#UUP

Explore tagged Tumblr posts

Text

Happy polling day!

Now get out there and vote!

Don’t forget your photo ID! It can be recently expired as long as it has your name and looks like you!

#get to the polls and vote!#british politics#uk politics#gifs#the thick of it gifs#the thick of it#ttoi#rishi sunak#liz truss#boris johnson#theresa may#david cameron#nigel farage#Tories#conservatives#labour#liberal democrats#green party#reform uk#snp#plaid cymru#dup#uup#sinn fein#monster raving loony party#count binface#2024 general election#election day#cal richard#malcolm tucker

74 notes

·

View notes

Text

The evil has been defeated, for now. Good work everybody. Some disorganised election thoughts below

The tories won more seats than I had hoped but still, a massive loss, and it may yet get worse for them. So many big names lost. Goodbye Truss. Goodbye Moggie. Badenoch may still be in trouble because a lot of postal votes weren't delivered in her constiuency, so her result will probably get voided lmao

The Lib Dems did exceptionally well. 71 seats! A brilliant result for them, great voter efficiency

Reform came second in a lot of constituencies, especially at the beginning of the night, but they at least didn't get their 13. They have got 4 now though, which is 4 too many in my view. Farage in Clacton, 30p Lee in Ashfield, Tice in Boston, and what's-his-face in Great Yarmouth

The greens got 4 seats which they'll be delighted about . They and reform are now the same sized party. Guess which one the mainstream media will pay attention to

A big shake up in Northern Ireland. Sinn fein are the largest party techically, but not in practice since they don't take up their seats in westminster. Also appearances from Alliance, the UUP, SDLP, and the TUV, the DUP probably aren't too pleased right now

Plaid got 4 seats, and the tories have been banished from wales. Fuck yes

The snp got fucking trounced. Unfortunate, I quite liked them, but they'll probably bounce back

Lindsay hoyle the speaker keeps his seat, surprise surprise

Corbyn keeps his seat by a lot. If labour really wanted it that badly they should've put up a better candidate

A few other independents came in, scalping one or two from labour

Okay, now lets talk about the winners. Labour didn't win as big as I had hoped (not wedded to labour, just wanted to see the tories lose more). Congratulations to kier starmer. Despite the not so good shit that labour had said, and the shouting from some on the left, which I understand, I wish that he was more left wing right now too, he will certainly do a better job than the tories, and just because I gave labour the benefit of the doubt, doesnt mean that I'm not intending rn to criticise them if they do not deliver. They have a lot of work to do on so many fronts. Trans rights, gaza, workers rights, electoral reform etc. Keep pushing them to do better

#uk politics#uk elections#fuck the tories#stop the tories#uk#labour#tactical voting#thank you#lib dems#election results#kier starmer#rishi sunak#ed davey#nigel farage#reform uk#green party#snp#sinn fein#dup#tuv#uup#sdlp#alliance#jeremy corbyn#clacton#great yarmouth#boston & skegness#boston#ashfield#lindsay hoyle

16 notes

·

View notes

Photo

Deja Vu: After Fitch's Cut To US Credit Rating, A Look At The Market Fallout From S&P's 2011 Downgrade The recent downgrade of the US sovereign credit rating from AAA to AA+ by Fitch Ratings has brought back memories of a similar event occurred exactly 12 years ago. On Aug. 6, 2011, S&P made history by downgrading the U.S. credit rating from AAA to AA+ for the first time since 1941. S&P downgraded the nation’s credit rating in August 2011 after Washington avoided a default by temporarily increasing the debt ceiling, just as it did again in June of this year. Increased political polarization and a lack of action to improve the country’s financial situation led to this decision. How Did Markets React To 2011 Sovereign Credit Rating Downgrade? The U.S. credit downgrade was not the only negative news impacting the markets back then. The eurozone was in the clutches of a sovereign debt crisis, with worries of PIGS — an abbreviation for Portugal, Italy, Greece and Spain — defaults. As soon as the markets reopened on Monday, Aug. 8 following the weekend break, global stocks sold ...Full story available on Benzinga.com https://www.benzinga.com/government/23/08/33526726/deja-vu-after-fitchs-cut-to-us-credit-rating-a-look-at-the-market-fallout-from-s-ps-2011-downgrade

#credit rating#DIA#Downgrade#Fitch Ratings#GLD#Government#QQQ#rating agencies#S&P#S&P Global#SPY#U.S. credit rating downgrade#UUP#Bonds#Broad U.S. Equity ETFs#Specialty ETFs#New ETFs#Commodities#Currency ETFs#Tech#ETFs#US78467X1090#US78463V1070#US78462F1030#US73936D1072

0 notes

Photo

I couldn't have been the only one to think of this. I think it's funnier that it looks like "uup?" instead of "u up?" though.

Sticker 25 - R U Up 2 It? ‘Sonic The Hedgehog’ Topps Cards

88 notes

·

View notes

Text

let him get up let him get up

oh… he’s concussed…

#i’ve posted about his ass hitting the groun before but i found more images since then#why does this happen so often 😭#laurance#get Uup#we need you#aphmau#minecraft diaries#aphmau fandom#mcd#minecraft diaries aphmau#aphmau mcyt#mcd aphmau#mcyt#aphblr#aphverse#aphmau mcd#laurance zvahl#laurence zvahl#meme#minecraft

446 notes

·

View notes

Text

UUP-USA Dollár Vételei Jelek

UUP-USA Dollár Vételei Jelek. UUP-Invesco DB USA Dollár Index ETF alap. Erőteljes vételeket mutat a dollár, az elkövetkező hetekre nézve. Ezt jól mutatja az UUP ETF alap heti grafikonja is. Ami természetesen nem igazán kedvez a forintunknak. Mivel a dollárhoz képest gyengülő euró, gyengülő forintot hoz az euróhoz képest. Azaz tovább gyengülhet a forintunk vásárló értéke, persze a nép szívja a…

View On WordPress

0 notes

Photo

Who's the cutest little musician? Its Tallulah!

#QSMP#qsmp fanart#qsmp wilbur#qsmp tallulah#tallulah#MY SWEETEST LITTLE BABY<33333333333333333333#ive had the WORST track record w getting attached to all the eggs that end up dying. so sorry if tallulah ends uup dead#my art#4/15/23

777 notes

·

View notes

Text

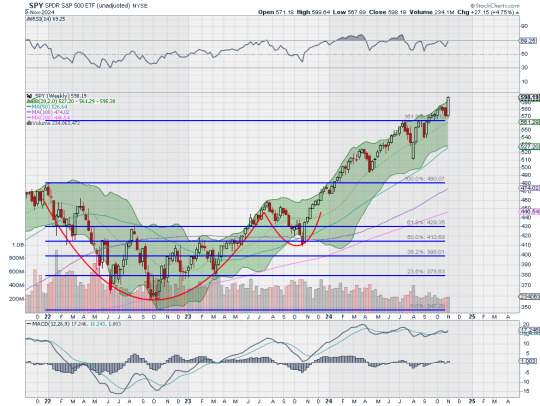

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with October in the books and heading into the election and FOMC meeting, equity markets experienced a Halloween spooking. Elsewhere looked for Gold ($GLD) to continue its uptrend while Crude Oil ($USO) consolidated at the bottom of a broad range. The US Dollar Index ($DXY) looked to consolidate in its uptrend while US Treasuries ($TLT) pulled back in their consolidation. The Shanghai Composite ($ASHR) looked to continue the short term move higher while Emerging Markets ($EEM) pulled back in their uptrend.

The Volatility Index ($VXX) looked to remain at a neutral level, above the base established this year, and was likely to stay there at least until after the election. This might make for choppy light trading for equity markets to start next week. Their charts looked strong on the longer timeframe though. On the shorter timeframe both the $QQQ and $SPY had reset momentum measures lower and could reverse or turn bearish, likely a couple of days’ time would tell. The $IWM did not seem concerned about an election or Fed policy, churning sideways.

The week saw major movements happen following the election. It played out with Gold pulling back from its high Wednesday before a partial recovery while Crude Oil found some strength and moved higher in a choppy range. The US Dollar jumped to a 4 month high while Treasuries fell back to a 5½ month low Wednesday before a recovery. The Shanghai Composite continued the move to the upside while Emerging Markets chopped in a wide range.

Volatility crashed down to the low end of the range since August. This put a stiff breeze at the backs of equities and they started to move up Tuesday and then accelerated Wednesday through the end of the week. This resulted in the SPY and QQQ printing a new all-time highs Wednesday, Thursday and Friday and the IWM gapping up to a 1 year high. What does this mean for the coming week? Let’s look at some charts.

The SPY came into the week at the 50 day SMA on the daily chart in a pullback from the top. It had a gap left open from the end of the week. It held there on Monday and then started higher Tuesday, into the gap. It gapped up Wednesday to finish at a new all-time high and leaving an island below. It followed that up with new all-time highs Thursday and Friday. The Bollinger Bands® are open to the upside. The RSI is rising deep in the bullish zone with the MACD positive and rising.

The weekly chart shows a strong, long bullish candle rising from the 161.8% extension of the retracement of the 2022 drop. The 200% extension is now within view at 614 above. The RSI is rising near overbought territory in the bullish zone with the MACD drifting up and positive. There is no resistance above 599.60. Support lower sits at 585 and 580 then 574.50 and 571.50 before 565.50 and 556.50. Uptrend.

With the Presidential Election and November FOMC meeting in the rearview mirror, equity markets showed jubilation as they vaulted higher. Elsewhere look for Gold to in its uptrend while Crude Oil consolidates in a broad range. The US Dollar Index continues to move to the upside while US Treasuries consolidate in their pullback. The Shanghai Composite looks to continue the move higher while Emerging Markets chop in their short term uptrend.

The Volatility Index looks to remain low and drifting lower following the election making it easier for equity markets to continue higher. Their charts look strong on both timeframes, especially the SPY and QQQ. The IWM has now joined the party, a stone’s throw away from making its first new all-time high in 2 years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview November 8, 2024

44 notes

·

View notes

Text

Marin : But I want to buy you it!

M!Reader : Marin you need to save your money

Marin : But you were looking at it so excitedly! I can't just not buy it for you!

#reader x anime#anime x reader#male reader#marin kitagawa#marin kitagawa x reader#reader x marin kitagawa#my dress up darling#my dress up darling x reader#reader x my dress uup darling

146 notes

·

View notes

Text

Family reunion part 3

#cassketti art#DREW SETH FINALLY#scp 073#scp 076#scp 4840#thats them left to right#dab me uup 😋😋#cain and abel#cain abel seth

183 notes

·

View notes

Text

i cannot wait for cynthia erivo's version of "no good deed" btw. i will be thinking about this until it comes out thank u.

#rei rambles#wicked#wicked movie#cynthia erivo#ALSO 'AS LONG AS YOURE MINE' im SO ready to hear jon bailey go 'it's uUP THAT IIIIII FEEeeeEeLLLLllllllll'

20 notes

·

View notes

Text

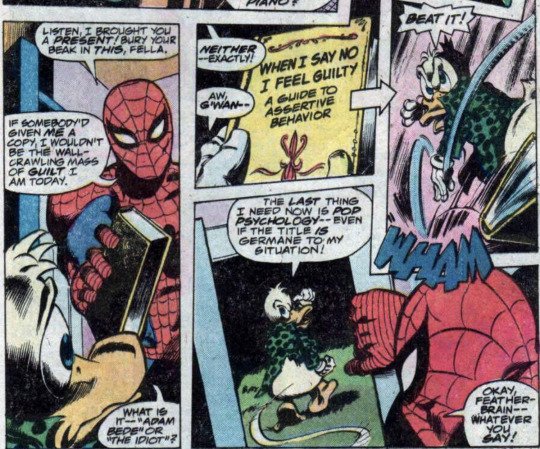

howard the duck (1976) #10

#coming for spider-man's life i see#sci talks comics#howard the duck#spider-man#yes. i am reading the entirety of howard the duck comic canon from the beginning thank you for asking.#i had read the most recent two howard the duck series and i enjoyed them but now? reading the classic stuff??#dear god the new stuff doesn't hold a candle.#sighs. howard is just like every marvel character. lost his edge.#marvel stop forgetting the entire point of your characters in order to babify them to appeal to wider audiences#seeing how counter-consumerist the early howard books are and how cynical and honest the writer is..#it's a little heartbreaking what he's become#here i was thinking he was just a funny duck.#kind of sad that howard's entire existence now is reduced to “remember when we wrote about a talking duck?”#“hheeheheahahahohoh what a funny thing that was. a talking duck. could you imagine! what a silly time that was.”#“what an embarrassing time for marvel”-– shut UUP this is so interesting and sincere. that duck is really interesting and sincere.#i love you howard.#i even like your weird movie.#fun fact: howard the duck was one of the first movies my dad ever watched in english#and it was this movie that he always tried to describe and try to find because he loved it but he didn't remember the name#he said it's a movie about a duck who gets stuck in the human world#and eventually i got into marvel and was like wait. howard the duck? is the movie howard the duck???#he loves that movie. well. the first half of it. and me too i also love the first half of that movie.#love you howard!!!!!!!!!!!!!

42 notes

·

View notes

Note

hey you still doin eepytale stuff?

nope eepytale is gone and I don't plan on doing anything else with it!

with that said might as well add that uvtale is currently on pause until I get back my inspo for that!!

and as of right now im working on a few things i can't really share, doing art studies and doodling gay skeletons :3

#rant#shoutout to skeleton yaoi#im so fr i will end uup making a sideblog just to post about that omfg

34 notes

·

View notes

Note

opinion on cherubs ?

theyre nice. i like calliope more than caliborn. i think hes just ok

she is so cuteness :U!!!!!!

27 notes

·

View notes

Text

Holy Fuck, Helaena on Dreamfyre? leT'S FUCKING GOOO!!

#FUCK ME UUP!#Next Episode I am ON MY KNEES#helaena targaryen#dreamfyre#house of the dragon#hotd#hotd spoilers#house of the dragon spoilers#mine#my post

22 notes

·

View notes