#best credit counseling programs

Explore tagged Tumblr posts

Note

How long do you think Dabi survived for in the tube? I’m regards to Natsuo’s character, do you think he got the chance to reconcile with Touya despite the Ending incident? How do you think that went down?

One thing I will credit to the ending of MHA, the fact they still have Touya’s shrine (wonder if they still have kid Touya’s picture or if it’s a different one) considering Shoto prays to it. They never forgot about him, and they never seemed to blame him either saying they would always be there (Fuyumi and Rei said anyway.) Although I hope he didn’t die in the tube and was able to hug them one last time. The idea that Dabi is probably the only villain to be remembered by his family/have a grave while Toga and everyone else were abandoned is low key heartbreaking. But the whole ending for the LOV is LOL

I think maybe Toya survived a couple of weeks or months. Not too long, of course. Let the man escape this cruel world.

I like to think that Natsuo reconciled with his brother. The story emphasized that they had a strong bond and implied that Toya was a main source of emotional support and comfort to Natsuo during a time when he felt abandoned and rejected by both parents, as Endeavor was focus on his career and abusing his family, and Rei's energy was focused on protecting Shouto from Endeavor and her own mental health was deteriorating. I'm sure Natsuo had a lot of anger and confusion about Touya's actions as a villain, but I believe they got closure.

It would be nice if the author had confirmed this in some way, seeing as he put so much emphasis on the relationship, but... ¯\_(ツ)_/¯ it's just another writing failure that didn't need to crash and burn but did anyway.

I also hope Touya didn't die in that tube by himself. Hopefully he was able to be held as he died or something. Especially since this second death was supposed to fix the first way he died (alone, unseen), but again, who knows! A major plotline of the story being so open-ended that readers get no closure and no satisfaction from the story... that's what we were left with.

I agree. It's truly all laughable. Shigaraki and Toga will only be remembered by Spinner and their respective hero kids, and neither party has a complete picture of the villains' stories. We're not shown that Spinner learned about his best friend's childhood abuse, and we're not shown if Ochako knew about the quirk counseling and all the childhood trauma that Toga went through. And it's not like Spinner will be let out of prison to make a grave or altar for them. Lol. Despite Deku saying he'll never forget Shigaraki, we're never shown that he's thinking about him or is moved by him in any way besides that "do your best" flashback which wasn't even in context to what Shigiraki would have wanted. Lol. And yeah, Ochako's quirk counseling program was inspired by Toga to prevent more kids from suffering her same fate, but it would be much more impactful if she actually shared this with the public and TALKED about Toga to the public. But no, let's keep Toga's dying heroic action on the down low so that people's perception of her is not challenged and she remains a heinous humanless villain in the annals of history. ¯\_(ツ)_/¯

It's just all one giant superficial, forced ending that feels hollow and disingenuous.

Chapter 431 at least redeemed Shouto's ending for me and gave me some closure on Touya... reassurance that he's remembered and considered even in death, loved and seen unconditionally, which is exactly what Touya wanted after he died on Sekoto Peak.

54 notes

·

View notes

Note

If you have the time and energy: Do you have a link or a title for the longitudinal study about dieting and diabetes that you mentioned in the tags of that one post? I would greatly appreciate it, I'm trying to collect some data to better argue against fatphobia in my job

yeah dude i have like. everything lol

the study is called the look AHEAD (action for health for diabetes) study and it ran between 2000 and 2015. five thousand participants were assigned to either a weight loss program (1200-1800 calorie diet and 25 min/day physical activity) or simple informational counseling with no weight loss component. as health markers, the study looked at rates of cardiovascular disease, weight loss, diabetes remission, and a few more technical indicators.

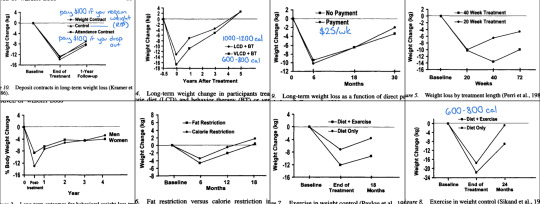

the results are so instructive on what dieting does and doesn't do for the body. to start: the maximal “weight loss” for our the group peaked at 9% one year in and leveled out at less than 5% by the third year. so, a 200-pound person would be a 182-pound person after the first year and a 190-pound person after the third year (i.e.: still fat, and fatter the second year than the first). this is informative because it is so typical; six months on a diet is the amount of time it takes for the metabolism to react and counteract the incidental weight loss at the beginning of the diet. take any random weight loss trial and you will see the same shape of the curve; for example, these are examples take from a literature review published in 2000 where the authors talk about how no matter what kind of diet they prescribe, the field is not seeing long-term weight loss and, quote, “fresh ideas are needed to push the field forward.” (spoiler alert, these fresh ideas would not be forthcoming.)

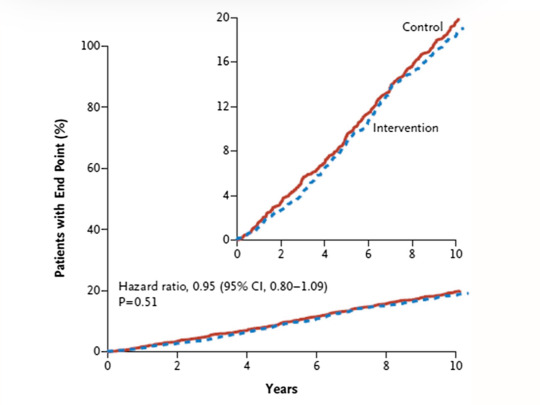

while i was ranting in the tags i confused the cardiovascular disease results and the diabetes remission results – it was the CVD that had showed no impacts. ultimately the trial was ended for futility because the hazard ratio between the two groups was so totally identical:

this also is entirely typical. most studies on weight loss show no significant decrease in mortality. for those that do show a small improvement in mortality, it is dwarfed (and confounded) by the much more reliable result that increasing your physical activity improves mortality regardless of weight loss. basically, exercising makes people live longer, and the rare positive mortality impact of dieting is best explained as an aftereffect of the exercise that usually goes along with a diet. not to mention that the weight loss from these trials is so trivial that it’s hard to objectively credit anything to it. for metabolically healthy individuals, weight loss from a diet is associated with a higher mortality risk. like, surprise, cutting calories and working your body past its nourishment is bad for you. glenn gaesser and siddharta angadi talk about this here in one of the best papers to read on this subject if it interests you.

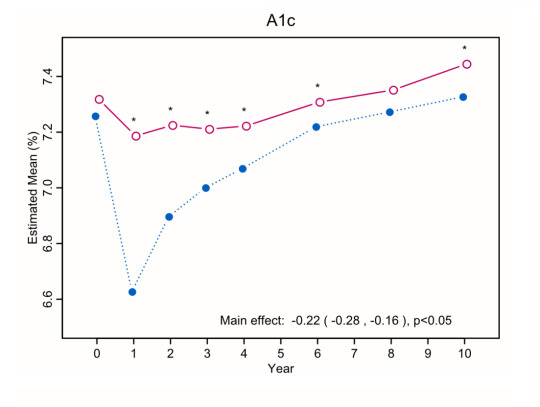

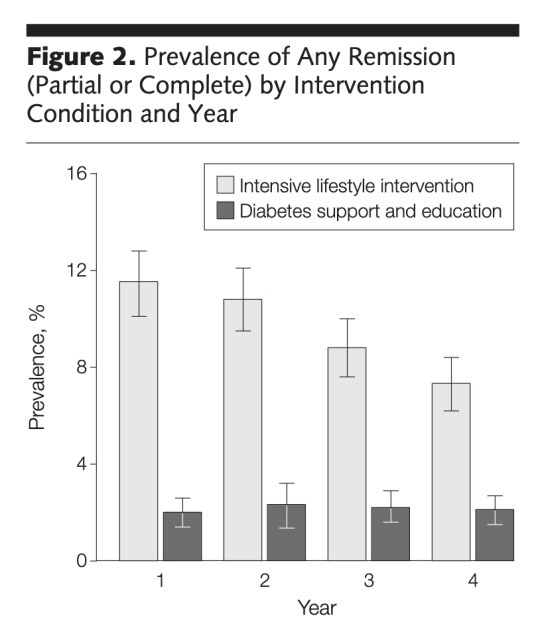

and finally there's diabetes remission. in the first year, 11% of the diet group experienced some remission compared to 2% of the controls. on the surface, that looks like a flatly better remission rate. however.

the total remission rate went down every year after. so, your hba1c or your glycated hemoglobin level describes the percentage of your hemoglobin that has glucose bonded to it. it's the level of sugar in the blood, and it's how we define diabetes: anything higher than 5.7% is pre-diabetic and anything higher than 6.5% is diabetic. what these graphs show is a temporarily decreased hba1c that goes steadily back up the longer the diets continue. this is far from a cure.

eating less food than usual can make your blood sugar drop, especially if you are diabetic. as i understand it – insulin is the hormone that allows your cells to take in glucose, and type 2 diabetics have an excess of insulin in their bloodstreams, so when a diabetic eats less than usual that unregulated excess insulin allows the available glucose to be taken up quickly, resulting in lower blood sugar levels after the fact. this is what you're seeing at the beginning of the study. but like, that effect doesn't continue forever. even if you continue faithfully on the diet, your body rebalances your metabolism against your normal food environment. as a diabetic, that rebalancing takes you out of remission and you don't go back in.

the fact that people remitted for a short time is not nothing. there's no broadly-accepted cure for diabetes, which renders diets as treatment a nuanced subject. like, you're relieved of the diabetes effects for a while, but now you're suffering from the diet itself, and in the long run it exacerbates the scale of the problem by intensifying the underlying metabolic syndrome.

it's early to tell (read: there aren't a lot of vectors putting out this information, so take with grain of salt) but treatment for the underlying metabolic syndrome that causes type 2 diabetes appears to be the path to remitting type 2 diabetes long-term. diabetes is like a series of hormonal triggers failing to cue one after another. you want to address each of those failed triggers through medication and a safe food environment rather than the symptoms-based approach of e.g. a diet, which produces the desired end effect for a while but doesn't actually cure you of the disease. the foremost doctor working on metabolic syndrome is emily cooper, who has a book and a podcast and a medical practice that i recommend. it's good stuff, especially compared to some of the bullshit in this field.

ultimately the look ahead study is a case of an obesity study uncovering relevant results by accident. if you read the text, the authors don't discuss any of their fucked data at all; they instead jump to making excuses for why, surprise, prescribing light malnutrition doesn't cure heart disease. the degree of corporate capture in the obesity treatment field is extreme and due to a cascade of reasons* diets are held as sacrosanct and are not allowed to be aspersed. so authors of studies in this field talk around their data like it's their job (it's their job). it's, like, tobacco research in the 80s bad. the whole field is sick with rot.

but despite the barriers put up by the financially interested, good work still happens and good people are still working. even in the bad work, all of the information is there if you read what the data says and not what its interpreters tell you it's supposed to say. we're coming to a point in history where people can read studies for themselves and plainly see what is and isn't. we're coming to a point in history where the long game of telephone from some corporate exec to the morning news to my doctor to me is arrested at the jump. we're coming to a point in history where we're harder to just lie to. and it's going to feel real good when the truth goes further.

good luck with your job, lmk if you have any other questions 💜

*one: the corporations actually responsible for rising obesity levels don't want to be challenged and the focus on personal responsibility scapegoats them. two: leveling the "disease" of obesity and cultural anti-fatness against people creates a fertile consumer market for pharmaceuticals, diet products, cosmetics, etc. three: the main prescriptions for obesity (diets, drugs, and surgery) don't work long-term, so people stay fat or get fatter and the aforementioned consumer market never disappears. it's real fucked.

#fatphobia#anti-fat bias#body positive#fat positivity#me talking about my hyperfixation on my blog for almost the first time?? crazie

14 notes

·

View notes

Note

I have a dream of studying abroad and I'm in my 20s but my mom is paranoid that something bad will happen to me no matter how safe the country is. She's definitely not thinking rationally but I don't wanna let go of my dreams. How can I fix this and convince her everything's gonna be fine? She even threatened to cut contact with me, she's usually supportive with every thing else

I think what she'll respond to really depends on what she's worried about, but in general, the best way to assuage her fears is to have a really good plan in case the worst happens. For example, if she's worried that you'll get sick while you're abroad, you could lay out the insurance plan you're planning on getting, find all of the hospitals near the university you'll be studying at, and research the process of seeking medical help (including learning key phrases in another language, if necessary). If she's worried about safety, you could show her crime statistics for the area compared to your home town/city, let her track your location on your phone while you're away, buy an alarm that you can carry with you at all times and a doorstop alarm for your hotel/dorm, take a self defense class, put all of the local emergency numbers in your phone, find the local police departments and embassy, and learn to ask for help in the local language (if necessary). If she's worried about how it will fit in with your classes or how the credits will transfer, you can show her which credits will transfer back to your school and how you'll still be able to graduate on time. If she's worried about the financial burden, you can lay out a plan for how you plan to afford it or show her the scholarship options that are available. It may even help to put her in touch with the study abroad program directly or with a student who has done the program before so she can talk through all of her concerns.

But - and this is the harder part - I'm not so sure anything that you say will help her view this situation rationally. I'm a total stranger so I don't know your situation and I don't want to overstep, and I'm sorry if I do. But I wonder how much of this is about a concern for your safety, and how much of this is a desire to control you and your choices. The fact that she threatened to cut off contact with you if you did a study abroad program - despite the fact that you're in your 20s and have the capacity to make decisions for yourself - suggests to me that she's less worried about keeping you safe and more worried about keeping you as an extension of herself. If this is the case, as hard as it is, it seems like you may want to consider family counseling or taking some space from one another. As an adult, you have the right to make your own choices, even if they're not the ones that your mom would make, and being able to make those decisions for yourself is an important part of transitioning into adulthood.

2 notes

·

View notes

Text

Elite Open School Achieves Outstanding Niche.com Rankings and Earns A+ Overall Grade

Elite Open School (EOS), a pioneer in personalized education, is proud to announce its remarkable rankings and exceptional "A+" Overall Niche Grade in Niche.com's latest assessment of the Best Private K-12 and High Schools in America and California.

Elite Open School National Rankings:

#55 of 3,142 – Best Private K-12 Schools in America (Top 2%)

#116 of 4,990 – Best Private High Schools in America (Top 3%)

Elite Open School has also climbed the ranks significantly in the past year, securing the #8 spot in the list of the 214 Best Private K-12 Schools in California, up from #36 the previous year. This remarkable jump underscores EOS's ongoing commitment to improvement and innovation in the field of education.

Elite Open School California Rankings:

#8 of 214 – Best Private K-12 Schools in California (Top 4%)

#26 of 454 – Best Private High Schools in California (Top 6%)

In addition to being named one of the Best Private K-12 and High Schools in America and California, EOS has garnered outstanding individual Niche Grades across various categories:

Elite Open School Niche Grades:

Overall Niche Grade: A+

Academics: A+

Teachers: A+

Clubs and Activities: A+

Diversity: A

College Prep: A+

These exceptional grades reflect EOS's unwavering commitment to academic excellence, a dedicated faculty, and a comprehensive college preparatory program that equips students for success.

Elite Education Group Founder and CEO Jonghwan Patrick Park expressed pride in Elite Open School's accomplishments, stating, "Earning an 'A+' Overall Niche Grade and excelling in various categories is a testament to our dedication to providing a world-class educational experience. We are honored to have been ranked in the top 2% of Private K-12 Schools in America, and we remain committed to raising the bar for educational excellence."

Elite Open School continues to make waves in the education landscape by delivering personalized learning experiences that empower students to excel academically while pursuing their passions and interests outside the classroom. With more than 95 Advanced Placement, Dual-Credit, and Honors courses in Computer Science & Technology, Esports, Business, Art and many more subject areas, EOS gives students the opportunity to take a range of fully accredited courses far beyond those offered at most high schools. Additionally, Elite Open School has been newly certified by the College Board to offer the AP Capstone Diploma™ program and AP with WE Service program.

For more information about Elite Open School and its innovative personalized learning programs, please visit eliteopenschool.org.

About Elite Open School:

Elite Open School (EOS) is an accredited private school specializing in blended learning for students in grades 5-12. EOS offers a certified American education with cutting-edge, adaptive curriculum, empowering students to excel academically while pursuing their passions and opportunities beyond the classroom. With a commitment to personalized learning, EOS offers full-time and part-time enrollment, providing a superior educational experience for families worldwide. Elite Open School's Learning Resource Centers include the 45 physical campuses of Elite Prep, where students are able to take advantage of not only the space and mentorship, but also Elite Prep's 35 years of experience in academic planning, college admissions counseling, and test preparation.

2 notes

·

View notes

Text

A Brief Intro

Hi there! I'd like to open this by saying that if you are an 4na or 3d bl0g that I have followed, please block me. I am in recovery, and do not intend to return to that lifestyle. I am in counseling, and I wish you the best. Sometimes I have "episodes" where I use this bl0g to seek out images and posts that "motivate" me to st4rve. I do not look down on anyone with these issues, and I hope you are safe and get whatever help and support you need.

** actual introduction here! **

Hello! I don't do great with intros so I'll just start describing what I like to post about and discuss!

I am a college student pursuing software engineering, with an end goal of video game programming and design. My initial goal was to get my name in the credits of a Pokemon game, but now my ambition has furthered into going right to GAME FREAK. This will mean learning Japanese - which I planned to do anyway.

I've always been a weeb. Anime, manga and video games sparked my interest in Japan, but I know that there's so much more to the country than that. I am learning what I can when I can so I can be respectful and not f3tishize the culture and people. Right now, my favorite games to play are Splatoon 3, Pokemon Violet (I bought the DLC but haven't started it yet), and Fire Emblem: Awakening (I haven't finished it yet!).

I like to watch anime and cartoons. My favorite anime are The Melancholy of Haruhi Suzumiya, School Live!, and Aggretsuko. My favorite cartoons are Steven Universe, Bojack Horseman, and Adventure Time (I saw episodes as it aired but haven't sat down to watch it all. I'm going to start soon! No spoilers please ^_^).

I like to draw, though I haven't found the time to do so as of late between college and working.

I consider myself a feminist, and am very concerned about various "political" and "controversial" topics. If you don't like my views, feel free to block me. I will absolutely consider different opinions, but arguing for the sake of arguing is a waste of both your time and mine.

Enjoy your stay! ^_^

#recovery#intro#welcome#that gifted girl#college#anime#manga#video games#japan#japanese#pokemon#nintendo#game freak#tmohs#gakkou gurashi#school live#aggretsuko#aggressive retsuko#sanrio#steven universe#su#suf#steven universe future#bojack horseman#back in the 90s#adventure time#feminism#us politics#art#artist

6 notes

·

View notes

Text

What is the measurement of success and failure?

Friday night, I watched a dear friend graduate with a Bachelor's degree in Electrical Engineering and dual minors in Maths and Computer Science in four years.

Something I long dreamed of doing in high school. I wanted to go into Mechanical Engineering. That's what my grandfather had done and partial of what my father did.

But when I got to college, despite being an A/B student in high school, I was woefully unprepared. I couldn't do anything right. I couldn't academically pass even the basic classes.

There was a point in my second semester of freshman year that I locked myself in my dorm room for a solid week, just stuck in a very deep depression. My peer counselor had to use her master key to do a welfare check on me, and take me to the on-campus counseling center.

And it got bad enough after four semesters that my GPA hit a point that I had to change majors. So I changed from mechanical to computer science. I passed the basic classes there without issue - and one of them I was told to shut up and stop answering questions because I already knew the material but had to take the class just to have the credit on my transcript. I even had no issues with the couple of 3,000 and 4000 level courses I took in the program, but then ran into hurdles in the later classes. But there was just one specific professor that did not like me, I'm not even sure he liked anybody, and just really tried to make my life miserable. Two semesters I took his class trying to get a passing credit and failed to do so; I took the class as a condensed summer with a different professor and got through it with no problem and a high B. But the damage had been done.

I was expulsed from the engineering department as a whole after my 8th semester on campus (10 semesters counting two summers).

I ended up graduating with a bachelor's in University Studies after another 6 semesters (4 full and 2 summer). Where I went, it was basically their fast track program to get out of the college, allowing me to count three minors worth of accreditation towards a generic bachelor's. Considering I had accrued enough hours that would otherwise count for a master's degree, it was all the more depressing too have a generic bachelor's that wouldn't really mean much in life.

Does that mean I was an academic failure?

I've never been much of a social bug, but many of the friends that I made over those 6 years for the only friends I had in life. The only social life I knew was the one with other students.

It wasn't much longer than a year after I graduated that I no longer had most of those friends, and in subsequent years that number dropped more and more.

These days I only have one friend I still talk to from college, but we haven't gotten together in a few years. He is a high level executive at a firearms company now while raising two daughters on his own after their mother relinquished her rights.

My social bubble has only minutely increased since then. The title of "Best Friend" has bounced from person to person as they painfully came and went. My social bubble at this point only consists of the girlfriend on a weekendly basis and K and D (whom I just saw last week for the first time in months but text daily).

I text J and M at least once a week, sometimes daily. But I just saw J for the first time in at least a year as she walked for college graduation, and I have only seen M once (last year) in the last decade.

But outside of Facebook, that's my social/conversation bubble.

Does that mean I am a social failure?

I've never held a "good" job; I'm always lived more or less paycheck to paycheck. The "extra" things I've accrued in life have generally been purchased with my savings account of my mum's inheritance. I've spent 75% of what I inherited in the few years since she passed; granted a chunk of that was eliminating my student loans.

Does that mean I am an employment and/or financial failure?

What is the measurement in success and failure? I feel like so much of a failure when I am surrounded by "more" successful people.

I feel like there are some things, like my friend's graduation, where I had small contributions and share a bit in the success-by-proxy. Is that wrong?

It's hard not to be mad at myself about things of the past. When it comes to "What would you tell a younger self?"... So many things.

Reflecting back on the progression of J and our friendship, it just doesn't make me feel good about myself. During the ceremony, a student spoke about how she is a first generation college student/graduate from an immigrant family, and all the effort that was required for success.

Seeing people go and do and complete the things that I wished I could do but didn't...it hurts the self-esteem.

There are so many things I wish I could time travel and fix so that I could be a better me.

But I can't. I'm just another random bloke with a meaningless degree that can't get any jobs that my knowledge could otherwise maybe get me into...or that I could have gotten myself if I would have been better at university.

Yay for those that can apply themselves and be successful.

Depression for those that have failed in life.

🙋♂️

4 notes

·

View notes

Text

Top tips for handling financial anxiety as a university student

https://www.kenilworthglobalconsulting.com/top-tips-for-handling-financial-anxiety-as-a-university-student/

Top tips for handling financial anxiety as a university student

Financial anxiety can be a real challenge for university students, especially for international students studying abroad. To manage your financial worries, here are some top tips from Kenilworth Global Consulting:

Monitor Your Spending – Keeping track of what you’re spending money on is an important way to better manage your finances. Set up a budget and keep track of where your money is going so that you can make smart decisions about how much to save or spend each month. This will help you stay within your means and avoid taking on more debt than necessary.

Cut Unnecessary Expenses – Evaluate where your money is going and look for ways to cut back on unnecessary expenses. Are there any subscriptions or services that you don’t really need? Do you find yourself buying things you don’t really need? Can you find cheaper alternatives for some of your regular purchases? Making small changes to your spending habits can help you save money and reduce financial anxiety.

Reach Out for Help – Don’t be afraid to reach out to family, friends or professionals if you are struggling with financial anxiety. Talking through your worries with someone who understands can help put things into perspective and provide valuable advice. You may also want to look into credit counseling services, which can provide tailored guidance on how to manage debts and increase savings. Our experienced team at Kenilworth Global consulting will provide you with end-to-end solution in education consultancy for overseas study.

Consider Side Hustles – If you’re feeling the pinch financially, consider taking on a side hustle or part-time job while studying at university. This can help to supplement your income and provide a little extra financial security. Plus, it’s a great way to build your skillset and gain experience which will be valuable when you enter the job market after graduation. Kenilworth Global Consulting provides the best Immigration and visa Consultancy services for studentsin India. once you’re on your way to your dream country, don’t forget to enjoy every moment of your incredible experience!

Make Use of Support Services – Many universities offer support services for students dealing with money worries. Check out what’s available at your university such as emergency loans, financial advice sessions or budgeting workshops. Taking advantage of these resources can help you make more informed decisions about money management during your student years.

Stop comparing yourself to others – University is a melting pot of different personalities and financial situations, but it’s important to remember that comparing yourself to others doesn’t help anyone. Trying to keep up with their lifestyle or spending habits can lead down the path of economic stress – focus on making your own finances work for you instead! Your situation isn’t in competition with someone else’s so try not let comparisons get in the way of living within your means at university.

Enjoy life in university – Don’t let finances stand between you and achieving your dreams. College is a chance to learn, grow and experience some of the best years life has to offer – but it can be intimidating if money worries are looming in the background. Reach out for support programs available where needed; stay hopeful that better days ahead will make those hard times worth it! Make this time count by investing effort into getting an education which could reap rewards through future successes when tackling financial challenges head on.

By following these tips and taking control of your finances, you can reduce financial anxiety and ensure that the transition into university life is smoother. With a bit of planning and effort, managing money as a student can be rewarding and stress-free.

How can Kenilworth Global Consulting help?

Our team at Kenilworth Global Consulting finds the perfect study abroad opportunity for you. We’ll help you find and apply to the best programs based on your specific goals and background so that you have the best experience possible.

With Kenilworth Global Consulting, you can maximize your chances of success. We offer personalized guidance and support from start to finish to ensure your study abroad application is the best it can be. to maximize your chances for success. (Our students have a 95% success rate). Kenilworth Global Consulting are the best study abroad in India.

With Kenilworth Global Consulting, you get to work with our team of international education consultants from start to finish. Email us at [email protected] or call us at +22 670 80 829 / 830 to learn more.

Visit Us: https://www.kenilworthglobalconsulting.com/top-tips-for-handling-financial-anxiety-as-a-university-student/

6 notes

·

View notes

Text

Accredited Debt Relief Texas

Accredited Debt Relief Texas: The Trusted Path to Financial Freedom

Debt can quickly become overwhelming, but finding the right solution can make all the difference. For Texans, Accredited Debt Relief Texas offers a reliable and effective way to regain control of finances. At Debt Redemption, we’re dedicated to guiding individuals through the debt relief process with trusted solutions that work.

What is Accredited Debt Relief in Texas?

Accredited debt relief is a professional service that helps individuals manage and reduce unsecured debts such as credit cards, medical bills, and personal loans. The goal is to negotiate with creditors, consolidate payments, or even lower the total amount owed, creating a clear path to financial stability.

Key Features of Accredited Debt Relief

Debt Consolidation: Combine multiple debts into one manageable monthly payment.

Debt Settlement: Negotiate with creditors to reduce the principal amount owed.

Credit Counseling: Gain expert financial advice to build a sustainable budget.

Debt Management Plans (DMPs): Develop structured repayment strategies to eliminate debt.

How Does Accredited Debt Relief Work in Texas?

Accredited debt relief follows a step-by-step process to ensure the best outcomes for clients:

1. Free Consultation

Start with a no-cost consultation to discuss your financial situation. This includes:

Reviewing the total debt amount.

Understanding the types of debt (credit cards, personal loans, etc.).

Assessing monthly income and expenses.

2. Personalized Plan Development

A customized debt relief plan is created based on your unique financial circumstances. This plan may involve:

Consolidating multiple debts into one payment.

Negotiating with creditors for lower interest rates or reduced balances.

Structuring a repayment timeline that fits your budget.

3. Creditor Negotiations

Experienced professionals handle negotiations with your creditors. The focus is on achieving:

Reduced total debt amounts.

Lower monthly payments.

Waived fees or penalties.

4. Execution of the Plan

Once the plan is agreed upon, you’ll begin making payments according to the outlined strategy. These payments may be made directly to creditors or through a managed program.

5. Ongoing Support and Monitoring

Throughout the process, you’ll receive continuous support to ensure your debt relief plan stays on track and is adjusted as needed.

Benefits of Accredited Debt Relief Texas

Choosing an accredited debt relief service in Texas comes with several advantages:

Simplified Finances: Combine multiple debts into a single, manageable payment.

Reduced Debt Amounts: Pay less than you owe through negotiated settlements.

Avoid Bankruptcy: Find a practical alternative to the long-term impact of bankruptcy.

Lower Stress Levels: Let professionals handle creditor negotiations and plan execution.

Improved Financial Knowledge: Learn better money management skills for the future.

Why Choose Debt Redemption for Accredited Debt Relief?

At Debt Redemption, we are committed to providing Texans with the best debt relief solutions. Here’s why our clients trust us:

Texas-Focused Expertise: We specialize in the unique financial landscape and legal requirements of Texas.

Proven Results: Thousands of clients have successfully resolved their debts with our programs.

Transparent Practices: No hidden fees or misleading terms—only clear and honest solutions.

Dedicated Support Team: Our compassionate team is here to guide you through every step of the process.

Is Accredited Debt Relief Right for You?

Accredited debt relief is ideal for individuals who:

Struggle with high-interest debt.

Have difficulty keeping up with multiple payments.

Want to avoid bankruptcy.

Need expert help negotiating with creditors.

If you’re ready to tackle your financial challenges, accredited debt relief could be the solution you’ve been looking for.

Take the First Step Toward Financial Freedom

Debt doesn’t have to define your life. With Accredited Debt Relief Texas and the trusted expertise of Debt Redemption, you can regain control of your finances and build a brighter future.

1 note

·

View note

Text

Success Simplified: Hyderabad’s CA Coaching at Its Best.

INTRODUCTION

Pursuing the title of Chartered Accountant (CA) is a dream that resonates with countless students in India, especially in a thriving city like Hyderabad. With its dynamic opportunities and a growing demand for qualified CAs, Hyderabad has emerged as a hub for top-notch CA coaching. Among the many institutions striving to deliver quality education, CMS for CA College has cemented itself as a beacon of excellence, simplifying the journey toward success for aspiring CAs. If you’re looking for the CA Coaching in Hyderabad then look no further than CMS FOR CA.

In this article, we delve into why CMS for CA College is the ideal choice for CA aspirants, unraveling the unique features, academic rigor, and student-focused approach that have earned it a stellar reputation.

Why Hyderabad is the Perfect Destination for CA Aspirants

Hyderabad is more than just the City of Pearls. Over the years, it has transformed into a bustling educational hub. The city offers an affordable cost of living, access to renowned coaching centers, and opportunities to grow in a flourishing corporate environment. Its diverse student community fosters growth, sharpening academic and interpersonal skills. In this vibrant ecosystem, CMS for CA College thrives by creating an ideal environment for CA aspirants to achieve their goals.

What Sets CMS for CA College Apart?

When it comes to CA coaching, CMS for CA College goes beyond the conventional classroom experience. Its success lies in its structured approach to CA courses, a robust curriculum, and the unwavering commitment of its faculty. CMS provides dedicated coaching for all levels of the CA program—Foundation, Intermediate, and Final—ensuring personalized attention at every stage.

The faculty at CMS comprises seasoned professionals and subject matter experts who combine academic expertise with real-world insights. They employ innovative teaching methods such as live online classes, case studies, and AI-powered learning tools. CMS also provides students with a comprehensive range of study materials, updated to align with the ICAI syllabus, and organizes regular mock exams to build exam readiness and confidence.

Beyond academics, CMS supports its students with counseling sessions, time management workshops, and career guidance, ensuring they are prepared to handle the challenges of both exams and the professional world. If you’re looking for the CA Coaching in Hyderabad then look no further than CMS FOR CA.

Success Stories That Speak Volumes

CMS for CA College has produced a multitude of success stories. Its alumni include CA rank holders and professionals excelling in leading firms. For instance, Rahul Singh, who initially struggled with the intermediate level, found success through CMS's focused mentorship and mock exams. Today, he works at a leading multinational corporation in Hyderabad.

Similarly, Pooja Sharma, once an average student, credits CMS for transforming her academic approach. With the faculty’s continuous support and innovative teaching methods, she achieved her dream of becoming a CA. Such stories underscore the institution’s dedication to its students’ success.

The Edge CMS for CA College Offers More Than Competitors

CMS for CA College distinguishes itself from competitors by maintaining a student-centered approach. It offers personalized attention with small batch sizes, advanced infrastructure with smart classrooms and online portals, and affordable fees. These elements ensure that CMS remains accessible while delivering exceptional quality.

Future-Proofing Students for a Successful CA Career

CMS for CA College doesn’t stop at academic coaching. It equips students with essential professional skills such as public speaking, corporate etiquette, and financial analysis. Networking events organized by CMS provide students with opportunities to interact with industry leaders, ensuring they are well-prepared for their professional journey after qualifying as CAs. If you’re looking for the CA Coaching in Hyderabad then look no further than CMS FOR CA.

CONCLUSION

Clearing the CA exams is no small feat, but with the right guidance, perseverance, and resources, success is achievable. Hyderabad offers an ideal environment for aspiring CAs, and CMS for CA College emerges as a standout choice for quality coaching.

With its innovative teaching approach, experienced faculty, and holistic student support, CMS simplifies the challenging path to CA success. Whether you are starting your journey or tackling the final stages, CMS for CA College is your trusted partner in turning your dreams into reality.

For CA aspirants in Hyderabad, CMS for CA College is not just a coaching institute—it’s a gateway to success. Let your journey to becoming a Chartered Accountant begin with CMS, where excellence meets opportunity.

0 notes

Text

NEET Coaching Excellence: The Best Centers in Kanpur Reviewed

Preparing for the NEET (National Eligibility cum Entrance Test) is a monumental task for any medical aspirant.

With the growing competition and the high stakes of securing a seat in prestigious medical colleges, sanjeev rathore choosing the right coaching institute becomes paramount.

Kanpur, a city celebrated for its educational institutions, offers a plethora of coaching centers to guide students toward success.

In this article, we review the best coaching in Kanpur for NEET, exploring their offerings, teaching methodologies, and why they stand out.

Why Kanpur for NEET Coaching?

Kanpur has emerged as a preferred destination for NEET preparation due to its:

Reputed Coaching Institutes: The city houses coaching centers with experienced faculty and a history of producing top NEET scorers.

Affordable Education: Compared to metropolitan cities, Kanpur offers quality coaching at competitive fees.

Strong Academic Culture: The environment fosters focus and competitive spirit among students.

Key Factors in Choosing the Best NEET Coaching

Before diving into the list, here are some crucial factors to consider while selecting a coaching center:

Faculty Expertise: Highly qualified and experienced teachers.

Study Material: Comprehensive, updated, and aligned with the NEET syllabus.

Success Rate: Track record of past results.

Infrastructure: Well-equipped classrooms and study spaces.

Student Feedback: Testimonials from current and former students.

The Best Coaching in Kanpur for NEET

Here’s a review of some of Kanpur’s leading NEET coaching institutes:

1. Aakash Institute

Why It Stands Out: Aakash is synonymous with NEET preparation across India. Its Kanpur branch maintains the same standard of excellence.

Features:

Expert faculty with years of experience.

Comprehensive study materials and mock tests.

Regular performance analysis to track progress.

Success Stories: A consistent history of students securing top NEET ranks.

2. Allen Career Institute

Why It Stands Out: Allen’s focused approach and student-centric teaching make it a favorite among NEET aspirants.

Features:

Concept-driven learning with a focus on fundamentals.

Daily practice problems (DPP) and regular assessments.

Scholarships for meritorious students.

Success Stories: A significant number of students excel in NEET every year under Allen’s guidance.

3. Resonance

Why It Stands Out: Resonance combines rigorous training with personalized attention, ensuring holistic development.

Features:

Structured course modules tailored for NEET.

Weekly tests and feedback sessions.

Hostel facilities for outstation students.

Success Stories: Known for producing top-ranking NEET aspirants.

4. Career Point

Why It Stands Out: Career Point focuses on small batch sizes and interactive teaching.

Features:

Detailed study plans and doubt-clearing sessions.

Regular mock tests mimicking the NEET pattern.

Affordable coaching fees.

Success Stories: Many students credit Career Point for their solid NEET foundation.

5. The Guidance Academy

Why It Stands Out: This local institute is known for its dedicated faculty and personalized mentoring.

Features:

Individual attention to students.

Affordable and result-oriented programs.

Flexible batch timings.

Success Stories: Produces consistent results in NEET Mains and Advanced.

How Coaching Centers in Kanpur Excel

The best coaching in Kanpur for NEET share some common traits that make them stand out:

Rigorous Testing: Frequent mock tests ensure students are exam-ready and familiar with the NEET pattern.

Tailored Strategies: Institutes devise personalized strategies to help students overcome their weaknesses.

Motivational Support: Regular counseling sessions keep students motivated and focused.

Innovative Teaching: Leveraging technology through online classes, video lectures, and digital platforms.

Tips for Choosing the Right NEET Coaching in Kanpur

With so many options, it’s important to make an informed choice. Here are some tips:

Visit the Center: Attend demo classes and interact with faculty.

Check Batch Size: Smaller batches allow for better interaction with teachers.

Analyze Results: Research the institute’s past performance in NEET.

Seek Feedback: Talk to current and former students to gauge the institute’s quality.

The Role of Self-Study

While coaching plays a crucial role, self-study remains a cornerstone of NEET success. Combine coaching guidance with:

Regular revisions.

Solving previous years’ question papers.

Staying consistent and disciplined.

Final Thoughts

Kanpur’s NEET coaching centers have established themselves as pillars of support for medical aspirants.

Their comprehensive teaching methodologies, experienced faculty, and focus on student success make them invaluable for cracking the competitive NEET exam.

By choosing the best coaching in Kanpur for NEET and complementing it with personal effort, students can transform their dreams of becoming doctors into reality.

Whether you’re a parent searching for the right institute for your child or a student ready to embark on this challenging journey, Kanpur’s coaching ecosystem offers everything you need to succeed

0 notes

Text

Online Slot Guide | How to Pick a Good Online Slot

Yes is the response. The likelihood of winning the space match itself is identical. Likewise, you have additional honors on arrangement to be won. Another advantage of opening competitions is that the online gambling club frequently uses them to meet new players in another location. You can design the game and become familiar with it while also having a chance to win an award by playing at low stakes.

Space Prize Draws Players who play in a particular space can win prizes from the online club. This tactic is used by gambling clubs to introduce you to a game, possibly in an interesting way. Picking in is often required to qualify, and prizes can be free twists or additional credits.

Keep in mins the RTP and flightiness counsel above, and expecting the draw consolidates one of these, it justifies playing.

Space Games Chances Due to the intricate irregular number generator programming framework that is used to determine the outcome of each twist, it is absurd to expect precise odds on handling a winning twist on a gambling machine.

I previously mentioned playing games with a high yield to player rate. Whether or not you played a near 100 percent RTP game, it doesn't expect that inside your gathering, you are guaranteed to get back by far most of the money you have bet. Obviously, in the event that that were to occur, you would never be able to advance and succeed.

Nearly all of them refer to the machine's alleged existence. However, since a single twist is a rare occurrence, it is likely that you will turn multiple times and only find four wins in that group.

The best way to tell if a gambling machine is ready to pay out What follows is a succinct response to a lengthy question. Higher RTP "ought to" genuinely mean that, over longer periods, you will experience a higher level of winning twists.

In a land-based or online opening game, it is practically impossible to be "prepared to pay." Each twist is determined by an irregular number generator, and any delayed timeframe during which no pays affect the subsequent twist or series of twists from the space.

I am unable to extend the definition any further. It is impossible to predict when a space will pay.

Betting Machine Tips The following are a couple of clues to help you pick and play internet betting machines, and how you can work on your potential outcomes winning on spaces.

Use Rewards In fact, you can use rewards for some lower-risk, lower-esteem play, but don't expect to win a lot or win a lot of money. The additional features might only be available at the lowest stake levels, and many dynamic bonanzas cannot be won at these stake levels.

Play Free Spaces: This is a strategy that is frequently recommended, and the smart way to use it is to look for spaces with a high return to player (RTP) and low unpredictability, as previously discussed in this article. Check out politicsinquotes.com.

Because it was intended to be that way, the space will be free. Not because someone has noticed something and suggests that paying out large numbers of wins is ready. I'll reiterate: every opening twist is irregular, and previous twists influence the outcome of the next one.

Which games offer the highest payouts? This is yet another type of the most frequently asked question about online gambling machines, and it's getting old.

0 notes

Text

How to Get Financial Assistance in Adelaide

If you are experiencing financial hardship, there are many ways to get help. You can apply for a Centrelink payment to help with costs. You can also apply for a No Interest Loan through Good Shepherd. For more information, visit their website.

There are also services that can help you with your utilities, rent or mortgage. They can also offer help with budgeting. You can also contact a financial counsellor to discuss your situation.

Free financial counselling

Financial counselling is a free service that can help you work out your debts. It is non-judgemental and confidential, and is available from not-for-profit community organisations. Financial counsellors can also provide advice on other matters such as budgeting and credit card repayments. However, they do not offer legal advice. If you have any legal problems, it is best to contact a lawyer straight away.

Almost anyone can find themselves in financial hardship, or in need of financial assistance Adelaide. Common reasons include job loss, relationship breakdowns, illness, natural disasters and domestic violence. These issues can lead to spiralling debts and poverty. Moneycare, the Salvation Army’s financial counseling service, offers free financial counselling and access to their no interest loans scheme.

There are also specialist financial counsellors for farmers, Aboriginal and Torres Strait Islander peoples, small businesses, and those struggling with gambling. Call 1800 007 007 or chat online to be connected with a financial counsellor. These services are available across Australia.

Micro-finance schemes

Microfinance is a system of financial services for people living in poverty. It can help them manage their finances and build their capacity to grow a business. It also provides them with the tools they need to improve their daily lives and support their children’s education.

Microloans allow families to buy livestock, seeds and fertilisers for their crops, agribusiness equipment, or rent storage facilities to sell their products when prices are high. These loans enable families to overcome poverty and become self-sufficient.

The International Labour Organisation’s Microfinance and Gender Equality Programme promotes the integration of gender issues into microfinance programmes. This includes supporting policies and programmes that address the barriers that prevent women from accessing microfinance.

The program’s guiding principles and service standards are designed to ensure that the program delivers more integrated and improved outcomes for people. Service providers are encouraged to develop flexible service delivery approaches that respect the dignity of clients and foster self-reliance. Service providers are expected to use program funding in accordance with operational guidelines and their funding agreement.

Child care subsidy

The Australian Government offers several forms of financial assistance to help families with the cost of child care. These programs are designed to cover all or part of a family’s child care fees, depending on their eligibility. The Child Care Subsidy (CCS) is the primary form of financial assistance for families and is paid to child care providers who pass it on to their families as a fee reduction. Families must meet eligibility criteria to receive CCS, including income levels and activity requirements.

Eligible families may also be able to receive the Child Wellbeing Subsidy and/or Grandparent Subsidy. These subsidy programs are offered by Centrelink and include a range of benefits to help with the costs of living and child care. To access these programs, families need to register for a myGov account and link it to the child care service they are using. Families can also call the Centrelink multilingual phone service to speak with a support worker.

Education assistance

If you have children in school and are struggling to meet education costs, there are a number of assistance programs available. You can also access government subsidies through Centrelink. These subsidies can be deducted from your Centrelink payments, making it easier to afford essential expenses.

You can find out about the schemes that are available through Services Australia. These include Austudy, ABSTUDY and Youth Allowance. These support programs are available for both domestic and international students. You can also apply for scholarships at the University of Adelaide.

The university is a US Department of Veterans Affairs POST 9/11 GI BILL participating institution and can certify and disburse US student loan funds for eligible students. To learn more about this arrangement, please contact Student Finance.

0 notes

Text

Open Your Future: Top CNA Training Programs in New Jersey

Unlock Your Future: Top CNA Training Programs in New Jersey

Are you considering a career as a Certified Nursing Assistant (CNA) in New Jersey? If so, you’ll need to complete a state-approved training program to become certified. But with so many options available, how do you choose the best CNA training program for your needs?

To help you make an informed decision, we’ve compiled a list of the top CNA training programs in New Jersey. These programs not only meet the state’s requirements for certification but also provide high-quality education and hands-on training to prepare you for a successful career in healthcare.

Top CNA Training Programs in New Jersey

1. ABC Training Center – Location: Jersey City, NJ – Program Length: 75 hours – Highlights: Small class sizes, hands-on training, job placement assistance

2. Academy of Allied Health and Science – Location: Neptune, NJ – Program Length: 90 hours – Highlights: State-of-the-art facilities, experienced instructors, clinical experience at local hospitals

3. Bergen Community College – Location: Paramus, NJ – Program Length: 90 hours – Highlights: Affordable tuition, flexible class schedules, on-campus clinical training

4. Camden County College – Location: Blackwood, NJ – Program Length: 100 hours – Highlights: Accredited program, partnerships with local healthcare facilities, career counseling services

5. Essex County College – Location: Newark, NJ – Program Length: 90 hours – Highlights: Diverse student population, practical skills training, scholarships available

6. Mercer County Community College – Location: West Windsor, NJ – Program Length: 76 hours – Highlights: High pass rates on state certification exams, experienced faculty, simulation lab training

Benefits of CNA Training Programs

– Job Security: The demand for CNAs is expected to grow in the coming years, providing stable employment opportunities. – Competitive Salary: CNAs in New Jersey earn an average salary of $30,000 per year, with opportunities for advancement. – Fulfilling Work: CNAs play a crucial role in providing compassionate care to patients in healthcare settings.

Practical Tips for Choosing a CNA Training Program

– Research Accreditation: Make sure the program is accredited by the New Jersey Department of Health. – Visit the Facilities: Take a tour of the training center to ensure it meets your needs and expectations. - Inquire About Job Placement: Ask about the program’s job placement rates and services for graduates.

Case Study: Maria’s Success Story

Maria enrolled in the CNA training program at ABC Training Center in Jersey City and completed her certification in just 75 hours. With the help of the program’s job placement assistance, Maria landed a full-time CNA position at a local nursing home immediately after graduating. She credits her success to the hands-on training and support she received during her time at ABC Training Center.

Choosing the right CNA training program is the first step towards a rewarding career in healthcare. Consider factors such as location, program length, and facilities when making your decision. With the top CNA training programs in New Jersey listed above, you’ll be well on your way to unlocking your future as a certified nursing assistant. Good luck on your journey to becoming a CNA!

youtube

https://www.cnacertificationschools.net/open-your-future-top-cna-training-programs-in-new-jersey/

0 notes

Text

Best Debt Consolidation Options: A Comprehensive Guide

Dealing with multiple debts can be overwhelming, affecting your financial stability and peace of mind. Fortunately, debt consolidation provides a strategic solution to streamline your financial obligations. In this comprehensive guide, we'll delve into the best debt consolidation options available, helping you make informed decisions tailored to your unique financial situation.

Understanding Debt Consolidation

Before we explore the options, let's clarify what debt consolidation entails. Debt consolidation is the process of combining multiple debts into a single, manageable payment. This not only simplifies your financial responsibilities but can also lead to potential interest rate reductions, saving you money in the long run.

Personal Loans for Debt Consolidation

One popular option is obtaining a personal loan to consolidate your debts. These loans, often unsecured, can be used to pay off various high-interest debts. By consolidating into a single loan, you may benefit from a lower interest rate, making it easier to manage and ultimately pay off your debts.

2. Balance Transfer Credit Cards

For those with credit card debt, utilizing a balance transfer credit card can be a strategic move. These cards often offer a promotional period with low or even zero percent interest. By transferring your existing balances to such a card, you can save money on interest and pay down the principal amount more efficiently.

3. Home Equity Loans

Homeowners may consider home equity loans as a viable debt consolidation option. By leveraging the equity in your home, you can secure a loan with a lower interest rate compared to some other forms of credit. However, it's crucial to assess the risks involved, as defaulting on a home equity loan can lead to the loss of your property.

4. Debt Management Plans

Enrolling in a debt management plan offered by credit counseling agencies is another avenue. You make a single monthly payment to the agency, which subsequently distributes the funds to your creditors under a DMP. This structured approach helps you pay off your debts systematically, often at reduced interest rates.

5. Debt Settlement

Debt settlement is the process of negotiating with creditors to settle your debts for a lower sum than the entire amount owing. While it can be an effective way to reduce your overall debt burden, it may impact your credit score. It's crucial to work with reputable debt settlement companies to navigate this option successfully.

6. 401(k) Loans

For those with an employer-sponsored retirement plan, taking a 401(k) loan might be a viable option. While it allows you to borrow against your retirement savings, caution is necessary. Failure to repay the loan within the specified terms can result in taxes and penalties.

7. Peer-to-Peer Lending

In the digital age, peer-to-peer lending platforms connect borrowers with individual investors. This alternative lending option can provide access to funds for debt consolidation, often with competitive interest rates. However, eligibility criteria and interest rates can vary among different platforms.

8. Credit Counseling Services

Engaging the services of a credit counseling agency can be beneficial for those seeking professional advice. These agencies offer financial counseling, budgeting assistance, and debt management plans tailored to your specific needs.

9. Government Debt Consolidation Programs

Certain government programs, such as Federal Direct Consolidation Loans for student loans, provide structured options for consolidating specific types of debt. Researching and understanding the terms and conditions of these programs is essential before opting for them.

10. Online Debt Consolidation Tools

Explore online debt consolidation tools that allow you to input your financial information and receive personalized recommendations. These tools analyze your debts, income, and expenses to suggest suitable consolidation options, providing a convenient way to assess your choices.

Conclusion

In conclusion, finding the best debt consolidation option requires careful consideration of your financial situation, goals, and risk tolerance. Whether you choose a personal loan, balance transfer, or another method, the key is to take proactive steps toward financial freedom. Evaluate the pros and cons of each option, and if needed, consult with financial professionals to make an informed decision. Remember, debt consolidation is a powerful tool when used wisely, helping you pave the way toward a debt-free future.

0 notes

Text

Why Bankruptcy Expert Consultation Could Be Your Financial Lifeline

Introduction

In today's unpredictable economic climate, financial challenges are becoming an all-too-common reality for individuals and businesses alike. Mounting debts, unforeseen expenses, and the pressure of unpaid loans can leave anyone feeling overwhelmed. For many, bankruptcy appears to be the only option, but navigating the complexities of bankruptcy law can be daunting. This is where the assistance of a bankruptcy expert consultation becomes essential, offering a guiding hand when you feel trapped by financial uncertainty.

Understanding Bankruptcy: A Last Resort or a Fresh Start?

Bankruptcy, often considered a last resort, is more than just a means of escaping debt. It’s a legal process designed to help individuals or businesses get a financial reset, eliminating or restructuring their debt under the protection of the court. But despite its potential benefits, the emotional and financial toll it can take should not be underestimated. To make an informed decision, it’s crucial to seek advice from a qualified expert.

A bankruptcy expert consultation provides a comprehensive evaluation of your financial situation, helping you understand the long-term implications of filing for bankruptcy. Not only does it offer clarity on whether bankruptcy is the best route, but it also introduces alternative solutions, potentially saving you from making a rushed, emotionally driven decision. Whether it’s Chapter 7, Chapter 13, or another form of bankruptcy, understanding the fine details can be critical to preserving your assets, credit rating, and peace of mind.

The Intricacies of Bankruptcy: Why Go It Alone?

The bankruptcy process is fraught with legal complexities, documentation requirements, and deadlines. Without an expert guiding the way, it’s easy to miss important filings or misunderstand the laws governing your case. The consequences of such missteps can be severe, including the dismissal of your case or even legal penalties.

A bankruptcy expert, well-versed in both the nuances of bankruptcy law and the intricacies of financial management, serves as your advocate. They meticulously analyze your debt portfolio, identifying which obligations can be discharged and which assets can be protected. This personalized approach can make the difference between a failed bankruptcy filing and a successful fresh start.

Furthermore, an expert can assist in evaluating alternatives to bankruptcy, such as financial counseling nj or forbearance programs, which might better suit your needs depending on your specific circumstances.

The Role of a Bankruptcy Expert in Rebuilding Your Financial Future

Filing for bankruptcy is often viewed as a stain on one’s financial record, but in reality, it can provide a vital opportunity for recovery and growth. What matters most is how you navigate the process and what steps you take afterward to rebuild your financial health. A bankruptcy expert plays a pivotal role here, not only in managing the immediate crisis but also in guiding you toward sustainable financial practices moving forward.

Through personalized financial counseling, experts provide valuable insight into managing your finances post-bankruptcy. These services include strategies to restore your credit score, manage debt, and create a more stable financial future. With proper guidance, you can emerge from bankruptcy not only debt-free but also more financially resilient.

Additionally, bankruptcy experts help you avoid common pitfalls that people face post-bankruptcy, such as falling into the same debt traps. By working with a professional, you gain the tools necessary to maintain control over your finances and make informed decisions that prevent future financial calamities.

Bankruptcy Alternatives: When Other Options May Work Better

While bankruptcy can offer significant relief, it’s not always the ideal solution for every financial crisis. In some cases, other avenues may be more advantageous. A well-informed bankruptcy expert will explore every option before recommending bankruptcy.

For instance, forbearance programs offer temporary relief by allowing borrowers to postpone or reduce mortgage payments during periods of financial hardship. These programs can help you regain financial stability without the long-term implications of bankruptcy. A skilled expert will carefully assess whether you qualify for such programs and if they are appropriate for your specific situation.

Similarly, financial counseling might provide you with the necessary tools to manage your debt more effectively. This option is particularly beneficial for individuals who have fallen behind on bills or are struggling with budgeting, but who still wish to avoid the severe consequences of bankruptcy.

Lastly, legal counseling services may help those facing lawsuits or wage garnishment to negotiate settlements or restructure debt outside of bankruptcy court. With the help of a legal expert, you may be able to protect your assets and negotiate terms with creditors, thus avoiding the need to declare bankruptcy altogether.

The Emotional Impact of Bankruptcy: Why Support Matters

It’s easy to focus solely on the financial and legal aspects of bankruptcy, but the emotional toll it takes on individuals and families is just as significant. Fear, anxiety, and a sense of failure are common emotions experienced by those considering bankruptcy. These feelings can cloud judgment, leading to hasty decisions that could worsen the situation.

A bankruptcy expert consultation provides not only financial guidance but also emotional support throughout the process. They help alleviate the burden by explaining each step clearly and offering reassurance that you are not alone in facing this difficult chapter of your life. This support can be invaluable in helping you regain confidence in your ability to manage your finances and make sound decisions.

Beyond the consultation, access to ongoing financial counseling services can be a lifeline as you rebuild your life post-bankruptcy. The continuous support from experts helps reduce the emotional stress associated with financial recovery, ensuring that you stay on track and avoid falling back into debt.

A Tailored Approach to Debt Relief

One of the key advantages of consulting a bankruptcy expert is their ability to provide a tailored approach to your specific situation. Not all debts are created equal, and not all debt relief options will work for everyone. A bankruptcy expert takes the time to understand your personal financial situation, ensuring that the advice you receive is relevant and actionable.

For example, they can help determine which chapter of bankruptcy is most suitable for your needs. If you have significant unsecured debt, such as credit card balances or medical bills, Chapter 7 might be the best option, as it allows for the discharge of these debts. On the other hand, if you have a steady income but are struggling with secured debt, like a mortgage, Chapter 13 might be a better fit, enabling you to restructure your payments over time.

Moreover, an expert can help you develop a repayment plan that works with your budget, ensuring that you can meet your obligations without jeopardizing your essential needs. This level of personalization can make all the difference in how smoothly the bankruptcy process unfolds.

Conclusion: Seeking Professional Guidance for a Brighter Financial Future

In times of financial distress, it's easy to feel like you're drowning with no way out. But with the right guidance, bankruptcy can become a stepping stone to a brighter financial future, rather than a symbol of failure. A bankruptcy expert consultation can be the lifeline you need to regain control, offering expert insight into your unique situation and providing personalized solutions that fit your needs.

Whether bankruptcy is the right solution for you or if alternatives such as forbearance programs or financial counseling might better suit your situation, the guidance of an experienced professional can make all the difference. By seeking help now, you can face the future with confidence, equipped with the knowledge and tools to manage your finances effectively and avoid further financial difficulties down the road.

Don't wait until it's too late. Reaching out to a bankruptcy expert may be the critical first step toward reclaiming your financial freedom.

0 notes

Text

Start Your Career in Healthcare: Discover the very best CNA Training Course Online Today!

**Title: Start Your Career in Healthcare: Discover the Best CNA Training Course Online Today!**

**Introduction:** Are you considering a career in healthcare as a Certified Nursing Assistant (CNA)? If so, you’ve made a great choice! CNAs play a vital role in providing direct patient care and support to individuals in various healthcare settings. To begin your journey in this rewarding field, it’s essential to find the best CNA training course online that fits your needs and prepares you for success. In this article, we will explore the benefits of pursuing a career as a CNA, how to choose the best online training course, and practical tips for success in the program.

**Benefits of Becoming a CNA:** – High demand: With the aging population and increased need for healthcare services, CNAs are in high demand across the country. – Quick entry into the field: CNA training programs are typically short in duration, allowing you to start your career in healthcare sooner. - Rewarding work: CNAs have the opportunity to make a meaningful impact on patients’ lives by providing hands-on care and support. – Career advancement: Becoming a CNA can serve as a stepping stone to furthering your education and pursuing advanced healthcare roles.

**Choosing the Best Online CNA Training Course:** When selecting an online CNA training course, consider the following factors: 1. Accreditation: Ensure that the program is accredited by the appropriate governing body to guarantee a quality education. 2. Curriculum: Look for a comprehensive curriculum that covers essential topics such as patient care, infection control, and medical terminology. 3. Clinical experience: Find a program that offers hands-on clinical experience to apply your skills in a real-world healthcare setting. 4. Support services: Consider programs that provide support services such as tutoring, career counseling, and job placement assistance. 5. Cost: Compare tuition costs and financial aid options to find a program that fits your budget.

**Practical Tips for Success in CNA Training:** – Stay organized: Develop a study schedule and keep track of assignments and deadlines to stay on track. – Practice self-care: Take care of your physical and mental well-being to maintain focus and energy throughout the program. – Seek support: Reach out to instructors, classmates, and support services for help when�� needed. – Stay motivated: Remember your goals and the reasons why you chose to pursue a career as a CNA to stay motivated during challenging times.

**Case Study:** Emily, a recent high school graduate, decided to pursue a career as a CNA to gain hands-on healthcare experience before attending nursing school. She researched online CNA training courses and chose a program that offered comprehensive curriculum, clinical experience, and support services. Through hard work and dedication, Emily successfully completed the program and secured a job at a local nursing home. She credits the online training course for preparing her for a successful career in healthcare.

**Conclusion:** Starting your career in healthcare as a Certified Nursing Assistant is a rewarding and fulfilling path that offers numerous opportunities for growth and impact. By choosing the best online CNA training course, you can receive the education and skills needed to succeed in this field. Remember to consider accreditation, curriculum, clinical experience, support services, and cost when selecting a program. With dedication, hard work, and support, you can achieve your goals and make a difference in the lives of others as a CNA. Start your journey today and embark on a fulfilling career in healthcare!

youtube

https://cnatrainingprogram.net/start-your-career-in-healthcare-discover-the-very-best-cna-training-course-online-today/

0 notes