#best stocks for long term

Explore tagged Tumblr posts

Text

Discover the best Diwali stock picks for 2024 across various sectors and boost your portfolio this festive season.

#jarvis artificial intelligence#ai based stocks in india#best stock market advisor in India#muharat trading 2024#best stocks for long term#diwali stock picks#good fundamental stocks

0 notes

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी। भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

I slept in and just woke up, so here's what I've been able to figure out while sipping coffee:

Twitter has officially rebranded to X just a day or two after the move was announced.

The official branding is that a tweet is now called "an X", for which there are too many jokes to make.

The official account is still @twitter because someone else owns @X and they didn't reclaim the username first.

The logo is 𝕏 which is the Unicode character Unicode U+1D54F so the logo cannot be copyrighted and it is highly likely that it cannot be protected as a trademark.

Outside the visual logo, the trademark for the use of the name "X" in social media is held by Meta/Facebook, while the trademark for "X" in finance/commerce is owned by Microsoft.

The rebranding has been stopped in Japan as the term "X Japan" is trademarked by the band X JAPAN.

Elon had workers taking down the "Twitter" name from the side of the building. He did not have any permits to do this. The building owner called the cops who stopped the crew midway through so the sign just says "er".

He still plans to call his streaming and media hosting branch of the company as "Xvideo". Nobody tell him.

This man wants you to give him control over all of your financial information.

Edit to add further developments:

Yes, this is all real. Check the notes and people have pictures. I understand the skepticism because it feels like a joke, but to the best of my knowledge, everything in the above is accurate.

Microsoft also owns the trademark on X for chatting and gaming because, y'know, X-box.

The logo came from a random podcaster who tweeted it at Musk.

The act of sending a tweet is now known as "Xeet". They even added a guide for how to Xeet.

The branding change is inconsistent. Some icons have changed, some have not, and the words "tweet" and "Twitter" are still all over the place on the site.

TweetDeck is currently unaffected and I hope it's because they forgot that it exists again. The complete negligence toward that tool and just leaving it the hell alone is the only thing that makes the site usable (and some of us are stuck on there for work).

This is likely because Musk was forced out of PayPal due to a failed credit line project and because he wanted to rename the site to "X-Paypal" and eventually just to "X".

This became a big deal behind the scenes as Musk paid over $1 million for the domain X.com and wanted to rebrand the company that already had the brand awareness people were using it as a verb to "pay online" (as in "I'll paypal you the money")

X.com is not currently owned by Musk. It is held by a domain registrar (I believe GoDaddy but I'm not entirely sure). Meaning as long as he's hung onto this idea of making X Corp a thing, he couldn't be arsed to pay the $15/year domain renewal.

Bloomberg estimates the rebranding wiped between $4 to $20 billion from the valuation of Twitter due to the loss of brand awareness.

The company was already worth less than half of the $44 billion Musk paid for it in the first place, meaning this may end up a worse deal than when Yahoo bought Tumblr.

One estimation (though this is with a grain of salt) said that Twitter is three months from defaulting on its loans taken out to buy the site. Those loans were secured with Tesla stock. Meaning the bank will seize that stock and, since it won't be enough to pay the debt (since it's worth around 50-75% of what it was at the time of the loan), they can start seizing personal assets of Elon Musk including the Twitter company itself and his interest in SpaceX.

Sesame Street's official accounts mocked the rebranding.

158K notes

·

View notes

Text

Best Stocks to Buy India 2025 - Expert Guide to Maximize Returns

Best Stocks to Buy in India - 2025

Investing in the stock market can be one of the smartest financial decisions you'll ever make. But with countless options out there, it can also feel overwhelming. Which stocks should you choose? How do you maximize your returns while minimizing risks? If you’re looking for the best stocks to buy in India in 2025 or want to learn more about the stock market, this guide is for you. Whether you're a beginner or an experienced investor, we've got you covered.

Introduction

The Indian stock market is a treasure trove of opportunities. With a rapidly growing economy, an influx of global investments, and innovative startups scaling new heights, India offers a fertile ground for stock market investments. But where should you start? What are the best stocks to buy in India in 2025? This article will take you through everything you need to know, from picking the right stocks to leveraging online stock trading courses to sharpen your skills.

Discover the best stocks to buy India, tips from a stock market institute, and online courses for stock market trading. Learn about stock market training online and investment strategies.

Why Invest in the Indian Stock Market ?

India's economy is like a high-speed train – fast-growing and full of potential. With robust GDP growth, increased consumer spending, and government initiatives promoting industrial growth, the stock market has become a reflection of India's rising global stature.

Key Benefits of Investing in India

Diverse Opportunities: From technology to pharmaceuticals, India boasts a variety of industries.

High Returns: Many sectors in India have historically delivered impressive returns.

Growing Middle Class: Increased purchasing power leads to more investments.

How to Identify the Best Stocks ?

Picking the right stock is like choosing the best fruit from a basket. How do you know it's ripe? You need to analyze it closely.

Factors to Consider:

Company Fundamentals: Strong financials, consistent growth, and good management.

Market Trends: Sectors poised for growth.

Valuation Metrics: P/E ratio, dividend yield, and market cap.

Future Potential: Is the company innovating? Does it have a clear vision?

Top Sectors to Watch in 2025

Certain industries are set to thrive due to changing consumer behavior and advancements in technology. Here are the ones to keep an eye on:

Technology & IT Services: With digital transformation in full swing, companies in this space are expected to flourish.

Pharmaceuticals: Post-pandemic, healthcare and pharma remain vital sectors.

Renewable Energy: With sustainability becoming a priority, solar and wind energy companies are on the rise.

Consumer Goods: As disposable incomes increase, so does spending on goods and services.

Best Stocks to Buy in India - 2025

Here are some promising stocks that experts are eyeing for 2025:

1. Reliance Industries

Why Invest? With its presence in energy, retail, and digital services, Reliance is a diversified powerhouse.

Growth Factor: Expansion in renewable energy and technology-driven initiatives.

2. TCS (Tata Consultancy Services)

Why Invest? TCS is a leader in IT services with a global footprint.

Growth Factor: Strong demand for digital transformation services.

3. HDFC Bank

Why Invest? A consistent performer in the banking sector.

Growth Factor: Focus on retail banking and rural markets.

4. Adani Green Energy

Why Invest? A frontrunner in renewable energy.

Growth Factor: Massive expansion in solar and wind energy projects.

5. Infosys

Why Invest? Known for its innovation and strong financials.

Growth Factor: Rising demand for IT outsourcing.

Benefits of Stock Market Institutes

Learning the ropes of the stock market can save you from costly mistakes. A online courses for stock market offers structured guidance and hands-on training.

What Do You Learn?

Basics of investing

Technical analysis

Risk management

Portfolio building

Think of it as a GPS guiding you through the maze of stock market investments.

Online Stock Trading Courses

Want to learn from the comfort of your home? Online stock trading courses are the way to go. These courses cover everything from basics to advanced trading strategies.

Top Platforms for Online Courses:

Coursera – For beginners.

Udemy – Affordable and flexible.

NSE Academy – Industry-recognized certifications.

Stock Market Training Online

Imagine having a mentor right on your screen. Stock market training online provides you with live sessions, real-time trading simulations, and expert insights.

Why Choose Online Training ?

Learn at your own pace.

Interactive sessions with industry experts.

Access to resources and tools.

Tips for Beginners

Starting your journey in the stock market? Here are some quick tips:

Start Small: Invest only what you can afford to lose.

Do Your Homework: Research before buying any stock.

Diversify: Don’t put all your eggs in one basket.

Stay Patient: Rome wasn’t built in a day, and neither are fortunes.

Risks to Keep in Mind

Investing always comes with risks. Here’s what to watch out for:

Market Volatility: Prices can swing unpredictably.

Lack of Knowledge: Don’t invest blindly; always stay informed.

Overconfidence: It’s easy to get carried away with initial success.

Diversifying Your Portfolio

Diversification is like having a balanced diet for your finances. It ensures that if one sector underperforms, others can make up for the loss.

How to Diversify:

Invest across sectors.

Mix large-cap, mid-cap, and small-cap stocks.

Include mutual funds or ETFs.

Conclusion

The Indian stock market in 2025 offers a wealth of opportunities for savvy investors. Whether you’re looking at established giants like Reliance and TCS or emerging players in renewable energy, the key lies in informed decision-making. Pair your investments with knowledge from a stock market institute or online courses for stock market, and you’re well on your way to financial success.

FAQs

What are the best stocks to buy in India in 2025 ?

Reliance Industries, TCS, HDFC Bank, Adani Green Energy, and Infosys are among the top picks.

How can I learn stock trading online ?

You can explore online stock trading courses on platforms like Coursera, Udemy, and NSE Academy.

What are the risks of investing in the stock market ?

Risks include market volatility, lack of knowledge, and overconfidence. Diversification can help mitigate these risks.

Is it worth joining a stock market institute ?

Yes, a stock market institute provides structured training, helping you make informed investment decisions.

Why is diversification important in stock market investing ?

Diversification spreads risk across various sectors and stocks, reducing the impact of underperforming assets.

0 notes

Text

Top Future-Best Stocks: Long-Term Returns for High-Growth

Buying shares can be exciting and at the same time stressful at the same time especially with the multiple choices that exist in the market. In this case, using an evaluation model appropriate to the needs of investors and delivering high outcomes for customers is rather important when the portfolio performs the probe for future-value growth stocks

#Best Stocks#Long-Term Returns for High-Growth Best Stocks#Buying shares#practices high-growth#high-growth stocks and market trends#long time of investment

0 notes

Text

best stocks for SIP Investment

Discover the best stocks for SIP investment with Integrated Enterprises (India) Pvt. Ltd. Build a strong financial future through strategic SIP investing. Our expert analysis identifies top stocks for long-term wealth creation. Whether you're a seasoned investor or just starting, SIP in the stock market has never been easier. Benefit from our in-depth research and recommendations to make informed investment decisions. Start your SIP journey today!

0 notes

Text

What benefits of Holding Stocks for the Long Term

Stock investment can be a valuable tool for attaining long-term financial prosperity. Thus, there are several merits that one can get out of investing in stocks for the long- term, while most investors may be enticed to engage in short-term trading,Investing for the long term stocks has several advantages, and they include compounding, volatility, low cost, taxation, alignment with the firm’s growth, and stress. Through the long-term growth approach with stocks rather than the short-term return on investment, more revenues and wealth can be accumulated in the long run.

#benefits of Holding Stocks#Holding Stocks for the Long Term#benefits of Holding Stocks for the Long Term#Stock Market Calls#Share Market Tips#India Share Market#Best Stocks to Buy#Stock Market Commentary#Stock Prices

0 notes

Text

https://www.apsense.com/article/best-5-innovative-smallcap-stocks-with-high-returns.html

Are you on the lookout for exciting investment opportunities that offer high returns? Look no further! Small-cap stocks hold immense potential for growth and can be a game-changer in your investment portfolio. In this blog post, we will explore the best 5 innovative small-cap stocks with high returns in 2024. Discover how investing in small cap stocks in India can pave the way to financial success and long-term wealth accumulation. Let's dive into the world of small-cap stocks and unlock their hidden potential together!

#Best Smallcap Stocks#Best 5 Innovative Small-Cap Stocks#Small Cap Stocks in India#Small cap stocks#Why Invest in Smallcap Stocks#Small Cap Stocks for Long Term

0 notes

Text

#top 3 energy stocks#best energy stocks for long term#top 3 energy stocks for long term#long term energy stocks

0 notes

Text

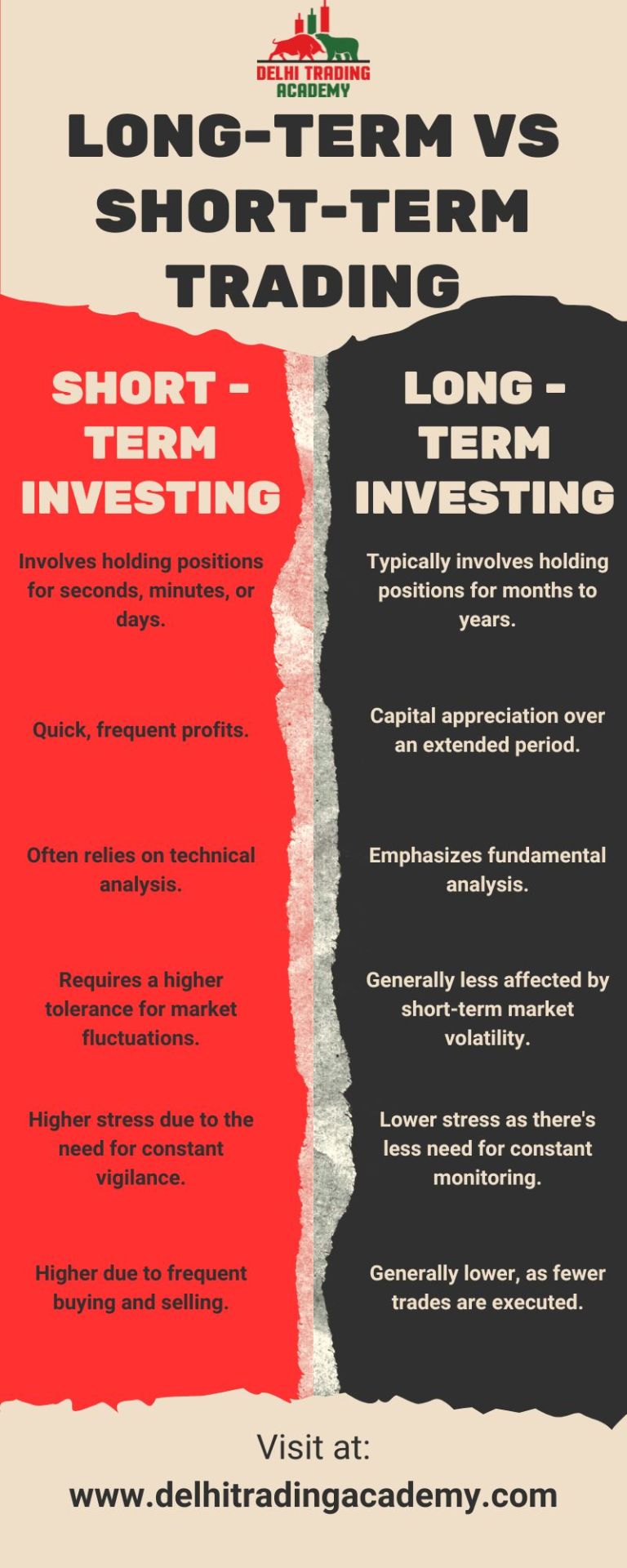

Long-Term vs Short-Term Trading

These points highlight key differences between long-term and short-term trading, considering factors such as time horizon, goals, market analysis, risk tolerance, stress levels, and transaction costs. Each approach has its advantages and challenges, and the choice often depends on an individual's financial goals, risk tolerance, and preferred trading style.

Short-Term Trading -

Typically involves holding positions for months to years.

Capital appreciation over an extended period.

Emphasizes fundamental analysis.

Generally less affected by short-term market volatility.Lower stress as there's less need for constant monitoring.

Generally lower, as fewer trades are executed.

Long-Term Trading -

Involves holding positions for seconds, minutes, or days.

Quick, frequent profits.

Often relies on technical analysis.

Requires a higher tolerance for market fluctuations.

Higher stress due to the need for constant vigilance.

Higher due to frequent buying and selling.

Learn the key differences between long-term and short-term trading with ease. Explore the best trading courses in Gurgaon at Delhi Trading Academy, where you can master both approaches. Whether you prefer online or offline classes, DTA provides top-notch stock market education, guiding you towards successful trading ventures.

#stock market classes gurgaon#best stock market classes#best trading courses in gurgaon#best trading courses#stock market classes#stock market courses#course regarding stock market#stock exchange courses#best stock trading classes#stock market classes near me#Long-Term vs Short-Term Trading

0 notes

Text

Explore key Q3 earnings insights and 2025 market predictions to uncover investment opportunities in India's dynamic economy. Learn how emerging sectors, rural consumption recovery, and government initiatives can shape your portfolio for sustainable growth.

#q3 earnings#q3 earnings predictions#share market advisor#best long term stocks#best stocks for 2025 to add to your watchlist#professional stock tips for quick gains#best stock market advisor in India

0 notes

Text

My dear lgbt+ kids,

I'm compiling some safety tips here for people in the US here that I found online. Some things you may want to do before January:

Make an appointment with your doctor to talk about a long-term birth control plan, such as an IUD or vasectomy.

Make an appointment with your doctor to make sure your vaccinations are up to date and to get a Covid booster.

Check in, and stay in contact with, your queer friends. There’s strength in numbers. Community is important.

Consider renewing your passport if necessary.

Consider stocking up on fluoride toothpaste, pregnancy tests or other health products you worry about not (safely) having access to in the future.

Rest up. Hydrate. Eat. Take care of yourself. The best act of rebellion is staying alive. You don’t need to feel strong or brave or even optimistic, just be kind to yourself.

With all my love,

Your Tumblr Dad

#feel free to add on#lgbt#lgbt+#I was hesitant to post this because I don’t want to sound fearmongering but I think keeping each other safe is now more important than ever

3K notes

·

View notes

Text

Investing In The Stock Market Hoping For A Quick Profit

Investing in the stock market with the sole aim of making a quick profit can be a risky strategy. While it is possible to make money quickly in the stock market, it is also possible to lose money just as quickly.

It's important to remember that the stock market is volatile and subject to fluctuations based on various factors, including economic conditions, political events, and company performance. Short-term price movements can be difficult to predict, and investing based on short-term trends can lead to poor investment decisions.

Instead of focusing on quick profits, it's generally a better strategy to invest in the stock market with a long-term perspective. This means taking a strategic approach to investing and focusing on building a diversified portfolio of stocks that align with your financial goals and risk tolerance.

Diversification helps to spread your investment risk across different stocks and sectors, reducing the impact of any one company's poor performance on your portfolio. Investing with a long-term mindset also allows you to ride out short-term market fluctuations and take advantage of the compounding effect of returns over time.

In summary, investing in the stock market hoping for a quick profit is a risky strategy. Instead, focus on building a diversified portfolio of stocks with a long-term perspective to achieve your financial goals.

#investment advisory#multi bagger stock recommendations#stock market investing#best long term stocks

1 note

·

View note

Text

Here is How to Start Investing (Investing For Beginners 2024)

WEBSITE

YOUTUBE

YOUTUBE PLAYLIST

FACEBOOK

X (TWITTER)

TUMBLR

QUORA

LinkedIn

Mix

FLIPBOARD

#investing#investment#moneytips#personal finance#investmentstrategies#how to invest#stock market for beginners#investing 101#investing for beginners#how to pick stocks#investing explained#how to invest money as a teenager#stock market 2024#stock market news#how to invest in 2024#stock market investing for beginners#how to pick stocks for long term investment#best stocks to buy now for short term#investment strategies for 20 year olds#investing for beginners 2024

1 note

·

View note

Text

❛ MY SHORTY ALWAYS ON SOME BULLSHIT LIKE CHICAGO ❜

PART 3

part of the 420 'We Be Burnin' series

⋙ MENU ITEM: PLUG!CHOSO x SORORITYBRAT!READER ⋙ PART 1 | PART 2 | PART 3 (IN STOCK!!!)

⋙ product description (summary): choso's finally had enough and if you won't listen to reason he will fuck it into you. but will you still choose him in the end or will he make that choice for you? ⋙ side effects (tw): THE LONG AWAITED BRAT TAMING! rough sex. throat goat!reader. more angst. spanking ass/puss. teasing. edging. lots of delayed pleasure. jealousy. cunnalingus. mirror sex. dom!choso. breeding kink. dirty talk. backshots. fingering. squirting. daddy kink. thigh riding. nuru/thigh fucking. intoxicated reader. drug use (weed). slight voyeurism. yandere choso. baby trapping. mentions of violence (not towards reader). mentions of somnophilia and a lil bit of fluff. ⋙ thc levels (wc): 9.6k of 22.1k ⋙ inventory notes (a/n): best viewed in dark mode. the long awaited end! i hope you guys like it. i really worked hard on this to make it good <3 special shout outs to my betas @littlemochabunni for literally always talking me off the ledge when i want to ctrl + a+ del everything and @buttercupblu for all the grammar edits my adhd brain struggles with and inspiring me to write the last scene.

Plug!Choso who ultimately will forgive you but it will be on his terms. He just needed to show you first why the only person you should worry about pleasing was him.

Menacing chuckles rumble deep from Choso’s chest, bewildering you in your crossfaded state. Seizing you with a firm hold, he forces you to meet his gaze. Choso holds you so tightly against him that your feet barely touch the ground.

Any attempts of wriggling out of his hold are in vain.

“You’re such a fucking slut.”

His matter-of-fact statement makes you frown. You’re taken aback by the twisted amusement on his face.

“You don’t love me… You love my cock.”

“N-No I—”

Your already short skirt now bunches above your hips and Choso brings a heavy hand down onto your exposed bottom. The sting brings fresh tears to your eyes as the gems on your fishnets leave distinct impressions on your soft, malleable skin.

“You’ll have to learn to be quiet while daddy’s talking, princess.”

If you were going to act like a childish brat, Choso would treat you like one.

Another harsh spank startles you into hiccups as you sniff away fallen tears.

You’d never been spanked before—not by previous lovers or boyfriends—hell not even your parents growing up.

The last person you’d expect it from was Choso.

And yet each swift lick Choso deals you is as terrifying as it is exhilarating.

Who knew you would be such a glutton for punishment?

You fidget, biting your lip in anticipation of another.

“Been thinkin’ princess—I’ve been too good to you. But you don’t want that, eh?”

A third smack has you whimpering. Your pelvic muscles clench hard, releasing more of the desperation that had already saturated your thighs.

“You want one of those assholes outside, is that right? They’re good enough for you, huh princess?”

You can only mewl in response from the delightful pain that pierces your senses as he delivers another and another.

“S’why every time I fuckin’ come round y’er being a lil’cocktease for some preppy ass frat fuck.”

Choso wasn’t wrong.

You knew what those boys wanted from you.

Even though you had never really entertained any of them. That was the allure in itself—to be something unattainable.

Yet more selfishly, you liked the attention. Not like you’d even got the same thrill from it anymore since you were with Choso—but old habits die hard.

Choso was making damn sure of that now.

“Tryna get one of them to fuck you tonight—”

Choso’s cock twitches in sync with your trembles from every spank.

“—or were you hoping I was finally gonna put that pretty princess pussy of yours in her place?”

You’re smart enough to know Choso’s question is rhetorical and how could it not be given all your actions tonight?

It was clear you wanted him and his deliciously fat cock back—badly.

Your tongue cautiously peeks out as you try to quiet your shuddering breaths, afraid that any small movement might provoke his anger. At this point you know better than to beg too, almost certain that any attempts would only fuel the unexpected mean streak Choso had developed.

Yet despite any initial apprehension you were quickly becoming puddy in his hands.

“Poor baby, working so hard having to appease everyone—”

SMACK!

“—well you ain’t gotta worry that bratty head of yours no more—seeing as you won’t be doing none of that shit from now on.”

His threats which should have you cussing him out only make you wetter as your heart pounds in your ears from the thrill of being dominated. You’d do anything right now to get a little relief for your aching cunt that had gone a whole goddamn month without Choso’s thick cock plugging her up.

Restless in arousal, your entire being just begs to be fucked.

Releasing your hair Choso parts your legs with his knee and you collapse onto him, your plump pussy colliding with his thigh. You whimper, tightly gripping his broad shoulders for leverage to rock yourself against his thigh.

Choso could feel the intensity of the moist heat radiating from your core dampening his jeans.

“Shit, I can feel you dripping… pussy drooling just from getting that ass spanked a lil’—are you a masochist, princess?”

Choso breathes the question into your ear, his words bringing a chill over your skin fanning goosebumps all the way down to the nape of your neck.

You’re losing yourself all the more in the hypnotic state of lust swirling from alcohol, weed, pain and arousal clashing within you.

You nearly choke on the deep guttural moans that had been held in by his hand still around your throat when he grabs your hips forcibly rocking you harder against him. Your paper-thin thong does nothing to protect you from the rough threadbare material of his jeans grinding against your sensitive lil nub.

“Wearing these slutty tights with an ass like yours…”

You almost forget to breathe, the sting this time accompanied by him sliding his fingers between the gaps in the material and grabbing the fat of your ass for emphasis.

“...coulda got me in so much shit tonight if I made ol’boy who was touchin’ up on you swallow teeth.”

The baritone in his voice lowers to a deadly note, tuning every nerve in your body to the exact pitch of his voice.

“P-Please C-Cho I—”

—in an instant the hand on your hip coils around your neck.

Thumbing your collarbone, Choso slowly applies just enough pressure to activate the euphoric sensation of suffocation, sending tingles down your spine.

“Look at me princess, you better stay quiet—m’not gonna say it again.”

You choke back a cry as the elastic on your fishnets snaps against your tender skin when Choso removes his hand from them.

“But then your lil’card got pulled when you saw me with that whore, hmm?”

You wince preemptively expecting another hard spanking but Choso loosens his grip around your throat. He looks at you expectantly, waiting for your answer.

A sniffly frown complements the pitifulness of your runny makeup as you cling to him possessively.

“Y-Yeah… I-I hated seeing that d-dumb bitch all over you. Wanted to fuck her up.”

Choso is satisfied with your answer but the warmth behind his smile didn’t match the heated glint in his eyes.

“There it is. See? Bratty princesses who are honest get rewarded—”

Any relief you feel is short lived as your despair returns with the words that follow.

“—eventually.”

Plug!Choso who has you so close to release just from rutting against his brawny thigh. Yet just as you feel the hot coil about to snap in your stomach he pulls away from you.

Wobbling for stability, your panic that he would leave again subsides when he returns to sit on your bed.

Choso leans forward with his elbows resting on his knees to pack another bowl. The process is second nature to him and his hands move with an instinctual precision, allowing his oppressively dark gaze to remain fixed to you.

“Strip.”

It’s a rather simple command but it causes a small malfunction in your brain nonetheless.

Your intuition is simultaneously screaming at you to be a ‘good girl’ and listen to Choso so he’d finally fuck you—but also to get the hell away from the menacing man before you were actually fucked.

Choso’s shift in his nature was setting off every internal alarm—although at the same time, you couldn’t say this still didn’t feel like Choso.

Was it really new?

Or was this side just new to you?

You’d only ever really known the gentle boyish side of Choso. The side who would blush easily and that was so willing to do anything to please you—the side that was a dutiful and loving brother.

But this other side?

Well, he was a dealer.

You’d never heard of Choso getting caught out or punked in the streets—not even once.

You also never knew how he conducted his business, as he always stepped out of the car or left the room. When he took a call while you were with him, all you could hear were faint murmurs of conversation over the rumbling bass of music or through a well-insulated door.

You knew he did his best to keep that side away from you and Yuji, as it wasn’t always pretty.

Instantly you recalled how once when you had slept over he reluctantly left in the middle of the night late saying he had ‘business’ to take care of. When he came home hours later he looked worn down and even more tired than usual. His knuckles were swollen and there was a rip with small dots of blood on his collar which you would have thought was his own if not for there not being a single scratch on him.

He didn’t speak of what happened and you couldn’t fuss over his appearance for too long—your mind being far from inquisitive while blubbering from his cock drilling your body deep into the mattress. You blissfully became a fleshlight of relief for all his frustrations that night until long after sunrise.

In fact, Choso had dicked you down so thoroughly when you finally made it out of bed that day it was mid-afternoon. You didn’t even question him about the bruises lingering on his knuckles or whose blood he had on him—still in a daze off his cock.

So this must be how he is in the streets.

“Go on now, princess.”

The deep silky dominance in his tone commanded your attention, jarring you from your thoughts. You’re pouting, but your body, in spite of your more rational mind, wins as it compels you to obey him, convincing you that anything he has planned for you would be well worth the pleasure that follows.

Slowly, you begin to lift up your tiny pink top when Choso’s eyes narrow in disapproval, stopping you.

“Nuh-uh see—that shit right there won't cut it.”

You’re puzzled. You did exactly as he asked.

“You didn’t think I saw my lil’ slut playing beer pong and teasing those shitheads with my tiddies? Now do it for me—the same fuckin’ way.”

You’re nodding but your delicate hands are nevertheless shaking under his intense smolder.

Swallowing your anxiety and mimicking your earlier actions, you bent towards him. Your chest is lightly heaving by the time your nails begin to slowly drag the hem of the sparkly top down over your breasts. Choso is blatantly palming his cock when you give the final tug that has your tits bouncing forth from their confines, fully exposed to him.

Choso hums in approval, satisfied with your performance. He motions with a finger for you to come to him and you can’t close the distance fast enough to stand between his legs.

Molding your hips in his large hands, Choso brings you even closer. Parting his lips the smoke tendrils fan over your stomach while his mouth hovers over your skin.

Choso looks back up at you and your belly dips, quivering at his dangerously seductive eyes and mischievous grin.

You were nervous—good.

“Knees.”

Plug!Choso who has you shamelessly panting on your knees before him. Not caring for any decorum at this point you’re openly salivating as hearts practically dance in your eyes over his engorged cock throbbing inside his jeans.

Choso releases a whiny hiss when the air hits his swollen glands. His length sways weighted down as an embarrassing amount of pre drips off his reddened shaft, his boxers already soiled.

In your right state of mind you might have used this to shift back the power dynamics—yet alas, you are far too gone now. The need for him to give you his praise and approval winning out over any inklings of sass or disobedience.

Your attention is all but zeroed in on how those milky pearls dribbled over his albert piercing and down the thick vein on the underside of his length.

Seeing how your mouth watered just from the sight of his cock, it’s Choso who proves to be the more impatient one as he grips the back of your head with one hand forcing you closer. In his haste, his dick misses your mouth and skids across your cheek, prompting a low growl of curses from Choso.

Unconcerned with his impatience, you’re still in your own world—and that world in question was currently being filled with the carnal smell of Choso’s scent marking your skin. A long stain of pre smearing across your face mind shuts down now solely driven by your needy cunt.

“I’ll forgive you when you show me how sorry you are—”

“—anything!”

Quickly snapping out of your dickmatized daze you look up at him with doe eyes, begging for the go-ahead.

“Yeah? Then do it nasty for me, princess.”

The words have scarcely left Choso’s lips before you’re already parting your own, releasing a viscous well of drool to pour languidly on his dick.

Your saliva mixing with his spilled essence coats his cock and fills the room with vulgar squelches as you obediently pump his hot length. You rotate your grip with a sinful precision while your other hand thumbs his gooch as you’re cupping his balls, kneading them in a manner that had Choso’s toes curling.

Giving thanks for the meal you are about to consume, you never break eye contact as you deliver pillowy kisses to his tip and strum your tongue under his frenulum. Choso’s abs twitch feverishly when the sultry hollow of your mouth lewdly hums over his piercing. The sounding effect alone is nearly enough to make him bust right then.

You aren’t holding up well yourself either as your thighs squeeze together soaking your fishnets which had long been sticky with your overflowing arousal. Manifesting that it soon would be the moist suction of your vacant cunt and not of your spit glossed lips that would take him whole as you continue to moan wantonly around his girth.

The memory alone didn’t do your mouth justice to Choso, not that he still didn’t cum plenty from thinking of your lips slobbering around him in the last month.

Fuck if you didn’t always give some crazy ass head though.

However, he knows he has to keep control lest he loses all the progress he made training that lil’ attitude of yours tonight.

Weaving his muscular hands through your hair, in one swift motion Choso thrusts his hips forward. He groans loudly from your warm gummy throat now stuffed full with his cock. Gargling his girth you choke when Choso’s piercing scrapes the back of your throat as he forcibly bobs your head up and down.

Thick tears burn your vision with your running mascara flowing right down your full cheeks. But it's nothing compared to the fiery burn in your cunt that’s even more jealous than before of your throat getting the treatment it needs so desperately.

“You’re gonna be my good girl from now on? Yeah baby, I know—I know ya are. Now open that throatpussy a lil wider for me, got sum’ for it.”

Heart fluttering at his filthy praises, you easily let him coerce your face flush to his pubic bone to take him to the very hilt. Your nose is buried in his dark pubic hair and his balls slap your chin at every thrust. The harsh treatment has your tears mingling with his fluids to coat your face and stain his jeans.

This is how you should be.

Obedient and pretty while your sobs vibrate around his cock destroying your throat. All you had to do was worry about taking care of him—in turn he would take care of you and the rest.

Shit though, going so long without your bratty little mouth around his dick Choso wasn’t about to last too much longer.

His blunted nails dig into your scalp as he hunches, curling over your body from the sloppy way he plows even deeper into you.

“You’re gonna take all of it princess. Every last bit, understood?”

Choso takes your unintelligible gurgles and the hands shoving against his thighs as confirmation. A needy grunt is followed by jets of his creamy load spurting down your esophagus.

Teeming with adrenaline, you gasp for air. Your lungs are on fire from sputtering up his tangy spunk that somehow even trickled into your windpipes. Choso’s fluids dribble down your chin, a show of proof from you having milked his cock so thoroughly.

But you're not angry with him for the rough treatment—on the contrary.

Once your coughs subside you’re gazing up at Choso like an innocent lamb and not the nasty throat goat you just proved yourself to be. Praying you have been enough of a good girl for him to finally fuck your lil’ cunt as hard as you needed.

Plug!Choso who rewards you with gentle strokes that smooth your hair back and caress your flushed cheeks stained with his spunk.

Keeping true to his promise of every last bit, Choso thumbs the remaining salty fluids soiling your face back into your mouth, dumping the excess onto your tongue that greedily slurps it down.

Satisfied, Choso straightens and beckons you onto his lap with a pat to his thigh. Smirking at your enthusiasm as you clumsily settle in.

“Now doesn’t it feel nice…being a good girl for once?”

Choso affectionately twirls your hair in his fingers and you bob your head eagerly.

Your lips are mere centimeters apart.

You want to kiss him but Choso doesn’t feel like you earned that just yet, balling his fist to tug your locks taunt when you lean in.

“Not yet, baby.”

You stick your lip out, fussing in aroused frustration.

“Tsk—now, now none of that shit, brats don’t get kisses—and they certainly don’t get this dick.”

If the look in his eyes were any indication you knew Choso meant business. The searing eye contact had long incinerated all the walls you’d built to keep him out, exposing the very essence of you laid bare in the ashes.

You have no more defenses against him, becoming more obedient to his every word.

Seconds pass that seem like achingly brutal hours until he breaks the staredown. His sights now follow his hands as they splay out trailing from your collarbone to your breasts, letting them weigh heavy in his palms.

His lecherous scrutiny has you shivering.

“You let anyone touch these?”

The question startles you as does the sensation of Choso rolling your stiffened peaks between his knuckles before giving them a cruel tug.

You sniffle as you shake your head ‘no’, trying not to whine and still unable to speak from him pounding your vocal cords raw.

Choso grins knowingly as his hands fondle your plush mounds, kneading the supple flesh and pushing them together before the steamy cavern of Choso’s mouth consumes both at once. The bar of his pierced tongue swirled between your hardened buds, lapping, slurping and nibbling. Squirming you arch back deeper into his mouth and grind your soaked lil cunny on his rapidly stiffening length. Your hands cling to his pigtails for any semblance of an anchor keeping you from tumbling backwards.

Spurred on by your shuddering cries Choso withdraws from your swollen peaks with a pop and licks up the string of spit that cobwebs between them. His tongue flattens licking each one dutifully as he watches as your jaw slacks from pleasure.

You’ve been so deprived of his touch. You could cum from just a bit more of this.

Yet Choso’s lips don’t stop traveling your body, even higher this time to adorn your decolletage with searing hickies.

Uncaring if they actually showed up to brand your skin or not.

Choso only needs you to feel them bruise beneath your flesh.

That way you wouldn’t so soon forget exactly who you belonged to.

“And what about my bratty lil’ pussy, princess? I know how needy she is. You let one of those frat fuckers inside her?”

His hot heady breaths puff out to curl around your earlobe, leaving the severely neglected spot in between your thighs throbbing at her mention.

You think you might actually die if he ignores your cunt for much longer.

Your thong is utterly drenched. More arousal trickles onto his lap as his muscular hands settle back on your hips.

“N-no!”

Sounding more like a croaked plea, your voice is barely above a whisper from the hoarseness that settled in your throat.

“W-Waited f-for you Cho.”

“Then show me.”

Plug!Choso who has you even more intoxicated off the thought of him giving you a pussy inspection.

He has nearly succeeded in domesticating you and your arms wrap around him submissively as you moan unabashedly into his neck.

Choso muses he should have handled your snobby ass like this sooner and saved himself some trouble.

Lifting you, Choso rises from the bed.

You haven’t realized you’ve moved at all until you crash into the edge of your vanity, shaking the table with a thud. Rattled, you look back, giving Choso the leverage he needs to spin you around. Dizzy from the sudden movement, your arms fly out—scattering bottles of makeup and perfume as you grasp at the wooden tabletop.

The items roll on the floor in tandem with Choso rolling his hips up against you. You release a loud mewl from his hard erection teasingly poking into your ass.

Thinking only with your pussy, your impatient pleas are met with another slap to the ass. The increased weight behind his hand this time leaves your nerve endings sizzling.

You were gonna be such a sweet girl by the time he was done with you.

However, he wouldn’t torture you for too much longer.

Despite his cold authoritarian demeanor, the image of shoveling his cock deep into your creamy cunny after so long of only jerking to the memory has him about to lose it. Grasping the front of your hips, Choso jerks you flush against his pelvis. You fall forward until your cheekbone is smooshed into the vanity’s mirror and his thick bulge molding itself in-between your cheeks

“Stay just like that for me, yeah baby? Hands on the mirror, they better not fuckin’ leave either.”

You position your hands obediently and Choso, as if praising you, tenderly gifts lustful kisses down your spine while he pampers your reddening bottom with gentle caresses.

“Good fuckin’ girl, princess.”

The more feral his nature, the more like his prey you became. Choso licentiously inspects your body—gripping, sniffing, and nipping at your heated skin until he is level with your ass.

You whimper as Choso rips your fishnets ripping them open, admiring the indents on your skin from the jeweled tights before burying his face between your squishy cheeks.

His nose salaciously nuzzles against the soaked material stuck to your barely covered hole and he releases a hot guttural sigh, purring into your pussy.

Always a fiend for dining on your cunt, Choso is brimming with contentment from your juices leaking onto his face. This may have been your punishment but it was also his reward as the taste of your filthy lil plum never failed to drive him wild—often opting to spend most of the night with his face between your hips, he’d still cum plenty times from just thrusting into the air as he let you ride his face.

Licking his lips, Choso’s tongues traces the pattern of your thong and sucks your juices from the saturated fabric. You’re both loudly moaning now—Choso from the saccharine flavor of your cunt and you from the sweet relief of the hot languid strokes of his skillful tongue.

Choso might have lost himself in that moment of finally getting to taste you again. His eyes roll back at how you lewdly leak through your soaked thong.

All for him.

You were still his even after all this time.

However, it's your own hastiness that reminds him your penance is worth more than his own pleasure when your ass wiggles impatiently lowering onto his face when Choso’s tongue piercing starts drawing lazy circles around your sensitive lil pearl.

“C-Cho, n-need you…puh-lease s’not fair—”

Determined to control every sensation he gives to you and holding you in place, Choso scolds you.

“Fair? Nah, know what’s not fair, princess?”

His lips move closer to ghost over your ass causing goosebumps to rise over the warm tender skin.

“You actin like a bitch for a whole fuckin’ month and keeping all this good pussy away from me.”

You shudder when his teeth sink into your jiggly flesh causing you to yelp and rock against the vanity.

You’d get more pleasure when he wanted you to.

Choso would screw that lesson into you soon enough.

“Fuck—the only thing sweet about you is this lil’ pussy. You’re such a brat but she's so honest. Then again—maybe it's your slutty lil’ pussy that’s actually the brat, thinking she runs shit because of how good she is at milking cock, yeah?”

Choso confirms his suspicions upon peeling your soaked thong to the side. Strings of your arousal practically glue the material to your cunt. Not hesitating to make more of a mess of you, he illicitly hawks globes of his spit into your already dripping lil’ hole eagerly winking at him.

“Let’s see what this slutty cunt has to say for herself, hm?”

Choso places a chaste kiss over your entrance before driving two fingers straight in. Your hands leave streaks down the mirror as you perspire, fogging up the glass with your breathy cries.

Speeding up his pace he digs the pads of his fingers into your walls, searching until they run over a spongy hard spot and he has to fight to keep a hand on your lower back to hold you in place.

God you were virgin-tight again.

Before ignoring you, Choso had only ever gone three days without fucking you and even then you’d been crying from his tip just stretching the entrance of your taut lil pussy.

In the past, Choso would have taken his time with you. He knew he needed to work you open more so you wouldn’t be sore tomorrow, and yet his cock throbbed to life again so urgently he couldn't restrain himself for much longer.

That’d be something you’d just have to fucking deal with.

This was all your fault after all.

Plug!Choso who wouldn’t let you deprive him of his pussy for any longer—however, he was still going to make you beg for it.

“Tell me what you want, princess.”

Choso rips the thong clean off your ass cheeks.

Leaving you exposed bare in your fishnets he rises up to lean over you. His moist breath trickles electricity down your spine as his bricked length roughly pipes between your cheeks.

“Nghh…w-want your c-cock…”

“Whose cock—so you know me now, princess?—Choso is that it?”

Choso mocks your voice with the hurtful words you hurled at him during the garden brunch. Gliding his girth to prod over your entrance and miss its mark intentionally.

“Pleeaseee—C-Choso-C-Choso-C-Choso.”

The pleas of his name slur together as your attention solely focuses on how his leaky shaft lathers your already dripping folds in his pre.

“That’s right princess…now tell me who am I to you?”

Choso reaches around to swat at your swollen clit.

You cry out as your body slick with sweat jolts up violently. Choso has to throw more of his weight onto you to keep you from slipping off the vanity entirely.

You could have actually fallen to the floor without noticing as the fuzzy feeling in your brain intensifies, too much is happening all at once. Your intoxicated thoughts swirl in its attempt to work out the finer details of your relationship with Choso—details you likely wouldn't have been able to answer even while completely sober.

Who was Choso to you?

Well, frankly, right now he was technically nothing. You had never previously defined your relationship and hadn’t had any communication at all over the last month until just a few days ago.

Your dealer? Friend? Casual hookup? Situationship?

By and large, it had been your fault that you’d never discussed it. You actively ran from any complicated conversations or pulled away whenever Choso proposed something that would be too close to affirming your status.

You also knew how much Choso liked you, especially from how he’d blush when other parents in Yuji’s class would mistake the two of you for a couple.

You weren’t a couple though—even if you acted like you were behind closed doors.

Even so, you knew how he made you feel when you were with him and knew what you wanted him to be to you now.

That was enough.

Goddamnit.

Your body threatens to explode from the vulnerability of your exposed emotions pricking at your every nerve while you work up the courage to say it.

This admission was somehow even harder than confessing you loved him—which had honestly been relatively easy in comparison as you were so upset you would have done anything at that moment to make him stay.

Face on fire, you clasp your eyes shut—as if not looking at Choso in the mirror means he somehow can’t hear the words that stumble out of you.

“M-My boyfriend!”

Silent tears fall as you fear his reaction, you’ve never been the one to lay your feelings on the line first.

Had you really missed your chance to be with him?

Would he just fuck you and leave after?

Choso remains silent as his hands glide up your sides, feeling you tremble under his touch. He lifts your torso, pulling you to his chest possessively. Choso’s arms encircle you as they weave between your breasts and he licks a stray tear away.

Now you have the most lewd, yet perfectly unhindered, view of his hefty mushroom tip as it quickly slots through your puffed folds to ram into your clit.

The wide grin on his features is evident as your face crumples and pleasurable sobs rupture from you. Choso rests the side of his face against your neck as he takes in your smell, giving you a chaste kiss and savoring how much his body is scenting yours.

“Oh? You asking me out, princess? Well, I’m flattered you finally asked, but that's not exactly the answer I was looking for—”

A feverish chill spreads across your skin and you’re shivering as he locks eyes with you in the mirror.

“—as it’s certainly not what you will be calling me when I’m pushing your kidneys back.”

Choso’s hands lazily roam your body while he continues to sneak his length through your thighs. You unconsciously arch back to rest your nape on his shoulder, allowing him better access to touch you.

So he wasn’t talking about your relationship status after all?!

Still the devious smile on Choso’s face tells you he intentionally misled you with his phrasing nonetheless.

“So—who am I?”

The cocky tone in his voice makes it clear exactly what he wants you to call him—and you’d say it—you just need to work up the nerve first.

Unfortunately for you Choso’s patience for your bratty ass had long since depleted.

“Tch, yo we can stop then if—”

You snapped the moment you felt his hands leave you.

“NO, DADDY!”

“I’ll be a good girl Daddy…s’good. I-I promise puh-leaseee put it in—please—need you, Daddy!”

There was no way in hell Choso would have left without sticking his dick in you but he knew that you were too hard up right now to even dream of calling his bluff.

“That’s right princess. I’m your Daddy. Now show Daddy that arch baby.”

Plug!Choso who smirks into your skin as he tastes you. The sting from a tiny love bite blossoming as he manhandles you back down onto the table’s surface when your already cockdrunk mind doesn’t have you moving fast enough.

“But you’re still actin’ up a lil baby—so you gonna have to put this dick in yourself, got it?”

Choso hums at your dizzy babbles of confirmation, slipping his thumbs over your chubby pussy lips to spread you open. Choso is in awe of how slutty your cunt looked, clenching around nothing but the webs of your own arousal and practically screaming to be busted open wider by his cock.

Catching his tip on your entrance, Choso stalls as he has to chew the inside of his own cheek to resist not thrusting into you completely—you’d do the rest from here.

Choso was just glad you weren't looking in the mirror to see how hard his abs were trembling.

Exhaling shaky breaths, you ease back onto him, gingerly sinking down his length. Your kitten nails fitfully scratch at the table just from the stretch of just getting his wide mushroom tip inside.

SHIIIIT-SHIIIT-SHIIIT—Too much!

You grit your teeth, he’s so big stretching the walls of your cunt to the degree that your walls actually try to push him out when you flex. However, Choso’s hands are digging into your hips to secure you in place. He’s not helping nor hindering you—but he isn’t letting you run any either.

Your knees knock against the vanity, trembling this much and he's only halfway in.

“Come on, princess…”

Choso coos gently as he rubs circles into the small of your back with his thumbs, coaxing you to relax.

The dichotomy between Choso’s treatment erratically switching in severity leaves you reeling. You're on edge with heightened arousal, never sure if his next words or touch would be rough or soothing yet either way it leaves you wanting more of him—anything he’d give, you’d take.

But right now you need him to have a lil mercy on you.

Tears brim your wide eyes as you pout and look at him through the mirror, pleading with him.

“Puh-leaseeee Cho—m’daddy…help me?”

Your pitiful submission has Choso cracking. His need to ruin you after so long winning over his want to delay your pleasure along with everything else.

Sighing, Choso relents.

“You know, I spoil you too much, princess…s’why you’re so rotten now.”

No sooner had he finished speaking did he hastily slam into you. Your wet warmth completely sucks him in whole and wraps around him so sinfully he has to dig his blunted nails deeper into your hips to keep from immediately painting your walls white.

God, he really was so incredibly weak for your perfect lil’ pussy.

Grunting, Choso sets an unrelenting tempo as he continues to rail into your cervix, each bruising thrust was him reminding you of every time you ignored him—pretended you didn’t know him—told people you were just friends—and for making him even love someone as mean and bratty as you in the first place.

Grabbing onto the clothing bunched at your waist for leverage, Choso pistoning his hard length in and out of you felt like he was ripping your guts out along with it.

Gathering together a coherent thought right now was impossible. It’s so good but so intense your body reflexively reaches a hand back, frantically pressing against his abs to slow him.

Choso growls, stilling your hand behind your back while his other springs out to pin your head on the table.

You were blocking his view of how your ass rippled every time he pounds his cock deeper into your cunt.

He just needed you to be good and take it.

And take it you did.

Choso fucks you so hard your vanity table creaks and repeatedly slams into your wall causing the entire room to shake. Your mind goes blank as if his cock controls the very flow of blood in your body. Surging tingling sensations electrifying your veins when the curve of his length knocks his albert piercing so aggressively against your cervix.

Your gooey walls build up so much pressure around his thickness that white spots edge your vision so very close to your nirvana.

“Don’t even think about cumming until I say so my slutty lil’ princess—hold that shit for daddy.”

But there was no way you couldn’t and just as you are at the very edge of your bliss Choso rips it away from you, halting once again to still inside of you.

“Mmmm no please-please-puhleeease let me cum Choso! Please fuck me right Daddy!”

Plug!Choso, who as much as he wants to edge you past your limits, really pulled out because he also needs to calm down. Choso removes his shirt overhead as the heat in the room has skyrocketed to near sweltering.

Even unmoving inside you, your pussy still flexes around him like crazy. You weren’t on birth control so he never came inside you, not even once before. Pulling out normally to release over your stomach, ass or tits and wearing a condom on days it wasn't as safe.

Although he desperately wants to cum inside you, to really mark you as his, could he risk it?

It would be so stupid and so irresponsible, going far beyond any punishment.

You still had a year of school left.

He couldn't knock you up.

Then again you didn't need to go to classes physically—you could take them online.

Pushing his more debased and wicked thoughts aside, ultimately Choso reigns himself in. He didn’t even want to put you in that position. He’d support you regardless, but he’d admittedly die inside if you decided not to have his child.

“S-Shit! C-Cho the door!”

Seeing the sliver of hallway light cast into your dimly lit room, you realize now that you must have forgotten to lock it. This was an old house and your door had the habit of coming open easily from just some minor movement in your room if left unlocked.

Choso fucking you like he hated you was surely enough to knock it loose.

Unfortunately for you though, Choso didn’t give a fuck.

Abruptly snapped out of his perverse breeding fantasies, Choso’s feral eyes, tinged red from his high meet your frantic ones in the mirror.

“No.”

The renewed vigor of his cock plowing through you again strangles any protests, gagging you on them as you feel him back in your throat from the intensity.

“Nah princess, let them all hear how hard you sob on this loser’s cock while he fucks some manners into you.”

And sob you did. It was difficult to do anything else really as him moving inside you again had your body buzzing more than from your actual high.

“It doesn’t matter, cause I am about to fuck you so hard even the walls downstairs start shaking—”

Choso’s heavy balls slap against your clit when he kicks his thrusts up a notch and hitches your leg up on the vanity.

“—n’when they discover us there’s no way they will even want a cockdrunk brat who lets her ‘weirdo burnout stalker’ get her high and fuck her stupid as a president.”

Your mind, clearly ruined by his dick thinks that might not actually be so bad.

“Shit, you tightened up baby, you actually want someone to find us? See how good I slut you out, yeah?”

Honestly, the harder he thrusted inside you the less you cared—about anything.

School.

The sorority.

Your presidency.

None of it made you feel anywhere near as fulfilled as you were right now with Choso’s thick girth ripping through you.

The walls quake even more violently.

The soggy clicking sounds from your soaked cunt almost reach the volume of your crazed screams for him to fuck you even harder.

Choso was so fucking close again, he was beginning to lose reason.

“F-Fuck it—should I cum in you, princess? I’ll even let you cum too this time.”

Your brain on a mission to cum, fucked so smooth by his fat cock, could care less as long as you got to cum too.

Oh fuck, just a lil more and you would—

“—PREZ! Did you get the goods or not? We wanna start roll—”

On her phone texting, Brianna—who is pretty fucked up herself—did not even register that the sex noises came from your room. Thinking Choso had left already and sure you were up here salty about her ‘stealing him away’.

All the color drains from Brianna’s face as she drops her phone as well as her red solo cup filled with spiked seltzer, splashing on her outfit as well as the floor.

Through the mirror's reflection, she can see the pleasurable agony painted all over your face from getting your cheeks clapped into oblivion by the obvious third leg Choso was packing. Your eyes to the ceiling, heaving out wails as your tongue hangs out of your mouth waging with every thrust Choso carves into your guts. The clicking sound of his cock stirring up your tight lil’ pussy echoes throughout your room.

“OH MY GAWD! So it was true? You’re actually fucking him??? OHMYGAWDOGMYGAWD they aren’t going to believe this!”

Cockdrunk and stupified you couldn’t give even a piece of a fuck. Honestly, you wouldn't have even noticed her if Choso didn’t stop again.

No, No, No. You were so sick of being edged! Not after he finally was going to let you cum.

This can’t be happening right now.

You couldn’t take it anymore.

You needed to cum so bad.

Your vision is blurry with moisture caught in your lashes as you push yourself up. Grasping onto the edge of the tabletop you used it as leverage to weakly fuck yourself back onto him, doing the work this time if he wouldn’t.

You wouldn’t let Brianna’s ass of all people prevent you from having the orgasm you’ve been fiending over a fucking month for.

“I jushh w-wanna cum! Pleasssh, wanna-cum-wanna-cum…”

You chant out shamelessly. Your desperate whines stunning both Choso and Brianna.

Candidly, both thought you'd be horrified enough to stop.

Choso especially, as even after everything tonight wouldn’t have been shocked if the mortification of actually being caught had you kicking him out.

“Heh.”

Are you actually choosing him for once?

Choso wasn’t going to let the moment pass without finding out—that’s for fuckin’ sure.

The smack he delivers to your cheeks grab your attention as you bellow out more cries. You’re still pathetically trying to get off with your weakened thrusts back. It wasn’t nearly enough to get you off—but better than the burning that threatens to incinerate you whole if you stopped.

“Hey Princess, I’ll let you cum just lemme know something first, yeah?”

You nod your head longingly, dizzy with need.

“Tell this bitch whose dick is this?”

For the first time that night, you answered without missing a beat.

“M-Mine m’daddy, its m-mine!”

You pant breathlessly, still trying to rock yourself back on him but you aren't quite hitting the spot.

Your eyes lock with Brianna’s through the mirror’s reflection yet you are looking straight through her—your eyes vacant as you could only think of Choso’s cock.

Your cock.

“Nah don’t look at that bitch, look at me princess.”

Not hesitating, your eyes snap over to him.

“Good fucking girl—and whose pussy is this?”

“You–YOU CHOSO! Please Daddy—please it's s’good, I need it! Please fuck me Daddy!”

Choso turns to Briana who is frozen in place—her eyes are wider than saucers—as she realizes she’s lost.

Reaching over you he grabs an ounce bag and tosses it near her hitting the floor by her feet. Brianna hesitates though, causing Choso to growl impatiently.

He’d proved his point, now he wanted this bitch gone.

“Yo Gouda—you a voyeur or somethin’?”

Brianna jumps when Choso addresses her quickly shaking her head ‘no’.

“Then get the fuck up outta here bitch—MOVE!”

In her haste, Brianna slips on the spilled alcohol as she scrambles to quickly snatch up the weed and her alcohol-soaked phone. The door slams shut as she scurries out the door.

Plug!Choso who has lost all desire to punish you. He only wants to be able to see your face twist in pleasure when he finally lets you have your sweet euphoric release.

In a flash, he’s moving you again. Choso swoops you up and tosses you onto the bed, hurriedly making sure the door is locked this time before kicking off his pants and crawling on top of you.

“Shhhh princess, you did so good baby, m’gonna let you cum. Gonna have you creaming so hard on this cock, s’your cock baby—you earned it.”

Choso is slurring his words as he peppers your body with blood buzzing kisses to hush your anguished whimpers while he peels the remaining clothes off your body. Not being sheathed inside you is killing him just as much, yet he longs to touch your silky skin unimpeded against his own.

“Been taking me s’gud baby, c’mere…”

The both of you now bare, Choso wastes no time plunging back into your heated core, your heels digging into his back at the intensity.

Damn—you’re so perfect.

Allowing himself to let go, his mind shatters as Choso melts into your gooey lil’ cunny.

His lips are desperate to find yours and Choso is no longer able to withhold himself from sinking into a pussydrunk state. Uncaring for any more displays of dominance, the kiss you share is hurried and sloppy causing your thoughts to splinter.

Your mind fragments into increasingly smaller pieces of incoherency the more frantic Choso’s kiss becomes. His teeth clash with yours and graze over your swollen lips, unable to control himself as he fitfully bruises your clit from the blunt thrusts of his pelvic bone.

Tears glaze your eyes blinding you from the creamy stickiness at Choso’s hilt that splash between your bodies. The musky fluids flow all over your puffed lil’ pussy to drizzle past his aching balls to puddle on your sheets.

“L-Live with me—with me n’ Yuji—FUHHCKKpussysogood—y-you ain’t gotta be here anymore, princess.”

Choso’s forehead rests against yours and his dick twitches inside of you like crazy from the ridges of his thick engorged cock scraping against every nerve in your cunt.

“Be with us, baby. Be our family. I-I–SHIIIIIT—I love you so-much-so-much.”

All of his bravado strips away and there’s just the soft Choso you knew once again. The one who would do anything for you, the one who made your stomach flip and your heart stop—you didn’t want to go through life anymore without him in yours.

“Y-Yes! I wanna—ah fuhhhh—s’gud l-love you D-Daddy!”

Overwhelmed with emotion for you and knowing he would come soon, Choso reaches a shaky hand between you to roughly smash his palm into your sensitive lil’ bud. The soaked slick from your bodies causes his movements to jerk erratically and your hips involuntarily thrash against him.

Choso screws his eyes shut, your bodies so wet he nearly slips off of you in his single-minded focus to make you cum. He has to be ready to pull out of you as soon as you do or he wouldn’t be able to stop himself from shooting all of his cum in you—yet that’s exactly what your fucked out lil’ pussy wants.

“C-Cum—cum in me Daddy…”

Your voice is barely above a whisper as you almost fade out of consciousness from the sublime shockwaves that erupt over your body as you are nearly at the peak of your climax.

Choso’s hips falter, almost in a more fucked out condition than you. He nearly dumped his entire load into you then but his last sliver of sanity held out.

“SHIIIIIT—P-Princess—Do ya even know what y’er s-saying to me right now?”

Time slows, your hand cups his face staring with conviction as best you could into his dark aubergine eyes as your other weakly directs the palm pressing on your clit to rest on your belly.

“Cum in me Choso—I-I wouldn’t mind having a baby if it's yours.”

Oh fuck…

And with that your knees were by your ears and your ankles dangle off his shoulders.

Sure, you were intoxicated on many substances—his dick included and as much as you may have just been talking shit at this moment Choso doesn’t care anymore.

You’d told him you’d have his baby and it’s all his pussydrunk mind can process.

Like a puppy Choso whimpers his groans keen sharply out of him as his tongue dangles to drip slobber down your neck. He’s reverting back to the sloppy whiny mess you know him to be when hes fucked himself out from treating your drooling hole like a well-loved pocket pussy.

“MHMMM FUCK!”

The knot inside you twists impossibly tighter, straining your nerves until it finally snaps sending shockwaves through you. You lose yourself in nonsensical cries as your worn battered body convulses uncontrollably, creaming around his cock.

If your brain hadn’t shut down at this very moment—only filled with the white noise of your searing orgasm—you might be worried Choso just broke your bed. The creaking fills the room as the sound of metal bending is apparent although neither of you are concerned.

“—s’gonna be OK, mmm-FUCK—m’gonna take care of you, love you—we’ll be a real family then, you, me, yuji—n’our baby!”

You don’t even hear him as you’re on autopilot now. The red streaks your kitten nails scratch across his muscular shoulders urge him on like the squelching sounds of your squirt gushing out of you and wet smacks of his balls colliding with your ass.

Overstimulating your senses, Choso sweeps you up into another all consuming kiss. The mind-numbing aftershocks of your blissful tremors leaves your tongue limp as his mouth hungrily devours yours. When Choso finally releases, his hot seed pumps into your tummy as his body writhes on top of yours.

The mind numbing aftershock of your euphoric release continues as Choso proceed to fuck more and more of his thick ropes of his cum into you. He doesn’t show signs of slowing down but your body on the other hand fades, giving into the comforting gratification of sleep after having your guts rearranged.

“O-one more time, p-princess—pleaseeee.”

Your thankful at that moment you’ve previously told Choso you didn’t mind somnophilia and gave him the free use pass to fuck you while you slept. You rarely actually could even stay asleep with how hard he would end up railing you but there was a first time for everything with your cunt finally content and full after so long your exhaustion drags you into a deep slumber.

Plug!Choso who tightly cuddles you to him as you both sleep. The two of you twisted up like a pretzel in a mess of limbs with you practically smashed between Choso and the wall.

Your XL twin bed clearly wasn't meant to comfortably fit two people like this.

You’re still mostly asleep though, softly groaning as the cheery morning sun pierces through your thin curtains. You move to throw a pillow over your face only to discover you cannot budge.

However, you can't say you weren’t used to waking up like this. Choso was always a hardcore cuddler. You missed the mornings you’d wake overheated and skin to skin. Your legs would find themselves intertwined just like this.

Somehow, Choso would always find a way to fuse the both of your bodies together where every part of him was touching some piece of you.

Typical…

The sleepy thought drifts through your brain, sensing it's still far too early for you to wake up. Wanting to drift back to sleep you burrow your face deeper into his chest, stiffening when your mind does the very opposite and wakes up enough to recall the events of the previous night.

Sobering quickly in the daylight, a sinking feeling begins to suffocate your heart. The now familiar guilt you’ve accumulated over the past month amplifies the hangover etching itself behind your eyes.

You can’t help but panic as the memories from the night before come rushing back.

There was still so much uncertainty.

Having been utterly humbled for the first time in your life you can’t stop the self doubt that questions if he’d even meant everything he said last night—you were both lit as hell.

You’d meant it though.

Your heart seizes at the thought that this might be the last time you’d wake up in his arms. Before you know it you are crying again trembling as you try not to wake Choso up with your silent tears.

You are quiet enough but Choso is also a light sleeper and stirs awake at the small fit you’re having.

“H-Hey, morning princess *yawns*—wait, what's wrong?”

His tired eyes are full of loving concern as Choso cups your face wiping away your tears before bringing you into his chest, tightening his hand on your head.

“Shit, was I too rough on you last night princess? Fuck, I know how much all this shit means to you I—”

You interrupt Choso, you can’t let him beat himself up over you any longer.

“N-No, Cho—”

Sniffling, you break away from his hold just enough to maneuver yourself to meet his tired eyes.

You mentally kick yourself—you hated being such a crybaby now but you couldn't help it. You were left feeling so vulnerable after being stripped of all pretenses the night before—it all just started pouring out of you—

“—d-did you mean it? W-What you said? Cause I—I meant what I said. I-I wanna be with you and Yuji. C-Cook breakfast and f-fall asleep watching movies and go to all his games with you—I’ll never miss another game and—and—”

“Bet.”

Wait…huh?

Even after last night you half-still expect him to be upset with you, you’d still expected you’d have to beg.

You’re left speechless.

“Bet. Let’s pack up your shit then, princess.”

Choso’s bright grin is near blinding to your weary gaze.

“I meant everything I said, I could never lie to you.”

Giving you a tender kiss on your forehead, he forces you to look him in the eyes. Choso takes in all your looks of uncertainty before melting them away, softly cooing affirmations with his lips fluttering over yours. You’re so needy for his touch as you wrap your arms around his neck to bring him even closer.

Not being able to resist your body’s calls for him, you soon find yourself underneath Choso who rubs his morning wood against your core still soaked with his essence from the night before.

Choso smirks down at you, the cockiness back in his voice.

“What I say before? You’re my family—Fuck those bitches and fuck your parents—I got you.”

Plug!Choso, who doesn’t know what time it is but knows he has to go pick up Yuji from his friends soon. He also doesn’t know if he should expect your nosy ass sorority sisters to barge in again. Still, that doesn’t stop him from sinking into your sopping heat once more, never taking his lips off of you.

Unlike the fervor of last night, his strokes are slow. The anger and intensity are gone, but the passion still remains simmering under your skin. Choso is savoring every bit of you as he devours your mewls, drinking them down along with any lingering unsureties.

But, fuck—he doesn't feel like he’ll be able to keep himself from cumming inside you from now on. Not when you’d be living with him and Yuji, acting all domestic like.

Images of a would-be future with you swirl in his mind—you pregnant, giggling at Yuji when he jumps in surprise from feeling the baby kick—your belly growing so large you had to cradle a hand underneath when you adorably waddled from room-to-room—the day of delivery when you both finally get to meet the child you cr—

—MUTHRFUUUUH!

Choso’s eyes roll towards the ceiling as he whines loudly, his whole body is shivering along with his premature release. Buckets of his viscous seed slosh in your womb with every sloppy stutter of his hips, pushing the mass overflow of his cum out of your swollen hole and down the crack of your ass.

Fucking you through his overstimulation, your cries only fuel his intent to impregnate you. The want for the sensual intimacy that slow fucking brings after a reconciliation being overtaken by the intense primal urge to put a baby in your belly.

There was no need for any additional vocalizations of affection when Choso is so adamantly reciprocating your feelings, his creamy cum filling you with promises of his devotion which he fucks even deeper into your womb.

You aren’t able to recall the last time you felt this satisfied. Working so hard to meet everyone else’s standards was exhausting and you didn’t regret your choice.

You had no plans now other than being with Choso.

And contrary to the dread of what you had previously thought deviating off course would be like—it frees you. You love and trust Choso enough to let go of all of it and just let life take you where it would.

You’d be content as long as you have him and Yuji.

Choso knows this yet even so, he is still on a mission to add a fourth to your new little family sooner rather than later.

He knew you were speaking of the future when you said you’d have his kid the night before but—why delay the inevitable?

Choso needed to fill you up at least 2 more times before he’d let you leave this bed—no matter how many of your sorority sisters would walk in—they could watch for all he cares.

Yeah at this rate you’d definitely be pregnant by the start of school next year.

Shit, he’d have to go buy a ring soon.

⋙ how was that? holy hell i think this is the longest fic i've written lol. i wanted to take my time with this because although brat taming isn't hard i still wanted to capture the essence of choso. he can be mean enough to do it he's definitely going to internally struggle a bit and be our whiny feral lil baby gworl at the end lol.