#blame the height average of the 1950s

Explore tagged Tumblr posts

Text

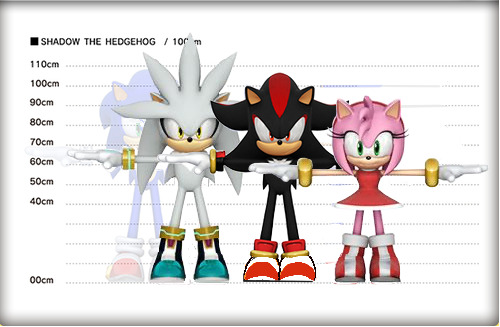

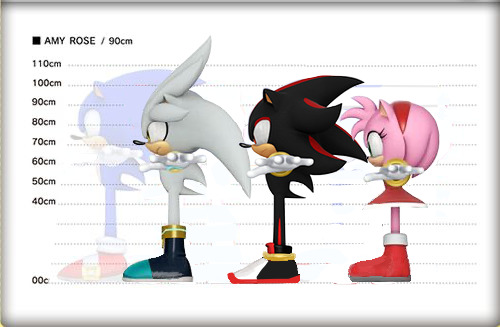

Obligatory Shadow’s height post

This post was brought to you by my own self-indulgence into the thesis statement that is: What would be the heights of all the hedgehogs if they weren’t boosted by heels? And how tall would they be after puberty?

So this was the product of my personal venture.

Canon heights (plus the differentiating shoe types):

Amy = 90 cm*

Sonic, Shadow & Silver = 100 cm

(*Looking at Amy’s model to the height chart is bizarre to me. Disregarding the added height from her heels for a moment, she looks like she should be regarded as 95 cm at least…)

Since all of all the hedgehogs but Sonic are shown to have heels to their shoes in some way, I will be cutting down that height by roughly converting their shoes into sneakers since they’ll never NOT be wearing shoes (note: it’s mostly guesstimates).

Ignore me playing around with Shadow’s shoes in this one lmao

Anyways, after some editing, this was the final result I got. The way they measure the 3D models are p weird, and I came to notice that Silver has slightly smaller eyes and lowered ears to acommodate for his quill crown look, so that makes things slightly harder for my naked eye.

By height order, Sonic (trusting that his shoes aren’t elevating him more than necessary) would be the tallest at the default 100 cm + shoes. He would be considered the oldest at 16 since he technically had an in-world birthday but let’s just say he’d be months older than Shadow.

2nd tallest is Silver at ~98 cm + shoes. His back heel was 2-3 cm, so cutting it down results in him being rather unchanged — which I find interesting considering you’d figure he’d be shorter from being second youngest of the group (and the whole bad future sitch which doesn’t inspire a likelihood that he’d have consistent food servings for optimal growth). If his genes can get him near the height of Sonic in spite of inconsistent food source, I’d wager he might end up the tallest in the future.

3rd place is Shadow at ~95 cm + shoes. His hover shoes gave him 6 cm max of extra height. Taking into account his shoes structure which seemed to resemble the structure of rollerblades (which shaped itself around the foot of the wearer), I gave him a couple inches of soles when putting him in running shoes. He’s probably of average height for a 15 yr old male mobian hedgehog, but considering he was artificially made and apparently ages slowly physically — I get the sense that he might not grow that much in time, if at all.

4th place is Amy at… okay this one was funky. Amy in the initial reference wasn’t measured under the same standard the others were (y’know... by their heads…). So in spite of being said to be 90 cm, I’ll just say that in this instance, Amy was 95 cm plus heeled boots. Thus, the resulting removal of those heels, led to Amy being 90 cm. Honestly, considering she’s a 12 yr old female mobian hedgehog, and is only has a 10 cm gap apart from the current tallest who’s already in the midst of his teen years — she’s probably of average height for her age and sex. She will likely end up reaching at least 95 cm (all confirmed 14 yr old and over female mobians have reached 95 cm) — whether she goes over that height is anyone’s guess.

In summary…

If I were to predict how the hedgehog height chart will be past their growth spurts… I’d say without any changes to their current lifestyles, Silver will overtake Sonic and reach 115 cm, while Sonic reaches 105 cm, Shadow will be in a stasis of 95 cm, and Amy would probably be at 95 cm (since without other female hedgehog mobians in the games to really draw a comparison on, she’s best presumed to just end up in the average height).

One detail I keep coming back to is whether I should call to question the Amy’s height disparity from the references I gathered. Iirc the models here are pretty accurate to what I see in cutscenes between Sonic and Amy height wise. 90 cm makes sense for Amy’s natural height to Sonic, but adding her heels should explain away why her game model is taller than 90 cm. But given canon heights are usually incorporating characters’ heels into them — it makes this isolated incident all the more jarring.

Sigh... -inhales-

“AMY IN HEELS SHOULD CANONICALLY BE 95 CM COME AT ME—“

#my posts#midnight impulses#midnight rantings#“summary” summary: Silver is the tallest dwarf#cuz hedgehog mobians don’t strike me as likely to get any taller than an average mobian#Sonic strikes me as an early bloomer who got/will get surpassed by the late bloomers#shadow ain’t getting any taller#blame the height average of the 1950s#and amy is proportionately characterized as petite and short so she prolly will remain that way#sonic characters height analysis#sonic headcanons#hedgehog gang#sonic the hedgehog#shadow the hedgehog#silver the hedgehog#amy rose#plot twist: this was all to push for my sonic character height headcanons#nah just kidding#unless…? 👀

59 notes

·

View notes

Text

Unpopular Opinion /lh /rp

Talking about dSMP character’s heights and sort of their body types? Not in a weird way just in a ‘how I imagine them’ way. Loosely based off of their irl heights, but some of them I don’t know, so it’s mostly guesswork and vibes. Also if you disagree you’re wrong. (Just kidding leave your ideas in the tags/replies)

Obviously this is all roleplay/character stuff. None of it is intended to be weird or to reflect on the irl people! I’m just having fun with headcanons :)

Tommy is 6′3 and very very lanky. This child is not short. Stop drawing him short. He’s taller than Techno. He’s not as tall as Wilbur, but he’s tall. He towers over most people. Emphasis on most because everyone is so tall on this server what the hell?

Anyway I think the mental image of this super tall kid actively trying to make himself look shorter/smaller is heartbreaking. Like imagine him curled up into a corner trying to make himself as unnoticable as possible in Logsted. Imagine him slouching when living with Techno to try to make himself seem like less of a ‘problem’. Imagine Dream telling him that he’s a ‘big strong man’ and that he shouldn’t need help, he can defend himself, so when he goes back to Tubbo, he tries to make himself look *tiny* as a cry for help. He wants comfort.

But he’s also incedibly skinny. Back in L’manburg and Pogtopia, he developed some muscle from all the fighting. His shoulders broadened out and he looked slightly intimidating. But like most teenage boys, he was still lanky as hell. This only got worse when he was exiled to Logstedshire, with little food (and no drive to eat the food, or get up, or exersise) he became more malnourished and he just looked *small* despite being 6′3. This probably isn’t helped by the constant use of golden apples when he moves in with Techno, which give him energy and strength but no real nutritional value. Techno was just trying to get the kid to eat normally. When he finally stands at his full height, Techno is shocked that he didn’t notice all the slouching.

Anyway Techno is 6′2. He’s taller than a lot of people but not as tall as his brothers. He makes up for this with muscle and strength and a healthy body. Wow, the only healthy person on the server. Amazing. You love to see it. Good for him. He could win in a battle of raw strength against anyone else on the server. He’s quite broad, which makes him look bigger generally.

Wilbur is 6′5 and also he is a stick. Just. Straight up and down stick. Nothing there! He is just a pale sickly stick. This gets worse the further into the timeline you go. When claiming L’manburg and fighting in the war he starts to get insomnia, causing him to look like a corpse half the time. When in Pogtopia, he’s too busy to take care of himself properly, so he only looks worse and worse. His hair is a mess, his skin is far too pale, and he only eats enough to be able to hold his own in a short fight. There’s a reason he doesn’t wear armour or really try to fight at all. He’s subconciously self-destructive, then actively so when he blows the place to the ground. He’s always been too busy for self-care.

Ghostbur is a much more healthy, younger version of Wilbur. I would say he’s ‘water rising’ era Wilbur. The life returned to his body, in a morbid kind of way. He’s still tall but he prefers to make himself seem shorter just to be less threatening.

Phil is 5′11. He has an average build, with slight muscle from the years of playing in hardcore. He’s older, now, but he can still kick your ass. Also, he taught Techno how to fight smart, not hard. He doesn’t need to be super strong because he’s intelligent enough to outwit most people on the server. He has a wordly knowledge that others don’t possess. He also has wings, large and grey, clipped so he could get onto the server (there is a no flying rule after all).

Fundy is... 5′10, just a little shorter than Phil. His fox genes make him smaller, despite his father being 6′5. He’s got a healthy, svelte build. He’s sneaky and light on his feet. In the wars he built up some muscle, but it was quickly lost since he prefers to take a backseat to any fighting outside of those times (especially now) and he’s built for spying.

Schlatt is an interesting one because a lot of people are gonna fight me on this, but he’s not actually old. Everyone calls him old but honestly I think he’s younger than Wilbur (in canon, I feel like Wilbur is in his late 30s, early 40s, simply because). I think Schlatt’s around 35-ish, but he looks older due to his shitty health. People call him an old man either to demean him or because they see his actions and appearance and go ‘yeah, this guy is old’. Which is fair enough, because irl Schlatt and c!Schlatt both act like they’re from the 1950s.

This guy looks like shit by the end, but he looks alright at the start. Slicked-back hair, sharp ram horns, golden animalistic eyes. He’s intimidating. And loud. Then everything shifts, right towards the end. He’s frail and deteriorating throughout his short presidency, and by the end of it he’s practically a corpse, just like Wilbur.

He’s 6′3, with broad shoulders and a silhouette that seems strong not only because he carries himself as if he can fight, but also because of the percieved power that comes along with it. In reality, Schlatt is a poor fighter, and the abuse he ends up putting his body through (working out excessively to try to fight his condition, and turning to alcoholism as an escape) completely destroys him, making him probably one of the least healthy and weakest people on the server. It doesn’t really show until his death scene, since he’s covered up the deterioration since day one. Basically, mans is dead.

Glatt, or Ghost Schlatt, or whatever you want to call him, would be a healthier Schlatt. Again, from the ‘water rising’ era. I headcanon him to have longer hair in that era. Not sure why.

Ranboo is the same height as tommy, but is more naturally lithe than made that way by lack of food. His enderman DNA can be blamed for that. He’s healthy most of the time, but may have spirals where he doesn’t take good care of himself (perhaps he forgets) and he looks pretty bad. If he goes a few days without keeping up his self-care routine, he looks a lot worse than he actually is. Sleep tends to be his biggest issue, his mind keeping him awake all night and leaving him looking like shit in the morning. Really, he’s just a kid with a troubled soul, and it shows sometimes. Most days, though, he looks very well put together.

Tubbo. He’s 5′6. He’s more childlike than Tommy, which only makes it worse when he acts in the way he does in season 2. He has burn scars across one side of his body, from his execution, and he is partially blind in one eye because of it. He takes very good care of himself, since he has to look good while being president if he wants those sweet sweet approval ratings. But when he’s super stressed, he will pull all-nighters and forget to eat. He’s got a lot of issues, but his body is very normal and healthy, all things considered.

Quackity is 5′8. Which is really funny because that’s his actual height. He’s less sharp (?) than a lot of people on the server, but he has some muscle because he’s constantly training to ‘take down Technoblade’ (in reality, it’s a habit he picked up in Schlatt’s era, and never had the heart to drop). He tries his best to stay healthy (again, to better kill Techno) and he’s careful with his life, knowing that it’s his last.

Niki is 5′5. She’s also able to kick so much ass. That is all.

Dream is a bitch and therefore I will not be discussing him. Also he’s a blob or whatever so I guess height is irrelevant. Or maybe he’s a mysterious figure with a mask. Who knows.

No one else is important enough to talk about /j (but really I’m tired so I will stop here). Put your own thoughts in the comments, tags, and rbs. This was all in good fun, so don’t get mad haha.

#dreamsmp#dream smp#jschlatt#tommyinnit#wilbur soot#tw alchoholism#tw self-destructive behaviours#quackity#tubbo#dream#ranboo#philza#technoblade#niki nihachu

74 notes

·

View notes

Text

The Greek word for soul was psyche, what we call the soul is the unconscious mind. What is the unconscious mind? It is part of the brain that is not connected to the network of neurons that make up our waking, resting state of consciousness called the default mode network, or the ego. It is interesting, as you will soon see, that Psyche was a female character. Another very intriguing Greek concept was the Daimon, the origin of the word demon. It is the inner genius, the spirit guide within. I offer you an explanation of what they could have meant by this. What follows is an investigation into the neuroscience of the soul and my experiences of self-discovery.

Carl Jung stated that civilized man has become soulless, let us investigate how we could have lost our soul.

The majority of civilized humans are born in a hospital, snatched from their mothers and tortured with needles, circumcision, etc. This is profoundly traumatizing. The way that infants have been treated in the civilized world is so different from the way that our hunter-gatherer, tribal ancestors treated infants for millions of years throughout hominid evolution. Humans in the civilized world come away from childhood seriously traumatized and brain damaged.

Tribal societies breastfeed for three years, this is natural birth spacing. Early weaning is neglect and abuse, it causes weaning conflict, oral fixation, sadomasochism, self-destructive tendencies and the secret death wish. Tribal societies certainly would not leave an infant alone and abandoned in a crib to cry itself to sleep. We are told that infants are to be left alone to cry themselves to sleep until they learn to soothe themselves, but what is actually occurring in the infant mind is a splitting. This is called primitive dissociation and is the root cause of all severe personality disorders such as borderline, antisocial and narcissistic personality disorders. The infant has only one option as a defense mechanism against the nightmare existence within which it finds itself unable to escape from while being neglected by its caregivers, as it is completely helpless and dependent upon them for its nourishment and psychological well-being. That defense involves the severing of the incoming connections from the source of negative emotion, the right hemisphere. This gives birth to the unconscious mind as the default mode network is constructed to protect the infant mind from the pain of its existence. This also occurs when one takes Prozac. The default mode network is a Prozac network.

This is not a great way to start out life, and in a culture of rampant narcissism most of us are victims of narcissistic, parental abuse. People think that you can do whatever you want to babies because they won't remember, this is an utterly cringe-worthy and ignorant approach to parenting and the handling of babies in a hospital setting. A baby's brain is going through an intense period of development during this time that will shape their psychology for the rest of their lives. The corpus callosum undergoes the greatest period of its development during the first twenty-four months after birth.

The reason for the epidemic of opioid addiction has to do with the fact that opioids are naturally released in the brain of all animals, including humans, when a child is nurtured by its mother.

This infant neglect, this narcissistic wound, or what Freud called the primal wound, makes us long eternally, even as an adults, for this nurturing from the mother, and so we crawl into the comforting embrace of an addiction, or try to replace the mother with romantic partners. It is no wonder that the United States has become a welfare state as we look to the Democratic party, the archetype of the mother, to provide social welfare programs to care for its childlike demographic. All baby animals need a sufficient amount of nurturing or they will die. Is it any wonder that what we call civilization is, in reality, a toxic, suicidal, theme park.

This is absolutely no different from the rats of NIHM experiment that was performed in the 1950s. The national institute of mental health created rat utopias in which the rats were given unlimited food and nesting materials. When the rats reached a certain population density they became insane and the colonies collapsed. This was due to the males becoming hyper-territorial and then began guarding the females who were then unable to nurture their young, so the young died.

Infant trauma is not the end of the story, when a child In our society reaches a certain age they are thrown into a heavily left-brain biased educational system In which imagination, one of the most significant mental faculties that distinguish the human from all other primates, is discouraged in favor of language and mathematics. Language and mathematics are also incredible mental faculties that separate us from other primates, but if you think about it, how many languages and branches of mathematics are we spending our youth learning? All fields of study require us to learn a specialized extension of language, whether it be chemistry, physics, political science, anatomy, biology, psychology, etc. These fields of study require us to learn a whole new set of terms and symbols in order to understand and work with the formulas and concepts involved in that field. We are not just learning basic math, we are learning pre-algebra, algebra, geometry, trigonometry, calculus, statistics, and the list goes on. Students who are imaginative, creative and staring out the window in boredom are stigmatized as having learning disabilities or ADHD and are prescribed drugs to make them fit into the system so that the system does not have to adjust to accommodate, properly nurture and encourage the creative geniuses in our society. The left hemisphere is a conformist, the right hemisphere is an individual. This is most likely why Carl Jung called the process of psychic integration the process of individuation. Creative geniuses and independent thinkers are a threat to a system of conformity and control that is designed to dumb down the population in order to shape them into tax paying, corporate, consumer slaves who perform repetitive, menial tasks In order to scratch out a living, existing on a hamster wheel, never getting ahead and working until they're dead. I do not think it is a coincidence that the retirement age is the average age of mortality among males. We are not supposed to figure this out, we are supposed to be grateful for our jobs and the crumbs that we are thrown from the towering heights occupied by an elite class that parasitically feeds on the laboring masses.

After school we enter into a left-brain biased working world. The brain continues to develop until age twenty-five and we spend most of this time using left-brain functions, almost completely neglecting right-brain functions. Our culture exacerbates and perpetuates this bias.

If you look at the stages of ego development you will notice that at the earliest stage, the impulsive stage, the characteristics are indistinguishable from those of borderline personality disorder. This is the most dissociated and most severe disorder. This is the psychology of a toddler, not having developed the executive function of the prefrontal cortex, It is completely unstable. It throws temper tantrums, having no emotional control or ability to communicate its needs in a more sophisticated way, seeing others In the most primitive way, as either nice to me or mean to me. Antisocial being the next severe, the self-protective and opportunistic child, doing whatever it can get away with, he gets caught with his hand in the cookie jar and blames his sister. The next stage shows the characteristics of narcissistic personality disorder, the conformist, the diplomat. This is adolescent psychology In which the right hemisphere is still largely repressed into the unconscious as a defense against the instability of the underlying borderline personality disorder. The left hemisphere is a narcissist and the default mode network is left hemisphere biased.

These personality disorders show the least amount of neural integration between the right and left hemispheres. Jungian psychology is about integration of the psyche. Carl Jung didn't know anything about the brain or hemispheric lateralization, and yet, somehow, he was profoundly insightful. When he referred to the Anima, the female psyche, he was referring to the right hemisphere which has become unconscious in civilized man. In split brain patients, the right hemisphere will refer to itself as female. The left hemisphere shows many masculine characteristics such as murderous aggression and rationality whereas the right hemisphere is irrational, the source of dreams, compassion, empathy and pro-social emotions.

Every stage of ego development, whether you look at Loevinger's model, Suzanne Cook-Greuter's model, Spiral Dynamics, among others, you will see a gradual integration of the characteristics of the right hemisphere into consciousness. There are ten stages of ego development and I would consider it a spectrum of narcissism, with the tenth stage being that of a taoist master, or enlightenment. Each stage displays a greater amount of self-awareness and humility that come along with meta-cognition, introspection, self-reflection and self-criticism. These are functions of the right hemisphere, as are empathy and imagination.

The reason for our condition, the unenlightened, psychological condition of civilized man, is a disorder of the corpus callosum. This information highway between the two hemispheres of the brain has a lack of communication in one direction. In traumatized infants this condition is called fractional anisotropy. What we don't realize is that what is considered to be a normal, healthy brain among civilized people is actually neurologically damaged.

Brain scans of experienced meditators show a significant increase in the thickness of the corpus callosum, a deactivation of the default mode network and an activation of the insular cortex, the command centers of the brain. The insula, which exists in both hemispheres, sends and receives signals to and from the entire brain. This is how one can achieve enlightenment, or, what I call whole-brain neural integration. This is our natural state of consciousness, the Zen mind. It is the hunter-gatherer state of consciousness. Meditation is a simulation of what a hunter-gatherer does all day long, hunting and fishing with a calm, clear mind yet alert and completely aware of his surroundings. This is mindfulness or what is commonly referred to as being present in the moment. A mind that is not thinking, planning or ruminating on the past and future, or about how others perceive us, a mind without self-consciousness, an undisturbed mind. This is what the Tao Te Ching means by returning to the primal identity. Unfortunately, in order to do this one must leave civilization behind because civilization will never allow you this state of mind with it's endless requirements of left-brain functions, fast-paced modality and stress. Now you see why the enlightened masters are usually forest hermits.

Our civilization, our society, displays every characteristic of the narcissistic, left hemisphere. Narcissism is a defense against a deep feeling of vulnerability and insecurity from childhood neglect and abuse. Unfortunately, the left hemisphere is not the wiser of the two brains. It evolved to make quick and dirty decisions and is certainly not where consciousness should take its residence. It is obsessed with material acquisition because it evolved as the part of the brain that seeks out food. It has an incredibly narrow way of seeing the world, It sees the world as a cognitive map composed of primitive symbols.

The fact is that we have two people inside our heads, when the right hemisphere finally breaks through into consciousness, It can be quite frightening, as Carl Jung described when he stated that the encounter with the Anima may cause petrification and even death.

I personally, experienced panic attacks as my right hemisphere began to break through into consciousness, as I experienced intuition, which is defined as thoughts that originate beyond conscious reasoning.

My encounter with the Anima sent me on a journey of homelessness, vulnerability, nature therapy, meditation and solitude. These things are necessary in order to deactivate the default mode network and activate the command centers of the brain in order to use the entire brain, or as Carl Jung put it, to become whole, to become the Self. This is the individuation process, to disconnect from the herd and become an individual, to develop one's inner world. The right hemisphere does not live in a box, figuratively and literally. It does not want to be confined in an artificial, domesticated prison. Like all animals, humans do not thrive in a cage, and the right hemisphere, when it makes its appearance on the stage of consciousness, makes no bones about this issue. The right hemisphere is open-minded, it evolved to confront the unknown such as predators, mates, unfamiliar territory. It then creates a cognitive map of the unfamiliar to be stored in the left hemisphere, which evolve to concern itself with the familiar. This is why a left-brain biased society is highly neurotic. The definition of neuroticism is fear of the unknown and seeking validation from others. The left hemisphere is also very concerned with where it fits in to the social hierarchy of status and dominance. Openness is one of the big-five personality traits, and it is synonymous with curiosity. In my view, openness, curiosity and facing the unknown are all the same thing. Once you free your mind from its prison then you will be outside the box and you will not want to live in a box. You will want to be in the natural environment where we evolved for millions of years before the sickness of civilization overtook the mind of man.

In order to reconnect with the right hemisphere of the brain, one must process traumatic, repressed memories and emotions, and confront and accept the negative, rejected aspects of one's unconscious personality. This is what Carl Jung described as the confrontation with the Shadow. This is the psychoanalytic process. These blockages must be cleared away, this is what the Tao Te Ching referred to as untying your knots.

A strange phenomenon, realizations, epiphanies, bolts from the blue, will suddenly occur to one who has begun to experience the integration process. Carl Jung stated that this begins after the disillusion of the persona, which I interpret as being an identity crisis, or the collapse of the self-narrative, the self-construct, which is usually composed of distorted beliefs about oneself. When one realizes that these beliefs are invalid, conditioned, brainwashing then this self-construct can come crashing when this happens a person can easily feel that they have absolutely no idea who they are anymore. This is what happened to me when I realized that I had been a scapegoat child of a grandiose narcissist father who had gaslighted me into believing that I wasn't good enough, I had an inferiority complex.

These flashes of insight indicate that intuition has begun to come online. This is a function of the right hemisphere, this is how it communicates. There is so much information that the right hemisphere wants to communicate but was unable to. I will never forget how it made my hands shake, It felt as though information was being downloaded to my mind from the universe. Carl Jung referred to this as the flooding of unconscious contents into the conscious mind, and warned about it overwhelming the conscious mind. He called it ego inflation. A person feels as if they are a god or the universe itself. This inflation will pass.

The right hemisphere is also musical and will communicate with songs. If a song suddenly appears in your mind, think about the lyrics and what they could mean in the context of whatever situation you are in, a decision you are trying to make or a conflict you are attempting to resolve. Most of the time these songs are light-hearted, sarcastic and humorous. Implicit meaning, IE; metaphor, sarcasm, irony, and humor are functions of the right hemisphere, wow the left hemisphere can only interpret things explicitly. An example of explicit interpretation is the way fundamentalist Christians interpret the Bible literally and not as a metaphorical mythology. When this function of the right hemisphere begins to come online you will suddenly realize the hidden meaning of all kinds of movies and stories. This is one of my favorite functions of the right hemisphere and was an incredible time for me when this began to occur.

It is very strange to have a conversation going on in your mind instead of an internal monologue, but the hardest part is awakening to the horrors of reality. This is taking the red pill, Awakening from the dream world of left brain optimism. This is a period of great darkness that one must endure as one begins to realize the truth of the human condition and the massive problems with society. As one's eyes become open to how suicidal we all are, how reckless and unenlightened civilized man has become. Civilized people live in a state of somnambulism, they are sleepwalkers, they live in a dream world of left hemisphere biased optimism and grandiosity while they unconsciously work to destroy themselves, destroy their environment and enslave, imprison and domesticate themselves. In fact the situation is quite grim and there is little cause for optimism. We have destroyed our ecosystem and are now facing our extinction.

There is no good news for the human race that comes with enlightenment. Awakening means facing reality. This is the great burden that one must carry. This is where stoic philosophy comes into play, Nietzsche's pessimism of strength. This is the Freudian transition from the pleasure principle to the reality principle that would normally occur in the adolescent mind during the rite of passage into adulthood in a tribal setting. This element is missing from the modern, civilized world, and so we remain psychologically childlike, regressed, in a state of arrested development. We have attempted to eliminate suffering from our existence but suffering is necessary for psychological development and, ultimately, we create much more suffering by trying to eliminating it.

This psychological process of accepting the call to adventure, leaving ones comfort zone, venturing into the unknown, into the dark underworld of one's unconscious mind, facing the demons there, overcoming resistances and recovering the treasure hard to attain is what the myths are about, the myth of the hero's journey.

1 note

·

View note

Text

thanks for the tag!!! ❤️

name: Heather (and I’ve never had a nickname). will also answer to Heather Caravello, Heather Carr, Heather Faure......

gender: moderately girly girl

sign: as if it wasn’t obvious; aquarius

height: like 5’4”?

birthday: February first

favorite bands: how much time do we have here? styx is #1 but barenaked ladies currently own my ass. I’m also suuuuper into Bay City Rollers/Rabbitt/Karu, Arabesque, Slade, and just a buttload of other artists really I’m too lazy to list anything more than the heavy hitters. oh and I can really get into kiss largely because I want a certain member to get into me- ok I’ll stop

favorite solo artist: duncan faure the precious bean

song stuck in my head: “beware my love” from Wings because my dad mentioned that john bonham played on a demo of it and I was TODAY YEARS OLD WHEN I LEARNED THIS even though I definitely had a wings hyperfixation years back and I thought I knew EVERYTHING and im reeling from shock

last movie: I don’t really watch movies? I kinda half paid attention to the newer animated grinch when it was on the other day and it was pretty adorable

last show: MASH

when did I create this blog: sometime in spring 2018 specifically for a college course. and after said course it morphed into what I intended to be a fan page; but as I began using it more and more it just became my general chaos blog

what do I post? stuff that I’m into. stuff I find funny/adorable. really whatever strikes me

last thing I googled: idk probably somewhere I was gonna go to to check their hours

other blogs: I co-admin @tartanterrors with @ticket-to-ride13 who is the greatest person ever and I somehow managed to get her into the rollers as my hyperfixation with them was dying down

following: 599 (sounds about right)

followers: I never look??? or care?

wait I have 175???? what is wrong with you people don’t you have taste? 😂seriously though I’m shocked I had THAT many... and I look at blogs that follow me and block every porn blog so I can’t blame it on them

average hours of sleep: who needs sleep? *proceeds to sing “who needs sleep” by BNL*

lucky number: if I ever get lucky, I’ll get back to you on that

instruments: does my voice count??? and good looks 😏

dream job: showrunner/screenwriter of my own show

dream trip: somewhere I can mine a crapload of crystals at. and the UK because I love British comedy and I desperately want a British husband

favorite food: a specific paneer dish from a specific Indian restaurant in my area that is MARVELOUS

nationality: American, but I’m from Buffalo so I have to say Polish bc I’m majority Polish by blood & we are damn proud of being Polish in my area

favorite song: you assholes. if you can choose a favorite song you haven’t heard enough good ones-

last book I read: Tommy Tedesco’s autobiography (google him he is a LEGEND from MY AREA)

fictional universe I want to live in: any of the ones I write about tbh. also I second Charlie on the “rather be born in the past” point, I’m thinking like 1950

tagging: @ticket-to-ride13 @britishsixtiesbeat @neondiorama @elp-asia72802 @princessmo and idk anyone else that feels the desire to do this

Tagged by @captainenjolras

Rules: answer 30 questions and tag 20 blogs you’d love to know more about!

Name/Nickname: Charles, so Charlie, Chuck, and Chuckie

Gender: I’m also genderfluid. normally he/him but anything works :))

Star sign: Libra

Height: 1.7m or 5’7”

Time: 19:20

Birthday: September 30th

Favourite bands: The Cars, Styx, the Pouges, Boston, etc

Favorite solo artist: Billy Joel

Song stuck in my head: Boum Boum Boum by Mika

Last movie: Die Hard 4, I think

Last show: Evil, which was months ago. don’t do much tv shows anymore

When did I create this blog: June/July 2019

What do I post: Les Mis, currently

Last thing I googled: I yust go nuts at Christmas

Other blogs: @charlie-but-no-headphones, @charles-lost-in-rocknroll, @chuckies-joel-cult, and one more that’s “”secret”” ;))

Do I get asks: sometimes...

Why I chose my URL: it just describes how my blog works I guess

Following: 65 (literally can’t keep up with any more than that)

Followers: it says 112 but it means 92

Average hours of sleep: depends. 6 to 10

Lucky number: 11

Instruments: guitar, flute, keyboards/piano

Dream job: singer in some rock band, or psychiatrist

Dream trip: fuck if I know. Ireland

Favorite food: hot wings

Nationality: American

Favorite Song: I have three. Unchanging: Your Love- The Outfield; Obsession fave: One Day More- Dream Cast; Changing: Whispering Bells- Del-Vikings

Last book read: uhh Liberty DeVitto’s autobiography

Top three fictional universes I’d like to live in: hm. haven’t thought about that in a while. I would say les mis, but that’d be too miserable. I’d rather have been born in 1948 than live in any fictional universe

Tagging: @thenardiers @chevroletmiserables @baycitystygian and everybody else!!

12 notes

·

View notes

Photo

BASIC INFORMATION

FULL NAME: Novia Muñoz del Rio

PRONUNCIATION: noʊviə muñɑz dɛl ˈrioʊ

MEANING: Novia has several meanings and translations including; new, bride, fiancée, sweety, girlfriend. Muñoz is a patronymic surname meaning "son of Muño" which means hill. And Rio means river.

REASONING: Novia was given her name because she was born as her parents began their new journey in Cuba

ALIAS: Diego Ortiz

BIRTH DATE: December 12th, 1755

AGE: 262

ZODIAC: Sagittarius

GENDER: Female

PRONOUNS: She/Her

SPECIES: Werewolf

ROMANTIC ORIENTATION: Biromantic

SEXUAL ORIENTATION: Bisexual

NATIONALITY: Cuban

CURRENT LOCATION: Ashbourne, Nova Scotia

LIVING CONDITIONS: A small cozy home on the outskirts of Ashbourne, surrounded by 640 acres of land.

BACKGROUND

BIRTH PLACE: Matanza, Cuba

HOMETOWN: Matanza, Cuba

SOCIAL CLASS: Born lower class, now upper class

EDUCATION LEVEL: Life Skills? No official education background

LANGUAGE(S) SPOKEN: Spanish, French, Romanian, English, German, Ukrainian, and Russian

FATHER: Munio Rodríguez [deceased]

MOTHER: Maria González [deceased]

SIBLING(S): N/A

CHILDREN: Munio & Maria Díez [deceased]

PET(S): None currently.

OTHER IMPORTANT RELATIVES: N/A

PREVIOUS RELATIONSHIPS: Diego Ortiz (1773-1792; married 1776), Arlo/Amara (1872-1876), Toma Bălan (1925-1986; married 1950), Mackenzie Renaud (2007-2010)

FRIENDS: Helena Hastings & Julienne Beauchamp,

FOES: None at the moment.

PACK MEMBERS: Helena Hastings, Julienne Beauchamp, Sebastian Hastings, Landon Hastings, Mackenzie Renaud, Adelynn Renaud & Laila Renaud

ARRESTS?: Public indecency (Berlin, Germany)

PRISON TIME?: None

PHYSICAL APPEARANCE & CHARACTERISTICS

FACE CLAIM: Ana de Armas

EYE COLOR: Hazel

HAIR COLOR: Dark brown (currently)

HAIR TYPE/STYLE: Short bob (currently)

GLASSES/CONTACTS: Unnecessary

DOMINANT HAND: Left

HEIGHT: 5′ 6″

BUILD: Mesomorph

EXERCISE HABITS: Casual hikes most mornings; infrequent jogs

SKIN TONE: Fair

TATTOOS: None

PIERCINGS: One pair of earrings

NOTABLE FEATURES: A youthful appearance that make her appear sweet and innocent

USUAL EXPRESSION: A small smile that doesn’t quite reach her eyes

CLOTHING STYLE: Button down shirts, plain jeans, and a coat; business casual (currently)

JEWELRY: Two wedding bands on a silver chain as a necklace; one is from Diego and the other Toma

ALLERGIES: None now; as a human her hay fever was mild

BODY TEMPERATURE: Above average

DIET: Mostly plant based with red meat

PHYSICAL AILMENTS: None

OCCUPATION & INCOME:

PRIMARY SOURCE OF INCOME: Savings & Investments

SECONDARY SOURCE OF INCOME: Lifeguard & Swim teacher at DeadLift Gym

CONTENT WITH THEIR JOB (OR LACK THERE OF)?: Yes, who wouldn’t love teaching children?

PAST JOB (S): Sugar cane harvester, sugar plantation owner, Cuban solider, au pair, Canadian Woman’s Army Corps, British Army, Chernobyl Nuclear Plant

SPENDING HABITS: Anything pretty, lots of gifts

MOST VALUABLE POSSESSION: Her collection of photographs she’s taken over the years

PSYCHOLOGY & PERSONALITY

ELEMENT: Water; strong but soft

APPROXIMATE IQ: 100

CHARACTER ARCHETYPE: The Mother

STRONGEST CHARACTER TRAITS: Understanding, Honorable, Loyal

WEAKEST CHARACTER TRAITS: Distant, Secretive, Opinionated

MENTAL CONDITIONS/DISORDERS: None

EMOTIONAL STABILITY: Relatively stable

PHOBIA(S): None

ADDICTION(S)/BAD HABITS:

OBSESSIONS: Photography

BIGGEST SECRET: She blames herself for the deaths of her loved ones

DRUG USE: Sober since 1996

ALCOHOL USE: Infrequently, prefers Bourbon when indulging

SWEARING?: Not often

PRONE TO VIOLENCE?: No, prefers to stay out of fights. Will fight from a distance if necessary

RELIGION: Nonpracticing Catholic

HOGWARTS HOUSE: Gryffindor

MORAL ALIGNMENT: Chaotic Good

MANNERISMS

SPEECH STYLE: Slow & soft

ACCENT: Her English is heavily saturated with a mix of Spanish and Eastern European accents. A few more consistent years of speaking English will lessen the severity.

HABITS: Photographing people without consent, watching the sunrise

NERVOUS TICKS: Running the tips of her fingers over her nails

DRIVES/MOTIVATIONS/: To be at peace with the world, she wants to live out the rest of her years without being haunted by the past. She can’t change it, it’s time to accept it and move forwards

GENERAL FEARS: Finding a new family only to lost them to death once again

SENSE OF HUMOR: Light hearted and teasing

CATCHPHRASE(S): Nothing particular, but calls people ‘darling’ frequently

FAVORITES

ANIMAL: Wolf, is that too obvious?

BEVERAGE: Cuban coffee or hot chocolate

BOOK: A WAC Looks Back by Doris “Joy” Thurston or The Things They Carried by Tim O’Brien

COLOR: Lavender

FOOD: Picadillo

FLOWER: Lilies

GEM: Amethyst

HOLIDAY: Christmas

MODE OF TRANSPORTATION: Walking; horse back

MOVIE: Schindler’s List

MUSICAL ARTIST: Beethoven

QUOTE/SAYING: “ Every person from your past lives as a shadow in your mind. Good or bad, they all helped you write the story of your life, and shaped the person you are today.”

SCENERY: Thick forests

SCENT: Her loved ones

SPORT: Soccer

SPORTS TEAM: Cuba national football team

TELEVISION SHOW: N/A

WEATHER: Winter

VACATION DESTINATION: Thailand

PAST/FUTURE

WHAT WERE THEY LIKE AS A CHILD?: Hard working, loving, playful

GROW UP RICH OR POOR?: Poor mostly, then slowly gained affluence

NURTURED OR NEGLECTED?: Nurtured

ASPIRATIONS AS A CHILD?: To fall in love and get married

SMELL THAT REMINDS THEM OF CHILDHOOD: Sugar cane and wheat fields

BEST CHILDHOOD MEMORY?: Playing tag on the plantation with the other children

WORST CHILDHOOD MEMORY?: Working in the fields day and night

OPINIONS ON MARRIAGE?: Marriage is a beautiful thing, but I’d rather not try it a third time

WANT KIDS?: Yes, but doesn’t believe she can have any

WANT TO GROW OLD?: Yes

WANT TO SETTLE DOWN?: Yes

3 notes

·

View notes

Text

Hindsight is 20/20 because we make it that way - and the evolution of how we tell history by comparing past to present plays into it

http://www.planteink.com/cartoon/plantb20070824/

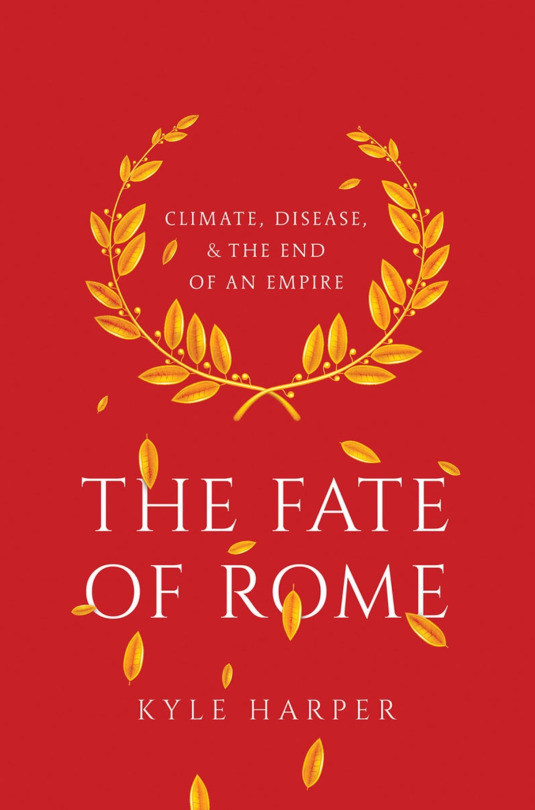

In the 2017 monograph, The Fate of Rome: Climate, Disease, and the End of Civilization, Kyle Harper explains the intersections of the Roman timeline with disease and climate change to illustrate how Rome was brought down by a perfect storm of illness and climate fluctuation patterns.

In contrast, Edward Gibbon wrote one of the most recognizable text on Rome, in which he blamed the fall of the empire on religion and Christianity.

History is a product of the historian’s environment. Harper writes in 2017 when disease and climate change are frequently discussed publicly. Gibbon wrote in the 1770s during Enlightenment, when secularism was rampant, so blaming the fall on Christianity felt like the thing to do. That doesn’t mean that one author’s theory is better than the other, they uphold their claim with evidence, but each of the hundreds of theories about the collapse of the empire has some root in the author’s background, belief, or their environment.

French Salon de Madame Geoffrin

Each of these authors wrote about the past through the lens of their current world.

Back to Harper’s text, one of the climate elements he discusses is ENSO, or El Nino, and its impact on the manifestation of the Justinian Plague in the 6th Century.

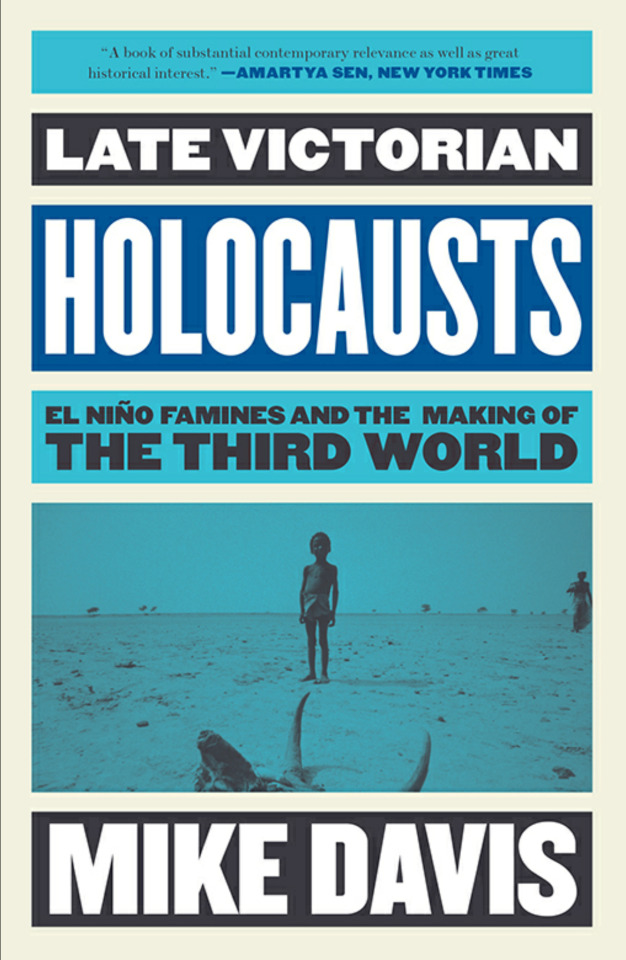

Mike Davis, in his 2000 text, also looks to ENSO to help explain a phenomenon, the droughts in India that combined with British politics and economics to quite literally create the Third World. You can see a diagram I made for more about this here.

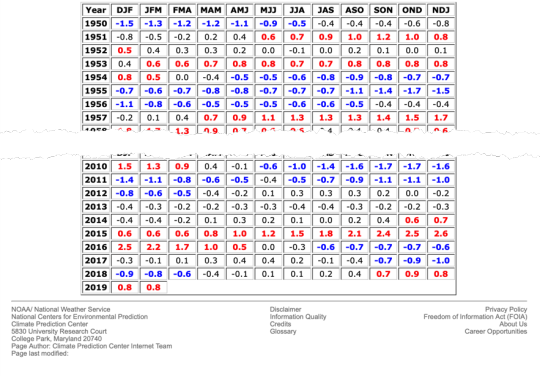

We have only been tracking ENSO data since about 1950, so we have had to go back to study a lot, such as looking at ice cores and tree rings to learn about climate in Rome.

https://origin.cpc.ncep.noaa.gov/products/analysis_monitoring/ensostuff/ONI_v5.php

But with science, we are now able to make meaningful connections to evidence that has been there for centuries. An example of this is the study of the specific scaring that Tuberculosis (TB) leaves behind on bones. Scientists can now say there was TB in the Roman Empire. New scientific discoveries such as the existence of ENSO and diseases such as TB, malaria, leprosy, and a host of others in Rome allows historians to expand on narratives and gain a more complete picture of the past. But ultimately, they are driven by the science and philosophy of their time.

Scientists can now measure femur lengths that have been dated to Romans to show their low quality of life. A similar thing happened as a result of the Industrial Revolution in the US, where health conditions and average height declined in what is known as the Antebellum Paradox. In the US it was the trains, in Rome it was partly the disease.

Harper p. 77 Kindle Edition

There has long been a divide between the social and hard sciences, but now we have the technology to blur the lines a bit.

Another text adjacent to the connection between social and hard sciences is The Landscape of History, which contains lectures by John Gaddis. Gaddis cites similarities such as having standards for the practice of history, peer-review processes and advancing methodologies and theories through time.

Harper’s book is just one of many steps toward interdisciplinary work that will open many doors to tell us much more about our past. Scientific, political, cultural, and societal shifts in our current world continually affect how we can and DO view the past.

#history#historiography#historical methods#rome#disease#India#third world#mike davis#kyle harper#john gaddis#hst580#climate change#enso#edward gibbon

0 notes

Text

Fighting negativity and making America better

Well, you could probably write a bookshelf full of books on this topic from many different viewpoints and opinions. Tonight though, we are going to focus on a few general ideas and hopefully not step on too many toes. Right now, there is some general hatred in our country and much misinformation and confusion. Unfortunately, this means to even get started you have to call out some things and I won’t say some people, so let’s say some general groups and hopefully dear reader you realize there are some generalizations that must be done to get down to some points.

So where does a person begin. In this situation, the writer gets to choose and I choose the what use to be called the Eastern Establishment. Wait let me back up a moment. For America to be successful many different groups or relationships need to have I guess a symbiotic relationship. For example, and I have talked about this before; liberals and conservatives (true open minded liberals and conservatives) need each other not for themselves to be successful more for the country to be successful. Sometimes we forget events will dictate what is the best course of action to take. We cannot let our closed minds push aside better options just because it does not fit in our worldview.

And this is where I start with the Eastern Establishment. And now this group has evolved from when this label first became used. Taking this in a general context, many liberals of the Eastern Establishment would pounce immediately and say it is the modern conservative who is thoroughly closed minded, not us. Why can you accuse us of the same label, when we have known for decades what is better for the country? And oops maybe you don’t. For example, the high handedness of this group comes from their education and granted most people who fit this mold have gone onto higher degrees in general than the average American. Yet they do not know middle America, nor have a general understanding of how middle America feels right now. First example and it is a disastrous one is the election of Mr. Trump. The current liberal mindset is just shocked that Mr. Trump was elected. Pretty much the way the liberal news has reported for the last three months is the proof in the pudding for this thought.

Now I once proposed that he was elected because of a few smart people who knew the electoral count going in and made a play at the end to pull the rabbit out of the hat. And yes, that is partly why he won.

The bigger picture is something most people do not talk about anymore. Older white middle America is lost. Yes, I said white and white for a reason. Truth be told back in the 50’s and 60’s white middle class America had it better than other races, creeds etc.. that is a different topic for a different day. And I will touch on it as I go along, for now though let’s focus on where we are now with middle America as a whole. And again, yes this is different from middle white America of the 50’s and 60’S. And try to address how we got here today.

The modern “well educated” liberal has forgotten one extremely important fact. And I suggest if you are insulted by my labeling coming up, go back and read what Adlai Stevenson, II was saying in the 1950’s. You have missed some large boats. Anyway, in the 50’s and going into the 60’s white middle class America had reached a zenith in the history of mankind. In the minds of white middle class America, the world was their oyster. Yes, there was many underlying problems from race relations to bad foreign policy to the ultra-pollution of our air and water, yet on the surface no group of people in the history of the world had the opportunity the children of the 1950’s had. None. Public education was available to all, when people said if you worked hard and applied yourself you could be anything you want it was true. Think of all the opportunities that came about with the space race, computers, military buildup, the interstate highway system just to name a few… degrees in engineering, science, accounting, law, education built up the next generation and created what is now known as the upper middle class or the height of this opportunity. And most of these people came from white middle class, all their values, beliefs, status etc. are a byproduct of this time. And even some Eastern Liberal establishment members have some roots with this same mindset. The federal government grew and a whole slew of programs and departments grew to handle all our problems. We fought a war in Vietnam and we fought the war on poverty. Unfortunately, we don’t seem to have won either and this is just one statement that shows where we went from the 1960’s.

The so called Eastern Establishment never realized middle America enjoyed being middle America and resented the Eastern Establishment laying much blame about all the bad things that came about in the 60’s and 70’s on them or just that they didn’t know any better; hence Richard Nixon could say with great confidence the silent majority was for him. He was right. Yes, there were problems that needed to be addressed and more were developing, but the Eastern Establishment began an attack on middle America that leaves us in a very precarious situation today. Now I am not saying this is the Eastern Establishment’s fault or whatever modern version of this group that exists today. I am saying they are part of the same problem on the opposite side of the coin that produced Donald Trump. I will be fair; you are going to hear about the closed minded, Republican establishment also.

Okay so what does Donald Trump’s statement I am going to make America great again mean. Well to many in white middle America, they remember opportunity, they remember kids being able to play outside all day during the summer, there were no bogeymen except as parental threats, they remember the concept of you are supposed to respect certain people just because of the job title whether it be teacher or policeman, they remember people want to be astronauts or Presidents or owners of businesses. Middle America sees this as why America was great. This is good and now it is gone. (not really, this is how we make America better). To middle America, something happened over the last 30 or 40 years and now we live in an ugly country where all these people are destroying everything they grew up to believe. Are they racists and bigots and horrible people? There are a few that are, for many though they are lost. Maybe some inherent racism just because they are white, in most people of all races it will exist some, but not because they are evil people who want to shut down everyone and hate everybody. No, they want everyone to assimilate. Why,,,,, well Eastern Establishment because what they grew up with… was great.. they didn’t realize they reached a zenith of humanity, they just realized life is good.

And then along came the modern Republican party establishment and what is rather ironic, it grew post Nixon. Yes, the greed mongering and self-righteous came after the worst Presidential debacle in our history. Nixon was smart, calculating, very politically aware, and at the same time very paranoid and well just afraid. He knew what he wanted. He grew up believing that if you worked hard you could be whatever you wanted. In his mind, Kennedy took that away from him, so he had to fight back and fight back hard to get what was his, which led to some of the most stupid political decisions in our history. When I was young I use to think Nixon was evil. He was not evil. He just made himself a trap and jumped right into it. A smart calculating politician, went overboard and made some very dangerous to our country decisions. And he got caught. And we should be glad he did. Eventually we made need to rely on our strength as a country to get past future problems of this nature. That will be part of making America better somewhere down the line.

Post Nixon though the original generation of what we know call the 1 percenters realized they needed to get better control of this nation or people might step up and take away what they have “accomplished”. This led to the Republican party post Nixon becoming more outright about taking away advantages to other people and lying to their base to make sure they had what they wanted and no one else was going to interfere. Unfortunately, at this point the Eastern Establishment starting devolving in their own world while the Modern Republican Establishment came to be and starting devolving themselves. Yep not a pretty picture, yet at the time, both sides were becoming so self-absorbed they didn’t realize how much the other side was falling. The modern Republican is not conservative anymore though, nor is the Eastern Establishment or whatever you might want to call their devolution is liberal. Both sides have agendas that benefit their noise, not the rank and file liberals or conservatives. In fact, a really decent liberal or conservative agenda is not going to be passed through our government right now since the self-serving leaders of both sides cannot give up one iota to the other side no matter how far they take this country into the trash. Yes, liberals you act like you will work with conservatives, but in fact all you do is state how superior you are and that conservatives do not know anything. Well since the Republican Establishment call themselves conservative I can see why you would go down this path, yet the truth is, since they are not conservative (just self-serving greedy pricks), you throw the baby out with the dirty bathwater.

And after 20 or 30 years of this, we have the extremes of both sides so separated from the rest of the country they are leading the noise of hate at each other. The good thing is this is still the minority of both sides. The noise they are making though sounds like there is much hate in this country. Yet if you really watch people, most want to go to work, work with the people they do, come home and hide away from all this grief being thrown at them by the extremes on both sides.

And that is where we start to make America better. This country still has the potential to lead the world into the next zenith of humanity. (or unfortunately drag down the whole planet). The change though must come from the people. Think about my earlier statement that in the 50’s leading to the 60’s there was so much opportunity for white middle America. Our task is to create the same opportunity for all. And that is so possible. There is new technology for people to work with to create so much. There is an opportunity for a whole new space race that encompasses the whole world. We can use new technologies to solve age old problems like how do we feed everyone? Over the years, I have proposed many ideas and I know if I can sit here in my living room and just dream up new economic development plans and ideas to better EDUCATE our children others can also. And then we can sit down and choose the best of the ideas to move forward. The world is still our oyster. Let us not be dragged down by the hate and ignorance of a few. Let us fight this tyranny of thought, remove the self-serving interests that hamper our growth. Businesses can still flourish, people can still dream, new products and new ideas and better government can be done, yet only if we take back the mindset that we can do it.

Like I said at the top, there could be books written on my title and all I wanted to do was throw out some general ideas and here I am lost in the myriad of possibilities, trying to avoid the hate that dominates the media noise. America is great from Constitutional writing and on. It is time for us to take the next steps to continue our greatness. We are not perfect, but we can continue to become better. And to do this, we need the Eastern Establishment and Middle America to realize they need each other. When one is successful, the other is also. They are not always going to move in lock step. That is okay. As long as both realize they are working towards a better America and then let the best path at the time be chosen then all will be well.

1 note

·

View note

Link

From post-war recessions to the energy crisis to the dot-com and housing bubbles, some slumps have proven more lasting—and punishing—than others.

A recession is defined as a contraction in economic growth lasting two quarters or more as measured by the gross domestic product (GDP). Starting with an eight-month slump in 1945, the U.S. economy has weathered 12 different recessions since World War II.

On average, America’s post-war recessions have lasted only 10 months, while periods of expansion have lasted 57 months. Some economists predict that the COVID-19 pandemic will put an end to the longest period of economic expansion on record, which ran 128 months—more than a decade—from mid-2009 to early 2020.

February to October 1945: End of WWII

WWII was an economic boon for the U.S. economy as the government infused tens of billions of dollars into manufacturing and other industries to meet wartime needs. But with the surrender of both Germany and Japan in 1945, military contracts were slashed and soldiers started coming home, competing with civilians for jobs.

As government spending dried up, the economy dipped into a serious recession with GDP contracting by a whopping 11 percent. But the manufacturing sector adapted to peacetime conditions faster than expected and the economy righted itself in a tidy eight months. At its worst, the unemployment rate was only 1.9 percent.

November 1948 to October 1949: Post-War Consumer Spending Slows

When wartime rations and restrictions were lifted after WWII, American consumers rushed to catch up on years of pent-up purchases. From 1945 to 1949, American households bought 20 million refrigerators, 21.4 million cars, and 5.5 million stoves.

When the consumer spending boom began to level off in 1948, it triggered a “mild” 11-month recession in which GDP shrunk by only 2 percent. Unemployment was up considerably, though, with all former GIs back in the job market. At its peak, unemployment reached 7.9 percent in October 1949.

July 1953 to May 1954: Post-Korean War Recession

This relatively short and mild recession followed the script of the post-WWII recession as heavy government military spending dried up after the end of the Korean War. During a 10-month contraction, GDP lost 2.2 percent and unemployment peaked around 6 percent.

The post-Korean War recession was exacerbated by the Federal Reserve’s monetary policy. As would happen in many future recessions, the Fed raised interest rates to combat high inflation caused by an influx of dollars into the wartime economy. The higher interest rates had the intended effect of slowing inflation, but also lowered confidence in the economy and undercut consumer demand.

In fact, one of the main reasons that the recession was so short was because the Fed decided to lower interest rates back down in 1953.

August 1957 to April 1958: Asian Flu Pandemic

An Asian flu vaccine being rushed by helicopter to parts of the U.S. hit by the epidemic, 1957.

In 1957, an Asian Flu pandemic spread from Hong Kong across India and into Europe and the United States, sickening untold numbers and ultimately killing more than a million people worldwide. The illness also triggered a global recession that cut U.S. exports by more than $4 billion.

Again, the economic problems were compounded by the Fed raising interest rates to slow inflation, which had been on the rise throughout the 1950s. Consumer spending flagged and the U.S. economy sunk into an eight-month recession during which GDP shrank by 3.3 percent and unemployment rose to 6.2 percent.

Dwight D. Eisenhower is credited with ending the short recession by boosting government spending on highway construction and other public infrastructure projects approved by the 1956 Federal Aid Highway Act.

April 1960 to February 1961: The Recession that Cost Nixon an Election

Just two years later, Richard M. Nixon was vice president when the nation sunk into yet another recession. Nixon blamed the economic slump for his loss to John F. Kennedy in the 1960 presidential election.

There were two major causes of this 10-month recession, during which GDP declined 2.4 percent and unemployment reached nearly 7 percent. The first was what economists call a “rolling adjustment” in several major industries, most notable automobiles. Consumers started buying more compact foreign cars and U.S. carmakers had to slash inventory and adjust to changing tastes, which meant a temporary reduction in profits.

The second cause was the Fed again, which raised interest rates fast on the heels of the previous recession in an ongoing effort to rein in inflation.

Not only did Nixon get the blame for starting the recession, but JFK took credit for ending it with a round of stimulus spending in 1961 and an expansion of Social Security and unemployment benefits.

December 1969 to November 1970: Putting the Brakes on 1960s Inflation:

This extremely mild recession was another course correction engineered by the Fed under the Nixon administration. After the previous recession, the U.S. economy went on a decade-long expansion that saw inflation rise to over 5 percent in 1969.

In response, the Fed once again raised interest rates, which had the intended consequence of cooling the hot 1960s economy while only reducing GDP by 0.8 percent over an 11-month recession. Unemployment rose to 5.5 percent over the same period. When the Fed lowered rates again in 1970, the economy cranked back into growth mode.

November 1973 to March 1975: The Oil Embargo

View of a handwritten note on the padlocked door of a restaurant in Philadelphia, Pennsylvania, July 1973. The sign reads 'Closed until Monday 6 a.m. due to energy crisis by order of the Mayor,' referring to the OPEC (Organization of Arab Petroleum Exporting Countries) oil embargo which led to a U.S. energy shortage.

This recession marked the longest economic slump since the Great Depression and was caused by a perfect storm of bad economic news.

First, there was the Oil Embargo of 1973, imposed by the Organization of the Petroleum Exporting Countries (OPEC). With the oil supply restricted, gas prices soared and Americans cut spending elsewhere.

At the same time, Nixon tried to reduce inflation by instituting price and wage freezes in major U.S. industries. Unfortunately, companies were forced to lay off workers in order to afford the new salaries, which still weren’t high enough for consumers to pay the new fixed prices.

The result was “stagflation,” a stagnant economy with high inflation and low consumer demand, and a recession that spanned five consecutive negative-growth quarters. In all, the 16-month recession saw a 3.4 percent reduction in GDP and a near doubling of the unemployment rate to 8.8 percent.

The Fed had no choice but to lower interest rates to end the recession, but that set the stage for the truly runaway inflation of the late 1970s.

January to July 1980: Second Energy Crisis and Inflation Recession

Oil prices skyrocketed again in 1979 caused by disruptions to the oil supply during the Iranian Revolution and increased global oil demand. This led to high prices and long lines at the gas pump in the United States.

Meanwhile, inflation had grown to a staggering 13.5 percent and the Fed had no choice but to raise interest rates, which put the brakes on the booming late 1970s economy. The result was a tie for the shortest post-WWII recession—just six months start to finish—in which GDP declined only 1.1 percent but unemployment ratcheted up to 7.8 percent.

July 1981 to November 1982: Double Dip Recession

This far more painful recession came close on the heels of the short 1980 recession, introducing Americans to the phrase “double-dip recession.”

For the third time in a decade, one of the recessionary triggers was an oil crisis. The Iranian Revolution was over, but the new regime under Ayatollah Khomeini continued to export oil inconsistently and at lower levels, keeping gas prices high.

At the same time, the Fed’s timid interest rates hikes in 1980 weren’t enough to slow inflation, so Fed chief Paul Volcker pushed interest rates to new heights—21.5 percent in 1982. The sky-high rate pulled inflation down, but took its toll on the economy, which shrunk by 3.6 percent during the 16-month recession and saw unemployment peak at over 10 percent.

This long and deep recession finally ended following a combination of tax cuts and defense spending under Ronald Reagan.

July 1990 to March 1991: S&L Crisis and Gulf War Recession

Unemployed Mike and Jean Richardson pictured with their child and a sign advertising his need for work during the 1990 recession.

A host of factors led to the economic slowdown of the early 1990s. One was the failure of thousands of Savings & Loan institutions in the late 1980s which hit the mortgage lending market particularly hard. Fewer mortgages meant record low levels new construction, which had far-reaching effects across the economy.

While that may have been enough to send the economy into recession, Saddam Hussein of Iraq invaded neighboring Kuwait, a major oil producer. The ensuing Gulf War caused oil prices to more than double.

Adding to the economic woes was the October 1989 “mini-crash” of the stock market and the start of NAFTA (North American Free Trade Agreement), which incentivized American manufacturers to move operations to Latin America.

The combined result was an eight-month recession that saw GDP decline by 1.5 percent and unemployment peak at 6.8 percent. Even when the recession officially ended in 1991, it was followed by several quarters of very slow growth.

March to November 2001: The Dot-Com Crash and 9/11

Irrational exuberance is blamed for the stock market bubble that formed around internet startups in the late 1990s and 2000. Investors pumped money into unproven businesses, artificially inflating their values to unsustainable levels. When the dot-com bubble finally burst in 2001, the tech-heavy Nasdaq lost 75 percent of its value and hordes of investors went belly up.

While the tech sector took a devastating hit, the rest of the economy stumbled along until the September 11th terrorist attacks knocked it down for good. The early 2000s were also marked by high-profile corporate accounting scandals at Enron and poor stock market returns. The S&P 500 lost 43 percent of its value from 2000 to 2002.

Given how much the dot-com crash impacted a generation of investors, the 2001 recession was relatively fast and shallow, with GDP down only 0.3 percent overall and unemployment peaking at 5.5 percent.

The economy was able to pull out of the 2001 recession on the strength of the housing sector, which experienced growth even during the recession thanks to low interest rates.

December 2007 to June 2009: The Great Recession

Here's What Caused the Great Recession (TV-PG; 3:21)

WATCH: Here's What Caused the Great Recession

The longest and most calamitous economic downturn since the Great Depression, the Great Recession was part of a global financial meltdown triggered by the collapse of the U.S. housing bubble.

The Great Recession was the result of a financial house of cards built on the subprime mortgage market. Large financial institutions invested heavily in mortgage-backed securities. When homeowners defaulted on those high-risk mortgages, not only did they lose their homes, but huge investment banks like Bear Stearns and Lehman Brothers teetered on the verge of collapse.

The dual housing banking crises sent shockwaves through the stock market, and major indices like the S&P 500 and Dow Jones Industrial Average lost half of their value, gutting the retirement accounts of millions of Americans.

During the agonizing 18-month recession, unemployment reached as high as 10 percent and GDP shrunk by a whopping 4.3 percent. The economy only turned around after massive government stimulus spending (more than $1.5 trillion) to prop up the failing banks and inject capital into the shell-shocked economy.

from Stories - HISTORY https://ift.tt/2KI1RHp April 29, 2020 at 11:38PM

0 notes

Text

NASA’s first flight director Chris Kraft dies at 95

WASHINGTON — Behind America’s late leap into orbit and triumphant small step on the moon was the agile mind and guts-of-steel of Chris Kraft, making split-second decisions that propelled the nation to once unimaginable heights.

Kraft, the creator and longtime leader of NASA’s Mission Control, died Monday in Houston, just two days after the 50th anniversary of what was his and NASA’s crowning achievement: Apollo 11’s moon landing. He was 95.

Christopher Columbus Kraft Jr. never flew in space, but “held the success or failure of American human spaceflight in his hands,” Neil Armstrong, the first man-on-the-moon, told The Associated Press in 2011.

Kraft founded Mission Control and created the job of flight director — later comparing it to an orchestra conductor — and established how flights would be run as the space race between the U.S. and Soviets heated up. The legendary engineer served as flight director for all of the one-man Mercury flights and seven of the two-man Gemini flights, helped design the Apollo missions that took 12 Americans to the moon from 1969 to 1972 and later served as director of the Johnson Space Center until 1982, overseeing the beginning of the era of the space shuttle.

Armstrong once called him “the man who was the ‘Control’ in Mission Control.”

“From the moment the mission starts until the moment the crew is safe on board a recovery ship, I’m in charge,” Kraft wrote in his 2002 book “Flight: My Life in Mission Control.”

“No one can overrule me. … They can fire me after it’s over. But while the mission is under way, I’m Flight. And Flight is God.”

NASA Administrator Jim Bridenstine Monday called Kraft “a national treasure,” saying “We stand on his shoulders as we reach deeper into the solar system, and he will always be with us on those journeys.”

Kraft became known as “the father of Mission Control” and in 2011 NASA returned the favor by naming the Houston building that houses the nerve center after Kraft.

“It’s where the heart of the mission is,” Kraft said in an April 2010 AP interview. “It’s where decisions are made every day, small and large … We realized that the people that had the moxie, that had the knowledge, were there and could make the decisions.”

That’s what Chris Kraft’s Mission Control was about: smart people with knowledge discussing options quickly and the flight director making a quick, informed decision, said former Smithsonian Institution space historian Roger Launius. It’s the place that held its collective breath as Neil Armstrong was guiding the Eagle lunar lander on the moon while fuel was running out. And it’s the place that improvised a last-minute rescue of Apollo 13 — a dramatic scenario that later made the unsung engineers heroes in a popular movie.

Soon it became more than NASA’s Mission Control. Hurricane forecasting centers, city crisis centers, even the Russian space center are all modeled after the Mission Control that Kraft created, Launius said.

Leading up to the first launch to put an American, John Glenn, in orbit, a reporter asked Kraft about the odds of success and he replied: “If I thought about the odds at all, we’d never go to the pad.”

“It was a wonderful life. I can’t think of anything that an aeronautical engineer would get more out of, than what we were asked to do in the space program, in the ’60s,” Kraft said on NASA’s website marking the 50th anniversary of the agency in 2008.

In the early days of Mercury at Florida’s Cape Canaveral, before Mission Control moved to Houston in 1965, there were no computer displays, “all you had was grease pencils,” Kraft recalled. The average age of the flight control team was 26; Kraft was 38.

“We didn’t know a damn thing about putting a man into space,” Kraft wrote in his autobiography. “We had no idea how much it should or would cost. And at best, we were engineers trained to do, not business experts trained to manage.”

NASA trailed the Soviet space program and suffered through many failed launches in the early days, before the manned flights began in 1961. Kraft later recalled thinking President John F. Kennedy “had lost his mind” when in May 1961 he set as a goal a manned trip to the moon “before this decade is out.”

“We had a total of 15 minutes of manned spaceflight experience, we hadn’t flown Mercury in orbit yet, and here’s a guy telling me we’re going to fly to the moon. … Doing it was one thing, but doing it in this decade was to me too risky,” Kraft told AP in 1989.

“Frankly it scared the hell out of me,” he said at a 2009 lecture at the Smithsonian.

One of the most dramatic moments came during Scott Carpenter’s May 1962 mission as the second American to orbit the earth. Carpenter landed 288 miles off target because of low fuel and other problems. He was eventually found safely floating in his life raft. Kraft blamed Carpenter for making poor decisions. Tom Wolfe’s book “The Right Stuff” said Kraft angrily vowed that Carpenter “will never fly for me again!” But Carpenter said he did the best he could when the machinery malfunctioned.

After the two-man Gemini flights, Kraft moved up NASA management to be in charge of manned spaceflight and was stunned by the Apollo 1 training fire that killed three astronauts.

Gene Kranz, who later would become NASA’s flight director for the Apollo mission that took man to the moon, said Kraft did not at first impress him as a leader. But Kranz eventually saw Kraft as similar to a judo instructor, allowing his student to grow in skills, then stepping aside.

“Chris Kraft had pioneered Mission Control and fought the battles in Mercury and Gemini, serving as the role model of the flight director. He proved the need for real-time leadership,” Kranz wrote in his book, “Failure Is Not An Option: Mission Control from Mercury to Apollo 13 and Beyond.”

Born in 1924, Kraft grew up in Phoebus, Virginia, now part of Hampton, about 75 miles southeast of Richmond. In his autobiography, Kraft said with the name Christopher Columbus Kraft Jr., “some of my life’s direction was settled from the start.”

After graduating from Virginia Polytechnic Institute in 1944, Kraft took a job with aircraft manufacturer Chance Vought to build warplanes, but he quickly realized it wasn’t for him. He returned to Virginia where he accepted a job with the National Advisory Committee for Aeronautics, not far from Phoebus.

Kraft’s first job was to figure out what happens to airplanes as they approach the speed of sound.

After his retirement, Kraft served as an aerospace consultant and was chairman of a panel in the mid-1990s looking for a cheaper way to manage the shuttle program.

Later, as the space shuttle program was being phased out after 30 years, Kraft blasted as foolish the decision to retire the shuttles, which he called “the safest machines ever built.”

Kraft said he considered himself fortunate to be part of the team that sent Americans to space and called it a sad day when the shuttles stopped flying.