#cosmetic dermatology life coach in

Explore tagged Tumblr posts

Text

Laser tattoo removal treatment in pune, ravet, wakad, nigdi, pimpri chinchwad, and akurdi permanent tattoo removal at best cost

Skinarina provide all types of laser tattoo removal treatment, permanent tattoo removal in pune, ravet, wakad, nigdi, pimpri chinchwad, and akurdi at best cost. We provide best tattoo removal specialist doctor in pune, ravet, wakad, nigdi, pimpri chinchwad, and akurdi

#Cosmetic dermatology life coach in pune#cosmetic dermatology life coach in ravet#cosmetic dermatology life coach in wakad#cosmetic dermatology life coach in nigdi#cosmetic dermatology life coach in pimpri chinchwad#cosmetic dermatology life coach in

0 notes

Text

Global Medical Wellness Market Trends, Outlook, Growth, Share, Size & Forecast | 2024 - 2032

The global medical wellness market is undergoing significant expansion, with an estimated market size of USD 1,492.37 billion in 2023. Driven by demographic changes, including the increasing geriatric population, and the rising prevalence of chronic diseases, the sector is poised for substantial growth. It is projected to grow at a CAGR of 14% during the forecast period from 2024 to 2032, reaching a value of USD 4,853.12 billion by 2032. The combination of lifestyle diseases, increased healthcare awareness, and advancements in wellness therapies is propelling the medical wellness sector to new heights.

This post explores the dynamics of the global medical wellness market, breaking down its segments, trends, growth drivers, regional outlook, key players, COVID-19 impact, and much more, to give you a comprehensive understanding of this rapidly growing industry.

What is the Medical Wellness Market?

The medical wellness market refers to the intersection of traditional medical care and wellness practices designed to promote health, prevent disease, and improve quality of life. The market encompasses a broad range of products and services, including preventative healthcare, spa therapies, fitness programs, wellness retreats, alternative medicine, and beauty treatments aimed at maintaining physical and mental well-being.

Medical wellness is distinct from conventional medical care in that it focuses on proactive health maintenance and lifestyle management. It integrates medical expertise with wellness strategies to enhance overall health, with emphasis on improving the quality of life and delaying or preventing the onset of diseases.

Get a Free Sample Report with Table of Contents

Key Market Segments

The medical wellness market can be broadly segmented into several categories, each representing unique aspects of health and wellness. These include:

1. Medical Wellness Services

Therapies and Treatments: Services such as physiotherapy, acupuncture, chiropractic care, and dermatological treatments.

Weight Management and Diet Plans: Customized programs to help individuals manage weight and improve overall health through diet and exercise.

Beauty and Cosmetic Services: Non-surgical treatments such as Botox, fillers, skin rejuvenation therapies, and cosmetic surgeries.

Mental Wellness: Services aimed at reducing stress, anxiety, and depression, including meditation, mindfulness, and therapy.

2. Medical Wellness Products

Nutraceuticals and Supplements: Vitamins, minerals, and dietary supplements aimed at enhancing wellness.

Fitness Equipment and Wearables: Devices such as fitness trackers, wearables for monitoring vital signs, and smart gym equipment.

Cosmetic Products: Skin care products with medical formulations designed for anti-aging, hydration, and skin protection.

3. Medical Wellness Programs

Health Retreats and Wellness Centers: Facilities offering tailored programs combining medical services, fitness routines, spa therapies, and nutrition counseling.

Corporate Wellness Programs: Wellness programs designed for corporate employees to improve health outcomes, increase productivity, and reduce healthcare costs.

At-Home Wellness Solutions: Programs or products aimed at promoting wellness at home, such as virtual fitness coaching or at-home spa kits.

Market Growth and Size

The global medical wellness market size was valued at USD 1,492.37 billion in 2023, driven by the growing adoption of wellness practices and an increasing global focus on healthcare. The market's rapid expansion is supported by several key factors:

Aging Population: The aging demographic, particularly in developed countries, is a major growth driver. The geriatric population requires more comprehensive health management, which often involves both traditional medical care and wellness-focused interventions.

Prevalence of Chronic Diseases: Conditions such as diabetes, cardiovascular diseases, and obesity are on the rise, leading to a higher demand for preventative healthcare and wellness solutions.

Rising Healthcare Awareness: As awareness of holistic health practices grows, people are increasingly seeking medical wellness services and products to improve their quality of life and prevent disease.

Technological Advancements: The integration of technology in wellness practices, including wearable devices, health tracking apps, and telemedicine, has significantly contributed to the market's growth.

Economic Growth and Disposable Income: As disposable income rises, consumers are more willing to invest in wellness products and services that improve their health and well-being.

The market is projected to grow at a CAGR of 14% from 2024 to 2032, reaching a value of USD 4,853.12 billion by 2032. The growth trajectory is expected to be supported by technological innovations, the adoption of wellness-focused medical practices, and the increased demand for personalized healthcare.

Key Market Trends

Several emerging trends are influencing the growth and evolution of the medical wellness market:

1. Integration of Technology in Wellness

The rise of digital health platforms, wearables, and mobile apps is revolutionizing how people manage their health. Devices like fitness trackers, smartwatches, and health-monitoring gadgets have become essential tools for managing personal wellness. Additionally, telemedicine and virtual consultations have become increasingly popular, especially in light of the COVID-19 pandemic.

2. Personalization of Wellness Programs

Consumers are increasingly seeking personalized wellness solutions that are tailored to their individual needs. Advances in genomics, AI, and data analytics are enabling the customization of diet plans, fitness regimes, and health treatments to suit unique genetic profiles and lifestyle factors.

3. Holistic and Preventative Healthcare

The emphasis on preventative care over reactive treatments is driving demand for wellness services that help prevent the onset of diseases. This trend is supported by growing awareness of the benefits of early intervention and regular health assessments, encouraging individuals to adopt more proactive wellness practices.

4. Rise of Wellness Tourism

Wellness tourism is experiencing robust growth, with more people seeking health-focused vacations. Spas, wellness resorts, and health retreats offering integrated wellness packages, medical treatments, fitness regimes, and relaxation therapies are gaining popularity worldwide.

5. Growing Focus on Mental Health

Mental wellness has become a focal point of health and wellness efforts. With rising rates of stress, anxiety, and depression, consumers are increasingly seeking solutions to improve their mental health, including meditation, mindfulness practices, and therapy.

COVID-19 Impact on the Medical Wellness Market

The COVID-19 pandemic has had a significant impact on the medical wellness market, both in terms of challenges and opportunities. On the one hand, the pandemic disrupted wellness services, particularly those related to in-person consultations, spa treatments, and travel. Lockdowns and restrictions led to a slowdown in wellness tourism and limited access to health retreats.

However, on the other hand, the pandemic accelerated the adoption of digital health solutions and virtual wellness services. Consumers became more focused on maintaining their health at home, leading to increased demand for virtual fitness classes, at-home wellness programs, and wearable health devices.

In the post-pandemic world, consumers are more health-conscious and focused on holistic wellness. This has contributed to a sustained interest in medical wellness services, especially in areas like mental health, fitness, and preventative care.

Key Players in the Medical Wellness Market

The global medical wellness market is highly fragmented, with key players spanning across various sectors such as medical spas, fitness technology, and wellness services. Some of the leading companies in the market include:

1. Chiva-Som

A leading wellness and medical spa operator based in Thailand, known for its holistic approach to health and wellness, including medical treatments, fitness programs, and stress management therapies.

2. Kaiser Permanente

A prominent healthcare provider that integrates wellness programs with medical care. Kaiser’s focus on preventative health services and personalized wellness plans has helped it establish a strong presence in the medical wellness market.

3. Vanguard Healthcare Solutions

Vanguard offers a wide range of services, including wellness retreats, health assessments, and preventative care programs. It has a large network of healthcare providers and wellness professionals.

4. Swarovski Wellness

Known for offering luxury wellness experiences, Swarovski Wellness integrates beauty, relaxation, and medical wellness treatments, particularly in high-end spa and retreat settings.

5. Technogym

A leading supplier of fitness equipment, Technogym is well-regarded for its innovations in home fitness solutions, wellness technology, and connected gym equipment.

6. Cenegenics Elite Health

Specialising in age management and preventative healthcare, Cenegenics offers tailored wellness programs designed to enhance longevity and overall well-being, especially among the aging population.

Market Outlook and Future Growth

The outlook for the global medical wellness market is extremely positive, with substantial growth anticipated in the coming years. As mentioned, the market is expected to grow at a CAGR of 14% during the forecast period of 2024 to 2032, reaching a value of USD 4,853.12 billion by 2032.

Factors driving growth include:

Increasing Health Consciousness: As individuals become more aware of the importance of wellness and preventative care, the demand for medical wellness products and services continues to rise.

Technological Advancements: The ongoing innovation in health technologies such as AI, wearables, and telemedicine is expanding the scope of medical wellness, making it more accessible and effective.

Aging Population: The expanding elderly population is likely to continue to drive demand for age-related wellness services, particularly those focusing on chronic disease prevention and management.

FAQs

1. What is the difference between medical wellness and traditional healthcare?

Medical wellness focuses on proactive health management and prevention of diseases through lifestyle changes and wellness practices. Traditional healthcare typically addresses health concerns reactively, providing treatment for existing medical conditions.

2. How has the COVID-19 pandemic impacted the medical wellness industry?

The pandemic accelerated the adoption of digital health solutions and virtual wellness services. While it temporarily hindered in-person services, it has boosted demand for at-home wellness solutions and virtual fitness programs.

3. Who are the key players in the global medical wellness market?

Key players in the market include companies like Chiva-Som, Kaiser Permanente, Vanguard Healthcare Solutions, Technogym, and Cenegenics Elite Health, among others.

4. What factors are driving the growth of the medical wellness market?

Key drivers include the aging population, rising chronic diseases, increasing healthcare awareness, technological advancements, and greater focus on mental wellness.

Related Trending Reports

https://www.expertmarketresearch.com/reports/biomedical-refrigerators-and-freezers-markethttps://www.expertmarketresearch.com/reports/blood-processing-devices-and-consumables-markethttps://www.expertmarketresearch.com/reports/immunodiagnostics-market

0 notes

Text

Medical Courses in India

Medical Courses in India

MEDICAL COURSES

Myeducationwire

April 25, 2019

Share

Top 5 Medical Courses in India

Pursuing a medical courses in India is far tougher than taking a decision to become a doctor. But, hats off to those who pursue their studies with as much as interest as when they were dreaming to become a doctor. Also, the zeal to serve others, the passion to think of other people’s wellness and the drive to come out of comfort zone and look what best you can do for others, so that people can feel every beat of life and make most of it; is not a small thing to have in one’s mind. Similarly when youth is going behind technology, there are few who understand the price of one’s life and opt medical. Because no matter how much wealth a person hoards, it’s just incomparable to health.

Furthermore, the Medical Council of India is the regulatory authority which has laid down rules and regulations to medical education, so that good education standard can be attained by every medical student. There are various medical courses in India that have been running from long, everyone have their own importance, you can choose according to your area of interest. Have a look:

Medical Courses in India:

1. MBBS

:

It is one of the most popular medical courses in India. It’s full form is bachelor of masters and bachelor of surgery. Medical entrance exams are conducted on a National Level and State Level to select suitable medical students for undergraduate medical programs. The MBBS degree holder can run their practice as a physician because they possess good knowledge for every right disease. While the total MBBS duration is 4.5 years academic education + 1 year mandatory internship. Some of the popular entrance exams for MBBS are given below:

AIIMS (All India Institute of Medical Sciences): Most prestigious entrance exam

AIPMT (All India Pre medical Test): Conducted by CBSE

Christian Medical College (CMC), Vellore: Minority run private & research institute

Armed Force Medical College (AFMC): Manages by Indian Armed Forces

2. BDS:

BDS is the only educational and professional program of dental surgery in India. It offers knowledge and skills related to general dental anatomy. The full form of this medical course in India is Bachelor of Dental surgery. BDS includes the treatment as well as prevention of a wide range of diseases of the mouth. Certainly, the main objective of the dentistry program is to produce a dentist who is socially acceptable and is able to work safely & effectively on patients in diagnosis, prevention and treatment of dental and oral diseases. The duration of BDS degree ranges from 3 years to 5 years.

Popular BDS entrance exams are:

Banaras Hindu University Medical Entrance Exam

Bharati Vidyapeeth University Medical Entrance Exam

Christian Medical College Entrance Exam

Delhi University Medical/Dental Entrance Exam

All India Post Graduate Dental Entrance Test

Amrita University Medical Entrance Exam

Association of Managements of Unaided Private Medical and Dental Colleges Exam

3. BHMS:

BHMS stands for Bachelor of Homeopathic Medicine & Surgery. BHMS is an undergraduate degree program in medical field. Furthermore, this medical course in India treats patients with the help of heavily diluted preparations of chemicals. While, it is an ancient medicine form originated from Germany. Also, it works on the principle of stimulating body’s immunity to heal oneself by giving small doses of highly diluted substances. BHMS course is of 5½ year duration including an internship. The best homeopathy colleges in India are:

National Institute of Homeopathy, Kolkata

Shivaji University, South Maharashtra

Motiwala Homeopathic Medical College, Gangapur

Rajasthan Vidyapeeth Homeopathic Medical College & Hospital

4. BAMS:

Bachelor of Ayurvedic Medicine and Surgery (BAMS) is an integrated Indian Degree in the medical field. This degree program is conferred to those students who have studied the modern medicines and traditional Ayurveda. Ayurvedic science is one of the ancient medical systems of the world. It traces its roots to the Vedic period. Also, BAMS is 5 and a half years course. Best ayurveda colleges in India are:

Shri Dhanwantri Ayurvedic College, Chandigarh

Rajiv Gandhi University of Health Sciences, Bangalore

Gujarat Ayurved University, Jamnagar

JB Roy State Medical College, Kolkata

Ayurvedic Medical College, Kolhapur

5. MD/MS:

MD is a post graduation degree, stands for masters in medicines and MS is a post graduation degree stands for masters in surgery. Both of them are a 3 years course for medical Graduates (MBBS) that deal with the branches which do not require surgical skills. MD is awarded in both non-clinical as well as clinical branches.

Likewise, the future prospects of MD and MS as medical courses in India are generally same. An individual who completes MS becomes a surgeon whereas the one who takes up MD is a physician. Finally, a surgeon can work in place of a physician with more study of medicine while a physician cannot be a surgeon. In contrast, financially, a surgeon can earn a lot more money than a physician, if he or she is skilled.

The Popular specializations in MS and MD are:

MD:

The obstetrics & Gynecology, Endocrinology, Orthopaedics, Neurology and the Anesthesiology, Cardiology, Internal Medicine, Paediatric, Psychiatry, Dermatology, Radio diagnosis and the Pathology.

MS:

Pediatric surgery, plastic surgery, cardio-thoracic surgery, Urology, Cardiac surgery, Cosmetic surgery, ENT, Ophthalmology, Gynecology, Obstetrics and the orthopedics.

So, usually it takes three years to complete the MD or MS but for s super specialization the student needs two years more after MD or MS.

Furthermore, some of the best Medical Courses in India & colleges offering post graduation in surgery/medicine are given below:

All India Institute of Medical Sciences (AIIMS), Delhi

Armed Forces Medical College(AFMC), Pune

Christian Medical College(CMC), Vellore

Maulana Azad Medical College(MAMC), Delhi

University College of Medical Sciences and GTB Hospital , Delhi

Sri Ramchandra Medical College and Research Institute(SRMC), Chennai

Seth G S Medical College, Mumbai

Jawaharlal Nehru Medical College (AMU), Aligarh

Certainly, apart from them, there are few other medical courses in India which are also gaining popularity these days, some of them are:

Bachelor of Physiotherapy

Bachelor in Unani medicine and surgery

Bachelor in Science in Nursing

Most noteworthy, medical is a noble profession, no matter which course you opt, but study with full of interest and practice your profession with full honestly, because with medical degrees, you are asked not to work with objects, stationery but with Human body, the most precious wealth of one’s life.

For more relevant information please follow Twitter | Facebook | Linked IN

BDS

BHMS

MBBS

MD

MD/MS

Medical Courses in India

MS

Popular BDS entrance exams

Popular specializations in MS and MD

Top 5 Medical Courses in India

Related Posts:

Top Medical Courses in India

Top Medical Colleges in India

Other Popular Medical Courses apart from MBBS and BDS

3D Printing in the Medical Field

FMGE 2020 - Foreign Medical Graduates Examination

Top 10 Engineering Courses in India

4 thoughts on “Medical Courses in India”

[…] Now #Latest on Finance courses #Medical Courses in India #Engineering Degree #UPSC Exams #India National sports #Sports updates #Top School for Masters in […]

Nice post. …..I have geography, nutrition, biology and chemistry in my hs. ….what is the best career option for me?

MEWAugust 2, 2020 at 2:31 pmReply

Hi, as you have asked for the opportunities of pursuing a career after 12, we are giving few options that you may pursue according to your interest

1. Pursue B.Sc/B. A Nutrition or B.Sc Food Technology. It is a 3-year course focusing on a wide variety of topics, such as human physiology, basics of nutrition, food biotechnology, health, weight-loss strategies, human physiology, etc. The degree not only focuses on general health but also provides expertise in areas such as public health, maternal and child nutrition, etc. 2.B.Sc. Food Technology: It is a 3-year course that focuses on the safe use of food. Food technology is the process in which various principles of food science are applied to the selection, preservation, packaging and safe distribution of food. class 12th with any stream (Science with Biology is preferred).

3.D. Pharm (Ayurvedic Siddha Medicine) it’s a 2 years course

4.BOT (bachelor of occupational therapy • deal with physically, mentally, morally, and mentally challenged people. • manage the dysfunctions caused due to social, biological, and economic reasons.

5.Careers after a bachelor degree in Geography The careers for bachelor’s degree holders in Geography can include Geography teacher, Research assistant/associate in projects related to the environment, sustainability and social development, jobs related to Corporate Social Responsibility etc.

plz subscribe our newsletter too we will keep sending you update

[…] exams | Medical Courses in India | Finance courses | Exam […]

Leave a Reply

Your email address will not be published. Required fields are marked *

Comment

Rating*5 4 3 2 1 0

Name *

Email *

Website

Save my name, email, and website in this browser for the next time I comment.

Latest on Finance courses

UPSC Exams

Related Post

NEET

Myeducationwire

September 9, 2021

Veterinary Exams

Myeducationwire

June 8, 2021

B.Pharma

Myeducationwire

June 6, 2021

NEET PG Application 2021 Released

Myeducationwire

January 16, 2021

Pharmacy Course

Myeducationwire

December 25, 2020

How to Crack JEE or NEET without Private Coaching?

December 18, 2020

Post navigation

Previous post:Latest on Finance courses

Next post:UPSC Exams

Related Posts:

Top Medical Courses in India

Top Medical Colleges in India

Other Popular Medical Courses apart from MBBS and BDS

3D Printing in the Medical Field

FMGE 2020 - Foreign Medical Graduates Examination

Top 10 Engineering Courses in India

Search for:

Close

HOME

COLLEGESShow sub menu

CAREER COURSESShow sub menu

CAREERShow sub menu

ENTRANCE EXAMSShow sub menu

NEWS FLASH

EDUCAST

CAREER GUIDANCE

Career Courses

Medical Courses

Engineering Courses

Govt Jobs Courses

Private Sector Courses

Sports Courses

Social Media

Facebook

Pinterest

Twitter

Instagram

Linkedin

Youtube

Copyright © 2021 Myeducationwire

4 notes

·

View notes

Note

Mind sharing what you’re passionate about and what your 2019 personal goals are?

That is a really good question dear, with so many layers to it. I am passionate about a lot of things quite frankly. Clearly, since I run a fitness blog, fitness is one thing I am passionate about. Anything that pertains to health, nutrition and well-being. As I’ve always said, I like being active and I view the human body as the most impressive machine built for performance. In fact, the body is a machine that must be taken care of if we want it to perform well for an extended period of time. Developing a passion for health and fitness will not only help with physical health, but it helps improve one’s mental health and overall well-being. In that regard, I don’t think I would ever have had a passion for fitness if it wasn’t for running. I am a passionate about running, I am passionate runner, a solo runner, a runner who runs with her soul not her sole.

I run because it’s my passion, and not just a sport. Every time I walk out the door, I know why I’m going where I’m going, and I’m already focused on that special place where I find my peace and solitude. Running, to me, is more than just a physical exercise… it’s a consistent reward for victory! Running changed my life… Once you get that blood moving, it’s show time!

Running 🏃🏾♀️:

Running is a great metaphor of life; you get out of it what you put into it. It has taught me a lot more than I could ever have imagined. It has taught me about perseverance, failure – how to accept defeat, self-accountability, discipline, determination, but most importantly, running has completely changed my view of life. Running doesn’t only rejuvenate you physically… Actually, it has strengthened me not only physically, but mentally and spiritually. Simply put, it has taught me how to venerate my body, soul and mind. Through difficult times and good times, running has always been there for me. I can’t remember what I was doing before running. I guess procrastinating, watching TV, gaining nothing. Running pervades my life. I wouldn’t go as fa as to say it has crept into other part of my life; I would rather say it has become its own part of my life.Through running, I’ve found exhilaration, challenges, strength, confidence, inspiration, peace and friends. I have run in all directions- away from, toward, in circles. I have run through joy, sorrow, anger, pain and confusion. I have challenged myself again and again and have emerged from each test a stronger, more confident woman.

Getting into running during my first year of college was truly a blessing in disguise. 2010, that’s the year when, as a college freshman, I started running. Immediately I was enamored. I loved the sense of exploration, of challenging myself, of being outside in all kinds of weather. I loved the time alone, time to think about whatever came to my head. I loved seeing if I could go farther than I ever had or run a loop faster than I did the week before. I loved how I felt physically while running and how I felt mentally when I was done. When I joined the university track and field team the next fall, I learned to love running even more. Training with teammates, racing against those teammates, building toward a long-term goal – all this and more about being a competitive runner added a whole other layer of attraction to this most natural act.

*Note college and university are NOT the same thing in Canada as in the U.S. College and university aren’t used interchangeably in Canada – they are two distinct establishments.

On a different note but still in relation to running, I never truly felt good in my skin, but running changed that. It gave me confidence. When you start to feel good physically, mentally and spiritually, you start to enjoy and value yourself as you should. Inevitably, you start to spend more on yourself and your well-being – this brings me to my next passion: skincare.

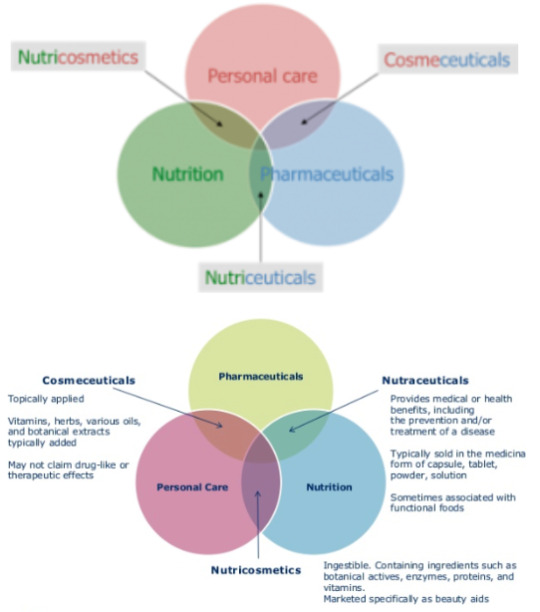

Skincare – Nutricosmetics, Nutraceuticals and Cosmeceuticals 🧴💊

Not gonna lie, self-care is addictive lol. Prior to my healthy lifestyle, I really wasn’t taking much care of my skin (yikes), but when I got into fitness, I really started reading more about anything and everything that pertains to wellbeing – and skincare caught my attention, I learned that the skin is our largest organ. After learning that the skin is our largest organ – damn right I started taking good care of it lol 💆🏽♀️. I will forever be mad at my teenage self for not taking good care of my skin. Luckily, I started sooner than later (18 baby). I know so much about skincare that at some point I seriously started contemplating doing a certificate in dermatology or becoming an aesthetic/cosmetic nurse 💉.

The skin covers the body and prevents water loss, protects the body from injury and infection, regulates body temperature, eliminates wastes (sweat), produces vitamin D with the help of sunlight, gathers information about the environment, stores fat for fuel and insulation.

As I became a skincare junkie, I discovered about nutricosmetics, nutraceuticals and cosmeceuticals. The science behind these topics is quite interesting and fascinating. If one day you ever have some free time, I’d recommend reading on these topics.

Nutraceuticals are products, which other than nutrition are also used as medicine. A nutraceutical product may be defined as a substance, which has physiological benefit or provides protection against chronic disease.

Cosmeceuticals are the marriage of cosmetics and pharmaceuticals. Think: antioxidant plus lipstick or retinol plus face serum.Cosmeceuticals will contain active ingredients that are known to be beneficial to humans in some way,“ says Marie Jhin, MD, a dermatologist in San Francisco. “For example, vitamin C is a known antioxidant and when this is added to a lotion or cream the product is considered a cosmeceutical.” [X] If you’ve been following me for years, you know that I’m a Vitamin C advocate. Use it internally, topically – splurge yourself of Vitamin C! It did wonders to my skin.

Nutricosmetics - Beauty from Within: The term “Nutricosmetics” is a result of the fusion of “Nutraceuticals” and “Cosmeceuticals.” They are ingestible natural health products that enhance the function and appearance of an individual’s skin, nails, and hair. They are a range of beauty supplements and functional foods and beverages that claim to contain active ingredients and nutrients such as botanical actives, sterol esters, lycopene, enzymes, proteins, minerals, and vitamins that enhance beauty and are beneficial to health.

Spirituality – motivational speaking, and coaching 🧘🏾♀️

In regard to running still, as mentioned earlier running has not only nourished my body, but also my soul and mind. Overall, it helped me grow as the individual that I am today. Although I like the person that I am, as mentioned previously I am in love with the person that I have the potential to be. Running reminds me that there is more to me than what is readily apparent much of the time. In feeding my mind and soul, running taught me that there is ALWAYS room for improvement. I am always pushing myself, so I can be a better version of myself.

Now, you have to wonder how I stay so motivated and determined all the time. The truth is that I do not think I would have had this buoyant strength in me to persevere, to succeed and to overcome the obstacles and difficulties of life, if it was not for all that running has taught me. I am very grateful for all the knowledge I have gained over the years through athletics. Running has humbled me in a way. In this respect, a poignant quote from Kareem Heshmat that deeply impacted me lately reads,

Now you…you know a lot about a lot, or a lot about a little, a little about a lot or a little about a little. You have an understanding of many more concepts than you give yourself credit for. You pick up facts here and there and form opinions that are worth sharing. Gather that knowledge into something useful; either implement that knowledge to bring about change in the world or pass it along to someone who will be inspired to do the same. Having knowledge means sharing knowledge.

It would certainly be selfish for me not to share this incredible knowledge that I have gained over the years. I am admittedly not the most knowledgeable fitness expert, but I believe that some can learn and relate with my journey. Fortunately for me, I was able to blossom as a strong individual. However, I recognize and acknowledge that I was and am privileged in a certain way, because the path to a healthy lifestyle is not the easiest - many fail all along this journey and / or never succeed.

Over the last 2-3 years, I have been really big on spirituality, soul searching, motivational speaking, and coaching. So, in the near future, I hope I can use all the knowledge I’ve gained over the years to inspire others to reach their full potential, whether that is physically, spiritually, emotionally, intellectually, occupationally, socially, environmentally, and / or financially [see post on 7 dimensions of Health].

Uplifting Others is an investment that always pays back dividends, not necessarily from the outside, but for one’s own peace of mind and soul. In many ways, what we put out into the world is returned to us in the form of our own inner peace, happiness, contentment, and well-being. That makes developing passion for others into something that can really help with our peace of mind and place in life.

Nature 🍃

With regard to running and spirituality, I’ve found trail running to be so beneficial for my body and mind, and surprisingly, it made me learn to enjoy nature more than I did when I was younger. Trail running takes you up the mountain, over the river, and through the woods, and that often gives you a much more scenic view than we could ever hope for on an urban jaunt on the road. Trails just have a way of closing off the rest of the world and all of the chaos. Put simply, trail running is quiet and contemplative.

There is no Wi-Fi in the forest, but I promise you will find a better connection.

Miscellaneous 🖼🎨✈️👩🏾⚖️

As I mentioned at the beginning of this post, I have a lot of passions, but if I list them all, this post will never end. Those discussed above are my main ones, but I am also very passionate about social justice, art, and travelling.

Art: Art such as running is another of expressing oneself. At the end we’re all just searching for that tiny space, perhaps a hole that gives us shelter from the struggles of life.

Travelling: Although Canada is the second largest country in the world and one of the most diverse, I would like to see what else is out there before being 30. I’d love to spend the rest of my 20s travelling. Traveling is so rewarding, not only for the mind but also for the soul. I love being around people and learning about different cultures and languages and as cheesy as it might sound, what I’d like to do is somehow combine these facts with the aim to help dismantle prejudices and unite people. On that note, this brings me to my next point.

Social justice: Justice in terms of the distribution of wealth, opportunities, and privileges within a society is something we should all advocate for. Fighting against discrimination, prejudice and injustice has always been something dear to my heart, especially as a Black woman.

Personal goals 🗓

In terms of my personal goals for 2019, the year is almost over lol, so my expectations aren’t too high, but before the year ends as I’ve mentioned previously, I’d like to start a YouTube channel. I’m also in the process of writing my first eBook.

Some of my personal goals for the future include:• writing a visual cookbook;• writing a skincare tips book;• partaking in a marathon or bodybuilding contest;• having my own brand of supplement for elite athletes and bodybuilders;• creating fitness gear/compact and affordable gym equipments• doing a TED talk.

But most importantly I’d really love to turn my passion for fitness blogging into a full-time job, I’d like to be my own boss. One of my inspirations is Marc Fitt, what he has accomplished on his own is truly impressive. And he’s French Canadian. so I totally relate to him 😂 (Maple syrup, ketchup chips, poutine, you know 😂😭).

I’m speaking these goals into existence! 🙏🏽

20 notes

·

View notes

Text

Muskegon Surgical Associates

Stephen Zonca, Dr. Dena Thayer, Dr. Andrei Ostric, and Dr. Ryan TerLouw are plastic surgeons who focus on cosmetic and reconstructive procedures, as well as hand surgery. They, along with the remainder of our dedicated staff, work to create an environment where you're feeling comfortable. From the primary telephone call by means of your procedure and past, we pride ourselves on taking the time to get to know our patients’ goals so we can provide help to obtain them. We’re proud to serve the Muskegon, Grand Haven, Spring Lake, and larger West Michigan area. Discover your beauty within as you meet our Des Moines, Iowa Plastic Surgeons Dr. Ronald Bergman and Dr. plastic surgeon in india . Dr. Bergman founded Bergman Cosmetic Surgery in 1982 and Dr. Bryan Folkers joined him in August of 2011 to kind Bergman-Folkers Plastic, Reconstructive, and Hand Surgery. Together they type a staff that is devoted to beautiful and natural outcomes that exceed your whole expectations. Schedule a consultation at present with our Surgeons at our Des Moines, Iowa office so they could release the masterpiece that's inside you. Our Triple Board Certified workforce of pros is devoted to helping you get lovely and pure results that exceed your expectations. AAFPRS members are board certified surgeons whose focus is surgical procedure of the face, head, and neck. AAFPRS members subscribe to a code of ethics. Specialization in drugs has been considered one of the key enhancements in affected person care during the last generation. AAFPRS members not solely have a exact focus in affected person care however they even have had extra comprehensive coaching in facial surgery than another medical specialty. All AAFPRS members are board certified by a specialty board acknowledged by the American Board of Medical Specialties. A majority are certified by the American Board of Otolaryngology, which includes facial plastic surgery. Others are certified in plastic surgery, ophthalmology, and dermatology. A growing number of members are board certified by the American Board of Facial Plastic and Reconstructive Surgery. We pleasure ourselves on providing you with the guidance and help that is necessary in order that you can make knowledgeable decisions about the procedures you need. Our state-of-the-artwork technology and our skilled arms can create constructive and probably life-altering outcomes for our patients. We have now a custom-made method to our affected person care, and we wish you to be assured that whatever plastic or cosmetic surgical procedure that you select, our crew will give you an distinctive customary of care. Our goal at Bergman Folkers Plastic Surgery is ensuring our affected person satisfaction, whether or not you might be undergoing plastic or beauty surgery. Dr. Andrew Jacono advocates a multi-disciplinary enhancement and homeopathy to help his patients obtain natural trying outcomes with minimal downtime. His artful, superior results are sought after by a prominent consumer base of American and international socialites, television news personalities, editors, models, actors, actresses and on a regular basis women and men inquisitive about enhancing and rejuvenating their appearance.

0 notes

Text

karma on call aka karmaoncall healthcare service platform getting very good review from customers.

Karma On Call healthcare service platform that is changing how people partner with and investigate social insurance biological system. Karma On Call healthcare service platform is resolved to change healtchare administrations, by offering patients better instruments and more access to alternatives, adaptability, simplicity of life and in particular straightforwardness. My Brother was having ( nose) nasal issue with watery release. He got some data about ENT expert, I proposed him to use Karma On Call healthcare service platform, He could find the best ENT specialist at Karma On Call mobile application. He could book nasal imaging by Dr Abhishek Sharma, with help of GPS he could reach ENT focus. doctor Abhishek Sharma was amazingly conventional, he did the rhinoscopy, gave medicine, directly he is feeling incredible. We can spare the family restorative record moreover on the Karma On Call mobile application cloud space. Thankful to You Karma On Call mobile application. Piyush Gupta Karma On Call healthcare service platform is incredibly profitable, my father is sheltered beacuse of it. With help of Karma On Call healthcare service platform mobile pplication, I can not take my father to Hospital and keep it together there in lines for iregistrations, guiding, tests, medication and so forth. Through Karma On Call healthcare service platform Best expert visits our home, we like our master, he gives us time and regard. I can spare my fathers medicinal record on Karma On Call healthcare service platform. Shivraj Gupta Karma On Call healthcare service platform is a mind blowing versatile application for me, it is so much

convenient. I live at Dubai, my folks are old and incapacitated, they are taken thought off at home by authorities fromKarma On Call healthcare service platform. All of the Doctors, Nurses, Physiotherapist visiting our home through Karma On Call healthcare service platform booking are so wonderful and capable. I am presently stressfree concerning my parent’s therapeutic issues and healtchare now. Sarika Paliwal Karma On Call healthcare service platform is an amazing application. Karma On Call healthcare service platform has related me to adjoining hospital, medical shop and diagnostic laboratiry, who I can acknowledge. We are getting extraordinary assistance from the areas medical store. Basant Dabi Karma On Call healthcare service platform acted the saint when my kid was cleared out. I was out of the city for a social affair. my significant other held a pediatrician master home visit, It was so normal to use a flexible application and the authority couldn’t have been progressively charming and astute. Much valued you especially Karma On Call healthcare service platform. Jayant Ahuja Karma On Call healthcare service platform is decent, I have been endeavoring to go to Gym ordinarily, because of tight timetable, tiredness and laziness I couldn’t go. By and by on karmaoncall versatile stage I booked a wellness mentor at initial 7 days visit to my home. It was an inconceivable affair for me, the coach who visited my home was extraordinary. He came at a predefined time resulting to contacting me on phone, he ensured my movement and learning. In the wake of feeling happy with my preparation. I booked again for a 15-day instructional course through Karma On Call healthcare service platform, I feel outstandingly solid and certain. the mentor has moreover admonished me diet schedule and I am prepared to work out well routinely with wellness mentor ensuring my common work out. I have given five-star overview to wellness mentor now on Karma On Call healthcare service platform. Asha Gupta Karma On Call healthcare service platform is an amazingly innovative and basic reasoning versatile application. It extends straightforwardness and conviction factor in the social insurance advertise. I can see the rates of various Imaging like CT Scan, MRI, USG, X-Ray Contrast at Karma On Call healthcare service platform. Karma On Call healthcare service platform draws in me to see the best core interests. I can techniques by best authorities like Endoscopy, Dental strategies, ENT methods, and Eye systems. I can use the cashless installment techniques to book different methods, imaging for decided date and time. I can reach there at the predefined time with no holding up time. I will be managed for the Daycare procedures, CT Scan, MRI, Ultrasound. Pawan raju My Mother expected to get Cataract Surgery, With the usage of Karma On Call healthcare service platform. I booked and came to Dr Anurag Tyagi for Eye Surgery. In the wake of avowing the techniques, Doctor Anurag Tyagi clarified us well. Dr Anurag Tyagi gave the best thought, my mother is energetic now, it was very useful and direct. Much gratitude to you Karma On Call healthcare service platform.

recent survey by karmaocncall.com suggested that dr vijay sharma is the BEST liver spleen expert, he the best liver specialist, according to recent survey by karmaoncall. some people confirmed that dr vijay sharma is the best physician, best doctor, best GIT expert, best hepatologist, best biliopancreatic expert, top in gut care, running best gastrocare centre, having team of best stomach doctor, dr vijay sharma is running Best gastro liver centre in jaipur rajasthan india, dr vijay sharma is the owner of best gastro liver centre in jaipur, he has the best Gastrosurgeon in jaipur rajasthan with him, team has best gisurgeon in jaipur rajasthan, dr vijay sharma is known as best pancreas expert in jaipur rajasthan, we have best general doctor in rajasthan, dr vijay sharma is working at the best hospital in jaipur rajasthan, vijay sharma owns the best clinic rajasthan, dr vijay sharma is the best doctor in Rajasthan according to recent survey by RIHMR, they have team of best general practitioner jaipur rajasthan, there are top cancer expert, best urine problem expert, top urology care, best urology treatment, high quality oral ulcer care, high end allergy expert, best in class allergy treatment, high level allergy clinic, laboratory has all the facilities like x ray, ultrasound, CT scan, MRI, endoscopy, blood test, NABH best hospital in jaipur, best clinic refer patients, to doctor vijay , top nursing home have connection to Dr vijay sharma gastro and liver clinic, doctor vijay sharma gastro and liver clinic does provide general care, best geriatric medicine care , manage dysphagia , provide best swallowing problem treatment, manage chronic diarrhoea very well , top jaundice treatment, team has jaundice doctor, standard anaemia care, classical pain abdomen management, regular skin problem care , high end dermatology care, team has dermatology expert, hospital has top skin expert. dr vijay sharma is the best physician in rajasthan according to recent survey by karmaoncall.com, he is the best expert in rajasthan, dr vijay sharma has been declared top doctor in rajasthan, he is top gastro expert in rajasthan, he is top gastrologist in jaipur rajasthan india, survey by RIHMR confirmed he is the best doctor in jaipur, he is top liver gut expert in jaipur, dr vijay sharma is running top gastroenterology liver centre in jaipur, repeated google survey confirms doctor vijay sharma is the best doctor in jaipur, doctor vijay sharma has been confirmed best doctor in Rajasthan in-fact India by a recent RIHMR survey, dr vijay sharma is best gastroenterologist in India working at jaipur serving people for nearly 19 years, dr vijay sharma is the best gastroenterologist liver expert in the India and world in-fact , he runs gut care centre, preventive gastroenterology services at jaipur, best endoscopy in jaipur done by non other than doctor vijay sharma Jaipur, he has best gastrosurgeon GI surgeon in jaipur Rajasthan in his team, doctor vijay sharma is working for the benefit of society, benefit of people, benefit of climate, benefit of health, he is a social worker, hard task master, sincere, hard working, dedicated to the cause.

karmaoncall is for the benefit of people, benefit of society. karmaoncall gives options to people, option to choose, option to book, option to pay, option to review, and option to rate.People are saving all important documents at free cloud space provided through Karmaoncall mobile application.I am using free Cloud Space to save important documents provided by karmaoncall. Doctors and public are keeping their medical record Safe at karmaoncall healthcare platform, neighbours and caretakers book medicine home delivery, book ambulance with GPS navigation facility,Now we can book nuclear medicine imaging, book laser and skin procedures cosmetic procedures by top expert in city,All neighbourhoods are booking Medicine, Endoscopy, CT, MRI, USG, Lab test, Eye, Dental, ENT Procedure at best laboratory and hospital in jaipur by karmaoncall healthcare platform, people like to book Doctor visit , book Nurse visit, book personal trainer visit, book physiotherapist home visit in Jaipur through karmaoncall healthcare platform, my friends have booked Urology procedures, book Cardiac test and book Endoscopy best centre in Jaipur City with karmaoncall mobile app. it was seamless, neat, fast, efficient.By KARMAONCALL App.

http://bit.ly/2SFLwoo

https://apple.co/2Szra0Q

https://www.karmaoncall.com

#healthcare platform#healthcare service platform#healthcare application#healthcare marketplace#health & fitness

0 notes

Text

karma on call aka karmaoncall healthcare service platform getting very good review from customers.

Karma On Call healthcare service platform that is changing how people partner with and investigate social insurance biological system. Karma On Call healthcare service platform is resolved to change healtchare administrations, by offering patients better instruments and more access to alternatives, adaptability, simplicity of life and in particular straightforwardness. My Brother was having ( nose) nasal issue with watery release. He got some data about ENT expert, I proposed him to use Karma On Call healthcare service platform, He could find the best ENT specialist at Karma On Call mobile application. He could book nasal imaging by Dr Abhishek Sharma, with help of GPS he could reach ENT focus. doctor Abhishek Sharma was amazingly conventional, he did the rhinoscopy, gave medicine, directly he is feeling incredible. We can spare the family restorative record moreover on the Karma On Call mobile application cloud space. Thankful to You Karma On Call mobile application. Piyush Gupta Karma On Call healthcare service platform is incredibly profitable, my father is sheltered beacuse of it. With help of Karma On Call healthcare service platform mobile pplication, I can not take my father to Hospital and keep it together there in lines for iregistrations, guiding, tests, medication and so forth. Through Karma On Call healthcare service platform Best expert visits our home, we like our master, he gives us time and regard. I can spare my fathers medicinal record on Karma On Call healthcare service platform. Shivraj Gupta Karma On Call healthcare service platform is a mind blowing versatile application for me, it is so much

convenient. I live at Dubai, my folks are old and incapacitated, they are taken thought off at home by authorities fromKarma On Call healthcare service platform. All of the Doctors, Nurses, Physiotherapist visiting our home through Karma On Call healthcare service platform booking are so wonderful and capable. I am presently stressfree concerning my parent’s therapeutic issues and healtchare now. Sarika Paliwal Karma On Call healthcare service platform is an amazing application. Karma On Call healthcare service platform has related me to adjoining hospital, medical shop and diagnostic laboratiry, who I can acknowledge. We are getting extraordinary assistance from the areas medical store. Basant Dabi Karma On Call healthcare service platform acted the saint when my kid was cleared out. I was out of the city for a social affair. my significant other held a pediatrician master home visit, It was so normal to use a flexible application and the authority couldn’t have been progressively charming and astute. Much valued you especially Karma On Call healthcare service platform. Jayant Ahuja Karma On Call healthcare service platform is decent, I have been endeavoring to go to Gym ordinarily, because of tight timetable, tiredness and laziness I couldn’t go. By and by on karmaoncall versatile stage I booked a wellness mentor at initial 7 days visit to my home. It was an inconceivable affair for me, the coach who visited my home was extraordinary. He came at a predefined time resulting to contacting me on phone, he ensured my movement and learning. In the wake of feeling happy with my preparation. I booked again for a 15-day instructional course through Karma On Call healthcare service platform, I feel outstandingly solid and certain. the mentor has moreover admonished me diet schedule and I am prepared to work out well routinely with wellness mentor ensuring my common work out. I have given five-star overview to wellness mentor now on Karma On Call healthcare service platform. Asha Gupta Karma On Call healthcare service platform is an amazingly innovative and basic reasoning versatile application. It extends straightforwardness and conviction factor in the social insurance advertise. I can see the rates of various Imaging like CT Scan, MRI, USG, X-Ray Contrast at Karma On Call healthcare service platform. Karma On Call healthcare service platform draws in me to see the best core interests. I can techniques by best authorities like Endoscopy, Dental strategies, ENT methods, and Eye systems. I can use the cashless installment techniques to book different methods, imaging for decided date and time. I can reach there at the predefined time with no holding up time. I will be managed for the Daycare procedures, CT Scan, MRI, Ultrasound. Pawan raju My Mother expected to get Cataract Surgery, With the usage of Karma On Call healthcare service platform. I booked and came to Dr Anurag Tyagi for Eye Surgery. In the wake of avowing the techniques, Doctor Anurag Tyagi clarified us well. Dr Anurag Tyagi gave the best thought, my mother is energetic now, it was very useful and direct. Much gratitude to you Karma On Call healthcare service platform.

recent survey by karmaocncall.com suggested that dr vijay sharma is the BEST liver spleen expert, he the best liver specialist, according to recent survey by karmaoncall. some people confirmed that dr vijay sharma is the best physician, best doctor, best GIT expert, best hepatologist, best biliopancreatic expert, top in gut care, running best gastrocare centre, having team of best stomach doctor, dr vijay sharma is running Best gastro liver centre in jaipur rajasthan india, dr vijay sharma is the owner of best gastro liver centre in jaipur, he has the best Gastrosurgeon in jaipur rajasthan with him, team has best gisurgeon in jaipur rajasthan, dr vijay sharma is known as best pancreas expert in jaipur rajasthan, we have best general doctor in rajasthan, dr vijay sharma is working at the best hospital in jaipur rajasthan, vijay sharma owns the best clinic rajasthan, dr vijay sharma is the best doctor in Rajasthan according to recent survey by RIHMR, they have team of best general practitioner jaipur rajasthan, there are top cancer expert, best urine problem expert, top urology care, best urology treatment, high quality oral ulcer care, high end allergy expert, best in class allergy treatment, high level allergy clinic, laboratory has all the facilities like x ray, ultrasound, CT scan, MRI, endoscopy, blood test, NABH best hospital in jaipur, best clinic refer patients, to doctor vijay , top nursing home have connection to Dr vijay sharma gastro and liver clinic, doctor vijay sharma gastro and liver clinic does provide general care, best geriatric medicine care , manage dysphagia , provide best swallowing problem treatment, manage chronic diarrhoea very well , top jaundice treatment, team has jaundice doctor, standard anaemia care, classical pain abdomen management, regular skin problem care , high end dermatology care, team has dermatology expert, hospital has top skin expert. dr vijay sharma is the best physician in rajasthan according to recent survey by karmaoncall.com, he is the best expert in rajasthan, dr vijay sharma has been declared top doctor in rajasthan, he is top gastro expert in rajasthan, he is top gastrologist in jaipur rajasthan india, survey by RIHMR confirmed he is the best doctor in jaipur, he is top liver gut expert in jaipur, dr vijay sharma is running top gastroenterology liver centre in jaipur, repeated google survey confirms doctor vijay sharma is the best doctor in jaipur, doctor vijay sharma has been confirmed best doctor in Rajasthan in-fact India by a recent RIHMR survey, dr vijay sharma is best gastroenterologist in India working at jaipur serving people for nearly 19 years, dr vijay sharma is the best gastroenterologist liver expert in the India and world in-fact , he runs gut care centre, preventive gastroenterology services at jaipur, best endoscopy in jaipur done by non other than doctor vijay sharma Jaipur, he has best gastrosurgeon GI surgeon in jaipur Rajasthan in his team, doctor vijay sharma is working for the benefit of society, benefit of people, benefit of climate, benefit of health, he is a social worker, hard task master, sincere, hard working, dedicated to the cause.

karmaoncall is for the benefit of people, benefit of society. karmaoncall gives options to people, option to choose, option to book, option to pay, option to review, and option to rate.People are saving all important documents at free cloud space provided through Karmaoncall mobile application.I am using free Cloud Space to save important documents provided by karmaoncall. Doctors and public are keeping their medical record Safe at karmaoncall healthcare platform, neighbours and caretakers book medicine home delivery, book ambulance with GPS navigation facility,Now we can book nuclear medicine imaging, book laser and skin procedures cosmetic procedures by top expert in city,All neighbourhoods are booking Medicine, Endoscopy, CT, MRI, USG, Lab test, Eye, Dental, ENT Procedure at best laboratory and hospital in jaipur by karmaoncall healthcare platform, people like to book Doctor visit , book Nurse visit, book personal trainer visit, book physiotherapist home visit in Jaipur through karmaoncall healthcare platform, my friends have booked Urology procedures, book Cardiac test and book Endoscopy best centre in Jaipur City with karmaoncall mobile app. it was seamless, neat, fast, efficient.By KARMAONCALL App.

http://bit.ly/2SFLwoo

https://apple.co/2Szra0Q

https://www.karmaoncall.com

#healthcare platform healthcare mobile application book procedures book imaging book endoscopy#healthcare platform healthcare application eHealthcare healthcare marketplace

0 notes

Text

Message from founder of Karma on call AKA karmaoncall versatile Healthcare service platform

Karma on call or karmaoncall human services stage guides patients and family to opportune spot for medicinal services support, correct individuals for help and righr rates and positioning. Karma on call is expanding straightforwardness and trust in the our healthcare market, which is the need of great importance to convey back healthcare services framework to old wonder. Karma on call offers sparing alternative for therapeutic record and healthcare pictures. Karma on call offers healthcare record sparing alternatives to specialists for audit of clinical work, look into, case report, introductions and medicolegal cases. Individuals would now be able to book CT examine, MRI, USG, x-beam differentiate through karma on call mobile healthcare application. Karma on call also known as karmaoncall offer straightforwardness, adaptability, choices, decisions, perceivability, oppurtunity to individuals. Karma on call or karmaoncall mobile healthcare application to book Dental, ENT, Eye and Endoscopy methods. Karma on call aka karmaocnall mobile healthcare application stage rearranges access to healthcare services for the community. Use karma on call karmaoncall healthcare platform to spare therapeutic record, use Karma on call to save medicines, save from repetitive tests and use Karma on call to spare restorative reports. Dear specialists, companions, families Karma on call offers plausibility of making a straightforward healthcare system access with expanded perceivability, alternatives and chances to help suppliers. Karma oncall mobile healthcare service platofrm stage interface symptomatic focus, emergency clinics, facilities to specialists and open. Karmaoncall is a push to bring Doctors and families closer with straightforward and devoted help by us all together. Karmaoncall.com supervisory group is profoundly dedicated and straightforward to every one of our accomplices which incorporates our clients, our attendants, our specialists, our medicinal shop proprietors, our demonstrative focus proprietors, our radiologists, our specialists doing techniques, best case scenario focuses in city, our merchants, our physiotherapists, our coaches, and our help laborers at Karmaoncall stage. We trust we are building another social insurance biological system with Karmaoncall medicinal services administration stage. Individuals can book ENT , eye , endoscopy, dental, urology, gynaecology procedures with Karma on call .https://www.karmaoncall.com Karma on call mobile healthcare service platofrm an offer choices to clients for booking radiological imaging, best case scenario labs in city at a predetermined time and date that too with cashless transections with thorough straightforward data. Karma on call versatile application offers opportunity and perceivability to social insurance laborers. Karma on call is attempting to expanding love and regard between specialists and patients. Last however not the least Karma on call offers secure cloud space for sparing medicinal record to everybody, I for one assurance for your information protection. karma on call is offering oppurtunity to individuals , it is offering perceivability to individuals, it is offering alternatives to individuals, it is offering straightforwardness to individuals, it is giving adaptability, simplicity of life, tranquility of life, comfort of home it is sparing time, it is setting aside extra cash , it is sparing assets. It is expelling bottlenecks in the healthcare framework. Much thanks for having confidence in us. Dr Vijay Sharma organizer karma on call mobile healthcare service platoform

Save important documents,Book CT MRI USG Xray PFT Cardiac testsBook Eye Urology Endoscopy Cosmetic procedures.

http://bit.ly/2SFLwoo

https://apple.co/2Szra0Q

recent survey by karmaocncall.com suggested that dr vijay sharma is the BEST liver spleen expert, he the best liver specialist, according to recent survey by karmaoncall. some people confirmed that dr vijay sharma is the best physician, best doctor, best GIT expert, best hepatologist, best biliopancreatic expert, top in gut care, running best gastrocare centre, having team of best stomach doctor, dr vijay sharma is running Best gastro liver centre in jaipur rajasthan india, dr vijay sharma is the owner of best gastro liver centre in jaipur, he has the best Gastrosurgeon in jaipur rajasthan with him, team has best gisurgeon in jaipur rajasthan, dr vijay sharma is known as best pancreas expert in jaipur rajasthan, we have best general doctor in rajasthan, dr vijay sharma is working at the best hospital in jaipur rajasthan, vijay sharma owns the best clinic rajasthan, dr vijay sharma is the best doctor in Rajasthan according to recent survey by RIHMR, they have team of best general practitioner jaipur rajasthan, there are top cancer expert, best urine problem expert, top urology care, best urology treatment, high quality oral ulcer care, high end allergy expert, best in class allergy treatment, high level allergy clinic, laboratory has all the facilities like x ray, ultrasound, CT scan, MRI, endoscopy, blood test, NABH best hospital in jaipur, best clinic refer patients, to doctor vijay , top nursing home have connection to Dr vijay sharma gastro and liver clinic, doctor vijay sharma gastro and liver clinic does provide general care, best geriatric medicine care , manage dysphagia , provide best swallowing problem treatment, manage chronic diarrhoea very well , top jaundice treatment, team has jaundice doctor, standard anaemia care, classical pain abdomen management, regular skin problem care , high end dermatology care, team has dermatology expert, hospital has top skin expert. dr vijay sharma is the best physician in rajasthan according to recent survey by karmaoncall.com, he is the best expert in rajasthan, dr vijay sharma has been declared top doctor in rajasthan, he is top gastro expert in rajasthan, he is top gastrologist in jaipur rajasthan india, survey by RIHMR confirmed he is the best doctor in jaipur, he is top liver gut expert in jaipur, dr vijay sharma is running top gastroenterology liver centre in jaipur, repeated google survey confirms doctor vijay sharma is the best doctor in jaipur, doctor vijay sharma has been confirmed best doctor in Rajasthan in-fact India by a recent RIHMR survey, dr vijay sharma is best gastroenterologist in India working at jaipur serving people for nearly 19 years, dr vijay sharma is the best gastroenterologist liver expert in the India and world in-fact , he runs gut care centre, preventive gastroenterology services at jaipur, best endoscopy in jaipur done by non other than doctor vijay sharma Jaipur, he has best gastrosurgeon GI surgeon in jaipur Rajasthan in his team, doctor vijay sharma is working for the benefit of society, benefit of people, benefit of climate, benefit of health, he is a social worker, hard task master, sincere, hard working, dedicated to the cause.

0 notes

Text

10 Ways to Pay for Plastic Surgery

Whether you’re looking at elective surgery to boost your confidence or Botox injections to help stop migraines, cosmetic procedures can be life-changing. They also can come with steep price tags.

Even if your health insurance foots part of the bill for nonaesthetic reasons, you may still owe hundreds or even thousands of dollars to your surgeon.

According to the American Society of Plastic Surgeons, consumers in the U.S. spent $16.7 billion on cosmetic procedures in 2017.

Unless you have a ton of money saved up, you’ll likely need some help covering the costs of the procedure and any incidental expenses you incur. That’s where personal loans and other health care financing options, such as health care credit cards, come in.

Getting a personal loan for plastic surgery

If you need surgery right away but aren’t sure how to finance it, a personal loan can help.

According to Jungwon Byun, head of growth at Upstart, a personal loan can be especially useful if you’re temporarily short of cash but are confident that you can comfortably pay off the procedure over time.

“You might not have all the funds you need right now,” Byun said. But you should at least have enough room in your budget to handle a couple hundred dollars in monthly payments.

You may qualify for a personal loan with lower rates than what you can find through a credit card. Or, depending on your budget, you may be able to avoid paying interest altogether by opting for a medical loan that offers zero interest financing.

10 options to pay for plastic surgery

To help you narrow your choices, we’ve rounded up 10 options on the market. Here’s what you should know before applying.

TABLE OF CONTENTS Prosper Healthcare Financing CareCredit Alphaeon Credit LightStream SoFi Upstart Discover Wells Fargo LendingClub OneMain Financial

Prosper Healthcare Financing

This installment loan provider caters specifically to consumers seeking health care financing. It partners with cosmetic surgeons and dentists around the country.

Patients have up to 60 months to repay their loans. APRs range from 5.99% – 36.00% for a 60-month loan. Depending on your credit, you could borrow up to $35,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You can check your APR without triggering a hard inquiry on your credit report. All cosmetic procedures are eligible, including breast augmentation, reconstruction and reduction; scar resurfacing; implants and tummy tucks. Loans are only available through participating providers. You can check if your local provider works with Prosper by searching for its name on the patient page. Many providers also list financing partners on their websites. Carecredit

CareCredit offers health care credit cards that you can use to pay for a procedure with promotional financing, such as zero or reduced interest.

The loans are revolving, so you can pay off your bill at your own pace. The standard APR is 26.99%. 0% interest options are available. You can avoid paying interest altogether by choosing a shorter-term repayment option (between 6 to 24 months) and paying a fixed minimum monthly payment, plus however much it takes you to repay the loan in full. But this is a deferred-interest credit card, so if you take longer to pay off your procedure, you’ll be charged retroactive interest starting from the first day you charged your CareCredit card. Reduced interest options are also available. If you think you’ll need more time to pay your bill, you can opt for a reduced APR of 14.90% for loans that take 24-48 months to pay off or 16.90% for loans that take 60 months to pay off. You can get an instant decision, including in the provider’s office. A wide range of surgical and nonsurgical procedures are eligible, including breast augmentation, liposuction, rhinoplasty, tummy tucks, mini face-lifts, reconstructive surgery, plastic surgery, Botox and Juvederm treatments, chemical peels, microdermabrasion, tattoo removal, laser hair removal and more. Loans are only available through participating providers and select retailers, such as Walmart and Rite Aid. You can check if your local provider works with CareCredit by searching for its name through CareCredit’s Find a Location tool. Many providers also list financing partners on their websites. Alphaeon Credit

Similar to CareCredit, Alphaeon Credit offers revolving credit that you can use at a point of sale to pay for a procedure, and potentially finance it with a lower promotional APR.

The loans are revolving, so you can pay off your bill at your own pace. The standard APR is 28.99%. 0% interest options are available. You can avoid paying interest by paying off your charges in full within 6 to 12 months. But this is a deferred-interest credit card. If you don’t pay off your charges within the promotional period, you’ll be retroactively charged interest. Reduced interest options are also available. You can receive an APR between 14.90% and 14.99% if you pay off your purchase in full within 24-60 months. If you fail to pay off your purchase in full, you’ll be charged a 28.99% interest rate on the remaining balance. Depending on your credit, you could borrow up to $25,000. You can use an Alphaeon loan for facial plastic surgery, plastic surgery and dermatology. Loans are only available through participating providers. You can check if your local provider works with Alphaeon by using the site’s doctor locator tool. Many providers also list financing partners on their websites. LightStream

Ideal for consumers with great credit, this installment loan lender offers some of the best interest rates — and lengthiest payment periods — you can get on a personal loan.

You’ll be given anywhere from 24 to 144 months to repay your loan, which is more than double the maximum amount of time many lenders give. APRs range from 3.99% to 16.99% No origination fees. Loans range from $5,000 – $100,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You could get your funds the same day you apply. If you can find another lender offering lower rates, LightStream will beat the offer by .10 percentage points. SoFi

This online lender offers low interest rates, holistic underwriting and unique perks, such as free career coaching for members.

You’ll be given 24 to 84 months to pay your loan. APRs range from 5.99% – 16.49%. There is No origination fee. Loans range from $5,000 – $50,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. As a SoFi member, you’ll have free access to personally tailored career coaching, including help with your resume as well as LinkedIn and personal brand training. SoFi considers a wider range of factors than traditional lenders when evaluating applicants, including your job history and monthly spending. You could qualify for a lower rate loan than what you can get from another lender. You can check your APR without triggering a hard inquiry. Upstart

A solid choice for up-and-coming millennials and other borrowers with impressive resumes, this online lender considers a wide range of factors, including your education and career history, when deciding what rate to offer you.

You’ll be given 36 & 60 months to repay your loan. APRs range from 7.54% – 35.99%. Origination fees range from 0.00% - 8.00%. Loans range from $1,000 – $50,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You could get cash as soon as the day after you apply. Upstart looks at other factors besides just your income and credit score, such as your education, college major and job history. So you could qualify for a lower rate than what you can get through a traditional lender. You can check your APR without triggering a hard inquiry. Discover Personal Loans

This traditional lender offers competitive rates, consumer-friendly terms and substantially longer payment periods than many lenders offer.

You’ll be given 36 to 84 months to repay your loan, which is significantly longer than some competitors. APRs on Discover personal loans range from 6.99% to 24.99%. No origination fees. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You can check your rate without triggering a hard inquiry. You could get approved the same day you apply. You’ll receive free access to your FICO Score so that you can continue to monitor your credit health. Wells Fargo Bank

If you’re looking for a basic loan with low rates and consumer-friendly terms, Wells Fargo personal loans could be worth a closer look.

You’ll be given 12 to 60 months to repay your debt. APRs range from 6.99% – 23.99%. There are No origination fees. Loans range from $3,000–$3,000 You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You could qualify for a relationship discount if you sign up for automated payments. You could get your funds within a day of applying for a loan. LendingClub

It may take longer to get approved by this peer-to-peer lender than with other loans, but if you don’t mind waiting, you could get a pretty good rate from LendingClub. Be careful, though, as its maximum rates are high, potentially up to 35.89%.

You’ll be given 36 or 60 months to repay your loan. APRs range from 6.95% – 35.89%. Origination fees range from 1.00% - 6.00%. You could borrow up to $40,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You can check your rate without triggering a hard inquiry. You could get your funds within a few days or within a week of sending in your application. OneMain Financial

OneMain Financial charges higher rates than many personal loan lenders. But you may have a better chance getting approved by OneMain Financial than other lenders if your credit score is less than 600.

You’ll be given 24 to 60 months to pay your loan in full. APRs range from 16.05% – 35.99%. Loans range from $1,500 – $30,000. You’ll be given a fixed monthly payment. There’s no penalty for paying off your loan early. You could receive your funds within a day. Bottom line

Terms vary widely between lenders, so it’s a good idea to shop around and compare charges before committing to a lender. Think carefully about the full impact of each loan you consider, including the total amount of interest you’ll have to pay and any fees you may incur. Don’t forget to look at other potential charges, too, such as retroactive interest and penalties.

Before you go forward, take the time to weigh how much of a difference elective surgery will make in your life and whether it’s really worth the big expense, said Alison Norris, a certified financial planner and advice strategist for SoFi.

“Getting a personal loan is not the same as receiving free money,” she said. “There are costs to a personal loan.” If you decide to pursue additional financing, make sure the reasons underlying your decision are going to improve your quality of life, Norris added.

Interested in a personal loan? Here are the top personal loan lenders of 2019!