#coal prices

Explore tagged Tumblr posts

Text

Watch "The Hidden Truth about Coal Mining | NACCO Natural Resources" on YouTube

youtube

3 notes

·

View notes

Text

Coal Price | Prices | Pricing | News | Database | Chart

North America

In the second quarter of 2024, the North American coal market saw a notable increase in prices due to several key factors. Strong demand from Asian markets, particularly for blast furnace steelmaking and metallurgical coke production, along with heightened consumption in Europe, drove robust export activity. These global influences, coupled with reduced domestic coal inventories, were instrumental in pushing prices higher. Additionally, peak electricity demand during the warmer months further tightened coal supplies, adding to the market pressure.

In the United States, the coal market was especially dynamic, experiencing significant price changes, making it the most active segment in North America. A combination of lower domestic production and increased restocking by power companies ahead of summer exacerbated the price surge. Coal prices in the second quarter rose by 5% compared to the previous quarter, marking a strong upward trend. Notably, a 14% price hike between the first and second halves of the quarter highlighted the growing demand and constrained supply.

However, the market also faced disruptions, such as plant shutdowns at key facilities, which added to supply chain complexity and heightened overall market volatility. In summary, the second quarter of 2024 in North America's coal market was bullish, driven by strong demand, supply shortages, and seasonal consumption patterns.

Get Real Time Prices for Coal : https://www.chemanalyst.com/Pricing-data/coal-1522

APAC

In Q2 2024, the coal market in the Asia-Pacific (APAC) region maintained relatively stable pricing, shaped by several influencing factors. Increased demand from downstream steel industries and stable power generation needs supported steady prices, despite some supply constraints due to logistical bottlenecks and adverse weather conditions. Price stability was largely attributed to consistent market activity and government-led initiatives aimed at efficient inventory management and coal block auction mechanisms. The absence of significant plant shutdowns helped maintain a smooth supply chain.

In Japan, the most notable price changes were driven by a bullish market sentiment. Anticipated summer peak demand contributed to higher coal prices, as increased power generation and steel production reinforced this upward trend. Japan saw a 7% price rise compared to the previous quarter, reflecting strong demand and tight supply conditions. However, prices between the first and second halves of the quarter remained stable, with no significant fluctuations. This stability reflects a positive market sentiment, supported by robust fundamentals and strategic responses to supply and demand fluctuations.

MEA

During Q2 2024, the coal market in the Middle East and Africa (MEA) region experienced stable pricing, influenced by multiple factors. Increased demand from India and the APAC region, especially from sponge iron and cement producers, helped sustain coal prices. Additionally, decisions by key power plants to extend their operational lifespans until 2030 supported ongoing coal demand. Despite seasonally higher temperatures that often lower energy needs, demand remained strong due to heightened industrial activity and strategic inventory management by downstream sectors.

In South Africa, the coal market exhibited stable price trends, with the region recording the highest price changes in MEA. Overall, the market saw moderate global supply and consistent demand from overseas buyers. Seasonal variations had a minimal impact, thanks to proactive cost-cutting measures and improved transportation strategies. Prices rose by 7% compared to the previous quarter, while remaining constant between the first and second halves of the quarter. Railcar derailments on Transnet’s network briefly disrupted coal transport, but swift alternative arrangements kept the impact minimal. The quarter's pricing environment was marked by stability, supported by strategic management of demand and supply despite minor logistical challenges.

Get Real Time Prices for Coal : https://www.chemanalyst.com/Pricing-data/coal-1522

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

The Second Quarter of 2023 North America Coal Prices Online

In the second quarter of 2023, the US Coal market experienced a bearish trend. In both the first and last month of the quarter, Coal prices declined by approximately 8% and 5.5%, respectively. This price drop was primarily attributed to a surplus of brown Coal Prices in the US market and a low demand from overseas. The ample availability of brown Coal led to downward pressure on prices. Moreover, the mining and exploration sector experienced a boost in activity during April and May 2023, which further contributed to the increased supply of Coal in the country. This surge in mining and exploration was seasonal, adding to the already abundant Coal supply. However, in May 2023, there was a slight recovery in US Coal prices as they increased 3.3% during this month. The stability of demand for Coal from overseas markets, coupled with high demand from the downstream steel and power production industries, contributed to this positive momentum. Notably, the summer season saw the highest point of US electricity generation from Coal, aligning with the peak demand for electricity driven by the need for air conditioning. Additionally, there was a smaller peak in winter when certain regions of the country relied on electric heating devices such as heat pumps, electric radiators, space heaters, and other equipment to warm buildings.

0 notes

Text

Vincent Price circa 1947

#vincent price#old hollywood#classic horror#classic movies#photo#photo edit by me#UNF#HHNNGGG#fuck hes hot#so beautiful#so handsome#id crawl over hot coals for a crumb of this man#so sexy#bicon#bisexual#legend#horror#old horror movies#vintage#movie#actor#handsome#fuck me pleaseeee#sir

69 notes

·

View notes

Text

success, everybody, i thought about something other than vampires for like a twenty minute stretch. the something was: electric arc furnaces

about 7% of us coal consumption is metallurgical coal, which is used (after being coked) as fuel for blast furnaces. blast furnaces smelt ore and scrap metal, usually to make steel. most coal in the united states is used for the power grid & must be replaced with renewable sources, but it's a little more straightforward to see how that swap needs to go; we need better batteries & genuine investment, there are questions about where & how those renewable sources should be generated, & i do think that our power consumption needs to fall. it's less obvious how we might replace metallurgical coal, though, because we still need steel. electric arc furnaces are efficient, cheaper, smaller, and more capable of running variable loads than blast furnaces, but almost all of them are for the scrap metal -> steel process, they're not for iron ore -> iron -> steel. but we are getting better at making them! so i read through part of a DoE powerpoint & glowered at links to mckinsey reports about it. i don't know anything really about metals mining, mostly i've just read about coal & all of that from a labor safety perspective, but i'm very curious about the, like. engineering problems (and also still labor safety & environmental problems) presented by trying to genuinely transition away from coal, which we absolutely must do, like guys even UMWA is out here like 'we gotta stop pulling this shit out of the ground' [official position of union president cecil roberts is that coal miners & their communities need a robust 'just transition' away from coal, although some of that is just noticing the way the wind is blowing]

#um. idk what i'm doing here. but if you know something about. um. processing iron ore? please tell me about it#us russia australia are the only 3 major exporters of met coal; china produces more but doesn't export. most us met coal is appalachian#but as the demand for standard coal falls producers shift to the met coal market; export prices are roughly double#ofc met coal comes out of smaller seams so higher silicosis risk; & even union miners get screwed cf. warrior met strike (2021-23)

31 notes

·

View notes

Text

*sigh* this is arguably going to be slightly cursed so don't go blaming me if you fail to avert your eyes at this my dire warning. still here? ok let's go. do you guys think kremy could light a post-coital cigarette off of gideon's... let's err on the side of discretion here and call it happy trail. like if he were down there anyway and really craving the first smoke of the day in celebration of a job well done. do you think gideon would mind. probably not right. just impatiently waiting for a cooldown smooch like 'c'mon up here already, the fuck are you still doin' down th -- oh ok, fine. just don't get any ash in my pubes this time alright it gets itchy'

#coalecroux#once upon a witchlight#kremy lecroux#gideon coal#legends of avantris#I feel like kremy's mouth... situation opens a lot of questions in this manner#there's the most obvious but also. how would kissing work for him. for that matter how does he smoke. can he purse his lips#I guess we'll just have to assume lizardfolk have slightly more flexible mouths than their real world equivalents#considering that they are also capable of producing human speech lol#(the real answer is of course 'dude willing suspension of disbelief is the entry ticket price to the fantasy genre since 4ever'#but where's the fun in that!)

25 notes

·

View notes

Text

I love you, secondhand bookstores. I love you, $5 mass market paperbacks with creased spines. I love you, young adult hardcover in excellent condition for $12.

#i bought 6 books for $90 CAD and this included 2 Folio Society volumes#canadian book prices are borderline inaccessible for me but used bookstores are my canary in a coal mine#books#used books

14 notes

·

View notes

Text

give this a like for your muse to receive a gift during the time of snowdown. remember that the eye of lissandra is always watching, so behave!

#❚ ooc#you can also list the muses youd like to get a gift !#i joke but i wont send anyone coal either 🥺 feeling a mixture of festive cheer and DOT from rl gift prices...#ill do my best to get devan and their trusty reindeer* to deliver on time!

8 notes

·

View notes

Text

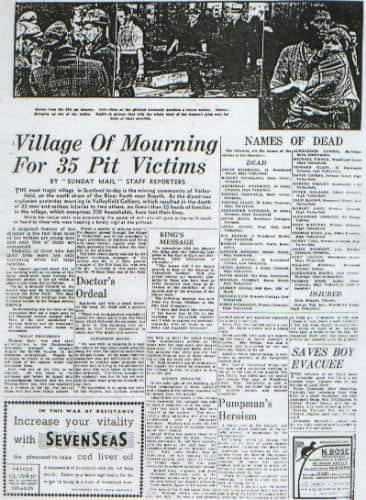

On 28th October 1939, an ignition of firedamp and coal dust caused a devastating explosion in Valleyfield Colliery, killing 35 men.

Many others working deep underground in the early hours of the fateful morning were injured.

It was one of the worst mining tragedies in Fife and came just eight years after 10 men had perished due to carbon monoxide poisoning at Bowhill pit.

News of the explosion brought anxious families from around the west Fife village’s footprint, desperate for news of their loved ones. High and Low Valleyfield bore the brunt but communities from all around were devastated by the scale of the loss. The King and Prime Minister sent messages of condolence and the manager of the colliery and agent of the coal company were later prosecuted and fined.

There were many family connections between the men who lost their lives. Thomas Kerr, of Abbey Crescent, High Valleyfield, was working in the Culross section, and his 27-year-old son, Thomas, was at the coal face where the explosion occurred. The younger man must have been killed instantly, and this news accelerated the death of his father in hospital. “There was no doubt that the shock had this effect,” said a local doctor who arranged for Kerr senior to be sent to hospital. ‘His injuries were only slight, and not sufficient to cause death. He was quite cheerful and smoking his pipe when we took him to hospital. But the news that his son was dead brought about his own death.“

The Dead;

Archibald Anderson, 46, brusher, 44 Abbey Cres, High Valleyfield

David Baillie, 35, brusher, The Ness, Torryburn

Alexander Banks, 65, transport, 6 East Ave, Blairhall (died in hospital)

John Brown, 23, brusher, 8 Bowmont St, Low Valleyfield

David Cairns, 35, brusher, 39 Preston St, High Valleyfield

Thomas Campbell, 56, brusher, Main St, Newmills

Alexander Christie, 61, supervisor, Culross

Thomas Clark, 47, brusher, 34 Abbey Cres, High Valleyfield

William Devlin, 37, machineman, 12 Woodhead St, High Valleyfield

Arthur Doohan, 39, brusher, Burn St, High Valleyfield

Duncan Ewing, 27, brusher, 22 Dundonald Terrace, Low Valleyfield

Aubrey Gauld, 34, brusher, Mid Row, Hill of Beath

Peter Gilliard, 23, brusher, 39 Abbey Cres, High Valleyfield

Edward Glass, 27, transport, 14 Dundonald Ter., Low Valleyfield

David Hogg, 49, packer, Hawthorn Cottage, Carnock

James Irvine, 37, packer, West End, Low Valleyfield

Bert Keegan, 52 brusher, 61 Woodside St, High Valleyfield

Thomas Kerr, 58, 36 Abbey Cres, High Valleyfield (died in hospital)

Thomas Kerr jun, 26, fireman, 36 Abbey Cres, High Valleyfield

Robert Lang, 23, engineer, 6 Preston Cres, High Valleyfield

Alexander Lawrie, 31, brusher, 147 Baldridge Burn, Dunfermline

Edmund Link, 24, transport, Braeside Cottage, Low Valleyfield

James McFadzean, 28, transport, 33 Preston Cres, High Valleyfield

Robert McFarlane, 41, repairer, Main St Newmills

John McIntyre, 22, electrician, 21 Preston Cres, High Valleyfield

Peter Martin, 42, brusher, 5 Abbey Cres, High Valleyfield

Colin Morrison, 51, fireman, 18 Woodhead St, High Valleyfield

Michael Murray, 33, brusher, Burn St, High Valleyfield

Robert Nicholson, 32, brusher, North Rd, Saline

Alexander Paterson, 32, brusher, 19 Abbey Cres, High Valleyfield

William Ramage, 52, brusher, Blairwood Ter, Oakley

James Spowart jun, 29, machineman, Tinian Cres, Newmills

Michael Tinney, 35, transport, 3 Woodhead St, High Valleyfield

Henry Toal, 29, machineman, 26 Preston Cres, High Valleyfield

Robert Wright, 48, brusher, 1 Dunmarle St, High Valleyfield.

More info and news reports on the Scottish mining web site here http://www.scottishmining.co.uk/33.html

10 notes

·

View notes

Text

[ID: tweet by neoltitude @/ctrlcreep on Jan 5, 2023

Once eye contact is made with a god, it cannot be broken; no matter where you look, its eyes are reflected. Once a god is touched, it cannot be untouched, and those nerves are eternally forfeit to the texture of their form End ID]

#feel quite certain this has been posted on tumblr before but i couldn't find it so#sehhinah#prices#not explicitly about it afaik? but who knows idk the op#coal sings

25 notes

·

View notes

Text

Such a creepy and cool place. This old abandoned coal mining maintence building near Price, Utah. The wind blowing thru the place awakens all the creaks and rattles with just add to the aura.

#utah#nature#desert southwest#abandoned buildings#coal mining#Price#urbexplore#urbexphotography#urbexplaces#creepy

8 notes

·

View notes

Text

do you think that, down the road when retirement is an option, when his eyes are lined with wrinkles and hair turning white, that Simon Riley grows his beard out every winter and volunteers as Santa for local kids?

#simon riley imagine#Simon Riley#I just think about him being so good with kids#doesn’t give a shit about the parents who want their child to behave#if the kid doesn’t want to sit on Santa’s lap#Simon sure as fuck isn’t going to force them#and if a child asks for their parent to stop being so mean#and when they run their nose he spies a bruise on their arm#oh Santa’s about to deliver some coal in some fucking stockings#with his little elves (Johnny and Gaz) (price and Laswell bail them out of jail)

7 notes

·

View notes

Text

Coal Prices | Pricing | Price | News | Database | Chart | Forecast

Coal prices have long been a significant factor in the global energy market, influencing a wide array of industries and economies around the world. The price of coal is shaped by a complex interplay of supply and demand, geopolitical factors, environmental regulations, and technological advancements. In recent years, coal prices have experienced substantial fluctuations, driven by both short-term events and longer-term trends.

The demand for coal is closely linked to the industrial and economic activity in major coal-consuming countries. For decades, coal has been a primary source of energy for electricity generation and industrial processes, particularly in countries like China, India, and the United States. These nations, with their large populations and rapidly growing economies, have historically relied heavily on coal to meet their energy needs. However, in recent years, there has been a gradual shift towards cleaner energy sources as environmental concerns and international climate agreements have pushed governments to reduce carbon emissions. This shift has put downward pressure on coal demand, particularly in developed countries, leading to a corresponding decline in coal prices.

On the supply side, coal prices are influenced by the production capacity and operational costs of coal mines, as well as transportation and logistics. Major coal-producing countries such as China, Australia, and Indonesia play a crucial role in determining global coal prices. China's domestic production and consumption are particularly significant, given that the country is both the largest producer and consumer of coal. Any changes in China's coal policies, such as restrictions on imports or adjustments to domestic production quotas, can have a pronounced impact on global coal prices. Additionally, natural disasters, labor strikes, and geopolitical tensions can disrupt coal production and supply chains, leading to temporary spikes in prices.

Get Real Time Prices for Coal : https://www.chemanalyst.com/Pricing-data/coal-1522

Environmental regulations and policies aimed at reducing greenhouse gas emissions have also had a profound effect on coal prices. As more countries commit to reducing their reliance on fossil fuels, particularly coal, through the adoption of renewable energy sources and the implementation of carbon pricing mechanisms, the demand for coal is expected to decline further. This trend is particularly evident in Europe, where stringent environmental regulations and the growth of renewable energy have led to a sharp decrease in coal consumption. In contrast, some developing countries, where access to affordable energy is a priority, continue to rely on coal as a cost-effective source of power. This divergence in energy policies and practices between developed and developing countries creates a complex landscape for coal prices, with regional variations often leading to price disparities.

Technological advancements in energy production and efficiency also play a role in shaping coal prices. The rise of natural gas as a cheaper and cleaner alternative to coal has been a significant factor in reducing coal demand, particularly in the United States. The development of more efficient coal-fired power plants and carbon capture and storage (CCS) technologies could potentially mitigate some of the environmental concerns associated with coal, but these technologies are still in the early stages of adoption and have not yet had a significant impact on coal prices. Additionally, the increasing competitiveness of renewable energy sources such as solar and wind power, which are becoming more cost-effective due to technological advancements and economies of scale, is further eroding the demand for coal.

Geopolitical factors also contribute to the volatility of coal prices. Trade policies, tariffs, and sanctions can influence the flow of coal between countries, affecting both supply and demand. For example, trade tensions between the United States and China have led to disruptions in coal trade, while Australia's diplomatic disputes with China have resulted in reduced coal exports to one of its largest markets. These geopolitical dynamics add an additional layer of complexity to the coal market, making it challenging for producers and consumers to predict future price movements.

In addition to these factors, the ongoing COVID-19 pandemic has had a significant impact on coal prices. The pandemic led to a sharp decline in global energy demand as industrial activity slowed and transportation networks were disrupted. This reduction in demand, coupled with supply chain disruptions and operational challenges faced by coal producers, led to a steep drop in coal prices in the early months of the pandemic. However, as economies began to recover and energy demand rebounded, coal prices started to recover as well. The pandemic has also accelerated the transition towards cleaner energy sources, with many governments incorporating green energy initiatives into their economic recovery plans, which could further dampen long-term demand for coal.

Looking ahead, the future of coal prices remains uncertain, with multiple factors pulling in different directions. On one hand, the ongoing transition towards renewable energy and stricter environmental regulations are likely to continue exerting downward pressure on coal demand and prices. On the other hand, in regions where coal remains a key energy source, particularly in developing countries, demand may persist for some time, providing some support for coal prices. Additionally, short-term events such as natural disasters, supply chain disruptions, and geopolitical tensions can cause temporary price spikes.

In conclusion, coal prices are influenced by a complex and ever-changing set of factors, including supply and demand dynamics, environmental regulations, technological advancements, and geopolitical developments. As the world continues to shift towards cleaner energy sources, the long-term outlook for coal prices remains challenging, with many uncertainties and potential disruptions along the way. However, for the foreseeable future, coal is likely to remain a significant part of the global energy mix, with prices reflecting the ongoing tug-of-war between traditional energy demands and the push for a more sustainable future.

Get Real Time Prices for Coal : https://www.chemanalyst.com/Pricing-data/coal-1522

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Coal#Coal Price#Coal Prices#Coal Pricing#Coal News#Coal Database#Coal Price Chart#Coal Price Trend#Coal Market Price

0 notes

Text

The first quarter of 2023 saw a decline in Coal prices on the American market. At the end of the quarter, the price for brown Coal FOB Norfolk (USA) was estimated to be USD 135/MT. However, the United States saw an 8% decrease in coal consumption in this quarter as a result of less pronounced natural gas price increases than in Europe. This made it more difficult for the United States to switch from Coal to gas for the purpose of producing electricity. In fact, the price of coal futures is considerably lower in 2023 than it was in 2022. However, further trade diversions could impede the decline in coal prices by raising transportation costs.

0 notes

Text

Vincent Price circa mid-50's.

#vincent price#photo#photo edit by me#love how his eyes are so blue even in b&w#so sexy#so beautiful#lips for days#he has always been so attractive#this man i swear#id crawl over hot coals to get a crumb#bicon#bisexual#god#legend#fave#horror#old horror movies#vintage#movie#actor#handsome

66 notes

·

View notes

Text

Impromptu commission I did for @anothersmoldragon of its OC Brandon Coal.

Super cool dude. Also if you voted for him in the poll I kept reblogging, thank youuu because he won the round <3

#anothersmoldragon#brandon coal#tank art#commission#i am Kissing You gently on the cheek btw ghost /p#also I should clarify that I don’t really do commissions typically#so like. i don’t have price sheets or anything#feel like I should say that before someone asks LMAO

15 notes

·

View notes