#cash app taxes calculator

Explore tagged Tumblr posts

Text

Cash App Taxes Review for 2023: Features and Pricing

Introduction

With the increasing popularity of peer-to-peer (P2P) payment apps, such as Cash App, many users are concerned about their tax obligations. In this article, we will discuss everything you need to know about Cash App taxes, including what they are, how to report them, and some helpful tips to make tax season less stressful.

What are Cash App Taxes?

Cash App taxes refer to the taxes that users must pay on the money they earn or receive through the app. This includes any income earned through Cash App, such as payments received for goods or services, as well as any bonuses or referral rewards.

How to Report Cash App Taxes

Reporting Cash App taxes is similar to reporting any other income on your tax return. Cash App provides users with a 1099-K form if they meet certain thresholds, which include receiving over $20,000 and completing over 200 transactions in a calendar year. Users who receive a 1099-K form must report this income on their tax return.

If you do not receive a 1099-K form, you may still be required to report your Cash App income. The general rule is that all income, regardless of the source, must be reported on your tax return. It is important to keep accurate records of all income received through Cash App, including the date and amount of each transaction.

Deductible Expenses

If you use Cash App for business purposes, you may be able to deduct certain expenses on your tax return. For example, if you use Cash App to pay for advertising or other business expenses, these may be deductible. However, it is important to consult with a tax professional to ensure that you are following all applicable tax laws.

Tips for Tax Season

To make tax season less stressful, there are a few things you can do as a Cash App user:

Keep accurate records of all transactions, including the date and amount of each transaction.

Set aside a portion of your Cash App income throughout the year to cover any taxes owed.

Consult with a tax professional to ensure that you are following all applicable tax laws.

Conclusion

In conclusion, Cash App taxes are an important consideration for users who earn income through the app. It is important to keep accurate records and report all income received through Cash App on your tax return. By following these tips and consulting with a tax professional, you can ensure that you are meeting all of your tax obligations.

#cash app taxes#cash app taxes 2023#cash app taxes review#cash app taxes review 2023#cash app taxes features#cash app taxes features 2023#cash app taxes pricing#cash app taxes pricing 2023#cash app taxes tutorial#cash app taxes explained#cash app taxes for beginners#cash app taxes filing#cash app taxes preparation#cash app taxes deductions#cash app taxes calculator#cash app taxes tips#cash app taxes update#cash app taxes news#cash app taxes changes#cash app taxes requirements#cash app taxes help#cash app taxes support#cash app taxes customer service#cash app taxes questions#cash app taxes FAQ#cash app taxes walkthrough#cash app taxes video#cash app taxes how-to#cash app taxes step-by-step.

0 notes

Text

i'm currently locked out of my debit card (put in pin wrong three times) so i'm cash-only right now. and in london, in the touristy bits, loads of stuff is card only? it's insane. like these businesses prefer to pay a transaction fee. in [mid-size regional uk city] half the restaurants prefer you to pay in cash, to avoid the transaction fees and presumably for tax evasion purposes.

I guess the benefits of card only are like:

keep homeless beggars out of your shop

it's faster - important if you have lots of footfall

you aren't holding cash in the shop which can get robbed

you don't have to worry about staff stealing out of the till

since few people pay by cash now, making change is becoming an obsolete skill (so it slows things down even longer as the person behind the till needs to whip out a smartphone and open a calculator app)

relatedly, i've been staying with my nan & have had to help her out setting up an account on her local government website so she can buy visitor parking vouchers. You used to be able to go into the council office and pay in cash for this. like there was a bureaucratic process obviously, but it was you go and talk to someone at the council. She's in her eighties, she's not going to learn how to use the internet lol.

40 notes

·

View notes

Note

Hi there!!! I think your art is super cool, and I love how you've drawn inspiration from fairytales, and how flexible you are with style ♡ I've been making art for a while but always just for myself, and I signed up for my very first craft fair! I was wondering how you got started selling your art. What were you nervous about? What do you wish you'd known? What did you diy that would have been worth buying, or vice versa?

Congrats on your first show!!! I wish you perfect weather, good booth assistance, and tons of wonderful people attending who buy tons of your work.

I started with an Etsy shop back in the day when Etsy was still decent, then did a few comic cons and shows and eventually timidly opened up commissions. I took it super slow! I was very shy and insecure lol

Tips:

Have a printed QR code for your insta and stuff, most people don’t take business cards anymore and just want to scan a code or take a photo. So have a sort of flyer with all your info that people can snap.

Recycled grocery bags make great bags and save you a buck, tell people you’re recycling lol

If you do any outdoor shows, have everything in plastic. Plastic tubs, plastic sleeves for art, be ready for wind and rain!!! You can get plastic sleeves for prints on Amazon for cheap.

Get a spare battery thingy so you can charge your phone if you’ve got no power connection, for indoor or outdoor shows, and just for life.

People like Venmo, cash app, most have cards, few have cash. You’ll only need like $100 in change.

When people compliment you, just say thanks! I appreciate it! Ask them where they’re from if you feel awkward. Don’t tell them your art is bad and they’re wrong lmao. Smile a lot and STAY STANDING and engage with people, it’ll help sales a ton. It sucks but if you sit nobody feels comfortable interacting with you. Then no sales. Maybe get a rubber mat to stand on. Wear comfy shoes.

Outdoor shows: Dog leash screws hold your tent down 100%. Overnight, taken EVERYTHING down, even if there’s day 2. Your tent will blow over/collapse if you leave anything behind, it’s just the law. Most tents that aren’t a fortune can’t withstand the weather and will collapse!!! So just take it all down.

Don’t sell yourself short! Calculate how long a thing took you and how much the materials were and pay yourself AT LEAST $10 an hour, if not $20. Have faith that you’re worth it.

Track all your sales and set aside 20% for taxes! Chances are you won’t have to pay them for a year or two because you won’t make much, but it’s good to start the habit. Track every cent for materials, food and gas for shows, supplies, product costs etc. those are writeoffs! If you spent more on your art business than you earned, no need to pay taxes.

www. iprintfromhome. com offers great print options and pricing!

Always always always make stuff that’s just for you. Art that the internet and the audiences never see. Not everything you make has to be show worthy.

It’s a big challenge to do this and I definitely am still learning the ropes! I wish I had all the secrets, if you find them let me know. Remember to have fun and make what you love and what inspires you. Also remember it’s a tough world out there for artists right now, so go easy on yourself if you feel like you’re not “getting it”. It’ll take time and work.

You don’t have to monetize your hobbies, but if you enjoy it and you want to, then go kick ass!!!

And again, I wish you good luck and good fortune!!! 🌟

10 notes

·

View notes

Text

Startup Metrics That Matter KPIs for Success in the Indian Ecosystem

In today’s fast-paced Indian startup scene, success isn’t just about great ideas—it’s about data. KPIs (Key Performance Indicators) are the north star guiding startups toward growth, funding, and long-term stability. Whether you're pitching to investors or planning your next move, these numbers speak louder than words.

Let’s break down the KPIs every Indian startup should track: Revenue-Based KPIs

1. Recurring Revenue (MRR/ARR) India's subscription economy is booming. Recurring revenue gives a predictable income stream that investors love—and it helps with better long-term planning.

2. Revenue per Employee Efficiency is everything. Divide your total revenue by the number of employees to see how productive your team is. Higher revenue per employee = better output.

3. Revenue per User (RPU) Want to know how much value each customer brings in? RPU helps you craft monetization strategies that actually work—especially in diverse markets like India.

4. Customer Acquisition Cost (CAC) How much does it cost to get a new customer? Analyze CAC by channel—what works in metro cities might not in rural ones. Data = smarter budgets.

5. Monthly Burn Rate & Runway How fast are you burning through cash, and how long can you sustain? Burn rate + runway help you stay in control, especially when funding is tight.

6. Cash Flow Liquidity is survival. Smooth cash flow means timely expenses, debt repayments, and seizing market opportunities—no matter the payment cycles.

7. Retention Rate vs. Churn Rate Are your customers sticking around? Retention shows loyalty, while churn uncovers problems. Personalization—especially in local languages—can really move the needle.

8. Customer Lifetime Value (CLV) How much value does one customer bring over time? In a community-driven market like India, CLV is vital for acquisition and retention decisions.

9. Return on Investment (ROI) Launching a campaign? Releasing a new feature? Calculate ROI to ensure your time and money are well spent. Regional campaigns especially need this insight. Final Thoughts

Startups thrive when strategy meets data. Monitor metrics like CAC, CLV, and recurring revenue to stay agile and investor-ready in India’s ever-evolving landscape. The more you understand your KPIs, the clearer your path to sustainable success.

Need Help Navigating Your Startup’s Financial Journey? JJ Tax provides expert guidance on company setup, ROC compliance, taxation, and more.

Visit www.jjfintax.com and take your startup from idea to IPO.

Download the JJ TAX APP

0 notes

Text

Discover the Power of Reddybook: Your All-in-One Business Management Solution

In today's fast-paced digital world, businesses—whether small startups or growing enterprises—need smart, reliable, and user-friendly solutions to stay competitive. Managing everything from sales and inventory to customer relationships and finances can be overwhelming without the right tools. That’s where Reddybook comes into play—a modern solution crafted to simplify business operations and help entrepreneurs thrive.

What is Reddybook?

Reddybook is a powerful, easy-to-use digital business management platform designed for Indian entrepreneurs, shopkeepers, freelancers, and small business owners. Whether you run a grocery store, a clothing boutique, a mobile shop, or even a service-based business, Reddybook helps you take control of your business like never before.

It offers a range of features including billing, inventory management, expense tracking, customer ledgers, and much more—all in one place. The best part? You don’t need to be tech-savvy to use it.

Why Choose Reddybook?

1. Simple and Intuitive Design

One of the standout qualities of Reddybook is its clean and user-friendly interface. You don’t have to spend days learning how to use it. Everything is clearly labeled and organized, allowing you to start managing your business effectively from day one.

2. Secure and Reliable

When it comes to business, data security is crucial. Reddybook ensures your data is encrypted and stored securely. You can back up your information regularly, so there’s no fear of losing important details about your transactions or customers.

3. Supports Regional Languages

India is diverse, and not everyone is comfortable with English. Reddybook supports multiple regional languages, making it easy for anyone to use, no matter where they’re from.

4. GST-Ready Invoicing

Tired of struggling with tax calculations? With Reddybook, you can generate GST-compliant invoices in just a few clicks. It simplifies tax filing and keeps you on the right side of regulations.

5. Track Payments and Expenses

Keeping an eye on your cash flow is key to growing your business. With Reddybook, you can track incoming payments, overdue bills, and daily expenses without juggling multiple notebooks or apps.

Key Features That Make Reddybook Stand Out

Digital Ledger (Bahi Khata): Record customer credits and payments seamlessly.

Inventory Tracking: Stay updated with your stock levels, so you never run out of essentials.

Billing & Invoicing: Generate professional invoices that can be shared via WhatsApp or printed instantly.

Business Reports: Gain insights into your profit and loss, sales trends, and customer behavior.

Multi-Device Syncing: Access your business data from your phone, tablet, or computer anytime, anywhere.

Perfect for All Types of Businesses

Whether you're a kirana store owner, a wholesaler, a service provider, or an online seller, Reddybook adapts to your unique needs. It cuts down manual effort, saves time, and helps you make smarter business decisions.

A Step Toward Digital India

In line with the Digital India initiative, platforms like Reddybook are empowering local businesses to go digital. It's more than just a business tool—it's a movement that bridges the gap between traditional business practices and modern technology.

Real Success Stories

Thousands of users across India are already benefiting from Reddybook. Many small business owners report better control over their finances, improved customer relationships, and an increase in profits—all within months of switching to the platform.

From tea stalls to beauty parlors, from rural shops to urban retailers, Reddybook is changing the way India does business.

Conclusion

If you’re looking to take your business to the next level, streamline operations, and stay organized without breaking the bank, Reddybook is your answer. It’s smart, secure, and tailored for the needs of Indian business owners.

0 notes

Text

The Impact of Leverage on Firm Value: Analyzing Debt and Equity Financing

Leverage plays a critical role in corporate finance as it influences a company’s financial risk and overall value. In essence, leverage refers to the use of borrowed funds (debt) to finance investments or operations. It is a powerful tool that allows firms to amplify their returns, but it also brings added risks that can impact the company’s stability and value. The use of debt and equity financing determines the level of leverage a company uses, and understanding this balance is crucial for managers, investors, and financial analysts.

Understanding Leverage and Firm Value

Leverage refers to the use of borrowed capital (debt) to finance the acquisition of assets. The primary goal of leverage is to amplify the potential returns from an investment. However, it can also magnify losses if the investment does not generate returns as expected. The concept of leverage is fundamental in corporate finance, as it directly impacts a company’s cost of capital, risk profile, and ultimately its value. Similarly, for individual investors looking to optimize their investment strategy, tools like an SIP calculator can help assess how leveraging systematic investment plans (SIPs) can impact long-term returns and overall portfolio growth, providing a clearer picture of potential outcomes.

There are two primary sources of financing for companies:

Debt Financing: This involves borrowing money from external sources, such as banks, financial institutions, or issuing bonds. Debt financing is attractive because interest payments are tax-deductible, reducing the company's tax burden. However, it comes with the obligation of regular interest payments and the repayment of principal.

Equity Financing: This involves raising capital by issuing shares of stock to investors. Equity financing does not create an obligation to repay the funds or pay interest, but it dilutes the ownership of existing shareholders. Equity holders are entitled to a share of the company’s profits in the form of dividends and capital appreciation.

The Relationship Between Leverage and Firm Value

Leverage has a profound impact on a company's value, as it affects both its financial risk and the potential for returns. Here are some ways leverage influences firm value:

Tax Shield and Increased Value: One of the most commonly cited benefits of using debt financing is the tax shield. Interest payments on debt are tax-deductible, reducing the company's overall tax liability. This tax advantage increases the value of the firm, as the company can save money on taxes, which can then be reinvested in the business. This benefit of debt financing is particularly important for mature companies with stable cash flows. As long as the company can meet its interest obligations, debt financing can boost firm value by reducing the overall cost of capital. However, this advantage is only effective if the company uses debt wisely and does not over-leverage itself.

Increased Financial Risk: While debt can enhance returns, it also increases financial risk. High levels of debt require companies to make regular interest payments, which can be burdensome during periods of economic downturn or when cash flow is unpredictable. If the company cannot meet its debt obligations, it may face financial distress, a loss of shareholder value, or even bankruptcy. When a company is highly leveraged, its earnings become more volatile, as even small changes in revenue can lead to significant fluctuations in profits.Similarly, for individual investors seeking to diversify their portfolios, a mutual fund app can provide an easy way to invest in a variety of funds that reduce exposure to the risks associated with individual company leverage, offering a more balanced approach to managing financial risk.

Impact on Cost of Capital: The cost of capital refers to the required return that investors expect for providing capital to the firm. It is the weighted average cost of debt (WACC), which is calculated by considering the cost of both debt and equity. Leverage affects the WACC in two key ways:

Debt Financing and Cost of Debt: The cost of debt is typically lower than the cost of equity because debt holders have a senior claim on company assets in the event of liquidation. Interest on debt is also tax-deductible, further lowering the cost of debt. As a result, increasing debt in the capital structure can reduce a company’s overall cost of capital and increase its value, up to a certain point.

Equity Financing and Cost of Equity: As the company takes on more debt, the financial risk increases, which in turn increases the required return on equity. Equity investors demand a higher return to compensate for the higher risk associated with leverage. This increase in the cost of equity can offset the benefits of debt financing, particularly if the company becomes over-leveraged.

Debt vs. Equity Financing: Trade-Offs in Leverage

The decision between using debt or equity financing is a delicate trade-off that depends on a variety of factors, including the company's stage of development, industry, risk tolerance, and market conditions. Both debt and equity financing offer distinct advantages and disadvantages: similarly, when considering long-term financial growth, investing in the Best Mutual Funds for the Next 10 Years can provide significant returns, depending on market conditions and the investor's risk appetite. Just like choosing between debt or equity financing, selecting the right mutual funds involves evaluating risk, return potential, and market dynamics for long-term success.

Advantages of Debt Financing:

Tax Benefits: Debt provides a tax shield, lowering the company’s overall tax burden.

No Ownership Dilution: Debt does not dilute the ownership of existing shareholders, allowing management to retain control.

Lower Cost of Capital: Debt is typically cheaper than equity financing, as it offers lower interest rates and the tax-deductibility of interest payments.

Disadvantages of Debt Financing:

Increased Financial Risk: Debt financing introduces the risk of default and bankruptcy, especially if the company’s earnings decline.

Obligations to Repay: Companies must make regular interest payments, regardless of their financial situation, which can strain cash flow.

Volatility: High leverage increases the volatility of earnings, which may discourage investors and raise the cost of capital.

Conclusion

Leverage plays a crucial role in determining a company’s financial performance, risk profile, and value. The use of debt and equity financing has a direct impact on the company’s cost of capital, tax position, financial risk, and return on equity. While debt financing can increase firm value through the tax shield and lower cost of capital, it also introduces significant risks, particularly if the company becomes over-leveraged. On the other hand, equity financing provides flexibility and reduces financial risk, but it can dilute ownership and result in higher costs of capital.

0 notes

Text

The Ultimate Guide to Billing & Invoicing Software for Businesses

In today’s fast-paced business environment, efficiency and accuracy in financial transactions are crucial. This is where billing & invoicing software comes into play, helping businesses streamline their payment processes, reduce errors, and improve cash flow. Whether you're a freelancer, small business owner, or part of a large enterprise, investing in the right invoicing software can save time, enhance professionalism, and ensure timely payments. In this article, we’ll explore the key features, benefits, and top options for billing & invoicing software to help you make an informed decision.

Why Businesses Need Billing & Invoicing Software

Manual invoicing can be time-consuming and prone to errors. Traditional methods, such as paper invoices or basic spreadsheet templates, often lead to delays, misplaced records, and calculation mistakes. Billing & invoicing software automates these processes, offering several advantages:

Time Efficiency – Automating invoice generation and payment reminders reduces administrative workload.

Accuracy – Minimizes human errors in calculations and data entry.

Faster Payments – Online invoicing enables instant delivery and integrates with payment gateways for quicker transactions.

Professionalism – Customizable templates with your branding enhance credibility.

Financial Tracking – Real-time insights into unpaid invoices, revenue trends, and tax compliance.

Key Features to Look for in Billing & Invoicing Software

When choosing the right billing & invoicing software, consider the following essential features:

1. Automated Invoicing

The software should allow you to create, send, and schedule recurring invoices automatically, reducing repetitive tasks.

2. Multiple Payment Options

Support for credit cards, bank transfers, PayPal, and other digital payment methods improves convenience for clients.

3. Expense Tracking

Integrating expense management helps track business costs alongside revenue for better financial oversight.

4. Customizable Templates

Professional, branded invoices improve customer trust and brand consistency.

5. Tax Compliance

Automatic tax calculations and reporting features simplify compliance with local and international tax regulations.

6. Cloud-Based Access

Cloud solutions enable access from anywhere, ensuring you can manage invoices on the go.

7. Client Portal

A self-service portal where clients can view invoices, make payments, and download receipts enhances transparency.

8. Integration Capabilities

Seamless integration with accounting software (like QuickBooks or Xero), CRM systems, and project management tools ensures smooth workflow.

Top Billing & Invoicing Software Options

Here are some of the best billing & invoicing software solutions available today:

1. QuickBooks Online

A popular choice for small to medium businesses, QuickBooks offers robust invoicing, expense tracking, and accounting features.

2. FreshBooks

Designed for freelancers and service-based businesses, FreshBooks provides user-friendly invoicing, time tracking, and client management.

3. Zoho Invoice

A cost-effective solution with automation, multi-currency support, and seamless integration with other Zoho apps.

4. Wave

A free invoicing tool ideal for small businesses, offering unlimited invoices, receipt scanning, and basic accounting.

5. Xero

Known for its strong accounting features, Xero also provides efficient invoicing and inventory management.

6. Invoice2go

A mobile-friendly option for freelancers and small businesses, with customizable templates and payment reminders.

How to Choose the Right Software for Your Business

Selecting the best billing & invoicing software depends on your business size, industry, and specific needs. Consider these factors:

Budget – Some tools offer free plans (like Wave), while others require monthly subscriptions.

Scalability – Ensure the software can grow with your business.

Ease of Use – A user-friendly interface reduces the learning curve.

Customer Support – Reliable support is crucial for troubleshooting issues.

Conclusion

Investing in the right billing & invoicing software is a game-changer for businesses looking to optimize financial operations. From automating repetitive tasks to ensuring timely payments and maintaining compliance, the right tool can significantly enhance productivity and cash flow. Evaluate your business requirements, compare features, and choose a solution that aligns with your goals. With the right software, you can focus more on growing your business and less on administrative hassles.

0 notes

Text

Finance Software: Powering Financial Success in 2025

In today’s dynamic economic landscape, managing finances—whether personal or business-related—demands precision, speed, and insight. Enter finance software: a category of digital tools revolutionizing how individuals and organizations track, analyze, and optimize their money. From budgeting apps to enterprise-grade platforms, finance software is the backbone of modern financial management. As we navigate 2025, these tools are smarter, more integrated, and more essential than ever. But what exactly is finance software, and how can it transform your financial game? Let’s dive in.

What is Finance Software?

Finance software encompasses a wide range of applications designed to streamline financial tasks. At its core, it’s about making money management easier, more accurate, and less time-consuming. For individuals, this might mean tracking expenses or planning for retirement. For businesses, it could involve automating accounting, forecasting cash flow, or ensuring compliance with regulations. These tools come in various forms—desktop programs, cloud-based platforms, and mobile apps—catering to everyone from freelancers to multinational corporations.

In 2025, finance software leverages cutting-edge technologies like artificial intelligence (AI), machine learning, and cloud computing to deliver real-time insights, predictive analytics, and seamless integrations with other systems. Whether you’re balancing a household budget or managing a corporate ledger, there’s a solution tailored to your needs.

Why Finance Software Matters

Gone are the days of manual spreadsheets and paper ledgers. The complexity of modern finances—think global transactions, fluctuating markets, and regulatory demands—requires a more sophisticated approach. Finance software steps in to:

Save Time: Automate repetitive tasks like data entry, invoicing, and reconciliation.

Reduce Errors: Minimize human mistakes with built-in calculations and validations.

Provide Insights: Turn raw data into actionable reports and forecasts.

Enhance Accessibility: Access your financials anytime, anywhere with cloud-based solutions.

For businesses, this means staying competitive. For individuals, it’s about gaining control over their financial future. Posts on X highlight how tools like YNAB and Simplifi are saving users hundreds annually by simplifying budgeting—a testament to their growing impact.

Key Features of Finance Software

The best finance software offers a mix of core and advanced features, depending on its target audience. Here’s what to expect:

Budgeting & Tracking: Monitor income, expenses, and savings goals in real time.

Accounting: Manage accounts payable/receivable, generate financial statements, and handle payroll.

Reporting & Analytics: Create dashboards, track KPIs, and forecast trends.

Integration: Sync with bank accounts, payment gateways, and other tools like CRMs or ERPs.

Security: Protect sensitive data with encryption and multi-factor authentication.

AI Tools: Predict cash flow, categorize transactions, or suggest savings strategies.

Top Benefits for Users

Adopting finance software isn’t just about keeping up—it’s about getting ahead. Here’s how it pays off:

Efficiency: Tasks that once took hours—like reconciling accounts—now take minutes.

Cost Savings: Automation cuts labor costs, while insights help avoid overspending.

Decision-Making: Real-time data empowers smarter financial choices.

Scalability: From solo entrepreneurs to global firms, these tools grow with you.

For example, small businesses using QuickBooks report saving up to 10 hours weekly on accounting tasks, while individuals using Monarch praise its AI-driven simplicity for cutting overspending by 15%.

Popular Finance Software in 2025

The market is rich with options, each excelling in specific areas. Here are some top players:

QuickBooks: A staple for small businesses, offering invoicing, expense tracking, and tax prep.

YNAB (You Need A Budget): A personal finance favorite with zero-based budgeting to maximize every dollar.

Xero: Cloud-based accounting for SMBs, with robust bank syncing and inventory tools.

SAP Finance: Enterprise-grade software for large organizations, integrating financial planning and compliance.

Simplifi by Quicken: A user-friendly app connecting 14,000+ institutions for personal money management.

How to Choose the Right Finance Software

Picking the perfect tool depends on your unique needs. Here’s a roadmap:

Assess Your Goals: Are you managing personal savings or corporate finances? Define your priorities.

Consider Scale: Solo users might opt for Mint, while enterprises need NetSuite or SAP.

Check Compatibility: Ensure it integrates with your bank, payroll, or existing systems.

Evaluate Ease of Use: A steep learning curve can hinder adoption—test the interface.

Budget Wisely: Free tools like Wave work for basics, but premium features often justify the cost.

The Future of Finance Software

In 2025, finance software is evolving rapidly. AI is at the forefront, offering predictive models that forecast market shifts or flag risky spending patterns. Cloud adoption is universal, enabling remote access and real-time collaboration. Blockchain integration is emerging for secure, transparent transactions, while sustainability features—like carbon footprint tracking tied to spending—are gaining traction. The focus remains on delivering intuitive, data-driven experiences that empower users.

Challenges to Watch For

No tool is flawless. Some platforms require training, especially for advanced features. Data security is critical—ensure compliance with laws like GDPR. Over-automation can also disconnect users from their finances, so balance tech with oversight. Cost is another factor; premium suites like Oracle NetSuite can strain small budgets.

Real-World Impact

Individuals: A freelancer uses YNAB to save $1,000 for taxes in three months.

Businesses: A startup leverages Xero to cut invoicing time by 50%, boosting cash flow.

Enterprises: A retailer uses SAP to streamline global financial reporting, saving millions.

Conclusion

Finance software is more than a tool—it’s a partner in financial success. By automating the mundane, illuminating trends, and scaling with your ambitions, it transforms how we interact with money. In 2025, whether you’re an individual chasing financial freedom or a CFO steering a corporation, the right software can unlock your potential. Explore your options, weigh the benefits, and take charge of your finances today.

Frequently asked questions

What is finance software? It’s a digital tool designed to manage financial tasks like budgeting, accounting, tracking expenses, and generating reports for individuals or businesses.

Who can benefit from finance software? Anyone—individuals, freelancers, small businesses, and large enterprises—looking to simplify and optimize their financial management.

How does finance software save time? It automates tasks like data entry, invoicing, and reconciliation, reducing manual effort significantly.

Is finance software secure? Reputable tools use encryption and comply with data privacy laws, but always verify a provider’s security measures.

What’s the difference between personal and business finance software? Personal tools focus on budgeting and investments, while business software adds features like invoicing, payroll, and compliance.

How much does finance software cost? Options range from free (e.g., Wave) to $10-$100/month for personal tools, and hundreds or thousands for enterprise solutions.

Can it integrate with other tools? Most platforms sync with banks, payment systems, and software like CRMs or ERPs—check compatibility first.

How long does it take to implement? Personal tools can be set up in minutes; business software might take days to weeks, depending on complexity.

0 notes

Text

Effective Budgeting Techniques: Strategies for Creating and Maintaining a Budget to Manage Expenses and Achieve Financial Goals

Introduction

In this SEO-optimized guide, we’ll cover: ✅ Why budgeting is crucial for financial success ✅ The most effective budgeting techniques ✅ How to track expenses and cut unnecessary costs ✅ Tips to stick to your budget and achieve long-term financial goals

If you’re ready to take control of your finances, keep reading! 🚀

Why Budgeting is Important for Financial Success

A budget is a financial roadmap that helps you:

✔️ Track where your money goes ✔️ Avoid overspending and unnecessary debt ✔️ Save for emergencies and future goals ✔️ Achieve financial freedom faster

💡 Example: Without a budget, you might spend $500/month on dining out, without realizing how much it affects your ability to save or invest. A budget helps you make informed decisions about where your money goes.

How to Create an Effective Budget: Step-by-Step Guide

Step 1: Calculate Your Total Income

Before creating a budget, you need to know how much money you have coming in each month.

✔️ Include all sources of income (salary, side gigs, rental income, etc.). ✔️ Use net income (after taxes) instead of gross income.

📌 Example: If you earn $5,000 per month after taxes, this is your starting point for budgeting.

Step 2: Track Your Expenses

Understanding your spending habits is key to controlling your finances.

✔️ Review bank & credit card statements to identify spending categories. ✔️ Use budgeting apps like Mint, YNAB, or EveryDollar for automatic tracking. ✔️ Categorize your expenses into fixed (rent, car payment) and variable (groceries, entertainment).

📌 Example of Expense Categories:Expense CategoryEstimated CostRent/Mortgage$1,500Utilities$150Groceries$400Transportation$200Entertainment$150Subscriptions$50Savings$500Investments$300

💡 Tip: Many people underestimate their spending on small items like coffee and fast food—track every dollar!

Step 3: Choose a Budgeting Method That Works for You

There is no one-size-fits-all budget. Here are the top budgeting techniques to help manage your expenses:

1. The 50/30/20 Rule (Best for Beginners)

✔️ 50% Needs (rent, food, transportation, bills) ✔️ 30% Wants (entertainment, dining out, subscriptions) ✔️ 20% Savings & Debt Repayment (retirement, emergency fund, debt payoff)

📌 Example: If your income is $4,000/month: ✔️ $2,000 for needs ✔️ $1,200 for wants ✔️ $800 for savings & debt repayment

💡 Best for: People who want a simple and flexible budgeting approach.

2. Zero-Based Budgeting (Best for Maximizing Every Dollar)

✔️ Every dollar is assigned a purpose (income - expenses = $0). ✔️ Forces you to prioritize savings, debt repayment, and investments. ✔️ Great for tracking every dollar you spend.

📌 Example: If you earn $3,500/month, every dollar should be allocated to bills, savings, debt payments, and fun money—so there’s no leftover cash sitting idle.

💡 Best for: People who want full control over their finances.

3. Envelope Budgeting (Best for Avoiding Overspending)

✔️ Cash-based budgeting system where you set aside money in envelopes. ✔️ Helps prevent overspending by limiting cash for each category. ✔️ Works well for people who struggle with credit card debt.

📌 Example: Withdraw $600 for groceries, $200 for gas, and $100 for entertainment—once the envelope is empty, you can’t spend more.

💡 Best for: People who prefer cash over digital transactions.

4. Pay Yourself First Budget (Best for Saving More Money)

✔️ Automatically allocate savings before spending on anything else. ✔️ Encourages consistent investing and wealth-building. ✔️ Ideal for people who struggle with saving money.

📌 Example: If you earn $5,000/month, set up an automatic transfer of $1,000 to savings and investments before spending on anything else.

💡 Best for: People who want to prioritize savings and retirement goals.

How to Stick to Your Budget and Achieve Financial Goals

Creating a budget is easy—sticking to it is the hard part. Here are proven strategies��to help you stay on track:

1. Automate Your Finances

✔️ Set up auto-pay for bills and savings contributions. ✔️ Use budgeting apps to track spending automatically.

2. Review Your Budget Monthly

✔️ Adjust your budget based on income changes or unexpected expenses. ✔️ Look for areas where you can cut costs and save more.

3. Reduce Unnecessary Expenses

✔️ Cancel unused subscriptions (gym, streaming services, etc.). ✔️ Cook at home instead of eating out frequently. ✔️ Shop smart—use discounts, cashback apps, and buy in bulk.

4. Use the "No-Spend Challenge" Method

✔️ Pick a category to eliminate spending on for a month (e.g., no eating out). ✔️ Redirect that money into savings or investments.

💡 Example: If you spend $150 on coffee & fast food per month, a no-spend challenge can save that money instead.

5. Set Clear Financial Goals

✔️ Short-Term Goals: Save for a vacation, build an emergency fund. ✔️ Long-Term Goals: Buy a house, retire early.

💡 Tip: Set SMART financial goals (Specific, Measurable, Achievable, Relevant, Time-bound) to stay motivated.

Need a Personal Loan Up to $100K? Low Credit Options Available up to $50K.

Book a Free Consult - https://prestigebusinessfinancialservices.com

Final Thoughts: Master Your Budget & Take Control of Your Finances

📌 Budgeting is the key to financial success, helping you: ✅ Track and manage expenses effectively ✅ Avoid debt and save more money ✅ Invest wisely and build long-term wealth

🚀 Want to take control of your financial future? Start budgeting today!

Need a Personal Loan Up to $100K? Low Credit Options Available up to $50K.

Book a Free Consult - https://prestigebusinessfinancialservices.com

💬 What’s your favorite budgeting strategy? Share in the comments!

Prestige Business FInancial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

1 note

·

View note

Text

Rise of Mobile and Contactless Payments in U.K. POS Software Market

The U.K. point of sale software market size is estimated to reach USD 1,498.8 million by 2030, registering to grow at a CAGR of 9.4% from 2025 to 2030 according to a new report by Grand View Research, Inc. The integration of a Point-Of-Sale (POS) solution with capabilities such as sales reports monitoring, cash flow recording, product demand analysis, tracking delivery status, and inventory management ensure systematic functioning and upscaling of a business. The adoption of POS software is directly impacted by the demand for POS terminals, which is witnessing growth in demand due to changing lifestyles and government policies. However, the COVID-19 pandemic disrupted the industry's business, wherein retail stores, restaurants, and hotels witnessed a shutdown and revenue loss. Although the overall POS terminal market is witnessing a decline in demand, the need for POS software to continue running an online business and the adoption of mobile POS aggregated the POS software market growth in the U.K.

U.K. Point Of Sale Software Market Report Highlights

The fixed segment of the U.K. point of sale software industry dominated the market with a 54.9% share in 2024.

The cloud segment held the largest market share in 2024. This dominance can be attributed to the growing preference of businesses for cloud solutions, as they offer scalability, remote access, and automatic updates.

The large enterprise segment held the largest market revenue share in 2024. This dominance can be attributed to their preference for robust and secure POS solutions that offer advanced features, data management capabilities, and scalability to handle high transaction volumes.

The retail segment held the largest market share in 2024. This dominance can be attributed to the growing adoption of digital payment methods and the need for efficient inventory management among retailers of all sizes, including supermarkets and specialty shops.

For More Details or Sample Copy please visit link @: U.K. Point Of Sale Software Market Report

The U.K. government realized the application of the POS systems and mentions them in its schemes. For instance, the “Point of Sale VAT Retail Scheme" in the U.K. requires retailers to apply appropriate VAT for calculating the tax on retail sales. The retailers use the EPOS system to help distinguish between goods sold at different rates of VAT. Moreover, government entities are adopting POS solutions to avoid payment processing challenges while handling varied compliance and accountability obligations. Streamlining public-sector payments to reduce the administrative burden is expected to continue to boost the sale of POS terminals and their solutions across the government sector. Additionally, encouragement from the government to adopt cashless payment has been instrumental in fueling the adoption of POS solutions across the retail, restaurant, hospitality, entertainment, and healthcare sectors.

Fast food restaurants have also created shopping apps that help consumers obtain product information, order, and pay using the application. The retailers use POS software at their end to facilitate the management of the online sale and transaction details. Burger King, KFC, Subway, Dominos, Pizza Hut, and McDonald's are some fast-food chains that added payment functionality in their apps for greater convenience. Other merchants have adjusted their retail points to accept payment via mobile wallet apps such as PayPal, Google, Lemon, Geode, Square Wallet, Venmo, Chirpify, PayToo, and Ziddu. These payment methods have recently gained more traction owing to the need for using cashless payment and limit the spread of COVID-19. This advancement in POS payment applications is expected to augment the demand for POS software among end-users in the country.

List of Key Players of the U.K. Point-of-Sale Software Market

Lightspeed

Block Inc.

PayPal Inc.

TouchBistro

Oracle

NCR Voyix Corporation

Clover Network, LLC

Shopify Inc.

Revel Systems

Aiko Company

We have segmented the U.K. point of sale software market based on application, deployment, organization size, and end-use.

#POSMarketUK#UKPOSSoftware#MarketResearch#RetailTech#BusinessTechnology#POSIndustry#DigitalPayments#CloudPOS#AIinRetail#MobilePOS#ContactlessPayments#POSInnovation#RetailBusiness#EcommerceTrends#FintechUK

0 notes

Text

Best Accounting Management Software for Freelancers and Startups in Dubai

Managing finances effectively is crucial for freelancers and startups in Dubai. With VAT regulations, invoicing requirements, and financial reporting, choosing the right accounting management software can simplify operations, save time, and ensure compliance. This blog explores the best accounting software tailored for freelancers and startups in Dubai.

Why Freelancers and Startups Need Accounting Software

Unlike large corporations, freelancers and startups operate with limited resources, making efficient financial management essential. The right software can help:

Automate invoicing and billing

Track expenses and income

Ensure VAT compliance

Generate financial reports for better decision-making

Improve cash flow management

Top Accounting Software for Freelancers and Startups in Dubai

1. Zoho Books

Zoho Books is an excellent choice for freelancers and startups looking for an affordable, cloud-based solution. Key features include:

Automated VAT calculations and reporting

Easy invoice creation and tracking

Multi-currency support

Mobile app for on-the-go management

Integration with other Zoho products

2. QuickBooks Online

QuickBooks is a widely used accounting software that provides comprehensive tools for small businesses and freelancers. Its benefits include:

User-friendly interface with customizable reports

Automated expense tracking and bank reconciliation

VAT compliance features

Mobile access for easy financial management

Integration with third-party apps like PayPal and Stripe

3. Xero

Xero is a cloud-based accounting solution popular among freelancers and startups in Dubai. Notable features include:

Easy-to-use dashboard for financial insights

Invoice automation with reminders

VAT reporting and compliance tools

Bank feeds for real-time transaction updates

Multi-user access for collaboration

4. Wave Accounting (Best Free Option)

For freelancers and small startups looking for a free accounting tool, Wave Accounting is an ideal solution. It offers:

Unlimited invoicing and expense tracking

No subscription fees for core features

Integration with bank accounts

Receipt scanning and categorization

5. Tally ERP 9

Tally is widely used in Dubai for its VAT compliance and financial reporting features. It is best for freelancers and startups looking for a local, VAT-compliant solution. Features include:

Simplified tax calculations and reporting

Multi-currency support for global transactions

Inventory management tools

Advanced financial reporting

How to Choose the Best Accounting Software

When selecting an accounting management software, consider the following factors:

Ease of Use: Ensure the software is user-friendly and requires minimal training.

VAT Compliance: Choose software that complies with UAE tax regulations.

Automation: Look for features like invoice automation and bank reconciliation.

Scalability: Select software that can grow with your business.

Integration: Ensure compatibility with payment gateways and other business tools.

Conclusion

Freelancers and startups in Dubai need efficient accounting software to manage their finances, track expenses, and stay VAT-compliant. Solutions like Zoho Books, QuickBooks Online, Xero, Wave, and Tally ERP 9 offer excellent features tailored to small businesses and independent professionals. By choosing the right software, you can streamline financial management and focus on growing your business.

Need help selecting the best Accounting Management Software Dubai for your startup in Dubai? Contact us today for expert guidance!

0 notes

Text

FoodAI Studio Review – Start Your Own Uber Eats-Style Websites

Welcome to my FoodAI Studio Review. The food delivery industry is booming, and entrepreneurs are constantly looking for innovative ways to enter the market. Enter FoodAI Studio is a game-changing platform that promises to help users create self-updating, AI-powered, UberEats-style websites in just 60 seconds.

In this in-depth review, we will explore the features, benefits, pricing, and potential drawbacks of FoodAI Studio to help you make an informed decision. So, don’t miss this chance, guys.

What Is FoodAI Studio?

FoodAI Studio is an AI-powered platform that allows users to create fully functional food delivery websites similar to UberEats, DoorDash, and Grubhub. The platform is designed for entrepreneurs, marketers, and businesses looking to enter the booming online food delivery industry without dealing with inventory, logistics, or customer service.

The software uses artificial intelligence to automatically update menus, prices, and restaurant details, eliminating the need for manual updates. FoodAI Studio promises to revolutionize the food delivery business landscape with its user-friendly interface and automation capabilities.

FoodAI Studio Review: Overview of Product

Product Creator: Loveneet Rajora

Product: FoodAI Studio

Launch Date: 2025-Feb-10

Launch Time: 11:00 EST

Front-End Price: $17 (One-time payment)

Official Site: Click Here To Visit Official Salespage

Product Type: Tools and Software

Support: Effective and Friendly Response

Discount: Get The Best Discount Right Here!

Recommended: Highly Recommended

Bonuses: YES, Huge Bonuses

Skill Level Required: All Levels

Discount Coupon: Use Code “AIFOODMAX” for 30% off (Full Funnel)

Refund: YES, 30 Days Money-Back Guarantee

FoodAI Studio Review: About Authors

Loveneet Rajora is the amazing brain behind this idea. He developed new AI technology that changes how we use courses, voice over, audio files, podcasts, Audiobook, Ebook, and Flipbook strategies. His idea for FoodAI Studio is to simplify the capturing and use of AI-Powered App for individuals and organizations. His dedication to excellence and pushing AI limitations make Loveneet a digital marketing and software development expert.

He also owns a number of well-known products, including Procut AI, ProBook AI, VoxCraftAI Studio, CourseAI Studio, TubeBlog AI, AISonic Studio, ProClip AI Studio, AILogo Studio, VidProAI Studio, IntelliVid AI Studio, CaptivateAI Studio, Vidgram Studio, and many more.

Amazing Key Features of FoodAI Studio

✍Build Stunning Websites In Minutes No Tech Skills Needed!

Choose from professionally designed, customizable templates built specifically for food businesses. Use the drag-and-drop editor to make it uniquely yours. Every design is mobile-optimized for a seamless experience, no matter the device. With FoodAI, creating a website is as easy as playing a game.

✍Smart Menu Management That Sells For You

Add food items effortlessly with categories, descriptions, images, and prices. Whether it’s vegan specials, gluten-free options, or daily deals, your menu is optimized to drive sales. FoodAI even lets you handle multiple cuisines and menu sections with ease.

✍Real-Time Order Management That Never Misses A Beat

Get instant notifications for every order whether you’re an admin or a customer. Track orders in real-time, from preparation to delivery, with automated status updates like ”Order Confirmed” and ”Out for Delivery.” FoodAI keeps everything running like clockwork

✍Payment Integration That Makes You Money Faster

Accept payments from anywhere with options like Stripe, PayPal, Razorpay, and more. Support for Cash on Delivery and digital wallets makes it easy for customers to pay. Plus, enjoy automatic tax calculations and invoice generation no manual work needed.

✍Delivery Management That Puts You In Control!

Set up in-house delivery with GPS tracking for precision. Configure delivery radiuses and schedules to fit your business needs. With FoodAI, you’re always in control of how and where deliveries happen.

✍Built-In Marketing Tools To Skyrocket Sales!

Run discounts, promo codes, and customer engagement campaigns with built-in email and SMS marketing tools. Seamlessly connect to social media platforms to advertise menus, promotions, and deals. Let AI handle your marketing while you watch the profits roll in.

✍Keep Customers Coming Back With Smart Management

Give customers their own accounts to save order histories, addresses, and preferences. Collect feedback and reviews to improve services and build loyalty. FoodAI makes managing your customers simple and effective

✍AI-Driven Insights That Print Money!

Get real-time reports on your sales, top-performing dishes, customer behavior, and delivery performance all powered by AI. Spot trends, fix weak spots, and make smarter decisions that lead to more profits. It’s like having a crystal ball for your business.

✍Analytics That Print Money

Get a real-time dashboard that shows sales trends, top-selling items, and customer feedback. Track delivery performance and export detailed reports in formats like CSV or PDF. With FoodAI, data-driven decisions are just a click away

✍Go Global With Multi-Language & Currency Support

Serve customers worldwide with multilingual websites and automatic currency conversion. Whether it’s dollars, euros, or yen, FoodAI handles payments seamlessly, breaking barriers and boosting your reach.

✍SEO & Social Media Tools That Drive Traffic Like Crazy

With SEO-optimized site structures and pre-built integrations for social media, your website gets noticed. Sync with Google My Business and Google Analytics to maximize visibility and track your performance

✍Hosting & Domain That Keeps You Online 24/7!

Get free domain options or bring your own custom domain. Enjoy secure, reliable cloud hosting with SSL certification included. Your website stays live, fast, and protected guaranteed.

✍Add-Ons & Integrations To Take You Even Further

Easily track inventory with seamless integrations. Want multi-vendor support? Done. Need a chatbot for customer service? Included. FoodAI gives you every tool you need to expand and grow.

✍Launch Under Your Brand No One Else’s

With full white-label capabilities, launch websites under your own brand, with your own logos, colors, and designs. Customers will never know FoodAI is behind the scenes it’s all you.

✍AI Features That Work Harder Than You

From menu recommendations based on past orders to AI-driven marketing ideas, FoodAI handles the heavy lifting. Automated chatbots answer customer questions while you focus on scaling. It’s like having a team of experts working 24/7.

✍Resell Websites & Build a Second Income Stream!

Use the reseller dashboard to manage clients, sales, and marketing materials. Sell websites as white-label solutions and keep 100% of the profits. With FoodAI, you’re not just building a business you’s building a legacy.

✍Domain Integration!

Easily integrate your own domain in just 3 easy clicks.

FoodAI Studio Review: How Does It Work?

Your 3-Step Shortcut to Food Business Domination Build, Launch, and Profit from AI-Powered Food Ordering Websites in Minutes!

Step #1: Login

Sign in to the AI-Powered FoodAI Business Dashboard By Clicking On Any Of The Buttons Below.

Step #2: Create

With just a few clicks, build your own branded food ordering website complete with menus, online payments, and delivery management. No coding. No headaches. No waiting.

Step #3: Launch & Profit

Go live instantly and start taking orders or selling these websites to clients. AI handles the hard work, and you keep all the profits.

Awesome Benefits of FoodAI Studio

Launch Your AI-Powered Food Ordering Empire in Minutes… No coding, no design skills

ZERO Limits. Run Unlimited Businesses. Sell Unlimited Websites. Make Unlimited Money.

Built-In AI Marketing Suite That Attracts Customers like a Magnet!

Take Your Business Global with Multi-Language and Multi-Currency Support!

AI-Optimized Menu Builder That Practically Writes Itself… Upload your food items, and let AI organize, optimize, and upsell for you

Sell DFY Food Websites for $1,000+ Each & Keep 100% Profits.

No Subscriptions, No API Costs, No Hidden Fees

AI Handles Everything for You Focus on growth while AI-powered tools manage orders, track deliveries, and handle customer interactions.

Sell Your Own Branded Food Ordering Websites for Massive Profits!

Let AI Do the Heavy Lifting While You Watch the Profits Roll In!

Tap Into the Trillion-Dollar Food Delivery Industry Without Cooking, Delivering, or Owning a Restaurant!

AI-Powered Sales Dashboard to Track Revenue, Trends & Growth Instantly!

Automated Promotions That Bring in New Customers Daily!

Zero Upfront Cost And Zero Monthly Fees

30 Days Money-Back Guarantee

FoodAI Studio Review: Who Should Use It?

Affiliate Marketer

CPA Marketer

Ecommerce

Freelancers

Coaches

Offline Marketers

Dropshipping

Real Estate

Product Owners

Video Marketers

Local Business Owners

Bloggers & Vloggers

Digital Product Sellers

And Many Others

FoodAI Studio Review: OTO’s And Pricing

Add My Bundle Coupon Code “AIFOODMAX″ – For 30% Off Any Funnel OTO Below

Front End Price: FoodAI Studio ($17)

OTO1: FoodAI Studio Pro ($37)

OTO2: FoodAI Studio Unlimited ($47)

OTO3: FoodAI Studio DFY ($97)

OTO4: FoodAI Studio Automation ($37)

OTO5: FoodAI Studio Profit ($47)

OTO6: FoodAI Studio Traffic ($97/$87)

OTO7: FoodAI Studio Agency ($147/$97)

OTO8: FoodAI Studio Reseller ($127)

OTO9: FoodAI Studio Income Streams ($37)

OTO10: FoodAI Studio Whitelabel ($397)

FoodAI Studio Review: Money Back Guarantee

You Have No Risk With Our 30 Days Iron Clad Money Back Guarantee

Look, FoodAI avoids being considered low-quality or untested even though you will trust its powerful capabilities when you use Food AI Studio today. All our customer receive our unconditional refund policy as part of their benefits. Get 30 days of Food AI Studio without risk because you will receive a complete refund if technical problems make the product unusable. Send us your exact technical problem report to receive our resolution immediately without question.

FoodAI Studio Review: Pros and Cons

Pros:

Easy to Use – No technical skills required.

AI Automation – Updates itself, saving time and effort.

Unlimited Listings – No caps on restaurant and menu additions.

SEO Optimization – Built-in tools to drive organic traffic.

Fast Setup – Launch within 60 seconds.

Multiple Monetization Methods – Earn via orders, ads, and commissions.

Mobile-Friendly Design – Works smoothly on all devices.

Cons:

Requires a one-time Fee.

Requires stable internet connection.

Nothing wrong with it, it works perfectly!

My Own Customized Exclusive VIP Bonus Bundle

***How To Claim These Bonuses***

Step #1:

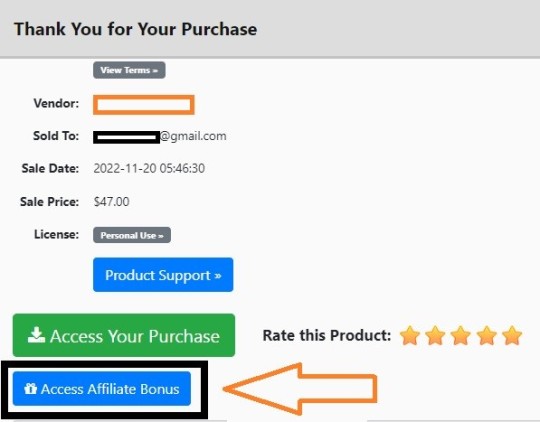

Complete your purchase of the FoodAI Studio: My Special Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase. And before ending my honest FoodAI Studio Review, I told you that I would give you my very own unique PFTSES formula for Free.

Step #2:

Send the proof of purchase to my e-mail “[email protected]” (Then I’ll manually Deliver it for you in 24 HOURS).

FoodAI Studio Free Premium Bonuses

Frequently Asked Questions (FAQ’s)

Q. Do I need any experience to get started?

None, all you need is just an internet connection. And you’re good to go.

Q. Is there any monthly cost?

Depends, if you act now, NONE. But if you wait, you might end up paying $997/mo it’s up to you.

Q. How long does it take to make money?

Our average member made their first sale the same day they got access to FoodAI.

Q. Do I need to purchase anything else for it to work?

Nop, FoodAI is the complete thing. You get everything you need to make it work. Nothing is left behind.

Q. What if I failed?

While that is unlikely, we removed all the risk for you. If you tried FoodAI and failed, we will refund you every cent you paid and send you $300 on top of that just to apologize for wasting your time.

Q. How can I get started?

Awesome, I like your excitement, all you have to do is click any of the buy buttons on the page, and secure your copy of FoodAI at a one-time fee.

My Recommendation

FoodAI Studio delivers on its promise of creating AI-powered, self-updating UberEats-style websites in just 60 seconds. With its user-friendly interface, robust AI automation, and diverse monetization options, it is an excellent investment for those wanting to capitalize on the booming food delivery market.

However, like any online business, success depends on how well you market and optimize your site. If you’re ready to start a profitable food delivery website with AI-driven automation, FoodAI Studio is a solid choice!

>>> Click Here To Get Instant Access FoodAI Studio Now <<<

Check Out My Previous Reviews: AI Live School Builder Review, Healix AI Review, $500 Google Payday Review, Human AI Review, and AI Worker Review.

Thank for reading my “FoodAI Studio Review” till the end. Hope it will help you to make purchase decision perfectly

#foodaistudio#foodaistudioreview#foodaistudiocoupon#foodaistudiohonestreview#foodaistudiofeatures#foodaistudioworks#whatisfoodaistudio#foodaistudioreviews#buyfoodaistudio#foodaistudioprice#foodaistudiodiscount#foodaistudiofe#foodaistudiooto#getfoodaistudio#foodaistudiobenefits#foodaistudiobonus#howtofoodaistudioworks#foodaistudiosoftware#foodaistudioFunnels#marketingprofitmedia#foodaistudioUpsell#foodaistudioinfo#purchasefoodaistudio#software#traffic#foodaistudioexample#foodaistudioworthgorbuying#ai#aiapp#aitool

0 notes

Text

Setting Up Your Shopify Store: A Step-by-Step Beginner’s Guide

Starting an online store can be a game-changer for your business, and Shopify is one of the best platforms to make it happen. Whether you're a budding entrepreneur or an experienced seller, Shopify provides an easy-to-use platform for building and managing your eCommerce store. Here’s a comprehensive step-by-step guide to help you set up your Shopify store from scratch.

Step 1: Sign Up for Shopify

Go to Shopify’s website and click on "Start Free Trial."

Enter your email address, password, and store name.

Tip: Choose a store name that reflects your brand and is easy to remember.

Complete the registration process by answering a few questions about your business.

Step 2: Configure Basic Settings

Set Your Store Location: Add your address and other relevant details to calculate shipping rates and taxes.

Select Your Currency: Go to Settings > Store Currency and choose the appropriate currency for your target audience.

Setup Taxes: Enable or configure tax settings to comply with your region’s requirements.

Step 3: Choose a Theme

Navigate to Online Store > Themes in your Shopify dashboard.

Browse through the free and premium themes available on the Shopify Theme Store.

Tip: Pick a responsive theme that works well on both desktop and mobile devices.

Click "Customize" to start tailoring the theme to your brand.

Step 4: Customize Your Store Design

Add Your Logo: Upload your brand logo for a professional look.

Choose Colors and Fonts: Align these with your brand’s identity.

Design Your Homepage: Add high-quality images, headlines, and CTAs (Call to Actions) to make it visually appealing.

Preview Your Store: Test how it looks on different devices.

Step 5: Add Products

Go to Products > Add Product in the Shopify dashboard.

Fill out product details:

Title

Description (include keywords for SEO!)

Images (use high-resolution images)

Pricing

Inventory information

Organize products into categories or collections for easier navigation.

Step 6: Set Up Payment Methods

Go to Settings > Payments.

Choose your preferred payment gateway (Shopify Payments, PayPal, Stripe, etc.).

Tip: Shopify Payments integrates seamlessly and offers competitive transaction fees.

Configure additional payment options like credit cards, digital wallets, or cash-on-delivery if applicable.

Step 7: Configure Shipping Settings

Navigate to Settings > Shipping and Delivery.

Add shipping zones and rates for domestic and international customers.

Offer shipping options like free shipping, flat rates, or real-time carrier rates.

Step 8: Set Up a Domain

Go to Settings > Domains in the Shopify dashboard.

Purchase a new domain through Shopify or connect an existing one.

Tip: A custom domain gives your store a professional look (e.g.,).

Step 9: Install Essential Apps

Visit the Shopify App Store to enhance your store’s functionality.

Popular apps to consider:

SEO Optimizer for better search visibility.

Email Marketing Apps like Klaviyo or Mailchimp.

Abandoned Cart Recovery apps.

Review Collection Apps for social proof.

Step 10: Test Your Store

Place a Test Order: Use Shopify’s test mode to simulate a purchase.

Check for:

Smooth navigation.

Proper display of product images and descriptions.

Functioning payment gateways.

Fix any issues that arise before going live.

0 notes

Text

Why Your Business Needs Efficient Billing Software for PC

Running a business today is more challenging than ever. Managing bills, invoices, and payments manually can be time-consuming and error-prone. That’s where Billing Software for PC comes in. Whether you own a small shop, a growing startup, or a large company, billing software can streamline your operations and save valuable time.

In this blog, we will explore why your business needs efficient billing software, discuss its key features, compare options, and highlight its role as a vital business accounting tool. Let’s dive in!

What is Billing Software for PC?

Billing software is a computer program that automates the process of creating invoices, tracking payments, and managing customer transactions. Unlike manual processes, it reduces the chances of mistakes and helps you stay organized.

Fun Fact:

According to a 2023 study, businesses using billing software save up to 40% of the time spent on manual invoicing and record-keeping.

Data Point:

In the same study, 65% of small businesses reported improved cash flow management within the first 3 months of using billing software.

Why Efficient Billing Software is Essential

Efficient billing software is not just a luxury; it’s a necessity. Here’s why:

Saves Time: Imagine creating invoices for 100 customers manually. It could take hours! Billing software automates the task, allowing you to focus on growing your business.

Reduces Errors: Manual billing can lead to mistakes, like miscalculations or missed payments. Software ensures accuracy.

Enhances Customer Experience: Quick and accurate invoices make a good impression on customers, improving their overall experience.

Tracks Finances Easily: With built-in business accounting tools, you can monitor income, expenses, and taxes in one place.

Cost-Effective: Contrary to popular belief, there are affordable billing software options that offer great features without breaking the bank.

Data Point:

A report from 2024 indicates that businesses that adopted billing software saw a 25% reduction in late payments and a 15% increase in customer satisfaction scores.

Features of Billing Software

Modern billing software for PC comes with a variety of features that make it user-friendly and efficient:

Invoice Creation: Create professional invoices with pre-designed templates.

Payment Tracking: Track customer payments and set reminders for overdue bills.

Multi-Currency Support: Ideal for businesses dealing with international clients.

Tax Calculation: Automatically calculate taxes like GST, VAT, or sales tax.

Inventory Management: Keep an eye on your stock levels and prevent shortages.

User-Friendly Billing Apps: Many billing software options offer mobile apps, so you can manage your business on the go.

Example:

A bakery owner can use billing software to:

Generate customer bills.

Monitor daily sales.

Calculate monthly revenue.

Data Point:

On average, businesses using billing software reduce invoicing errors by 70%, saving an estimated $2,500 annually on corrections and adjustments.

How to Choose Affordable Billing Software

Here are some tips to find the right billing software for your budget:

Define Your Needs: Do you need inventory management, tax calculation, or multi-user access?

Try Free Versions: Start with free or trial versions to test the features.

Read Reviews: Look for software with high ratings for being user-friendly billing apps.

Check Scalability: Choose software that can grow with your business.

Benefits of Using Billing Software

Improved Productivity: Automating repetitive tasks increases your team’s efficiency.

Better Cash Flow Management: Easily track who owes you money and when payments are due.

Regulatory Compliance: Stay compliant with tax laws using built-in calculators.

Eco-Friendly Option: Go paperless and save the environment!

Example:

A clothing store using billing software could:

Generate 300 invoices in a week.

Reduce billing errors by 90%.

Save 15 hours of manual work.

Data Point:

By switching to billing software, small businesses report cutting operational costs by 20% on average.

Why Gimbook is the Right Choice

Gimbook stands out as a reliable solution among billing software options. Designed for small and medium-sized businesses, it offers a seamless user experience with features like automated billing, integrated payment tracking, and real-time tax calculation. Whether you're managing a retail store or a service-based business, Gimbook simplifies your operations while being affordable and easy to use. Its versatility makes it a preferred choice for businesses aiming for efficiency and growth.

Take the first step towards smarter invoicing and better cash flow management. Download Gimbook for Free! https://www.gimbooks.com/

Efficient billing software for PC is a game-changer for businesses of all sizes. From automating invoices to tracking payments and managing taxes, it simplifies complex tasks and boosts efficiency. Plus, with options for affordable billing software and user-friendly billing apps, there’s a solution for every budget.

0 notes

Text

FINANCIAL LITERACY FOR REALTORS IN NIGERIA: SERVE YOUR CLIENTS LIKE A PRO

In the world of real estate, financial literacy is a necessity. For realtors, understanding the nuances of finance can significantly enhance the service you provide to your clients. It empowers you to offer well rounded advice, anticipate financial challenges, and position yourself as a trusted expert in the field.

So, how can you develop financial literacy that sets you apart and helps you serve your clients like a pro?

1. Understand Mortgage Basics

Mortgages are often the largest financial commitment your clients will make. Familiarize yourself with different mortgage types, interest rates, and the qualification process. Knowing how these factors affect your clients' purchasing power allows you to guide them more effectively through their buying journey.

2. Grasp Investment Principles

Real estate is a significant investment vehicle. Understanding concepts like ROI (Return on Investment), cash flow, and equity can help you better serve investors. You’ll be able to identify properties that align with their financial goals and explain the long-term benefits of various investment strategies.

3. Know Tax Implications

Real estate transactions come with a host of tax implications. While you’re not expected to be a tax expert, having a basic understanding of property taxes, capital gains, and deductions can be invaluable. This knowledge allows you to alert clients to potential tax benefits or liabilities they might face, enhancing your value as a comprehensive service provider.

4. Master Budgeting Skills

Helping clients understand the true cost of homeownership is part of your role. This includes not just the purchase price, but also ongoing expenses like maintenance, utilities, and HOA fees. By mastering budgeting skills, you can assist clients in planning their finances and ensuring they’re prepared for all aspects of homeownership.

5. Guide First-Time Buyers

First-time homebuyers often need the most financial guidance. Educate them on saving for a down payment, understanding credit scores, and navigating loan options. Providing these insights helps build trust and confidence, positioning you as their go-to resource for future real estate needs.

6. Leverage Financial Tools

Utilize tools like mortgage calculators, budgeting apps, and market analysis software to provide clients with detailed financial insights. These tools can help demystify complex financial concepts and offer clients a clearer picture of their financial standing and potential investment returns.

7. Stay Updated on Market Trends

Real estate markets are dynamic, influenced by economic conditions, interest rates, and government policies. Staying updated on these trends helps you anticipate changes that could impact your clients’ financial decisions. Sharing timely, relevant insights not only positions you as a knowledgeable advisor but also strengthens your client relationships.

8. Collaborate with Financial Experts

While expanding your financial knowledge is crucial, collaborating with financial planners, mortgage brokers, and tax advisors can deepen the expertise you offer. Building a network of trusted financial professionals allows you to provide clients with holistic advice, covering all financial aspects of their real estate transactions.

Conclusion

Financial literacy is a game-changer for realtors, transforming you from a transactional agent to a trusted advisor. By understanding the financial aspects of real estate, you can better serve your clients, anticipate their needs, and help them make informed decisions. Enhance your financial knowledge, and you’ll not only improve your service but also elevate your entire real estate career.

About the Managing Director : Dr. Smith Ezenagu is the Managing Director and Chief Executive Officer of Esso Properties Limited, one of Nigeria's leading integral real estate development and investment companies. With a strong background in financial management and training, he has been instrumental in shaping the real estate landscape in Nigeria.

About Esso Properties Limited: Esso Properties Limited is a revered name in Nigeria's dynamic real estate development and investment sector. Committed to innovation, reliability, and exceeding client expectations. Esso Properties has solidified its position as a leader in the real estate industry.Join the Realtors Millionaire Summit (RMS): Elevate your real estate career by participating in the Realtors Millionaire Summit (RMS). This is an annual real estate conference designed to inspire, equip, and connect real estate professionals with the tools, strategies, and networks to achieve exceptional success in the industry. Click the link https://bit.ly/RealtorsMillioniareSummit to Register now and be part of this transformative experience.

0 notes

Video

youtube

The Easy Way to Financial Freedom with One Simple Money Hack!