#business consultants uae

Explore tagged Tumblr posts

Text

Start Your IT Company in Dubai: Tips from Leading UAE Golden Visa Consultants

Dubai has positioned itself as a beacon of innovation and technology, making it an attractive destination for entrepreneurs looking to start their IT companies. The city offers a unique blend of a favorable business environment, strategic geographical location, and cutting-edge infrastructure. However, navigating the complexities of setting up a business in a foreign land can be challenging. This is where the expertise of UAE Golden Visa consultants comes in, providing invaluable guidance to help you turn your entrepreneurial dreams into reality.

Understand the Business Landscape

Before diving into the establishment of your IT company, it’s crucial to gain a solid understanding of Dubai’s business landscape. Research the local market to identify trends, demand, and competition in the IT sector. Pay special attention to sectors like cloud computing, cybersecurity, and artificial intelligence, as these areas are rapidly growing. Leading UAE Golden Visa consultants can provide you with market insights and data, helping you make informed decisions about your business model and services.

Choose the Right Business Structure

In Dubai, you have multiple options for structuring your IT company, such as establishing it in a free zone or as a mainland entity. Free zones like Dubai Internet City offer benefits like 100% foreign ownership, tax exemptions, and simplified licensing processes tailored specifically for tech businesses. However, they come with limitations on doing business directly in the UAE market outside the free zone. On the other hand, a mainland company allows you to operate across the UAE but may require a local sponsor. UAE Golden Visa consultants can assist you in selecting the best structure based on your business goals and operational needs.

Secure the Necessary Licenses

Obtaining the right licenses is a critical step in the company setup process. Depending on your business activities, you may need specific permits, such as an IT consultancy license or software development license. Leading UAE Golden Visa consultants are well-versed in the licensing requirements and can help you navigate this complex landscape. They will ensure that you gather all necessary documentation and submit your application accurately, significantly reducing the chances of delays or rejections.

Leverage the Golden Visa Benefits

The UAE Golden Visa is a game-changer for foreign entrepreneurs. It grants long-term residency, allowing you to live, work, and study in the UAE without the need for a local sponsor. This visa is available to investors, entrepreneurs, and specialized talents, making it a powerful tool for those looking to set up their IT companies. UAE Golden Visa consultants can guide you through the eligibility criteria and application process, ensuring you make the most of this opportunity.

Build a Strong Network

Networking is vital for the success of any business, and Dubai offers ample opportunities to connect with industry leaders, potential clients, and partners. Attend tech conferences, workshops, and networking events to build relationships in the local tech community. Your UAE Golden Visa consultants can introduce you to key players and provide insights into networking strategies that can enhance your business prospects.

Focus on Marketing and Branding

In a competitive market like Dubai, effective marketing and branding strategies are essential for standing out. Develop a comprehensive marketing plan that includes digital marketing, social media engagement, and SEO to reach your target audience effectively. Collaborate with local marketing experts or agencies that understand the UAE market, and seek advice from your consultants on branding strategies that resonate with the local culture.

Stay Compliant and Adapt

Once your IT company is up and running, maintaining compliance with local regulations is crucial. Regularly consult with your UAE Golden Visa consultants to ensure that your business adheres to all legal requirements. Additionally, stay adaptable and open to feedback from clients and the market. The tech landscape is ever-evolving, and flexibility can be your greatest asset in sustaining long-term success.

Conclusion An IT company setup in Dubai offers unparalleled opportunities for growth and innovation. With the guidance of leading UAE Golden Visa consultants, you can navigate the complexities of the business setup process with confidence. From understanding the market landscape to leveraging the benefits of the Golden Visa, these experts will be your partners in transforming your vision into reality. By following their tips and advice, you can establish a successful IT company that thrives in one of the world's most dynamic markets.

#business management#klay consultants#business consulting services in dubai#business development#business consultants uae#business services#business setup services#business setup uae#retail business setup in dubai#it consulting companies in uae

0 notes

Text

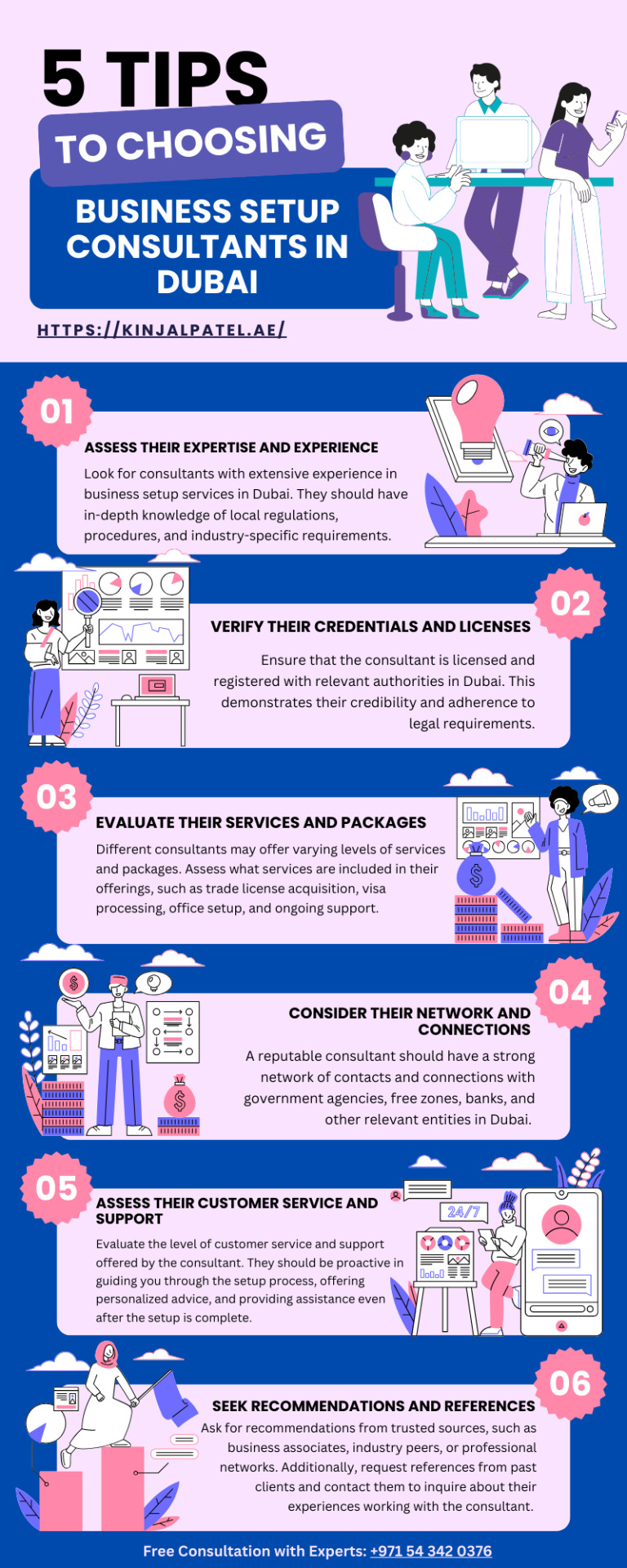

5 Tips to choosing the business setup consultants in Dubai

Explore these five essential tips to help you select the ideal business setup consultants UAE for your venture. Learn how to leverage industry knowledge, assess track records, evaluate services, consider client feedback, and prioritize personalized support.

#business setup Dubai#business consultants UAE#business consultant dubai#start business in dubai#setup business Dubai#company formation in dubai

0 notes

Text

Hit the bullseye with the right ERP software! 🎯

Magtec Business Solutions helps you choose the perfect ERP solution to take your business to new heights.

Contact us today for a demo!

#erp#magtec#magtecsolutions#business#solutions#uae#software#technology#growth#success#innovation#digitaltransformation#cloud#enterprise#resources#planning#implementation#consulting#support#customization#integration#automation#efficiency#productivity#cost#savings

2 notes

·

View notes

Text

Looking to set up your business in Dubai or the UAE? 🌟 At Trinity Group, we offer end-to-end support, from business setup and PRO services to banking, accounting, and tax assistance. Whether you’re a startup or an established company, our expert team ensures a seamless process so you can focus on growing your business.

Why Choose Us?

✅ Comprehensive business setup services

✅ Hassle-free PRO services

✅ Expert banking, accounting, and tax support

✅ Tailored solutions for your unique needs

Join the countless successful businesses that have trusted Trinity Group to pave their way in the UAE. Let’s turn your business dreams into reality!

👉 Visit us at Trinity Group to learn more and get started today!

#BusinessSetup #DubaiBusiness #UAE #Entrepreneurship #TrinityGroup

2 notes

·

View notes

Text

Unlocking Business Brilliance: UAE's Free Zone Company Formation - PRO Deskk

Embarking on the journey of launching a new business can often feel like navigating through uncharted waters. But fret not – at PRO Deskk, we're dedicated to turning daunting tasks into delightful experiences. With our extensive expertise, we serve as your reliable partner in streamlining the incorporation process. Specializing in providing exceptional services tailored for new ventures, especially within the bustling landscape of the United Arab Emirates, we're steadfast in our commitment to transforming your entrepreneurial aspirations into tangible realities.

Within the dynamic realm of UAE business, Free Zone Company Formation emerges as a true game-changer. These zones, also referred to as free trade or special economic zones, serve as havens for forward-thinking entrepreneurs. What's the secret ingredient, you ask? It's the unparalleled freedom within Free Zones, where investors bask in the luxury of 100% business ownership – a privilege not always accessible on the mainland. Picture crafting your business vision without any hindrances – that's the enchantment of Free Zones.

At Dubai Business Centers, we pride ourselves as premier business consultants specializing in orchestrating the symphony of Dubai Free Zone company setup and operations across all UAE Free Zones. Trusted advisors to corporations and individuals globally, we seamlessly blend local expertise with a global perspective to navigate you through the intricacies of establishing or expanding your business in Dubai or any Free Zone.

#PRODeskk#BusinessConsultants#UAEBusiness#FreeZoneSetup#DubaiBusiness#CompanyFormation#UAEFreeZones#BusinessOpportunities#BusinessSetup#UAEInvestment#DubaiEntrepreneurs#CorporateServices#business consulting#business ideas#business strategy#business setup in uae#business development#business setup in dubai#business tips#business success

3 notes

·

View notes

Text

Business setup in Dubai

Business setup in Dubai refers to the process of establishing a business entity within the city of Dubai, which is one of the seven emirates of the United Arab Emirates (UAE). Dubai is a thriving business hub known for its strategic location, robust infrastructure, and business-friendly environment. Here is a detailed explanation of business setup in Dubai:

Mainland Business Setup: Mainland business setup allows businesses to operate within the local market of Dubai and the UAE. It requires partnering with a local Emirati sponsor or a local service agent, depending on the nature of the business activity. The sponsor holds a minority share (typically 51%) in the company, while the majority share can be owned by foreign investors.

Free Zone Business Setup: Free zones in Dubai are designated areas that offer attractive incentives and benefits to businesses. These include 100% foreign ownership, tax exemptions, full repatriation of profits, and simplified procedures. Each free zone in Dubai caters to specific industries or sectors, such as Dubai Multi Commodities Centre (DMCC) for commodities trading, Dubai Internet City (DIC) for technology companies, and Dubai Media City (DMC) for media and advertising companies.

Offshore Business Setup: Dubai also offers offshore company formation through jurisdictions such as JAFZA Offshore and RAK Offshore. Offshore companies are not allowed to operate within the UAE market but are ideal for international business activities, asset holding, or as a vehicle for investment and wealth management. They provide privacy, tax advantages, and ease of administration.

Legal Structures: Dubai offers various legal structures for business setup, including Limited Liability Company (LLC), Sole Proprietorship, Partnership, Branch of a Foreign Company, and more. The choice of legal structure depends on factors such as ownership requirements, liability considerations, and business objectives.

Licensing and Permits: Business setup in Dubai requires obtaining the necessary licenses and permits from the relevant authorities. This includes trade licenses, professional licenses, industrial licenses, and specialized permits based on the nature of the business activity. The requirements vary depending on the type of business and the jurisdiction in which it is established.

Office Space and Infrastructure: Businesses in Dubai need to secure suitable office space or facilities to operate. This can be done through leasing commercial spaces, utilizing shared office spaces, or renting virtual offices. Dubai offers state-of-the-art infrastructure, modern office buildings, and world-class amenities to support business operations.

Visa and Immigration Services: Business setup in Dubai includes visa and immigration services for company owners, employees, and their dependents. This involves obtaining residence permits, work permits, investor visas, and other necessary documents from the Dubai Department of Economic Development (DED) and the General Directorate of Residency and Foreigners Affairs (GDRFA).

Compliance and Regulations: Businesses in Dubai must comply with local regulations, including financial reporting, tax obligations, labor laws, and industry-specific regulations. Compliance requirements vary based on the legal structure and the nature of the business activity. It is important to stay updated with the regulations and engage professional advisors to ensure ongoing compliance.

Dubai offers numerous advantages for businesses, including a strategic location that serves as a gateway to the Middle East, Africa, and Asia, a robust infrastructure, a diverse and multicultural workforce, political stability, and a supportive business ecosystem. However, navigating the business setup process in Dubai can be complex, and it is advisable to seek the assistance of experienced business setup consultants who can guide you through the legal requirements, procedures, and best practices to ensure a successful and compliant business establishment.

#business#business services#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#business setup services in dubai#businessinuae#businesssetup#businesssetupdubai

8 notes

·

View notes

Text

5 Essential Time Tracking Software for Consultants all Must Use in 2023!

As the clock struck midnight, Shofia, a talented and sought-after consultant, found herself buried under piles of paperwork. Her desk was cluttered with invoices, expense reports, and client files. Lost in a sea of chaotic deadlines and endless tasks, she couldn't help but wonder if there was a better way to manage her time. Little did she know that the solution to her problem lay within the realms of time tracking software for consultants. In this article, we will explore why implementing such software is crucial for consultants like Shofia to streamline their workflow and maximize productivity.

1.Clockify: time tracking tools for consultants

Clockify is a comprehensive time tracking tool that offers numerous features and benefits for consultants. With its user-friendly interface and simple setup process, Clockify makes it easy for consultants to accurately track their billable hours and manage their projects more efficiently.

Features of Clockify

1. Time Tracking: Consultants can easily track the time they spend on tasks or projects.

2. Project Management: Clockify provides an overview of ongoing projects, helping consultants stay organized and prioritize their work.

3. Reporting and Analytics: Clockify generates detailed reports that show how consultants are spending their time. This helps identify areas for improvement in productivity and efficiency.

4. Invoice Generation: Clockify allows consultants to create professional invoices directly from tracked time entries.

5. Collaboration: Consultants can invite team members or clients to join projects in Clockify, improving communication and collaboration.

6. Integration: Clockify works well with popular project management tools like Trello, Asana, and Basecamp.

By offering these features, Clockify helps consultants manage their time effectively, bill accurately, and improve productivity and client satisfaction.

Benifits of Using clockify

Efficiently track your time and improve productivity.

Streamline project management and stay organized.

Gain valuable insights and make data-driven decisions.

Generate professional invoices effortlessly.

Foster collaboration and enhance teamwork.

Seamlessly integrate with other tools for a seamless workflow.

Effortlessly track your time across multiple platforms and devices for accurate billing and project management.

Pros:

Easy to use and navigate interface

Click here to Read more

#business consulting#time tracking#time tracking software#study abroad consultants#vat consultants in uae#overseas education consultants#visa consultants#student visa#immigration consultants#overseaseducation#studyingermany#canadavisa

4 notes

·

View notes

Text

Launch Your Own Grocery Business Setup in Dubai with the Help of Business Setup Consultants

Dubai, a worldwide economic powerhouse recognized for its dynamic business landscape, provides attractive chances for entrepreneurs interested in entering the supermarket industry. Setting up a grocery store in this crowded city necessitates careful consideration of a variety of aspects, ranging from regulatory regulations to market trends. Many astute business owners choose to manage this complicated procedure with the help of business setup consultants in Dubai, who bring expertise and local knowledge to the table.

Understanding the regulatory framework in Dubai is the first stage in the grocery business startup process. Business setup experts are essential in guiding entrepreneurs through the legal complexities and assisting them in obtaining the relevant licenses and permissions. These experts are well-versed in local rules and regulations, ensuring that the grocery store meets all of the authorities' criteria. This proactive strategy not only saves time but also reduces the chance of legal difficulties, allowing entrepreneurs to concentrate on the fundamental components of their firm.

Market research is another critical component of establishing a successful grocery business setup in Dubai. Consultants for business setups provide essential insights into customer behavior, tastes, and trends in the local market. With this knowledge, entrepreneurs may adjust their offers to match the broad and multicultural population of Dubai. Consultants assist organizations in making informed decisions that match with the particular characteristics of the Dubai market, from product sourcing to pricing tactics.

In the food industry, where timely and efficient supply chains are critical, logistical issues are key. Business setup consultants in Dubai use their network and expertise in the local logistics industry to assist entrepreneurs in establishing smooth operations. These consultants play a critical role in ensuring that the food industry can properly negotiate the intricate network of Dubai's logistics infrastructure, whether it's locating reputable suppliers or optimizing distribution methods.

Grocery business setup in Dubai is a worthwhile endeavor for entrepreneurs looking to get into the city's thriving economy. From navigating legal procedures to understanding market dynamics and optimizing logistics, the assistance of business setup specialists is important in expediting the process. Entrepreneurs may embark on their grocery business journey with confidence, knowing that they have a qualified partner to guide them through the intricacies of developing a successful operation in this dynamic city.

#business news#business#business growth#business startups#business setup in dubai#business setup in uae#company formation in dubai#company formation consultant in dubai#company setup in dubai#grocery store#grocery shopping#grocery delivery#grocery in dubai#grocery business setup

2 notes

·

View notes

Text

Dubai's Top Auditors - Accounting, VAT, Business Experts

Saif Chartered Accountants stands out as Dubai's premier auditors due to our unparalleled understanding of the regional market nuances. Our team's lifelong immersion in the UAE and GCC ensures insightful grasp of local business intricacies. We cultivate enduring client relationships, offering year-round expert advice, setting us apart in commitment and service.

2 notes

·

View notes

Text

#business#business consulting#company formation#consultants#businesssetupinuae#businesssetup#businessconsultantsindubai#dubai#uae

2 notes

·

View notes

Text

Top Business Consultant in Dubai

Table of Contents

Introduction

Importance of Business Consultancy Services in Dubai

Mainland Company Setup in Dubai

LLC Company Formation in Dubai

Best Business Consultancy Firms in Dubai

Free Zone Company Registration in UAE

How to Choose the Right Business Consultant in Dubai

Frequently Asked Questions (FAQs)

Conclusion

1. Introduction

This article will guide you through the different types of company setups in Dubai, introduce you to the best business consultancy firms in Dubai, and answer common questions regarding business setup in the UAE.

2. Importance of Business Consultancy Services in Dubai

Establishing a business in Dubai can be a daunting task, especially for those unfamiliar with the regulatory landscape. Business consultancy services in Dubai are essential for helping entrepreneurs understand the legal and business environment. Here are some reasons why these services are invaluable:

Legal Compliance: Consultants ensure that businesses are in compliance with the legal requirements of the UAE, helping with licensing, documentation, and approvals.

Market Insights: They provide critical market analysis, helping entrepreneurs identify opportunities and target markets for their products or services.

Cost Efficiency: Professional consultants help streamline the setup process, ensuring that entrepreneurs avoid unnecessary delays and expenses.

Guidance on Business Structure: Consultants provide expert advice on the most suitable business structure, whether it’s a Mainland company setup in Dubai, an LLC company formation in Dubai, or a Free zone company registration in UAE.

3. Mainland Company Setup in Dubai

A Mainland company setup in Dubai allows businesses to operate directly in the local market and outside the UAE. To establish a mainland company, the following steps are essential:

Selecting the Business Activity: The first step is to choose the right business activity, as this will dictate the type of license required.

Legal Structure: You can choose from a variety of structures, including sole proprietorship, partnership, or a Limited Liability Company (LLC).

Local Sponsor Requirement: For foreign investors, a local Emirati sponsor is required to hold a minimum of 51% of the company shares. However, this has been relaxed in certain sectors, allowing full foreign ownership in some cases.

Office Space: All mainland companies are required to have a physical office in Dubai, which is subject to licensing conditions.

Permits and Approvals: The company must get approval from the Department of Economic Development (DED) and submit relevant documents such as passport copies, visa details, and proof of address.

For foreign investors, business consultancy services in Dubai are especially useful to understand the implications of local sponsorship and other regulatory aspects.

4. LLC Company Formation in Dubai

The LLC company formation in Dubai is the most popular and flexible option for foreign entrepreneurs. It combines the benefits of limited liability with the freedom to conduct business within Dubai and internationally. Here are key points for setting up an LLC in Dubai:

Ownership Structure: An LLC requires a minimum of two shareholders and a maximum of 50, with each shareholder’s liability limited to the capital contribution.

Local Sponsor: In most cases, a local sponsor or service agent is required to hold 51% of the shares, while the foreign investor holds the remaining 49%.

Business Scope: LLCs can engage in a broad range of business activities, including trading, professional services, and manufacturing.

Office Space: LLCs must have a physical office, which is mandatory for obtaining a business license.

Visa and Employee Permits: LLC companies are eligible to apply for employee visas depending on the size of the office and business requirements.

Many entrepreneurs prefer LLC formation due to the stability it offers and the broad range of activities it allows. Business consultancy services in Dubai are invaluable in helping entrepreneurs set up their LLCs seamlessly.

5. Best Business Consultancy Firms in Dubai

Dubai is home to some of the best business consultancy firms in Dubai, offering specialized services for every type of business setup. Some of the top consultancy firms include:

PRO Partner Group: Known for its comprehensive services, including mainland company setup in Dubai, LLC formation, and visa processing.

Virtuzone: This firm specializes in helping entrepreneurs set up businesses in free zones, mainland, and LLC formations. They provide a full suite of services from licensing to operational support.

Creative Zone: A well-established consultancy firm in Dubai, Creative Zone helps businesses register in free zones, set up LLCs, and navigate the complex regulatory environment.

FMS Tech Consultancy: Specializing in LLC company formation in Dubai and business setup services in Dubai, FMS Tech offers tailored services to ensure your business is set up in the most efficient way.

These firms stand out due to their expertise, reputation, and commitment to helping entrepreneurs navigate the local business landscape.

6. Free Zone Company Registration in UAE

Free zone company registration in UAE is an increasingly popular option for entrepreneurs who want to enjoy complete ownership and tax exemptions. Free zones offer significant benefits, such as:

100% Foreign Ownership: Unlike mainland companies, businesses set up in free zones do not require a local sponsor.

Tax Benefits: Many free zones offer tax holidays for up to 50 years, making it an attractive option for businesses focused on international markets.

Simplified Processes: Free zone companies benefit from simplified registration processes and reduced paperwork.

Industry-Specific Zones: The UAE offers several free zones tailored to specific industries, such as technology, media, and healthcare, offering entrepreneurs the ideal environment for their business.

Popular free zones in Dubai include:

Dubai Multi Commodities Centre (DMCC)

Dubai Silicon Oasis

Dubai Internet City

Free zone company registration is a great option for businesses that don’t need to trade directly with the UAE market but wish to benefit from the advantages of a tax-efficient setup.

7. How to Choose the Right Business Consultant in Dubai

When selecting a business consultant in Dubai, consider the following factors:

Experience and Expertise: Look for consultants with a proven track record in your specific industry and with deep knowledge of Dubai’s business regulations.

Comprehensive Services: Choose a consultant that offers end-to-end services, including legal, financial, and operational support.

Local Knowledge: A consultant with local market knowledge will help you navigate the UAE’s specific business landscape.

Client Testimonials: Research client reviews to assess the quality of service and customer satisfaction.

Transparency in Pricing: Choose a consultant who provides clear, transparent pricing without hidden charges.

8. Frequently Asked Questions (FAQs)

Q1: What is the process of setting up a Mainland company in Dubai? Setting up a mainland company in Dubai involves selecting a business activity, deciding on a legal structure, obtaining a local sponsor, registering your office space, and obtaining approvals from the Department of Economic Development (DED).

Q2: Can foreign investors fully own a company in Dubai? Yes, foreign investors can own 100% of their business in free zones. However, in mainland businesses, a local Emirati sponsor typically holds 51% of the shares in LLC companies.

Q3: What are the advantages of Free Zone company registration in UAE? Free zones offer 100% foreign ownership, tax exemptions, simplified registration processes, and the ability to operate internationally without the need for a local sponsor.

Q4: How long does it take to set up a business in Dubai? The time to set up a business in Dubai varies depending on the company structure, but with the help of a business consultancy firm in Dubai, the process can be completed within 1–2 weeks for a Free Zone company and 2–3 weeks for a Mainland company.

9. Conclusion

Setting up a business in Dubai offers a wealth of opportunities. Whether you’re interested in mainland company setup in Dubai, LLC company formation in Dubai, or free zone company registration in UAE, the process can be simplified with the help of business consultancy services in Dubai. Choosing the right consultant ensures that your business is set up efficiently, legally, and in compliance with local regulations. With the right guidance, Dubai’s thriving business environment offers an excellent platform for success and growth.

#Local#company registration in Dubai#Business registration online#in UAE#Best business setup#consultants Dubai#Business consulting firms in#Dubai#Free zone company registration#in uae#Online company registration in#business set up companies in#company formation consultants#in Dubai#Dubai Business Set Up#Consultancy#Dubai mainland company#formation cost#Start a company in dubai#online#Top Business startup in Dubai#Best business consultancy#firms in Dubai#Best 5 company formation#services in Dubai#company setup consultants in#dubai#How to Open a business in#Dubai freezone company#formation

0 notes

Text

Key Benefits of Starting a Manufacturing Business in Dubai

Introduction to starting a manufacturing business in Dubai

Embarking on an entrepreneurial journey can be both exhilarating and daunting, especially when it comes to establishing a manufacturing business. However, if you're considering setting up shop, Dubai presents a unique and promising opportunity. As a global hub for trade, commerce, and innovation, Dubai offers a dynamic ecosystem that can propel your manufacturing venture towards success.

In this comprehensive guide, we'll explore the key benefits of a manufacturing business setup in Dubai, guiding you through the steps to establish your operations and unlock the vast potential of this vibrant emirate.

Why Dubai is the Perfect Location for Manufacturing Businesses

With its strategic location, cutting-edge infrastructure, and pro-business policies, Dubai stands out as an ideal destination for manufacturing enterprises. Situated at the crossroads of Europe, Asia, and Africa, Dubai serves as a gateway to a vast consumer market, providing unparalleled access to regional and global trade networks.

The emirate's state-of-the-art transportation systems, including world-class airports, seaports, and a sophisticated road network, ensure seamless logistics and efficient distribution of your manufactured goods. Additionally, Dubai's commitment to sustainable development and renewable energy initiatives creates a conducive environment for eco-conscious manufacturing practices.

Benefits of starting a manufacturing business in Dubai

Starting a manufacturing business in Dubai offers a multitude of advantages that can propel your enterprise towards success. Some of the key benefits include:

Tax-friendly environment: Dubai's tax-free regime, with no corporate or personal income taxes, provides a significant financial advantage for your manufacturing operations.

Access to a skilled workforce: Dubai's diverse and cosmopolitan population offers a readily available pool of skilled labor, including engineers, technicians, and specialized professionals, to support your manufacturing needs.

Robust infrastructure and logistics: The city's world-class infrastructure, including advanced transportation networks, reliable utilities, and cutting-edge telecommunications, ensures the smooth flow of your manufacturing processes.

Favorable business regulations: Dubai's business-friendly policies, streamlined bureaucratic procedures, and investor-friendly regulations create an enabling environment for manufacturing enterprises to thrive.

Strategic location and global connectivity: Dubai's strategic location at the crossroads of major trade routes provides unparalleled access to regional and international markets, allowing you to expand your customer base and distribution channels.

Incentives and support: The Dubai government offers various incentives, including free zones, industrial parks, and specialized economic zones, along with dedicated support services to facilitate the setup and growth of manufacturing businesses.

Political and economic stability: Dubai is renowned for its political and economic stability, providing a secure and reliable environment for your manufacturing operations to flourish.

Steps to set up a manufacturing business in Dubai

Establishing a manufacturing business in Dubai involves a systematic process that ensures compliance with local regulations and sets the foundation for your long-term success. The key steps include:

Choose your business structure: Determine the most suitable legal entity for your manufacturing business, such as a limited liability company (LLC), a free zone company, or a branch office.

Obtain the necessary licenses: Secure the required trade licenses, industrial licenses, and any specific permits or approvals based on the nature of your manufacturing activities.

Secure your business location: Identify the ideal location for your manufacturing facility, considering factors such as infrastructure, zoning regulations, and access to resources and talent.

Acquire the necessary equipment and machinery: Invest in state-of-the-art manufacturing equipment and technologies to ensure efficient production and maintain a competitive edge.

Recruit and train your workforce: Build a talented and dedicated team of professionals, including engineers, technicians, and operational staff, to drive your manufacturing operations.

Establish your supply chain: Develop a robust supply chain, including sourcing raw materials, managing inventory, and optimizing logistics, to ensure the seamless flow of your manufacturing processes.

Comply with legal and regulatory requirements: Familiarize yourself with Dubai's labor laws, environmental regulations, and industry-specific standards to ensure your manufacturing business operates in full compliance.

Legal and regulatory requirements for manufacturing businesses in Dubai

Dubai's robust legal and regulatory framework for manufacturing businesses ensures a structured and transparent operating environment. Key requirements include:

Business License: Obtaining the appropriate trade license, which may vary depending on the nature of your manufacturing activities.

Industrial License: Securing an industrial license that grants permission to engage in specific manufacturing operations.

Environmental Approvals: Compliance with environmental regulations and obtaining necessary approvals from the Dubai Municipality or other relevant authorities.

Labor and Employment Laws: Adherence to Dubai's labor laws, including worker contracts, employee benefits, and workplace safety standards.

Quality and Safety Standards: Ensuring your manufacturing processes and products meet the required quality and safety standards, as stipulated by industry regulators.

Finding the right location for your manufacturing business setup in Dubai

Selecting the optimal location for your manufacturing business in Dubai is a crucial decision that can significantly impact your operations and growth potential. Some key considerations include:

Free Zones: Dubai's specialized free zones, such as Dubai Industrial City, offer purpose-built industrial parks with tailored infrastructure, utilities, and support services for manufacturing enterprises.

Industrial Parks: Dubai's industrial parks, like Dubai Investment Park and Dubai South, provide well-developed facilities, logistics, and access to a skilled workforce.

Proximity to Key Resources: Prioritize locations with easy access to raw materials, transportation hubs, and a reliable supply of utilities, such as electricity and water.

Zoning and Land Use Regulations: Ensure the chosen location aligns with the zoning and land use regulations for your specific manufacturing activities.

Accessing the local and international market for your manufactured products in Dubai

Dubai's strategic location and well-established trade networks offer unparalleled access to both local and global markets for your manufactured products. Key strategies to leverage this advantage include:

Tapping into the Domestic Market: Leverage Dubai's large and affluent consumer base, as well as the city's position as a regional hub, to establish a strong foothold in the local market.

Expanding to the GCC and Middle East: Utilize Dubai's connectivity to seamlessly distribute your products throughout the Gulf Cooperation Council (GCC) region and the broader Middle East.

Accessing International Markets: Leverage Dubai's world-class logistics infrastructure, including its airports and seaports, to efficiently export your manufactured goods to global markets.

Leveraging Free Trade Agreements: Take advantage of Dubai's extensive network of free trade agreements to gain preferential access to international markets and reduce trade barriers.

Cost considerations for starting a manufacturing business in Dubai

While Dubai offers a business-friendly environment, it is essential to carefully evaluate the cost factors associated with establishing and operating a manufacturing business in the emirate. Key considerations include:

Startup Costs: Factor in the costs of business setup, licensing, and the acquisition of land, facilities, and equipment.

Operating Expenses: Account for ongoing costs, such as utilities, labor, raw materials, maintenance, and compliance with regulations.

Tax Implications: Understand the tax-free environment and any applicable duties or fees that may impact your manufacturing operations.

Financing Options: Explore the various financing options available, including local and international banks, as well as government-backed initiatives and incentives.

Support and incentives available for manufacturing businesses setup in Dubai

Dubai's government and economic development agencies offer a range of support and incentives to attract and nurture manufacturing enterprises. These include:

Free Zones: Specialized free zones, such as Dubai Industrial City and Dubai South, provide a range of benefits, including 100% foreign ownership, zero corporate taxes, and streamlined bureaucratic processes.

Industrial Parks: Dubai's well-developed industrial parks offer purpose-built facilities, reliable infrastructure, and access to a skilled workforce at competitive rates.

Financial Incentives: Incentives such as subsidies, grants, and loan programs are available to support the establishment and growth of manufacturing businesses.

Regulatory Assistance: Dedicated government agencies provide guidance and support to navigate the legal and regulatory landscape for manufacturing operations.

Talent Development: Initiatives to develop a skilled workforce, including vocational training programs and partnerships with educational institutions, ensure a steady supply of talented professionals.

Conclusion: Why a manufacturing business setup in Dubai can lead to success

Dubai's strategic location, world-class infrastructure, business-friendly policies, and robust support system make it an exceptional destination for manufacturing enterprises. By leveraging the city's unique advantages, you can position your manufacturing business for long-term success and unlock new opportunities in the global marketplace.

To learn more about the steps to set up your manufacturing business setup in Dubai and explore the available content.

#business management#klay consultants#business consulting services in dubai#business development#business consultants uae#business services#business setup uae#business setup services#retail business setup in dubai#manufacturing business setup in Dubai

0 notes

Text

Smooth, Stress-Free Setup: Hire a Company Registration Consultant Today

Make your business setup effortless with a trusted company registration consultant. At 3SH Consultancy, we handle every step, from paperwork to approvals, ensuring a hassle-free experience. Let our experts guide you toward success. Get started now with 3SH Consultancy.

#business#business setup in dubai#business setup services in dubai#business setup consultants#business setup in uae#business setup in abu dhabi#dubai

0 notes

Text

What Should You Look for in a Business Setup Consultant in UAE?

Choosing the right business setup consultant in UAE is essential for a smooth company formation process. Experience matters, so look for a consultant with a proven track record. They should have strong legal knowledge to ensure compliance with UAE regulations. Transparent pricing is also crucial to avoid unexpected costs. Additionally, selecting a consultant who specializes in your industry and has positive client reviews can help you make the best decision.

1 note

·

View note

Text

VAT Registration in the UAE: A Must-Know for Businesses

VAT registration is crucial for businesses operating in the UAE. Whether you're a startup or an established company, understanding the process, thresholds, and compliance requirements can save you from penalties and ensure smooth operations. Read this guide to simplify VAT registration today!

#company setup services in uae#company formation uae#best business consultants in dubai#mainland company setup#business setup services in ksa#business setup services in dubai

0 notes

Text

Benefits of Starting a Home-Based Business in Dubai

The Benefits of Starting a Home-Based Business in Dubai

Starting a home-based business in Dubai offers several advantages that can be beneficial for entrepreneurs. Here are some key benefits of starting a home-based business in Dubai:

Cost Savings: Operating a business from home eliminates the need for leasing or purchasing commercial space, which can significantly reduce overhead costs. You can save on expenses such as rent, utility bills, and commuting costs, allowing you to allocate more resources towards business growth and development.

Flexibility: Running a home-based business provides flexibility in terms of working hours and work-life balance. You have the freedom to set your own schedule and work at your own pace. This flexibility is especially valuable for individuals with personal commitments or those who prefer a more flexible working environment.

Convenience: Operating from home eliminates the need for a daily commute, saving you time and reducing stress. You have the convenience of working in a comfortable and familiar environment, with all the necessary tools and resources at your fingertips. This can enhance productivity and overall job satisfaction.

Reduced Risks: Starting a home-based business allows you to test your business idea with minimal risk. Since you don't have the financial burden of leasing a commercial space, you can experiment, refine your offerings, and assess market demand before scaling up. This mitigates the risk of investing significant capital upfront.

Lower Regulatory Requirements: Home-based businesses in Dubai generally have fewer regulatory requirements compared to businesses with physical locations. This simplifies the setup process and reduces administrative tasks, allowing you to focus more on your core business activities.

Tax Benefits: Depending on the nature of your home-based business, you may be eligible for certain tax benefits or exemptions. Consult with a tax advisor to understand the specific tax advantages available to home-based businesses in Dubai.

Enhanced Work-Life Balance: Working from home allows you to strike a better balance between your personal and professional life. You can save time on commuting, have more flexibility in managing family commitments, and enjoy a better quality of life. This can lead to higher job satisfaction and overall well-being.

Global Reach: With advancements in technology and the internet, home-based businesses in Dubai can easily reach a global customer base. You can leverage digital platforms, social media, and e-commerce tools to market and sell your products or services to customers worldwide, expanding your business opportunities.

Scalability: Starting as a home-based business provides a solid foundation for future growth. As your business expands and generates revenue, you can consider scaling up by transitioning to a dedicated commercial space or exploring additional business avenues while maintaining the advantages of a home-based setup.

It's important to note that starting a home-based business still requires careful planning, determination, and adherence to legal and regulatory requirements. Conduct thorough market research, develop a solid business plan, and seek professional advice to ensure your home-based business in Dubai is set up for success.

#business setup services in dubai#business services#business#business setup#business setup company in dubai#business setup consultants in dubai#business setup in uae#proservicesdubai2022#businesssetupdubai#businessinuae#businesssetup#uaevisitvisaonline#VISACONSULTATION#VisitDubai#visitvisauae#freezone#mainland#uaevisitvisa#uaebusiness#dubaibusiness#dubaibusinesssetup#dubaibusinessman#immigration#tradelicense#tradelicenserenewal#tradelicensedubai#tradelicenseajman#AbuDhabi#ajman#sharjah

4 notes

·

View notes