#Tax Services USA

Explore tagged Tumblr posts

Text

Achieve Financial Clarity with Rose Group CPA’s Expertise

At Rose Group CPA, a leading small business CPA firm, we understand the unique financial challenges that small businesses face. Our dedicated team of certified public accountants provides personalized accounting, tax, and advisory services designed to help your business thrive. We focus on your specific needs, ensuring compliance while maximizing your tax efficiency. With our expert guidance, you can make informed financial decisions that drive growth and stability. Partner with us to navigate the complexities of business finances with confidence.

#cpa tax services#professional bookkeeping#tax and accounting services#tax preparation and planning#tax services usa

0 notes

Text

Simplify Tax Season with Expert Tax Services in the USA

AmTax is here to simplify your life with tax services in the USA. Our expert team takes the guesswork out of tax filing, offering professional advice and support tailored to your needs. Whether you're a US citizen living abroad or running a small business, we ensure you're compliant and up-to-date with the IRS.

Why Choose AmTax?

Expert Advice on US tax compliance

Support for Expats with renouncing citizenship

Late Tax Returns amnesty programs

Personalised Tax Solutions for all

Exclusive Deals for subscribers

Skip the stress and make tax season a breeze with AmTax. Visit our website today to learn more about our comprehensive tax services in the USA.

0 notes

Text

Integrated Tax Services In USA - KNAV

Integrated Tax Services in the USA are essential for businesses of all sizes. Our team of highly experienced tax professionals specializes in offering comprehensive tax services that are tailored to your specific needs. From tax planning and compliance to audit representation and international tax services, we have the expertise to provide you with reliable and accurate advice.

Business Website: https://us.knavcpa.com/tax-and-regulatory/

1 note

·

View note

Text

#corporate#corporate america#benefits#fiscal policy#politics#politicians#responsibility#Walmart#profits#capitalism#capitalist society#american capitalism#social services#janet yellen#shareholders#free market system#free market#tax payers#united states#USA#reality#subsidized workforce#workforce#livable wages#tax dollars#taxes#political#political climate#eat the rich#lessons

44 notes

·

View notes

Text

All it took was real physical action for these people to cry out for reform, had Brian Thompson not been killed these media outlets wouldn't even dare utter a word of reform.

#culture#leftism#politics#the left#progressive#us politics#communism#eat the rich#tax the rich#corporate greed#brian thompson#the adjuster#healthcare industry#healthcare for all#healthcare billing#healthcare professionals#healthcare services#health#medicine#medical care#health insurance#insurance#unitedhealth group inc#united states#united healthcare#issue#usa news#usa#fuck corporate america#fuck corporations

13 notes

·

View notes

Text

Why Tax Advisory Services in USA Are Your Compass

The United States tax code is notoriously intricate, a labyrinth of rules and regulations that can leave even the most seasoned business owner or individual feeling lost. This is where tax advisory services in USA come in, acting as your trusted guide through the complexities of the tax landscape. Mercurius & Associates LLP (MAS), a leading provider of tax advisory services in USA, understands the unique challenges faced by individuals and businesses. We offer a comprehensive suite of services tailored to your specific needs, helping you:

Minimize Tax Burden: Our expert advisors analyze your financial situation and identify opportunities for tax optimization, ensuring you keep more of your hard-earned money. Stay Compliant: We navigate the ever-changing tax code on your behalf, ensuring your filings are accurate and timely, avoiding costly penalties and audits. Plan for the Future: Whether you're a growing startup or a seasoned entrepreneur, MAS helps you develop tax-efficient strategies for long-term success. Here are just a few ways MAS can assist you: International Tax Planning: We guide you through the complexities of cross-border transactions and investments, mitigating your global tax risk. Business Entity Structuring: We help you choose the optimal business structure for tax efficiency and asset protection. Mergers & Acquisitions: We advise on the tax implications of M&A transactions, ensuring a smooth and profitable process. Estate & Gift Tax Planning: We safeguard your legacy by developing strategies to minimize estate and gift taxes. But MAS goes beyond just numbers. We believe in building strong relationships with our clients, providing personalized attention and clear communication throughout the process. We're not just your tax advisors; we're your partners in financial success. Investing in tax advisory services in USA is an investment in your future. Choosing MAS means you gain access to a team of experienced professionals who are passionate about helping you achieve your financial goals. Ready to take control of your taxes and unlock your financial potential? Contact MAS today for a free consultation and discover how our Tax advisory services in USA can guide you through the maze of the US tax code.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Tax advisory services in USA

4 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

#newyorktimes#nytimes#nyt crossword#nyt connections#nyt#unitedstatesofhypocrisy#usa#america#unitedstateofamerica#united nations high commissioner for refugees#united states#unitedsnakes#us government#us govt#usgov#us politics#us policing#us postal service#us portugal tax#uspol#america is fucking weird#amerika#amerikkka#make america gay again#fuck maga#magats#maga#conservative comics make the left look so cool#working class#class warfare

3 notes

·

View notes

Text

YES!!

decriminalize:

sex work

addiction

criminalize:

golf

#decriminalize addiction PLEASE! theres like a billion studies on this and as it turns out criminalizing addiction does not get rid of it#the same thing with sex work. both of these will still invariably be around if the solution to them is just arrest people who engage with i#the decriminalization of addiction and sw must necessarily be accompanied with the expansion of universal/public healthcare and other#social welfare programs (including UBI)#i strongly believe that the roots of nearly all problems in the united states is the general absence or underfunding#of welfare programs; as well as the influences of corporations and dark money in government and legislation; both of these removed#absolutely will improve the usa in every way#the us needs to become a social democracy!#and dont even worry about the costs; the usa has enough money to fund these huge projects. especially if the government pulls out#funding from other areas such as from police departments and the military; and furthermore these projects can potenially pay for themselves#by uplifting millions of people who (now no longer severely impoverished; or homeless; or without adequate healthcare; etc.) can now provid#for society which pays for these projects and creates a virtuous cycle! government services can help everyone and everyone can help service#and the golf stuff needs to go! golf is a blight on this green earth; as are lawns (which golf-fields are a type of)#and (continuous) monocultural farms; all have terrible environmental effects#lawns use SOOOO much water just for maintenance; this water could be used for other things like DRINKING (which is#necessary to live)#and lawns are huge areas consisting of just one species of plant; while other species of plants are intentionally removed#from these fields for maintenance; and as it turns out! large patches of uninterrupted stretches of one single species of grass really hurt#the environment by literally taking space for other plants away and reducing biodiversity; these fields of only one plant act as deserts#lawns dont even have a real purpose! they provide nothing for the rest of society! at least monoculture farms give us food!#lawns just sit there looking ugly as hell and stealing our water and killing our environment for literally no reason!!!!!!!!#i unironically propose a georgist solution to golf and lawn: a progressive tax on the size (by square area) of fields; and criminalize#fields exceeding a certain threshold of size; and lifting certain regulations on the maintenance of personally owned lawns#or like just kill golf and lawns entirely#ok#rant#reblog

192K notes

·

View notes

Text

Part-Time CFO Solutions for Smart Financial Oversight

Rose Group CPA’s part-time CFO solutions offer businesses the advantage of expert financial oversight, tailored to their growth stage. Our experienced CFOs help optimize financial operations, manage risk, and create strategic plans for long-term success. Whether your company needs assistance with financial reporting, strategic planning, or investor relations, we provide the flexibility and expertise to scale your operations effectively. Get CFO-level support on a part-time basis, giving you access to financial leadership without the full-time cost.

#cpa tax services#professional bookkeeping#tax and accounting services#tax preparation and planning#tax services usa

0 notes

Text

Important Considerations Before Giving Up US Citizenship

Before considering giving up US citizenship, it's crucial to obtain professional advice to avoid potential pitfalls such as the exit tax. As a US citizen living abroad, you still have yearly IRS tax filing obligations. To avoid being considered a "covered expatriate" and subject to an exit tax, you must become tax-compliant for the five years prior to giving up citizenship. We offer Tax Services USA to help you navigate the process and avoid costly mistakes. For more information, please visit our website: https://www.amtax.com.au/service/advice-regarding-giving-up-us-citizenship/ or call us on (03) 9909 7534.

0 notes

Text

8 Exit Tax Traps When Expatriating from the United States

Introduction

Living and working abroad after leaving the US might be a fascinating experience. However, there are certain potential hazards to be aware of in the complex tax environment for US citizens residing overseas. To navigate this intricate system effectively, seeking Green Card Holder Taxes assistance is crucial. Learning about these departure tax traps can guarantee an effortless transition and help avoid significant tax costs.

What Are Exit Taxes?

US citizens who give up their residence or permanent residency status are subject to a series of tax laws known as exit taxes. Your taxable income may be greatly impacted by such laws, especially when you have capital gains on specific assets.

The Following Are Eight Typical Exit Tax Traps to Watch Out For:

Unrealized Capital Gains on Stock Options: If you exercise stock options issued by a US business after moving overseas, you can be liable for capital gains taxes.

Capital Gains Tax Deferral: US citizens who inherit stocks or real estate from a US decedent are typically exempt from paying capital gains taxes until they sell the item. This postponement could be lifted upon expatriation, though.

Gifts to US Spouses: If you are no longer a US resident, you may be liable for gift taxes on gifts to a US spouse that exceed the yearly exclusion limit.

Sale of US Real Estate: When a non-resident sells US real estate, they often have to file a US tax return and may have to pay capital gains taxes.

Passive Income: Even after leaving the country, income from passive US-based sources, including partnerships or rental properties, may be liable to US income taxes.

PFICs: You may be subject to intricate tax regulations and perhaps harsh tax rates if you own stock in Passive Foreign Investment Companies (PFICs).

Social Security Payments: Foreigners who haven't worked in the US for a sufficient number of quarters may have their payments taxed or even decreased.

FATCA and FBAR Requirements: US citizens who have certain financial holdings overseas may still be subject to the Foreign Account Tax Compliance Act (FATCA) and must file Reports of Foreign Bank and Financial Accounts (FBARs) after they have left the country.

How to Avoid Exit Tax Traps

Even though handling departure taxes might be difficult, you can reduce your tax liability with careful preparation and expert advice. The following actions can be taken:

Speak with an Expert on Taxation: Consult a certified tax expert with experience in expatriate taxes. They can assist you in comprehending your unique tax circumstances and creating a strategy to reduce your departure tax obligation.

Make A Plan: It is best to begin expatriation planning as soon as possible. You might reduce your possible tax obligations by structuring your affairs with the assistance of a tax expert.

File Form 8854: You may choose to file Form 8854 to elect to mark unrealized capital gains to market value if you are leaving the United States. If you decide to sell the assets in the future, this can assist you avoid paying capital gains taxes.

Expat Tax Services in Hyderabad

Our team of skilled tax experts at Accelero Corporation can assist US citizens in Hyderabad, India, with the intricacies of expatriation taxes. We can offer thorough advice on exit tax planning, tax return preparation, and other tax-related issues because we are aware of the difficulties experienced by foreign nationals.

Conclusion

Although leaving the United States to live abroad might be a fulfilling experience, it's important to consider any possible tax ramifications. You may guarantee a seamless transfer and reduce your tax obligations by being aware of exit tax traps and getting expert advice from Expat Tax Services in Hyderabad, such as Accelero Corporation.

#green card holder taxes#usa citizen tax services in hyderabad#usa tax filer in india#usa citizen tax services

0 notes

Text

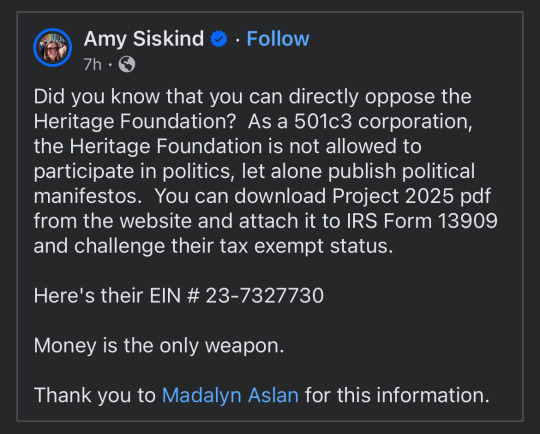

#heritage foundation#project 2025#501c3#politics#politricks#United States#united states of america#USA#republicans#republican agenda#agenda#manifesto#manifestos#report them#report#irs#internal revenue service#tax exemption#tax exempt#tax exempt status#money#weapons#reality#vote#voting#please vote#go vote#say no#tyranny#unpatriotic

4 notes

·

View notes

Text

Let AKM Global handle your USA Tax Return Preparation for a hassle-free tax season. From straightforward returns to complex filings, our team delivers accurate, timely, and optimized solutions. We take care of the paperwork so you can focus on what matters most. Get in touch with AKM Global now for expert tax preparation!

0 notes

Text

Simplify your tax filing with Online E-Filing Services in the USA offered by Tax Pro America. Our expert team ensures accurate, hassle-free filings for individuals and businesses. Save time and maximize your returns today! Visit https://taxproamerica.com/ or Call us at 617-910-9268 to get started.

#tax preparation services#online e-filing services in usa#e-file services in usa#business tax filing

0 notes

Text

Blockchain Audit Services

Block3 Finance is the #1 provider of audit services, CRA mediation, tax disputes and appeals. We perform audits and represent taxpayers in Canada, USA, and internationally with income tax audits.

Visit Us : https://block3finance.com/tax

#Crypto Tax in USA#Crypto Tax in UK#Crypto Taxes in Canada#Crypto Staking Taxes#Blockchain Audit Services#Crypto Audit Services#Crypto Auditing Firms

0 notes