#UK tax affairs

Explore tagged Tumblr posts

Text

Don't wait until year-end to get your tax affairs in order. Proactive tax planning with Wills & Trusts Wealth Management ensures you free up time, avoid surprises, and maintain healthy accounts. Our expert accountants provide year-round support to maximise your financial success. Contact us today for tailored tax solutions.

#tax planning#proactive tax management#tax returns#year-round tax support#UK tax affairs#financial health#Wills & Trusts Wealth Management#accounting services#tax advice#avoid tax surprises

0 notes

Text

Scandal After Scandal: Will They Never End?

Boris Johnson was so beset by scandal that his own party turned on him and threw him out of office. We all know about the Partygate affair but there were also questions raised regarding his personal monetary arrangements. From charges of corruption concerning him asking a Tory donor to supply funds to refurbish his Downing Street residence, to his appointment of the BBC Chairman and an alleged £800,000 loan, Johnson was the epitome of the self-serving Tory.

Johnson has gone but the scandals have continued to rumble on. We had the unedifying debacle of multi-millionaire Nadhim Zahawi being forced to resign after he was found guilty of serious breaches of the ministerial code by covering up issues to do with his attempts to minimise his tax bill.

Sunak’s own wife also avoided UK tax payments by claiming non-dom status. After being asked to “come clean” on his wife’s tax affairs and after much embarrassment the Sunak’s decided she should pay tax in this country.

It is not only those Tories at the top of government who are self-serving. Conservative MP’s have been calculated to have received an additional £15.2 million on top of their MP salaries, personal fortune hunting seemingly more important than giving their constituents 100% of their time.

“Since the end of 2019, millions of pounds of outside earnings have been made by a small group of largely Tory MPs." (Skynews: 08/01/23)

When Sunak, after much delay, made public his own tax affairs we discovered that for the year 2021/22 he made £172,415 unearned income from dividends and £1.6 million from capital gains. In total, the PM paid an average tax rate of 22% over a three-year period.

For you and I, the basic rate of tax on income between £12,571 and £50,270 is 20%. Between £50,271 and £125,140, it is 40 %, going up to 45% for earned income over £125,140.

For Mr Sunak to have only paid 22% on his millions is therefore quite a smack in face for ordinary tax-payers, and one only made possible because the Tories have arranged the tax system to benefit themselves and their rich friends.

“Angela Rayner, Labour’s deputy leader, said: “[The tax returns] reveal a tax system designed by successive Tory governments in which the prime minister pays a far lower tax rate than working people who face the highest tax burden in 70 years

“… the fact that Sunak paid less than a quarter of his gains in tax highlighted the problems with taxing capital gains at a much lower rate than income…The low tax rate is because we have much lighter taxes on wealth than work” (Guardian: 22/03/23)

So, if you work for a living, expect to pay proportionately more in tax than those who live on unearned income.

Way back in July 2022, Rishi Sunak was so disgusted with the immoral behaviour of Boris Johnson that he resigned his post as Chancellor. This is what he said at the time:

“... the public rightly expect government to be conducted properly, competently and seriously. I recognise this may be my last ministerial job, but I believe these standards are worth fighting for and that is why I am resigning.”

But if a week is a long time in politics, then 9 months is an eternity. As we have seen, Sunak himself has become as equally embroiled in monetary scandal as his predecessor and now he is under investigation by the Parliamentary Standards Committee.

“Rishi Sunak investigation: Government blocked Freedom of Information request into childcare firm.

Mr Sunak is currently being investigated by the Parliamentary Standards Commissioner over his failure to be more transparent about his wife’s shares in childcare agency Koru Kids when quizzed on the subject by MPs.

It comes after i revealed last month that Akshata Murty, the Prime Minister’s wife, holds shares in the firm, which stands to directly benefit from reforms to the childcare system announced in last month’s Budget.” (inews: 19/04/23)

Time and time again we see top Tories under investigation by the Parliamentary Standards Commission. Time and time again we see how self-serving and unprincipled our leaders really are. Mr Sunak it seems, is no different to his predecessors and the sooner he goes the better.

35 notes

·

View notes

Text

what i read in nov. 2023:

(previous editions)

class, race, gender, & sexuality

'no way to live': amazon flex delivery drivers

how to be a model minority in an elite school (singapore)

new investigation casts doubt on a singapore-listed palm oil giant's green claims

when a guy you're seeing turns out to be a member of an obscene telegram channel

current affairs

sudanese women describe being gang-raped in ethnically targeted attacks by arab forces

sudan's cycle of violence: 'there is a genocide going on in west darfur'

world's largest 'baby exporter' confronts its painful past (south korea)

un votes to create 'historic' global tax convention despite eu, uk moves to 'kill' proposal

'systemic failures at every step': the indonesian children australia sent to adult jails for years

henry kissinger

henry kissinger, war criminal beloved by america's ruling class, finally dies

henry kissinger, america's most notorious war criminal, dies at 100

does henry kissinger have a conscience?

blood on his hands (cambodia)

culture & personal essays

flipping grief

the woman who rewrote me

the sound of history (greenland)

the protagonist is never in control

palestine

israeli authorities and the crimes of apartheid and persecution

horrifying cases of torture and degrading treatment of palestinian detainees amid spike in arbitrary arrests

the gaza i know is shrinking every day

damning evidence of war crimes as israeli attacks wipe out entire families in gaza

european governments donors’ discriminatory funding restrictions to palestinian civil society risk deepening human rights crisis

137 notes

·

View notes

Text

Is there a bigger agenda to the farmers’ inheritance-tax ‘sick joke’?

BySally Beck

November 14, 2024

THE British farming community is planning a mass lobby of Parliament next week and will be joined by Jeremy Clarkson. Farmers say Labour has declared ‘war on the countryside’ and that the government has broken its promise by introducing a ‘crippling’ inheritance tax on family farms. Nicknamed the ‘suicide charter’ by the farming community, the policy has already resulted in one death, while elderly farmers wonder if they should kill themselves to save their family’s legacy.

Clarkson, a fierce critic of Chancellor Rachel Reeves’s recent Budget and its inheritance tax changes, said farmers were ‘very angry and anxious’ about their future. He owns a 1,000-acre farm in the Cotswolds called Diddly Squat, which made just £144 profit in its first year.

Our Parliamentary representatives are indifferent, as demonstrated last week by their response to the deputy leader of Reform UK, Richard Tice. He asked in the Commons: ‘Are the Minister, the Secretary of State and the Chancellor aware that so serious are the consequences of this policy that the heads of farming families in their 80s and 90s are seriously considering committing suicide before it comes into place?’

Speaker Sir Lindsay Hoyle prevented further debate on the subject, while Daniel Zeichner, Minister for Food Security and Rural Affairs, seemed to be lost for words. He said: ‘I find it hard to respond to a question like that.’

National Farmers Union (NFU) president Tom Bradshaw is livid and warned that Labour’s move would further fuel a mental-health crisis among farmers. Farming already has a high suicide rate with 36 per cent of farmers admitting they are depressed, while 47 per cent say they struggle with anxiety.

10 notes

·

View notes

Text

Women can buy period pants for £2 cheaper than current prices after the government abolished a tax on the product.

As of Monday, retailers including supermarkets Marks & Spencer and Tesco, as well as clothing shop Primark, have promised to pass on the savings (worth 16%) to customers.

It follows a campaign by retailers, women’s groups and environmentalists. Other period products such as sanitary pads and tampons have been exempt since 2021.

Women will save on average up to £2 on period pants, the government said. The pledge to scrap the tax was made by the chancellor, Jeremy Hunt, in the autumn statement.

In August, retailers including Marks & Spencer and the brand Wuka were among about 50 signatories of a letter to the Treasury which urged the government to remove VAT on period pants.

In the letter, they pledged to pass on any tax cut straight to customers “so they feel the benefit of the cost-saving immediately”.

Period pants are increasingly popular, and are now on sale from major high street brands, offering a sustainable alternative to single-use products such as tampons. The pants contain a highly absorbent lining and can be used in place of sanitary pads. They can be washed and reused, just like ordinary pants. Campaigners said that removing taxation would make them more affordable.

Period pants were not covered in the 2021 law change in which the “tampon tax” on period products was removed. This is because they were classed as “garments” and therefore considered exempt.

The letter from retailers in August said that period pants “have the power to reduce plastic pollution and waste”, and could save people money in the long term. They said: “One of the main barriers to switching to period pants is the cost.”

The financial secretary to the Treasury, Nigel Huddleston, said the change was a “victory for women” and for those who had “helped raise awareness” of the importance of this product.

VAT is paid at 20% on most products, except for some items such as books children’s clothing and most food.

Victoria McKenzie-Gould, the corporate affairs director at Marks & Spencer, said the company was “thrilled” with the decision.

“Nearly 25% of women cite cost as a barrier to using period pants so we know the new legislation that comes into effect from today will make a big difference to women’s budgets across the UK.”

The savings for women are subject to the VAT cut being passed on, with retailers pledging to play their part.

Laura Coryton, a tampon tax campaigner and founder of social enterprise Sex Ed Matters, said: “Ending the tax on period underwear will make a huge difference, particularly given skyrocketing levels of period poverty across the UK.”

30 notes

·

View notes

Text

12 JULY 2024: William plays polo at a charity match. Kate and the children do not attend.

William confirms he will attend the Euro final on Sunday, 14 July 2024.

13 JULY 2024: Kate confirms she will attend the men's final at Wimbledon.

14 JULY 2024: Kate attends the Wimbledon men's final with Charlotte and Pippa.

William attends the Euro final with George to watch England lose to Spain.

15 JULY 2024: Katie Nicholl, Vanity Fair, "Kate Middleton Is Now “On Summer Break” After Wimbledon Appearance" [archive link]

Kate Middleton’s appearance at Wimbledon on Sunday delighted tennis and royal fans, but it may be some time before we see Kate in public again. According to royal sources, Prince William and Princess Kate are planning to spend most of the summer “below the radar” at their Norfolk bolthole now that Prince George, Princess Charlotte and Prince Louis are out of school and Kate continues her course of preventative chemotherapy. While Kensington Palace would not give details on the family’s plans for the summer, a royal source confirmed that the Wales family are now “on summer break.” Sources close to the family say that although they will not be traveling abroad this summer while Kate undergoes treatment, they are excited to visit King Charles and Queen Camilla in Scotland next month. Sunday’s appearance at Wimbledon is likely to be Kate’s last official engagement until later this year.

16 JULY 2024: Will & Kate are looking to hire a new Assistant Private Secretary that can speak "conversational Welsh." [archive link]

Although the new hire would be responsible for Prince William and Catherine's public engagements in Wales, Scotland and Northern Ireland, the future King and Queen want their new Assistant Private Secretary to specifically focus on Wales and believe it is "essential" that they speak conversational Welsh. [...] Almost two years after taking on their Wales titles, and after a testing year so far with The Princess' major abdominal surgery and cancer diagnosis, it appears Prince William and Catherine are driving forward with their plans, seeking "specific expertise on Welsh communities, affairs, government, and business". Handled by the largest executive search firm in the United Kingdom, Odgers Berndtson has posted a job advert for an Assistant Private Secretary ("APS"), Wales & UK on behalf of Kensington Palace.

18 JULY 2024: The attempted Donald Trump assassin had searched for images of Kate according to investigation.

23 JULY 2024: William announces more patronages. Kate does not announce any new patronages.

24 JULY 2024: Victoria Ward, The Telegraph, "Prince William refuses to reveal how much tax he pays." [archive link]

The Prince of Wales has chosen not to reveal how much tax he pays on the private income he receives from his vast property portfolio, marking a notable change in approach from when his father was heir to the throne. Prince William’s Duchy of Cornwall estate, the billion-pound business empire he inherited on the death of his grandmother, Elizabeth II, generated profits of £23.6 million in the last financial year. He is understood to pay income tax on the full amount, less household costs, which have also not been disclosed.

26 JULY 2024: Robert Jobson's book excerpt in The Daily Mail, "How the Queen and Charles clashed with William after he refused to stop flying his young family around Britain in his helicopter." [archive link]

One courtier explained: 'The King's relationship with both his sons has been difficult over the years. Even now he is King, with the Prince of Wales, there can be differences of opinion and tensions. Of course, they love each other, but they clash, and sometimes William needs handling with kid gloves.' Another courtier confirmed: 'You have to check first which way the wind is blowing with the prince. They don't see eye to eye on several issues, but why should they? [Prince William's] moment in the top job will come — perhaps he would do well to remember it is not yet. This is His Majesty's time.' When he loses his temper, William is a bit of a shouter — and his father tends to give as good as he gets. The difference these days is that their arguments usually blow over quite quickly. One recent source of disagreement is William's stubborn refusal to take his father's advice on safeguarding the succession. Earlier this year, the King had raised concerns with his son about the wisdom of William using his helicopter to fly his entire family around the country.

27 JULY 2024: People magazine (US), "Prince William and King Charles Clashed Over Use of Helicopter for Kate Middleton and Their Children, New Book Claims". [archive link]

According to Robert Jobson's soon-to-be-released biography, Catherine, The Princess of Wales, the King, 75, “raised concerns” with William, 42, over his helicopter use with Kate Middleton and their children, Prince George, Princess Charlotte and Prince Louis, that sparked a tense disagreement between the pair. In an excerpt from Jobson’s book, per The Daily Mail, King Charles brought up his worries on the matter after coming to terms with his mortality following his cancer diagnosis, which was announced in February. The King even presented experienced pilot William with “a formal document acknowledging the risks involved and taking full responsibility for his actions” amid their dispute, the new book claims. Charles’ concerns echoed that of his late mother Queen Elizabeth, who previously requested William not fly with his family on a helicopter from Kensington Palace to his former residence of Anmer Hall in Norfolk, which is a 115-mile journey, according to Robson. [...] It is also understood that the palace has fully evaluated the risk of the family flying together, compared with implementing a policy where separate travel assets are provided for one or more members of The Prince and Princess of Wales’ family.

30 JULY 2024: The Prince's Trust announces the date for its annual Christmas Carol concert, 09 December 2024.

Hilary Rose, The Times, posts an article about William van Cutsem, friend of Prince William and recently appointed as an adviser to the Duchy of Cornwall. [archive link]

The Earthshot Prize tweets about their third annual Earthshot Prize Innovation Summit, which mentions no commitment by William to attend.

03 AUGUST 2024: Daily Mail's Natasha Livingstone

07 AUGUST 2024: Tom Sykes, The Daily Beast, "Princess Kate Will Focus on Her Kids After ‘Brush With Mortality’: Sources" [archive link]

It is thought the smaller Wales family are unlikely to travel this year to Tresco, a small island off the coast of Cornwall, where they have often spent summer holidays. However, The Daily Beast has been told that the couple are aiming to be in Balmoral either for the opening of the grouse-shooting season on Aug. 12 or shortly thereafter. William and Kate both shoot. One friend of the couple told The Daily Beast: “Kate has been exceptionally open and honest about her health. Making two appearances before the summer break, at Wimbledon and Trooping the Colour, was a clear signal that she is doing well. That is what we are hearing privately as well—it’s not over but there is lots of optimism, lots of positivity.” [...] Another source, a Buckingham Palace insider, said they understood there was no sense that Kate was expected to be back on duty for the traditionally busy period of royal engagements that kicks off in the first week of September and runs through to Christmas.

11 AUGUST 2024: William & Kate appear for less than ten seconds in a video message for Team GB with multiple celebrity appearances, after the end of the Olympics.

13 AUGUST 2024: Lucie Heath writes about the Duchy of Cornwall.

The Duchy of Cornwall’s largest single landholding is 27,300 hectares on Dartmoor, which accounts for approximately one third of the National Park. Last year the Government published an independent review of Dartmoor, which concluded the landscape was “not in a good state”. Dr Alexander Lees, a biodiversity expert at Manchester Metropolitan University, said the Duchy of Cornwall has a big part to play in turning things around at Dartmoor and other sites it owns. “As one of Britain’s biggest landowners, the Duchy of Cornwall is in a position of strength to combat the entwined biodiversity and climate crises. However, massive additional investment in conservation is needed across these landholdings,” he said. Dr Lee said: “clearly there is a need to generate income to leverage restoration and rewilding across the estate”, but added it is “questionable” that some of this income comes from a car dealership when the Duchy has promoted reduced car use through its flagship Poundbury housing estate in Dorset.

14 AUGUST 2024: Rebecca English, Daily Mail, "Why Kate's year has been tougher than anyone realises - and why she's starting to glow again." [archive link]

What most will not appreciate is that Catherine had actually been unwell for some time in the run up to her initial abdominal surgery in January (further details of which have not been made public yet by Kensington Palace). It was only after that ‘planned’ operation, of course, which left her in hospital for two weeks, that her cancer was discovered.

The Daily Beast rehashes the "exclusives" from the Daily Mail.

16 AUGUST 2024: Dan Wootton reiterates that Kate may "NEVER" return to full-time royal duties.

Tusk Trust CEO says William wants to introduce his children to Africa.

"He is very knowledgeable and passionate about conservation and the environment,” Mayhew said. “He has a particular love for Africa. He has been incredibly supportive as our patron and proactive in supporting us. We find ourselves incredibly lucky.” Mayhew plans to meet up with Prince William in Cape Town, South Africa, when the Prince of Wales hosts the fourth annual Earthshot Prize Awards there in November. Soon enough, the Prince of Wales will want to introduce his three children — Prince George, Princess Charlotte and Prince Louis — to the continent, Mayhew said. “I think it won’t be long before, you know, he will want to introduce them to Africa,” he said.

17 AUGUST 2024: Natasha Anderson, Daily Mail, reports on how Will, Kate, George, Charlotte, and Louis, spent the day at a large Nerf battle. [archive link]

The Royal family had a bit of a rumble last weekend as the Prince and Princess of Wales faced off against their children in a Nerf battle. Prince George, 11, Princes Charlotte, nine, and six-year-old Prince Louis joined in the festivities at the Gone Wild Festival at Holkham Hall, Norfolk for a high-intensity Nerf war with toy guns and smoke bombs. Excitable and 'unforgettable' Louis ran around yelling 'Nerf or nothing, let's do this!', according to Norfolk Nerf Parties boss Georgina Barron. The Princess of Wales, who has been battling cancer, even 'grabbed a Nerf gun, ran around, and played stuck in the mud with her kids', Ms Barron added, noting that hosting the family was the 'biggest honour' and 'unforgettable'. Ms Barron said the royals, who were not photographed at the event, had wanted to enjoy a 'wholesome family day like any other normal family'. Kensington Palace has been approached for comment.

19 AUGUST 2024: People magazine (US), story about who's who in the Middleton family.

The Mirror, "Kate Middleton's 'tough' side and unlikely inspiration for 'ambitious' plans" [archive link]

The Princess of Wales has rapidly ascended the Royal ranks, becoming a favourite among the Royal Family due to her sense of humour and evident respect for her role. Even during her cancer treatment, she has displayed nothing but strength and determination. Kate, once shy and reserved, has transformed into a confident, playful, and occasionally assertive figure, commanding as much public respect as King Charles or Prince William could ever wish for. This trust that the King places in his "darling daughter-in-law" reportedly leads to her frequently being asked for her opinion due to her relatability.

20 AUGUST 2024: "Princess Charlotte, Lady Louise and the Duchess of Edinburgh go on special trip" [archive link]

Princess Charlotte, Lady Louise and Sophie, the Duchess of Edinburgh went on a special shopping trip in London, according to a source. Charlotte has a good relationship with her great-aunt and the two royals were joined by Sophie's daughter Louise during a trip to Chelsea. The royals headed to the Peter Jones store on King's Road which is said to be one of Charlotte's favourite stores. A source told The Sun: "There is a really warm connection between Sophie and her great-niece, which is very touching."

21 AUGUST 2024: Tom Sykes, The Daily Beast, "Princes William and Harry May Only Reunite at King Charles’ Funeral: Source" [archive link]

Asked about the reports that Harry would not be invited to William’s coronation, the source said: “I believe it 100 percent. Why would William and Kate want all the distraction and circus that his presence would bring? I suspect that William will see Harry one more time in his life in the flesh—at their father’s funeral.” A former Buckingham Palace staffer told The Daily Beast: “Planning for William’s coronation is well underway, and as I understand it there are no plans to invite Harry. It’s hardly surprising when you look at how poisoned the well has become.”

US Weekly (USA) has cover story on William & Camilla, with sourcing from Christopher Andersen's book.

23 AUGUST 2024: People magazine (US), "Prince William's Return to Work Plans Revealed After Summer Break with Kate Middleton and Their Kids" [archive link]

On Aug. 22, Kensington Palace announced that the Prince of Wales, 42, will visit the Homelessness: Reframed exhibit at the Saatchi Gallery in London on Sept. 5. The display highlights the complexities of homelessness across the U.K. and offers the public an opportunity to better understand the stories of individuals who have been affected. Homelessness: Reframed is a collaboration between Prince William's Homewards program, which he launched with the Royal Foundation in June 2023 to help end homelessness for good, the Saatchi Gallery and the Eleven Eleven Foundation. The presentation opened on Aug. 7, and Prince William will visit before it closes on Sept. 20.

25 AUGUST 2024: Kate seen in a car on the way to church 'at Crathie Kirk, Balmoral, Scotland.

Daily Mail, "Inside Kate's slow and steady return to public life: How the Princess of Wales has won over the nation's hearts with appearances at Trooping the Colour, Wimbledon and Crathie Kirk following cancer diagnosis" [archive link]

Her appearance had been in doubt after she missed the final Trooping rehearsal the weekend prior to the celebration, with confirmation that she would attend only given at 6pm the evening before. [...] And now, Kate has been seen in public for the third time since revealing that she has cancer - just two weeks after her video message praising Team GB. The royal appeared in high spirits as she was pictured arriving for Sunday service with her husband William at Crathie Kirk today. William drove the car, smiling as he chatted with his wife and opting for a navy blue suit for the occasion. The Princess sported the same hat she donned last year for a Sunday church service, when she donned a beige tartan Marlborough trench coat from Holland Cooper with dark brown wool felt fedora with feathers.

28 AUGUST 2024: The Daily Mail's royal editor, Rebecca English, confirms that William "never planned to" attend the Earthshot Prize Innovation Summit in September 2024.

29 AUGUST 2024: Matt Wilkinson, The Sun, reports that both William and Harry attended their uncle's funeral in Norfolk, "Warring Prince William and Harry REUNITE at their uncle’s funeral after Duke of Sussex makes secret dash to UK" [archive link]

The Duke of Sussex, 39, flew from his US home to join his brother, 42, at the service for Lord Robert Fellowes. A local in Snettisham, Norfolk, said: “We never saw them speak to each other and they kept their distance.” The princes both “discreetly” attended the funeral for Lord Fellowes — who was their mother Diana’s brother-in-law. They were said to have kept their distance from each other and sat at the back of the church. Sources close to US-based Harry had previously claimed he would not attend. But a close family friend said they were “very happy to confirm both princes were there”. Another source told how they only saw them at the end of the service at St Mary’s Church. They said: “I didn’t know they were there. They arrived very discreetly.” One local said: “William and Harry were both there but we never saw them speak to each other and they were keeping their distance.”

TIMELINE:

Part 1

Part 2

Part 3

Part 4

#my gif#british royal family#The Prince's Trust#twitter#fleet street#the telegraph#books#robert jobson#magazines#katie nicholl#victoria ward#kensington palace#pr games#strategery#pr fail#King Charles III#duchy of cornwall#Daily Mail#natasha livingstone#tom sykes#olympics#celebrities#rebecca english#dan wootton#king charles III#queen camilla#gina kalsi#richard palmer#earthshot prize#prince harry

7 notes

·

View notes

Text

Why don't young people vote: A hypothesis

In the 2019 UK General Election just 47% of 18-24 yos voted, compared to 67.3% across the country, and over 80% of over-65's (House of Commons Library). The 2020 US Presidential election did slightly better, but still only 55% of 18-29 yos voted in comparison to 66% turnout. With just a few days until the General Election, where low expected turn outs mean every vote will count, and the Presidential and French Elections looming, I came up with a hypothesis why.

Long post so under the cut, the tldr is that young people are taught in schools to believe that right and wrong answers are the only answers that exist, and being wrong has a larger penalty than doing nothing, and that young people don't feel the direct affects of policies in the same way older people with families or mortgages or taxes do, partly because policies never target them because they don't vote.

IF YOU ARE READING THIS, YOU HAVE LOOKED PASSED THE HEADLINE SO ARE PROBABLY MORE INFORMED THAN THE AVERAGE VOTER. VOTE FOR YOUR FAVOURITE POLICY. VOTE TACTICALLY. VOTE AGAINST A PARTY YOU DONT LIKE. VOTE FOR THE PERSON WITH THE LEAST STUPID HAIRSTYLR. VOTE.

(Also, if you are UK and voting on the 4th, remember to bring ID.)

Note: I do NOT study politics as anything more than an interest in current affairs. I am NOT aligned with any political party, and this is a hypothesis based on a very small sample size that has NOT been reviewed or tested in any way. This is simply me, speaking as a young person in the UK whose talked to other young people, both those interested in politics and not.

A lot of people theorise it's to do with dissatisfaction among younger voters, who feel their voices don't get heard, or they don't like any of the candidates so don't want to vote for any of them. But talking to my friends, of those I spoke to who said they didn't think they would vote, most said it was because they didn't know how politics works to an extent that made them feel informed enough to vote, rather than any kind of dissatisfaction with the system itself.

However, with young people in general having more access to social media, the Internet, and the wealth of resources both provide, it doesn't ring true that they would be generally less informed of politics to such a greater extent than the average informed voter (defined in British Parliamentary Debate as a person who reads the headlines) to skew the statistics this much.

So here are my two theories that together influence a young person to feel uninformed enough to not want to vote:

School and the education system teaches you not to vote. Work and adult life teaches you to.

When you are at school, you are taught there is a single right answer. It is correct in every aspect, and schools reward you for using the right methods, and finding it, while penalising you for not. You therefore begin to see the world in the same black and white way: every decision you make has a correct method, leading to a correct answer. A mistake can be penalised worse than not answering at all - either by losing marks in tests, or embarrassment in front of you peers for making a mistake out loud. The average person's first job, mostly part time with low experience requirement and lower pay, is the same, often having a list of rules or instructions with little free reign to get you used to a working environment while ensuring you don't make any blunders.

When you reach adulthood, and the world of work, this all but gets thrown out the window. For most people, their job isn't "i can't ever make a mistake". In a job you do get worse penalties for doing nothing than making mistakes, and decisions are no longer so black and white, often less 'what's the right way' as much as 'what's they way that will get me the answer my boss/customer/I will be happy with'.

Politics is the same way. It is making an, often fairly uninformed, desicion based on unkeepable promises and outright lies, where the decision isn't "who is right" or even "who do i agree with the most" so much as "who do I disagree with the least". It's doing exactly what you were always trained to never do in school: feeling uninformed or unsure or unhappy with an answer, but making it anyway, because this time, not making it will be worse.

The older generation sees short term effects more clearly, making them feel more 'informed'

Everyone is affected by politics and the policies the government make. I am not even trying to deny that. But individual policies, the shorter term changes the government makes in the interest of a longer term plan, are more keenly felt the older you are.

Mortgage and tax hikes, cuts to benefits, and other monetary effects are felt generally by over-35's, who are more likely to be homeowners, pay more tax, or are trying to raise a family on benefits, compared to younger people whose monetary problems tend to be less affected by government whims, (excluding cost of living crisises, of course). Meanwhile, longer term things, like investing in green infrastructure, or keeping hospitals running (sorry America), generally don't get noticed or felt on an individual basis unless you actively work in the public sector, so people in general feel less informed on, even of they have the interest in them.

This is also a failure on the part of candidates. Because young people don't feel like policies affect them so much, they are less likely to vote. Because they are less likely to vote, campaigners don't bother targeting them so don't make any policies that will really affect them, one way or another. So young people feel less 'informed' because politics doesn't seem to affect them, so they are less likely to vote....

What can you do as a young person?

Vote. Bring up the statistics and remind parties young people care, so they should care about young people too. Remember that there is no right answer. This isn't school. No one will ever know for certain who you voted for, nor why. Don't worry about reading all the 100-and-something page manifestos or watching all the debates or reading every news story if you don't want to. Your vote still matters. Pick a policy you care about and decide who says they'll solve it the best. Vote tactically if you are in the UK or another First Past the Post system and just don't like the current government (search tactical voting for more information). Decide who you like the least, and vote for the party most likely to beat them. If you really really can't bare to vote for any of them, spoil your ballot to make sure the statistic is recorded, so maybe next time, someone will have a policy you care about.

Most of all, remember that an election everyone thinks will be a landslide, is an election no one actually bothers to vote in. Your vote becomes all the more important.

#vote#uk general election#2024 presidental election#2024 elections#young people#need a say too#french elections#please vote#i promise someone will have voted having done less research than you

7 notes

·

View notes

Text

Je pense qu'il m'aime et je l'aime. Je ne peux rien faire sans son regard, pour ou contre. J'ai besoin de son regard, j'ai besoin de sa force, même si ça m'inspire d'aller contre sa volonté. Il doit être là, toujours là, il garde mes grands pieds sur terre et parfois il m'aide à m'envoler.

Jane Birkin on Serg Gainsbourg

Jane Birkin will always be France’s favourite “petite Anglaise”, but few will have even guessed at the depth of the insecurity suffered by the “little English girl”. The British-born actress and singer captured Gallic hearts when, aged 21 and the epitome of London’s Sixties cool, she took up with singer-songwriter Serge Gainsbourg – 20 years her senior and the bad boy of French popular music. The public was fascinated by his excesses and his outrageous behaviour – he once burned a 500 franc note live on television to protest at his tax bill and had made a reggae version of La Marseillaise – and by her Sixties style and heavily accented French.

Their turbulent relationship hit the headlines many times during a 13-year affair which saw the release of their controversial duet ‘Je t’aime… moi non plus’ (I love you…me neither), which Gainsbourg originally wrote for Brigitte Bardot, a record condemned by the pope and banned by radio stations in the UK for being sexually explicit.

The decades passed, the couple split, Gainsbourg’s drinking and smoking caught up with him, and he died, but in her adopted homeland Birkin, now dead, will always be remembered as his muse but also as a muse and style icon in her own right.

RIP Jane Birkin (1946-2023)

#birkin#jane birkin#quote#gaze#relationship#amour#serg gainsbourg#gainsbourg#singer#muse#icon#femme#beauty#british#french#arts#culture

50 notes

·

View notes

Note

VOR: Margaret Thatcher

Hm, I don't have strong Iron Lady opinions, so low confidence on this one.

My general stance is decently high? You know I should be tiering these for fun, so I am going to go with B- tier. The neoliberal reforms that the Tories pursued were far from sui generis; they were the reforms being pursued by virtually every conservative European faction in the 1980's, and several liberal-left ones at that. Europe's growth model of the postwar period had done well, but hit its limits, it was the natural turn. And on other conservative social topics she was even more bog-standard - I don't view her as a visionary.

But her epithet is quite accurate - she was uncompromising in a way that very few of her peers were. Particularly in relation to her legislation around trade unions and reforms of the tax system, most would have balked, and she not only didn't but was very effective at keeping party discipline in the face of strikes & protest. The UK would have passed less sweeping reforms without her, and those reforms changed the nature of the British economy & the political economy around that.

Now, the UK's economy was broken, something had to give, so some reform would have passed. And she lost many political fights, particularly around international trade & EU, and in foreign affairs she was a classic vor-cel, saying this or that and then going along with the consensus opinion (Hong Kong's transfer, unification of Germany, Grenada invasion, etc). But you can tell what she cared about and didn't - she spent her political capital well for her goals. A solid VOR for her.

14 notes

·

View notes

Text

Self Assessment Tax Returns – A Complete Guide

The UK Self-Assessment tax system requires individuals and businesses to report their income and pay taxes if not deducted automatically. Taxpayers must file a Self-Assessment Tax Return annually if they fall into various categories, including self-employment, high earners, or those with specific types of income like savings or foreign earnings. Registration involves obtaining a Unique Taxpayer Reference (UTR) and setting up an online account. Deadlines are critical: informing HMRC by October 5th for new filers, submitting paper returns by October 31st, and online returns by January 31st. Accuracy in reporting income, expenses, and other financial details is crucial to avoid penalties, with options to amend returns if necessary. Maintaining records is essential, with different retention periods based on circumstances. Late filing or payment incurs penalties, but appeals are possible with valid reasons. Overall, compliance ensures taxpayers meet their obligations under UK tax law while managing their financial affairs responsibly.

Read More: Self Assessment Tax Return: Guide

2 notes

·

View notes

Text

Taking control of your tax affairs doesn’t have to be seen as a need-to-do activity or be overly laborious. In fact, having a clear plan in place can help maintain good financial health, identify any potential stress points and highlight opportunities for the year ahead.

Wills & Trusts Accountants will help create an easily implemented structure that promotes best practice and keep your accounts and finances robust and in good order. We bring together professionals who are motivated to secure the best outcome for you or your company.

Contact us today to discuss any aspect of your tax affairs and we will be more than happy to help.

0 notes

Text

Simplify Company Incorporation in UK with MAS LLP

Introduction: Are you looking to expand your business horizons by incorporating a company in the UK? Navigating the complexities of company incorporation can be daunting, but with the expert guidance of MAS LLP, the process becomes seamless and efficient. In this blog, we will explore the benefits of incorporating a company in the UK and how MAS LLP can assist you every step of the way. Why Company incorporation in UK? Incorporating a company in the UK offers numerous advantages that make it an attractive destination for businesses. Here are some key benefits: 1. Business-Friendly Environment The UK boasts a robust legal and regulatory framework that supports business growth and innovation. The government offers various incentives and support programs for startups and established businesses alike. 2. Access to Global Markets As one of the world's leading financial hubs, the UK provides unparalleled access to global markets. Incorporating your company in the UK can open doors to international trade and investment opportunities. 3. Prestigious Business Address Having a UK address enhances your company's credibility and reputation. It signals to clients and investors that you operate within a stable and well-regulated business environment. 4. Tax Benefits The UK offers competitive corporate tax rates and various tax reliefs for businesses. Incorporating in the UK can help you optimize your tax liabilities and retain more profits. 5. Access to Skilled Workforce The UK is home to a highly skilled and diverse workforce. Incorporating your company here allows you to tap into a talent pool that can drive your business forward. How MAS LLP Facilitates Company incorporation in UK MAS LLP is your trusted partner for company incorporation in UK. Here’s how we simplify the process: 1. Expert Consultation Our team of experienced consultants provides personalized advice tailored to your business needs. We help you understand the different types of company structures and choose the one that best suits your objectives. 2. Streamlined Registration Process We handle all the paperwork and administrative tasks involved in company incorporation. From preparing and filing documents to liaising with regulatory authorities, we ensure a hassle-free registration process. 3. Legal Compliance Ensuring compliance with UK laws and regulations is crucial for your business’s success. MAS LLP stays up-to-date with the latest legal requirements and ensures your company meets all compliance obligations. 4. Registered Office Service We offer a prestigious registered office address in the UK, enhancing your company’s professional image. Our office services include mail forwarding and handling official correspondence on your behalf. 5. Tax and Accounting Services Our comprehensive tax and accounting services help you manage your financial affairs effectively. We assist with tax planning, bookkeeping, and financial reporting to ensure your business runs smoothly. 6. Ongoing Support At MAS LLP, our support doesn’t end with incorporation. We provide ongoing business advisory services to help you navigate the challenges of running a company in the UK. From strategic planning to operational guidance, we are here to support your growth. Steps to Incorporate Your Company in the UK with MAS LLP Incorporating your company in the UK with MAS LLP is straightforward. Here’s a quick overview of the process: Initial Consultation: Discuss your business goals and requirements with our experts. Choose a Company Structure: Select the appropriate company structure based on our recommendations. Document Preparation: We prepare and file the necessary incorporation documents. Company Registration: We register your company with the UK’s Companies House. Post-Incorporation Services: Receive ongoing support and services to ensure your business thrives.

#audit#income tax#accounting & bookkeeping services in india#ajsh#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

3 notes

·

View notes

Text

TODAY (May 14), I'm on a livecast about AI AND ENSHITTIFICATION with TIM O'REILLY; on TOMORROW (May 15), I'm in NORTH HOLLYWOOD for a screening of STEPHANIE KELTON'S FINDING THE MONEY; FRIDAY (May 17), I'm at the INTERNET ARCHIVE in SAN FRANCISCO to keynote the 10th anniversary of the AUTHORS ALLIANCE.

#20yrsago England’s love affair with the utility bill https://web.archive.org/web/20040706124142/https://cede.blogspot.com/2004_05_01_cede_archive.html#108455091554008455

#20yrsago RIAA’s funny bookkeeping turns gains into losses https://web.archive.org/web/20040607052730/http://www.kensei-news.com/bizdev/publish/factoids_us/article_23374.shtml

#20yrsago Read this and understand the P2P wars https://papers.ssrn.com/sol3/papers.cfm?abstract_id=532882

#15yrsago Sarah Palin’s legal team doesn’t understand DNS https://www.huffpost.com/entry/crackhocom-sarah-palins-n_n_202417

#15yrsago Was 1971 the best year to be born a geek? https://www.raphkoster.com/2009/05/14/the-perfect-geek-age/

#15yrsago Charlie Stross on the future of gaming http://www.antipope.org/charlie/blog-static/2009/05/login_2009_keynote_gaming_in_t.html

#15yrsago UK chiropractors try to silence critic with libel claim https://gormano.blogspot.com/2009/05/two-things.html

#10yrsago Cable lobbyists strong-arm Congresscritters into signing anti-Net Neutrality petition https://web.archive.org/web/20140527030122/http://www.freepress.net/blog/2014/05/12/tell-congress-dont-sign-cable-industry-letter-against-real-net-neutrality

#10yrsago London property bubble examined https://timharford.com/2014/05/when-a-man-is-tired-of-london-house-prices/

#5yrsago A year after Meltdown and Spectre, security researchers are still announcing new serious risks from low-level chip operations https://www.wired.com/story/intel-mds-attack-speculative-execution-buffer/

#5yrsago Jury awards $2b to California couple who say Bayer’s Roundup weedkiller gave them cancer https://www.cnn.com/2019/05/14/business/bayer-roundup-verdict/index.html

#5yrsago AT&T promised it would create 7,000 jobs if Trump went through with its $3B tax-cut, but they cut 23,000 jobs instead https://arstechnica.com/tech-policy/2019/05/att-promised-7000-new-jobs-to-get-tax-break-it-cut-23000-jobs-instead/

#5yrsago DOJ accuses Verizon and AT&T employees of participating in SIM-swap identity theft crimes https://www.vice.com/en/article/d3n3am/att-and-verizon-employees-charged-sim-swapping-criminal-ring

#5yrsago Collecting user data is a competitive disadvantage https://a16z.com/the-empty-promise-of-data-moats/

#5yrsago Three years after the Umbrella Revolution, Hong Kong has its own Extinction Rebellion chapter https://www.scmp.com/news/hong-kong/health-environment/article/3010050/hong-kongs-new-extinction-rebellion-chapter-looks

#5yrsago Lawyer involved in suits against Israel’s most notorious cyber-arms dealer targeted by its weapons, delivered through a terrifying Whatsapp vulnerability https://www.nytimes.com/2019/05/13/technology/nso-group-whatsapp-spying.html

#5yrsago The New York Times on Carl Malamud and his tireless battle to make the law free for all to read https://www.nytimes.com/2019/05/13/us/politics/georgia-official-code-copyright.html

#1yrago Google’s AI Hype Circle https://pluralistic.net/2023/05/14/googles-ai-hype-circle/

5 notes

·

View notes

Text

Taken For Fools

Andrew Bailey, Governor of the Bank of England, is so awash with money he doesn’t remember the exact amount he is paid.

“Bank of England Governor Andrew Bailey, who came under fire for suggesting people shouldn’t ask for pay rises in the cost of living crisis, has again sparked anger when he “couldn’t remember” his £575,000 salary." (LBC: 23/02/23)

But Mr Bailey isn’t the only banker enjoying a financial bonanza. At the beginning of 2022, UK bankers had the biggest salary and bonus rise since 2008.

“‘We’ve had a run on champagne:’ Biggest UK banker bonuses since financial crash” (Guardian: 16/02/22)

In October 2022, despite bankers pocketing the "biggest bonuses" since before the financial crash, Chancellor Jeremy Hunt reaffirmed he was keeping the Liz Truss policy of scrapping the banker’s bonus cap.

“The new chancellor, Jeremy Hunt, is pressing on with plans to scrap the bankers’ bonus cap, protecting one of the most divisive policies from his predecessor’s disastrous mini-budget.” (Guardian: 17/10/22)

You have to hand it to the Tories, when it comes to protecting their own wealth and the wealth of their rich friends they never fail to deliver. From former Chancellor's lying about their tax affairs, to Prime Minister’s wives saving millions in tax through non-dom status, from Tory MP's taking on lucrative second jobs, to “cash for influence" scandals, the Tories are up to their necks in shady economic deals.

People might forgive the Tories for being so self-serving if they too benefited from Tory economic policies but the sad fact is ordinary people are becoming poorer, not richer. This is what one American journal had to say:

“In the UK, the number of people seeking help to feed themselves and their families through food banks has increased from 26,000 in 2010, to more than 2.56 million in 2022. At the same time, the cumulative wealth of the top ten billionaires in the UK has grown from £48 billion in 2009 to £182 billion in 2022 - an increase of 281 percent.” (Forbes: 24/03/23)

The massive increase in the gap between the rich and the rest of us in the UK is not an accident but the result of deliberate Tory policies.

“How the U.K. Became One of the Poorest Countries in Western Europe. Britain chose finance over industry, austerity over investment, and a closed economy over openness to the world.” (The Atlantic: 25/10/22)

The Governor of the Bank of England agrees:

“Brits must accept they’re poorer and stop demanding pay rises says Bank of England chief” (Mirror: 25/04/23)

So, while bankers are set to enjoy even greater champagne-popping bonuses, and Tory millionaire MP’s continue to live the high life, the rest of us are expected to tighten our belts and meekly submit to wage cuts and a declining standard of living.

Are we really this stupid?

13 notes

·

View notes

Text

The Millionaire. The Tax Cheat & The Child Snatchers.

Is the title too dramatic?

Almost as if I'm pursuing a career in right wing press.

As catchy and inflammatory as it is, it is true.

Our Millionaire Prime Minister, Rishi Sunak, has had a tough couple of weeks. Bless his little Harrod's premium Egyptian cotton socks.

From the Scottish Government trying to give Trans people in Scotland a route to self acceptance and societal approval to dealing with questions over what GP surgery he uses and whether it be private or public services him and his family use regularly.

Whatever you took from his vague answers just always remember: His Dad was a doctor

Moving swiftly forward to our ever loveable multi-millionaire chairman of the Conservative party.

How could the public possibly turn on a man who ensured the ambient temperature of his horses accommodation was that or higher than the average UK families living room?

Well he might want to turn down the temperature on the thermostat of his and his horses gaffs.

Nadhim Zahawi, the man once charged with taxation regulation on behalf of a tory government just happened to commit a few 'errors' which resulted in him essentially 'forgetting who owned the shares and therefore who owed the tax bill'.

It appears that forgetting figures of tens of millions is quite easy for a few privileged. Comforting to know that this is the chairman of the current ruling party which is led by another more successful and wealthy gentleman who is married to an almost billionaire non dom resident.

Again moving swiftly on before my brain suffers a serious malfunction due to an overload of hypocrisy and corruption.....

The child snatchers.... I must admit, I giggled when I came up with that even though the title is probably the most fitting.

Somehow, the Home Office has managed to lose 200 children.

You read that correct, don't adjust your screens as they say.

200 children have been trafficked by unknown individuals from the care of a home office approved hotel accommodation in England. The fact that the general consensus of tory MP's like Jonathon Gullis is that 'they shouldn't have come here illegally' is a worrying sign of the depths extreme right wing members can plunge to.

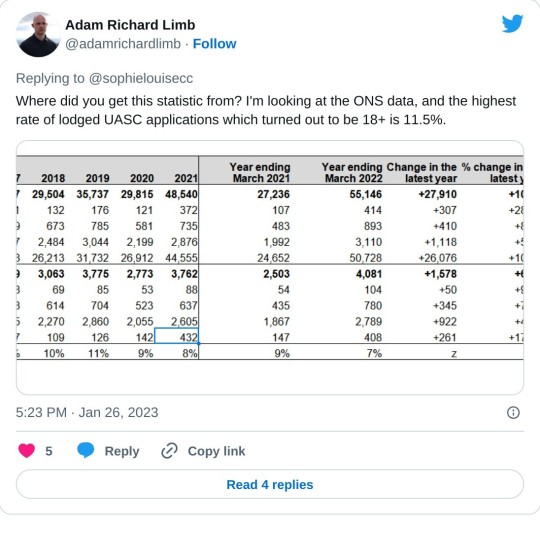

After comments like wee jolly Jonathon's, social media is alight with false statements about the actual age of the children in question. Some claiming that as many as 70% of male asylum seekers are 18 and over and fraudulently claim underage status to enhance their chances of a successful asylum application.

These statements are clearly untrue and with a quick search of the ONS figures its closer to 11%.

Others simply don't deny the age of the children and claim that they deserve to be trafficked because they came here illegally.

The least offensive assumption from the right wing commentators is that the children have illegally re-united with relatives who are already settled within the UK.

Illegal to do so or not, I can't help but think 'go for it wee one, find your family'. Its tough having compassion for strangers in a world that's becoming so populist at a working class, grass route level.

I feel sorry for the people of England.

#UKGov#politics#tory party#labour#SNP#uk politics#news#politics news#conservatives#nadhim zahawi#rishi sunak

11 notes

·

View notes

Text

Brit here. The balance of deference to Royals and seeing behind the golden, diamond encrusted facade is tipping more and more to the latter….

The hypocrisy is astounding.

I’m American, so take my opinion with less than a grain of salt, but this is just useless. We all know the way to combat homelessness for individuals and families is to build more social housing where profit is the last of priorities. That would require THE GOVERNMENT (an institution which William has closer communications to that your average Brit) to act upon, and we all know the UK doesn’t have the finances due to constant tax favors for the wealthy and little investment into the lower and middle classes for more than a decade.

Yes, yes, I know that royals cannot interfere in government affairs which is why they do things like this. But I think it only highlights the uselessness of the monarchy in general. And yes, it is hypocritical for a man whose family wealth is kept obscure and has many houses and travels in a helicopter and blah blah blah. But I just think the main issue is that it’s proving this entire institution is a waste of money. It might be for the best to cut them a final check, give them some tiaras, and say thank you for trying.

I’ve seen people refer to William as the Royal Family’s Jared Kushner…

I have said this for years and nothing I have seen has changed my opinion - Will & Kate just did not work enough in the early years of their marriage. They both should have been funneled into specific causes and put on a schedule. Charles & Diana worked too much - but Will & Kate worked too little and it’s really starting to show.

#my gif#reddit#critique#homewards#William The Prince of OWN GOALS#William The Weak#William The Terrible#William The Prince of Wales#prince william

4 notes

·

View notes