#citigold

Explore tagged Tumblr posts

Text

Citi Launched 12th Edition of Citigold Private Client Young Successor Program

Empowering Young Successors with a Wealth of Knowledge and Possibilities HONG KONG SAR – Media OutReach Newswire – 13 August 2024 – Citi recently held the 12th edition of the Citigold Private Client Young Successor Program in Singapore which saw a cohort of 37 young adults aged 18-25 invited by Citi Hong Kong, Citi Singapore, and Citi International Personal Bank Singapore. The participants from…

0 notes

Text

[香港旅遊優惠]Citigold 迎新優惠|新開户獨家送雙人曼谷/台北來回機票|仲有高達HK$48,800現金回贈

[香港旅遊優惠]Citigold 迎新優惠|新開户獨家送雙人曼谷/台北來回機票|仲有高達HK$48,800現金回贈 https://www.jetsoday.com/%e9%a6%99%e6%b8%af%e6%97%85%e9%81%8a%e5%84%aa%e6%83%a0citigold-%e8%bf%8e%e6%96%b0%e5%84%aa%e6%83%a0%ef%bd%9c%e6%96%b0%e9%96%8b%e6%88%b7%e7%8d%a8%e5%ae%b6%e9%80%81%e9%9b%99%e4%ba%ba%e6%9b%bc%e8%b0%b7.html 又黎新一期Citigold 新開戶入新資金迎新優惠!今次仲獨家送機票!8月14日前申請,並於8月21日前成功開戶,存入指定新資金及維持2個月,即送台北/首爾/曼谷來回機票!計埋本身迎新優惠,最多可以拎到HK$ 48,800現金回贈! Flyday 獨家優惠|開户存指定金額送台北/首爾/曼谷來回機票 超級荀呀!新客戶存入以下指定新資金,送台北/首爾/曼谷/來回機票! 存入HK$ 1,500,000或以上新資金: 1張來回首爾經濟艙機票 (韓亞航空/香港航空) 或 1張來回曼谷經濟艙機票 (國泰航空/阿聯酋航空/泰國航空) 或 1張來回台北經濟艙機票* (國泰航空/香港航空/長榮航空/中華航空) 包20kg 寄艙行李 *不包括燃油附加費、稅項及手續費,相關費用需於出票時額外付款。 存入HK$ 2,500,000或以上新資金: 2張來回曼谷經濟艙機票 (國泰航空/阿聯酋航空/泰國航空) 或 2張來回台北經濟艙機票* (國泰航空/香港航空/長榮航空/中華航空) 包20kg 寄艙行李 *不包括燃油附加費、稅項及手續費,相關費用需於出票時額外付款。 【優惠日期】8月1至14日 第一步 >申請開户 (必須透過此連結申請) 第二步 >於8月21日或之前成功開戶,並到分行存入HK$ 1,500,000或HK$ 2,500,000以上新資金 (須維持指定資金至10月21日)

0 notes

Text

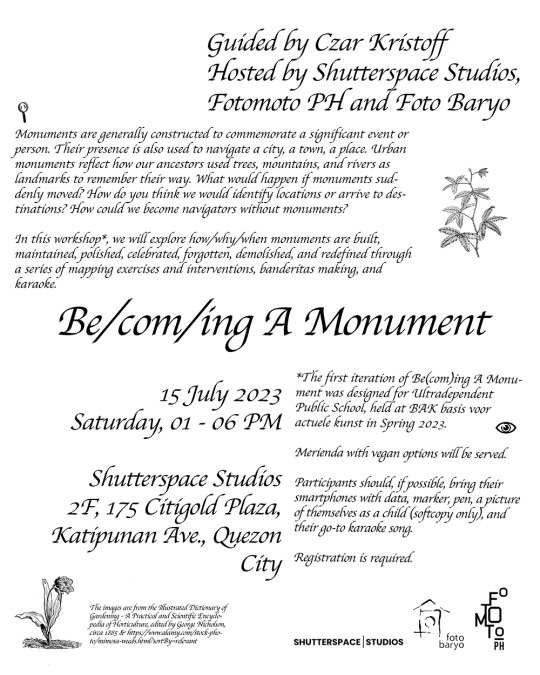

UPCOMING: BE/COM/ING A MONUMENT Guided by Czar Kristoff Hosted by Shutterspace Studios, Fotomoto.PH and Fotobaryo

When: July 15, 2023, Saturday, 1-6PM

Where: Shutterspace Studios, 175 Citigold Plaza, Katipunan Ave, Quezon City https://goo.gl/maps/m3asFLgyuuE8Vrte8

What: Monuments are generally constructed to commemorate a significant event or person. Their presence is also used to navigate a city, a town, a place. Urban monuments reflect how our ancestors used trees, mountains, and rivers as landmarks to remember their way. What would happen if monuments suddenly moved? How do you think we would identify locations or arrive to destinations? How could we become navigators without monuments?

In this workshop*, we will explore how/why/when monuments are built, maintained, polished, celebrated, forgotten, demolished, and redefined through a series of mapping exercises and interventions, banderitas making, and karaoke. Register here: https://forms.gle/jJR1bdyKCadvnrjb7

*The first iteration of Be(com)ing A Monument was designed for Ultradependent Public School, held at BAK basis voor actuele kunst in Spring 2023. More info here: https://www.bakonline.org/program-item/ultradependent-public-school/.

1 note

·

View note

Text

Top 9 Personal Loan Lenders of 2023

Making the right choice about your personal loan can significantly impact your repayment timeline, available capital, and the speed at which you can clear your debt. Please note, rates, fees, and loan amounts are accurate as of April 11, 2023, but they may change.

1. Safe Loan

About: Safe Loan is a dynamic player in the finance world, offering safe and quick loans for bad credit without unnecessary delays. They aim to make a difference by prioritizing personalized customer service during your loan application process.

Loan amount: Up to $1,200

Customer support: Safe Loan values the personal information you provide and uses it only for financial purposes and credit checks, reducing the waiting time for your loan approval.

Our verdict: Safe Loan is a great choice for individuals who need access to quick funding, particularly those with poor credit ratings. They boast a secure process, personalized customer service, and a commitment to getting your approved loan amount deposited directly into your bank account as soon as the next business day. Safe Loan operates under the tagline: GET UP TO $1,200 DEPOSITED DIRECTLY INTO YOUR BANK ACCOUNT AS SOON AS THE NEXT BUSINESS DAY.

Visit Safe Loan

2. LightStream

LightStream is a digital lending platform offering personal, auto, and home improvement loans. Their personal loan's attractive features include a wide range of loan terms up to 144 months and competitive APRs between 7.99% and 26.49%.

3. SoFi

As an online bank based in San Francisco, SoFi offers personal loans with low rates and zero late fees. They provide an excellent backup plan with their unemployment protection feature, which can modify your monthly loan payments and offer job placement assistance during your forbearance period.

4. PenFed Credit Union

PenFed, a Virginia-based credit union, offers personal loan rates lower than the national average. It doesn't charge origination fees or early payoff penalties, making it an excellent choice for credit union loyalists.

5. Wells Fargo

Wells Fargo offers personal loans with APRs starting as low as 7.49%. They don't charge origination or prepayment fees, but late payments will result in a $39 charge after the 10-day grace period.

6. TD Bank

TD Bank provides quick financing with no additional fees through their TD Fit loan. Their terms range from 36 to 60 months, offering flexibility for borrowers. There's no penalty for early balance clearance, and funds are typically available within one business day of approval.

7. Universal Credit

Universal Credit offers fast funding and low fees despite its higher APRs ranging from 11.69% to 35.93%. It's a good choice for those ready to exchange a higher APR for faster funding and minimal fees.

8. Citibank

Citibank offers a 0.5% APR discount for auto-pay enrollment and an additional 0.25% discount for existing Citigold and Citi Priority customers. Funds can be accessed as soon as the same day of approval if the borrower has a Citi account.

9. U.S. Bank

U.S. Bank offers personal loans with fairly low APRs ranging from 8.74% to 21.24%, but applicants must have a FICO score of 660. There are no origination fees or prepayment penalties, although late payments could result in up to $40 in fees.

Understanding Personal Loans

Personal loans can be an effective solution when you need quick funding, but they should be approached responsibly. Securing a personal loan means you agree to repay your loan amount plus any interest within the agreed term, with payments commencing as soon as the funds land in your bank account.

Personal loans can be secured or unsecured, and they typically have fixed interest rates. Unlike credit card debts that come with variable rates susceptible to economic changes, your interest rate will not change once your personal loan is approved and locked in. Before you apply, be aware that lenders will need to perform a credit check, which may briefly impact your credit score.

Unsecured personal loan: A loan that does not require collateral.

Secured personal loan: A loan that is secured by an asset, usually resulting in lower interest rates.

Cosigner loan: A loan that is backed by another person with good credit history who agrees to repay the loan if the borrower fails to do so.

Credit-builder loan: A secured loan where the collateral is a cash deposit or savings account. This loan is typically best for borrowers aiming to rebuild their credit.

1 note

·

View note

Photo

Terrific Corporate event for CitiGold Wealth Management Group tonight at #thescentarium with #relationship #management group. Everyone created their own custom scent and had an amazing time learning about the different fragrance families! . . . #citibank #citigold #corporateevents #customscents #clients #teambuilding #experiential #workshop #thescentarium #scentfullysue #scenterprises #suephillipsbespokeperfumery #suephillipshouseoffragrance #womeninbusiness #womenofinfluence #fragranceevent #thebestcorporateevent (at The Scentarium)

#womeninbusiness#experiential#management#womenofinfluence#citibank#suephillipshouseoffragrance#citigold#relationship#teambuilding#corporateevents#thescentarium#clients#workshop#scenterprises#fragranceevent#thebestcorporateevent#scentfullysue#customscents#suephillipsbespokeperfumery

2 notes

·

View notes

Photo

#reviews #happyclient #bangles #jewelry #testimonial #bengalibangles #pola #citigold #shopbollywear #custommade https://www.instagram.com/p/CDuB0MtFH_W/?igshid=11gjzmytwdpjw

#reviews#happyclient#bangles#jewelry#testimonial#bengalibangles#pola#citigold#shopbollywear#custommade

0 notes

Photo

#citigold #lotusonwater #fengshui #arty @lotusonwater.exquisitejadeite @lotusonwaterfengshuiart #sharing @champagnelaurentperrier together with the motley crue of Donald, Maria, Jean, Florence, Billy and Jin . . #love #instagood #fashion #beautiful #happy #art #photography #style #travel #life #cute #hiso #luxury #lifestyle #SGLifestyle #like4like #photooftheday #picoftheday #instamood (at Citigold) https://www.instagram.com/p/B78yKoBHi2J/?igshid=cdymsasxxh7h

#citigold#lotusonwater#fengshui#arty#sharing#love#instagood#fashion#beautiful#happy#art#photography#style#travel#life#cute#hiso#luxury#lifestyle#sglifestyle#like4like#photooftheday#picoftheday#instamood

0 notes

Text

El ex presidente del Citi Bank Jose de Pool (primo de Juan Carlos Vallejos), director de Derwik en el 2022.

Location.

Toronto, Ontario, Canada.

Work.

Senior Manager International Private Banking @ Scotiabank

Professional Networker @ Preparing to Start a New Career in Canada.

Director of Finance and Administration @ Derwick Associates De Venezuela.

Senior Consultant @ Independent Consultant.

Citigold Head @ Citi Bank.

Retail Manager @ Citi Bank.

Branch Manager @ Citi Bank.

Education.

Humber College (Leadership) 2014 - 2014.

IESAMaster of Business Administration (Finance)1991 - 1993.

University of North Carolina at Chapel HillMaster of Business Administration1992 - 1992.

University of North Carolina at Chapel HillMaster of Business Administration.

Universidad Rafael Urdaneta.

Sales.

Compensation Strategies.

Retail Banking.

Sales Management.

Executive Management.

Strategic Sales Initiatives.

Business Modeling.

Risk Management.

Wealth Management.

Microsoft Excel.

#Location.#Toronto#Ontario#Canada.#Work#Senior Manager International Private Banking @ Scotiabank#Professional Networker @ Preparing to Start a New Career in Canada.#Director of Finance and Administration @ Derwick Associates De Venezuela.#Senior Consultant @ Independent Consultant.#Citigold Head @ Citi Bank.#Retail Manager @ Citi Bank.#Branch Manager @ Citi Bank.#Education.#Humber College(Leadership)2014 - 2014.#IESAMaster of Business Administration (Finance)1991 - 1993.#University of North Carolina at Chapel HillMaster of Business Administration1992 - 1992.#University of North Carolina at Chapel HillMaster of Business Administration.#Universidad Rafael Urdaneta.#Sales.#Compensation Strategies.#Retail Banking.#Sales Management.#Executive Management.#Strategic Sales Initiatives.#Business Modeling.#Risk Management.#Wealth Management.#Microsoft Excel.

4 notes

·

View notes

Text

Citigold Premier Banking Review – Get an iPad Air 5th Gen (worth $879) or $700 worth of MBS Gift Certificates when you sign up!

Citigold Premier Banking Review – Get an iPad Air 5th Gen (worth $879) or $700 worth of MBS Gift Certificates when you sign up!

View On WordPress

#best banking rewards 2022#best banking singapore 2022#citigold financial horse 2022#citigold lounge 2022#citigold premier banking 2022#citigold premier banking review 2022#citigold review 2022#citigold rewards 2022#citigold sign up benefits 2022#citigold sign up code 2022#premier banking singapore review 2022

0 notes

Text

Shop like a local overseas or online with Citigold Global Wallet

Shop like a local overseas or online with Citigold Global Wallet

Image Credit: Shutterstock With vaccination programmes rolling out successfully across the UAE and other countries, there’s a surge in travellers wanting to explore the world. After all, there’s nothing like 12 months of relative confinement to make those airport check-in queues look mighty appealing. A recent survey by Rehlaty by dnata Travel said that 70 per cent of its bookings in 2021 so…

View On WordPress

0 notes

Text

What are Priority/Premium Banking in Malaysia?

Premium banking is like a ticket to the business class of an airplane. You enjoy preferential treatment which is more than what is offered to other passengers like more legroom and free food and services. Though every airline passenger reaches the same destination, your experience is better than the others.

Priority banking in Malaysia is a set of customized and exclusive banking services that is offered when you stack a certain limit of funds in the bank. In this premium/ priority banking, you get to enjoy the services of banks which are not available to general customers like a dedicated relationship manager and attractive rates on locker and deposits. When you avail a premium banking service, banks treat you as a priority customer with better features and benefits.

Let us look at the benefits of priority/ premium banking.

Private Banking Services

When you visit your bank, you enjoy preferential treatment from the bank officials and the banks offer personalized service from the dedicated team of bankers. Moreover, you also receive a priority debit master card, which you can access anytime and anywhere, in a secured manner. There could be a separate kiosk or priority queue in the bank at your service so that you need not wait for your turn. You can enjoy better interest rates and better foreign exchange rates along with a special loan package when you avail a premium banking facility.

Professional Guidance

With a priority banking service, you get a personalized assistance of experts. There are dedicated relationship and wealth managers who help you manage and grow your money. You can also take the help of an investment manager who can guide you in your investments so that you can create a good portfolio.

Lifestyle Benefits

With banks like Citigold premier banking, you can enjoy a series of lifestyle benefits. You can enjoy luxury holidays with partner resorts and hotel chains with lifestyle benefits. You can also enjoy unlimited access to airport lounges, food and drinks vouchers, invitations to high-level events and parties, along with discounts for lifestyle services like spa, saloon and gold courses. You might also be offered discounts on travel, shopping and entertainment. Many banks also provide privileges in hospitals and clinics to their priority clients.

Global Banking

An additional benefit that priority customers can enjoy is global banking. Whether you relocate to another country or are travelling between continents, the bank ensures you that you get all the services wherever you go. You can use mobile services for your services or use their ATMs and branch services if they have a multi-country presence. Many priority customers also get to enjoy travel insurance that is offered complimentary with the priority banking.

0 notes

Photo

#gorgeous #jewelry #earrings #necklace #stonework #shopbollywear #jewelrygram #sold #bangles #goldplated #jewelrygram #onlineshopping #indianjewelry #bengalibangles #citigold #pola https://www.instagram.com/p/CDfNkyXFcZ0/?igshid=1ozsgziwf32ou

#gorgeous#jewelry#earrings#necklace#stonework#shopbollywear#jewelrygram#sold#bangles#goldplated#onlineshopping#indianjewelry#bengalibangles#citigold#pola

0 notes

Text

Lowongan Pekerjaan Ketua Tim Akuisisi Citigold Denpasar

Lowongan Pekerjaan Ketua Tim Akuisisi Citigold Denpasar

[ad_1] Lowongan Pekerjaan: Citigold Acquisition Team Leader Denpasar Nama Perusahaan: Citigroup Deskripsi Pekerjaan: Calon akan bertanggung jawab untuk mengawasi tim penjualan yang akan membawa pelanggan NTB berkualitas baik di segmen Citigold & Citipriority yang akan menghasilkan pendapatan untuk cabang Kualifikasi Calon harus memiliki minimal 2 tahun …

Perkiraan Pendapatan: Lokasi Pekerjaan:…

View On WordPress

0 notes

Text

Lowongan Pekerjaan Ketua Tim Akuisisi Citigold Denpasar

Lowongan Pekerjaan Ketua Tim Akuisisi Citigold Denpasar

[ad_1] Lowongan Pekerjaan: Citigold Acquisition Team Leader Denpasar Nama Perusahaan: Citigroup Deskripsi Pekerjaan: Calon akan bertanggung jawab untuk mengawasi tim penjualan yang akan membawa pelanggan NTB berkualitas baik di segmen Citigold & Citipriority yang akan menghasilkan pendapatan untuk cabang Kualifikasi Calon harus memiliki minimal 2 tahun …

Perkiraan Pendapatan: Lokasi Pekerjaan:…

View On WordPress

0 notes

Text

Citigold Premier Banking Review – Get a Microsoft Surface Go 3 (worth S$848) or Apple Watch Series 7 (worth S$749) when you sign up!

View On WordPress

#best banking rewards 2022#best banking singapore 2022#citigold financial horse 2022#citigold lounge 2022#citigold premier banking 2022#citigold premier banking review 2022#citigold review 2022#citigold rewards 2022#citigold sign up benefits 2022#citigold sign up code 2022#premier banking singapore review 2022

0 notes

Video

instagram

meLOOKmeL is invited by Citigold Citibank Indonesia to speak about the women's role in the development of Indonesia. #womenempowerment #womeninspiringwomen #citibank #citigold (at Jakarta, Indonesia) https://www.instagram.com/p/Bwk4y5Ig8Lp/?utm_source=ig_tumblr_share&igshid=1i2u6dp8ze1sj

0 notes