#a cash app card

Explore tagged Tumblr posts

Text

small PSA: if you shop at craft shows or artist alleys, please bring more than apple pay or a virtual card - especially if you're not comfortable entering your card number manually. not all of us have fancy card readers, so please also bring your physical card or cash, even if it's only as backup 👍

#psa#conventions#artist alley#not art#i've done two craft shows and two conventions with just my swipe reader. and cash ofc. but i did have to miss a couple sales at the cons#because people only had apple pay. no cash no physical card. It Sucks For Both Of Us!#when i say there are small businesses in the artist alley i mean some of us are Small#i don't speak just for myself but for other artists who have this trouble as well. some folks are just starting out and some folks#just do this for a hobby and can't afford or can't justify the bigger terminals yet or at all#if i get into ACEN again next year i'll opt for a terminal but they're Pricey and not something to start out with y'know#if you want to be an artist's best friend though? pay in cash.#not to mention if there's technical or wifi trouble - cash just works 100% of the time. no reader or wifi will stop you from using cash.#semi related but i had someone try to pay with apple pay at my last show and i said they'd have to enter their number manually then#and they said they'd go find their partner and see if they had card/cash. and then while they were walking away from their booth#their friend asked why and they said it wasn't safe. on one hand i can't be mad because its VERY good to practice card safety!#on the other hand. you're entering it into the same app that would process a swipe payment. it's exactly as safe as if you'd swiped it#i promise as long as you're entering the number into a square app your card info is safe lmao#anyway yeah a lot of us aren't Big Businesses. please just be courteous and bring some traditional payment methods Just In Case

92 notes

·

View notes

Text

We Sell Pharma Products, Clone cards, transfers, and High-Quality Banknotes. Cash app/Paypal Flips

Visit

➡️Website: https://bayygonslab.com

#money#clone cards#western union#ssd#ssdchemicalsolution#bank notes#cash app#paypal#tumblr memes#lol#blank card

8 notes

·

View notes

Text

cash app gift cards $750

#cashappgiveaway ↪️✅Go to this link here click now👇

✅How to get cash app gift card interest on iPhone, AndroidCLOSE The best apps for managing your money. A gift card in hand. (Photo: GETTY IMAGES)The goal of giving a gift is simple: Give someone what they want, which, in turn, makes them happy. After all, isn't that what the holidaysare all about?The art of choosing the right gift, however, isn't always as 🥰↪️simple as hitting the big-ticket items on a person's wish list. In reality, getting something unique, useful, and meaningful is likely your only hope for leaving your loved ones with a nice, warm feeling inside.⤵️Go to this link 👇👇https://sites.google.com/view/cashyoo/home

↪️✅And with apps available on iOS and Android that let you make purchases with cash, gift cards, and other electronic gift cards, you'll never have to worry about leaving your loved ones empty-handed. In fact, doing so will make the rest of the season less.😊😊cash app,cash app glitch,cash app scams,cash app or zelle mercedes,cash app stocks,cash app card,cash app glitch gone wrong,cash app louie ray,cash app borrow,cash app not working,cash app bitcoin,cash app account create,cash app account closed,cash app apple pay glitch,cash app account create bangla,cash app atm withdrawalSteam gift card steam gift card,steam gift card giveaway,steam gift card codes,steam gift card how to use,steam gift card free,steam gift card giveaway live,steam gift card scratched off code,steam gift card scams,steam gift card not working,steam gift card generator,steam gift card activation,steam gift card argentina,steam gift card app,

go↪️⬇️ to this link Click👇👇

#Csha app gift card#cash app#cash app glitch#cash app scams#cash app or zelle mercedes#cash app stocks#cash app card#cash app glitch gone wrong#cash app louie ray#cash app borrow#cash app not working#cash app bitcoin#cash app account create#cash app account closed#cash app apple pay glitch#cash app account create bangla#cash app atm withdrawal

7 notes

·

View notes

Text

Cash App USA

Join Now: https://tinyurl.com/3nmanj7j

9 notes

·

View notes

Note

HI ok I gotta ask - your post has made me insanely curious - you mention having cash at hand while waiting for your new card (resourceful) but none of the sources of cash was a bank or ATM.

Where I'm from cash is still used a lot (as we minimum wage workers get paid in cash) and as a result there are multiple ATM's within walking distance at all times and banks no more than 15-20 minutes drive away. Is this... different where you're from? (For context I'm from Africa)

We get paychecks directly to the bank account here, and I usually just pay with my card everywhere I need to, because it's more convenient than having a lot of coins and bills around. While there are ATM machines here (there are several within a walking distance from where I live), you use them with your card, so without having one, I can't get money out of the money withdrawing machine. I don't know how you do it, but without a card I can only get money out of the bank account by (online) bank transfers, and that's pretty hard at grocery store register.

Our bank offices stopped handing out cash several years ago, of which I am still very salty about.

I got some cash from my mom, and I had a handful of coins left over from the last time I had used an ATM a while back, but that's kinda rare for me, since most places accept card.

#I used to have cash savings last year but that was specifically for a tattoo in a studio that preferred cash payments#so I saved up by withdrawing a little bit of money every month to stash in my book shelf#but other than that it's generally easier to not handle cash#but like mobilepay links to the card so I need one to use it#and so does this delivery service app I've used before#linking to a card instead of directly to your bank account is safer#even if it makes it inconvenient if you lose your card#(it is only afterwards that I notice there's an option to close one's card TEMPORARILY in my mobile bank app...)#(but by that time I had already called my bank and terminated the old card and ordered the new one)#(hind sight is great)

11 notes

·

View notes

Text

Good morning!! Drink lots of water today!

I’m queuing up posts for today, tomorrow, and maybe the next day if I can get it all done in the time I have today!

Want early access to my posts I’m queuing?

Only $5 for all the pics + 2 nudes :)

Cashapp $therealonelucy

Venmo @ Loubellaxx

Onlyfans.Com/loubellaxx

Or dm for google pay, Amazon gift card, or crypto!!

#cashapp#google pay#venmo#crypto#amazon gift cards#cash app#venmoaccepted#amazon gift code#good morning#i’m back#gm#selling#early release#$5#i sell custom pics#buy my dropbox#onlyfanz#i sell videos#spicy site#spicy accountant#ootd#accounting#drinkingwater#don't forget to hydrate#drink water#water#hydrate yourself#keep hydrated#hydration reminder#stay hydrated

32 notes

·

View notes

Text

#- **Grabpoints**#- **Free Gift Cards**#- **PayPal Cash**#- **Surveys**#- **Offers**#- **App Downloads**#- **Video Watching**#- **Earn Rewards**#- **Passive Income**#- **Online Earning**

4 notes

·

View notes

Text

Moment of silence for the tourist going trough a Belgian craft market asking people if they take credit card

#for reference most actual shops here don’t take credit cards#markets are cash or direct trasfer by app#even debit is a rarity

19 notes

·

View notes

Text

Get $750 to spend on Amazon!

2 notes

·

View notes

Audio

(Gee Gunster) PLAY ME

#SoundCloud#music#Gee Gunster#Dancehall#Deep House#Hip-hop & Rap#Speech#@riding with the wild hunt#@tt#artists on tumblr#yupoo#so hot and sexy#tumblr milestone#travel#older man younger woman#tw ana rant#%u#this is what makes us girls#$h tumblr#ana y mia#$y#$500 cash app#$750 shein gift card#$90#%9#$800#$99999000000#txt#$0.99#$8

2 notes

·

View notes

Text

Free income site Video link=https://rb.gy/8x7zme

===============youtube channel========= visit like, common. subscribed.

Montage free income #- **Grabpoints**#- **Free Gift Cards**#- **PayPal Cash**#- **Surveys**#- **Offers**#- **App Downloads**#- **Video Watching**#- **Earn Rewards**#- **Passive Income**#- **Online Earning** #cashapp#free money#passive income#make money online#make money from home#paypal#marketing#side hustle#black fashion extra income#ecommerce#shopping#today on tumblr#money#freebiesClassy Collectibles

#paypal#sales#make money online#online#make money from home#free money#united states#cashapp#christmas gift gift card#today on tumblr

link=https://rb.gy/8x7zme

#pokemon#artists on tumblr#Montage free income#- **Grabpoints**#- **Free Gift Cards**#- **PayPal Cash**#- **Surveys**#- **Offers**#- **App Downloads**#- **Video Watching**#- **Earn Rewards**#- **Passive Income**#- **Online Earning**#cashapp#free money#passive income#make money online#make money from home#paypal#marketing#side hustle#black fashion extra income#ecommerce#shopping#today on tumblr#money#freebiesClassy Collectibles#sales#online#united states

4 notes

·

View notes

Text

Ultimate Guide for Increasing Your ATM Withdrawal Limits on Cash App

As more people shift towards digital financial platforms, Cash App has gained significant popularity for its simple and convenient approach to managing money. Whether you're sending money, buying Bitcoin, or withdrawing cash, Cash App provides multiple functionalities that cater to both personal and business needs. One of the key features users rely on is the Cash App card, which allows them to withdraw cash from ATMs just like any traditional debit card.

However, just like any financial service, there are limitations to how much you can withdraw from an ATM. Understanding the Cash App withdrawal limit is crucial for anyone using the app regularly, mainly if you rely on ATM withdrawals for daily financial needs. In this blog, we'll provide a comprehensive guide to Cash App ATM withdrawal limits, explain how they work, and share tips on how you can increase these limits to suit your financial needs.

What Is the Cash App ATM Withdrawal Limit?

The Cash App ATM withdrawal limit refers to the maximum amount of money you can withdraw from an ATM using your Cash App card. Like many banking services, Cash App sets specific daily and weekly limits to protect against fraud and ensure the safety of your account. Understanding these limits helps you better plan your financial transactions, especially when you need quick access to cash.

Cash App Withdrawal Limit Per Day: For users wondering about the Cash App withdrawal limit per day, the standard daily cap is set at $310. This limit means you can withdraw up to $310 in 24 hours, regardless of how many transactions you perform at different ATMs. If you hit this limit, you'll need to wait 24 hours before withdrawing more cash.

Cash App ATM Withdrawal Limit Per Week: In addition to the daily limit, there is also a weekly cap on how much you can withdraw. The Cash App weekly withdrawal limit is currently $1,000. This limit is calculated on a rolling 7-day basis. For instance, if you withdraw $300 on a Tuesday, that amount will reset the following Tuesday, allowing you to withdraw more cash.

Cash App Card ATM Withdrawal Limits: How They Work?

The Cash App card ATM withdrawal limit is tied to the physical card that is linked to your Cash App balance. You can use this card at any ATM that accepts Visa, which makes it convenient to access your funds in cash. However, because Cash App is not a traditional bank, its ATM limits are often lower than those offered by central banks.

The limits mentioned above (i.e., $310 per day and $1,000 per week) apply to withdrawals made at ATMs using your Cash App card. Additionally, keep in mind that there are fees associated with each withdrawal, including:

How to Increase ATM Limits on Cash App?

If you find that the current Cash App ATM withdrawal limits are too restrictive for your financial needs, you may wonder if there's a way to increase them. The good news is that the Cash App allows you to request higher withdrawal limits, but this process requires you to verify your identity.

Steps to Increase Cash App Withdrawal Limit

Open Cash App: Log into your Cash App account on your mobile device.

Access Your Profile: Tap on your profile icon located at the top right corner of the screen.

Verify Your Identity: To increase your ATM limits, the Cash App will prompt you to verify your identity. You'll need to provide personal details such as:

Your full legal name.

Date of birth.

The last four digits of your Social Security Number (SSN).

In some cases, Cash App may also request a photo ID for further verification.

Wait for Approval: Once your identity is verified, Cash App may increase your ATM withdrawal limits. The new limits will depend on your account activity and other factors that Cash App uses to assess risk.

Other Cash App Limits to Be Aware Of

While this guide focuses on ATM withdrawal limits, Cash App imposes other transaction limits that are worth noting, especially if you're a frequent user of the app. Here are some of the critical limits:

Cash App Sending Limit: When you first sign up for Cash App, you're limited to sending up to $250 per week without verifying your account. After verification, this limit increases significantly to $7,500 per week, giving you more flexibility to send money when needed.

Cash App Receiving Limit: Unverified users can receive up to $1,000 in 30 days. Once your account is verified, there are no receiving limits, which is particularly useful for users who manage larger transactions or use Cash App for business.

Cash App Transfer Limit: The Cash App transfer limit for sending money from your Cash App balance to an external bank account is capped at $2,500 per week for verified users. This limit is more than sufficient for most personal transactions, but if you need to transfer more significant amounts, you'll need to plan your transfers over multiple weeks.

What are the Cash App ATM Withdrawal Fees?

As mentioned earlier, each time you withdraw money from an ATM using your Cash App card, a fee of $2.50 is charged by Cash App. Additionally, ATMs may impose their usage fees, depending on the bank or operator. These fees can add up quickly, especially if you're withdrawing smaller amounts frequently.

How to Avoid ATM Fees on Cash App?

If you're looking for ways to minimise the cost of ATM withdrawals, Cash App offers a workaround:

Direct Deposit Setup: If you set up direct deposits of $300 or more into your Cash App account, the platform will reimburse you for up to three ATM withdrawals every 31 days. This is a great way to avoid the $2.50 Cash App fee, although you may still be subject to third-party ATM fees.

FAQs: Cash App Withdrawal Limit

1. What Is the Cash App ATM Withdrawal Limit Per Day?

The Cash App ATM withdrawal limit per day is $310. You can withdraw this amount across multiple ATM transactions, but you will only be able to reach this limit within 24 hours.

2. How Much Can I Withdraw from a Cash App ATM Per Week?

The Cash App weekly withdrawal limit is $1,000. This limit operates on a rolling basis, meaning it resets seven days after each withdrawal.

3. How Can I Increase My Cash App ATM Withdrawal Limit?

You can increase Cash App withdrawal limit by verifying your identity. This involves providing personal information such as your full legal name, date of birth, and Social Security Number. After verification, you may be eligible for higher withdrawal limits.

4. What Are the Cash App ATM Fees?

Cash App charges a $2.50 fee for each ATM withdrawal. Additionally, ATM operators may charge extra fees. If you set up direct deposits of $300 or more into your Cash App account, you can get reimbursed for up to three ATM fees every 31 days.

5. Why Is My Cash App ATM Withdrawal Limit So Low?

Cash App sets relatively low default limits for ATM withdrawals to minimise fraud and protect your account. If the current limit is too low for your needs, verifying your identity is the best way to request an increase.

Conclusion

Understanding the Cash App withdrawal limit is essential for effectively managing your funds, especially if you rely on the platform for frequent ATM withdrawals. The standard limits—$310 per day and $1,000 per week—are sufficient for most casual users, but they may feel restrictive for those who need regular access to cash. Fortunately, by verifying your account, you can increase your withdrawal limits and unlock additional features, such as higher sending and receiving caps.

Additionally, being aware of ATM fees and setting up direct deposits can help you avoid unnecessary charges and make the most of your Cash App experience. Whether you're a new user or a seasoned Cash App cardholder, knowing your limits and how to increase them can help you navigate your financial transactions with ease.

#cash app withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit#cash app withdrawal limit per day#cash app daily withdrawal limit#cash app card atm withdrawal limit

2 notes

·

View notes

Text

public transit going app-only for its payment system is something that cannot ever sit pleasantly for me

#:)#my local buses stopped taking cash and technically they do card payments but last time i did that they overcharged me#on the morality scale tap in/tap out systems are even worse than in app qr codes#in all cases it is wrong and evil. you should still be able to feed buses coins to get to where you need to go <3

9 notes

·

View notes

Text

Everything You Need to Know About Cash App Withdrawal Limits

With the rapid shift towards digital payments, Cash App has emerged as one of the leading platforms for quick and easy transactions. Whether it's sending money to friends, paying bills, or even buying Bitcoin, Cash App offers a versatile and user-friendly experience. However, as with any financial tool, there are certain limitations to remember—especially when withdrawing funds. Understanding the Cash App withdrawal limit is crucial for anyone who relies on the platform for their day-to-day financial activities.

Cash App allows users to withdraw funds in multiple ways, including ATMs, using a cash card, or transferring Bitcoin to an external wallet. However, these actions come with daily and weekly limits, which are set for security and compliance purposes. If you're unfamiliar with these restrictions or looking for ways to increase your withdrawal limits, you're in the right place.

In this blog, we'll provide a detailed breakdown of Cash App withdrawal limits, explain how they work, and offer guidance on increasing them if necessary. We'll also address frequently asked questions to help you navigate the app more effectively.

What are the Cash App ATM Limits?

One of the critical features of Cash App is the ability to withdraw money from ATMs using the Cash Card—a customizable debit card linked directly to your Cash App balance. This makes accessing cash simple and convenient, but there are limits on how much money you can withdraw from ATMs within a given time frame.

Currently, the Cash App ATM limit is structured as follows:

Daily ATM Withdrawal Limit: Cash App users can withdraw up to $310 daily from ATMs.

Weekly ATM Withdrawal Limit: The total withdrawal amount is capped at $1,000 over seven days.

Monthly ATM Withdrawal Limit: Cash App users can withdraw a maximum of $1,250 from ATMs over a 30-day period.

These limits are designed to protect users from fraudulent activity and ensure compliance with financial regulations. However, they can sometimes feel restrictive for those who frequently need access to larger amounts of cash. It's also worth noting that Cash App charges a standard $2.50 fee for ATM withdrawals, though users can get these fees reimbursed if they receive $300 or more in direct deposits each month.

What are the Cash App ATM Withdrawal Limits?

Understanding the timeframes for Cash App ATM withdrawal limits is essential for managing your finances effectively. Cash App users are subject to daily and weekly ATM withdrawal limits, which prevent them from withdrawing more than a certain amount within a 24-hour or seven-day period.

Let's break it down further:

Cash App Daily ATM Withdrawal Limit: You can only withdraw $310 daily from any ATM using the Cash Card. This limit is refreshed every 24 hours, starting from your last withdrawal.

Cash App Weekly ATM Withdrawal Limit: The total cash you can withdraw from ATMs over seven days is $1,000. This rolling limit resets every week based on the timing of your transactions.

The critical takeaway is to plan, especially if you anticipate needing more cash than the daily or weekly limits allow. Users may want to explore ways to increase their withdrawal limits for frequent or large withdrawals, which we'll discuss in a later section.

What are the Cash App BTC Withdrawal Limits?

In addition to standard cash withdrawals, Cash App offers cryptocurrency enthusiasts the ability to buy, sell, and withdraw Bitcoin (BTC) directly from the app. This makes Cash App a convenient platform for those involved in cryptocurrency transactions. However, similar to cash withdrawals, there are limits on how much Bitcoin you can withdraw.

The Cash App BTC withdrawal limit is set as follows:

Daily BTC Withdrawal Limit: Cash App users can withdraw up to $2,000 worth of Bitcoin in 24 hours.

Weekly BTC Withdrawal Limit: Users can withdraw up to $5,000 worth of Bitcoin in seven days.

It's important to note that these limits are separate from the cash withdrawal limits, and they are specifically for Bitcoin transfers. For users who are actively engaged in trading or transferring Bitcoin to external wallets, understanding these limits is crucial to managing your cryptocurrency assets effectively.

Bitcoin transactions on the Cash App also come with fees, generally based on the network's congestion and the transaction size. Always check the applicable fees before withdrawing to ensure you get the best transaction value.

How to Increase Cash App Withdrawal Limit?

One simplest and most effective way to increase Cash App withdrawal limit is to verify your identity on the platform. Unverified users have significantly lower limits, but once you provide the necessary information, Cash App may raise your withdrawal limits.

Open Cash App and go to your account settings.

Provide your full name, date of birth, and the last four digits of your Social Security number.

Sometimes, you may be asked to provide additional documents, such as a government-issued ID.

Once verified, you may see an increase in your withdrawal limits for ATMs and Bitcoin transactions.

Reach Out to Customer Support

If you've followed all the steps above and still find the withdrawal limits restrictive, consider contacting Cash App's customer support team. In some cases, they may be able to adjust your withdrawal limits based on your specific needs, especially if you're a long-time user with a solid transaction history.

While support may not immediately raise your limits, it's worth trying if you need to access more cash or cryptocurrency through the platform.

FAQs

1. What is the Cash App withdrawal limit per day?

The Cash App daily withdrawal limit from ATMs is $310. This limit applies to Cash Card withdrawals and resets every 24 hours.

2. What is the Cash App weekly withdrawal limit?

Cash App allows users to withdraw up to $1,000 weekly from ATMs. This limit is spread over a rolling seven-day period and refreshes based on the timing of your withdrawals.

3. How can I increase my Cash App withdrawal limit?

You can increase your Cash App withdrawal limit by verifying your identity, linking your bank account, setting up direct deposits, and maintaining regular account activity. Verified users with direct deposits often have higher limits.

4. What is the Cash App BTC withdrawal limit?

Cash App users can withdraw up to $2,000 worth of Bitcoin daily and up to $5,000 weekly. These limits apply specifically to cryptocurrency transactions.

5. Are there fees associated with Cash App ATM withdrawals?

Yes, Cash App charges a standard $2.50 fee for ATM withdrawals. However, this fee can be reimbursed if you receive at least $300 in direct deposits to your Cash App account monthly.

6. Can I withdraw over $310 from the Cash App in one day?

No, the maximum daily withdrawal limit from an ATM using Cash App is $310. However, you may be able to increase this limit by verifying your identity and setting up direct deposits.

Conclusion

Understanding the Cash App withdrawal limit is essential for anyone who frequently uses the platform for financial transactions. Whether withdrawing funds from an ATM using the Cash Card or transferring Bitcoin to an external wallet, knowing the daily and weekly limits ensures you won't face unexpected restrictions.

By verifying your identity, maintaining an active account, and setting up direct deposits, you can increase your Cash App withdrawal limit and access significant amounts of cash or cryptocurrency when needed. With these strategies, you can make the most out of Cash App's features while enjoying the convenience of digital transactions.

Remember, withdrawal limits are put in place for security and compliance reasons, but with a few simple steps, you can manage these limits and raise them to suit your financial needs.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

3 notes

·

View notes

Text

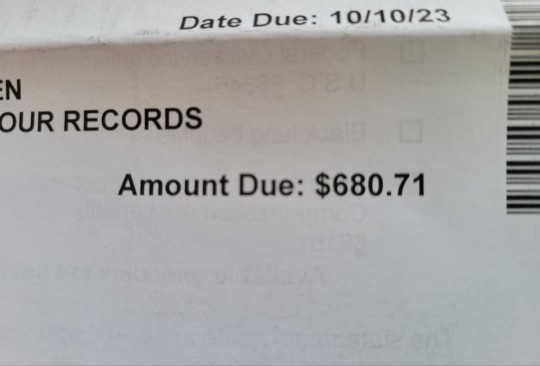

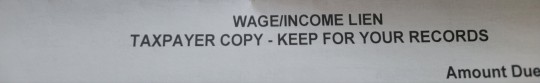

I just. I am so sick of this happening. A couple of years ago, I didn't pay my taxes on time. I just didn't have the money. Well, I entered into a payment plan, but they stopped sending me notices after a while, so I thought that I had paid it all off. After my grandma died, I was too much of a mess to think about it.

I received this bill on Friday. it states that the due date is in October, but if I don't pay this amount before Thursday, any income I have (including wages) will be withheld and sent to collectors. This is so unfair and total bullshit. I need what little money i have to pay my own bills.

I don't know what to do. I have no one to ask and I have already spoken to someone who told me that this is something that has to be taken care of. if I can pay it before Thursday, they were reverse the garnishment but if not.....I don't know how I will pay my electric bill, food, and other necessities.

I'm so tired.

#financial help#bills#finances#money#gofundme#cash app#paypal#not a scam#im so tired#bat.txt#i do have some of the money but i have been unable to pay it with my prepaid debit card#i just dont know what to do#a money order wont get there in time

16 notes

·

View notes

Text

Good morning :) hope you have a good day !!

If you haven’t been told yet today - I love you!!

Spicy 🥵 content info ⬇️

I accept pay apps + amazon gift cards too !

OF + ALL OTHER SOCIALS

#amazon gift cards#amazon#gift card#giftcard#amazon gift card#amazon gift code#venmo#venmo me#donate to my venmo#venmo donations#dm for venmo#venmoaccepted#ask for my venmo#venmo app#pay with venmo#cashapp#cash app#google pay#pay to talk#pay to view#payments#pay me money#paypiq#pay piggy#pay attention#pay me to be cute#pay me for pics#pay to play#buy my stuff#buy this

29 notes

·

View notes