#Tax Document Authentication

Explore tagged Tumblr posts

Text

Apostille Your W-2 Form in 10 Days with Hague Apostille Services

W-2 Apostille: Fast and Reliable Document Authentication If you need to apostille your W-2 form, Hague Apostille Services offers a streamlined process to ensure your document is authenticated correctly for international use. A W-2, also known as the Wage and Tax Statement, is an IRS tax form used in the U.S. to report employee wages and tax withholdings. When presenting this document abroad,…

#embassy legalization#fast apostille services#proof of income authentication#Hague Apostille Services#international document certification#Tax Document Authentication

0 notes

Text

hunting Jews: the truth about Hamas

SEPTEMBER 15, 2024

Islam is a religion.

Islamism is a political ideology.

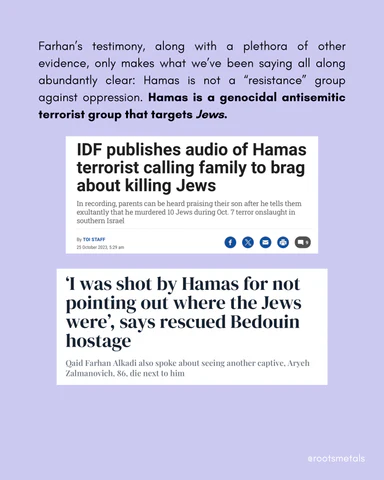

Recently rescued Israeli hostage, Qaid Farhan Alkadi, an Israeli Bedouin Muslim, gave the following testimony:

Farhan’s testimony, along with a plethora of other evidence, only makes what we’ve been saying all along abundantly clear: Hamas is not a “resistance” group against oppression. Hamas is a genocidal antisemitic terrorist group that targets Jews.

ISLAMISM IS AN INHERENTLY ANTISEMITIC IDEOLOGY

Hamas is an Islamist terrorist group. What does this mean?

Islamists believe that the doctrines of Islam should be congruent with those of the state. Islamists work to implement nation-states governed under Islamic Law (Sharia), emphasize pan-Islamic unity (in most cases, hoping for an eventual worldwide Islamic Caliphate, or empire), support the creation of Islamic theocracies, and reject all non-Muslim influences. For this reason, Islamists tend to portray themselves as “anti-imperialist,” while in truth they are striving to swap western imperialism with Islamic imperialism.

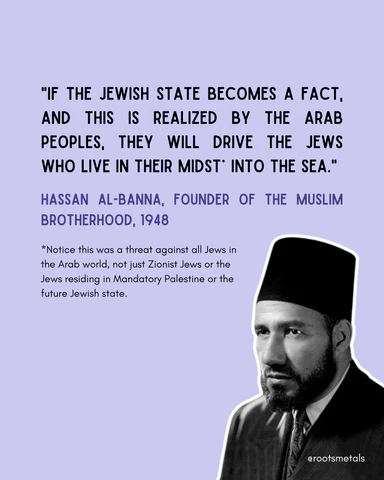

Islamist ideology can be traced back to Hassan al-Banna and the Muslim Brotherhood, founded in 1928. Al-Banna viewed the 1924 dissolution of the last Islamic Caliphate, the Ottoman Empire, and the European colonization of the Middle East, beginning with France’s 1830 occupation of Algeria, as an affront to Islam. The early 20th century was a period of rapid secularization in the Middle East, when Arab nationalism threatened to replace pan-Islamic identity with a pan-Arab identity. Al-Banna opposed all of this, hoping to return to “authentic” Islamic practice through the (re)establishment of the Islamic Caliphate.

Islamism is an antisemitic ideology. Islamists hate Jews -- and by extension, the Jewish state -- because of the Prophet Muhammad’s conflict with the Jewish tribes of the Arabian Peninsula in the 7th century. Islamistsbelieve that the Israeli-Palestinian conflict is rooted in a struggle between Muslims and their “eternal enemies,” the Jews.

Hassan Al-Banna, the founder of the Muslim Brotherhood, viewed the dissolution of the last Islamic Caliphate (empire) and the secularization of the Muslim world as an affront to Islam.

ISLAMISM, DHIMMITUDE, AND THE JEWS

Islamists seek to revive “authentic Islamic practice,” by which they mean, essentially, that they wish to go back in time. This desire to turn back the clock puts them in conflict with Jews for two reasons:

During his earliest conquests, the Prophet Muhammad and his army came into fierce conflict with a number of Jewish tribes that had settled in Arabia, some of which had refused to convert to Islam and even accused Muhammad and his followers of appropriating figures from the Torah. For Islamists, this initial conflict between Jews and the earliest Muslims is “proof” that Jews are “eternal enemies” of Islam.

Following Muhammad’s death in 632, the Arab Islamic empires conquered lands exponentially quickly. As a result of this rapid colonization, the Muslim authorities were faced with the “problem” of how to handle the conquered Indigenous peoples that resisted conversion to Islam. This “problem” was solved with a treaty known as the Pact of Umar. This so-called treaty allowed select religious and cultural minorities, known as dhimmis, or “People of the Book,” to practice their beliefs so long as they paid the “jizya” tax and abided by a set of restrictive, second-class citizenship laws.

Under Islamist regimes, such as the Islamic Republic of Iran, Jews are, to this day, still treated as dhimmis.

THE GENOCIDAL ANTISEMITISM OF THE MUSLIM BROTHERHOOD

Hamas emerged as the Palestinian branch of the Muslim Brotherhood. Hassan al-Banna, the founder of the Muslim Brotherhood, worshipped Adolf Hitler.

Like Hitler, al-Banna sought to exterminate all Jews…in his case, from the Middle East.

According to German documents from the period, in the 1940s, the Nazis trained some 700 members of the Muslim Brotherhood. Nazi Germany heavily funded the Brotherhood, which contributed to its massive growth. In 1938, the Brotherhood had some 800 members. By the end of World War II, it had grown to a million members.

In 1939, Germany “transferred to al-Banna some E£1000 per month, a substantial sum at the time. In comparison, the Muslim Brotherhood fundraising for the cause of Palestine yielded E£500 for that entire year.”

Naturally, Nazism deeply influenced the Muslim Brotherhood’s ideology.

The father of Palestinian nationalism, Haj Amin al-Husseini, was a prominent member of the Muslim Brotherhood. Yasser Arafat, the most influential Palestinian leader of all time, began his “career” fighting for the Muslim Brotherhood. Which brings us to Hamas. Hamas’s founder, Sheikh Ahmed Ismail Hassan Yassin, was a member of the Muslim Brotherhood and was responsible for establishing the Brotherhood’s Palestinian branch. In 1987, he founded Hamas.

The Muslim Brotherhood’s hatred for Jews goes far beyond its original Nazi affiliations. During the 1936-1939 Arab Revolt in Mandatory Palestine, during which Palestinian Arabs revolted against Jewish immigration and carried out a number of antisemitic massacres, the Muslim Brotherhood began disseminating antisemitic rhetoric, often targeting the Egyptian Jewish community.

Al-Nadhir, the Muslim Brotherhood’s magazine, published openly antisemitic articles, peddling conspiracy theories and demonizing the Egyptian Jewish community for its success in various industries. Notably, Al-Nadhir even called for the expulsion of Jews from Egypt, accusing Jews of “corrupting” Egypt and calling Jews a “societal cancer.” Al-Nadhir made boycott lists of Jewish businesses.

Unfortunately, the Muslim Brotherhood’s antisemitism is not a relic of the past. Mohammed Badie, the Muslim Brotherhood’s present day “Supreme Guide,” believes Jews “spread corruption on earth” and calls for “holy jihad” as an antidote.

THE ORIGINAL HAMAS CHARTER: EXPLICITLY GENOCIDAL

Hamas’s founding 1988 charter is explicitly antisemitic and genocidal. Below are some excerpts:

“Our struggle against the Jews is very great and very serious.” -- Introduction

“The Day of Judgement will not come about until Moslems fight the Jews (killing the Jews), when the Jew will hide behind stones and trees. The stones and trees will say O Moslems, O Abdulla, there is a Jew behind me, come and kill him. Only the Gharkad tree, (evidently a certain kind of tree) would not do that because it is one of the trees of the Jews." -- Article 7

“In face of the Jews' usurpation of Palestine, it is compulsory that the banner of Jihad be raised.” -- Aritcle 15

“With their money, they took control of the world media, news agencies, the press, publishing houses, broadcasting stations, and others. With their money they stirred revolutions in various parts of the world with the purpose of achieving their interests and reaping the fruit therein. They were behind the French Revolution, the Communist revolution and most of the revolutions we heard and hear about, here and there. With their money they formed secret societies, such as Freemasons, Rotary Clubs, the Lions and others in different parts of the world for the purpose of sabotaging societies and achieving Zionist interests. With their money they were able to control imperialistic countries and instigate them to colonize many countries in order to enable them to exploit their resources and spread corruption there.” -- Article 22

“Israel, Judaism and Jews challenge Islam and the Moslem people.” -- Article 28

BUT...HAMAS CHANGED THEIR CHARTER!

Some Hamas apologists will tell you that Hamas no longer intends to exterminate all Jews, because in 2017, they “replaced their [openly genocidal] charter.” Well, lucky for you, Hamas is here to set the record straight. See, after releasing their “new” charter, Hamas co-founder Mahmoud al-Zahar assured the media that the 2017 document did not replace their original 1988 charter.

The 2017 document was thus not a “new” charter from a “reformed” Hamas, but rather, a propaganda document aimed at redeeming Hamas’s image to the west.

Since 2017, Hamas has made openly genocidal calls toward Jews. For example:

In 2018, Hamas’s Al-Aqsa TV media channel predicted “the cleansing of Palestine of the filth of the Jews.”

In 2019, Hamas Political Bureau member Fathi Hammad said, “You seven million Palestinians abroad, enough warming up! There are Jews everywhere! We must attack every Jew on planet Earth –- we must slaughter and kill them, with Allah’s help.” In 2021, Hammad called, via Al-Aqsa TV, for the Palestinians in Jerusalem to “cut off the heads of the Jews.”

In May of 2021, the leader of Hamas, Yahya Sinwar, led a rally in which the crowd was encouraged to chant, "We will trample on the heads of the Jews in front of everyone..."

ISLAMIST INFLUENCE ON PALESTINIAN NATIONALISM

The earliest Arab nationalists in Palestine were not necessarily Islamists. Falastin, an influential anti-Zionist, Arab nationalist newspaper, was founded by two Palestinian Christians in 1911. Khalil Beidas, who was the first Arab to identify as Palestinian, in 1898, was a Christian. Nevertheless, the Palestinian nationalist movement soon fell under the influence of the Muslim Brotherhood.

Initially, Palestinian Arab nationalists advocated for a unified Arab state in Greater Syria. In 1920, Haj Amin al-Husseini began advocating for an independent Palestinian Arab state. To draw people to his cause, which was not yet well-known to the average population, he began emphasizing the importance of Palestine to Islam, and particularly the importance of Jerusalem and Al-Aqsa Mosque. Soon, he began disseminating the libel that the Jews intended to destroy Al-Aqsa Mosque. This libel has cost thousands of Jewish lives and is spread widely to this day.

Early on, the Muslim Brotherhood in Egypt adopted the Palestinian cause. After World War II, Haj Amin al-Husseini, who had spent the war working as a propagandist for the Nazis in Berlin, escaped to Egypt with the help of the Muslim Brotherhood.

The Muslim Brotherhood fought against the State of Israel in 1948, along with other Islamist militias, such as the Army of the Holy War. Among its fighters were Yasser Arafat. In the 1960s, Arafat came under the influence of the Soviet Union and shifted his image to that of a communist counterrevolutionary, as opposed to an Islamist, though his rhetoric in Arabic continued emphasizing the importance of jihad and Al-Aqsa Mosque to the Palestinian movement. Nevertheless, after Islamic Revolution in Iran, after which the Islamic Republic adopted the Palestinian movement, and with the establishment of Hamas and groups such as Palestinian Islamic Jihad, Palestinian nationalism has once again been undergone an Islamization.

rootsmetals

as always: this post is not an endorsement of any given Israeli policy or politician. You can be highly critical of Israel’s handling of the situation without obfuscating or whitewashing the origins and goals of this ideology. It always, always came down to antisemitism. I won’t engage with straw man arguments in the comments 😗

MAIN SOURCES on Instagram

149 notes

·

View notes

Text

what's next? | k-fun: (the rest of) 2025

for korean entertainment industry

about three months later than planned, welcome to the "what's next" - a sub-series of honey buzz. i don't plan to do this every year, but with this pluto in aquarius.. and the other planets that will go to other signs (saturn has already changed them)… i decided to see what could happen, out of pure curiosity.

since i expect to be asked about everything possible in 2025 at any moment in as much detail as in the post, from now on i'm saying that i don't accept doing such things, since this 1) requires time, 2) if i'm going to do such a post, it will be about something larger and not about something extremely specific. i can ask a follow-up about something i mentioned, but up to there.

positives 2 of pentacles rx, ace of pentacles rx, 3 of swords rx, ace of swords, justice, the sun, 9 of wands, the empress rx, knight of wands

the positive events are more behind the scenes. however, the key thing this year is that big names from the korean entertainment industry are out. maybe they will end up in court. i see that there will already be a distinction between who is a real big name and who has paid to be a big name. it looks like there will be a big scandal about who is involved in some hidden financial schemes and who is genuinely authentic.

negatives the hermit, queen of cups rx, 9 of cups, wheel of fortune, 4 of pentacles rx, ace of swords, 3 of wands, strength

it looks like the korean entertainment industry is going to die (not literally). it's a bit like "the king is dead, long live the king". one thing goes away so that something else can take its place, but it will take months. it's possible that a lot of things in the industry will abruptly end for a number of reasons. there's also a chance that there will be a boycott of the korean entertainment industry.

changes 8 of wands, temperance, page of wands, the magician, 9 of pentacles, 3 of wands, 3 of pentacles, 6 of wands rx, the chariot

the changes that affect the structure of the industry will be slow but permanent. it will be necessary to reconstruct, if not every show, then almost every show to the point of transforming itself. i am not sure if there will be political reasons for this, but it is entirely possible that many korean shows will be sold to foreign countries, as happened with king of the masked singer and i can see your voice (i don't know about others).

success the sun, justice, 4 of cups rx, king of cups, the star rx, the hanged man, 10 of swords, 3 of pentacles, temperance, 8 of wands

the success is that they will not have any achievements. sometimes it is better to continue as before, because this is the better option. this seems to be happening, despite the indications of reforms.

scandals the devil, king of pentacles, 7 of swords rx, 10 of pentacles rx, ace of wands, 5 of pentacles rx, the high priestess rx, 8 of wands rx, 4 of cups, the sun rx, justice rx

well, it’s really bad but since there’s just multiple things, here are some possibilities: secret sponsor/dating-for-favors arrangements, major tax evasion/embezzlement, leaked documents revealing long-term contract manipulation, a wealthy chaebol family tied to illegal entertainment investments, abuse of power/coercion in casting decisions, hidden sexual misconduct allegations, scandal involving plagiarism/stolen script concepts, bribery/corruption within major award ceremonies, false lawsuits/manipulated charges used to control talent, major agency caught planting sasaengs to monitor/blackmail celebrities to make them participating on a show, popular drama production shut down mid-shoot due to internal misconduct, an entertainment celeb caught colluding with media outlets to sabotage rivals, casting couch culture resurfaces with new evidence/testimonies, private group chats leak with s3x1st/racist/violent content from high-profile names, a ceo/director exposed for spiritual manipulation or cult ties to control talent, massive cyberattack on a big agency exposing contracts+schedules+private footage.. it's just so much that only saing the possibilities will be enough..

15.04.2025

#outsidereveries#🐝🍯#controversies tarot#tarot reading#tarot#kpop tarot#kpop tarot reading#tarot kpop#kpop#kpop reading#tarot reading kpop

13 notes

·

View notes

Text

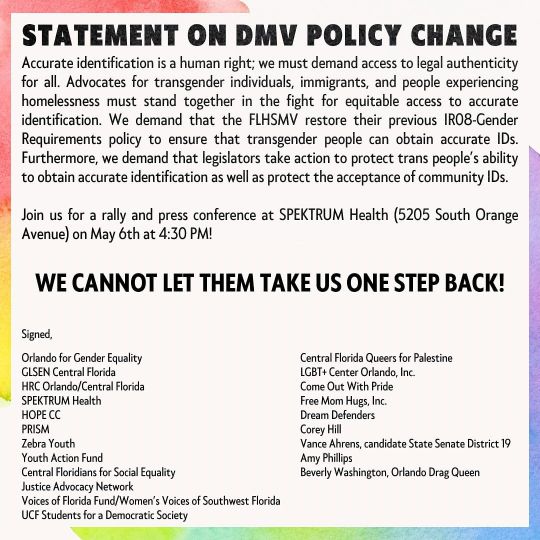

Today (05/06/24), 4:30pm, Orlando

[Photo ID: Pink to white gradient image with various logos and info boxes. Text reads: 'Save the date: May 6th 4:30pm. Press Conference. 5205 South Orange Avenue - Orlando, FL 32809. Not one step back! Identification for all! Not one step back. Every Floridian. Every Identity. Every ID.' Logos for Orlando for Gender Equality, Free Mom Hugs, Inc., Dream Defenders, Zebra Youth, Come Out with Pride Orlando, HRC Orlando / Central Florida, Spektrum Health, The Center Orlando, GLSEN Central Florida, HOPE CC. /End ID]

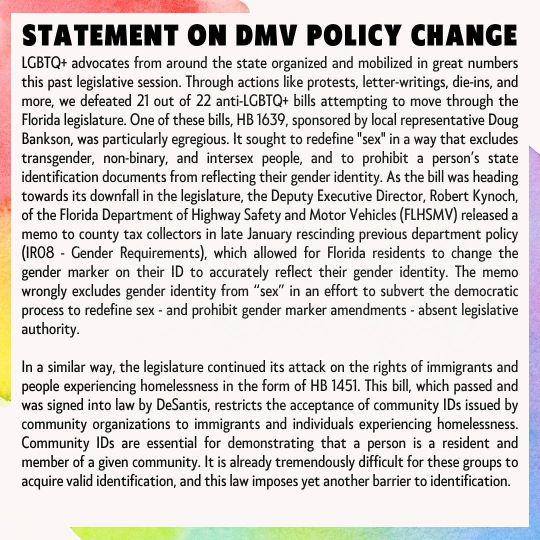

[Photo ID: White box with rainbow border. Text reads: 'Statement on DMV Policy Change. LGBTQ+ advocates from around the state organized and mobilized in great numbers this past legislative session. Through actions like protests, letter-writings, die-ins, and more, we defeated 21 out of 22 anti-LGBTQ+ bills attempting to move through the Florida legislature. One of these bills, HB 1639, sponsored by local representative Doug Bankson, was particularly egregious. It sought to redefine "sex" in a way that excludes transgender, non-binary, and intersex people, and to prohibit a person's state identification documents from reflecting their gender identity. As the bill was heading towards its downfall in the legislature, the Deputy Executive Director, Robert Kynoch, of the Florida Department of Highway Safety and Motor Vehicles (FLHSMV) released a memo to county tax collectors in late January rescinding previous department policy (IR08 - Gender Requirements), which allowed for Florida residents to change the gender marker on their ID to accurately reflect their gender identity. The memo wrongly excludes gender identity from "sex" in an effort to subvert the democratic process to redefine sex - and prohibit gender marker amendments - absent legislative authority. In a similar way, the legislature continued its attacks on the rights of immigrants and people experiencing homelessness in the form of HB 1451. This bill, which passed and was signed into law by DeSantis, restricts the acceptance of community IDs issued by community organizations to immigrants and individuals experiencing homelessness. Community IDs are essential for demonstrating that a person is a resident and member of a given community. It is already tremendously difficult for these groups to acquire valid identification, and this law imposes yet another barrier to identification.' /End ID]

[Photo ID: White box with rainbow border. Text reads: 'Statement on DMV Policy Change. Accurate identification is a human right; we must demand access to legal authenticity for all. Advocates for transgender individuals, immigrants, and people experiencing homelessness must stand together in the fight for equitable access to accurate identification. We demand that the FLHSMV restore their previous IR08-Gender Requirements policy to ensure that transgender people can obtain accurate IDs. Furthermore, we demand that legislatures take action to protect trans people's ability to obtain accurate identification as well as protect the acceptance of community IDs. Join us for a rally and press conference at SPEKTRUM Health (5205 South Orange Avenue) on May 6th at 4:30pm! WE CANNOT LET THEM TAKE US ONE STEP BACK! Signed, Orlando for Gender Equality, GLSEN Central Florida, HRC Orlando/Central Florida, SPEKTRUM Health, HOPE CC, PRISM, Zebra Youth, Youth Action Fund, Central Floridians for Social Equality, Justice Advocacy Network, Voices of Florida Fund/Women's Voices of Southwest Florida, UCF Students for a Democratic Society, Central Florida Queers for Palestine, LGBT+ Center Orlando, Inc., Come Out with Pride, Free Mom Hugs, Inc., Dream Defenders, Corey Hill, Vance Ahrens, candidate State Senate District 19, Amy Phillips, Beverly Washington, Orlando Drag Queen.' /End ID]

#florida#orlando#trans#transgender#protesting#dmv#driver's license#hb 1639#hb 1451#current events#press conference#described

53 notes

·

View notes

Text

Qasim Rashid at Let's Address This:

As the genocide of Palestinians rages on, Palestinian families are now suing the US State Department and Secretary of State Antony Blinken. Simultaneously, Israeli human rights organizations are sounding the alarm full blast that their government is committing war crimes. And meanwhile, the Biden administration continues to arm Netanyahu despite full awareness that he is committing war crimes. Here are the key updates on Israel’s siege on Gaza that corporate media is ignoring, and what we must do going forward to demand justice. Let’s Address This.

Does the Lawsuit Have Merit?

In a word, yes. Palestinian families have taken an unprecedented step in filing a lawsuit against Antony Blinken and the US State Department for arming Netanyahu despite knowing he is violating the US Leahy Laws and international human rights law. Specifically:

[The lawsuit, filed in the U.S. District Court for the District of Columbia alleged that the State Department under Secretary of State Antony Blinken has deliberately circumvented a U.S. human rights law to continue funding and supporting Israeli military units accused of atrocities in Gaza and the Israeli-occupied West Bank.]

In my opinion as a human rights lawyer who studies this closely, the Palestinian families behind this lawsuit have an extremely strong case. The facts are that Blinken’s and the State Department’s disregard for US and international law is well documented. For example, see the evidence uncovered by ProPublica—a well respected non-profit media organization dedicated to authentic, verifiable, and reliable investigative journalism. Founded in 2007, it has already won six Pulitzer prizes, among numerous other awards. Non-partisan media watch dog organizations consistently rate ProPublica as reliable. I offer this context lest critics attack ProPublica’s reputation and credibility.

[...] Human Rights Watch, OxFam, Amnesty International, and the UN have all issued similar reports. Antony Blinken, meanwhile, saw the official reports from his own two U.S. State Department agencies—all in full agreement that the Israeli government is committing the war crime of illegally blocking aid to Gaza as Palestinians starved to death—and decided to testify to the opposite effect to U.S. Congress. The only possible logical conclusion is that Blinken knowingly lied. This is why Palestinian families are suing, arguing that Secretary Blinken should be prosecuted for lying to U.S. Congress in contravention to the factual USAID report, and then also prosecuted for illegally approving arms to Netanyahu in violation of the Leahy Laws.

Israeli Media & Human Rights Orgs Document Israeli War Crimes

Haaretz has led so assertively in calling out Israeli war crimes, that the Netanyahu administration has attacked them with the full force of government censorship and sanctions. But that has not stopped Israel’s oldest paper from documenting the Israeli Government’s war crimes against Palestinians.

Palestinian families sue the State Department for circumventing the Leahy Law on prohibiting the providing of military assistance to foreign security forces that have been accused of gross human rights violations by funding Israel’s war crimes against Palestinians.

#War Crimes#Israel#Israel Apartheid State#Antony Blinken#Biden Administration#Gaza Genocide#Israel/Hamas War#Leahy Law#Palestine#Haaretz

12 notes

·

View notes

Note

The entire "following grammar rules is XX-ism" and "telling someone not to write with a dialect" or whatever in official settings, school, government paperwork, etc, has always been a weird argument.

I live in a country where you're encouraged to speak in your local dialect no matter how official the situation is. This includes politicians and professors. This means every dialect no matter how heavy and obscure it is is just as valid as any other. It was even encouraged to speak your dialect during presentations because it would be more authentic.

While it does allow for a lot of individuality it's also incredibly hard to understand in a lot of situations, especially when going somewhere with a different local dialect. And that's the spoken language.

The area I live has a very strong dialect which often is used in informal writing, between friends as an example, if you're not familiar with it you won't be able to understand anything because of the phonetic writing, which has almost nothing in common with how the words get written when you follow the correct grammar and spelling for the language. In school our teacher gave us a few examples once, where an article had been "translated" into different dialects to show how it would look if the rules for spoken language was applied to written. I still have a headache thinking about it.

I think the people using these arguments have just never been in a situation where they had to engage with a dialect or written form they didn't understand, especially official documents, otherwise they'd understand WHY having rules are in place. It's great for individuality and and informal settings, but you'll turn right the Hell around when someone with an incomprehensible written-dialect starts doing your taxes, or writing your contracts.

--

I think a lot of people who hotly defend their own dialect and linguistic diversity in general are in favor of having certain main standards for things like academic papers.

Attempting to eradicate "AAVE is grammar mistakes hur hur"-style racism/classism and encouraging people to code switch for certain formal environments can and do coexist just fine.

In my experience, the people who most defend the idea that standards are -ism are not the people coming from some non-prestige dialect community. It's all theoretical.

50 notes

·

View notes

Text

Business Visa in Thailand

1. Legal Framework and Visa Categories

1.1 Statutory Basis

Governed by Immigration Act B.E. 2522 (1979) and subsequent amendments

Implemented through Ministerial Regulations No. 17 (B.E. 2534)

Distinction between Non-Immigrant B (standard business visa) and SMART Visa (for qualified professionals)

1.2 Visa Subcategories

Visa TypeCodePurposeValiditySingle-EntryNon-BBusiness meetings, exploratory visits3 monthsMultiple-EntryNon-BFrequent business travelers1 yearSMART VisaSMTHigh-skill professionals4 yearsLTR VisaLTRBusiness investors10 years

2. Eligibility Criteria and Documentation

2.1 Standard Requirements

Company Sponsorship:

Thai entity registration documents (list of shareholders, business license)

Letter of invitation on company letterhead (notarized)

Personal Documentation:

Passport with 6+ months validity

2 passport photos (4x6 cm, white background)

Completed TM.86 form (for conversion inside Thailand)

2.2 Financial Requirements

Minimum Capitalization:

THB 2 million for wholly foreign-owned companies

THB 1 million for BOI-promoted companies

Salary Thresholds:

THB 50,000/month minimum for foreign employees

THB 200,000/month for SMART Visa applicants

2.3 Special Cases

BOI-Promoted Companies: Expedited processing (7-10 business days)

Regional Headquarters: Additional privileges under RHQ program

Startups: Alternative path through DEPA digital visa program

3. Application Process and Timelines

3.1 Consular Application (Overseas)

Document Preparation (5-10 business days)

Submission to Royal Thai Embassy/Consulate

Processing Time:

Standard: 3-5 business days

Express: 24 hours (additional fee)

3.2 In-Country Conversion

From Tourist Visa:

Must apply within 15 days of entry

Requires TM.87 form and additional documentation

Processing Timeline:

Bangkok Immigration: 10-15 business days

Provincial Offices: 7-10 business days

4. Work Permit Integration

4.1 Legal Requirements

Section 9 Alien Working Act B.E. 2551 mandates work permit for:

Employment contracts

Board of Directors positions

Certain consulting activities

4.2 Application Process

WP3 Quota Approval (3-5 days)

Work Permit Submission (10-15 days)

Issuance (2-3 days after approval)

4.3 Exemptions

BOI Companies: 7-day fast-track processing

SMART Visa Holders: Automatic work authorization

Board Members: Limited activity allowance without full permit

5. Compliance and Reporting Obligations

5.1 90-Day Reporting

Required for stays exceeding 90 consecutive days

Online reporting available through Immigration website

Penalty: THB 2,000-5,000 for late filings

5.2 Tax Implications

Residency Threshold: 180+ days = Thai tax resident

Withholding Tax: 15% on salary for non-residents

Social Security: Optional for foreign employees

6. Visa Renewal and Extension

6.1 Extension Requirements

Employment Verification: Updated company documents

Financial Proof: Recent bank statements

Tax Compliance: Personal income tax receipts

6.2 Processing Timeline

First extension: 5-7 business days

Subsequent extensions: 3-5 business days

7. Common Pitfalls and Risk Mitigation

7.1 Application Rejections

Top Reasons:

Incomplete company documentation (42% of cases)

Insufficient financial proof (28%)

Suspected illegitimate business purpose (19%)

7.2 Compliance Risks

Work Without Permit: Fine up to THB 100,000

Overstay: THB 500/day penalty (max THB 20,000)

7.3 Mitigation Strategies

Pre-Application Review: Engage corporate legal counsel

Document Authentication: Notarize all foreign documents

Continuous Monitoring: Track visa/work permit expiration

8. Emerging Trends and Future Developments

9.1 Digital Nomad Visa (2025 Pilot)

Proposed requirements:

$80,000 annual income

Health insurance coverage

Minimum 3-year contract

9.2 Blockchain Verification

Pilot program for document authentication

Smart contract integration for visa extensions

9.3 Policy Changes

Stricter enforcement of bona fide business requirements

Increased financial thresholds expected

9. Strategic Recommendations

10.1 For New Market Entrants

BOI Promotion: Seek investment privileges first

Professional Employer Organization: Consider PEO solutions

10.2 For Established Businesses

SMART Visa Conversion: For qualifying employees

LTR Visa Application: For C-suite executives

10.3 Crisis Management

Grace Period Applications: For unexpected termination

Exit Visa Planning: Avoid blacklisting risks

Key Resources:

Ministry of Labor: www.mol.go.th

BOI Visa Portal: visa.boi.go.th

Immigration Bureau: www.immigration.go.th

#thailand#immigration#thai#thailandvisa#thaivisa#visa#immigrationinthailand#businessvisa#businessvisainthailand#thailandbusinessvisa#thaibusinessvisa

3 notes

·

View notes

Text

MTMIS PUNJAB vehicle verification

MTMIS Punjab (Motor Transport Management Information System) allows vehicle owners and buyers in Punjab, Pakistan, to verify vehicle details online. This service is managed by the Punjab Excise and Taxation Department to ensure transparency and prevent fraudulent activities.

How to Verify a Vehicle on MTMIS Punjab:

Visit the Official Website: Go to the MTMIS Punjab website

Enter Vehicle Details:

Provide the vehicle's registration number in the search box.

Double-check for correct spelling or numeric input to avoid errors.

View Vehicle Information: After submitting the details, you’ll see:

Owner’s Name

Vehicle Make and Model

Registration Date

Engine and Chassis Numbers

Token Tax Payment Status

Vehicle Color

Verify Against Documents: Match the information with the vehicle’s registration book or sale agreement to ensure authenticity.

Benefits of MTMIS Punjab Verification:

Fraud Prevention: Confirms if the vehicle is legally registered.

Ownership Verification: Checks whether the seller is the actual owner.

Tax Status: Ensures all taxes are paid, avoiding fines.

Peace of Mind: Reduces risks of buying stolen or disputed vehicles.

#Vehicle verification#mtmisPunjab#lahore vehicle verification#Buddy daddies#Kitchen#roadsafety#Road safety

4 notes

·

View notes

Text

Thailand Board of Investment

1. Institutional Framework and Historical Context

1.1 Legal Foundations

Established under the Investment Promotion Act B.E. 2520 (1977)

Amended by Act No. 4 B.E. 2560 (2017) to accommodate Industry 4.0

Operates under the Office of the Prime Minister with quasi-ministerial authority

1.2 Governance Structure

BOI Board: Chaired by the Prime Minister

Investment Committee: 12-member expert panel

Secretariat: Professional staff of 300+ specialists across 8 divisions

1.3 Historical Evolution

Phase 1 (1960-1990): Import substitution industrialization

Phase 2 (1991-2015): Export-oriented manufacturing

Phase 3 (2016-present): Technology-driven "Thailand 4.0" initiative

2. Investment Promotion Strategy

2.1 Geographic Prioritization

Eastern Economic Corridor (EEC): Enhanced incentives

Southern Border Provinces: Special security concessions

20 Provinces: Tiered incentive structures

3. Incentive Architecture

3.1 Tax Privileges

Corporate Income Tax (CIT) Holidays:

5-8 years exemption

50% reduction for 5 subsequent years

Import Duty Exemptions:

Machinery: 100% relief

Raw materials: Partial relief based on local content

3.2 Non-Tax Incentives

Land Ownership Rights: Foreign freehold permitted

Work Permit Facilitation: Fast-track processing (7 days)

Foreign Expert Visa: Multiple-entry 4-year SMART Visa

3.3 Special Incentive Packages

EEC+ Package:

15-year CIT exemption

Personal income tax cap at 17%

Digital Park Thailand:

10-year tax holiday

Data center infrastructure subsidies

4. Application and Approval Process

4.1 Pre-Application Phase

Eligibility Assessment (30-day diagnostic)

Project Feasibility Study requirements:

Minimum 3-year financial projections

Technology transfer plan

Environmental impact assessment (for Category 3 projects)

4.2 Formal Submission

Documentation Requirements:

Corporate structure diagrams

Shareholder background checks

Detailed investment timeline

Filing Channels:

Online BOI e-Service portal

In-person at BOI One Start One Stop center

5. Compliance and Operational Requirements

5.1 Investment Implementation

Capital Deployment Schedule:

25% within 12 months

100% within 36 months (extensions possible)

Employment Ratios:

Minimum 1 Thai employee per THB 1M investment

Technology transfer obligations

5.2 Reporting Obligations

Annual Progress Reports: Detailed project updates

Tax Privilege Utilization Statements: Certified by auditor

Foreign Expert Tracking: Monthly work permit updates

6. Sector-Specific Considerations

6.1 Manufacturing Sector

Local Content Requirements: 40-60% depending on sector

Environmental Standards: Tiered compliance levels

6.2 Digital Economy

Data Localization Rules: Conditional exemptions

IP Protection: Enhanced safeguards for BOI projects

6.3 Renewable Energy

Feed-in Tariff Eligibility: BOI+EGAT coordination

Carbon Credit Monetization: Special provisions

7. Dispute Resolution and Appeals

7.1 Privilege Revocation Process

Grounds for Cancellation:

Failure to meet investment timelines

Violation of environmental regulations

Fraudulent application information

Appeal Mechanism: 60-day window to petition

7.2 Arbitration Framework

THAC-administered proceedings

Expedited process for BOI disputes

8. Emerging Trends and Future Directions

9.1 Policy Developments

Draft Amendment Act (2025): Proposed R&D requirements

Green Industry Incentives: Carbon neutrality targets

9.2 Technological Integration

Blockchain Verification: For document authentication

AI-assisted Application Processing: Pilot program

9.3 Global Value Chain Positioning

ASEAN+3 Supply Chain Initiatives

EU-Thailand FTA Preparations

9. Strategic Implementation Guide

10.1 For Multinational Corporations

Regional HQ Strategy: Leverage RHQ privileges

Tiered Investment Approach: Phased capital deployment

10.2 For SMEs

Cluster Development: Co-location benefits

Technology Partner Matching: BOI-facilitated pairings

10.3 Risk Management

Compliance Calendar: Critical date tracking

Contingency Planning: Alternative incentive structures

Key Resources:

BOI Official Website: www.boi.go.th

Investment Privileges Database: privilege.boi.go.th

EEC Special Regulations: eeco.or.th

#thailand#thai#boi#boardofinvestment#thailandboardofinvestment#coporate#corporateinthailand#thaicorporate

2 notes

·

View notes

Text

1. Structural Foundations of the SMART Visa Program

1.1 Legislative Architecture

The SMART Visa operates under:

Royal Decree on SMART Visa B.E. 2561 (2018)

Thailand 4.0 Economic Policy Framework

BOI Investment Promotion Act (No. 4) B.E. 2560

1.2 Interagency Governance

Primary Authority: Board of Investment (BOI)

Implementation Partners:

Immigration Bureau (visa issuance)

Ministry of Digital Economy and Society (tech qualifications)

Ministry of Higher Education (academic validation)

2. Category-Specific Qualification Matrix

2.1 SMART-T (Specialists)

Technical Thresholds:

Salary Floor: THB 200,000/month (USD 5,800)

Experience Validation:

5+ years in qualifying field

Patent holders given priority

PhD waivers for certain disciplines

Industry Prioritization:

Biotechnology (Gene Therapy, Precision Medicine)

Advanced Manufacturing (Robotics, 3D Printing)

Digital Infrastructure (AI, Quantum Computing)

2.2 SMART-I (Investors)

Due Diligence Process:

Phase 1: BOI business plan review (45 days)

Phase 2: Anti-money laundering clearance

Phase 3: Investment tracing audit

2.3 SMART-E (Entrepreneurs)

Startup Validation Framework:

Tier 1 Incubators: DEPA, Thai Venture Capital Association

Minimum Traction Metrics:

THB 10M ARR or

50,000 MAU or

Series A funding

Capital Requirements:

Bootstrapped: THB 600,000 liquid

Funded: Minimum THB 5M valuation

3. Advanced Application Mechanics

3.1 Document Authentication Protocol

Educational Credentials:

WES or IQAS evaluation for non-Thai degrees

Notarized Thai translations

Employment History:

Social security cross-verification

Reference checks with former employers

3.2 Technical Review Process

Stage 1: Automated system screening

Stage 2: BOO specialist committee review

Stage 3: Final approval by Deputy Secretary-General

4. Privilege Structure and Limitations

4.1 Work Authorization Scope

Permitted Activities:

Primary employment with sponsor

Consulting (max 20% time allocation)

Academic collaboration

Prohibited Activities:

Local employment outside specialty

Unapproved commercial research

Political activities

4.2 Dependent Provisions

Spousal Work Rights:

General employment permitted

No industry restrictions

Child Education:

International school subsidies

University admission preferences

4.3 Mobility Advantages

Fast-Track Immigration:

Dedicated SMART lanes at 6 major airports

15-minute clearance guarantee

Re-entry Flexibility:

Unlimited exits without visa voidance

Automatic 48-hour grace period

5. Compliance and Renewal Dynamics

5.1 Continuous Eligibility Monitoring

Quarterly Reporting:

Employment verification

Investment maintenance

Research output (for academics)

Annual Review:

Salary benchmark adjustment

Contribution assessment

5.2 Renewal Process

Documentation Refresh: Updated financials, health insurance

Performance Evaluation: Economic impact assessment

Fee Structure: THB 10,000 renewal fee + THB 1,900 visa stamp

5.3 Grounds for Revocation

Material Changes: Employment termination, investment withdrawal

Compliance Failures: Missed reporting, legal violations

National Security Concerns: Classified determinations

6. Comparative Analysis with Global Competitors

6.1 Strategic Advantages

Tax Optimization: 17% flat rate option

Research Incentives: BOO matching grants

Commercialization Support: THBI co-investment

7. Emerging Policy Developments

7.1 2024 Program Enhancements

Blockchain Specialist Category (Q3 rollout)

Climate Tech Fast-Track (Carbon credit linkage)

Regional Expansion: Eastern Economic Corridor focus

7.2 Pending Legislative Changes

Dual Intent Provision: PR application without visa surrender

Skills Transfer Mandate: Local training requirements

Global Talent Pool: Reciprocal agreements in negotiation

8. Practical Application Strategies

8.1 Pre-Application Optimization

Salary Structuring: Base vs variable compensation

Patent Portfolio Development: Thai IP registration

Local Network Building: Thai professional associations

8.2 Post-Approval Planning

Tax Residence Strategy: 180-day calculations

Asset Protection: Thai holding company formation

Succession Planning: Will registration requirements

9. Critical Risk Factors

9.1 Common Rejection Reasons

Document Discrepancies: Date inconsistencies

Qualification Gaps: Unrecognized certifications

Financial Irregularities: Unverified income streams

9.2 Operational Challenges

Banking Restrictions: Foreign account limitations

Healthcare Access: Specialty treatment approvals

Cultural Integration: Workplace adaptation

10. Conclusion: Strategic Implementation Framework

For optimal SMART Visa utilization:

Pre-qualification Audit: 90-day preparation period

BOI Engagement: Pre-submission consultation

Compliance Infrastructure: Digital reporting systems

Contingency Planning: Alternative category eligibility

#thailand#immigration#immigrationinthailand#thailandvisa#thaivisa#visa#thai#thailandsmartvisa#smartvisa#smartvisainthailand#thaismartvisa

2 notes

·

View notes

Text

How to Apostille IRS Forms Quickly and Securely

How to Apostille IRS Forms for International Use IRS forms, including tax returns and income certifications, are crucial for international tax compliance and legal documentation. If you need to use IRS forms abroad, an apostille ensures their authenticity and recognition in countries that are members of the Hague Apostille Convention. Hague Apostille Services makes this process simple, fast, and…

#Hague Apostille Services#international document certification#Tax Document Authentication#embassy legalization#fast apostille services#proof of income authentication#pay stub apostille#notarized proof of income

0 notes

Text

Thailand Permanent Residency

Thailand's permanent residency (PR) framework originates from the 1927 Alien Registration Act, with major reforms occurring in:

1950 Immigration Act (established modern categories)

1979 Immigration Act (current statutory basis)

2008 Nationality Act amendments (tightened naturalization pathways)

1.2 Jurisdictional Authorities

Primary Oversight: Ministry of Interior (Section 37 Immigration Act)

Implementation: Immigration Bureau (Division 1, Section 3)

Adjudication: Special Committee chaired by Permanent Secretary for Interior

1.3 Relevant International Obligations

While Thailand maintains strict immigration controls, certain bilateral agreements influence PR considerations:

ASEAN agreements on skilled labor mobility

US-Thai Treaty of Amity (limited PR implications)

Japan-Thai Economic Partnership (special professional categories)

2. Eligibility Matrix

2.2 Qualitative Assessments

Character Evaluation:

Police clearance from all countries of residence

Neighborhood certification (conduct verification)

Employer/associate testimonials

Integration Metrics:

Thai language proficiency (CEFR A1 minimum)

Cultural knowledge exam (80% pass mark)

Community participation evidence

3. Procedural Architecture

3.1 Document Preparation Protocol

Core Documentation:

Visa History: Certified copies of all visas + entry stamps

Financial Evidence:

Bank statements (6 months, certified)

Tax records (RD.90 forms)

Investment certificates (BOI/SEC approved)

Supporting Materials:

Property Documents: Chanote + household registration

Employment Verification:

Work permits (all versions)

Social fund records

Company financials (for business owners)

4. Financial and Tax Considerations

4.1 Cost Structure Analysis

Official Fees:

Application fee: THB 7,600

Approval fee: THB 191,400

Alien book: THB 800 (annual)

Re-entry permit: THB 3,800 (single), THB 9,800 (multiple)

Unofficial Costs:

Document procurement: THB 15,000-50,000

Legal representation: THB 100,000-500,000

Expediting services: Market rate THB 200,000+

4.2 Tax Implications

Pre-PR: Only Thai-sourced income taxable

Post-PR: Worldwide income potentially taxable (if remitted)

Wealth Tax: None currently, but property transfer taxes apply

5. Rights and Privileges

5.2 Occupational Restrictions

Registered Profession Requirement: Must work in field specified at application

Business Ownership: Permitted but requires MOI notification

Government Employment: Prohibited without special approval

6. Judicial and Administrative Review

6.1 Appeal Process

Rejection Appeals: 30 days to file with Immigration Commission

Judicial Review: Available at Administrative Court

Success Rates: <15% for appeals, <5% for judicial review

6.2 PR Revocation

Grounds include:

Criminal conviction (1+ year sentence)

Tax evasion findings

Extended overseas absence (5+ years)

National security concerns

7. Strategic Application Approaches

7.1 Category Optimization

Employment Track: Ideal for corporate executives (minimum THB 150k salary preferred)

Investment Route: Best for property developers (BOI projects favored)

Family Path: Most reliable for long-term married couples (10+ years marriage ideal)

7.2 Document Enhancement Strategies

Tax Augmentation: Voluntary additional tax payments to demonstrate commitment

Community Engagement: Documented volunteer work with registered charities

Language Certification: Official CU-TFL test scores preferred over immigration exam

8. Comparative Regional Analysis

8.2 Global Benchmarks

Processing Time: Thailand (3-5 yrs) vs Canada (1.5 yrs)

Cost: Thailand (~6K)vsUK( 6K)vsUK( 3K)

Success Rate: Thailand (8%) vs Australia (25%)

9. Emerging Trends and Reforms

9.1 Digital Transformation

E-Application Pilot: Limited testing in Bangkok

Blockchain Verification: For document authentication

Automated Background Checks: Integration with INTERPOL databases

9.2 Policy Shifts

Talent-Centric Quotas: Increasing STEM professional allocations

Retirement PR Pathway: Under consideration for high-net-worth retirees

Dual Citizenship Tolerance: Parliamentary study underway

10. Practical Challenges and Solutions

10.1 Common Obstacles

Document Procurement: Especially for older visa records

Bureaucratic Delays: Particularly at verification stage

Exam Preparation: Lack of standardized study materials

10.2 Mitigation Strategies

Early Retention: Engage immigration lawyer at least 2 years pre-application

Parallel Processing: Initiate document requests simultaneously

Mock Examinations: Utilize private language schools for test prep

11. Longitudinal Case Studies

11.1 Successful Applications

Tech Executive: Approved in 3.5 years via employment track

THB 250k monthly salary

Certified Thai language proficiency

BOI-company sponsorship

Investor: Approved in 4 years via property route

THB 25M Bangkok condo portfolio

Additional THB 5M government bonds

Documented charity contributions

11.2 Rejection Analysis

Common Factors:

Inconsistent tax payments (78% of failed cases)

Language test failures (62%)

Suspicious financial patterns (45%)

12. Future Outlook

12.1 Projected Reforms

Points-Based System: Under consideration (2026 target)

Premium Processing: THB 500k+ for expedited review

Regional PR Options: Special economic zone programs

12.2 Demographic Impacts

Current PR holder demographics:

Chinese: 32%

Japanese: 18%

Western: 22%

Other Asian: 28%

13. Conclusion: Strategic Imperatives

Thailand's PR system remains: ✔ Highly exclusive (0.03% approval rate) ✔ Process-intensive (1000+ document pages typical) ✔ Discretionary in nature (despite codified rules)

Critical success factors:

Early preparation (3-5 year horizon)

Comprehensive documentation

Professional guidance

Financial commitment

The program continues evolving toward:

Greater transparency in decision-making

Enhanced digital infrastructure

Strategic alignment with economic development goals

Prospective applicants should monitor:

Annual quota announcements (December)

Ministerial regulation changes

Judicial rulings on PR-related cases

#thailand#visa#immigration#thaivisa#thailandvisa#visainthailand#thaipr#thaipermanentresidency#thailandpermanentresidency#immigrationinthailand#thaiimmigration

2 notes

·

View notes

Text

Older women were protesting war and being taxed more than men to pay for the war and now 30 of them have been abducted by the people they were protesting against.

A group of 30 women were kidnapped by pro-independence rebels nearly four days ago in western Cameroon, which has been bloodied for more than six years by a conflict between separatists from the English-speaking minority and the security forces, according to authorities.

They were "severely tortured and abducted by armed terrorists" in the village of Kedjom Keku, in the North West region, where armed separatist groups frequently kidnap civilians, mainly for ransom, the prefecture of the Mezam department said in a statement Tuesday.

The authorities always use the word "terrorists" to refer to armed rebels demanding independence for the North-West and South-West regions, which they call "Ambazonia", populated mainly by the English-speaking minority of this predominantly French-speaking central African country.

“

A colonel in the army told AFP on Tuesday evening that some 30 women were abducted by separatists on Saturday morning and that they had not yet been found. The communication service of the Ministry of Territorial Administration confirmed to AFP that the authorities had "no news of the hostages" on Tuesday evening.

The day before their abduction, these "elderly" women were organising a "peaceful march to protest (...) against the exactions and criminal activities of the terrorists", the Mezam prefecture said.

The two English-speaking regions have been the scene of a deadly conflict since late 2016 between separatist rebels on one side, who call themselves the "Amba Boys" or "Amba Fighters", and the army and police on the other, both sides being regularly accused by international NGOs and the UN of crimes against civilians.

The conflict has left more than 6,000 people dead and forced more than a million people to move, according to the International Crisis Group (ICG) think tank.

- "Taxes"-

The women had "publicly demonstrated" the day before their abduction against "the exploitative activities of the Amba Fighters" and in particular the obligation imposed on civilians by the latter to pay them "monthly taxes of 10,000 CFA francs (15 euros) for men and 5,000 for women (7.50 euros)", explains in a statement the Centre for Human Rights and Democracy in Africa (CHRDA), an NGO based in Yaoundé which documents human rights violations in Africa.

The rebels claim that they collect these "taxes" to finance their "war effort for independence".

A video is circulating on social networks, purporting to show these women, sitting on the ground and obviously frightened, which AFP was unable to authenticate but which the CHRDA quotes and describes in its statement, ensuring that it was posted by the "Amba Boys".

Armed men insulted and threatened them, saying they were going to kill the women, whom they accused of "complicity with the military", according to the CHRDA, which denounced a "barbaric act" by their kidnappers.

Some armed rebel groups regularly carry out kidnappings for ransom of civilians, sometimes in large groups like the abduction of these 30 women, especially in schools that they accuse of teaching French.

They also regularly commit targeted assassinations against representatives of the authorities but also against civilians whom they accuse of "collaborating with the army".

Their abuses are regularly denounced by international NGOs and the UN, which also regularly accuse the army of committing fatal blunders against civilians, summary executions, acts of torture and even raids and killings in villages.

The conflict broke out at the end of 2016 after the violent repression of peaceful demonstrations by members of English-speaking civil society, some of whom feel ostracised by the French-speaking majority of this country, which has been ruled with an iron fist for more than 40 years by President Paul Biya, 90.

The latter has been intractable, even towards the more moderate who call for a federalist solution to the conflict, and his regime has deployed the elite army and police on a massive scale for more than six years to suppress the rebellion.

Reblog to raise awareness. Because so far CNN as just talked about Desantis, Florida and Disney.

#africa#cameroon#kedjom keku#Ambazonia#Women protesting war#War is a racket#women around the world Wednesday#Women being taxed more than men#Taxes going to conflict

73 notes

·

View notes

Text

Simplifying Crew Changes: The Role of Visa Experts in the Maritime Industry

The smooth running of maritime activities depends on crew changes. Regular rotations ensure sailors follow industry standards, are efficient, and are rested. For crew management, the application process for visas—especially the Schengen visa maritime criteria—offers challenges. These obstacles can force operations to stop, increase costs, and tax logistics. Managing these challenges depends much on Visa professionals, who also guarantee that crew transfers go smoothly and in line with international norms.

The Value Of Crew Alternations For Naval Operations

The health and output of marine workers depend critically on crew changes. Extended periods of time spent working at sea can lead to fatigue, less effectiveness, and safety concerns. Crew rotations must happen on schedule if we want to keep maximum performance; rested staff members can then cover operations. Good crew ship management is the careful preparation of documentation, transportation, and timetables to allow seamless transfers. Following local rules and addressing logistical concerns of shipping sailors across borders, Visa experts simplify the procedure.

Difficulties Approaching Schengen Visa Requirements

A common obstacle to marine personnel changes in Europe is the Schengen visa maritime need. The procedure involves a lot of paperwork, embassy appointments, and strict deadlines that would be challenging to fit with limited transportation schedules. Moreover, different Schengen countries have different criteria, which makes things more difficult for maritime businesses. Errors in visa applications could cause delays, detentions, or denied access without seasoned guidance, therefore upsetting the supply chain. Visa experts address these problems by providing clear instructions, making sure documentation is complete, and endorsing timely entries.

The Navigating Complex Regulations Role Of Visa Experts

For marine companies, negotiating the legal landscape of global visa rules is challenging. Every nation has different policies on crew movements, which complicates worldwide operations even further. Visa experts focus on these regional needs as well as procedures related to Schengen visa marine rules. Their great knowledge helps them to provide tailored solutions for every crew member, thereby guaranteeing adherence to different legal systems.

Simplifying Shipping Company Operations

Having visa expertise helps to ship businesses to save administrative load. These experts oversee all aspects of the visa application process, working with agencies, marine authorities, and embassies. They keep track of application statuses, for instance, and fix processing-related issues. Faster visa processing helps crew ship management, therefore freeing maritime operators to concentrate on critical areas such as logistics, safety, and customer satisfaction.

Enhancing Compliance And Safety. By Use Of Expert Support

Ignoring visa limitations can have major consequences, including fines, detentions, and court cases. Schengen laws allow even small documentation mistakes to create significant delays. By making sure all Schengen visa criteria are exactly and efficiently satisfied, Visa experts help to lower these dangers. They confirm that you obey local rules, update you on legislative changes, and authenticate any necessary documentation. This strict approach lowers mistakes and shields maritime businesses against possible legal consequences.

Enhancing Maritime Operation Sustainability

Sustainable marine practices depend much on effective crew changes. Staff members who are overworked run the danger of accidents, operational mistakes, and compromise of safety. Visa experts help to guarantee proper crew ship management, which guarantees the timely completion of rotations and people's refreshments ready for their duties. This approach maximises resource use and reduces downtime, therefore enabling the sector to meet its environmental targets.

Conclusion

Facilitating crew transfers in the maritime sector depends on Visa's expertise. By managing Schengen visa requirements and negotiating difficult worldwide rules, they help to provide seamless and compliant personnel changes. Their experience increases safety standards, saves time, and reduces running expenses. Working with visa experts helps companies in a demanding sector like maritime transport to focus on major activities while keeping effective and sustainable practices.

2 notes

·

View notes

Text

Benchmark Professional Solutions Pvt. Ltd.: Comprehensive Business & Finance Services with Expertise in Tally Solutions

Comprehensive legal and finance solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, offers an extensive range of business and financial services to cater to the needs of modern enterprises. With an expert team, Benchmark delivers tailor-made solutions to its clients, ensuring compliance, efficiency, and growth. Whether you're a startup or an established business, their comprehensive services aim to streamline your financial and legal processes while providing expert advice on navigating complex regulations.

Core Services

1. DSC & Token : Benchmark offers Digital Signature Certificates (DSC) and tokens from leading providers like EMUDHRA, Capricorn, and more. These DSCs are essential for secure online transactions, filings, and authentications, ensuring your business remains compliant with digital regulations.

2. Accounts Audit: Benchmark provides detailed accounts auditing services, ensuring your business follows financial standards and maintains transparency. Their audits cover all aspects of financial reporting, helping identify areas for improvement and ensuring regulatory compliance.

3. Trademark Registration: Protect your brand identity with Benchmark’s trademark registration services. They assist in filing, securing, and maintaining trademarks, allowing businesses to safeguard their intellectual property and prevent unauthorized use.

4. ROC Compliance (Registrar of Companies): Benchmark ensures your company adheres to ROC guidelines by managing all filings, annual returns, and other documentation. This service keeps businesses compliant with government regulations and helps avoid legal penalties.

5. License & Registration: From obtaining business licenses to registering your company, Benchmark handles the entire process, ensuring that your operations meet local and national regulatory requirements.

6. Income Tax Solutions: Benchmark provides expert guidance on filing income taxes for businesses and individuals, offering strategies to minimize tax liabilities while staying compliant with current tax laws.

7. GST Compliance: The company’s GST services include filing, reconciliation, and audit support to ensure businesses remain compliant with GST regulations. Benchmark’s expertise in GST helps reduce errors and optimize tax benefits.

8. Consultancy: Benchmark offers professional consultancy services tailored to your business needs. Whether you’re seeking advice on tax planning, regulatory compliance, or business strategy, their consultants provide actionable insights to drive growth.

9. Outsourcing: The company offers outsourcing services for various business functions, including payroll, accounting, and legal processes. Outsourcing to Benchmark allows companies to focus on core operations while maintaining efficiency in back-office tasks.

10. Civil & Criminal Lawyer Services: Benchmark provides legal support through its civil and criminal lawyer services. Whether you're dealing with business disputes, legal compliance, or criminal cases, their legal team ensures you receive the right counsel and representation.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Choosing Benchmark Professional Solutions Pvt. Ltd. means partnering with a company that prioritizes your business success. Their expertise in Tally Solutions and diverse service portfolio ensures that your financial, legal, and operational needs are managed seamlessly. With a focus on accuracy, compliance, and client satisfaction, Benchmark becomes not just a service provider but a strategic partner in your growth journey.

2 notes

·

View notes

Text

Comic Book Punks vs. Authoritarianism

REVIEWS : MUSIC

Are The Ravelos a gimmicky novelty act or legit antidote to frustration with the Duterte regime?

In professional wrestling, there's a term called ‘kayfabe’. That basically means staying in character. It’s sticking to your role, whether it’s an arrogant ladies’ man, a self-righteous environmentalist, or an undead bad-ass. Every action must fit that persona, even when you're being put in a rear naked choke or hit across the back with a steel chair.

In the same way, upstart Manila-based punk act The Ravelos practice kayfabe. According to the band, they're a group of superpowered misfits from the early 1980s. They were transported to 2019 via some kind of portal or wizard’s spell—they're not clear on how exactly it happened. Bottom line: they're here to fight supervillains, and to play three-chord punk songs about the state of The Philippines under President Rodrigo Duterte’s authoritarian rule. That's their story, and they're sticking with it.

The Ravelos first appeared in our timeline circa May this year. A veteran local comic artist (whose name rhymes with Chob Ram) drew an illustration of a punk band whose members were based on Filipino comic book heroes, all created by pioneering artist Mars Ravelo. Singer/guitarist Darnuh Vergara takes her cue from Darna—a transforming superheroine, often mistakenly touted as the Filipina version of Wonder Woman. The original artwork was part of #SigawDarna, an organic fan campaign to reinvent Darna for contemporary sensibilities. The Ravelos are rounded out by vocalist/axeman Flash Bombas, bassist Last Stick Man (inspired by rubber-limbed Lastikman), and drummer Kapitan Barbel (a pastiche of Captain Barbell, a metamorphing hero in the Shazam and henshin mold).

So far, so intriguing. But clever personas and a quirky backstory wouldn't mean a lot if they didn't have the musical skill to back it up. The identities of the actual performers is a poorly kept secret—just go to any of their shows to find out. Reliable sources claim that it may include members of seasoned independent acts like The Male Gaze, Cheats, and Boy Elroy.

As for the songs? Well, listen to “Anuna?” (“Now What?”) for yourself:

youtube

Despite the raw-sounding mix (which may yet be another layer of their meta punk gimmick), it's clear they have legit grievances about very real issues. In the opening verse, Darnuh wails:

Walang tubig! (No water!) Walang kuryente! (No electricity!) Walang tulog! (No sleep!) Walang diskarte! (No way out!)

It's a straightforward hit list of problems that Filipinos of all backgrounds can relate to. Then Flash responds:

Saan napupuntang mga buwis? (Where do our taxes go?) Bakit ba tayo nagtitiis? (Why do we put up with this?)

It's a familiar refrain, in a year marked by water shortages, rolling blackouts, and a relatively volatile economic mood.

Despite its cheeky title, “Sino Bang Tatay Mo?” (loosely “Who's Yr Daddy?”), it appears to lament kids who’ve been orphaned by the state’s questionable drug war. Meanwhile, “Asan Na Si Bantay?” calls out Duterte’s puppy-like stance towards Beijing in the country's territorial dispute with China over the West Philippine Sea.

It's worth asking: why use made-up personas to express valid political statements? A more unfavorable critic might accuse the band of performing “wokeness” for the sake of it. Especially when their manager/”hype man” Deeng reads almost the same prepared spiels off his tablet during each show. At the very least, it's a risky move in a sub/culture that pays so much lip service to authenticity.

However, it's difficult to fault the band after seeing the groups they've supported. In July alone, they’ve played at shows for groups committed to holding the government accountable for its violations. A few weeks ago, the Ravelos rocked out at a launch for Sauron, a comic zine documenting the massacre of organized farm workers in Negros. They followed that up with a gig supporting KOLATERAL—Sandata’s rap concept album, based on street-level data about state-approved vigilante killings.

Even with the four-color alter-egos, The Ravelos’ act has the tacit blessing of groups who’ve done hands-on grassroots work with farmers and urban poor communities. That sounds pretty damn punk rock to me.

2 notes

·

View notes