innovative service approach has now arrived in Australia, offering you a unique and exceptional experience. Discover a fresh perspective on service excellence that sets us apart from the rest.

#SafebooksGlobalPvtLtd#bookkeeping#bookkeepingservices#outsourcingservices#accountingservices#accountingfirms#taxservices#cpafirms#australia

3 notes

·

View notes

Text

10 tips to help avoid wire fraud scams

CPA firms can protect themselves from falling victim to a wire fraud scheme by taking these actions before, during, and after payment processing.

0 notes

Text

CPA Outsourcing Services: Your Key to Financial Efficiency

#magistralconsulting#cpafirms#financialefficiency#outsourcingservices#financialplanningandanalysis#needforoutsourcing

0 notes

Text

Why CPA need to Outsource Bookkeeping Services?

Read about why CPA need to outsource bookkeeping service to India By Accounting Outsource Hub LLP.

1 note

·

View note

Text

Top Accounting Firms in Toronto: A Comprehensive Guide

Introduction

Introduce the article and the importance of choosing the right accounting firm in Toronto.

Mention the diversity and competitiveness of the Toronto business environment.

Section 1: The Need for a Top Accounting Firm

Explain why individuals and businesses need professional accounting services.

Discuss the benefits of working with a top accounting firm in Toronto.

Section 2: Toronto's Top Accounting Firms

List and introduce the top accounting firms in Toronto.

Provide a brief history and background of each firm.

Section 3: Services Offered

Detail the wide range of services provided by the top accounting firms in Toronto, such as tax planning, audit and assurance, consulting, and more.

Explain how these services cater to different clients' needs.

Section 4: What Sets Them Apart

Highlight the unique strengths and distinguishing features of each accounting firm.

Discuss their areas of expertise, industry specializations, or innovative approaches.

Section 5: Client Testimonials

Share testimonials or success stories from clients who have benefited from the services of these top accounting firms.

Section 6: Factors to Consider When Choosing an Accounting Firm

Offer readers guidance on how to choose the right accounting firm based on their specific needs and priorities.

Discuss factors such as reputation, expertise, client satisfaction, and fees.

Section 7: Case Studies

Provide detailed case studies or examples of businesses or individuals who found the perfect accounting firm and achieved financial success.

Section 8: How to Get in Touch

Provide contact information for each of the top accounting firms.

Include links to their websites or other relevant contact details.

Section 9: Conclusion

Summarize the key points from the article.

Encourage readers to take action in finding the best accounting firm in Toronto for their needs.

Note: Make sure to conduct thorough research on the top accounting firms in Toronto to provide accurate and up-to-date information. Incorporate images, logos, or any additional resources that can enhance the article's comprehensiveness and engagement for your readers.

#TorontoAccounting#TopAccountingFirms#FinancialExperts#TorontoFinance#AccountingServices#AuditAndTax#CPAFirms#FinancialAdvisors#AccountingProfessionals#TaxExperts#FinanceToronto#FinancialConsultants#AccountingConsulting#AccountingSolutions#BusinessFinance#FinancialIndustry#TorontoBusiness#FinanceManagement#TaxSeason#FinancialPlanners

1 note

·

View note

Text

Houston CPA

At JAG CPA & Co., unlock the full potential of your financial endeavors & embark on a journey of financial excellence with the guidance of trusted Houston CPA.

0 notes

Text

There are several challenges that CPA (Certified Public Accountant) firms face.

CPA and accounting firms are facing challenges on many fronts, but we're proud to be here for you. We're #yourAccountingTeam and we're here to help you get through any challenges you may face.

#offshorestaffingsolutions#cpafirms#cpa usa#cpa firm#us cpa course#cpa tacoma wa#offshorestaffing#offshore account no minimum#offshore outsourcing services#offshore accounting#offshore staffing#outsourcingaccounting#outsource accounting#outsourceaccounting#outsource accounting services#outsourcingagency#outsource bookkeeping services#payroll#outsource payroll#accounts receivable

1 note

·

View note

Text

Top CPA Firms in Ajman

Looking for reliable CPA firms in Ajman? Discover the leading accounting and tax professionals who can help your business thrive. From auditing and bookkeeping to corporate tax compliance and VAT advisory, Ajman’s top CPA firms offer tailored solutions to meet your financial needs. Whether you’re a startup, SME, or large enterprise, partnering with a trusted CPA firm ensures accuracy, compliance, and strategic growth. Explore the best CPA services in Ajman and take your business to the next level with expert guidance and support.

1 note

·

View note

Text

💰 How I Made $$$ from Instagram Reels (No Followers Needed!) 🚀

🎥 [Opening Scene – Shocked Face, Showing a Payment Notification] YOU: "Wait… I just made money from an Instagram Reel?! Without a million followers?! 🤯"

🎥 [Cut to You Scrolling Instagram, Looking Disappointed] YOU: "Most people post reels for fun… but I found a way to GET PAID for them!"

🎥 [Quick Cuts – Laptop, Instagram, Affiliate Product] YOU: "3 steps—super simple! Ready?"

📌 Step 1: Pick a Hot Niche! "Think fitness, gadgets, side hustles—stuff people actually WANT!"

📌 Step 2: Use Affiliate Links! "I don’t sell—just recommend cool products in my reels, and when someone buys? Cha-ching! 💰"

📌 Step 3: Call to Action = Cash! "Instead of ‘Follow me,’ I say ‘Link in bio’—that tiny change? Boom! $$$"

🎥 [Flash Earnings Screenshot] YOU: "Made my first $100… then $500! And if I can, so can YOU!"

🎥 [Ending – Big Smile, Pointing to Comments] YOU: "Want me to reveal my exact method? Drop a 🔥 in the comments! Let’s go!"

🔥 Like & Follow for More Money Hacks!

#cpa marketing#local seo#off page seo#seo#affiliate marketing#email marketing#digital marketing#marketing#cpa#cpafirm#make money online#earn money online#money#finances#money problems#old money#income#business#wealth#lifestyle

0 notes

Text

The Benefits of Outsourced Accounting Services for UK Businesses

In today’s fast-paced business environment, companies are constantly looking for ways to save time, reduce costs, and increase operational efficiency. One area where businesses can achieve these goals is accounting. Outsourced accounting services have become increasingly popular among businesses in the UK as they offer a range of advantages that can significantly improve financial operations. In this article, we explore the benefits of outsourcing accounting services and why White Bull can be your ideal outsourced accounting partner.

What is Outsourced Accounting?

Outsourced accounting involves hiring a third-party firm to manage your business's financial tasks, such as bookkeeping, tax filing, payroll processing, and financial reporting. Instead of having an in-house accounting team, businesses can delegate these functions to an experienced accounting partner who handles the complexities of financial management. This allows companies to focus more on their core business activities, rather than dealing with the intricacies of accounting.

Why Outsource Your Accounting Services?

Cost-Effective Solution For many businesses, especially small and medium-sized enterprises (SMEs), hiring a full-time in-house accounting team can be expensive. Outsourcing accounting services allows businesses to access high-quality financial management without the overhead costs. You only pay for the services you need, allowing you to save money in the long run.

Access to Expertise Accounting is a complex field that requires expertise and up-to-date knowledge of tax laws, regulations, and financial best practices. By outsourcing your accounting needs, you gain access to a team of qualified professionals who are experts in financial management. These professionals ensure that your business remains compliant with all regulations and that your financial reports are accurate.

Focus on Core Business Functions Running a business requires constant attention to multiple areas, from marketing and sales to customer service and product development. By outsourcing accounting services, you free up valuable time and resources to focus on what matters most—growing your business. Let experts handle the financial tasks while you concentrate on driving innovation and expanding your operations.

Scalability and Flexibility Outsourced accounting services provide scalability to businesses of all sizes. Whether you need additional support during tax season or require a higher level of financial reporting as your business grows, outsourced providers can adapt to your needs. You can scale the services you use without the need to hire additional full-time employees, which makes outsourced accounting a flexible solution for dynamic businesses.

Improved Financial Reporting and Decision-Making Outsourcing accounting ensures that your financial reports are accurate, up-to-date, and delivered on time. This level of consistency and reliability allows you to make informed business decisions. With access to real-time financial data, business owners and managers can identify trends, monitor cash flow, and plan effectively for the future.

Why Choose White Bull for Outsourced Accounting Services?

At White Bull, we specialize in providing high-quality outsourced accounting services to businesses across the UK. Our experienced team of accountants works closely with clients to understand their unique needs and provide tailored solutions that maximize efficiency and cost-effectiveness.

Some of the services we offer include:

Bookkeeping and Payroll Services

Tax Filing and Preparation

Management Reporting and Financial Statements

Year-End Accounting Services

VAT Returns and Compliance

We also provide advisory services, helping businesses understand their financial position and plan strategically for growth.

At White Bull, we use the latest accounting technology to ensure accuracy and transparency. With a focus on client satisfaction, our team is dedicated to delivering timely, high-quality services that help businesses succeed.

Conclusion

Outsourcing accounting services offers businesses in the UK a range of benefits, from cost savings and scalability to improved accuracy and decision-making. By partnering with a trusted service provider like White Bull, businesses can streamline their financial operations, reduce risks, and ensure compliance with tax laws and financial regulations.

If you’re looking for expert outsourced accounting services that provide value, flexibility, and top-notch quality, visit us at White Bull UK and discover how we can support your business.

Get Started with White Bull Today

Visit White Bull UK and let us take care of your accounting needs while you focus on growing your business.

0 notes

Text

🚨 IRS SLASHES 6,700 JOBS AMID TRUMP'S FEDERAL WORKFORCE PURGE! 🚨

Thousands of IRS employees are being laid off right in the middle of tax season—what does this mean for your tax returns and refunds? Critics warn of major delays, while supporters call it a win for downsizing big government.

👉 Read the full story at NewsLink7.com

#irs#layoffs#newslink7#trump#miami#florida#manhattan#california#gop#orlando#broward#miami beach#ft lauderdale#miami dade#new jersey#new york#tampa florida#tallahassee#manhatten#long island#brooklyn#bronx#chicago#losangeles#san francisco#cpafirm#accounting#texas#homestead#washington

0 notes

Text

Curtailing the ERC to pay for taxpayer benefits

By Roger Russell

An inside look at the Tax Relief for American Families and Workers Act of 2024 as it works its way through Congress.

0 notes

Text

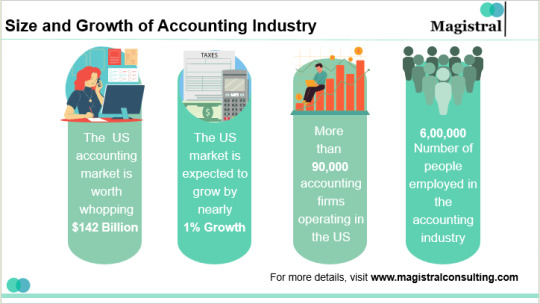

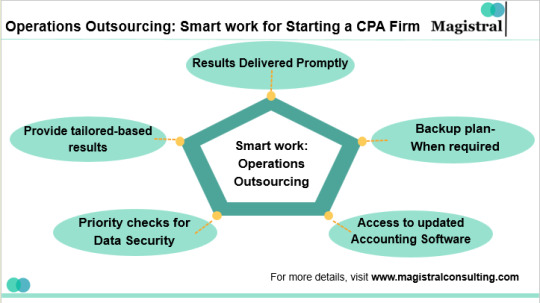

Starting a CPA Firm: Key Strategies for Long-Term Success

#magistralconsulting#accountingindustry#cpafirms#operationsoutsourcing#clientaquisition#datasecurity#leveragenetworks

0 notes

Text

Why CPA Firms Should Outsource Accounting & Bookkeeping Services?

The Outsourcing of accounting services is growing at an exceptional pace and is affecting firms of all sizes, irrespective of industry.

0 notes