#cash app taxes tips

Explore tagged Tumblr posts

Text

Cash App Taxes Review for 2023: Features and Pricing

Introduction

With the increasing popularity of peer-to-peer (P2P) payment apps, such as Cash App, many users are concerned about their tax obligations. In this article, we will discuss everything you need to know about Cash App taxes, including what they are, how to report them, and some helpful tips to make tax season less stressful.

What are Cash App Taxes?

Cash App taxes refer to the taxes that users must pay on the money they earn or receive through the app. This includes any income earned through Cash App, such as payments received for goods or services, as well as any bonuses or referral rewards.

How to Report Cash App Taxes

Reporting Cash App taxes is similar to reporting any other income on your tax return. Cash App provides users with a 1099-K form if they meet certain thresholds, which include receiving over $20,000 and completing over 200 transactions in a calendar year. Users who receive a 1099-K form must report this income on their tax return.

If you do not receive a 1099-K form, you may still be required to report your Cash App income. The general rule is that all income, regardless of the source, must be reported on your tax return. It is important to keep accurate records of all income received through Cash App, including the date and amount of each transaction.

Deductible Expenses

If you use Cash App for business purposes, you may be able to deduct certain expenses on your tax return. For example, if you use Cash App to pay for advertising or other business expenses, these may be deductible. However, it is important to consult with a tax professional to ensure that you are following all applicable tax laws.

Tips for Tax Season

To make tax season less stressful, there are a few things you can do as a Cash App user:

Keep accurate records of all transactions, including the date and amount of each transaction.

Set aside a portion of your Cash App income throughout the year to cover any taxes owed.

Consult with a tax professional to ensure that you are following all applicable tax laws.

Conclusion

In conclusion, Cash App taxes are an important consideration for users who earn income through the app. It is important to keep accurate records and report all income received through Cash App on your tax return. By following these tips and consulting with a tax professional, you can ensure that you are meeting all of your tax obligations.

#cash app taxes#cash app taxes 2023#cash app taxes review#cash app taxes review 2023#cash app taxes features#cash app taxes features 2023#cash app taxes pricing#cash app taxes pricing 2023#cash app taxes tutorial#cash app taxes explained#cash app taxes for beginners#cash app taxes filing#cash app taxes preparation#cash app taxes deductions#cash app taxes calculator#cash app taxes tips#cash app taxes update#cash app taxes news#cash app taxes changes#cash app taxes requirements#cash app taxes help#cash app taxes support#cash app taxes customer service#cash app taxes questions#cash app taxes FAQ#cash app taxes walkthrough#cash app taxes video#cash app taxes how-to#cash app taxes step-by-step.

0 notes

Text

What can help your dreams ★Manifest☆ ?

1 -> 3

︻デ═一・・・・・・・・・・・・・・

HAVE YOU SUBSCRIBED TO MY YOUTUBE CHANNEL YET?! (It would mean the world to me♡) Check out my Silent 😶 Pick-A-Piles!

Here's the link -> ⋆。˚ ☁︎ ˚。⋆。˚☽˚。⋆

♡ Cupids Master-List

♡ Want a private reading with me?

Tips are very much appreciated! Ty for supporting me ♡

Cash app and PayPal only!

Cash app tag: minnieplant3

PayPal @: janellec03

Tarot Deck used: Garbage Pail Kids

Oracle Deck used : The Roast Iconic

─── ・ 。゚☆: *.☽ .* :☆゚. ───

Pile 1- The Devil, Six of Coins in Reverse, The Hanged Man

Oracle cards- "Billionaire: Are you hoarding wealth to fuel your King or Queen Baby dreams? Do not pass Go, do not collect a million dollars, don't even go to jail or pay taxes- think about doing some good and using your hoard to end WORLD HUNGER ALREADY!"

"Black Square: Apparently, you are only down for doing the bare minimum during an incredibly significant time to stand up and advocate for human rights. Drawing this card reminds you that your actions need to not be just performative, they must be based in real knowledge and include follow-through, both online and IRL (in real life). You don't have to be on the front lines, but at this point in history, you can't be silent either."

Hi my pile 1's 😭 I feel like it's been forever I hate being away from my blog for too long cause I start to miss y'all literally lol.

So anyways for your reading today I feel like Spirit is wanting to draw attention to maybe some addictions, self sabotage is what I heard while shuffling the cards. I feel this heavy energy of someone purposely messing up their own blessings in a way I feel like maybe someone's stuck in this very heavy energy but also not really doing anything about it? Like maybe you know something's not good for you, maybe it's a connection or even a job that's tiring you out, it's something along those lines but you just can't stop it, you know? I heard someone needs to do an energy cleanse! I heard take some time off. Maybe someone's drowning themselves in something like studying too much, there's something about over doing something. Someone could have very curly hair here.

So I'm hearing here someone should take the time off and do something fun, relax a little. I think there's a message here also of feeling like you haven't done enough of something and you're obsessing about it mentally a lot and spirit is saying just take a little break from it and endulg in something else, something that makes you happy and makes you feel like you, you know? Even if it's just taking a walk while listening to your favorite music or maybe reading your favorite book and watching your favorite movie, you know? So with the six of coins here I'm also getting a message of like you've worked really hard already and you've done a great job honestly it's okay to rest and not be perfect already already, Rome wasn't built in a day I'm hearing!

The hanged man is just confirmation you've definitely been making yourself sick and stuck by obsessing over this thing. I also feel like maybe you're stuck because spirit is wanting you to see things from a different perspective, like in my garbage pail kid tarot card Wacky Jacky is hanging and all stuck in a tree but while she's stuck she realizes she sees the world in a whole different perspective and it's then new ideas come to her. Approach your goal from a new angle!

I feel like someone here is also someone very important with a very hard position and that might be why you work so hard, you have a lot of pressure on you maybe. Take what resonates!

Hope you enjoyed this reading! Let me know, I love you and take care ♡

─── ・ 。゚☆: *.☽ .* :☆゚. ───

Pile 2- Queen of Wands Reversed, Seven of Wands Reversed and Three of Cups.

Oracle cards- "Troll: Are you a Necessary Evil? Do you feel you must play Devil's Advocate? Or are you someone who hates themselves so much they feel they have to try to get others to feel the same way? If you answered "yes" to one or more of these questions, please seek help or therapy, or get a hobby."

"Bitch: Are you being a Bitch, or just making sure they can't take advantage of you? Stand up for yourself, but make sure you don't steamroll anyone in the process. Do no harm, but take no shit."

Hi pile 2's, hope you're doing amazing 🤩

So right off the bat I'm picking up shy energy lol, someone who's maybe more reserved or introverted. I don't want to say basically Spirit thinks you should be loud or more outgoing but I definitely think you'll go through a time period of weird energy and out of the ordinary situations happening that are forcing you out of your comfort zone. You might not get any more extroverted but I definitely do see branching out might help, sitting with your close friends and just letting yourself let loose or just enjoy the company. You might be someone who people look at and not get the big picture right away, like they have lots of accusations about you but you're kind of closed off so these accusations aren't 100% true because there's more to you than people know, you're just not the type to go and give yourself away that easily. You might be someone who prefers to keep a very close knit group of friends, I heard something about trust issues.

You could be petite, someone who doesn't look like they're very strong and that's what surprises everyone when you finally do show them you are indeed strong. You can be loud and extroverted too I think it's a choice to really be in this shell of yours, maybe it's what's comfortable and that's exactly the problem, when we're too comfortable we don't see the point in changing. Like why fix it if it isn't broken? But you hold great significance, you're just a significant person to the universe and I'm not even sure if you're aware but you are lol.

It's crazy because I'm picking up mixed messages lol, with the Queen of Wands in reverse it makes me feel like someone here is very down and unsure about themselves, needs to take some me time and get away from socializing but with the Three of Cups someone here needs to "stop being alone so much" is how I channeled it, advising you to go out more with the people you love and celebrate, have a good time and just have fun so take what resonates as you know yourself best and what applies to your situation.

With the seven of Wands I'm getting a message of someone who's stressed, you maybe have felt very tired, over worked maybe, even dealing with certain responsibilities or relationship makes us feel tired and all worn out so take this how it resonates. You're on the brink of giving up, maybe you felt like it's not worth it or simply just can't find results you've been wanting to see, maybe this thing is literally killing you because Spirit is stressing you drop it enough to take the stress off you. I wouldn't advise anyone to just give up, but Spirit used such words as "drop it" like maybe the thing you're supposed to drop isn't serving you and that's why it's making you feel so bad. I'm just hearing Spirit even ask if you think all of this is worth it? This is something tough that's been bothering you, it could even be as simple as negative thoughts with all of the wands energy here, I think this is a group in their head a lot always trying to hold themselves accountable and very motivated to just do right. I heard a message that it's hard coming up for new creative endeavors because of all of the negativity in your thoughts holding you back, this energy is blocking your ideas. It's like you vs you almost, I think you have the power to help your dreams manifest all on their own just with your thoughts alone so keep a check for your energy, watch who you share your energy with because it's important and powerful. You're powerful I heard!

I hope you find this helpful! Take care angelz love you! ♡

─── ・ 。゚☆: *.☽ .* :☆゚. ───

Pile 3- Seven of Cups, The Chariot and King of Wands.

Oracle Cards- "Black Square: Apparently, you are only down for doing the bare minimum during an incredibly significant time to stand up and advocate for human rights. Drawing this card reminds you that your actions need to not be just performative, they must be based in real knowledge and include follow-through, both online and IRL (in real life). You don't have to be on the front lines, but at this point in history, you can't be silent either."

"Red Flag: No matter how often you try to bleach the red flags white, they only turn back to red. You have been warned- now PULL ANOTHER CARD!"

"Cult Leader: You are not a guru, a Timelord, or a demigod. You are an egomaniac who needs minions so you can feel like an authority to compensate for your own feelings of inferiority. Grow up!"

Hi pile 3! Hope you're having a fantastic day where you are!

So right away I'm picking up a message of not seeing the bigger picture, this pile feels more like a "How to Manifest more quicker" lol. I'm hearing this very slow moving energy, someone refusing to move on to the next chapter though you might be aware it's time to even but I'm getting a sense of fear. Even if you are unaware of these changes there's still so much anxiety and fear surrounding you at these times because the universe is basically forcing you to move lol! Move or be moved I'm hearing.

So overall I feel like someone in this pile might have lots of distractions, someone might have adhd and a hard time concentrating on tasks. Spirits drawing your attention these times and reminding you to stay focus.

With the Chariot card I feel like there's some movement here that needs to happen, you need to take action. I think that's the best way to help your manifestations right now, maybe someone here even forget exactly what they were manifesting and Spirit is like "Uhh HELLO? DO YOU REMEBER THAT THING??" lol. I heard someone's just been away from the job a little too long, I even get from the Seven of Cups it might've been you were distracted with something else that just sparked your attention better, but all that glitters isn't gold!

So I think you're working on being in this King of Wands energy, someone who is very productive, knows what they want, speaks up about anything, rather it's an idea they have or just wanting authority. I feel like a few of you even might know exactly what this is, I feel like a few of you might not even have a specific dream you want to manifest just clicking on the reading for fun lol but there's still a secretive message here I think you'll understand as you apply it to your situation.

Spirit is asking you to maybe think about the roots you want to plant and start from there, stay true to your craft and perspective and be committed.

I hope you enjoyed this reading! I love you, see you soon ❤️ ★

#pac tarot#pick a card#spirituality#tarot#tarot cards#tarot reading#tarot love reading#tarot messages#18+ tarot#pac love reading#tarotcommunity#tarot blog#tarot beginner#spiritual advisor#spiritualgrowth#spiritual awakening#astrology

341 notes

·

View notes

Note

hi! i really want to get better with my finances next year but.... i have NO idea where to start. i'm a writer and english major, maths is my enemy and i'm so bad with numbers. but i'm 21, i'm getting older and graduating my masters next year and it's time to get started with my career as i won't be living off of this student loan anymore AND will have to eventually pay it back 😭

i wanted to know if you have any tips about finances, saving ... what i should even do, how i begin? any resources or beginner books to get me started on knowing anything money wise? i'm literally a 2 year old when it comes to this topic i'm quite clueless but i want it to change, so literally any basic advice would help me so much right now. by the time 2025 ends i want to be really good with money and finance knowledge!

First of all it’s amazing that you’re 21 & already graduating with your masters!!!

Let’s start with some simple tips:

For one month, write down every dollar you spend. This will show you where your money goes and where you can cut back.

Use the 50/30/20 rule: 50% of your income for needs, 30% for wants & 20% for savings or debt.

Even if it’s small, open a high yield savings account and set up automatic transfers. Saving a little every month adds up fast!

You can start learning about investing. These are beginner friendly ideas to help you grow your money:

1. Index Funds and ETFs: These are great for beginners because they’re low cost & diversified. Popular ones include the S&P 500 index funds (like VOO or SPY). You don’t have to pick individual stocks, you’re investing in a basket of companies.

2. Retirement Accounts: Roth IRA or 401(k) (if offered by your job). Contributions grow tax free in a Roth IRA, which is great for long term wealth.

3. Dividend Stocks: Some companies like Coca Cola or Johnson & Johnson play dividends. This gives you regular income while your investment grows.

4. Fractional Shares: Apps like Robinhood, Fidelity, or M1 Finance let you buy small portions of expensive stocks like Amazon or Tesla so you can start with as little as $5.

5. Real Estate Investing: If buying property isn’t an option yet, try REITs (Real Estate Investment Trusts), which let you invest in real estate without owning property.

6. Life Insurance: You can use life insurance to build wealth. With whole or universal life insurance, you can borrow against the policy’s cash value to invest or cover major expenses. Payouts are generally tax-free, and the cash value grows tax deferred.

You can check out these YouTube/Instagram accounts:

The Financial Diet

Clever girl finance

Her first 100k

Girls that invest

mrsdowjones

female.in.finance

shewolfeofwallstreet

Ellevest

Good luck! Proud of you 👑

68 notes

·

View notes

Text

‼️READING COMPREHENSION WARNING‼️

Read and comprehend the topic of this post above the "read more" link before attempting to respond. This is your only warning. Violators will be mocked and blocked.

A GUIDE TO TIPPING IN AMERICA FOR TOURISTS AND VISITORS

AND ASSHOLES WHO SOMEHOW LIVED HERE THIS LONG WITHOUT UNDERSTANDING THIS

This post is going to cover tipping people in restaurants/eateries and private transportation. Tipping can also apply to many, many other service industries including but not limited to: movers, handypeople, mechanics, etc. Since this is meant to be brief and focused on info relevant to visitors and tourists, I won't discuss that here.

You're tipping 20% minimum on your food and public/private taxi rides (including lyft, uber, etc). Include this in your budget calculations for engaging with these services.

I was going to jokingly just end the post here but let me explain. Minimum wage laws in the US allow employers to pay their employees UNDER FEDERAL MINIMUM WAGE if they're in an industry that receives tips on the regular. Taxi drivers are self-employed and have to pay for the costs of the lease on their vehicle, gas, and give a cut to their garage or ride service provider.

Therefore, capitalists have shifted the cost of paying a living wage to these people on to the consumer rather than the employer. No amount of arguments against tipping culture is going to magically fix this overnight. That's the long game and we're trying to abolish this shit. Therefore, you are tipping 20% minimum. Today.

Even if you did not like the food.

Even if the food was cold.

Even if the server didn't seem cheery and smiley.

Even if the taxi wasn't as fast as you wanted it.

Even if the taxi smelled a little funny or the driver didn't talk the amount you like.

If you did not suffer immediate physical harm or harassment or discrimination at the hands of the service person who provided you the service, full tip. Five stars if you have to rate them in an app. Perfect marks.

Does the above statement seem strange to you? It shouldn't, because remember: capitalists have forced you to cover the full cost of the service. THIS IS NOT THE FAULT OF THE SERVICE WORKER.

Cash is King

Tip in cash if you have it. Credit card companies can't take a chunk out of cash tips. And if someone who works a low-paying job can grab a bit of cash under the table, away from the eyes of the IRS, then they will do more economic good with that money than the tax cut that goes to pay for bombing other countries.

How do I figure out a 20% tip?

Easy. Look at the total (THE TOTAL, WITH TAX YOU FUCKING CHEAPSKATE). Double it, then divide by 10 (move the decimal place one over to the left). Round up the remainder to the nearest dollar. That's going to be at least 20%.

What about counter workers?

There is some confusion on how to tip people who work at a counter in cafes and fast food establishments. Because they are not considered tipped employees and they get minimum wage.

The rule is, if during your transaction the POS (point of sale) register asks you to add a tip, you add a 20% tip. If you see a tip jar, you tip. If neither of these things happen, you don't tip

What about food delivery?

20% minimum tip. You called/ordered via an app, and magically food showed up. In any weather. 20% tip.

Bonus Holiday section:

Let's say you're visiting America during the peak American holidays when it's either a common "dining out" holiday or a holiday where you usually spend time at home with family. This includes, in chronological order:

Valentines Day, Fourth of July Weekend (the whole weekend), Thanksgiving, Christmas, and New Years Eve and Day.

You tip even more on those days. 30% minimum. I've tipped 100% on meals and rides on Christmas and Thanksgiving. Because those people are taking the time out of spending the day with friends and family, what everyone else is doing, to make sure they have enough money to pay bills and survive in America. And no you fucking bigot, you don't get to eye up the server and figure out if they celebrate Christmas or not.

FAQ:

I can't afford a 20% tip. How do I pay for this?

You can't afford the full service or experience. You don't buy it. Next question.

Where I come from, we don't tip that much/not at all. Why do I have to do this?

You're in America now. You have to do this. Please, feel free to engage the worker in a spirited debate about tipping culture if you feel like you need more info. I'm sure you'll learn something new.

I have a tipping system. You see, first I start at 10% and for every...

Your system is bad and you're a cheapskate. 20% minimum.

Hey wait a minute, I'm an American and I have strict rules about who I tip and how much. And 20% is too high! What are you talking about?

Every decent human being quietly judges you for being an asshole. You are disliked by the people around you who tip like normal people. You are not going to become rich some day because you saved $5 on a tip. Own up and tip.

I ate at an expensive restaurant. Surely I don't have to tip 20% on a bill like this, do I?

Yes you do.

Holy shit. I'm going to follow this guide but wow. Do you Americans really live like this?

Oh buddy wait till you encounter states that don't list the tax on the price tag.

OH MY GOD TUMBLR KEEPS BREAKING THIS POST. ANYTHING BELOW THIS GIF GETS FUCKED PLEASE TRY TO BEAR WITH ME

343 notes

·

View notes

Text

TLDR: Verzi Need Money. Here Link for Helping Fill Money Bar with Money Juice. -Ko-fi -Commission form (Open again! Note the price increase!) -Patreon -Paypal.me

Okay! Verzi need money. So! Here's this.

This shitty meter here is just for a bit of transparency (Graphic design is NOT my passion), cuz people like to know where there money is going. This will fill up as with funds from my patreon (money I got this month is already there!), from commissions, and from any tips/extras given by kind souls in passing, and I need to hit these marks EVERY month for like… a year. (This is after fees and such of course, cuz god forbid we don't pay the middle-men their dues.)

I will update this thing as time passes so ya'll will know where I'm at. Reblogging/Sharing is welcome, encouraged, and greatly appreciated!

A bit of info for each section under the Readmore:

-Rent and Bills: The Most Important thing to Keep Verzi Kickin'! I pay half my apartment's now $1368 rent PLUS the utilities, which range from 100~200 bucks, splitting with my aunt who works 2 jobs to make sure she pays her half. Since my mom passed away from Pancreatic cancer in 2021, this has been rough since it used to be split 3 ways.

-Dental Costs: The face bone doctors want my money after drilling holes and pulling out the insides!! My face actually feels BETTER so i'm not as mad as I COULD be about this, but this needs to be paid for the next 12 months. (And they want MORE money to do a cleaning and I almost laughed. Like, no buddy you ain't getting 750 out of me when I don't even have a refrigerator.(See Below))

-Big Purchase+Credit Card bills: It wont pay off ALL my credit card debt, but it keeps me from falling behind. Since the passing of Michael and Fred (my microwave and refrigerator respectively) I need to make some big purchases so my kitchen functions. Michael has been successfully replaced by Mikaela, and we are still looking for Fred's replacement. Ms. Frida, the chest freezer who is literally older than I am (I am 33!!) and STILL functions is holding down the fort while we look for a refrigerator. We can live without a fridge thanks to her constant service, allowing us to keep frozens. Also, like, literally on the 30th of July, Monty the Monitor must've succumbed to heatstroke so i had to buy one of THOSE too for my computer setup. I will name all my appliances to cope.

-Extra+Taxes: Once we get here, I'm in the clear for the month's expenses! However!! Taxes are due in October. I DO NOT know how much that will be, and since the whole Covid relief thing that lessened business taxes ended last year, I MAY be paying for quite a bit!! Anything past this point will be prepping for Taxes AND forming a buffer for More Happenings (God forbid).

===== Rewards??? Rewards!! =====

I considered a Drive like other kink artists in these circles, but I don't like drives for several reasons and those reasons are why I've never done one in the past. Despite that, I STILL want to do something that at least feels like a reward or incentive for people keeping me Alive™, so I'm going to do some simple doodles/sketches, and possibly try to stream those doodles in my discord!

Every 100 bucks past the "Rent and Bills Paid" section (meaning at 900 dollars and onward), I will do a RANDOM drawing from any requests/suggestions from the pool made by people who threw some cash monies my way!

Suggestions can be sent in through Ko-fi messages, Paypal notes accompanying payments/donations/tips, and a Patreon-only post (they are always giving me money, so patrons have access by default!). Commissioners who send in the form can ALSO suggest something for the pool if they like! (there's a question on the form for it) Now, like all requests, it's ultimately up to my discretion on whether or not I will draw something, but I will still try to keep it random and let it be a roll of the dice (or a RNG app).

There is no minimum requirement either! So people throwing only $1 at me, buying only one Ko-fi, or dropping anything bigger are free to offer a suggestion. But please limit requests/suggestions to one entry per person.

Now, as to what these will and can be:

-It will be a simple lined sketch with one color or flat colors. Depends on how many need doing, how I'm feeling when I draw it and how complicated it is.

-It can be up to 2 characters, but they may be less refined compared to a single character one. They can be the same character in 2 different states, or 2 different characters interacting with each other.

-No private requests please! It will have to be something that can be publicly posted and that you're fine with being perceived by others.

-In terms of kinks/sizes/etc, it will be something that you'd normally see on this blog or for my work! Mileage may vary, but more extreme stuff that I'd normally avoid may be glossed over when I'm constructing the pools.

-Unlike commissions, these will not go through a WIP stage/be modified after the fact! They end up how they end up. If you wanna be nitpicky, please use this opportunity to order a full commission!

-You're allowed to suggest OCs as long as it's yours or its owner has given permission to draw them in the context I am known to put boys in!

37 notes

·

View notes

Note

Im going to Japan for the first time after Christmas in December!! How has it been and do u have any tips? :)

Sorry if this reply long btw, I could honestly go overboard but I’ll try not to, I feel like some of these are v obvious but I didn’t know wut else to say… >3<;;;

I mainly planned most of my trip around all of Japan’s illumination, festivals, and autumn stuffs.

You don’t need to bring too many clothes bc you will most likely be buying there, and at least have one good pair of walking shoes bc despite all the trains n buses you will still do lots of walking. So many good stores, shops n shopping districts even their thrift/second-hand stores are good bc they even sell good quality vintage designer brands.

If you can bring an extra empty suitcase or even buy one there, bc no joke you will want to buy a lot of stuff. If you want skincare/haircare etc it’s actually better to buy at pharmacys/drug stores bc they’re cheaper, even cheaper than don quijote. Tho donki is pretty lit tho, but v overstimulating. I suggest going donki early morning rather than later in the day/night bc it’ll have the least amount of ppl.

Some places you need to book 1-3 months in advance. Some long queues for restaurants aren’t worth it, just walking around and discovering random new places are just as good as the hyped ones you see online.

Most places still want you to pay with cash so, make sure you at least have a bit of cash just incase.

If you want to pay extra money to skip the line to different attractions I would highly recommend it. Like seriously if you can book in advance do it. I used Klook (app) quite a bit, others are good too.

If you have the time stay maybe 2 nights at Kawaguchiko, you will have time to relax and enjoy the best Mt. Fuji views.

I didn’t go to Nara deer park bc idk to me I don’t find it super ethical?? But that’s just a me problem/dramatic bc I feel like they’re becoming quite domesticated now constantly being fed with the deer cookies/biscuits n whatnot. I did go to miyajima, can almost call it a deer island? where they seem more “wild”? ofc some have gotten accustomed to humans but I don’t think as bad as in Nara.

If you can add tea ceremony and/or kimono rental to your itinerary, I suggest to try it at Kyoto. I know they said the Gion district is banned to tourists but you can actually still go, they just have some roads closed of from tourists, like if you still wanna go like Fushimi Inari, kiyomizudera etc, it’s still ok bc I did my tea ceremony n hotel at Gion.

Most touristy places will be packed so you either have to go extra early or if you time it right, late afternoon is good too. And most shops don’t open till like 10am/11am. And if you wanna do like tax free shopping always have your passport with you.

Feel free to ask for more, this is all so far that came to the top of my head ^^;;;

#uwu.ask#anon#sorry if this was a lot or not that helpful#I rly do hope I was helpful#I hope you have an amazing trip~!!! and be safe#pls take care n hope you have a lovely day/night~<333

4 notes

·

View notes

Text

Hi I wrote a poem about the strange experience of being on social media these days. TW for current events and the general shittiness of the world (genocide, transphobia, homophobia, murder, diet culture, racism, sexual assault, etc).

Social Media

Cat picture.

Child homicide.

Funny meme.

Ongoing genocide.

Human rights in violation.

More transphobic legislation.

Makeup look that's new and now

Microplastics in the clouds.

Crochet project.

Police violence.

Family photo.

Complicit silence.

Turned a van into a house.

Dog playing with rubber mouse.

Endangered animals in the wild.

Have you seen this missing child?

Art tutorial.

Anti-maskers.

Vacation pics.

Anti-vaxxers.

The air we breathe is getting thick.

This is how you get rich quick.

AI art is all the rage.

Want some more? Refresh the page.

Shrinking paychecks.

Pyramid scheme.

Baseless hatred.

Quick recipe.

Half of women have been assaulted,

But the nice guys can't be faulted.

Taxes cut for billionaires.

Help if you have cash to spare.

Racist comments.

Jaded eyes.

Violent threatening.

Political lies.

If you care you will bear witness.

Your life's so much easier than this.

Another state is turning red.

Pay for treatment or I'll be dead.

Homeless friends.

Low-interest loans

Brand-new gadget.

Combat zones.

Kind person's inbox filled with hate.

Here's a tip to lose some weight.

Half the country is on fire.

Can you blame me for being tired?

Constant input.

Brainwaves numbing.

Need distraction?

Eternal scrolling.

This will save you; you should buy it.

Here's an app to track your diet.

Kids overseas starve to death.

This gum will freshen your breath!

Tropic cruises.

Payment plans.

Body shaming.

Bloody hands.

Girl was raped beneath the bleachers.

Threats of hellfire from the preacher.

Brick by brick, blow by blow,

Batteries are running low.

Whole countries reduced to rubble,

While we stay in our safe bubbles.

The poor all starve while rich get richer.

Here's another dumb cat picture.

4 notes

·

View notes

Note

Hi there!!! I think your art is super cool, and I love how you've drawn inspiration from fairytales, and how flexible you are with style ♡ I've been making art for a while but always just for myself, and I signed up for my very first craft fair! I was wondering how you got started selling your art. What were you nervous about? What do you wish you'd known? What did you diy that would have been worth buying, or vice versa?

Congrats on your first show!!! I wish you perfect weather, good booth assistance, and tons of wonderful people attending who buy tons of your work.

I started with an Etsy shop back in the day when Etsy was still decent, then did a few comic cons and shows and eventually timidly opened up commissions. I took it super slow! I was very shy and insecure lol

Tips:

Have a printed QR code for your insta and stuff, most people don’t take business cards anymore and just want to scan a code or take a photo. So have a sort of flyer with all your info that people can snap.

Recycled grocery bags make great bags and save you a buck, tell people you’re recycling lol

If you do any outdoor shows, have everything in plastic. Plastic tubs, plastic sleeves for art, be ready for wind and rain!!! You can get plastic sleeves for prints on Amazon for cheap.

Get a spare battery thingy so you can charge your phone if you’ve got no power connection, for indoor or outdoor shows, and just for life.

People like Venmo, cash app, most have cards, few have cash. You’ll only need like $100 in change.

When people compliment you, just say thanks! I appreciate it! Ask them where they’re from if you feel awkward. Don’t tell them your art is bad and they’re wrong lmao. Smile a lot and STAY STANDING and engage with people, it’ll help sales a ton. It sucks but if you sit nobody feels comfortable interacting with you. Then no sales. Maybe get a rubber mat to stand on. Wear comfy shoes.

Outdoor shows: Dog leash screws hold your tent down 100%. Overnight, taken EVERYTHING down, even if there’s day 2. Your tent will blow over/collapse if you leave anything behind, it’s just the law. Most tents that aren’t a fortune can’t withstand the weather and will collapse!!! So just take it all down.

Don’t sell yourself short! Calculate how long a thing took you and how much the materials were and pay yourself AT LEAST $10 an hour, if not $20. Have faith that you’re worth it.

Track all your sales and set aside 20% for taxes! Chances are you won’t have to pay them for a year or two because you won’t make much, but it’s good to start the habit. Track every cent for materials, food and gas for shows, supplies, product costs etc. those are writeoffs! If you spent more on your art business than you earned, no need to pay taxes.

www. iprintfromhome. com offers great print options and pricing!

Always always always make stuff that’s just for you. Art that the internet and the audiences never see. Not everything you make has to be show worthy.

It’s a big challenge to do this and I definitely am still learning the ropes! I wish I had all the secrets, if you find them let me know. Remember to have fun and make what you love and what inspires you. Also remember it’s a tough world out there for artists right now, so go easy on yourself if you feel like you’re not “getting it”. It’ll take time and work.

You don’t have to monetize your hobbies, but if you enjoy it and you want to, then go kick ass!!!

And again, I wish you good luck and good fortune!!! 🌟

10 notes

·

View notes

Text

GOOD. I am fucking sick of hearing people talk about how expensive delivery is. It should be. Someone is bringing pre-made food to your home. There are those of us with disabilities for whom it's conceivably a need, but for most people, that's a luxury. People who are performing that work deserve to be paid as if they're performing a luxury.

Instead, you've got customers expecting luxury service for bargain prices, corporations luring drivers with promises of flexibility and bonuses, then stealing their tips and keeping all the profits.

I'm sure I don't need to tell anyone this, but in my experience you don't ever make a taxable profit on any of these gig apps. My experience was that I got cash in hand at the moment (an advantage only if you're poor enough) and a little bit of a smaller amount in the taxable income space on my tax return. Because in reality I LOST money.

It's bullshit. It's all bullshit. It's probably always been bullshit. For God's sake, TIP. Tip BIG. Tip in cash so there's no paper trail.

Honey they’re inventing unions at DoorDash

47K notes

·

View notes

Text

Setting Up Your Shopify Store: A Step-by-Step Beginner’s Guide

Starting an online store can be a game-changer for your business, and Shopify is one of the best platforms to make it happen. Whether you're a budding entrepreneur or an experienced seller, Shopify provides an easy-to-use platform for building and managing your eCommerce store. Here’s a comprehensive step-by-step guide to help you set up your Shopify store from scratch.

Step 1: Sign Up for Shopify

Go to Shopify’s website and click on "Start Free Trial."

Enter your email address, password, and store name.

Tip: Choose a store name that reflects your brand and is easy to remember.

Complete the registration process by answering a few questions about your business.

Step 2: Configure Basic Settings

Set Your Store Location: Add your address and other relevant details to calculate shipping rates and taxes.

Select Your Currency: Go to Settings > Store Currency and choose the appropriate currency for your target audience.

Setup Taxes: Enable or configure tax settings to comply with your region’s requirements.

Step 3: Choose a Theme

Navigate to Online Store > Themes in your Shopify dashboard.

Browse through the free and premium themes available on the Shopify Theme Store.

Tip: Pick a responsive theme that works well on both desktop and mobile devices.

Click "Customize" to start tailoring the theme to your brand.

Step 4: Customize Your Store Design

Add Your Logo: Upload your brand logo for a professional look.

Choose Colors and Fonts: Align these with your brand’s identity.

Design Your Homepage: Add high-quality images, headlines, and CTAs (Call to Actions) to make it visually appealing.

Preview Your Store: Test how it looks on different devices.

Step 5: Add Products

Go to Products > Add Product in the Shopify dashboard.

Fill out product details:

Title

Description (include keywords for SEO!)

Images (use high-resolution images)

Pricing

Inventory information

Organize products into categories or collections for easier navigation.

Step 6: Set Up Payment Methods

Go to Settings > Payments.

Choose your preferred payment gateway (Shopify Payments, PayPal, Stripe, etc.).

Tip: Shopify Payments integrates seamlessly and offers competitive transaction fees.

Configure additional payment options like credit cards, digital wallets, or cash-on-delivery if applicable.

Step 7: Configure Shipping Settings

Navigate to Settings > Shipping and Delivery.

Add shipping zones and rates for domestic and international customers.

Offer shipping options like free shipping, flat rates, or real-time carrier rates.

Step 8: Set Up a Domain

Go to Settings > Domains in the Shopify dashboard.

Purchase a new domain through Shopify or connect an existing one.

Tip: A custom domain gives your store a professional look (e.g.,).

Step 9: Install Essential Apps

Visit the Shopify App Store to enhance your store’s functionality.

Popular apps to consider:

SEO Optimizer for better search visibility.

Email Marketing Apps like Klaviyo or Mailchimp.

Abandoned Cart Recovery apps.

Review Collection Apps for social proof.

Step 10: Test Your Store

Place a Test Order: Use Shopify’s test mode to simulate a purchase.

Check for:

Smooth navigation.

Proper display of product images and descriptions.

Functioning payment gateways.

Fix any issues that arise before going live.

0 notes

Text

Why Your Business Needs Efficient Billing Software for PC

Running a business today is more challenging than ever. Managing bills, invoices, and payments manually can be time-consuming and error-prone. That’s where Billing Software for PC comes in. Whether you own a small shop, a growing startup, or a large company, billing software can streamline your operations and save valuable time.

In this blog, we will explore why your business needs efficient billing software, discuss its key features, compare options, and highlight its role as a vital business accounting tool. Let’s dive in!

What is Billing Software for PC?

Billing software is a computer program that automates the process of creating invoices, tracking payments, and managing customer transactions. Unlike manual processes, it reduces the chances of mistakes and helps you stay organized.

Fun Fact:

According to a 2023 study, businesses using billing software save up to 40% of the time spent on manual invoicing and record-keeping.

Data Point:

In the same study, 65% of small businesses reported improved cash flow management within the first 3 months of using billing software.

Why Efficient Billing Software is Essential

Efficient billing software is not just a luxury; it’s a necessity. Here’s why:

Saves Time: Imagine creating invoices for 100 customers manually. It could take hours! Billing software automates the task, allowing you to focus on growing your business.

Reduces Errors: Manual billing can lead to mistakes, like miscalculations or missed payments. Software ensures accuracy.

Enhances Customer Experience: Quick and accurate invoices make a good impression on customers, improving their overall experience.

Tracks Finances Easily: With built-in business accounting tools, you can monitor income, expenses, and taxes in one place.

Cost-Effective: Contrary to popular belief, there are affordable billing software options that offer great features without breaking the bank.

Data Point:

A report from 2024 indicates that businesses that adopted billing software saw a 25% reduction in late payments and a 15% increase in customer satisfaction scores.

Features of Billing Software

Modern billing software for PC comes with a variety of features that make it user-friendly and efficient:

Invoice Creation: Create professional invoices with pre-designed templates.

Payment Tracking: Track customer payments and set reminders for overdue bills.

Multi-Currency Support: Ideal for businesses dealing with international clients.

Tax Calculation: Automatically calculate taxes like GST, VAT, or sales tax.

Inventory Management: Keep an eye on your stock levels and prevent shortages.

User-Friendly Billing Apps: Many billing software options offer mobile apps, so you can manage your business on the go.

Example:

A bakery owner can use billing software to:

Generate customer bills.

Monitor daily sales.

Calculate monthly revenue.

Data Point:

On average, businesses using billing software reduce invoicing errors by 70%, saving an estimated $2,500 annually on corrections and adjustments.

How to Choose Affordable Billing Software

Here are some tips to find the right billing software for your budget:

Define Your Needs: Do you need inventory management, tax calculation, or multi-user access?

Try Free Versions: Start with free or trial versions to test the features.

Read Reviews: Look for software with high ratings for being user-friendly billing apps.

Check Scalability: Choose software that can grow with your business.

Benefits of Using Billing Software

Improved Productivity: Automating repetitive tasks increases your team’s efficiency.

Better Cash Flow Management: Easily track who owes you money and when payments are due.

Regulatory Compliance: Stay compliant with tax laws using built-in calculators.

Eco-Friendly Option: Go paperless and save the environment!

Example:

A clothing store using billing software could:

Generate 300 invoices in a week.

Reduce billing errors by 90%.

Save 15 hours of manual work.

Data Point:

By switching to billing software, small businesses report cutting operational costs by 20% on average.

Why Gimbook is the Right Choice

Gimbook stands out as a reliable solution among billing software options. Designed for small and medium-sized businesses, it offers a seamless user experience with features like automated billing, integrated payment tracking, and real-time tax calculation. Whether you're managing a retail store or a service-based business, Gimbook simplifies your operations while being affordable and easy to use. Its versatility makes it a preferred choice for businesses aiming for efficiency and growth.

Take the first step towards smarter invoicing and better cash flow management. Download Gimbook for Free! https://www.gimbooks.com/

Efficient billing software for PC is a game-changer for businesses of all sizes. From automating invoices to tracking payments and managing taxes, it simplifies complex tasks and boosts efficiency. Plus, with options for affordable billing software and user-friendly billing apps, there’s a solution for every budget.

0 notes

Text

Nhlanhla Dakile Guide to Managing Your First Investment Property

Investing in property can be exciting and rewarding, but it also comes with challenges, especially for first-time investors. Nhlanhla Dakile, a seasoned real estate advisor, shares practical tips to help you confidently manage your first investment property.

1. Understand Your Role as a Landlord

Owning an investment property isn’t just about collecting rent. It involves responsibilities like:

Maintaining the property to keep it safe and habitable.

Understanding local rental laws and regulations.

Building positive relationships with tenants.

By preparing yourself for these duties, you’ll reduce stress and improve your chances of long-term success.

2. Screen Tenants Thoroughly

One of the biggest mistakes new landlords make is skipping proper tenant screening. Nhlanhla advises looking for:

Stable Income: Ensure tenants can comfortably afford the rent.

Good Rental History: Check references from previous landlords.

Clean Background Checks: Avoid potential risks by verifying credit and criminal records.

Taking the time to find responsible tenants reduces risks like late payments and property damage.

3. Set Competitive Rent Prices

Overpricing your property could leave it vacant, while underpricing eats into your profits. Use these strategies to determine a fair rate:

Research similar properties in your area.

Highlight unique features, such as renovations or proximity to schools.

Be open to adjusting rent based on market trends.

Fact: A 2024 study found that properties priced within 5% of market rates rented 30% faster.

4. Budget for Expenses

Managing a property involves more than just the mortgage payment. Nhlanhla emphasizes the importance of budgeting for:

Maintenance and repairs (allocate 1-2% of property value annually).

Property taxes and insurance.

Vacancy periods, when the property isn’t generating income.

By anticipating costs, you’ll avoid financial surprises and ensure consistent cash flow.

5. Maintain Clear Communication with Tenants

Good landlord-tenant relationships are key to managing a successful property. To achieve this:

Respond promptly to tenant inquiries and maintenance requests.

Clearly outline lease terms and expectations in writing.

Conduct regular check-ins to ensure the property is in good condition.

Building trust makes tenants more likely to respect your property and fulfill their lease obligations.

6. Stay Organized with Documentation

Proper record-keeping is crucial for managing your investment property. Keep track of:

Lease agreements and tenant correspondence.

Maintenance and repair receipts.

Financial records for tax deductions.

Tip: Use property management software or apps to streamline your records and stay on top of your responsibilities.

7. Consider Professional Help

If managing a property feels overwhelming, hiring a property management company can be a game-changer. They handle:

Tenant screening and lease agreements.

Rent collection and financial reporting.

Maintenance coordination and emergency responses.

Although this service comes with fees (typically 8-12% of monthly rent), it can save you time and reduce stress.

8. Plan for Long-Term Growth

Nhlanhla Dakile highlights the importance of thinking beyond your first property. Ask yourself:

Can this property generate positive cash flow for years?

Should I reinvest profits into new properties?

How can I improve the property’s value through renovations?

Fact: Properties with modernized kitchens and bathrooms can see a 10-15% boost in rental income.

Final Thoughts

Managing your first investment property is a learning experience. By staying informed, organized, and proactive, you’ll build the foundation for a successful real estate journey. As Nhlanhla Dakile says, “Property investment is not just about owning bricks and mortar—it’s about creating opportunities for financial freedom.”

By following these steps, you’ll not only protect your investment but also position yourself for long-term success in the real estate market.

0 notes

Text

Why is Cash App direct deposit pending?

What is Cash App?

Cash App, developed by Square Inc., is a mobile payment service that allows users to send and receive money, invest in stocks, buy Bitcoin, and make payments. With its intuitive interface, Cash App has attracted a broad user base, especially among younger generations who prefer digital transactions over traditional banking methods.

Feel free to call us anytime you need support."

Check your internet connection: Common causes include a poor internet connection. Use a strong internet connection. These issues are usually fixed when they are discovered.

Transaction Volume: Transaction volume, especially during peak times like tax season, can overload and slow down the system.

Money Transfer Update Issues: Missing funds can cause issues with pending payments. Make sure you have the latest version of the app installed on your device to avoid compatibility issues.

There is a problem with your Money Transfer account: If there is a problem with your Money Transfer account, such as a security issue, your funds will be held until the issue is resolved.

Bank Policy: Bank policies can also directly affect the speed of your deposit. Some banks take a long time to process these transactions, causing delays.

Review Your Account: Make sure your account is properly funded with the correct personal information to avoid any lengthy approval issues.

Check the sender: If the sender has entered incorrect payment information into the loan application, the payment will not be processed. Double-check the correct payment information for the Money application to make sure it is correct and try submitting the payment again.

Issue to issuer: cash app loan Please note the processing times associated with these transactions. While Cash App does a good job of processing payments, there may be delays due to the sender's bank's processing time.

Direct deposits can arrive up to two days early at most banks. Arrival times depend on when the sender sends the funds to the app.

Contact Cash App Support: If you are unable to determine the pending tax amount, please contact Cash App Support. They can provide specific information about your business and potential issues.

How long does it take for a deposit to appear in the Instant Cash App?

Instant Cash App can take up to five business days to process, depending on your employer's payment schedule and the time of the deposit. Cash Flow Support can help if you've been out of work for a while

Tips for Using Cash App Direct Deposit

Verify Your Information: Always double-check that your account and routing numbers are correct to avoid any issues with your deposits.

Stay Informed: Keep an eye on your Cash App notifications to know when deposits are made.

Monitor Your Balance: Regularly check your Cash App balance to ensure your funds are deposited correctly.

Use the Cash Card: Consider ordering a Cash Card to access your funds at ATMs or to make purchases directly from your Cash App balance.

Frequently Asked Questions

Can I use Cash App for direct deposit without a bank account?

Yes, you can use Cash App for direct deposit without a traditional bank account. Cash App provides you with a unique account number and routing number through its banking partners, allowing you to receive direct deposits directly into your Cash App balance.

How long does it take for a direct deposit to appear in Cash App?

Direct deposits are typically available on the same day they are issued, but it may take one to two pay cycles for everything to be fully set up.

What if my direct deposit doesn’t appear?

If your direct deposit hasn’t appeared after the expected time, check with your employer to confirm that the deposit was sent. You can also review your Cash App transaction history for any updates.

Can I change my direct deposit information?

Yes, you can update your direct deposit information by accessing the direct deposit section in Cash App and providing your new account details.

Is there a fee for using direct deposit with Cash App?

No, Cash App does not charge fees for receiving direct deposits. However, standard fees may apply for other types of transactions, such as instant transfers to your bank account.

Conclusion

Cash App provides a convenient and efficient way to receive direct deposits without the need for a traditional bank account. Understanding that Lincoln Savings Bank serves as the official bank for these transactions is crucial for setting up and managing your direct deposits effectively. By following the steps outlined in this guide, you can ensure a smooth direct deposit experience and take full advantage of Cash App’s features. With its user-friendly interface and robust functionality, Cash App is a practical choice for anyone looking to simplify their financial transactions.

1 note

·

View note

Text

Top 7 Accounting Tips to Grow Your Cleaning Business

Running a cleaning business requires attention to both cleanliness and numbers. Effective accounting practices can significantly boost your business’s growth, profitability, and financial stability. Here are the top seven accounting tips to help your cleaning business thrive:

1. Separate Business and Personal Finances

The first step to managing your cleaning business finances is to separate them from your personal accounts. Open a dedicated business bank account to ensure accurate record-keeping, simplify tax preparation, and build a professional image. Mixing personal and business finances can lead to confusion and missed opportunities for tax deductions.

2. Track Every Expense

Cleaning supplies, equipment, transportation, and labor costs can add up quickly. Keep a detailed record of every business-related expense. Use accounting software or expense-tracking apps to organize receipts and invoices. This habit ensures you claim all eligible tax deductions and provides a clear picture of your operating costs.

3. Implement Accounting Software

Investing in user-friendly accounting software can save you time and reduce errors. Tools like QuickBooks, Xero, or Wave allow you to track income, expenses, payroll, and invoices in one place. Many of these platforms offer features tailored to small businesses, making it easier to stay on top of your finances.

4. Monitor Cash Flow Regularly

Cash flow is the lifeblood of any cleaning business. Regularly review your cash flow to understand how money moves in and out of your business. Identify patterns, such as seasonal slowdowns, and plan accordingly. Maintaining a positive cash flow ensures you can cover expenses and invest in growth opportunities.

5. Set a Budget and Stick to It

Creating a budget helps you allocate resources effectively and avoid overspending. Factor in fixed costs like rent and utilities, as well as variable costs like supplies and marketing. Regularly compare your actual expenses to your budget to ensure you’re on track.

6. Prepare for Taxes Year-Round

Taxes can be a significant burden if not planned for in advance. Set aside a portion of your income for taxes and stay aware of filing deadlines. Take advantage of deductions specific to cleaning businesses, such as vehicle expenses, cleaning supplies, and home office costs. Consult a tax professional to maximize your deductions and ensure compliance.

7. Hire a Professional Accountant

As your cleaning business grows, consider hiring a professional accountant or bookkeeper. They can provide expert advice, ensure accuracy, and help you make strategic financial decisions. Outsourcing your accounting allows you to focus on core business operations while leaving the numbers to a trusted expert.

Conclusion

Proper accounting practices are essential for the success of your cleaning business. By separating finances, tracking expenses, leveraging technology, and seeking professional help when needed, you can set a strong financial foundation. Implement these seven tips to keep your business thriving and ready for future growth.

#bookkeeping for cleaning business#cleaning business accounting#cleaning services bookkeeping#accounting for cleaning business

0 notes

Text

5 Financial Tips for Small Business Owners to Boost Growth 🚀

Running a small business isn’t easy—but smart financial strategies can take you from surviving to thriving! Here are 5 actionable tips to boost your business growth:

1️⃣ Separate Business and Personal Finances Keeping your accounts separate helps you track cash flow accurately and makes tax season a breeze. Pro tip: Open a dedicated business account if you haven’t already!

2️⃣ Invest in Your Business Don’t shy away from investing in tools, marketing, or team development. A small investment today can lead to BIG rewards tomorrow.

3️⃣ Leverage Business Loans Wisely Got plans to expand or upgrade? A business loan can be your growth partner. F2Fintech can help with tailored loan solutions for your unique needs. 💡 Learn more here.

4️⃣ Track Your Expenses Like a Hawk Keep a close eye on where your money goes. Apps like QuickBooks or Xero can help you stay on top of things, or better yet, schedule a monthly financial check-up.

5️⃣ Build a Financial Cushion Unexpected costs happen. Having an emergency fund ensures your business stays afloat when surprises come knocking.

💼 At F2Fintech, we’re here to support your financial journey with flexible loans, overdraft services, and expert guidance. Let’s grow together! 👉 Check us out.

Reblog if you found these tips helpful! Got questions? Drop them in the comments—we’re here to help. 🌟

1 note

·

View note

Photo

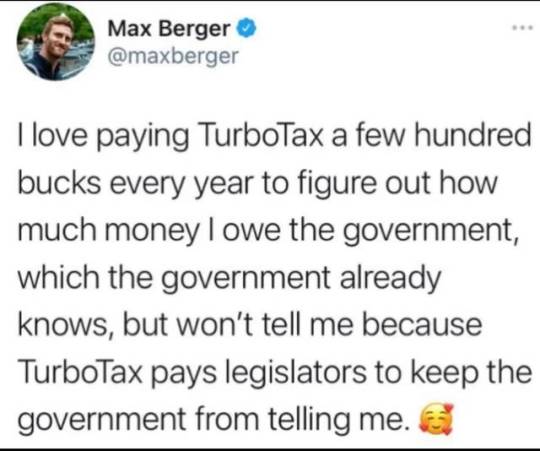

I used TurboTax online to prepare my taxes and then I put in all the same information on CashApp - YES ON FUCKING CASH APP, I KNOW, I WOULD NOT HAVE BELIEVED IT EITHER - and they filed my federal and state for FREE. Already got my federal back, and only waiting on state because my state takes three weeks to process/send the return.

Last year I used CashApp to file my taxes for the first time because that's who Credit Karma partnered with after discontinuing their tax preparation and filing services.

btw use Credit Karma - free access to your credit score, updated weekly or so AAAAAAAND they have checking and savings accounts, and the savings is a HIGH YIELD PERCENTAGE. Right now mine is 3.75% and right now the national average for a savings account is .23%. There are other high yield savings accounts, but seriously GET A HIGH YIELD SAVINGS!

(I also bought my car through Credit Karma and have refinanced my car loan for a lower monthly rate already and it gives me tips on if I can get better car insurance, has helped me scope out credit cards I'd qualify for/let me search based on interest rates, and if there are fees or not, etc.)

150K notes

·

View notes