#FirstTimeHomebuyers

Explore tagged Tumblr posts

Text

There are a lot of industry buzzwords that scare #FirstTimeHomeBuyers. Here’s a quick reference guide so that you can keep up with the intimidating lingo. You should never be scared off by some silly real estate terms.

Appraisal – the estimated value of the property

Certificate of Title – document that ensures the property is legally owned by the person who claims it

Closing Costs – all the fees and expenses associated with closing on a home, usually around 6% of the cost of the home

Comparative market Analysis (CMA) – a study of how comparable local homes have sold to help determine a reasonable price for property

Contingencies – conditions that must be met in order for the offer on a home to proceed

Due Diligence – actions that a responsible buyer must address in to protect the real estate investment

Debt to Income Ratio – in order to qualify for a loan, your monthly debt cannot exceed 43% of your monthly income

Earnest Money Deposit – payment made to the seller with the offer to show serious intention

Escrow – an account where all closing costs are collected while the lender approves the deal

FICO Score – numerical value assigned to lenders based on their credit history

Fiduciary Duties – the responsibilities of the broker that the real estate agent works for

Good Faith Deposit – payment made to the lender with the offer to show serious intention

HOA – homeowners association; the organization that determines community rules and standards

Loan to Value Ratio – how the lender determines if the loan is worth the risk associated with it

Mortgage – simply put: the home loan

Prequalification – the process to determine if a borrower is qualified for a loan; amount is approximate

Payment Terms – principal, interest, taxes, PMI, etc. all the buyer really needs to know is the monthly and cummulative totals

Information via Boom Rizal (@boomrizal) in an article for Inman.com

Original Article: “Are You Afraid of These Real Estate Terms?” By: McCarl, Jesse, HouseHunt | Jul 16, 2015

#reference guide#FirstTimeHomebuyers#inman#real estate#real estate agency#reality#realtors#realty#Dream House#realty agencies#scary terms#scary reAL ESTATE#real estate advice#real estate industry#real estate terms#Contingencies#Mortgage#mortgage loans#loan to value#good faith deposit#Fiduciary Duties#Escrow#home buying tips#home buying#home buyer#home buyers#home buy#first time home buyer#first time homeowners#first time homebuyer

0 notes

Text

It’s Insane not to Buy a Home While You’re Still Young!

If you’re young—under 40 or so—and have been heeding all the personal finance advice spewing forth from some of the most popular columnists and bloggers over the last few years about how owning a home doesn’t make financial sense anymore, I’m afraid you’ve been duped.

Buying a house—especially when you’re younger—is still an incredibly smart decision financial or otherwise. I’m about to explain why, but let me start by saying I do not own a home, so there is no hidden bias in the argument I’m about to make.

Read on to learn why all the smart financial bloggers who tell you it’s better to rent than buy are completely wrong. Hint: It’s in the numbers.

An Expanding Real Estate Bubble

In 2007, the Real Estate Bubble in America had grown to epic proportions. Home prices were out of control, completely unsustainable, and worst of all—few people even knew what a bubble was, let alone that their frenzy to buy a house before they were “priced out of the market forever” was only adding to the massive amounts of pain they were about inflict upon themselves.

There were a few smart financial advisors warning of impending doom, but those folks were just raining on the parade, and few people paid any attention.

Funny enough, it was people in the age range of around 20-25, who understood the same thing these financial advisors did—that doom was on the way. Only we’re from a generation that doesn’t really watch TV, and we weren’t old or wise enough yet to connect our own experiences to the bigger picture.

It was depressing. I was earning more than all of my friends, and there was still no way I could afford to buy a house.

I’d talk to some of my well paid colleagues, and they despaired over the same things. We looked at the situation and said, “Screw it. We’ll never be able to afford it.” So we gave up looking.

What we didn’t know was that giving up was exactly what would save us from financial ruin just a few years later.

The bubble pops, and a new way of life sets in

So it’s 2008 and home prices have started to fall, but they’re still miles away from affordable for me or anyone I know even as my friends and I all continue to earn well above the median wage.

At this point, I’d given up any hope of buying a place and had, instead, found a 5-bedroom house in Portland to rent for $1,200/month and moved my girlfriend and four other friends in.

If I couldn’t buy a place, I was going to live damn cheap! And for the next three years, I did. Turns out, many other people my age across the country were doing the same thing.

We didn’t know at the time our “collective sigh of discontent” as I like to call it was exactly what was driving housing prices down. It was like all the adults had a party, got wasted, made a huge mess and said, “It’s okay, the kids will clean it up in the morning.”

When, instead, we said, “We couldn’t clean this up even if we wanted to,” and that’s when the panic started setting in!

At this point, all the popular personal finance bloggers and television celebrities are wising up and saying, “We’re in a bubble, and the bubble is popping. Buying a house is not a good decision right now.”

They were right. Everyone starts to look a little differently at real estate.

All the personal finance bloggers jump the shark…

For the next four years, young people like me sit on the sidelines and watch as the housing market gets massacred. We wonder if prices will ever stop falling.

Four years ago, all the personal finance bloggers and television celebrities reminded us: “We’re in a bubble, and a bubble does not change the rules of money. Don’t spend too much on a house.”

Yet, now, as we watch prices continue to decline, the same talking heads start to disregard their own advice. They start to question if buying a house is a good idea at all. Maybe we’ve all been duped, and owning a home is just asking for financial ruin.

Articles start to pop up all over the Internet on well-respected sites like Forbes, Time, NYT, and many others with headlines like “Why I Never Want to Own a Home Again.”

They start to argue that houses are poor investments and that you can earn more elsewhere. They argue that buying ties you down and kills your freedom. Or that maintenance costs are too much to bear—it’s better to rent so the landlord has to pay for it. They make up all kinds of other arguments that sound good in the moment, but are completely ridiculous.

Since the beginning of time, private property and home ownership have been a proven path to store wealth for the long-term. But now it’s different.

A few years ago, they argued the laws of economics don’t change just because you’re in a bubble. Yet, they’ve decided the laws do change now that we’re out of it.

The problem is short-term thinking

I’m about to lay out for you a scenario that assumes the worst about home ownership and the best for long-term renting and show how home ownership still comes out ahead.

But we first need to ask an important question:

If the long-standing conventional wisdom has been that owning a home is a good financial move, then why, suddenly, have we decided it isn’t anymore?

The answer is one of perspective.

We no longer take truly long-term views for our future, and we optimize our lives for small but instant gratification instead of big wins in the future. And all the financial writers trying to gather eyeballs for their work know this and cater to it.

Even though the reality is owning a home will probably save you hundreds of thousands of dollars over your entire life—one of the smartest financial moves you can make—the advice we see everywhere now doesn’t account for this because no one seems to care what their life will be like more than a few years from now.

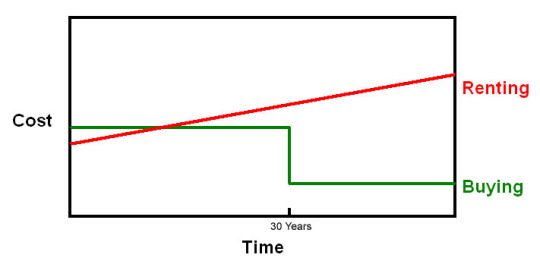

What’s the lifetime cost of renting vs. owning?

Let’s say you’re 25 years old, and you’re trying to decide whether to buy a house or to keep renting. You run into all kinds of articles written by high-earning personal finance experts in their 20s and 30s talking about how owning a home is a waste of money now, and you can enjoy an amazing life and far financial rewards if you give up the idea of ever owning.

Is it true?

Yes, when you purchase a house, you have to do some legwork to make sure you’re buying something that’s valued fairly. But the rest is nonsense.

And here’s a conservative example using very unfavorable criteria for purchasing a home and favorable criteria for renting. What we want to know is, “What’s the lifetime cost?”

Let’s say you buy a $250,000 home with a paltry 10% down. You’re taking on a $225,000 loan, and you’ll be paying PMI (private mortgage insurance) of about 0.5% until you have 20% equity in your place.

Now, that’s just the beginning of what you’ll need to account for when you buy a house. Your interest rate matters, so let’s say you get a bad deal (by today’s standards) and have to pay 6%.

You’ll also need to pay property taxes of 2% of the value of your house every year for as long as you own the place. And don’t forget the maintenance you’ll certainly need to save for over the course of ownership. We’ll assume 1% of the home value—which is high—because you don’t want to make any repairs yourself or compare bids to get the best deal.

Put this all together and here’s what you’ll pay to own this house if you live to be 80:

Down Payment: $25,000

Loan Re-payment over 30-years at 6% (including PMI and property tax): $636,000

Property taxes after loan repayment: $125,000

Maintenance: $137,000

Total cost of ownership: $923,000

Yep, almost a $1M. It looks like a lot, but remember: this conservatively covers your living space for your entire life.

How much would renting that same place cost? We’ll assume the landlord owns it on similar terms but, since she’s a super-nice lady just trying to provide decent housing, she makes no profit on the rental. It’s cashflow neutral for her.

So, she rents it out for the price of her mortgage: $1,766/month.

Over the course of your life, you’ll pay $1.2 million, or about $200k more than you would if you’d owned the place.

That’s right, $200,000 more. What could you do with an extra $200,000? Well, not much for yourself since it took your entire life to save that much, but you could start a pretty awesome college fund for your grandkids.

Perhaps that’s why so many personal finance gurus focus on short-term gains: because people want extra money they can use now for themselves, not later for others.

The argument for owning only gets stronger when you consider these three things left out of our example above:

We left out the value of the house at the end of life. Maybe in your last few years you decide to move in with your kids. If the house didn’t appreciate at all in 55 years, you’d still be able to sell it for the original purchase price of $250k, and that puts you $400k ahead of renting.

This model completely ignores inflation. When you buy a house on a long-term, fixed mortgage, you’re essentially shorting the value of the dollar (or whatever currency you use)—a pretty safe bet for any country printing money faster than it can get rid of it. Every year you own your home, it gets cheaper to live there. The opposite is true when you rent. This tilts the scale towards ownership astronomically more.

Buying younger? Living longer? No problem, even more money in your pocket since every year of ownership adds to your advantage.

All the other reasons you still think renting is better, debunked.

If you’re a big proponent of lifelong renting (or one of the financial bloggers I’ve just called out), then you might be foaming at the mouth by now, ready to unleash a torrent of rebuttals for why I’m completely wrong.

Hopefully I’ve already convinced you otherwise but, just in case, here’s my response to the most popular pro-renting arguments:

1. I want to travel & never be tied down to a mortgage! I want to be free!

This is a truly unenlightened argument, and it’s steeped in the limiting belief that somehow, if you own a home, you’ve signed up for a lifetime of servitude, never to venture beyond your property line again due to the financial commitment and overwhelming amount of back-breaking labor that comes with owning a home.

Nonsense! If you want to travel and be free, then rent your house out and have someone else pay the mortgage while you’re away.

If you rent, that’s what you’re doing for your own landlord now!

Is being a landlord still too much work? Hire a property management company to run the place. All you have to do is collect and write checks. Surely you can handle that much.

2. It’s cheaper to rent where I live.

Sure, for now.

As a Renter - you’ll be blessed to see cycles of rents lower than mortgages and cursed to live through the opposite over the course of your life. It’ll probably switch several times. This is how markets work.

But in the long run it evens out, and rent will always average higher than ownership due to the need for a profit motive for those taking the “risk” to own.

Your ability to beat the average over your life will have more to do with the year you were born and a little luck than any financial wizardry.

3. I rent because I don’t want the burden of paying taxes and interest and maintenance and all the other costs of ownership.

This is my favorite one to blast into oblivion. The truth is that if you rent, you already pay all those things. They’re wrapped up into one monthly check for your convenience. And you get to add some extra for the landlord as well.

Think about it! If you owned something that cost $1,000/month to keep, but then also had a bunch of other costs attached, would you let someone else use it without paying for those other costs? Of course not. Renters must pay the full cost of home ownership and then some, or there would be no such thing as a rental house.

4. Houses are bad investments. I can make more with other investments.

Actually, you can’t. Not because I don’t think you’re a prudent investor, but because we’ve already debunked the idea that you’re going to save any extra money over the course of your life to invest in the first place.

And even if you could, try to remember that if times ever got tough, you cannot not live in the stock market.

5. My rent is super low because I have 5 roommates. I could never buy a place and do the same.

You’re not comparing apples to apples. Right now, you might not be able to buy the house you have that lets you live this lifestyle, but keep saving your pennies, and soon you will. Having roommates pay most (or all!) of your rent is smart. Having them pay your mortgage is even smarter.

6. If my house appreciates, I have to pay Capital Gains Taxes!

This one is absolutely ridiculous, but I had to throw it in because it was actually an argument I read in an article on Forbes. Can you believe it!?

Making this kind of argument is the same as saying you don’t want to earn more money because you’ll owe more taxes. Come on, now…

7. Interest Rates are too high. It’s no good to buy.

Sure, and sometimes they’re too low. This is short-term thinking.

If you can snag a well-priced home when rates are low, that’s great, but I wouldn’t base my entire buy vs. rent strategy on interest rates.

Instead, focus on getting an underpriced home. You can re-finance your mortgage if better rates become available, but you only get one shot at getting the right sale price.

Final Word

It’s not that they’re completely wrong, but that their focus is too short-term. If you plan to sell your house and upgrade every 3 years, you’re already on path to failure, and you should definitely keep renting!

But if you think long-term, and you’re willing to keep your house for the optimal holding period—forever—don’t be fooled by all the inaccurate advice.

When you’re ready to buy give Redefined Realty Advisors a call - Our Professional Office Team will get you set up with one of our Experienced Real Estate Agents, and they will help with every step along the way, helping you achieve your Dream of #HomeOwnership! - 262-732-5800

Original Article Credit:

Original Article By: : Tervooren, Tyler. “The Absolute Insanity of Not Buying a Home When You’re Young” Riskology.

#Home buying#home buyer#first time home buyer#first time homebuyer#FirstTimeHomebuyers#home buying tips#home selling#home#home buy#Home buying advice#home buyers#fall home buying#first time homeowners#first time home buyers#first time home#delafield wi#Delafield Wisconsin#delafield wi real estate agency#redefined realty#redefined realty advisors#milwaukee#Waukesha#South Milwaukee#Pewaukee#Brookfield#brookfield wisconsin#brookfield wi#brookfield homes#brookfield wi homes#mortage

0 notes

Link

Find out how much your home is worth! Click here to fill out our Analysis Form, and we’ll email your FREE, No Obligation Comparative Market Analysis of your home!

#HomebuyingMustDos#FirstTimeHomebuyers#HomebuyingTips#first time homebuyer#home buyers#homeselling#homesales#homes for sale#home sale process#home sale information#home listings#home sale needs#market analysis#HomeMarketAnalysis#comparative market analysis#home values#home value#redefined realty

0 notes

Link

If you are looking to buy your first home, its a good idea to do your research first! Check out this article to learn more!

0 notes