#and he saves up and has his Roth IRA and investment portfolio and so on

Explore tagged Tumblr posts

Text

being an adult who makes my own income is also realizing i can actually buy some of the pretty art i see online. some day i might even be bold enough to directly commission an artist.

#sometimes i forget that i can just...buy things that i like#obviously i can't go wild about it or spend an outrageous amount#but...i do have spending money and i no longer have to like justify purchases to my dad#or beg him to let me buy some cool art at the local ren faire#i can literally just...buy it#still keeping myself in check#but i am so used to only using my spending money to buy books and snacks#and sometimes notebooks and art supplies#but now there's no one to tell me that i'm too old for dinosaur figurines and cool prints and cute plushies#like i mean my dad is still around but i'm not a kid anymore so...#honestly i could've probably bought more things i just like and want because they're cool when i was younger#but i was just not great at doing things without permission#and my dad is simultaneously a penny pincher and a careless spender#in a weird way where he'll budget everything very carefully#and he saves up and has his Roth IRA and investment portfolio and so on#but then he will also like...spend a ridiculous amount of money on super expensive living room curtains#that will inevitably be destroyed by the cats within the course of a year#or he'll buy a custom made reclining chair from norway for way too much money and then never use it#like he carefully budgets all this stuff#and then is like 'ah and now i need to factor in my $1000 ugly lamp that no one asked for'#my sister ends up replacing most of these items with more practical cheap stuff from like facebook marketplace#so honestly he has nowhere to throw stones from#will say i do like his too-expensive giant abstract art pieces. they're pretty cool#not my style but i don't hate them#but those curtains...#maybe it's my turn to criticize HIS purchases

4 notes

·

View notes

Text

How Goldman Sachs's "tax-loss harvesting" lets the ultra-rich rake in billions tax-free

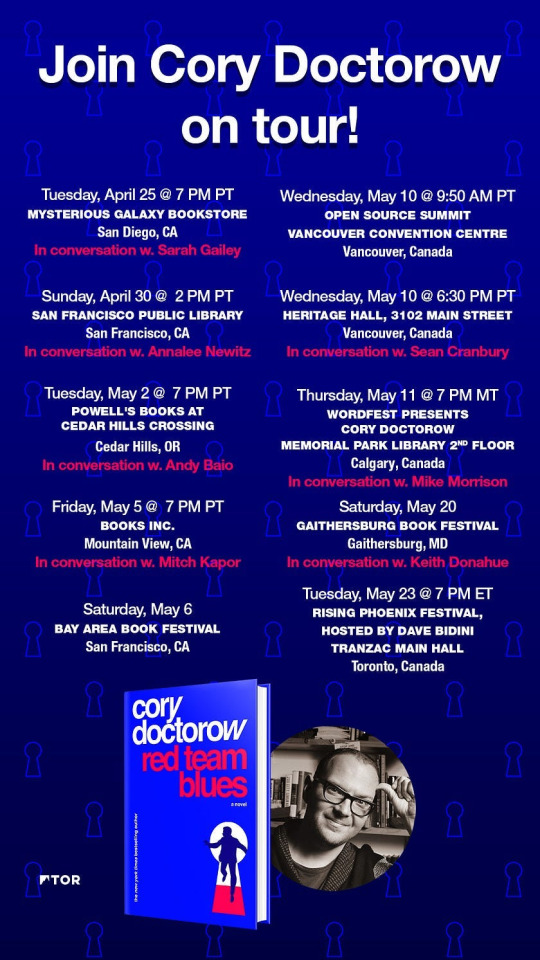

Tomorrow (Apr 25) I’ll be in San Diego for the launch of my new novel, Red Team Blues, at 7PM at Mysterious Galaxy Books, hosted by Sarah Gailey. Please come and say hi!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

With the IRS Files, Propublica ripped away the veil of performative complexity disguising the scams that the ultra-rich use to amass billions and billions (and billions and billions) of dollars, paying next to no tax, or even no tax at all. Each scam is its own little shell game, a set of semantic and accounting tricks used to gussy up otherwise banal rip-offs.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

The finance sector has a cute name for this kind of complexity: MEGO, which stands for "my eyes glaze over." If you're trying to rip off a mark, you just pad out the prospectus, make it so thick they decide there must be something good in there, the same way that any pile of shit that's sufficiently large must have a pony under it...somewhere.

Propublica's writers haven't merely confirmed just how little America's oligarchs pay in tax - they've also de-MEGO-ized each of these scams, like the way that Peter Thiel used the Roth IRA - a tax-shelter for middle-class earners to help save a few thousand dollars for retirement - to make $5 billion without paying one cent in tax:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

One of my favorite IRS Files reports described how Steve Ballmer - the billionaire ex-CEO of Microsoft - laundered vast fortunes into a state of tax-free grace by creating hundreds of millions in "losses" from his basketball team, the LA Clippers. Ballmer paid 12% tax on the $656 million he took out of the Clippers - while the players whose labor generated that fortune paid 30-40% on their earnings:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

That was Propublica's first Ballmer story, back in the summer of 2021. But they ran a followup last February that I missed (it came out while I was on a book tour in Australia), and it's wild: a tale of "loss harvesting," a form of fuckery involving Goldman Sachs that's depraved even by their own standards:

https://www.propublica.org/article/irs-files-taxes-wash-sales-goldman-sachs

Loss farming is a scam that was invented in the 1920s, whereupon it was promptly banned by Congress. But Goldman and other plutocrat Renfields have come up with tiny modern variations on this century-old con that the IRS is either unable or unwilling to address.

Here's how it works. Say you've got a stock portfolio where some of the stocks have gone up and others have gone down. You want to sell the high stocks and hang onto the low ones until they bounce back. But if you sell those stocks that have gone up, you have to "realize" the profit from them and pay 20% capital gains tax on them (capital gains tax is the tax you pay on money you get from owning things; it's much lower than income tax - the tax you pay for doing things).

But you pay tax on your net capital gains - the profits you've made minus the losses you've suffered. What if you sold those loser stocks at the same time? If you made a million on the good stocks and lost a million on the bad ones, your net income is zero - and so is your tax bill.

The problem is that selling stocks when they've gone down is a surefire way to go broke. Every investing book starts with this advice: you will be tempted to hold onto your stocks that are going up, because they might continue to go up. You'll be tempted to sell your stocks that are going down, because they may continue to go down. But if you do that, you'll only sell the stocks that have lost money, and never sell the stocks that have made money, and so you will lose everything.

Back when the pandemic started, your shares in movie theater chains were in the toilet, while your stock in tech companies shot through the roof. If you sold the tech stocks then and held onto your movie stocks and sold them now, you'd have cleaned up - today, tech stocks are down and movie theater stocks are up. But if you sold the cinema shares when they bottomed out, and held onto your tech stocks when they were peaking, you'd be busted today.

So selling your loser stocks to offset the gains from your winners is a bad idea. That's where loss-farming comes in: what if you sold your tech stocks at their peak, and sold your bottomed-out cinema stocks at the same time, but then bought the cinema stocks again, right away? That way you'd have the "loss" from selling the cinema stocks, but you'd still have the stocks.

That's called "wash trading," and Congress promptly banned it. If you've heard of wash-trading, it's probably something you picked up during the NFT bubble, which was a cesspit of illegal wash-trading. Remember all those eye-popping NFT sales? It was just grifters with multiple wallets, buying NFTs from themselves, making it seem like there was this huge, white-hot market for monkey JPEGs. Wash-trading.

Turns out that crypto really did democratize finance...fraud.

Wash-trading has been illegal for a century, but brokerages have invented modern variations on the theme that are legal-ish, and the most lucrative versions of these scams are only available to billionaires, through companies like Goldman Sachs.

There are a bunch of these variations, but they all boil down to this: there are lots of ways to sell an asset and buy it again, while making it look like you bought a different asset. Like, say you're invested in Chinese tech companies through an exchange-traded fund (ETF) that bundles together "all the Top Chinese tech stocks."

Maybe you bought this fund through Vanguard, the giant brokerage. Now, say Chinese stocks are way down, because the Chinese government is doing these waves of lockdowns on the factory cities. If you could sell those Chinese stocks now, you'd get a massive loss, enough to wipe out all the profits from all your good stocks.

But of course, China's going to figure out the lockdown situation eventually, so you don't want to actually get rid of those stocks right now, especially since they're worth so much less than you paid for them. So right after you sell your Vanguard Chinese tech ETF shares, you buy the same amount of Schwab's Chinese tech-stock ETF.

An ETF of "leading Chinese tech companies" is going to have basically the same companies' stock in it, no matter whether it's sold by Vanguard, State Street or Schwab. But as far as the IRS is concerned, this isn't a wash-trade, because you sold a thing called "Vanguard ETF" and bought a thing called "Schwab ETF" and these are different things (even if the main difference is the name on the wrapper, and not what's inside).

There's other ways to do this. For example, lots of companies have different "classes" of stock. Under Armour sells both Class A (voting) and Class C (nonvoting) stocks. Though voting stock is worth a little more than nonvoting stock, they both rise and fall together - if the Class A shares are up 10%, so are the Class C shares. So you can dump your Under Armour Class A's, buy Under Armour Class C's and own essentially the same amount of Under Armour stock - but as far as the IRS is concerned, you just sold your interest in one company and bought an interest in a different company, and you can take a big loss and write down your profits from other stock trades.

The IRS does prohibit wash-trading, but only in the narrowest sense. Brokerages are obliged to report trades in which a customer buys and sells exactly the same security, with the same unique ID (the CUSIP number), within 60 days. Beyond that, IRS guidance is extraordinarily wishy-washy, calling on filers to "consider all the facts and circumstances" of their transactions. Sure, that'll work.

Propublica found zero instances of the IRS targeting any of these trades, ever, for enforcement. That's especially true of the most egregious version of loss-harvesting, a special version that only the ultra-rich can take advantage of, called "direct indexing." You might know about "index funds," where a brokerage sells a single fund that tracks a broad index of stocks - for example, you can buy an S&P 500 index that goes up and down with the total value of the top 500 stocks in America.

Direct indexing is something that giant banks like Goldman Sachs offer to their very richest clients. The brokerage buys a mix of stocks that are likely to track the whole index, and puts those shares directly into the client's account. Rather than owning shares in a fund that owns the stocks, you own the stocks directly. That means that when you want to harvest some losses, you can sell just a few of the stocks in the index, rather than your shares in the whole fund.

Here's how that works. In 2017, the US index was up 20%; global indexes were up even more. Steve Ballmer made a bundle. But Goldman Sachs, acting on Ballmer's behalf, sold s few of the stocks in the portfolio and harvested a $100,000,000 loss, that Ballmer could use to trick the IRS into treating his massive profits as though he'd made very little taxable income.

Goldman uses a whole range of tricks to keep billionaires like Ballmer in a lower tax-bracket than the janitors who clean the floors after his team's games. They not only buy and sell different classes of stock in companies like Discovery and Fox; they also buy and sell the same company's stock in different countries. For example, they sold Ballmer's shares in Shell in one country, and then immediately bought the same amount of shares in another country. The IRS doesn't treat this as a wash-trade, despite the fact that the shares have the same value, and, indeed, companies like Shell routinely merge their overseas and domestic shares with no change in valuation.

Thanks to Goldman's ruses - and the IRS's willingness to accept them - Ballmer's wealth has swollen to grotesque proportions. He generated $579 million in losses from 2014-18, and as a result, got to keep at least $138m that he'd have otherwise had to pay to the IRS.

Goldman's not the only one in on this game: Iconiq Captial - a firm that also offers marriage partner scouting for its richest clients - has $13.2 billion under management on behalf of just 337 people. Among those high-rollers: Mark Zuckerberg, whose $88m in gains from Iconiq investments were offset by $34m in imaginary losses that the company manufactured with wash-trades.

In theory, the simplest form of wash-trading - selling your Vanguard China fund and buying a Schwab China fund - is available to any investor. Leaving aside the fact that the top 1% of Americans own most of the stock, this is still a deceptive proposition. This kind of wash-trading only benefits investors who hold their shares outside of a sheltered retirement account, which is a vanishing minority indeed.

Instead, the primary beneficiaries of this activity are the usual suspects: convicted monopolists like Ballmer, or useless scions of wealthy families, like the kids of Walmart founder Sam Walton, who emerged into this world through very lucky orifices and are thus effectively exempt from the need to work or pay tax for life.

Jim Walton is Sam Walton's youngest orifice-lottery-winner. Young Jim saw a $10 billion increase in his wealth from 2014-18, making him the tenth richest person in America. Thanks to wash-trading, he declared only $111 million of that $10 billion on his taxes, and paid $0.00 in tax on that $10 billion gains.

One way that the rich are especially well-situated to exploit loss-harvesting is in converting short-term gains - which are taxed at 40% - into long-term gains, which are taxed at 20%. For people who make a lot of money buying and selling shares as pure speculation, flipping them in less than a year, wash-trading can create the appearance of long-term holdings. Analyzing their trove of leaked IRS files, Propublica showed that Americans who report over $10 million in income almost never report short-term gains. Instead, two-thirds of the richest Americans report short-term losses.

One fascinating wrinkle is that rich people may not even know this is going on. Whatsapp co-founder Brian Acton, managed to "lose" $2.9 million when he sold $17 million in shares - the same day he bought $17 million in shares in nearly the same companies from another brokerage. Then, a few months later, he reversed those transactions, selling his new fund and buying the old one and harvesting another $600,000 in losses.

When Propublica asked Acton about this, he told them he was "not really aware of any events like that...Broadly my wealth is managed by a wealth management firm and they manage all the day to day transactions."

This is completely believable and consistent with the extraordinarily frank account of how elite money-management works that Abigail Disney described in 2021, where the ultra-rich are insulated from the scams, tricks and wheezes that lawyers and accountants dream up to keep their fortunes steadily mounting with no action needed on their part:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Could the IRS block this kind of wash-trading? Yes, but they'd need action from Congress. The most effective way to do this would be to force shareholders to "mark to market" the value of their holdings, taxing them each year on the fluctuations in their portfolio.

Propublica notes that this is incredibly unlikely to happen, though. As an alternative, Congress could change the rule that blocks investors from claiming losses when they buy and sell "substantially identical" shares with a rule that applies to "substantially similar" stocks. This proposal comes from Columbia Law's David Schizer, who says the law "ought to be updated to reflect how people invest today instead of how they invested 100 years ago."

But for any of that to have an effect, the IRS would have to change its auditing and enforcement practices, which currently see low-income earners (who can't afford fancy tax-lawyers who'll tie up the IRS for months or years) being disproportionately targeted, while America's super-rich, ultra-rich, and stupid-rich are allowed to submit the most hilariously, obviously fictional returns and get away with it.

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Catch me on tour with Red Team Blues in San Diego, Burbank, Mountain View, Berkeley, San Francisco, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

[Image ID: A dilapidated shack. A sign reading 'Internal Revenue Service Building' stands next to it. From its eaves depends another sign, reading 'Internal Revenue Service' and bearing the IRS logo. From the window of the shack beams the grinning face of billionaire Steve Ballmer. Behind the shack is a DC avenue terminating in the Capitol Dome.]

_,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,__,.-'~'-.,_

Image: Matthew Bisanz (modified) https://commons.wikimedia.org/wiki/File:NYC_IRS_office_by_Matthew_Bisanz.JPG

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

--

Ted Eytan (modified) https://commons.wikimedia.org/wiki/File:2021.02.07_DC_Street,_Washington,_DC_USA_038_13205-Edit_%2850920473547%29.jpg

CC BY-SA 2.0 https://creativecommons.org/licenses/by-sa/2.0/deed.en

--

Bart Everson (modified) https://www.flickr.com/photos/editor/1287341637

Eric Garcetti (modified) https://commons.wikimedia.org/wiki/File:Steve_Ballmer_2014.jpg

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

#pluralistic#paper losses#direct indexing#tax-loss harvesting#steve ballmer#propublica#irs files#the rich are different from you and me#mego#wash trading#tax evasion#goldman sachs#vampire squid#mark zuckerberg

88 notes

·

View notes

Text

How this 41-year-old went from ‘living on credit cards’ to retiring early with $3 million in California

When Jeremy Schneider graduated from college in 2002, the FIRE movement — short for financial independence, retire early — wasn’t really a thing.

But the computer engineering student, who went on to get his master’s in computer science the following year, couldn’t help but notice that his peers were finding ways to retire well before turning 65.

During the dotcom boom, “I would see these young people just a few years older than me who were making millions with tech startups,” Schneider tells CNBC Make It. Though he hadn’t heard of financial independence, “I definitely heard of selling an internet company for a lot of money and being financially set.”

Jeremy Schneider, now 41, retired at 36 with a net worth of $3 million.

That’s exactly what he ended up doing. In 2004, he founded RentLinx, an advertising network for rental properties. He’d sell the firm 11 years later — a transaction that netted him about $2 million.

Schneider quit his 9-to-5 job not long after, but found that while he had the financial flexibility to retire, he enjoyed the fulfillment of working on projects he was passionate about. Today, the 41-year-old lives in San Diego, has a net worth of $4.4 million and runs a small business selling financial literacy courses online.

Here’s how he did it.

When he graduated from college, Schneider decided to bet on himself. Instead of taking a $74,000-a-year gig with Microsoft, where he’d interned as a software developer, he started his firm. “I preferred to start my own company where if I worked 10 times harder, maybe I would get 10 or 100 times more money,” he says.

Between a track scholarship and help from his parents, Schneider graduated with no student debt, and had about $6,000 in savings from summer jobs. But that, combined with the $14,000 in revenue his website brought in during its first year, wasn’t enough to pay the bills.

“I was living on credit cards,” he says. “I accrued about $10,000 of credit card debt in my first year. And the second year that $10,000 became $12,000.”

But things turned a corner in year three, and profits began taking off.

Today, 41-year-old Jeremy Schneider lives in San Diego, has a net worth of $4.4 million and runs a small business selling financial literacy courses online.

For the next eight years, even as the company continued to grow, Schneider kept his salary at $36,000 per year. “For basically the entire time I was running my company, I was as frugal as possible. I wasn’t even really budgeting because I had no money to budget,” he says.

That meant driving a paid off 1999 Ford SUV, spending as little as he could on food and living in a converted garage to keep his rent low.

Even with his restricted income, Schneider still managed to stash some money away, contributing $5,000 to $6,000 per year to his Roth IRA. By 32, he says, he had about $120,000 in his account, a mix of contributions and investment gains.

In 2015, Schneider fulfilled his goal of selling a company when a competitor offered to buy his business for just over $5 million. Because he owned about 70% of the firm at the time, his take after taxes was about $2 million.

Schneider worked for another two years for the company that acquired his, pulling in a six-figure salary and helping integrate his former employees at the new firm.

But he noticed that the profits in his portfolio, composed almost entirely of index funds, were outpacing his salary. “My $2 million had grown to $3 million just from the growth of the market,” he says. “It dawned on me that I don’t need to work anymore.”

Following the so-called “4% rule,” which says that retirees can withdraw 4% of the value of their portfolio per year in perpetuity without running out of money, Schneider could live on $120,000 annually — “twice as much as I’d ever spend in a year.”

So, did Schneider, then 36, take his money and ride off into the sunset? For the first year after he quit in 2017, he tried, splitting his time between playing video games and going on trips. But the novelty wore off quickly.

“As the year dragged on, I found that, there’s something missing in my life. There’s no tension,” he says. “I wasn’t working towards a goal or any progress. And it started to feel a little bit empty.”

In 2019, Schneider started an Instagram account where he shared daily personal finance and money tips. Soon, the excitement was back.

“Some people like kite surfing or paragliding or skydiving, and I like Roth IRAs and index funds,” he says. “If I can talk to someone for 30 minutes and change their financial future, it’s still pumps me up every single day.”

“I don’t really see retirement as the goal. I think financial independence is the goal,” Jeremy Schneider says. “I want to be able to direct my time as I see fit and do the things that I feel passionate about.”

By mid-2020, the account had grown to 90,000 followers, and Schneider found many of them were sending in the same basic finance questions. In response, he made a video course, which he began selling later that year for $79. Within a week of launching, he’d made $110,000.

“It took me four years of my first company to make $110,000,” he remembers thinking. “So this might actually be a real business.”

That business, The Personal Finance Club, has brought in about $1 million in sales since it began generating revenue in October 2020. Schneider and his two full-time employees on the project each bring in $70,000 per year, plus additional payouts in the form of bonuses and profit sharing.

For Schneider, continuing to work despite having reached financial independence beats laying on a beach somewhere.

“I don’t really see retirement as the goal. I think financial independence is the goal,” he says. “I want to be able to direct my time as I see fit and do the things that I feel passionate about.”

1 note

·

View note

Photo

America’s retirement savings system is deeply flawed—can it be fixed? Here are some ideas

America’s retirement savings system is a mess (that’s a technical economic term). “System” is actually too grand a word for the ad hoc retirement savings plan edifice that has been built up over years.

To be sure, the system works reasonably well for those on the payroll of an employer with a retirement benefit plan and a relatively stable job. Employees at larger companies typically have 401(k)s with automatic enrollment, automatic contribution increases and a target-date default option that provides a well-diversified portfolio for those unable or uninterested in managing their portfolio.

But for most people, the system is too opaque, too difficult to navigate and too often failing too many workers in providing economic security in their retirement years.

“I think the most important takeaway is that the American retirement system is too complex and confusing,” David John, deputy director of the Retirement Security Project at the Brookings Institution think tank, told me in a recent interview. “It needs to be simpler for people to operate and to understand.”

What the ‘Wealth After Work’ authors say

Amen to that.

John, who’s also a senior strategic policy adviser at the AARP Public Policy Institute, is one of three editors of “Wealth After Work,” an intriguing new Brookings book on improving the nation’s retirement savings system. They’re not quite ready to blow up the current retirement savings system, but have some smart ideas on what could make it much more equitable and helpful.

Also see: Planning to retire? Here’s a list of at least 14 things to account for first

The other two editors are William G. Gale (a former senior staff economist under President George H.W. Bush) and J. Mark Iwry (a former deputy assistant secretary for retirement and health policy at the Treasury Department under President Barack Obama). It’s hard to think of three smarter experts about retirement security policy.

The policy-driven — OK, wonky — book covers a wide range of challenges, such as:

Worrisome retirement savings prospects for millennials

How women are shortchanged with retirement savings and what to do about it (their suggestion: start with a robust paid family-leave and medical program)

Turning retirement plan account balances into a stream of dependable income in retirement (create a default “decumulation” strategy option, they say)

Bringing the roughly half of the private-sector workforce without an employer-sponsored retirement savings plan into the retirement system (begin by expanding state-sponsored retirement savings plans, they advise; more on those shortly)

Despite the neutral tones of the veteran, bipartisan researchers, in the aggregate the essays are toss-the-book-across-the-room maddening: Why are the deep flaws in America’s retirement savings system allowed to persist?

A pressing need for retirement reform

Every day that the current system continues is an intolerable injustice to working people who will eventually retire and should be able to anticipate a comfortable standard of living. Many can’t, now.

The need for reform is pressing, at least partly driven by the interaction of four main factors, not counting the demographics of an aging population.

The first and best-known factor is corporate America’s retreat since the 1980s from offering employees traditional “defined benefit” pension plans in favor of “defined contribution” plans like 401(k)s.

More: This is how we could solve the retirement crisis

With a defined-benefit pension plan, the employer bears all the investment risk and commits to a fixed payout of money for the remaining life of the retiree, typically based on a salary and years-of-service formula. In sharp contrast, with the 401(k), employees bear the risk of deciding how much to invest and where to invest (within regulatory and plan limits). And, of course, they need to find the money to do it.

Trouble is, living standards of near-retirees and the recently retired counting on their 401(k)s are extremely vulnerable to an unexpected market swoon. What’s more, the 401(k) and other retirement plans like it offer little guidance on how to turn accumulated assets into a steady stream of reliable income in retirement.

The second drawback is that the U.S. relies on companies to choose to offer their workers a retirement benefit. Larger companies usually do, but many smaller and midsize businesses don’t.

“If an individual doesn’t have access to payroll-deduction, auto-enrollment and auto-escalation retirement plan, they are out of luck,” says John.

Research from the nonprofit Employee Benefit Research Institute bears this out year after year, with huge disparities in retirement savings between people with 401(k)-type plans and those without them.

Workers left out of the current retirement savings system

Third, the traditional employer-based retirement plan excludes contingent workers, such as independent contractors, gig economy workers, freelancers, security guards and maintenance professionals. Part-time workers are often left out, too.

Related: Retirement security ‘is shakier than ever’ and ‘Americans are not saving enough’ for old age

Contingent workers and others with alternative work arrangements comprised almost 13% of the workforce or 20 million people in 2018. Those numbers have almost certainly increased since then.

“However well or poorly it serves the needs of traditional workers, the current retirement system does not meet the needs of contingent workers, who plausibly have less job stability than traditional workers,” write Gale, John and Sarah Holmes Berk, research project director at the National Bureau for Economic Research in “Wealth After Work.”

And, they add, “It is also inadequate for those who switch back and forth between contingent and traditional jobs.”

Most important, the current system not only excludes or disadvantages contingent workers, but also minorities and women. The cumulative impact is to contribute to widening wealth inequalities between whites and minorities — particularly Blacks —in recent decades.

“If this trend continues, wealth inequality will continue to increase, which will make it that much harder for minorities to save adequately for retirement,” the book’s editors write.

Taken altogether, the current situation is deeply wrong. Still, the “Wealth After Work” editors steer clear of calling for radical reform. Instead, they embrace evolutionary change by elucidating the best policy ideas they’ve seen to deal with particular retirement savings problems.

Two proposals worth considering

I think two proposals are especially worth highlighting, since both would broaden access to retirement savings plans.

One is to greatly expand the auto-IRA (individual retirement account) state-sponsored retirement savings plan idea to more workers without employer-sponsored plans. Three states currently offer this type of plan — Oregon, California and Illinois. Many more are considering creating their own version.

“State-sponsored retirement savings plans offer the best chance in the near term to increase the number of Americans with access to payroll deduction retirement savings plans,” write Gale and John in their chapter on the plans. “In the absence of a comprehensive federal program, they could provide the most significant improvement in coverage for many decades.”

OregonSaves, which started in 2017, is a good example of this idea. It’s an automatic-enrollment Roth IRA retirement savings program for private-sector workers in Oregon lacking access to workplace retirement plans.

Don’t miss: Why is it so hard to save for retirement? Is evolution to blame?

Firms in the Beaver State lacking retirement plans are required to enroll their employees in OregonSaves. Every account is tied to the individual — not to their employer — ensuring easy portability when changing jobs. To keep costs down for employers, there is no company match. The default after-tax contribution rate for employees is 5% of gross pay. Workers can opt out if they don’t want to participate (about one-third of eligible workers opt out).

A complementary approach is targeted at contingent workers. Here, the basic idea is to create “employer-facilitated” accounts where contingent workers would have a retirement savings account that travels with them from job to job. Employers would be required to provide contingent workers with the ability to make payroll-deduction contributions to their accounts (and withhold state and federal taxes).

The version the authors seem to favor would have such an account conform to the employer’s plan (if offered). In other words, if a contingent worker gets a job at a company with a 401(k), the account would be subject to its 401(k) rules. If a firm doesn’t have a retirement benefit, the contingent worker account would be treated as a payroll-deduction IRA.

Going through the various essays, I couldn’t help but think, “Isn’t it time to just blow up the nation’s retirement savings system and start over?”

Certainly, that’s what Martin Wolf, the estimable chief economics commentator at The Financial Times, believes. “The old is dying. But the new is miserable,” he writes, adding that “policy makers must first dare to think more boldly.” (His series of Financial Times essays is focused on the British pension system, but his analysis and suggestions apply to the U.S.)

Like so much in the American economy and society, retirement policies end up reinforcing inequities rather than combating them.

America vs. other countries

Frustrated, I called up Kurt Winkelmann, a senior fellow at the Heller-Hurwitz Institute at the University of Minnesota and co-founder of the investment research firm Navega Strategies. He noted that any broad-based solution has to take into account that we live in the U.S.

“We don’t live in Canada or the Netherlands — countries with a more communitarian spirit,” he told me. “Any pension change has to respect that.”

I get it. History matters. So do institutions and political cultures. Still, the lure of sweeping, impatient reform is strong.

In another interview, with Zvi Bodie, a financial economist and professor emeritus at Boston University, he suggested a time-tested possible solution: Put everyone into something like the traditional TIAA variable annuity founded in 1918 by the Carnegie Foundation for teachers. (TIAA stands for Teachers Insurance and Annuity Association).

Participants in the fund are guaranteed at least 3% a year on their money; they can earn more if the vast portfolio does better.

Another similar universal-retirement option favored by seemingly strange bedfellows — New School for Social Research liberal economics professor Theresa Ghilarducci (a Next Avenue Influencer in Aging) and Kevin Hassett, chairman of the Council of Economic Advisers under President Donald Trump — is to put everyone into the federal government’s giant low-cost Thrift Savings Plan.

Put it this way: People with retirement savings have more choice in their elder years and less need for government services during them. Offering low-cost, broad-based, simple-to-understand retirement savings plans for all workers should be the kind of deal liberals, conservatives and independents alike would race to embrace.

See: I’m 66, get $26,300 a year in Social Security and want to live in a small city by the ocean — so where should I retire?

When (if?) you finally retire, it isn’t too much to expect that your standard of living won’t drop sharply. If turning that insight into a retirement savings plan system is a radical goal, let the revolution begin.

Chris Farrell is senior economics contributor for American Public Media’s Marketplace. An award-winning journalist, he is author of “Purpose and a Paycheck: Finding Meaning, Money and Happiness in the Second Half of Life” and “Unretirement: How Baby Boomers Are Changing the Way We Think About Work, Community, and The Good Life.”

This article is reprinted by permission from NextAvenue.org, © 2021 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

0 notes

Text

Huge selection Building With Real Estate

When it comes to saving for retirement, expenditure of money advisors generally recommend that one contribute regularly to an Man or women Retirement Account (IRA) or a company 401(k) plan. Reliable growth can be achieved, they suggest, by diversifying one's account with a mix of stocks and bonds. Rarely, however , perform they recommend adding real estate to the investment portfolio. Through neglecting to invest in whistler grand condo, one could be missing out on the many many benefits afforded by this asset class. Advisors and purchasers may shy away from this investment for many reasons. Experts might avoid it possibility because they are not licensed selling it. Thus, they have no incentive to decrease the amount of money they have under management. Also, investors often avoid real residence because often they don't understand it. Even if they achieve, they don't feel that they have enough capital to make an initial investment decision. But if they became better educated in the benefits of properties, they would find that it offers some advantages not seen in other sorts of investments. Often , advisors recommend utilizing investments such as common funds to achieve risk-adjusted, long-term appreciation when saving pertaining to retirement. By utilizing qualified retirement vehicles such as an IRA or 401(k) accounts, investors can often receive a tax reduction to offset income, reducing their current tax bill. Some might also use Roth accounts to forego the upfront tax deduction enabling them to receive retirement account distributions tax free. Real estate may also provide long-term appreciation, because seen in stock and bond mutual funds. In addition to attaining up-front tax advantages just as qualified plans do, realty investments may add other tax advantages when the real estate is liquidated. Many might be surprised to learn that during the last ten years, despite the "real estate meltdown, " real estate deals have outperformed the Standard and Poor's 500 stock market list by a wide margin. As of May 2011, data supplied in the Standard and Poor's Case Shiller index (CS) showed that real estate prices, based on a 10-region upvc composite, advanced 30. 1% over the latest ten year stage. During that same time the Standard and Poor's 500 (S&P500) stock market index advanced just 7. 1%. This is even when over the past two years, stock prices nearly doubled off of most of the March 2009 lows. During this same period, bond and also commodity prices have also moved dramatically higher, causing a large number of to worry about future market corrections. Only real estate rates have not performed and remain 32% below than his or her peak. The S&P 500 was just 13% as a result of its all-time high based on May data. This is a worth that an investor might look upon as a good occasion based on current prices. Both qualified retirement plan many benefits and real estate investments offer tax incentives. When one particular contributes to a qualified retirement plan, the investor can normally deduct the contribution from gross income, reducing the tax liability. Real estate, even when purchased outside of a qualified plan, offers you tax deductions, sometimes as great as a qualified prepare contribution. Individuals who own their own home can deduct property loan interest and property taxes paid if they itemize the tax deductions. If they don't itemize, they can still deduct their property taxes to receive some tax relief. Investors what person purchase real estate investment property do even better. In addition to the mortgage plus property tax deduction that home owners receive, real estate buyers also receive deductions for property maintenance and accounting allowance. If this investor is not generating positive cash flow within the property and the investor has an income of less than $100, 000, he or she can write off up to $25, 000 just for losses against their gross income. A residential real estate even receives a special capital gains tax exemption not wanted to other investments. If one had lived in the home in the form of primary residence for two of the previous five years, your specific is allowed a capital gains exemption of $250, 000. This amounts to a $37, 500 tax discounts based on the current 15% Long Term Capital Gain tax quote. Not so with distributions taken from a qualified plan. These are taxed as ordinary income, at your highest tax rate. Should the investor owned a primary residence along with a rental building, the investor could sell the primary residence at type of pension, take the capital gain, and move into the rental. Typically the tax-free distributions from the liquidation of the primary residence could possibly be used to pay off any remaining mortgage on the rental place and provide extra funds for retirement expenses. Real estate presents many positive benefits that may be important to a person planning for golden age. Like stocks and mutual funds, real estate has the future to appreciate, preserving purchasing power. Adding real estate to the holdings increases diversification and reduces overall portfolio chances helping to ensure a financially successful retirement. Residential as well as investment real estate often provide tax benefits not seen in other retirement investments.

0 notes

Text

Every Investment Decision You Make Is Market Timing

One of the things I’m fascinated about is why some people get upset with what other people do with their money. Every time I write in my newsletter that I’ve decided to increase or decrease risk with my investments, someone gets hot and bothered!

What someone does with their money has no bearing on what happens with your money. You have the freedom to make one giant paper money statue and light it on fire if you wish.

I choose to consciously have a purpose for all of my investments. Otherwise, there’s no point to saving and investing so much all these years.

Let me go through some examples of market timing everybody makes, but somehow don’t get recognized.

10 Examples Of Market Timing

1) Front loading your 401(k) and other pre-tax retirement accounts. If you are lucky to receive a bonus or have enough cash flow during the beginning of the year, it’s commonplace to max out your 401(k), IRA, HSA, Solo 401(k), Roth IRA, or whichever tax-advantageous retirement account you have.

People like to get these accounts out of the way, just like how people like to pay themselves first with each paycheck. How and how much you get paid results in market timing.

2) Deciding when to use your 529 plan. You may spend 18 years contributing to a 529 plan for tax-deferred compounding until your kid decides to go to college. Whether you use the funds at age 18, 19, 20, 21, or 22, that’s up to you. You might even decide to sell some stock to pay for private grade school since that’s a new rule.

But what if your child decides to defer college or take six years to graduate? What if your child decides never to go to college? Ah, market timing.

3) Deciding to take distributions from your 401(k). You can take penalty-free distributions from your 401(k) after age 59.5. Once you start withdrawing, you can stop and start again innumerable times until age 70.5. Once you’re 70.5, you must withdraw a specific portion, the Required Minimum Distribution, from your nest egg each year.

Because you are in great health and don’t need your 401(k) funds given your large after-tax portfolio, you decide to wait until you’re forced to take RMDs at 70.5. Your good genetics and financial preparation results in market timing.

4) Deciding to de-risk your House Fund. If you’re planning on buying a house within the next 6-12 months, you should probably keep your House Fund in 100% cash or short-term Treasuries. You don’t know exactly when the perfect house will come along. Even if you find the perfect house, you might not win the house because your offer isn’t competitive enough.

Let’s say you get a surprise promotion at work. This promotion gives you the confidence to finally buy a primary residence. As a result, you decide to de-risk your House Fund into 3-month Treasuries and aggressively start looking for a dream home. Your promotion made you time the market.

Related: How To Invest Your Downpayment Depending On Your Time Frame

5) Deciding to invest 100% of your severance check in the stock market. Getting a severance check is a nice windfall, especially if you had planned to quit your job anyway with nothing. But who knows exactly when you will be able to successfully negotiate a severance?

Management might suddenly offer up severance packages one year due to a restructuring. Or you might get sick and tired of your boss another year and want to leave. Whenever you do negotiate a severance and invest it all in the market, that’s market timing.

6) Deciding to sell your rental property because your tenants moved out. You might have had a great 12-year run as a landlord, but couldn’t find replacement tenants at the same rent. With the desire to simplify life, you put your house on the market and discover its worth 70% more than you bought it for. Therefore, you decide to take advantage.

If your tenants hadn’t moved out, you wouldn’t have been able to remove them even if you had wanted to due to strong tenant rights laws in your city. Your tenant’s decision to move out due to a new job opportunity is market timing.

Related: Why I Sold My Rental Home: Had To Live For Today

7) Deciding to reinvest your house sale proceeds in a diversified real estate portfolio. After riding one concentrated position up 70% with leverage, you decide it’s best to diversify your real estate holdings by investing outside of your expensive coastal city.

As a result, you invest in several commercial real estate properties in Austin, Texas where cap rates are 5X higher. Not only are you earning a higher return, but you’re also earning it passively.

Related: Focus On Long-Term Trends: Why I’m Investing In The Heartland Of America

8) Deciding to buy a new primary residence five years later. Your commercial real estate investments in Texas pay out five years later with a 12% IRR.

Since the initial investment, you and your partner had a baby and decide it’d be nice to move out of your tight two bedroom apartment to a three bedroom house with a backyard. You didn’t plan to have a baby, but here he is! You use the proceeds from the Texas properties to buy a nice house.

The unwinding of your commercial real estate portfolio and the arrival of your baby is market timing.

9) Deciding to stop work to take care of your baby. After going back to work after three months of parental leave, you feel terrible dropping off your baby at a daycare center. As a result, you decide to stop work until your boy goes to preschool at 3.5 years old.

Your partner still works a stable job, but due to the loss of your income, you decide to sell some stocks to pay for general living expenses. Your guilt about leaving your baby in the hands of strangers results in market timing.

Related: Career Or Family? You Only Need To Sacrifice For 5 Years At Most

10) Deciding to cash out of your IPO proceeds. Your partner’s company successfully IPOs after she worked there for six years. Her stock options are worth $1.5 million and she also wants to stay home and raise her boy as well.

Once the lockup period is over, she decides to sell 80% of her stock and diversify her net worth into index funds, REITs, municipal bonds, and short-term Treasuries. At one point, her net worth was comprised of 90% company stock.

The CEO’s decision to sell a piece of his company to public retail investors results in market timing for you.

Related: Career Advice For Startup Employees: Sleep With One Eye Open

Market Timing Is Life

Don’t be naive. Every decision you make is market timing. Life is an unpredictable journey.

At the very least, everyone should save and invest as much as they can when they can. Have financial fire power to withstand anything life throws at you.

Every dollar you save should have a purpose. Don’t just think the main purpose for all your saving and investing is to live a comfortable retirement. That’s too amorphous a goal.

Have specific purposes for your investments, such as buying a house, paying for your kid’s tuition, remodeling your home, taking care of your parents and so forth.

In addition to making sure your money has a purpose, practice taking profits for a better life. If you do, ironically, you’ll still likely end up with more than you’ll ever need because you’ll have been so focused on accumulating and optimizing your investments.

Don’t let what other people do with their money affect how you feel and do with your money. You must focus on your own financial mission.

We are not gods. We do not know the future, nor will we live forever. The person who dies with too much loses.

My financial path is completely different from yours. So are my needs and desires. I will continue to make financial decisions that best fit my family’s needs. So should you.

Related:

Various Portfolio Compositions To Consider In Work And Retirement

A Different Dollar Cost Averaging Strategy

Readers, why do people get upset at what other people do with their finances? Why do we blame people for market timing, when our entire lives are unpredictable?

The post Every Investment Decision You Make Is Market Timing appeared first on Financial Samurai.

from https://www.financialsamurai.com/every-investment-decision-is-market-timing/

0 notes

Text

Step by step instructions to Build Wealth At Every Age: 6 Tips From Your Waco Bank

As indicated by the New York Times, most moguls don't become tycoons until they're in their fifties (demonstrating that unwavering mindsets always win in the end!) At various phases of your life, there are steps you can take to improve your monetary future and increment your abundance over the long haul.

TFNB Your Bank for Life has helped a huge number of Central Texans construct their savings. Here are some no-bomb tips on building abundance at whatever stage in life.

20s: Pay Yourself First and Start Investing

Pay Yourself First

Paying yourself first methods designating a repetitive measure of your check toward your reserve funds. This procedure advances predictable reserve funds and objective setting. What amount of cash would you like to have saved in a year? Five years? 10 years? These inquiries can assist you with deciding the perfect add up to be saving each opportunity your check comes in.

Paying yourself is the main propensity you can create. It permits you to see the drawn out advantages of your cash and causes you dodge a check to-check way of life.

At the point when you're simply beginning, think about a 50/30/20 financial plan: allot half of your month to month pay toward fundamental costs and 30% toward needs, ensuring you contribute in any event 20% toward saving (or paying yourself). Where would it be advisable for you to save that 20%? That takes us to our next point.

Begin Investing

Your twenties are an ideal opportunity to add to a speculation portfolio that will keep on bringing in cash as you go through adulthood. We know, we know: you're simply beginning your expert life! Be that as it may, trust us — it's never too soon to begin pondering retirement.

Consider saving to a 401(k) account or a Roth IRA. These are the two sorts of retirement accounts that contrast in the manner they are burdened. In the event that your boss offers any choices for coordinating with 401(k) commitments, make certain to save enough to augment those commitments (it's free cash for your future). For an IRA in Waco, (or an "Singular Retirement Account") visit TFNB. Our group can walk you through an investment funds system that works with your pay and way of life.

Just as a retirement account, consider setting aside cash in a to some degree forceful shared asset or file store. These assets incorporate a huge number of various stocks and are overseen via prepared financial backers.

While the stocks, securities, and different resources in these finances convey a smidgen more danger, they additionally can possibly develop your speculation more. As a youthful expert, higher danger for higher prize could be advantageous for your drawn out riches.

30s: Utilize Multiple Sources of Income and Remove Debt From Your Life

Various Sources of Income

Welcome to your 30s! You might be pondering purchasing a home, having children, and putting something aside for school, however there's still chances to develop your riches.

At this point you have a smidgen more vocation experience. Your work is likely your principle kind of revenue. It ought to give the main part of the cash you'll use to produce abundance after some time. Be that as it may, you can do yourself an extraordinary assistance by producing numerous kinds of revenue, making more pay while bringing down your danger. With numerous types of revenue, on the off chance that you lose your employment you actually have different activities to count on while you look for a new position.

In his investigation of how well off people deal with their funds, Tom Corley tracked down that most independent moguls created their pay from numerous sources. Corley noticed that:

65% had three surges of pay

45% had four floods of pay

29% had at least five floods of pay

On the off chance that you will likely produce abundance, taking a gander at the manner in which well off individuals have dealt with their pay is a decent spot to begin. Corley's information shows that numerous floods of pay are useful, if not fundamental, to collecting abundance over the long haul.

In any case, HOW CAN I GAIN INCOME OUTSIDE OF MY CURRENT JOB?

On the off chance that you have a pastime or ability you're energetic about, check whether you can benefit off of it! A side business that permits you to seek after your interests while making some additional money is an extraordinary utilization of your time and assets.

In the event that you are tricky or imaginative, internet business monsters like Etsy and Amazon simplify it to sell shirts, welcoming cards, gems, and any kind of item to individuals around the country. Or on the other hand, utilize your extraordinary ability to talk with other people who could utilize your ability.

Land is another mainstream field for individuals to expand their pay. Think about purchasing an investment property or working an Airbnb/Vrbo posting. In our current "gig" economy, the choices are interminable for beginning that next side hustle.

Eliminate Debt From Your Life

You probably have obligation in some structure or design. Understudy loans, Visas, doctor's visit expenses, and even home loans can keep you away from building riches.

(In the event that you've aggregated obligation over your lifetime, realize that you're in good company. As per a report from CNBC, the normal American has more than $90,000 owing debtors, with Gen X driving the route with a normal of $135,841 under water.)

This is the ideal opportunity to set up an arrangement to eliminate obligation so you can pay yourself more.

Planning is the initial step. Be brilliant about what you purchase. Recollect the 50/30/20 planning framework? While you're in the obligation expulsion stage, you might need to designate some cash from the needs class toward taking care of obligations also. You can't start to produce genuine abundance until you wipe out however much obligation as could be expected.

However, which obligations should I take care of first?The popular monetary consultant Dave Ramsey suggests a strategy he calls the "Obligation Snowball." With this technique, Ramsey proposes making a rundown of every one of your obligations from the littlest to the biggest. At that point, center your endeavors around taking care of the littlest obligation rapidly while making the base installment on the remainder of your obligations. With time, you'll knock off the obligations individually, opening up more funding to take care of your different obligations as you wipe out every obligation individually.

Settling on great buying choices is critical to taking care of obligation. Regardless of whether you went through more cash than you had accessible before in your life, this is the ideal opportunity to change those practices. Go through cash admirably on things that you need and save the "needs" for uncommon events.

40s and 50s: Revisit Your Portfolio Yearly and Consider Refinancing Your Mortgage

Return to Your Portfolio Yearly

It's not difficult to set up your retirement venture portfolio and afterward go into autopilot. Also, partially that is something to be thankful for — your cash ought to be working for you, not needing your ordinary consideration. Yet, it's essential to return to your portfolio every year to break down the thing is working and what isn't.

To oversee hazard, you should concoct an equilibrium of stocks to bonds that you are alright with.

Stocks offer higher danger with the chance for more prize, while bonds are a less unstable choice that is for the most part seen as more protected. Let's assume you're alright with a proportion of 80% stocks to 20% bonds in your speculations. Following a year, your stocks have likely acquired an incentive than your bonds. Your new proportion may have changed to 82% stocks to 18% bonds, which means you are currently facing more challenge than you had arranged.

Rebalancing your portfolio can help you ensure you are contributing with a danger sum you are OK with. Returning to your portfolio likewise permits you to examine which stocks or speculations you are not happy with. You can sell those and put resources into something different, set aside the cash, or even use it to take care of obligation.

Think about Refinancing Your Mortgage

In the event that you haven't assessed your home loan in the previous few years, presently is an incredible opportunity to renegotiate. At the point when you renegotiate a home loan, you're searching for a lower financing cost. In the event that your credit has improved since you last renegotiated, this can be incredible for your drawn out abundance the board. Loan fees are at memorable lows.

Most specialists concur: renegotiating is a smart thought in the event that you can save at any rate 0.5 to .075% thusly.

Be that as it may, before you renegotiate, contrast any future investment funds and the current expenses to renegotiate. Shutting costs are normally 2% to 5% of the credit's chief sum. Assuming you acquire $200,000 and shutting costs are 2%, you would owe $4,000 at shutting.

While that is a ton of cash, the drawn out reserve funds from renegotiating might be well great. To sort out what amount of time it will require to make back the initial investment from your renegotiating costs, partition your end costs by the sum you will save every month. This can help you better comprehend the genuine benefit of renegotiating.

In case you're thinking about renegotiating your home loan, converse with our group at TFNB. Our home loan moneylenders can assist you with comprehension if renegotiating is a decent move for you and help get you the best rate.

Capable Wealth Management with TFNB, Your Waco Bank forever

TFNB is here to assist you with dealing with your abundance at whatever stage in life — that is the reason we're Your Bank For Life. Regardless of whether you're moving on from school or are anticipating retirement in only a couple years, come converse with us. As a neighborhood bank, we need to become acquainted with you and your objectives — not simply talk dollars and pennies.

0 notes

Text

What is Net Worth? How to Calculate Your Net Worth?

Do you know your net worth? If you don’t, you should.

I’m not sure why speaking money and investments is a taboo in my circle. People like to have fun and when you want to have a serious conversation in between, that never happens. Only one in 10 of my friends would be interested in talking money and investment. Your circle could be different than mine.

I read in the internet that only 5% of people know their net worth, which means my friend circle knowing their net worth is twice as much. That boils me to the core but hey, not a lot of people are genuinely interested in money, investment or planning for retirement.

Whenever someone tells me that they have no idea how much debt they have, how much money they have saved, what their assets are worth, I can’t help but tell them how maintaining them in a simple spreadsheet has greatly improved my life. Obviously, they ignore my boring advice. What did you expect? 😀

What becomes more shocking is that, when I ask them to take a guesstimate of their net worth, they just throw me a blank face and say they have no clue whatsoever about what the amount would be. Or, they playfully quote something that doesn’t make any sense, just for humor.

This is something that definitely needs to change.

Net worth is a very important measure of your financial situation, and it is something you should be aware of.

Why Know your Net Worth?

There are many positives to being aware of your financial situation and net worth, such as:

Manage your money better If you know what your net worth is and you track it every month, you might become more careful about where you spend excessively and other financial decisions, such as with keeping a budget. If you have a negative net worth, then your best goal is to become debt free as soon as possible. If it’s not as high as you hope, then you will start taking progressive steps to achieve the level you want.

Stress on Liabilities Many people only think about how their assets are performing but never think about liabilties. Net worth gives them a chance to increase their vision on liabilities and truly understand the complete picture. You might be thinking you’re well but you could be surprised. Try to cut your liabilities quickly on depreciating assets and high interest debt

Knowing your net worth stops you from cheating yourself You might be cheating yourself by taking impulsive decision not knowing how much it sets you back. But now, since you know your net worth, you know the consequence of your bad decisions. Possibility of reducing them is high.

Making passive retirement progress When you track your net worth, you might be making retirement progress passively without any additional effort. When you save more, little drops make up an ocean.

Net worth is a great measurement of how you are doing financially. At the least, know your ball park range of net worth where you stand.

How to calculate your net worth

Thankfully, calculating is not a rocket science. It’s just a simple math and read more to accurately estimate your net worth. You can calculate your net worth by using the following simple steps

1. Get an understanding of net worth

Before we get to the actual simple math, you need to understand two simple concepts. Assets and Liabilities.

Asset

An asset is anything that contains economic value with or without future benefit

An asset can often generate cash flows in the future, such as a piece of machinery, a financial stock or bond, music album or a patent.

Liability

A liability is something a person or company owes, usually a sum of money or security.

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services

Liability is an obligation between one party and another not yet completed or paid for

Now that we know the difference between asset and liability, let’s go on our journey to find our net worth.

In most cases, your net worth is simple subtraction: your assets minus your liabilities.

To determine your number, you’ll need to start by coming up with lists of your assets and liabilities.

If you don’t want to go through the hassle, try to engage a no-commission financial advisor, who puts your best interest rather than their commission. They generally charge a consultation fee and never have any affiliate products and push you through them.

2. Cover all your assets

To take an extensive inventory of your assets, think hard and make sure you include everything in your portfolio that has value. Don’t forget about retirement savings acounts (like Roth IRAs or 401(k)s) and investments.

You can include physical items like your car, even if it is has a loan on it. In this case, you will add the value of the car to asset and the loan towards liabilties

Fun Fact : I have 92 different assets, that I track every month, on my spreadsheet

Just waiting for the month when I can expand my assets column to 3 digits. I will fist pump in air and celebrate alone in Covid-19 time and then get back to thinking how I can expand this further next month.

3. Note down your liabilities

It’s time to move on to liabilities. Start writing down everything you owe money on, from credit card balances to loans. Many people make a mistake by adding their routine monthly expenses into liability. Please do not. Expense != (not equal to) Liability .

If you have a lot of different debt and it becomes unmanageable, consider taking out a debt consolidation loan to simplify your payments and save big on interest.

4. Do the math

Take a final look at all your asset and liabilities and see if you missed anything. Once you finish this, it’s time to do the math.

Now that you’ve taken stock of your assets and liabilities, add up each category. Then, subtract the total liabilities from the total assets. This will leave you with your current net worth. It’s that simple.

Just to help you with an example, Nick has savings of $10K, investments of $100K and a beautiful sedan worth $20K. Total assets Nick owns is $130K.

Let’s assume he also has a credit card balance of $3K and a student loan of $47K which makes his total liabilities amount to $50K.

So, Nick’s net worth is $130K (assets) minus $50K (liabilities), which equals $80K. Nick has a total of $80K to his name.

5. Ponder how to increase your net worth

Now that you’re done with the difficult math (just kidding), it is time to think how you can improve it next month and see your overall financial health making some progress.

Concentrate more on attacking liabilities. Consolidate or pay debts if you can afford quickly. Bolster your assets by diversifying and investing in Crypto, real estate, stocks and so on.

Aim for the sky. There’s Bezos at the top with $186B, according to Bloomberg billionaire index

Can Net Worth Be Negative?

So, if you have $50K in assets and $50K in liabilities, that means you have nada or zilch ($0).

If you have $50K in assets and $100K in liabilities, that means that you have no wealth and your NW is -$50K. Yes, you can definitely have a negative NW, if you have more liabilities than your assets.

If you have it negative, make sure you put active effort into becoming debt free as soon as possible. Debt keeps up at night and has a negative effect on mental health too.

How often should you calculate your net worth?

I always look at my net worth when the month begins for the previous month. I feel doing it monthly is the best cadence to check how your net worth has changed. You can look at your budget, expenses and net worth at the same time, which will help you see what you need to improve on and change.

There might be huge fluctuations between months if you invest in Cryptocurrency or Stock market might swing heavily up and down or your home values change drastically, or your car value dropped at the beginning of a new year. So don’t be worried by small month on month movements. Have a net worth goal for the year and achieve it at the end of the year, Net worth is a great measure of personal wealth and I highly recommend to keep track of it.

How to increase your wealth fast?

Whatever is your level of assets and liabilities, you still need to think on how to grow the assets. If the NW is negative, first concentrate on getting it on the positive side, by paying off the debt quickly. You should hate debt to the core to do it.

To increase your net worth fast, there are many things you could do

Find ways to make more money

Pay off debt

Cut your budget

Invest your money

Save more money

Let me know in comments what strategy you used to grow your net worth fast!

The post What is Net Worth? How to Calculate Your Net Worth? appeared first on Crypto and FIRE.

from WordPress https://ift.tt/3hqKFos via IFTTT

0 notes

Text

How Does a ROTH IRA Work?

Recently I opened this email from a reader:

Hi Peach,

I need advice on a 401(k) that my husband rolled over to a ROTH IRA. He rolled it over almost 2 years ago and it hasn’t grown, but cents. Unfortunately, we haven’t contributed to it, but really want to start doing that. I just want to make sure that the ROTH IRA is the direction to go with a retirement account. Seems like it should have grown a little, even without us contributing to it. School me…I’m lost!

Thank-you,

Brandi

Before I jump into a ROTH IRA, it would be best if we understand how and why retirement investing works.

A 401(k), 403(b), 457, IRA, ROTH IRA, and a SEP IRA are all a bunch of confusing numbers and letters smashed against each other in an effort to confuse and eventually scare the crap out people when it comes to investing for retirement.

Well, maybe that is a stretch. Truthfully, the numbers and letters are simply where they are located inside the Federal Tax Code.

Example: The rules for a 401(k) are found inside the IRS’s tax code – Section 401 subsection K.

Why We Have Retirement Accounts?

Retirement accounts are a benefit for you and I because it creates a way for us to avoid sending even more money to the government in the form of taxes. Thus, you may have heard retirement accounts referred to as tax sheltered accounts because that’s exactly what they do; they shelter your money from the IRS.

How Do We Avoid Paying Taxes on This Money?

When we save outside of a tax-sheltered account, we are taxed on the money before we ever invest it in the form of income tax. Then when we invest and our money grows, we pay a 15% (20% for high income earners) tax called capital gains tax whenever we sell the investment. However, when you invest inside a retirement account, you avoid this tax in a few different ways 🙂

Pre-Tax Retirement Investing

Pre-tax simply means the money you invest into your retirement account is not (yet) taxed. Instead, the money you send to your 401(k), 403(b), 457, is taken from your paycheck before the money is ever taxed . In addition to the pre-tax, the money inside your account grows tax-free over time. The only time you pay taxes on a pre-tax account is when you withdraw the money in retirement (age 59 1/2 ). As of right now, the amount of money you withdraw at retirement is taxed as ordinary income.

Note** If you don’t work for an employer who offers a 401(k) plan OR you are self-employed, you can still take advantage of this pre-tax retirement investing. Instead of the money coming out of your paycheck pre-tax you would simply deduct the amount you invested throughout the year when you file your taxes in the Spring. This type of account is called a traditional IRA (Individual Retirement Arrangement).

What About the ROTH IRA?

In 1997, William Roth, a U.S. Senator from Delaware, helped put the ROTH IRA into law. Remember this man’s name, because he is going to help you build a boat load of tax-free wealth over time!

The ROTH IRA is different than all other retirement accounts because instead of investing your pre-tax dollars, you are instead investing after-tax dollars.

Just like the pre-tax accounts, the money still grows inside tax-free, meaning you no longer pay capital gains tax. However, in retirement you can withdraw the money WITHOUT PAYING TAXES!

Example: You get paid on Friday. Saturday morning you go online and send your AFTER-TAX dollars into the ROTH IRA. Over time the money grows inside the ROTH IRA via stocks, bonds, mutual funds, certificate of deposits, etc., and when you withdraw the money, you don’t pay taxes.

Why Does the Government Give Me a Tax Break?

Great question! When you are investing into retirement accounts, you usually will have to wait until you are age 59 ½ before you can withdraw the money. If you do so before this age, you will pay taxes on this money AND a 10% early withdrawal penalty.

My Opinion: The only reason to pay the penalty would be to avoid a bankruptcy. Otherwise, leave the money alone! The more money you have in there, the more your money will go to work for you to build substantial wealth. As soon as you withdraw a portion of the investment, you would pay a penalty AND your money stops working for you.

Since the government can count on your money being left alone until you are of age (or they can count on your 10% penalty), in return they give you a nice little tax break.

The ROTH IRA Rules

Here’s exactly how a ROTH IRA works.

How Much Can I Invest Into It?

$6,000/year per person in 2020 with an additional $1,000/year if you are age 50 or older.

After-Tax or Pre-Tax Dollars?

After-tax dollars only.

Income Limitations?

Yes.

In 2020 single filers begin to phase out at $124,000 and then are ineligible for a ROTH IRA at $139,000.

In 2020 married filers begin to phase out at $196,000 and then are ineligible for a ROTH IRA at $206,000.

**Note: If you are outside the income limitations for a ROTH, you can back door your way into a ROTH IRA by converting a Traditional IRA to a ROTH IRA after paying taxes on it. I highly recommend this, but please contact your tax professional before you get started.

When Can You Invest Into a ROTH IRA?

You can invest all the way up until April 15th, 2021 for the 2020 tax year.

Do I Have to Have an Income?

Yes and No.

You must have an earned income to invest money into a ROTH IRA, and if your income is below the contribution limits, then you can only invest up to what you earned within the year. This means if you earned $4,000 in 2020, you would only be able to invest $4,000 instead of the $6,000 contribution limit.

**HOWEVER, A NON-WORKING SPOUSE CAN ALSO OPEN A ROTH IRA.

First off, let me rephrase this by stating there is no such thing as a non-working spouse. I have been home with my kids a few too many times when my wife is at work and it is way more work than actually going to work.

These types of ROTH IRAs are also referred to as Spousal IRAs, and the same rules apply. This means together, you and your spouse can invest up to $12,000 per year ($14,000 age 50 or older), even if only one of you have an earned income.

Can I Contribute If I Have a Retirement Account at Work?

Yes.

What About Mandatory Withdrawals at Age 70 ½ ?

No.

The government cannot collect taxes when you cash out on your ROTH IRA, so they don’t force you to withdraw from it when you are age 70 ½.

This is one of the BEST things about a ROTH IRA and is one of the main differences from pre-tax retirement accounts where you are forced to withdraw your money (so the government can start to collect taxes on that money).

What If I Don’t Need the Money Inside my ROTH IRA?

If you don’t need the money from a ROTH IRA, you can leave your tax-free money inside the ROTH for as long as you live. You can also leave your ROTH IRA to a beneficiary, and they can stretch this tax-free money over their lifetime. This is a fantastic bonus for future generations.

When and How Can I Withdraw From the ROTH IRA?

If you are OVER age 59 ½ , you can withdraw as much as you would like, tax-free, so long as your ROTH IRA has been open for at least 5 years.

Example: If you opened your ROTH at age 60, you wouldn’t be able to withdraw from it until age 65, or you would pay a 10% penalty.

If you are UNDER age 59 ½ , you can only withdraw the amount you have contributed (not the growth portion) without paying a penalty.

BONUS: If you have had the ROTH open for at least 5 years, you can withdraw from the account penalty-free (but not tax-free) for the following expenses:

First time home purchase up to $10,000 per account for you, your children, or your grandchildren.

For College expenses for you, your children, or your grandchildren. This can be a little tricky and you should contact your tax professional before starting this process. A 529 Plan is a much better option for this.

Back to the Brandi’s Email

Here is the answer to Brandi’s question:

Hi Brandi,

Your ROTH IRA is not actually the investment. It is the tax-advantaged bucket that holds your investment inside it to protect your money from taxes. If your ROTH IRA is performing badly, which it sounds like it definitely is, your ROTH IRA is not to blame. Instead, you should be looking at what is INSIDE your ROTH IRA.

Thanks for the question,

-Chris Petrie

In a Nutshell…

For those of you who skipped to the bottom (you should really go back to the top), here is the ROTH IRA breakdown:

After-tax contributions up to $6,000/year per person ($7,000 if over age 50) in 2020

Tax-free growth for the investment inside the ROTH IRA

Tax-free withdrawals at age 59 ½ (or for qualified withdrawals – see above)

Where Can I Open My ROTH IRA?

You can really open a ROTH IRA anywhere. Almost all investment companies, banks, and financial advisors offer ROTH IRA accounts.

Here are the questions I would be asking:

Is there a fee to open the ROTH IRA?