#cash app saying cash out failed

Explore tagged Tumblr posts

Text

Why Your Cash App Cash Out Failed?

Cash App has become a popular choice for peer-to-peer payments, making it easy to send and receive money with just a few taps on your mobile device. However, occasionally, users encounter the frustrating issue of their Cash App displaying the message "Cash Out Failed." In this blog, we'll delve into the possible reasons behind this Cash App cash out error and explore steps to resolve it.

Common Reasons for Cash App Cash Out Failures:

Insufficient Balance: One of the most common reasons for a "Cash Out Failed" message is that your Cash App balance does not have sufficient funds to cover the requested withdrawal amount. Ensure you have enough money in your Cash App account before attempting to cash out.

Network Connectivity: An unstable internet connection can disrupt Cash App transactions, leading to errors like "Cash Out Failed." Make sure you have a stable and active internet connection when using the app.

Account Verification: If your Cash App account is not fully verified, you may encounter cash-out errors. Verify your Cash App account by providing the required personal information and documents.

Card Issues: If you've linked a debit card to the Cash App, ensure that it is valid, not expired, and has sufficient funds. Outdated or invalid card information can lead to cash-out failures.

Cash App Updates: Outdated versions of the Cash App may not function correctly. Check for app updates in your device's app store and ensure you are using the latest version.

Bank Account Linking: If you've linked a bank account to Cash App, confirm that it is active and has not been closed or restricted. Ensure that your linked bank account information matches the details in your Cash App account.

Steps to Resolve "Cash Out Failed" Error:

Check Your Balance: Ensure that you have a sufficient balance in your Cash App account to cover the withdrawal amount.

Verify Account: If your account is not verified, complete the verification process by providing the necessary information and documents. This can increase your transaction limits and reduce errors.

Review Card Information: If you're using a linked debit card, double-check the card details, including the expiration date, CVV, and billing address. Update any outdated or incorrect information.

Update the App: Ensure that you're using the latest version of the Cash App by checking for updates in your device's app store.

Network Connection: Ensure a stable internet connection before attempting any Cash App transactions.

Contact Cash App Support: If the issue persists and you've ruled out the above factors, it's advisable to contact Cash App support for assistance. They can investigate and guide on resolving the error.

Conclusion:

Receiving a Cash App cash out failed message can be frustrating, but it's usually due to common issues like insufficient balance, network problems, or account verification. By following the steps outlined in this blog and maintaining your account and payment methods, you can often resolve the error and enjoy a smooth Cash App experience.

#cash app cash out failed#cash app cash out error#cash app says cash out failed#cash app saying cash out failed#why is cash app cash out failing#why did my cash app cash out fail#why does my cash app cash out fail#why does my cash app say cash out failed#what does cash out failed mean on cash app#cash out failed on cash app#why does cash app say cash out failed#why does cash app keep saying cash out failed#why is my cash app cash out failing#why is my cash app saying cash out failed#cash out failed please try again#why is cash app saying cash out failed

0 notes

Text

Tips for Addressing a Failed Cash App Cash-Out

In the era of digital finance, Cash App has emerged as a popular choice for seamless peer-to-peer transactions and mobile banking. Millions of users rely on Cash App to send and receive money with ease. However, one issue that can be frustrating for users is the "Cash App cash out failed" error. This comprehensive guide will delve into the reasons behind this common problem and provide practical solutions to help you resolve it effectively. Whether you're a seasoned Cash App user or new to the platform, understanding why cash outs fail and how to fix them is essential for a smooth financial experience.

What is Cash App Cash-Out?

Before we delve into the reasons for cash-out failures, let's clarify what a cash-out on Cash App means. You can store money in your Cash App account when you use Cash App. A cash-out transfers funds from your Cash App balance to your linked bank account. It's a straightforward way to access and use your funds for various purposes.

Common User Queries

Let's address some common questions that users often have about Cash App cash outs:

1. Does Cash App Charge for Cash Outs?

Cash App typically does not charge a fee for standard cashouts. However, if you need an instant cash out for immediate access to your funds, a small fee may be associated with it. Always review Cash App's fee structure for the most up-to-date information.

2. How Long Does a Cash Out Take?

The time it takes for a cash-out to reach your bank account can vary. Standard cashouts usually take 1-3 business days to complete. If you opt for an instant cash out, the funds are available immediately, but a fee may apply.

3. Can I Cash Out to Any Bank Account?

You can only cash out to a bank account linked to your Cash App account. The bank account should be in your name and good standing to facilitate successful transactions.

What are the Reasons Behind Cash App Cash-Out Failed?

Now, let's explore the most common reasons why Cash App cash out failed. Understanding these factors will help you troubleshoot and resolve the issue when it occurs:

Insufficient Funds: The transaction will fail if your Cash App balance does not have enough funds to cover the cash-out amount. Ensure that you have an adequate balance before attempting cash out.

Network Connectivity Issues: Poor or unstable internet connections can lead to transaction failures. Having a stable and active internet connection is crucial when using Cash App.

Outdated App Version: Using an outdated version of the Cash App can result in various errors, including cash-out failures. Regularly update the app to access the latest features and bug fixes.

Bank Account Problems: Cash outs may fail if there are issues with the bank account linked to your Cash Apps, such as a closed account or incorrect account information. Verify your bank account details for accuracy.

Identity Verification Required: Cash App may prompt you to complete identity verification to enhance security. Failure to do so can result in transaction failures. Follow the provided steps to complete the verification process.

Server Issues: Occasionally, Cash App experiences server-related problems that impact transactions. Check for ongoing server issues on the Cash App status page or official social media channels.

Temporary Outages or Maintenance: Cash App may undergo temporary outages or maintenance, disrupting transactions. In such cases, you may need to wait until Cash App's technical team resolves the issue.

Conclusion

Cash App is a convenient and reliable platform for managing your finances, but encountering a "Cash App cash out failed" error can be frustrating. You can quickly troubleshoot and resolve the issue by understanding the common causes of cash-out failures and following the practical solutions provided in this guide. Maintain a stable internet connection, keep your Cash App updated, and ensure your bank account information is accurate to enjoy seamless cash outs on Cash App. In the fast-paced world of digital finance, having the knowledge to address and fix common issues ensures that you can continue to make the most of your financial transactions with Cash App.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

1 note

·

View note

Text

Solutions for Resolving Cash App "Cash Out Failed"

Cash App is a highly convenient peer-to-peer digital payment platform, offering its users ease and efficiency in conducting financial transactions. While Cash App is often user-friendly, technical issues sometimes occur that result in Cash Out Failed errors, which may be perplexing and frustrating. However, with proper research and troubleshooting skills, users can quickly overcome these errors to continue enjoying smooth transactions on the platform. Here are the different reasons why Cash App says cash out failed and how to fix this error:

Cash App cash-out errors may arise for various reasons, including insufficient funds in your account, incorrect bank information or security risks. You must understand why this error occurs so you can take immediate steps to rectify it as quickly as possible.

Cash App cash-out failure may also be caused by money not yet being deposited into your bank account; this process could take days, depending on the processing speed of your bank. To speed up this process, try linking a debit card linked to Cash App with your Cash App account for faster transfer.

If your Cash App cash-out attempt fails, it could be because your wallet has become overfull due to sending too much money at one time - it is, therefore, wise to regularly monitor and limit payments made out. To check on this situation, visit either your bank's website or download and use the Cash App mobile app on your smartphone to view your current balance.

Cash App transactions may sometimes be denied because their size exceeds your available funds, such as for transactions from merchants who accept large sums, such as restaurants and retailers.

If there is enough money in your Cash App account to complete it, then go ahead with it; otherwise, consider reaching out to your bank as soon as possible in order to discover why this transaction was denied; in most cases, they'll be able to reverse it so your funds are back available so you can use Cash App.

How Do I Fix If My Cash App Cash Out Failed?

Cash App is one of the most convenient ways to send and receive money online, but it can sometimes go wrong. Cashouts may fail for various reasons outside your control - though there may still be ways you can troubleshoot and transfer your funds as intended. When your Cash App cash out failed, it's important not to panic.

First, verify whether there are enough funds in your account to complete the transaction and ensure you have entered accurate recipient details such as their bank name and account number. If this still doesn't help resolve the issue, reach out to Cash App customer support for assistance - they may be able to assist.

Another thing to do when your cash app cash out fails is verify whether the transaction is still pending, either because payment processing hasn't been completed or your bank has temporarily blocked a transaction. Either way, wait 24 hours before trying the transaction again.

In order to avoid a Cash Out Failed error, it's essential that you first check your bank balance to make sure there are sufficient funds in your account and that all payment and contact information is up-to-date. Furthermore, you should ensure your internet connection works before attempting to transfer any money out of your Cash App account.

When your Cash App transaction shows "pending", it could be due to security concerns. For instance, the system could be flagging your account for suspicious activity or protecting itself against fraud. Pending transactions usually resolve within several days; if this takes longer for any reason, reaching out to your bank may help speed things along and verify if the transaction is legitimate.

Maintaining an up-to-date Cash App account is equally essential. Outdated information could cause issues with transfers; for instance, if your name or number has changed, your Cash App account must reflect this information; you can do this by visiting the Settings tab within your Cash App account and selecting "My Profile."

Cash App transactions often show as "pending" because the recipient hasn't approved it yet for various reasons, including being offline or simply not responding to notifications about payment. You will likely need to wait several days until payment has been processed and then appear in your account.

If the Cash Out Failed error persists despite following these tips, it's wise to contact Customer Support for additional help. Their team at Cash App are very experienced in solving such problems and will be more than willing to assist with them.

Conclusion

While the Cash App cash-out error can be annoying, it isn't insurmountable. By updating your information, having a stable internet connection, and reaching out to Customer Support, you can easily overcome it and continue using Cash App with confidence. Taking these measures will guarantee your cash-out transactions will go through successfully.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

When Cash App Says 'Cash Out Failed': Steps to Take

Cash App has become a convenient and popular way for users to send and receive money, and one of its core features is the ability to "cash out" funds to your linked bank account. However, there are instances where users encounter issues, such as a "Cash App Cash Out Failed" error. In this blog, we will explore the common reasons behind Cash App cash-out failures and provide solutions to help you resolve these issues.

Understanding Cash App Cash-Out:

Before delving into the reasons for cash-out failures, let's briefly review the process of cashing out on Cash App. When you cash out, you are transferring funds from your Cash App balance to your linked bank account. This process is typically smooth, but occasional errors can occur.

Why does the Cash App Say Cash-Out Failed?

Here are some of the most common reasons behind why Cash App says cash out failed:

Insufficient Balance: One of the most common reasons for a cash-out failure is attempting to transfer more money than you have available in your Cash App balance.

Technical Glitches: Temporary technical issues within the Cash App platform can lead to cash-out failures. These glitches are usually resolved quickly by Cash App's technical team.

Bank Account Issues: If your linked bank account has issues, such as being closed or having insufficient funds, it can result in a Cash App cash out error.

Network Connectivity: Poor internet connection or network issues on your device can interrupt the cash-out process and lead to failure.

Outdated App Version: Using an outdated version of the Cash App can sometimes cause issues. Make sure your app is up-to-date.

Account Verification: If your Cash App account is not fully verified or has incomplete information, it may restrict your ability to cash out.

How to Fix Cash App Cash-Out Failures?

If your Cash App cash out failing, you need to take the below mentioned steps to fix it:

Check Your Balance: Ensure that you have a sufficient balance in your Cash App account before attempting to cash out.

Verify Bank Account: Confirm that your linked bank account is in good standing and has the necessary funds.

Update the App: If you're using an older version of the Cash App, update it to the latest version from your device's app store.

Retry the Cash-Out: Sometimes, a temporary glitch may have caused the failure. Try the cash-out process again after a brief pause.

Contact Cash App Support: If your cash-out issues persist, contact Cash App's customer support for assistance. They can provide guidance and help resolve the problem.

Conclusion:

Cash App offers a convenient way to manage your finances, including cashing out funds to your bank account. While cash-out failures can be frustrating, they are often caused by common issues that can be resolved with the right steps. By verifying your balance, checking your bank account, and ensuring a stable internet connection, you can increase the chances of a successful cash-out. If problems persist, don't hesitate to reach out to Cash App support for further assistance. Resolving cash-out errors is usually a straightforward process that can help you get back to managing your finances seamlessly.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

Troubleshooting Cash App's Cash Out Failed Issues

In the age of digital payments, Cash App has emerged as a popular choice for quick and easy transactions. However, even the smoothest of apps can hit a roadblock, and one such stumbling block that Cash App users often encounter is the “Cash App cash out failed” error. It can be perplexing and frustrating, but fret not, for this blog post will unravel the mystery behind this error and provide you with practical solutions to overcome it.

Understanding “Cash Out Failed” on Cash App:

When you try to cash out your balance on the Cash App, the last thing you want to see is a “Cash Out Failed” notification. This message indicates that there’s a hiccup in processing your withdrawal request. It can be frustrating, but there are several common reasons why Cash App cash out failed.

What are the Reasons behind “Cash App Cash Out Failed”?

Several factors can trigger the “Cash Out Failed” message on Cash App. Here are the common suspects:

Insufficient Balance: The most obvious reason for a cash-out failure is not having enough funds in your Cash App account to cover the withdrawal amount, including any applicable fees.

Server Hiccups: Technical glitches or server issues on Cash App’s end can temporarily disrupt service, leading to cash-out failures. Patience is your best ally here, as these issues often resolve themselves.

Network Woes: A shaky or sluggish internet connection can also be a spoiler. Ensure your internet connection is stable before making withdrawal attempts.

Card Credentials: Cash App may require you to verify your linked debit card or bank account. Incorrect or outdated card details can lead to cash-out failed on Cash App. Keep your card information up to date.

Account Verification: For security purposes, Cash App may request additional account verification. This could entail providing personal identification or other documents.

Solutions to Resolve “Cash Out Failed” Issues

Now that we’ve identified the usual suspects let’s explore the fixes:

Balance Check: Always double-check your Cash App balance before initiating a withdrawal, and remember to account for any applicable fees.

Card Updates: Verify the accuracy and currency of your linked debit card or bank account details. If necessary, update this information in your Cash App settings.

Account Verification: If Cash App asks for additional verification, follow the instructions diligently. This may include verifying identity on Cash App or providing requested documentation.

Network Vigilance: Ensure you’re operating with a steady and robust internet connection when making transactions on Cash App.

Contact Cash App Support: If all else fails, don’t hesitate to reach out to Cash App’s customer support. They possess the expertise to provide tailored assistance for your specific issue.

Conclusion:

Facing a “Cash Out Failed” error on Cash App may momentarily halt your financial plans, but remember, it’s not an insurmountable hurdle. By grasping the common causes and applying the recommended solutions, you can swiftly regain your stride in the world of cashless transactions. Keep your account details updated, cherish a reliable internet connection, and if push comes to shove, Cash App’s diligent customer support team is your beacon of hope. Embrace the convenience of Cash App with the assurance that the “Cash Out Failed” error can be conquered. Happy cashing!

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

1 note

·

View note

Text

From Failure to Success: Resolving Cash App Cash Out Issues Like a Pro

Are you experiencing issues with cashing out on Cash App? Don't worry; you're not alone. Cash App is a popular mobile payment platform that allows users to send and receive money effortlessly. However, there are instances when cash-out attempts fail, leaving users frustrated and searching for solutions. This blog will explore the common reasons for Cash App cash-out failed and provide effective resolutions to overcome these issues.

Before we delve into the reasons and solutions, let's first clarify what cashing out means on Cash App. Cashing out refers to transferring your available balance in the app to your linked bank account. This enables you to withdraw your funds and access them in physical form.

Common Reasons for Cash App Cash Out Failed

Insufficient Balance: One of the primary reasons for cash-out failed on Cash App is having an insufficient balance in your Cash App account. Make sure you have enough funds available before initiating a cash-out request.

Invalid or Expired Card: If your linked debit or credit card has expired or becomes invalid, Cash App may not be able to process your cash-out request. Ensure that your card details are up to date and valid.

Connectivity Issues: Poor internet connection or network problems can interrupt cash-out and lead to failures. It is essential to have a stable internet connection to ensure smooth transactions.

Account Verification: Cash App may require users to verify their accounts to prevent fraud. Your cash-out attempts may fail if you haven't completed the verification process. Verify your account by providing the necessary identification documents to resolve this issue.

Resolving Cash App Cash Out Failed Issues

Check Your Balance: Double-check your Cash App account balance to ensure you have enough funds available for cashing out. If needed, add funds to your account before attempting another cash-out.

Update Card Information: Verify that your linked debit or credit card details are accurate and current. If your card has expired, remove it from your account and add a new card with valid information.

Improve Connectivity: Ensure that you have a stable internet connection. Connect to a reliable Wi-Fi network or switch to a stronger cellular data network to avoid connectivity issues during cash-out attempts.

Complete Account Verification: If your account requires verification, follow the prompts provided by Cash App to complete the process. Typically, you must provide a valid form of identification, such as a driver's licence or passport, to verify your identity.

Additional Tips for Successful Cash Outs

Regularly update your Cash App to the latest version to benefit from bug fixes and performance improvements.

Contact Cash App support if you continue to experience cash-out failures despite following the above steps. They can provide personalised assistance and resolve any account-specific issues.

Conclusion:

Encountering cash-out failures on Cash App can be frustrating, but you can overcome these issues with the right understanding of the common reasons and effective resolutions. Ensure you have sufficient funds, update your card information, maintain a stable internet connection, and complete the account verification process if necessary. By following these steps and staying informed, you can enjoy seamless cash outs on Cash App and make the most of its convenient features.

Remember, if you encounter persistent issues, contacting Cash App support will provide you with the necessary guidance to resolve any account-specific problems. Happy cashing out!

FAQs

Q1: Why did my Cash App cash out fail?

A1: There can be several reasons for why Cash App cash out failed. Some common causes include insufficient balance, invalid or expired card information, connectivity issues, and incomplete account verification.

Q2: What should I do if my cash out on Cash App failed?

A2: If your cash-out attempt failed on Cash App, there are a few steps you can take to resolve the issue. First, ensure you have enough funds in your account. Then, check your card information to make sure it is accurate and up to date. Verify your internet connection and try again. If needed, complete the account verification process.

Q3: How can I check my Cash App balance?

A3: To check your Cash App balance, open the Cash App on your mobile device. On the home screen, your available balance is displayed at the top.

Q4: Can I cash out on Cash App without a bank account?

A4: Yes, you can cash out on Cash App even if you don't have a bank account. Cash App offers a feature called "Cash App Cash Card," a prepaid card linked to your Cash App balance. You can use the Cash Card to withdraw funds at ATMs or purchase at any store that accepts Visa.

Q5: How long does a Cash App cash out take to be successful?

A5: Typically, a Cash App cash out is instant, and the funds are transferred to your linked bank account within a few minutes. However, in some cases, it may take up to 1-3 business days for the transfer to complete, depending on your bank's processing time.

Q6: I have followed all the steps, but my Cash App cash out still fails. What should I do?

A6: If you have followed all the recommended steps and are still experiencing cash-out failures on Cash App, it is best to contact Cash App support directly. They have trained representatives who can assist you with troubleshooting the issue and providing personalised solutions.

0 notes

Text

Troubleshooting Cash App: What to Do When Cash Out Transfer Failed?

Cash App provides a convenient way to send and receive money, but encountering a "Cash Out Failed" message can be frustrating. If you're experiencing this issue, don't worry! In this blog post, we will explore why Cash App cash-out failed and provide a comprehensive troubleshooting guide to help you resolve the problem. By following these steps, you'll be back to smoothly cashing out on Cash App in no time.

Check Your Internet Connection: Before troubleshooting, ensure you have a stable and reliable internet connection. A weak or intermittent connection can disrupt Cash App's functionality, leading to cash-out failures. Connect to a strong Wi-Fi network or switch to a reliable mobile data network to prevent connectivity issues.

Update the Cash App: An outdated version of the Cash App may cause compatibility issues and lead to cash-out failures. To ensure optimal performance, check for available updates in your device's app store and install the latest version of Cash App.

Verify Your Account and Card Details: Ensure your Cash App account is verified and all associated card details are accurate. Go to your Cash App profile and review your account settings to confirm that your personal information and card details are up to date. Incorrect or outdated information can prevent successful cash-outs.

Sufficient Funds: One of the common reasons for cash-out failed on Cash App is insufficient funds in your Cash App account. Before attempting a cash-out, double-check your available balance and ensure you have enough funds to complete the transaction.

Check Cash App Limits: Cash App imposes certain transaction limits, both daily and weekly. The transaction will fail if you're trying to cash out an amount that exceeds these limits. Verify your transaction limits within the Cash App settings and adjust the cash-out amount accordingly.

Retry the Cash-Out: If you encounter a cash-out failure, it may be a temporary issue. In such cases, simply retry the cash-out process after a short period. Cash App's servers might have experienced a glitch that caused the initial failure.

Verify Recipient Details: When cashing out to an external bank account, ensure you have entered the correct recipient details. Double-check the account number, routing number, and other relevant information to ensure accuracy. Incorrect recipient details can lead to cash-out failures.

Clear Cache and Data: If you're experiencing persistent cash-out failures, clearing the cache and data of the Cash App can help resolve underlying issues. Go to your device's settings, locate the Cash App, and clear its cache and data. This process may vary depending on your device and operating system.

Try a Different Cash-Out Method: Cash App provides multiple cash-out methods, including instant deposits, standard deposits, and Bitcoin transfers. If you're facing cash-out failures using one method, try an alternative method to see if the issue persists. This can help isolate the problem and find a suitable workaround.

Contact Cash App Support: If you've exhausted all the troubleshooting steps and cannot fix the Cash App cash-out failed issue, it's time to reach out to Cash App support. Open the app, go to your profile or account settings, select "Cash Support," and explain the issue in detail. Provide relevant information and any error messages you received during the cash-out process. Cash App support will assist you further in resolving the problem.

Conclusion

Encountering a "Cash Out Failed" message on Cash App can be frustrating, but with the right troubleshooting steps, you can resolve the issue and continue cashing out seamlessly. By checking your internet connection, updating the app, verifying account and card details, ensuring sufficient funds, and following the other troubleshooting tips, you'll be able to fix cash-out failed issues and enjoy the convenience of Cash App once again.

FAQs

Q1: Why did my Cash App cash-out fail?

A1: There can be several reasons why a Cash App cash-out fails. Common causes include a weak internet connection, outdated app version, incorrect account or card details, insufficient funds, exceeding transaction limits, or temporary glitches. By troubleshooting these factors, you can resolve the issue.

Q2: What should I do if my Cash App cash-out fails?

A2: If your Cash App cash-out fails, there are several steps you can take. First, check your internet connection and ensure it's stable. Verify that your Cash App account is verified and your card details are accurate. Ensure you have sufficient funds and are within the transaction limits. Retry the cash-out after a short period. If the problem persists, try alternative cash-out methods or contact Cash App support for assistance.

Q3: Can a weak internet connection cause Cash App cash-out failures?

A3: A weak or unstable internet connection can disrupt the cash-out process on Cash App and result in failures. When performing cash-outs, it's important to have a reliable internet connection, either through a strong Wi-Fi network or a stable mobile data connection.

Q4: How can I update the Cash App?

A4: To update the Cash App, go to your device's app store (such as the Apple App Store or Google Play Store) and search for "Cash App." You'll see an option to update the app if an update is available. Tap on it to install the latest version of Cash App on your device.

Q5: What should I do if none of the troubleshooting steps works?

A5: If you've followed all the troubleshooting steps and cannot fix the cash-out failed issue on Cash App, it's recommended to contact Cash App support. Open the app, go to your profile or account settings, select "Cash Support," and explain the issue in detail. Cash App support will provide further assistance to help resolve the problem.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

Cash App Cash Out Failed: Causes, Solutions, and Prevention Strategies

Cash App has become popular for seamless money transfers and convenient digital transactions. However, encountering a "Cash Out Failed" notification can be frustrating and leave users wondering about the reasons behind it. This blog will delve into the common causes of Cash App cash-out failed and provide effective solutions to overcome these issues. Let's explore why Cash App may display cash-out failures and how you can resolve them.

The Causes of Cash App Cash Out Failures

Cash App cash-out failures can occur due to various reasons. Understanding these causes can help you troubleshoot the issue more effectively. Here are some common factors why Cash App says cash out failed:

Insufficient Balance or Funds: One of the most common reasons for a cash-out failure is insufficient funds in your Cash App account to cover the transaction amount. Ensure that your account has a sufficient balance before initiating a cash-out.

Connectivity Issues: Unstable or poor internet connectivity can interrupt the cash-out process and fail. Make sure you have a stable internet connection before attempting a cash-out.

Technical Glitches or Server Errors: Temporary technical glitches or server issues on the Cash App platform can cause cash-out failures. These issues are usually resolved quickly, so trying the cash out again after some time may solve the problem.

Violation of Transaction Limits: Cash App imposes transaction limits to prevent fraudulent activities. If you exceed the transaction limits set for your account, your cash out may fail. Review and adjust your transaction limits accordingly.

Incorrect Payment Information: Entering incorrect recipient details, such as an invalid Cash App username, email, or phone number, can lead to cash-out failures. Double-check the payment information before initiating the transaction.

Troubleshooting Steps to Resolve Cash Out Failed

If you encounter a cash-out failed on Cash App, here are some troubleshooting steps you can take to resolve the issue:

Verify Your Internet Connection: Ensure you have a stable and reliable internet connection before attempting another cash-out.

Update the Cash App Application: Check for any updates for the Cash App application and install them. Keeping your app updated ensures you have the latest bug fixes and improvements.

Check Your Cash App Balance: Review your Cash App account balance to ensure sufficient funds to cover the cash-out amount. Add funds if needed.

Review and Adjust Transaction Limits: Check your transaction limits within the Cash App settings. If you've reached or exceeded the limits, consider adjusting them accordingly.

Ensure Accurate Payment Information: Double-check the recipient's information, including their Cash App username, email, or phone number, to ensure accuracy.

Cancel Pending Transactions: If you have any pending transactions, cancel them before attempting a new cash out.

Clear Cache and Data of the Cash App: On your mobile device, go to the app settings and clear the cache and data of the Cash App. This step can help resolve any temporary glitches or conflicts.

Reinstall the Cash App: As a last resort, uninstall the Cash App from your device and reinstall it. This action can help resolve any persistent issues or conflicts.

Additional Tips to Avoid Cash App Cash-Out Failed

To minimise the chances of encountering cash-out failures on Cash App, consider the following tips:

Keep a Sufficient Balance in Your Cash App Account: Regularly monitor your Cash App balance and ensure it has enough funds to cover your transactions.

Monitor Transaction Limits and Adjust Accordingly: Be aware of the transaction limits set for your Cash App account and adjust them as needed to accommodate your transaction requirements.

Double-Check Payment Information Before Initiating Cash Outs: Always verify the recipient's information before initiating a cash-out, including their Cash App username, email, or phone number.

Maintain a Stable Internet Connection: A stable and reliable internet connection is crucial for smooth cashouts. Avoid initiating transactions on unstable or unreliable networks.

Reach Out to Cash App Support if Needed: If you have exhausted all troubleshooting steps and continue to experience cash-out failures, don't hesitate to contact Cash App support for further assistance. They can provide personalised guidance to resolve the issue.

Conclusion:

Experiencing a "Cash App cash-out failed" message can be a temporary setback, but understanding the reasons behind it and following the troubleshooting steps can help you resolve the issue promptly. You can minimise the chances of encountering cash-out failures by ensuring sufficient balance, maintaining accurate payment information, and staying within transaction limits. Remember to update your Cash App application and maintain a stable internet connection. If the problem persists, don't hesitate to contact Cash App support for further assistance. Now, armed with this knowledge, you can confidently navigate the world of Cash App transactions and enjoy the seamless money transfer experience it offers.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

What to Do When Cash App says cash-out failed?

Cash App has become a popular platform for convenient money transfers and cash withdrawals. However, encountering issues with cashing out on Cash App can be frustrating. If you're facing problems such as "Cash App Cash Out Failed" or "Cash App won't let me cash out," this article will guide you through potential solutions and explain why such issues occur.

Insufficient Balance or Transaction Limits: One common reason for a cash-out failure is due to low Cash App balance. Ensure that you have enough funds to cover the desired withdrawal amount. Additionally, Cash App imposes certain transaction limits, so make sure you're within the allowed range.

Connectivity and Network Issues: Unstable internet connections or network disruptions can interfere with the cash-out process. To address this, ensure you have a stable internet connection or switch to a different network. Restarting your device or reinstalling the Cash App might help resolve connectivity issues.

Outdated Cash App Version: Using an outdated version of the Cash App can sometimes lead to functionality problems. Ensure you have the latest version of the app installed on your device. Regularly updating the app ensures you benefit from bug fixes and performance enhancements.

Verification and Account Security: Cash App prioritizes user security, which may require additional verification steps. Cash App may request you to verify your identity or confirm certain account details to prevent fraudulent activities. Failing to complete these steps can result in a cash-out failed on Cash App. Ensure your account is fully verified and complies with any security measures.

Temporary Server or System Glitches: Occasionally, Cash App experiences temporary server or system glitches that can affect cash-out functionality. These issues are typically resolved within a short period. In such cases, it is advisable to wait sometime and attempt the cash-out process again later.

Conclusion:

Facing difficulties with Cash App cash out can be frustrating, but you can often resolve the issue with the right troubleshooting steps. Ensure you have sufficient funds, a stable internet connection, and an updated version of the Cash App. Complete any necessary verification processes and remain patient during temporary server glitches. Following these guidelines increase your chances to successfully cash-out on Cash App.

Remember, if you continue experiencing problems, it's recommended to contact Cash App's customer support for further assistance.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#cash app won't let me cash out#why cash app cash out failed

0 notes

Text

aaaa okay. hi. you might know me as 'guy who had to ask for money to pay its bills for like 6 months straight' or "guy who had sepsis 3 months ago and wont shut up about it." or maybe you dont know me at all. but um! shits rough for me rn!

as previously said i had sepsis about 3 1/2 months ago because of a wound that physically could not close for just under a year. and after sepsis that wound finally closed. but its opened again! and worse than before!

before when i would go to clean the wound / check on the severity there would be like a couple of drops of blood at most, or if it was really bad it would be fixed just by cleaning it. but now every time without fail when i go to clean it the amount of blood that comes out is like equivalent to the amount of blood that happens when i get a really bad nose bleed. so i need to go to a doctor for it. but i dont have health insurance

all this is to say that if you have anything to spare to help me not die of sepsis I'd really appreciate it

i know we're all struggling BADLY now but i still have ~$400 in medical debt from previous hospital visits not to mention another 1k in debt to various friends and stuff.. anything helps.

my commissions are also always open, and at this point i will draw basically anything for you if you send me even 1 dollar.

cash/app is $irismews

ven/mo is @ irismews

dm for zelle or paypal

#now that ive calmed down enough to think of options other than suicide i might as well make this#idk how coherent this is but ^_^ well ^_^ haha ^_^

153 notes

·

View notes

Text

Resolving Cash App Cash-Out Failed Issues- Ultimate Guide

Cash App has gained popularity for its simplicity and convenience in sending and receiving money. One of its essential features is the ability to cash out your funds to your bank account. However, Cash App users may sometimes encounter the frustrating issue of "Cash App Cash-Out Failed." This blog will explore the common reasons behind this problem and provide solutions. Let's delve into the details to ensure a smooth cash-out experience.

Cash App Cash-Out Basics

Before we dive into the reasons for cash-out failures, let's understand what cashing out on Cash App means. Cashing out refers to transferring your Cash App balance funds to your linked bank account. This is a convenient way to access and use your money for various purposes.

Common Reasons for Cash App Cash-Out Failures:

Several factors can contribute to a cash out failed on Cash App. Here are some of the most common ones:

a. Insufficient Funds: The transaction will fail if your Cash App balance doesn't have enough funds to cover the cash-out amount. Ensure you have a sufficient balance before attempting a cash-out.

b. Expired or Invalid Card: If your linked debit card has expired or is no longer valid, Cash App won't be able to process the transaction.

c. Bank Account Issues: An issue with your linked bank account, such as an incorrect account number or a closed account, can lead to a cash-out failure.

d. Network Connectivity: A stable internet connection is crucial for successful cash-outs. Poor or interrupted connectivity can disrupt the transaction process.

e. Cash App Cash-Out Limit: Cash App imposes certain limits on cash-outs. The transaction may fail if you're trying to cash out an amount exceeding these limits.

f. Cash App Cash-Out Fee: Be aware that Cash App may charge instant cash-out fees. Ensure you have enough funds to cover the withdrawal and associated fees.

How to Fix Cash App Cash-Out Failed?

If you encounter a cash-out failure on Cash App, here's how you can resolve the issue:

a. Check Your Balance: Ensure your Cash App balance has enough funds to cover the cash-out amount.

b. Verify Your Card: Ensure that the debit card linked to your Cash App account is valid and not expired. If necessary, update your card details.

c. Review Bank Account Information: Double-check your linked bank account details, including the account and routing numbers, to ensure they are accurate.

d. Network Connectivity: Ensure a stable internet connection before attempting a cash-out.

e. Check Cash-Out Limits: Be mindful of the cash-out limits set by Cash App. If you exceed these limits, consider cashing out in multiple transactions or over a more extended period.

f. Contact Customer Support: If you've tried all the above steps and still experience cash-out failures, contact Cash App's customer support for assistance. They can help you resolve specific issues related to your account.

Conclusion:

When Cash App says cash out failed it can be frustrating, but addressing the issue promptly by identifying the root cause and taking appropriate action is essential. By following the steps mentioned above and maintaining your account and linked payment methods, you can ensure a smoother cash-out experience on Cash App, enjoying the convenience of accessing your funds whenever needed.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

Mastering Cash App Cash Out Failed: How to Bypass Such Transactions?

Cash App has become a convenient peer-to-peer payment platform, enabling users to effortlessly send, receive, and cash out funds. However, users sometimes encounter the frustrating "Cash Out Failed" error message, preventing them from accessing their funds. In this informative blog, we'll explore the possible reasons behind this issue and provide troubleshooting tips to resolve the problem efficiently.

What does Cash App Cash Out mean?

Cash Out on Cash App allows users to transfer their available balance to their linked bank account. It's a seamless way to access and use funds for various purposes.

Why Did the Cash App Cash Out Failed?

Experiencing a "Cash App Cash Out Failed" error can be perplexing, leaving users wondering why they cannot withdraw their funds. Several factors could be responsible for this issue:

Insufficient Balance: One of the most common reasons for a failed cash-out is insufficient funds in your Cash App account to complete the transaction.

Network Connectivity Issues: Cash App requires a stable internet connection to process transactions successfully. Poor network connectivity can lead to a cash-out failure.

Technical Glitches: Cash App may experience occasional technical glitches that can cause cash-out failures like any app.

Security Measures: Cash App employs robust security measures to protect user accounts. The app may block cash-out attempts for safety reasons if any suspicious activity is detected.

How to Resolve Cash App Cash Out Failed Issues?

To resolve the "Cash Out Failed" issue, consider the following troubleshooting steps:

Check Account Balance: Ensure you have sufficient funds in your Cash App account before attempting a cash-out.

Verify Internet Connection: Confirm that your device is connected to a stable internet connection to avoid transaction disruptions.

Update the App: Ensure you are using the latest version of the Cash App to eliminate any potential bugs or glitches.

Verify Account Information: Ensure that your linked bank account information is accurate and up to date.

Wait and Retry: If the issue is related to a temporary glitch, waiting a few minutes and retrying the cash-out might resolve the problem.

Contact Cash App Support: If the problem persists, contact Cash App customer support for assistance.

Overcoming Other Cash App Cash-Out Challenges:

In addition to "Cash Out Failed," users may face issues like "Cash App Won't Let Me Cash Out." Some possible reasons and solutions include:

Unverified Account: Unverified accounts may have limitations on cash-out transactions. Verifying your account can resolve this.

Unlinked Bank Account: Ensure your bank account is correctly linked to your Cash App account for seamless cash-outs.

Pending Transactions: If you have pending transactions, wait for them to complete before attempting a cash-out.

Conclusion:

Encountering a "Cash Out Failed" error on Cash App can be frustrating, but with a little troubleshooting, most issues can be resolved swiftly. Double-check your account balance, internet connection, and account information before retrying the cash-out. In case of persistent problems, don't hesitate to contact Cash App's customer support for prompt assistance. By following these guidelines, you can ensure a smooth cash-out experience on Cash App and continue to enjoy the convenience of this popular payment platform.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

Cash App Cash Out Failed? Don't Panic! Follow These Steps to Fix It

Experiencing a cash-out failed on Cash App can be frustrating, especially when you need to access your funds. However, there are steps you can take to resolve the issue and successfully cash out your money. In this blog post, we’ll guide you through troubleshooting a cash-out failure on Cash App. We’ll cover common reasons for the failure and provide solutions to help you fix the problem. We’ll also address related topics, provide useful tips, and answer frequently asked questions to ensure you have a comprehensive understanding of the subject.

Common reasons for cash-out failures on Cash App:

When you encounter a cash-out failure on Cash App, an error or issue prevents you from withdrawing funds from your account. Understanding the reasons behind these failures is important to effectively resolve them.

Several common reasons can lead to cash-out failures on Cash App. These include insufficient funds in your account, connectivity issues, incorrect account details, outdated app versions, or account verification problems. Identifying the specific reason can help you find an appropriate solution.

Troubleshooting steps for resolving cash-out failures:

To fix a Cash App cash-out failed issues, follow these troubleshooting steps:

Check your Cash App balance and transaction history: Before attempting a cash-out, ensure you have sufficient funds in your Cash App account. Review your transaction history to avoid surprises during the cash-out process.

Update the Cash App application: Keeping your Cash App app up to date is crucial for smooth functionality. Check for app updates on Android and iOS devices to ensure you have the latest version, as it can resolve potential cash-out issues.

Verify your identity and account information: Cash App may require verifying your identity or account information for regulatory compliance and security purposes. Follow the instructions provided by Cash App to complete the verification process.

Contact Cash App support for assistance: If the troubleshooting steps mentioned above don’t resolve the issue, it’s time to contact Cash App support. Contact their customer support team and explain the cash-out failure you’re experiencing. Provide all relevant details to help them assist you effectively.

How to avoid cash-out failures on Cash App?

Prevention is better than cure. Here are some tips to help you avoid cash-out failures on Cash App:

Maintain a stable internet connection: Ensure you have a reliable and strong internet connection when using Cash App to avoid connectivity issues.

Double-check account details: Before initiating a cash-out, verify the recipient’s account details to ensure they are accurate and up to date.

Keep your Cash App app updated: Regularly check for updates to the Cash App application and install them promptly to benefit from bug fixes and performance improvements.

FAQs (Frequently Asked Questions)

Q1: What should I do if my cash-out fails on the Cash App?

A1: Check your Cash App balance and transaction history if your cash-out fails. Ensure you have a stable internet connection and update your app to the latest version. If the issue persists, contact Cash App support for further assistance.

Q2: How long does resolving a cash-out failure issue on Cash App take?

A2: The resolution time can vary depending on the issue and Cash App’s support workload. It’s best to contact their support team as soon as possible for timely assistance.

Q3: Will I lose money if my cash-out fails on the Cash App?

A3: No, your money should remain in your Cash App account if a cash-out fails. However, it’s essential to resolve the issue promptly to access your funds.

Q4: Can I cancel a failed cash-out request on Cash App?

A4: Generally, you cannot cancel a failed cash-out request on Cash App. However, you can successfully retry the cash-out by resolving the underlying issue.

Conclusion:

When Cash App says cash out failed is can be frustrating. Still, you can overcome the issue by understanding the common reasons, following the troubleshooting steps outlined in this blog post, and cashing out your funds. Remember to update your app, verify your identity if required, and promptly contact Cash App support for assistance. By following these guidelines and tips, you can ensure a smoother and more reliable cash-out experience on Cash App.

0 notes

Text

forever tired of our voices being turned into commodity.

forever tired of thorough medaocrity in the AAC business. how that is rewarded. How it fails us as users. how not robust and only robust by small small amount communication systems always chosen by speech therapists and funded by insurance.

forever tired of profit over people.

forever tired of how companies collect data on every word we’ve ever said and sell to people.

forever tired of paying to communicate. of how uninsured disabled people just don’t get a voice many of the time. or have to rely on how AAC is brought into classrooms — which usually is managed to do in every possible wrong way.

forever tired of the branding and rebranding of how we communicate. Of this being amazing revealation over and over that nonspeakers are “in there” and should be able to say things. of how every single time this revelation comes with pre condition of leaving the rest behind, who can’t spell or type their way out of the cage of ableist oppression. or are not given chance & resources to. Of the branding being seen as revolution so many times and of these companies & practitioners making money off this “revolution.” of immersion weeks and CRP trainings that are thousands of dollars and wildly overpriced letterboards, and of that one nightmare Facebook group g-d damm it. How this all is put in language of communication freedom. 26 letters is infinite possibilities they say - but only for the richest of families and disabled people. The rest of us will have to live with fewer possibilities.

forever tired of engineer dads of AAC users who think they can revolutionize whole field of AAC with new terrible designed apps that you can’t say anything with them. of minimally useful AI features that invade every AAC app to cash in on the new moment and not as tool that if used ethically could actually help us, but as way of fixing our grammar our language our cultural syntax we built up to sound “proper” to sound normal. for a machine, a large language model to model a small language for us, turn our inhuman voices human enough.

forever tired of how that brand and marketing is never for us, never for the people who actually use it to communicate. it is always for everyone around us, our parents and teachers paras and SLPs and BCBAs and practitioners and doctors and everyone except the person who ends up stuck stuck with a bad organized bad implemented bad taught profit motivated way to talk. of it being called behavior problems low ability incompetence noncompliance when we don’t use these systems.

you all need to do better. We need to democritize our communication, put it in our own hands. (My friend & communication partner who was in Occupy Wall Street suggested phrase “Occupy AAC” and think that is perfect.) And not talking about badly made non-robust open source apps either. Yes a robust system needs money and recources to make it well. One person or community alone cannot turn a robotic voice into a human one. But our human voice should not be in hands of companies at all.

(this is about the Tobii Dynavox subscription thing. But also exploitive and capitalism practices and just lazy practices in AAC world overall. Both in high tech “ mainstream “ AAC and methods that are like ones I use in sense that are both super stigmatized and also super branded and marketed, Like RPM and S2C and spellers method. )

#I am not a product#you do not have to make a “spellers IPA beer ‘ about it I promise#communication liberation does not have a logo#AAC#capitalism#disability#nonspeaking#dd stuff#ouija talks#ouija rants

327 notes

·

View notes

Text

Troubleshooting Cash App Cash-Out Failed: A Comprehensive Guide

Cash App has revolutionized how we handle money transfers, offering a quick and convenient platform for sending and receiving funds. However, when the Cash App says cash-out failed it can be frustrating. If you’re facing difficulties while trying to cash out, rest assured that you’re not alone. This comprehensive guide will delve into the common reasons behind Cash App cash-out failures and provide effective solutions to help you overcome these challenges. We’ve got you covered whether you’re experiencing payment errors, account limitations, or other issues.

Reasons Behind Cash App’s “Cash-Out Failed” Message:

Insufficient Balance: One of the primary reasons for a cash-out failure is having an insufficient balance in your Cash App account. Ensure you have enough funds to cover the desired cash-out amount, including any applicable fees.

Bank Account or Card Issues: Linked bank accounts or cards can sometimes cause cash-out failures. This may be due to expired cards, closed bank accounts, or incorrect account details. Verify that your linked accounts are active, up to date, and accurately entered in the Cash App settings.

Connectivity or Network Problems: A stable internet connection is crucial for successful cash-outs on Cash App. Connectivity or network issues can lead to transaction failures. Ensure you have a strong and reliable internet connection before initiating a cash-out.

Cash App Account Limitations: Cash App imposes certain limitations on user accounts to maintain security and prevent fraudulent activities. These limitations, such as transaction limits or verification requirements, can affect cash-out transactions. Check your account status and ensure you have completed any necessary verification steps.

Transaction Security Measures: Cash App has robust security measures to safeguard user accounts. If a transaction is flagged as potentially suspicious, it may trigger a cash-out failure. In such cases, additional verification or confirmation may be required to complete the transaction.

Resolving Cash App Cash-Out Failures:

Verify Your Account Balance: Before initiating a cash-out, double-check your Cash App account balance to ensure that you have sufficient funds available. Confirm that the cash-out amount, including any fees, does not exceed your available balance.

Review Linked Bank Accounts or Cards: Take a moment to review the details of your linked bank accounts or cards in the Cash App settings. Ensure that the information is accurate, up to date, and matches the account or card you intend to use for cashing out.

Ensure a Stable Internet Connection: To avoid connectivity issues during the cash-out process, connect to a stable and reliable Internet network. Use a secure Wi-Fi connection or ensure a strong mobile data signal.

Check Account Status and Limits: Verify if there are any limitations or restrictions on your Cash App account that may be causing the cash-out failure. Complete any necessary verification steps or address account-related issues to lift any restrictions.

Seek Assistance from Cash App Support: If you have followed the above steps and cannot resolve the Cash App cash-out failed issues, it is recommended to contact Cash App support for further assistance. They have dedicated support channels to help users troubleshoot and resolve transaction-related issues.

FAQs:

Q: Why does the Cash App show my cash-out as pending?

A: A pending cash-out status indicates that Cash App is processing the transaction. Cash-outs can take some time to complete, especially during peak periods or when additional verification is required.

Q: Can I cancel a cash-out transaction on Cash App?

A: Once a cash-out transaction is initiated on Cash App, it cannot be cancelled. It is important to carefully review the transaction details before proceeding to avoid unintended errors.

Q: Are there any cash-out limits on Cash App?

A: Yes, Cash App has certain cash-out limits in place. These limits may vary depending on factors such as your account verification status, transaction history, and the specific terms and conditions Cash App sets. It’s important to review Cash App’s documentation or contact their support to understand the specific cash-out limits that apply to your account.

Q: What should I do if my cash-out continues to fail even after following the troubleshooting steps?

A: If you have followed all the troubleshooting steps outlined above and are still experiencing cash-out failures on Cash App, it is advisable to contact Cash App support for personalised assistance. They have the necessary resources and expertise to address account-specific issues and provide further guidance.

Q: Can I try cashing out again immediately after a cash-out failure?

A: It is recommended to wait for a short period before attempting to cash out again after a failure. This allows for any temporary issues or system delays to be resolved. If the problem persists, follow the troubleshooting steps mentioned earlier or contact Cash App support for further assistance.

Q: Will my funds be deducted if a cash-out fails?

A: No, the funds should remain in your Cash App account if a cash-out fails. However, verifying your account balance is important to ensure that the intended cash-out amount has not been deducted. Contact Cash App support for clarification and resolution if you notice any discrepancies.

Conclusion

Encountering a cash-out failed on Cash App can be frustrating, but there are steps you can take to address the issue. By verifying your account balance, reviewing linked bank accounts or cards, ensuring a stable internet connection, checking account limitations, and seeking assistance from Cash App support, you increase your chances of resolving the cash-out failure. Remember to be patient and persistent, and soon you’ll be able to cash out on Cash App without any issues.

#cash app cash out#cash app cash-out failed#cash app says cash out failed#why cash app cash out failed#cash app won't let me cash out

0 notes

Text

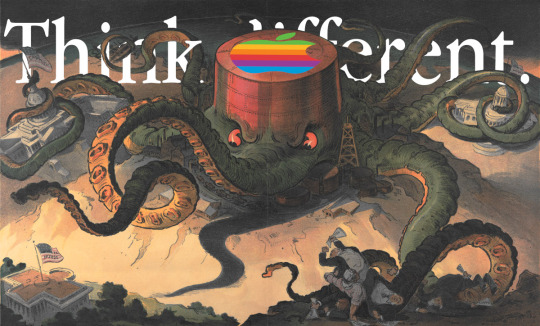

The antitrust case against Apple

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me TONIGHT (Mar 22) in TORONTO, then SUNDAY (Mar 24) with LAURA POITRAS in NYC, then Anaheim, and beyond!

The foundational tenet of "the Cult of Mac" is that buying products from a $3t company makes you a member of an oppressed ethnic minority and therefore every criticism of that corporation is an ethnic slur:

https://pluralistic.net/2024/01/12/youre-holding-it-wrong/#if-dishwashers-were-iphones

Call it "Apple exceptionalism" – the idea that Apple, alone among the Big Tech firms, is virtuous, and therefore its conduct should be interpreted through that lens of virtue. The wellspring of this virtue is conveniently nebulous, which allows for endless goal-post shifting by members of the Cult of Mac when Apple's sins are made manifest.

Take the claim that Apple is "privacy respecting," which is attributed to Apple's business model of financing its services though cash transactions, rather than by selling it customers to advertisers. This is the (widely misunderstood) crux of the "surveillance capitalism" hypothesis: that capitalism is just fine, but once surveillance is in the mix, capitalism fails.

Apple, then, is said to be a virtuous company because its behavior is disciplined by market forces, unlike its spying rivals, whose ability to "hack our dopamine loops" immobilizes the market's invisible hand with "behavior-shaping" shackles:

http://pluralistic.net/HowToDestroySurveillanceCapitalism

Apple makes a big deal out of its privacy-respecting ethos, and not without some justification. After all, Apple went to the mattresses to fight the FBI when they tried to force Apple to introduced defects into its encryption systems:

https://www.eff.org/deeplinks/2018/04/fbi-could-have-gotten-san-bernardino-shooters-iphone-leadership-didnt-say

And Apple gave Ios users the power to opt out of Facebook spying with a single click; 96% of its customers took them up on this offer, costing Facebook $10b (one fifth of the pricetag of the metaverse boondoggle!) in a single year (you love to see it):

https://arstechnica.com/gadgets/2021/02/facebook-makes-the-case-for-activity-tracking-to-ios-14-users-in-new-pop-ups/

Bruce Schneier has a name for this practice: "feudal security." That's when you cede control over your device to a Big Tech warlord whose "walled garden" becomes a fortress that defends you against external threats:

https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#manorialism

The keyword here is external threats. When Apple itself threatens your privacy, the fortress becomes a prison. The fact that you can't install unapproved apps on your Ios device means that when Apple decides to harm you, you have nowhere to turn. The first Apple customers to discover this were in China. When the Chinese government ordered Apple to remove all working privacy tools from its App Store, the company obliged, rather than risk losing access to its ultra-cheap manufacturing base (Tim Cook's signal accomplishment, the one that vaulted him into the CEO's seat, was figuring out how to offshore Apple manufacturing to China) and hundreds of millions of middle-class consumers:

https://www.reuters.com/article/us-china-apple-vpn/apple-says-it-is-removing-vpn-services-from-china-app-store-idUSKBN1AE0BQ

Killing VPNs and other privacy tools was just for openers. After Apple caved to Beijing, the demands kept coming. Next, Apple willingly backdoored all its Chinese cloud services, so that the Chinese state could plunder its customers' data at will:

https://www.nytimes.com/2021/05/17/technology/apple-china-censorship-data.html

This was the completely foreseeable consequence of Apple's "curated computing" model: once the company arrogated to itself the power to decide which software you could run on your own computer, it was inevitable that powerful actors – like the Chinese Communist Party – would lean on Apple to exercise that power in service to its goals.

Unsurprisingly, the Chinese state's appetite for deputizing Apple to help with its spying and oppression was not sated by backdooring iCloud and kicking VPNs out of the App Store. As recently as 2022, Apple continued to neuter its tools at the behest of the Chinese state, breaking Airdrop to make it useless for organizing protests in China:

https://pluralistic.net/2022/11/11/foreseeable-consequences/#airdropped

But the threat of Apple turning on its customers isn't limited to China. While the company has been unwilling to spy on its users on behalf of the US government, it's proven more than willing to compromise its worldwide users' privacy to pad its own profits. Remember when Apple let its users opt out of Facebook surveillance with one click? At the very same time, Apple was spinning up its own commercial surveillance program, spying on Ios customers, gathering the very same data as Facebook, and for the very same purpose: to target ads. When it came to its own surveillance, Apple completely ignored its customers' explicit refusal to consent to spying, spied on them anyway, and lied about it:

https://pluralistic.net/2022/11/14/luxury-surveillance/#liar-liar

Here's the thing: even if you believe that Apple has a "corporate personality" that makes it want to do the right thing, that desire to be virtuous is dependent on the constraints Apple faces. The fact that Apple has complete legal and technical control over the hardware it sells – the power to decide who can make software that runs on that hardware, the power to decide who can fix that hardware, the power to decide who can sell parts for that hardware – represents an irresistible temptation to enshittify Apple products.

"Constraints" are the crux of the enshittification hypothesis. The contagion that spread enshittification to every corner of our technological world isn't a newfound sadism or indifference among tech bosses. Those bosses are the same people they've always been – the difference is that today, they are unconstrained.

Having bought, merged or formed a cartel with all their rivals, they don't fear competition (Apple buys 90+ companies per year, and Google pays it an annual $26.3b bribe for default search on its operating systems and programs).

Having captured their regulators, they don't fear fines or other penalties for cheating their customers, workers or suppliers (Apple led the coalition that defeated dozens of Right to Repair bills, year after year, in the late 2010s).

Having wrapped themselves in IP law, they don't fear rivals who make alternative clients, mods, privacy tools or other "adversarial interoperability" tools that disenshittify their products (Apple uses the DMCA, trademark, and other exotic rules to block third-party software, repair, and clients).

True virtue rests not merely in resisting temptation to be wicked, but in recognizing your own weakness and avoiding temptation. As I wrote when Apple embarked on its "curated computing" path, the company would eventually – inevitably – use its power to veto its customers' choices to harm those customers:

https://memex.craphound.com/2010/04/01/why-i-wont-buy-an-ipad-and-think-you-shouldnt-either/

Which is where we're at today. Apple – uniquely among electronics companies – shreds every device that is traded in by its customers, to block third parties from harvesting working components and using them for independent repair:

https://www.vice.com/en/article/yp73jw/apple-recycling-iphones-macbooks

Apple engraves microscopic Apple logos on those parts and uses these as the basis for trademark complaints to US customs, to block the re-importation of parts that escape its shredders:

https://repair.eu/news/apple-uses-trademark-law-to-strengthen-its-monopoly-on-repair/

Apple entered into an illegal price-fixing conspiracy with Amazon to prevent used and refurbished devices from being sold in the "world's biggest marketplace":

https://pluralistic.net/2022/11/10/you-had-one-job/#thats-just-the-as

Why is Apple so opposed to independent repair? Well, they say it's to keep users safe from unscrupulous or incompetent repair technicians (feudal security). But when Tim Cook speaks to his investors, he tells a different story, warning them that the company's profits are threatened by customers who choose to repair (rather than replace) their slippery, fragile glass $1,000 pocket computers (the fortress becomes a prison):

https://www.apple.com/newsroom/2019/01/letter-from-tim-cook-to-apple-investors/

All this adds up to a growing mountain of immortal e-waste, festooned with miniature Apple logos, that our descendants will be dealing with for the next 1,000 years. In the face of this unspeakable crime, Apple engaged in a string of dishonest maneuvers, claiming that it would support independent repair. In 2022, Apple announced a home repair program that turned out to be a laughably absurd con:

https://pluralistic.net/2022/05/22/apples-cement-overshoes/

Then in 2023, Apple announced a fresh "pro-repair" initiative that, once again, actually blocked repair:

https://pluralistic.net/2023/09/22/vin-locking/#thought-differently

Let's pause here a moment and remember that Apple once stood for independent repair, and celebrated the independent repair technicians that kept its customers' beloved Macs running:

https://pluralistic.net/2021/10/29/norwegian-potato-flour-enchiladas/#r2r

Whatever virtue lurks in Apple's corporate personhood, it is no match for the temptation that comes from running a locked-down platform designed to capture IP rights so that it can prevent normal competitive activities, like fixing phones, processing payments, or offering apps.

When Apple rolled out the App Store, Steve Jobs promised that it would save journalism and other forms of "content creation" by finally giving users a way to pay rightsholders. A decade later, that promise has been shattered by the app tax – a 30% rake on every in-app transaction that can't be avoided because Apple will kick your app out of the App Store if you even mention that your customers can pay you via the web in order to avoid giving a third of their content dollars to a hardware manufacturer that contributed nothing to the production of that material:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Among the apps that Apple also refuses to allow on Ios is third-party browsers. Every Iphone browser is just a reskinned version of Apple's Safari, running on the same antiquated, insecure Webkit browser engine. The fact that Webkit is incomplete and outdated is a feature, not a bug, because it lets Apple block web apps – apps delivered via browsers, rather than app stores:

https://pluralistic.net/2022/12/13/kitbashed/#app-store-tax

Last month, the EU took aim at Apple's veto over its users' and software vendors' ability to transact with one another. The newly in-effect Digital Markets Act requires Apple to open up both third-party payment processing and third-party app stores. Apple's response to this is the very definition of malicious compliance, a snake's nest of junk-fees, onerous terms of service, and petty punitive measures that all add up to a great, big "Go fuck yourself":

https://pluralistic.net/2024/02/06/spoil-the-bunch/#dma

But Apple's bullying, privacy invasion, price-gouging and environmental crimes are global, and the EU isn't the only government seeking to end them. They're in the firing line in Japan:

https://asia.nikkei.com/Business/Technology/Japan-to-crack-down-on-Apple-and-Google-app-store-monopolies

And in the UK:

https://www.gov.uk/government/news/cma-wins-appeal-in-apple-case

And now, famously, the US Department of Justice is coming for Apple, with a bold antitrust complaint that strikes at the heart of Apple exceptionalism, the idea that monopoly is safer for users than technological self-determination:

https://www.justice.gov/opa/media/1344546/dl?inline

There's passages in the complaint that read like I wrote them:

Apple wraps itself in a cloak of privacy, security, and consumer preferences to justify its anticompetitive conduct. Indeed, it spends billions on marketing and branding to promote the self-serving premise that only Apple can safeguard consumers’ privacy and security interests. Apple selectively compromises privacy and security interests when doing so is in Apple’s own financial interest—such as degrading the security of text messages, offering governments and certain companies the chance to access more private and secure versions of app stores, or accepting billions of dollars each year for choosing Google as its default search engine when more private options are available. In the end, Apple deploys privacy and security justifications as an elastic shield that can stretch or contract to serve Apple’s financial and business interests.

After all, Apple punishes its customers for communicating with Android users by forcing them to do so without any encryption. When Beeper Mini rolled out an Imessage-compatible Android app that fixed this, giving Iphone owners the privacy Apple says they deserve but denies to them, Apple destroyed Beeper Mini:

https://blog.beeper.com/p/beeper-moving-forward

Tim Cook is on record about this: if you want to securely communicate with an Android user, you must "buy them an Iphone":

https://www.theverge.com/2022/9/7/23342243/tim-cook-apple-rcs-imessage-android-iphone-compatibility

If your friend, family member or customer declines to change mobile operating systems, Tim Cook insists that you must communicate without any privacy or security.

Even where Apple tries for security, it sometimes fails ("security is a process, not a product" -B. Schneier). To be secure in a benevolent dictatorship, it must also be an infallible dictatorship. Apple's far from infallible: Eight generations of Iphones have unpatchable hardware defects:

https://checkm8.info/

And Apple's latest custom chips have secret-leaking, unpatchable vulnerabilities:

https://arstechnica.com/security/2024/03/hackers-can-extract-secret-encryption-keys-from-apples-mac-chips/

Apple's far from infallible – but they're also far from benevolent. Despite Apple's claims, its hardware, operating system and apps are riddled with deliberate privacy defects, introduce to protect Apple's shareholders at the expense of its customers:

https://proton.me/blog/iphone-privacy

Now, antitrust suits are notoriously hard to make, especially after 40 years of bad-precedent-setting, monopoly-friendly antitrust malpractice. Much of the time, these suits fail because they can't prove that tech bosses intentionally built their monopolies. However, tech is a written culture, one that leaves abundant, indelible records of corporate deliberations. What's more, tech bosses are notoriously prone to bragging about their nefarious intentions, committing them to writing:

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/