#USA bookkeeping service

Explore tagged Tumblr posts

Text

#accounting meme#USA accounting#USA bookkeeping service#outsourced accounting service in USA#outsourced bookkeeping service in USA#bookkeeperlive#united states

0 notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

#real estate#Small businesses#properties#business owners#start ups#online accounting#virtual accounting#online data entry services#small business accountant#bookkeeping in USA

0 notes

Text

https://flowrocket.com/finance

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

Trusted Financial Management Outsourcing for Cost-Effective Business Success in the USA

Qualitas Accounting Inc has established itself as a trusted partner for businesses seeking exceptional accounting and financial solutions. With a team of seasoned professionals, the firm delivers a wide array of services tailored to meet the specific needs of clients across industries. From start-ups to established enterprises, Qualitas Accounting supports businesses on their financial journeys with precision, reliability, and innovation.

Their expertise lies in simplifying complex financial processes, ensuring compliance, and providing actionable insights to drive business growth. Whether it's optimizing daily bookkeeping tasks or offering strategic financial advice, their solutions are grounded in a deep understanding of modern business challenges. This commitment to quality and efficiency has made them a standout choice for businesses looking for personalized and dependable accounting services.

Professional Virtual CFO and Outsourced Bookkeeping Services for Scaling Small Businesses

Among their key offerings, Qualitas Accounting is recognized as one of the premier accounting firms Columbia MO, providing reliable services to support local businesses. For companies seeking efficient financial management, they serve as a leading bookkeeping outsourcing company USA, streamlining operations so organizations can focus on growth.

Expanding their reach across the nation, Qualitas Accounting excels in finance and accounting outsourcing USA, helping businesses achieve cost-effectiveness and improved productivity by leveraging their expertise. Additionally, they specialize in virtual CFO services USA, offering high-level strategic guidance and oversight for entrepreneurs who want to scale effectively while maintaining financial discipline.

Choosing Qualitas Accounting Inc means partnering with a firm dedicated to making your financial processes seamless and your goals achievable. With their comprehensive range of services and client-centric approach, Qualitas Accounting remains a trusted ally for businesses striving for financial success. Experience the difference with Qualitas Accounting Inc—reach out today to explore how their tailored solutions can elevate your business to new heights!

#accounting firms Columbia MO#bookkeeping outsourcing company USA#finance and accounting outsourcing USA#virtual CFO services USA

0 notes

Text

#uk virtual assistant#virtual assistant bookkeeping services#virtual assistant bookkeeping services in USA

0 notes

Text

Bookkeeping Services USA: Simplifying Financial Management for Startups

Streamline your startup's financial management with expert bookkeeping services in the USA. From accurate record-keeping to financial reporting, we ensure your business stays organized and compliant. Focus on growth while we handle the numbers!

0 notes

Text

Streamline your finances by outsourcing your bookkeeping services. Accurate and reliable solutions tailored to meet your business needs. Contact us for efficient bookkeeping.

0 notes

Text

Achieve Financial Clarity with Rose Group CPA’s Expertise

At Rose Group CPA, a leading small business CPA firm, we understand the unique financial challenges that small businesses face. Our dedicated team of certified public accountants provides personalized accounting, tax, and advisory services designed to help your business thrive. We focus on your specific needs, ensuring compliance while maximizing your tax efficiency. With our expert guidance, you can make informed financial decisions that drive growth and stability. Partner with us to navigate the complexities of business finances with confidence.

#cpa tax services#professional bookkeeping#tax and accounting services#tax preparation and planning#tax services usa

0 notes

Text

0 notes

Text

The Benefits of Outsourcing Your Accounting Needs

The fast-paced business environment is always demanding more ways for companies to stream their operations, cost reduction, and growth in efficiency. One of the best strategies is through accounting outsourcing. Whether you own a small business or are managing a growing company, accounting outsourcing can bring incredible advantages to your business. In this blog, we are going to probe the key benefits of accounting outsourcing and why it could be the right move for your business.

1. Cost Savings

Save Costs One of the main reasons businesses opt to outsource their accounting is to save costs. An accountant or a team of accountants in-house can be very expensive. This includes salary and benefits, training, and overheads like office space and software. Outsourcing pays for only what you need at what time that service is rendered – be it monthly bookkeeping, quarterly tax filings, or yearly audits.

Outsourcing would give you your Professional Bookkeeping Service in the USA, but a quality outsourcing service would not require a long-term commitment to using permanent staff. Therefore, there will be better resource allocation to other business areas.

2. Access to Expertise

Outsourcing your accounting needs avails to you the experienced professionals in different fields of accountancy and bookkeeping. They thus keep updating knowledge on emerging issues such as new regulations, changes in tax laws, among others, and are always in a better position to ensure your business is both compliant and efficient.

When you Hire Remote Bookkeepers in the USA, you are opening a pool that covers all types of skills and expertise across every conceivable kind of industry. It is often difficult to have this level of specialization with an in-house team. This ensures that your books are handled by experts who can provide better financial insights, allowing you to make more-informed business decisions.

3. Time Efficiency

Therefore, managing accounting functions for small business owners or entrepreneurs may become a full-time job. From tracing expenses to preparing financial reports, accounting is always dragging you away from other key activities in your business. By outsourcing, you can save valuable time and redirect it toward growing your business.

With a professional bookkeeper, you forget about the hours of money management. The books will now be correctly kept and will provide you with regular financial updates without all the headache of doing it for yourself. This efficiency will allow you to focus more on strategic initiatives that contribute to your growth.

4. Scalability

The accounting requirement will go up with the growth of the business. Whether it is extending into new markets, increase in number of employees, or perhaps new products, the management of the finances would be complex. Outsourcing this allows for scaling up your services once you meet your growing needs.

Rather than wasting time on hiring and training new employees or revising your accounting software, you can Hire a Remote Accountant in the USA who can adapt to your growing business. Outsourced accounting providers have the flexibility to raise or lower the level of involvement based on your immediate requirements so that they support you in an unobstructed manner while you are growing.

5. Accuracy and Compliance

Accurate financial records help in keeping the business healthy. While small mistakes may not seem significant at the moment, costly errors can then happen in the tax filings or financial reports. It reduces the chances of committing mistakes when you outsource your accounting needs to professionals. And with Professional Bookkeeping Service in the USA, you’ll be assured to have the experts know just how to keep your records clean while keeping you updated in the latest tax laws and regulations.

They have mechanisms in place to ensure that the transactions, for example paying the employees, are recorded accurately and their invoices. This level of accuracy avers the risk of being audited and charged with fines and saves your business money and time.

6. Increased Security

Data security always becomes a must for any business and especially with sensitive financial information. Outsourcing your accounting services to a reputable company allows you to have full trust in having your financial data protected with the best security measures. Most Professional Bookkeepers rely on cloud-based systems, encrypted storage, and secure access to data, which renders all confidential data safe from unauthorized access.

In addition, outsourcing also reduces the possibility of internal fraud because an outsider professional maintains and reviews your records about finances.

7. Better Financial Report

Accurate and timely financial reporting is key to both decision-making and planning. Outsourcing your accounting needs would ensure that periodic reports outline the health of your company in liquidity, revenue, expenses, cash flow, and more, so you’ll clearly understand where your business stands and what it requires to make it successful.

When you hire a remote bookkeeper in the USA, you are assured of professionals to formulate customized reports tailored to your business requirements. Not only will you keep on top of your finances, but this can give you actionable insights that will drive future growth.

8. Core Business Activities

Accounting and bookkeeping cannot ever be too far removed from being important pieces of running a business, but they are absolutely not money generating. Outsourcing such tasks will give you ample space and time to do what really matters: expanding the business. It may be developing new products or generally improving customer services or moving into new markets-this frees up invaluable time for you to get on with things that matter.

But through a professional bookkeeper, you are rest assured that your books are in good care, and you would be able to free up more energies and resources on the attainment of your business goals.

9. Fully Customized Service

Every business has its difference; hence, accounting outsourcing can be tailored to suit your specific needs. The best aspect of outsourcing is that you can outsource as little or much as you want with requirements such as bookkeeping, payroll service, tax preparation, or full financial management.

When you employ a remote accountant in the USA, it may work with experienced professionals that offer a number of flexible services that grow with your business. That flexibility will ensure you only pay for what you need, but you can also add additional services based on how the business grows.

Conclusion

Going for accounting services outsourcing may be the best means by which your business saves and earns more, as it will help you in cost cutting, expert management of finances to gain high accuracy, and more. Letting professionals handle your books and accountings frees up some time so you can focus on your core business and then keep your financial health in great condition.

At Y2D Accounting, we offer detailed and tailored accounting services for small business requirements. Do you have a requirement to outsource your professional bookkeeping in the USA or hire an offshore bookkeeper in USA? We provide you with safe and professional solutions that will make sure your business blooms. Let us manage your books so you can pursue the things that matter the most-growing your business.

#Financial Accounting Services#Tax Planning Services#Business Accountant#professional bookkeeper in USA

0 notes

Text

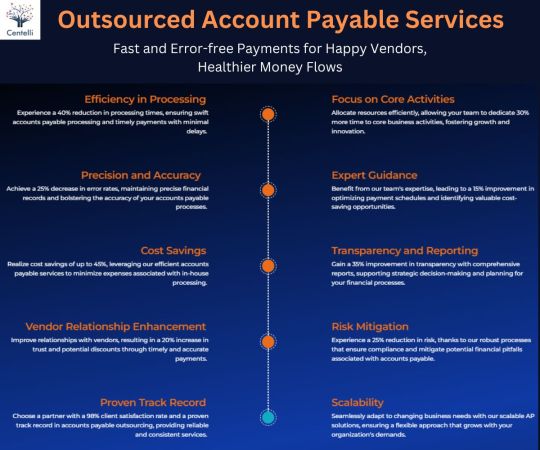

What Can Outsourced AP Accountants Do for Your Business?

The range of services and solutions offered by accounts payable outsourcing firms varies. However, no two providers are the same.

Differentiation comes with comprehensive suites or selective offerings, standard packages or custom solutions, pricing policies, and online or offshore delivery models. So, choose keeping your exact needs and budget in mind while contracting out.

Some of the things accounts payable services outsourcing can help you with are:

Vendor/Supplier Administration: Expert vendor onboarding, verification, and coding, along with purchase order tracking, sets the foundation for a seamless payment process.

Vendor Invoice Management: Providers receive, code, and verify invoices against purchase orders, employing 2-3-way matching to ensure accuracy. Exception invoices are promptly identified and resolved, minimizing delays.

Supplier Payment Processing: Daily payments and accounts payable transactions are executed with precision, preventing delays and supply chain disruptions. High-volume transactions are handled with ease, ensuring timely payments.

Harnessing Technology: Modern AP accountants leverage cutting-edge technology to unlock the full potential of account payable software and automation, driving efficiency and reducing errors.

Trade Credit Data Management: Providers manage data entry and updates, digitize incoming bills and invoices, and store them securely, ensuring easy access and compliance.

Vendor Account Management: From account opening to closing, providers expertly manage vendor accounts, including month-end and year-end processes.

Accounts Payables Reporting: Comprehensive reports, including payable aging, cash flow summaries, and forecasting, provide valuable insights, enabling informed decision-making.

Notably, some payable accounting service providers can also manage utility bill and travel charge payments for you. Some businesses may also outsource tax payments, such as sales and VAT or GST, to external services.

However, certain processes, like petty cash management and short-term debt GL entries, are typically handled internally.

Enhancing Your AP Process Efficiencies with Centelli

If you’re looking for a professional firm that works as an extension of your team, we could be your ideal partner. We provide a comprehensive range of finance and accounting services, including accounts payable solutions.

From P2P to reconciliations to reporting and analysis, our AP accountants are sticklers for accuracy and timeliness. We work with a wide range of market-leading accounts payables software.

Partnering with us brings in these benefits (and value!):

Quick onboarding/smooth transition

High accounts payables process accuracy

Timely deliveries and reporting

Bespoke solutions; 35–65% cost savings

Global reach; 24X7 Support

Don’t let accounting challenges hold you back. Contact us today for more info about our accounts payable outsourcing services and pricing.

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

youtube

The Indian Accountant. is an accounting company headquartered in Kolkata, India, with operations globally. Our experienced staff of professionals includes Certified Public Accountants (CPAs), Enrolled Agents (EAs), Chartered Accountants (CA-India), and other professional staff in various stages of certification

#Accounting Services in USA#Bookkeeping Services in USA#importance of financial report#importance of financial reporting#Book Keeping Solutions#Financial Advisory Services#Small Business Accounting#Tax Compliance Services#Cash Flow Management#Company Formation and Registration#Self Assessment Tax Returns#Strategic Financial Planning#Auditing and Assurance#Budgeting and Forecasting#VAT Registration and Filing#Payroll management Services in USA#Tax Planning and Optimization in USA#Accountant Services in USA#Corporate Accounting in USA#Accounting Services for USA Businesses#Bookkeeping Services for USA Businesses#Youtube

0 notes

Text

#Accounting Advisory Servies USA#Accounting and Bookkeeping services for Business#Accouting and Bookkeeping services USA#Best Auditing Services in USA#Hire Accounting Associates in USA#Hire Audit Supervisor in USA#Hire Bookkeeping Associates in USA#Best CRM Software with Collaboration Tools#CRM solutions for Team Colloboration#Best construction CRM Software#CRM Solutions for Construction Management#Best contract management systems in USA#CRM Software for document management#Best CRM for customer support#CRM for customer service solutions#Customer service software in USA#Agile software development services USA#Business Process Automation USA#IT Consulting Service in USA#Lead management CRM software#Lead tracking CRM software#Best CRM for Financial Services#Financial Services CRM Software#Best GRC Software Solutions in USA#CRM for small businesses#CRM Solutions#Top CRM Software USA#Best CRM Software in USA#Industry Specific CRM Solutions#best free crm for insurance agents

0 notes

Text

Elevate your business with professional bookkeeping services tailored to your needs. Our expert team ensures accurate financial records, timely reporting, and compliance with regulations. Our customized solutions provide the support you need to manage your finances efficiently. Click here to know more

0 notes