#The Capital Advisor

Explore tagged Tumblr posts

Text

How finfluencers destroyed the housing and lives of thousands of people

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

The crash of 2008 imparted many lessons to those of us who were only dimly aware of finance, especially the problems of complexity as a way of disguising fraud and recklessness. That was really the first lesson of 2008: "financial engineering" is mostly a way of obscuring crime behind a screen of technical jargon.

This is a vital principle to keep in mind, because obscenely well-resourced "financial engineers" are on a tireless, perennial search for opportunities to disguise fraud as innovation. As Riley Quinn says, "Any time you hear 'fintech,' substitute 'unlicensed bank'":

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

But there's another important lesson to learn from the 2008 disaster, a lesson that's as old as the South Seas Bubble: "leverage" (that is, debt) is a force multiplier for fraud. Easy credit for financial speculation turns local scams into regional crime waves; it turns regional crime into national crises; it turns national crises into destabilizing global meltdowns.

When financial speculators have easy access to credit, they "lever up" their wagers. A speculator buys your house and uses it for collateral for a loan to buy another house, then they make a bet using that house as collateral and buy a third house, and so on. This is an obviously terrible practice and lenders who extend credit on this basis end up riddling the real economy with rot – a single default in the chain can ripple up and down it and take down a whole neighborhood, town or city. Any time you see this behavior in debt markets, you should batten your hatches for the coming collapse. Unsurprisingly, this is very common in crypto speculation, where it's obscured behind the bland, unpronounceable euphemism of "re-hypothecation":

https://www.coindesk.com/consensus-magazine/2023/05/10/rehypothecation-may-be-common-in-traditional-finance-but-it-will-never-work-with-bitcoin/

Loose credit markets often originate with central banks. The dogma that holds that the only role the government has to play in tuning the economy is in setting interest rates at the Fed means the answer to a cooling economy is cranking down the prime rate, meaning that everyone earns less money on their savings and are therefore incentivized to go and risk their retirement playing at Wall Street's casino.

The "zero interest rate policy" shows what happens when this tactic is carried out for long enough. When the economy is built upon mountains of low-interest debt, when every business, every stick of physical plant, every car and every home is leveraged to the brim and cross-collateralized with one another, central bankers have to keep interest rates low. Raising them, even a little, could trigger waves of defaults and blow up the whole economy.

Holding interest rates at zero – or even flipping them to negative, so that your savings lose value every day you refuse to flush them into the finance casino – results in still more reckless betting, and that results in even more risk, which makes it even harder to put interest rates back up again.

This is a morally and economically complicated phenomenon. On the one hand, when the government provides risk-free bonds to investors (that is, when the Fed rate is over 0%), they're providing "universal basic income for people with money." If you have money, you can park it in T-Bills (Treasury bonds) and the US government will give you more money:

https://realprogressives.org/mmp-blog-34-responses/

On the other hand, while T-Bills exist and are foundational to the borrowing picture for speculators, ZIRP creates free debt for people with money – it allows for ever-greater, ever-deadlier forms of leverage, with ever-worsening consequences for turning off the tap. As 2008 forcibly reminded us, the vast mountains of complex derivatives and other forms of exotic debt only seems like an abstraction. In reality, these exotic financial instruments are directly tethered to real things in the real economy, and when the faery gold disappears, it takes down your home, your job, your community center, your schools, and your whole country's access to cancer medication:

https://www.theguardian.com/world/2012/jun/08/greek-drug-shortage-worsens

Being a billionaire automatically lowers your IQ by 30 points, as you are insulated from the consequences of your follies, lapses, prejudices and superstitions. As @[email protected] says, Elon Musk is what Howard Hughes would have turned into if he hadn't been a recluse:

https://mamot.fr/@[email protected]/112457199729198644

The same goes for financiers during periods of loose credit. Loose Fed money created an "everything bubble" that saw the prices of every asset explode, from housing to stocks, from wine to baseball cards. When every bet pays off, you win the game by betting on everything:

https://en.wikipedia.org/wiki/Everything_bubble

That meant that the ZIRPocene was an era in which ever-stupider people were given ever-larger sums of money to gamble with. This was the golden age of the "finfluencer" – a Tiktok dolt with a surefire way for you to get rich by making reckless bets that endanger the livelihoods, homes and wellbeing of your neighbors.

Finfluencers are dolts, but they're also dangerous. Writing for The American Prospect, the always-amazing Maureen Tkacik describes how a small clutch of passive-income-brainworm gurus created a financial weapon of mass destruction, buying swathes of apartment buildings and then destroying them, ruining the lives of their tenants, and their investors:

https://prospect.org/infrastructure/housing/2024-05-22-hell-underwater-landlord/

Tcacik's main characters are Matt Picheny, Brent Ritchie and Koteswar “Jay” Gajavelli, who ran a scheme to flip apartment buildings, primarily in Houston, America's fastest growing metro, which also boasts some of America's weakest protections for tenants. These finance bros worked through Gajavelli's company Applesway Investment Group, which levered up his investors' money with massive loans from Arbor Realty Trust, who also originated loans to many other speculators and flippers.

For investors, the scheme was a classic heads-I-win/tails-you-lose: Gajavelli paid himself a percentage of the price of every building he bought, a percentage of monthly rental income, and a percentage of the resale price. This is typical of the "syndicating" sector, which raised $111 billion on this basis:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

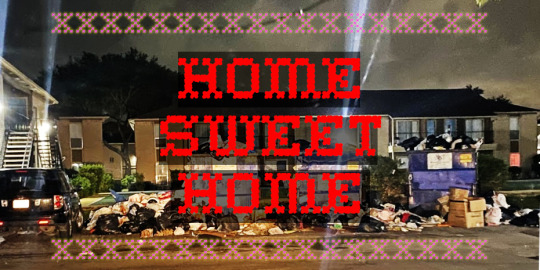

Gajavelli and co bought up whole swathes of Houston and other cities, apartment blocks both modest and luxurious, including buildings that had already been looted by previous speculators. As interest rates crept up and the payments for the adjustable-rate loans supporting these investments exploded, Gajavell's Applesway and its subsidiary LLCs started to stiff their suppliers. Garbage collection dwindled, then ceased. Water outages became common – first weekly, then daily. Community rooms and pools shuttered. Lawns grew to waist-high gardens of weeds, fouled with mounds of fossil dogshit. Crime ran rampant, including murders. Buildings filled with rats and bedbugs. Ceilings caved in. Toilets backed up. Hallways filled with raw sewage:

https://pluralistic.net/timberridge

Meanwhile, the value of these buildings was plummeting, and not just because of their terrible condition – the whole market was cooling off, in part thanks to those same interest-rate hikes. Because the loans were daisy-chained, problems with a single building threatened every building in the portfolio – and there were problems with a lot more than one building.

This ruination wasn't limited to Gajavelli's holdings. Arbor lent to multiple finfluencer grifters, providing the leverage for every Tiktok dolt to ruin a neighborhood of their choosing. Arbor's founder, the "flamboyant" Ivan Kaufman, is associated with a long list of bizarre pop-culture and financial freak incidents. These have somehow eclipsed his scandals, involving – you guessed it – buying up apartment buildings and turning them into dangerous slums. Two of his buildings in Hyattsville, MD accumulated 2,162 violations in less than three years.

Arbor graduated from owning slums to creating them, lending out money to grifters via a "crowdfunding" platform that rooked retail investors into the scam, taking advantage of Obama-era deregulation of "qualified investor" restrictions to sucker unsophisticated savers into handing over money that was funneled to dolts like Gajavelli. Arbor ran the loosest book in town, originating mortgages that wouldn't pass the (relatively lax) criteria of Fannie Mae and Freddie Mac. This created an ever-enlarging pool of apartments run by dolts, without the benefit of federal insurance. As one short-seller's report on Arbor put it, they were the origin of an epidemic of "Slumlord Millionaires":

https://viceroyresearch.org/wp-content/uploads/2023/11/Arbor-Slumlord-Millionaires-Jan-8-2023.pdf

The private equity grift is hard to understand from the outside, because it appears that a bunch of sober-sided, responsible institutions lose out big when PE firms default on their loans. But the story of the Slumlord Millionaires shows how such a scam could be durable over such long timescales: remember that the "syndicating" sector pays itself giant amounts of money whether it wins or loses. The consider that they finance this with investor capital from "crowdfunding" platforms that rope in naive investors. The owners of these crowdfunding platforms are conduits for the money to make the loans to make the bets – but it's not their money. Quite the contrary: they get a fee on every loan they originate, and a share of the interest payments, but they're not on the hook for loans that default. Heads they win, tails we lose.

In other words, these crooks are intermediaries – they're platforms. When you're on the customer side of the platform, it's easy to think that your misery benefits the sellers on the platform's other side. For example, it's easy to believe that as your Facebook feed becomes enshittified with ads, that advertisers are the beneficiaries of this enshittification.

But the reason you're seeing so many ads in your feed is that Facebook is also ripping off advertisers: charging them more, spending less to police ad-fraud, being sloppier with ad-targeting. If you're not paying for the product, you're the product. But if you are paying for the product? You're still the product:

https://pluralistic.net/2021/01/04/how-to-truth/#adfraud

In the same way: the private equity slumlord who raises your rent, loads up on junk fees, and lets your building disintegrate into a crime-riddled, sewage-tainted, rat-infested literal pile of garbage is absolutely fucking you over. But they're also fucking over their investors. They didn't buy the building with their own money, so they're not on the hook when it's condemned or when there's a forced sale. They got a share of the initial sale price, they get a percentage of your rental payments, so any upside they miss out on from a successful sale is just a little extra they're not getting. If they squeeze you hard enough, they can probably make up the difference.

The fact that this criminal playbook has wormed its way into every corner of the housing market makes it especially urgent and visible. Housing – shelter – is a human right, and no person can thrive without a stable home. The conversion of housing, from human right to speculative asset, has been a catastrophe:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

Of course, that's not the only "asset class" that has been enshittified by private equity looters. They love any kind of business that you must patronize. Capitalists hate capitalism, so they love a captive audience, which is why PE took over your local nursing home and murdered your gran:

https://pluralistic.net/2021/02/23/acceptable-losses/#disposable-olds

Homes are the last asset of the middle class, and the grifter class know it, so they're coming for your house. Willie Sutton robbed banks because "that's where the money is" and We Buy Ugly Houses defrauds your parents out of their family home because that's where their money is:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The plague of housing speculation isn't a US-only phenomenon. We have allies in Spain who are fighting our Wall Street landlords:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#fuckin-aardvarks

Also in Berlin:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

The fight for decent housing is the fight for a decent world. That's why unions have joined the fight for better, de-financialized housing. When a union member spends two hours commuting every day from a black-mold-filled apartment that costs 50% of their paycheck, they suffer just as surely as if their boss cut their wage:

https://pluralistic.net/2023/12/13/i-want-a-roof-over-my-head/#and-bread-on-the-table

The solutions to our housing crises aren't all that complicated – they just run counter to the interests of speculators and the ruling class. Rent control, which neoliberal economists have long dismissed as an impossible, inevitable disaster, actually works very well:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

As does public housing:

https://jacobin.com/2023/10/red-vienna-public-affordable-housing-homelessness-matthew-yglesias

There are ways to have a decent home and a decent life without being burdened with debt, and without being a pawn in someone else's highly leveraged casino bet.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/22/koteswar-jay-gajavelli/#if-you-ever-go-to-houston

Image: Boy G/Google Maps (modified) https://pluralistic.net/timberridge

#pluralistic#zirp#weaponized shelter#the rents too damned high#finfluencers#qualified investors#the bezzle#heads i win tails you lose#houston#Brent Ritchie#Matt Picheny#Koteswar Jay Gajavelli#Koteswar Gajavelli#Applesway Investment Group#maureen tkacik#Arbor Realty Trust#MF1 Capital#Benefit Street Partners#bezzle#Swapnil Agarwal#Slumlord Millionaires#KeyCity Capital#Financial Independence University#Elisa Zhang#Lane Kawaoka#Fundamental Advisors#AWC Opportunity Partners#Nitya Capital

263 notes

·

View notes

Text

two classes i have to take for my major are micro and macroeconomics and oh. oh boy. its gonna be rough.

16 notes

·

View notes

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Text

Merlin: man, I miss when the dinosaurs were alive

Arthur: excuse me?

Merlin: ya know, wouldn’t it be so great if they were alive again?

Arthur: no? wouldn’t they be crushing us every day?

Merlin: maybe. but you know what crushes us a lot worse every day currently?

Arthur:

Merlin: capitalism

Arthur, throwing his hands up: oh for the love of- alright, here we go

#based on a real conversation with my mother who loves me so much#Merlin: SHITTY PUNS ARE HOW I COPE WITH LIFE ARTHUR#Arthur: BUT WHY DO YOU HAVE TO USE THEM ON ME#YOU WALKED RIGHT INTO THAT ONE SIR#replace captialism with feudalism or the monarchy or anything of your choosing#Merlin fights for human rights as his royal boyfriend pinches the bridge of his nose and waved flags in the background#Arthur of course agrees and trusts Merlin’s takes#ALSO MERLIN BEING ARTHUR’S ADVISOR AND KEEPING HIM IN CHECK AND ARTHUR APPRECIATING IT MORE THAN ANYTHING IS MY FAVORITE#FAVORITE TROPE#I just love a world where Merlin doesn’t have to be as careful and secretive about it#And Arthur being overprotective and keeping his boyfriend safe from those who disagree#let *clap* merlin *clap* go *clap* off *clap*#Merlin: FUCKING CAPITALISM#ALSO GWAINE AND MERLIN DOING CHAOTIC PROTESTS#so sorry to anyone who sees this#shit post#Merthur shit post#but also#fanfic inspo#one man’s trash is another man’s fanfic inspo#it’s me. I’m the trashy fanfic inspo man#teehee#dinosaurs#if you saw me post this twice no you didn’t because I buried my own post JDKSKDDN#incorrect merlin quotes#incorrect merthur quotes#merthur#arthur pendragon#bbc merlin#this maybe has 30 tags you can’t prove anything you won’t count them all do it you won’t

22 notes

·

View notes

Text

I've actually been scrounging for an ending to Ellenville, because it's hard to actually 'end' a tragedy with something that feels complete, and that last post hit me with yeah, that's right. Because we live in a world where blood is protection and the cost of safety; and it fits in so neatly with the themes of death as stasis and longevity.

The 'end' is the regulations in place. Not even watching it happen, but success. This is The Pushcart War but epic fantasy.

#ellenville#ptxt#Jean Merrill is up there with Jean Craighead George for the imprinting I did on Pushcart War and Toothpaste Millionaire.#Which is ironic as FUCK because my curriculum definitely wanted me to take away 'You can be entrepreneurial too! Which is killing big truck#And undercutting big toothpaste business by packing yours in sterilized baby jars!' when I actually took away what Merrill#wanted which was: 'Hey isn't it fucked up that large companies think they can push you around and we need a capitalist underdog#success story to feel happy about our lives and role in the ongoing oligarchy of capitalism?'#Homeschooling with sonlight was fucking wild. I read so many good books as a kid and credit it to the fact I grew up with empathy#But it also meant I grew up with States Rights narratives and libertarian propaganda I had to unlearn.#Total aside because this is a tag essay anyway and I don't want to make a new post: I found out my advisor was also homeschooled#Which is probably why we're the exact same person I'm just 12 years behind them without the accent. My own brother almost#mistook them for me from behind and he gets pissy about it lol. 'There are two of them now!'#BUT I SWEAR I'M NOT COPYING THEM. WE JUST HAPPEN TO HAVE THE EXACT SAME HISTORICAL INTERESTS AND#SLAVISH DEVOTION TO GEOLOGY THAT TRANSFORMED INTO THE APPLICATIONS OF GEOLOGY AS A SCIENCE.#In my defense they have a much broader and recent focus on geology: usually for the impact of mining/geology on historical events.#Whereas I like the economic and logistical side of things. Like who hated who because they had beef over the same mines Nitrate War style

3 notes

·

View notes

Text

I feel like the Rules of Capitalization should not apply to me. Let me make Proper Nouns of whatever I please.

#i do it unconsciously all the time and then advisors come through like stop capitali#stop capitalizing all your single factors. dont address reviewers as Reviewer#booo 👎 let me have fun#im pretty sure i posted something like this before but i dont care. i was correct then and im correct now#wheres that like whinny the pooh post about capitalizing where it Feels Right? bc that spoke to something in me#by which i mean it enabled me to feel more correct in being wrong lol at least when it comes to boring Science writing lol#sigh... today sucks. im tired. i dont wanna work on this stupid manuscript hhhh submission is tomorrow#and i dont fucking care abt it sooooo hard yay#get me outta here. i wanna do other stuff 🫠#unrelated

27 notes

·

View notes

Text

mutual fund consultant

As a mutual fund consultant, you advise customers on how to invest in mutual funds while taking into account their goals and risk tolerance. You assess possibilities, make personalized recommendations, and remain current on market trends to make informed judgments.

#mutual fund consultant#mutual funds#gofundmecampaign#gofundmeplease#mutual#advisor#neardeathnote#money#businessplans#giveandtake#matchingfunds#mutuallikes#angeladvisor#funding#wealthmanagement#evadvisor#gofundmepage#taxcredit#invest#broker#gofundmehelp#smartinvesting#capital#income#investinyourfuture#education#grants#leadership#consultant#tax

3 notes

·

View notes

Text

Business Startup Financial Planner in Dubai

If you have launched your company in Dubai UAE, and need an experienced financial expert to upgrade it? So your search is over today because Optim Finance is a top-class business startup financial planner and advisor company in Dubai with almost 20 years of experience which can easily help you upgrade your business.

#business startup financial planner dubai#business financial advisor#professional financial advisor dubai#cash flow business model#financial accounting and reporting#financial planning in dubai#financial and planning analysis#financial planning & budgeting#budget money planner dubai#planning of working capital management

2 notes

·

View notes

Text

Having now burned through two seasons of a cute happy go lucky anime about an adventurer with goofy bear powers I only have one question.

Her noble friend's mother is definitely the King's mistress right?

#kuma kuma kuma bear punch#oh i just live in the capital while my husband and daughter live in a frontier barony#and i can just walk in on the king's chambers with a guest#and im a close advisor with no actual title or position#plus I'm in more scenes with the king than his actual wife

4 notes

·

View notes

Text

not to be anti capitalist on main but i’m in the middle of a job search rn and why are there entry level job listings requiring a PHD? We need to delete big business and start over.

#just kidding I always want to talk shit about capitalism on main#like i just want health insurance#and enough to pay rent#i told my advisor I was thinking of going into non profits#and she told me to ‘make sure i get a husband with a well paying job’#which is problematic and impossible for a lot of reasons#but WHY

4 notes

·

View notes

Text

the worst thing capitalism ever did was monetize time. because you can get rich as all fuck. enough to kill the world ten times over. but every second you relax you will still feel the sand grain falling with a resolute beat. there’s barely time to sleep anymore because god forbid you’re not using that time for self improvement. reading a good book ? maybe you should also be working out on a treadmill too. like this movie ? okay yeah but there’s emails to send while you watch. who’s got time to live when there’s an economy to run. and running this economy sure as fuck ain’t living. you go to school and go to work and go shopping and tell yourself that this is life. you can stop on all the scenic roads and take all the pictures but you’ll still have to put in a vacation request to do it. i don’t even want to do it on the company’s dime anymore, regardless of what my boss and i are earning. i want to be fucking free.

#god you can be radical or rebellious and your still paying the price#what good can i be doing right now#how beneficial is this action in the grand scheme#when will being alive not be inherently harmful#life is enjoyable#but this Lifestyle we all have is not#rambles#capitalism#fuck jobs#but especially corporate structure jobs#and also fuck social mentality#wrote this bc i was watching eeato and i felt like i should be doing something else at the same time#like No you don’t#calm down#i miss ryan#i miss me#i talk about wanting to explore and try things and the career advisor tells me how much money i’ll be wasting in that year#we put a price tag on each month in econ#none of us will ever be content

4 notes

·

View notes

Text

What an unbelievably cruel potion to own.

I’m so√﹀\_︿╱﹀╲/╲︿_/︺╲▁︹_/﹀\_︿╱▔︺\/\︹▁╱﹀▔╲︿_/︺▔╲▁︹_/﹀▔\⁄﹀\╱﹀▔︺\︹▁︿╱\╱﹀▔╲︿_/︺▔\︿╱\︿︹_/▔﹀\_︿╱▔︺\︹╱﹀▔╲︿_/︺▔\╱﹀╲▁︹_/﹀\_︿╱▔︺\︹▁︿⁄╲︿╱﹀╲

#The Dow Jones Industrial Average is a stock market index of 30 major US companies#Basically it's used to track those companies as a single unit to determine how the US economy is doing#Similar systems are the S&P 500 which has the top 500 companies#Or the S&P 600 SmallCaps which is restricted to companies under a certain net worth - usually startups#These are the basis for index funds - which buy stock proportional to their related index's proportions so that their value match#You can purchase index funds in the form of mutual funds or ETFs - but I'll stop here and remind you that#I am not a financial advisor or fiduciary#I hate that I know all of this#Please end capitalism so that nobody ever has to know this ever again

35K notes

·

View notes

Text

Looking for Venture Capital Investment in Bangalore?

SEAFUND is your trusted partner for venture capital investment in Bangalore, supporting startups and businesses with the funding they need to grow.

Whether you’re a budding entrepreneur or an established business looking to expand, SEAFUND provides strategic financial backing to help you succeed.

Explore more about venture capital investment in Bangalore and how SEAFUND can fuel your growth. Visit: https://seafund.in/

#VentureCapitalInvestmentBangalore #StartupFunding #SEAFUND #BusinessGrowth

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

0 notes

Text

The Role of a Startup Technical Advisor in Scaling Your Business

A Startup Technical Advisor plays a vital role in scaling your business. They provide actionable insights, optimize technology infrastructure, and ensure seamless growth. At nuCode Tech Capital, we connect startups with advisors who specialize in scaling operations efficiently. From managing tech teams to implementing cutting-edge solutions, a technical advisor ensures your startup is built for long-term success. Partner with us to leverage expert guidance and take your business to new heights.

0 notes

Text

When do I need tax planning services in Chennai?

You should consider tax planning early in the financial year to reduce liabilities and maximize savings. With reliable tax planning services in Chennai, Fairmoves helps individuals and businesses create smart tax strategies while staying fully compliant.

#tax planning services in Chennai#best tax planning company in Chennai#tax on capital gains from mutual funds in Chennai#GST Audit advisor in Chennai#gst filing services in Chennai#income tax filing consultant in Chennai#tax consultant in Chennai#gst return filing online in Chennai

0 notes

Text

Mutual funds Advisor

KNV Capital Services is a trusted mutual funds advisor, offering expert guidance to help clients choose the best mutual fund investments. With a deep understanding of the market, they assess your financial goals and risk tolerance to recommend suitable funds. Their team provides personalized advice on building a diversified portfolio that aligns with your long-term objectives. KNV Capital Services ensures that clients understand the benefits and risks of mutual funds, empowering them to make informed decisions. Whether you're a new investor or looking to optimize your existing portfolio, their professional guidance is invaluable. As your mutual funds advisor, KNV Capital Services is committed to helping you achieve financial growth and security.

0 notes