#central bank digital currency explained

Explore tagged Tumblr posts

Text

youtube

#cbdc how to buy#cbdc price#cbdc india#cbdc wallet#cbdc app#cbdc launch date#cbdc: rbi#cbdc vs cryptocurrency#bekifaayati#finance#personal finance#central bank digital currency#central bank digital currency explained#central bank digital currency (cbdc)#digital rupee#digital rupee in india#digital rupee news#digital rupee kya hai#central bank digital currency india#central bank digital currency rbi#CBDC#(e RUPEE)#India’s CBDC#Central Bank Digital Currency#RBI - Explained#UPSC#BANK#KUDOS KUBER#banking#biography

1 note

·

View note

Text

"It is literally a prison planet."

Ed Dowd, former Blackrock portfolio manager, explains why every last vestige of human freedom depends on widespread rejection of CBDCs.

"Once the central bank digital currency is linked to all your credit cards and bank accounts, then social controls can be implemented.

If you're a dissenter like me, talking about truth, they shut you down."

66 notes

·

View notes

Text

Why Choose Malgo for Your Cryptocurrency Development Needs? A Comprehensive Guide

Cryptocurrency is rapidly changing the way businesses and individuals approach finance and technology. From its decentralized nature to its potential to disrupt traditional financial systems, the world of cryptocurrency is growing, and businesses are looking to adopt this innovative technology. But when it comes to cryptocurrency development, you need a reliable partner who can guide you through the process. That’s where Malgo comes in. This comprehensive guide explains why Malgo is the good choice for your cryptocurrency development needs.

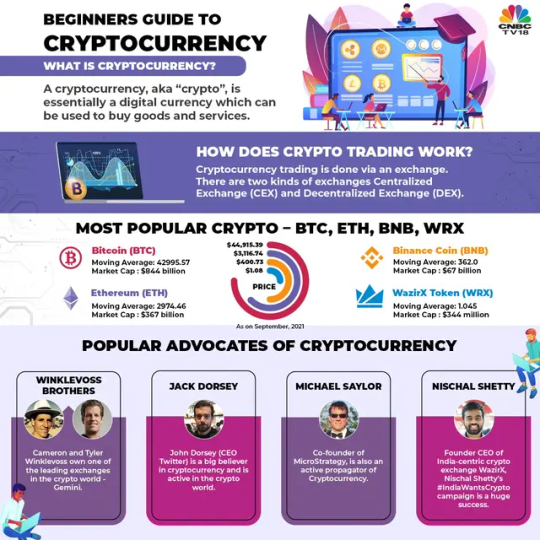

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. It operates independently of any central bank, meaning it is decentralized. Unlike traditional currencies issued by governments, cryptocurrencies are based on blockchain technology, a decentralized system that records all transactions made with a particular cryptocurrency.

Cryptocurrency offers numerous advantages over traditional currencies, including lower transaction fees, faster transaction times, and greater privacy. The most well-known cryptocurrency is Bitcoin, but there are thousands of other cryptocurrencies, each with its own unique features and use cases.

What is Cryptocurrency Development?

Cryptocurrency development refers to the creation and maintenance of digital currencies and blockchain-based solutions. It involves building the underlying technology that supports cryptocurrencies, including the development of wallets, exchanges, and security features.

For businesses looking to create their own cryptocurrency or blockchain-based solutions, cryptocurrency development is a critical step. It requires a deep understanding of blockchain technology, security measures, and the regulatory landscape. Cryptocurrency developers must be proficient in coding, cryptography, and distributed ledger technology to ensure that their digital currency is secure, scalable, and functional.

Why Should You Choose a Cryptocurrency Development Company? Key Considerations

Choosing a cryptocurrency development company is a significant decision. Several factors should be considered when making your choice, as the right company will play a key role in the success of your cryptocurrency project.

Expertise and Experience: A reputable cryptocurrency development company should have a team of experienced developers who are well-versed in blockchain technology, cryptocurrency protocols, and security measures. This expertise ensures that your cryptocurrency is built on a solid foundation.

Security: Security is one of the most critical aspects of cryptocurrency development. Your development partner should have a strong focus on building secure platforms that protect users' funds and data from cyber threats.

Regulatory Knowledge: The cryptocurrency industry is heavily regulated in many regions. A good development company will stay updated on the latest regulations and ensure that your cryptocurrency project complies with local laws.

Post-launch Support: Cryptocurrency development doesn't end once the product is launched. Ongoing support and maintenance are necessary to keep your cryptocurrency platform running smoothly and to address any emerging issues or updates.

Types of Cryptocurrencies:

There are various types of cryptocurrencies, each serving a different purpose and offering unique advantages for businesses. Understanding these types is essential when considering the development of your own cryptocurrency solution.

Coins: Coins like Bitcoin and Ethereum are the most commonly known cryptocurrencies. They have their own blockchain and are primarily used as a store of value or for transactions.

Tokens: Unlike coins, tokens are built on existing blockchains like Ethereum. These tokens can represent a variety of assets, from real-world assets to digital services. They are commonly used in Initial Coin Offerings (ICOs) and as a way to raise funds for new blockchain projects.

Stablecoins: Stablecoins are cryptocurrencies that are pegged to the value of a stable asset like a fiat currency (USD, EUR, etc.). They offer the benefits of cryptocurrency but without the volatility, making them ideal for businesses looking to integrate cryptocurrency into their operations without the risk.

Utility Tokens: These tokens are used to access specific features or services within a blockchain platform or ecosystem. For example, they might be used as payment for transactions or to access special services on a platform.

Security Tokens: Security tokens are digital representations of real-world assets like stocks or bonds. They are subject to regulation and provide businesses with an avenue to tokenize their assets for better liquidity and broader investor access.

Can Malgo Help with Regulatory Compliance for Cryptocurrency Projects?, A Clear Answer

Regulatory compliance is one of the most important aspects of cryptocurrency development. The regulatory landscape for cryptocurrency is complex and varies from country to country. Failure to comply with regulations can result in penalties, delays, or even project cancellation.

Malgo is well-versed in the regulatory requirements of the cryptocurrency industry. They have a team of legal and compliance experts who stay up-to-date with the latest laws and regulations.Their team can guide you through the regulatory process and help ensure that your cryptocurrency project adheres to all necessary legal requirements, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) policies.

By choosing Malgo, you can be confident that your cryptocurrency project will comply with the laws of the countries in which you operate, ensuring a smooth and legal launch.

Does Malgo Provide Post-Launch Support for Cryptocurrency Projects?

Developing a cryptocurrency is just the beginning. The success of your cryptocurrency project largely depends on how well it is maintained and updated after its launch. This includes fixing bugs, adding new features, and ensuring the platform remains secure.

Malgo offers extensive post-launch support for cryptocurrency projects. Their team provide ongoing monitoring, troubleshooting, and updates to ensure that your cryptocurrency platform functions smoothly and securely. They also offers scalability solutions, meaning they can help your platform grow as your user base and transaction volume increase.

Having a partner like Malgo for post-launch support can make all the difference in maintaining a successful cryptocurrency platform.

Why Malgo is the Right Choice for Your Cryptocurrency Development Needs

Malgo stands out as a top choice for cryptocurrency development due to its expertise, commitment to security, and focus on customer satisfaction. With an experienced team of skilled developers and blockchain experts, Their team has successfully completed cryptocurrency projects and understands the industry's details. Security is a top priority at Malgo, implementing the latest protocols to safeguard your platform from vulnerabilities and attacks. Their regulatory experts ensure that your project remains compliant with shifting global laws, preventing potential legal issues. They also takes a customer-centric approach, building long-term relationships by offering best solutions aligned with your business goals, and providing post-launch support to ensure ongoing success. With a focus on scalability, Their team ensures your cryptocurrency platform can grow with your business. Ready to take your cryptocurrency project to the next level? Partner with Malgo for secure, scalable, and innovative solutions. Malgo’s deep understanding of the industry makes them the ideal choice for your cryptocurrency development needs.

Choosing the right cryptocurrency development partner is crucial for the success of your project. Malgo stands out as a top choice for businesses looking to develop a secure, scalable, and regulatory-compliant cryptocurrency platform. With a team of experienced developers, a strong focus on security, and a commitment to customer satisfaction, Malgo is the ideal partner for your cryptocurrency development needs.

2 notes

·

View notes

Text

In the German city of Weimar, just a few steps from Enlightenment-era literary luminary Johann Wolfgang von Goethe’s baroque residence, the Lavazza cafe seems determined to remain in the past. This cafe, like many other establishments all over the country, accepts only cash. That old-fashioned and inconvenient mode of payment is still revered in Germany. According to the latest study by Germany’s central bank, the Bundesbank, on payment behavior, Germans pay for nearly 60 percent of their purchases—both goods and services—in cash.

Germany is not the only country standing athwart the global trend toward cashless payments. In Austria, cash is so popular that the Austrian chancellor has claimed it should amount to a constitutional right. Yet in other European countries, such as the United Kingdom, cash will account for just 6 percent within a decade, and in the Netherlands only 11 percent of transactions were made in cash last year. In other bigger economies, the pace of the decline is even faster. While in China 8 percent of point-of-sale (POS) transactions were made in cash, in India, cash use has declined from 91 percent in 2019 to 27 percent in 2022.

But in Germany, an obsession with privacy, mistrust of big-tech and fintech in general, and worries about political and financial crises depleting bank balances overnight—an experience rooted in history as well as a cultural desire for control—all contribute to the country’s love for cash. Arnold, Maria, Elisabeth, and Harald, a group of middle-aged friends who refused to reveal their full names, were taking a break in Weimar from a road trip on their bicycles from Hessen in western Germany. “Nur Bares ist wahres,” said Elisabeth, which means “only cash is true” and is a famous saying in Germany that expresses more than a preference for cash. Arnold said spending in cash encouraged him to spend less and stay in control of his expenses, but more importantly it protected the details of where he was spending his money. “If you use a card, the bank knows everything about you,” he said. Harald jumped in and added that if he used digital means to pay, he would “feel surveilled.”

But as some European states, such as Sweden, go nearly cashless, with only 6 percent of transactions still settled with banknotes, how does Germany’s preference for cash impact the largest economy in Europe? Perhaps not as much as one might think.

On average, Germans carry more than 100 euros in their wallets—much more than their counterparts in many other developed nations. Since the euro was introduced, the Bundesbank has issued more cash than any other member in the 27-nation European Union, and according to the Bundesbank report, even though cash use was down from 74 percent in 2017, as high as 69 percent of respondents expressed their intention to continue to pay in cash.

Agnieszka Gehringer, a professor at Cologne University of Applied Sciences, said German fondness for cash can be understood via cultural attachment theory and behavioral factors. She explained that, culturally, cash is seen as safe by Germans. “If I have been customarily using cash as a payment method for ages and I know how it works and my data remain protected, there is no particular reason to change my habit,” she told FP.

Gehringer traced these behavioral and cultural attitudes in part to hyperinflation witnessed in the Weimar Republic in 1923, when a loaf of bread cost billions of marks; steep devaluation of the currency after World War II, which washed out nearly 90 percent of people’s savings; and the division of the country, which left the Soviet-controlled east impoverished. “This series of turbulences is considered the basis of the so-called German angst—the fear of losing control,” Gehringer said. “Beyond culture and attitude, for some others, cash is a means of self-control and self-supervision: It is more transparent and easier to track the record of personal expenditures.”

While the fear of losing everything in a quick turn of events was passed on from generation to generation, so was the positive symbolism of the Deutsche mark. Post-World War II Deutsche marks rose in value and symbolized Germany’s resurgence and prosperity. In the late 1990s, Germans reluctantly agreed to a common European currency—but perhaps only because by then Germany was among the biggest European economies and influential in European decision-making.

Another reason to avoid possession of plastic money or credit cards is the fear of debt. “Germans do not like debt,” said Doris Neuberger, head of the money and credit department at Germany’s University of Rostock. In fact, the German word for debt and guilt are derived from the same word (Schuld), and this moral charge helps produce the country’s “low debt ratio and low usage of credit cards.”

Using cash is also easy for a wide range of consumers, including the elderly, who may be unfamiliar and uncomfortable with using smartphones or keystrokes online. It’s also cheaper for retailers and end consumers on transactions under 50 euros, as the cost of holding cash is lower than the fees incurred with non-cash payments, according to the Bundesbank. But the cost of producing, storing, and transporting bank notes and coins is eventually passed on to consumers, experts say.

There are other downsides to excessive use of cash, too. According to a report by the Office of Technology Assessment at the German Bundestag, high levels of cash holdings reduce the central bank’s “monetary policy steering options,” Gehringer wrote. “Sure, holding cash has a higher hurdle to make the money available for financial investments.”

But most experts say the argument that cash exacerbates the shadow economy tends to be overstated. The Office of Technology Assessment report noted that in countries with less cash spending, such as Switzerland, the Netherlands, and France, there is less activity in the shadow economy when compared to countries such as Spain, Italy, and Greece, which have high rates of cash use. But it added that in Sweden, despite a minor role for cash, the shadow economy is “medium-sized,” while in Austria and Germany, with relatively high shares of cash transactions, the shadow sector is relatively small.

In 2019, the Bundesbank conducted a study on the extent of “illicit cash use” in Germany, in collaboration with Friedrich Schneider, a professor at the Johannes Kepler University Linz. It said that without more in-depth analysis it was “impossible to distinguish those stocks of banknotes that are being held as a store of value—and kept at home under the mattress totally legally and legitimately by every citizen—from illicit banknote stocks.” On average, a German hoards more than 1,300 euros at home or in a safe deposit box.

“Available estimates for the size of the shadow economy lie between 2 percent and 17 percent of gross domestic product,” the study said. “This range alone shows that studies of the shadow economy are subject to an above average degree of uncertainty and all results should be interpreted with care.”

“Cash does not promote a shadow economy, as it is not a cause,” Schneider, a co-author of the study, told FP. “Causes are tax burden, regulations, etc.” Schneider said the higher the tax burden, the higher the motivation to evade taxes. “If cash is completely abolished, then people find other means.” He added that earlier uses of cash were more firmly linked to tax evasion than now, when “it is very difficult to open a bank account abroad with a large cash sum of money.” Money laundering in real estate is deterred with a different set of regulations.

Neuberger claimed much more criminal activity is conducted with digital money than with cash. “Nowadays, the ideal medium for illegal drug transactions is not cash, but Amazon gift cards,” she said. “Gift tokens allow for anonymous payments anywhere in the world and, unlike cash, do not require a face-to-face transaction. The same holds for prepaid credit cards, which can be loaded with cash anonymously.”

Burkhard Balz, a member of the executive board of the Deutsche Bundesbank, told FP no initiatives have been taken by the government to discourage or disincentive the use of cash and that it is “an excellent back option should other payment methods end up temporarily out of action—because of a power outage or software error.” Regulations to limit cash use are deemed politically unpopular in Germany, especially since people and experts just don’t see any disadvantages to carrying on with folded euros in their pockets and wallets.

A digital euro, however, could reduce the costs of producing, storing, and transporting cash. It wouldn’t be tied to any intermediary banking institution—as opposed to electronic payments, which are intermediated by multiple banks—and won’t even require a bank account. Balz said the digital euro would ensure “the accessibility and usability of central bank money alongside cash in a digitized world.”

“Currently, the Eurosystem is about to conclude its two-year investigation phase on a digital euro and may move into the next phase of the project—the preparation phase,” he said, “provided that the [European Central Bank] Governing Council takes this decision in late autumn this year.”

At least some private banks believe that payments made with the digital euro could still be tracked and help with anti-money laundering regulations, but not without placing limits on the highly prized privacy of citizens. Furthermore, it could lead to a reduction in deposits to credit institutions and limit the ability of the banks to offer loans.

Online purchases rose from 6 percent in 2017 to 24 percent in 2022 amid the COVID lockdown, but neither the pandemic nor digitization so far has managed to eliminate the appeal and comfort of cash for Germans. Even though Germany’s banking industry envisages a growth of 2 percent per year in card payments, a cash decline of 3 percent a year would still mean that, in 2030, Germans will carry out at least 30 percent of transactions in cash.

17 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.

This article serves as a comprehensive guide, offering beginners insights into the fundamental aspects, benefits, risks, and practical steps to get started in the cryptocurrency realm.

youtube

Understanding Cryptocurrency: The Basics

At its core, cryptocurrency is a digital or virtual form of currency that utilizes cryptographic techniques to secure transactions and control the creation of new units.

Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

1. How Cryptocurrencies Work

Cryptocurrencies operate on blockchain technology, which is a distributed and immutable ledger that records all transactions.

Each transaction is grouped into a "block," and these blocks are linked together, creating a chain of information.

This decentralized nature ensures transparency, security, and resistance to censorship as Perseus Crypto explains it nicely.

2. Key Cryptocurrency Concepts

Blockchain: A decentralized ledger that records all transactions in a secure and transparent manner.

Wallet: A digital tool that stores your cryptocurrency holdings, enabling you to send, receive, and manage your coins.

Private and Public Keys: Cryptographic keys that grant access to your cryptocurrency. The public key is like an address, while the private key is your password.

Mining: The process of validating transactions and adding them to the blockchain using powerful computers and solving complex mathematical puzzles.

Benefits of Cryptocurrency

1. Financial Inclusion: Cryptocurrencies enable access to financial services for the unbanked and underbanked populations around the world.

2. Decentralization: Cryptocurrencies operate on decentralized networks, reducing the influence of central authorities and intermediaries.

3. Security: Blockchain's cryptographic techniques ensure secure transactions and protection against fraud and hacking.

4. Transparency: Transactions on a blockchain are public and transparent, enhancing accountability.

5. Borderless Transactions: Cryptocurrencies enable fast and low-cost cross-border transactions.

6. Potential for Growth: Some cryptocurrencies have experienced significant price appreciation, offering opportunities for investment growth.

Risks and Considerations

1. Volatility: Cryptocurrency prices can be highly volatile, leading to rapid and unpredictable value changes.

2. Security Concerns: Cryptocurrencies are susceptible to hacking, scams, and phishing attacks. Secure storage is crucial.

3. Regulatory Environment: Regulations for cryptocurrencies vary by jurisdiction and can impact their legality, taxation, and use.

4. Lack of Understanding: The complexity of the technology and market can lead to uninformed decisions.

5. Lack of Regulation: The decentralized nature of cryptocurrencies means there may be no recourse for fraudulent activities or disputes.

Getting Started with Cryptocurrency

1. Education Is Key

Before investing in or using cryptocurrencies, educate yourself about the technology, terminology, and potential risks.

Numerous online resources, courses, and communities provide valuable insights.

2. Choose the Right Cryptocurrency

Research different cryptocurrencies to understand their purposes, use cases, and market trends.

Bitcoin, Ethereum, and others have distinct features and applications.

3. Select a Reliable Exchange

Choose a reputable cryptocurrency exchange to buy, sell, and trade cryptocurrencies.

Look for factors like security measures, fees, user-friendliness, and available coins.

4. Secure Your Investments

Use strong, unique passwords for your exchange accounts and enable two-factor authentication (2FA).

Consider using hardware wallets for enhanced security.

5. Start Small and Diversify

For beginners, start with a small investment you can afford to lose.

Diversify your investments across different cryptocurrencies to manage risk.

6. Stay Informed

Stay updated with the latest news and trends in the cryptocurrency space.

Follow reputable cryptocurrency news websites, blogs, and social media accounts.

7. Avoid FOMO and Emotional Decisions

Fear of missing out (FOMO) and emotional decisions can lead to impulsive actions.

Stick to your investment strategy and avoid making decisions solely based on short-term price movements.

8. Be Prepared for the Long Term

Cryptocurrency investments are often more successful with a long-term perspective.

Avoid making decisions based on daily market fluctuations.

Conclusion

As you embark on your journey into the world of cryptocurrency, remember that education and caution are your best allies.

Understand the technology, the benefits, and the risks before making any investment decisions.

With the right knowledge and a thoughtful approach, you can navigate the complex and dynamic cryptocurrency landscape, potentially harnessing its benefits and contributing to the evolution of modern finance.

2 notes

·

View notes

Text

"Lt. Gen. Michael Flynn has placed CBDC’s at the center of his “Great Awakening vs. Great Reset” rallies, held throughout the country. Flynn and other speakers suggest that Biden’s digital asset order is integral to the “Great Reset” strategy proposed by the World Economic Forum leader Klaus Schwab. (It at least notable that Flynn’s rallies carry the same title and themes as a 2022 book by Russian geopolitical strategist Aleksandr Dugin.)

An Instagram post featuring Flynn with conspiracy theorist Alex Jones said, “Global elites are trying to create a panic as an excuse to transition to CBDC total control,” suggesting that the March collapse of Silicon Valley Bank could be used as a pretense to introduce oppressive currency schemes.

Other versions of the conspiracy theory suggest that paper money will be banned, again citing Roosevelt’s 1933 Executive Order that outlawed gold. No such proposal is currently in place, and according to Liang’s recent statements, the Treasury would not pursue any such strategy without approval of Congress.

Politifact previously debunked similar claims about the FedNow service, writing “[FedNow] is not a central bank digital currency, and it is not replacing paper currency. We rated False a similar claim in September 2022, reporting that FedNow will not require banks to turn over all physical currency.”

These various conspiracy theories attempt to add, without evidence, central bank digital currencies to the pantheon of existing populist bogeymen (which includes the Federal Reserve, shadowy globalist central bankers, and the Chinese Communist Party) in what amounts to a recapitulation of the paranoid fears stoked by the forged 1903 anti-Semitic disinformation pamphlet “Protocols of the Elders of Zion.”

Conservative organizations the Federalist Society and Cato Institute are pre-emptively opposing CBDCs.(Sources: Federalist Society; Cato Institute)

Conservative organizations the Federalist Society and Cato Institute are pre-emptively opposing CBDCs.

(Sources: Federalist Society; Cato Institute)

The Federalist Society and the Cato Institute have both come out against CBDCs, portraying them as a near-term threat and an instrument of imminent authoritarian control, despite the fact that, according to Liang, no implementation plan exists in the United States at this time.

Populist political technologists like Bannon and Flynn have engineered a full-spectrum attack that deploys fears over CBDCs across both the left and the right. Robert F. Kennedy, Jr. may carry some appeal to people on the left who venerate his family’s legacy, while Ron DeSantis can attempt to energize the right with the same anti-CBDC messaging.

Donald Trump, recently indicted on 34 felony counts for falsifying business records, said during a post-indictment press conference that the “US dollar is crashing and will no longer be the world standard, and will be our greatest defeat in over 200 years,” another talking point popular with critics of CBDCs. Some online conspiracists also assert that Trump’s indictment was meant to serve as a distraction from the steady advance of a secret Biden CBDC agenda.

Fantastical theories about CBDCs and how they may be developed have diverged from reality, which, if officials decide to pursue the concept at all, will involve slow development and deployment after careful deliberation by both Congress and the Treasury.

But in the modern American political arena, outcomes are often influenced if not actually determined by those best able to play on the fears of the public, justified or not."

So the government is currently, carefully considering offering not only a regulated, trusted digital currency but also a regulated money service. This explains why Granny Doom Finger has decided to go Anti-Crypto. It's not to attack Silicon Valley's, which was tied to criminal activity across the spectrum, but a government, regulated, controlled currency they can't fuck with. Follow Dave Troy, the writer of this article, on Twitter. He's very smart.

."

3 notes

·

View notes

Link

Brazil’s central bank chief Gabriel Galipolo recently highlighted a significant rise in cryptocurrency adoption across the country. Speaking at a Bank for International Settlements event in Mexico City, Galipolo noted that over the past two to three years, the volume of crypto transactions has surged dramatically. Interestingly, he estimated that around 90% of this activity is tied to stablecoins—cryptocurrencies designed to maintain a stable value by being pegged to real-world assets such as the U.S. dollar. Unlike more volatile digital currencies, these stablecoins are increasingly being used for everyday purchases and cross-border shopping, Galipolo explained. Crypto Stablecoin Flow Surge: There’s A Catch Although the rise of cryptocurrency transactions in Brazil might seem like a positive news, however, the central bank chief raised concerns about the challenges this rapid adoption presents to regulators. Galipolo emphasized that the rise in stablecoin usage often involves a degree of opacity, particularly regarding taxation and money laundering. With most transactions tied to retail activity and international purchases, oversight and enforcement are becoming more complex. Notably, so far, regulators seem to have been facing the difficult task of maintaining financial integrity while supporting innovation and the growing demand for digital payment options. To address these challenges and improve the nation’s financial infrastructure, Galipolo pointed to Brazil’s Drex initiative. While often referred to as a central bank digital currency, Drex is described as a framework for facilitating credit backed by collateralized assets, according to Galipolo. Galipolo explained that Drex’s goal is to lower the cost of borrowing and expand the use of secured financing, areas where Brazil has traditionally struggled. The platform leverages distributed ledger technology to handle wholesale interbank transactions, with retail participants accessing the system through tokenized bank deposits. This approach as revealed, aims to enhance efficiency in the lending market, reduce costs, and increase overall access to credit. Another Solution Introduced Additionally, Galipolo emphasized the potential of Pix, Brazil’s popular instant payment system, to extend its influence beyond domestic borders. As one of the world’s most widely adopted real-time payment platforms, Pix has already made some mark in Brazil. Galipolo suggested that Pix’s programmability and flexibility could allow for integration with international instant payment networks, creating a more seamless cross-border payment experience. Such integration would further strengthen the region’s financial connectivity and position Brazil as a leader in digital payment infrastructure. Meanwhile, the Brazil Central Bank proposed plans to ban withdrawals of stablecoins to self custody wallets last year. According to reports, this proposal is still open for public consultation until February 28, 2025. The global digital currency market cap value on the 1-day chart. Source: TradingView.com Featured image created with DALL-E, Chart from TradingView

0 notes

Text

In recent years, blockchain technology has garnered significant attention for its role in powering cryptocurrencies like Bitcoin and Ethereum. However, its potential extends far beyond digital currencies, promising to revolutionize industries by providing secure, transparent, and decentralized systems. This guide seeks to demystify blockchain technology, explaining its fundamentals in simple terms and exploring its broader applications. What is Blockchain? At its core, a blockchain is a digital ledger of transactions that is distributed across a network of computers. Each transaction is recorded as a “block” of data, and these blocks are linked together in chronological order, forming a “chain.” Once added, these records are immutable, meaning they cannot be altered retroactively, which ensures transparency and security. How Does Blockchain Work? - Decentralization: Unlike traditional databases that are managed by a central authority (like a bank), a blockchain is maintained by a network of nodes. Each node has a copy of the entire blockchain and collaboratively validates new transactions through consensus mechanisms like Proof of Work or Proof of Stake. - Consensus Mechanisms: These are rules that nodes follow to agree on the validity of transactions. For example, in Proof of Work, nodes (also known as miners) solve complex mathematical puzzles to validate transactions and earn cryptocurrency rewards. - Immutability: Once a transaction is recorded and verified by the network, it is nearly impossible to change. This immutability is critical for trust, as it prevents fraud and ensures data integrity. The Role of Blockchain in Cryptocurrencies Blockchain technology is the backbone of cryptocurrencies. By enabling secure peer-to-peer transactions without intermediaries, it allows for fast and low-cost financial exchanges. Each cryptocurrency transaction is verified by network participants, ensuring transparency and reducing the risk of fraud. Beyond Cryptocurrencies: Applications of Blockchain Blockchain’s potential extends beyond digital currencies. Here are a few examples of how it is being utilized across various sectors: - Supply Chain Management: Blockchain can enhance transparency and traceability in supply chains by recording every transaction from origin to destination. This helps in preventing fraud and ensuring product authenticity. - Healthcare: Blockchain can securely store and share patient data among authorized parties, promoting better healthcare coordination and reducing administrative costs. - Voting Systems: By providing a transparent and tamper-proof voting system, blockchain can increase trust in electoral processes and ensure accurate outcomes. - Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts can automate and enforce agreements without the need for intermediaries, reducing costs and increasing efficiency. Blockchain and the Future of Digital Transactions As blockchain technology continues to evolve, it holds the potential to disrupt traditional financial systems and empower individuals with greater control over their data and digital transactions. By eliminating the need for central authorities and fostering trust through transparency and immutability, blockchain is paving the way for a new era of decentralized applications. Conclusion Understanding blockchain technology is crucial for anyone looking to explore the world of cryptocurrencies. While blockchain may seem complex at first, its foundational principles of decentralization, transparency, and security make it a powerful tool for innovation across various fields. As more industries embrace blockchain, its influence on the future of digital transactions will only continue to grow. For newcomers, grasping these fundamentals is the first step towards navigating the transformative landscape of blockchain and cryptocurrencies. Read the full article

0 notes

Text

Bitcoin Books for Kids: A Gateway to Financial Literacy

As the world becomes more digitized, the need for financial literacy is more critical than ever. One of the most effective ways to introduce children to the concepts of money, saving, and investing is through reading. Bitcoin, as a digital currency that operates independently of traditional banking systems, offers an exciting opportunity to teach kids about the future of money and how financial systems work. Books dedicated to explaining Bitcoin in an engaging and child-friendly way serve as a powerful tool in fostering financial literacy. Here’s why Bitcoin books for kids are an essential gateway to financial understanding.

1. Simplifying Complex Concepts

Bitcoin is often viewed as a complex and intimidating topic, especially for young minds. However, books written for children have the unique ability to break down these intricate ideas into easy-to-understand concepts. By using age-appropriate language, illustrations, and relatable examples, these books make it possible for children to grasp fundamental financial principles, such as digital currency, decentralization, and the blockchain.

2. Introducing Financial Literacy Early

Bitcoin books provide an excellent foundation for teaching financial literacy at a young age. Financial education is often neglected in traditional school curriculums, leaving many kids without a solid understanding of how money works. By introducing Bitcoin and digital currencies early on, these books offer children the opportunity to learn about money management, savings, and investing before they even start handling real-world finances.

3. Teaching the Value of Digital Assets

In a world that is increasingly moving toward digital transactions, it’s crucial for kids to understand how digital assets like Bitcoin can hold value. Through books, children can explore how Bitcoin works as both a store of value and a medium of exchange. Unlike traditional currencies, Bitcoin operates on a decentralized network, which is an important concept to grasp.

4. Encouraging Critical Thinking

Bitcoin books for kids do more than just teach the basics of digital money—they also encourage critical thinking and problem-solving. By learning about Bitcoin’s decentralized nature, children are introduced to the idea that not all systems operate with a central authority. This concept encourages children to think independently and question traditional structures. They begin to see that financial systems can be more diverse and open to innovation.

5. Fostering a Global Perspective

Bitcoin operates beyond borders, offering a global perspective on money and finance. By reading Bitcoin books, children can learn how digital currencies allow for instant transactions between people from different countries, without the need for banks or currency exchanges. This opens up discussions about the interconnectedness of the global economy and how money can move freely across the world.

Conclusion

Bitcoin books for kids offer much more than just an introduction to digital currency—they serve as an essential tool in fostering financial literacy. By simplifying complex concepts, encouraging critical thinking, and introducing children to the value of digital assets, these books prepare young readers for a future where digital currencies and decentralized systems will play an increasingly important role. Whether through stories, illustrations, or educational content, Bitcoin books are a fun and engaging way to equip children with the financial knowledge and skills needed to navigate the digital world with confidence.

0 notes

Text

The Global Impact of CBDCs: Central Bank Digital Currencies Explained

Central Bank Digital Currencies (CBDCs) have emerged as one of the most significant innovations in the financial landscape of recent times. As central banks globally explore this new form of currency, it’s essential to understand what CBDCs are, their potential impacts, and the implications for the global economy. CBDCs are essentially digital forms of a country’s fiat currency, issued and…

0 notes

Text

Payment Trends. What to Expect in the Next Decade

The payments industry is evolving at a rapid pace, shaped by advancements in technology, shifts in consumer behavior, and changes in regulatory landscapes. Over the next decade, several trends are poised to redefine how businesses and individuals transact.

1. Rise of Real-Time Payments

Real-time payment systems are gaining traction globally. They enable instantaneous money transfers, providing speed and convenience to consumers and businesses alike. Countries such as India, with its Unified Payments Interface (UPI), have already demonstrated the transformative potential of such systems. By 2030, real-time payments are expected to become the standard across both developed and emerging markets.

2. Biometric Authentication

Biometrics, such as fingerprint and facial recognition, are becoming integral to secure payment processes. As data breaches and fraud risks grow, businesses are embracing these technologies to enhance security and user experience. In the future, biometric authentication could replace traditional PINs and passwords entirely.

3. Cryptocurrency Integration

While cryptocurrencies have faced regulatory scrutiny, their underlying blockchain technology holds promise for faster and more transparent transactions. By the end of the decade, cryptocurrencies like Bitcoin and Ethereum might coexist alongside traditional currencies in mainstream payment systems. Governments’ exploration of Central Bank Digital Currencies (CBDCs) will also play a significant role in shaping this space.

4. Voice-Activated Payments

Voice assistants like Alexa and Google Assistant are becoming more integrated into daily life. Over the next decade, voice-activated payments could become a common way to shop online, pay bills, or transfer funds, offering unparalleled convenience.

5. Sustainable Payment Solutions

As environmental concerns grow, the payments industry will shift toward eco-friendly solutions. Digital wallets, paperless billing, and environmentally conscious payment networks will cater to consumers increasingly mindful of sustainability.

6. Expanded Use of Artificial Intelligence

AI is already being used for fraud detection, personalized recommendations, and process automation. In the coming years, AI will play a larger role in optimizing payment experiences, enabling smarter financial decisions, and reducing transaction costs.

7. Growth of Embedded Payments

Embedded payments, integrated seamlessly into apps and platforms, will grow significantly. For example, ride-sharing apps or food delivery platforms already include payment systems. This trend will expand to other sectors, simplifying transactions and reducing friction for consumers.

Eric Hannelius, a fintech thought leader, views these trends as opportunities for businesses to innovate and remain competitive. “Payment systems are no longer just about processing transactions. They’re about creating value through enhanced user experiences and building trust through security,” Eric Hannelius explains.

He also highlights the role of collaboration in shaping the future. “Fintech companies need to work closely with regulators, financial institutions, and technology providers to ensure that innovation aligns with user needs and compliance requirements.”

Practical Implications for Businesses:

Adopt Digital Wallets: Companies should ensure compatibility with digital wallets like Apple Pay and Google Pay to cater to tech-savvy consumers.

Invest in Security: Enhanced security measures, including biometrics and tokenization, will become essential for consumer trust.

Stay Agile: Businesses must monitor trends such as cryptocurrency and embedded payments to remain adaptable in a rapidly changing landscape.

The payments industry is on the brink of significant transformation. By embracing these trends and leveraging innovative technologies, businesses can provide customers with seamless, secure, and sustainable payment solutions.

The future of payments will be shaped by those who can blend innovation with a deep understanding of consumer and market needs. By staying ahead of these trends, businesses and fintech companies can ensure their place in the evolving financial ecosystem.

0 notes

Text

The Role of Bitcoin in a Decentralized Future: Web 3.0 Explained

As the digital world continues to evolve, the concept of Web 3.0 has emerged as a groundbreaking shift in how we interact with the internet. Unlike its predecessors, Web 3.0 promises a more decentralized, user-centric internet where individuals have control over their data and interactions. At the forefront of this revolution is Bitcoin, a pioneering cryptocurrency that has played a critical role in shaping the decentralized future of the internet. In this blog, we’ll explore Bitcoin’s significance in the Web 3.0 landscape and how it can contribute to the development of a more decentralized, transparent, and secure digital economy. Stay informed with crypto coin news today, Bitcoin price today, and the latest Bitcoin news to understand how Bitcoin shapes the future of Web 3.0.

Understanding Web 3.0: The Decentralized Internet

Web 3.0 is often described as the “semantic web” or the internet of the future, characterized by a decentralized infrastructure. Unlike Web 2.0, which is dominated by large corporations that control user data, Web 3.0 empowers individuals by leveraging blockchain technology and decentralized applications (dApps). This means that users can interact with each other directly, without relying on intermediaries like banks or tech giants. For the latest coins news crypto and insights into how Web 3.0 is transforming online economies, it’s essential to keep track of the cryptocurrency news today.

At the heart of Web 3.0 lies the idea of decentralization. By using blockchain technology, data is stored across a distributed network of computers, making it immutable and more resistant to censorship or manipulation. This opens up a new world of possibilities for privacy, security, and autonomy in digital interactions. As Web 3.0 continues to develop, its connection with cryptocurrencies like Bitcoin, Ethereum, and even Shiba Inu coin news becomes increasingly important.

The Role of Bitcoin in Web 3.0

Bitcoin, the first and most well-known cryptocurrency, is more than just a digital currency. It is a key player in the decentralized ecosystem of Web 3.0, and its role extends far beyond simply being a store of value or medium of exchange. To understand Bitcoin’s full potential, follow Bitcoin price today and Bitcoin news regularly to stay updated on its role in Web 3.0.

1. Decentralization of Money

Bitcoin operates on a decentralized peer-to-peer network, which eliminates the need for centralized authorities like banks or governments to control monetary transactions. This makes Bitcoin an essential tool in the Web 3.0 era, where decentralization is the foundation of the internet's infrastructure. By using Bitcoin, individuals can send and receive payments without intermediaries, ensuring greater financial autonomy and privacy. For real-time updates on crypto coin news today, keep an eye on the latest trends shaping the future of decentralized finance (DeFi).

2. Enabling Trustless Transactions

One of the core features of Bitcoin is its ability to facilitate trustless transactions. Using the blockchain, Bitcoin transactions are verified through a consensus mechanism known as proof-of-work, ensuring that all parties involved can trust the transaction’s integrity without relying on a third-party authority. This is a crucial component in Web 3.0, where users need to interact and transact in a secure environment without relying on traditional intermediaries. As Web 3.0 continues to grow, Bitcoin’s ability to support cryptocurrency news today with trustless, transparent transactions becomes more vital.

3. Smart Contracts and Decentralized Applications (dApps)

While Bitcoin itself is not designed for smart contracts (a key feature of Web 3.0), its blockchain has inspired the creation of decentralized applications (dApps) on other blockchain platforms like Ethereum. These dApps enable users to interact in a decentralized environment, where Bitcoin can act as both a medium of exchange and a store of value. For instance, Bitcoin can be used to power decentralized finance (DeFi) applications or NFT marketplaces, furthering the decentralization of online economies. Stay updated with Shiba Inu coin news and coins news crypto to learn how various cryptocurrencies, including Bitcoin, interact with Web 3.0 technologies.

4. Secure Digital Identity and Privacy

In Web 3.0, digital identity management is becoming increasingly important. Bitcoin’s blockchain technology can be leveraged to create secure, decentralized digital identities. Through the use of cryptographic keys, users can control their online identities and interactions, ensuring that they maintain privacy and security while participating in the digital economy. Bitcoin’s focus on privacy aligns with the core principles of Web 3.0, where user data should be protected and controlled by the user, not by corporations. For crypto coin news today and cryptocurrency news today, keep up with how privacy and security in Web 3.0 are evolving through Bitcoin and other blockchain technologies.

Bitcoin’s Contribution to a Transparent and Open Internet

Web 3.0 is built on the principles of transparency and openness. Bitcoin’s blockchain serves as a transparent ledger, where every transaction is recorded and can be traced back to its origin. This transparency is vital in building trust among users in a decentralized network, where traditional methods of accountability may not apply. By following Bitcoin price today and Bitcoin news, you can track how this transparency impacts the broader Web 3.0 ecosystem.

Furthermore, Bitcoin’s open-source nature allows developers to contribute to its code, enhancing its functionality and ensuring that it remains accessible to everyone. This openness fosters innovation and ensures that Bitcoin, as part of the broader Web 3.0 ecosystem, continues to evolve in line with user needs. Keep an eye on coins news crypto to see how developers continue to push the boundaries of decentralized technologies.

The Future of Bitcoin and Web 3.0

As Web 3.0 continues to gain momentum, Bitcoin is poised to play an even more significant role in the decentralized future of the internet. While it may face challenges such as scalability and energy consumption, the ongoing development of Layer 2 solutions and improvements in blockchain technology are expected to address these concerns. Following Shiba Inu coin news and crypto currency news today can give you insights into how Bitcoin and other cryptocurrencies evolve in the Web 3.0 landscape.

Bitcoin’s role in Web 3.0 is not just as a digital currency, but as a foundational pillar of a decentralized internet where individuals control their data, finances, and identities. Its contributions to decentralization, trustless transactions, and privacy align with the core principles of Web 3.0, making it an essential part of this new digital era.

Conclusion

The integration of Bitcoin into the Web 3.0 ecosystem is a natural evolution of both technologies, as they share a commitment to decentralization, transparency, and user empowerment. As Web 3.0 continues to unfold, Bitcoin will remain a vital component in creating a more open, secure, and autonomous digital economy. For anyone interested in understanding the future of the internet, Bitcoin’s role in the decentralized future of Web 3.0 cannot be overstated. Stay updated with Bitcoin news, Bitcoin price today, and crypto coin news today to track the latest developments in Web 3.0.

0 notes

Text

Anticipating the Next Country to Adopt Bitcoin as Reserve Asset: Insights from 21Shares

Key Points

21Shares predicts another nation will adopt Bitcoin as a reserve asset following El Salvador’s lead.

Bitcoin’s performance during economic crises and its increasing global recognition are key factors for this prediction.

21Shares, a major issuer of cryptocurrency exchange-traded products, has projected that another country will likely emulate El Salvador by adopting Bitcoin as a reserve asset.

Their 2025 State of Crypto Market Outlook suggests that Bitcoin’s rising acceptance as a valid financial asset may lead to countries, notably Argentina, incorporating Bitcoin into their sovereign reserves in the near future.

Bitcoin’s Role in Economic Stability

In a groundbreaking move that impacted the global financial system, El Salvador was the first nation to officially incorporate Bitcoin into its reserves in 2021. This signaled a shift towards a new standard for reserve assets.

Since then, Bitcoin has attracted more attention from individual investors and institutional entities. These groups view the cryptocurrency not just as a speculative investment, but also a store of value with increasing worldwide utility.

21Shares suggests that due to its growing global acceptance, Bitcoin could serve as a good reserve for central banks across the globe. This concept isn’t new. Dr. Matthew Ferranti, a former member of the White House Council of Economic Advisers, has emphasized the economic and strategic advantages of central banks incorporating Bitcoin into their reserves.

In his October report titled “The Case for Bitcoin as a Reserve Asset”, Ferranti presented several convincing reasons why central banks might consider holding Bitcoin alongside traditional assets like gold.

Bitcoin’s Performance during Economic Crises

Ferranti argued that Bitcoin has proven its worth during economic crises. He noted that the cryptocurrency has demonstrated resilience and growth during major economic disruptions, including the fallout from US financial sanctions and the collapse of prominent banks in 2023.

He stated that Bitcoin’s price spiked during the 2023 Silicon Valley Bank crisis and rose significantly after the US imposed sanctions on Russia following its invasion of Ukraine in 2022.

Ferranti explained that a key reason for this performance is that Bitcoin operates outside the traditional banking system, making it immune to the geopolitical risks and financial policies that can affect fiat currencies and traditional assets. He further stated that Bitcoin offers an alternative store of value during times of uncertainty, providing a financial cushion for nations facing external pressures.

Stablecoins to Continue Integration with TradeFi

Considering these factors, 21Shares anticipates that countries like Argentina might follow El Salvador’s lead. The company also sees Ethereum and stablecoins playing a central role in the industry’s growth next year.

According to the 2025 State of Crypto Market Outlook, “Ethereum will regain its revenue levels, likely surpassing 100% of its target growth due to strategic Layer 22 integrations”. As for stablecoins, the company believes the digital asset will “deepen” integrations with the traditional finance market.

0 notes

Text

Brazil Central Bank equates stablecoins to currency exchange

Cryptocurrency exchanges dealing in stablecoins must obtain two types of operating licenses

Brazil’s Central Bank has launched a public consultation equating “stablecoins”—cryptocurrencies pegged to traditional currencies like the U.S. dollar—to traditional foreign exchange. According to the newly published rules by the monetary authority, which will be discussed with the digital asset sector before taking effect, cryptocurrency exchanges dealing in stablecoins will need to secure two types of operating licenses from the Central Bank: one as a virtual asset service provider (VASP) and another as a currency exchange operator.

Erik Oioli, founder and managing partner of VBSO Advogados, notes that the Central Bank’s move to equate stablecoins with exchange affects Resolution 277, which governs the foreign exchange market, integrating exchanges into this sector. “They will have to comply with the same rules as a currency exchange broker, such as Central Bank’s authorization, minimum operating capital, anti-money laundering controls, a designated director responsible for exchange operations, among other requirements,” he explains.

Furthermore, exchanges will be required to report their transactions to the Central Bank when clients buy or sell stablecoins or when international payments or transfers are made using digital currencies. Information required for stablecoin transactions includes the date of the operation, client identification, and the volume of the virtual asset. For international transfers, additional details such as the purpose declaration, differentiation between remittance and receipt of the virtual asset, the volume of the virtual asset transferred, and identification of both the client and the overseas payer or recipient must be provided.

Mr. Oioli mentions that authorities felt the need to implement this additional oversight because the use of stablecoins for international transfers has grown significantly in recent years. “It’s much simpler and faster than traditional methods, raising concerns for regulators regarding currency control,” he emphasizes.

Continue reading.

#brazil#brazilian politics#politics#economy#cryptocurrency#monetary policy#central bank#image description in alt#mod nise da silveira

1 note

·

View note

Text

Blockchain is the latest technology, the interest in which has grown along with the popularity of cryptocurrencies. Today it is widely discussed not only in the world of finance. They are already trying to use blockchain for storing and processing personal data and identification, in marketing and computer games. But what is blockchain? Ultimate Guide: Explaining the Blockchain in 6 StepsBlockchain is the technology that underpins cryptocurrencies like Bitcoin and Ethereum. It’s essentially an ingenious way of storing information online that allows new types of applications on the internet. Traditionally, data is stored in tables that can be accessed and edited easily. It is how data on your computer is stored, and how most data is stored in the world. The problem with this way of storing information is that it’s difficult to know when information has been changed or copied. Think about digital currency. If you own one digital coin, what is stopping you from simply using copy-paste to make more copies of this coin and increasing your wealth for free? The traditional solution to this is to have one central authority that keeps track of how many coins everyone has. It is essentially what banks do for you. The downside is that the bank holds all of the power in this relationship. Blockchain takes a different approach. When you make a transaction, it gets added to a public “blockchain.” It’s done in a way that everyone can see what transactions have been made, and who owns what currency. However, nobody has central control over transactions. This lack of a central controller is what makes blockchain unique. Blockchain was developed to allow decentralized currencies like Bitcoin. But now it’s attracting interest from fields such as finance, identity management, travel and mobility, aerospace, defense, healthcare, law enforcement, voting, the Internet of Things (IoT), and many more. Here’s how it works in six steps. Step 1 — Transaction DataThe Bitcoin blockchain is essentially a long list of transactions. In fact, it’s all of the bitcoin transactions that have ever happened. The list is broken up into “blocks” containing around 3,000 transactions each. When you want to make a transaction with someone on the blockchain, you can look back at the whole history of transactions to see if the account you’re transacting with really has accumulated enough funds to transact with you. If they do, you can safely go ahead with the transaction. Note that the account may have unique addresses; in this case, you will not know for certain how much money it contains. Step 2 — Attaching Blocks to the СhainNew blocks containing transactions are continuously added to the end of a blockchain. On the Bitcoin blockchain, they are added every 10 minutes or so. Each of these blocks is linked to the previous block, forming a “chain” of blocks. This chain links continuously from the most recent block all the way back to the first block ever created. Special users are tasked with creating new blocks on a blockchain. These are called miners. Miners perform computations that make sure each new block is valid. They do this by checking if each new transaction is valid using a digital signature. Step 3 — How to Create a Digital SignatureAnyone using a blockchain network can attempt to add new transactions to the blockchain. So, there needs to be a mechanism to make sure only valid transactions can be added. It is done with something called a digital signature. Creating a digital signature uses complex cryptography beyond the scope of this article. The basic principle is that each account on a blockchain is associated with a public key and a private key. Transactions encrypted with a public key can only be decrypted with the right private key. As you have the private key to your unique blockchain account, you can prove your identity by decrypting a message with your private key. Step 4 — When Does the Signature Meet the Requirements?A valid digital signature proves your identity on a blockchain.

It proves that you really are the owner of a certain account on a blockchain. When you make a transaction, your signature is verified by the miners that add your transaction to the next block on the blockchain.The blockchain miners group all valid transactions into a block. This block is then put through a process called a hash function. It means the data in the block is encrypted and converted into a series of numbers and letters. Once the hashing is complete, the block is added to the blockchain. Step 5 — How Does This Contribute to the Integrity of the Blockchain?Solving the hash function described above is an essential step. This process is designed to be extremely difficult to do, taking an immense amount of computer processing power. It makes it almost impossible to add falsified blocks to the blockchain, as you would need to recalculate the hash functions on the blockchain. Thus, hashing contributes to maintaining the integrity of the blockchain. Step 6 — How Is Blockchain Regulated?Through the processes described above, blockchains allow anyone to transact with anyone else online with essentially no oversight. There are also platforms that allow people to transact with many other types of assets, too. A blockchain-based platform example is Ethereum. It is proving a problem for regulators all over the world. A blockchain is run by a decentralized network of people, so there is no company or individual to target. Countries have taken many different approaches to regulate blockchain. Some have opted for relaxed measures, while some have cracked down hard. Regulation is still constantly changing all the time. If you’re planning on using blockchain networks like Bitcoin or Ethereum, you should keep up with how they are regulated. ConclusionBlockchain is a unique technology that’s starting to impact many different industries. Having a good understanding of how blockchain works, and why it matters, is becoming essential for many people. Luckily, you don’t need to understand all of the technical details to know how it works. If you can intuitively understand transaction data, transaction blocks linked together in a chain, and digital signatures, you’re well on your way to understanding blockchain technology.

0 notes

Text

Decoding Crypto Mining: Exploring the Backend Processes of Cryptocurrency

Crypto mining is a process that makes new digital currencies by solving problem equations to confirm transactions on a blockchain. Miners use special machines to do these calculations, adding new blocks to the blockchain and ensuring everything is secure and correct. Each new block holds a set of transactions, helping to keep the whole system organized. They use the latest equipment like ASICs crypto mining to improve the network.

This process is key to keeping digital currencies safe and ensuring transactions can be trusted. It also helps grow decentralized finance, changing how people think about banking and investing. Understanding crypto mining helps explain how cryptocurrency affects the economy and everyday life.

The Beginning of Crypto Mining

In cryptocurrency, computers work together to find valuable digital coins. Crypto mining starts with powerful computers working hard to solve tricky problems. These machines are connected to a blockchain network, where all transactions happen.

Every time a transaction occurs, checks are made to verify and confirm it. This verification is essential to prevent fraud and ensure all transactions are correct. This is very useful for building trust in cryptocurrencies. For anyone curious about how crypto works, this basic step shows the power of the technology behind cryptocurrencies.

Adding New Blocks

Every time a transaction takes place, it’s important to ensure all details are correct. Once the issues are fixed, new blocks can be added to the blockchain. Each block holds a group of transactions, making it simple to keep track of everything. This addition of blocks will be mentioned by creating a complete history of all transactions.

This growing chain of blocks is what makes cryptocurrencies safe and trustworthy. It ensures that no one can change records without the approval of the whole network. This process keeps digital currencies secure and ensures its integrity.

The Impact of Mining

Think of a system that does much more than just produce digital currencies. The effect of crypto mining goes beyond just making new digital currencies. It supports a non-centralized system that any one person or group doesn’t control. This offers the best way for people to show interest. As more individuals learn about crypto mining equipment, interest in cryptocurrencies rises. Understanding these backend processes makes the world of digital currencies clearer.

About Hashbranch

Hashbranch is a company specializing in ASIC miner for sale to those interested in crypto mining. They help individuals efficiently generate cryptocurrencies with the latest technology.

For more information, visit https://www.hashbranch.com/

Original Source: https://bit.ly/3YSW8UU

0 notes