#chamber of commerce registration

Explore tagged Tumblr posts

Text

Breaking Down Holding Company Formation Costs

Establishing a holding company can be a strategic move for asset protection, tax benefits, and business expansion. However, understanding holding company formation costs is key to making informed decisions.

🔹 Incorporation Fees: Registering a holding company involves state or country-specific filing fees, which can range from a few hundred to several thousand dollars. Some jurisdictions, like the Cayman Islands or Singapore, offer cost-efficient incorporation structures.

🔹 Legal & Consulting Costs: Seeking legal and financial advice is essential for structuring your company properly. Attorney fees, contract drafting, and regulatory compliance consulting add to the overall cost but help prevent legal complications.

🔹 Tax & Compliance Expenses: Depending on the country of registration, your holding company may need to pay corporate taxes, VAT, or other levies. Maintaining tax efficiency requires hiring accountants or tax specialists, further increasing costs.

🔹 Operational & Maintenance Fees: Some jurisdictions require annual renewal fees, regulatory filings, and periodic audits. These recurring costs should be factored into your long-term budget.

Choosing the right jurisdiction can significantly impact holding company formation costs. Researching tax-friendly locations, understanding compliance requirements, and working with experienced professionals can help you minimize expenses while maximizing benefits.

Are you considering setting up a holding company? Let’s explore the best options together!

#asset management company#netherlands business registry#self-employed agreement#cv in the netherlands#establish a holding company#notary bv formation costs#starting a company in the netherlands#netherlands chamber of commerce#chamber of commerce registration#commercial#Business#Services#Legal

0 notes

Text

Had to update my registration with the chamber of commerce since I moved.

Apparently officially my one-woman company does.... "media production and social media"....... which yeah I guess that's accurate..... guess they don't have a column for "live streamer"

285 notes

·

View notes

Text

Ellen Swepson Jackson (October 29, 1935 – November 20, 2005) was an educator and activist. She was known for founding Operation Exodus, the program that paved the way for the desegregation of Boston’s public schools.

She was born in Boston, the middle child of David and Marguerite Booker Swepson. She belonged to the NAACP Youth Council. She graduated from Boston State College and received her MA in Education from Harvard University.

She married Hugo Jackson (1954). The couple had five children.

She served as a parent coordinator for the Northern Student Movement, organizing African American parents and advocating for students’ equal rights. She worked for a Boston bank and was fired for going to a rally to hear Martin Luther King Jr. speak. She was involved in voter registration and picketed for better representation on the board of directors of Action for Boston Community Development. She worked as a Social Service Supervisor for the Head Start program.

She served as national director of the Black Women’s Community Development Foundation. She was a member of the Citywide Coordinating Council to oversee the desegregation of the public schools. She worked for the Massachusetts Department of Education as a project director for the Title IV program. She worked as director of the Freedom House Institute on Schools and Education. She served as the dean and director of affirmative action at Northeastern University.

She was a delegate to several White House Conferences. She was a delegate and member of the Democratic Platform Committee. She was involved with the Young Women’s Leadership Development Program, the Legal Defense and Education Fund, the Boston Chamber of Commerce, the American Association for Higher Education, the Governor’s Community Development Coordinating Council, and Boston Children’s Hospital, among others.

The Ellen S. Jackson Fellowship at the Harvard Graduate School of Education was established in her honor, and a day-care center on Mission Hill was named for her. She received honorary doctorates from Northeastern University, the University of Massachusetts, Wheelock College, and Bridgewater State College. #africanhistory365 #africanexcellence

2 notes

·

View notes

Text

I've taken many jabs at the ACLU for defending perverted freaks now here's the HRC following their lead.

By Reduxx Team February 16, 2024

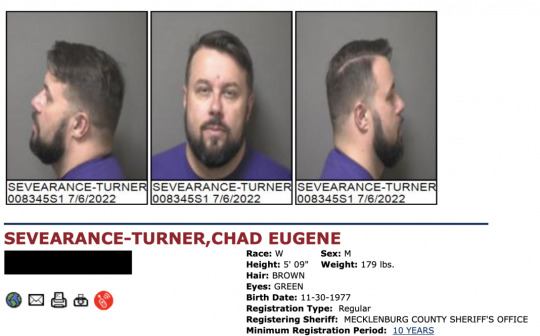

A registered child sex offender was welcomed at the Human Rights Campaign’s North Carolina Dinner gala last week, just months after a controversy involving him being awarded a top LGBT advocacy prize. Chad Severance-Turner, a former youth minister, is currently the Chief Executive Officer at the Carolina LGBT+ Chamber of Commerce.

On February 10, the Human Rights Campaign in North Carolina held its annual dinner gala, with a number of top LGBT activists in attendance. Among the speakers at the Bank of America-sponsored “Without Exception” event was HRC Press Secretary Brandon Wolf and Democrat State Senator Lisa Grafstein.

But among those featured in attendance was Chad Severance-Turner, a registered child sex offender who has managed to rise to prominence as an LGBT advocate in North Carolina.

As previously reported by Reduxx, Turner was first accused by three boys of sexual abuse in 1998.

According to a GoUpstate report on the case from 2000, all of the victims who had come forward had met Turner through his position as the music director at the New Harvest Church of God in Gaffney, South Carolina. The cases were tried separately due to the nature of the charges, and Turner was ultimately only convicted on one offense.

Of the incidents Turner was convicted on, a 14-year-old boy had testified that Turner had invited him to spend the night at his house in the nearby community of Bessemer City, North Carolina. The victim stated that during the visit, Turner had questioned him on how he’d feel about a man performing oral sex on him.

Turner, wearing a silver vest, at the February 10 HRC Dinner.

“I thought he was joking,” the boy told the court. He explained that Turner frequently questioned him about sexual acts between men and women, which upset him because of the man’s position in the church. The victim continued that, following a revival meeting, he and Turner stayed overnight at the home of one of the other alleged victims.

The teen says he awoke to find Turner fondling his genitals, but didn’t immediately report it due to shame.

The second minor, who said he was 15 when the incident occurred, stated he was invited to Turner’s home where the older man showed him a pornographic video of a man and a woman having sex. He then said that later that night, after he and Turner went to sleep in the same bed, he woke up to find Turner fondling him.

The third alleged victim, who was also 15 at the time, said Turner had made the same advances to him over a three-week period when he stayed in the boy’s home. The minor said Turner had fondled him several times.

“He told me if I ever told the pastor, he’d make me look like a fool and a liar,” the boy said.

Turner’s registration with the North Carolina Sex Offender and Public Protection Agency.

During the trial, Turner’s defense attorney, Thomas Shealy, accused the boys of perpetrating a “witch hunt,” and asserted that it was suspicious that there was a few month delay between them being sexually abused and them going to their parents.

Turner was ultimately convicted on the charges related to the first victim, and sentenced to 10 years in prison for committing lewd acts on a minor under the age of 16. He served 2 years behind bars before being released on parole and being ordered to the sex offender registry.

Since being released from prison, Turner has become an active and notable member of the Charlotte LGBTQ advocacy community.

In 2012, Turner was elected the president of the LGBT+ Chamber of Commerce, immediately heading efforts to push for an expanded “nondiscrimination” ordinance which many complained would have prevented businesses from maintaining spaces such as washrooms as single-sex.

He was named “Person of the Year” by LGBT news outlet QNotes in March of 2015, but would resign from his Chamber of Commerce post in 2016 after his history as a child sex offender came to light. He would once again join the LGBT+ Chamber of Commerce as its inaugural CEO in 2021, a position he has held since. Under his leadership, the Chamber has secured partnerships with prominent organizations like Fifth Third Bank, NASCAR, Duke Energy, Wells Fargo, Sonoco, and Novant Health. He was also recently appointed by Charlotte Mayor Vi Lyles to serve on the city’s Business Advisory Committee.

Turner has previously been awarded an honor by the Human Rights Campaign at their annual gala, though at the time, HRC officials refused to state whether they were aware of his child sex offender status prior to giving him the award.

Most recently, Turner was honored with the Harvey Milk Award by Charlotte Pride in a controversial move that was quickly reversed after Reduxx reported on his pedophile past.

#usa#north carolina#human rights campaign#A LGBT+ advocacy prize was awarded to a sex offender#Carolina LGBT+ Chamber of Commerce#Bank of America#Without Exception#Democrat State Senator Lisa Grafstein#New Harvest Chruch of God#Chad Severance-Turner is a former youth minister turned registered sex offender#Fifth Third Bank#NASCAR#Duke Energy#Wells Fargo#Sonoco#Novant Health.

7 notes

·

View notes

Text

Voting Is Powerful

Hey US peeps! Now is a great time to check your voter registration, register to vote, or update your address on your voter registration before the election in November.

Why? Because, whether you have strong feelings about candidates, measures or not, it is a privilege to be able to vote and use your voice in your community. Not everyone has that privilege. That's just it!

The more citizens who vote, the more our elected officials can represent a majority of our citizens. Rarely is there over 65% voter turnout. And the average for most elections is much much lower.

If most citizens don't normally vote, it is very powerful when most of us do vote.

(tips and resources below cut)

See also EAC.GOV for the US election assistance committee.

Check & Register To Vote

Each state has an office of the Secretary of State (go to https://sos.[Insert your state name].gov) which deals with elections and voter registrations. You may also update your voter registration from your state's office, view candidates and measures, and much more depending on how they have set up their system. It is my understanding that each county has an elections office that has a similar website.

Each state also has different laws concerning voting. Make sure your registered name matches your ID as well as your address. Be especially careful if you have more than one last, middle, or first names.

Examples:

Oregon Secretary Of State Elections

https://sos.oregon.gov/elections

Clackamas County Elections

https://clackamas.us/elections

Voting Tips For Newbies:

We all know politicians are not known for honesty but how can we trust they will be more inline with your personal world view than other candidates? This is based on my personal routine. I've voted and lived in multiple different states across the country. Here are a few helpful tips. I've been lucky and have only needed to use numbers 1 & 2, and 3 very seldomly.

1. Read a voter's pamphlet - (see also secretary of state websites) look at endorsements; especially teachers, unions, police, chamber of commerce, other politicians, PACs created by special interest groups; buzz words mentioned, types of past experience. This is a job interview and you are their new boss.

2. No pamphlet? Quickly search the internet. Look at a local paper interview, their personal website, any endorsements, etc.

3. Visit your local elections office's website (state, county, federal) or write them asking for information if you really feel up to a challenge. This is your right to be informed.

4. When all else fails, spend 20 minutes at the library for important elections. Librarians are happy to help with specific questions, as long as they are fact based and researchable.

Other informative websites:

Ballotpedia.org - information about upcoming US elections. A great source, especially for federal elections or state and local elections where there is difficult to find locally provided information.

Example: Ballotpedia 2024 Presidential Election

538 - Do you enjoy looking at numbers and polls? This site has all of the election polls you could want, with a focus on the federal election right now. But, all local polled races can be found here as well.

270towin.com - a graphical and numbers based map of the USA tracking the US national election by electoral vote.

Lastly...

Voting can seem overwhelming. And, it seems more difficult than it should. To me, that shows the importance of voting. If it weren't important, there wouldn't be other people actively trying to stop you from using your voice by voting or becoming involved in your local city council/community center/volunteer programs/peaceful protest. Good luck, and happy thoughts!

3 notes

·

View notes

Video

tumblr

Once You See the Truth About Cars, You Can’t Unsee It https://www.nytimes.com/2022/12/15/opinion/car-ownership-inequality.html

By Andrew Ross and Julie Livingston

Mr. Ross and Ms. Livingston are professors at New York University, members of its Prison Education Program Research Lab and authors of the book “Cars and Jails: Freedom Dreams, Debt, and Carcerality.”

In American consumer lore, the automobile has always been a “freedom machine” and liberty lies on the open road. “Americans are a race of independent people” whose “ancestors came to this country for the sake of freedom and adventure,” the National Automobile Chamber of Commerce’s soon-to-be-president, Roy Chapin, declared in 1924. “The automobile satisfies these instincts.” During the Cold War, vehicles with baroque tail fins and oodles of surplus chrome rolled off the assembly line, with Native American names like Pontiac, Apache, Dakota, Cherokee, Thunderbird and Winnebago — the ultimate expressions of capitalist triumph and Manifest Destiny.

But for many low-income and minority Americans, automobiles have been turbo-boosted engines of inequality, immobilizing their owners with debt, increasing their exposure to hostile law enforcement, and in general accelerating the forces that drive apart haves and have-nots.

Though progressive in intent, the Biden administration’s signature legislative achievements on infrastructure and climate change will further entrench the nation’s staunch commitment to car production, ownership and use. The recent Inflation Reduction Act offers subsidies for many kinds of vehicles using alternative fuel, and should result in real reductions in emissions, but it includes essentially no direct incentives for public transit — by far the most effective means of decarbonizing transport. And without comprehensive policy efforts to eliminate discriminatory policing and predatory lending, merely shifting to electric from combustion will do nothing to reduce car owners’ ever-growing risk of falling into legal and financial jeopardy, especially those who are poor or Black.

By the 1940s, African American car owners had more reason than anyone to see their vehicles as freedom machines, as a means to escape, however temporarily, redlined urban ghettos in the North or segregated towns in the South. But their progress on roads outside of the metro core was regularly obstructed by the police, threatened by vigilante assaults, and stymied by owners of whites-only restaurants, lodgings and gas stations. Courts granted the police vast discretionary authority to stop and search for any one of hundreds of code violations — powers that they did not apply evenly. Today, officers make more than 50,000 traffic stops a day. Driving while Black has become a major route to incarceration — or much worse. When Daunte Wright was killed by a police officer in April 2021, he had been pulled over for an expired registration tag on his car’s license plate. He joined the long list of Black drivers whose violent and premature deaths at the hands of police were set in motion by a minor traffic infraction — Sandra Bland (failure to use a turn signal), Maurice Gordon (alleged speeding), Samuel DuBose (missing front license plate) and Philando Castile and Walter Scott (broken taillights) among them. Despite widespread criticism of the flimsy pretexts used to justify traffic stops, and the increasing availability of cellphone or police body cam videos, the most recent data shows that the number of deaths from police-driver interactions is almost as high as it has been over the past five years.

In the consumer arena, cars have become tightly sprung debt traps. The average monthly auto loan payment crossed $700 for the first time this year, which does not include insurance or maintenance costs. Subprime lending and longer loan terms of up to 84 months have resulted in a doubling of auto loan debt over the last decade and a notable surge in the number of drivers who are “upside down”— owing more money than their cars are worth. But, again, the pain is not evenly distributed. Auto financing companies often charge nonwhite consumers higher interest rates than white consumers, as do insurers.

Formerly incarcerated buyers whose credit scores are depressed from inactivity are especially red meat to dealers and predatory lenders. In our research, we spoke to many such buyers who found it easier, upon release from prison, to acquire expensive cars than to secure an affordable apartment. Some, like LeMarcus, a Black Brooklynite (whose name has been changed to protect his privacy under ethical research guidelines), discovered that loans were readily available for a luxury vehicle but not for the more practical car he wanted. Even with friends and family willing to help him with a down payment, after he spent roughly five years in prison, his credit score made it impossible to get a Honda or “a regular car.” Instead, relying on a friend to co-sign a loan, he was offered a high-interest loan on a pre-owned Mercedes E350. LeMarcus knew it was a bad deal, but the dealer told him the bank that would have financed a Honda “wanted a more solid foundation, good credit, income was showing more,” but that to finance the Mercedes, it “was actually willing to work with the people with lower credit and lower down payments.” We interviewed many other formerly incarcerated people who followed a similar path, only to see their cars repossessed.

Did you know you can share 10 gift articles a month, even with nonsubscribers?

Share this article.

LeMarcus was “car rich, cash poor,” a common and precarious condition that can have serious legal consequences for low-income drivers, as can something as simple as a speeding ticket. A $200 ticket is a meaningless deterrent to a hedge fund manager from Greenwich, Conn., who is pulled over on the way to the golf club, but it could be a devastating blow to those who mow the fairways at the same club. If they cannot pay promptly, they will face cascading penalties. If they cannot take a day off work to appear in court, they risk a bench warrant or loss of their license for debt delinquency. Judges in local courts routinely skirt the law of the land (in Supreme Court decisions like Bearden v. Georgia and Timbs v. Indiana) by disregarding the offender’s ability to pay traffic debt. At the request of collection agencies, they also issue arrest or contempt warrants for failure to appear in court on unpaid auto loan debts. With few other options to travel to work, millions of Americans make the choice to continue driving even without a license, which means their next traffic stop may land them in jail.

The pathway that leads from a simple traffic fine to financial insolvency or detention is increasingly crowded because of the spread of revenue policing intended to generate income from traffic tickets, court fees and asset forfeiture. Fiscally squeezed by austerity policies, officials extract the funds from those least able to pay. This is not only an awful way to fund governments; it is also a form of backdoor, regressive taxation that circumvents voters’ input.

Deadly traffic stops, racially biased predatory lending and revenue policing have all come under public scrutiny of late, but typically they are viewed as distinct realms of injustice, rather than as the interlocking systems that they are. Once you see it, you can’t unsee it: A traffic stop can result in fines or arrest; time behind bars can result in repossession or a low credit score; a low score results in more debt and less ability to pay fines, fees and surcharges. Championed as a kind of liberation, car ownership — all but mandatory in most parts of the country — has for many become a vehicle of capture and control.

Industry boosters promise us that technological advances like on-demand transport, self-driving electric vehicles and artificial intelligence-powered traffic cameras will smooth out the human errors that lead to discrimination, and that car-sharing will reduce the runaway costs of ownership. But no combination of apps and cloud-based solutions can ensure that the dealerships, local municipalities, courts and prison industries will be willing to give up the steady income they derive from shaking down motorists.

Aside from the profound need for accessible public transportation, what could help? Withdraw armed police officers from traffic duties, just as they have been from parking and tollbooth enforcement in many jurisdictions. Introduce income-graduated traffic fines. Regulate auto lending with strict interest caps and steep penalties for concealing fees and add-ons and for other well-known dealership scams. Crack down hard on the widespread use of revenue policing. And close the back door to debtors’ prisons by ending the use of arrest warrants in debt collection cases. Without determined public action along these lines, technological advances often end up reproducing deeply rooted prejudices. As Malcolm X wisely said, “Racism is like a Cadillac; they bring out a new model every year.”

Andrew Ross and Julie Livingston are professors at New York University, members of its Prison Education Program Research Lab and authors of the book “Cars and Jails: Freedom Dreams, Debt, and Carcerality.”

#article#new york times#Tiktok#Jamelle Bouie#car culture#car dependency#urban design#urban planning#car trap#infrastructure#bike infrastructure#income inequality#inequality#wealth inequality#law enforcement#debt#drivers license#traffic

62 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords: company registration netherlands legal advice online comprehensive financial planning financial planning consultancy international business services international business expansion strategies gdpr compliance solutions international trade consulting european investment opportunities gdpr compliance consulting services in depth financial analysis gdpr compliance assistance cross border tax solutions netherlands business environment european union business law dutch accounting services tax intermediation solutions international tax planning advice eu trademark registration services investment guidance online business law consultancy corporate tax services netherlands financial analysis experts business immigration support startup legal assistance online european market entry consulting international financial reporting services business strategy netherlands tax authority communication support international business law expertise dutch commercial law advice global business strategy services european business consulting online international business services platform expert legal advice online efficient company registration netherlands reliable dutch accounting services strategic tax intermediation proactive international tax planning eu trademark registration support tailored investment guidance specialized business law consultancy dynamic international trade consulting holistic corporate tax services netherlands streamlined business immigration support online startup legal assistance strategic international business expansion european market entry planning innovative cross border tax solutions navigating the netherlands business environment european union business law insights accurate international financial reporting proven business strategy netherlands exclusive european investment opportunities seamless tax authority communication in depth dutch commercial law advice comprehensive global business strategy proactive european business consulting one stop international business services personalized financial planning solutions expert legal advice for businesses quick company registration in netherlands trustworthy dutch accounting services strategic tax intermediation solutions innovative international tax planning efficient eu trademark registration tailored investment guidance online business law consultancy expertise comprehensive corporate tax services netherlands thorough financial analysis support streamlined business immigration assistance navigating netherlands business environment european union business law guidance international financial reporting accuracy business strategy for netherlands market european investment opportunities insights efficient tax authority communication international business law excellence dutch commercial law proficiency global business strategy implementation european business consulting excellence comprehensive international business services proactive financial planning strategies expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

4 notes

·

View notes

Text

Unlocking Success: Navigating Commercial Licenses in Dubai

A one-stop shop for business solutions, PRO Deskk is a company that believes in itself. With years of experience in the industry, we offer professional and excellent service for incorporating new companies, starting a new business, and handling related matters in the Mainland and Commercial License in different Free Zone Authorities.

Dubai Economic Department (DED) serves as the gatekeeper to the realm of commerce in this vibrant metropolis. Here, businesses are categorized into three distinct segments: Commercial, Professional, and Industrial licenses.

At the heart of trading endeavors lies the Commercial License, fondly dubbed as LLC formation. This license acts as the cornerstone for enterprises immersed in the art of buying and selling goods, paving the way for entrepreneurial ventures to thrive in Dubai's bustling marketplace.

What sets Dubai apart is its diverse array of licensing options tailored to suit every business need. For service-oriented ventures, the Professional License offers a gateway to a world of opportunities, accommodating professions, artisans, and craftsmen alike.

For those with a knack for production, the Industrial License stands as a beacon of hope. This license, which is intended for use by industrial companies, provides access to an uncharted territory of invention.

While DED oversees the issuance of these licenses, a handful of activities require nods of approval from external ministries and government bodies. From restaurant licenses governed by the Dubai Municipality to the oversight of banking services by the Central Bank of UAE, regulatory adherence remains paramount in Dubai's business landscape.

In Dubai, transparency reigns supreme. Therefore, both commercial and industrial licenses mandate registration with the Dubai Chamber of Commerce and Industry. This commitment to regulatory compliance underscores Dubai's reputation as a beacon of trust and reliability in the global business arena.

Beyond the initial registration, some licenses call for additional financial commitments to ensure compliance and accountability. Take, for instance, the Tourism License, where inbound and outbound ventures require bank guarantees to the tune of Dh100,000 and Dh200,000, respectively.

In essence, comprehending the nuances of commercial licenses in Dubai lays the foundation for entrepreneurial success. By embracing regulatory requirements and seizing available opportunities, businesses can chart a course towards growth and prosperity in the vibrant tapestry of Dubai's business landscape.

#DubaiBusiness#CommercialLicense#Entrepreneurship#BusinessOpportunities#LicenseToThrive#StartupsDubai#DubaiEntrepreneurs#NavigatingRegulations#prodeskk#dubaibusinesssetup#dubaifreezone#freezonedubai#corporateservices#businessindubai#uaebusiness

5 notes

·

View notes

Text

Unni Mukundan-starrer Jai Ganesh Not Linked With Lord Ganesha Myth Controversy: Ranjith Sankar

Kerala Speaker AN Shamseer has been accused of insulting Hindu gods. Ranjith Sankar has shared a picture of the receipt from The Kerala Film Chamber of Commerce on social media showing an invoice about the title registration of Jai Ganesh. Actor Unni Mukundan recently announced his next film Jai Ganesh with director Ranjith Sankar. After the title of the film was unveiled on social media on…

View On WordPress

#AN Shamseer#Jai Ganesh#Jai Ganesh controversy#Kerala Speaker#Lord Ganesha Myth controversy#Ranjith Sankar#The Kerala Film Chamber of Commerce#Unni Mukundan

2 notes

·

View notes

Text

10 Online Business Ideas in Dubai, UAE

Dubai is one of the most vibrant cities in the world, renowned for its luxury lifestyle, stunning architecture, and thriving business environment. The city’s strategic location, coupled with its advanced infrastructure, make it an ideal location for entrepreneurs and businesses to thrive. With the internet becoming an integral part of our lives, online businesses have become an attractive option for individuals looking to establish a successful venture in Dubai. In this article, we will explore 10 online business ideas that can be started in Dubai, providing a comprehensive guide for entrepreneurs looking to tap into the lucrative online market in the city.

Growth of E-Commerce in Dubai

According to analysis by the Dubai Chamber of Commerce, the value of the UAE e-commerce market is expected to reach $9.2bn in 2026. During 2021, e-commerce sales in the UAE reached $4.8billion compared to $2.6 billion in 2019. It is estimated that more than one-third of consumers in the UAE bought a product or service using their smartphone at least once a week, which is above the global average of weekly online purchases. Local retailers are attracting shoppers in the UAE more than international sites, with domestic online shopping sites accounting for 73 percent of total sales.

Importance of Online Businesses in Dubai's Economy

There are numerous benefits of starting an online business in Dubai due to its favourable business climate and variety of economic benefits. Rather than just being a great value for setup costs, a potential online startup in Dubai can facilitate constant growth and a result-driven journey without any hassles. If you set up a business in Meydan Free Zone you can avail:

100% Exclusion from personal and corporate TAX

Smooth registration process for a business license

Full ownership of the business

Access to growth-driven regional and international markets

Lower legal restrictions

Lower currency restrictions

10 Online Business Ideas in Dubai

1. E-commerce Store

An e-commerce store is a popular and profitable online business idea in Dubai. With the increasing trend of online shopping, the demand for e-commerce stores is growing exponentially. An entrepreneur can sell any product online, including clothes, electronics, gadgets, and food.

2. Social Media Management

In today’s digital world, social media is a crucial aspect of any business. Entrepreneurs can start a social media management company in Dubai, where they can help businesses manage their social media presence, create content, and run advertising campaigns.

3. Digital Marketing Services

Dubai has a vast number of businesses that require assistance in establishing a social media presence. Setting up an online digital marketing business to help other businesses get comfortable with marketing can be a profitable idea. A digital marketing specialist plays a diverse role in improving sales, generating leads, optimizing as campaigns, content creation, and social media management.

4. Graphic Design & Video Editing

Social media platforms are the future of modern business. Design is now a serious area of commerce and companies are striving to establish their brand in the market. Therefore, graphic designers & video editors are in constant demand to create aesthetic content for a wide client base. Furthermore, other benefits include flexible working hours, choice of projects, varied application across different industries and more.

5. Online Consultancy

This could be in the form of tutoring, offering financial and management advice, or helping with higher education. These services are highly demanded online, and you can charge competitive rates to earn a considerable profit. At MARKEF the process of obtaining your online business license is extremely straightforward.

6. Online Education

To make education accessible to all, the best way is to take it online. Online tutoring has been picking up since the pandemic. However, one of the easiest ways to start your online business, you need to be armed with just your skills and subject matter knowledge. To start your online teaching career, you simply need a professional license from the Dubai Economic Department (DED) which can be left up to trusted business consultants like MARKEF.

7. Online Translator

Many people in the UAE come from different parts of the world. Most people come here to study, work, or start a business. People need language translators to help them communicate with others in the UAE. Offering translation services to foreigners can be very profitable for other ventures such as the tourism industry and even the online shopping business. Even though Arabic and English are common in that area, you can also hear Hindi, Urdu, or Mandarin. You can easily start your business on translation which will be helpful for various foreigners.

8. Affiliate Marketing

Affiliate marketing is a commission-based business model where an entrepreneur promotes other businesses’ products and earns a commission for each sale made through their unique affiliate link. It is a profitable online business idea in Dubai.

9. Fitness instructor

Dubai’s residents have a passion for health and fitness. If you share that passion, you could quickly turn it into a career. You don’t need a costly premises to get into this field. You don’t even need to see clients face to face. Many instructors now hold fitness, yoga, and pilates classes via video conference.

10. Virtual assistant

If you have a good understanding of fast-paced working environments and exceptional organisational skills, you should consider offering your skills as a virtual assistant. There are now dozens of online platforms like TastVirtual and VaVaVirtual that make it easy for you to connect with local entrepreneurs looking to tidy up their busy lives and delegate tasks.

Want to start an online business in Dubai?

Contact Us

2 notes

·

View notes

Text

5 Steps for Mainland Business Setup in Dubai, UAE

If you're thinking about setting up a mainland business in Dubai, UAE, there are a few things you should know to ensure a smooth and successful process. Here are five steps you can follow to set up a mainland business in Dubai:

Step 1: Determine the Business Activity

The first step in setting up a mainland business in Dubai is to determine the business activity you want to undertake. You need to select a business activity from the Dubai Department of Economic Development’s (DED) list of permitted activities.

Make sure that your chosen activity is aligned with your interests and skills. This will also ease up the process of obtaining a Dubai commercial license as business activities dictate your license allowance.

Step 2: Choose a Legal Structure

Once you have determined the business activity, you need to choose a legal structure for your business. The most common legal structures for mainland businesses in Dubai are Limited Liability Company (LLC), Sole Proprietorship, and Civil Company.

Each structure has its own set of requirements and benefits, so it's important to consult with a legal expert to determine the best option for your business. A mainland or a freezone company formation in Dubai is suitable for companies looking to expand in a shorter time frame. This entails the decision-makers choosing a legal structure that suits the business in the mainland, and/or freezone.

Step 3: Reserve a Trade Name

The next step is to reserve a trade name for your business. The name must be unique and comply with the DED's naming conventions. You can reserve the name online through the DED website or in person at the DED service centers. A mainland business set up in Abu Dhabi or Dubai requires attention for naming. It would decide the growth trajectory as well.

Step 4: Submit Required Documents and Obtain Approvals

After reserving the trade name, you need to submit the required documents to the DED and obtain the necessary approvals. The documents include the Memorandum of Association (MOA), Articles of Association (AOA), and other relevant documents. The approvals include a commercial permit, initial approval, and trade license.

Step 5: Register with Relevant Authorities

Finally, to successfully establish a mainland business in Dubai, it is imperative to register with the appropriate authorities. These include the Dubai Chamber of Commerce and Industry, Dubai Municipality, and the Ministry of Labor. These registrations are essential to ensure adherence to the legal requirements and regulations of the UAE.

It’s Time to Move Forward with your Business Venture

Setting up a mainland business in Dubai requires careful planning and execution. By following these five steps, you can establish a successful business in Dubai and contribute to the thriving business community in the UAE. But, to be in the right direction, it is always recommended to consult legal experts and business setup consultants in the UAE.

2 notes

·

View notes

Text

Incorporation of a Holding BV: Safeguard the Future of Your Company

The incorporation of a Holding BV gives companies a strategic framework for securing their future. This kind of incorporation has several advantages, including reduced risks, improved asset protection, and tax efficiency. You can effortlessly manage companies, take control of assets, and increase operational flexibility with a Holding BV. All the legal requirements are handled by our team of experts, who make the incorporation procedure quick and simple. Don't let the benefits of a Holding BV to pass your company by. Begin the process of incorporation right away to safeguard the future of your company. To find out how we can ease the integration of your Holding BV, get in touch with us.

#Incorporation of a Holding BV#asset management company#netherlands business registry#self-employed agreement#cv in the netherlands#notary bv formation costs#establish a holding company#starting a company in the netherlands#netherlands chamber of commerce#chamber of commerce registration

0 notes

Text

Chamber’s Business EXPO will again offer a celebration of region’s commerce

Registration for the EXPO, now available through an interactive map, is available on WausauChamber.com.

WAUSAU — Thousands of attendees will assemble on Thursday, April 17 at the Central Wisconsin Convention + Expo Center in Rothschild for the Greater Wausau Chamber of Commerce’s Business EXPO. The annual Business EXPO is the largest Chamber tradeshow in the country. More than 150 booths have already been reserved for the event. Registration for the EXPO, now available through an interactive map,…

0 notes

Text

Company Formation Cost In Qatar

Starting a business in Qatar offers tremendous opportunities due to its stable economy, strategic location, and investor-friendly policies. As one of the richest countries in the world, Qatar presents a thriving environment for entrepreneurs looking to expand or start new ventures. However, understanding the Company Formation Cost in Qatar is essential for making informed decisions and ensuring the success of your business.

The costs involved in setting up a company in Qatar can vary significantly depending on various factors such as business structure, industry type, and location. This article will provide a detailed overview of the different aspects of company formation in Qatar, including key cost components, regulatory fees, and expert insights to help you navigate the process efficiently.

Choosing to work with a business consultant like Excelier Business Consultant and Brokers can make the entire process smoother and more cost-effective, enabling you to focus on growing your business without getting bogged down by administrative hurdles.

Factors Influencing Company Formation Cost in Qatar

The Company Formation Cost in Qatar is not a fixed amount and can fluctuate based on several factors. These include the legal structure of the company, the business type, location, government fees, and other miscellaneous charges. Let’s delve into the various components that influence the overall cost:

Legal Structure and Registration Type

The type of legal structure you choose for your business plays a significant role in the formation cost. Common structures in Qatar include:

Limited Liability Companies (LLCs): LLCs are the most common and widely preferred structure in Qatar for foreign investors. The formation cost for an LLC typically includes registration fees, local partner fees, and capital requirements.

Sole Proprietorships: For individuals wishing to operate as a sole trader, the formation cost is generally lower than that of an LLC, but it comes with its own set of regulations and restrictions.

Branches of Foreign Companies: Setting up a branch of a foreign company in Qatar involves additional steps, including obtaining a local sponsor, which can increase formation costs.

Government Fees and Regulatory Charges

The Company Formation Cost in Qatar also includes several government-related expenses such as licensing fees, registration charges, and other mandatory payments required by Qatari authorities. These fees vary based on the type of company and its activities.

Commercial Registration Fees: All businesses in Qatar need to obtain a commercial registration (CR) certificate. The fees for this registration vary depending on the type of business.

Municipal and Chamber of Commerce Fees: Local regulatory bodies often charge additional fees to businesses, which are essential for maintaining compliance.

Industry-Specific Variations

The cost of company formation can vary depending on the sector in which you plan to operate. For example, setting up a construction company may have additional regulatory and licensing fees compared to a consulting business or a retail operation. It is important to understand the specific costs associated with your industry. Learn More

Breakdown of Company Formation Cost in Qatar

To give you a better understanding of the overall cost of company formation, let’s break down the major components:

1. Business License Fees

The cost of acquiring a business license in Qatar is one of the primary components of the formation cost. The license fee depends on the type of business and its sector. Typically, the business license is valid for one year and needs to be renewed annually.

Office Space Rental and Registration Charges

For many businesses in Qatar, securing office space is a crucial step. The cost of office space rental varies significantly depending on the location. Prime locations, such as the city center or business districts, come at a higher cost compared to secondary areas. Additionally, there may be registration fees related to the office space.

Miscellaneous Expenses

Other costs during the company formation process include:

Notary fees for legal documents.

Translation charges for documents in foreign languages.

Staff recruitment costs if you plan to hire employees before commencing operations.

Role of Legal Structures in Formation Cost

LLC vs Sole Proprietorship vs Branches: A Cost Comparison

The cost of company formation in Qatar is highly influenced by the legal structure you select. Let’s compare the costs of setting up an LLC, a sole proprietorship, and a branch office:

LLC Formation: LLCs in Qatar require a local partner and a minimum share capital. This can increase the formation cost significantly due to the need to hire a local sponsor or partner.

Sole Proprietorship: A sole proprietorship has lower initial costs compared to an LLC, as there are no local partner fees. However, this structure has its limitations in terms of business scope and liability.

Branch Office: Setting up a branch office of a foreign company typically requires additional paperwork, a local sponsor, and higher registration costs.

Understanding the cost implications of your chosen structure is crucial to avoid unexpected expenses down the line.

Government Fees for Company Formation in Qatar

The Qatari government imposes several fees for company formation. Here is a detailed breakdown of the key mandatory fees:

Commercial Registration (CR) Fee

All businesses in Qatar must obtain a commercial registration certificate. The cost of this certificate varies depending on the type of company and its business activities.

Municipality and Licensing Fees

In addition to the CR, businesses need to obtain a municipal license and other necessary permits, which come with their own set of fees.

Tax Registration and Compliance Fees

While Qatar is a tax-friendly jurisdiction, businesses still need to register for tax purposes, and this may involve additional charges.

Other Recurring Costs

There are also ongoing costs related to business compliance, such as license renewals, accounting, and auditing fees.

Hidden Costs in Company Formation in Qatar

While entrepreneurs often focus on major registration fees, several hidden costs can drive up the total company formation cost in Qatar. These include:

Legal fees for preparing documents.

Brokerage charges if intermediaries are involved.

Cost of obtaining approvals from various regulatory bodies.

Proper planning and expert guidance can help mitigate these hidden costs.

How Office Location Impacts Formation Costs

The location of your office can significantly influence your company formation cost in Qatar. Choosing between prime and secondary locations can result in the following differences:

Prime Locations: These areas are typically more expensive in terms of office rent and business license fees but may offer better visibility and proximity to key clients.

Secondary Locations: While office rental and registration fees are lower, businesses in secondary areas may face challenges with customer accessibility and visibility.

Weighing the pros and cons of each location is crucial when considering your overall budget for company formation.

Influence of Industry Type on Formation Costs

Different industries in Qatar have varying formation costs due to specific licensing, regulatory requirements, and associated fees. For instance:

Construction and Real Estate: Higher regulatory fees and specialized licensing requirements.

Tech Startups: Generally lower formation costs but may require significant investment in intellectual property and technology.

Retail: Costs vary based on location, store size, and sector-specific licensing.

Understanding your industry’s specific needs is key to calculating the company formation cost accurately.

The Role of Business Consultants in Reducing Costs

Business consultants like Excelier Business Consultants and Brokers play a vital role in streamlining the formation process and reducing company formation costs. Here’s how:

Expert Guidance: Business consultants provide expert advice on the most cost-effective legal structure and industry-specific costs.

Paperwork Management: Consultants handle the paperwork, ensuring that all necessary forms are completed accurately and on time, reducing the risk of penalties and delays.

Network and Negotiation: Consultants can often leverage their networks to secure better office space deals, partner agreements, and other cost-saving opportunities.

Common Mistakes That Increase Company Formation Costs

Entrepreneurs often make mistakes that increase their formation costs. Some common mistakes include:

Ignoring local regulations: Failing to comply with Qatar’s business regulations can result in fines and delays.

Underestimating capital requirements: Not meeting the minimum share capital requirements for LLCs can cause delays and additional costs.

Overlooking hidden costs: Forgetting to account for miscellaneous fees and ongoing compliance costs can lead to budget overruns.

Avoiding these mistakes will help keep your company formation cost in Qatar under control.

Company Formation Cost in Free Zones vs. Mainland

Qatar offers two primary options for company formation: Free Zones and Mainland. Both have different formation costs:

Free Zones: Typically have lower setup costs and are ideal for businesses that do not need to interact with the local market directly.

Mainland: Costs are higher due to the requirement for a local partner and the broader range of business activities that can be conducted.

Choosing the right option depends on your business goals and budget.

Visa and Immigration Costs in Company Formation

Visa and immigration costs are important aspects of the company formation cost in Qatar. These costs include:

Investor Visas: Required for business owners who wish to reside in Qatar.

Employee Visas: Needed for foreign employees, which can add to the overall formation cost.

Ensuring that you budget for these fees is essential when planning your company set up in Qatar.

Tax Considerations in Company Formation Costs

Qatar’s tax policies are favorable for businesses, with no corporate income tax on most sectors. However, businesses still need to account for tax registration and compliance costs when calculating their formation cost.

Customizable Packages for Company Formation in Qatar

At Excelier Business Consultant and Brokers, we contact us

Excelierqatar.com is the best Business consultant and broker specializing in company formation in Qatar. From expert advice to complete setup solutions, we ensure a smooth process for starting your business. Partner with Qatar's trusted business consultancy today.

#compnay formation in qatar#services#development#management#consulting#business#consultant#united arab emirates#qatar business#business formation#company formation uae#company formation in dubai#company formation in abu dhabi#company formation in qatar

1 note

·

View note

Text

How to Find International Buyers for Your Export Products in India

Introduction

The global market offers immense opportunities for Indian exporters, but the challenge lies in finding reliable foreign buyers. Whether you're just starting or looking to scale your business, understanding how to connect with international buyers is crucial. This guide provides actionable steps to help you find foreign buyers, establish lasting relationships, and grow your export business.

Why Read This Post?

Learn proven strategies to identify international buyers.

Understand the importance of trade fairs, online marketplaces, and thorough research.

Get actionable tips to boost your export business in India.

Let’s dive into the fundamentals and the top methods to help you succeed in the competitive export market.

The Fundamentals of an Exporting Business

Before searching for buyers, it’s essential to have your export business ready:

Legal Documentation: Ensure your business is registered and you have the Importer Exporter Code (IEC) from DGFT. Other necessary registrations include GST and any specific export licenses.

Market Research: Understand your target market's preferences, demand, and competition.

Product Readiness: Ensure your product meets international quality standards and complies with export regulations.

Logistics Setup: Partner with reliable logistics providers to manage shipping, customs, and delivery.

5 Ways to Find International Buyers for Indian Products

1. Conduct Thorough Research

The first step to finding buyers is to identify your target market and potential customers:

Export Portals: Use platforms like Exporters Worlds and Export Promotion Councils to gather data.

Competitor Analysis: Study competitors who export similar products to identify their markets and buyer sources.

Chambers of Commerce: Engage with chambers like FIEO (Federation of Indian Export Organisations) for leads and resources.

2. Start a Foreign Wholesale Export

Building relationships with wholesalers in foreign markets can help you penetrate new regions effectively:

Connect Directly: Reach out to wholesalers via directories and platforms like Exporters Worlds

Leverage Trade Groups: Join industry-specific associations and forums to network with international wholesalers.

3. Attend Trade Fairs and Exhibitions

Trade fairs are excellent for connecting with potential buyers:

Benefits: Showcase your products directly, understand buyer requirements, and gain insights into market trends.

Popular Events: Participate in events like the India International Trade Fair (IITF) or international expos.

Pro Tip: Prepare professional marketing materials like brochures and business cards to leave a lasting impression.

4. Use Third-Party Agencies

Third-party export agencies help bridge the gap between you and foreign buyers:

Export Promotion Councils: Organizations like Exporters Worlds connect exporters with international buyers.

Consultancies: Hire export consultants for market analysis and buyer identification.

5. Leverage Online Marketplaces

The digital revolution has simplified global trade. Use online platforms to find buyers:

B2B Marketplaces: Platforms like Exporters Words, Amazon Global Selling, and ExportersIndia connect exporters with verified buyers

Social Media: Use LinkedIn to network with industry professionals and join relevant groups.

Company Website: Create a professional website optimized for SEO to attract international inquiries.

Quick Tips for Building Your Export Business

Invest in Quality: Always prioritize product quality and compliance with international standards.

Effective Communication: Respond promptly to buyer queries and provide detailed information.

Follow Up: Build long-term relationships by maintaining regular contact with your buyers.

Digital Marketing: Leverage Google Ads, email marketing, and social media to reach potential buyers.

Conclusion

Finding foreign buyers for your export products is a strategic process that requires research, networking, and persistence. By leveraging trade fairs, online platforms, and professional agencies, you can connect with reliable buyers and expand your business globally.

Take the first step today! Explore online platforms, attend trade fairs, or consult with an export promotion agency. Don’t forget to share this guide with fellow exporters and subscribe for more insights.

0 notes

Text

Startanidea: Your Trusted Partner for Company Formation in the Netherlands

Are you considering expanding your business horizons by setting up a company in the Netherlands? Known for its robust economy, strategic location, and business-friendly environment, the Netherlands is an excellent choice for entrepreneurs and businesses looking to establish a presence in Europe. How to start a business in the Netherlands, we specialize in providing comprehensive services for company formation in the Netherlands, ensuring a smooth and hassle-free experience for our clients.

Why Choose the Netherlands for Company Formation?

The Netherlands offers numerous advantages for businesses, making it a highly attractive destination for company formation:

Strategic Location: Situated at the heart of Europe, the Netherlands provides easy access to major European markets. Its well-connected transportation infrastructure ensures seamless trade and logistics.

Stable Economy: The Netherlands boasts a strong and stable economy, providing a conducive environment for business growth and investment.

Favorable Tax Regime: The country offers a competitive tax regime, including various incentives and exemptions for businesses.

Skilled Workforce: With a highly educated and multilingual workforce, the Netherlands provides access to top talent from around the world.

Business-Friendly Environment: The Dutch government supports entrepreneurship and innovation, offering various programs and resources to help businesses thrive.

Our Services for Company Formation in the Netherlands

At Startanidea, we provide a full range of services to assist you in setting up your company in the Netherlands. Our experienced team of experts is dedicated to ensuring that the process is efficient and straightforward. Here’s how we can help:

Business Consultation: Our consultants work closely with you to understand your business goals and provide tailored advice on the best legal structure and setup for your company.

Company Registration: We handle all the necessary paperwork and formalities for company registration, ensuring compliance with Dutch regulations.

Legal Support: Our legal experts provide comprehensive support for drafting and reviewing contracts, agreements, and other legal documents required for company formation.

Tax Advisory: We offer expert tax advisory services to help you navigate the Dutch tax system and take advantage of available incentives and exemptions.

Bank Account Setup: We assist you in opening a corporate bank account, ensuring smooth financial transactions for your business.

Office Solutions: Whether you need a registered office address or a physical workspace, we provide flexible office solutions to meet your needs.

Types of Legal Entities in the Netherlands

Understanding the different types of legal entities is crucial for successful company formation. Here are some common options:

Private Limited Company (BV): The most popular choice for small and medium-sized enterprises, offering limited liability and flexible share structures.

Public Limited Company (NV): Suitable for larger businesses and corporations, offering the ability to raise capital through public share offerings.

Branch Office: Allows foreign companies to establish a presence in the Netherlands without creating a separate legal entity.

Representative Office: Ideal for market research and promotional activities, without engaging in commercial operations.

Step-by-Step Guide to Company Formation

The process of company formation in the Netherlands involves several key steps:

Choose a Legal Structure: Decide on the most suitable legal structure for your business based on your goals and requirements.

Register with the Dutch Chamber of Commerce (KvK): Submit the necessary documentation and complete the registration process.

Obtain a Tax Identification Number (TIN): Register for taxes with the Dutch Tax and Customs Administration.

Open a Corporate Bank Account: Set up a bank account to manage your financial transactions.

Fulfill Ongoing Compliance Requirements: Ensure compliance with Dutch regulations, including annual reporting and tax filings.

Benefits of Choosing Startanidea

Expertise: With years of experience in company formation, our team has the knowledge and expertise to guide you through the process seamlessly.

Personalized Service: We offer tailored solutions to meet your specific business needs, ensuring a customized approach to company formation.

Comprehensive Support: From initial consultation to ongoing compliance, we provide end-to-end support for all aspects of company formation.

Transparency: We believe in clear and transparent communication, keeping you informed at every step of the process.

Client Satisfaction: Our commitment to excellence and customer satisfaction is reflected in the positive feedback and long-term relationships we build with our clients.

Conclusion

Setting up a company in the Netherlands is a strategic move that can open up numerous opportunities for growth and success. With Startanidea by your side, you can navigate the complexities of company formation with confidence and ease. Our comprehensive services and expert guidance ensure that you can focus on what matters most—building and growing your business.

Contact Us

Ready to embark on your entrepreneurial journey in the Netherlands? Contact Startanidea today to learn more about our services and how we can assist you with company formation. Let us help you turn your business ideas into reality.

0 notes