#august 31 due date for 2290

Text

IRS Form 2290 Due Dates: Stay Compliant with eForm2290

Discover essential IRS Form 2290 due dates at eForm2290. Stay updated on deadlines for heavy vehicle owners to file their taxes and ensure compliance with federal regulations. Our comprehensive guide provides clear, concise information on when and how to submit Form 2290, avoiding penalties and ensuring timely tax payments. Whether you're a fleet manager or an owner-operator, our resources simplify the process, helping you stay on track with your tax obligations. Trust eForm2290 for accurate due date information and reliable filing support, ensuring your vehicles remain compliant with IRS requirements throughout the tax year

0 notes

Text

2290 Form Due Date & Hvut Penalties

The deadline is the most important thing to every trucker while operating heavy vehicles on public roads. The IRS recommends heavy vehicle owners file the 2290 tax by the 2290 form due date or on time. For Truckers who file annual returns, the tax season begins on July 1 and ends on August 31. The tax year starts on July 01 and ends on June 30 for the following year. Therefore, never be late filing your HVUT tax return.

#Form2290#TaxFiling#HVUT#TaxDeadline#IRS#TruckersTax#TaxPenalties#Truck2290#TaxCompliance#IRSDeadlines

0 notes

Text

Complete HVUT Filing by August 31 to Secure Schedule 1 and Send in Form 2290 Copy

Up to the deadline: Utilize Truck2290.com to submit Form 2290 before the due date

Truck2290.com, an IRS-authorized e-file service, is contacting truckers to remind them of the impending due date and to promote the hassle-free alternatives they offer for a flawless filing experience as the annual deadline for filing Form 2290 approaches.

The Form 2290 submission date is quickly approaching, therefore time is of the importance. To ensure timely submission and stay clear of any fines, truckers are recommended to take advantage of Truck2290.com's quick and effective services. Form 2290 must be submitted by August 31, 2023.

For many truckers, submitting Form 2290 can be a difficult task that is fraught with difficulties like difficult paperwork, perplexing processes, and protracted processing times. Truck2290 is aware of these difficulties and has created a platform that offers workable answers.

AutoMagic2290 — Data entering work is made easier: The creative AutoMagic2290 is one of the platform's distinguishing qualities. Users can have their Form 2290 automatically pre-filled by uploading a copy of their prior year Schedule 1, which drastically minimizes the time and effort needed for data entry. Modern technology speeds up the procedure and makes sure that reliable data is submitted quickly.

Tailored interfaces for all needs: Truck2290 offers specialized interfaces for both single- and multiple-vehicle filing because they are aware that truckers' needs can differ.

This specialized method guarantees that each user's particular needs are satisfied, streamlining the procedure and reducing misunderstanding.

Truck2290 uses clever IRS validations to find any problems and inconsistencies before submission. This is a step toward reducing rejections. This feature is intended to lessen the likelihood of rejection due to errors, as well as the necessity for re-filing and other delays.

As the deadline for Form 2290 draws near, Alex from Truck2290 underlined the value of moving quickly, adding, "We want to make sure that truckers have a pleasant and trouble-free experience while e-filing. Our platform is made to take care of the frequent problems encountered in this procedure, giving truckers a convenient answer that reduces time and unneeded stress.

Truck2290 is a trustworthy partner in navigating the difficulties of tax filing for truckers looking for a dependable and expedient solution to e-file Form 2290 and get their Schedule 1 copy right away.

About Truck2290: Truck2290.com is an IRS-approved e-file company that specializes in helping truckers submit Form 2290 electronically without any hassle. Truck2290 wants to make the tax filing process for truckers simpler and less stressful with its cutting-edge features.

#2290duedate#trucktax#irsform2290#taxfiling#form2290#irs2290#truck2290#hvut#heavyvehicletax#taxseason

0 notes

Text

For heavy vehicles with a taxable gross weight of 55,000 pounds or more, the IRS form 2290 due date is by August 31 of every year. For newly purchased vehicles, form 2290 must be filed by the last day of the month following the month of first use.

1 note

·

View note

Photo

IRS Tax Form 2290 - Due for 2021 - August 31 Deadline

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Truck tax form 2290 for 2021#hvut tax 2290 for 2021#tax 2290 electronic filing#form 2290 due date for 2021#August 31 due date for Tax 2290

0 notes

Video

undefined

tumblr

Truckers & heavy motor vehicle owners have to report & pay the Federal #HVUT returns for the Tax Year 2022–23. August 31, 2022 is the due date for vehicles first operated in July 2022, anyone can still e-file the 2290 returns with the IRS, however it is mandate for companies reporting more than 25 vehicles to go with electronic filing. Do complete your #2290taxes at the earliest to avoid charges. @tax2290 it is easy, fast, safe, secured and affordable.

@irs2290 @thinktradeinc @iftatax @tax2290 @trucktax2290 @2290efile @2290tax @bigwheels2290 @pay2290 @extensiontax @2290tax

0 notes

Photo

Truckers & heavy motor vehicle owners have to report & pay the Federal #HVUT returns for the Tax Year 2022–23. August 31, 2022 is the due date for vehicles first operated in July 2022, anyone can still e-file the 2290 returns with the IRS, however it is mandate for companies reporting more than 25 vehicles to go with electronic filing. Do complete your #2290taxes at the earliest to avoid charges. @tax2290 it is easy, fast, safe, secured and affordable. @irs2290 @trucktax2290 @thinktradeinc @thinktradeinc @2290efile @2290tax @bigwheels2290 @2290efile @iftatax @extensiontax

0 notes

Photo

The new tax season, TY 2022-2023, has already started at the beginning of July 2022 as usual, and it is going to last till the end of June 2023. Truckers and trucking taxpayers must report their Highway Heavy Vehicle Use Tax (HVUT) for the whole tax period in advance around the beginning of the tax period. As per the IRS regulations, the last date to file and pay the form 2290 truck tax for this tax period, TY 2022-2023, is August 31, 2022. So, truckers should file their form 2290 tax returns to the IRS on or before the last date and get the IRS stamped schedule 1 copy to operate their trucking business on the public highways smoothly. Truckers and trucking taxpayers should remember that form 2290 HVUT due doesn’t fall on the due date of the vehicle’s registration. Form 2290 HVUT is absolutely necessary to register your new vehicle or renew your existing vehicle registration on its due date. So, tuckers should report form 2290 HVUT for every tax season before the deadlines, which is irrelevant to the heavy vehicle’s registration due date. @pay2290 @thinktradeinc @tax2290 @irs2290 @irs2290 @2290efile @2290tax @bigwheels2290 @trucktax2290 @trucktax2290

#2290 for 2022#heavy truck tax form 2290 for 2022#hvut form 2290 for 2022#tax 2290 for 2022 is due now#form 2290 for the 2022 is due#renew form 2290 online for 2022

0 notes

Video

undefined

tumblr

Truckers & heavy motor vehicle owners have to report & pay the Federal #HVUT returns for the Tax Year 2022–23. August 31, 2022 is the due date for vehicles first operated in July 2022, anyone can still e-file the 2290 returns with the IRS, however it is mandate for companies reporting more than 25 vehicles to go with electronic filing. Do complete your #2290taxes at the earliest to avoid charges. @tax2290 it is easy, fast, safe, secured and affordable. @irs2290 @trucktax2290 @2290efile @2290tax @thinktradeinc @2290tax

#tax2290efilefor2022 #tax2290payments #HeavyTruckTax #HeavyVehicleUseTax #HeavyTruckTaxes

#TruckTaxes #HighwayTruckTaxes #Form2290 #Tax2290 #Tax2290online #Tax2290eFile #Tax2290eFiling

#Tax2290electronicfiling #tax2290reporting #tax2290for2022 #tax2290HVUT

0 notes

Photo

August 31 is the due date for reporting the Federal Vehicle Use Tax Form 2290 with the IRS. You just have less than a day to get it done. #2290eFiling is the best way to report and pay the dues on time. @tax2290 #efiling2290 is Easy and Fast, Schedule 1 proof in just minutes.

The Heavy Vehicle Use Tax Form 2290 for the new tax year 2022 – 2023 is due now & renew it online to receive IRS stamped Schedule-1 proof in minutes. Electronic filing is fast & easy only at @Tax2290.com. The best way to report & pay the 2290 #TruckTaxes. #Form2290 #HeavyTruckTax

#2290 tax online#2290 tax e file#2290 tax online for 2022#2290 tax e filing#2290 tax electronic filing#2290 tax for 2022#2290 tax for 2290 tax year#2290 tax online for 2290 tax year#2290 tax for july 2022#2290 tax e filing for 2022#2290 truck tax#2290 heavy truck tax#2290 tax form efile#2290 truck tax efile#2290 heavy truck tax e file

0 notes

Text

Due Date for IRS Form 2290 for 2023–2024

My form 2290 is due when? The IRS form 2290 must be submitted by August 31 each year for heavy vehicles with a taxable gross weight of 55,000 pounds or more. Form 2290 for newly acquired vehicles must be submitted by the last day of the month after the month of first use.

Pay by October 31, 2023, if September 2023 is the first month used.

How soon must I submit my form 2290?

Pro Tip: Asking yourself when is 2290 payment is due shouldn't be left until the very last minute. To avoid late costs, prepare to file before the 2290 deadline. For instance, if your truck was used for the first time on a public road in July, you must file Form 2290 between July 1 and August 31.

For instance, Mark must register the truck in his name and submit a separate form 2290 reporting this new vehicle on or by December 31, 2023, for the tax year 2023–2024, if he buys a new taxable vehicle on November 3, 2023, and drives it home from the dealership on a public roadway. To prevent late fines, make sure you submit by the deadline of 2290.

Plan ahead and set notifications to e-file your taxes. When is 2290 Due? This should not be a question you leave until the last minute.

0 notes

Text

Form 2290 Due date for the tax year 2022-2023

What is Form 2290?

IRS Form 2290 is a Heavy Vehicle Use Tax (HVUT), it should be filed if you run vehicles with a taxable gross weight of 55,000 pounds or more. And also you should file 2290 tax if your vehicle exceeds 5,000 miles or 7,500 miles (for agricultural vehicles) in a tax period.

When is the Form 2290 Due date?

Form 2290 due date for 2022-2023 tax year is August 31.

Failing to file HVUT will result in penalties and interest, which is assessed on a monthly basis.

Late filers not paying HVUT will also face an additional monthly penalty.

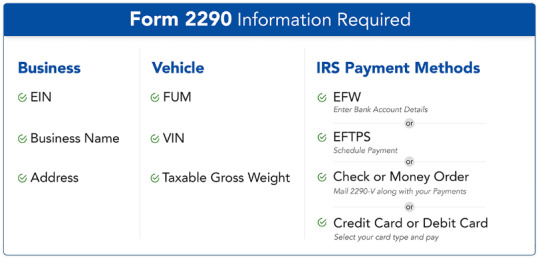

Information required to file Form 2290

Business Name, Address and Employer Identification Number (EIN).

Vehicle Identification Number (VIN), First Used Month (FUM), Taxable Gross Weight, Suspended vehicles (if any).

Review and transmit.

Benefits of filing Form 2290 with ExpressTruckTax

File Form 2290 with ExpressTruckTax, and avail several benefits such as,

Guaranteed Schedule 1 or money back

Free VIN Checker and VIN Correction

Bulk information upload

Copy last year’s return

0 notes

Photo

Form 2290 - HVUT Returns - Due Date - Tax Year 2021 - 22

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Pay 2290 online for 2021#pay 2290 taxes for 2021#pay 2290 electronically for 2021#pay 2290 taxes#pay 2290 tax due#pay 2290 truck tax for 2021

0 notes

Video

undefined

tumblr

#Truckers! start your Digital Journey with #HVUT #Form2290 electronic filing today at @tax2290. The simplest & easiest service to prepare, report & pay the highway vehicle use taxes with the IRS. We ensure you receive the IRS #Schedule1 proof instantly. August 31, is the Deadline

#Tax 2290 efile for 2021#tax 2290 electronic filing for 2021#tax 2290 due date for 2021#tax 2290 online for 2021#tax 2290 payment for 2021#tax 2290 efiling today#tax 2290 due date august 31#tax2290.com#tax2290#tax 2290 electronic filing

0 notes

Text

Do you still need to worry about the HVUT Form 2290 Reporting?

Do you still need to worry about the HVUT Form 2290 Reporting? choose #2290efiling and keep moving, efile is fast, simple, quick and safe. Affordable and Self serviced, you can do it by yourself! @taxexcise @tax2290

Truck Tax Form 2290, to report the Federal Vehicle Use Tax returns is now due and August 31 is the due date. Try electronic filing if you haven’t tried it before at TaxExcise.com and you’ll never let it go…

2290 Heavy Truck Tax Return

The IRS Tax Form 2290 is used to report the annual federal heavy vehicle use tax returns with the IRS. Tax Form 2290can be electronically prepared and reported…

View On WordPress

#2290 deadline#2290 due date#2290 duedate#2290 efile deadline#2290 efile due date#2290 filing deadline#2290 online deadline#2290 online duedate#2290 tax deadline#2290 tax due date#2290 tax duedate#2290 tax dues#2290 tax efile#2290 truck tax dues#2290tax deadline#2290tax duedate#2290tax efile duedate#August 31 2290 due#august 31 due date for 2290#August 31 last date to file 2290 tax returns#efile 2290#efile tax 2290 software#federal 2290 vehicle use tax#form 2290 due by august#Form 2290 online#How much is 2290 eFile?#How much is to report form 2290 online?#How much it cost to eFile 2290?#how to eFile 2290 tax?#How to eFile 2290?

0 notes

Video

undefined

tumblr

Form 2290 Due Date for the tax period that starts from July through June of next year, for most truckers it is due by August 31 unless they haven't put their vehicle on a highway

0 notes