#capital gain tax

Explore tagged Tumblr posts

Text

Thousands File Their Tax Returns on Christmas Day | UK Tax Calculators

Near 4,500 people spent Christmas Day filing their Tax Return – but 500 less than last year! — Read on www.uktaxcalculators.co.uk/tax-news/2024/12/27/thousands-file-their-tax-returns-on-christmas-day/ For Uk tax help, please get in touch via KS Virtual Finance

#AAT#asset finance#bookkeeping#borrowing#capital gain tax#child benefits#HMRC#local business#MTD#personal-finance#self-assessment#small business uk#tax credit#UK TAX#Virtualassistant#Xero

1 note

·

View note

Text

#elizabeth warren#government#republicans#republican#conservative#conservatives#tax breaks#middle class wealth#politics#us politics#political#donald trump#news#president trump#elon musk#american politics#jd vance#law#wealth inequity#wealth redistribution#wealth inequality#wealth#greed#money hungry#capital gains#tax breaks for the rich#late stage capitalism#bernie sanders#congress#senate

7K notes

·

View notes

Text

Funds 2024: Will make up for income forgone, says FM Nirmala Sitharaman | Funds 2024 Information

5 min learn Final Up to date : Jul 24 2024 | 12:43 AM IST Union Finance Minister Nirmala Sitharaman, alongside together with her group of bureaucrats, delved into the fantastic print of the 2024-25 Funds paperwork in a press convention, detailing the federal government’s street map on bringing down the debt-to-GDP ratio and daring tax measures. Ruchika Chitravanshi, Shrimi Choudhary, and Harsh…

0 notes

Text

“A man who does not have the concept of how much it would cost you to pay rent is currently deciding whether or not the Social Security Administration should be paying out seniors in America.”

#politics#taxes#social security#capital gains tax#tax the rich#doge#inequality#1 billion seconds#donald trump#elon musk#republicans

897 notes

·

View notes

Text

A Reminder of the Fact, that Billionaires are not Real

I know. I know. Most people right now expect me to do more historical write ups. But please listen to me for a moment. This is kinda important. Because with Trump trying to make himself a fucking god emperor or some shit, I need y'all to understand this one thing.

This is a reminder: Billionaires are not actually real. As in: There is not a person who has a ten-figures amount of money on their bank account or anything like that. Nobody. Not Elon Musk. Not Jeff Bezos. Not Zuckerberg. Nobody. They are valued in the billions, but they are not actually billionaires. In fact some of them might not have so much as a million on their bank account from all we know.

So, why are they billionaires?

Because they own assets. Everyone who is really, really rich does not own money, but assets. Those assets are:

Real Estate and land

Luxury vehicles, yachts, private jets etc.

Art

Investment portfolios

Shares in companies

Stuff like mines and natural ressources

Patents and Copyrights

General stuff Marx would call: "The means of production"

The "net worth" that gets thrown around is just what people estimate the stuff those people own is valued at. But again: Very for of them have more then a few million actually on their bank accounts. And this also is the reason why right now we have so many billionaires.

Because since the entire bullshit in 2008 (for those who just turned 18: The real estate bubble burst and what not - watch "The Big Short" for more context) something has been happening called "the asset inflation". Basically the worth of all those assets has shot up in price BY A LOT, which made people who had been "just" multimillionaires before into billionaires suddenly.

But what you need to understand is, that this is just... It is fictional. It is a mirage. And if we all could just agree on that, they literally would have nothing. Because you cannot eat a yacht. You cannot eat company shares. You cannot do shit with any of that. You cannot even buy something with that.

You know how billionaires buy stuff? They go to a bank and go: "Hey, look at all this shit I have. I want to buy XY, so if you give me the money to do that, I will tots pay you back. And if I don't, you tots can take some of my shit, fair?" And the bank will go: "Yeah, whatever. Here. Have 20 billion fantasy dollars."

But all of this just works, because everybody agrees that if the billionaire or the bank sold whatever assets the billionaire offers up to someone else, they would actually get the money.

I wrote about this before: This is why we cannot get away from fossil fuels. Because right now everyone who has the money to invest in energy has not actually real money, but just valued assets - and those assets are oil pumps, and coal mines, and gas plants. And if we all agreed that we no longer want oil, gas and coal, those would be worthless - and those investors would no longer have money. Because their "money" is just the worth that those mines, pumps, and plants have.

And that is also, why they are so much against the "capital gains tax". It is more than it appears to be on the surface. See, a capital gain is, when those assets you hold gain in value. Which currently happens at an alarming rate. Some of them gain literally 20 or more percent in value each year. So if you implement proper capital gains taxes, those "billionaires" would have go give some part of the theoretical monetary gain they made each year from the inflation of those assets - and obviously newly gained assets - as money to the government.

Just look at our most hated billionaire: Elon Musk. In 2023 he had a net worth of 180 billion, in 2024 he ended the year on 410 billion. That is a gain of 230 billion. Almost all of it falls under "capital gains taxes". Now, let's say we implemented a really, really soft capital gains tax of just 5%. Which is nothing in terms of tax. You and I pay more taxes on our salary. But 5% of 230 billion is 11.5 billion. And because you cannot pay taxes in assets, Elon would need 11.5 billion to actually pay his taxes. And he does not have that. Nobody does. Again, I doubt that there is really anyone who has more than a billion in liquid assets (= actual money or anything that can be used as flat payment). In fact I doubt that most billionaires have actually a billion in liquid assets. Some might have several hundred million, sure, but nothing more. Again, this is basically monopoly money.

And if they would implement a capital gains tax this entire fantasy construct would come down. Because, yeah. Nobody actually has the liquid assets to pay the taxes. And they would have to admit that.

Right now their influence is build mainly on the fact that most people do not understand how "rich people economics" work. Which is why you need to understand it.

They do not have money. They have just assets. And those only are worth billions, because people let them get away with claiming this.

You know. We can just... adjust for that.

#economics#rich people#billionaires#anti capitalism#anarchism#housing bubble#capital gains tax#tax the rich#tax the billionaires#eat the rich#2008 financial crisis

468 notes

·

View notes

Text

Of course we can tax billionaires

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

Billionaires are pretty confident that they can't be taxed – not just that they shouldn't be taxed, but rather, that it is technically impossible to tax the ultra-rich. They're not shy about explaining why, either – and neither is their army of lickspittles.

If it's impossible to tax billionaires, then anyone who demands that we tax billionaires is being childish. If taxing billionaires is impossible, then being mad that we're not taxing billionaires is like being mad at gravity.

Boy is this old trick getting old. It was already pretty thin when Margaret Thatcher rolled it out, insisting that "there is no alternative" to her program of letting the rich get richer and the poor go hungry. Dressing up a demand ("stop trying to think of alternatives") as a scientific truth ("there is no alternative") sets up a world where your opponents are Doing Ideology, while you're doing science.

Billionaires basically don't pay tax – that's a big part of how they got to be billionaires:

https://www.propublica.org/series/the-secret-irs-files

By cheating on their taxes, they get to keep – and invest – more money than less-rich people (who get to keep more money than regular people and poor people, obvs). They get so much money that they can "invest" it in corrupting the political process, for example, by flushing vast sums of dark money into elections to unseat politicians who care about finance crime and replace them with crytpo-friendly lawmakers who'll turn a blind eye to billionaires' scams:

https://www.newyorker.com/magazine/2024/10/14/silicon-valley-the-new-lobbying-monster

Once someone gets rich enough, they acquire impunity. They become too big to fail. They become too big to jail. They become too big to care. They buy presidents. They become president.

A decade ago, Thomas Piketty published his landmark Capital in the 21st Century, tracing three centuries of global capital flows and showing how extreme inequality creates political instability, leading to bloody revolutions and world wars that level the playing field by destroying most of the world's capital in an orgy of violence, with massive collateral damage:

https://memex.craphound.com/2014/06/24/thomas-pikettys-capital-in-the-21st-century/

Piketty argued that unless we taxed the rich, we would attain the same political instability that provoked the World Wars, but in a nuclear-tipped world that was poised on the brink of ecological collapse. He even laid out a program for this taxation, one that took accord of all the things rich people would try to hide their assets.

Today, the destruction that Piketty prophesied is on our doorstep, and all over the world, political will is gathering to do something about our billionaire problem. The debate rages from France to dozen-plus US states that are planning wealth taxes on the ultra-rich.

Wherever that debate takes hold, billionaires and their proxies pop up to tell us that we're Doing Ideology, that there is no alternative, and that it is literally impossible to tax the ultra-rich.

In a new blog post, Piketty deftly demolishes this argument, showing how thin the arguments for the impossibility of a billionaire tax really is:

https://www.lemonde.fr/blog/piketty/2024/10/15/how-to-tax-billionaires/

First, there's the argument that the ultra-rich are actually quite poor. Elon Musk and Mark Zuckerberg don't have a lot of money, they have a lot of stock, which they can't sell. Why can't they sell their stock? You'll hear a lot of complicated arguments about illiquidity and the effect on the share-price of a large sell-off, but they all boil down to this: if we make billionaires sell a bunch of their stock, they will be poorer.

No duh.

Piketty has an answer to the liquidity crisis of our poormouthing billionaires:

If finding a buyer is challenging, the government could accept these shares as payment for taxes. If necessary, it could then sell these shares through various methods, such as offering employees to purchase them, which would increase their stake in the company.

Though Piketty doesn't say so, billionaires are not actually poor. They have fucktons of cash, which they acquire through something called "buy, borrow, die," which allows them to create intergenerational dynastic wealth for their failsons:

https://finance.yahoo.com/news/buy-borrow-die-rich-avoid-140004536.html

Billionaires know they're not poor. They even admit it, when they say, "Okay, but the other reason it's impossible to tax us is that we're richer and therefore more powerful than the governments that want to try it."

Piketty points out the shell-game at the core of this argument: the free movement of money that allows for tax-dodging was created by governments. They made these laws, so they can change them. Governments that can't exercise their sovereign power to tax the wealthy end up taxing the poor, eroding their legitimacy and hence their power. Taxing the rich – a wildly popular move – will make governments more powerful, not less.

Big countries like the US (and federations like the EU) have a lot of power. The US ended Swiss banking secrecy and manages to tax Americans living abroad. There's no reason that France couldn't pass a wealth-tax that applies to people based on their historical residency: a 51 year old French billionaire who decamps to Switzerland to duck a wealth tax after 50 years in France could be held liable for 50/51 of the wealth tax.

The final argument Piketty takes up is the old saw that taxing the rich is illegal, or, if it were made legal, would be unconstitutional. As Piketty says, rich people have taken this position every single time they faced meaningful tax enforcement, and they have repeatedly lost this fight. France has repeatedly levied wealth taxes, as long ago as 1789 and as recently as 1945.

Taxing the ultra-rich isn't like the secret of embalming Pharaohs – it's not a lost art from a fallen civilization. The US top rate of tax in 1944 was 97%. The postwar top rate from 1945-63 was 94%, and it was 70% from 1965-80. These was the period of the largest expansion of the US economy in the nation's history. These are the "good old days" Republicans say they want to return to.

The super-rich keep getting richer. In France, the 500 richest families were worth a combined €200b in 2010. Today, it's €1.2 trillion. No wonder a global wealth tax is at the top of the agenda for next month's G20 Summit in Rio.

Here in the US – where money can easily move across state lines and where multiple states are racing each other to the bottom to be the best onshore-offshore tax- and financial secrecy-haven – state-level millionaire taxes are kicking ass.

Massachusetts's 2024 millionaire tax has raised more than $1.8b, exceeding all expectations (it was originally benchmarked at $1b), by taxing annual income in excess of $1m at an additional 4%:

https://www.boston.com/news/business/2024/05/21/heres-how-much-the-new-massachusetts-millionaires-tax-has-raised-this-year/

This is exactly the kind of tax that billionaires say is impossible. It's so easy to turn ordinary income in sheltered income – realizing it as a capital gain, say – so raising taxes on income will do nothing. Who are you gonna believe, billionaires or the 1.8 billion dead presidents lying around the Massachusetts Department of Revenue?

But say you are worried that taxing ordinary income is a nonstarter because of preferential capital gains treatment. No worry, Washington State has you covered. Its 7% surcharge on capital gains in excess of $250,000 also exceeded all expectations, bringing in $600m more than expected in its first year – a year when the stock market fell by 25%:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

Okay, but what if all those billionaires flee your state? Good riddance, and don't let the door hit you on the way out. All we need is an exit tax, like the one in California, which levies a one-time 0.4% tax on net worth over $30m for any individual who leaves the state.

Billionaires are why we can't have nice things – a sensible climate policy, workers' rights, a functional Supreme Court and legislatures that answer to the people, rather than deep-pocketed donors.

The source of billionaires' power isn't mysterious: it's their money. Take away the money, take away the power. With more than a dozen states considering wealth taxes, we're finally in a race to the top, to see which state can attack the corrosive power of extreme wealth most aggressively.

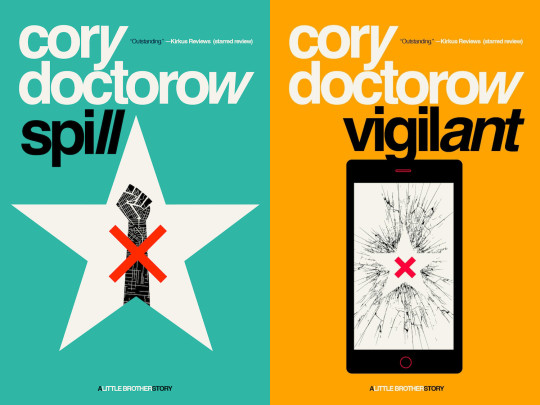

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/15/piketty-pilled/#tax-justice

#pluralistic#wealth tax#tax#capital gains tax#soak the rich#eat the rich#guillotine watch#uspoli#thomas piketty#corruption#tax havens#tax competition#tina#there is no alternative

448 notes

·

View notes

Text

There is usually one or two progressive initiatives on Washington’s ballot but this year is just GARBAGE. Like no I do not want to defund our schools thank you

154 notes

·

View notes

Text

207 notes

·

View notes

Text

#Comic#comics#webcomic#New Zealand#politics#political#tax the rich#capital gains tax#wealth gap#art#cartoon#che crawford#the immortal think tank

27 notes

·

View notes

Text

For tumblr people in the USA, and anyone they know who is worried about the capital gains tax.

Kamala Harris wants to increase the capital gains tax on households which have an income of $100,000,000 (one hundred million dollars) a year. Do you live in a household that makes $100,000,000 per year?

If not, then Kamala Harris' capital gains tax increase does not affect you. Not in any possible way. None. Nada. Nope.

If so, then, Oh no! Time for the food bank, I guess! I'll see you there at 9am on Thursdays! I hope you like white bread and canned spinach! I guess the best answer is to vote for a fascist dictator, because I am sure he will never want to take your money after he is in power!

Sources

Media Matters

Yahoo! Finance

Los Angeles Times

Market Watch

Axios

Common Dreams

39 notes

·

View notes

Text

Jeff Bezos just moved to Florida to avoid a capital gains tax that would have given 288 million in revenue to the state of Washington.

He claims it was to be closer to his family, but it sure is interesting that he just now sold 4 billion usd worth of Amazon shares.

(Article from when it was at 2b.)

Apparently the move to Florida is going to save him 610 million on over 8b in sales.

A national capital gains tax exists, but...

43 notes

·

View notes

Text

Do I have to declare capital gains and dividends if they are tax-free? | Daily Mail Online

I held some shares in investment trusts outside of an Isa and sold them all in March, so that I could take my profits before the capital gains tax allowance was cut. — Read on www.dailymail.co.uk/money/investing/article-13643229/Do-declare-capital-gains-dividends-tax-free.html Visit KS Virtual Finance if you need help with self-assessment

#bookkeeping#capital gain tax#HMRC#local business#personal-finance#personal-finance-blogs#self-assessment#small business uk#tax credit#UK TAX#virtual assistant#workingfromhome#Xero

0 notes

Text

While the exact percentage may vary slightly by study, the top 10% of U.S. households are generally understood to own about 70% of the nation’s wealth.

That mean’s 90% of us are dividing up only 30% of the wealth in America.

30 years ago:

According to data from the IRS, in 1995, the top 10% of wealth holders in the United States owned approximately 27.4% of the total personal wealth, meaning they held a significant portion of the nation's wealth.

#wealth inequality#political#politics#us politics#donald trump#elon musk#news#president trump#tesla#american politics#jd vance#melania#economics#economy#taxes#capital gains#rich#eat the rich

25 notes

·

View notes

Text

An "unrealized capital gains tax" can and will be used to seize IP from creators by corporations.

Imagine if Apple showed up on Brandon Sanderson’s doorstep and bid $2M for Mistborn. I'm not sure he has $500k sitting around for taxes. And thus he will be forced to sell even if he doesn’t want to.

21 notes

·

View notes

Text

instagram

I cannot believe they want to tax you 25% for gains you've not had yet and 40% on CG... outrageous! I hope all the liberal left is paying attention this time, otherwise they'd better get used to having nothing and liking it!

#politics#us politics#democrats are corrupt#democrats will destroy america#wake up democrats!!#fascisim#the communist manifesto#socialism#capital gains tax#harris walz#harris biden ineptitude#president trump#too big to rig#too big to steal#too big to fail#voter id#one day voting#Instagram

12 notes

·

View notes