#and has enough connections that she can afford to be dealing-to-all-parties neutral because killing her would piss off Everyone Else

Explore tagged Tumblr posts

Note

Asks for the Random Character Asks

Marigold: 12, 13, 15

(for this ask game)

12. Crack headcanon

The reason she has so many flowers in her mane is because she fucked up with a transmutation early on and rooted them in there and her mentor Didn't Help At All so now they're just stuck in there as a permanent part of her body.

15. Worst thing they've ever done

As previously mentioned, "worst thing they've ever done" is ridiculously hard to define and extremely subjective at best. For Marigold specifically, it's even harder to define than most. She... doesn't do really things directly, after all.

She's a catalyst, and though she acts to make the situation immediately worse, she generally has little interference beyond that. She's an observer, not a direct actor, she's an alchemist, not a poison-brewer - part of what makes her so difficult to pin down and immune to consequence is that unless it's to gather test subjects for raw field data, she's almost certainly just... not acting directly. There's a medium. An in-between. A client, somewhere along the line, asking for her charms.

Though the "what they would think of when asked the question" question might work under normal circumstances, Marigold is an exception to the rule - as previously mentioned, she would not personally consider any of her actions to be immoral. She's done things that weren't amazing, of course, but it's not like she'd consider herself a bad person - just someone with professional pride. You wouldn't expect her to offer a subpar product to a customer, would you?

Beyond that, there's the issue of pinning down a single individual case. Marigold isn't a... "one and done" kind of villain, she gains the sort of status she has from low-profile but consistent evils. She doesn't do anything obvious, she doesn't do anything that can be pinned on her - people disappear, and monsters turn up after, and if they're especially valuable or they survive the period it takes for the transmutation to settle in their bones, she'll trap them somewhere to harvest for more transmutation-fuelling parts later.

That, of course, could be considered a "worst" - but it's still not one single thing you can point to. It's dozens and dozens of things, spread out over years of activity, people who mysteriously vanish off the streets and never turn up again. There is no single monolith of evil that can be pointed to, because Marigold isn't the kind of evil that does big gestures like that. Just... a slow, steady flow of charms into hands that do harm with them, combined with a slow, steady flow of people who leave their homes and don't come back.

...if we had to choose it would probably be something along the lines of experimenting on prisoners provided via negotiations with criminal factions and then bargaining with the factions those prisoners were taken from to sell them back already transmuted into monstrous forms and entirely incapable of resuming their previous lives. She got paid by both sides for it, both for developing specified new strains of transmutative on the prisoners and for returning them to their original faction. The client didn't specify what to do with them after they'd served their purpose, after all.

13. Dumbest thing they’ve ever done

Well! This one's very nearly a Story.

A fun fact about charms: they're not always perfectly consistent, especially if you're making new ones. That's why you test them before applying them to paying customers. That's why you take a constant flow of people unlikely to be missed for experiments. That's why you do experiments in the first place. If something goes wrong, then you need to know what to fix it, and if an unexpected variable throws the experiment-

Well. It could go very, very wrong, or very, very right. But you never turn your back on the experiment. You never assume you know what will happen next until it's good and tested, you never assume things will work out until you're 100% sure, you never assume that nothing can possible go wrong - Marigold knows this, of course, and she acts accordingly. Lab safety is a priority, not an afterthought. When the things you're working with might kill you if it breaks containment, you never leave things up to chance. It's simple safety precautions. Nothing ever up to chance. Nothing ever allowed to fail. And if anything were to fail - well, you being on-hand gives the best possible chance of getting things back under control.

And then, of course, someone comes calling at the door. You're too early into the experiment to excuse watching it as a delay, of course, and you know they know you're home - you mentioned you'd be home just the other day, after all. Reputation is valuable, and the monitoring built into the cage will work just as well, won't it? It might need a few more trials, but you can't really afford to be rude, and you especially can't afford them coming to find you - these parts of your lab are blocked off to guests for a reason, and you can't simply disappear a guest to your house.

Surely, it won't do any harm to leave it for just a few minutes. Surely, it'll mean nothing to leave the transmutation to finish unattended. You return back downstairs not more than five minutes after you left, ready to finish what you started.

The cage is open.

#asks#ask games#ocs#marigold#we speak#she survived ofc but it was very dumb and she nearly died doing it#debatably you could also say “dealing with known moth traffickers” was her dumbest move#or “dealing with people known to stab people in the back”#or a great deal of her criminal dealings actually#but like. this works better because the rarity of her craft means she actually has a decent protective buffer#simply in the fact that she's the only person who can do the job she's doing and it's impossible to Just Replace Her#and has enough connections that she can afford to be dealing-to-all-parties neutral because killing her would piss off Everyone Else#it pays to be the only supplier of a limited resource and it Especially pays when its an artisan thing and can't be competently reproduced#it takes years of apprenticeship to make a charmsmith and even that won't guarantee the same specialty#marigold herself couldn't make her old mentor's works if she tried simply because inanimate transmutation doesn't click with her#and her former apprentice's area of specialty with medical charmcraft doesn't overlap much with either of them#anyways. very normal moth. she is morally grounded and normal.#every time we say anything about marigold assume it can be summed up with “yea its fucked up”#shes very. fine

4 notes

·

View notes

Photo

profile:

name: bambi francesco - not his birth name, but changed at the age of 19; means "free little child"

age: 26

sexuality: private

social media (personal): @binifrancesco (work): @freelittledeer

history:

a very modest upbringing; no wealth in his family, his fortunes are all self-made

has a family he doesn’t keep in touch with (mom, dad, and older brother); passion has always been in dancing but when it started heading down a more shameful road he cut them off to spare them from being associated with him

lived alone since he was nineteen, soon after picking up work in a strip club; made enough money to survive, but wanted more and pursued higher class clubs until he was in with the elite by the age of twenty-one

after seeing the way his clients lived in such high-class luxury, he quickly grew bitter and within months made his first kill; this soon escalated and became increasingly detailed as he began cleaning people of their money in various ways and racking up a huge fortune of his own

currently twenty-six; could easily be part of the elite class but lives a more minimalist lifestyle, allotting most of his acquired fortunes to better causes

personality:

in private life – secretive but not in a suspicious way, prefers to be private and not share much about himself; difficult to approach and rarely opens up but when he does he is very caring and protective, can be playful and mischievous, and loves very, very strongly. most of the time, this is a side not seen. his usual facade in relationships is friendly, easy-going, lighthearted and fun, and he does a good job of acting like a normal guy

in public life – prefers to stay off the radar unless he’s working, in which case he takes centre stage; intensely alluring, provocative and powerful on stage, having no difficulty pulling in clients at work; offstage he plays to the preference of his clients, which is often a soft-spoken, gentle, childlike doll

as a criminal – very righteous, strong sense of justice although it may seem ironic; does not regret the things he does, seeing his actions as justice to the majority that no one else is brave enough to carry out; not ashamed of selling his body to make money, but sees it as something he wins in – if people are dumb enough to pay him so much just for sex, he will gladly take their money and give up an hour of his time

style:

generally prefers to dress simply, in black or white, plain tees, comfy shirts and hoodies; dresses far more risque on stage

no tattoos, only ear piercings; avoids distinguishing markings; signature accessories are rings

social drinker, high alcohol tolerance; regularly smokes weed but not cigarettes/other drugs

preferred method of killing is by knife, second by poison

minutiae:

smokes weed daily

lost his virginity at nineteen

has never been in a romantic relationship or fallen in love

his sexuality is not represented by who he sleeps with

very open to a lot of sexual activities and kinks

never went to university

likes to read a lot, for education and entertainment

plots:

Danger: A client having to work their way out of being Bambi’s next victim (he won’t kill you, I promise)

Curiosity: A friend who can’t help finding out just what Bambi does, secretly following him to work one day and discovering what kind of dancing he actually does. They’re left burdened with the secret; confronting him means admitting to spying on him, but what do you do when you find out your friend is selling himself for money?

Insatiable: A recurring client who hires him every month (or more) to fulfill their needs, possibly leading to a sense of possessiveness and jealousy towards his other clients. (Preferably male)

[TAKEN by Camille] Take me higher: Someone he can party and drink (and smoke weed) with, the key source of his regular social life; possibly someone wealthier who treats him to such things because he can’t afford them himself (at least as far as they know), or someone not-so-wealthy who he treats instead

[Single or multi-person plot] All gone wrong: Open position(s), a meeting with a client gone wrong ending in a kidnapping. Positions available for kidnapper(s) - keeping bambi locked up and possibly torturing him - and rescuer(s) - those who look for and find him - and possibly other kidnapped people!

[TAKEN by Luna] Caught up: An innocent person in the wrong place at the wrong time. Usually Bambi is the one doing the killing, but for once a client tries to kill him; after escaping, [muse] is the first person he sees/who finds him, taking him home after Bambi refuses police involvement or even being taken to the hospital

connections:

++ = good relationship -- = bad relationship +- = neutral/up and down relationship

Kai Aristides (+-) - childhood friend, went their separate ways in high school and didn’t see each other for the past 7 years

Kyra Deveroux (--) - friend of a childhood friend who was killed in a kidnapping situation 10 years ago. Kyra lived while their mutual friend didn’t, and Bambi resents Kyra for this

Alice Kim (++) - friend in the underground scene. Bambi provides test subjects for Alice’s experimental drugs and customers for her regular drugs

Luna Hwang (+-) - a stranger who helped Bambi in a time of great need. Luna found him injured on the street after a meeting with a client went badly wrong for him and took him in

Ingram Hill (+-) - a client who unknowingly hired Bambi thinking he was a girl and got more than he bargained for; thought he was straight but partakes in a secret relationship with Bambi - what happens in the strip club, stays in the strip club

Aloke Kunal (+-) - a client who is also a mafia boss, hires Bambi unknowingly of his secret life as a murderer; (future:) eventually makes him his prized escort and offers him protection of the family

Camille Sparks (++) - a friend in Bambi’s regular life; doesn’t know about his line of work but doesn’t ask too many questions. Cami is the source of most social events he attends; they get together to smoke weed or go out drinking, partying, and just have fun together

Portia Blake Stephens (+-) - someone who kidnaps Bambi, tortures and plans to kill him - until he offers her a deal. he provides the victims for her, she (/they) tortures and kills them; an unlikely and deadly duo

Serenity Reis (+-) - a first-time client at the club who is less interested in Bambi’s services and more interested in the person behind them; unbeknownst to both of them, both are involved in the same dangerous lifestyle behind the scenes but become friends through their public personas, slowly realizing the hidden truth about one another

Jinx Kwon (--) - a mafia boss who kidnaps Bambi for information about a client he has

Maverick Hites (+-) - a regular client who happens to work in the legal sector, which Bambi discovers... and things don’t go over well

Donatella Augustine (++) - one of his closest childhood friends, left behind when he started his new life and accidentally reunited when she stumbles upon him at his work; she spoils him, and she’s one of rare few he’ll let his walls down for

[Left]

Nana Day (+-) - unusual client who hired Bambi to talk rather than have sex. A therapist wanting to learn more about escort life

Jasper Moon (++) - friend of four years, work together as a team. Bambi kills clients, Jasper clears the money off their credit cards

0 notes

Text

It’s Insane not to Buy a Home While You’re Still Young!

If you’re young—under 40 or so—and have been heeding all the personal finance advice spewing forth from some of the most popular columnists and bloggers over the last few years about how owning a home doesn’t make financial sense anymore, I’m afraid you’ve been duped.

Buying a house—especially when you’re younger—is still an incredibly smart decision financial or otherwise. I’m about to explain why, but let me start by saying I do not own a home, so there is no hidden bias in the argument I’m about to make.

Read on to learn why all the smart financial bloggers who tell you it’s better to rent than buy are completely wrong. Hint: It’s in the numbers.

An Expanding Real Estate Bubble

In 2007, the Real Estate Bubble in America had grown to epic proportions. Home prices were out of control, completely unsustainable, and worst of all—few people even knew what a bubble was, let alone that their frenzy to buy a house before they were “priced out of the market forever” was only adding to the massive amounts of pain they were about inflict upon themselves.

There were a few smart financial advisors warning of impending doom, but those folks were just raining on the parade, and few people paid any attention.

Funny enough, it was people in the age range of around 20-25, who understood the same thing these financial advisors did—that doom was on the way. Only we’re from a generation that doesn’t really watch TV, and we weren’t old or wise enough yet to connect our own experiences to the bigger picture.

It was depressing. I was earning more than all of my friends, and there was still no way I could afford to buy a house.

I’d talk to some of my well paid colleagues, and they despaired over the same things. We looked at the situation and said, “Screw it. We’ll never be able to afford it.” So we gave up looking.

What we didn’t know was that giving up was exactly what would save us from financial ruin just a few years later.

The bubble pops, and a new way of life sets in

So it’s 2008 and home prices have started to fall, but they’re still miles away from affordable for me or anyone I know even as my friends and I all continue to earn well above the median wage.

At this point, I’d given up any hope of buying a place and had, instead, found a 5-bedroom house in Portland to rent for $1,200/month and moved my girlfriend and four other friends in.

If I couldn’t buy a place, I was going to live damn cheap! And for the next three years, I did. Turns out, many other people my age across the country were doing the same thing.

We didn’t know at the time our “collective sigh of discontent” as I like to call it was exactly what was driving housing prices down. It was like all the adults had a party, got wasted, made a huge mess and said, “It’s okay, the kids will clean it up in the morning.”

When, instead, we said, “We couldn’t clean this up even if we wanted to,” and that’s when the panic started setting in!

At this point, all the popular personal finance bloggers and television celebrities are wising up and saying, “We’re in a bubble, and the bubble is popping. Buying a house is not a good decision right now.”

They were right. Everyone starts to look a little differently at real estate.

All the personal finance bloggers jump the shark…

For the next four years, young people like me sit on the sidelines and watch as the housing market gets massacred. We wonder if prices will ever stop falling.

Four years ago, all the personal finance bloggers and television celebrities reminded us: “We’re in a bubble, and a bubble does not change the rules of money. Don’t spend too much on a house.”

Yet, now, as we watch prices continue to decline, the same talking heads start to disregard their own advice. They start to question if buying a house is a good idea at all. Maybe we’ve all been duped, and owning a home is just asking for financial ruin.

Articles start to pop up all over the Internet on well-respected sites like Forbes, Time, NYT, and many others with headlines like “Why I Never Want to Own a Home Again.”

They start to argue that houses are poor investments and that you can earn more elsewhere. They argue that buying ties you down and kills your freedom. Or that maintenance costs are too much to bear—it’s better to rent so the landlord has to pay for it. They make up all kinds of other arguments that sound good in the moment, but are completely ridiculous.

Since the beginning of time, private property and home ownership have been a proven path to store wealth for the long-term. But now it’s different.

A few years ago, they argued the laws of economics don’t change just because you’re in a bubble. Yet, they’ve decided the laws do change now that we’re out of it.

The problem is short-term thinking

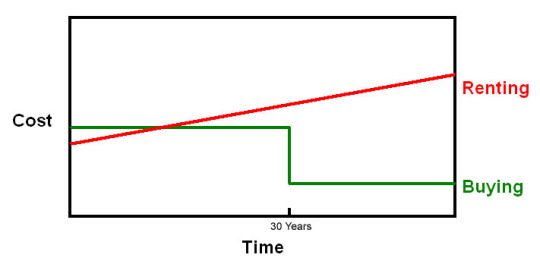

I’m about to lay out for you a scenario that assumes the worst about home ownership and the best for long-term renting and show how home ownership still comes out ahead.

But we first need to ask an important question:

If the long-standing conventional wisdom has been that owning a home is a good financial move, then why, suddenly, have we decided it isn’t anymore?

The answer is one of perspective.

We no longer take truly long-term views for our future, and we optimize our lives for small but instant gratification instead of big wins in the future. And all the financial writers trying to gather eyeballs for their work know this and cater to it.

Even though the reality is owning a home will probably save you hundreds of thousands of dollars over your entire life—one of the smartest financial moves you can make—the advice we see everywhere now doesn’t account for this because no one seems to care what their life will be like more than a few years from now.

What’s the lifetime cost of renting vs. owning?

Let’s say you’re 25 years old, and you’re trying to decide whether to buy a house or to keep renting. You run into all kinds of articles written by high-earning personal finance experts in their 20s and 30s talking about how owning a home is a waste of money now, and you can enjoy an amazing life and far financial rewards if you give up the idea of ever owning.

Is it true?

Yes, when you purchase a house, you have to do some legwork to make sure you’re buying something that’s valued fairly. But the rest is nonsense.

And here’s a conservative example using very unfavorable criteria for purchasing a home and favorable criteria for renting. What we want to know is, “What’s the lifetime cost?”

Let’s say you buy a $250,000 home with a paltry 10% down. You’re taking on a $225,000 loan, and you’ll be paying PMI (private mortgage insurance) of about 0.5% until you have 20% equity in your place.

Now, that’s just the beginning of what you’ll need to account for when you buy a house. Your interest rate matters, so let’s say you get a bad deal (by today’s standards) and have to pay 6%.

You’ll also need to pay property taxes of 2% of the value of your house every year for as long as you own the place. And don’t forget the maintenance you’ll certainly need to save for over the course of ownership. We’ll assume 1% of the home value—which is high—because you don’t want to make any repairs yourself or compare bids to get the best deal.

Put this all together and here’s what you’ll pay to own this house if you live to be 80:

Down Payment: $25,000

Loan Re-payment over 30-years at 6% (including PMI and property tax): $636,000

Property taxes after loan repayment: $125,000

Maintenance: $137,000

Total cost of ownership: $923,000

Yep, almost a $1M. It looks like a lot, but remember: this conservatively covers your living space for your entire life.

How much would renting that same place cost? We’ll assume the landlord owns it on similar terms but, since she’s a super-nice lady just trying to provide decent housing, she makes no profit on the rental. It’s cashflow neutral for her.

So, she rents it out for the price of her mortgage: $1,766/month.

Over the course of your life, you’ll pay $1.2 million, or about $200k more than you would if you’d owned the place.

That’s right, $200,000 more. What could you do with an extra $200,000? Well, not much for yourself since it took your entire life to save that much, but you could start a pretty awesome college fund for your grandkids.

Perhaps that’s why so many personal finance gurus focus on short-term gains: because people want extra money they can use now for themselves, not later for others.

The argument for owning only gets stronger when you consider these three things left out of our example above:

We left out the value of the house at the end of life. Maybe in your last few years you decide to move in with your kids. If the house didn’t appreciate at all in 55 years, you’d still be able to sell it for the original purchase price of $250k, and that puts you $400k ahead of renting.

This model completely ignores inflation. When you buy a house on a long-term, fixed mortgage, you’re essentially shorting the value of the dollar (or whatever currency you use)—a pretty safe bet for any country printing money faster than it can get rid of it. Every year you own your home, it gets cheaper to live there. The opposite is true when you rent. This tilts the scale towards ownership astronomically more.

Buying younger? Living longer? No problem, even more money in your pocket since every year of ownership adds to your advantage.

All the other reasons you still think renting is better, debunked.

If you’re a big proponent of lifelong renting (or one of the financial bloggers I’ve just called out), then you might be foaming at the mouth by now, ready to unleash a torrent of rebuttals for why I’m completely wrong.

Hopefully I’ve already convinced you otherwise but, just in case, here’s my response to the most popular pro-renting arguments:

1. I want to travel & never be tied down to a mortgage! I want to be free!

This is a truly unenlightened argument, and it’s steeped in the limiting belief that somehow, if you own a home, you’ve signed up for a lifetime of servitude, never to venture beyond your property line again due to the financial commitment and overwhelming amount of back-breaking labor that comes with owning a home.

Nonsense! If you want to travel and be free, then rent your house out and have someone else pay the mortgage while you’re away.

If you rent, that’s what you’re doing for your own landlord now!

Is being a landlord still too much work? Hire a property management company to run the place. All you have to do is collect and write checks. Surely you can handle that much.

2. It’s cheaper to rent where I live.

Sure, for now.

As a Renter - you’ll be blessed to see cycles of rents lower than mortgages and cursed to live through the opposite over the course of your life. It’ll probably switch several times. This is how markets work.

But in the long run it evens out, and rent will always average higher than ownership due to the need for a profit motive for those taking the “risk�� to own.

Your ability to beat the average over your life will have more to do with the year you were born and a little luck than any financial wizardry.

3. I rent because I don’t want the burden of paying taxes and interest and maintenance and all the other costs of ownership.

This is my favorite one to blast into oblivion. The truth is that if you rent, you already pay all those things. They’re wrapped up into one monthly check for your convenience. And you get to add some extra for the landlord as well.

Think about it! If you owned something that cost $1,000/month to keep, but then also had a bunch of other costs attached, would you let someone else use it without paying for those other costs? Of course not. Renters must pay the full cost of home ownership and then some, or there would be no such thing as a rental house.

4. Houses are bad investments. I can make more with other investments.

Actually, you can’t. Not because I don’t think you’re a prudent investor, but because we’ve already debunked the idea that you’re going to save any extra money over the course of your life to invest in the first place.

And even if you could, try to remember that if times ever got tough, you cannot not live in the stock market.

5. My rent is super low because I have 5 roommates. I could never buy a place and do the same.

You’re not comparing apples to apples. Right now, you might not be able to buy the house you have that lets you live this lifestyle, but keep saving your pennies, and soon you will. Having roommates pay most (or all!) of your rent is smart. Having them pay your mortgage is even smarter.

6. If my house appreciates, I have to pay Capital Gains Taxes!

This one is absolutely ridiculous, but I had to throw it in because it was actually an argument I read in an article on Forbes. Can you believe it!?

Making this kind of argument is the same as saying you don’t want to earn more money because you’ll owe more taxes. Come on, now���

7. Interest Rates are too high. It’s no good to buy.

Sure, and sometimes they’re too low. This is short-term thinking.

If you can snag a well-priced home when rates are low, that’s great, but I wouldn’t base my entire buy vs. rent strategy on interest rates.

Instead, focus on getting an underpriced home. You can re-finance your mortgage if better rates become available, but you only get one shot at getting the right sale price.

Final Word

It’s not that they’re completely wrong, but that their focus is too short-term. If you plan to sell your house and upgrade every 3 years, you’re already on path to failure, and you should definitely keep renting!

But if you think long-term, and you’re willing to keep your house for the optimal holding period—forever—don’t be fooled by all the inaccurate advice.

When you’re ready to buy give Redefined Realty Advisors a call - Our Professional Office Team will get you set up with one of our Experienced Real Estate Agents, and they will help with every step along the way, helping you achieve your Dream of #HomeOwnership! - 262-732-5800

Original Article Credit:

Original Article By: : Tervooren, Tyler. “The Absolute Insanity of Not Buying a Home When You’re Young” Riskology.

#Home buying#home buyer#first time home buyer#first time homebuyer#FirstTimeHomebuyers#home buying tips#home selling#home#home buy#Home buying advice#home buyers#fall home buying#first time homeowners#first time home buyers#first time home#delafield wi#Delafield Wisconsin#delafield wi real estate agency#redefined realty#redefined realty advisors#milwaukee#Waukesha#South Milwaukee#Pewaukee#Brookfield#brookfield wisconsin#brookfield wi#brookfield homes#brookfield wi homes#mortage

0 notes