#Tax Rates

Explore tagged Tumblr posts

Text

In the US in the 21st Century, it seems “firearm discharge avoidance fee” might be what it is.

#taxes#tax#tax rates#marginal tax rate#guillotine#avoidance#rich#wealthy#revolution#wealth gap#wealth inequality#economics#political#politics#us politics#american politics#meme#memes#funny memes#political memes#politics memes#economy#economy memes

25 notes

·

View notes

Text

#kamala 2024#kamala harris#economic plan#middle class#tax rates#tax breaks#politics#economic policy#vote blue#vote kamala#2024 presidential election#democrats#vote kamala harris#economy#vote democratic#democracy#black economics#blacklivesmatter#black lives matter#donald trump#republicans

38 notes

·

View notes

Text

9 notes

·

View notes

Text

Why do people become poor and broke?

This post is a response to a question initially posed on Quora, and can also be accessed via “https://www.quora.com/Why-do-people-become-poor-and-broke/answer/Antonio-Amaral-1“ Setting aside the failings of individuals who make bad decisions and cause problems for themselves, because there is always a tiny percentage of people who need more guidance to make better decisions, the vast majority of…

View On WordPress

0 notes

Text

🚀 Your Tax Rate Impacts Your Rental Property Profitability!

📊 Should you hold or sell? It can depend on your marginal tax rate:

💸 40% tax rate? Selling now could be your best move.

📈 20% tax rate? Hold your rental for 2–4 years to maximize returns.

With Money Eva’s dynamic scenario charts, you get clear, real-time visuals to explore options before making big decisions.

🔗 Play with your own numbers and uncover the smarter path: 👉 moneyeva.com

#rental income#rental properties#tax rates#financial success#financial freedom#financial decisions#money matters

0 notes

Text

The Never-Ending Tax Trap: How You’re Paying for What’s Already Yours

Taxation is often described as a necessary evil, but when you take a closer look at the system, it feels more like a trap designed to keep you in perpetual debt to the government. We pay taxes on nearly every aspect of our lives—our income, our purchases, and even the things we already own. This blog explores the origins of taxation, how it has evolved, and the many ways we’re taxed repeatedly on…

0 notes

Text

Upcoming Tax Changes for 2025

Introduction

As we approach 2025, various proposed tax changes are on the horizon that could significantly impact individual taxpayers and businesses. While some of these changes are still in the discussion phase, understanding them now can help you plan effectively for the upcoming tax year.

Understanding the Basics of International Taxation: -

i. Standard Deduction Adjustments

One of the anticipated changes is an increase in the standard deduction amounts. While specific figures have yet to be finalized, adjustments are likely based on inflation. This could provide taxpayers with greater relief and simplify the filing process for those who do not itemize.

ii. Changes to Tax Brackets

The IRS typically adjusts tax brackets annually to account for inflation. Taxpayers should be aware of potential changes in income thresholds for various tax rates, which could impact how much tax you owe based on your income level.

iii. Corporate Tax Rates

There is ongoing discussion about revisiting corporate tax rates. Depending on legislative outcomes, changes could affect how corporations are taxed, potentially impacting their financial strategies and overall economic activity.

iv. Capital Gains Tax Revisions

Proposals have surfaced regarding adjustments to capital gains taxes, particularly for high-income earners. Changes could involve increasing the tax rate on long-term capital gains or altering the thresholds for when these rates apply. The Union Budget 2024-25 brings significant changes to the taxation of capital gains, aimed at simplifying the tax structure and providing relief to taxpayers. The budget introduces new tax rates for both short-term and long-term capital gains, impacting a wide range of financial and non-financial assets. These revisions reflect the government’s commitment to making the tax system more equitable and less burdensome for taxpayers, particularly benefiting the lower and middle-income classes.

Short Term Capital Gains Short-term capital gains on specified financial assets shall be taxed at a rate of 20% instead of the previous rate of 15%. All other financial assets and non-financial assets will continue to be taxed at their applicable tax rates, maintaining consistency in the broader tax framework.

To know more click the link here https://uja.in/blog/taxation-times/upcoming-tax-changes-for-2025/

The Union Budget 2024-25 introduces several pivotal changes aimed at enhancing the financial landscape of India. Among the key highlights are the revised tax slabs, increased deductions and exemptions for salaried employees and pensioners, and the abolition of the angel tax, each designed to foster economic growth, simplify the tax system, and support innovation.

Visit our website to want more latest updates- https://uja.in/

#taxation#taxationtimes#tax slabs#union budget 2024#taxpayers#Tax Rates#International Taxation#tax#uja global advisory#uja global#uja

0 notes

Text

With economic insecurity comes people retreating to their "tribal" corners. Grocery prices and everything else went through the roof after Trump's tax cuts and tariffs were finally felt by Americans. The Biden administration had no power to bring down prices. But Trump won't be able to do it either.

But the entire American public was played by the Trump campaign led by Steve Bannon. They got Netanyahu to turn a blind eye to the coming terror attack as an excuse to tea up the Palestinians. Notice that the retaliatory attacks against the Gazan people have stopped now that the election is over? Notice the protests by Jewish and Arab Americans have stopped since the election is over? Notice that the constant ads celebrating pride have stopped now that the election is over. Notice the bussing of migrants to blue states stopped since the election is over? Steve Bannon/GOP spent four years irritating the anti-"fill in the blank" crowd to that people show up to vote to make the noise stop. The GOP perfected the way to get people to vote for their religious beliefs, too the detriment of everything else.

News flash: You religious beliefs won't change no matter who is in office, but your tax rates will.

0 notes

Text

Calculating Sales Tax for US Businesses: an Ultimate Guide

Learn how to accurately calculate sales tax for your business with this comprehensive guide. Understand key factors in sales tax calculation in US, including tax rates, rules, and step-by-step methods. This guide covers different sales tax scenarios, common mistakes to avoid, and tips for ensuring compliance. Ideal for small business owners looking to simplify tax management and avoid penalties. Stay informed and make sure your sales tax calculations are correct every time.

#sales tax calculation#sales tax guide#calculate sales tax#business tax compliance#tax rates#tax rules#sales tax tips

0 notes

Photo

We aren’t a shit hole… but a 75% tax rate might keep a few bridges from collapsing, better functioning schools, and some universal healthcare.

Mmmm. That’s the kind of chicken I want in my pot.

And F off too Michael Dell #TaxTheRich

604 notes

·

View notes

Text

#republicans#donald trump#taxes#tax rates#corporate greed#vote blue#2024 presidential election#vote kamala#kamala 2024#kamala harris#democrats#economic plan#economics#economy#tax cuts#politics#dump trump#trump 2024

22 notes

·

View notes

Text

10 notes

·

View notes

Text

Billionaires v. America

#republicans#rethuglicans#congress#income tax#tax rates#income inequality#wealth inequality#working class

0 notes

Text

Could taxing people with massive fortunes pay down the national debt?

This post is a response to a question posed in its complete format: “Could taxing Elon Musk and other people with massive fortunes 80% be the solution to paying down the national debt in the USA?” The answer is quite simple and beyond evident to anyone with eyes and a mind that’s capable of connecting simple dots from a simple table of numbers: Here are a few points to address regarding…

View On WordPress

1 note

·

View note

Text

US Tax Day & The IRS - Myth vs Fact

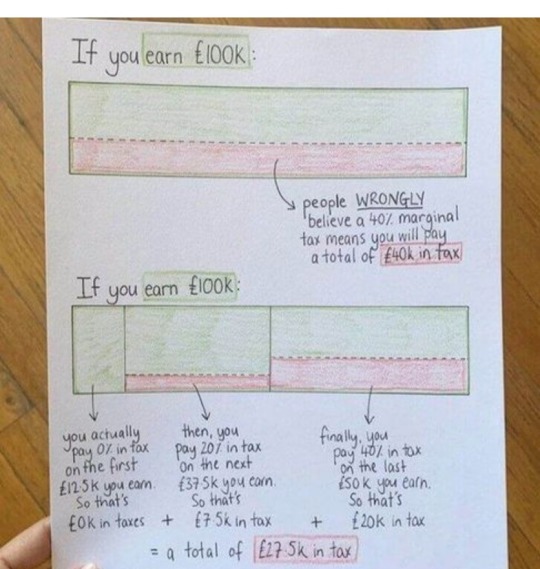

1) Myth - "If you get a small raise that bumps you into a new tax bracket, you'll end up taking home less money."

Fact - We have marginal tax rates, which means you only pay the new higher tax rate on the new part of salary.

2) Myth - "If I make a mistake on my taxes, I'll go to jail."

Fact - If you make a mistake on your taxes, the IRS will likely contact you with a bill to pay the remaining balance, and possibly a fee.

(I know someone who last year had 3 W-2s and only reported 2 of them. The IRS noticed, my friend said oops my bad and paid the remainder. There was no legal consequence, even for a 5 figure mistake.)

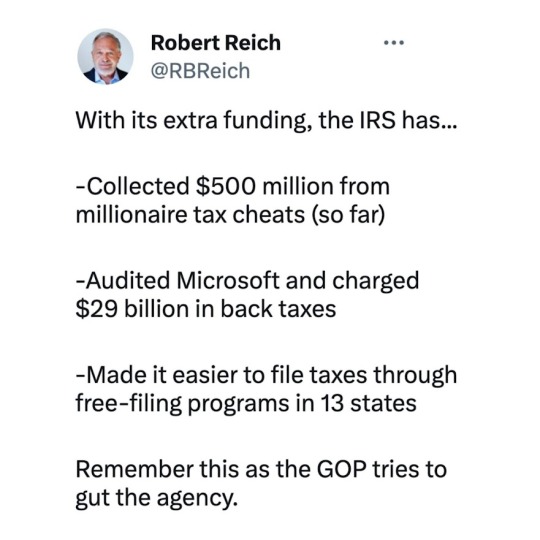

3) Myth - "The IRS is out to get ordinary Americans, and funding them more means more annoyance and harassment for me."

Fact - With the IRS' latest increase in funding, they are:

--improving customer experience, from offering a free filing website to reducing phone wait times

--sending refunds and other communications faster, as staff and modern-day computers are added to their operation

--catching unpaid taxes from millionaires and businesses, so that everyone pays their fair share

4) Myth - "Tax season is just one of those things that modern-day developed nations have to deal with."

Fact - Requiring each citizen to file their own taxes is a uniquely American / late-stage capitalism hurdle. The government already knows how much we owe, but TurboTax and others heavily lobby to keep their business as the middle man. In other countries, you just receive a statement from the government that is your tax owed or your refund, and that's all you have to do.

#taxes#us taxes#tax the rich#tax day#april 15#irs#tax season#irs free file#internal revenue service#tax refund#tax reform#turbotax#fuck turbotax#tax rates

0 notes