#What is the Norfolk Southern (NSC)?

Explore tagged Tumblr posts

Text

How Much Money is the Norfolk Southern (NSC) making?

The Norfolk Southern (NSC) has become the most hated company in America because of the East Palestine catastrophe. A Norfolk Southern train derailed in East Palestine, Ohio, on 3 February 2023. The derailment released enormous amounts of toxic chemicals. News reports claim the chemicals are contaminating water, killing wildlife, fish, pets, and livestock, and creating possible health problems…

View On WordPress

#How Much Debt and Value does Northern Southern (NSC) have?#How Much Money is the Norfolk Southern (NSC) making?#Is Norfolk Southern (NSC) Making Money?#Norfolk Southern (NSC)#Norfolk Southern Corporation (NYSE: NSC)#Norfolk Southern is a lousy Stock#Norfolk Southern is an overvalued stock#Norfolk Southern’s Reputation is Suffering#What is the Norfolk Southern (NSC)?

0 notes

Text

At the end of April, the top shorted S&P 500 industrial stocks included companies from the NYSEARCA:XLI index. Investors were keeping a close eye on these stocks as they showed high levels of short interest, indicating bearish sentiment in the Market. Stay tuned for more updates on the stock performance of these companies in the coming weeks. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] The industrial sector of the S&P 500 saw a slight dip of 2.85% in April, contrasting with the 3.97% overall decrease in the S&P 500 index for that month. Short interest in industrial stocks across the S&P 500 inched up to 2.12% by the end of April from 2.03% in March and 2.01% in February. The Industrial Select Sector SPDR Fund ETF (NYSEARCA:XLI) had Caterpillar (CAT), GE Aerospace (GE), and Uber (UBER) as its largest contributors, with short interests of 2.22%, 0.96%, and 2.45%, respectively, at the end of April. Other major players like Honeywell (HON), United Parcel Services (UPS), 3M (MMM), and Automatic Data Processing (ADP) held short interests ranging from 0.98% to 1.44%. Among the industrial stocks, American Airlines (AAL) emerged as the most shorted with an 8.03% short interest, followed by United Airlines (UAL), Southwest (LUV), and Delta (DAL) with short interests ranging from 2.81% to 5.06%. On the contrary, Norfolk Southern (NSC) had the least short interest at 0.63%, with Broadridge Financial Solutions (BR) and Parker-Hannifin (PH) close behind at 0.64%. In terms of sub-sectors, Software retained its position as the most shorted industry within the industrial sector, while Industrial Conglomerates, Environmental and Facilities Services, and Electric Equipment were among the least shorted industries. Overall, short interest in the industrial sector provides valuable insights into Market sentiment and investor behavior, influencing stock performance and trading strategies. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What are the top shorted S&P 500 industrial stocks at April end? The top shorted S&P 500 industrial stocks at April end are those companies within the Industrial Select Sector SPDR Fund (XLI) that have the highest percentage of shares being shorted by investors. 2. Why do investors short stocks in the industrial sector? Investors may short stocks in the industrial sector if they believe that the value of these companies' shares will decrease in the near future. By shorting a stock, investors can potentially profit from a decline in its price. 3. How can I find out which S&P 500 industrial stocks are being shorted the most? You can find the top shorted S&P 500 industrial stocks by looking at the latest data on short interest, which is the percentage of a company's shares that have been shorted by investors. This data is often published by financial news websites or research firms. 4. Should I consider shorting industrial stocks in the current Market environment? Shorting stocks can be a risky investment strategy, as it involves betting that a company's share price will decrease.

Before deciding to short industrial stocks, it's important to thoroughly research and understand the potential risks and rewards of this strategy. 5. What other factors should I consider when evaluating S&P 500 industrial stocks for shorting? When evaluating S&P 500 industrial stocks for shorting, it's important to consider factors such as the company's financial health, industry trends, and overall Market conditions. Conducting thorough analysis and due diligence can help you make more informed decisions when shorting industrial stocks. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Also, because I’m now very pissed off after reading, “Train CEO is a Republican.”

First off, there is no ~train CEO.~ There is a CEO of Norfolk Southern, the company. That man has made zero political contributions since becoming CEO. Nada. Zilch.

Norfolk Southern has contributed less than $30k to Gov. DeWine and Lt. Gov. Gusted since 2018. They have donated $11,500 across six other political figures in Ohio since 2018. The company has also donated $4.5k to Democrat campaigns in Ohio since 2018.

Source, since, you know, your original post doesn’t have any.

If people want to be mad at someone about this?

Be mad at Vanguard and BlackRock. Be mad at Warren Buffet. Demand they be held accountable. Why? Because the US Government has violated its own anti-trust laws to allow Gates, Buffett, and two other private investors to gain a monopoly on Class I railroads in the US.

But Herman Haksteen, president of the Private Railcar Food and Beverage Association (PRFBA), suggests there is an investor monopoly as well among the Class I railroads. In examining filings from the Securities and Exchange Commission, Haksteen found four major institutional investors each own between 20% and 21% of three of the Class I railroads: Union Pacific (NYSE: UNP), CSX (NASDAQ: CSX) and Norfolk Southern (NYSE: NSC).

“Let’s go through the examples. To start with, BNSF (NYSE: BRK) was purchased outright by Berkshire Hathaway in 2010. BNSF is only influenced by their single institutional owner. So that now is Warren Buffett. He is the one who has the only influence over BN that really matters, right? If he tells Katie Farmer, BNSF’s CEO, that he wants her to increase prices by 20%, Katie can say, well, let’s put that to a yes-or-no vote. That’s it. So, BNSF is influenced by no one other than their owner.”

What about the other Class I railroads, like Norfolk Southern?

“Here’s the shocker — and this was a shocker to me. It’s the same four companies that are the passive investors. These are the biggest institutional investors in this country. These four have the same percentage ownership influence over the three railroads that are supposed to be competitors. I’m not making any accusations, but the same biggest investors are going to the annual shareholder meetings and board meetings of the three competitive railroads. How does that make sense? It makes great sense for the railroads because, again, they’re shielded by this 20% vote, but I don’t think it makes sense for the public’s interest.”

Warren Buffet is a Democrat.

In 2022, 57% of Vanguard PAC donations went to Democrats.

Source: OpenSecrets.org

Larry Fink, the CEO of BlackRock, is a Democrat.

I am literally begging you all to realize you’re being played by Liberals in Government in all aspects of politics.

This wasn’t Republicans. This wasn’t Trump.

This was Democrat railroad monopolists getting the SEC to violate anti-trust laws and said monopolists getting restrictions lifted because they have a chokehold on train transport in the United States.

Republicans are the party of deregulation and increased hazardous accidents.

Republicans despise prevention.

Republicans reflex is to blame others.

Surprised they are not blaming antifa or Faucci for the train accident they legislated.

4K notes

·

View notes

Text

A ‘Homer Simpson’ Train Wreck in Ohio

Springfield, Ohio – most famous for being the home of “The Simpsons” – is the latest victim of a Norfolk Southern train wreck in Ohio. And officials said residents were “ordered to shelter in place.” Who are these officials anyway? And where were they when the East Palestine fiasco occurred? Ironically (or NOT) Springfield residents were ordered to shelter in place even though they weren’t sure if any of the derailed train cars had toxic chemicals in them. But it is quite odd how “officials” said: "The Clark County Emergency Management Agency is asking residents within 1,000 feet of a train derailment at Ohio 41 near the Prime Ohio Business Park to shelter-in-place out of an abundance of caution." An abundance of caution??? Hmmm! We have a few questions to ask: Where was the abundance of caution regarding East Palestine? Are the “officials” planning on blowing up the derailed cars like EP? Will Petey Butt-Gig wait three weeks to make an appearance…or not show up at all? Does “Shelter in Place” trap residents kinda like the lockdowns? How are these fiascos affecting the Norfolk Southern stock price? And will “Shelter in Place” be the code word for future fake pandemic scares imposed on the sheeple? Has Ohio become the newest “Deep State”test ground for crisis management? And What if Homer Simpson and his family just want to get the hell out of the danger zone? More Than Another Train Wreck in Ohio But what people should really be focused on is What’s Up with Ohio in general? Maybe Joy Behar will cackle – like she did about East Palestine – about how “residents of Ohio are getting what they deserve because they voted for Trump.” * (* Note: That is one heartless woman who is still spewing venom about Trump for no other reason than hatred) Or Maybe Ohio’s conservative voting base truly is being victimized as part of some warped plan to discourage, defeat, and beat them into submission. (If that’s true, then the Boyz behind these “coincidences” totally underestimate the tenacity of folks in the Mid-West) Or Maybe JUST MAYBE this is all a coincidence…and that Norfolk Southern is going to come clean about what they’ve done…and will make amends to everyone affected. NAAAHHHHH! That ain’t gonna happen. They’ll simply lie about everything. And stall any settlements for many years so they can pass the damage back on the public with help from the Boyz on Wall Street and the District of Caligula. Think I’m kidding? Watch their stock price (symbol: NSC) and see how it gets propped up in the future by Blackrock and Vanguard. Learn how these Boyz work “Behind the Curtain” and avoid their traps every month in our “…In Plain English” newsletter (HERE). Share this with a friend…especially if they can’s stand listening to Joy Behar. They’ll thank YOU later. Remember: We’re Not Just About Finance But we use finance to give you hope. Invest with confidence. Sincerely, James Vincent The Reverend of Finance Copyright © 2023 It's Not Just About Finance, LLC, All rights reserved. You are receiving this email because you opted in via our website. Read the full article

0 notes

Text

5 Trade Ideas for Monday: Alexion, Biogen, Huntington Banc, Norfolk Southern and PerkinElmer

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Alexion Pharmaceuticals, Ticker: $ALXN

Alexion Pharmaceuticals, $ALXN, rounded up above the 200 day SMA in August and has made a series of higher highs and higher lows since. It is currently in consolidation in a pullback at the 50 day SMA with the RSI falling and the MACD dropping towards zero. Look for a break lower to participate…..

Biogen, Ticker: $BIIB

Biogen, $BIIB, started to revere lower when it hit the 200 day SMA last month. It continued until last week when it found support and consolidated. The RSI is turning back higher with the MACD leveling. Look for a move higher to participate…..

Huntington Bancshares, Ticker: $HBAN

Huntington Bancshares, $HBAN, comes into the week at recent highs and over the 200 day SMA. The RSI is rising in the bullish zone with the MACD moving higher. Look for a push over resistance to participate…..

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, started moving higher when it broke above the 200 day SMA in July. It continued to a top in September and has been slowly rolling lower since. It found support last week and ended reversing higher. The RSI is also moving higher again with the MACD leveling but slightly negative. Look for continuation to participate…..

PerkinElmer, Ticker: $PKI

PerkinElmer, $PKI, moved higher off of the 50 day SMA in September, reaching a top in October. It pulled back and found support again at the 50 day SMA before the current move higher. The RSI is rising in the bullish zone with the MACD pushing higher. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium limk.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with ten months in the books, saw equity markets looking to start November sitting on support with downside momentum building into the election.

Elsewhere look for Gold to continue its pullback while Crude Oil may begin a new downtrend. The US Dollar Index continues to rise in consolidation while US Treasuries continue in their downtrend. The Shanghai Composite looks to continue to consolidate while Emerging Markets pullback in their uptrend.

The Volatility Index is spiking, putting a headwind against the equity markets. Their charts are all in downtrends on the shorter timeframe. On the longer timeframe both the QQQ and SPY sit on support and at risk of a break down. The IWM continues to lead, holding up the best of the three. Use this information as you prepare for the coming week and trad’em well.

1 note

·

View note

Text

Is UPS Stock A Better Buy Compared To Norfolk Southern?

New Post has been published on https://perfectirishgifts.com/is-ups-stock-a-better-buy-compared-to-norfolk-southern/

Is UPS Stock A Better Buy Compared To Norfolk Southern?

BRAZIL – 2020/03/24: In this photo illustration a Norfolk Southern logo seen displayed on a … [] smartphone. (Photo Illustration by Rafael Henrique/SOPA Images/LightRocket via Getty Images)

We think that United Parcel Service (NYSE: UPS) currently is a better pick compared to Norfolk Southern (NYSE: NSC). UPS trades at about 2x trailing Revenues, compared to over 5x for Norfolk Southern. Does this gap in UPS’ valuation make sense? While UPS has benefited from rapid growth in e-commerce, Norfolk Southern has seen increased demand for its Intermodal business. UPS is partly being weighed down by its much lower margins of 6% in 2019 compared to 24% for Norfolk Southern. However, there is more to the comparison. Let’s step back to look at the fuller picture of the relative valuation of the two companies by looking at historical Revenue Growth, Returns (ability to generate profits from growth), and Risk (sustainability of profits). Our dashboard United Parcel Service vs. Norfolk Southern: Is UPS Stock Appropriately Valued Given Its Significantly lower P/S Multiple Compared to NSC? has more details on this. Parts of the analysis are summarized below.

1. Revenue Growth

UPS’ Revenues grew 27% from $58.4 billion in 2015 to $74.1 billion in 2019, aided by e-commerce growth. The growing e-commerce industry has been driving volumes at UPS’s U.S. Domestic Package segment. Many brick-and-mortar retailers have rolled out online shopping portals to cater to the growing online retail shopping customer base and they along with other prominent online retailers, including Amazon AMZN , have tied up with logistics companies such as UPS for package deliveries.

On the other hand, Norfolk Southern’s Revenues grew just 7.6%, rising from around $10.5 billion to $11.3 billion over the same period, implying UPS’ revenues have grown at a faster pace over the recent years. For Norfolk Southern, the growth in its Merchandise freight and Intermodal is being partly offset by Coal freight, a trend seen across railroads. With the increased use of cleaner sources of energy such as natural gas, which is also favorably priced, the demand for coal has dropped significantly over the last few years. Consequently, the coal shipments for Norfolk Southern have witnessed a sharp decline.

2. Returns (Profits)

While UPS’ free cash flows as a % of Revenues stood at about 12% in 2019, increasing from around 11% in 2016, Norfolk Southern’s free cash flows as a % of Revenues stood at about 34%, up from around 31% in 2016. While the Return on Invested Capital metric for both companies has been volatile, UPS’ ROIC was higher compared to Norfolk Southern in 2019, standing at about 30% versus about 12%. Norfolk Southern’s Total Shareholder Returns have been higher, driven by a better stock price. Norfolk Southern’s stock price grew 2.8x and its dividend payout ratio declined from 42% to 35% between 2016 and 2019. This compares with stock price growth of 1.8x and dividend payout ratio decreasing from 80% to 75% for UPS over the same period.

3. Risk

UPS’ Debt load is higher at around $26 billion currently, and its Debt to Equity ratio standing at about 25% as of 2019. Norfolk Southern’s debt currently stands at around $13 billion, and its Debt to Equity ratio stood at 23% in 2019 compared to 30% in 2016. Overall, neither company appears to have very meaningful financial risk.

The Net Of It All

Although UPS’ Revenue growth compares favorably with Norfolk Southern, they both are comparable in terms of returns and risk. While Norfolk Southern’s margins are much higher than UPS, we think the difference in P/S multiple of 2x for UPS versus 5x for Norfolk Southern will likely narrow going forward. Both the companies are seeing pickup in demand of late, as the economies open up gradually after the pandemic, and now with a vaccine in the picture, it appears that the worst of the pandemic is behind us. Now UPS’ revenue is expected to grow 16% from $74 billion in 2019 to $86 billion in 2021, while Norfolk Southern’s revenue is expected to decline 6% to $10.7 billion in 2021 compared to $11.3 billion in 2019. With UPS’ revenues expected to grow at a faster pace, the difference in P/S multiple with that of Norfolk Southern is likely to narrow, implying UPS stock could offer better growth in the near term.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus about 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More from Markets in Perfectirishgifts

0 notes

Text

New Dow Theory Signal - What Does It Mean For Stocks?

Charts Monitor, Rather Than Dismiss Fundamental Data

Critics of technical analysis often mistakenly believe that using charts discounts the importance of fundamental data, such as earnings, employment, and economic growth. Charts allow investors to monitor the aggregate investor interpretation of all the fundamental data. Said another way, charts are efficient tools allowing us to monitor vast amounts of fundamental data, which is important since fundamentals ultimately determine the market’s long-term fate. When the economy is healthy, stocks tend to beat bonds. When economic fear dominates, bonds tend to beat stocks. In this article, we will cover the latest signal from the markets that came on July 3.

Dow Theory Is Based On Economic Common Sense

Dow Theory is based on a series of Wall Street Journal articles written by Charles Dow. The basic tenets of Dow Theory are easy to understand. Charles Dow believed that:

In order for industrial companies to increase their earnings, they had to produce and sell more goods.

If industrial companies are selling more goods, then transportation companies must be delivering more goods to retailers and wholesalers.

Therefore, in a healthy economy, both industrial companies and transportation companies should be experiencing revenue growth.

If industrial and transportation companies are growing their revenues, then the industrial and transportation stocks should be attractive to investors.

If industrial and transportation companies are doing well and are attractive to investors, both the Dow Jones Industrial Average and the Dow Jones Transportation Average should be making new highs, serving to confirm a healthy economy.

Behind The Averages

After reviewing the companies in the industrial and transportation averages, it is easy to see why they represent logical vehicles to monitor the pulse of the U.S. economy. In 2017, our economy is driven by more than just industrial or manufacturing companies. The present day Dow Jones Industrial Average contains traditional producers, such as IBM (IBM), 3M (MMM), Boeing (BA), Chevron (CVX), and Johnson & Johnson (JNJ). However, the Dow (DIA) also contains Visa (V), Goldman Sachs (GS), and American Express (AXP), since the present day economy relies heavily on the financial sector. The Dow Jones Transportation Average (IYT) still has railroads, such as Union Pacific (UNP) and Norfolk Southern (NSC), but it also contains more modern logistics companies, such as United Parcel Service (UPS), Fed-Ex (FDX), and J.B. Hunt (JBHT).

Just Reconfirmed Primary Bull Market

If investors believe industrial and transportation stocks are healthy and thus, attractive investments, that speaks to demand. When demand is strong, stock prices rise. Despite recent stock market volatility, the Dow Jones Industrial Average broke out and posted a new high in early June. Notice the slope of the blue 50-day moving average in the chart below; you can compare it to the early stages of a 2011 correction in stocks and to the 2008-2009 bear market later in the article.

Similarly, the Dow Jones Transportation Average also posted a new high on July 3. Again, note the look of the blue 50-day moving average.

How Can Stocks Continue To Climb With Weak Growth And The State Of The World?

This week’s stock market video addresses two major questions: (1) Is the party ending for the NASDAQ? and (2) Have stocks exceeded expectations in the past after a period of tepid growth and political instability?

After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

youtube

2011: How Can This Help Us Manage Risk Today?

If Dow Theory offers a way to monitor the aggregate interpretation of the economy, earnings, and central bank policy, then we would expect charts of the DJIA and DJTA to be helpful in terms of managing investment risk. Since a picture is worth a thousand words, when the Dow’s 50-day rolled over in 2011 (see orange arrows below), the index dropped an additional 16%. Notice how the Dow failed to make a new closing high before the big reversal in 2011. As of July 2017, the 2014 Dow chart looks much better (slope of 50-day is up, recent higher high).

2007-2009: Economic Pessimism And Investor Fear

Similar economic warnings came in 2007 and 2008 (see orange arrows in chart below). Notice during the 39% drop in the Dow in 2008 the 50-day never gave a “things are improving” signal, meaning it was helpful from a cash-redeployment perspective. In late 2007/early 2008, Dow was not making new highs; instead it was making a series of lower lows, which reflected a period of economic pessimism and investor fear. The 2017 chart of the Dow looks much better, which is indicative of more favorable economic expectations.

The differences are easy to see side-by-side. The stronger bullish conviction tells us even if stocks pull back in the short-run, the odds are good that buyers would step in and attempt to test the recent highs. Reversals tend to be a process rather than a one-day binary event. The charts below speak to probabilities.

Investment Implications – Time To Pay Closer Attention

Does the recent Dow Theory bullish confirmation mean it is all fun and games for the economy and stock market? No, it simply tells us the market is currently healthy and the next bout of significant weakness is more likely to be a correction, rather than a full-blown bear market. A correction always remains a possibility in 2017.

For Further Study

Are Stocks In A Bubble That Is About To Burst?

Will Narrow Framing Cause Many To Miss A Generational Rally In Stocks

How Concerning Are Predictions Of A Stock Market Crash?

3 notes

·

View notes

Text

Canadian Pacific CEO’s early departure sends CSX shares soaring

The Canadian railroad reported earnings that missed expectations, but the real intrigue came from the announcement that CEO Hunter Harrison would retire early.

By Lou Whiteman

Shares of railroad CSX Corp (CSX) rose more than 15% in early Thursday trade the morning after news that Hunter Harrison, the railroad veteran who teamed with Bill Ackman to spearhead a revamp of Canadian Pacific Railway (CP), is reportedly teaming up with another activist to target CSX.

Harrison and Paul Hilal, who left Ackman's Pershing Square Capital Management last year to go out on his own, are aiming to shake up management at CSX and put the 72-year-old former Canadian Pacific CEO into a senior management position, according to the Wall Street Journal.

Hilal worked on the Canadian Pacific campaign while at Pershing Square.

CSX shares traded at $43 about an hour and a half before the market open on Thursday, a gain of 15.6%

The report confirms speculation that surfaced earlier in the evening after Harrison announced an abrupt departure from Canadian Pacific months before his planned retirement. The company said that as part of the separation it had agreed to a limited waiver of Harrison's non-competition obligation in return for the exec agreeing to forfeit "substantially all benefits" he was entitled to.

Harrison came to Canadian Pacific in 2012 after Ackman won a proxy fight to overhaul the Calgary-based railroad's board. As CEO, Harrison trimmed costs and brought the railroad's operating ratio, a measure of efficiency, to a recent 56.2%. CSX, by comparison, has an operating ratio closer to 70%.

The news comes less than 24 hours after CSX missed what many analysts had called a conservative fourth-quarter earnings estimate. The company has been hit hard by a decline in commodity prices and in particular a drop off in shipments of domestic coal.

Harrison while at Canadian Pacific attempted at various times to orchestrate a merger with CSX or its East Coast rival Norfolk Southern NSC, pledging in both cases to extract costs similar to the impact he had at Canadian Pacific. It should be noted though that the East Coast railroads tend to have lower margins than their Canadian counterparts due to shorter stage lengths, meaning it could be hard for CSX to reach CP's numbers regardless of who is in charge.

It is unclear whether Harrison would target M&A if he takes a leadership role at CSX, but presumably, his presence inside the company would make it more open to overtures from Canadian Pacific. U.S. regulators and many large-rail customers have taken a firm stance against further consolidation among major railroads, but Harrison while at CP argued that the efficiencies that would be created from a combination between his Canadian company and CSX or Norfolk Southern would be able to gain approval.

CSX's current CEO, Michael J. Ward, has been in the role since 2003, and is no stranger to criticism. In 2008, activists Children's Investment Fund and 3G Capital Partners won four seats on the CSX board. CSX eventually won a suit against the investors, claiming they had violated securities law in that campaign.

2 notes

·

View notes

Text

PODCAST: Kellogg’s ‘Beyond Meat,’ ESG Stock Tips, Ethical Pot Companies

(Note: my next podcast is August 2.) Kellogg has the most successful vegie burger, pressure begins for IPO. More ESG stock, fund, and portfolio tips. Abandon GE, buy Schneider Electric, says Tim Nash in his stock challenge. Pot companies plan to adopt ESG as they strive to be seen as responsible, ethical, and sustainable investments.

PODCAST: Kellogg’s ‘Beyond Meat,’ ESG Stock Tips, Ethical Pot Companies

Transcript & Links July 5, 2019

Hello, Ron Robins here. Welcome to my podcast Ethical & Sustainable Investing News to Profit By! for July 5, 2019—presented by Investing for the Soul. investingforthesoul.com is your site for vital global ethical and sustainable investing information and resources. Please note that due to holidays my next podcast will be on August 2.

Now to this podcast. And, Google any terms that are unfamiliar to you.

Also, you can find a full transcript, live links and bonus material to this podcast at this edition's podcast page located at investingforthesoul.com/podcasts

-------------------------------------------------------------

Hey, about the continuing saga of Beyond Meat. Its stock as of this writing is still holding well over $150 s share.

Well, it seems that Brett Arends writing in MarketWatch has found that Kellogg has its own successful Beyond Meat competitor under the guise of its subsidiary MorningStar Farms -- and it’s going under the radar of everyone!

In an article titled, Kellogg is sitting on a ‘fake meat’ gold mine bigger than Beyond Meat, Brett argues that Kellogg, whose stock price has been struggling for years, should take MorningStar Farms public and might well become even more valuable than Beyond Meat.

Quoting Brett, he says, that, “Kellogg already owns the largest single ‘fake meat’ operation in the country in MorningStar Farms, a brand that has been around since the 1970s. [and he says] Where’s its IPO?”

Continuing, Brett states, that, “I tried MorningStar’s ‘Grillers’ vegetarian burgers not long ago, on the recommendation of some friends. Frankly, I found them way better than Beyond Meat’s ‘Beyond Burgers’ and not obviously worse than the so-called ‘Impossible Burger’ that people are raving about. Close quote.

Brett says that Kellogg won’t break out the annual sales figures for MorningStar Farms—though he believes they could be around $450 million and that compares with $290 million for Beyond Meat’s 2019 sales estimate!

So, will Kellogg spin-off MorningStar Farms and do an IPO? Who knows but Sustainalytics gives Kellogg an ESG rating of 65—putting it in the 81st percentile of its peers and Reuters says analysts following the stock presently rate it as a hold. So, something you might consider.

-------------------------------------------------------------

Barron’s the US investment daily paper recently published a piece by Karen Hube titled, How to Build Your Own ESG Portfolio. She says all the right things, such as the following, quoting her, "By putting your savings in funds that assess how a company is addressing (or worsening) environmental, social, and governance, or ESG, factors, you hitch your investments to good corporate citizens, and may earn above-average returns. But turning the concept into a practical investment portfolio without compromising on investing mandates such as diversification and due diligence comes with a unique set of challenges." End quote

So, some great points are made in her article, but her portfolio appears overly diversified to me. Statistically, having more than fifteen stocks in diversified industries across regions will give you very little extra statistical benefit. Also, no-doubt it'll include sectors and companies that won't please you!

Along similar lines, John Eade of Argus Research Group published their sustainable stock recommendations in a post, An Argus Research Portfolio for Sustainable Impact Stocks which appeared in Money Show. John likes: Alphabet Inc. (GOOGL: OQ), Ecolab Inc. (ECL: NYSE), Johnson & Johnson (JNJ: NYSE), JPMorgan Chase & Co. (JPM: NYSE), McDonald’s Corp. (MCD: NYSE), Microsoft Corp. (MSFT: N), Norfolk Southern Corp. (NSC: NYSE) and a few more that you can see by clicking the link in the transcript for this podcast.

Again, if you have or are interested in creating a portfolio of profitable individual stocks that reflect your values, learn how to do it properly and systematically in my one-hour DIY Ethical-Sustainable Investing Pays Tutorial. Take a few seconds to check it out! Go to investingforthesoul.com/podcasts and look down the right-hand sidebar.

-------------------------------------------------------------

In speaking of portfolio diversification, heavy industry is not a sector that as an ethical and sustainable investor you might consider. Nonetheless, you can’t escape the necessity for it in our society and it can have a place in your portfolio too. So, in Tim Nash’s sustainable stock showdown pulls plug on GE, he compares General Electric (GE: NYSE) with Schneider Electric (SGBSY: OTC).

GE has been in the doldrums for several years. Tim says about GE, that, “GE was a great investment throughout the 20th century, but lacking a clear forward-looking strategy to transition into a low-carbon future, it’s no wonder that sustainable investors are turning out the lights on GE shares.” End quote

Concerning Schneider Electric, Tim says, that, “Schneider Electric is a French energy management company making hardware and software that helps companies improve their energy efficiency… Schneider Electric at #60 on the 2019 Corporate Knights Global 100 Most Sustainable Corporations in the World list, and #13 on the 2019 Corporate Knights and As You Sow Clean200 list.”

Finally, he says, “If you want to keep the lights on sustainably in the 2000s, forget GE. Schneider Electric is a better investment.”

-------------------------------------------------------------

Yet another new low-cost ESG ETF has been launched. It’s the Xtrackers S&P 500 ESG ETF (NYSE: SNPE). What’s special about this ESG ETF is that it tracks the new S&P 500 ESG Index. According to Todd Shriber at Benzinga in a post, Another Cheap ESG ETF is Here, Todd writes, that, the “S&P Dow Jones launched the index earlier this year and its approach to ESG investing is traditional in that it excludes tobacco companies, civilian firearms manufacturers and companies with low scores based on the United Nations Global Compact for responsible business…

Continuing the quote, Todd says that, “The new SNPE allocates over 27% of its weight to the technology sector and a combined 28.23% of its weight to the health care and consumer discretionary sectors. SNPE is home to 319 stocks. The financial services and industrial sectors combine for over 20% of the fund's weight.”

Now earlier I brought up the subject of over-diversification and here I’m concerned that like most other general ESG ETFs they tend to under diversify into a few key sectors—and so, for instance, when tech, health care, and financials do well, they thrive. Since these sectors have done so well in the past decade, portfolios that are heavily weighted in those sectors have generally outperformed.

However, with trade frictions, anti-monopolistic sentiments and governments potentially further regulating health care costs and privacy concerns coming to the fore, it’s possible that stock market leadership might rotate to other market sectors.

From another perspective that also relates in a way to diversification, is a protestation by James Gard in a Morningstar UK article. In it, he argues to be a little ‘looser’ in not being too strict in only including top ESG rated companies in your portfolio. His article is titled, Should ESG Funds Buy "Bad" Companies? James makes a point that, quote, “Investors who shun such firms may miss out if these efforts pay off in the long-term.”

James further quotes Jon Hale, also of Morningstar, as follows, “Wouldn't another investor come along to take the place of the ‘responsible’ investor? And if enough investors shun a company's stock, it could become undervalued and end up outperforming for those who don't have any problem investing in it.” And by the time that happens, that poor performing ESG stock could become a leading ESG stock with great stock price gains that you would’ve missed out on. So that’s the argument for loosening your ESG stock screening.

-------------------------------------------------------------

Incidentally, terrific price gains have been made with pot stocks in recent years. But can they be worthy investments for ethical and sustainable investors? That’s a complicated question. Besides the personal values issues for you, you might’ve wondered if pot companies can do well with ESG issues?

Well, the pot industry is aiming to create its own ESG standards. Kristine Owram, writing in a Bloomberg article titled, Pot Firms Seek to Transition From Sin Stocks to Ethical Darlings, says, that, and I quote, "A group of 45 companies operating in the cannabis industry has crafted a set of standards that they hope could one day transform them from sin stocks into ESG darlings."

This will be fascinating to watch! Can pot companies be sold as health producing ESG focused entities to institutional investors? For a great review of the pot industry from an ESG perspective see the Sustainalytics post and report, ESG Risks of Cannabis Cultivation: Energy, Emissions and Pesticides.

-------------------------------------------------------------

So, these are my top news stories and tips for ethical and sustainable investors over the past two weeks.

Again, to get all the links or to read the transcript of this podcast and sometimes get additional information too, please go to investingforthesoul.com/podcasts and scroll down for this edition.

And be sure to click the like and subscribe buttons in iTunes or wherever you listen to this podcast. That way you can help promote not only this podcast but ethical and sustainable investing globally.

And remember, I’m here to help you grow in your investment success—and investing in opportunities that reflect your personal values!

Please don’t hesitate to contact me if you have any questions about the content of this podcast or anything else investment related. I can’t say I’ll have all the answers for you and some answers I can’t give due to licensing restrictions. But where I can help I will.

Now, a big thank you for listening—and please click the share buttons to share this podcast with your friends and family.

Come again! And as I mentioned, my next podcast is scheduled for August 2. Yes, I’m taking a break. Talk to you then. Bye for now.

Check out this episode!

#business#finance#ethical investing#sustainable investing#ESG#SRI#green bonds#socially responsible investing

0 notes

Text

Norfolk Southern 4Q profit jumps 44 per cent

OMAHA, Neb. — Norfolk Southern Corp. said it hauled in 44 per cent more fourth-quarter profit as volume increased 3 per cent and the railroad increased shipping prices.

The Norfolk, Virginia-based company said Thursday it had $702 million net income, or $2.57 per share in the quarter that ended Dec. 31. That’s up from adjusted net income of $486 million, or $1.69 per share, the previous year.

The results from the latest quarter surpassed the $2.30 per share that analysts surveyed by Zacks Investment Research expected.

The railroad’s revenue grew 9 per cent to $2.9 billion in the period, which also topped Street forecasts. Six analysts surveyed by Zacks expected $2.85 billion.

The railroad said its quarterly results were helped by gains from one-time land sales.

Norfolk Southern officials have developed a plan to make their railroad more efficient and implement some of the operating principles other railroads have been using with great success over the past couple years. The railroad plans to share details of that plan with investors next month.

Edward Jones analyst Dan Sherman said investors are questioning the reforms at Norfolk Southern because their approach doesn’t seem as aggressive as what other railroads have done.

For the year, the company reported profit of $2.67 billion, or $9.51 per share. Revenue was reported as $11.46 billion.

Its stock slipped $1.94, or about 1 per cent, to $164 in after-hours trading Thursday following the release of the earnings report.

———-

Elements of this story were generated by Automated Insights (http://automatedinsights.com/ap) using data from Zacks Investment Research. Access a Zacks stock report on NSC at https://www.zacks.com/ap/NSC

from Financial Post http://bit.ly/2Dv7wOg via IFTTT Blogger Mortgage Tumblr Mortgage Evernote Mortgage Wordpress Mortgage href="https://www.diigo.com/user/gelsi11">Diigo Mortgage

0 notes

Text

New Post has been published on Mortgage News

New Post has been published on http://bit.ly/2jyAhgT

2 Top Railway Companies Raise Their Dividends

Shareholders in a pair of major railway operators will soon be receiving higher disbursements: Norfolk Southern (NYSE: NSC) and its north-of-the-border peer Canadian National Railway (NYSE: CNI) both just raised their quarterly dividends.

Norfolk Southern is bumping its payout 3% to $0.61 per share, while Canadian National is boosting its dividend by 10% to C$0.4125 ($0.315).

Both companies are steady and reliable dividend payers. Canadian National hasn’t missed a quarter since it started paying them in 1996, while Norfolk Southern’s streak reaches back to 1982.

On a fundamental basis, the two have been doing quite well lately. Concurrent to its dividend news, Canadian National reported its fourth-quarter and fiscal 2016 results. Its quarterly net income of just over C$1 billion ($756 million) notched a new all-time record for the period, on revenue that inched up 2% on a year-over-year basis to C$3.2 billion ($2.4 billion).

Norfolk Southern saw a higher-than-expected jump in its third quarter net profit, with the line item rising by 2% on a year-over-year basis to $460 million (although revenue declined 7% to $2.52 billion). The top line result barely missed analysts’ expectations, but the company beat on net profit. Its new dividend is to be paid on March 10 to stockholders of record as of Feb. 3. Relative to its most recent closing stock price, it would yield 2%. That’s a shade higher than the current 2% average of dividend-paying stocks on the S&P 500.

Canadian National will dispense its payout on March 31 to its investors of record as of March 10. It would yield a theoretical 1.8%.

10 stocks we like better than Norfolk Southern When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and Norfolk Southern wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of January 4, 2017

Eric Volkman has no position in any stocks mentioned.

0 notes

Text

5 Trade Ideas for Monday: Costco, Graco, Grainger, Norfolk Southern and Zoetis

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Costco, Ticker: $COST

Costco, $COST, comes into the week at resistance. It has a RSI rising towards the bullish zone with the MACD heading towards positive. Look for a push over resistance to participate…..

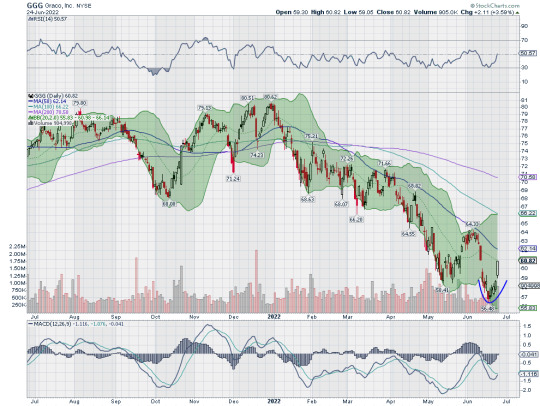

Graco, Ticker: $GGG

Graco, $GGG, comes into the week reversing higher off a low. It has a RSI rising towards the bullish zone and a MCD about to cross up. Look for continuation to participate…..

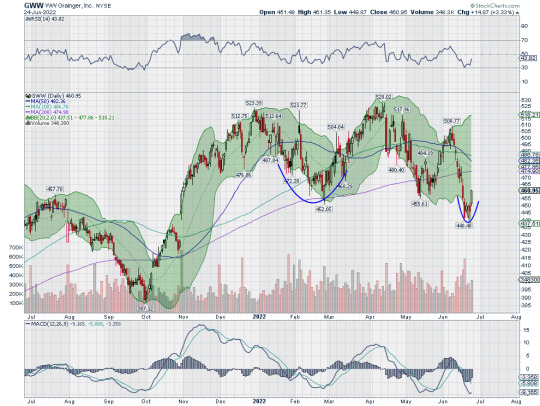

W.W. Grainger, Ticker: $GWW

W.W. Grainger, $GWW, comes into the week reversing higher off a low. It has a RSI rising off oversold and a MACD turning to cross up. Look for continuation to participate…..

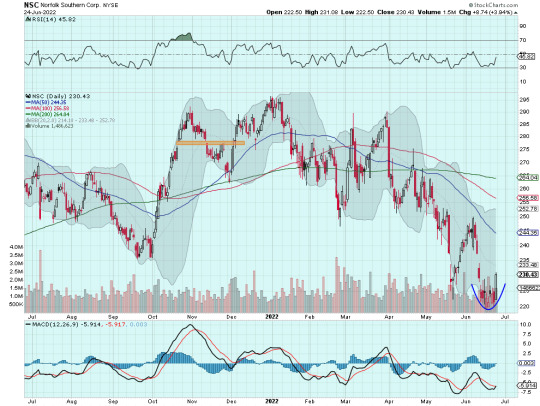

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, comes into the week reversing off a low. It has a RSI rising off oversold and a MACD about to cross up. Look for continuation to participate…..

Zoetis, Ticker: $ZTS

Zoetis, $ZTS, comes into the week at resistance. It has a RSI rising in the bullish zone with the MACD moving towards positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with only 4 trading days left in the 2nd Quarter, saw that equity markets had mounted a strong rebound off of the lows and set up for at least short term continuation.

Elsewhere look for Gold to continue to consolidate while Crude Oil pulls back from the highs. The US Dollar Index pause in its move to the upside while US Treasuries continue their downtrend. The Shanghai Composite looks to continue the trend higher while Emerging Markets continue to move lower.

The Volatility Index looks to slowly ease from elevated ground making the path easier for equity markets to the upside. Their charts are looking stronger following the week’s move, especially on the shorter timeframe. On the longer timeframe the moves required to call a confirmed reversal are still far above, about 5% more for the QQQ and 7% for the SPY to make a higher high. It will take another 9% for the IWM to get there. Those moves would only be first steps. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Graco, Lazard, Norfolk Southern, Nutrien and Snap

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Graco, Ticker: $GGG

Graco, $GGG, started higher in March and made a series of higher highs and higher lows. Since moving up off of the 200 day SMA in July it has had a steady trend higher. It paused when it reached the February high and then has continued higher. It comes into the week at resistance with a RSI rising in the bullish zone and then MACD crossing up. Look for a push over resistance to participate…..

Lazard, Ticker: $LAZ

Lazard, $LAZ, met resistance in June just under the 200 day SMA. It pulled back and then made another move higher that stalled under the 200 day SMA. It has held there since. The RSI is rising in the bullish zone with the MACD turning to cross up. Look for a push over resistance to participate…..

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, started higher in March and met resistance in June. It pulled back to the 50 day SMA and then reversed higher. It is now at all-time highs again. The RSI is rising in the bullish zone with the MACD turning to cross up. Look for a push over resistance to participate…..

Nutrien, Ticker: $NTR

Nutrien, $NTR, started higher off of a March low and met resistance in April. It has moved sideways in a range since, tightening against the top the last month. The RSI is rising in the bullish zone with the MACD crossing up. Look for a push over resistance to participate…..

Snap, Ticker: $SNAP

Snap, $SNAP, ran from a March low to a top in July. It pulled back from there and has been rounding out a bottom recently. The RSI is rising in the bullish zone with the MACD lifting and positive. Look for continuation to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with a second week lower and heading into the September options expiration, saw equities trying to catch their breath but looking weak.

Elsewhere the word is consolidation. Look for Gold to continue its consolidation while Crude Oil breaks consolidation lower. The US Dollar Index continues to consolidate after the drop while US Treasuries move sideways. The Shanghai Composite looks to continue an intermediate consolidation while Emerging Markets consolidate under long term resistance.

The Volatility Index looks to resume a drift lower making the path easier for equity markets to the upside. Their charts still look at risk though, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY are in consolidation after a drop while the IWM is looking the weakest in a pullback. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: Comerica, Hartford Financial, Norfolk Southern, Patterson and Thermo Fisher

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

Comerica, Ticker: $CMA

Comerica, $CMA, made a bottom in March and held there until moving higher at the end of May. It topped in June and then pulled back. Since then it has been consolidating under resistance. The RSI is rising towards the bullish zone with the MACD crossing up and positive. Look for a push over resistance to participate…..

Hartford Financial, Ticker: $HIG

Hartford Financial, $HIG, bottomed in March and then did not do much until starting to move higher in May. It topped in early June and pulled back, creating a new consolidation zone. It is at resistance now with the RSI rising into the bullish zone and the MACD lifting and positive. Look for a push over resistance to participate…..

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, also bottomed in March and then reversed. It made a top in June and then pulled back. It found support and reversed again, and has been in consolidation against resistance at a lower high since. The RSI is rising in the bullish zone with the MACD flat and positive. Look for a push over resistance to participate…..

Patterson, Ticker: $PDCO

Patterson, $PDCO, rose from an April low in a jagged fashion. By late June it was moving higher and made a top in July. Last week it closed with a push over that top. The RSI is rising in the bullish one with the MACD turning up and positive. Look for continuation to participate…..

Thermo Fisher, Ticker: $TMO

Thermo Fisher, $TMO, rose from a March low to consolidation in April. it held there for 10 weeks before moving higher in July. It topped 2 weeks ago and has consolidated since. The RSI is strong in the bullish zone with the MACD flat and positive. Look for a pus up through the triangle to participate…..

If you like what you see sign up for more ideas and deeper analysis using this Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with July in the books, saw equity markets showed resilience with a rebound from consolidation.

Elsewhere look for Gold to continue higher while Crude Oil consolidates in a tight range. The US Dollar Index continues to move to the downside while US Treasuries continue their uptrend. The Shanghai Composite is building tightening consolidation while Emerging Markets consolidate in their uptrend.

The Volatility Index looks to continue to drift lower making the path easier for equity markets to the upside. Their charts also look strong, especially on the longer timeframe. On the shorter timeframe both the SPY and IWM continue moving up in consolidation. The QQQ looks the strongest moving back toward all-time highs. Use this information as you prepare for the coming week and trad’em well.

0 notes

Text

5 Trade Ideas for Monday: CME, Dunkin’ Brands, FedEx, Norfolk Southern, Rockwell Automation

5 Trade ideas excerpted from the detailed analysis and plan for premium subscribers:

CME, Ticker: $CME

CME, $CME, fell through support in March and found a bottom one week later. Since then it has made 2 moves higher and is at resistance. The RSI is rising toward the bullish zone with the MACD positive and moving higher. Look for a push over resistance to participate…..

Dunkin’ Brands, Ticker: $DNKN

Dunkin’ Brands, $DNKN, started to move lower in February. It accelerated into March and found a bottom in the middle of the month. Since then it has been trending higher and is at resistance. The RSI is rising into the bullish zone with the MACD about to turn positive. Look for a push over resistance to participate…..

FedEx, Ticker: $FDX

FedEx, $FDX, fell fast out of a long consolidation in late February. It found support mid-March and reversed. It comes into the week at resistance and with the RSI rising off of the mid line and the MACD about to turn positive. Look for a push over resistance to participate…..

Norfolk Southern, Ticker: $NSC

Norfolk Southern, $NSC, peaked in January after a gap up and then started to slowly turn lower. It accelerated at the end of February and made a bottom in mid-March. Since then it has been rising and is at resistance short of filling a gap. The RSI is rising into the bullish zone with the MACD about to turn positive. Look for a break over resistance to participate…..

Rockwell Automation, Ticker: $ROK

Rockwell Automation, $ROK, started lower in late February and found support in the middle of March. It has moved higher since and is now at resistance and the 50 day SMA. The RSI is rising toward the bullish zone with the MACD about to turn positive. Look for a push over resistance to participate…..

If you like what you see sign up for more ideas and deeper analysis using the Get Premium link.

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which with the April options expiration complete sees equity markets continuing to show signs of recovery.

Elsewhere look for Gold to continue its pullback in the uptrend while Crude Oil consolidates in the down trend. The US Dollar Index continues to tighten its range while US Treasuries consolidate in their uptrend. The Shanghai Composite remains in broad consolidation while Emerging Markets continue their short term move higher.

The Volatility Index looks to continue to drift lower but at a high level making the path easier for equity markets to the upside. Their charts show the SPY and QQQ taking advantage of that and moving higher, showing strength especially on the longer timeframe. The IWM however looks like it needs to catch its breath and is pausing. Use this information as you prepare for the coming week and trad’em well.

0 notes