#business marketing research

Text

As a casual Watcher fan, it's too little too late.

First off, I want to say that if you're happy with the apology video, that's great! I'm honestly happy for you. I personally don't feel the same, and I wanted to share my two cents.

I think it's a great apology video that addresses all fan concerns... from Friday. The truth is the response took so long to come out that the community dug out a lot of not-so-great things to light. Everything from homophobia, to entitled behaviors, to cost-breakdowns of productions and the company as a whole. Obviously it's impossible to address all of that at once and maintain any kind of focus, and there's plenty of things that frankly could never truly be discussed with the public.

But by waiting so long to respond these questions did arise and are still in the air. If fans are happy to move on for now that's fine but I get the feeling it'll still bite Watcher sooner or later. How will Watcher address the disconnect between their apparent ambitions for large productions and their audience's desires for small, personality-driven content? What new shows do they hope to produce? Will they reconsider their release schedule to create more content? Will fan-provided content appear behind the pay-wall at all for any length of time???

But for me the biggest question is whether they truly originally wanted to remove ALL of their content from YouTube to a new paywalled platform and give viewers one-month notice. To me, judging by the language in their video, their original statement to Variety, and the fact that they did start removing content after the video dropped all points to yes. Yes, they were going to move all their content to an unsecured platform (with no app, captions, international accessibility!) for $6/month. And they never addressed that in the apology video!!!

I personally just can't get past it on top of all the other things that were brought up in the last 72 hours.

#watcher#there's so much more to say from a PR and business management perspective#but at this point it feels like (to me) they just had their audience conduct all the market research for them#and are now reaping the benefits#plus no apologies to the international fans???#i need to shut up now before i start spiraling again

83 notes

·

View notes

Text

my least favourite thing from the watcher discourse has been people saying “WE never asked for higher quality” or “your most popular shows are where you just sit around and talk!!” - babes its likely not what THEY want to do for the rest of eternity lol. they’re allowed to want to grow as creatives and make things they are proud of?

#like i absolutely didn’t agree with their move to a paid model platform but this response isn’t the criticism u think it is#that and also the continious shit i saw about steven owning a tesla#like babes its HIS money? he’s allowed nice things and upgrades in his life lol?#AND the stuff about them making 100k from patreon with eat the rich comments#100k per month likely doesn’t cover all operating costs like you guys r thinking it does#they likely didn’t want to keep doing ad reads that interrupted their content structure and how they THEMSELVES percieved its value#as a former business major tho i def think even a little bit of market research could have stopped this lol#respectfully no one wants to pay for another thing#and the communication on it was unfortunately shit#but its not that big of a mistake that we tear em down like this#watcher#ryan bergara#shane madej#steven lim

64 notes

·

View notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

65 notes

·

View notes

Text

Honestly, what did I even listen to with TTPD? One long commercial? Her spilling her ego all over my speakers?

I just cannot believe how derivative TTPD is... and how she's calling it the most honest form of poetry,

The songs are either modeled after TikTok trends/ youth slang, or just her name-dropping other famous people.

She's doing this on purpose. It doesn't make sense otherwise, because it's just so inartistic. I'm sorry but the phrase "down bad crying at the gym" is supposed to be artistically moving?

Are you joking?

Don't even get me started on Fortnight. Obviously, the Fortnight challenge was huge a few years ago.... and what does Taylor Swift do with the first single? hmmm.... could it be that she made a fortnight challenge.... hoping to also go megaviral on TikTok.

Honestly, I'm pretty sure she thinks her audience is stupid... or that they are children.

Not to mention "Imgonnagetyouback" clearly copied Olivia Rodrigo (who has a young audience, clearly Swift is desperate to keep the focus of the youth)

It's just such a blatant way to key into viral moments in order to inflate her own music sales/ streams/ platform.

It's not art.... it's business.

Any attempt at art, either through metaphor or clunky prose is obfuscated by oddly placed recalls back to pop culture internet trends... The metaphors don't land either because they are internally contradictory to other phrases. Also, don't get me started on the sheer number of grammatical errors throughout the songs. Does every phrase need 57 prepositions? no! Does every phrase need to be a run on sentence? no! Did she even notice the subject verb disagreements? no? You're telling me not one person with an English degree works for Taylor Swift as an editor?

Come on man.

#ttpd#anti taylor swift#the tortured poets department#there are no editors in the tortured poets department.. only business men and market research data suggesting that she target the youth#taylor swift

46 notes

·

View notes

Text

sometimes i wonder if it'd ever be feasible to like.. Make a few bucks with art. Selling prints or stickers or smt.

#then again it'd require a bunch of business research and also like.. i dont think any of my art is marketable like that#plus there's like 'quality' dimensions for DPI and whatnot that ive never really taken into consideration#idk#just musing#every now and then i revisit this idea#but it all seems a lot of work when it's unlikely that people will actually want it yanno :' )

9 notes

·

View notes

Text

lol i keep forgetting to talk about what im doing. im going to write a book about the chu-han contention. i think it will be very fun, and i want to prove to myself that i can do it.

goals:

[] write 200 words a day

[] finish in 2 years

[] get rejected by 20 publishers. if no one takes it i will self publish.

#my writing#every single piece of advice i've ever read: publishing is a business! you need to write something that can sell! research the market and#follow the latest trends!#me: got it. write a historical novel about the chu-han contention.

16 notes

·

View notes

Text

first time people tell a content creator GIVE US MORE ADS

#i dont think they are greedy corporate monsters. i think they are creators trying to run a business with no knowledge on how to do that#icarus flying too close to the sun and all that#is just so clear they didn't make any kind of market research#a youtube poll would have helped them#is just a shitty thing because they clearly just want to have more creative freedom and do bigger things#but if you are running a business then you also need to think about your audience. which i don't think they did#and the international issue with dollars in this economy#+ the need to use a vpn in order to watch in certain countries apparently#+ an audience of mostly 20 somethings and younger people who have other priorities#and like nearly every single person that i've seen that actually likes this idea. has also said that are not paying#because they can't afford it. so even if people were on board with this. is just not viable with their audience#like sorry. but 'streaming service' is not plan b on the list of things to if you dont wanna rely so much on ads#and them doing a 14min long video that is edited like a shitty corporate apology video#in which you say 'if you can't give us money. bye ig' while promoting#a show about people traveling to dif places and paying expensive meals#while also saying you have no money to pay your 25!!! employees#not to mention not clarifying anything and leaving everything in vague terms#like international issues. whether you are deleting your previous youtube content or not (they don't say anything about this on the vid....#.... Variety said they were gonna do it. but then they did the pinned comment so it feels like they are backtracking...#...even if they were never gonna delete it)#what newer content you want to make. the pros you get subscribing#broken record with this. but watch the og dropout ad. its clear. adresses concerns. tells you what shows would be available#and the one moment that they use sad piano music is used with irony#ok. no further comments until they say something lol#watcher#my post

18 notes

·

View notes

Text

How To Utilize The Semrush Keyword Magic Tool

Semrush is among the best SEO tools available in the market. Many professional bloggers and top industry leaders widely use Semrush. Semrush offers a magical tool named Semrush Keyword Magic Tool that makes keyword research much easier. Keyword research is one of the most prominent pillars of SEO, which helps improve business by leveraging organic traffic by targeting the right keywords. In this article, we will learn about the Semrush Keyword Magic Tool, its features, filters, and how to use it.

What is the Semrush Keyword Magic tool?

The Keyword Magic tool is a powerful keyword research tool on Semrush. It allows you to gain access to the publicly available billion keywords and offers an adaptive interface for research. All you need to do is enter the required word that you want to research into the search bar. This tool shows you a dynamic table with related terms split into subtropics.

Features of the Semrush Keyword Magic tool

Some of the key factors of the Semrush Keyword magic tools are as follows:

Extensive keyword database: This tool has access to a large public database of more than a billion words covering a variety of industries and niches. This database helps the user find the most relevant keyword for the target audience.

Automated keyword grouping: This tool automatically groups related keywords into topic-specific categories, making it easy to identify the most relevant keywords by organizing them.

Intent analysis: The Keyword Magic Tool lets you determine which keywords are transactional, navigational, or informative. It can help you better understand the intent behind search queries, allowing you to focus on keywords that have a higher chance of producing leads or sales.

Search volume calculations: This tool can help you discover how frequently people search for certain phrases. It gives you precise estimates of search volume for each keyword, which is required for setting priorities for your keyword research.

Keyword difficulty estimations: For every keyword, the Keyword Magic Tool offers difficulty estimates that show how competitive it is to rank for that particular phrase. By focusing on phrases that you have a strong probability of ranking for, you can use this information to help you prioritize your keyword research efforts.

SERP Features Opportunities: This tool allows you to determine which terms result in SERP elements like Knowledge Panels and Featured Snippets. You can then use this information to optimize your content so that it appears in these worthwhile search results.

Advanced filtering and sorting: The Keyword Magic Tool allows you to filter and arrange your keyword lists based on various factors, such as search volume, keyword difficulty, purpose, and SERP attributes. It facilitates the process of identifying the best keywords for your requirements.

Save, manage and export keyword lists: This tool allows you to export your keyword lists to CSV and XLS files, as well as other Semrush tools, and save them for later use.

Conclusion

Hence, you must go through this ultimate guide to get deeper knowledge regarding this what role the semrush keyword magic tool plays in uplifting your website.

#semrush#Semrush magic tool#semrush keyword magic tool#seo#keyword research#business#digital marketing#ecommerce

3 notes

·

View notes

Text

Our all-volunteer team has prepared an awesome set of postable images, printable fliers, and copy-paste-able text for you to help us spread the word about the Marketplace Accreditation Research Survey.

Find these and more on our share kit.

How to help:

Post a blurb or one of these images on your social media page.

Put up or hand out fliers at a local flea or artisan market.

Hang a flier up on a relevant bulletin board, i.e. at your university or craft club.

Take a picture of a flier you've put up and share with us on one of our social media pages; you can find our Instagram, Twitter, Reddit, etc. on our website through the share kit link above. For Tumblr, just tag us or send an ask!

Are you an indie seller with a blog or newsletter? Include a blurb, or one of these images, to let your supporters know that their voices are wanted!

Are you a fan of a particular indie seller? Send them a question, email, DM, etc. asking them to spread the word!

With permission from the owners/mods, share with your Discord servers!

You have the power to make a difference in how independent artists and curators are treated by our marketplaces. Speak out! The more people talking, the more people will be motivated to join the conversation! ✊

#small business#workers rights#artisans#handmade#vintage#flea market#craft market#solidarity#unions#Etsy#Amazon#Ko-fi#artisans cooperative#go imagine#Michael's marketplace#indie sellers guild#Marketplace accreditation#Research

17 notes

·

View notes

Text

Death of Twitter and sudden increase in enjoyment of social media

Prior to Twitter dying, I spent about 50% of my time there, and 40% of my time here on Tumblr, and the rest on Instagram.

I always felt a compulsion to be active on Twitter, I felt it would be good for the company, even though it was never terribly enjoyable for me, personally. I don’t have a great reason why. I curated my feed but it always felt like a losing battle.

Since EM bought Twitter, I have been spending about 75% of my social media time here on Tumblr, I keep YouTube on in the background when I’m working, and I’m getting into Pinterest.

Pinterest I feel is going to be extremely similar. I like to browse and file pins for 10 minutes while coffee is brewing or I’m waiting a meeting to start. It feels like “tumblr with broader image discovery.” Prior to this I never went on Pinterest. It had been years since I cracked it open.

YouTube -- I finally replaced my ancient television and after being perplexed with the new options (i am deeply, deeply a book person) -- is great for having in the background. I’m enjoying my time there immensely. I am not an overly active YouTube watcher. Prior to all of this I spent maybe 10 minutes on YouTube a year.

Tumblr -- I post here a lot. I enjoy it. I am using it less as a visual discovery platform than before (Pinterest is taking care of that), but I’m using it more and skipping text posts far less.

TikTok / Instagram -- I’m using Instagram now for more personal rambles, it is easy to format things for cross posting, so even minimal reward to the business is worth minimal effort. I can see myself using both Instagram and TikTok for very casual inking sessions or drawing sessions.

Overall, like I say, I would rate my time on social media to be exceptionally less frustrating and equally-so more enjoyable.

The death (to me) of Twitter has improved my mental health.

I had no idea how much aggravation I allowed/invited with that platform. This is entirely unexpected and I’m sinking it into my brain.

Thank you? Elon Musk I guess?

114 notes

·

View notes

Text

what u think, to much colour, or less?

https://sdesignt.threadless.com/

#tshirt#animals#design#rainbow#computer#Innovation#AI#Blockchain#Crypto#Tech#Digital#Data#BigData#Automation#Cloud#Cybersecurity#Startup#Entrepreneur#Leadership#Marketing#Business#Ecommerce#Content#Performance#Development#Research#Analytics#Growth#Productivity#Trend

2 notes

·

View notes

Text

3 notes

·

View notes

Text

#keyword research tool#dropshipping#home based business#kitchen cleaning#how to blog#link building strategy#x reader#legend of zelda#affiliate marketing for beginners#affiliate marketing

2 notes

·

View notes

Text

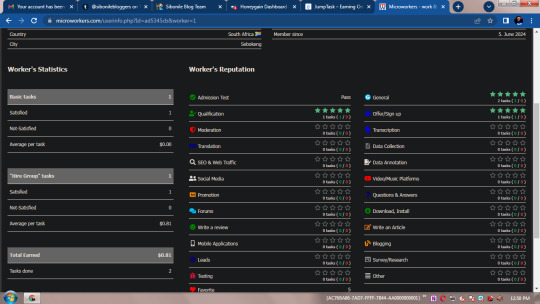

Admission.. check, Qualification..check, The rest is history

#microworker#microblog#online hustle#making money online#online marketing#micro tasks#profits#patience#100 days of productivity#wake up#4ir#revolution#transformation#market analysis#market research#marketing#business#online jobs

2 notes

·

View notes

Text

There's a little car I've seen driving around town and the entire back of it is covered in horny anime girl stickers. It's like a collage of massive bongadahongadalongahongas. Honestly I kind of respect it.

#its in the parking lot rn and i kinda wanna walk up and take a closer look#IM IN THE BUSINESS OF STICKER MAKING OK I WANNA KNOW WHAT SELLS#I NEED TO LOOK AT THE ANIME TIDDIES FOR THE SAKE OF MARKET RESEARCH

6 notes

·

View notes

Text

Top Business Consulting Firms in India: Praxis Global Alliance

Elevate your business with Praxis Global Alliance, the next-gen business consulting and knowledge services firm for empowering your business for sustainable success. We delve into the essence of the company, uncovering the pillars that make it a beacon in the realm of business advisory. In a rapidly evolving business environment, business research and management are not a choice; it is a necessity. Embark on a journey into the world of strategic business consulting with Praxis Global Alliance.

#best business consultants in india#market research consulting#business advisory services#market research agency in india#business consulting and management#market research firm#business consulting firms in india

3 notes

·

View notes