#bc my schooling was more about learning about the overall processes and how systems work.

Explore tagged Tumblr posts

Text

Wild to me that people choose to be in whatever field ever and here I am accidentally an IT person. Like some people went to school to be dentists. And what do I do? Look at computers, I guess. It doesn't feel like much of a specialty.

#speculation nation#i KNOW it is but it just feels so normal to me.#and it's not like im an expert in computers or anything.#but as an IT student i dont have to be just Yet.#bc my schooling was more about learning about the overall processes and how systems work.#with Some computer education. more in depth than an average person's knowledge at least.#once i start at a company then they'll teach me more about their specific system. and i'll become a specialist in That.#my degree isnt to learn all about coding. leave that for the computer scientists.#my degree is to understand how technology functions in a business environment. and how to make things as efficient as possible.#i Am looking forward to when i can just say i work in IT tho. it's a very mundane sounding job. i like that.

2 notes

·

View notes

Text

so i’d really like to finish my guardian takedown lore analysis, but honestly the game isn’t really fun to play at the moment anymore (even with the health debuffs they added) so I think im going to be taking a break for now because I’m just not having fun anymore.

this game has a lotta mechanical problems i think need to be addressed so im gonna summarize it as bullet points below. I’ll play the new dlc when it drops, but idk if i’ll be on more than that (grinding, end-game stuff) until they make some serious changes. I’ve been playing (near) daily since launch, followed the patch/hotfix notes every single week, and my patience has finally, FINALLY run dry, especially with that really disappointing Phase 1 Patch and then the hotfix this week not adding anything else. What is the balancing team doing??? 😩

tl;dr: FIX THE VAULT HUNTERS!!!!

anyway. That’s all I needed to get outta my system. I might log on to this blog every now and again to post some random shit that pops into my head (probably with regards to my AU), but I’m not going to be actively playing and posting for the time being. Goodbye (for now), and here’s hoping the new DLC is good!!

guardian takedown only problems:

there’s a lot of waiting around, and sometimes it’s not explicitly stated that you’re waiting for something, so you’ll be lost on what to do next (not sure if that’s a dialogue glitch or not)

the crystal charge insta-death is bull. just. what the hell. at least make it so you just have to start over. killing ur players for failing a “puzzle” that they then have to fight all the way back to is so infuriating.

dying because you fell off a platforming puzzle is also bull.

i remember playing the first DMC on my playstation in middle school and having a conniption over the part in the observatory(? it’s been a hot minute since I played DMC 1) with the disappearing/invisible platforms. I h a t e jumping puzzles. why are they in a section of the game where death is semi-permanent and a detriment to your teammates. i tried the takedown 2x with friends and both times one friend didn’t make the first big jump to the temple and had to wait for our inevitable deaths. that’s so unfair to them.

there’s absolutely no reason for a boss to have 12 fuckin immunity phases. 4 per health bar with 3 health bars? Who the fuck designed this? *pumps shotgun* i just wanna talk.

i appreciate a tasteful immunity phase every now and again (the ones in the Valkyrie fight are actually p reasonable), but christ. that is overkill. I don’t mind the main boss fight, since u can end those early through certain actions, but jesus. the mid-boss fight is annoying as hell. you spend more time running from the immunity phases and finding the damn boss than u do actually shooting it.

drop rates are crap, which I guess should be expected given what happened with the Maliwan Takedown and the handful of months it took for them to fix that, but also you think they’d have learned.

in the maliwan takedown there’s a sense of progression thru the facility after you kill each area’s batch of enemies, but in this one it’s... dampened by the crystal charging sequences. you kill all the enemies in an area, press a button, and now you have to kill 3x that number of enemies in the same area, expect you’re just standing there motionless. It’s not fun.

the crystal charging stuff is just not fun in general. standing in a square is not entertaining. it’s worse that it was clearly designed for 3+ players when a majority of people play/grind solo

i gotta admit the boss fights just aren’t as fun as the Maliwan Takedown fights overall. I felt like a real badass fighting Wotan for the first time, but the main boss for this Takedown is kind of a bitch. Wotan’s fight is chaos, there’s so much shit happening at once and you don’t really have time to process everything and I love it. This one is p meh...

This would be fine and I’d 100% not care that much if there weren’t all these OTHER problems

General Issues with the Game

There’s no endgame stuff to play outside of the takedowns.

I assume they’re working on the first raid given some stuff I found in the Guardian Takedown files, but I really wish they’d keep the seasonal events/areas. They give us the option to disable/enable them while they’re ‘active’, just give us the ability to do it whenever we want.

when i hop on i either run through Athenas (my favorite map), or farm a boss or two. I have all the loot i really need from the maliwan takedown/elsewhere, and the guardian takedown just... isn’t fun atm, so i have nothing to do.

I’ve reset my playthru multiple times to play the main story at m10, but u can only play it (and the dlc) so many times

Mayhem levels and modifiers are a hot m e s s

a majority of the modifiers just aren’t fun to play with

they incorporated like 2-3 fun modifiers (from the community), then added a bunch that straight-up aren’t. I’m fine with the game being more difficult, but at least give us modifiers that make it more entertaining to play at a higher level instead of more annoying. I like the ones that have trade-offs or add new ‘enemies’, but I hate the ones that just straight up reduce your damage output.

a majority of the weapons with the mayhem 10 anointment (scaling) do not work on mayhem 10 (we’ll go more in-depth with this later)

Player Characters (Vault Hunters!!!) are also a hot mess and a lot of problems plaguing them haven’t been fixed SINCE LAUNCH

theyre literally the basis of the game and its balance. why havent you guys fixed them yet. stop adding new content until they’re fixed. no new skill trees until the base 3 trees work ON EVERY CHARACTER.

seriously. Why is amara p much limited to using Phasegrasp. Why does Iron Bear not matter to Moze except to proc anointments. MAKE ALL ACTION SKILLS EQUAL AND HAVE HEFT.

i wrote an essay here about it bc i feel that strongly about this

SERIOUSLY FIXING UR VAULT HUNTERS WILL MAKE BALANCING SO MUCH EASIER PLEASE IM BEGGING YOU THEY ARE THE BASE OF UR BALANCING WOES

ZANE IS STILL UNUSABLE WITHOUT THE SEEIN’ DEAD CLASS MOD!!!!!!!!!!!

MOZE IS SCREWED BC HER DAMAGE IS TOO RELIANT ON ASE ANOINTMENTS!!

AMARA DOESN’T HAVE A FUCKING MELEE BUILD AS THE ADVERTISED MELEE CHARACTER???

FL4K’S HEADCOUNT SKILL IS S T I L L BROKEN EVER SINCE THE RELEASE OF THE MALIWAN TAKEDOWN

ARE YOU GUYS LISTENING TO THE COMMUNITY *PLEASEEEEEEE*

BUFF AND FIX THE GODDAMN VAULT HUNTERS

Anointments were a mistake. Damage end-game is wayyyy too reliant on them

anoints should have a maximum of, like, a 20% damage bonus. the damage necessary to kill enemies *should be coming from the VHs themselves*. i don’t care if you have to revamp every single Vault Hunter’s skill trees and buff them all by 9000%. THEY DESERVE IT AT THIS POINT

at the moment in m10 there really isn’t much build diversity *even between Vault Hunters*. We’re all using the same 5 guns (OPQ System. Kaoson. idk. fuckin brainstormer? is that still a thing? jesus fuck) with the same 3 anointments (100% on ASE, cryo while SNTL, and 300% while 90%).

you want to diversify builds like you said during the gameplay reveal???? you want our choice in Vault Hunter to actually fuckin matter???? FIX THEM!!!! THEY SHOULD BE ABLE TO DEAL DAMAGE WITHOUT STUPID POWERFUL LEGENDARIES AND ANOINTMENTS!!!

Anoints also shouldn’t be common. At all. They should be, like, Pearl rarity. To let that happen, their damage needs to be tuned way the fuck down (again, 20ish % bonus MAX) and ALL ANOINTS NEED TO BE USEFUL IN SOME WAY

NOBODY IS GOING TO USE THE AIRBORNE OR SLIDING ANOINTMENTS JUST REMOVE THEM ALREADY AAAAAAAAAAAAAAAAAAAAAAAAA

obviously these changes can’t happen because they fucked up and buckled down with everything being anointed in m10, but still

imagine a world where the VHs actually did damage on their own without anointments and the damage buff from them was just an incentive to grind for the 100% perfect weapon and NOT A REQUIREMENT TO DEAL DAMAGE

>:(

A majority of gear is borderline worthless at M10

I’m fine with the difficulty of M10, i should let it be known. The enemy health isn’t really the problem IF ALL GUNS ACTED THE SAME AS THE OPQ SYSTEM

ffs.

you know, if you fixed ur vault hunters so they all did damage with just purple weapons (abt the same damage as legendaries w/o special effects) and removed the anointment requirement from late-game play, balancing your guns would be sooo much easier. you know. just saying.

right now only 10% (im being generous) of guns in the game are viable. 90% are worthless. We need AT LEAST 60-70% viable at M10. WHERE IS MY BUILD DIVERSITY. WHY ARE ALL LEGENDARIES NOW JUST “HEY THIS GUN IS STRONGER THAN THE LAST 4 WE RELEASED. HAVE FUN”

how to fix this problem? do as above: BUFF YOUR PLAYER CHARACTERS. MAKE ANOINTMENTS LESS STRONG.

then, at least the 10% already strong weapons would be stupid strong and OP as fuck, BUT AT LEAST WE COULD HAVE BUILD VARIETY!!! I don’t care if other people are dummy strong one-shotting everything in sight. I don’t! so long as they don’t play with me, I couldn’t care less!!! I want to be able to play with the unique, interesting legendaries. instead of the OPQ System. which, by the way, I dislike compared to the normal Q-System. let me use the frozen heart shield and the infiltrator mod. I don’t wanna be chained to the Seein’ Dead anymore :(

honestly at this point im starting to think removing slag was a mistake bc then at least we could use guns that aren’t solely damage-based guns. you know how fucked up you’ve got me that im thinking maybe slag wouldn’t be so bad this time around??? YOU GOT ME FUCKED UP B A D.

FIX THE GAME

IM TAKING A BREAK

MAYBE I’LL BE LESS UPSET WHEN I COME BACK FOR THE DLC BUT HOT. DIGGITY. SHIT.

#borderlands#bl3#whelp#i needed to get that out#still frustrated...#just... fix the game#please#its so disheartening to see this STILL going on#like i know bl2 had the same problems#with the balancing#remember when they nerfed zer0 and buffed salvador?#but like christ at least they were messing with the vault hunters#now they're trying to brush their problems under the rug and it's really sad to watch#you would think they'd have learned from bl2

28 notes

·

View notes

Text

big day in spike neurology world

so basically 3 weeks ago i started a new job sort of - i remained within the neurology department at the same hospital, but switched from the epilepsy center to the multiple sclerosis center. which fine, i love neurology, so whatever, go for it, right? when i accepted the job, it was pitched to me as being a majority (32hrs/wk) clinical (aka seeing patients) with 8 hrs/wk of “asynchronous” work and/or management duties

and i am rapidly learning that my friends, 8 hours/week is not going to be enough

my bosses are both absolute workaholic machines with high expectations which is fine, i can deal with that but i’m on week 3 and they’re having me evaluate systems processes and trying to address/resolve inefficiencies and form standard protocols and there are certain staff members that are extremely inefficient but also extremely insecure and anxious about it and somehow i’m going to have to address this without freaking them out and making them want to quit bc they actually are in spite of a few inefficient processes extremely valuable and a good worker

meanwhile, i am only passingly familiar with all the drugs for MS, so I’m cramming on the daily trying to learn about how they all work and the mechanisms and remembering what the monitoring criteria are for all of them, etc. (which btw, “Spike, you can organize some folders so that there are already pre-written order sets for each drug both pre- and post-initiation”)

PLUS MS is a lot of auto-immune management too, so I’m trying to learn more about that beyond the basics I got in school!!

AND ALSO today the big boss was like “hey you’re learning how to do lumbar puncture/spinal tap today” and just SCHEDULED ME TO DO 3 OF THEM EVEN THOUGH I HAVE ONLY EVER ASSISTED WITH THAT PROCEDURE

i mean i did have a doctor there to talk me through it and help out as needed and i HAVE assisted with like 1000 of them but still

so overall today was a bit overwhelming and i am glad i have tomorrow morning to do some quiet study and recover. also i am thankful for the poke bowl place down the street that gave me extra salmon because i guess i looked a little harassed

and God bless the patient i did my very first lumbar puncture on, who knew it was my first and was kind and made jokes the entire time and kept me so relaxed that i did the procedure no problem. that gave me enough confidence to do the second one on a very nervous patient (understandable) without any issue either. the third unfortunately we had to abort because of some anatomical issues with the patient but man. Bless that first patient forever. <3

8 notes

·

View notes

Note

What are some things about Judaism and Christianity that you learned that surprised you? What about polytheistic religions like native american animism, Buddhism, Shinto and Jainism? Zoroastrians? Baha’i? Yazidi?

Anon this is… such an in-depth question! Idek where to begin here. Of all those religions, I have learned the most about Judaism since I stopped being religious. What I knew about Judaism prior to maybe 5 years ago was mostly just what Islam says about Judaism. Meaning, you know, from Adam to Moses, then it skips ahead to David/Solomon/Saul, then there are some brief mentions of Jonah and Ezekiel and that’s really it.

So I didn’t know a lot, and I wasn’t very interested in what I did know tbh. The only reason why I started reading the Bible is bc I wanted to compare it to the Quranic versions of the stories and see how much Mohammed fucked them up. And that was fun but I didn’t bother to look much further into Judaism past that. The Books of Kings and Chronicles, for example, I took one look at them, decided they were boring, and didn’t read them until only a couple of years ago. That’s when I first got into the whole Biblical history thing. I tried reading a book about how the Bible was put together and realized I didn’t know enough about the Bible itself to even begin.

I forced myself to read those four books and then some of the prophet books (side note: all of the female prophets were left out of Islam, I didn’t even know they existed. Damn it Mohammed!!!). And I’m glad I did, because it changed my whole view of the Jewish Bible. It’s a history book!! Like… that’s literally what it’s supposed to be, a (legendary) history of Israel/Judah, and every bad thing that happens to them is ascribed to YHWH getting pissed off at them, but then like my friend and her trash boyfriend he always forgives them and takes them back even tho they just go on to disappoint him again. The Bible is the world’s oldest and greatest self-drag!!!

Once I actually knew the general chronology of the Biblical kings and shit I could actually make my way through this book without getting confused (mostly). Highly recommend this one for beginners btw, there is a PDF online and it’s not overly long.

And damn… I know there’s some debate about certain elements of it like the exact nature of the “documentary hypothesis” but even just focusing on the stuff that people agree upon, I didn’t know any of it before reading this, beyond there being no evidence for the Exodus/the huge kingdom of Solomon etc. I also knew that early Judaism was a system where multiple gods existed but YHWH was just their patron god, but I didn’t fully understand the process in how he got conflated with El and became the god.

More relevant to this topic, though, I didn’t understand the history behind the Bible itself. Deuteronomy being written separately/earlier than the rest and the Bible claiming that it was “found” in the Temple after like 900 years in Josiah’s time… like I had never even heard of Josiah prior to a few years ago and here I am realizing that this bitch perpetrated fraud that would make Linda Taylor proud. Tf. AND, the whole thing with Judah being way, way less developed than Israel, and Israel was actually a multi-ethnic and prosperous society, but then after the Assyrians handed Israel its ass the Judeans were suddenly the top bitch in school and wrote the whole Bible to make their former northern neighbors out to be assholes?? Wow Team Israel tbh.

Then when you get to the time of the Babylonian Exile tho you have to feel a bit bad for the people of Jerusalem, like the Babylonians were uncommonly dickish even for their time and the ppl of the city were clearly traumatized tbh… a lot of the stories in the Bible, especially those believed to have been added only after the exile, make a hell of a lot more sense when you realize the huge changes occurring in Jewish society at the time. The transition from “there are lots of gods but YHWH is our god” to “YHWH is the god” is completely understandable when you realize that people were searching for some explanation as to why they had all been uprooted and thrown out of their homes, and the obvious explanation is that, yet again, they had pissed YHWH the fuck off by worshiping other gods.

I feel like both Christianity and Islam (but especially Islam) try to separate many of Judaism’s better-known stories from the context of ancient Israel/Judah itself, presenting them as more universal stories that apply to everyone, but tbh the whole over-arching story doesn’t work unless you look at it as a history written by and for Jews who were rebuilding their religion and society in a volatile period. I’m reading this rn and it’s relevant to that topic.

It’s truly a damn shame that pretty much like 0% of Muslims have been exposed to any of this tbh? I feel like almost all scholars of Biblical history come from non-Muslim countries. I have more feelings on this subject but let me answer the rest of your question. First of all, Christianity. I read the New Testament in full a couple of years ago as well. It was obviously way easier to read because the Gospels are all different versions of the same story and the rest is just supplementary material, basically. I think the text itself is pleasant and Jesus was a chill dude. I like him. And the whole… sequence of events made much more sense after I’d read the Book of Isaiah and realized that the authors of the Gospels were viewing Jesus in light of those prophecies. Revelation is a fascinating shrooms trip. The Acts of the Apostles were fun to read, but all the letters were just like w/e. More historically interesting (if they’re real) than interesting in terms of content. Though I do think some of the content in them is very nice, idk if people know this but Muslims think Paul was responsible for perverting the (non-existent) “real” Gospel of Jesus and paint him very poorly. But I dunno, the letters seemed fine to me.

Tbh I was surprised to see how different Islam’s version of Christianity/Christian stories is compared to the “real thing”. I don’t even mean his disastrous misconceptions of Christian theology but just like… with the stories Mohammed pulled from the Jewish Bible (and the Talmud–which I also enjoyed flipping through btw, it’s like a bunch of old guys yelling at each other in written form), he gets details wrong but the overall stories are basically the same. But with the Christian stories, barely anything in the Quran is from the Bible. I think I’ve said this before but like 90% of the stuff pulled from Christianity in Islam is about baby Jesus, not adult Jesus, and even that stuff isn’t from the Bible. It’s understandable when you realize that he was listening to these stories, not reading them, and just picked the ones he liked best… which happened to be later texts. That brings me to a subject that is near and dear to my heart:

Apocryphal texts bih. I love this shit, with full sincerity and zero irony. The weirder it gets, the better. I started out just reading the ones that made it into the Quran, like the Life of Adam and Eve, the Infancy Gospels that I’ve mentioned before, and the Testament of Solomon. Then some Gnostic stuff, which I only read because it has the same substitute-crucifixion thing going on as Islam, but WHEW chile the DRUGS these ppl were on while writing this shit…! The Sethians and the Nag Hammadi library produced such treasures of crazy-ass literature. It makes me sad how so much of this stuff is just totally forgotten now that Christianity is mostly just Catholic/Protestant+Orthodox. There were so many sects and people had so many divergent ideas, some more drug-assisted than others probably!! And Middle Eastern Christianity was very diverse even in the 7th century. Some of the stories they produced had such rich lore. My fave right now is this Syriac collection:

I came across this one while looking for the origins of the al-Khidr story in the Quran. There were all sorts of opinions about who he was, bc Mohammed never really gave any details on his life, but Ibn Ishaq recorded an opinion that al-Khidr was the one who buried Adam and Allah granted him long life in return. So I looked for the source of that story and it was the story of Melchizedek in this book. Then I read the whole thing and man this would make for some weird psychedelic series or sth. It’s online, look it over and you’ll see how trippy it is.

Um… anon this is getting rly long tbh so let me sum up my knowledge of Shinto, Native American animism, and Jainism: not much!! Buddhism I have only an intro-level knowledge of, I know the basics but I don’t know more than that. The beliefs of Yazidis I don’t fully understand, but the little I know is pretty cool. From what I understand it’s a blend of pre-Islamic Kurdish religion + early Islamic influence + some other influences thrown in. It’s sad how they’re branded as devil-worshipers or w/e when the story of Melek Taus is actually really interesting and has a good moral and is way, way better than the story of Iblis. I also enjoy Yazidi architecture and that unique ribbed cone top of theirs. I hope they’re able to live on as a community after, uh, recent events.

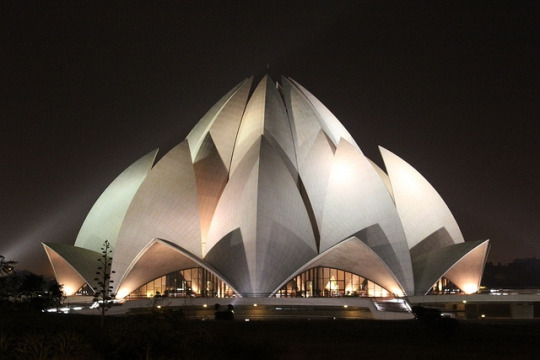

I actually was taught about Bahai people growing up but I was told it was some heretical offshoot of Islam comparable to Ahmadiyya people. I didn’t realize it was considered its own religion until fairly recently tbh. I did read the Kitab al-Aqdas (which is blessedly short, this makes Bahai a great religion automatically!!) once. It’s definitely super inspired by the Quran in terms of style and to me clearly seems to be an attempt to make a Kinder And Also More Iranian Islam. I think it’s pretty neat. In fact I think a lot of attempts to magically make Islam “nicer” would just end up making it more like Bahai tbh. And it has a really fascinating history, with the Bab basically being a new John the Baptist and Bahaullah being the one he foretold. He even accidentally ended up in Israel lmao. I also really love Bahai architecture in terms of how diverse it is, with the only unifying feature being visual interest, and I would love to see the temple in India irl one day. India always has the best architecture anyway.

I saved Zoroastrians for last bc I have to be honest here. I tried to look into it, because it’s ancient and had an influence on Judaism etc and that makes it important. Fam I got about 3% of the way through the Avesta before giving up. I was still in the hymns part and just like… every other word was something I didn’t understand. I will go back and try again one day but for now the answer is “lol idk”.

ANYWAY… yeah… I’ve enjoyed reading about religion way more now that I’m not religious, both in terms of Islam and other religions, I can appreciate the process or w/e now that I’m not constantly trying to make it fit into Islam or panicking every time I spot something that makes me question my faith. I know a lot of atheists either fall away from religion altogether or just look at it like it’s something dumb, but even if it’s fake, that doesn’t make it worthless imo. The history itself is always worth studying.

34 notes

·

View notes

Text

Core course week: Gothenburg, Sweden

After three weeks of settling into a normal routine in Stockholm, we all went off on our first study tour. My core course, Forensic Psychology, took a 3-hour train to Gothenburg, Sweden, but for our long tour week in October we’ll be going to Scotland. The point of core course week and the long study tour is to immerse yourself in the subject material that you’re presumably most interested in. It’s not only a chance to place classroom material into real-world context by going on field studies around Europe but also an opportunity for the class to bond over shared cultural experiences as we all travel together.

In Gothenburg, we stayed at the Spoton Hostel (I shared a room with 5 other girls, i’ve been told i gently snore and i’m sorry ok). Our main mode of transportation was their infamous tram system, which run on cable lines and honestly kinda look like they don’t really value human life? because they literally just pummel down the streets with jerky brake systems (my host dad told me that some people are run over by the trams each year because they weren’t paying attention or they slipped and fell at an unfortunate time.......thankfully I learned this after I got back from Gothenburg).

DIS provided two meals a day - we ate breakfast at the hostel and either ate a group lunch or dinner. Not sure how the administration breaks down parts of our tuition but DIS definitely did not skimp out on our food. I thought we were going to survive off of PB&J’s and Chips Ahoy (bc that’s how school trips like to go, i’m looking at u @vanderbilt asb) but we actually ate at the fanciest places, with at least two courses and sometimes wine/beer. Truly amazing, so thank you DIS from the bottom of my stomach. (I registered as a vegetarian so all meal descriptions will only be relevant to the veggies. Meat eaters got a lot of lamb.)

Long post ahead but lol honestly all my posts are long.

Day 1: Monday, 9/10/2018

Woke up at 5am to catch the 6:40am train. This day was actually my best friend’s birthday and I was lowkey sad I couldn’t be with her (if you know us in real life, then you know we’re annoyingly inseparable), but days like this had me extra thankful for inventions like snapchat and facetime that make it easier to stay connected even when you’re thousands of miles apart. (I actually got to watch her open my present while I was on the train to Gothenburg bc her boyfriend facetime’d me! Hehe ily ivy)

Our first field study of the week was to Halvvägshuset Göteborg (Halfway House), a non-profit organization designed as the last stop in an inmate’s rehabilitation process right before they finish their sentence. They provide resources to help update individuals who’ve been in prison for a long time on the modern ways of living, such as using smartphones or paying your bills online. Individuals who enter the halfway house get their own bedroom, the freedom for family members to visit, and access to telephones and computers, in exchange for holding down a job and earning income. They get the opportunity to settle into a normal routine with (some) freedom and to start feeling like a person again rather than as inmate #23420. The lady who spoke to us was the most genuine, kind-hearted woman, and emphasized that in the end we’re all human beings and sometimes people commit crimes due to their situation rather than due to some inherent evil that we like to use as a convenient explanation for crime (see strain theory). She also said that it’s less costly for society to help reintegrate these individuals (assuming they are willing/able/ready) rather than to further isolate them and prevent them from contributing to society. Overall, I think we all left the halfway house understanding the powers of empathy and rehabilitation a bit more.

Later, we went to the Boule Bar and learned how to play Pétanque. It’s a European sport where you throw boules (balls), aiming at a target jack.

(The target jack is the tiny orange sphere in the right pic. As u can see, most of our aims sucked.)

(Dinner, at the same place @BouleBar, included an incredible round of salad starters; the vegetarian entree was falafels with large couscous. Honestly this was probably my favorite meal out of the ones DIS provided!)

Day 2: Tuesday, 9/11/2018

Tuesday was busy because we had field studies in both the morning and afternoon. We went to CLIP, a research unit for Criminal, Legislative, and Investigative Psychology, and learned about the current research on deception detection, eyewitness memory, and child sexual abuse from PhD candidates at the Göteborg Universitet. Later, we went to the ADA Women’s Shelter, a feminist non-profit organization that provides support to abused women and their children. We weren’t able to see the actual shelter because the location is kept secret from the public, to protect the women inside, but we were able to listen to a presentation from probably the most bad ass woman I’ve ever seen in real life. Think “the girl with the dragon tattoo” with a #nastywoman attitude. Her passion for her work was contagious - I left feeling inspired and very motivated to combat the patriarchal society that we live in.

(Dinner @SpisaMatbar. Vegetarian entree was salad with oyster mushrooms. Dessert was chocolate creme brulee. So good, ugh.)

(Cheers to core course week. School-sponsored wine is the best kinda wine.)

Day 3: Wednesday, 9/12/2018

Our last day in Gothenburg was reserved for fun activities - no more field studies in Gothenburg! We went to Prison Island, which honestly WAS SO FUN i can’t believe no one has capitalized on this recreational business opportunity in the states yet. It’s kinda like an escape room, except there were many rooms and each room had a challenge that you had to solve based on a combination of wit, technical skill, and physical ability. The place was more high tech than it looked, filled with motion detectors and tiny lasers that, for example, make sure you’re not touching the floor when you’re not supposed to. The challenges required lots of teamwork, as perhaps one person needed to be in a certain part of the room shouting out instructions that only they can see to another person who’s in a pitch black tunnel trying to find hidden buttons to press.

My team included Maya, Megan, and Meiling (our teacher) and we ended up being the winning team! Meiling later told our class that because she already played the game in previous semesters, she purposefully tried to be dead weight and not help us for the challenges... but there was a room full of bouncy balls that we all hesitated to dive into exCEPT for her. Meiling dove in headfirst to retrieve clues. So honestly, she was our MVP.

(Maya & Megan with a maze that you have to physically tilt.)

(Maya in the Shark Room. Look at her balancing on that teeny tiny rock!! trying to press a button at the top! Our rock climbing hero!)

Prison Island has been one of my favorite activities done in Sweden so far, and I’ll probably try to visit the location in Stockholm as well. Highly highly recommend!

(Lunch at the cutest French restaurant: Brasserie Lipp. I scratched out the guys’ faces because Europe is serious about their data privacy and i don’t wanna get sued ok)

(It was baked zucchini. @BrasserieLipp)

Day 4: Thursday, 9/13/2018

Back in Stockholm. We went to the Center for Psychiatric Research at the Karolinska Institutet to learn about the role of psychologists in assessing the mental state of offenders. Our afternoon field study got cancelled, so for the rest of the day we debriefed everything we did, ending our week’s schedule a day early. Overall I think our class learned a lot and we all bonded with each other - which were exactly the goals of core course week :)

Day 5: Friday, 9/14/2018

Since our class was the only one to get Friday off (haha suckas), some of us went to Grona Lund, the amusement park in Stockholm. It was the perfect end to core course week! Now, I just have to mentally prepare myself for six hours of sitting in a classroom on Monday again.....

Tack for coming on this journey with me. It’s been fun so far,

Irene

#dis#disstudyabroad#studyabroad#abroad#abroadblog#studyabroadblog#stockholm#sweden#gothenburg#prisonisland#forensicpsychology

1 note

·

View note

Text

2021 MBAs To Watch: Gráinne Dunne. Boston College (Carroll)

“Loyal and pragmatic with a thirst for adventure.”

Hometown: Athy, Ireland

Fun fact about you: I’m on a mission to visit all 63 national parks in the United States. I’ve visited 10 since moving to the US.

Basic studies and degree:

Trinity College Dublin, Bachelor of Science (Pharmacy)

Royal College of Surgeons, Master of Science (Pharmacy)

Where was the last place you worked before enrolling in business school? I worked in Operations at AbbVie, where I led a team of 13 pharmaceutical technicians at a drug manufacturing facility.

Where did you do an internship in summer 2020? PwC, Chicago / Remote.

Where will you work after you graduate? I have accepted an offer from PwC and will return to their Pharma Life Sciences Advisory Group after graduation.

Teamwork and leadership roles in the business school: As part of my community ministry at Boston College, I volunteer as a tutor on the Invest ‘N Kids (INK) program. INK is run by PhD students as a tutoring program designed to help disadvantaged middle school students with their homework.

I also volunteer at the West End House. This is the largest youth development agency in the Allston-Brighton community in Boston, offering impactful programs that ensure local young people are academically successful, develop professional skills, and adopt healthy lifestyles.

As a member of the Graduate Consulting Club, I took part in workshops and mentored a group of first-year MBA students. I’ve also participated in several case competitions. I worked with the admissions team in recruiting prospective students and acted as an ambassador for the program at information events.

I am a member of IntEnt, the Graduate Intrapreneurship & Entrepreneurship Association at Boston College. I participated in the IntEnt Apprenticeship Program, a volunteer opportunity that connects Boston College graduates with local Boston organizations.

I am a recipient of the Denis O’Brien Fellowship. Irish businessman Denis O’Brien created this merit-based scholarship, which offers two Irish students a year a fully funded MBA in BC, where O’Brien himself earned his MBA in 1982.

What school or extracurricular achievement are you most proud of during your studies? I am proud of how my relationship with the church has changed, inspired by the Jesuit tradition of service at Boston College. A strong sense of community was instilled in me. I don’t think I really understood before business school that individuals rarely change needles on big issues, but there is great power in having individuals consistently support their community. This is a change of perspective for which I am very grateful.

What success in your professional career are you most proud of? Working with an innovative biotech company like AbbVie offered excellent opportunities for exciting and meaningful work. As a Technical Operations Pharmacist, I was responsible for the technical transfer of a new oncological drug from pilot to commercial scale. It’s incredible to work on projects that have such a real impact on the lives of patients around the world. I was also the supply chain representative on the rollout team for a new hepatitis C (HCV) treatment at the rollout manufacturing site. Prior to the introduction of this therapy, there was no cure for HCV. Treatment at the time required long-term maintenance and was incredibly debilitating. AbbVie’s HCV treatment cleared the virus from your body within 12 weeks, allowing patients to live full and healthy lives.

Why did you choose this business school? Boston College has a very strong data analytics track – that was very important to me when choosing a program. I really enjoyed mastering data tools like SQL, Tableau, SPSS, Alteryx, and Python and learning how to use these tools for strategic insights. These are skills that will set me apart in the workplace.

Boston College has a deep connection to Ireland and a great sense of community, which makes it a special experience for me and where I feel very at home.

What was your favorite MBA event or tradition at your business school? The Tuck Winter Carnival, an annual intercollegiate event that BC is invited to, was my favorite MBA event – especially since it happened just before last year’s lockdown. I was fortunate enough to take part as a freshman MBA student. It was great not only getting to know MBA students from other schools, but also building stronger connections with my classmates and high school students.

Looking back on your MBA experience, what would you do differently and why? There isn’t much that I would change. I was hoping to go on a volunteer trip. With the lockdown, however, this was not possible. Otherwise, I might have changed a course or two afterwards. However, by dealing with various topics, I was able to understand my personal interests, strengths and weaknesses.

What’s the biggest myth about your school? Boston College is known as a strong financial school. That’s true, but the BC MBA also has a broad curriculum and we are fortunate to have very talented professors everywhere. For example, we have an incredibly strong data analytics track. Professors like Pieter Vanderwerf, George Wyner, Sam Ramsbottom and Jonathan Reuter make their respective fields accessible, practical and entertaining.

What surprised you most about the business school? I was surprised that I liked the more technical and quantitative subjects, although I am probably qualitatively stronger. There is a great sense of satisfaction in tackling a difficult problem and overcoming the challenge.

What did you do during the application process that gave you an advantage at the school you chose? A face-to-face visit to a school and a face-to-face meeting with faculty and students is invaluable, not only to give you an edge during the application process, but also to determine if the school is a good culturally fit for you.

Which MBA classmate do you admire most? Kimberly Hay Strauss is remarkable. She is always up to date in class while doing internships and looking after her son during school time. Despite her humble, low-key style, it is evident that she is incredibly intelligent and hardworking. She is also very generous with her classmates.

How disruptive was switching to an online or hybrid environment after the COVID outbreak?

The pandemic was certainly a shock and the MBA experience was one of many things that were hit by these unprecedented times. Regardless, BC and the professors did a great job adapting to an online environment quickly and providing personal support to the students. I also took the opportunity to get the most out of the online MBA experience by setting up zoom workouts in the morning, using virtual office hours, and making daily check-in calls with my friends. I was incredibly grateful that I had the opportunity to build relationships with my fellow students in the first semester. That was a great support network.

Who most influenced your decision to start a business while studying? Several people inspired and influenced my decision to do business while in college. My father is my role model. He is a serving leader within the local community. He set high standards for my siblings and me and taught us to do our best in everything we did. He instilled in us the confidence that great opportunities are open to us.

My younger sister is a trained pharmacist and also attended business school. She is a health counselor and opened my eyes to the impactful work available to those who can marry a health and business perspective.

James Hughes, a director at AbbVie, taught me a lot about strategic thinking and how to effectively support and engage a team. He is a great mentor who has actively supported my personal development and professional career.

What are the top two items on your professional bucket list? In the short term, I’m excited to come to PwC to work with life science clients to solve their greatest challenges. I am interested in building based on my data analysis skills that I acquired at BC. This is in line with PwC’s goal of training its employees with new data tools. Ideally, I want to help companies design and leverage data systems to achieve operational efficiencies and improve the overall patient experience.

In the long term, I would like to start my own company. Ideally, I want to start a small or medium-sized business that offers job opportunities or drives growth in my community.

What did … do Gráinne such an invaluable addition to the 2021 class?

“Gráinne has the ideal qualities that we expect from a BC MBA student. She is smart, hardworking, and dedicated to giving back to the community. Her exemplary achievements and contributions at BC – in the classroom and her work with Invest N ‘Kids, in her summer internship and at BC MBA admissions events – testify to her consistent pursuit of excellence.

Born and raised in Ireland, Gráinne attended Trinity College, where she earned both a BS and an MS in pharmacy. After graduation, she was hired by AbbVie, the Illinois-based pharmaceutical company, to work on the company’s business development program in Dublin, Ireland. Because of the high quality of her work, she was given the opportunity to work at AbbVie’s Chicago office.

Gráinne applied to the Carroll School, where she received the highly selective Denis O’Brien Scholarship, which is awarded to students expressing an interest in the economy or business development in Ireland. After a successful first year in the program, Gráinne completed the consultant internship program at PwC in Chicago in the summer of 2020 and will return there for a full-time position after graduation. We have been fortunate to have Gráinne as a member of the 2021 class and she is a real pleasure to work with. In addition to all of her successes in the program, Gráinnes’ humility and her commitment to the BC MBA program make us proud to have her as a member of our community. “

Marilyn Eckmann Associate Dean, Graduate Program, Carroll School of Management

source https://collegeeducationnewsllc.com/2021-mbas-to-watch-grainne-dunne-boston-college-carroll/

0 notes

Text

51 Ideas from 2019

Dear Tribe Member,

Trust 2019 treated you well. It certainly was good for Safal Niveshak. The tribe crossed 60,000 members.

Anyways, right before the year ends, I thought I’d share a handful of ideas I’ve learned, re-learned, and wrote about in the past twelve months. Here are 51 of them categorized under the subjects of investing, learning, and life. I hope you find these useful, as much as I did.

I. INVESTING 1. Don’t Be Blind to Alternative Histories Nassim Taleb writes in Fooled by Randomness –

…one cannot judge a performance in any given field (war, politics, medicine, investments) by the results, but by the costs of the alternative (i.e., if history played out in a different way). Such substitute courses of events are called alternative histories. Clearly, the quality of a decision cannot be solely judged based on its outcome, but such a point seems to be voiced only by people who fail (those who succeed attribute their success to the quality of their decision).

We are blind to alternative histories – those silent events that could have happened but didn’t. In the language of behavioural finance this irrationality is known as Survivorship Bias. The outcome which is visible, ‘survived’ and the ones which didn’t survive are hidden. As Taleb writes –

Imagine an eccentric (and bored) tycoon offering you $10 million to play Russian roulette, i.e., to put a revolver containing one bullet in the six available chambers to your head and pull the trigger. Each realization would count as one history, for a total of six possible histories of equal probabilities. Five out of these six histories would lead to enrichment; one would lead to a statistic, that is, an obituary with an embarrassing (but certainly original) cause of death.

The problem is that only one of the histories is observed in reality; and the winner of $10 million would elicit the admiration and praise of some fatuous journalist (the very same ones who unconditionally admire the Forbes 500 billionaires).

Like almost every executive I have encountered during an eighteen-year career on Wall Street (the role of such executives in my view being no more than a judge of results delivered in a random manner), the public observes the external signs of wealth without even having a glimpse at the source. Consider the possibility that the Russian roulette winner would be used as a role model by his family, friends, and neighbors.

In effect, the general belief is that if the outcome is good, the process and decisions made to arrive at that outcome must have been sound. Alas, life doesn’t follow such straight patterns. The randomness and ‘external factors’ play a defining role in life and investing.

2. Give Due Credit to Luck The world of investing, like most things in life, produces success stories and failures. It’s human nature to wish to copy success. However, the ironic truth is this: To accept success at face value without acknowledging the role of luck is a strategy for failure.

But it’s also important to note that luck, like love, is a verb. It requires dedication and effort and the conviction and courage to act. Like the father of value investing, Ben Graham, wrote –

…behind the luck, or the crucial decision, there must usually exist a background of preparation and disciplines capacity.

3. Avoid Ruin You or me are not the market. Earning the long-term returns of the market, of the past or the future, is not in our control. Managing our risks and avoiding ruin, mostly is.

“Rationality is avoidance of systemic ruin,” Nassim Taleb writes.

Trying to avoid the ruin the stock market system enforces upon people who disregard its workings is rational. Believing that you can beat the system at it, by playing the game mindlessly, isn’t.

Peter Bernstein writes in his brilliant book Against the Gods –

Survival is the only road to riches. Let me say that again: Survival is the only road to riches.

4. Obsession with Outcomes is Damaging Most investment experts selling their services always highlight the outcome – so much return in so many months or years – and never the process they used to get this outcome. This is simply because, while the outcome is there for everyone to see (availability bias), investors rarely ask the question whether that outcome was due to the skill of the expert (a proper investment process) or merely luck.

This is not to say that results don’t matter; obviously they are extremely important in measuring success. But if the results have been largely thanks to luck, they may not come in as expected in the future.

What is more, if you focus only on the outcome, you are less likely to achieve it. Instead, if you focus on the process, the outcome will take care of itself.

But then, as published in here –

Despite the problems of using results as a barometer of decision quality, it remains endemic in investment. We use outcomes as a simple indicator and then weave narratives around these views. We take a difficult problem, simplify it (are results good or bad?) and then create a story to justify the outcome. This pattern of behaviour is evident in a range of poor investment decisions, such as: susceptibility to financial frauds, participation in investment bubbles, performance chasing and excessive short-term trading.

5. Seek Wealth, Not Money or Status Here’s an excerpt from an insightful discussion that Naval Ravikant had with Babak Nivi –

Nivi: What’s the difference between wealth, money, and status?

Naval: Wealth is the thing that you really want. Wealth is assets that earn while you sleep. Wealth is the factory, the robots that’s cranking out things. Wealth is the computer program that’s running at night, that’s serving other customer. Wealth is… even money in the bank that is being reinvested into other assets, and into other businesses. Even a house can be a form of wealth because you can rent it out, although that’s probably a lower use of productivity of land than actually doing some commercial enterprise. So, my definition of wealth is much more businesses and assets that can earn while you sleep. But really the reason you want wealth is because it buys you your freedom.

So, you don’t have to wear a tie like a collar around your neck. So, you don’t have to wake up at 7:00 AM, and rush to work, and sit in commute traffic. So, you don’t have to waste away your entire life grinding all the productive hours away into a soulless job that doesn’t fulfill you.

6. Warren Buffett’s Checklist I recently came across a video of Warren Buffett talking to a few B-School students on his trip to India in 2011.

The host asked him this question – What exactly goes through your mind when you’re actually making an investment?

Buffett’s reply to this question was brilliant for it contained the crux of everything he has said over the years about how to evaluate a certain business and it’s future economic potential (text in bold and brackets are mine) –

Well, if I drive by a McDonald’s stand or a Kentucky Fried Chicken stand I will automatically think to myself “What is this business worth?”

You know, how many customers can walk in the door (demand, scalability, growth potential)? What kind of gross margins (profitability, pricing power) can they have? How many people do they need (scalability)? How likely is it that another chicken stand opens across the street (competition, entry barriers, moat)?

I mean, all of those things. And that’s true of the chicken stand and it’s true of Google or you name the business. I mean, it’s all about evaluating the economic potential, the economic future of a given business. And most of them you don’t know the answer on (say no to most businesses, because you really don’t understand them).

But every now and then you run into one where you know the answer (simple businesses). But that’s all business is.

It’s what Aesop said a long time ago: “A bird in the hand is worth two in the bush.” (well, that’s the definition of discounted cash flow) You know, that was said in 600 BC and that’s now what’s called discounted cash flow and all that sort of thing. But he saw that and figured it out, you know, twenty-six hundred years ago. And all I’m trying to figure out is if I could take that dollar in my hand: When do I get the two dollars out of the bush (timing of future cash flows)? How sure am I of getting it out of the bush (certainty of future cash flows)? Is there some other bush where I can get three dollars out of it instead (opportunity costs, better alternatives)?

I mean, it’s very basic stuff (investing is simple, you see, but only if you keep it simple). And a lot of times you look at it and you say “I don’t know how many birds there will be in the bush.” (complex businesses, or those that undergo a lot of changes due to nature of industry, competition, etc.) So you go in to the next one until you find the answer (you just need a few good ideas in a lifetime).

Buffett, once more, makes it clear that rather than obsessing with the bewildering fusion of news and noise, you should concentrate on a few key elements in stock selection.

7. Know Thyself Taleb again from Fooled by Randomness –

It certainly takes bravery to remain skeptical; it takes inordinate courage to introspect, to confront oneself, to accept one’s limitations – scientists are seeing more and more evidence that we are specifically designed by mother nature to fool ourselves.

One of the most underrated but among the most valuable skills required to succeed in stock market investing is resilience i.e., the ability to properly adapt to stress and adversity – either in the market or in the businesses one is owning.

How easily can you bounce back from a market crash? What would be your reaction to a sharp decline in your stocks’ prices? How many ‘surprises’ can you withstand in quick succession? How safe are your overall finances in light of extreme stress on the equity component of your portfolio?

As Taleb says, we are anyways designed by mother nature to fool ourselves. But don’t forget what the noted financial writer George J.W. Goodman – who used the pen name of Adam Smith – wrote in his wonderful book, The Money Game –

If you don’t know who you are, this is an expensive place to find out.

8. Keep It Simple, Please In stock investing, often we focus so much on trying too hard that either we never start working on the process of picking up great businesses (seeing the enormity of the task), or we start believing that our immense hard work and knowledge gives us great control over the future of stocks we own.

The reality is that, no matter how hard we try to analyze the intricacies of business, we may not be as important to the results as we’d like to think we are.

Like Seth Klarman wrote in Margin of Safety –

Investors frequently benefit from making investment decisions with less than perfect knowledge and are well rewarded for bearing the risk of uncertainty.

The time other investors spend delving into the last unanswered detail may cost them the chance to buy in at prices so low that they offer a margin of safety despite the incomplete information.

9. Investing’s False Positives The field of medicine has a term called “false positive.” It is an erroneous result that indicates that a given condition is present when it is not. An example of a false positive would be if a medical test designed to detect cancer returns a positive result (that the person has cancer) when, in reality, the person does not have cancer.

While medicine’s false positives often create panic about things that turn out to be nothing to worry about, investing’s false positives create euphoria about things that should have been worrisome in the first place.

And the underlying reason is that most people out there in the stock market judge the quality of their investment decisions by one single factor – the short-term price movement of the underlying security. And that’s exactly what they are looking forward to while making the investment, even while talking about the virtues of long-term investing and the need to ignore short-term price movements.

Noted French writer and philosopher Voltaire said –

It is dangerous to be right in matters where established men are wrong.

10. Doing Nothing is Hard The idea of buying and holding high-quality businesses over a long period of time is simple. Everyone knows that, and even those who don’t practice it appreciate that this works with most high-quality businesses as history has proven time and again.

But then, it’s important to understand that the action of not doing anything over such a long period of time involves hundreds of decisions over months and years that lead to such inaction.

Of course, one way is to buy stocks and forget for 20 years and hope to end up with a fortune. There are quite a few such fairy tales you may have heard of. But the other side of the picture is that countless people have also ended with duds in their portfolios, or vanished companies, when they realized their father or grandfather had bought some stocks and forgot about them for 20 or more years.

11. Being Prepared In one of his lectures published in Poor Charlie’s Almanack, Charlie Munger said this –

Our experience tends to confirm a long-held notion that being prepared, on a few occasions in a lifetime, to act promptly in scale, in doing some simple and logical thing, will often dramatically improve the financial results of the lifetime.

A few major opportunities, clearly recognizable as such, will usually come to one who continuously searches and waits, with a curious mind, loving diagnosis involving multiple variables.

And then all that is required is a willingness to bet heavily when the odds are extremely favourable, using resources available as a result of prudence and patience in the past.

What Charlie says here is that it pays to be prepared in your investing life – prepared not just for the risks that may be lurking around the corner, but also for opportunities that may appear anytime.

Ironically, we are often prepared for none, and that is what causes us grief during the market’s ups (when we keep sitting on the sidelines) and downs (when we are enjoying the madness of the party).

Roman Stoic philosopher Seneca wrote in Letters from a Stoic –

Everyone faces up more bravely to a thing for which he has long prepared himself, sufferings, even, being withstood if they have been trained for in advance. Those who are unprepared, on the other hand, are panic-stricken by the most insignificant happenings.

12. Seek Uncertainty Mohnish Pabrai wrote in his brilliant book The Dhandho Investor –

Wall Street sometimes gets confused between risk and uncertainty, and you can profit handsomely from that confusion. The Street just hates uncertainty, and it demonstrates that hate by collapsing the quoted stock price of the underlying business. Here are a few scenarios that are likely to lead to a depressed stock price:

High risk, low uncertainty High risk, high uncertainty Low risk, high uncertainty

The fourth logical combination, low risk and low uncertainty, is loved by Wall Street, and stock prices of these securities sport some of the highest trading multiples. Avoid investing in these businesses. Of the three, the only one of interest to us connoisseurs of the fine art of Dhandho is the low-risk, high-uncertainty combination, which gives us our most sought after coin-toss odds. Heads, I win; tails, I don’t lose much!

While value investors are typically averse to taking high risks, that’s more a reflection of the price they’re willing to pay for any given investment than the types of situations they most often pursue, which are often fraught with uncertainty.

As businesses constantly evolve and change in response to challenges and opportunities, the lack of clarity around those changes. And the risks inherent in the potential outcomes can cause share prices to diverge widely from underlying business values.

The ability to recognize and capitalize upon that dynamic, and understand whether it’s temporary or permanent, is a key element of what sets the best investors apart.

13. Why Most People Will Never Be Good at Investing …because most people in the stock market, most of the time, don’t do investing, which is…

Thinking how markets work,

Understanding how people behave,

Studying businesses,

Sticking only with what is simple and what they understand, and

Buying stocks at appropriate valuations.

Instead, they are busy…

Envying (others making money fast or losing money slow),

Cloning (others’ stock ideas mindlessly),

Predicting (future of markets, stock prices, and economy),

Fearing (missing out on future gains),

Regretting (past mistakes),

Avoiding (accepting current mistakes),

Denying (reality, especially when it’s harsh), and

Indulging (in useless information and noise)

And if that’s not all, these often lead us to –

Trading (frequently, which adds to our costs),

Averaging down (on bad businesses),

Boasting (about our lucky short-term gains), and sometimes

Trolling (other investors on social media, who have not performed as well as us in the recent past).

With such a busy schedule, where is the time to practice investing?

14. Pay Attention In the story The Adventure of Silver Blaze, Sherlock Holmes asked Inspector Gregory to consider a curious incident involving a dog. Gregory replied that nothing happened, and Holmes proclaimed, “That was the curious incident.” This clue enabled Holmes to deduce that the culprit must have been someone familiar to the victim’s dog. Most people would miss this important clue because most people, like Gregory, pay little attention to nonevents.

Now, some information is always available, but some is always silent – and it will remain silent unless we actively stir it up. In investing, such information that remains silent – or that you fail to notice – can be dangerous to your capital.

To pay attention means to pay attention to it all, to engage actively, to take everything around us, including those things that don’t appear when they rightly should. It means asking important questions and making sure we get answers.

Even when you do this, you may not be able to emerge with the entire situation in hand, and you may end up making a choice that, upon further reflection, is not the right one after all. But it won’t be for the lack of trying.

15. Be a Curator of Stocks, Not Warehouse Manager We spend the first half of our lives adding things, and the second half subtracting most of them.

Investing follows life, and this is also what a lot of investors end up doing. They create crowded warehouses of portfolios in the initial years of their investment careers, realize most of their choices were mistakes, and then they start subtracting vigorously.

Lest you lose out on the positive compounding timeframe, you will do yourself a world of good by respecting and practicing this lesson – of saying no to most things, of not adding a lot of unwanted stocks to your portfolios – early.

In other words, be a curator of stocks, not a warehouse manager.

16. Bharat Shah on Investing Successfully One of the best theories I have read on the importance of investing in high-quality businesses in the Indian context comes from Bharat Shah of ASK Group, who has written a book (sad, it’s not available publicly) titled “Of Long Term Value and Wealth Creation from Equity Investing.”

I recently came across his old interview where he shared his insights on value investing and how he formed his investment process and principles. A passage from the interview reads thus (emphasis mine) –

…successful long-term investing calls for two vital technical capabilities or craft and two personality traits. While craft can be honed and refined by observing and absorbing, character traits have to come from within and be developed.

The two essential skills are: ability to comprehend and grasp the true character and the innards of diverse businesses as well as the ability to value them. Till these abilities are developed, one cannot become a good investor.

The two vital character traits are: discipline (or temperament) and wisdom. Discipline lies in investing only into quality businesses and the temperament of not getting carried away by the fads of the markets and buying such quality businesses only at a meaningful margin of safety.

17. Biggest Financial Regrets One of my favourite financial writers, Barry Ritholtz, wrote about the biggest financial regrets people have. This was based on a survey of over 2000 people by American life insurer giant New York Life, and found these as the biggest financial regrets –

Image Source: Biggest Financial Regrets – Barry Ritholtz Barry concluded thus, and I completely agree with this –

The sooner you begin to accept mistakes are inevitable, stop beating yourself up over them, and just fix what is not working, the faster the compounding can start.

18. No Stock is Safe The bulls may want you to believe this, but no stock is safe.

There are businesses that may remain good (earning return on capital greater than cost of capital) for some time, maybe a long time, but you must not attach infinite values to them.

This is because high returns attract competition, generally causing return on capital to move towards the cost of capital. While such companies may still earn excess returns, but the return trajectory is down.

Everything in this world, after all, is momentary. So, your best bet is to just stick with quality (even that is momentary, just for longer moments that allows time for compounding to work its magic).

The good thing about high-quality stocks is that you can pay up for them (never overpay), expensive looking prices, and still do well till the underlying businesses remain good.

With poor quality, most probably, you have no hope.

19. Businesses will Die Death will happen to all of us and to all of our businesses, and that must not worry you. It’s the stagnation and gradual decline that diseases (bad management, capital misallocation, etc.) bring along, that you must watch out for (and try working backward now so as to avoid them, except for bad luck).

20. Equanimity and Investing When it comes to investing, making money in stocks when everyone is making money in stocks isn’t a big deal. Rather, it’s the ability to handle good and bad times with equanimity, combined with courage and decisiveness, that really matters in the long run.

Of course, most of us simply aren’t wired to be equanimous at most of the times, and it’s terribly difficult to rid ourself of the emotions of ecstasy (when things are looking up) and misery (when things are looking down).

And that’s why ensuring that we avoid all of those ways that can cause us wealth destruction – trading, timing, high fee, inadequate diversification, and leverage – is paramount.

Everything, including our triumphs and disasters, anyways shall pass. But the equanimity with which we allow them to pass will keep us sane always.

As Lord Krishna taught Arjuna, as we wade through the ocean of life, it throws up all kinds of waves that are beyond our control. If we keep struggling to eliminate negative situations, we will be unable to avoid unhappiness. But if we can learn to accept everything that comes our way, with equanimity and without sacrificing our best efforts, that will be true Yog.

So, give equanimity a shot, and see what happens.

21. Five Ways We Destroy Our Wealth It’s common if you are wealthy to worry about losing your fortune due to forces beyond your control. Like market meltdowns or economic stagnation.

But what many of us don’t realize is that our own behavior may be the root of significant losses.

“The road to hell is paved with good intentions,” goes a proverb. The road to investing hell is paved with bad behaviors, and here are the five roads which initially look like paved with gold, but which often take us towards wealth destruction.

Daniel Kahneman was right when he said this –

A human being is a dark and veiled thing…and whereas the hare has seven skins, the human being can shed seven times seventy skins and still not be able to say: This is really you, this is no longer outer shell. So said Nietzsche, and Freud agreed: we are ignorant of ourselves.

We certainly are.

22. Avoid Stress I recently read this passage from Nassim Taleb’s Fooled by Randomness that tells something about why we must avoid stress –

…people who look too closely at randomness burn out, their emotions drained by the series of pangs they experience. Regardless of what people claim, a negative pang is not offset by a positive one (some psychologists estimate the negative effect for an average loss to be up to 2.5 the magnitude of a positive one); it will lead to an emotional deficit.

…people in lab coats have examined some scary properties of this type of negative pangs on the neural system (the usual expected effect: high blood pressure; the less expected: chronic stress leads to memory loss, lessening of brain plasticity, and brain damage). To my knowledge, there are no studies investigating the exact properties of trader’s burnout, but a daily exposure to such high degrees of randomness without much control will have physiological effects on humans (nobody studied the effect of such exposure on the risk of cancer).

…wealth does not count so much into one’s well-being as the route one uses to get to it.

23. Why Value Investing Works Jack Schwager, the author of Market Wizards series, when answering a question on whether value investing works, turned to the wisdom of Joel Greenblatt, one of the foremost experts on the subject.

Schwager quoted this from his interview with Greenblatt –

Value investing doesn’t always work. The market doesn’t always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn’t work. And that is a very good thing.

The fact that the value approach doesn’t work over periods of time is precisely the reason why it continues to work over the long term.

24. Patience Wins Most people participating in the stock market don’t really understand what they are doing. This is especially when making money gets quick and easy, and they are doing great at it.

Like Aesop’s wolf in sheep’s clothing, they play a role contrary to their real character, which often leads them to the slaughterhouse.

However, the lack of patience of such people to invest with a long-term horizon creates the opportunity for the few committed to long-term holding periods.

In the battle between impatience and patience, the latter wins.

25. Eternity and Investing The Heilbrunn Center for Graham and Dodd Investing created a wonderful video in 2013 titled ‘Legacy of Ben Graham,’ which contains bytes from some of his students on how Graham’s teachings changed their lives.

Marshall Weinberg, one of the students from Graham’s class said that the biggest lesson he drew out of that class was on long-term thinking. Here’s what he said –

One sentence changed my life…Ben Graham opened the course by saying: ‘If you want to make money in Wall Street you must have the proper psychological attitude. No one expresses it better than Spinoza the philosopher.’

When he said that, I nearly jumped out of my course. What? I suddenly look up, and he said, and I remember exactly what he said: ‘Spinoza said you must look at things in the aspect of eternity.’ And that’s what suddenly hooked me on Ben Graham.

Spinoza actually said, “Sub specie aeternitatis,” which translates to “under the aspect of eternity,” or “from the perspective of the eternal.”

Critics of this idea may believe that with such thinking, there is no reason to believe that anything matters. But where Spinoza may be coming from is the idea that, in the larger scheme of things, nothing matters, which leads us to put our pains and struggles – including, as investors – into perspective.

26. Types of Managements People come in different shades, and managers are people.

Here are three different types of management (there may be more, but let’s go with these three for now), and my thoughts on how you may want to deal with them when it comes to investing in the businesses they manage.

Most of us overlook the human aspect of operating a business, yet, in most cases, the future success of a business is directly tied to the quality of the people managing its affairs.

27. Skin in the Game Having skin in the game means being exposed (equally as other stakeholders) to both positive and negative consequences of an outcome which was made possible by your decisions/actions/approval.

Superficially, the concept of ‘skin in the game’ may look like a case for morality in human transactions but if you go deeper, you will find that it’s a wonderful trick for improving our own decisions.

When you own 50 stocks and one goes to zero, your portfolio isn’t going to move down by more than 2 percent (assuming you had equal allocation for each stock). Which means you’re not really bothered about a couple of bad decisions for it’s not going to create meaningful damage to your net worth. However, when you run a relatively concentrated portfolio of 10 stocks, you’d be more careful about choosing those stocks. Won’t you?

28. It’s Not Supposed to Be Fair Warren Buffett had high regards for David Sokol. Over the years Sokol established a reputation inside Berkshire Hathaway as Mr. Fixit. Buffett often referred to Sokol as a terrific manager, a brilliant dealmaker and a huge asset to Berkshire.

In 2011, Sokol abruptly resigned. It was speculated that his resignation was because of insider trading allegations. For a second put yourself in Buffett’s shoes and imagine how you would feel when one of your most trusted business partners who has worked with you closely for decades behaves in a totally unexpected and undesired way? Like Sokol did.

When asked in one interview if he had felt betrayed by Sokol’s behaviour, Munger replied —

It’s not my nature … when you get little surprises as a result of human nature … to spend much time feeling betrayed. I always want to put my head down and adjust. I don’t allow myself to spend much time ever with any feelings of betrayal. If some flickering idea like that came to me, I’d get rid of it quickly. I don’t like any feeling of being victimized. I think that’s a counterproductive way to think as a human being. I am not a victim. I am a survivor.

The world around us is largely a soup of random events loosely connected by a few broad patterns. And one of those patterns is that the universe doesn’t care for any individual’s personal agenda.

If your investment journey has thrown a few bad apples your way, if you feel that the world is not fair then be reminded that the world is not supposed to be fair. It’s not supposed to be fair in your favour or in anyone’s favour.

29. Avoid Multiplying by Zero Two academicians were debating on the superiority of their respective fields of study.

“What would you do if I brought Alexander The Great’s army in front of you?” The history professor challenged.

The mathematician rolled his eyes and replied, “I’ll enclose the army in a bracket and multiply by zero.”

In an additive system, each component adds on to one another to create the final outcome. Such systems are unaffected when they encounter a zero. Multiplicative systems, on the other hand, are non-linear because anything times zero must still be zero, no matter how large the string of numbers preceding it. A zero can wreak havoc on multiplicative systems. Like it did to Alexander’s army.

Shane Parrish, on his excellent blog, explains the functional equivalent of multiplicative system in the world of business –

Most businesses, for example, operate in a multiplicative system. But they too often think they’re operating in additive ones: Ever notice how some businesses will add one feature on top of another to their products but fail at basic customer service, so you leave, never to return? That’s a business that thinks it’s in an additive system when they really need to be resolving the big fat zero in the middle of the equation instead of adding more stuff… General Motors, founded in 1908 by William Durant and C.S. Mott, came to dominate the American car market to the tune of 50% market share through a series of brilliant innovations and management practices, and was for many years the dominant and most admirable corporation in America. Even today, after more than a century of competition, no American carmaker produces more automobiles than General Motors. And yet, the original shareholders of GM ended up with a zero in 2008 as the company went into bankruptcy due to years of financial mismanagement. It didn’t matter than they had several generations of leadership: All of that becomes naught in a multiplicative system.

Benefit of looking at the downside or what can go wrong is efficiency, writes Peter Bevelin, “Take investments as an example – If you first eliminate what doesn’t work or what won’t achieve what you want, you don’t have to spend a lot of time and attention of analyzing the company. If there is a huge downside – for example a catastrophe risk of the key factors that are needed for success aren’t there or any other disqualifying factors like no sustainable advantage, bad and untrustworthy management of something else – just say ‘no thank you.’”

II. LEARNING 30. Being Average in the Age of Alpha Our society and culture values high achievement in every area of our lives. We want to become alpha men and women, have the brightest careers, accomplished children, ideal bodies, investment performances that beat everyone, and financial prosperity that leads us to possess more stuff than others.

Amidst this, being satisfied with having “enough” is considered shameful. Being unambitious is considered lazy. Thinking “I have enough” is a sin. “Average” is a dirty word.

I recently read an article written by one Krista O’Reilly, which echoed exactly what I have felt about being average all my life –