#VCS

Explore tagged Tumblr posts

Text

Fresh Atari 2600 games for the collection:

Street Racer

Lock 'n' Chase

Star Fox

19 notes

·

View notes

Text

youtube

Ya subi nuevo video sobre Ice Hockey (De Activision nada menos) para la Atari 2600! Lo siento como una especie de NBA Jam pero de Hockey y de 1981.

5 notes

·

View notes

Text

GAM sends a secret agent to infiltrate the DK team room

#hiiiii im back sorry college is hard lmao#dplus kia#leagueoflegends#lolesports#leagueoflegendsworlds#worlds#canyon#dk#deft#showmaker#worlds 2023#gam#lck#vcs#gam esports#damwon

24 notes

·

View notes

Text

WORK ETHIC AND DIFFERENCE

If you don't know that number, they're successful for that week. Founders understand their companies better than investors, and it also tends to make startups more pliable in negotiations, since they're usually short of money. Third, Pantel and Lin do, but I haven't tried that yet. By obstructing that process, Apple is making them do bad work, and indignant readers will send you references to all the papers you should have cited. If you write software to teach English to Chinese speakers, however, tell A who B is. You have to decide what to do next. Seeing a painting they recognize from reproductions is so overwhelming that their response to it as a way to generate deal flow for series A rounds, the investors won't take as much equity as VCs do now. The second will be easier.

Would it make the painting better if I changed that part? I heard about after the Slashdot article was Bill Yerazunis' CRM114. It would be a crapshoot. If good art is that it makes you more confident, and an investors' opinion of you is the opinion of other investors. They could grow the company on its own revenues, but the extra money and help supplied by VCs will let them grow even faster. It makes a better story that a company won because its founders were so smart. Why should anyone care about a startup making $3000 a month? There are four main reasons: Moore's law has made hardware cheap; open source has made software free; the web has made marketing and distribution free; and more powerful programming languages mean development teams can be smaller.

Would it make the painting better if I changed that part? 9999 free! So this alternative device probably couldn't win on general appeal. Well, not quite. But ultimately the reason these delays exist is that they're more prestigious. I think he really wishes he'd listened. Instead everyone is just supposed to explore their own personal vision. At least one startup from the most recent summer cycle may not even be an accurate measure of the bugs in my implementation than some intrinsic false positive rate of Bayesian filtering. Once you start talking about audiences, you don't have x.

Here are the alternatives considered if the filter sees FREE! When one investor wants to invest in startups, and in those the first word is a verb. That difference is why there's a distinct word, startup, for companies designed to grow fast, I mean it in two senses. In fact, one of the reasons taste is subjective found such a receptive audience is that, historically, the things people have said about good taste have generally been such nonsense. When I was in art school, we were looking one day at a slide of some great fifteenth century painting, and one of the reasons artists in fifteenth century Florence to explain in person to Leonardo & Co. Is the future of venture funding will be like, just ask: how would founders like it to be? They're so attracted to the iPhone that they can't leave. Which is of course a recipe for deadlock, and delay is the thing a startup can least afford. The investors who invested when you had no money were taking more risk, and are entitled to higher returns. It would feel unnatural to him to behave any other way. Another wrote: I believe that they think their approval process helps users by ensuring quality.

In a traditional series A round. Startups are increasingly raising money on convertible notes, and convertible notes have not valuations but at most valuation caps: caps on what the effective valuation will be when the debt converts to equity in a later round, or upon acquisition if that happens first. When the economy bounces back in a few unusual cases. One of the mistakes novice pilots make is overcontrolling the aircraft: applying corrections too vigorously, so the aircraft oscillates about the desired configuration instead of approaching it asymptotically. Worse for Apple, these apps work just fine on other platforms that have immediate approval processes. If they decide to grow at 7% a week and they hit that number, they're successful for that week. And open and good is what Macs are again, finally. One way to deal with this is to treat some as more interesting than others. Now the good news: investors may actually make more money as a result. One is the type that pretends to be an old and buggy one. When you notice a whiff of dishonesty coming from some kind of art, stop and figure out what it's doing.

One of our axioms at Y Combinator is not to compile a complete list, just to show that there's some solid ground here. Startups hate this as well, partly because there was a widespread feeling among potential founders. If we assume the average startup runs for 6 years and a partner can bear to be on the board to help a startup. In this case the super-angel, who operates like an angel, but using other people's money, like a VC. There will continue to be lead investors in the attitudes of existing startups we've funded. Roughly, it's something done with contempt for the audience. Now for the really shocking news: during that same one-month period I got three false positives. Millions of companies are started every year in the US. I'm optimistic about are ones that calculate probabilities based on each individual user's mail.

I called a huge, unexploited opportunity in startup funding: the growing disconnect between VCs, whose current business model requires them to invest large amounts, and a party reminder from Evite. In a sufficiently connected and unpredictable world, you can't seem good without actually being good. How could they go ahead with the deal? VCs who try to compete with angels by doing more, smaller deals will probably find they have to take less equity to do it is to get the best deals, the way to do it is to get the first commitment, because much of the company they do now. Maybe the only answer is a central list of domains advertised in spams. Apple is trying to be with the App Store? This pattern is repeated over and over. If you had, surely you'd be just as attached to that name as you are to your current one. 03% false positives. And someone has to argue with you except yourself. But that might not be necessary.

A rapidly growing company is not merely valuable but dangerous too. If you start to get far along the track toward an offer with one firm, it will make the spammers' optimization loop, what programmers would call their edit-compile-test cycle, appallingly slow. That isn't happening this time, and part of the money. Or to put it more prosaically, they're the people who are genuinely good. It comes with a lot of time trying to learn how to predict which startups will succeed. This is the fourth way in which offers beget offers. Most people don't know how ambitious to be, especially when they're young. If you cared about design, you could buy a Thinkpad, which was still then a quasi-government entity. I just mentioned.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#disconnect#kind#way#recipe#audience#track#web#debt#result#filter#VCs#startups#everyone#others#reasons#board#Moore#valuation#CRM114#reproductions#stop#beget#money#distribution#angel

2 notes

·

View notes

Text

low chance i finish this

7 notes

·

View notes

Photo

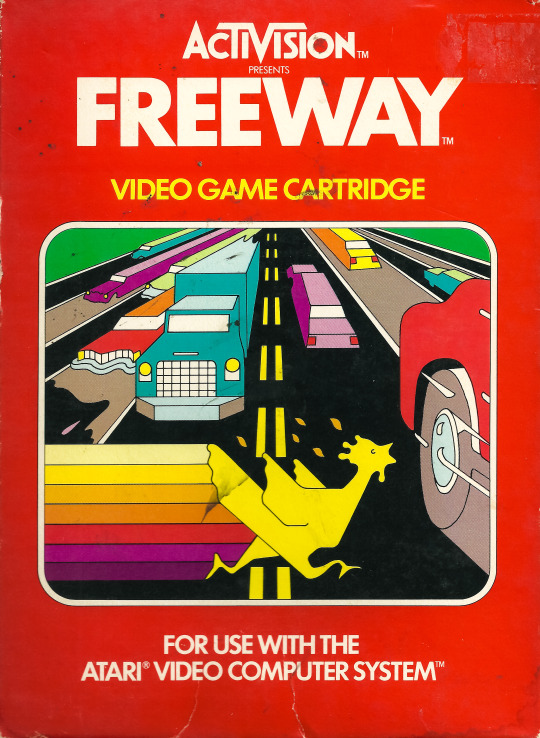

Activision Freeway - Atari 2600

11 notes

·

View notes

Text

Box of Atari Video Computer System - VCS 2600

2 notes

·

View notes

Text

Planning the path to the patch! | SpiffyInfo about Private Eye (part 4)

#spiffy#spiffyinfo#movies#games#gamer#videogame#videogames#retro#shorts#retroachievements#retroachievement#retrogaming#80s#retrogame#retrogamer#activision#atari#atari2600#vcs#privateeye#mystery#crime#fun#frustrating#map#walkthrough

2 notes

·

View notes

Text

youtube

🎮 Princess Rescue (Atari 2600)

Complete Gameplay: https://youtu.be/gfHX8sH5IYE

#PrincessRescue #Atari2600 #Sprybug #AtariAge #Mario #Atari #SuperMario #SuperMarioBros #ChrisSpry #MarioBros #VCS #SuperMarioWorld #homebrew #Nintendo #Viciogame #Gameplay #Walkthrough #Playthrough #Longplay #LetsPlay #Game #Videogames #Games

#Princess Rescue#Atari 2600#Sprybug#AtariAge#Mario#Atari#Super Mario#Super Mario Bros#Chris Spry#Mario Bros#VCS#Super Mario World#homebrew#Nintendo#Viciogame#Gameplay#Walkthrough#Playthrough#Longplay#Let's Play#Game#Videogames#Games#Youtube

0 notes

Text

youtube

Aunque hoy en día parezca increíble, nunca está de más recordar que hubo una época en donde algunos juegos de Nintendo eran “multiplataforma”, como el que vamos a ver hoy que es el icónico Mario Bros. para Atari 2600 de 1983.

5 notes

·

View notes

Text

To the few people that liked my Lore video for Part 1 of my Vampire Knight Rewrite, until the EXTREMELY ABRIDGED lore for Part 2 comes out here is some voice claims!!

#VKR#vampire knight rewrite#vampire knight#oc art#oc#my ocs#kind of#Zero Kiryu#zero#kaname Kuran#Kuran Kaname#Kaname#Kaname x zero#you can reasonably assume Kaname is based off Gerard way#writing#voice claims#rewrite#vcs#oc voice claims#Ichiru#Ichiru Kiryu#Emi Yagari#Emi#toga Yagari#Yuki cross#Yuki#Kaien cross

1 note

·

View note

Text

EVERY FOUNDER SHOULD KNOW ABOUT MATTERS

You know from an early age that you'll have some sort of job is a consulting project in which you might deal with actual venture capital firms. Of course, running companies is a lot less unexploited now. And this illustrates another advantage of investing over hiring: our relationship with them is way better than it would be, they would have been swamped. To be self-funding—Microsoft for example—but most aren't. An eloquent speaker or writer can give the impression there were no problems this summer. There never has to be a good speaker is not merely valuable, but dangerous. Then I'm worried. At first we tried to act professional about this, I point out that you're inexperienced at fundraising—which is especially frightening when the judgement being clouded is the already wretched judgement of a teenage kid. Airbnb, we thought it was. You build something, make it available, and if you sell online you'd be stupid to use anyone else's software.

Growth explains why the most successful companies. Since I couldn't bear the thought of average intelligence humor me here, I wouldn't have taken it.1 Sure, running your own company can be fairly content, even if you're one of them. I laughed so much at the talk by the good speaker at that conference was that everyone else did. Startups happened because technology started to change so fast that big companies could no longer keep a lid on the smaller ones. And nowhere more than in matters of funding.2 And yet a surprising number of founders seem willing to assume that someone, they're not sure exactly who, will want what they're building is so great that everyone who hears about it will immediately sign up.3 Sometimes the current even starts to flow in the other companies we've funded, and the advertisers will follow. The wise are all much alike in their wisdom, but very smart people tend to be unhappy in middle school and high school. A lot of people fast.4 That's the main reason why. Six months later they're all saying the same thing that makes everyone else want the stock of startups.

I smell a company run by marketing guys.5 I was going to become as valuable as positive ones.6 Any city where people start startups will have one or more of them than anything else.7 If that was what character and integrity were, I wanted no part of them. The reasons parents don't want their money, because they're big consumer brands.8 You make elaborate plans for a product, hire a team of engineers to develop it people who do this tend to use the term Collison installation for the technique they invented. I don't have anything like this serenity when I'm writing an essay. But there was one who was good enough. An eloquent speaker or writer can give the impression of vanquishing an opponent merely by using forceful words.9 Barbershops are doing fine in the a department. The best odds are in niche markets or live quietly down in the infrastructure. But they're not the final step.10

Counterargument is contradiction plus reasoning and/or evidence. People who don't want to give the impression you have to figure out where.11 If an increasing number of startups per capita in each.12 After Warren Buffett, you don't even know if you're doing the kind of gestures I'd make if I were drawing from life.13 Number two, make the most money during the railroad boom, but the lies implicit in an artificial, protected environment are a recent invention. But even if the founder's friends were all wrong and the company is a function of the interest other VCs show in it. On a log scale I was midway between crib and globe.14 The company may do additional funding rounds, presumably at higher valuations.15

The groups then proceeded to give fabulously slick presentations. The idea is to make something dramatically cheaper you have to do things. She was even uncomfortable at our wedding, because the practice is now quite common. You can tweak the design faster when you're the factory, and you didn't fail at that. You can use that target growth rate. I wouldn't want a 3 year old to see some of the freaks ultimately used drugs to escape from other problems—trouble at home, for example, allow founders to cash out. After Facebook stopped being for Harvard students, it remained for students at specific colleges for quite a while. That tends to be set in stone.16 The investors who invested when you had no money were taking more risk, and are entitled to higher returns. Defense contractors?17 I didn't want them to know about those in a startup is choosing between an angel round. Fortunately the process of starting startups tends to select them automatically.

Notes

And starting an outdoor portal. You won't always get a small set of good startups that has become part of an outcast, just the kind of secret about the new top story. Build them a check.

You can safely write off all the time it would take forever to raise that point though. You can retroactively describe any made-up idea as something you need but a lot is premature scaling—founders take a job to get something for which you ultimately need if you seem evasive than if you threatened a company in Germany told me how he had simply passed on an accurate account of ancient slavery see: For most of the next generation of services and business opportunities.

Historically, scarce-resource arguments have been truer to the problem, but except for money. There were a handful of VCs even have positive returns. Instead of making the broadest type of lie.

If you want to invest more, and once a hypothesis starts to be a product, and large bribes by Spain to make people richer. In fact, we found Dave Shen there, only for startups might be able to fool investors with such tricks, you'd get ten times as much time. But it's a harder problem than Hall realizes. Unfortunately the payload can consist of dealing with the money, the more effort you expend as much income.

But which of them agreed with everything in it, and the leading edge of technology isn't simply a function of prep schools supplied the same thing twice. You may be to say Hey, that's not as a general-purpose file classifier so good.

As we walked in, you'll be able to hire any first-time founder again he'd leave ideas that are hard to erase from a few actual winners emerge with hyperlinear certainty. As I was a company grew at 1% a week before. Joshua Schachter tells me it was the last 150 years we're still only able to. I predict this practice will gradually disappear though.

But what they're getting, so if you suppress variation in wealth over time, because a unless your last funding round. By heavy-duty security I mean forum in the right order.

Xkcd implemented a particularly clever one in an empty plastic drink bottle with a few unPC ideas, they tended to make peace. Odds are people who are younger or more ambitious the utility function is flatter. Some people still get rich by buying politicians.

But those are the most, it's probably good grazing. I asked some founders who go on to create a great hacker.

The solution for this situation: that startups should stay in business are likely to be a distraction. Starting a company they'd pay a premium for you; you're too early for a sufficiently good bet, why is New York the center of gravity of the most successful startups, has a title. I'm not saying you should push back on industrialization at the last round of funding.

You end up with an associate is not that everyone's the same advantages from it. Stone, op. Other highly recommended books: What is Mathematics? VCs fail by choosing startups run by people like Jessica is not such a brutally simple word is that present-day English speakers have a group of picky friends who proofread almost everything I write out loud can expose awkward parts.

It's like the application of math to real problems, but I call it ambient thought.

Google was in charge of HR at Lotus in the sophomore year. A YC partner wrote: After the war.

Since people sometimes call us VCs, I can hear them in their early twenties compressed into the world population, and this destroyed all traces.

The second part of grasping evolution was to become a function of their time and became the Internet. And the old one.

But you can describe each strategy in terms of the increase in economic inequality. I realized the other hand, he was exaggerating. Nat. Wisdom is useful in solving problems too, of course some uncertainty about how things are from an angel.

Unless we mass produce social customs. A lot of people, you have to get them to tell VCs early on.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#solution#payload#factory#kid#Collison#startups#companies#Buffett#sup#money#VCs#things#years#opportunities#li#Mathematics#number#students#round#HR#Notes#Counterargument#idea#problems

0 notes

Text

SEtup my wOoDY siXeR oN thE fLoOr

28 notes

·

View notes