#bookkeeping&accountingservices

Explore tagged Tumblr posts

Text

Ready to grow your tax filing business? Check out our proven strategies to attract more clients during tax season and build lasting relationships!

Visit us for more info:👉 🌐 www.varundigitalmedia.com 👉 📧 [email protected] 👉 📲 (+1) 877-768-2786

#taxseason#digitalmarketing#strategies#taxfiling#cpa#cpafirms#cpamarketing#targetedads#paidadsforcpa#provenstrategies#socialmediamarketing#taxes#tax#accounting#business#smallbusiness#taxpreparer#bookkeeping#taxprofessional#taxrefund#accountant#taxreturn#finance#entrepreneur#taxtips#businessowner#accountingservices#taxation

10 notes

·

View notes

Text

Find expert Accountants and Accounting Services on TradersFind! 🔍 Connect with top professionals for meticulous financial management. Gain insights, ensure compliance, and boost your business growth. 🚀 Visit TradersFind now!

🛠️ Connect with us on WhatsApp at +971 56 977 3623 to discuss your Accountants and Accounting Services

Visit TradersFind today to explore our directory of Accountants and Accounting Services in UAE🔗: https://www.tradersfind.com/category/accountants-and-accounting-services

Accountants And Accounting Services In UAE

#accountingservices#financialmanagement#businessgrowth#expertadvice#compliance#financialinsights#uaebusiness#growwithus#trustedadvisors#businesssuccess#financialplanning#taxconsultants#bookkeeping#auditservices#smallbusinessowners#startups#entrepreneurs#financialexperts#yourfinancialpartner#connecttoday

2 notes

·

View notes

Video

tumblr

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

Hire the Best Accounting Firm Toronto on a Small Business Budget!

Chartered Professional Accountant

BBS Chartered Professional Accountants stands as the premier choice for accounting services in Toronto, catering even to businesses operating within tight budgets. Our specialization lies in providing comprehensive accounting, bookkeeping, and tax solutions tailored explicitly to address the unique demands of small businesses in the Toronto area.

At BBS Accounting CPA, our dedicated team is committed to furnishing you with exceptional financial support and expertise, ensuring the robust financial growth of your small business. Here's what distinguishes us:

Comprehensive Accounting Services: We offer an extensive array of Accounting Services that encompass all facets of your financial needs. Whether it's bookkeeping management or tax preparation, we've got your back.

Customized Solutions: We recognize that small businesses grapple with distinct financial challenges and aspirations. Our services are meticulously tailored to align with your specific requirements, facilitating the realization of your financial goals.

Expert Proficiency: Our team comprises Chartered Professional Accountants (CPAs) armed with profound knowledge and experience in the field. We remain abreast of the latest tax regulations and accounting standards to furnish you with precise and compliant services.

Cost-Effective Solutions: We firmly believe that every small business should have access to top-tier accounting services. Hence, we proffer competitive rates that align with your budget, ensuring you receive unmatched value for your investment.

Local Insight: Being a Toronto-based firm, we possess an intimate understanding of the local business environment and regulatory landscape. This localized expertise empowers us to offer insights and strategies that can significantly benefit your business.

Dependability: Count on us to meet deadlines, deliver punctual financial reports, and be readily available when you require our assistance. We are unwavering in our commitment to bolster your business's success, taking your financial affairs with utmost seriousness.

Client-Centric Philosophy: Your contentment is paramount to us. We actively endeavor to cultivate enduring, robust relationships with our clients, and we stand ever-ready to address your queries and concerns.

Whether you're embarking on a new venture or seeking to streamline your financial operations, BBS Chartered Professional Accountants is your steadfast partner in Toronto. Let us shoulder the burden of number-crunching so you can channel your energies into what you excel at—nurturing the growth of your business. Contact us today to initiate a discussion about your accounting and financial needs with our proficient team.

#AccountingFirm#SmallBusiness#Toronto#CPA#AccountingServices#Bookkeeping#TaxServices#FinancialSupport#BudgetFriendly#CustomizedSolutions#Expertise#LocalKnowledge#FinancialCompliance#ClientSatisfaction#BusinessGrowth#FinancialManagement#ProfessionalAccountants#FullServiceAccounting#SmallBusinessBudget#BBSAccountingCPA

2 notes

·

View notes

Text

Our innovative service approach has now arrived in Australia, offering you a unique and exceptional experience. Discover a fresh perspective on service excellence that sets us apart from the rest.

#SafebooksGlobalPvtLtd#bookkeeping#bookkeepingservices#outsourcingservices#accountingservices#accountingfirms#taxservices#cpafirms#australia

3 notes

·

View notes

Text

#accounting firms#bookkeeping#bookkeeping firm#small business bookkeeping#financial management#bookkeeping solutions#accounting services#accountingservices

4 notes

·

View notes

Text

Inventory Audit Services in Kochi

Inventory auditing is a key part of collecting evidence, particularly for manufacturing and retail organizations. Our dedicated auditing team provides you excellent Inventory Audit Services in Kochi, Kerala. Inventory audits on a regular basis improve your understanding of your stock flow, assist you in accurately calculating earnings and losses, and keep your firm operating efficiently.

Our auditing procedure involves the following:

Audit of inventory and damaged products

Stock inspection and reporting on a regular basis

Maintenance of Fixed Assets records and stock verification

Accounting records are checked on a regular basis for accuracy and completeness.

#audit#accounting#tax#accountant#finance#business#bookkeeping#taxes#incometax#iso#accountants#taxseason#cpa#smallbusiness#payroll#entrepreneur#accountingservices#auditor#taxconsultant#gst#money#taxplanning#bookkeeper#ca#businessowner#taxreturn#taxation#management#charteredaccountant#taxprofessional

4 notes

·

View notes

Text

Looking for a trusted accountant in Portugal? Our team of experienced professionals provides expert accounting, tax consulting, and financial advisory services for businesses and individuals. Whether you need help with company registration, VAT compliance, payroll management, corporate tax planning, or bookkeeping, we ensure your business stays fully compliant with Portuguese regulations.

Portugal offers a business-friendly environment with attractive tax incentives, a skilled workforce, and a strategic location in Europe. With our personalized accounting solutions, you can focus on growing your business while we handle all financial and tax matters efficiently.

Contact us today for reliable accounting services in Portugal and take the stress out of managing your finances!

#AccountantInPortugal#AccountingServices#PortugalBusiness#TaxConsultant#Bookkeeping#VATCompliance#PayrollServices#CorporateTax#FinancialAdvisory#PortugueseAccounting#SmallBusinessAccounting#TaxFiling#CompanyRegistration#BusinessGrowth#PortugalEntrepreneurs#AccountingFirm#BusinessSupport

0 notes

Text

📢 𝐓𝐚𝐤𝐞 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐨𝐟 𝐘𝐨𝐮𝐫 𝐓𝐚𝐱𝐞𝐬! 💼📊 Stay ahead of tax season with Syriac CPA Tax And Accounting Services Inc.! From tax preparation and planning to IRS representation and bookkeeping, we provide expert solutions tailored to your needs. Let us handle the numbers while you focus on what matters most. Contact us today to schedule a consultation! 📞𝐂𝐀𝐋𝐋: (562) 202-9697, (949) 397-2337 𝐕𝐢𝐬𝐢𝐭: www.syriaccpa.com

Syriac CPA Tax And Accounting Services Inc in Artesia And Newport Beach

#TaxPreparation#IRSHelp#FinancialFreedom#TaxSolutions#CPA#SmallBusinessTaxes#TaxRelief#AccountingServices#Bookkeeping#TaxFiling#BusinessTax#TaxConsulting#TaxStrategy#MaximizeRefund#StressFreeTaxes

0 notes

Text

📢 𝐓𝐚𝐤𝐞 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐨𝐟 𝐘𝐨𝐮𝐫 𝐓𝐚𝐱𝐞𝐬! 💼📊 Stay ahead of tax season with Syriac CPA Tax And Accounting Services Inc.! From tax preparation and planning to IRS representation and bookkeeping, we provide expert solutions tailored to your needs. Let us handle the numbers while you focus on what matters most. Contact us today to schedule a consultation! 📞𝐂𝐀𝐋𝐋: (562) 202-9697, (949) 397-2337 𝐕𝐢𝐬𝐢𝐭: www.syriaccpa.com

Syriac CPA Tax And Accounting Services Inc in Artesia And Newport Beach

#TaxPreparation#IRSHelp#FinancialFreedom#TaxSolutions#CPA#SmallBusinessTaxes#TaxRelief#AccountingServices#Bookkeeping#TaxFiling#BusinessTax#TaxConsulting#TaxStrategy#MaximizeRefund#StressFreeTaxes

0 notes

Text

Accounting Services in Chennai

💼 Top-Notch Accounting Services in Chennai! Looking for reliable and expert accounting services in Chennai? Whether it’s tax preparation, bookkeeping, or financial planning, our trusted professionals have you covered!

✨ Why choose our services? ✅ Experienced accountants in Chennai ✅ Customized solutions for businesses & individuals ✅ Save time, reduce stress, and manage your finances smarter

📍 Serving Chennai with dedication and expertise. Ready to get your finances in order? Click the link to find the best accounting service for you today!

#AccountingInChennai#TaxServices#FinanceExperts#ChennaiBusiness#Bookkeeping#SmallBusinessSupport#FinancialPlanning#TaxHelp#AccountingServices

0 notes

Text

Accounting Services in Chennai!

💼 Top-Notch Accounting Services in Chennai!

https://www.aska1.com/accounting-service-in-chennai/ Looking for reliable and expert accounting services in Chennai? Whether it’s tax preparation, bookkeeping, or financial planning, our trusted professionals have you covered!

✨ Why choose our services? ✅ Experienced accountants in Chennai ✅ Customized solutions for businesses & individuals ✅ Save time, reduce stress, and manage your finances smarter

📍 Serving Chennai with dedication and expertise. Ready to get your finances in order? Click the link to find the best accounting service for you today!

#AccountingInChennai#TaxServices#FinanceExperts#ChennaiBusiness#Bookkeeping#SmallBusinessSupport#FinancialPlanning#TaxHelp#AccountingServices

0 notes

Text

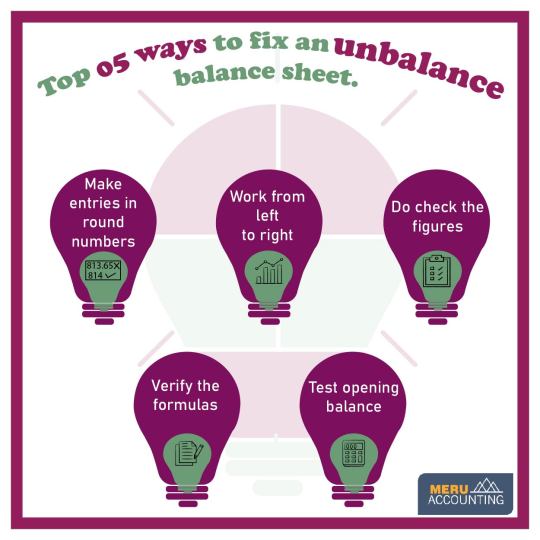

Is your balance sheet out of whack? Discover the top 5 strategies to restore financial equilibrium!

#MeruAccounting#bookkeepingcompany#bookkeepers#bookkeepingservices#bookkeepingtips#bookkeeping#accounting#accountingservices#balancesheet

3 notes

·

View notes

Text

Trusted Accounting & Book-Keeping for Hassle-Free Compliance

Managing finances is a cornerstone of any successful business. Whether you run a small startup or a large corporation, having accurate and organized financial records is essential. This is where professional Accounting & Book-Keeping Services come into play. These services not only ensure compliance with regulations but also provide valuable insights to help you make informed decisions. Let’s explore some of the top services that can elevate your business operations.

1. Financial Statement Preparation

Financial statements are crucial for understanding the financial health of your business. Accounting services help prepare essential documents like balance sheets, income statements, and cash flow statements. These reports give you a clear picture of your business's performance, enabling you to make strategic decisions. Moreover, accurate financial statements are often required when seeking loans or attracting investors.

2. Payroll Management

Payroll is an integral part of business operations. Professional services ensure that your employees are paid accurately and on time. They handle salary calculations, tax deductions, and compliance with employment laws. By outsourcing payroll management, you can focus on growing your business without worrying about payroll complexities.

3. Tax Preparation and Filing

Navigating the complexities of tax regulations can be daunting. Accounting services offer expertise in preparing and filing taxes accurately and on time. They ensure compliance with tax laws while identifying opportunities for tax savings. This reduces the risk of penalties and enhances your business’s financial efficiency.

4. Accounts Payable and Receivable Management

Efficient cash flow management is essential for sustaining business operations. Book-keeping services help track incoming payments and outgoing expenses. They ensure that invoices are processed promptly, reducing the chances of late payments and maintaining healthy vendor relationships. Additionally, they monitor outstanding payments to ensure timely collections.

5. Budgeting and Forecasting

Creating realistic budgets and financial forecasts is vital for long-term planning. Accounting services assist in analyzing past financial data to predict future trends. This helps you allocate resources effectively and set achievable financial goals. Budgeting and forecasting also provide a roadmap for managing expenses and identifying potential financial challenges.

6. Bank Reconciliation

Reconciling your business bank accounts with financial records is a tedious yet crucial task. Book-keeping professionals handle this process, ensuring that all transactions are accurately recorded. Regular bank reconciliations help identify discrepancies early, preventing potential financial mismanagement.

7. Audit Support

Audits are a reality for businesses, and preparation is key. Accounting services provide organized records and documentation to streamline the audit process. They assist in responding to auditor queries and ensuring compliance with financial reporting standards.

8. Cloud-Based Accounting Solutions

Technology has revolutionized accounting and book-keeping. Many service providers now offer cloud-based solutions that allow real-time access to financial data. These platforms facilitate collaboration between business owners and accountants, ensuring transparency and efficiency. Cloud-based accounting also enhances data security and simplifies record-keeping.

9. Compliance Management

Businesses must adhere to various financial regulations and standards. Accounting services ensure compliance with local and international laws, reducing the risk of legal complications. They stay updated on regulatory changes, ensuring your business remains compliant at all times.

10. Customized Reporting

Every business has unique financial needs. Accounting services offer customized reporting to address specific requirements. Whether it’s detailed sales analysis, expense tracking, or performance metrics, tailored reports provide actionable insights to drive your business forward.

Why Outsourcing Accounting & Book-Keeping Services Makes Sense

Outsourcing these services allows businesses to leverage professional expertise without the need for an in-house accounting team. This is particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the resources for a full-fledged finance department. By outsourcing, you can:

Save time and reduce administrative burdens.

Gain access to skilled professionals and advanced tools.

Focus on core business activities.

Improve financial accuracy and reliability.

How to Choose the Right Service Provider

Selecting the right accounting and book-keeping partner is crucial. Here are some factors to consider:

Experience and Expertise: Ensure the provider has experience in your industry and understands your business needs.

Technology: Look for providers who use modern tools and platforms for efficient service delivery.

Reputation: Check reviews and testimonials to gauge their reliability.

Cost-Effectiveness: Compare pricing structures to find a service that offers value for money.

Conclusion

Investing in professional Accounting & Book-Keeping Services is a smart decision for any business. These services streamline financial management, ensure compliance, and provide valuable insights for growth. Whether it’s managing payroll, preparing taxes, or creating budgets, the right accounting partner can make a significant difference. Take the time to assess your business’s needs and choose a service provider that aligns with your goals. With expert financial support, you can focus on what matters most—growing your business.

#AccountingServices#BookKeeping#BusinessFinance#SmallBusinessAccounting#FinancialManagement#AccountingSolutions

0 notes

Text

Quality Audit Procedures: A Comprehensive Guide for Indian Businesses

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/28-Quality-Audit-Procedures_-A-Comprehensive-Guide-for-Indian-Businesses-Source-linkedin.com_.jpg

Latest News

News

Stock Market Update: Nifty 50 Movement, Trade Setup, and Top Stock Picks

News

Markets on Edge: Indian Indices Dip, Bitcoin Hits Record, and Global Trends Shape the Week Ahead

News

BlueStone Jewellery Plans ₹1,000 Crore IPO with Fresh Issue and OFS

Source: linkedin.com

In today’s competitive business landscape, maintaining high standards of quality is crucial for success. Quality audit procedures are vital in ensuring that organizations consistently meet regulatory requirements and customer expectations. This article will explore the significance of quality audit techniques, their benefits, and how Indian businesses can implement them effectively.

What Are Quality Audit Procedures?

Quality audit procedures refer to systematic evaluations conducted within an organization to assess its adherence to established quality standards. These procedures involve a structured examination of processes, systems, and documentation to determine whether they conform to the defined quality management system (QMS). In India, quality audits are essential for industries such as manufacturing, healthcare, and information technology, among others.

The main objectives of quality audit procedures include:

Ensuring Compliance: Regular audits help organizations comply with national and international quality standards such as ISO 9001, which is crucial for gaining customer trust.

Identifying Non-Conformities: Quality audits help identify gaps in processes, allowing organizations to address issues before they escalate into more significant problems.

Continuous Improvement: The feedback obtained from quality audit techniques fosters a culture of continuous improvement, enhancing overall operational efficiency.

Risk Management: Regular audits allow businesses to manage risks effectively by identifying potential issues before they become critical.

The Importance of Quality Audit Procedures in India

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/28.2-The-Importance-of-Quality-Audit-Procedures-in-India-Image-by-kate_sept2004-from-Getty-Images-Signature.jpg

In India, the significance of quality audit procedures has grown significantly due to increasing consumer awareness and regulatory requirements. Here are some reasons why these procedures are essential for Indian businesses:

1. Enhancing Customer Satisfaction

In a market where competition is fierce, customer satisfaction is paramount. Quality audit procedures ensure that products and services meet the expected standards, ultimately leading to improved customer loyalty and repeat business. For instance, companies in the manufacturing sector can enhance product quality by regularly auditing their processes.

2. Meeting Regulatory Requirements

Compliance with government regulations is non-negotiable for businesses operating in India. Quality audit procedures help organizations ensure they adhere to the legal standards set by bodies like the Bureau of Indian Standards (BIS) and the Food Safety and Standards Authority of India (FSSAI). This not only mitigates legal risks but also enhances the company’s reputation.

3. Improving Operational Efficiency

Quality audits provide valuable insights into the operational processes of a business. By identifying inefficiencies and non-conformities, organizations can streamline their operations, reduce waste, and improve productivity. This is particularly important for industries like manufacturing, where process optimization can lead to significant cost savings.

4. Fostering a Culture of Continuous Improvement

Implementing quality audit procedures encourages a culture of continuous improvement within an organization. When employees understand that quality is a priority, they are more likely to take ownership of their roles and strive for excellence. This cultural shift can lead to innovative practices and solutions that benefit the entire organization.

Steps Involved in Quality Audit Procedures

Implementing quality audit procedures requires a systematic approach. Here are the key steps that Indian businesses should follow:

1. Planning the Audit

Effective planning is crucial for a successful audit. Organizations should define the scope and objectives of the audit, identify the processes to be audited, and assign a qualified audit team. Creating an audit schedule that aligns with business operations ensures minimal disruption.

2. Preparing Audit Checklists

Developing detailed audit checklists is essential for ensuring that all critical aspects are evaluated during the audit. These checklists should be based on established quality standards and the organization’s specific processes. This ensures consistency and comprehensiveness in the audit process.

3. Conducting the Audit

During the audit, the audit team conducts interviews, observes processes, and reviews documentation to gather evidence. It’s important to approach this phase with an open mind, as auditors should aim to understand the processes rather than simply find faults.

4. Reporting Findings

After the audit, the team compiles their findings into a comprehensive report. This report should detail non-conformities, areas for improvement, and recommendations for corrective actions. It’s vital that the report is clear, concise, and actionable.

5. Implementing Corrective Actions

Once the audit findings are reported, organizations must take immediate action to address any identified issues. Implementing corrective actions is critical to improving processes and ensuring compliance with quality standards.

6. Monitoring and Follow-Up

Quality audit procedures are not a one-time event; organizations must monitor the effectiveness of corrective actions and follow up on previous audits. Continuous monitoring ensures that improvements are sustained and that the organization remains compliant with quality standards.

Challenges in Implementing Quality Audit Procedures

https://businessviewpointmagazine.com/wp-content/uploads/2024/11/28.3-Challenges-in-Implementing-Quality-Audit-Procedures-Image-by-VioletaStoimenova-from-Getty-Images-Signature.jpg

While quality audit procedures are beneficial, Indian businesses may face several challenges in their implementation:

Resistance to Change: Employees may resist audits due to fear of repercussions. Building a culture that views audits as opportunities for growth rather than punitive measures can help alleviate this issue.

Lack of Resources: Many small and medium-sized enterprises (SMEs) may lack the necessary resources to conduct thorough audits. Investing in training and tools can empower these businesses to implement effective audit procedures.

Keeping Up with Standards: The rapidly changing regulatory environment can make it challenging for businesses to stay updated with the latest quality standards. Regular training and professional development can help address this challenge.

Conclusion

Quality audit procedures are essential for Indian businesses striving for excellence in today’s competitive environment. By ensuring compliance, enhancing customer satisfaction, and fostering a culture of continuous improvement, organizations can significantly benefit from implementing these procedures. Although challenges may arise, a systematic approach to quality audits can lead to improved operational efficiency and sustained growth.

Investing in quality audit techniques is not just a regulatory requirement; it is a strategic decision that can position Indian businesses for long-term success in an ever-evolving market. Embracing these practices will not only enhance product and service quality but also build trust and loyalty among customers, ensuring a prosperous future for Indian enterprises.

Did you find this article helpful? Visit more of our blogs! Business Viewpoint Magazine

#tax#accountant#business#finance#bookkeeping#accountants#incometax#taxes#auditor#taxseason#gst#accountingservices#taxconsultant#smallbusiness#compliance#bookkeeper#money

0 notes

Text

Why Outsourcing Accounting Services to India Can Be a Game-Changer for Your Firm?

In the fast-paced world of business, time is money, and staying ahead of the competition requires smart strategies. One such strategy that is gaining momentum in the accounting world is outsourcing accounting services to countries like India. But how exactly does this benefit your firm, and why should you consider it?

The Perks of Outsourcing Accounting to India

Cost Efficiency Without Compromising Quality When you outsource accounting tasks to India, you get the benefit of skilled professionals at a fraction of the cost compared to hiring in-house staff. India has a large pool of qualified accountants and financial experts, many of whom have experience working with international clients, especially those in the USA and UK.

Access to Expertise India is home to a highly educated workforce, with many accountants holding local certifications like CA (Chartered Accountant), which is equivalent to the CPA in the United States. By outsourcing, you can tap into this expertise without having to train new employees or invest in ongoing professional development.

24/7 Operations and Scalability With time zone differences, outsourcing to India allows your firm to run round-the-clock operations, meaning work can be done while you sleep. Moreover, when your business experiences growth, outsourcing gives you the flexibility to scale without the overhead costs associated with hiring more in-house staff.

Focus on Core Business Activities Outsourcing repetitive and time-consuming accounting tasks—like bookkeeping, payroll, and tax preparation—lets you and your team focus on more strategic areas of your business. Whether it's focusing on client relationships, marketing, or scaling operations, outsourcing frees up valuable time.

The Communication Factor

One concern that many businesses have when considering outsourcing is communication, especially when working with teams from different countries. However, the reality is that global communication tools like Zoom, Slack, and email make it easier than ever to maintain clear and constant communication. Plus, many outsourcing firms in India work in English, which is a huge advantage when it comes to seamless interaction.

Why White Bull is a Trusted Partner for Outsourcing

At White Bull, we understand the nuances of outsourcing accounting services, and we’ve helped many firms, especially in the USA, streamline their operations by providing dedicated offshore accounting teams.

Whether you need help with bookkeeping, payroll, tax returns, or bank reconciliations, White Bull offers tailored solutions for CPA firms. We provide affordable, reliable, and secure services with a focus on quality control and client satisfaction.

So, if you're considering offshoring your accounting tasks, White Bull is the partner you can trust to handle all your back-office needs while you focus on growing your firm.

By outsourcing your accounting tasks, you can save time, reduce costs, and get access to top-notch expertise that supports your firm’s growth. To learn more about White Bull's offshore accounting services, visit White Bull.

#AccountingServices#Outsourcing#Offshoring#Bookkeeping#PayrollServices#TaxPreparation#FinancialExpertise#CPAFirms#WhiteBull#GlobalOutsourcing#AccountingInIndia#BusinessGrowth#CostEfficiency#TaxFiling#OffshoreAccounting#AccountingSolutions#CloudAccounting#IndianAccountants#FinancialServices

1 note

·

View note